Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - American Water Works Company, Inc. | d8k.htm |

| EX-99.1 - PRESS RELEASE - American Water Works Company, Inc. | dex991.htm |

Investor Conference

February 15, 2010

Exhibit 99.2 |

February 2011

1 |

Investor Conference

February 15, 2010 |

February 2011

3

Please review the corresponding video link "Customer

Service Video" on the American Water website |

Introduction

Ed Vallejo

Vice

President

-

Investor

Relations |

February 2011

5

Certain statements in this presentation are forward-looking statements within the

meaning of the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements are predictions based on our current

expectations and assumptions regarding future events and may relate to, among

other things, our future financial performance, our growth and portfolio

optimization strategies, our projected capital expenditures and related funding

requirements, our ability to repay debt, our ability to finance current operations

and growth initiatives, the impact of legal proceedings and potential fines

and penalties, business process and technology improvement initiatives, trends in our

industry, regulatory or legal developments or rate adjustments. Actual results could

differ materially because of factors such as the completion of the independent

audit of our financial statements; decisions of governmental and regulatory bodies,

including

decisions

to

raise

or

lower

rates;

the

timeliness

of

regulatory

commissions’

actions

concerning

rates;

changes

in

laws, governmental regulations and policies, including environmental, health and

water quality and public utility regulations and

policies;

weather

conditions,

patterns

or

events,

including

drought

or

abnormally

high

rainfall;

changes

in

customer

demand for, and patterns of use of, water, such as may result from conservation

efforts; significant changes to our business processes and corresponding

technology; our ability to appropriately maintain current infrastructure; our ability to obtain

permits

and

other

approvals

for

projects;

changes

in

our

capital

requirements;

our

ability

to

control

operating

expenses

and

to

achieve efficiencies in our operations; our ability to obtain adequate and

cost-effective supplies of chemicals, electricity, fuel, water and other

raw materials that are needed for our operations; our ability to successfully acquire and integrate water and

wastewater systems that are complementary to our operations and the growth of our

business or dispose of assets or lines of business that are not complementary

to our operations and the growth of our business; cost overruns relating to

improvements or the expansion of our operations; changes in general economic,

business and financial market conditions; access

to

sufficient

capital

on

satisfactory

terms;

fluctuations

in

interest

rates;

restrictive

covenants

in

or

changes

to

the

credit

ratings

on

our

current

or

future

debt

that

could

increase

our

financing

costs

or

affect

our

ability

to

borrow,

make

payments

on

debt

or

pay

dividends;

fluctuations

in

the

value

of

benefit

plan

assets

and

liabilities

that

could

increase

our

cost

and funding requirements; our ability to utilize our U.S. and state net operating

loss carryforwards; migration of customers into or out of our service

territories; difficulty in obtaining insurance at acceptable rates and on acceptable terms and

conditions; the incurrence of impairment charges ability to retain and attract

qualified employees; and civil disturbance, or terrorist threats or acts or

public apprehension about future disturbances or terrorist threats or acts. Any

forward-looking statements we make, speak only as of the date of this presentation. Except as required by law, we do not

have any obligation, and we specifically disclaim any undertaking or intention, to

publicly update or revise any forward- looking statements, whether as a

result of new information, future events, changed circumstances or otherwise.

Cautionary Statement Concerning

Forward-Looking Statements |

6

Jeff Sterba: Strategy Overview

Walter Lynch: Regulated Overview

Break

Ellen Wolf: Financial Overview

Closing and Q&As

Today’s Agenda

February 2011 |

American Water Overview:

Strategy & Goals

Jeff Sterba

President and Chief Executive Officer |

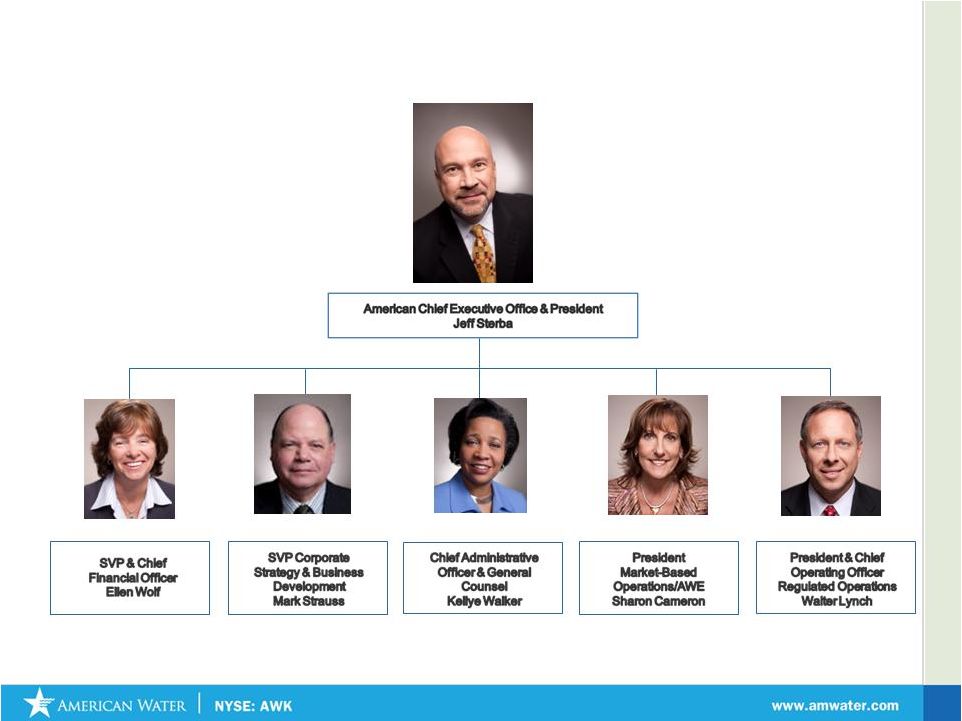

8

Executive Team

February 2011 |

9

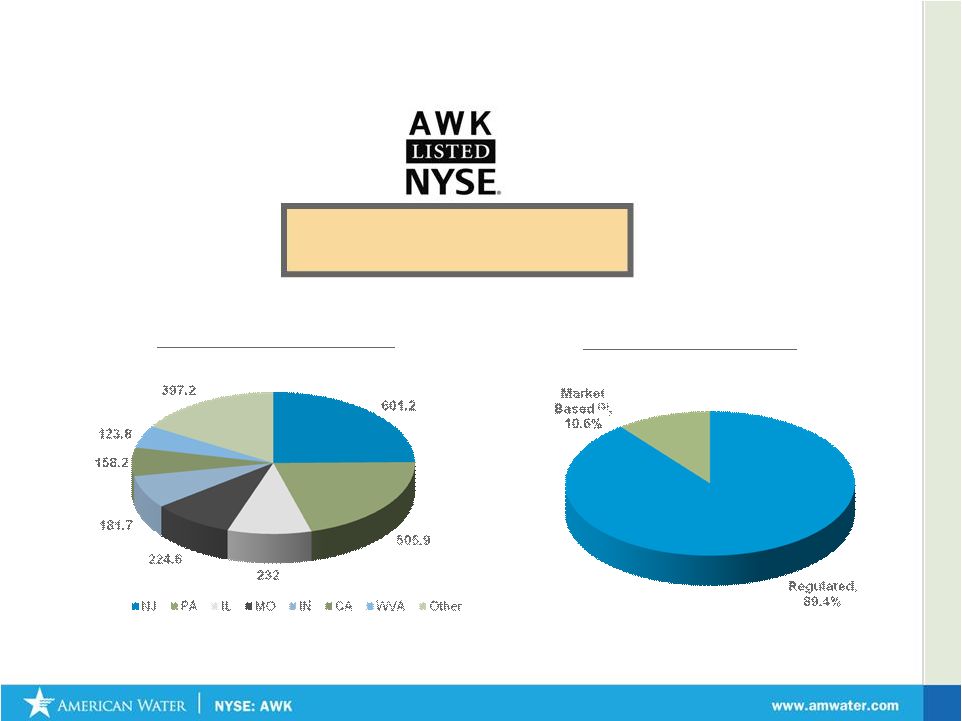

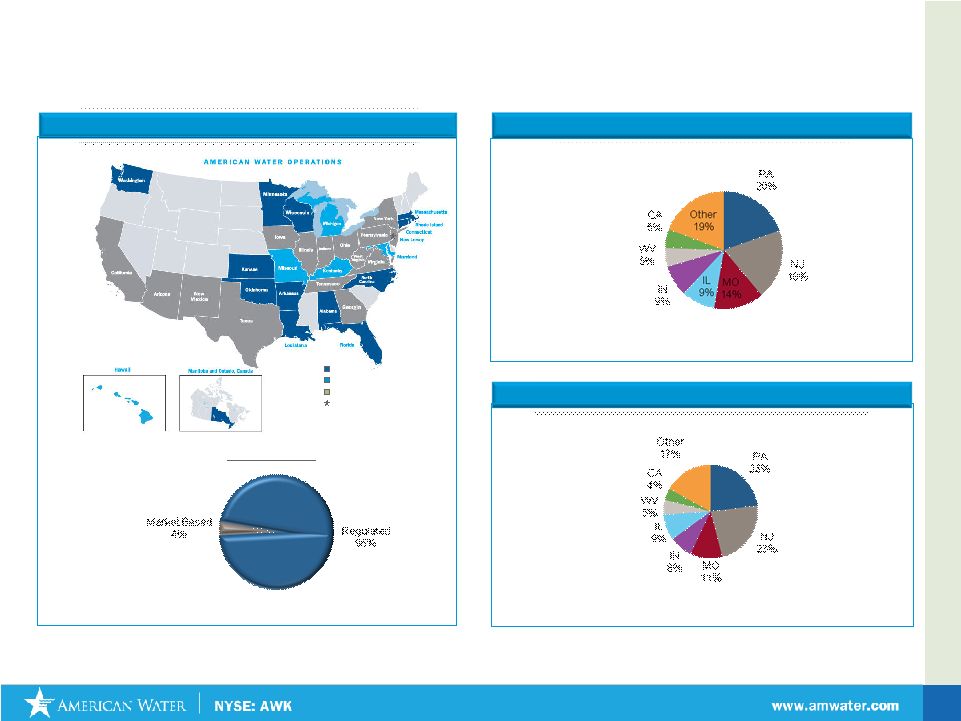

American Water: The Premier Water Services Provider in

North America

Geographic Diversity

(1)

Business Diversity

(1)

Market Cap: $4.7 Billion

Enterprise Value: $10.2 Billion

Average Volume Traded: 1.1 Million shares

(1)

2010 Revenues

(2)

Market data as of 2/9/11

(3)

Market Based includes Other

February 2011 |

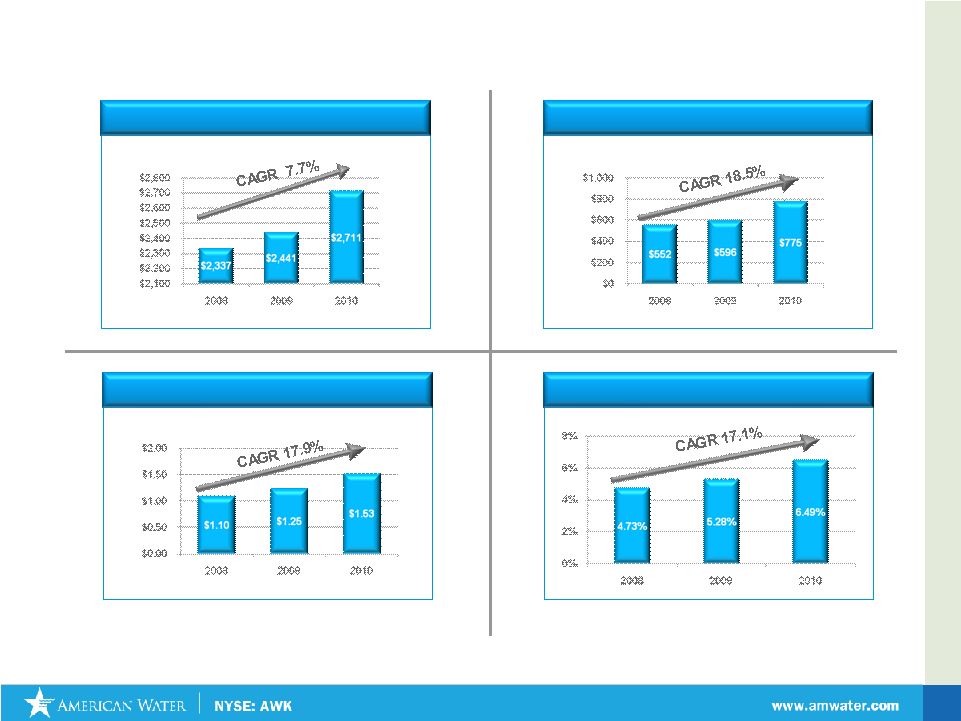

February 2011

10

American Water: A Snapshot

•

2010 Preliminary Results

•

EPS and ROE exclude impairment charges

Cash Flow From Operations

(in millions)

Earnings Per Share

Operating Revenues

(in millions)

Return on Equity |

11

What You’ll Hear Today

Sound Corporate Strategy and Key Initiatives

Portfolio Optimization

Regulatory Policy

Regulated and Market-Based Opportunities

Operational Excellence

Continued Investment in Infrastructure

Driving Excellent Results and Prospects

2010

Financial

Results

–

Expected

$1.53

Long Term Growth

2011 Guidance of $1.65-$1.75

Sustained 7-10% EPS Growth

Improving Rates of Return

Commitment to our Customers, Employees and Shareholders

February 2011 |

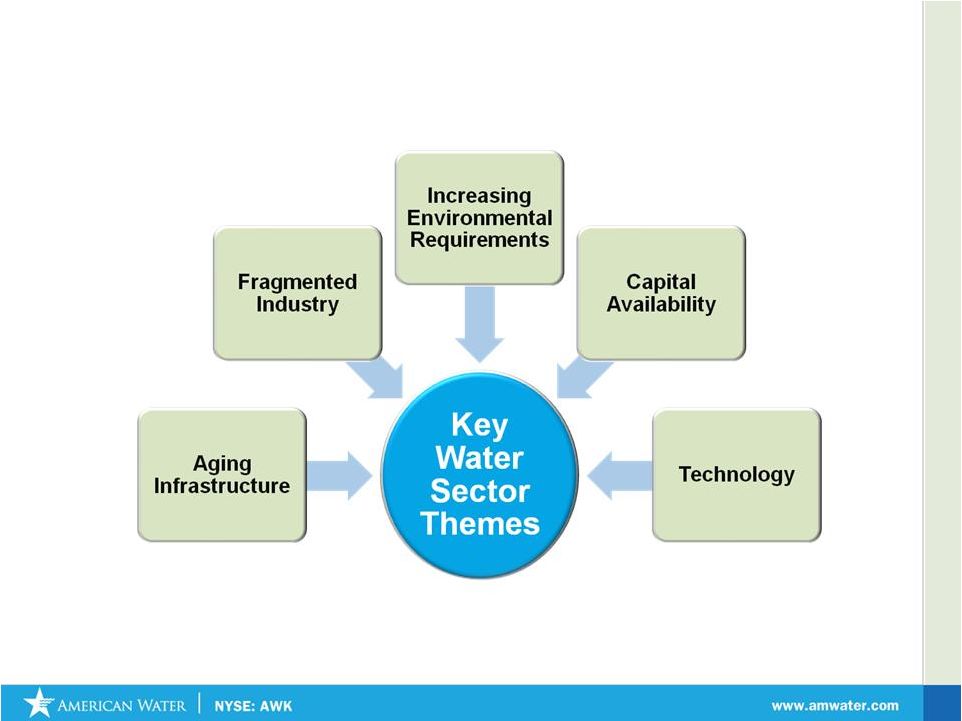

The

U.S. Water Industry February 2011

12 |

February 2011

13

Water Industry Has a Favorable Utility Profile

Water Utility

Characteristics

Implications

•

Capital projects focused on maintaining

public health & safety standards

•

Regulators supportive of prudent projects

•

Water bills low portion of household budget

•

Essential product –

no substitutes

•

Demand is more price inelastic than

electric or gas

•

Raw input costs (i.e. water and chemicals)

less volatile than other utility commodity

costs (i.e. coal and natural gas)

•

More stable rates for customers

•

Cost forecasting and regulatory lag is more

manageable

•

M&A primarily small tuck-ins enabling

targets to meet health & safety standards

•

Regulators generally support the

strengthening of water systems via M&A

•

Water storage more feasible and cheaper

than electricity or gas storage

•

Water utilities can be more cost efficient

and responsive to demand fluctuations

•

Large water utilities diversified across

multiple geographies

•

Mitigates impact of localized severe

weather conditions / regulatory outcomes |

February 2011

Our Values

•

Honesty and Integrity

•

Communication

•Teamwork

•

Excellence

•

Engagement

Our Mission

•

Providing safe, reliable water services

to our customers and communities

•

Driving Operational Excellence

•

Enabling employees to innovate

•

Ensuring long-term stewardship of all

resources

•Engaging customers, regulators and other

constituencies in solving critical water issues

•Earning a fair return for our shareholders

Our Vision

To be the trusted steward of

your precious resource –

water

What We Stand For

14 |

15

American Water: Providing Value to Customers,

Employees and Shareholders

Operational

Excellence

Employer of

Choice

Sustainability

Customer

Focus

Regulatory &

Public Policy

Targeted

Growth

American Water provides value-added products

and services that address customers’

needs

Investor Driven

Customer Driven

Value

Price

Cost

February 2011 |

February 2011

•

Earn appropriate

return

on investments

•

Promote constructive

regulatory frameworks

•

Grow Regulated

Businesses

through focused

acquisitions

•

Pursue “regulated-like”

opportunities

•

Focus on Operations

Efficiencies

Goals

Actions

Regulated Operations & Support

•

Invest in states where we can

add

value

to

customers

and

generate

an appropriate return

•

Move from “Rate Case Catchup”

to

“Regulatory Strategy”

•

Drive Operational Excellence

Market Based Operations

•

Regulated-Like

•

Value-Added Services

Future Pursuits

•

Disciplined pursuit of growth through

acquisitions and applying technological

expertise

Strategy Specifics

16 |

17

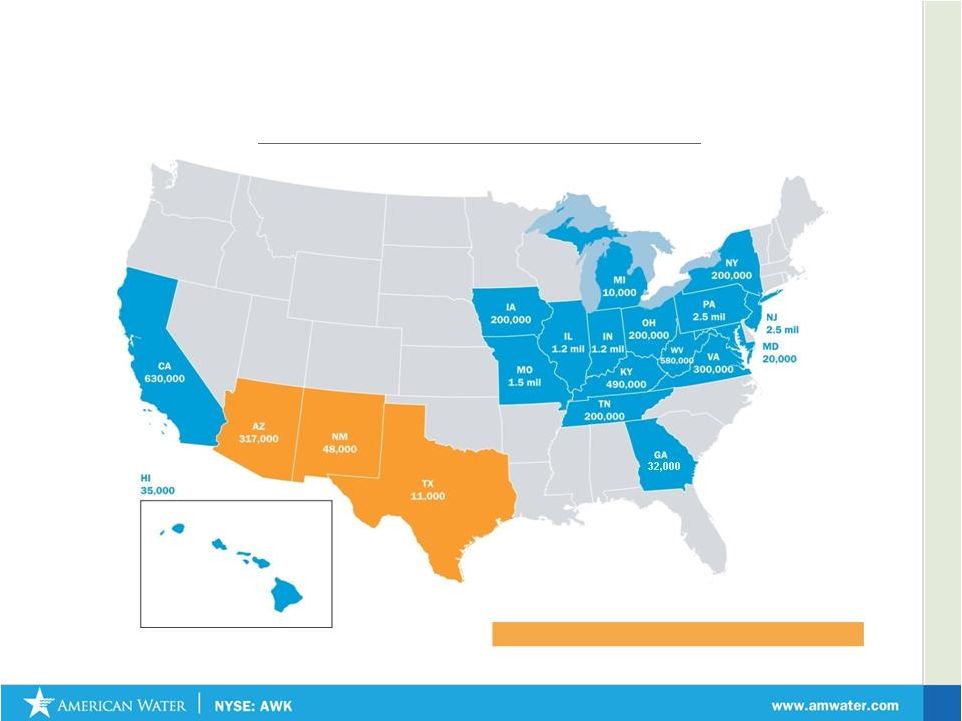

Strategy Specifics: Regulated Operations -

Invest in

states where we can add value

American Water Regulated Operations: Population Served

States we are in process of exiting thru Portfolio Optimization

32,000

* 2009 Data

February 2011 |

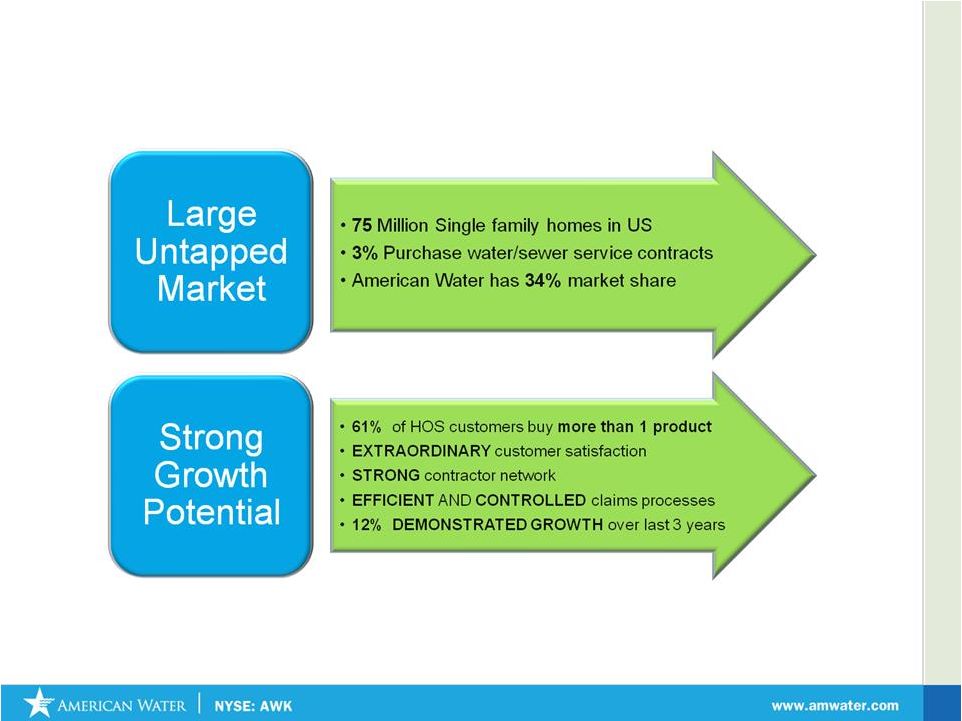

Strategy Specifics: Homeowner Services Growth

18

February 2011 |

19

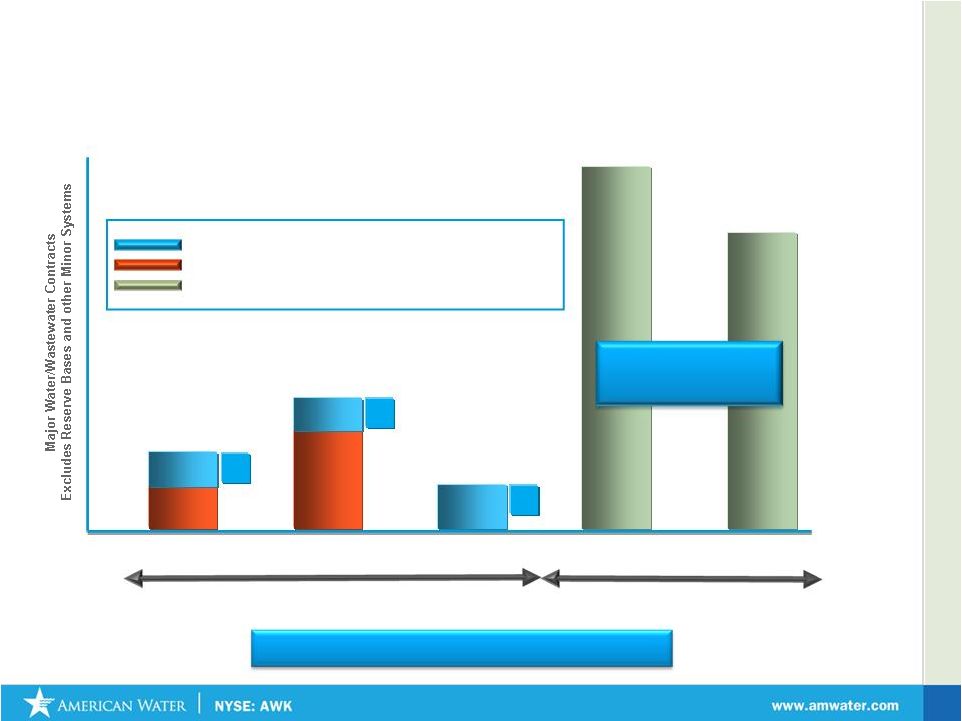

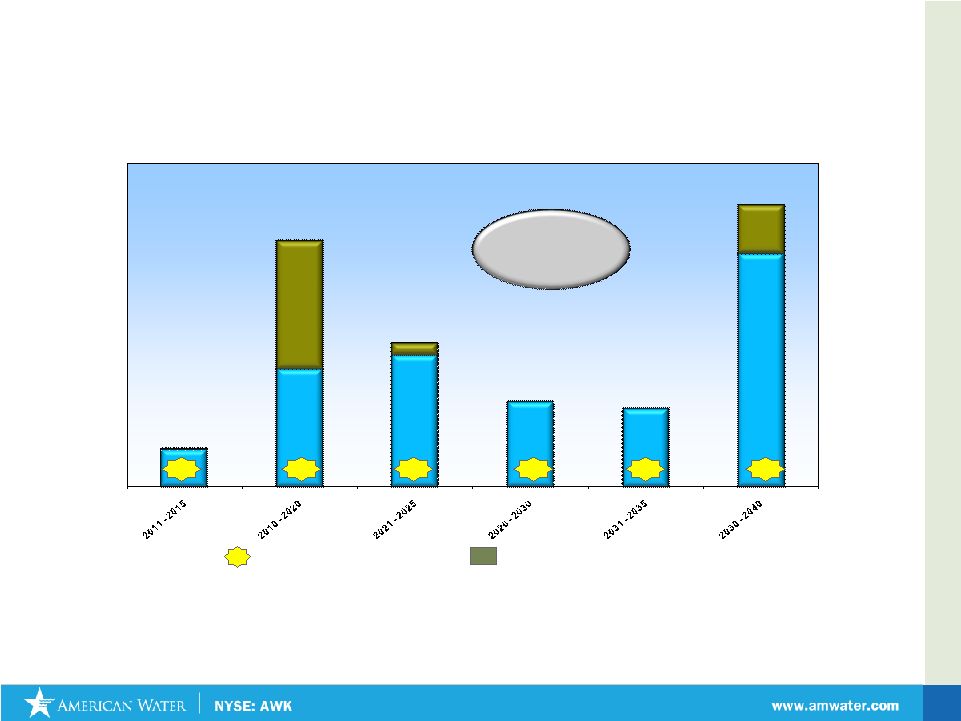

Strategy Specifics: Market Size of Military Utility

Privatizations

2011-13

2014-16

Major Water/Wastewater Contracts

to be Awarded

Contracts Awarded to American Water

Contracts Awarded to Competitors

Contracts Programmed by Dept. of Defense for Award

Over $2 Billion in Revenues Backlog

2002

2005-07

2008-10

Major Water/Wastewater Awards to Date

Market Opportunity

represents approximately

$11Bn in Total Revenues

3

3

4

7

12

4

February 2011 |

February 2011

20

•

Shorter Term Contracts

•

Heavy Competition

•

High Risk

•

Low Margin

•

Resource Intensive

•

Minimal Scalability

Strategy Specifics –

Municipal Contract

Operations

The Current Model

Our Value Model

•

Longer Term Contracts

•

Form of Public Private

Partnership

•

Shared Risk

•

Performance Metrics

•

Price Redetermination

•

Priority of Payment |

21

Profitable

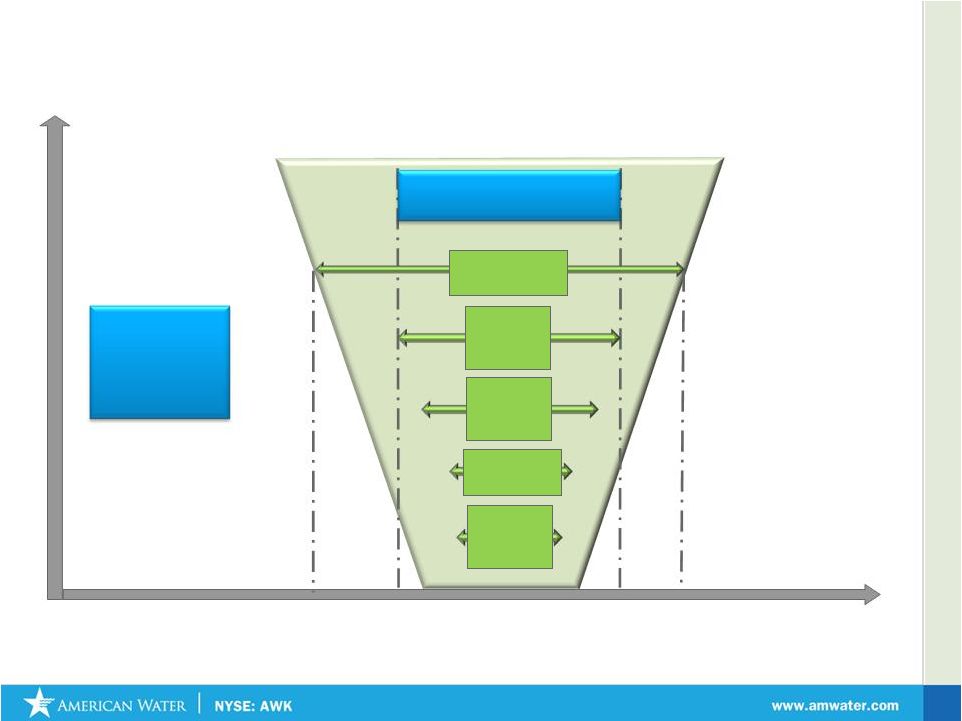

Growth

Drivers

Core

Businesses

•

Infrastructure

Investment

•

Tuck Ins

•

Homeowner Services

•

Military Utility

Privatizations

New

Markets

New

Products

Strategy Specifics: Growth Avenues

•

Acquisitions in new

territories

•

Homeowner Services

(new territories)

•

Military (beyond Army)

•

Homeowner Services

(new services)

•

New Municipal Contract

Model

•

Technology

.

February 2011 |

February 2011

22

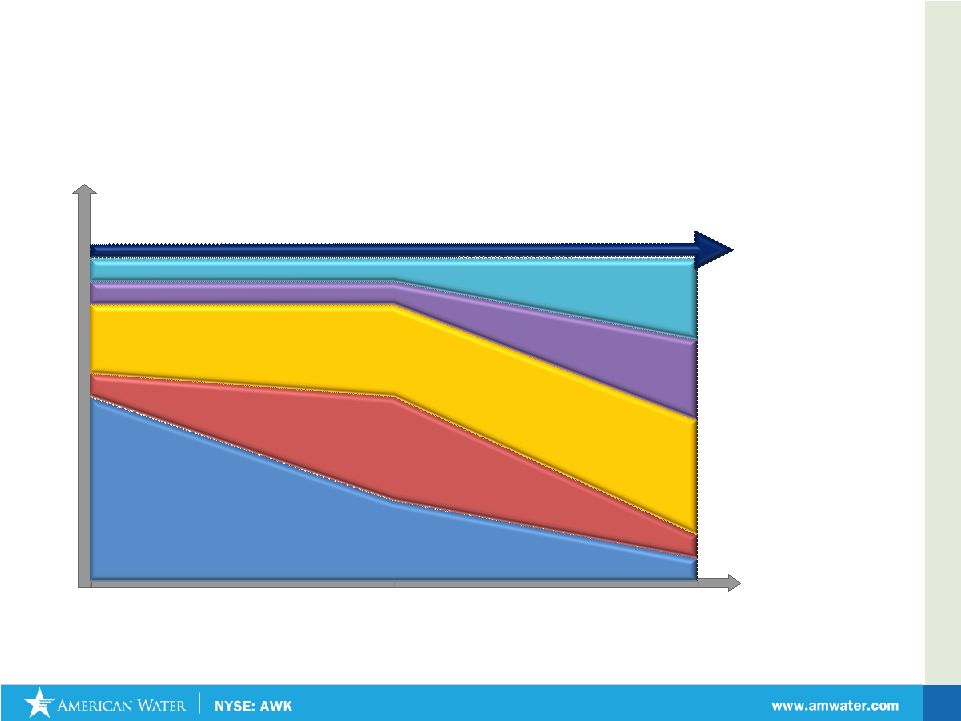

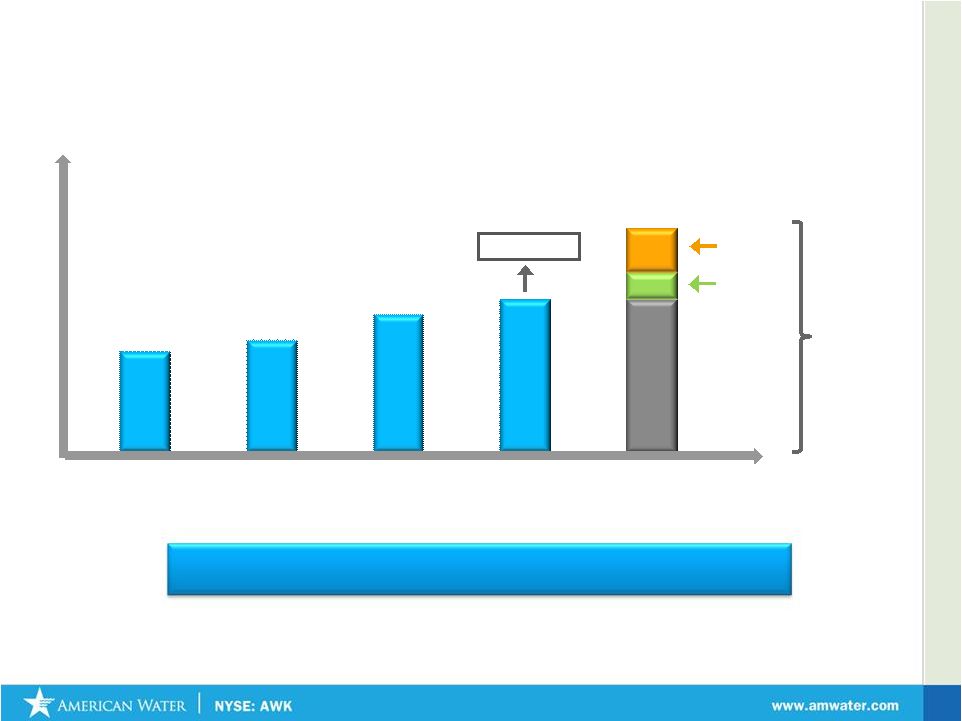

Investment Thesis: Sustained 7-10% EPS Growth

Future Growth

Short Term

Long Term

New Services

Regulated Investments

Acquisitions

Operational Excellence/

Efficiencies

ROE improvement

Long Term Growth

Conceptual Representation |

Regulated Operations Initiatives

Walter Lynch

President & Chief Operating Officer

Regulated Operations |

February 2011

24

Regulated Customers

Net Utility Plant

Total = 3,335,518

Regulated

Market Based

Both

Corporate headquarters

2010 EBIT

Total = $748 million

American Water’s Geographic Presence

Total = $11.1 billion

American Water’s Regulated Portfolio |

American Water: Providing Value to customers

and shareholders

25

Operational

Excellence

Employer of

Choice

Sustainability

Customer

Focus

Regulatory &

Public Policy

Targeted

Growth

Value

Price

Cost

February 2011 |

February 2011

Goal: To earn

appropriate

rate of return

on investments

Advancing consistent

operational

regulations

Shaping

constructive

regulatory policies

through

participation in

industry, regulatory

and legislative

settings

Working with

stakeholders to

determine

appropriate allowed

ROE

American Water’s Regulatory Initiatives

26 |

American Water’s Business Transformation Project

Promote operating

excellence,

efficiency, and

economies of

scale

Business

Transformation

Project

Increase

employee

effectiveness and

satisfaction

Enhance the

customer

experience

Upgrade legacy

systems near

the end of

useful lives

February 2011

27 |

28

American Water’s Business Transformation Project:

Looking Ahead

Implementation

Oct. ’10

System

Implementer

selection

Sep. ’11

Start EAM & CIS

(Target “go live”

Summer 2014)

May ’11

Start ERP

(Target “go live”

summer 2012)

Blueprint

Project to be completed late 2014

Jan. ’11

Blueprint Phase begins

(Completed in April 2011)

May ’10

SAP

software

selection

February 2011 |

American Water’s Portfolio Optimization Initiatives

Continue to Lower

Costs

Focus on

Value Drivers

Optimizing

Long-term

Value Through

Proactive

Management

Redeploy Value Into

Core Growth Markets

•

Balanced Portfolio Analysis

•

Focus Achieving Authorized

Rates of Return

•

Monetize Non-Producing Assets

•

Focused Capital Resources

•

Selective Acquisition Opportunities

•

Leverage Internal Growth

Explore Opportunities for

Long-Term Success

Drive Profitability and

Returns

29

February 2011 |

Portfolio

Optimization

Criteria

STRATEGIC

IMPORTANCE

& RELEVANCE

MATERIALITY OF

INVESTMENT

PROJECTED

CAPITAL

INTENSITY

REGULATORY

ENVIRONMENT

POTENTIAL TO

ACHIEVE

CRITICAL MASS

American Water’s Portfolio Optimization Criteria

30

February 2011 |

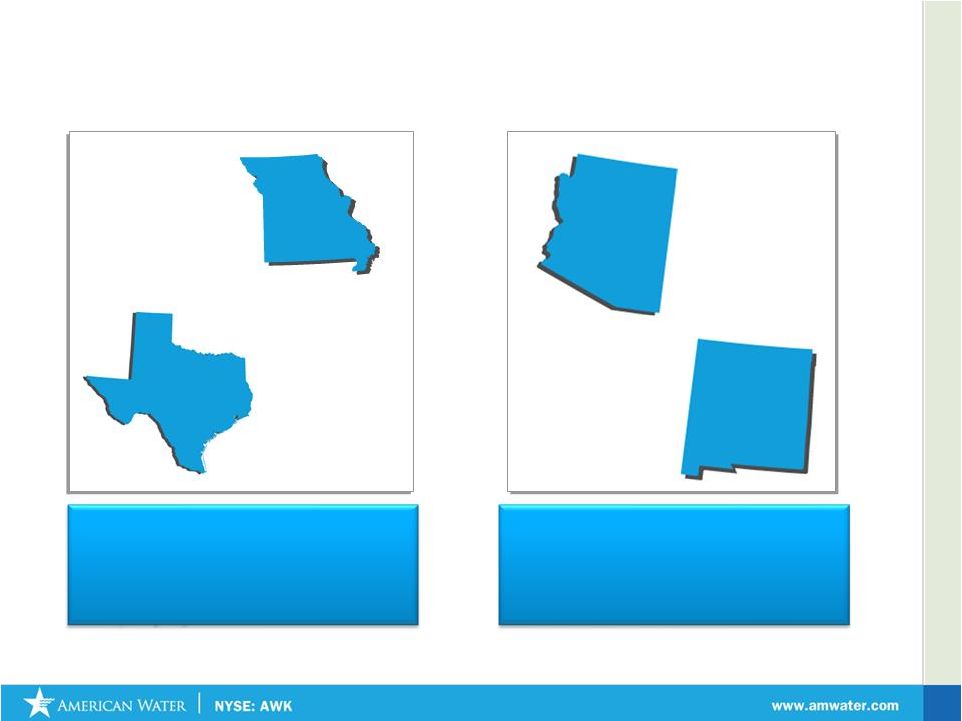

31

Portfolio Optimization Implementation

*Transaction Details

•

Sale Price: $470 million

•

Sale Multiple: 1.14x Book Equity

•

AZ Rate Base

(1)

: $319 mm

•

NM Rate Base

(1)

: $34 mm

Acquired by

American

Water

Sold to AQUA

MO

TX

NM

AZ

Agreement to

sell by

American

Water

* Missouri Transaction Details

•

Purchase Price: $3 million

•

Annual Revenue of $3.4 million

•

59 wastewater systems

•

10,000 people served

(1) Rate base approved in rate cases by respective commissions

*Transactions subject to closing risk and regulatory approval

February 2011 |

February 2011

32

Please review the corresponding video link "KY Capex

Video" on the American Water website |

Financial Overview

Ellen Wolf

Senior Vice President & Chief Financial Officer |

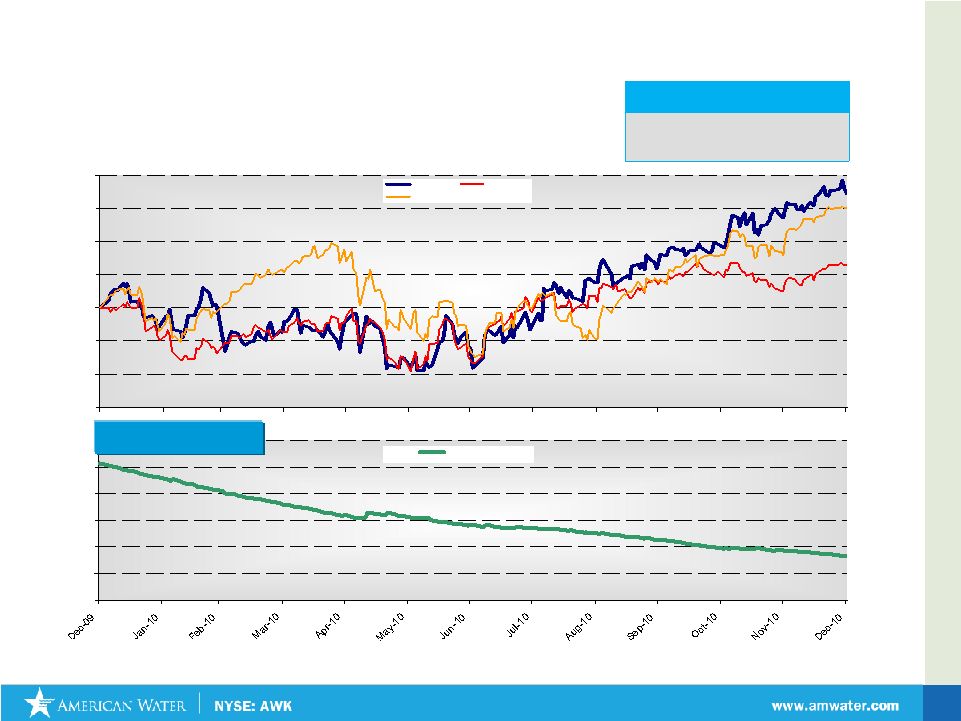

February 2011

85%

90%

95%

100%

105%

110%

115%

120%

AWK

DJ Util

S&P 500

0.40

0.45

0.50

0.55

0.60

0.65

0.70

AWK Beta

34

Price as a percent of base (December 31, 2009 = 100%)

Shareholder Return

YTD

American Water

S&P 500

Dow Jones Utilities

+17.3%

+15.1%

+6.5%

S&P 500 Beta = 1

Total Shareholder Return : American Water vs. Indices

(January 1, 2010 –

December 31, 2010) |

February 2011

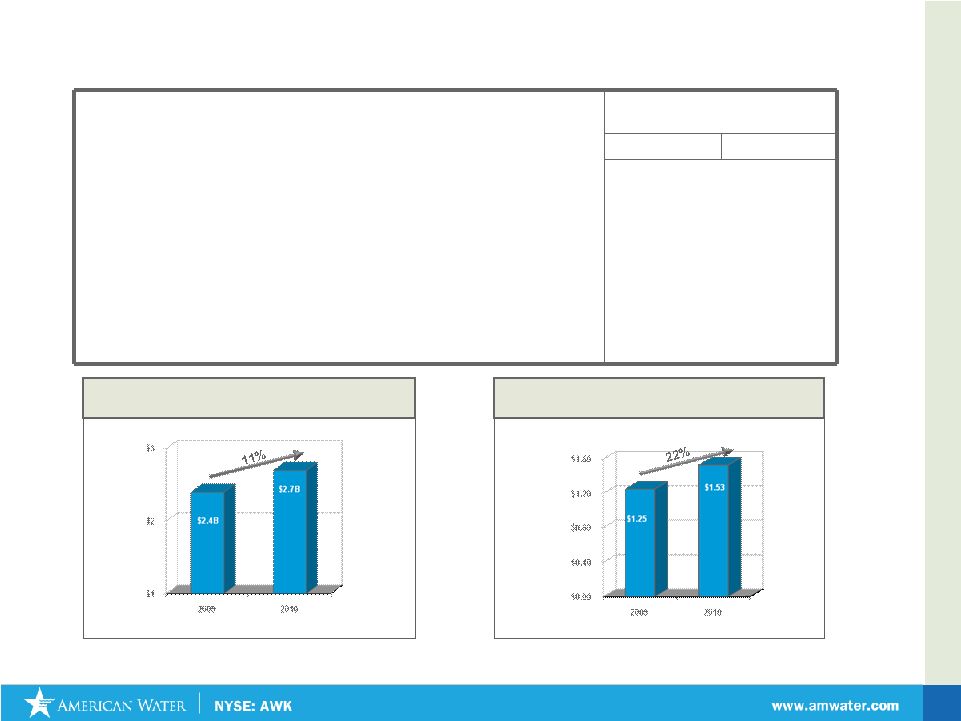

35

For the Year Ended

December 31,

2010

2009

(In thousands, except per share data)

Revenue

$2,710,677

$2,440,703

Gross Margin

$748,091

$623,609

Gross Margin %

27.6%

25.6%

Net income to common

$267,827

$209,941

Common dividends paid

$150,301

$137,331

Average common shares outstanding during the period

175,124

168,164

Net income per common share

$1.53

$1.25

2010 Preliminary Financial Results

Operating Revenues (in billions)

Earnings per Share

*

Note: 2009 excludes impairment charge |

February 2011

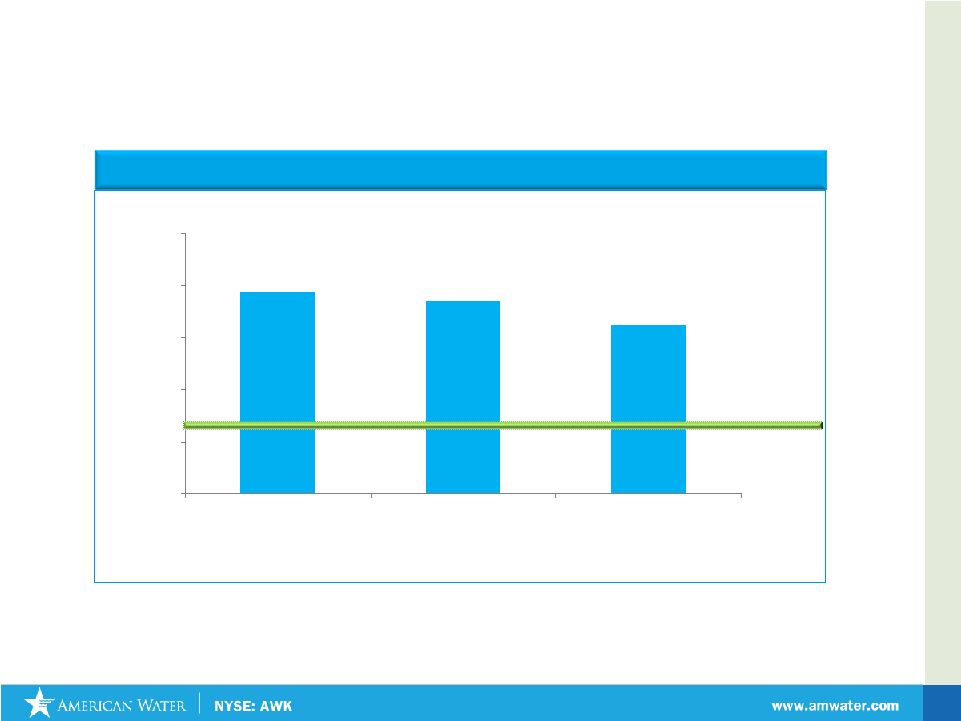

36

Adjusted O & M Efficiency Ratio*

49.4%

48.5%

46.2%

30%

35%

40%

45%

50%

55%

2008

2009

2010

Regulated O&M Efficiency Ratio Continues to

Improve

*O&M Efficiency Ratio = operating and maintenance expenses / revenues,

adjusted for purchased water Long Term Goal:

Below 40% |

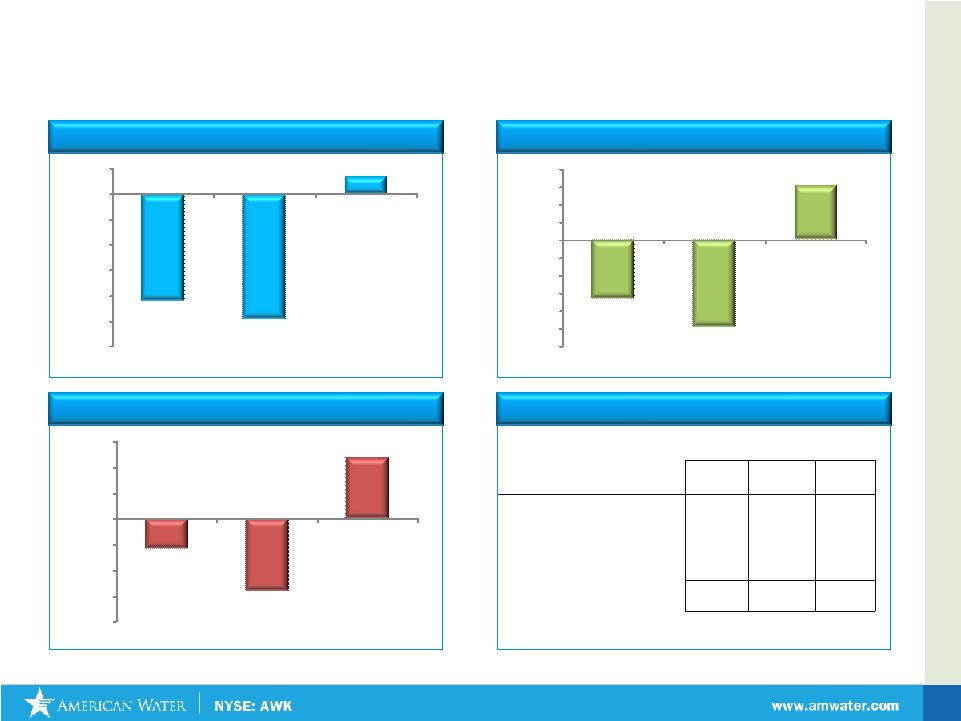

February 2011

37

Residential

Commercial

Industrial

American Water Total

American Water Customer –

Gallons Consumption –

Period over Period Analysis

-5.8%

-13.8%

11.9%

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

15.0%

2007-2008

2008-2009

2009-2010

-4.2%

-4.9%

0.7%

-6.0%

-5.0%

-4.0%

-3.0%

-2.0%

-1.0%

0.0%

1.0%

2007-2008

2008-2009

2009-2010

-3.3%

-4.9%

3.1%

-6.0%

-5.0%

-4.0%

-3.0%

-2.0%

-1.0%

0.0%

1.0%

2.0%

3.0%

4.0%

2007-2008

2008-2009

2009-2010

Fiscal Year

Gallons by customer class

2008

2009

2010

Residential

213,423

203,701

204,575

Commercial

90,542

86,120

88,749

Industrial

42,032

36,212

40,539

Public and Other

58,838

55,911

56,604

Total Water Sales Volume

(MM gal)

404,835

381,314

390,467 |

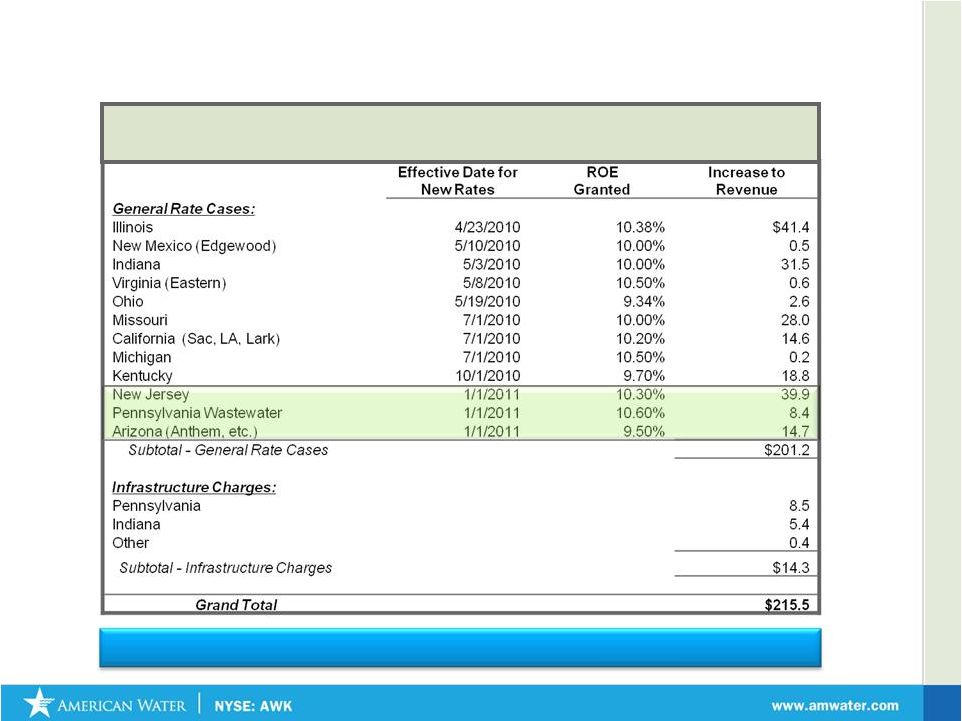

Rate Cases & Infrastructure Charges Granted in

2010 that will have impact on 2011

Core Strategy: Continuing Effort to Earn Appropriate Rate of

Return on Prudent Investments

Average Timing of Rate Cases: Approximately every 2 Years

February 2011

38 |

February 2011

39

Rate Cases Awaiting Final Order as of December 31, 2010

Index of Rate Case Status

1 - Case Filed

2 - Discovery (Data Requests, Investigation)

3 - Negotiations / Evidentiary Hearings / Briefings

4 - Recommended order issued / settlement reached, without interim

rates 5 - Interim rates in effect, awaiting final order

Docket /

Revenue Increase

ROE

Rate Base

Filing

Case Number

Date Filed

Filed

Requested

(Filed)

Status

Virginia

Case No. PUE 2010-00001

3/8/2010

$6.9

11.50%

$99.1

5

California

Case No. A 10-07-007

7/1/2010

$37.3

10.20%

$409.6

2

West Virginia

Case No 10-920-W-42T

6/22/2010

$18.4

11.50%

$437.6

3

Tennessee

Case No 2010-00189

9/17/2010

$10.0

11.50%

$125.5

2

Arizona

W-01303A-10-0448

11/3/2010

$20.8

11.50%

$148.9

1

Total

$93.4

$1,220.7

* Final Order not yet issued. Interim rates are in effect.

|

February 2011

40

Key Business Assumptions

Continued decline in water usage per customer

Low flow fixtures

Declining family size

Unemployment

General conservation (promoted by US EPA)

Downward trend has accelerated in most states since the late

1990’s

Continued improvement in operating efficiency and cost structure

Continued rate case recovery of prudent investments

Gradual economic recovery by industrial and commercial

customers

Housing market slow to recover |

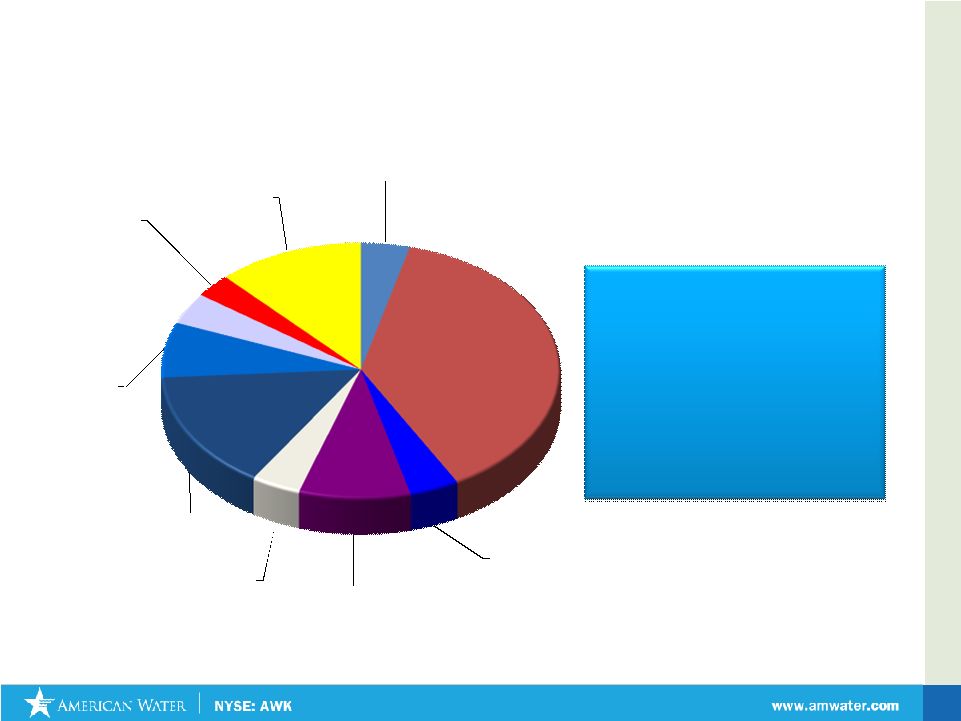

February 2011

Land, Bldgs, &

Structures

4%

Distribution

38%

Pumping and

Power

4%

Treatment

9%

Storage

4%

Customer Meters

15%

Source of Supply

incl Mains

7%

Info. and Comm.

Systems *

4%

Wastewater

3%

Other

12%

Capital Expenditure Plan, by Asset Type: 2011-2013

* includes Business Transformation capital spend

•

$800 -

$1 Billion in Capex

to be spent each year for

the foreseeable future

•

20% of Capital

Expenditures will be

recovered by

Infrastructure Surcharge

mechanisms

41 |

February 2011

42

Cash Flow from Operations Continues to Improve

Relative to Capital Expenditures (CAPEX)

No anticipated need for Equity Offering in 2011

Improving Cash Flow Metrics Increasingly Offset

Need for Capital Raising

CAPEX $800 Million -

$1 Billion |

* Not to scale

Key

Factors

Influencing

Earnings

* Not to scale

2011

Earnings

Per

Share

Guidance:

$1.65

-

$1.75

Interest

Rates

(+/-

1%)

2011 EPS Guidance

$1.65 -

$1.75

Consumption

(+/-1%)

Fuel &

Power

(+/-

10%)

Chemicals

(+/-

10%)

O&M

Expense

(+/-

1%)

$1.77

$1.63

$1.65

$1.75

February 2011

43 |

4.73%

5.28%

6.49%

2008

2009

2010

2011

Allowed ROE

Expected Return on Equity

10 % -

10.5 %

ROE

(2)

6.8% -

7.2%

1.

ROE calculation excludes impairment charges

2.

Range of allowed ROE

1.25%

Parent Co.

Debt

Opportunity

American Water continues to close ROE Gap

February 2011

44 |

February 2011

45

$235

$728

$816

$524

$485

$1,439

$7

$790

$70

$303

Total Debt:

$5,397M

5.5%

6.0%

6.0%

6.3%

6.0%

Weighted Average Interest Rates

Debt Maturities

(in millions)

Parent Company Debt

6.4%

*

* Amount excludes Preferred Stock with Mandatory Redemptions

|

February 2011

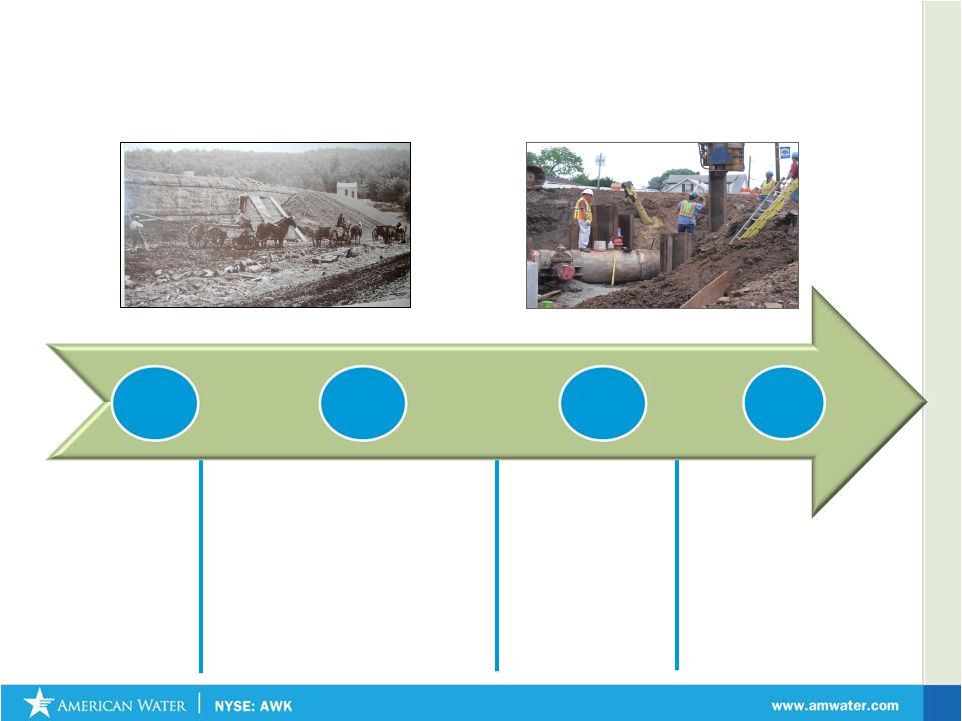

125 years Investing in Water Infrastructure and

paying Dividends to Shareholders

1886

1947

2003

2008

Dividend

paid to

private

holders

American Water

Listed on NYSE –

Dividend paid to

common

shareholders

RWE takes

AWK private.

Dividend

paid to

shareholder

AWK IPO

Lists on

NYSE. Pays

dividends to

common

shareholders

Watermain

work in Pennsylvania. in the early 1900’s

Infrastructure improvement in New Jersey in 2009

46 |

February 2011

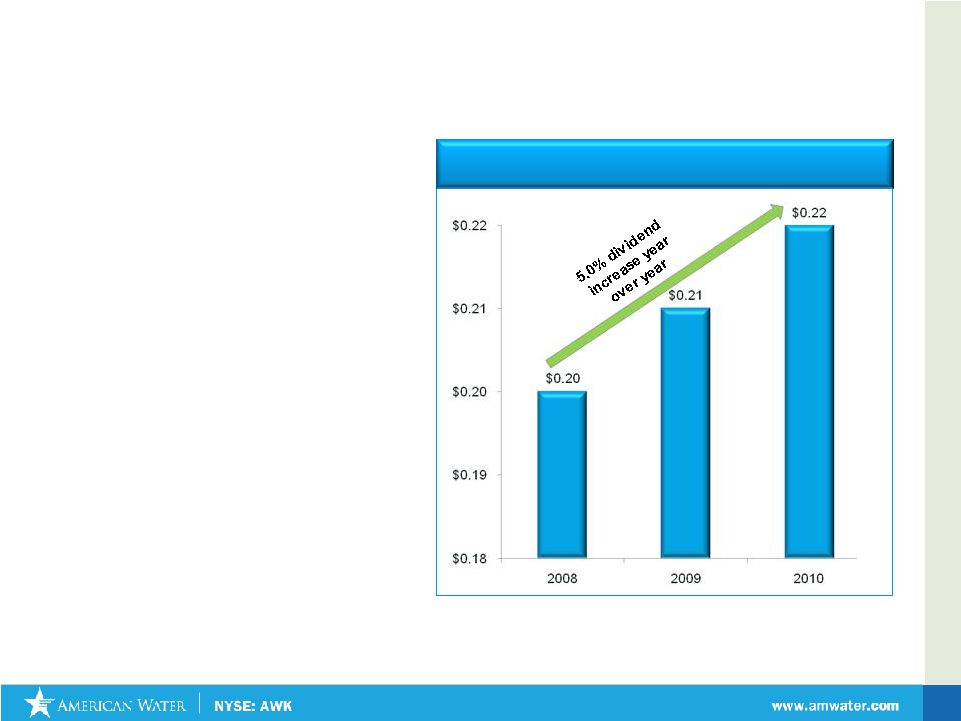

Recent Dividend History

Quarterly Dividend Rate as of Year-end

•

Key component of American

Water’s total shareholder return

proposition

•

Dividend Growth –

Board of

Directors increased dividend 5%

to $0.22 or $0.88 annualized

•

Dividend Yield –

3.3% at

2/9/2011

•

Growth in Dividend reflects

growth in Net Income

47 |

February 2011

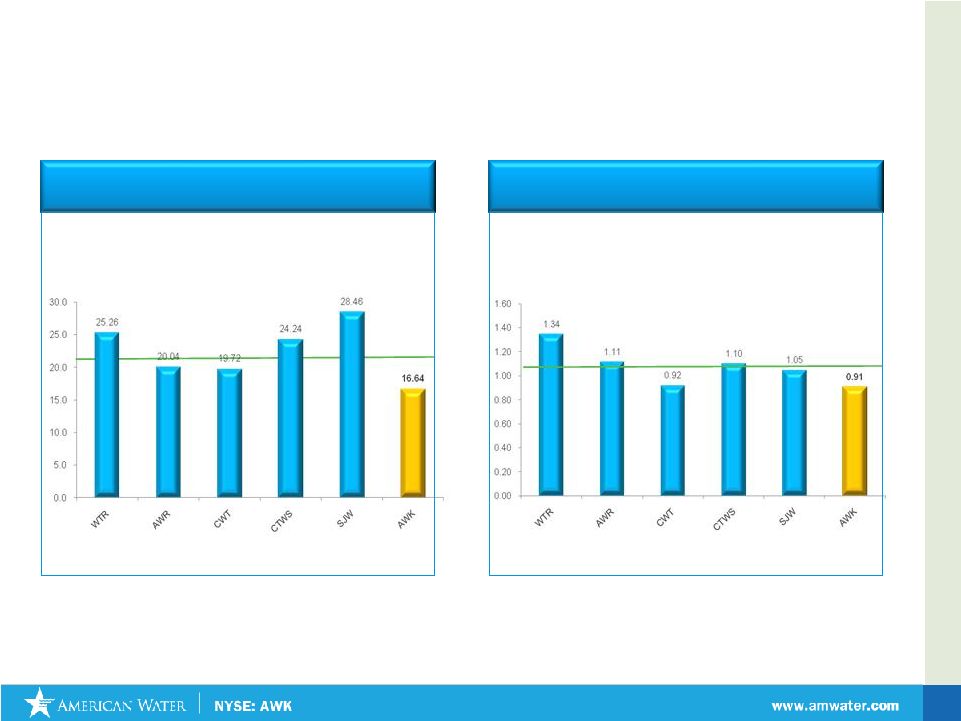

P/E Ratio

Enterprise Value* / Net PP&E*

American Water –

A Compelling Value

48

AW Stock Price at Average PE: $34.04

AW Stock Price at Highest PE: $43.26

AW Stock Price at Average EV/Net PP&E: $35.29

AW Stock Price at Highest EV/Net PP&E: $52.30

Average

Average

Close price 12/31/10 unless otherwise indicated; trailing twelve months diluted GAAP EPS as of

9/30/2010 *Data from Bloomberg Data Systems |

Closing |

February 2011

50

What to Expect from American Water in 2011

Start execution of Portfolio Optimization Initiative

December 15, 2010: Announcement of acquisition of Missouri

properties & sale of Texas American

January 24, 2011: Announcement of sale of Arizona American and

New Mexico American

Resolve Rate Cases worth $93MM of filed Annualized Revenues by

December 31, 2011

Initiate state specific efforts to address declining usage

Continue reduction in Operating Efficiency Ratio

Five-year goal below 40%

Increase Earned Regulated Return

Expand Market Based businesses with focus on Homeowner Services &

Military Contract Operations

Optimize Municipal Contract Operations Business Model

|

February 2011

American Water –

A Compelling Value

Value Proposition

Market

Leader

Strong Visible

Growth

Proven

Management

Trades at

Discount to Peers

Sound Regulatory

Framework

51 |

February 2011

Investor

Relations

Contacts:

•

Ed Vallejo

Vice

President

–

Investor

Relations

Edward.vallejo@amwater.com

•Muriel

Lange Manager

–

Investor

Relations

Muriel.lange@amwater.com

Tel: 856-566-4005

Fax: 856-782-2782

52 |

|