Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Air Transport Services Group, Inc. | d8k.htm |

Investor Meetings

February 2011

Joe Hete, President & CEO

Quint Turner, CFO

Exhibit 99.1 |

Safe Harbor,

Non-GAAP Reconciliations Except

for

historical

information

contained

herein,

the

matters

discussed

in

this

release

contain

forward-looking

statements

that

involve

risks

and

uncertainties.

There

are

a

number

of

important

factors

that

could

cause

Air

Transport

Services

Group's

("ATSG's")

actual

results

to

differ

materially

from

those

indicated

by

such

forward-looking

statements.

These

factors

include,

but

are

not

limited

to,

changes

in

market

demand

for

our

assets

and

services,

the

cost

and

timing

associated

with

the

modification

of

Boeing

767-200

and

767-300

aircraft,

ABX

Air’s

ability

to

maintain

on-time

service

and

control

costs

under

its

new

operating

agreement

with

DHL,

and

other

factors

that

are

contained

from

time

to

time

in

ATSG's

filings

with

the

U.S.

Securities

and

Exchange

Commission,

including

its

Annual

Report

on

Form

10-K

and

Quarterly

Reports

on

Form

10-Q.

Readers

should

carefully

review

this

release

and

should

not

place

undue

reliance

on

ATSG's

forward-looking

statements.

These

forward-looking

statements

were

based

on

information,

plans

and

estimates

as

of

the

date

of

this

release.

ATSG

undertakes

no

obligation

to

update

any

forward-looking

statements

to

reflect

changes

in

underlying

assumptions

or

factors,

new

information,

future

events

or

other

changes.

ATSG, Inc. Non-GAAP Reconciliation

EBITDA,

Adjusted

EBITDA

and

Net

Debt

are

non-GAAP

financial

measures

and

should

not

be

considered

alternatives

to

net

income

(loss)

or

any

other

performance

measure

derived

in

accordance

with

GAAP.

EBITDA

is

defined

as

income

(loss)

from

operations

plus

net

interest

expense,

provision

for

income

taxes,

depreciation

and

amortization.

Net

Debt

is

defined

as

Long-term

debt

obligations

plus

Current

portion

of

debt

obligations

minus

Cash

and

cash

equivalents.

The

Company’s

management

uses

these

adjusted

financial

measures

in

conjunction

with

GAAP

finance

measures

to

monitor

and

evaluate

its

performance,

including

as

a

measure

of

liquidity.

EBITDA,

Adjusted

EBITDA

and

Net

Debt

should

not

be

considered

in

isolation

or

as

a

substitute

for

analysis

of

the

Company’s

results

as

reported

under

GAAP,

or

as

alternative

measures

of

liquidity.

2008

2009

9Mo.10

3Q09

3Q10

(56,619)

45,358

43,352

4,647

16,670

Impairment of goodwill & intangibles

91,241

0

0

0

0

34,622

45,358

43,352

4,647

16,670

Interest Income

(2,335)

(449)

(241)

(74)

(83)

Interest Expense

37,002

26,881

14,424

6,236

4,641

Depreciation and amortization

93,752

83,964

65,310

19,954

22,758

163,041

155,754

122,845

30,763

43,986

GAAP Pre-tax Earnings (Loss)

Reconciliation Statement ($ in 000s)

Adjusted EBITDA from Cont. Oper.

from Continuing Operations

Adjusted Pre-Tax

Earnings

from Continuing Operations

Earnings from Continuing Operations Before Interest, Taxes, Depreciation

& Amortization (Adjusted EBITDA) Net Debt

12/31/07

12/31/08

12/31/09

9/30/10

Long term debt obligations

567,987

450,628

325,690

277,031

Current portion of debt obligations

22,815

61,858

51,737

36,112

Cash and cash equivalents

(59,271)

(116,114)

(83,229)

(44,465)

Net Debt

531,531

396,372

294,198

268,678

Reconciliation Statement ($ in 000s)

1 |

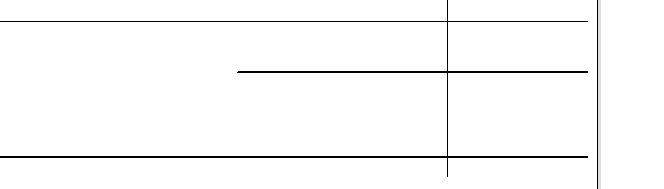

The

ATSG Story Premier Provider of Freighter Leasing & Support Services

Global Reach Via

Long-Term Relationships

With Large Global Clients

Favorable

Air Cargo

Industry Dynamics

ROIC Discipline

Drives Growth Capital

Allocations

Leading Position in

Converted Medium

Widebody Freighter Market

Strong Balance Sheet,

Lower-Risk

Free Cash Flow

Differentiated Model

Features ACMI & Dry

Leasing, Support Services

2 |

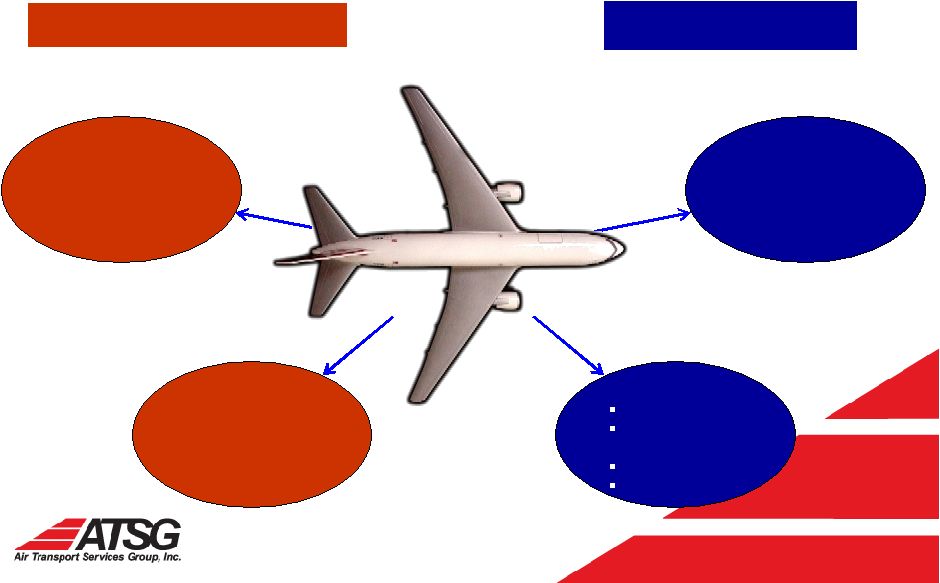

3

•

Provides 727, 757 ACMI services

•

Customers include BAX Schenker

and DHL

•

Provides 767, DC-8, DC-8 Combi

ACMI services

•

Customers include BAX Schenker,

U.S. Military and Qantas

•

Provides 767 ACMI/CMI services

•

Customers include DHL, JAL and

TNT

ACMI / CMI Businesses

Dry Leasing

Support Services

•

Heavy & line maintenance, component

overhaul, engineering & manufacturing

•

Customers include major airlines,

private operators

•

Dry leases 767, 757, 727 and DC-

8 freighters to ATSG airlines and

external customers

•

Access to engine maintenance

and component services

•

External customers include DHL,

Amerijet, CargoJet, First Air

•

Equipment leasing, and equipment and

facility maintenance services

•

Customers include: DHL, Allegiant Air,

Branson Airport, Tampa Intnl

Jet Center

•

Logistic support services

•

Sort management services for USPS

Unique Blend of Complementary Businesses |

4

ATSG Business Model

Cargo Aircraft Dry or ACMI, with Complementary Services

ACMI:

ACMI:

Dedicated Aircraft,

Dedicated Aircraft,

Crew, Maintenance

Crew, Maintenance

& Insurance

& Insurance

(excludes fuel)

(excludes fuel)

Charter:

Charter:

Unscheduled & military

Unscheduled & military

Dry Lease Plus

Dry Lease Plus

Crew

Crew

Airframe, Engine

Airframe, Engine

Maintenance

Maintenance

Pilot Training

Pilot Training

Cert. Support

Cert. Support

Standard

Standard

Dry Lease

Dry Lease

Leased Externally

Leased to ATSG Airline |

5

March 2010 DHL Agreements Transform ATSG

Growth with Secure Cash Flows, Minimal Risk

Thirteen seven-year 767F leases,

Aircraft operating agreement for five to ten years

Aircraft (A) Lease Terms

DHL

to

lease

thirteen

767Fs

from

CAM

under

7-year

terms;

DHL

responsible

for

airframe

and

engine maintenance costs

Airborne

Maintenance

and

Engineering

Services

(“AMES”)

will

provide

airframe

heavy

maintenance

DHL

provides

fuel

at

its

own

expense

Crew, Maintenance, Insurance (CMI) Agreement Terms

ABX

operates

13

aircraft

for

DHL

for

5

years,

with

2-year

extension

right

to

DHL,

2

nd

5

years

mutual

Defined-fee

scaled

for

the

number

of

aircraft;

logical

choice

to

support

domestic

network

expansion

ABX operates with monthly performance incentive bonuses

Subject

to

$70mm

amortizing

break-up

fee

if

DHL

prematurely

terminates

$26.35

million

balance

of

the

DHL

Note

(at

December

31,

2010)

amortizes

to

zero

over

the

CMI’s

term;

no

cash,

interest

fully

reimbursable |

6

ATSG Global Opportunities

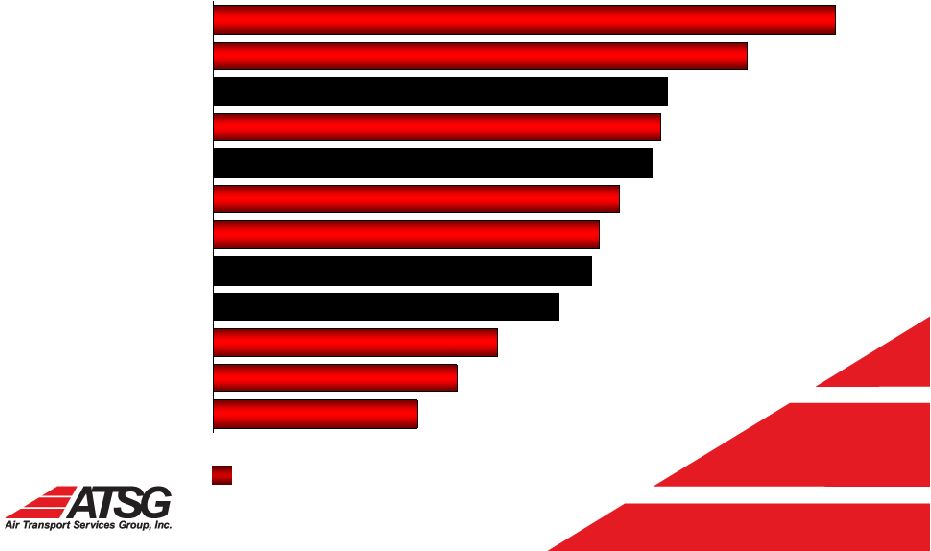

3.0%

3.6%

4.2%

5.1%

5.6%

5.7%

6.0%

6.5%

6.6%

6.7%

7.9%

9.2%

Intra North America

Intra Europe

Europe-N. America

Europe-Africa

Europe-Latin America

L. America-N. America

Europe-Middle East

S. Asia-Europe

Europe-Asia

Asia-N. America

Intra Asia

Intra China

ATSG target markets

Average Annual Demand Growth By Region, 2009-2029

Source: Boeing World Air Cargo Forecast, 2010-2011

|

7

Global Freighter Fleets

Big Opportunity in Medium-Size Market

Aircraft

Fuel

(gallon/

block hr)*

Crew

Payload (lbs.)/

Capacity (cu. ft.)

Range

(NM)

767-

300SF

1,775

2

124,900 / 16,034

3,200

767-

200SF

1,380

2

100,000 / 11,138

2,800

A300-B4

1,900

3

99,200 / 11,445

1,680

A300-600F

1,850

2

104,900 / 14,654

2,650

A310-300F

1,390

2

88,420 / 10,922

3,360

DC-8 63

1,760

3

96,800 / 10,060

2,150

DC-8 73

1,600

3

111,800 / 10,060

2,470

Sources: Boeing, Airbus

Medium Freighter Comparisons

Standard body

Medium Widebody

Large Widebody

2009: 1,755 freighters

2029: 2967 freighters (est.)

650

475

630

800

980

1187

Medium Wide-bodies

Gaining Freighter Share |

8

767s Serve Asia, Americas, Europe:

‘Spoke’

Routes from Global Airfreight Hubs

767-200ER,

767-300ER Ranges

w/ max. payload

Frankfurt

Miami

Hong

Kong

45-60 ton payload potential to

global “gateway”

cargo

airports, regional hub cities.

Pallet size, layout options

complement larger 747/ 777s.

Miami

767 reaches booming Brazil markets, perishable food and

floral markets in Colombia, Venezuela, Puerto Rico, etc.

Frankfurt

Range covers NE U.S., entire Middle East, Mumbai &

New Delhi, Lagos, Moscow, etc.

Hong Kong

Entire Asian continent from India to all of China and

Japan, plus Australia/New Zealand |

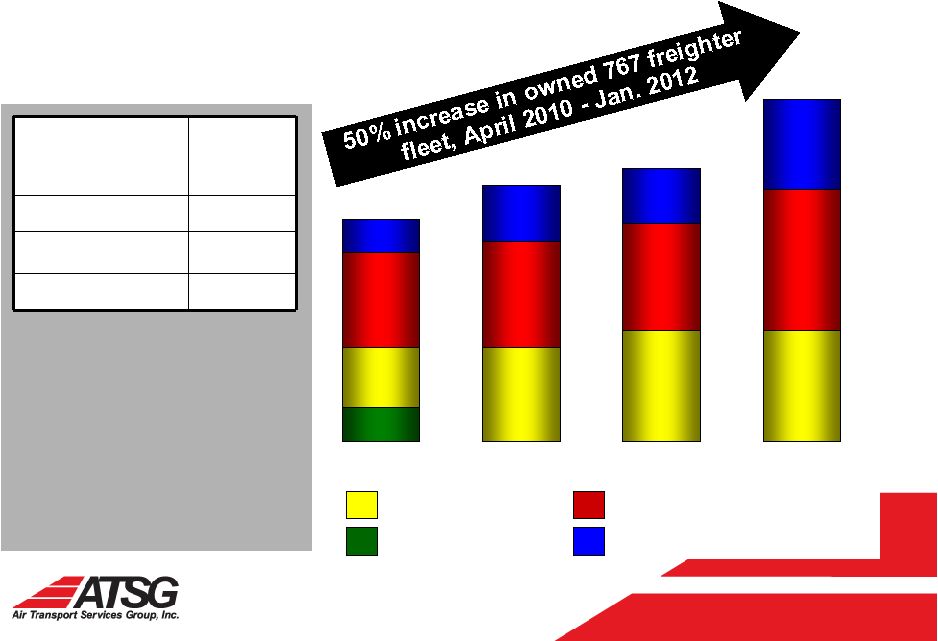

9

ATSG Investment Strategy:

Value-Creating Freighter Conversions

11-13

11-20*

April 2011

Jan. 2012

DHL-CAM Dry Leased

Other Customers-CAM Dry Leased

14

11

Jan. 2011

4

*

Includes conversion by 2012 of ten owned Boeing 767-200s,

three Boeing 767-300s. Excludes one 767-300 in ACMI

service under 45-mo. operating lease beginning Nov. 2010.

Deployment as leased vs. ACMI operated aircraft subject to

market conditions, customer preference.

7

11

April 2010

DHL-Interim Leased

ACMI Services-ACMI/Charter

13

13

4

5

6-8

6-15*

26

30*

32*

39*

Dry Lease Investment

Return Illustration*

(in millions)

(13)

767-Series

Freighters

Capex Required

$200 MM

Projected EBIT

$23.4 MM

Unlevered ROIC

11.7%

*

Margin from ACMI or other

complementary services would be

incremental. |

10

Go-to-Market Strategy

Drive higher return on capital by optimally

positioning opportunities and bundling

additional services

Bundled marketing strategy led by neutral,

non-airline, lead sales organization

Develop packaged programs cross-selling

entities

Amerijet International program (ACMI

migration to CAM-leased 767s, with full

ATSG support) symbolizes this approach

Market Approach

Market Opportunities

Airline Operators

Key drivers

Replacement

Capacity growth

New markets

Non-Operators

Examples

Forwarders/Brokers

Integrators

Shippers |

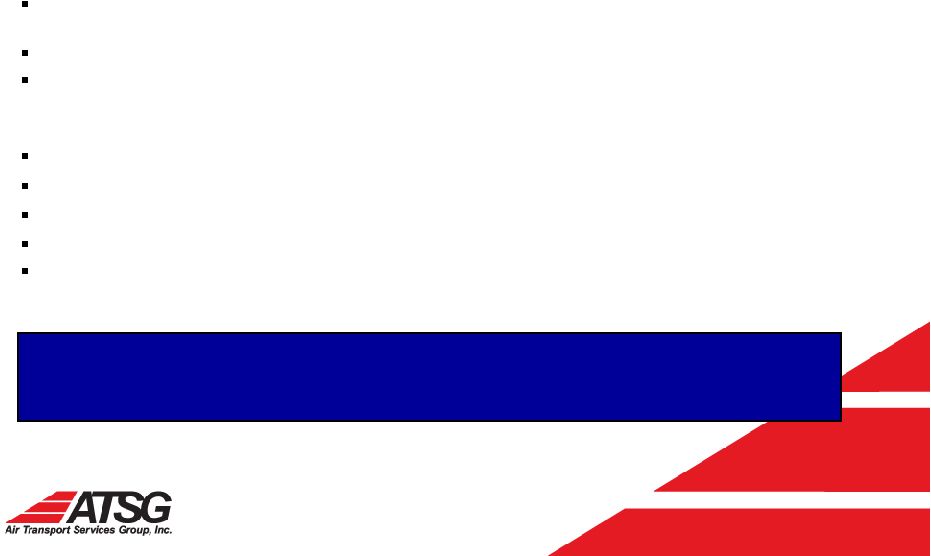

11

Flexible

Global

Solutions

Premier Source of Medium Freighter Solutions

•

767-200, -300

with GE CF6

engines

•

Low fuel burn

•

Low

maintenance

cost

•

Flexible

configuration

•

Power By Hour

engine services

The Global Leader of Medium Wide Body Operating and Leasing Solutions

Efficient Medium

Wide-Body

Aircraft

Dry leasing

ACMI/ wet

leasing

CMI

Combi

Full service

charter

Flight

operations

Heavy

maintenance

Line

maintenance

Maintenance

programs

Engineering

Technical

support

Manual services

Parts,

components

sales & service

Aircraft

conversion

services

Global

aircraft

deployment

Logistics

support

DHL

BAX

Schenker

TNT

JAL

UPS

Qantas

Amerijet

Air

Mobility

Command

CargoJet

Bundled

Maintenance

Solutions

Program

Management

Diverse,

Blue-Chip

Customer Base |

12

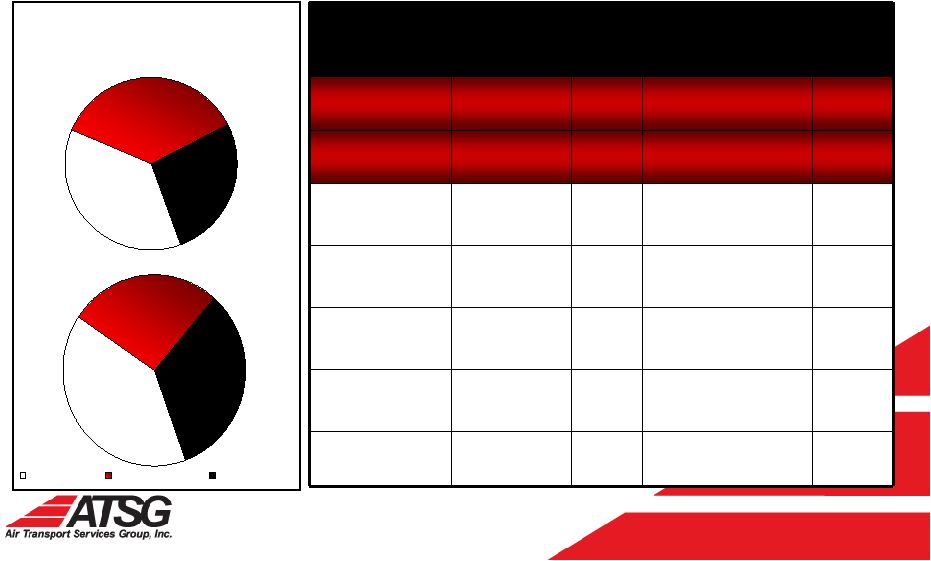

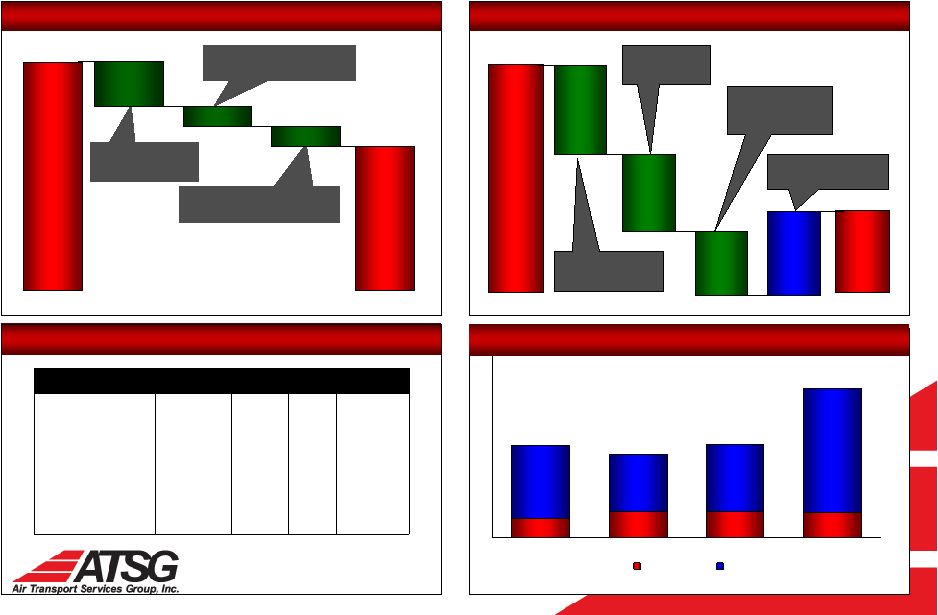

Balance Sheet Improves as Earnings Grow

EBITDA* (from continuing operations)

Pre-tax Earnings (from continuing operations)

Net Debt*

Stockholders’

Equity

$531.5

$396.4

$294.2

$268.7

$200.0

$80.4

$246.0

$297.2

$155.8

$122.8

2008

2009

9Mo 2010

$30.8

$44.0

2009

2010

Year

Third Quarter

Year

Third Quarter

-$56.6

$45.4

$43.4

2008

2009

9 Mo 2010

$34.6**

$4.6

$16.7

2009

2010

12/31/07

12/31/08

12/31/09

9/30/10

12/31/07

12/31/08

12/31/09

9/30/10

$163.0**

No settlement or

severance from legacy

DHL agreements.

*

EBITDA is defined as income (loss) from operations plus net interest expense, provision for income

taxes, depreciation and amortization. Net Debt is defined as Long-Term Debt Obligations

plus Current Portion of Debt Obligations minus Cash and Cash Equivalents. EBITDA, and Net Debt are non-GAAP financial

measures and should not be considered alternatives to net income (loss) or any other performance

measure derived in accordance with GAAP. See non-GAAP Reconciliation

Tables. * * 2008 EBITDA and 2008 Pre-tax Earnings adjusted to exclude

impairment charges of $91.2 million. |

13

Employer

Employer

contributions

contributions

DHL promissory

DHL promissory

note extinguishment

note extinguishment

De-levering Continues:

Cash Flow Available for Current Capex Commits

Transfer of aircraft

Transfer of aircraft

capital leases to DHL

capital leases to DHL

Principal

Principal

payments

payments

$313.1

$512.5

12/31/2008

9/30/2010

Total Debt Reduced 39%

Credit Facility Covenant Compliance

$98.3

$297.3

Actuarial costs

Actuarial costs

& adjustments

& adjustments

$119.6

$102.5

$102.4

Workforce

Workforce

contraction

contraction

& plan freeze

& plan freeze

$79.3

$ in millions

Gains on

Gains on

assets

assets

12/31/2008

9/30/2010

Post-Retirement Liabilities Reduced 64%

$ in millions

$31

$32

$30

$90

$70

$82

$22

Maintenance

Growth

2008

2009

2010

2011 est.

$170-200

$112

$101

$ in millions

* Requirements at year-end 2008 were 3.00 / 3.50 /

1.50 / 1.25

** Based upon twelve months trailing EBITDA

Capital Spending Trends

$104.2

$49.5

$45.7

Required*

2008

2009

3Q2010**

First Lien Debt /

EBITDA

< 2.75

2.58

2.17

1.83

Total Debt /

EBITDA

< 3.25

3.10

2.44

1.99

Fixed Charge

Coverage Ratio

> 1.50

2.55

1.99

2.17

Capital

Expenditures

> 1.05

1.58

1.65

1.20

$114

$140-

170*

* Actual 2011 growth capital spending will depend on the cost and timing to acquire

and convert additional aircraft, including Boeing 757 aircraft into

combi configuration. |

14

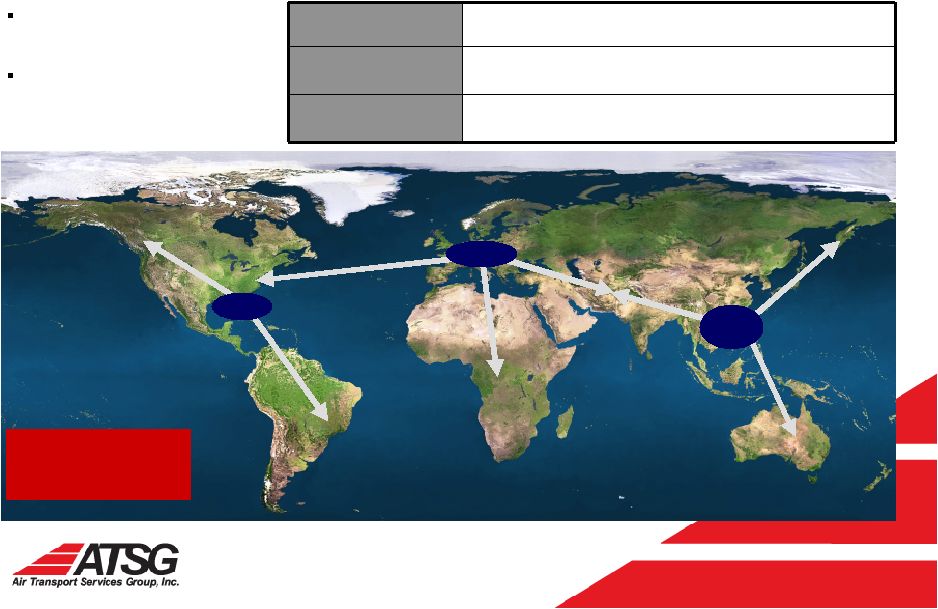

New Business on Three Continents

•

On

November

1,

ABX

Air

began

operating

one

Boeing

767-200

freighter

for

Japan

Airlines

in

ACMI

service

in

Asia.

•

Also on November 1, ATI added one DC-8 freighter and CCIA added

one

727

freighter

to

BAX

Global’s

North

American

network.

•

Amerijet

exercised

the

first

of

three

options

for

a

767-200

freighter

for

a

seven-year

dry

lease,

to

be

delivered

in

the

first

quarter.

Amerijet

currently

leases

two

767-200

freighters

from

CAM.

•

On

November

7,

ABX

Air

began

transatlantic

ACMI

service

for

DHL

between

England

and

Cincinnati

via

a

767-300

freighter

that

ABX

Air

has

leased

from

a

third

party.

•

In

October,

DHL

selected

ABX

Air

to

operate

four

of

DHL’s

own

Boeing

767

freighters

in

its

U.S.

network,

under

terms

of

the

CMI

agreement.

The

four

are

in

addition

to

13

Boeing

767s

that

CAM

will

lease

and

ABX

Air

operates

in

the

U.S.

for

DHL. |

15

ATSG Value Gaining Altitude

Limited

risk,

strong

cash

and

asset-value

returns

from

converted

767Fs

Expanding

767

freighter

fleet

will

yield

attractive,

annuity-like

cash

ROIs

via

long-term

leases

ACMI/CMI

flexibility

offers

options,

low-risk

transition

to

widebody

767s

from

older

narrow-bodies

767

platform

flexible

as

transcontinental

leader,

compatible

feeder

to

intercontinental

747s/777s

Significant

market-value

gains

on

P-2-F

aircraft

conversion

investments

Long-term

agreements

with

key

customers

Lease/CMI

approach

unlocks

value

of

aircraft

from

ACMI,

creates

more

options

for

customers

18

767s

&

757s

now

under

fixed

3-7

year

leases

or

operating

agreements

with

DHL,

CargoJet,

Amerijet,

etc.

5-year

CMI

with

DHL,

with

performance

factor

plus

$31m

amortized

note

forgiveness,

DPW

backing

Integrated, value-added services

Increase

return

on

invested

capital

Comprehensive

mix

allows

for

turnkey

customer

solutions

Competitive

terms

and

service

packages

for

third

party

maintenance

business

Attractive

balance

sheet

and

liquidity,

growth

capital

capacity

Low

debt-to-EBITDA

leverage;

limited

off-balance

sheet

obligations

2011

capital

requirements

can

be

financed

using

existing

cash

and

credit

resources

Secure

long-term

cash

flow

enhances

access

to

growth

capital

if

needed

Expanding opportunities around the globe

Expanding

presence

in

large,

fast-growing

air

cargo

regions:

Asia,

South

America,

Europe,

Middle

East/Africa

Sole

provider

of

combi

airlift

to

military

Uniquely

positioned

as

largest

independent

source

of

the

premier

medium

wide-body

freighter

–

the

Boeing

767 |

16

*

*

*

*

*

Appendix |

17

Balance Sheet Trend

September 30,

Dec. 31,

September 30,

Dec. 31

2010

2009

2009

2008

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

44,465

$

83,229

89,699

$

116,114

Marketable securities - available-for-sale

-

-

-

26

Accounts receivable, net of allowances

37,331

87,708

95,071

87,857

Inventory

5,769

5,226

6,523

11,259

Prepaid supplies and other

10,480

7,093

8,900

11,151

Deferred income taxes

31,597

31,597

20,171

20,172

Aircraft and engines held for sale

-

30,634

32,521

2,353

TOTAL CURRENT ASSETS

129,642

245,487

252,885

248,932

Property and equipment, net

660,988

636,089

614,433

671,552

Other assets

28,463

21,307

22,225

25,281

Deferred income taxes

-

-

1,040

54,807

Intangibles

9,472

10,113

10,335

11,000

Goodwill

89,777

89,777

89,777

89,777

TOTAL ASSETS

918,342

$

$1,002,773

990,695

$

$1,101,349

LIABILITIES AND STOCKHOLDERS' EQUITY

CURRENT LIABILITIES:

Accounts payable

37,329

$

38,174

32,825

$

36,618

Accrued salaries, wages and benefits

23,651

44,077

37,605

63,500

Accrued severance and retention

1,039

18,959

13,718

67,846

Accrued expenses

15,367

16,429

20,628

13,772

Current portion of debt obligations

36,112

51,737

55,487

61,858

Unearned revenue

14,335

15,340

17,251

14,813

TOTAL CURRENT LIABILITIES

127,833

184,716

177,514

258,407

Long-term obligations

277,031

325,690

350,463

450,628

Post-retirement liabilities

97,292

152,297

239,292

294,881

Other liabilities

54,863

44,044

44,321

17,041

Deferred income taxes

64,172

50,044

-

-

STOCKHOLDERS' EQUITY:

Preferred stock, 20,000,000 shares authorized, including 75,000 Series

A Junior Participating Preferred Stock

-

-

-

-

Common stock, par value $0.01 per share;

638

634

635

632

Additional paid-in capital

513,898

502,822

495,551

460,155

Accumulated deficit

(183,090)

(211,085)

(222,593)

(245,534)

Accumulated other comprehensive loss

(34,295)

(46,389)

(94,488)

(134,861)

TOTAL STOCKHOLDERS' EQUITY

297,151

245,982

179,105

80,392

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

918,342

$

1,002,773

$

990,695

$

1,101,349

$

|