Attached files

| file | filename |

|---|---|

| 8-K - AMERICAN EXPRESS CO | c64401_8k.htm |

American Express Company

Financial Community Meeting

Kenneth Chenault

Chairman and Chief Executive Officer

Doug Buckminster

President, International Consumer Card and Small

Business Services

February 9, 2011

This presentation contains certain non-GAAP financial disclosures, including information regarding the

Company’s “International Business Operations” and information that is reported

on a “managed” basis.

International Business Operations (IBO) includes the Company's International Card Services (ICS)

segment as well as the international portions of the Global Commercial Services (GCS) and the Global

Network

& Merchant Services (GNMS) segments. Reconciliations of this information to GAAP

information is included in the annexes. The Company is presenting information on an IBO basis

because management believes it presents a useful

perspective on the performance of the Company’s

international businesses. International represents the sum of the Europe, Middle East and Africa

(EMEA) region, the Japan, Asia/Pacific and Australia (JAPA) region and the Latin America,

Caribbean

and Canada (LACC) region to be set forth in the geographic operations footnote to the Company’s 2010

consolidated financial statements. Due to system limitations related to geographic reporting prior to

2008, the Company

is unable to identify the specific nature of the reconciling items related to amounts

previously reported in the Company’s financial statements and the IBO basis presentation. Managed

basis assumes no securitization transactions, i.e.,

all securitized loans and related income effects are

reflected as if they were in the Company's balance sheet and income statement, respectively. The

Company is presenting information on a managed basis because that is the way management

views

and manages the business. Management believes that a full picture of trends in the Company's

cardmember lending business can only be derived by evaluating the performance of both securitized

and non-securitized cardmember loans,

and that use of a managed basis presentation presents a more

comprehensive portrayal of the key dynamics of the cardmember lending business. These non-GAAP

measures are not intended to replace the Company’s GAAP information.

2

Note Relating to Non-GAAP Financial

Disclosures

This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to

risks and uncertainties. The

forward-looking statements, which address the company’s expected business and financial performance, among other

matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,”

“intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,”

“likely,” and similar expressions. Readers are cautioned not to place undue reliance

on these forward-looking statements, which speak only as of the

date on which they are made. The Company undertakes no obligation to update or revise any forward-looking statements. Factors that could cause

actual results to differ

materially from these forward-looking statements, include, but are not limited to, the following:

changes in global economic and business conditions, including consumer and business spending, the availability and cost of credit, unemployment and

political conditions, all of which may significantly

affect spending on the Card, delinquency rates, loan balances and other aspects of our business and

results of operations;

changes in capital and credit market conditions, which may significantly affect the Company’s ability to meet its liquidity needs, access to capital and

cost of capital, including changes

in interest rates; changes in market conditions affecting the valuation of our assets; or any reduction in our credit

ratings or those of our subsidiaries, which could materially increase the cost and other terms of our funding, restrict our access to the

capital markets or

result in contingent payments under contracts;

litigation, such as class actions or proceedings brought by governmental and regulatory agencies (including the lawsuit filed against the Company by

the U.S. Department of Justice and certain

state attorneys general), that could result in (i) the imposition of behavioral remedies against the Company or

the Company’s voluntarily making certain changes to its business practices, the effects of which in either case could have a material adverse

impact on

the Company’s financial performance; (ii) the imposition of substantial monetary damages in private actions against the Company; and/or (iii) damage

to the Company’s global reputation and brand;

the Company’s net interest yield on U.S. cardmember loans not trending over time to historical levels as expected, which will be influenced by, among

other things, the effects of the CARD

Act (including the regulations requiring the Company to periodically reevaluate APR increases), interest rates,

changes in consumer behavior that affect loan balances, such as paydown rates, the Company’s cardmember acquisition strategy, product mix,

credit

actions, including line size and other adjustments to credit availability, and pricing changes;

legal and regulatory developments wherever we do business, including legislative and regulatory reforms in the United States, such as the Dodd-Frank

Act’s stricter regulation of large, interconnected

financial institutions, changes in requirements relating to securitization and the establishment of the

Bureau of Consumer Financial Protection, which could make fundamental changes to many of our

business practices or materially affect our capital

requirements, results of operations, ability to pay dividends or repurchase our stock; or actions and potential future actions by the FDIC and credit rating

agencies applicable to securitization trusts,

which could impact the company’s ABS program;

changes in the substantial and increasing worldwide competition in the payments industry, including competitive pressure that may impact the prices

we charge merchants that accept our Cards and

the success of marketing, promotion or rewards programs;

changes in technology or in our ability to protect our intellectual property (such as copyrights, trademarks, patents and controls on access and

distribution), and invest in and compete

at the leading edge of technological developments across our businesses, including technology and intellectual

property of third parties whom we rely on, all of which could materially affect our results of operations;

3

Cautionary Note Regarding Forward-

Looking Statements

data breaches and fraudulent activity, which could damage our brand, increase our costs or have regulatory implications, and changes in regulation

affecting privacy and data security under federal,

state and foreign law, which could result in higher compliance and technology costs to ourselves or our

vendors;

changes in our ability to attract or retain qualified personnel in the management and operation of the company’s business, including any changes that may

result from increasing regulatory

supervision of compensation practices;

changes in the financial condition and creditworthiness of our business partners, such as bankruptcies, restructurings or consolidations, involving

merchants that represent a significant portion

of our business, such as the airline industry, or our partners in Global Network Services or financial

institutions that we rely on for routine funding and liquidity, which could materially affect our financial condition or results of operations;

uncertainties associated with business acquisitions, including the ability to realize anticipated business retention, growth and cost savings or effectively

integrate the acquired business into

our existing operations;

the underlying assumptions related to the Company’s pending acquisition of Loyalty Partner proving to be inaccurate; unrealized events impacting the

likelihood and timing of the completion

of the transaction; the Company’s ability to exploit the assets to be acquired upon consummation of the transaction;

and the Company's ability to execute its acquisition strategy including expanding to other countries, cross-selling and developing

new products;

changes affecting the success of our reengineering and other cost control initiatives, which may result in the company not realizing all or a significant

portion of the benefits that

we intend;

the actual amount to be spent by the Company on investments in the business, including on marketing, promotion, rewards and cardmember services and

certain other operating expenses, which will

be based in part on management’s assessment of competitive opportunities and the Company’s performance

and the ability to control and manage operating, infrastructure, advertising and promotion expenses as business expands or changes;

the effectiveness of the Company’s risk management policies and procedures, including credit risk relating to consumer debt, liquidity risk in meeting

business requirements and operational

risks;

changes affecting our ability to accept or maintain deposits due to market demand or regulatory constraints, such as changes in interest rates and

regulatory restrictions on our ability to obtain

deposit funding or offer competitive interest rates, which could affect our liquidity position and our ability to

fund our business; and

factors beyond our control such as fire, power loss, disruptions in telecommunications, severe weather conditions, natural disasters, terrorism, “hackers”

or fraud, which could affect

travel-related spending or disrupt our global network systems and ability to process transactions.

A further description of these uncertainties and other risks can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2009,

its Quarterly Reports on Form

10-Q for the three months ended March 31, June 30, and September 30, 2010, and the Company’s other reports filed with

the SEC.

4

Cautionary Note Regarding Forward-

Looking Statements (cont’d)

5

Annex 1

($ in millions)

2010

2009

%Inc/(Dec)

GAAP Total Revenues Net of Interest Expense

$27,819

$24,523

13%

Securitization Adjustments:

Discount revenue, net card fees and other

NA

331

Interest income

NA

3,097

Securitization income, net

NA

(400)

Interest expense

NA

(244)

Managed Total Revenues Net of Interest

Expense

$27,819

$27,307

2%

6

Annex 2

*FX adjusted information assumes a constant exchange rate between the periods being compared for purposes of currency translation into U.S. dollars. (e.g., assumes foreign exchange

rate used

for Q4'10 applies to Q4'09; rate used for Q3’10 applies to Q3’09, etc.)

Billed Business Metrics - Reported & FX Adjusted*

% increase/(decrease) vs. prior year:

Q1'08

Q2'08

Q3'08

Q4'08

Q1'09

Q2'09

Q3'09

Q4'09

Q1'10

Q2'10

Q3'10

Q4'10

Worldwide

Reported

14%

12%

8%

(10%)

(16%)

(16%)

(11%)

8%

16%

16%

14%

15%

FX Adjusted

11%

10%

7%

(5%)

(12%)

(13%)

(9%)

4%

12%

15%

14%

14%

International Business Operations

Reported

27%

26%

17%

(12%)

(19%)

(19%)

(9%)

21%

27%

19%

17%

16%

FX Adjusted

15%

16%

14%

3%

(3%)

(7%)

(3%)

7%

14%

16%

16%

15%

7

Annex 3

Cardmember Lending

($ in billions, except percentages)

Q1'07

Q2'07

Q3'07

Q4'07

Q1'08

Q2'08

Q3'08

Q4'08

Q1'09

Q2'09

Q3'09

Q4'09

Total Loans

Worldwide Cardmember Lending

Reported (GAAP)

$42.2

$48.2

$50.4

$54.4

$49.4

$49.6

$45.7

$42.2

$36.7

$32.5

$31.5

$32.8

Managed

$63.1

$68.5

$71.9

$77.1

$75.1

$76.5

$75.5

$72.0

$65.0

$62.9

$60.7

$61.8

Net Write-off Rate

Worldwide

Reported (GAAP)

7.4%

Managed

7.3%

USCS

Reported (GAAP)

4.5%

5.8%

6.1%

7.0%

8.5%

10.3%

9.8%

8.0%

Managed

4.3%

5.3%

5.9%

6.7%

8.5%

10.0%

8.9%

7.5%

2006

2007

2008

2009

2010

Total Loans Year Over Year

Reported (GAAP)

Managed

$43.3

$63.5

$54.4

$77.1

$42.4

$72.0

$32.8

$61.8

$60.9

$60.9

Growth Rate vs. Prior Year

Reported (GAAP)

Managed

31%

17%

26%

22%

(22%)

(7%)

(22%)

(14%)

86%

(1%)

Annex 4 (A)

($ in millions, except percentages)

(A) Beginning in the first quarter of 2010, the Company changed the manner in which it allocates related interest expense and capital to its reportable operating segments to more accurately reflect

the funding and capital characteristics of the Company's segments. The change to interest allocation impacted the segment’s net interest yield on cardmember loans. Accordingly, the net interest

yields for periods prior to the first quarter

of 2010 have been revised for this change. (B) For periods ended on or prior to December 31, 2009, the Company's cardmember loans and related debt

performance information on a GAAP basis was referred to as the “owned” basis presentation. The information

presented on a GAAP basis for such periods includes only non-securitized cardmember

loans that were included in the Company’s balance sheet. Effective January 1, 2010, the Company’s securitized portfolio of cardmember loans and related debt is

also consolidated on its balance

sheet upon the adoption of the new GAAP. Accordingly, beginning January 1, 2010, the GAAP basis presentation includes both securitized and non-securitized cardmember loans. Refer to page 19

of the earnings financial

tables for a discussion of GAAP basis information. (C) Represents net interest income allocated to the Company's cardmember loans portfolio on a GAAP or managed basis,

as applicable, in each case excluding the impact of card fees on loans and

balance transfer fees attributable to the Company's cardmember loans. (D) Represents average cardmember loans on a

GAAP or managed basis, as applicable, in each case excluding the impact of deferred card fees, net of deferred direct acquisition costs of

cardmember loans. (E) This calculation includes elements

of total interest income and total interest expense that are not attributable to the cardmember loan portfolio, and thus is not representative of net interest yield on cardmember loans.

The calculation

includes interest income and interest expense attributable to investment securities and other interest-bearing deposits as well as to cardmember loans,and interest expense attributable to other

activities, including cardmember receivables.

(F) Net interest yield on cardmember loans is a non-GAAP financial measure that represents the net spread earned on cardmember loans. Net interest

yield on cardmember loans is computed by dividing adjusted net interest income by adjusted average

loans, computed on an annualized basis. The calculation of net interest yield on cardmember

loans includes interest that is deemed uncollectible. For all presentations of net interest yield on cardmember loans, reserves and net write-offs related

to uncollectible interest are recorded through

provisions for losses - cardmember loans; therefore, such reserves and net write-offs are not included in the net interest yield calculation. (G) For periods ended on or prior to December 31, 2009,

information presented is based on the Company’s historical non-GAAP, or “managed” basis presentation. Unlike the GAAP basis presentation, the information presented on a managed basis in such

periods includes both the securitized and non-securitized

cardmember loans. The adoption of new GAAP on January 1, 2010 resulted in accounting for both the Company's securitized and non-

securitized cardmember loans in the consolidated financial statements. As a result, the Company's 2010 GAAP presentations and

managed basis presentations prior to 2010 are generally

comparable. Refer to page 19 in the earnings financial tables for a discussion of managed basis information.(H) For periods ended on or prior to December 31, 2009, the information presented

includes

the adjustments to the GAAP "owned" basis presentation for such periods attributable to securitization activity for interest income and interest expense to arrive at the non-GAAP "managed"

basis information, which adjustments are set forth under the U.S.

Card Services managed basis presentation on page 22 of the earnings financial tables.

8

12/31/08

3/31/09

6/30/09

9/30/09

12/31/09

3/31/10

6/30/10

9/30/10

12/31/10

USCS - Calculation based on 2010 and 2009 GAAP information (B):

Net interest income

$669

$766

$612

$649

$621

$1,221

$1,111

$1,124

$1,122

Average loans (billions)

$33.2

$30.2

$26.5

$23.4

$22.7

$50.5

$49.1

$49.1

$49.8

Adjusted net interest income (C)

$725

$775

$581

$558

$537

$1,246

$1,145

$1,150

$1,143

Adjusted average loans (billions) (D)

$33.3

$30.3

$26.6

$23.5

$22.8

$50.5

$49.2

$49.2

$49.8

Net interest income divided by average loans (E)

8.0%

10.3%

9.3%

11.0%

10.9%

9.8%

9.1%

9.1%

8.9%

Net interest yield on cardmember loans (F)

8.7%

10.4%

8.8%

9.4%

9.4%

10.0%

9.3%

9.3%

9.1%

USCS - Calculation based on 2010 and 2009 managed information (G):

Net interest income (H)

$1,341

$1,569

$1,335

$1,305

$1,292

$1,221

$1,111

$1,124

$1,122

Average loans (billions)

$63.0

$59.1

$55.1

$52.9

$51.8

$50.5

$49.1

$49.1

$49.8

Adjusted net interest income (C)

$1,418

$1,592

$1,343

$1,315

$1,308

$1,246

$1,145

$1,150

$1,143

Adjusted average loans (billions) (D)

$63.1

$59.2

$55.2

$53.0

$51.9

$50.5

$49.2

$49.2

$49.8

Net interest yield on cardmember loans (F)

8.9%

10.9%

9.7%

9.8%

10.0%

10.0%

9.3%

9.3%

9.1%

Quarters Ended

Annex 5

Note: The Company is presenting information on an IBO basis because management believes it presents a useful perspective on the performance of the Company’s

international businesses.

*Unallocated Corporate & Other Segment represents Corporate & Other Segment results which are not directly allocable to specific geographic regions. Examples include

costs

related to the negative spread earned on excess liquidity and executive office operations. **International represents the sum of the Europe, Middle East and Africa

(EMEA) region, the Japan, Asia/Pacific and Australia (JAPA) region and the Latin America,

Caribbean and Canada (LACC) region to be set forth in the geographic

operations footnote to the Company’s 2010 consolidated financial statements. ***Due to system limitations related to geographic reporting prior to 2008, the Company is

unable

to identify the specific nature of the reconciling items related to amounts previously reported in the Company’s financial statements and the IBO basis presentation.

****FX adjusted information assumes the average exchange rate in 2010 applies to all

prior periods for purposes of currency translation into U.S. dollars.

$ in millions; % increase/(decrease)

2006

2007

2008

2009

2010

GAAP Consolidated Pretax Income

$5,152

$5,694

$3,581

$2,841

$5,964

Pretax Income from continuing ops - United States

$4,312

$4,984

$3,322

$3,131

$6,112

Pretax Income from continuing ops - Unallocated Corp & Other Segment*

NA

NA

($527)

($1,162)

($1,527)

Pretax Income from continuing ops - International**

$840

$710

$786

$872

$1,379

Reconciliation to International Business Operations (IBO) Basis Presentation

Pretax Income from continuing ops - International**

$840

$710

$786

$872

$1,379

Reconciling Items***

($89)

($3)

-

-

-

Pretax Income from continuing ops - IBO Basis

$751

$707

$786

$872

$1,379

FX Adjustment****

$67

$16

($70)

$24

NA

Pretax Income from continuing ops - IBO Basis FX Adjusted

$818

$723

$716

$896

$1,379

PTI Growth IBO Basis FX Adj.

(12%)

(1%)

25%

54%

PTI Growth IBO Basis

(6%)

11%

11%

58%

PTI Growth International

(15%)

11%

11%

58%

PTI Growth Consolidated

11%

(37%)

(21%)

110%

PTI CAGR 2006 to 2010 IBO Basis FX Adj.

14%

PTI CAGR 2006 to 2010 IBO Basis

16%

PTI CAGR 2006 to 2010 International

13%

PTI CAGR 2006 to 2010 Consolidated

4%

9

Annex 6

10

*FX adjusted information assumes the average exchange rate in 2010 applies to all prior periods for purposes of currency translation into U.S. dollars.

Billed Business Metrics - Reported & FX Adjusted*

$ in billions, % increase/(decrease) vs. prior year:

2006

2007

2008

2009

2010

International Business Operations

Reported

154.7

$

188.0

$

212.2

$

196.1

$

234.0

$

FX Adjusted

163.3

$

185.6

$

205.8

$

202.7

$

234.0

$

Reported

22%

13%

(8%)

19%

FX Adjusted

14%

11%

(2%)

15%

CAGR 2006-2010 - Reported

11%

CAGR 2006-2010 - FX Adjusted

9%

"Growth Markets"

Reported

30.3

$

30.5

$

39.2

$

FX Adjusted

28.7

$

32.8

$

39.2

$

CAGR 2008-2010 - Reported

14%

CAGR 2008-2010 - FX Adjusted

17%

Annex 7

Note: The Company is presenting information on an IBO basis because management believes it presents a useful perspective on the performance of the Company’s

international businesses.

*Unallocated Corporate & Other Segment represents Corporate & Other Segment results which are not directly allocable to specific geographic regions. Examples include

costs

related to the negative spread earned on excess liquidity and executive office operations. **International represents the sum of the Europe, Middle East and Africa

(EMEA) region, the Japan, Asia/Pacific and Australia (JAPA) region and the Latin America,

Caribbean and Canada (LACC) region to be set forth in the geographic

operations footnote to the Company’s 2010 consolidated financial statements. ***FX adjusted information assumes the average exchange rate in 2010 applies to all prior

periods

for purposes of currency translation into U.S. dollars.

$ in millions; % increase/(decrease)

Revenues net of Interest Expense

2008

2009

2010

GAAP Consolidated Revenues net of Interest Expense

$28,365

$24,523

$27,819

Revenues net of Interest Expense - United States

$19,792

$17,489

$20,246

Revenues net of Interest Expense - Unallocated Corp & Other Segment*

($45)

($861)

($874)

Revenues net of Interest Expense - International**

$8,618

$7,895

$8,447

Reconciliation to International Business Operations (IBO) Basis Presentation

Revenues net of Interest Expense - International**

$8,618

$7,895

$8,447

Reconciling Items

-

-

-

Revenues net of Interest Expense - IBO Basis

$8,618

$7,895

$8,447

FX Adjustment***

($321)

$272

NA

Revenues net of Interest Expense - IBO Basis FX Adjusted

$8,297

$8,167

$8,448

Revenue net of Interest Growth - IBO Basis FX Adj.

(2%)

3%

Revenue net of Interest Growth - IBO Basis

(8%)

7%

Revenue net of Interest Growth - International

(8%)

7%

Revenue net of Interest Growth - Consolidated

(14%)

13%

11

Annex 8

Note: The Company is presenting information on an IBO basis because management believes it presents a useful perspective on the performance of the Company’s

international businesses.

*Unallocated Corporate & Other Segment represents Corporate & Other Segment results which are not directly allocable to specific geographic regions. Examples include

costs

related to the negative spread earned on excess liquidity and executive office operations. **International represents the sum of the Europe, Middle East and Africa

(EMEA) region, the Japan, Asia/Pacific and Australia (JAPA) region and the Latin America,

Caribbean and Canada (LACC) region to be set forth in the geographic

operations footnote to the Company’s 2010 consolidated financial statements. ***FX adjusted information assumes the average exchange rate in 2010 applies to all prior

periods

for purposes of currency translation into U.S. dollars.

$ in millions; % increase/(decrease)

2008

2009

2010

GAAP Consolidated Operating Expenses

$11,625

$9,902

$11,004

Operating Expenses - United States

$6,266

$5,468

$5,860

Operating Expenses - Unallocated Corp & Other Segment*

$482

$301

$653

Operating Expenses - International**

$4,877

$4,132

$4,491

Reconciliation to International Business Operations (IBO) Basis Presentation

Operating Expenses - International**

$4,877

$4,132

$4,491

Reconciling Items

-

-

-

Operating Expenses - IBO Basis

$4,877

$4,132

$4,491

FX Adjustment***

$191

($85)

NA

Operating Expenses - IBO Basis FX Adjusted

$4,687

$4,218

$4,491

Operating Expenses Growth - IBO Basis FX Adj.

(10%)

6%

Operating Expenses Growth - IBO Basis

(15%)

9%

Operating Expenses Growth - International

(15%)

9%

Operating Expenses Growth - Consolidated

(15%)

11%

Operating Expenses (Salaries & Benefits, Professional Services, Occupancy & Equipment, Communications &

Other, Net)

12

Annex 9

13

International Card Services Loans, FX Adjusted*

($ in billions, except percentages)

2008

2009

2010

Total Loans

Reported

$9.5

$9.2

$9.3

FX Adjusted

$10.7

$9.6

$9.3

Growth Rates vs. Prior Year

Reported

(3%)

1%

FX Adjusted

(10%)

(3%)

*FX adjusted information assumes the average exchange rate in 2010 applies to all prior periods for purposes of currency translation into U.S. dollars.

Annex 10

Note: The Company is presenting information on an IBO basis because management believes it presents a useful perspective on the performance of the Company’s

international businesses.

*Unallocated Corporate & Other Segment represents Corporate & Other Segment results which are not directly allocable to specific geographic regions. Examples include

costs

related to the negative spread earned on excess liquidity and executive office operations. **International represents the sum of the Europe, Middle East and Africa

(EMEA) region, the Japan, Asia/Pacific and Australia (JAPA) region and the Latin America,

Caribbean and Canada (LACC) region to be set forth in the geographic

operations footnote to the Company’s 2010 consolidated financial statements. ***FX adjusted information assumes the average exchange rate in 2010 applies to all prior

periods

for purposes of currency translation into U.S. dollars.

$ in millions; % increase/(decrease)

2008

2010

2008

2010

2008

2010

2008

2010

2008

2010

2008

2010

2008

2010

Pretax Income

$3,581

$5,964

$3,322

$6,112

($527)

($1,527)

$786

$1,379

$373

$572

$122

$304

$291

$503

Reconciling Items

-

-

-

-

-

-

-

-

Pretax Income - IBO Basis

$786

$1,379

$373

$572

$122

$304

$291

$503

FX Adjustment***

($70)

NA

($46)

NA

$1

NA

($25)

NA

Pretax Income - IBO Basis FX Adjusted

$716

$1,379

$327

$572

$123

$304

$266

$503

Pretax Income 2008 to 2010 CAGR - IBO Basis FX Adj

39%

32%

57%

37%

Pretax Income 2008 to 2010 CAGR - IBO Basis

32%

24%

58%

31%

Pretax Income 2008 to 2010 CAGR - Consolidated

29%

Provision for Loss by Region

2010

2010

2010

2010

2010

2010

2010

Provision for Losses

$2,207

$1,740

-

$468

$134

$148

$186

Reconciling Items

-

-

-

-

Provisions for Losses - IBO Basis

$464

$132

$147

$186

Europe, Middle East &

Africa

Japan, Asia/Pacific,

Australia

Latin America, Caribbean

& Canada

International**

GAAP Consolidated

United States

Unallocated Corporate

Segment*

GAAP Consolidated

United States

Unallocated Corporate

Segment*

International**

Latin America, Caribbean

& Canada

Japan, Asia/Pacific,

Australia

Europe, Middle East &

Africa

14

15

Supplemental Annex

Average Fee Per Card on Consolidated Basis – GAAP & Adjusted *

2010

Average Fee Per Card (GAAP)

$38

Average Fee Per Card (Adjusted)

$41

* Average fee per card is computed from proprietary card activities only. Average fee per card is computed based on net card

fees, including the amortization of deferred direct

acquisition costs, plus card fees included in interest and fees on loans (including related amortization of deferred direct acquisition costs), divided by average worldwide

proprietary cards-in-force.

The card fees related to cardmember loans included in interest and fees on loans were $220 million for the year ended December 31, 2010 on a

consolidated basis. The adjusted average fee per card is computed in the same manner, but excludes amortization

of deferred direct acquisition costs (a portion of which is

charge card related and included in net card fees and a portion of which is lending related and included in interest and fees on loans). The amount of amortization excluded was

$207 million

for the year ended December 31, 2010 on a consolidated basis. The Company presents adjusted average fee per card because management believes that this

metric presents a useful indicator of card fee pricing across a range of its proprietary card

products.

American Express Company

Financial Community

Meeting

Presentation of Kenneth Chenault

Chairman and Chief Executive Officer

February 9, 2011

Success in 2010

Investing in Transformation

AXP: The International Story

Q & A

17

Agenda

Historical Financial

Performance

*Net income, including results from discontinued operations, was $3.7B for 2006, down 1% vs. the prior year, $4.0B for 2007, up 8%; $2.7B for 2008, down 33%; $2.1B for 2009,

down 21%, and $4.1

for 2010, up 90%. **Attributable to common shareholders. Excludes preferred share dividends and earnings allocated to participating share awards.

Diluted EPS on a net income basis was $2.99 in 2006, $3.34 in 2007,

$2.32 in 2008, $1.54 in 2009 and $3.35 for 2010. †See Annex 1 for a reconciliation to GAAP basis.

Total Revenues Net of Interest

Expense

Income from Continuing

Operations*

Growth vs. Prior Year

Growth vs. Prior Year

($ in billions)

Return on Average Common

Equity

3%

$28.4

(30%)

$2.9

22%

11%

$27.6

14%

$4.1

11%

$24.8

18%

$3.6

35%

37%

Diluted EPS from Continuing

Ops**

18

Growth vs. Prior Year (Managed)

†

(14%)

$24.5

(26%)

$2.1

14%

13%

$27.8

90%

$4.1

27%

2%

$2.47

$3.44

$2.93

$1.54

$3.35

Historical Metric Trends

Mgd. Cardmember

Loans***

Credit Performance

Avg. Basic

Cardmember

Spending**

Total Cards In

Force

*Card billed business includes activities (including cash advances) related to proprietary cards, cards issued under network partnership agreements, and certain insurance fees

charged on proprietary

cards. **Computed from proprietary card activities only. ***Managed basis includes non-securitized and securitized

loans. On a GAAP basis, loan growth

increased/(decreased) by 31% in 2006, 26% in 2007, (22%) in 2008, (22%) in 2009 and 86% for 2010. See Annex 3 for reported basis.

Billed Business*

%

increase/(decrease

) vs. prior year:

19

$161

$141

$138

$61

$61

$45

Citi*

BofA***

JPM**

Cap One

AXP

Discover

$342

$313

$213

$107

$93

$713

AXP

Citi*

JPM**

BofA***

Cap One

Discover

Full Year 2010 Relative

Performance

Growth

vs. PY

15%

(5%)

6%

3%

5%

6%

*Includes Citi-Branded Cards and Citi Holdings Retail Partners North America Cards. **Includes the impact of the Washington Mutual

acquisition. Reported billings shown

above reflects sales volume, which excludes balance transfers. ***Credit Card, includes US consumer and foreign credit card. †Global Card. ††Fiscal year ends November 30.

Billed business is credit card sales volume; disclosed total credit card volume was $99B for full year 2010 ended 11/30/10 and increased 3%. ‡On a GAAP basis, loans

increased 86%, which reflects the consolidation of off-balance sheet assets. See

Annex 3 for reported basis.

Growth

vs. PY

(10%)

(12%)

(16%)

(10%)

(1%)

(5%)

($ in billions)

($ in billions)

‡

†

††

†

††

20

Mgd.

21

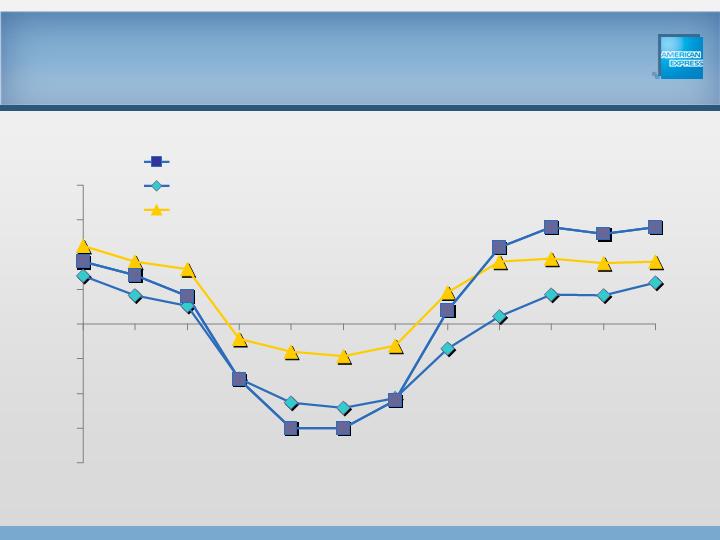

% increase/(decrease) vs. prior year:

Billings Growth – U.S.

*AXP includes credit and charge, excludes debit & cash. **Includes credit and charge only, but excludes debit and cash. ***Includes credit, charge and debit, but

excludes cash.

(20%)

(15%)

(10%)

(5%)

0%

5%

10%

15%

20%

Q1'08

Q3'08

Q1'09

Q3'09

Q1'10

Q3'10

AXP*

MasterCard/Visa - Credit & Charge Volume**

MasterCard/Visa - Total Payment Volume***

Q4’10

19.9%

20.6%

19.9%

19.5%

20.4%

21.2%

22.2%

23.0%

23.7%

24.0%

23.8%

25%+ (Est.)

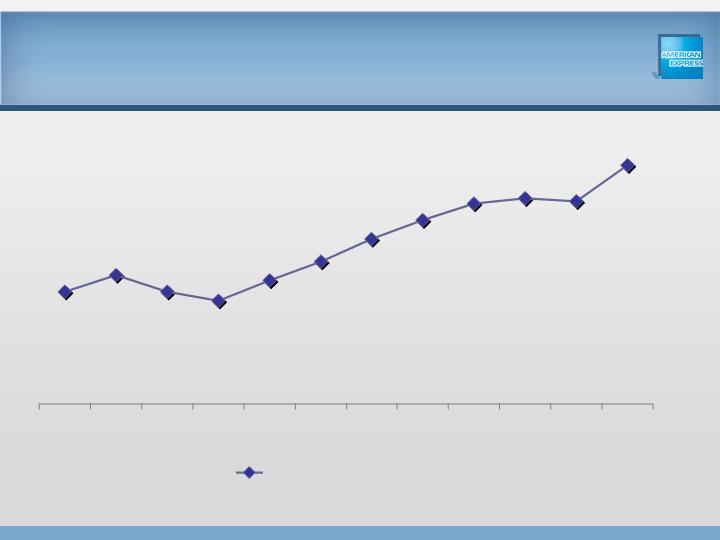

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010**

General Purpose Charge and Credit*

AXP Share of U.S. Purchase

Volume

Source: The Nilson Report. *Excludes cash advances. **Internal estimate of 2010 AXP share of U.S. Purchase Volume based on publicly disclosed AXP

results for 2010 and projections

of Discover, MasterCard and Visa U.S. Purchase Volume provided by a consulting firm.

22

Billings Growth – Global

23

†FX adjusted information assumes

a constant exchange rate between the periods being compared for purposes of currency translation into US dollars. (e.g., assumes foreign

exchange rate used for Q4'10 applies to Q4'09 and rate used for Q3'10 applies to Q3'09, etc.) *AXP includes credit

and charge, excludes debit and cash. See Annex 2 for

reported basis. **Includes credit and charge only, but excludes debit and cash. ***Includes credit, charge and debit, but excludes cash.

(20%)

(15%)

(10%)

(5%)

0%

5%

10%

15%

20%

Q1 '08

Q3'08

Q1'09

Q3'09

Q1'10

Q3'10

AXP*

MasterCard/Visa - Credit & Charge Volume**

MasterCard/Visa - Total Payment Volume***

FX adjusted† % increase/(decrease) vs. prior year:

Q4’10

77.078

57.2

$0

$20

$40

$60

$80

Q1'07

Q3'07

Q1'08

Q3'08

Q1'09

Q3'09

Q1'10

Q3'10

AXP Worldwide Managed Loans

See Annex 3 for loans on a GAAP basis for periods prior to 2010.

($ in billions)

24

Q4’10

February

implementation

of the CARD Act

Increased

Cost of Funds

due to spike in

October 1M

LIBOR rate

Repriced additional

segments of US

lending portfolio

Loss of revenue due

to August CARD Act

implementation

Impact of

Collections

Strategy

Lower revolve

rate

Improved Cost of

Funds due to

LIBOR reversion

Re-priced 55% of

US Lending

Portfolio

First full quarter

impact of Feb.

CARD Act

implementation

Cardmember

behavior

8.9%

10.9%

9.7%

9.8%

10.0%

10.0%

9.3%

9.3%

9.1%

Q4 '08

Q1 '09

Q2 '09

Q3 '09

Q4 '09

Q1'10

Q2'10

Q3'10

Q4'10

USCS Net Interest Yield

Managed Cardmember Loans

See Annex 4 for reconciliation of net interest income divided by average loans, a GAAP measure, and net interest yield, a non-GAAP measure.

25

*See Annex 3 for GAAP basis for Q4’09. **Fiscal year ends November 30. US Card. *** Includes the impact of the Washington Mutual acquisition. †Global

Card.

††Credit Card, includes US consumer and foreign credit card. ‡Citi-Branded Cards.

AXP Lending Managed Net Write-off

Rates versus Competitors

26

11.8%

10.3%

10.0%

7.3%

8.8%

9.3%

9.6%

11.9%

9.3%

9.0%

12.2%

4.3%

7.0%

7.9%

7.2%

8.2%

7.8%

AXP

Discover

JPMorgan

Cap One

Bank of

America

Citi

Q4'0

9

Q4'1

0

††

†

***

**

*

‡

Success in 2010

Investing in Transformation

AXP: The International Story

Q & A

27

Agenda

28

2010 Investment Priorities

Focus on premium customers

Charge Card

Co-Brands

Drive network growth

Coverage / brand awareness

GNS partner volume

Alternative payments

Drive new revenues

by leveraging

our unique business model

29

Total Expenses: A Year of

Investment

16.4

19.6

0.6

0.2

0.4

0.3

1.0

0.7

2009 Total

Expenses

Charge &

Premium

Lending*

Merchant

& GNS**

Fee Based

Revenue/Alt

Payments†

Brand

Investment

Cardmember

Rewards

Other††

2010 Total

Expenses

$ in billions; change in 2010 total expenses vs.

2009:

*Includes expenses related to acquisition, loyalty and cardmember sales force. **Includes sales force, marketing & promotion costs and other operating costs related to GNS.

†Includes operating costs of LoyaltyEdge, Business Insights and Serve Enterprise (formerly Revolution

Money), as well as variable technology investments. † †Consists of other

expenses

not directly related to these defined investment categories.

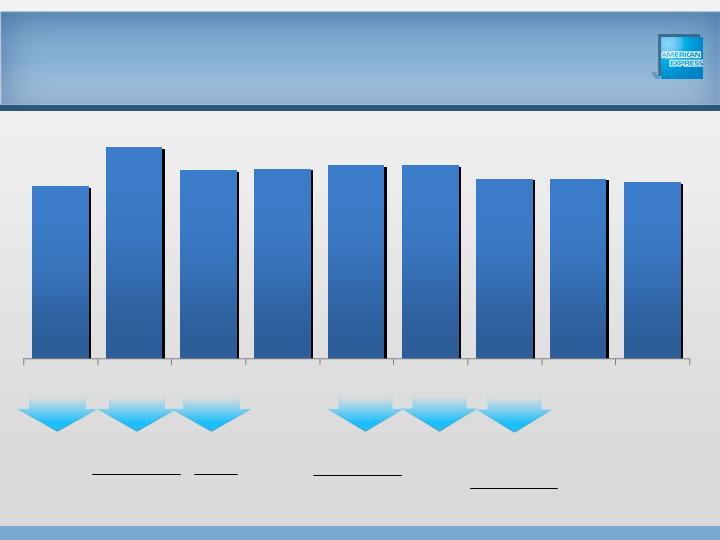

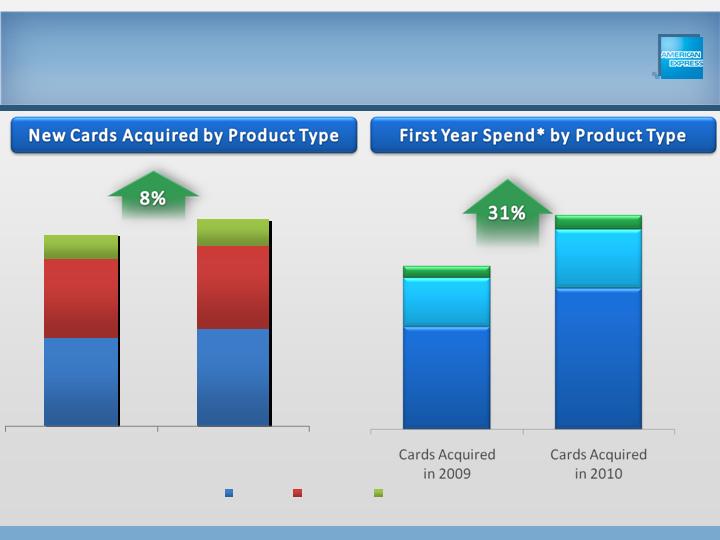

Global Proprietary

New Cards and First Year Spend

Acquired

*First Year Spend reflects the first 12 months of spending for a new card acquired. For future periods, internal estimates have

been used, i.e. new cards acquired in June’10

include 6 months of actual spend and 6 months of internally forecasted spend.

2009

2010

Charge

Co-Brand

Prop Lending

15%

4%

11%

YOY Growth

23%

20%

38%

YOY Growth

30

31

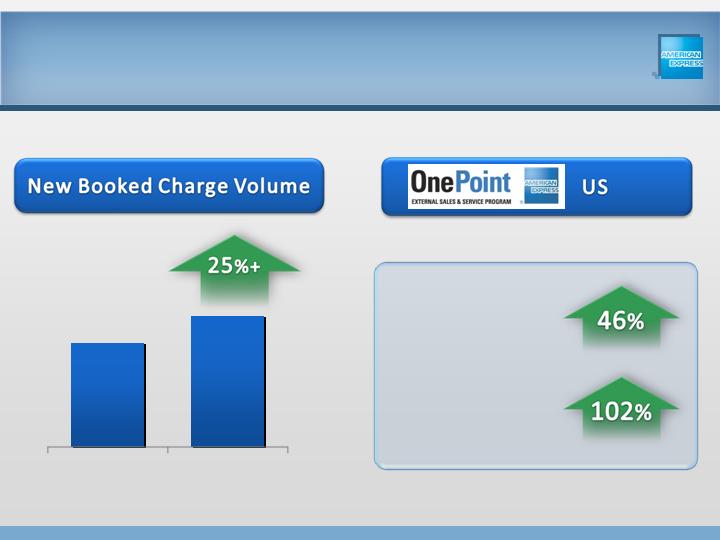

FY'2009

FY'2010

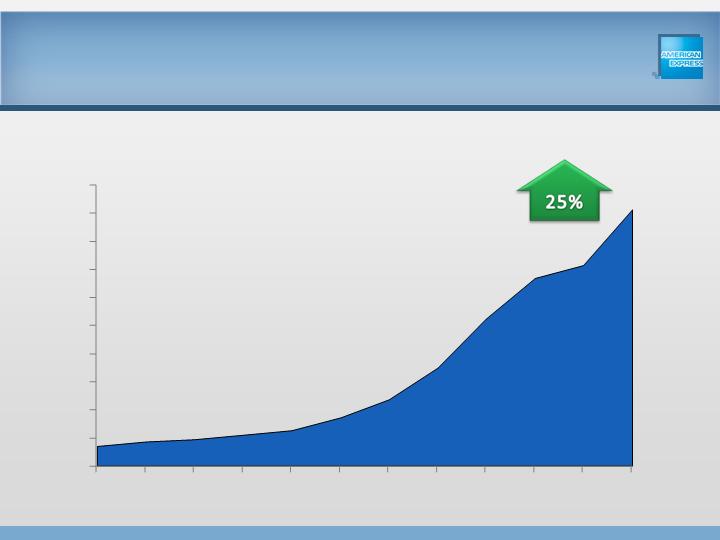

Global Coverage Expansion

Expanding Acceptance and Growing Spend

December ‘10 YTD vs. December ‘09

YTD

New Signings

New Booked

Charge

Volume

Global:

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Global Network Services

Billed Business

CAGR 1999-2010:

32

($ in

billions)

33

2010 Investment Priorities

Focus on premium customers

Charge Card

Co-Brands

Drive network growth

Coverage / brand awareness

GNS partner volume

Alternative payments

Drive new revenues

by leveraging

our unique business model

Fee Based Revenue

34

Registered Card

35

Strategic Acquisitions*

*The Loyalty Partner acquisition is expected to close in the first quarter of 2011, subject to regulatory approval.

36

2010 Investment Priorities

Focus on premium customers

Charge Card

Co-Brands

Drive network growth

Coverage / brand awareness

GNS partner volume

Alternative payments

Drive new revenues

by leveraging

our unique business model

Growth Drivers

38

Drive greater value to merchant base

Expand customer segment penetration

Accelerate International growth across

businesses

Achieve significant progress within Enterprise

Growth

Increase share of online spend

and enhance

digital experience

For the Moderate to Long-term:

Insights and

Information

Services to

Improve Merchant

Efficiencies

High Spending

Cardmembers

Services to

Drive Merchant

Revenues

Drive Greater Merchant Value

39

Sources of Value

Penetrate New Customer Segments

40

Minorities

Under 35

Women

Prospect Segments

Cardmember

Base

Accelerate International Growth

New Payment Options

Diversity

Multiple Models

Global Player

41

Enterprise Growth Business Units

42

Online and Mobile

Emerging Payments and

New Ventures

Global Payment Options

Fee Based Services

Growth Drivers

43

Drive greater value to Merchant base

Expand customer segment penetration

Accelerate International growth across

businesses

Achieve significant progress within Enterprise

Growth

Increase share of online spend

and enhance

digital experience

For the Moderate to Long-term:

2009

2010

44

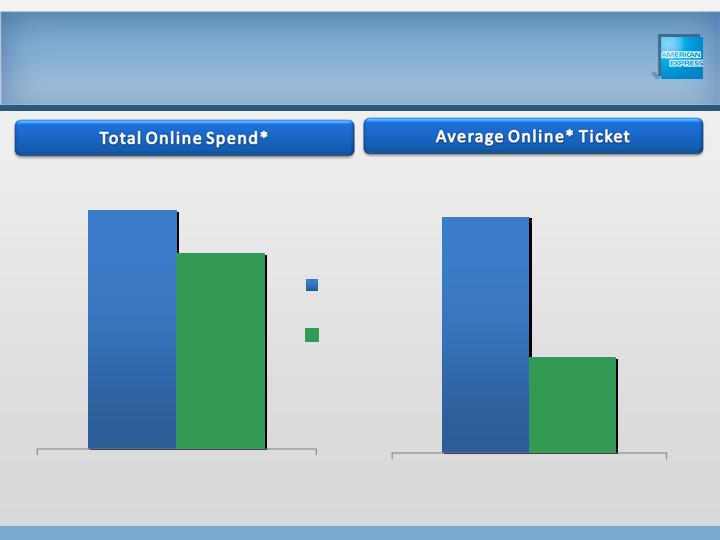

AXP Online Spend* – Global

$100B

+

*Primarily includes spending at pure online merchants and spending through known online channels for

merchants with both online and offline presence. Also

includes an estimate of online spend for merchants in industries where external and internal benchmarks around online spend are available.

Estimated

Spending:

Nov-Dec 2009

Nov-Dec 2010

45

AXP Online Holiday Spend*

Nov-Dec 2009

Nov-Dec 2010

Estimated

Spending:

*Primarily includes spending at pure online merchants and spending through known online channels for

merchants with both online and offline presence. Also

includes an estimate of online spend for merchants in industries where external and internal benchmarks around online spend are available.

2009

2010

46

AXP Online Spend* – Global

$100B

+

Estimated

Spending:

*Primarily includes spending at pure online merchants and spending through known online channels for

merchants with both online and offline presence. Also

includes an estimate of online spend for merchants in industries where external and internal benchmarks around online spend are available.

47

AXP vs. PayPal – Global

$100B+

$92B

2010

AXP

PayPal*

*

$156

$63

2010

*Primarily includes spending at pure online merchants and spending through known online channels for merchants with both online and offline presence. Also

includes an estimate of online spend

for merchants in industries where external and internal benchmarks around online spend are available. **Source: company

reports.

63%

70%

2009

2010

Offline

Online

48

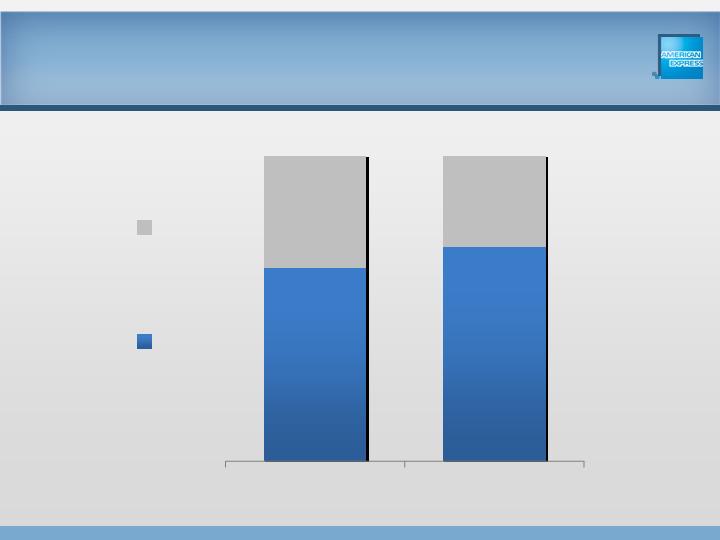

Membership Rewards –

U.S. Online Point Redemptions

49

Membership Rewards:

A Virtual Currency

Small Business Solutions

50

Launched 2009

All-in-one online

invoicing and

payment

acceptance

solution

Launched 2010

Online tool to

compare and

purchase

commercial

insurance more

effectively

Launched 2010

Online solution to

manage search

engine marketing

OPEN Business Apps:

Small Business – OPEN Forum

51

SCORE Speed

Coaching

August 10, Orange County,

CA

Connecting

Cardmembers to

share insights and

build relationships

A community designed to help

small businesses grow

Corporations – Product

Evolution

52

B2B Payment

Solutions

Corporate Card

Programs

Global Business Travel

Corporate Purchasing

Card

Buyer Initiated Payments

vPayment

Integrated Online

Expense Management

Growth Drivers

53

Drive greater value to Merchant base

Expand customer segment penetration

Accelerate International growth across

businesses

Achieve significant progress within Enterprise

Growth

Increase share of online spend

and enhance

digital experience

For the Moderate to Long-term:

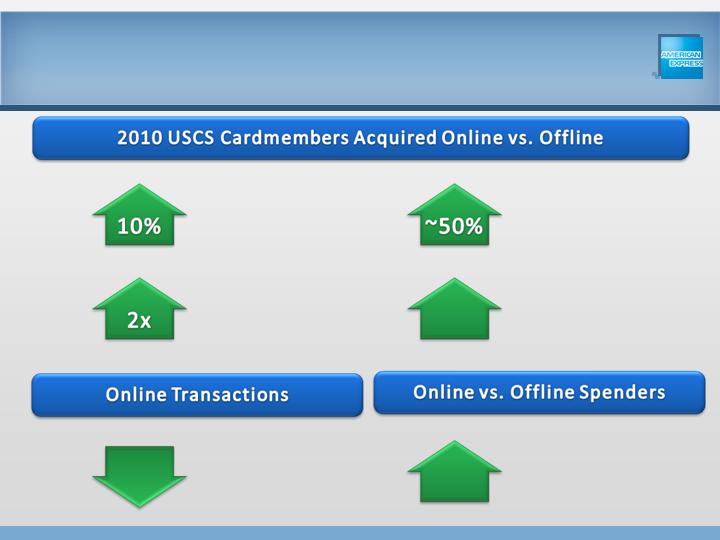

Profile: U.S. Online

Cardmembers

54

Household

Income

Under 35

Higher

Average

Spend

Online

Spending

Lower Credit

Losses

Enrollment in

Online

Servicing

Growth Drivers

55

Drive greater value to Merchant base

Expand customer segment penetration

Accelerate International growth across

businesses

Achieve significant progress within Enterprise

Growth

Increase share of online spend

and enhance

digital experience

For the Moderate to Long-term:

Success in 2010

Investing in Transformation

AXP: The International Story

Q & A

57

Agenda

American Express

Company

Financial Community

Meeting

Presentation of Doug Buckminster

President, International Consumer Card and Small

Business Services

February 9, 2011

Large and diverse footprint

Differentiated assets and capabilities

Flexibility to meet market conditions

Delivering strong growth

Accelerate momentum with growth

opportunities

Commitment to win a larger share of

International for AXP

59

AXP: The International Story

AXP Footprint in International

Performance in International

Growth Going Forward

60

Agenda

61

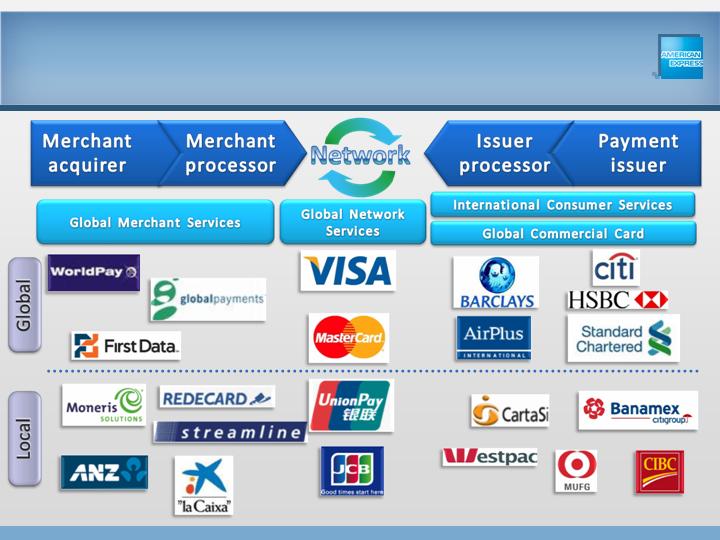

AXP International

Across the Payments Landscape

Note: The trademarks, logos and service marks used on this slide and throughout this presentation are the property of their respective owners.

AXP Top Ten Markets by Billings, 2010

Global Presence: Over 130

Markets

62

AXP International

Markets

$0.0

$0.5

$1.0

$1.5

2006

2007

2008

2009

2010

International Business Operations*

Business Growth

$0

$50

$100

$150

$200

$250

2006

2007

2008

2009

2010

63

$ in billions, FX

Adjusted**:

CAGR 2006-2010:

CAGR 2006-2010:

Growth

vs. PY

(12%

)

(1%

)

25

%

54%

Growth

vs. PY

14%

11%

(2%

)

15

%

*International Business Operations (IBO) includes the ICS segment and the international portions of the GNMS and GCS segments. See Annex 5 for a

reconciliation to the geographic operations

footnote to be set forth in the Company’s 2010 consolidated financial statements. **FX adjusted information assumes

the average exchange rate in 2010 applies to all prior periods for purposes of currency translation into U.S. dollars. See Annex

6 for billed business reported

basis.

64

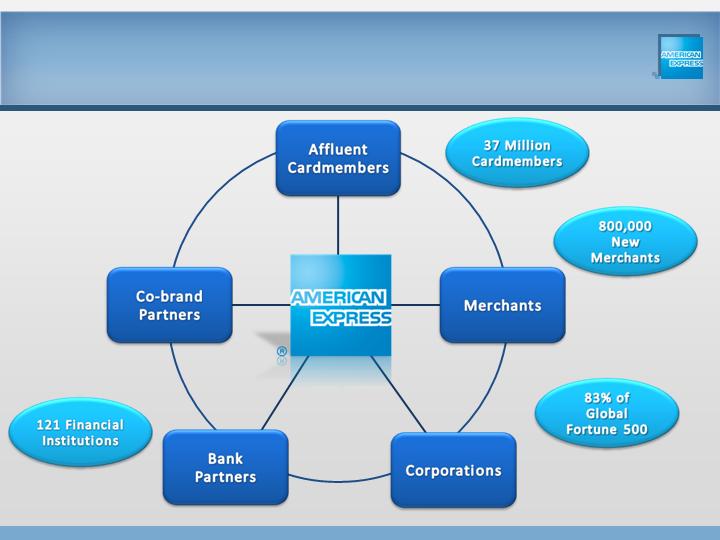

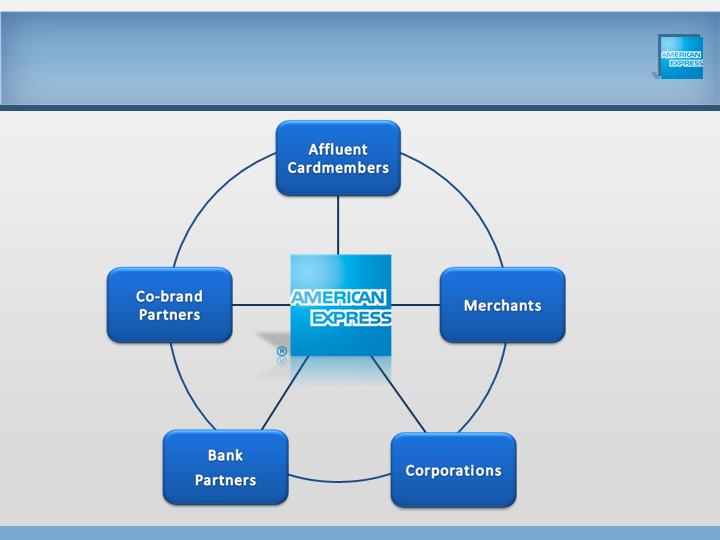

Strong Network of

Relationships

65

Partnership Excellence

66

Strong Network of

Relationships

Brand

Loyalty

Marketing

Marketing

Analytics

Co-branding

67

Unique Capabilities and Assets

Relationship

Management

Customer

Service

Partnership

Management

Risk

Management

New Product

Development

Global

Platforms

AXP Footprint in International

Performance in International

Growth Going Forward

68

Agenda

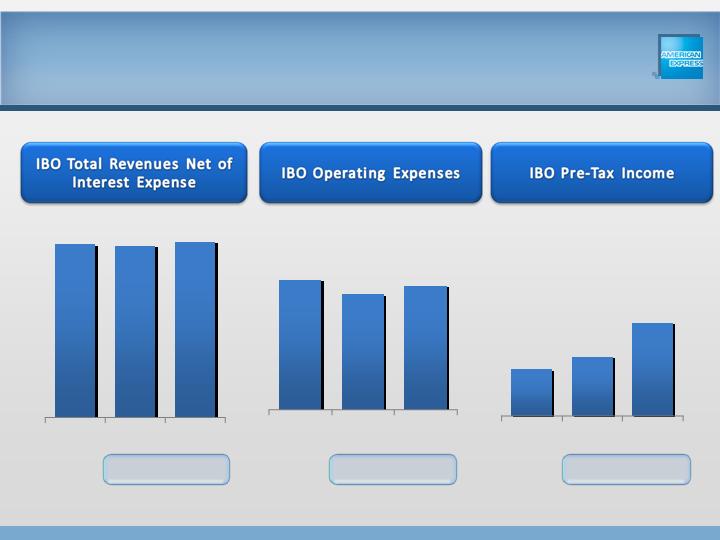

International Business Operations*

Financial

Performance

69

*International Business Operations (IBO) includes the ICS segment and the international portions of the GNMS and GCS segments. See Annex 5, 7 and 8 for a reconciliation to

the geographic operations

footnote to be set forth in the Company’s 2010 consolidated financial statements. **FX adjusted information assumes the average exchange rate in

2010 applies to all prior

periods for purposes of currency translation into U.S. dollars.

$4.7

$4.2

$4.5

2008

2009

2010

69

$0.7

$0.9

$

1.4

2008

2009

2010

$8.3

$8.2

$8.4

2008

2009

2010

($ in billions, FX

Adj.**)

(2%

)

3%

Growth

vs. PY

(10%

)

6%

25%

54

%

International Business Operations*

Cards in Force and Billed Business

$0

$50

$100

$150

$200

$250

2006

2007

2008

2009

2010

70

$ in billions, FX Adj.**

Growth

vs. PY

14%

11%

(2%)

15%

0

10

20

30

40

50

2006

2007

2008

2009

2010

Growth

vs. PY

14%

13%

2%

8%

millions

*International Business Operations (IBO) includes the ICS segment and the international portions of the GNMS and GCS segments. **

FX adjusted information

assumes the average exchange rate in 2010 applies to all prior periods for purposes of currency translation

into U.S. dollars. See Annex 6 for billed business

reported basis.

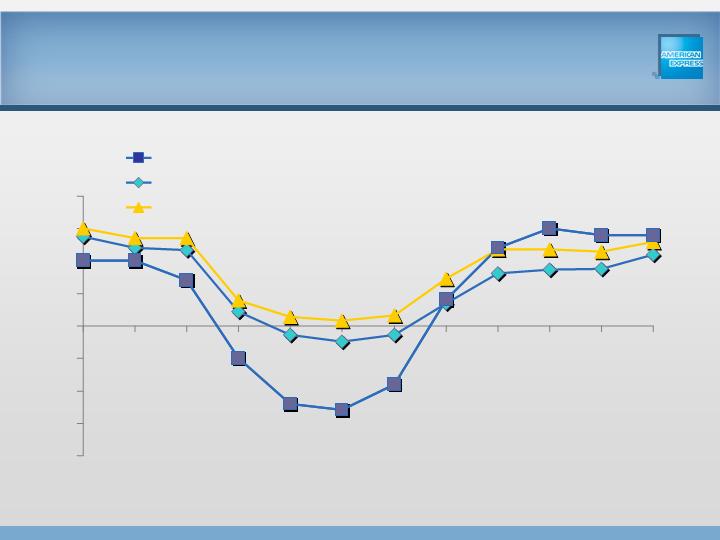

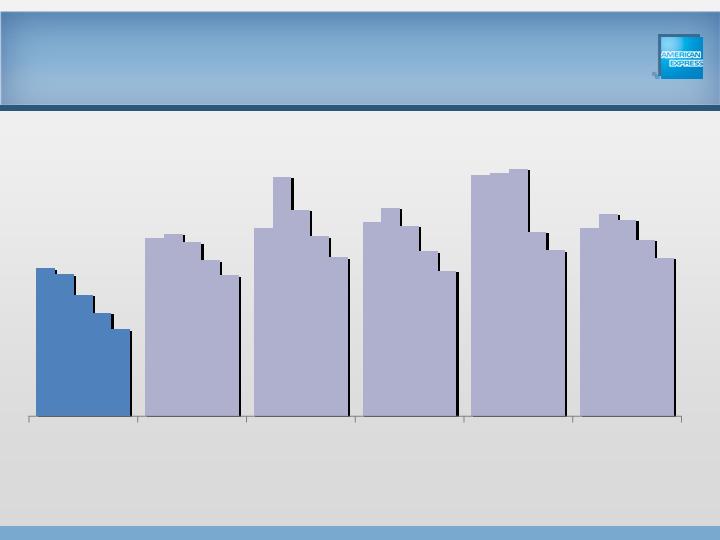

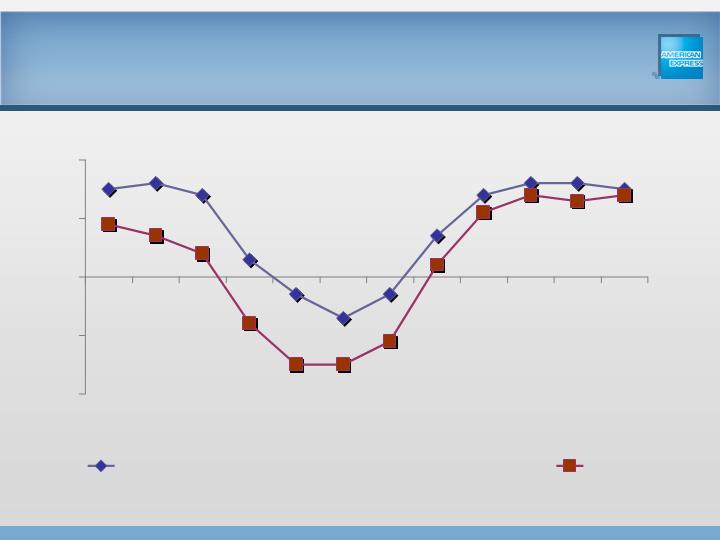

(20%)

(10%)

0%

10%

20%

Q1'08

Q3'08

Q1'09

Q3'09

Q1'10

Q3'10

International Business Operations (FX Adj.**)

U.S.

71

International Business Operations*

Billings Growth vs. U.S.

% increase/decrease vs. prior year:

Q4’10

*International Business Operations (IBO) includes the ICS segment and the international portions of the GNMS and GCS segments. **FX adjusted information

assumes a constant exchange rate between the periods being compared for purposes of currency translation into U.S. dollars. (e.g., assumes foreign exchange

rate used

for Q4’10 applies to Q4’09; the rate used for Q3’10 applies to Q3’09, etc.). See Annex 2

for reported basis.

$10.7

$9.6

$9.3

$0.0

$4.0

$8.0

$12.0

2008

2009

2010

International Card Services

Segment

72

$ in billions

Growth

vs. PY

(10%

)

(3%)

Canada

$2.5B

Australi

a

$2.1B

UK

$1.8B

Other

$1.9B

Mexico

$1.0B

*FX adjusted information assumes the average exchange rate in 2010 applies to all prior periods for purposes of currency

translation into U.S. dollars. See

Annex 9 for reported basis.

73

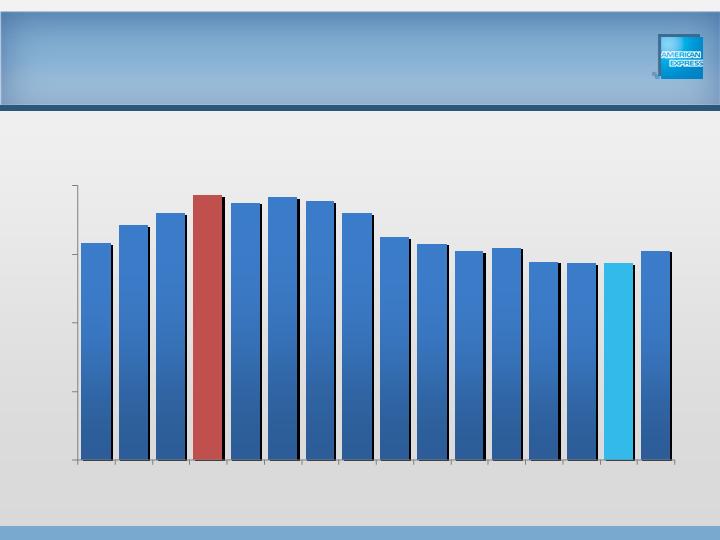

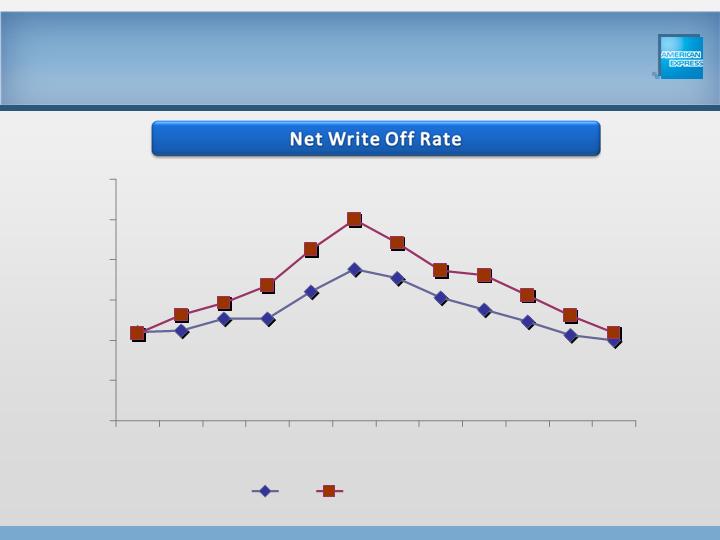

International Card Services

Segment

0%

2%

4%

6%

8%

10%

12%

Q1 '08

Q3'08

Q1 '09

Q3'09

Q1 '10

Q3'10

ICS

USCS Managed*

*See Annex 3 for a reconciliation to GAAP basis for periods prior to 2010.

Q4’10

International and US:

Similarities

High Spending Customer base

Strong Credit Quality

Strong Co-Brand Practice

75

Strong Digital Engagement

International and US: Differences

76

Spend Velocity

Outbound Spend

Average Fee

Per Card

(Adj.)*

7x

5x

19%

2%

$68

$36

*Average fee per card is computed from proprietary card activities only. Average fee per card is computed based on net card fees, including the amortization of deferred direct

acquisition

costs, plus card fees included in interest and fees on loans (including related amortization of deferred direct acquisition costs), divided by average worldwide

proprietary cards-in-force. On a consolidated basis, the average fee per card and average fee

per card (adjusted) for 2010 was $38 and $41, respectively. The card fees related

to cardmember loans included in interest and fees on loans were $220 million for the year ended December 31, 2010 on a consolidated basis. The adjusted average

fee per

card is computed in the same manner, but excludes amortization of deferred direct acquisition costs (a portion of which is charge card related and included in net card fees and a

portion of which is lending related and included in interest and

fees on loans). The amount of amortization excluded was $207 million for the years ended December 31, 2010 on

a consolidated basis. The Company presents adjusted average fee per card because management believes that this metric presents

a useful indicator of card fee pricing across

a range of its proprietary card products. See the Supplemental Annex for GAAP basis.

FY’ 2010

International Business Operations*

Regional Overview

Billed Business ($ in B)

Card in Force (in MM)

CAGR 2008-2010

CAGR 2008-2010

1%

$87.7

2%

14.2

77

12%

$85.5

13%

14.1

7%

$60.5

1%

13.8

IBO Pre-Tax Income ($ in MM)

CAGR 2008-2010

32%

$572

57%

$304

37%

$503

IBO Pre-Tax Income/Billed

Business

65bps

36bps

83bps

IBO Provision as % of Billed Business

15bps

17bps

31bps

*International Business Operations (IBO) includes the ICS segment and the international portions of the GNMS and GCS segments. See Annex 10 for a

reconciliation to the geographic operations

footnote to be set forth in the Company’s 2010 consolidated financial statements. **FX adjusted information

assumes the average exchange rate in 2010 applies to all prior periods for purposes of currency translation into U.S. dollars. On a reported

basis, the billed

business CAGR for 2008-2010 was (4%) for EMEA, 16% for JAPA and 6% for LACC.

FY’2010, FX

Adjusted**

78

Growth Markets

“Growth Markets“ include BRIC plus Turkey, Mexico, Indonesia and South

Korea

8.4

8.6

10.2

2008

2009

2010

International Business Operations*

Growth Market Performance

79

“Growth Markets“ include BRIC plus Turkey, Mexico, Indonesia and South

Korea

$203

$162

$318

2008

2009

2010

$28.7

$32.8

$39.2

2008

2009

2010

$ in

billions,

FX Adj.**

In millions

$ in

millions,

FX Adj.**

*International Business Operations (IBO) includes the ICS segment and the international portions of the GNMS and GCS segments. See Annex 5 for information relating to the

geographic footnote

to be set forth in the Company’s 2010 consolidated financial statements. **FX adjusted information assumes the average exchange rate in 2010 applies to

all prior periods

for purposes of currency translation into U.S. dollars. See Annex 6 for billed business on a reported basis.

Flexible, Multi-Model Approach

80

Attractive Stable Margins

Large Affluent Segment

Strong Credit Bureau

Financial Institution Loyalty

Co-Brand Availability

Merchant Value

Mexico: High Growth

Proprietary Market

81

Highly Profitable

High Share of Spend

Strong Brand, Relevance

2006-10

CAGR,

FX Adj*:

(1%)

*FX adjusted information assumes the average exchange rate in 2010 applies to all prior periods for purposes of currency

translation into U.S. dollars. The CAGR for 2006 – 2010 for billed business

for Mexico was 8% on a reported basis. **International Business Operations (IBO) includes the ICS

segment and the international portions of the GNMS and GCS segments. Due to system

limitations related to geographic reporting prior to 2008, the Company is unable to identify the specific nature of the reconciling items relating to amounts previously reported

in the Company’s

financial statements and the IBO basis presentation. See Annex 5 and 10 for information relating to the geographic footnote to be set forth in the Company’s 2010 consolidated financial statements.

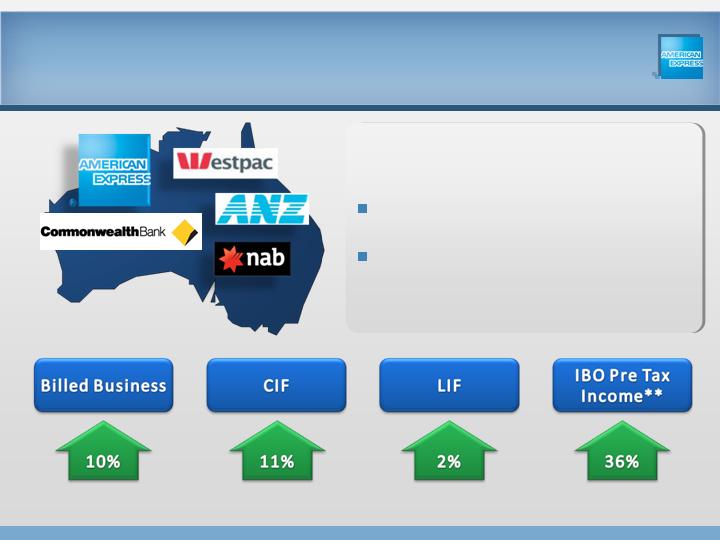

Australia: GNS and Proprietary

82

Large Affluent Segment

Strong Bank Concentration

2006-10

CAGR,

FX Adj*:

*FX adjusted information assumes the average exchange rate in 2010 applies to all prior periods for purposes of currency

translation into U.S. dollars. The CAGR for 2006 – 2010 for billed business for Australia was 16% on a

reported basis. **International Business Operations (IBO) includes the

ICS segment and the international portions of the GNMS and GCS segments. Due to system limitations related to geographic reporting prior to 2008, the

Company is unable to identify the specific nature of the reconciling items relating to amounts previously

reported in the Company’s financial statements and the IBO basis presentation. See Annex 5 and 10 for information relating

to the geographic footnote to be set forth in the Company’s 2010 consolidated financial statements.

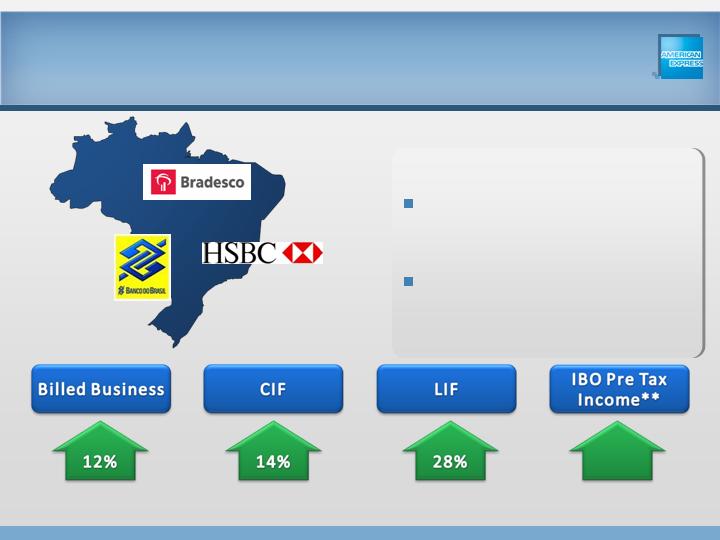

Brazil: Partnering for Growth

83

Strong bank distribution

– card & merchant

Relatively volatile

market

10%

Jul ‘05-Jun ’10*

CAGR,

FX Adj*:

*FX adjusted information assumes the average exchange rate in 2010 applies to all prior periods for purposes of currency

translation into U.S. dollars. The CAGR for Jul’05-Jun’10 for billed business for Brazil was 18% on a

reported basis. **International Business Operations (IBO) includes

the ICS segment and the international portions of the GNMS and GCS segments. Due to system limitations related to geographic reporting prior to 2008, the

Company is unable to identify the specific nature of the reconciling items relating to amounts previously

reported in the Company’s financial statements and the IBO basis presentation. See Annex 5 and 10 for information relating

to the geographic footnote to be set forth in the Company’s 2010 consolidated financial statements.

AXP Footprint in International

Performance in International

Growth Going Forward

84

Agenda

85

Growing International

Partnerships

85

Loyalty

New Segments

Alternative Payments

86

Growing International

Coverage & Utilization

Loyalty

Alternative Payments

Digital

Partnerships

86

New Segments

Fee Based Offerings

&

Small Business Services

87

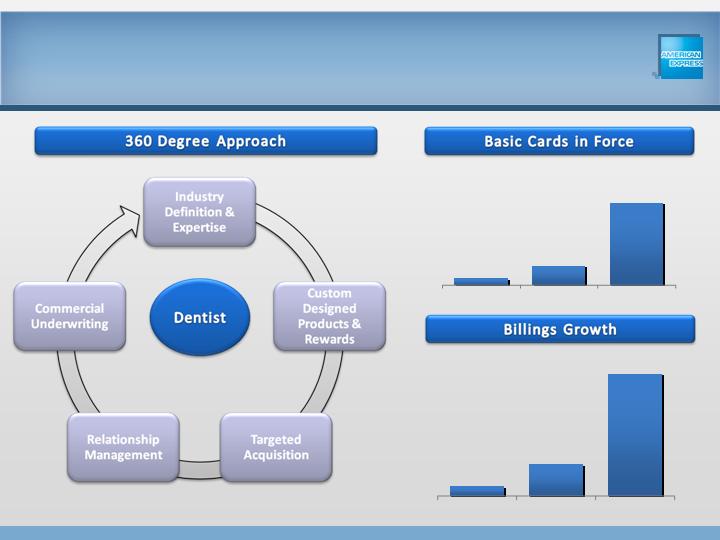

88

Dental Industry – Japan

2008

2009

2010

X

3X

12X

2008

2009

2010

4.2K

0.3K

89

Growth Through Partners

Help partners address high-end

segment through our unique expertise.

Increase size of business through

existing Bank and co-brand partners.

90

Expanding Merchant Coverage

Launched Sept 2010

Launched June 2010

Launched Nov 2010

91

Digitize the Business

In addition to meeting evolving customer needs, our

advancements in digital engagement create cost and

revenue opportunity.

Online Card Acquisition

Mobile Card Apps and

electronic wallet

Online Spend

Paperless statements

Online Servicing

Online Remittances

Deliver quality

service online

Provide channel of

choice for

Customers

1.

Strengthen value and price for

value

2.

Innovative products for current

base

3.

Add new sources of revenue

Fee Revenue Mix

92

21%

35%

44%

Net Card Fees & Other Revenue

Discount Revenue

Net Interest

Income

Why Loyalty Services?

93

94

Coalition Loyalty Structure

Consolidate loyalty

programs

More earn

opportunities

Access to valuable

discounts and

offers

Gain new

customers

Higher consumer

spend

Increased loyalty /

reduced churn

Build relationships

with large

customer pool

Access to rich data

Facilitate

commerce across

coalition

Loyalty Partner Synergies

Creating value through:

Card Distribution

New Card Products

Membership Rewards

Online and digital

channels

Location-based offers

New Markets

Add 100M

Consumers

95

Large and diverse footprint

Differentiated assets and capabilities

Flexibility to meet market conditions

Delivering strong growth

Accelerate momentum with growth

opportunities

Commitment to win a larger share of

International for AXP

96

AXP: The International Story