Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Swisher Hygiene Inc. | d8k.htm |

Road Show

Presentation February 2011

Exhibit 99.1 |

2

Forward-Looking Information

All statements, other than statements of historical fact, contained in this presentation,

including any information as to the future financial or operating performance of

Swisher, constitute “forward-looking information” or “forward-looking statements” within the meaning of certain

securities laws, including the provisions of the Securities Act (Ontario) and are based

on the expectations, estimates and projections of management as of the date of this

presentation unless otherwise stated. Forward-looking statements include, but are not limited to, possible

events and statements with respect to possible events. The words “plans,”

“expects,” “is expected,” “scheduled,” “estimates,” or “believes,” or

similar words or variations of such words and phrases or statements that certain actions,

events or results “may,” “could,” “would,” “might,” or

“will be taken,” “occur,” and similar expressions identify

forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by Swisher as of the date of such

statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The

estimates and assumptions of Swisher contained in this presentation, which may prove to be

incorrect, include but are not limited to, the various assumptions set forth herein as

well as: (1) the trading price of Swisher’s common shares; (2) there being no significant disruptions affecting

Swisher’s operations, whether due to labour disruptions, supply disruptions, power

disruptions, damage to equipment or otherwise; and (3) the acquisition described in

this presentation being completed. All of these assumptions have been derived from information currently available to

Swisher, including information obtained by Swisher from third-party sources. These

assumptions may prove to be incorrect in whole or in part. All of the

forward-looking statements made in this presentation are qualified by the above cautionary statements and those made in the “Risk

Factors” section of Swisher’s registration statement on Form 10 filed with the

Securities and Exchange Commission, the “Risk Factors” section of the most

recently filed management information circular of CoolBrands International Inc. dated September 24, 2010 and Swisher’s other filings

with Canadian securities regulators which are available on Swisher’s SEDAR profile at www.sedar.com. These factors are not intended to represent

a complete list of the factors that could affect Swisher. The forward-looking information set forth in this presentation is subject to

various assumptions, risks, uncertainties and other factors that are difficult to

predict and which could cause actual results to differ materially from those expressed or implied in the forward-looking information.

Swisher disclaims any intention or obligation to update or revise any forward-looking

statements, except to the extent required by applicable law. |

•

Swisher provides cleaning and sanitizing products and

services to commercial and residential customers in

North America and ten international markets

•

Our solutions are designed to provide those essential

services that enhance the safety, satisfaction and

well-being of our customers

•

We look for opportunities to continually expand our

customer relationships, becoming a single source

provider and maximizing organic growth

•

Combining acquisitions and organic growth leverages

our route-based delivery infrastructure to drive

higher margins and profitability

3

Who We Are

Full Service Hygiene Solution for Our Customers

•

Common denominator = solving our customer’s hygiene and sanitation needs

|

Corporate

Strengths Distinct Business Advantages Drive Success

Attractive Business Model

–

Solutions provider with full range of products and services

–

Recurring revenue business

–

Product line and services provide points of competitive

differentiation

–

Nationwide service capability

–

Low cost provider

–

Attractive gross margins and route margins

Established Brand Identity

–

Widely recognized as “hygiene experts”

–

Providing regular, ongoing service to more than 35,000

customers

–

Operating for more than 25 years

4 |

Industries are

Widely Followed –

Large, attractive, addressable market

–

Publicly traded competitors enjoy significant valuation multiples

–

Established patterns of consistent revenue and earnings growth

–

Industry economics generate significant earnings and cash flow

Business is Scalable

–National platform allows growth through corporate accounts and large distributors

–Heavy investment and integration cost to build national platform

is substantially

behind us

–Significant excess route capacity

–Corporate

overhead

is

highly

leverageable

and

scalable

–Large number of tuck-in acquisitions available at reasonable EBITDA multiples

5

Corporate Strengths

Distinct Industry Characteristics Drive Success |

H. Wayne

Huizenga – Chairman

Legendary entrepreneur, builder of four Fortune 500 companies:

•

Waste Management •

Republic Services •

Blockbuster Entertainment Group •

AutoNation

Steve Berrard

–

CEO

•

President

and

CEO

of

Blockbuster

Entertainment

Group

•

Co-CEO

of

AutoNation

Thomas Byrne –

COO

•

Vice-chairman

of

Blockbuster

Entertainment

Group

•

Director

of

several

leading

consumer

and

business

service firms

Thomas

Aucamp

–

EVP

•

Vice president of corporate development and strategic planning for Blockbuster Entertainment

Group Jeffrey Rhodes –

SVP of Operations

•

Vice president of distributor sales and corporate accounts for JohnsonDiversey

Supported by a management, operations and sales organization with managers and staff from

leading national and regional chemical and facility service providers

6

Management Team

30+ years Together Building Successful Businesses |

Timeline

2004-2011 From Private to Public

7

2004

93 domestic

franchisees

No company-

owned locations

Regional coverage

Inconsistent service

and product

offering

Rudimentary

route-delivery

system

2005-2009

Repurchased

90% of domestic

franchisees

Replaced all

management systems

Added industry

experience

Expanded product

lines to become

full-service

Added vans

and upgraded

facilities

2010

Expanded

chemical service

coverage to 90%

of North America

Launched corporate

account and

distributor programs

Completed reverse

merger

with

CoolBrands

-

providing company

~$60m (Can.) cash

Reporting issuer

in all provinces of

Canada

Public on TSX

2011-

NASDAQ listing

Expand distributor

program

Begin international

expansion

Continue to leverage

infrastructure with

organic and acquisition

growth

Evaluate other

markets that provide

other essential

hygiene and

sanitation

services |

•

Filed Form 10 and Form S-1 with SEC and become a U.S. reporting

company on February 1, 2010

-

Commenced NASDAQ trading on February 2

nd

•

Repurchased Swisher franchisees in five markets

-

Toronto

-

Edmonton

-

Calgary

-

Vancouver

-

Orange County, CA

•

Made strategic chemical acquisitions in key markets

-

Florida

-

Idaho/Montana

-

Washington/Oregon

-

Great Plains (MO, IL, AR, IA, KS, OK)

•

Incurred 4

th

quarter costs in excess of $5 million for:

-

Merger-related expenses and public company costs

-

Expanded infrastructure for 2011 expansion

•

Expect such costs will result in a 4

th

quarter 2010 income loss greater than

the $2.1 million loss incurred in the 4

th

quarter of 2009

Recent Events

Activities since November 2010 Merger |

Swisher

Today Swisher’s Corporate Position

9 |

Swisher in

2011 Full Service Solutions Provider

Company System

–

72 company branches

–

10 franchisees

–

Weekly service coverage to

90% of US population

–

Licensees in 10 countries

10

Franchise

Company-Owned

No Service

No Service |

Facility

Service Program Focused on Rental and Service

Germicide Mist

& Odor Control

•Powerful odor control

systems

•Full-facility misting of

all surfaces

•Use of proven

disinfectant

•Kill wide range of

contamination

Hygiene

Service

•Highly trained

technicians

•Proprietary

techniques •Weekly

service •Personal

attention Paper

Products

•Premium and

economy products

•Hand towels

•Toilet tissue

•Wipers

•Attractive, rugged

dispensers

Power Washing

•High power

sanitizing

•Floor-to-ceiling

treatment

•Address key touch

points

•Restore facilities to

outstanding condition

Mat, Mop and

Towel Service

•Carpet, scraper and

logo mats

•Mops and frames

•Bar towels, aprons and

related products

•Guaranteed service

and outstanding pricing

11

Weekly

expert

service

Customized

fulfillment

First-quality

products

Low,

consistent

pricing |

Average

savings

of

20%

Ongoing

expert

service

Flexible

scheduling

Multiple

delivery

options

Extensive

training

Chemical Program

Full Product Range with Frequent Service

Warewashing

•Detergents, sanitizers

and related chemicals

•Formulations for

automatic and manual

systems

•Machines available for

purchase, rental or lease

•Water filtration

systems Cleaning

Chemicals

•Full selection

•Value-priced

•Highly efficient

•Available as ready-to-

use and as

concentrates

Hand Care

•Offering

Purell®

and

custom branded

formulations

•Products available for

foodservice environments

and general surface use

•Personal protection

products available

Laundry

•Detergents, softeners

and related products

•Formulations for

commercial and

residential-style

machines

Specialty

•Broad range of

products

•Formulations for

specific use in

industrial, automotive,

healthcare, institutional

and other settings

12 |

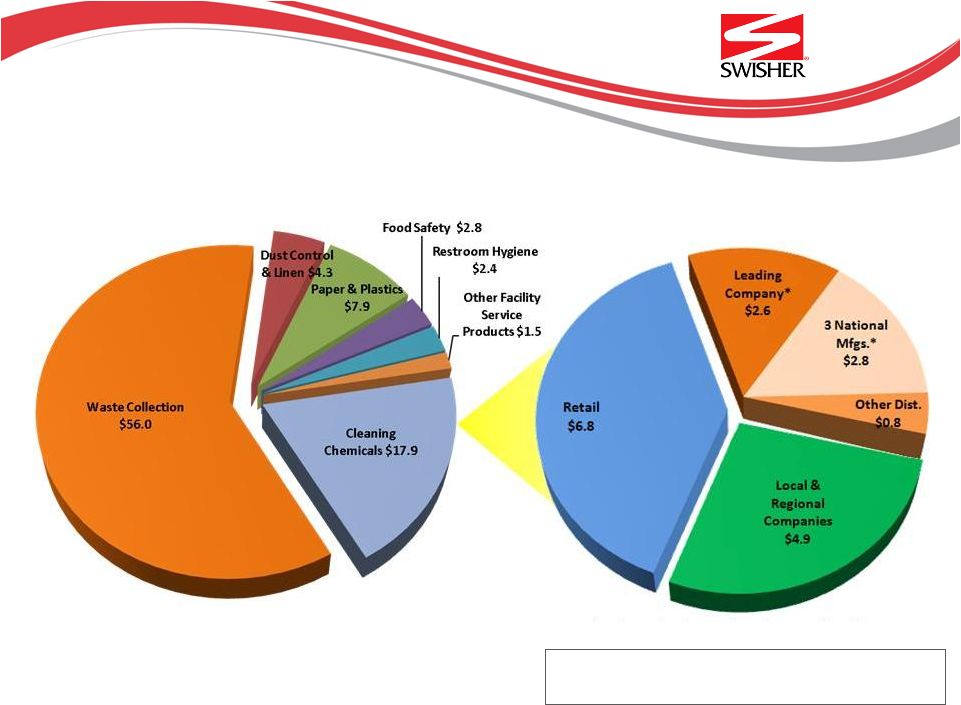

Commercial

Cleaning Chemical Market –

$17.9 Billion

Our Market Opportunity

Over $92 Billion

Current Addressable U.S. &

Canadian Market -

$92.8 Billion

Fragmented market with 2/3 split among retailers

and small independent chemical companies

13

* Primarily

through 3rd party distributors

Source: Kline Consulting, Textile Rental Services Association and

various other industry publications and public competitor filings.

|

Customer

Examples What Full Service Means

Major Cruise Line

Regional

Foodservice Chain

Weekly service to growing

regional restaurant chain

•Foodservice and cleaning

chemicals

•Dish machines

•Water filtration

•Hand care

•Hygiene and power-

washing

Weekly service to major

cruise line with ships

across the globe

•Warewash, laundry and

housekeeping chemicals

•Chemical and soap

dispensing equipment

•Water filtration

14

Large Healthcare

Provider

Leading Hospitality

Chain

Weekly service to

multi-unit luxury hotel

group

•Warewash

chemicals

•Housekeeping

chemicals

•Hand care products

Service to large,

national assisted

living chain

•Warewash, laundry

and housekeeping

chemicals

•Hand care products

•DfE

green certified

program |

Core Growth

Opportunities Strategies for Consistent Growth

15

FIELD SALES

•Direct and with distribution

partners

•Partnership with Bunzl USA,

$8 billion re-distributor

•Targeted to leverage excess

local route capacity

CORPORATE ACCOUNTS

•Dedicated team with prior

industry experience

•Significant pipeline of multi- unit prospects and tests

•Drives national and regional

volume

CURRENT CUSTOMERS

•Opportunity to significantly

increase revenue per customer

•Drives revenue per route

ACQUISITIONS

•Highly fragmented market

with hundreds of

opportunities

•Related, add-on services

•Synergies in purchasing,

routing and office expenses |

International

Opportunity Largely Untapped

Significant opportunity also exists for growth in worldwide markets

16

Highlighted areas represent current operations, franchisees or licensees.

|

Expanding

the Opportunity – Waste Collection

17 |

18

Strategic Rationale

Why Waste?

•

Exposure to another sizable, well-regarded industry

•

No intention of becoming primarily a waste business

•

Essential service of existing and new Swisher customers, providing

significant cross-selling opportunities

•

Service not offered by facility service and chemical competitors

•

Multiple small to mid-size acquisitions available

•

Exposure to Swisher name on equipment and collateral enhances brand

•

Complimentary route-based system leverages common infrastructure

•

Recurring revenue business with predictable cash flow and excellent

margins

•

Our

expansion

strategy

is

focused

in

markets

with

strong

Swisher

presence |

Eco-Friendly

Leader

24/7

Collection

and

Disposal

Multiple

Facilities

Total

Market

Coverage Commercial

&

Residential

Environmental Programs

Full Range of Sanitation Solutions

Recycling

•Material Recovery

Facilities

•Providing reclaimed

material to manufacturers

•Processing paper,

cardboard, aluminum,

steel, plastic, glass

Waste

Collection

•Commercial and

residential collection

•Full range of

containers

•Flexible service to

meet specific demand

Compactors

•35 and 40 yard

compactors available

•Reduce high volume of

waste significantly

•Ideal for multi-unit

residences, hospitals,

malls, markets, etc.

Portable

Sanitation

•Full-service solution

•Includes placement,

disposal and

management

•Ideal for work sites,

events, etc.

•Small and large temp

septic tanks available

Rolloff

•Temp and permanent

open top dumpsters

•20, 30 and 40 yard

units available

•Ideal for construction

projects, demolition,

remodels, events, short-

term needs

19 |

Our

Differentiation Comprehensive Range of Products

Product/Service

Uniform Co.

Chemical Co.

Waste Co.

Swisher

Restroom Hygiene Service

Germicidal Misting

Power Washing

Paper Program

Hand Care Program

Dust Control Programs

Mat, Bar Towels & Aprons

Cleaning Chemicals

Warewashing

Program

Laundry Program

Green Soap, Paper & Chemicals

Specialty Chemicals

Waste Collection

20 |

8

13

4

14

15

8

13

16

3

13

13

14

9

7

8

10

4

1

2

13

14

15

16

17

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

Full Coverage

Door-to-Dumpster Opportunity

21

Kitchen Chemicals

Dish Machines

Foodservice Wipers

Cleaning Chemicals

Laundry Products

Weekly Sanitizing Service

Pressure Washing

Germicidal Misting

Hand Sanitizer

Restroom Soap

Restroom Paper

Odor Control

Floor Mats

Floor Treatment

Drainline

Treatment

Disposable Gloves

Waste Management

4

6

9

9

9

9

4

13

Sample Hospitality Customer Floorplan

13

13

5

12

11 |

Current

Waste Acquisition Opportunity

22 |

Choice

Environmental* Highlights

•

Highly-recurring revenue tied to municipal

contracts

•

Attractive, near 20% EBITDA Margins

•

Strong management team with over 100 years in

waste business

•

Recent CapEx investments resulting in scaleable

platform / equipment

23

•

Founded in 2004 and based in Fort

Lauderdale, FL

•

Residential, commercial and industrial

solid waste and recycling services to

more than 150,000 residential and 7,500

commercial customers

•

Six hauling operations, three transfer and

MRF facilities

•

Operates throughout Southern and

Central Florida

•

Processes more than 120,000 tons of

material annually

•

320 employees and 150 collection

vehicles

*No definitive relationship yet exists with Choice Environmental; we are in

discussions with them but can not make any assurances that an agreement will

be consummated. |

24

Strategic Rationale

Why Choice Environmental?

•

Recurring revenue

•

Attractive margins

•

Senior management has over 100 years of waste experience with proven

success

consolidating

fragmented

industries

through

acquisitions

and

organic growth

•

Good mix of the services that Swisher plans to pursue in its waste

strategy

•

Geographic concentration of revenue in attractive Florida markets

•

Approximately 40% of revenue from exclusive municipal contracts |

Market

Integration Multiple Service Offerings Drive Synergies

25

Swisher Branch Office

Swisher Corporate Office

Choice Hauling Operation*

Choice Transfer/MRF Facility*

Choice CNG Fueling Station*

Choice Corporate Office*

Installation Centers

*Upon closing of acquisition |

26

Choice Environmental

Financial Summary

US$ in thousands

2007

2008

2009

2010

Revenue

17,937

$

33,577

$

37,534

$

44,894

$

Gross Margin

3,851

$

7,989

$

9,984

$

11,236

$

EBITDA

3,199

$

6,347

$

7,303

$

7,621

$

EBITDA %

17.8%

18.9%

19.5%

17.0%

2010 EBITDA Add-backs:

Start-up Costs in New Markets

1,063

$

Excess Owner's Comp

484

Adjusted 2010 EBITDA

9,168

$ |

Deal Profile

& Timing Terms of Acquisition

Consideration (US$)

Acquisition of Choice equity

(A)

$50,140,000

(9,200,000

shares)

Debt assumed

42,000,000

Total enterprise value

$92,140,000

(A)

Market value at the date purchase price was established

Anticipated Timing

Complete acquisition due diligence

February 8

Complete Private Placement commitment

February 11

Sign merger agreement

February 11

Announce merger and Private Placement

February 11

Closing of merger

(B)

and Private Placement

February 21

File registration statement

March

4

(B)

Assumes Hart-Scott-Rodino

filing is not required

27 |

Pro Forma

Results 28 |

29

LTM September 30, 2010 Pro Forma

Positive EBITDA Before Synergies

US$ in millions

Swisher

Target

Pro Forma

Revenue

61.1

$

44.9

$

106.0

$

Cost of Sales

22.9

14.6

37.5

Gross Margin

38.2

30.3

68.5

Route Expenses

13.2

13.9

27.1

Route Margin

25.0

16.5

41.5

SG&A

27.9

8.8

36.7

Depr. & Amort.

4.4

3.7

8.1

Operating Loss

(7.3)

$

3.9

$

(3.4)

$

(excl. $1.4 million of merger-related exp)

EBITDA

(2.9)

$

7.6

$

4.7

$

12 Months Ended Sept. 30, 2010 |

30

Pro Forma Balance Sheet

Assumes $50mm Financing

Pro Forma September 30, 2010

Swisher

Consolidated

Post-Transaction

Pro Forma

Target

Pro Forma

Pro Forma

Cash and Equivalents

$60,347

$503

$60,850

$5,762

$66,612

Other Current Assets

9,685

4,588

14,273

14,273

Current Assets

70,032

5,091

75,123

5,762

80,885

PP&E (Net)

9,430

25,782

35,212

35,212

Intangibles

24,202

17,305

84,350

84,350

Notes Receivable & Other Assets

1,836

2,088

3,924

3,924

Total Assets

$105,500

$50,265

$198,609

$5,762

$204,371

AP, Accrued Expenses & Other

$13,766

$5,821

$19,587

$19,587

Current Portion LTD

27,711

4,541

32,252

(4,541)

27,711

Current Liabilities

41,477

10,362

51,839

(4,541)

47,298

Non-Current Liabilities

12,576

34,447

47,023

(34,447)

12,576

Stockholder's Equity

51,447

5,456

99,747

44,750

144,497

Total Liabilities and Equity

$105,500

$50,265

$198,609

$5,762

$204,371

Private

Placement

Notes: Balance Sheets are as of September 30, 2010. Swisher Pro Forma is unaudited Pro

Forma assuming the merger with Coolbrands International would have been consummated as

of that date – note, however that the merger did not close until November 2, 2010. Target

balance sheet is audited as of September 30, 2010 , the end of their fiscal year.

Private Placement gross proceeds of $50MM estimated to be reduced by $3.75MM in total

transaction fees and $1.5MM related to payment of pre-payment penalty due Target lender. |

31

Pro Forma Ownership

At close of Financing and Acquisition

Assumptions:

Price at Offering

$5.50

Gross Proceeds

$50,000,000

Pre-Deal

Post-Deal

Insiders & Individuals

Shares

% Owned

Insiders & Individuals

Shares

% Owned

Wayne Huizenga

25,005,311

20.8%

Wayne Huizenga

25,005,311

18.0%

Steven Berrard

25,005,359

20.8%

Steven Berrard

25,005,359

18.0%

Others

15,220,996

12.6%

Others

15,220,996

11.0%

Total

65,231,666

54.2%

Total

65,231,666

47.0%

Institutions

10,456,423

8.7%

Institutions

10,456,423

7.5%

Public

38,326,974

31.8%

Public

38,326,974

27.6%

Fully-Diluted

Fully-Diluted

Options

880,000

0.7%

Options

880,000

0.6%

Warrants

5,500,000

4.6%

Warrants

5,500,000

4.0%

Total

120,395,063

100.0%

Deal-Related

M&A Consideration

9,200,000

6.6%

Issued in PIPE

9,090,909

6.6%

Total

138,685,972

100.0% |

Summary

Strong Foundation for Success

–

Attractive business model

–

Sustainable competitive difference

–

Not dependent on a single product line

–

Fixed costs already in place

–

Large, growing market which allows for:

–

Significant revenue and earnings growth

–

Considerable number of both small and large

acquisition opportunities

–

Continual leverage of existing infrastructure

increases margins

–

Target route margins above 45%

–

Target EBITDA margins above 15%

–

Proven management team

–

Considerable experience consolidating fragmented

industries

32 |

Purchaser’s Right of Action

33

Ontario

Part 5 of Ontario Securities Commission Rule 45-501 – Ontario Prospectus and

Registration Exemption (“Rule 45-501”) provides that the right of action

for damages and right of rescission referred to in Section 130.1 of the Securities Act (Ontario) (the “Act”) shall generally apply in respect of

an offering memorandum delivered to a prospective purchaser in connection with a distribution

made in reliance on certain exemptions from the prospectus requirements under the

Act. In the event that this presentation, together with any amendments hereto, is furnished to a

prospective purchaser of the securities of Swisher resident in Ontario and contains an untrue

statement of a material fact or omits to state a material fact that is required to be

stated or that is necessary to make a statement not misleading in light of the circumstances in which it was

made (a “misrepresentation”), a subscriber resident in Ontario who purchases the

securities offered by this presentation during the period of distribution has, without

regard to whether the subscriber relied on the misrepresentation, a right of action for damages against Swisher. The

subscriber may elect to exercise a right of rescission against Swisher, in which case, the

subscriber will have no right of action for damages against Swisher. No action to

enforce the right of rescission shall be commenced more than 180 days after the date on which payment for the

securities is made by a subscriber resident in Ontario and no action for damages shall be

commenced more than the earlier of: a)

180 days after the subscriber first had knowledge of the facts giving rise to the cause of

action, or b)

three years after the date on which payment for the securities is made by a subscriber

resident in Ontario. The rights of action for rescission or damages are subject to the

following defences and limitations available under Section 130.1 of the Act: a) Swisher will not be liable if it proves that the subscriber

purchased the securities with knowledge of the misrepresentation;

b)

in the case of an action for damages, Swisher will not be liable for all or any portion of

the damages that it proves do not represent the depreciation in value of the

securities as a result of the misrepresentation relied upon; and c)

in no case will the amount recoverable in any action exceed the price at which

the securities were offered to the subscriber. The right of action for rescission or

damages described herein is in addition to and without derogation from any other right or remedy otherwise

available at law to the subscriber. Prospective purchasers are encouraged to refer to the Act

and to Rule 45-501 promulgated thereunder for the complete text of the provisions

under which these rights are conferred. |