Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DOMINION ENERGY SOUTH CAROLINA, INC. | a11-5279_18k.htm |

| EX-99.1 - EX-99.1 - DOMINION ENERGY SOUTH CAROLINA, INC. | a11-5279_1ex99d1.htm |

Exhibit 99.2

|

|

SCANA CORPORATION Fourth Quarter & Full Year 2010 |

|

|

2 SCANA CORPORATION Safe Harbor Statement Statements included in this press release which are not statements of historical fact are intended to be, and are hereby identified as, “forward-looking statements” for purposes of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, but are not limited to, statements concerning key earnings drivers, customer growth, environmental regulations and expenditures, leverage ratio, projections for pension fund contributions, financing activities, access to sources of capital, impacts of the adoption of new accounting rules and estimated construction and other expenditures. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “expects,” “forecasts,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential” or “continue” or the negative of these terms or other similar terminology. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties, and that actual results could differ materially from those indicated by such forward-looking statements. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include, but are not limited to, the following: (1) the information is of a preliminary nature and may be subject to further and/or continuing review and adjustment; (2) regulatory actions, particularly changes in rate regulation, regulations governing electric grid reliability, environmental regulations, and actions affecting the construction of new nuclear units; (3) current and future litigation; (4) changes in the economy, especially in areas served by subsidiaries of SCANA Corporation (SCANA, and together with its subsidiaries, the Company); (5) the impact of competition from other energy suppliers, including competition from alternate fuels in industrial interruptible markets; (6) growth opportunities for SCANA’s regulated and diversified subsidiaries; (7) the results of short- and long-term financing efforts, including future prospects for obtaining access to capital markets and other sources of liquidity; (8) changes in SCANA’s or its subsidiaries’ accounting rules and accounting policies; (9) the effects of weather, including drought, especially in areas where the Company’s generation and transmission facilities are located and in areas served by SCANA's subsidiaries; (10) payment by counterparties as and when due; (11) the results of efforts to license, site, construct and finance facilities for baseload electric generation and transmission; (12) the results of efforts to attract and retain joint venture partners for South Carolina Electric & Gas Company’s (SCE&G) new nuclear generation project; (13) the availability of fuels such as coal, natural gas and enriched uranium used to produce electricity; the availability of purchased power and natural gas for distribution; the level and volatility of future market prices for such fuels and purchased power; and the ability to recover the costs for such fuels and purchased power; (14) the availability of skilled and experienced human resources to properly manage, operate, and grow the Company’s businesses; (15) labor disputes; (16) performance of SCANA’s pension plan assets; (17) changes in taxes; (18) inflation or deflation; (19) compliance with regulations; and (20) the other risks and uncertainties described from time to time in the periodic reports filed by SCANA or SCE&G with the United States Securities and Exchange Commission. The Company disclaims any obligation to update any forward-looking statements. |

|

|

3 SCANA CORPORATION Basic Earnings $0.74 (2010) vs. $0.62 (2009) EPS for the Fourth Quarter $2.99 (2010) vs. $2.85 (2009) EPS for the Year |

|

|

4 SCANA CORPORATION Note (1): In the first quarter of 2010, pursuant to authorization by the Public Service Commission of South Carolina (SCPSC) in connection with its annual review of fuel cost and rates, the Company accelerated the recognition of previously deferred state income tax credits in the amount of $17 million, or 9 cents per share (thereby lowering income tax expense) and recorded an offsetting reduction of 2010’s recovery of fuel costs (electric revenue). Note (2): In January 2010, the SCPSC approved SCE&G’s retroactive adoption of updated, lower depreciation rates for its electric operations effective January 1, 2009. The SCPSC also approved SCE&G’s request that the credit to depreciation expense resulting from the adoption of these rates be applied to reduce recovery of fuel costs (electric revenue). As such, the Company decreased both depreciation expense and electric revenue by $14 million, or 7 cents per share, in the quarter and year ended December 31, 2009. These offsetting decreases had no impact on 2009 net income. Fourth quarter 2009 depreciation expense reflects the entire annual impact of these lower depreciation rates. As a result, depreciation expense is $10 million, or 5 cents per share, lower in the fourth quarter of 2009 compared to the fourth quarter of 2010. Note (3): In May 2010, SCANA entered into an equity forward sales agreement. During periods when the average market price of SCANA’s common stock is above the per share adjusted forward sales price, the Company computes diluted earnings per share giving effect to this dilutive potential common stock utilizing the treasury stock method. 2010 Variances vs. 2009 ^ Quarter Ended Year Ended December 31, 2010 December 31, 2010 * Electric Margin (1)(2) .28 .60 * Natural Gas Margin .00 .15 * Operation & Maintenance Expense (.06) (.15) * Interest Expense (Net of AFUDC) .00 (.09) * Property Taxes .00 (.07) * Depreciation (2) (.08) (.10) * Dilution (.03) (.09) * EIZ State Income Tax Benefit (including interest) .00 (.11) * Other, Net .01 .00 •Total, Basic .12 .14 * Additional Dilution re: potential common stock(3) .00 (.01) •Total, Diluted .12 .13 |

|

|

5 Basic Earnings per Share by Company SCANA CORPORATION Q410 Vs. Q409 2010 Vs. 2009 $0.74 $0.62 $2.99 $2.85 Q410 Q409 SCE&G PSNC SEGA Corporate and Other 2010 2009 SCE&G PSNC SEGA Corporate and Other |

|

|

SCANA CORPORATION Financing Plan 2011 - 2013 6 ($ in Millions) 2010A 2011E 2012E 2013E Debt Refinancings: SCANA - $300 $250 - SCE&G - 150 - 150 PSNC - 150 - - New Issues: SCE&G - 200 450 450 PSNC 100 - - - Total Debt $100 $800 $700 $600 Equity 401(k)/DRP 94 95 100 100 Additional (estimated) 60 240 150 150 Total Equity $154 $335 $250 $250 Forward offering of equity, from May 2010 |

|

|

7 Electric Operating Statistics SCANA CORPORATION Quarter Ended December 31, 2010 2009 % Change Sales (Million KWH) Residential 1,908 1,740 9.7 Commercial 1,763 1,675 5.3 Industrial 1,450 1,310 10.7 Other 141 132 6.8 Total Retail Sales 5,262 4,857 8.3 Wholesale 481 388 24.0 Total Sales 5,743 5,245 9.5 Twelve Months Ended December 31, 2010 2009 % Change Sales (Million KWH) Residential 8,791 7,893 11.4 Commercial 7,684 7,350 4.5 Industrial 5,863 5,324 10.1 Other 581 562 3.4 Total Retail Sales 22,919 21,129 8.5 Wholesale 1,965 1,975 (0.5) Total Sales 24,884 23,104 7.7 Customers (Period-End, Thousands) 661 655 0.9 |

|

|

8 Gas Operating Statistics SCANA CORPORATION Twelve Months Ended December 31, 2010 2009 % Change Sales (Thousand Dekatherms): Residential 78,349 67,329 16.4 Commercial 42,029 39,745 5.7 Industrial 173,745 159,084 9.2 Total Retail Sales 294,123 266,158 10.5 Sales for Resale 8,133 10,369 (21.6) Total Sales 302,256 276,527 9.3 Transportation Volumes 154,623 138,810 11.4 Customers (Period-End, Thousands) 1,260 1,238 1.8 Quarter Ended December 31, 2010 2009 % Change Sales (Thousand Dekatherms): Residential 27,427 23,114 18.7 Commercial 13,616 12,501 8.9 Industrial 39,161 39,546 (1.0) Total Retail Sales 80,204 75,161 6.7 Sales for Resale 2,571 2,926 (12.1) Total Sales 82,775 78,087 6.0 Transportation Volumes 43,406 39,122 11.0 |

|

|

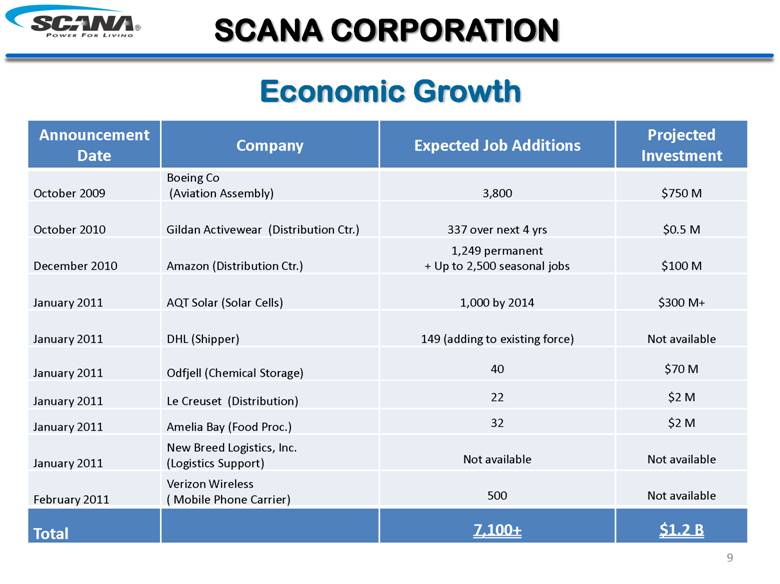

9 Economic Growth SCANA CORPORATION Announcement Date Company Expected Job Additions Projected Investment October 2009 Boeing Co (Aviation Assembly) 3,800 $750 M October 2010 Gildan Activewear (Distribution Ctr.) 337 over next 4 yrs $0.5 M December 2010 Amazon (Distribution Ctr.) 1,249 permanent + Up to 2,500 seasonal jobs $100 M January 2011 AQT Solar (Solar Cells) 1,000 by 2014 $300 M+ January 2011 DHL (Shipper) 149 (adding to existing force) Not available January 2011 Odfjell (Chemical Storage) 40 $70 M January 2011 Le Creuset (Distribution) 22 $2 M January 2011 Amelia Bay (Food Proc.) 32 $2 M January 2011 New Breed Logistics, Inc. (Logistics Support) Not available Not available February 2011 Verizon Wireless ( Mobile Phone Carrier) 500 Not available Total 7,100+ $1.2 B |

|

|

NC Growth: +18.5% SC Growth: +15.3% GA Growth: +18.3% National Growth: +9.7% Data Source: http://2010.census.gov/2010census/data/ Population Growth 2000 - 2010 SCANA CORPORATION SCANA Service Territory 10 |

|

|

2011E 2012E 2013E TOTAL SCE&G - Normal Generation $ 95 $ 137 $ 97 $ 329 Transmission & Distribution 202 228 225 655 Other 37 27 16 80 Gas 50 51 52 153 Common 18 15 17 50 402 458 407 1,267 PSNC Energy 66 63 71 200 Other 32 30 36 98 Total “Normal” 500 551 514 1,565 New Nuclear 478 832 827 2,137 Cash Requirements for Constr. $978 $1,383 $1,341 $3,702 Nuclear Fuel 81 57 106 244 Total Estimated Capital Exp $1,059 $1,440 $1,447 $3,946 CAPEX 2011-2013 SCANA CORPORATION 11 |

|

|

12 Normal weather O&M growth at 1% Customer usage flat Residential customer growth consistent with 2010 SCEG Electric Margins: BLRA rate relief effective 11/10 BLRA rate relief requested 11/11 SCEG Gas Margins: RSA rate decrease effective 11/10 PSNC Margins: Decoupling mechanism (CUT) for reduced consumption by residential & commercial customers Georgia Margins: $0.20 - $0.24 anticipated EPS The Assumptions and Long Term View SCANA CORPORATION |

|

|

13 SCANA CORPORATION Note: Amounts are as of BLRA –September 2010 Quarterly Filing Overview of Nuclear Project Status |

|

|

14 Schedule of Nuclear Project Capital Costs SCANA CORPORATION Projection 9/30/2010 As Approved In Order 2010-12 Change Base Capital Cost, 2007 Dollars $4,270,391 $4,096,455 $173,936* Add: Escalation $1,265,317 $1,807,948 ($542,631) Total Project Cash Flow $5,535,708 $5,904,403 ($368,695) Add: AFUDC $ 302,775 $ 283,721 $ 19,054 Gross Construction Cost $5,838,483 $6,188,124 ($349,641) Project Milestones % Total Milestones Completed 54 out of 146 37% “Forecasted escalation costs will vary as escalation indices are revised” * In 2010, the South Carolina Supreme Court ruled that contingency costs were not permitted to be part of the approved capital cost schedule. As a result, SCE&G is required to specifically identify and itemize costs that were previously classified as contingency costs. On November 15, the Company filed a petition with the SCPSC to identify currently known capital costs of $173.9 million that will be incurred during construction of the new nuclear units. |

|

|

BLRA Filings Filed Revenue Requested Revenue Granted % Req. Granted % Increase Effective BLRA Initial Filing 05/30/08 $7.8 $7.8 100% 0.4% APR ‘09 BLRA Annual RRA 05/29/09 $22.5 $22.5 100% 1.1% NOV ‘09 BLRA Annual RRA 05/28/10 $47.3(1) $47.3 100% 2.3% NOV ‘10 2011 Regulatory Schedule – SCE&G New Nuclear Other Matters 2/14 – Q4 2010 Status Report 1/31 – Demand Side Management Filing 4/4 – Updated Cost Hearing 2/28 - Integrated Resource Plan Filing 5/17 – Q1 2011 Status Report 3/24 – Electric Fuel Cost Review 5/27 - BLRA Revised Rate Application 6/15 - Gas RSA Filing 8/15 – Q2 2011 Status Report Nov. – Purchased Gas Adjustment Review 11/14 – Q3 2011 Status Report Completed ($ in Millions) SCANA CORPORATION Regulatory Update 15 Adjusted amount based on actual CWIP, net of Supreme Court decision (1) |

|

|

16 Questions? SCANA CORPORATION |