Attached files

| file | filename |

|---|---|

| EX-14 - CODE OF ETHICS - Globe Net Wireless Corp. | exhibit14.htm |

| EX-5.1 - LEGAL OPINION - Globe Net Wireless Corp. | exhibit5-1.htm |

| EX-23.1 - CONSENT AUDITOR - Globe Net Wireless Corp. | exhibit23-1.htm |

| EX-23.2 - CONSENT LEAGL - Globe Net Wireless Corp. | exhibit23-2.htm |

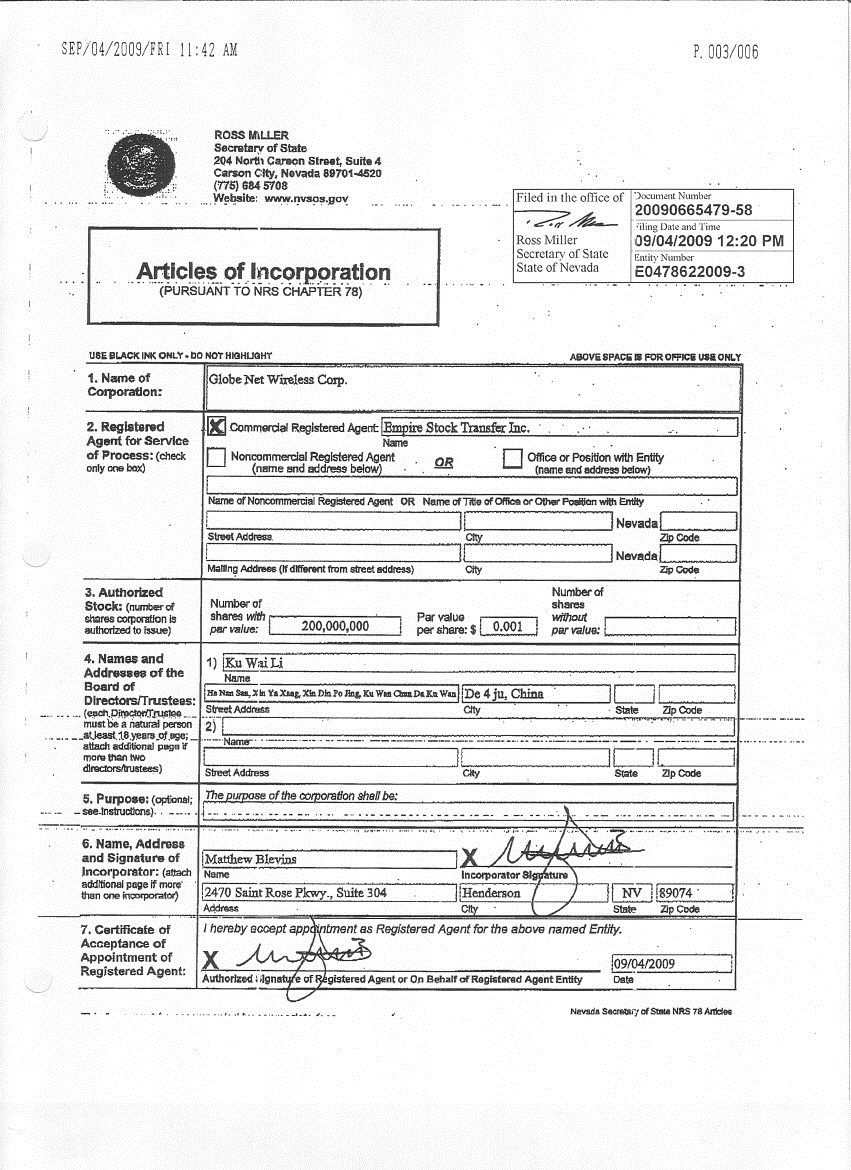

| EX-3.1 - ARTICLES - Globe Net Wireless Corp. | exhibit3-1.htm |

| EX-3.2 - BYLAWS - Globe Net Wireless Corp. | exhibit3-2.htm |

SEC File #

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Initial Filing

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

GLOBE NET WIRELESS CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

7375

|

00-0000000

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(IRS Employer

Identification Number)

|

2302-3 Pacific Plaza

410 Des Voeux Road West

Hong Kong, China

including area code, of Registrant’s principal executive offices)

|

Agent for Service:

Ku Wai Li

Globe Net Wireless Corp.

2302-3 Pacific Plaza

410 Des Voeux Road West

Hong Kong

Telephone: (852) 37-55-8010

Facsimile: (852) 37-47-7244

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

|

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box:

|

[X]

|

|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

|

[ ]

|

|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

|

[ ]

|

|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

|

[ ]

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company in Rule 12b-2 of the Exchange Act.

Larger accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ] (Do not check if a smaller reporting company) Smaller reporting company [ X ]

|

|

Page - 1

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities To Be Registered

|

Amount to be

registered

|

Proposed Maximum

Offering Price

per share [1]

|

Proposed Maximum

Aggregate Offering

Price [1]

|

Amount of

Registration

Fee

|

|

Shares of common stock ($0.001 par value),

to be registered by issuer

|

5,000,000 shares

|

$0.05

|

$250,000

|

$29.03

|

|

Shares of common stock ($0.001 par value),

to be registered by selling shareholders

|

7,500,000 shares

|

$0.05

|

$375,000

|

$43.54

|

|

Total

|

-

|

-

|

$625,000

|

$72.57

|

|

|

[1] Estimated in accordance with Rule 457(c) solely for the purpose of calculating the registration fee based on a bona fide estimate of the maximum offering price.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

Page - 2

The information in this prospectus is not complete and may be changed. The selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Dated *, 2011

Prospectus

GLOBE NET WIRELESS CORP.

5,000,000 shares of common stock

and

7,500,000 shares of common stock

Globe Net Wireless Corp. (“Globe Net”) is offering up to 5,000,000 shares of common stock on a self underwritten basis. The offering price is $0.05 per share and the maximum amount to be raised is $250,000. Globe Net intends to offer up to a maximum of 5,000,000 shares through its officers and directors to investors, outside the United States. There will be no underwriter or broker/dealer involved in the transaction and there will be no commissions paid to any individuals from the proceeds of this sale.

The offering by Globe Net is being conducted on a best efforts basis. There is no minimum number of shares required to be sold by Globe Net. All proceeds from the sale of these shares will be delivered directly to Globe Net and will not be deposited in any escrow account. If the entire 5,000,000 shares of common stock are sold, Globe Net will receive gross proceeds of $250,000 before expenses of approximately $23,000. Globe Net plans to complete or terminate this offering by August 31, 2011. No assurance can be given on the number of shares Globe Net will sell or even if Globe Net will be able to sell any shares.

In addition, the selling shareholders of Globe Net named in this prospectus are offering to sell up to 7.5 million shares of Globe Net’s common stock held by them. Globe Net will not receive any proceeds from the sale of the shares of common stock being offered by the selling shareholders. However, Globe Net will pay for the expenses of this offering and the selling shareholders’ offering, except for any selling shareholder’s legal or accounting costs or commissions.

Globe Net is a startup company that intends to engage in the development and sale of internet and wireless connectivity systems to provide both consumers and businesses in rural communities and remote industry sites with high-speed internet connectivity and other internet related services at speeds equal or better than existing competing services. As of the effective date of this prospectus Globe Net has not conducted any business operations nor generated any revenues.

Globe Net’s shares of common stock are not quoted on any national securities exchange. The selling shareholders are required to sell Globe Net’s shares at $0.05 per share until Globe Net’s shares are quoted on the Over-the-Counter Bulletin Board (OTCBB), and thereafter at prevailing market prices or privately negotiated prices.

This investment involves a high degree of risk. See “Risk Factors” beginning on page 7 for a discussion of certain risk factors and uncertainties you should carefully consider before making a decision to purchase any shares of Globe Net’s common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Page - 3

Table of Contents

| Page | |

|

Prospectus Summary

|

5

|

|

Risk Factors

|

7

|

|

Use of Proceeds

|

10

|

|

Determination of Offering Price

|

11

|

|

Dilution

|

12

|

|

Selling Security Holders

|

14

|

|

Plan of Distribution

|

15

|

|

Description of Securities to be Registered

|

18

|

|

Interests of Named Experts and Counsel

|

19

|

|

Description of Business

|

19

|

|

Description of Property

|

24

|

|

Legal Proceedings

|

24

|

|

SEC Filings

|

24

|

|

Market for Common Equity and Related Stock Matters

|

25

|

|

Financial Statements

|

28

|

| August 31, 2010 audited financial statements | 28 |

| November 30, 2010 unaudited financial statements | 40 |

|

Management Discussion and Analysis of Financial Condition

|

49

|

|

Changes in Disagreements With Accountants on Accounting and Financial Disclosure

|

52

|

|

Directors, Officers, Promoters, and Control Persons

|

52

|

|

Executive Compensation

|

54

|

|

Security Ownership of Certain Beneficial Owners and Management

|

54

|

|

Transactions with Related Persons, Promoters, and Certain Control Persons

|

55

|

|

Disclosure of Commission Position of Indemnification for Securities Act Liabilities

|

55

|

You should rely only on the information contained in this prospectus. Globe Net has not authorized anyone to provide you with information different from that contained in this prospectus. The selling shareholders are offering to sell shares of Globe Net’s common stock and seeking offers to buy shares of Globe Net’s common stock only in jurisdictions where such offers and sales are permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Globe Net’s business, financial condition, results of operations and prospects may have changed since that date.

Page - 4

Prospectus Summary

The following summary is a shortened version of more detailed information, exhibits and financial statements appearing elsewhere in this prospectus. Prospective investors are urged to read this prospectus in its entirety.

Globe Net is a startup company engaged in the development and sale of internet and wireless connectivity systems for the purpose of becoming a rural internet service provider. Globe Net’s mission is to provide rural communities with high-speed internet connectivity at speeds equal or better than existing competing services. Globe Net will try to provide internet and related services to both consumers and businesses in currently under serviced or unserviceable areas at real broadband speeds. To date, Globe Net has not conducted any business operations nor generated any revenues.

To date Globe Net has raised $17,000 via offerings completed between September 2009 and January 2010. The following table summarizes the date of offering, the price per share paid, the number of shares sold, and the amount raised for these two offerings.

|

Closing Date of Offering

|

Price Per Share Paid

|

Number of Shares Sold

|

Amount Raised

|

|

September 14, 2009

|

$0.001

|

2,000,000

|

$2,000

|

|

January 26, 2010

|

$0.002

|

7,500,000

|

$15,000

|

Globe Net has no revenues, has achieved losses since inception, has no operations, has been issued a going concern opinion by its auditor and relies upon the sale of its shares of common stock to fund its operations.

Name, Address, and Telephone Number of Registrant

Globe Net Wireless Corp.

2302-3 Pacific Plaza

410 Des Voeux Road West

Hong Kong, China

Telephone: (852) 37-55-8010

The Offering

The following is a brief summary of this offering.

|

Securities being offered to new and current investors:

|

Up to a maximum of 5,000,000 shares of common stock with no minimum purchase.

|

|

|

Securities being offered by selling shareholders:

|

7,500,000 shares of common stock

(These shares are being registered by Globe Net for resale on behalf of existing shareholders.)

|

|

|

Offering price:

|

$0.05

|

|

|

Offering period:

|

The shares are being offered until December 31, 2011.

|

|

|

Net proceeds to Globe Net:

|

Nil, as Globe Net will not be receiving any proceeds from the sale of shares by the selling shareholders.

|

|

|

Use of proceeds:

|

Not applicable.

|

|

|

Number of shares outstanding before the offering:

|

9,500,000

|

|

|

Number of shares outstanding after the offering:

|

14,500,000

|

Page - 5

Summary Financial Information

The tables and information below are derived from Globe Net’s audited financial statements for the year-ended August 31, 2010 and its unaudited financial statements for the three month period ended November 30, 2010. Globe Net had a working capital of $7,492 as at August 31, 2010 and a working capital deficit of $1,582 as at November 30, 2010.

|

Financial Summary

|

August 31, 2010

$

|

November 30, 2010

|

|

Cash

|

10,550

|

8,298

|

|

Total Assets

|

11,450

|

10,001

|

|

Total Liabilities

|

3,058

|

9,881

|

|

Total Stockholder’s Equity

|

8,392

|

120

|

|

Statement of Operations

|

Accumulated From

September 4, 2009

(Date of Inception)

to August 31, 2010

$

|

For the three month

period ended

November 30, 2010

|

|

Revenue

|

−

|

-

|

|

Net Loss For the Period

|

9,508

|

7,934

|

|

Net Loss per Share

|

0.001

|

0.001

|

The book value of Globe Net’s outstanding common stock was $(0.00001) per share as at November 30, 2010.

Page - 6

Risk Factors

An investment in the common stock of Globe Net involves a number of very significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this prospectus in evaluating Globe Net and its business before purchasing shares of Globe Net‘s common stock. Globe Net’s business, operating results and financial condition could be seriously harmed due to any of the following known material risks. Additional risk factors not presently known to Globe Net may also impair its business operations. You could lose all or part of your investment due to any of these risks.

Risks associated with Globe Net’s business:

|

1.

|

Because Globe Net has only recently commenced business operations, Globe Net faces a high risk of business failure and this could result in a total loss of your investment.

|

Globe Net has recently begun the initial phases of its plan of operations, and thus has no way to evaluate the likelihood whether Globe Net will be able to operate its business successfully. Globe Net was incorporated on September 4, 2009 and to date has been involved primarily in organizational activities, obtaining financing and market research. Globe Net has not earned any revenues and Globe Net has never achieved profitability as of the date of this prospectus. Potential investors should be aware of the difficulties normally encountered by new wholesale and retail companies and the high rate of failure of such enterprises. The likelihood of success must be considered in the light of problems, expenses, difficulties, complications and delays encountered in connection with the start-up of a wholesale / retail business that Globe Net plans to undertake. These potential problems include, but are not limited to, unanticipated problems relating to start-up and additional costs and expenses that may exceed current estimates. Globe Net has no history upon which to base any assumption as to the likelihood that its business will prove successful, and Globe Net can provide no assurance to investors that Globe Net will generate any operating revenues or ever achieve profitable operations. If Globe Net is unsuccessful in addressing these risks its business will likely fail and you will lose your entire investment in this offering.

|

2.

|

Globe Net does not have sufficient funds to complete each phase of its proposed plan of operation and as a result may have to suspend operations.

|

Each of the phases of Globe Net’s plan of operation is limited and restricted by the amount of working capital that Globe Net has and is able to raise from financings and generate from business operations. Globe Net currently does not have sufficient funds to complete each phase of its proposed plan of operation and management expects that Globe Net will not satisfy its cash requirements for the next 12 months. As a result, Globe Net may have to suspend or cease its operations on one or more phases of its proposed plan of operation. As of August 31, 2010, Globe Net had $10,550 in cash.

Until Globe Net is able to generate any consistent and significant revenue it will be required to raise the required funds by way of equity or debt financing. Globe Net intends to finance its plan of operation with equity financing and private loans initially and then with revenues generated from its business operations. If Globe Net cannot raise the funds necessary to proceed it may have to suspend operations until it has sufficient capital.

|

3.

|

Globe Net’s auditors have expressed substantial doubt about Globe Net’s ability to continue as a going concern.

|

The accompanying financial statements have been prepared assuming that Globe Net will continue as a going concern. As discussed in Note 2 to the financial statements, Globe Net was recently incorporated on September 4, 2009, and does not have a history of earnings, and as a result, Globe Net’s auditor has expressed substantial doubt about the ability of Globe Net to continue as a going concern. Continued operations are dependent on Globe Net’s ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Globe Net’s financial statements do not include any adjustments that may result from the outcome of this uncertainty.

|

4.

|

Because Globe Net has only recently commenced business operations, Globe Net expects to incur operating losses for the foreseeable future.

|

Globe Net has never earned any revenue and Globe Net has never been profitable. Prior to completing its plan of operations, Globe Net may incur increased operating expenses without realizing any revenues from its business operation. This could cause Globe Net to fail and you will lose your entire investment in this offering.

|

5.

|

Third party suppliers may provide Globe Net with equipment or services, and the loss of these suppliers or a disruption or interruption in the supply system may adversely affect Globe Net’s business.

|

Globe Net may rely on equipment suppliers and service providers operated by third-party vendors for substantially all of its equipment and service supplies. The loss of multiple or key suppliers or a significant disruption or interruption in the supply chain could have a material adverse effect on the marketing and sale of Globe Net’s systems. Furthermore, increases in the costs of equipment or services may adversely affect Globe Net’s profit margins if Globe Net is unable to pass along any higher costs in the form of price increases or otherwise achieve cost efficiencies in marketing and sale of its systems. If Globe Net encounters problems with its supply system, then Globe Net’s ability to meet customer expectations, manage inventory, complete sales, and achieve objectives for operating efficiencies could be harmed.

Page - 7

|

6.

|

Globe Net’s success will depend, in part, on the quality and safety of the systems it develops, sells and delivers to its customers.

|

Globe Net’s success depends, in part, on the quality and safety of the systems and service delivered to its customers. If the systems are found to be defective or unsafe, or if they otherwise fail to meet Globe Net’s customers’ standards, Globe Net’s relationship with its customers could suffer, Globe Net could lose market share, and Globe Net could become subject to liability claims, any of which could result in a material adverse effect on Globe Net’s business, results of operations, and financial condition.

Additionally, if defects in the compilation of Globe Net’s systems are not discovered until after such systems are purchased and installed, Globe Net’s customers could lose confidence in the technical attributes of the systems and, as a result, Globe Net’s operations could suffer and its business may be harmed.

|

7.

|

Globe Net’s success depends on significantly increasing the number of subscribers that sign-up for one of Globe Net’s service packages.

|

Globe Net’s revenue will be derived almost exclusively from subscription fees for its rural internet service packages. Depending on the package begin sold, Globe Net will receive revenue per subscriber as a fixed fee. To date, Globe Net has no subscribers. Globe Net’s short term success depends on obtaining a minimum number of subscribers. Globe Net’s success also depends on identifying viable target markets with potential subscribers. If Globe Net is unable to obtain a minimum number of subscribers, Globe Net’s financial results could be adversely affected.

Risks associated with Globe Net’s industry:

|

8.

|

Changes in government regulation of the wireless communications industry may adversely affect Globe Net’s business.

|

Currently, other than business and operations licenses applicable to most commercial ventures, Globe Net is not required to obtain any governmental approval for its business operations. However, there can be no assurance that current or new laws or regulations will not, in the future, impose additional fees and taxes on Globe Net and its business operations.

It is possible that a number of laws and regulations may be adopted in the United States and elsewhere that could restrict the rural Internet service provider industry. Management anticipates that regulation of the industry will increase and that Globe Net may be required to devote legal and other resources to address any new regulation. Changes in current laws or regulations or the imposition of new laws and regulations in the United States or elsewhere regarding this industry may lessen the growth or access of wireless communications services and may adversely impact on the financial results of Globe Net’s business operations.

|

9.

|

|

Globe Net faces competition in the rural Internet service provider industry and failure to successfully compete in the industry with established companies may result in Globe Net’s inability to continue with its business operations.

|

There are other companies that provide similar services. Management expects competition in this market to increase significantly as new companies enter the market and current competitors expand their services and target markets. Globe Net’s competitors may develop or offer technology or systems that are better than Globe Net’s or that achieve greater market acceptance. It is also possible that new competitors may emerge and acquire significant market share. Competitive pressures created by any one or more of these competitors could have a negative impact on Globe Net’s business, results of operations or financial condition, and as a result, Globe Net may not be able to continue with its business operations. In addition, if Globe Net is unable to develop and introduce new or enhanced systems or services quickly enough to respond to market or user requirements or to comply with emerging industry standards, or if its systems do not achieve market acceptance, Globe Net may not be able to compete effectively.

Risks associated with Globe Net:

|

10.

|

Globe Net’s sole officer and director resides outside of the United States, and as a result it may be difficult for a shareholder to enforce their rights against him or enforce United States court judgments against him in China.

|

Globe Net’s sole director and officer, Ku Wai Li, resides in China and substantially all of Globe Net’s assets may be located in China. As a result, it may be difficult for United States investors to enforce their legal rights, to effect service of process upon Ku Wai Li or to enforce judgments of United States courts predicated upon civil liabilities and criminal penalties of Globe Net’s directors and officers under federal securities laws. Further, it is unclear if extradition treaties now in effect between the United States and China would permit effective enforcement of criminal penalties of the federal securities laws.

Page - 8

|

11.

|

Globe Net’s management lacks any formal training or experience in operating an Internet service provider company, and as a result management may make mistakes, which could have a negative impact on Globe Net’s business operations.

|

Globe Net’s management is inexperienced in operating a wholesale and retail business. Globe Net’s sole officer and director, Ku Wai Li, has no direct training or experience in these areas and as a result may not be fully aware of all of the specific requirements related to working within this industry. Management’s decisions and choices may not take into account standard managerial approaches Internet service provider companies commonly use. Consequently, Globe Net’s operations, earnings, and ultimate financial success could suffer irreparable harm due to management’s lack of experience in this industry. As a result, Globe Net may have to suspend or cease operations and Globe Net’s business operations may be negatively impacted.

Key personnel represent a significant asset, and the competition for these personnel is intense in the wholesale and retail industry. Globe Net may have particular difficulty attracting and retaining key personnel in initial phases of its plan of operation. Globe Net does not maintain key person life insurance on any of its personnel. The loss of one or more of its key employees or its inability to attract, retain and motivate qualified personnel could negatively impact Globe Net’s ability to complete its plan of operation.

|

12.

|

If Globe Net is unable to attract or retain key personnel necessary for the implementation of its business operations, Globe Net’s plan of operation may be negatively impacted.

|

Globe Net’s future success depends largely upon the continued service of its sole director and officer and other key personnel. Globe Net’s success also depends on its ability to continue to attract, retain and motivate qualified personnel. Key personnel represent a significant asset, and the competition for these personnel is intense in the internet service provider industry. Globe Net may have particular difficulty attracting and retaining key personnel in initial phases of its plan of operation. Globe Net does not maintain key person life insurance on any of its personnel. The loss of one or more of its key employees or its inability to attract, retain and motivate qualified personnel could negatively impact Globe Net’s ability to complete its plan of operation.

|

13.

|

If Globe Net’s management is not able to commit sufficient time to the growth and development of Globe Net and its operations, Globe Net’s business operation may fail.

|

Currently Mr. Li is able to devote approximately 10 hours per week to Globe Net’s business operations. If Mr. Li or other key personnel are not able to commit a sufficient amount of time to the growth and development of the business operations of Globe Net then, as a result, Globe Net’s operations will be negatively impacted and may fail.

|

14.

|

This offering is on a best efforts basis with no minimum amount required to be raised and as a result Globe Net can accept your investment funds at anytime without any other investment funds being raised.

|

There is no minimum amount required to be raised before Globe Net can accept your investment funds. As the offering is based on a best effort with no stated minimum and, as a result, investment funds will not be placed in an escrow account pending the attainment of a minimum amount of proceeds. Once your investment funds have been accepted by Globe Net, there will be no obligation to return your investment funds even though no other investment funds are raised.

|

15.

|

Subscribers to this offering will suffer immediate and substantial dilution.

|

Subscribers of the shares of common stock offered will suffer immediate and substantial dilution. As a result, you will pay a price per share that substantially exceeds the value of Globe Net’s assets after subtracting its liabilities. If all shares of the offering are subscribed for, the subscribers will contribute 93.6% of all subscription funds received by Globe Net since September 4, 2009, but will own only 34.5% of the shares of common stock issued and outstanding. See “Dilution” on page 14 for more information.

|

16.

|

This offering is on a best efforts basis with no minimum amount required to be raised and as a result Globe Net can accept your investment funds at anytime without any other investment funds being raised.

|

There is presently no public market in Globe Net’s shares. While Globe Net intends to contact an authorized OTC Bulletin Board market maker for sponsorship of its common stock, Globe Net cannot guarantee that such sponsorship will be approved nor that Globe Net’s common stock will be listed and quoted for sale. Even if Globe Net’s shares are quoted for sale, buyers may be insufficient in numbers to allow for a robust market, and it may prove impossible to sell your shares.

|

17.

|

Globe Net does not expect to pay dividends in the foreseeable future.

|

Globe Net has never paid cash dividends on its shares of common stock and has no plans to do so in the foreseeable future. Globe Net intends to retain earnings, if any, to develop and expand its business.

Page - 9

|

18.

|

If the selling shareholders sell a large number of shares all at once or in blocks, the value of Globe Net’s shares would most likely decline.

|

The selling shareholders are offering 7.5 million shares of Globe Net’s common stock through this prospectus. They must sell these shares at a fixed price of $0.05 until such time as they are quoted on the OTC Bulletin Board or other quotation system or stock exchange. Globe Net’s common stock is presently not traded on any market or securities exchange, but should a market develop, shares sold at a price below the current market price at which the common stock is trading will cause that market price to decline. Moreover, the offer or sale of large numbers of shares at any price may cause the market price to fall. The outstanding shares of common stock covered by this prospectus represent approximately 79% of the shares of common stock currently outstanding.

| 19. |

Globe Net’s common stock is subject to the “penny stock” rules of the SEC and the trading market in Globe Net’s securities is limited, which makes transactions in Globe Net’s stock cumbersome and may reduce the value of an investment in Globe Net’s stock.

|

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to Globe Net, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

|

·

|

that a broker or dealer approve a person’s account for transactions in penny stocks; and

|

|

·

|

the broker or dealer receives from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

|

·

|

obtain financial information and investment experience objectives of the person; and

|

|

·

|

make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

|

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form:

|

·

|

sets forth the basis on which the broker or dealer made the suitability determination; and

|

|

·

|

that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

|

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of Globe Net’s common stock and cause a decline in the market value of Globe Net’s common stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

The following table indicates the use of proceeds based on the percentage of the financing that is successfully sold.

|

Sale

of

100%

|

Sale

of

80%

|

Sale

of

60%

|

Sale

of

40%

|

Sale

of

20%

|

||||||||||||||||

|

Gross Proceeds

|

$ | 250,000 | $ | 200,000 | $ | 150,000 | $ | 100,000 | $ | 50,000 | ||||||||||

|

Number of Shares Sold

|

5,000,000 | 4,000,000 | 3,000,000 | 2,000,000 | 1,000,000 | |||||||||||||||

|

Less expenses of offering:

|

||||||||||||||||||||

|

Legal and Registration Fees

|

$ | 10,000 | $ | 10,000 | $ | 10,000 | $ | 10,000 | $ | 10,000 | ||||||||||

|

Accounting and Auditing

|

8,500 | 8,500 | 8,500 | 8,500 | 8,500 | |||||||||||||||

|

Electronic Filing and Printing

|

2,000 | 2,000 | 2,000 | 2,000 | 2,000 | |||||||||||||||

|

Transfer Agent

|

2,500 | 2,500 | 2,500 | 2,500 | 2,500 | |||||||||||||||

|

Net Proceeds

|

$ | 227,000 | $ | 177,000 | $ | 127,000 | $ | 77,000 | $ | 27,000 | ||||||||||

|

Use of net proceeds

|

||||||||||||||||||||

|

Development of System

|

$ | 25,000 | $ | 20,000 | $ | 10,000 | $ | 5,000 | $ | 5,000 | ||||||||||

|

Licenses and Permits

|

$ | 20,000 | $ | 20,000 | $ | 20,000 | $ | 10,000 | $ | 5,000 | ||||||||||

|

Equipment and Supplies

|

$ | 100,000 | $ | 80,000 | $ | 50,000 | $ | 40,000 | $ | 10,000 | ||||||||||

|

Training staff

|

$ | 10,000 | $ | 10,000 | $ | 10,000 | $ | 5,000 | $ | 2,500 | ||||||||||

|

Marketing and Sales

|

$ | 50,000 | $ | 25,000 | $ | 25,000 | $ | 10,000 | $ | 2,500 | ||||||||||

|

Working Capital

|

$ | 22,000 | $ | 22,000 | $ | 12,000 | $ | 7,000 | $ | 2,000 | ||||||||||

Page - 10

Analysis of Financing Scenarios

After deduction of $23,000 for estimated offering expenses including legal and registration fees, accounting and auditing, electronic filing and printing, and transfer agent, the net proceeds from this offering may be as much as $227,000, assuming all 5,000,000 shares are sold. However, there can be no assurance that any of these shares will be sold. Globe Net will use the proceeds to (1) develop Internet and wireless connectivity systems and develop its website, (2) identify and establish supply contracts with equipment suppliers and service providers, (3) identify and obtain required licenses and permits, (4) market rural internet service packages to potential users, (5) train staff and technicians, (6) set up transmitting locations, and (7) sign up a minimum of 100 subscribers to its residential and commercial service packages.

Even if the offering is fully subscribed for, Globe Net may not have sufficient finds to cover its anticipated costs during the next 12 months and Globe Net may have to raise additional funds either from equity offerings, debt offerings, or revenue generation.

If only a portion of the offering is completed, the funds will be prorated accordingly.

The projected expenditures shown above are only estimates or approximations and do not represent a firm commitment by Globe Net. To the extent that the proposed expenditures are insufficient for the purposes indicated, supplemental amounts required may be drawn from other categories of estimated expenditures, if available. Conversely, any amounts not expended as proposed will be used for general working capital. Globe Net will amend the registration statement by post-effective amendment if there are any material changes to the use of proceeds as described above.

Working capital is the cost related to operating Globe Net’s office. It is comprised of telephone service, mail, stationery, administrative salaries, accounting, acquisition of office equipment and supplies, and expenses of filing reports with the SEC, which Globe Net has estimated at a minimum of $50,000 for one year.

Globe Net will not receive any proceeds from the sale of shares of Globe Net’s common stock being offered by the selling stockholders. If Globe Net fails to sell sufficient shares of common stock to cover the expenses of this offering, Globe Net will use existing working capital to pay all offering expenses.

Globe Net will not receive any proceeds from the sale of the shares of common stock being offered for sale by the selling shareholders through this Prospectus.

Determination of Offering Price

The offering price was determined by using a number of factors. Management considered the price of the most recent financing. Additionally, management estimated the cost of this offering plus the amount Globe Net needs to operate its business for the next 12 months. Management determined the offering price by assessing Globe Net’s capital requirements against the price management thinks investors are willing to pay for Globe Net’s common stock. Management has arbitrarily set the offering price of the shares of common stock at $0.05 per share, and in making such a determination considered several factors, including the following:

|

·

|

prevailing market conditions, including the history and prospects for the industry in which Globe Net competes;

|

|

·

|

Globe Net’s lack of business history;

|

|

·

|

the proceeds to be raised by the offering;

|

|

·

|

Globe Net’s capital structure; and

|

|

·

|

Globe Net’s future prospects.

|

Therefore, the public offering price of the shares of common stock does not necessarily bear any relationship to established valuation criteria and may not be indicative of prices that may prevail at any time or from time to time in the future. Additionally, because Globe Net has no significant operating history and has not generated any revenues to date, the price of its shares of common stock is not based on past earnings, nor is the price of the shares of common stock indicative of current market value for any assets owned by Globe Net. No valuation or appraisal has been prepared for Globe Net’s business and potential business expansion. You cannot be sure that a public market for any of Globe Net’s securities will ever be listed for trading or trade at a price higher than the offering price in this offering.

Page - 11

Globe Net is also registering for resale on behalf of selling stockholders up to 7,500,000 shares of common stock. The shares of common stock offered for resale may be sold in a secondary offering by the selling stockholders by means of this prospectus. Globe Net will not participate in the resale of shares by selling security holders. Currently there is no market for Globe Net’s common stock and Globe Net wanted to give its shareholders the ability to sell their shares for a price equal or greater to the price they paid for their shares. If Globe Net’s common stock is quoted for trading on the OTC Bulletin Board, the price of the common stock will then be established by the market. The offering price for the shares offered by the selling shareholders does not bear any relationship to Globe Net’s assets, book value, earnings, or other established criteria for valuing a privately held company. Accordingly, the offering price should not be considered an indication of the actual value of the Globe Net’s common stock nor should the offering price be regarded as an indicator of the future market price of Globe Net’s common stock.

Dilution

The shares offered for sale by the selling security holders are already issued and outstanding and, therefore, do not contribute to dilution.

Prior to this offering, Globe Net had 9,500,000 shares of common stock issued and outstanding as at November 30, 2010. The net tangible book value of Globe Net as at November 30, 2010 was $(1,582) or $(0.00017) per share. Net tangible book value per share is determined by dividing Globe Net’s tangible net worth, consisting of tangible assets less total liabilities, by the number of shares outstanding. The average price paid by the present stockholders is $0.0018. The following tables summarize the difference between the average price paid by present stockholders and the price to be paid by subscribers to this offering for 20%, 40%, 60%, 80%, and 100% subscription rates.

|

Analysis for 20% Subscription

|

|||||

|

Stockholder

Type

|

Price

Paid

$

|

Number of Shares Held

|

Amount of Consideration Paid

|

Percentage of

Consideration

|

Percentage of

Shares Held

|

|

Present

Stockholders

|

$0.0018

|

9,500,000

|

$17,000

|

25.4%

|

90.5%

|

|

Investors in

this Offering

|

$0.05

|

1,000,000

|

$50,000

|

74.6%

|

9.5%

|

|

Analysis for 40% Subscription

|

|||||

|

Stockholder

Type

|

Price

Paid

$

|

Number of Shares Held

|

Amount of Consideration Paid

|

Percentage of

Consideration

|

Percentage of

Shares Held

|

|

Present

Stockholders

|

$0.0018

|

9,500,000

|

$17,000

|

14.5%

|

82.6%

|

|

Investors in

this Offering

|

$0.05

|

2,000,000

|

$100,000

|

85.5%

|

17.4%

|

|

Analysis for 60% Subscription

|

|||||

|

Stockholder

Type

|

Price

Paid

$

|

Number of Shares Held

|

Amount of Consideration Paid

|

Percentage of

Consideration

|

Percentage of

Shares Held

|

|

Present

Stockholders

|

$0.0018

|

9,500,000

|

$17,000

|

10.2%

|

76.0%

|

|

Investors in

this Offering

|

$0.05

|

3,000,000

|

$150,000

|

89.8%

|

24.0%

|

|

Analysis for 80% Subscription

|

|||||

|

Stockholder

Type

|

Price

Paid

$

|

Number of Shares Held

|

Amount of Consideration Paid

|

Percentage of

Consideration

|

Percentage of

Shares Held

|

|

Present

Stockholders

|

$0.0018

|

9,500,000

|

$17,000

|

7.8%

|

70.4%

|

|

Investors in

this Offering

|

$0.05

|

4,000,000

|

$200,000

|

92.2%

|

29.6%

|

|

Analysis for 100% Subscription

|

|||||

|

Stockholder

Type

|

Price

Paid

$

|

Number of Shares Held

|

Amount of Consideration Paid

|

Percentage of

Consideration

|

Percentage of

Shares Held

|

|

Present

Stockholders

|

$0.0018

|

9,500,000

|

$17,000

|

6.4%

|

65.5%

|

|

Investors in

this Offering

|

$0.05

|

5,000,000

|

$250,000

|

93.6%

|

34.5%

|

Page - 12

“Dilution” means the difference between Globe Net’s public offering price ($0.05 per share) and its proforma net tangible book value per share after implementing this offering and accounting for the cost of the offering and accounting for the settlement of debt by issuance of shares for the convertible promissory notes. Net tangible book value per share is determined by dividing Globe Net’s tangible net worth, consisting of tangible assets less total liabilities, by the number of shares outstanding. The following table will show the net tangible book value of Globe Net’s shares both before and after the completion of this offering for 20%, 40%, 60%, 80%, and 100% subscription rates.

|

20%

|

40%

|

60%

|

80%

|

100%

|

|

|

Public offering price per share

|

$0.05

|

$0.05

|

$0.05

|

$0.05

|

$0.05

|

|

Net tangible book value per share before offering

|

$(0.00017)

|

$(0.00017)

|

$(0.00017)

|

$(0.00017)

|

$(0.00017)

|

|

Proforma net tangible book value per share after offering

|

$0.00461

|

$0.00856

|

$0.01187

|

$0.01470

|

$0.01713

|

|

Increase per share attributable to public investors

|

$0.00478

|

$0.00873

|

$0.01204

|

$0.01487

|

$0.01730

|

|

Dilution per share to public investors

|

$0,04539

|

$0.04144

|

$0.03813

|

$0.03530

|

$0.03287

|

Page - 13

Selling Shareholders

The selling shareholders named in this prospectus are offering all of their 7,500,000 shares of the common stock offered through this prospectus. These shares were acquired from Globe Net in the following private placement:

|

1.

|

7,500,000 shares of Globe Net common stock that the selling shareholders acquired from Globe Net in a minimum-maximum offering that was exempt from registration under Regulation S of the Securities Act of 1933 and was completed on January 26, 2010.

|

Until a public market is established for Globe Net’s common stock, the selling shareholders will be offering their shares at the offering price of $0.05.

The following table provides as of the date of this prospectus information regarding the beneficial ownership of Globe Net’s common stock held by each of the selling shareholders, including:

|

1.

|

the number of shares owned by each before the offering;

|

|

2.

|

the total number of shares that are to be offered for each;

|

|

3.

|

the total number of shares that will be owned by each upon completion of the offering; and

|

|

4.

|

the percentage owned by each upon completion of the offering.

|

|

Name of Selling Shareholder

|

Shares Owned Before the Offering

|

Total Number of Shares to be Offered for the Security Holder’s Account

|

Total Shares Owned After the Offering is Complete

|

Percentage of Shares Owned After the Offering is Complete

|

|

Peng Jing

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Zhang Pei de

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Wu Feng

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Wu Xiao Mei

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Lei Dan

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Wei Xiao Han

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Wei Xiao Shuang

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Wei Xian Ju

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Wang Wei Peng

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Zhong Hua

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Wang Yin Chun

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Zheng Xi Huan

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Chen Tian

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Liu Wei Qiong

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Dai Chun Hua

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Li Jun

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Wei Yu Duo

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Yang Jing Wen

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Li Zhen Guo

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Zhong Quan Sheng

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Chen Ji Peng

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Liang Heng Jun

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Zeng Wen Min

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Li Xian He

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Huang Xiu Hong

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Jin Bi Gu

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Ma Ke Mao

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Zhong Tao

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Ye Quan

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Wei Mao Chan

|

250,000

|

250,000

|

Nil

|

Nil

|

|

Total

|

7,500,000

|

7,500,000

|

0

|

0%

|

To the best of Globe Net’s knowledge and belief, (a) all of the shares of common stock are beneficially owned by the registered stockholders; (b) none of the selling stockholders has held any position or office with Globe Net, (c) none of the selling stockholders had or have any material relationship with Globe Net; (d) the registered stockholders each have the sole voting and dispositive power over their shares; (e) there are no voting trusts or pooling arrangements in existence; (f) no group has been formed for the purpose of acquiring, voting or disposing of the security; (g) none of the selling stockholders are broker-dealers or affiliates of a broker-dealer; and (h) all of the selling stockholders acquired their shares in a non-public offering that satisfied the provisions of Regulations S. Each of these selling stockholders also agreed, as set out in their respective subscription agreements, that they would not, within one year after the original issuance of those shares, resell or otherwise transfer those shares except pursuant to an effective registration statement, or outside the United States in an offshore transaction in compliance with Rule 904, or pursuant to any other exemption from registration pursuant to the Securities Act, if available.

Page - 14

Plan of Distribution

Globe Net will have two types of shares that will be available for distribution:

|

1.

|

a self-underwritten offering of new shares related to its Initial Public Offering; and

|

|

2.

|

a secondary offering of non-affiliate shares owned by selling stockholders.

|

New Shares Related to Globe Net’s Self-Underwritten Offering

Globe Net will attempt to sell a maximum of 5,000,000 shares of common stock to the public on a self underwritten basis at an offering price of $0.05 per share. Globe Net’s gross proceeds will be $250,000 if all the shares offered are sold. Since this offering is conducted as a self-underwritten offering, there can be no assurance that any of the shares will be sold. If Globe Net fails to sell all the shares it is trying to sell, its ability to implement its business plan will be materially affected, and you may lose all or substantially all of your investment. There is no minimum number of shares of common stock that must be sold on behalf of Globe Net in order to accept funds and consummate investor purchases. Neither Globe Net nor Mr. Ku Wai Li, nor any other person, will pay commissions or other fees, directly or indirectly, to any person or firm in connection with solicitation of the sales of the shares.

Globe Net will sell the shares in this offering through Mr. Li, its sole officer and director. Mr. Li will not register as broker/dealers under Section 15 of the Securities Exchange Act of 1934 in reliance upon Rule 3a4-1. Rule 3a4-1 sets forth those conditions under which persons associated with an issuer may participate in the offering of the issuer’s securities and not be deemed to be a broker/dealer. The conditions are that

|

|

1.

|

The person is not statutory disqualified, as that term is defined in Section 3(a)(39) of the Exchange Act, at the time of his participation;

|

|

|

2.

|

The person is not compensated in connection with his participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities;

|

|

|

3.

|

The person is not at the time of their participation, an associated person of a broker/dealer;

|

|

|

4.

|

The person meets the conditions of Paragraph (a)(4)(ii) of Rule 3a4-1 of the Exchange Act, in that he (A) primarily performs, or is intended primarily to perform at the end of the offering, substantial duties for or on behalf of the issuer otherwise than in connection with transactions in securities; and (B) is not a broker or dealer, or an associated person of a broker or dealer, within the preceding twelve (12) months; and (C) does not participate in selling and offering of securities for any issuer more than once every 12 months other than in reliance on Paragraphs (a)(4)(i) or (a)(4)(iii).

|

Mr Li is not statutorily disqualified, nor is Mr. Li being compensated, and nor is Mr. Li associated with a broker/dealer. Mr. Li is and will continue to be Globe Net’s sole officer and director at the end of the offering. Mr. Li has not been during the last 12 months, and is currently not, a broker/dealer or associated with any broker/dealer. Mr. Li has not during the last 12 months, and will not in the next 12 months, offered or sold securities for another issuer.

Mr. Li is fully aware of the provisions of Rule 3a4-1 under the Exchange Act and will conduct this offering in accordance with Rule 3a4-1, and will rely upon this rule. Should Mr. Li conduct this offering in any way that violates Rule 3a4-1, then each of Mr. Li and Globe Net could be subjected to enforcement proceedings, fines and sanctions by the Securities and Exchange Commission and by the regulatory authorities of any state or province in which Globe Net’s securities are offered.

Mr. Li, as well all current stockholders, may purchase securities in this offering upon the same terms and conditions as public investors. If any purchase by a current stockholder triggers a material change, Globe Net would promptly file a post effective amendment to this registration statement. Any of these purchasers would be purchasing Globe Net’s shares of common stock for investment and not for resale.

No broker or dealer is participating in this offering. If, for some reason, Globe Net’s directors and stockholders were to determine that the participation of a broker or dealer is necessary, this offering will be promptly amended by a post effective amendment to disclose the details of this arrangement, including the fact that the broker or dealer is acting as an underwriter of this offering. This amendment would also detail the proposed compensation to be paid to any such broker or dealer. The post effective amendment would also extend an offer of rescission to any investors who subscribed to this offering before the broker or dealer was named. In addition to the foregoing requirements; Globe Net would be required to file any such amendment with the Corporate Finance Department of the National Association of Securities Dealers, Inc. and to obtain from them a “no objection” position from that organization on the fairness of the underwriting compensation. Globe Net would also have to amend, as applicable, its filings at the state and provincial level.

Offering Period and Expiration Date

The offering will remain open until December 31, 2011.

Page - 15

Procedures for subscribing

If you decide to subscribe for any shares in this offering, you must

|

|

1.

|

complete, sign and deliver a subscription agreement, and

|

|

|

2.

|

deliver a check or certified funds to “Globe Net Wireless Corp.” for acceptance or rejection.

|

Right to reject subscriptions

Globe Net has the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by Globe Net to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within 48 hours after Globe Net receives them by contacting the subscriber via telephone. If Globe Net receives an offer on a Friday, Globe Net will confirm its acceptance or rejection of the subscription by telephone over the weekend to comply with the 48 hour commitment. Within 10 days of accepting a subscription Globe Net will deliver via courier to the subscriber a copy of the accepted and signed subscription agreement and a share certificate representing the shares subscribed for.

Secondary Offering of Non-Affiliate Shares Owned by Selling Shareholders

The selling shareholders who currently own 7,500,000 shares of common stock in the capital of Globe Net may sell some or all of their common stock in one or more transactions, including block transactions.

The selling shareholders will sell the shares at $0.05 per share until Globe Net’s shares may be quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices.

The shares may also be sold in compliance with the Securities and Exchange Commission’s Rule 144. A description of the selling limitations defined by Rule 144 can be located on page 25 of this prospectus.

The selling shareholders may also sell their shares directly to market makers acting as principals or brokers or dealers, who may act as agent or acquire the common stock as a principal. Any broker or dealer participating in such transactions as agent may receive a commission from the selling shareholders, or, if they act as agent for the purchaser of such common stock, from such purchaser. The selling shareholders will likely pay the usual and customary brokerage fees for such services. Brokers or dealers may agree with the selling shareholders to sell a specified number of shares at a stipulated price per share and, to the extent such broker or dealer is unable to do so acting as agent for the selling shareholders, to purchase, as principal, any unsold shares at the price required to fulfill the respective broker’s or dealer’s commitment to the selling shareholders.

Brokers or dealers who acquire shares as principals may thereafter resell such shares from time to time in transactions in a market or on an exchange, in negotiated transactions or otherwise, at market prices prevailing at the time of sale or at negotiated prices, and in connection with such re-sales may pay or receive commissions to or from the purchasers of such shares. These transactions may involve cross and block transactions that may involve sales to and through other brokers or dealers. If applicable, the selling shareholders may distribute shares to one or more of their partners who are unaffiliated with Globe Net. Such partners may, in turn, distribute such shares as described above. Globe Net can provide no assurance that all or any of the common stock offered will be sold by the selling shareholders.

Globe Net is bearing all costs relating to the registration of the common stock owned by the selling shareholders. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders must comply with the requirements of the Securities Act and the Securities Exchange Act in the offer and sale of the common stock. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

|

'

|

not engage in any stabilization activities in connection with Globe Net’s common stock;

|

|

'

|

furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and

|

|

'

|

not bid for or purchase any of Globe Net’s securities or attempt to induce any person to purchase any of Globe Net’s securities other than as permitted under the Securities Exchange Act.

|

The Securities Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Globe Net’s stock qualifies as a penny stock and as a result will be subject to these penny stock rules. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

Page - 16

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure document prepared by the Commission, which:

|

'

|

contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

|

|

'

|

contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties;

|

|

'

|

contains a brief, clear, narrative description of a dealer market, including “bid” and “ask” prices for penny stocks and the significance of the spread between the bid and ask price;

|

|

'

|

contains a toll-free telephone number for inquiries on disciplinary actions;

|

|

'

|

defines significant terms in the disclosure document or in the conduct of trading penny stocks; and

|

|

'

|

contains such other information and is in such form (including language, type, size, and format) as the Commission shall require by rule or regulation;

|

The broker-dealer also must provide, prior to proceeding with any transaction in a penny stock, the customer:

|

1.

|

with bid and offer quotations for the penny stock;

|

|

2.

|

details of the compensation of the broker-dealer and its salesperson in the transaction;

|

|

3.

|

the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and

|

|

4.

|

monthly account statements showing the market value of each penny stock held in the customer’s account.

|

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for Globe Net’s stock because it will be subject to these penny stock rules. Therefore, shareholders may have difficulty selling those securities.

Regulation M

During such time as Globe Net may be engaged in a distribution of any of the shares Globe Net is registering by this registration statement, Globe Net is required to comply with Regulation M. In general, Regulation M precludes any selling security holder, any affiliated purchasers, and any broker-dealer or other person who participates in a distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase, any security which is the subject of the distribution until the entire distribution is complete. Regulation M defines a “distribution” as an offering of securities that is distinguished from ordinary trading activities by the magnitude of the offering and the presence of special selling efforts and selling methods. Regulation M also defines a “distribution participant” as an underwriter, prospective underwriter, broker, dealer, or other person who has agreed to participate or who is participating in a distribution.

Regulation M under the Exchange Act prohibits, with certain exceptions, participants in a distribution from bidding for or purchasing, for an account in which the participant has a beneficial interest, any of the securities that are the subject of the distribution. Regulation M also governs bids and purchases made in order to stabilize the price of a security in connection with a distribution of the security. Globe Net has informed the selling shareholders that the anti-manipulation provisions of Regulation M may apply to the sales of their shares offered by this prospectus, and Globe Net has also advised the selling shareholders of the requirements for delivery of this prospectus in connection with any sales of the common stock offered by this prospectus.

Page - 17

Description of Securities to be Registered

General

Globe Net’s authorized capital stock consists of 200,000,000 shares of common stock at a par value of $0.001 per share.

Common Stock

As at the date of this prospectus, 9,500,000 common shares are issued and outstanding and owned by 31 shareholders of record. All of the common shares are fully paid for and non-assessable.

Holders of Globe Net’s common stock are entitled to one vote for each share on all matters submitted to a shareholder vote. Holders of common stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all of the directors. Holders of one-third of shares of common stock, represented in person or by proxy, are necessary to constitute a quorum at any meeting of Globe Net’s shareholders. A vote by the holders of a majority of Globe Net’s outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to Globe Net’s Articles of Incorporation.

Holders of common stock are entitled to share in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event of liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the common stock. Holders of Globe Net’s common stock have no preemptive rights, no conversion rights and there are no redemption provisions applicable to Globe Net’s common stock.

Dividend Policy

Globe Net has never declared or paid any cash dividends on its common stock. Globe Net currently intends to retain future earnings, if any, to finance the expansion of its business. As a result, Globe Net does not anticipate paying any cash dividends in the foreseeable future.

Share Purchase Warrants

As of the date of this prospectus, there are no outstanding warrants to purchase Globe Net’s securities. Globe Net may, however, issue warrants to purchase its securities in the future.

Options

As of the date of this prospectus, there are no options to purchase Globe Net’s securities. Globe Net may, however, in the future grant such options and/or establish an incentive stock option plan for its directors, employees and consultants.

Convertible Securities

As of the date of this prospectus, Globe Net has not issued and does not have outstanding any securities convertible into shares of Globe Net’s common stock or any rights convertible or exchangeable into shares of Globe Net’s common stock. Globe Net may, however, issue such convertible or exchangeable securities in the future.

Nevada Anti-Takeover Laws

The provisions of the Nevada Revised Statutes (NRS) sections 78.378 to 78.3793 apply to any acquisition of a controlling interest in an certain type of Nevada corporation known as an “Issuing Corporation”, unless the articles of incorporation or bylaws of the corporation in effect on the 10th day following the acquisition of a controlling interest by an acquiring person provide that the provisions of those sections do not apply to the corporation, or to an acquisition of a controlling interest specifically by types of existing or future shareholders, whether or not identified.

The provisions of NRS 78.378 to NRS 78.3793 do not restrict the directors of an “Issuing Corporation” from taking action to protect the interests of the corporation and its shareholders, including, but not limited to, adopting or signing plans, arrangements or instruments that deny rights, privileges, power or authority to a holders of a specified number of shares or percentage of share ownership or voting power.

An “Issuing Corporation” is a corporation organized in the State of Nevada and which has 200 or more shareholders of record, with at least 100 of who have addresses in the State of Nevada appearing on the stock ledger of the corporation and does business in the state of Nevada directly. As Globe Net currently has less than 200 shareholders and no shareholders in the State of Nevada the statute does not currently apply to Globe Net.

If Globe Net does become an “Issuing Corporation” in the future, and the statute does apply to Globe Net, its sole director Mr. Ku Wai Li on his own will have the ability to adopt any of the above mentioned protection techniques whether or not he owns a majority of Globe Net’s outstanding common stock, provided he does so by the specified 10th day after any acquisition of a controlling interest.

Page - 18

Interests of Named Experts and Counsel

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest exceeding $50,000, directly or indirectly, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Conrad C. Lysiak, Attorney at Law of Spokane, Washington has provided the legal opinion regarding the legality of the shares being registered.

The financial statements included in this prospectus have been audited by K. R. Margetson Ltd., Chartered Accountant, of 331 East 5th Street, North Vancouver, British Columbia, V7L 1M1, to the extent and for the periods set forth in their report appearing elsewhere herein, and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

Globe Net is a Nevada company and was incorporated on September 4, 2009. Globe Net is a startup company engaged in the development of proprietary wireless broadband technology for the purpose of becoming a rural internet service provider (RISP). Globe Net is a “shell” company as defined by the SEC as a result of only having nominal operations and nominal assets.

Globe Net’s mission is to provide rural communities with high-speed internet connectivity at speeds equal or better than existing competing services. Through the use of its Internet and wireless connectivity systems, Globe Net will try to provide internet and related services to both consumers and businesses in currently under serviced or unserviceable areas at real broadband speeds. See “Plan of Operation” and “Management’s Discussion and Analysis of Financial Condition” below for more information. As of the effective date of this prospectus Globe Net has not conducted any business operations nor generated any revenues.

Since September 2009, Globe Net has had its executive head office at 2302-3 Pacific Plaza, 410 Des Voeux Road West, Hong Kong. The telephone number at this office is (852) 37-55-8010. Globe Net is renting the administrative office on a month to month basis.

Globe Net has an authorized capital of 200,000,000 common shares with a par value of $0.001 per share with 9.5 million common shares currently issued and outstanding.

Globe Net has not been involved in any bankruptcy, receivership or similar proceedings. There have been no material reclassifications, mergers, consolidations or purchases or sales of a significant amount of assets not in the ordinary course of Globe Net’s business.

Plan of Operation