Attached files

| file | filename |

|---|---|

| EX-99.3 - UNAUDITED PRO FORMA - GSP-2, INC. | f8k02112011ex99iii_gsp2.htm |

| EX-2.1 - SHARE EXCHANGE AGREEMENT - GSP-2, INC. | f8k02112011ex2i_gsp2.htm |

| EX-99.1 - HENGCHANG SEPTEMBER 30, 2010 CONSOLIDATED FINANCIALS - GSP-2, INC. | f8k02112011ex99i_gsp2.htm |

| EX-99.2 - HENGCHANG DECEMBER 2009 AND 2008 CONSOLIDATED FINANCIALS - GSP-2, INC. | f8k02112011ex99ii_gsp2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest event Reported): February 11, 2011

GSP-2, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-54070

|

27-3120454

|

|

(State or other jurisdiction of

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

incorporation or organization)

|

||

|

Gongzhuling State Agriculture Science and Technology Park, location of 998 kilometers, Line 102,

Gongzhuling city, Jilin province, China

|

||

|

(Address of principal executive offices)

|

||

|

+86-434-627-8415

|

||

|

(Registrant’s telephone number, including area code)

|

||

|

650 Sweet Bay Avenue

Plantation, Florida 33324

|

||

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “seeks,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Such statements may include, but are not limited to, information related to: anticipated operating results; licensing arrangements; relationships with our customers; consumer demand; financial resources and condition; changes in revenues; changes in profitability; changes in accounting treatment; cost of sales; selling, general and administrative expenses; interest expense; the ability to secure materials and subcontractors; the ability to produce the liquidity or enter into agreements to acquire the capital necessary to continue our operations and take advantage of opportunities; legal proceedings and claims.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, references in this report to “we,” “us,” “our,” “our Company,” or “the Company” are to the combined business of GSP-2, Inc. and its consolidated subsidiaries.

In addition, unless the context otherwise requires and for the purposes of this report only:

|

●

|

“GSP-2” refers to GSP-2, Inc., a Nevada company;

|

|

●

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

|

|

●

|

“Heng Chang HK” refers to Heng Chang HK Produce (HK) Investments, Ltd., a Hong Kong company;

|

|

●

|

“Hengchang Agriculture” refers to Jilin Hengchang Agriculture Development Co., Ltd., a PRC company;

|

|

●

|

“Hengchang Business Consultants” refers to Siping Hengchang Business Consultants Co., Ltd., a PRC company;

|

|

●

|

“Hengjiu” refers to Jilin Hengjiu Grain Purchase and Storage Co., Ltd., a PRC company;

|

|

●

|

“Operating Companies” refers to Hengchang Agriculture and Hengjiu;

|

|

●

|

“PRC” refers to the People’s Republic of China; and

|

|

●

|

“Securities Act” refers to the Securities Act of 1933, as amended; and

|

|

●

|

“Shiny Gold” refers to Shiny Gold Holdings Limited, a British Virgin Islands company.

|

|

ITEM 1.01

|

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

|

Share Exchange Agreement

On February 11, 2011, we entered into a Share Exchange Agreement (the “Exchange Agreement”) by and among (i) the Company, (ii) Shiny Gold Holdings Limited, a British Virgin Islands company (“Shiny Gold”), and (iii) the shareholders of Shiny Gold (the “Shiny Gold Shareholders”) pursuant to which the Shiny Gold Shareholders transferred to us all of the membership interests in Shiny Gold in exchange for the issuance of 12,800,000 shares (the “Shares”) of our common stock to the Shiny Gold Shareholders (such transaction, the “Share Exchange”). As a result of the Share Exchange, the Shiny Gold Shareholders own approximately 92.8% of our outstanding shares of common stock. We are now a holding company, which, through Shiny Gold and its subsidiaries, sells high quality agricultural products as raw materials for commercial livestock feeding and other renewable energy uses.

|

ITEM 2.01

|

COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

|

On February 11, 2011, we completed the acquisition of Shiny Gold pursuant to the Exchange Agreement. The acquisition was accounted for as a recapitalization effected by a share exchange, wherein Shiny Gold is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

- 2 -

FORM 10 DISCLOSURE

As disclosed elsewhere in this report, on February 11, 2011, we acquired Shiny Gold in a reverse acquisition transaction. Item 2.01(f) of Form 8-K provides that if the registrant was a shell company, other than a business combination related shell company, as those terms are defined in Rule 12b-2 under the Exchange Act, immediately before the reverse acquisition transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10 under the Exchange Act reflecting all classes of the registrant’s securities subject to the reporting requirements of Section 13of the such Exchange Act upon consummation of the transaction.

Since we were a shell company immediately before the reverse acquisition transaction disclosed under Item 2.01, we are providing below the information that we would be required to disclose on Form 10 under the Exchange Act if we were to file such form. Please note that the information provided below relates to the combined enterprises after the acquisition of Shiny Gold, except that information relating to periods prior to the date of the reverse acquisition only relate to Shiny Gold and its consolidated subsidiaries unless otherwise specifically indicated.

DESCRIPTION OF BUSINESS

Overview

The Company is a China based agriculture company which engages in research and genetic development of corn seed, cultivation, production, purchasing, storage, and distribution of corn and other agriculture products. The Company sells high quality agricultural products as raw materials for commercial livestock feeding and other renewable energy uses.

The Company has developed a unique model for the Chinese agricultural industry. As Chinese governmental policies place more restrictions on the people of china to reduce the size of their families, there are less people to farm the agricultural crops. The Company’s business model is designed to vertically integrate and manage integral aspects of the agricultural process as a producer, processor, marketer and distributor of agricultural products. The Company engages in research, and genetic development of the seed used for growing corn. The Company sells the corn seed to the local provincial farmers, and provides a full service facility for the farmer when the corn is fully grown and harvested. Their state of the art facilities purchase, separate, store and distribute the corn products for the farmers. The Company will also be planting and harvesting its own land through land use rights that they acquire with the proceeds from future financing . The Company serves its well established customer base in the Jilin province with its 180 employees. With additional funding, the Company anticipates the acquisition of additional land rights, farming equipment, storage facilities, and additional distribution facilities.

Our Corporate History and Background

We were incorporated in the State of Nevada on December 31, 2009 as a blank check development stage company formed for the purpose of acquiring an operating business, through a merger, stock exchange, asset acquisition or similar business combination. Prior to our reverse acquisition of Shiny Gold on February 11, 2011, we made no efforts to identify a possible business combination and had not previously conducted negotiations or entered into a letter of intent concerning any target business.

On February 11, 2011, we completed a reverse acquisition transaction through a share exchange with Shiny Gold whereby we acquired all of the issued and outstanding ordinary shares of Shiny Gold in exchange for 12,800,000 shares of our common stock, par value $0.001 per share, which shares constituted approximately 92.8% of our issued and outstanding shares, as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Shiny Gold became our wholly owned subsidiary and the former shareholders of Shiny Gold became our controlling stockholders. The share exchange transaction with Shiny Gold was treated as a reverse acquisition, with Shiny Gold as the acquirer and the Company as the acquired party. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Shiny Gold and its respective consolidated subsidiaries.

Upon the closing of the reverse acquisition, Peter Goldstein resigned from all offices that he held effective immediately. In addition, Mr. Goldstein resigned from his position as our sole director, which will become effective on the tenth day following our mailing of an information statement (the “Information Statement”) to our stockholders in compliance with the requirements of Section 14f-1 of the Exchange Act. The Information Statement will be mailed to our stockholders on or about February 15, 2011.

Also upon the closing of the reverse acquisition, our board of directors appointed Yushan Wei to fill the vacancy created by the resignation of Mr. Goldstein. Such appointment will become effective on the tenth day following our mailing of the Information Statement to our stockholders. In addition, our board of directors appointed Yushan Wei to serve as our President and Chief Executive Officer and Yufeng Wei as our Chief Operating Officer, effective immediately at the closing of the reverse acquisition.

- 3 -

As a result of our acquisition of Shiny Gold, Shiny Gold became our wholly owned subsidiary and we have assumed the business and operations of Shiny Gold and its subsidiaries. We plan to change our name to more accurately reflect our new business operations.

Historical Sales & Income Summary

|

Fiscal Year Ended

December 31,

|

Nine Months Ended

September 30,

|

|||||||||||||||

|

($ in USD)

|

2009

|

2008

|

2010

|

2009

|

||||||||||||

|

Revenue

|

$ | 53,275 | $ | 26,541 | $ | 44,219 | $ | 27,385 | ||||||||

|

Gross Profit

|

12,701 | 3,954 | 39,302 | 24,499 | ||||||||||||

|

Net Income

|

11,130 | 1,104 | 1,812 | 2,127 | ||||||||||||

Corporate Structure

GSP-2, Inc. owns all of the Ordinary Shares of Shiny Gold. Shiny Gold was formed under the laws of the British Virgin Islands on May 20, 2010. Shiny Gold owns all of the share capital of Heng Chang HK. Heng Chang HK owns all of the share capital of Hengchang Business Consultants, a wholly foreign owned enterprise located in the PRC. On February 10, 2011, Hengchang Business Consultants entered into a series of agreements (the “Contractual Arrangements”)with each of the Operating Companies and their respective shareholders.

Shiny Gold controls and receives the economic benefits of their business operations through the Contractual Arrangements, but does not own any equity interests in the Operating Companies. In addition, as a result of the Contractual Arrangements, the Operating Companies are deemed to be Shiny Gold’s variable interest entities and, accordingly, Shiny Gold consolidates the Operating Companies’ results, assets and liabilities into its financial statements.

Shiny Gold’s organizational structure was developed to permit the infusion of foreign capital under the laws of the PRC and to maintain an efficient tax structure, as well as to foster internal organizational efficiencies. The corporate structure of the Company as a result of the Share Exchange is as follows:

- 4 -

Our Industry

China’s economy has grown rapidly in recent years making China one of the fastest growing economies in the world. China’s agricultural industry has also grown significantly, driven by the growth of the overall economy. According to the China Statistical Abstract, the increase in China’s agricultural production is the result of an increase in the consumption of food products such as crops and meat proteins for human and animal nutrition, as well as food products for industrial uses such as fuels and materials. However, while domestic productions have grown, it has not kept pace with consumption resulting in imports of many agricultural products such as corn.

Despite its recent rapid growth, the agricultural industry in China remains at an early stage of modernization, with significant manual labor and less usage of advanced machinery and irrigation than that of developed economies. In an effort to modernize and promote development of the agricultural industry in China, the Chinese government has provided substantial financial support to agricultural and related business through low interest loans, preferential tax treatments, financial subsidies and other measures. In the mean time, Chinese farmers are increasingly using improved production techniques and products, including hybrid seeds.

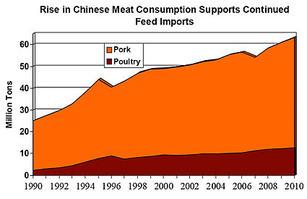

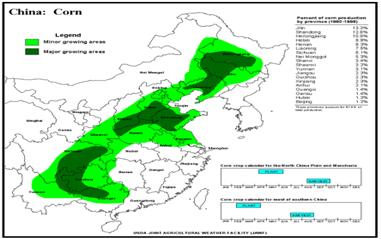

China is the world’s second largest corn producer after the United States. Coincident with the growth of its economy and the agricultural industry, corn production in China has grown at a rate more than twice the growth rate of the United States. Corn is used primarily as animal feed particularly for chickens and pigs as well as food for human consumption. According to the China National Grain and Oil Information Center, almost three quarters of Chinas total corn production was used to produce animal feed and 20% was used to produce ethanol, and the other 5% was used for human consumption.

- 5 -

The increasing demand for corn in China has been partially driven by the increasing demand for animal feed, which in turn has been driven by the significant growth in meat consumption as a result of the recent rapid growth in per capita disposable income in China. For more than two decades, China was one of the world’s largest net corn exporting countries. However, due to the rapid increase on domestic demand for corn in China, China now exports significantly less corn than it used to and its imports of corn have increased considerably.

We believe production of, and demand for, corn are likely to continue to rise as Chinas economy further develops, driven by increasing demands across all major uses of corn. Given limitations on land available for corn production, we believe use of hybrid corn seeds that can produce corn with characteristics such as high yielding drought or pest resistant or high oil content is also likely to continue to increase. As competition for suitable land in China for other crops continues while demand for corn increases, Chinese farmers may be inclined to utilize better production methods to increase yields and improve the quality and attributes of their corn products. We believe that the relatively low corn consumption per capita in China coupled with the rapid increase in domestic demand for corn demonstrates significant potential for China’s corn market to further grow.

Our Products

The chart below provides selected summary information about our proprietary corn seed products:

|

Name

|

Promoting Area

|

Growth Area

|

|

Defeng 10

|

Jilin Province

|

Mid-Late maturity

|

|

Hongyu 29

|

Jilin Province

|

Mid-Late maturity

|

|

Defeng 77

|

Jilin Province

|

Late maturity

|

|

Defeng 108

|

Jilin Province

|

Late maturity

|

Defeng seed varieties have been widely planted in three northeastern provinces. The seeds are also being planted in certain areas in inner Mongolia. Defeng 29 and 77 combined accounted for 90% of annual sales volume.

Research & Development

We believe that our future success depends on our ability to provide high quality and advanced products to our customers. We place strong emphasis on research and development to enhance the quality and competitiveness of our products. We conduct research and development through both our in-house research and development team and in cooperation with Jilin Academy of Agricultural Sciences, Tonghua City Academy of Agricultural Sciences and other research institutions.

- 6 -

Our own research team consists of research professionals and staff; among which are national corn and sorghum seed experts and senior technicians. Our research and development professionals have a primary and specialized focus in the agricultural biotechnology fields.

Quality Control

We believe our product quality standards are generally higher than the national industry standards in China.

Intellectual Property

Many elements of our proprietary information, such as production processes, technologies, know-how and data are not patentable in China. We rely primarily on a combination of trade secrets, trademarks, and confidentiality agreements with employees and third parties to protect our intellectual property.

Corn Seed

We have proprietary rights to four types of seed corns. New crop seeds must pass examination and approval by national or provincial governmental authorities before they are marketed and distributed. The examination and approval committees usually consist of professionals and experts from the agricultural and forestry governmental agencies. Defeng 10, 77,108 and Hongyu 29 have passed the examination and approval from the Jilin Crop Variety Examination and Approval Committee. Once they pass the test and verification, these types of corn may be marketed and distributed.

Growth Strategy

The Company anticipates growing its business through acquisition of additional land use rights, cultivation of that land, and modernization of farming techniques. The Company expects to begin cultivating and farming 10,300 plus acres in 2011. This will produce approximately 42,000 tons of corn. The Company’s state of the art facilities are set up to separate, store and distribute the corn products for the Company and the local farmers. This unique operating process facilitates the sales of the seed and fertilizer all the way through to the distribution and sales of the harvested corn and soybeans. Additional growth strategy for the Company is in their acquisition of land use rights. The Company anticipates acquiring upwards of 50,000 additional land use acreage rights. With the Company reaching its ultimate ability to control the cultivation and harvesting of more than 50,000 acres of corn, it will more than double its current volume, and with the increase in efficiency will continue to drive the profits of the Company.

Marketing and Customer Support

Our product marketing and our customer support are closely linked. The company supplies over 100,000 farmers in the Jilin, Liaoning and Heilongjiang provinces. In these provinces, where usually there is one agent assigned to each province, the Company has assigned 120 agents to the Jilin province, 42 in Liaoning, and 86 in Heilongjiang province.

Competition

The agricultural industry in China is highly fragmented, largely regional and competitive. We do expect future competition; however, there is no immediate or direct competitor with the Company, as the Company is the largest seller in the Gongzhulin province. Additionally, starting in 2010, there has been a shortage of corn supply globally and the supply in the PRC is very tight. The Company does not have any concern in being able to sell all of their crop inventories.

Competitive Advantages

We believe that the following strengths have contributed to our current market position:

|

●

|

We have expanded the production capacity in the corn seed segment by obtaining access to additional farmland across major geographic regions in China. We currently have access to approximately 3800 acres of farmland in the Jilin province for corn seed production.

|

|

●

|

We produce four types of proprietary corn seed products with one or more of the following special characteristics: high yield, disease resistance; drought resistance; high starch content; and stress tolerance. We are developing more varieties of corn seeds with these characteristics, as well as seeds for corn with high oil content and pest resistant corn.

|

|

●

|

Our core production base is strategically located in the Jilin province in the northern region of China, which is one of the largest corn seed production areas in China and is highly suited to growing corn and corn seeds due to its geographical and climate conditions.

|

- 7 -

|

●

|

The Company’s state of the art facilities separate, store and distribute the corn products for the farmers. This unique operating process facilitates the sales of the seed all the way through to the distribution and sales of the harvested corn. The Company has negotiated contracts with the government for sales of the harvested corn products. The Company owns its own railroad tracks that allow it to load up to 29 carts of corn at one time. Each cart holds approximately 60 to 70 tons of corn. As the Company’s main customers are the local governments, they ensure that the Company is able to get the rail time needed to ship the products on time.

|

|

●

|

Our quality management for the production of our corn seed involves rigorous quality control and inspection procedures. For corn seed production, we carefully select parent seeds before growing seeds on a mass scale. During the entire production process, we continually provide technical guidance to the village collectives and seed production companies that are contracted to grow our seeds, and we supervise the production and harvest process.

|

Facilities

Our principal executive offices are located in the Gongzhuling State Agricultural Technology Park. The Company operates the separation, storage and distribution processes along with the business offices on approximately 42 acres of land. The Company has 9 storage warehouses that can have a total capacity of 260,000 tons of product. All storage facilities are covered with cooling and air circulating systems, and are equipped with electronic grain temperature inspection systems. The Company also has approximately ¼ mile of rail tracks for distribution purposes that can hold 29 train cars, each which holds upwards of 60 to 70 tons of corn.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our shares of common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

Risks Relating to our Business and Industry

We are subject to the risks that are inherent in farming.

Our results of operations may be adversely affected by numerous factors over which we have little or no control and that are inherent in farming, including reductions in the market prices for our products, adverse weather and growing conditions, pest and disease problems, and new PRC regulations regarding farming and the marketing of agricultural products.

Our earnings are sensitive to fluctuations in market prices and demand for our products.

Excess supplies often cause severe price competition in our industry. Growing conditions in various parts of the PRC, particularly weather conditions such as windstorms, floods, droughts and freezes, as well as diseases and pests, are primary factors affecting market prices because of their influence on the supply and quality of product.

Fresh produce is highly perishable and generally must be brought to market and sold soon after harvest. The selling price received for each type of produce depends on all of these factors, including the availability and quality of the produce item in the market, and the availability and quality of competing types of produce.

In addition, general public perceptions regarding the quality, safety or health risks associated with particular food products could reduce demand and prices for some of our products. To the extent that consumer preferences evolve away from products that we produce for health or other reasons, and we are unable to modify our products or to develop products that satisfy new consumer preferences, there will be a decreased demand for our products.

Adverse weather conditions could reduce supply and/or demand for our products.

The supply of and demand for our products fluctuate significantly with weather conditions, which could have either a positive or negative effect on production. If any natural disasters, such as flood, drought, hail, tornadoes or earthquakes, occur, supply for our products would likely be reduced.

- 8 -

We may not be able to obtain regulatory or governmental approvals for our products.

The manufacture and sale of our agricultural products in the PRC is regulated by the PRC and the local Provincial Government. The legal and regulatory regime governing our industry is evolving, and we may become subject to different, including more stringent, requirements than those currently applicable to us. We may be vulnerable to local and national government agencies or other parties who wish to renegotiate the terms and conditions of, or terminate their agreements or other understandings with us, or implement new or more stringent requirements, which may require us to suspend or delay production of their products. Our many permits and licenses related to the agricultural and food industries may expire and there is not guarantee the government or certifying agency will renew our licenses and/or certifications.

Potential environmental liability could have a material adverse effect on our operations and financial condition.

To the knowledge of our management team, neither the production nor the sale of our products constitutes activities, or generates materials that create any environmental hazards or violates PRC environmental laws. Although it has not been alleged by PRC government officials that we have violated any current environmental regulations, we cannot assure you that the PRC government will not amend the current PRC environmental protection laws and regulations. Our business and operating results may be materially and adversely affected if we were to be held liable for violating existing environmental regulations or if we were to increase expenditures to comply with environmental regulations affecting our operations.

Any significant fluctuation in price of our raw materials may have a material adverse effect on the manufacturing cost of our products.

The prices for the raw materials that we use in the manufacture of our fertilizer products are subject to market forces largely beyond our control, including the price of coal, our energy costs, organic chemical feedstock costs, market demand, and freight costs. The prices for these raw materials may fluctuate significantly based upon changes in these forces. If we are unable to pass any raw material price increases through to our customers, we could incur significant losses and a diminution of the market price of our common stock.

We may experience major accidents in the course of our operations, which may cause significant property damage and personal injuries.

We may experience major accidents in the course of our operations, which may cause significant property damage and personal injuries. Significant industry-related accidents and natural disasters may cause interruptions to various parts of our operations, or could result in property or environmental damage, increase in operating expenses or loss of revenue. The occurrence of such accidents and the resulting consequences may not be covered adequately, or at all, by the insurance policies we carry. In accordance with customary practice in China, we do not carry any business interruption insurance or third party liability insurance for personal injury or environmental damage arising from accidents on our property or relating to our operations other than our automobiles. Losses or payments incurred may have a material adverse effect on our operating performance if such losses or payments are not fully insured.

We could face increased competition.

We believe that competitors will try to expand their sales and build up their distribution networks in our principal market. We believe this trend will continue and probably accelerate. Increased competition may have a material adverse effect on our financial condition and results of operations.

Our failure to comply with increasingly stringent environmental regulations and related litigation could result in significant penalties, damages and adverse publicity for our business.

In recent years, the government of China has become increasingly concerned with the degradation of China’s environment that has accompanied the country’s rapid economic growth. In the future, we expect that our operations and properties will be subject to extensive and increasingly stringent laws and regulations pertaining to, among other things, the discharge of materials into the environment or otherwise relating to protection of the environment. Failure to comply with any laws and regulations and future changes to them may result in significant consequences to us, including civil and criminal penalties, liability for damages and negative publicity. Additional environmental issues may require currently unanticipated investigations, assessments or expenditures, or that requirements applicable to us will not be altered in ways that will require us to incur significant additional costs.

Consumer concerns regarding the safety and quality of food products or health concerns could adversely affect sales of our products.

Our sales performance could be adversely affected if consumers lose confidence in the safety and quality of our products. Consumers in the PRC are increasingly conscious of food safety and nutrition. Consumer concerns could discourage them from buying certain of our products and cause our results of operations to suffer.

- 9 -

We may be subject to substantial liability should the consumption of any of our products cause personal injury or illness, and we do not maintain product liability insurance to cover our potential liabilities.

The sale of food products for human consumption involves an inherent risk of injury to consumers, and we do not have product liability or any other insurance covering such risks. Even if a product liability claim is unsuccessful or is not fully pursued, the negative publicity surrounding any assertions that our products caused personal injury or illness could adversely affect our reputation with customers and our corporate and brand image. We do not maintain product liability insurance. Product liability claims may be asserted against us, which could have a material adverse effect on our revenues, profitability and business reputation.

The government of the PRC has broad powers to set price controls, which, if adopted, could impair our profitability.

The government of the PRC has broad powers to adopt price controls, and has recently expressed concern about the effect of the rising prices of food. Although it has not sought to apply price controls to grains, the government has the power to do so. If price controls are adopted, our revenue would be affected.

We require various licenses and permits to operate our business, and the loss of or failure to renew any or all of these licenses and permits could require us to suspend some or all of our production or distribution operations.

In accordance with PRC laws and regulations, we are required to maintain various licenses and permits in order to operate our business. We are required to comply with applicable hygiene and food safety standards in relation to our production processes. Our premises and transportation vehicles are subject to regular inspections by the regulatory authorities for compliance with applicable regulations. Failure to pass these inspections, or the loss of or failure to renew our licenses and permits, could require us to temporarily or permanently suspend some or all of our production or distribution operations, which could disrupt our operations and adversely affect our revenues and profitability.

Adverse weather conditions could reduce supply and/or demand for our products.

The supply of and demand for our grain products fluctuate significantly with weather conditions, which could have either a positive or negative effect on production. If any natural disasters, such as flood, drought, hail, tornadoes or earthquakes, occur, supply for our products would likely be reduced.

We may encounter substantial competition in our business and our failure to compete effectively may adversely affect our ability to generate revenue.

We believe that existing and new competitors will continue to improve their products and to introduce new products with competitive price and performance characteristics. We expect that we will be required to continue to invest in product development and productivity improvements to compete effectively in our markets. Our competitors could develop a more efficient product or undertake more aggressive and costly marketing campaigns than ours, which may adversely affect our marketing strategies and could have a material adverse effect on our business, results of operations and financial condition.

Our major competitors may be better able than we to successfully endure downturns in our sector. In periods of reduced demand for our products, we can either choose to maintain market share by reducing our selling prices to meet competition or maintain selling prices, which would likely sacrifice market share. Sales and overall profitability would be reduced in either case. In addition, we cannot assure you that additional competitors will not enter our existing markets, or that we will be able to compete successfully against existing or new competition.

We may not be able to obtain regulatory or governmental approvals for our products.

The manufacture and sale of our agricultural products in the PRC is regulated by the PRC and the local Provincial Government. The legal and regulatory regime governing our industry is evolving, and we may become subject to different, including more stringent, requirements than those currently applicable to us. We may be vulnerable to local and national government agencies or other parties who wish to renegotiate the terms and conditions of, or terminate their agreements or other understandings with us, or implement new or more stringent requirements, which may require us to suspend or delay production of their products. Our many permits and licenses related to the agricultural and food industries may expire and there is not guarantee the government or certifying agency will renew our licenses and/or certifications.

- 10 -

Potential environmental liability could have a material adverse effect on our operations and financial condition.

To the knowledge of our management team, neither the production nor the sale of our products constitutes activities, or generates materials that create any environmental hazards or violates PRC environmental laws. Although it has not been alleged by PRC government officials that we have violated any current environmental regulations, we cannot assure you that the PRC government will not amend the current PRC environmental protection laws and regulations. Our business and operating results may be materially and adversely affected if we were to be held liable for violating existing environmental regulations or if we were to increase expenditures to comply with environmental regulations affecting our operations.

Any significant fluctuation in price of our raw materials may have a material adverse effect on the manufacturing cost of our products.

The prices for the raw materials that we use in the manufacture of our grain products are subject to market forces largely beyond our control, including the price of coal, our energy costs, market demand, and freight costs. The prices for these raw materials may fluctuate significantly based upon changes in these forces. If we are unable to pass any raw material price increases through to our customers, we could incur significant losses and a diminution of the market price of our common stock.

We may need to hire additional employees.

Our future success also depends upon our continuing ability to attract and retain highly qualified personnel. Expansion of our business and our management and operations will require additional managers and employees with industry experience, and our success will be highly dependent on our ability to attract and retain skilled management personnel and other employees. There can be no assurance that we will be able to attract or retain highly qualified personnel. Competition for skilled personnel in the agriculture industry is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees.

We may not be able to meet the accelerated filing and internal control reporting requirements imposed by the Securities and Exchange Commission resulting in a possible decline in the price of our common stock and our inability to obtain future financing.

As directed by Section 404 of the Sarbanes-Oxley Act, as amended by SEC Release No. 33-8934 on June 26, 2008, the Securities and Exchange Commission adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. In addition, the independent registered public accounting firm auditing a company’s financial statements must also attest to and report on management’s assessment of the effectiveness of the company’s internal controls over financial reporting as well as the operating effectiveness of the company’s internal controls. Commencing with our annual report for fiscal year 2011, we will be required to include a report of management on its internal control over financial reporting. The internal control report must include a statement:

|

●

|

of management’s responsibility for establishing and maintaining adequate internal control over its financial reporting;

|

|

●

|

of management’s assessment of the effectiveness of its internal control over financial reporting as of year end; and

|

|

●

|

of the framework used by management to evaluate the effectiveness of our internal control over financial reporting.

|

Furthermore, in the following year, our independent registered public accounting firm is required to file a separate attestation report regarding our internal financial reporting controls stating whether it believes that we have maintained, in all material respects, effective internal controls over financial reporting.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. In the event that we are unable to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the Securities and Exchange Commission, which could also adversely affect the market price of our securities and our ability to secure additional financing as needed.

Our operations are currently focused in China, and any adverse change to the economy or business environment in China could significantly affect our operations, which would lead to lower revenues and reduced profitability.

Our operations are currently concentrated in China. Because of this concentration in a specific geographic location, we are susceptible to fluctuations in our business caused by adverse economic or other conditions in this region, including natural or other disasters. A stagnant or depressed economy in China, or in any of the other markets that we serve, could adversely affect our business, results of operations and financial condition.

- 11 -

Labor disputes could significantly affect our operations.

Labor disputes with our employees or labor disputes, work stoppages or slowdowns at any of its subcontractors or suppliers could significantly disrupt operations or expansion plans. Delays caused by any such disruptions could materially affect projections for increased capacity, production and revenues, which could have a material adverse effect on our business, financial condition, results of operations and prospects.

Risks Relating to the People's Republic of China

Certain political, geographic and economic factors relating to operating in the PRC could adversely affect our company.

The PRC is transitioning from a planned economy to a market economy. While the PRC government has pursued economic reforms since its adoption of the open-door policy in 1978, a large portion of the PRC economy is still operating under five-year plans and annual state plans. Through these plans and other economic measures, such as control on foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the PRC government exerts considerable direct and indirect influence on the economy. Many of the economic reforms carried out by the PRC government are unprecedented or experimental, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive effect on our operations or future business development. Our operating results may be adversely affected by changes in the PRC's economic and social conditions as well as by changes in the policies of the PRC government, such as changes in laws and regulations (or the official interpretation thereof), measures which may be introduced to control inflation, changes in the interest rate or method of taxation, and the imposition of restrictions on currency conversion in addition to those described below.

The uncertain applications of many relatively new PRC laws that may apply to us create an unpredictable environment for our business operations and could have a material adverse effect on us.

The PRC legal system is a civil law system. Unlike the common law system, the civil law system is based on written statutes in which decided legal cases have little value. In 1979, the PRC began to promulgate a comprehensive system of laws and has since introduced many laws and regulations to provide general guidance on economic and business practices in the PRC and to regulate foreign investment. Progress has been made in the promulgation of laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. The promulgation of new laws, changes of existing laws and the abrogation of local regulations by national laws could have a negative impact on our business and business prospects.

Labor costs may be increased due to the implementation of the new PRC Labor Contract Law.

The PRC Labor Contract Law was adopted by the Standing Committee of the National People’s Congress of PRC on June 29, 2007 and became effective on January 1, 2008. The implementation of the new law, especially the following provisions, may increase our labor costs: (a) an employer shall make monetary compensation, which shall be based on the number of an employee’s working years with the employer at the rate of one month’s wage for each year, to the employee upon termination of the employment contract with certain exceptions (for example, in the circumstances where the term of a fixed-term employment contract expires and the employee does not agree to renew the contract even though the conditions offered by the employer are the same as or better than those stipulated in the current contract); (b) the wages of an employee on probation may not be less than the lowest wage level for the same job with the employer or less than 80% of the wage agreed upon in the employment contract, and may not be less than the local minimum wage rate; (c) if an employee has been working for the employer for a consecutive period of not less than 10 years, or if a fixed-term employment contract with an employee was entered into on two consecutive occasions, generally the employer should enter into an open-ended employment with such employee, unless the employee requests for a fixed-term employment contract; (d) if an employer fails, in violation of the related provisions, to enter into an open-ended contract with an employee, it shall each month pay to the employee twice his wage, starting from the date on which an open-ended employment contract should have been entered into; (e) if an employer fails to enter into a written employment contract with an employee more than one month but less than one year after the date on which the employer started using him, the employer shall each month pay to the employee twice his wage; and (f) if an employer hires an employee whose employment contract with another employer has not yet been terminated or ended, causing the other employer to suffer a loss, it shall be jointly and severally liable with the employee for the compensation of such loss. Our labor costs may increase due to the implementation of the new PRC Labor Contract Law and our business and results of operations may be materially and adversely affected.

- 12 -

Currency conversion could adversely affect our financial condition.

The PRC government imposes control over the conversion of Renminbi into foreign currencies. Under the current unified floating exchange rate system, the People's Bank of China publishes an exchange rate, which we refer to as the PBOC exchange rate, based on the previous day's dealings in the inter-bank foreign exchange market. Financial institutions authorized to deal in foreign currency may enter into foreign exchange transactions at exchange rates within an authorized range above or below the PBOC exchange rate according to market conditions.

Pursuant to the Foreign Exchange Control Regulations of the PRC issued by the State Council which came into effect on April 1, 1996, and the Regulations on the Administration of Foreign Exchange Settlement, Sale and Payment of the PRC which came into effect on July 1, 1996, regarding foreign exchange control, conversion of Renminbi into foreign exchange by Foreign Investment Enterprises, or FIEs, for use on current account items, including the distribution of dividends and profits to foreign investors, is permissible. FIEs are permitted to convert their after-tax dividends and profits to foreign exchange and remit such foreign exchange to their foreign exchange bank accounts in the PRC. Conversion of Renminbi into foreign currencies for capital account items, including direct investment, loans, and security investment, is still under certain restrictions. On January 14, 1997, the State Council amended the Foreign Exchange Control Regulations and added, among other things, an important provision, which provides that the PRC government shall not impose restrictions on recurring international payments and transfers under current account items.

Enterprises in the PRC (including FIEs) which require foreign exchange for transactions relating to current account items, may, without approval of the State Administration of Foreign Exchange, or “SAFE,” effect payment from their foreign exchange account or convert and pay at the designated foreign exchange banks by providing valid receipts and proofs.

Convertibility of foreign exchange in respect of capital account items, such as direct investment and capital contribution, is still subject to certain restrictions, and prior approval from the SAFE and its relevant branches must be sought.

Furthermore, the Renminbi is not freely convertible into foreign currencies nor can it be freely remitted abroad. Under the PRC’s Foreign Exchange Control Regulations and the Administration of Settlement, Sales and Payment of Foreign Exchange Regulations, Foreign Invested Enterprises are permitted either to repatriate or distribute its profits or dividends in foreign currencies out of its foreign exchange accounts, or exchange Renminbi for foreign currencies through banks authorized to conduct foreign exchange business. The conversion of Renminbi into foreign exchange by Foreign Invested Enterprises for recurring items, including the distribution of dividends to foreign investors, is permissible. The conversion of Renminbi into foreign currencies for capital items, such as direct investment, loans and security investment, is subject, however, to more stringent controls.

Exchange rate volatility could adversely affect our financial condition.

Since 1994, the exchange rate for Renminbi against the United States dollar has remained relatively stable. However, in 2005, the Chinese government announced that it would begin pegging the exchange rate of the Chinese Renminbi against a number of currencies, rather than just the U.S. dollar and, the exchange rate for the Renminbi against the U.S. dollar became RMB8.02 to $1.00. If we decide to convert Chinese Renminbi into United States dollars for other business purposes and the United States dollar appreciates against this currency, the United States dollar equivalent of the Chinese Renminbi we convert would be reduced. There can be no assurance that future movements in the exchange rate of Renminbi and other currencies will not have an adverse effect on our financial condition.

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities.

We are dependent on our relationship with the local government in the province in which we operate our business. Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

Future inflation in China may inhibit our ability to conduct business in China. In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. Rapid economic growth can lead to growth in the money supply and rising inflation. If prices for our products rise at a rate that is insufficient to compensate for the rise in the costs of supplies, it may have an adverse effect on profitability. These factors have led to the adoption by Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products.

- 13 -

Since most of our assets are located in the PRC, any dividends of proceeds from liquidation are subject to the approval of the relevant Chinese government agencies.

Our assets are predominantly located inside PRC. Under the laws governing Foreign Invested Enterprises in PRC, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to the relevant government agency's approval and supervision as well as the foreign exchange control. This may generate additional risk for our investors in case of dividend payment and liquidation.

Risks Associated with our Securities

Our securities are restricted securities with limited transferability.

Our securities should be considered a long-term, illiquid investment. Our Common Stock has not been registered under the Act, and cannot be sold without registration under the Act or any exemption from registration. In addition, our Common Stock is not registered under any state securities laws that would permit their transfer. Because of these restrictions and the absence of an active trading market for the securities, a shareholder will likely find it difficult to liquidate an investment.

We may be subject to penny stock rules which will make the shares of our common stock more difficult to sell.

We may be subject now and in the future to the SEC’s “penny stock” rules if our shares of common stock sell below $5.00 per share. Penny stocks generally are equity securities with a per share price of less than $5.00. The penny stock rules require broker-dealers to deliver a standardized risk disclosure document prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information must be given to the customer orally or in writing prior to completing the transaction and must be given to the customer in writing before or with the customer’s confirmation.

In addition, the penny stock rules require that prior to a transaction the broker dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. The penny stock rules are burdensome and may reduce purchases of any offerings and reduce the trading activity for shares of our common stock. As long as our shares of common stock are subject to the penny stock rules, the holders of such shares of common stock may find it more difficult to sell their securities.

Our shares of common stock are very thinly traded, and the price may not reflect our value and there can be no assurance that there will be an active market for our shares of common stock either now or in the future.

Our shares of common stock are thinly traded. Due to the illiquidity, the market price may not accurately reflect the relative value of the Company. There can be no assurance that there will be an active market for our shares of common stock either now or in the future. Investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. If a more active market should develop, the price may be highly volatile. Because there may be a low price for our shares of common stock, many brokerage firms may not be willing to effect transactions in the securities. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of such shares of common stock as collateral for a loans.

- 14 -

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The following discussion and analysis of the results of operations and financial condition of Jilin Hengchang Agriculture Development Co., Ltd. and Affiliate for the fiscal years ended December 31, 2009 and 2008, and for the periods ended September 30, 2010 and 2009, should be read in conjunction with the Hengchang Agriculture’s financial statements. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under the Risk Factors, Special Note Regarding Forward-Looking Statements and Business sections in this prospectus. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements.

Overview

Hengchang Agriculture is a PRC limited liability company and was formed under laws of the PRC on September 9, 2004 under the name of Jilin Province Hengchang Foodstuff Purchasing and Storage Co. Ltd. with registered capital of RMB 5,000,000 (approximately $729,000). Hengchang Agriculture is primarily engaged in the business of development, purchasing and distribution of agricultural products including corn, soybean, and crop seeds.

Hengjiu is a PRC limited liability company formed under laws of the PRC on August 10, 2009 with a registered capital of RMB 1,000,000 (approximately $146,000). Hengjiu currently is a development stage company and has yet to register with the State tax bureau. Hengjiu does not conduct any substantive operations of its own.

Hengchang Agriculture’s chairman of the board of directors and 52% majority shareholder, Mr. Yushan Wei is also Hengjiu’s chairman of the board of directors and principal shareholder. Almost all of Hengjiu’s assets are used in Hengchang’s business operations and controlled and managed by Mr. Wei. As a result, Hengchang Agriculture and Hengjiu are under common control.

Critical Accounting Policies And Estimates

While our significant accounting policies are more fully described in Note 1 to our consolidated financial statements for the year ended December 31, 2009, we believe that the following accounting policies are the most critical to aid you in fully understanding and evaluating this management discussion and analysis.

Our combined financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. We continually evaluate our estimates, including those related to bad debts, inventories, recovery of long-lived assets, and income taxes. We base our estimates on historical experience and on various other assumptions that we believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Any future changes to these estimates and assumptions could cause a material change to our reported amounts of revenues, expenses, assets and liabilities. Actual results may differ from these estimates under different assumptions or conditions. We believe the following critical accounting policies affect our more significant judgments and estimates used in the preparation of the combined financial statements.

Accounts receivable

We have a policy of reserving for uncollectible accounts based on our best estimate of the amount of probable credit losses in our existing accounts receivable. We periodically review our accounts receivable and other receivables to determine whether an allowance is necessary based on an analysis of past due accounts and other factors that may indicate that the realization of an account may be in doubt. Account balances deemed to be uncollectible are charged to the allowance after all means of collection have been exhausted and the potential for recovery is considered remote.

As a basis for accurately estimating the likelihood of collection, we consider a number of factors when determining reserves for uncollectable accounts. We believe that we use a reasonably reliable methodology to estimate the collectability of our accounts receivable. We review our allowances for doubtful accounts on at least a quarterly basis. We also consider whether the historical economic conditions are comparable to current economic conditions. If the financial condition of our customers or other parties that we have business relations with were to deteriorate, resulting in an impairment of their ability to make payments, additional allowances may be required.

- 15 -

Inventories

Inventories, consisting of raw materials, work in process and finished goods related to our products are stated at the lower of cost or market utilizing the weighted average method. An allowance is established when management determines that certain inventories may not be saleable. If inventory costs exceed expected market value due to obsolescence or quantities in excess of expected demand, we will record additional reserves for the difference between the cost and the market value. These reserves are recorded based on estimates. We review inventory quantities on hand and on order and record, on a quarterly basis, a provision for excess and obsolete inventory, if necessary. If the results of the review determine that a write-down is necessary, we recognize a loss in the period in which the loss is identified, whether or not the inventory is retained. Our inventory reserves establish a new cost basis for inventory and are not reversed until we sell or dispose of the related inventory. Such provisions are established based on historical usage, adjusted for known changes in demands for such products, or the estimated forecast of product demand and production requirements.

Property and equipment

Property and equipment are stated at cost less accumulated depreciation. Additions and major replacements and improvements to plant and equipment accounts are recorded at cost. The cost of repairs and maintenance is expensed as incurred. When assets are retired or disposed of, the cost and accumulated depreciation are removed from the accounts, and any resulting gains or losses are included in income in the year of disposition. We examine the possibility of decreases in the value of fixed assets when events or changes in circumstances reflect the fact that their recorded value may not be recoverable. Included in property and equipment is construction-in-progress which consists of leasehold improvements and equipment pending installation and includes the costs of construction and installation and any interest charges arising from borrowings used to finance these assets during the period of construction or installation. No provision for depreciation is made on construction-in-progress until such time as the relevant assets are completed and ready for their intended use. Depreciation is computed using the straight-line method (after taking into account their respective estimated residual value) over the estimated useful lives of the assets. The estimated useful lives of the assets are as follows:

|

|

Useful Life

|

||||

|

Building and building improvements

|

5 - 20

|

Years

|

|||

|

Manufacturing equipment

|

5 - 10

|

Years

|

|||

|

Office equipment and furniture

|

5

|

Years

|

|||

|

Vehicle

|

4 - 10

|

Years

|

|||

Land Use Rights

All land in the PRC is owned by the PRC government and cannot be sold to any individual or company. The Company has recorded the amounts paid to the PRC government to acquire long-term interests to utilize land underlying the Company’s facilities as land use rights. This type of arrangement is common for the use of land in the PRC. Land use rights are amortized on the straight-line method over the terms of the land use rights.

Revenue Recognition

Pursuant to the guidance of ASC Topic 605 and ASC Topic 360, we recognize revenue when persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, the purchase price is fixed or determinable and collectability is reasonably assured. We derive our revenue primarily from the sale of corn crop, soybean crop and branded corn seeds.

The sales price of product sold is stated in the sales contract and is final and not subject to adjustment. The Company generally does not accept sales returns and does not provide customers with price protection. We assess a customer’s creditworthiness before accepting sales orders. Based on the above, we record revenue related to product sales upon delivery of the product to the customers.

Research and Development

Research and development costs are expensed as incurred. These costs primarily consist of fees paid to third parties and cost of material used and salaries paid for the development of our products.

Income Taxes

We are governed by the Income Tax Law of the People’s Republic of China. We account for income taxes using the liability method prescribed by ASC 740 “Income Taxes”. Under this method, deferred tax assets and liabilities are determined based on the difference between the financial reporting and tax bases of assets and liabilities using enacted tax rates that will be in effect in the year in which the differences are expected to reverse. We record a valuation allowance to offset deferred tax assets if based on the weight of available evidence; it is more-likely-than-not that some portion, or all, of the deferred tax assets will not be realized. The effect on deferred taxes of a change in tax rates is recognized as income or loss in the period that includes the enactment date.

- 16 -

Foreign Currency Translation

The reporting currency of the Company is the U.S. dollar. The functional currency of the Company is the local currency, the Chinese Renminbi (“RMB”). Results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period, and equity is translated at historical exchange rates. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income. Transactions denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing on the transaction dates. Assets and liabilities denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing at the balance sheet date with any transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred. All of the Company’s revenue transactions are transacted in the functional currency. We do not enter any material transaction in foreign currencies and accordingly, transaction gains or losses have not had, and are not expected to have, a material effect on the results of operations of the Company.

Asset and liability accounts at December 31, 2009 and 2008 were translated at 6.8372 RMB to $1.00 and at 6.8542 RMB to $1.00, respectively. Equity accounts were stated at their historical rate. The average translation rates applied to the statements of income for the year ended December 31, 2009 and 2008 were 6.8409 RMB and 6.9623 RMB to $1.00, respectively. Cash flows from the Company's operations are calculated based upon the local currencies using the average translation rate. As a result, amounts related to assets and liabilities reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheets.

Accumulated Other Comprehensive Income

Comprehensive income is comprised of net income and all changes to the statements of stockholders' equity, except those due to investments by stockholders, changes in paid-in capital and distributions to stockholders. For the Company, comprehensive income for the six months ended June 30, 2010 and 2009 included net income and unrealized gains from foreign currency translation adjustments.

Recent Accounting Pronouncements

In October 2009, the FASB issued ASU No. 2009-13, “Multiple-Deliverable Revenue Arrangements.” This ASU establishes the accounting and reporting guidance for arrangements including multiple revenue-generating activities. This ASU provides amendments to the criteria for separating deliverables, measuring and allocating arrangement consideration to one or more units of accounting. The amendments in this ASU also establish a selling price hierarchy for determining the selling price of a deliverable. Significantly enhanced disclosures are also required to provide information about a vendor’s multiple-deliverable revenue arrangements, including information about the nature and terms, significant deliverables, and its performance within arrangements. The amendments also require providing information about the significant judgments made and changes to those judgments and about how the application of the relative selling-price method affects the timing or amount of revenue recognition. The amendments in this ASU are effective prospectively for revenue arrangements entered into or materially modified in the fiscal years beginning on or after June 15, 2010. Early application is permitted. The adoption of this new ASU is not expected to have any material impact on our financial statements.

In November 2009, the FASB issued an ASU regarding accounting for stock dividends, including distributions to shareholders with components of stock and cash. This ASU clarifies that the stock portion of a distribution to shareholders that contains components of cash and stock and allows shareholders to select their preferred form of the distribution (with a limit on the amount of cash that will be distributed in total) should be considered a stock dividend and included in EPS calculations as a share issuance. The adoption of this guidance did not have a material impact on our financial statements.

In December 2009, the FASB issued ASU No. 2009-17, Improvements to Financial Reporting by Enterprises Involved with Variable Interest Entities. This Accounting Standards Update amends the FASB Accounting Standards Codification for the issuance of FASB Statement No. 167, Amendments to FASB Interpretation No. 46(R). The amendments in this Accounting Standards Update replace the quantitative-based risks and rewards calculation for determining which reporting entity, if any, has a controlling financial interest in a variable interest entity with an approach focused on identifying which reporting entity has the power to direct the activities of a variable interest entity that most significantly impact the entity’s economic performance and (1) the obligation to absorb losses of the entity or (2) the right to receive benefits from the entity. An approach that is expected to be primarily qualitative will be more effective for identifying which reporting entity has a controlling financial interest in a variable interest entity. The amendments in this Update also require additional disclosures about a reporting entity’s involvement in variable interest entities, which will enhance the information provided to users of financial statements. The adoption of this ASU did not have a material impact on our financial statements.

- 17 -

In January 2010, the FASB issued ASU No. 2010-01- Accounting for Distributions to Shareholders with Components of Stock and Cash. The amendments in this Update clarify that the stock portion of a distribution to shareholders that allows them to elect to receive cash or stock with a potential limitation on the total amount of cash that all shareholders can elect to receive in the aggregate is considered a share issuance that is reflected in EPS prospectively and is not a stock dividend for purposes of applying Topics 505 and 260 (Equity and Earnings Per Share). The amendments in this update are effective for interim and annual periods ending on or after December 15, 2009, and should be applied on a retrospective basis. The adoption of this ASU did not have a material impact on our financial statements.