Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: February 11, 2011

Zhongtian Mould Technologies, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Cayman Islands

|

000-54038

|

27-3819552

|

|

(State or Other Jurisdiction

|

(Commission File Number)

|

(IRS Employer

|

|

of Incorporation)

|

Identification No.)

|

c/o Codan Trust Company (Cayman) Ltd.

Cricket Square, Hutchins Drive

Grand Cayman, KY1-1111

Cayman Islands

(Address of Principal Executive Offices)

(345) 945-3901

(Registrant's telephone number, including area code)

Tianyu Steel Inc.

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Item 1.01. Entry into a Material Definitive Agreement.

On February 11, 2011, Zhongtian Mould Technologies, Inc., a Cayman Islands corporation (the “Company”) entered into an agreement (the “Share Exchange Agreement”) with Sino-Mould International Company Limited, a Hong Kong, China company (“Sino-Mould”), and the shareholders of Sino-Mould (“Sellers”). The share exchange was closed on February 11, 2011. Pursuant to the terms of the Share Exchange Agreement, the Company acquired all of the outstanding capital stocks of Sino-Mould. Sino-Mould is a holding company whose only asset is 100% of the registered capital of Jinjiang Zhongtian Mould Co., Limited (“Zhongtian Mould”), a limited liability company organized under the laws of the People’s Republic of China (“China” or “PRC”). Substantially all of Sino-Mould's operations are conducted in China through Zhongtian Mould. Zhongtian Mould is one of the leading mould technology companies in China, focused on shoe manufacturing mould production.

In connection with the acquisition, the following transactions took place:

|

·

|

The Company issued 18,100,000 shares of the common stock, par value $.001 per share (the “Common Stock”) in exchange for all the shares of the capital stock of Sino-Mould (the “Exchange”). Upon the completion of the Exchange, the shareholders of Sino-Mould and their designees shall own approximately 99.45% common stocks of the Company.

|

|

·

|

The sole officer of the Company before the Exchange, Yoel Neeman, the Company’s President, resigned upon the effectiveness of the Exchange. Mr. ZHUANG Heping was elected as the Chairman of the Board, Mr. CHEN Fajin, as the Chief Executive Officer and Director of the Board, Mr. XIE Weizhi, as the Vice President, and Mr. CHEN Xinfa, as the Vice President and R&D Director.

|

|

·

|

Mr. Zhuang Heping, Chairman of Zhongtian Mould, was elected to serve on our Board of Directors as Chairman of the Board of the Company. Mr. CHEN Fajin, President and Chief Executive Officer of Zhontian Mould, was elected to serve as a Director of the Board. Mr. Neeman, the sole director prior to the Exchange, remained to be a director of the Company. Mr. Zhuang Heping and Mr. CHEN Fajin will become directors of the Board and Mr. Neeman will resign as a director of the Company ten days after the notice pursuant to Rule 14f-1 is mailed to the shareholders of record.

|

As a result of these transactions, persons affiliated with Zhongtian Mould now own securities that in the aggregate represent approximately 99.45% of the equity in the Company.

NEW MANAGEMENT

Upon the completion of the Exchange, the new executive officers and directors of the Company will be:

|

Name

|

Age

|

Positions with the Company

|

|

Zhuang Heping

|

52

|

Chairman

|

|

Chen Fajin

|

39

|

CEO

|

|

Xie Weizhi

|

45

|

Vice President

|

|

Chen Xinfa

|

33

|

Vice President and R&D Director

|

All directors hold office until the next annual meeting of our shareholders and until their successors have been elected and qualify.

Zhuang Heping, 52, Co-Founder & Chairman. Mr. Zhuang has over 20 years of experience in footwear industry management. Mr. Zhuang currently serves as Executive Director of Jinjiang Qingyang Chamber of Commerce and Vice Chairman of Jinjiang Equipment Manufacturers Association. He is responsible for the whole corporate strategies of the Company. Mr. Zhuang received his MBA degree from Huaqiao University in 2009.

Chen Fajin, 39, Co-Founder & CEO,. Mr. Chen has served on his post since the Company’s inception in 2002. Prior to that, he served as R&D Manager and General Manager of a shoe mould company invested by Taiwanese for 7 years. He has over 15 years of managerial experience in mould industry. He received his MBA degree from Huaqiao University in 2009.

1

Xie Weizhi, 45, Vice President and Sales Director. Mr. Xie has served on this position since 2003. Prior to that, he worked in Quanzhou Zheng-Gu Hospital, as Sales Manager for 9 years. Mr. Xie has 16 years of experience in sales and marketing. Mr.Xie graduated from Quanzhou Medical School in 1993.

Chen Xinfa, 33, Vice President and R&D Director. Mr. Chen has over 12 years of R&D experience in the mould industry. He joined the Company in 2002 and built up the R&D Department from scratch. In recent years, he has completed many R&D projects, such as, EVA mould, RB mould for slipper, PVC, high lever PVC, etc.. Mr. Chen graduated from Jiangxi Pinxiang Vocational School in 1997.

You should read the following discussion and analysis of our operations in conjunction with our consolidated financial statements and the related notes included elsewhere in this document. The following discussion contains forward-looking statements. Zhongtian Moulding Technologies, Corp., including its subsidiaries are referred to herein as “we,” “us,” “our,” or the “Company.” The words or phrases “would be,” “will allow,” “expect to,” “intends to,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” or similar expressions are intended to identify forward-looking statements. Such statements include, among others, those statements concerning our expected financial performance, our corporate strategy and operational plans. Actual results could differ materially from those projected in the forward-looking statements as a result of a number of risks and uncertainties, including, among others: (a) those risks and uncertainties related to general economic conditions in China, including regulatory factors that may affect such economic conditions; (b) whether we are able to manage our planned growth efficiently and operate profitable operations, including whether our management will be able to identify, hire, train, retain, motivate and manage required personnel or that management will be able to successfully manage and exploit existing and potential market opportunities; (c) whether we are able to generate sufficient revenues or obtain financing to sustain and grow our operations; and (d) whether we are able to successfully fulfill our primary requirements for cash which are explained below under “Liquidity and Capital Resources.” Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim any obligation, to update any forward-looking statements to reflect occurrences, developments, unanticipated events or any other circumstances after the date of such statement unless required by law. For additional information regarding these risks and uncertainties, see “Risk Factors.”

Prior to the Exchange, the Company was a “shell company” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, as required by SEC rules, set forth below is the information that would be required if the Company were filing a general form for registration of securities on Form 10 under the Exchange Act.

Please note that the information provided below relates to the combined Company after the Exchange, unless otherwise specifically indicated.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Upon completion of the Exchange, there were 18,200,000 shares of the Company’s common stock issued and outstanding.

The following table sets forth information known to us with respect to the beneficial ownership of our common stock as of February 11, 2011 by the following:

|

·

|

each shareholder who beneficially owns more than 5% of our common stock;

|

|

·

|

each of our named executive officers;

|

|

·

|

Each of our directors; and

|

|

·

|

Executive officers and directors as a group.

|

Beneficial ownership is determined in accordance with the rules of the SEC, which deem a person to beneficially own any shares the person has or shares voting or dispositive power over and any additional shares obtainable within 60 days through the exercise of options, warrants or other purchase rights. Shares of our common stock subject to options, warrants or other rights to purchase that are currently exercisable or are exercisable within 60 days of February 11, 2011 (including shares subject to restrictions that lapse within 60 days of February 11, 2011) are deemed outstanding for purposes of computing the percentage ownership of the person holding such shares, options, warrants or other rights, but are not deemed outstanding for purposes of computing the percentage ownership of any other person. Unless otherwise indicated, each person possesses sole voting and investment power with respect to the shares identified as beneficially owned.

2

|

Amount and

|

|||||

|

Nature

|

|||||

|

of Beneficial

|

Percentage

|

||||

|

Name and Address of Beneficial Owner(1)

|

Ownership

|

of Class

|

|||

|

ZHUANG Heping

|

1,416,800

|

(1)

|

7.78%

|

||

|

CHEN Fajin

|

1,127,000

|

(1)

|

6.19%

|

||

|

XIE Weizhi

|

676,200

|

(1)

|

3.72%

|

||

|

All such directors and executive officers as a group (3 persons) in addition to the persons named above

|

3,220,000

|

17.69%

|

|||

|

Five Percent Shareholders (other than directors and named executive officers)

|

|||||

|

Lin Chin Piao

|

8,050,000

|

(2)

|

44.23%

|

The address for the officers and directors is No. 100, Binyang Rd,Fangjiao New Village, Chen Dai Town, Jinjiang City, Fujian Province, China. Tel No.:0086-595-8519-2802, Fax No.: 0086-595-8519-2803. The address for Mr. Lin Chin Piao is Room 1401, 14/F, World Commerce Center, Harbour City, 7-11 Canton Road, Tsimshatsui, Knowloon, Hongkong

All such directors and executive officers above as a group (3 persons) own 17.69% past-Exchange. They are the founders of Zhongtian Mould (China) and they acquired Sino-Mould's shares through Share Transfer Agreement between Zhongtian Mould (China) and Sino-Mould signed on Oct. 10, 2010.

Mr. Lin Chin Piao is the controlling party of Sino-Mould and Zhongmo (BVI).

CORPORATE STRUCTURE AND HISTORY

Sino-Mould International Company Limited (“Sino-Mould HK”) (Registration No. 1505203) was incorporated in Hong Kong in September 2010 by Mr. Zhang Zhen-liang (Macau Citizen) and Mr. Lin Chin Piao (Hong Kong Citizen) in the name of Zhongmo Investment Holdings Corp., a BVI company. Sino-Mould HK has 10,000 shares of authorized equity stock at par value of $1.

Our operating subsidiary in China, Jinjiang Zhongtian Mould Co., Ltd. (“Jinjiang Zhongtian”) was incorporated in Jinjiang City, Fujian Province of P. R. China on July 5, 2002 as a limited liability company under the laws of the People’s Republic of China (PRC) with the original registered capital of $181,216 (equivalent to RMB 1.5 million) injected by three Chinese individuals, Mr. Zhuang Heping, Mr. Xie Weizhi and Mr. Chen Fajin. On June 18, 2009, Jinjiang Zhongtian increased its registered capital to $1,425,379 (equivalent to RMB 10 million). Since its inception, Jinjiang Zhongtian has engaged in designing, manufacturing and selling shoe-mould to shoe-makers all over the world.

On October 10, 2010, Sino-Mould HK signed “Share Transfer Agreement” with the controlling parties of Jinjiang Zhongtian to acquire 100% of the equity interests of Jinjiang Zhongtian for certain cash consideration and shares of the Company’s fully paid stock, which will be vested by Jinjiang Zhongtian’s shareholders under condition that this acquisition will be approved by the provincial government. On January10, 2011, Fujian Provincial Government has approved the “Share Transfer Agreement” between Jinjiang Zhongtian Mould Co., Ltd. and Sino-Mould International Company Limited, which made Sino-Mould International Company Limited officially become the then holding company of Jinjiang Zhongtian Mould Co., Ltd., in turn, Jinjiang Zhongtian’s three shareholders become the effective controlling persons of the Company.

3

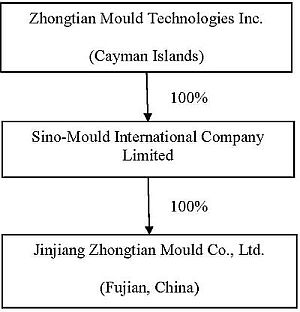

The following Chart illustrates our corporate structure as of the date of this document:

Chart 1. Organization Structure

Our Business

Our operating entity, Jinjiang Zhongtian Mould Co., Ltd., was founded in July 2002 in Jinjiang – “Capital City of the Top Brands in China.” Over the last 8 years, we have built three (3) mould processing centers with full R&D capacity and modern manufacturing facilities, which are capable to produce over 28,000 pairs of quality moulds annually for the shoe makers and shoe sole makers all over the world. We have our competitive advantage in providing the customers with full-turn-key solutions, short lead time and competitive pricing with our state-of-the-art mould manufacturing technologies and order management systems. On December 20, 2010, our company was recognized by Fujian Provincial Government as a “Hi-tech & Innovative Company,” which makes us eligible for reduced tax-rates and other government benefits in the coming years.

Our mould processing centers are equipped with 3D precision scanners, advanced CNC machines, pattern carving machines and mould testing systems. The combined production capacity of our three (3) mould processing centers is around 28,000 pairs of shoe moulds a year. In 2009, we produced 24,000 pairs of different shoe moulds which met the needs for diverse shoe types including slippers, sandals, leather shoes, and sneakers, etc. Our shoe moulds are designed and manufactured for a variety of materials used for the production of shoe soles including ethylene vinyl acetate (EVA), thermoplastic rubber (TPR), polyurethane (PU), rubber (RB), polyvinyl chloride (PVC), thermoplastic rubber (TR) and etc.

Our products are usually customized to clients’ orders and delivered on time. We also offer three (3) months of free after-sale services to our customers.

We have a large and diversified client base which covers a number of provinces in China and around the world through exporters and importers. We mainly develop our new business and customer relationships through customer referral from both down-stream customers and up-stream suppliers. We have also built up our own on-line business to business platform which generates orders from the Internet. We also attend trade fairs in China and abroad. We also provide our customers with technical support and after-sales service through our regional representatives located in the shoe-making hubs in Hebei, Zhejiang, Jiangsu, Liaoning, Guangdong, Fujian and Henan provinces of China and abroad. In addition, we send our regional managers, sales staffs, and service specialists to visit clients regularly, to provide technical support and to collect customers’ feedback as well as strengthen customer relationships.

4

Our Industry and Market Trend

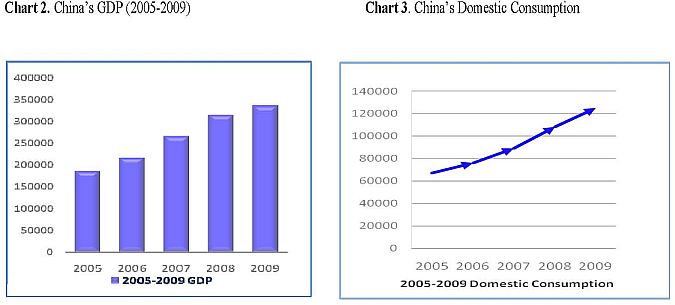

We provide our products and technical services to footwear industry, which is an important part of consumer goods industry and it is directly correlated to the macro-economy condition and consumer’s consumption. According to Yearbooks of China National Bureau of Statistics, China’s economy has experienced robust growth in the last 30 years. In 2009, its GDP increased by 8.7% from the previous year and reached RMB33.5 Trillion, which makes China the 3rd largest economy in the world. China’s domestic consumption also increased rapidly in recent years. In 2009, the consumer goods sales in the retail market have exceeded RMB 12.5 trillion, an increase of 15.5% annually.

World Footwear Market Overview

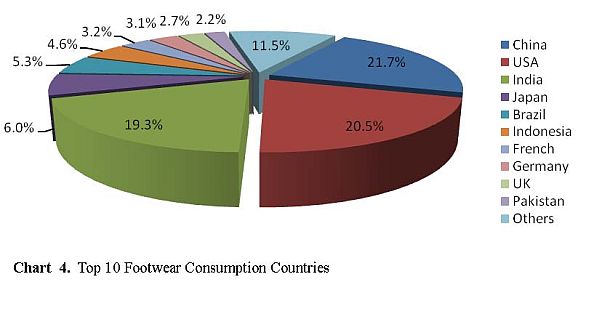

According to 2009 Global Footwear Market Analysis, published by China Industrial Research Institute, the world’s annual consumption of footwear has exceeded 10 billion pairs since we entered the 21st Century, which represents a market of over USD 100 billion. Among the world's top 10 footwear consumption countries, China takes the lead by selling at least 2.2 billion pairs of shoes a year, followed by the United States with 2.1 billion pairs and India with 2 billion pairs. The emerging countries with large populations, such as, China, India, Brazil and Indonesia, will foster a continuously expanding footwear market in the world.

China Footwear Industry and Footwear Market

According to China Footwear Market Analysis, published by RNCOS, China has emerged as the largest shoe producing and exporting country in the world. In 2009, China produced around 9 billion pairs of shoes, representing around 65% of the world's total footwear production in that year. The report reveals that the footwear sales will keep growing at a compound average growth rate (CAGR) of more than 7% over the next few years. This growth is supported by the fact that China’s domestic market will expand faster than the world average, driven by a fast-growing economy and urbanization movement, which will make Chinese citizens’ average annual consumption of footwear from the current level (less than 1.5 pairs a year) to the level close to 2.5 pairs a year.

5

Growth in footwear industry brings in an increasing demand for shoe mould

Each pair of shoes mainly has two parts: sole and upper. Shoe makers usually produce sole and upper separately. For the sole part, it has been made by injecting the raw material into shoe moulds. The sole and the plastic shoes made with moulds are characterized by its precision, production efficiency, and low cost. Based on the management’s industry knowledge, around RMB 1 of spending on shoe mould is needed for making each pair of shoes. That means for China’s footwear industry which produces 9 billion pairs of shoes annually, the estimated spending on shoe mould is around RMB 9 billion each year.

Competition in our business sector

The shoe mould design and manufacture market in China is intensely competitive and highly fragmented and includes more than one thousand companies spread all over China. Among those companies, only a small portion has reached the economy of scale with fully functional designing and manufacturing capacities. Most of our competitors are located in Fujian Province, the main business hub for shoe manufacture industry in China and where Jinjiang Zhongtian locates. We compete with these competitors by leveraging on our “full turn-key” business solution to our clients including 2D pattern design, 3D prototype design, computer programming for CNC machining, assembly and final testing and after sales service. Consequently, we believe that our leading position in the industry has enabled us to win more market share from our competitors as we compete on design capacity, quality of products, ability to complete the job in time, after-sales service and pricing.

As there is no public companies engaged in shoe mould design and manufacture industry in China, there are only limited reliable resources available to us about the information of our competitors. Based on management’s industry knowledge, the competitors with similar manufacture capacities with ours includes Xieli Mould Co., Ltd., Guangyu Mould Co., Ltd. and Minfa Mould Co., Ltd., all of which are located in Jinjiang City of Fujian Province.

Our Competitive Strengths

We believe we have the following competitive strengths:

|

●

|

Leading position in the existing markets with great potential for expansion

|

China’s shoe mould design and manufacturing industry is highly segmented with numerous small and mostly regional companies. There does not exist any dominant player with significant market share in this industry. In the following years, China’s shoe mould design and manufacturing industry is expected to undergo industry consolidation driven by market competition and technology innovation. Currently we maintain a leading position in China’s shoe mould design and manufacturing industry by leveraging our full-turn-key solution service and strong R&D innovation capacities. Over the last eight years, we have not only steadily expanded our market coverage geographically, but also established a solid and diversified client base which covers the major hubs of shoe-making industry in China and globally, by consistently offering high-quality shoe moulds with short lead time and lower cost. Consequently, we believe that our leading position will enable us to further expand our business in this highly segmented industry by gaining more market shares from smaller competitors in future, by leveraging on our higher business operation efficiency due to the larger scale of our business.

|

●

|

Our “full-turn-key” business solution model

|

We provide our customers in shoe-making industry with a one-stop “full-turn-key” business solution, which include the whole chain of manufacturing processes associated with the manufacture of a new shoe mould including 2D pattern design, 3D prototype design, computer programming for CNC machining, assembly and final testing and after sales service. Since most of companies in China’s shoe mould design and manufacturing industry are small and regional players, there are only limited number of companies have the capacity to provide customers with a one-stop “full-turn-key” business solution. We are one of the leading companies in China’s shoe mould design and manufacturing industry who implemented the business model of one-stop “full-turn-key” business solution to the market. Currently, with continuous improvement in operation process since our inception we have the capacity to complete the manufacture of a new shoe mould from scratch in the shortest time level in the industry.

6

|

●

|

Strong R&D capacities with proprietary technologies

|

We have the leading R&D capacities in China’s shoe mould design and manufacturing industry, with more than 160 technical professionals with extensive mould design and development experience in the industry. We have developed a series of proprietary technologies associated with our intellectual properties, which enable us to enhance our operation efficiency, leading to a lower manufacture cost and shorter turnaround time. Our strong R&D teams not only have the capacities to design new shoe moulds by following customers’ requirement, but also to develop internally and introduce new shoe designs of ourselves to the market by closely following the fashion changes in shoe industry. The capacity of introduction of our new shoe designs to the market enables us to enjoy much higher margins from the market than the design and manufacture jobs by following customers’ requirement.

|

●

|

A broaden sales and after-sales service network covering most of shoe manufacturing hubs in the world

|

We have established our leading position in China’s shoe mould design and manufacture industry with broaden sales network through our sales team and regional exporters and importerss covering most of the major shoe manufacturing hubs in China and globally. Our widely-spread sales network enables us to have the access to reach all our existing customers or potential customers to meet their requirement in mould design and production efficiently and closely follow the fashion change in the shoe industry as well. Our registered brand “ZT” has been widely accepted by the shoe manufacturers both in China and globally. Currently we have maintain a solid long-term business relationship with more than 100 customers, which include the sole makers for China leading local shoe brands including Anta, 361 and X-step. We also provide our customers with timely on-site and in-house technical support and fast after-sales service through our three mould processing centers and our regional representitives located closely with our customers.

|

●

|

Dedicated and seasoned management team

|

We have a dedicated management team with profound knowledge and management experience in the mould related industries. Mr. Zhuang Heping, our Co-Founder and Chairman, and Mr. Chen Fajin, our President, have been working in the mould industry since 1995. Our Vice President and R&D Director, Mr. Chen Xinfa, has more than ten years of experience in shoe mould industry. The rest of our management teams also have extensive experience in business development and management in shoe moulds or shoes making industry. Our senior and mid-level management team’s collective experience in shoe mould design and manufacture industry will help us effectively implement our business development strategy and growth plan in future.

|

●

|

Effective production management and quality control system

|

We design and introduce new products in response to identified market trends in shoe industry. We also generate sales by taking orders directly from our customers. Since all the processing orders will need to pass through prototype review and testing as well as customers’ confirmation prior to its production, the cost of each order could be effectively managed and controlled through our internal process management system.

We also keep our customers fully informed in the whole production process and listen to their feedback to our designs and prototypes. By accepting customers' feedback and taking immediate corrective and preventive measures in the production process, we can minimize errors and loss in our production. Our production management and quality control systems have effectively improved our production efficiency and reduced our production costs. Over the last three years, we have maintained low inventory in our production line. In order to maximize the utilization of our strong design capacities and our invested equipments with our own proprietary technologies as well as shorten our turnaround time, we have strategically outsourced some processes of production to our partner companies. This alliance with other partner companies allows us to manage a larger operation efficiently with our available resources.

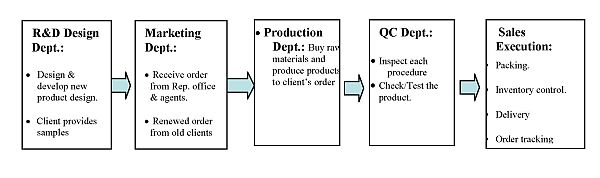

In June 2010, we received ISO 14001:2004 and ISO 9001:2008 certifications, which testifies our management system in terms of international standards. The chart below illustrates how our system works.

7

Chart 5. Working Flow

Our Properties

Our operating facilities are located in Jinjiang, Fujian Province, China. We currently occupy around 13,000 square meters of buildings and promises in three different locations. The lease terms varied from 2 years to 3 years with average total monthly rental of $8,420 in year 2008 and $9,063 in year 2009.

|

Address

|

Area

(approximate)sq. meter

|

Lease Term

|

|

Jinjiang

|

1,400

|

February 1, 2010 – January 31, 2011

|

|

Jinjiang

|

7,000

|

July 1, 2009 – June 30, 2011

|

|

Jinjiang

|

4,550

|

July 1, 2009- June 30, 2012

|

Our Intellectual Property

We have obtained the following patents:

|

Description of the Patent

|

Patent Number or Record Number

|

|

Shoe mould (new tech)

|

Patent no:2010202471312x

|

|

Shoe mould(new tech)

|

Patent no: 201020247361.3

|

|

Shoe mould(new invention)

|

Application no:201010217396.7

|

|

Air blow shoe mould(new tech)

|

Application no: 201020546991.0

|

|

Air blow shoe mould(new invention)

|

Application no: 201010296387.1

|

8

We have also developed six CAD/CAM software with copyrights set out below:

|

Description of the Copyrights

|

Copyrights Number

|

|

CNC host detection software V1.0

|

Register no:2010SR047575

|

|

Shoes mould intelligent parameter softwareV1.0

|

Register no:2010SR048537

|

|

CNC host performance optimization softwareV1.0

|

Register no:2010SR047303

|

|

Shoe mould CNC intelligent parameter softwareV1.0

|

Register no:2010SR048499

|

|

Shoe mould process control software V1.0

|

Register no:2010SR048575

|

|

Shoe mould host security data recovery software V1.0

|

Register no: 2010SR049422

|

The domain name of our official website, http://www.zhongtianmould.com, is authorized by China Internet Network Information Center (CNNIC).

As of the date of the report, Zhongtian Mould has the following trademark design, [Missing Graphic Reference] pending approval, with the Application No. 8198608.

Our Employees

We have 460, 420 and 384 full time employees as of September 30, 2010, December 31, 2009, and 2008 respectively. The following table set forth the number of our employees for each of our operation or functional areas of operations as of September 30, 2010:

|

Operation/Functional Area

|

Number of Employees

|

% of Total

|

||

|

R&D and Design

|

160

|

35%

|

||

|

Manufacturing

|

242

|

52%

|

||

|

Sales & Marketing

|

18

|

4%

|

||

|

General Administration, Purchasing & Logistics

|

40

|

9%

|

||

|

Total

|

460

|

100%

|

We believe that we have maintained a satisfactory working relationship with our employees and we have not experienced any significant labor dispute or any difficulty in recruiting and retain qualified staff for our operations.

Our Vision and Growth Strategies

We aim to become a world leading company in the shoe mould design and manufacture industry through further leveraging our “full-turn-key” business solution model, strong R&D capacities with proprietary technologies, and a broaden sales and after-sales network to seek innovations in the industry and to achieve accelerated growth with significantly lower cost. We intend to achieve our goals through the following key strategies:

|

●

|

We plan to expedite the establishment of our mould processing centers network to increase our production capacity to meet the increasing market demand and improve our adaptability to our customers located in different places in China and globally.

|

|

●

|

We plan to optimize our mould design and manufacture process in order to further reduce our production cost and to shorten our turnaround time and take the advantage of our economy of scale by fully utilizing the spare design and manufacture capacities in the increasing number of mould processing centers located in different places.

|

|

●

|

We plan to be strategic in mergers and acquisition opportunities. Our objective in potential selective and strategic mergers and acquisitions is to augment our organic growth strategy.

|

|

●

|

We plan to further strengthen our management and R&D capacities by attracting and retaining the top talents in the shoe mould design and manufacture industry.

|

9

Risks and Uncertainties

The successful execution of our strategies is subject to certain risks and uncertainties, including:

|

●

|

Uncertainties regarding our ability to open and profitably operate new plants and manage our growth effectively in China and overseas countries;

|

|

●

|

Risks associated with political relationship between China and our target countries;

|

|

●

|

Uncertainties regarding our ability to maintain and enhance the attractiveness of our products;

|

|

●

|

Risks related to the protectionism wave in foreign countries where we sell our products;

|

|

●

|

Uncertainties associated with the market condition change;

|

|

●

|

Uncertainties associated with the revolutionary change in the footwear and the mould industry.

|

These risks and uncertainties, along with others, are also described in the Risk Factors section of this Current Report on Form 8-K.

Risk Factors

An investment in our common stock or other securities involves a number of risks. You should carefully consider each of the risks described below before deciding to invest in our common stock. If any of the following risks develops into actual events, our business, financial condition or results of operations could be negatively affected, the market price of our common stock or other securities could decline and you may lose all or part of your investment.

The risk factors presented below are the ones that we currently consider material. However, they are not the only ones facing our Company. Additional risks not presently known to us, or which we currently consider immaterial, may also adversely affect us. There may be risks that a particular investor views differently from us, and our analysis might be wrong. If any of the risks that we face actually occur, our business, financial condition and operating results could be materially adversely affected and could differ materially from any possible results suggested by any forward-looking statements that we have made or might make. In such case, the trading price of our common stock could decline, and you could lose part or all of your investment.

Risks Relating to Our Business

Our limited operating history makes it difficult to evaluate our future prospects and results of operations.

We have a limited operating history. Accordingly, you should consider our future prospects in light of the risks and uncertainties experienced by early-stage companies in evolving markets, such as China. Some of these risks and uncertainties relate to our ability to:

|

•

|

offer new products to attract and retain a larger customer base;

|

|

|

•

|

increase awareness of our brand and continue to develop customer loyalty;

|

|

•

|

respond to competitive market conditions;

|

|

|

•

|

respond to changes in our regulatory environment;

|

|

•

|

manage risks associated with intellectual property rights;

|

|

|

•

|

maintain effective control of our costs and expenses;

|

|

•

|

raise sufficient capital to sustain and expand our business; and

|

|

|

•

|

attract, retain and motivate qualified personnel

|

Because we are a relatively new company, we may not be experienced enough to address all the risks in our business or in our expansion. If we are unsuccessful in addressing any of these risks and uncertainties, our business may be materially and adversely affected.

10

We expect to incur costs related to our planned expansion and growth into new plants and ventures which may not prove to be profitable. Moreover, any delays in our expansion plans could cause our profits to decline and jeopardize our business.

We anticipate that our proposed expansion of our plants may include the construction of new or additional facilities. Our cost estimates and projected completion dates for construction of new production facilities may change significantly as the projects progress. In addition, our projects will entail significant construction risks, including shortages of materials or skilled labor, unforeseen environmental or engineering problems, weather interferences and unanticipated cost increases, any of which could have a material adverse effect on the projects and could delay their scheduled openings. A delay in scheduled openings will delay our receipt of increased sales revenues, which, when coupled with the increased costs and expenses of our expansion, could cause a decline in our profits.

Our plans to finance, develop, and expand our facilities will be subject to the many risks inherent in the rapid expansion of a high growth business enterprise, including unanticipated design, construction, regulatory and operating problems, and the significant risks commonly associated with implementing a marketing strategy in changing and expanding markets. These projects may not become operational within their estimated time frames and budgets as projected at the time the Company enters into a particular agreement, or at all. In addition, the Company may develop projects as joint ventures in an effort to reduce its financial commitment to individual projects. The significant expenditures required to expand our production plants may not ultimately result in increased profits.

Our business and operations are growing rapidly. If we fail to effectively manage our operation, our business and operating results could be harmed.

To date we have experienced, and continue to experience, rapid growth in our operations. This has placed, and will continue to place, significant demands on our management, and on our operational and financial infrastructure. If we do not effectively manage our operations, the quality of our products and services will suffer, which would negatively affect our operating results. If the necessary funding can be obtained, we will be able to improve our operational, financial and management controls and our reporting systems and procedures. The complexity of this undertaking means that we are likely to face many challenges, some of which are not yet foreseeable. Problems may occur with our raw material acquisition, with the roll-out of efficient manufacturing processes, and with our ability to sell our products to our customers. If we are not able to obtain the necessary funding and operate efficiently, our business plan may fall short of its goals, and our ability to manage our growth could be hurt.

The capital investments that we plan may result in dilution of the equity of our present shareholders.

We intend to raise a large portion of the necessary funds by selling equity in our company. At present we have no commitment from any source for those funds. We cannot determine the terms on which we will be able to raise the necessary funds. It is possible that we will be required to dilute the value of our current shareholders’ equity in order to obtain the funds. If, however, we are unable to raise the necessary funds, our growth will be limited, as will our ability to compete effectively.

We operate in a highly competitive marketplace, which could adversely affect our sales and financial condition.

We compete on the basis of quality, price, product availability and security of supply, product development and customer service. Some competitors are larger than us in certain markets and may have greater financial resources that allow them to be in a better position to withstand changes in the industry. Our competitors may introduce new products based on more competitive alternative technologies that may be causing us to lose customers which would result in a decline in our sales volume and earnings. Our customers demand high quality and low cost products and services. The cost and availability of energy and strategic raw materials may continue to deteriorate domestically while improving in the international market, thus advantaging our foreign competition. Any such change in the global market could adversely impact the demand for our products. Competition could cause us to lose market share and certain lines of business, or increase expenditures or reduce pricing, each of which would have an adverse effect on our results of operations, cash flows and financial condition.

11

An inability to protect our intellectual property rights could reduce the value of our products, services and brand.

Our unique technologies and techniques are important assets for us. We have applied to the Chinese government for intellectual property right protection for some of the technologies that we own. However, this legal effort may sometimes not be sufficient or effective, due to the lack of effective legal enforcement in China. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. In addition, since protection of our intellectual property rights is costly and time consuming, any unauthorized use of our to-be-patented technologies could increase our cost of business and eventually harm our operating results. Moreover, since we only registered intellectual property rights for our technologies in China, our technologies may not be well protected in other countries in which our products may be sold in the future.

An increase in raw material prices could increase our costs and decrease its profits.

Changes in the cost of raw materials could significantly affect our business. Since cost for raw materials constitute a substantial part of our product price, increase in the cost of raw materials will decrease our profit margin. Although we may offset such deduction of our profit by increasing the price for our products, unforeseeable events in the market may occur to prevent the effectiveness of this method. We also rely on one major supplier to provide such raw materials. Failure to maintain business relationship with this one major supplier may make the raw materials inaccessible, and thus hurt our operation result.

Our performance and planned growth depend on raw material supply and related costs.

Difficulties with hiring, employee training and other labor issues could disrupt our operations.

We may not be able to successfully hire and train new team members or integrate those team members into the programs and policies of the Company. Any such difficulties would reduce our operating efficiency and increase our costs of operations.

Increased environmental regulation in China could increase our costs of operation.

Certain processes utilized in the production of modified plastics may result in toxic by-products. To date, the Chinese government has imposed only limited regulation on the production of these by-products, and enforcement of the regulations has been sparse. Recently, however, there is a substantial increase in focus on the Chinese environment, which has inspired considerable new regulation. This compliance regimen brings us into compliance with all Chinese environmental regulations. Additional regulation, however, could increase our cost of doing business, which would impair our profitability.

We may have difficulty establishing adequate management and financial controls in China.

The People’s Republic of China has only recently begun to adopt the management and financial reporting concepts and practices that investors in the United States are familiar with. We may have difficulty in hiring and retaining employees in China who have the experience necessary to implement the kind of management and financial controls that are expected of a United States public company. If we cannot establish such controls, we may experience difficulty in collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet U.S. standards.

We may incur significant costs to ensure compliance with U.S. corporate governance and accounting requirements.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley, and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors, on committees of our board of directors or as executive officers.

12

As a public company, we are required to comply with rules and regulations of the SEC, including expanded disclosure, accelerated reporting requirements and more complex accounting rules. This will continue to require additional cost management resources. We will need to continue to implement additional finance and accounting systems, procedures and controls as we grow to satisfy these reporting requirements. In addition, we may need to hire additional legal and accounting staff with appropriate experience and technical knowledge, and we cannot assure you that if additional staffing is necessary that we will be able to do so in a timely fashion. If we are unable to complete the required annual assessment as to the adequacy of our internal reporting or if our independent registered public accounting firm is unable to provide us with a qualified report as to the effectiveness of our internal controls over financial reporting in the future, we could incur significant costs to become compliant.

We rely on highly skilled personnel and, if we are unable to retain or motivate key personnel or hire qualified personnel, we may not be able to grow effectively.

Our performance largely depends on the talents and efforts of highly skilled individuals. Our future success depends on our continuing ability to identify, hire, develop, motivate and retain highly skilled personnel for all areas of our organization. Our continued ability to compete effectively depends on our ability to attract new technology developers and to retain and motivate our existing contractors.

We have limited business insurance coverage.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited business insurance products, and do not, to our knowledge, offer business liability insurance. As a result, we do not have any business liability insurance coverage for our operations. Moreover, while business disruption insurance is available, we have determined that the risks of disruption and cost of the insurance are such that we do not require it at this time. Any business disruption, litigation or natural disaster might result in substantial costs and diversion of resources.

Product liability claims could harm our business, financial condition and results of operations.

We face an inherent business risk of exposure to product liability claims in the event that the use of our products is alleged to have resulted in adverse effect. While we take what we believe are appropriate precautions, we may not be able to avoid significant product liability exposure. We currently do not have product liability insurance. Although we have yet to face a product liability claim, the assertion of this type of claim could have a material adverse affect on our business, financial condition and results of operations.

Our senior management and employees have worked together for a short period of time, which may make it difficult for you to evaluate their effectiveness and ability to address challenges.

Due to our limited operating history and recent additions to our management team, certain of our senior management and employees have worked together at our company for only a relatively short period of time. As a result, it may be difficult for you to evaluate the effectiveness of our senior management and other key employees and their ability to address future challenges to our business.

There may be more advanced technologies and products which may constitute challenge against Zhongtian Mould.

We need to upgrade our technologies continuously to keep our advantage. In respect of external environment, there may be more advanced technologies or products which may constitute challenge against us. In response to such risk, we will need to constantly improve our technologies and products to maintain our leading status.

Our revenue is particularly sensitive to changes in economic conditions.

Demand for our products, is particularly sensitive to changes in general economic conditions. During periods of economic downturn, tarmera may reduce the money they spend on our products, which would materially and adversely affect our ability to generate revenue from our business, and our financial condition and results of operations.

13

A substantial majority of our revenues are currently concentrated in China and exports. If the either of the markets experiences an economic downturn, our ability to generate adequate cash flow would be materially and adversely affected.

Substantial majority of our revenues are currently concentrated in China and exports market. We expect China and exports market to continue to be the important sources of our revenues. If China and exports market experience an economic downturn, negative changes in government policy, a natural disaster and so on, our ability to generate adequate cash flow would be materially and adversely affected.

We may not be able to successfully expand our business network into new regions which could harm or reverse our growth potential and our ability to increase our revenues, or even result in a decrease in revenues.

We are pursuing a strategy to expand our sales into new regions and countries. Based in Fujian province, we aim to expand our mould processing center into other cities of Guangdong, Zhejiang, Hebei province and other countries. In the new locations, we will encounter new difficulties and regulatory environments and political, cultural and economic environments, and compete with local competitors. The lack of local expertise may harm or reverse our growth potential and our ability to increase our revenues, or even result in a decrease in revenues.

We face intensive competition, and if we do not compete successfully against new and existing competitors, we may lose our market share, and our profitability may be adversely affected

Some of our existing and potential competitors, Minfa Mould (Fujian) Co.,Ltd. Xieli Mould Co. Ltd., Jinjiang Guangyu Mould Co., Ltd., may have competitive advantages, such as significantly greater financial, marketing or other resources and may be able to mimic and adopt our business model. We cannot assure you that we will be able to successfully compete against new or existing competitors.

We depend on the leadership and services of Mr. ZHUANG Heping, who is our founder, chairman, and our largest shareholder, and our business and growth prospects may be severely disrupted if we lose his services.

Our future success is dependent upon the continued service of Mr. ZHUANG Heping, our founder and chairman and a major shareholder. We rely on his industry expertise and experience in our business operations, and in particular, his business vision, management skills, and working relationships with our employees, our other major shareholders and many of our clients. If he was unable or unwilling to continue in his present position, or if he joins a competitor or forms a competing company in violation of his employment agreement and noncompeting agreement, we may not be able to replace him easily or at all. As a result, our business and growth prospects may be severely disrupted if we lose his services.

Our expansion plan would be restricted by managerial system deficiencies and shortage of human resources.

With the expansion of our business, update of related managerial systems and shortage of human resources may restrict our company’s development. We expand our business in a rapid speed, and there may not be enough talents. Theses factors may adversely affect our business.

If we do not continue to expand and maintain an effective sales and marketing team it will cause disruptions of our operations, restrict our sales efforts and negatively affect our revenue.

Many of our sales and marketing personnel have only worked for us for a short period of time. We depend on our marketing staff to sell to our existing and potential clients. We will need to further increase the size of our sales and marketing staff if our business continues to grow. We may not be able to hire, retain, integrate or motivate our current or new marketing personnel, which may cause short-term disruptions of our operations, restrict our sales efforts and negatively affect our business.

We may need additional capital and we may not be able to obtain it, which could adversely affect our liquidity and financial position.

To further expand our business we may require additional cash resources. If these sources are insufficient to satisfy our cash requirements, we may have to sell additional equity or debt securities or obtain credit facilities. The sale of convertible debt securities or additional equity securities may result in additional dilution to our shareholders. The incurrence of indebtedness would result in increased debt service obligations and may result in operating and financing covenants that may restrict our operations and liquidity.

Our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

|

·

|

investors’ perception of, and demand for, securities of alternative mould industry;

|

14

|

·

|

conditions of the U.S. and other capital markets in which we may seek to raise funds;

|

|

·

|

our future results of operations, financial condition and cash flows;

|

|

·

|

PRC governmental regulation of foreign investment in mould industry or shoe making industry in China;

|

|

·

|

economic, political and other conditions in China; and

|

|

·

|

PRC governmental policies relating to foreign currency borrowings.

|

We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us could have a material adverse effect on our liquidity and financial condition.

If we fail to maintain an effective system of internal controls, we may be unable to accurately report our financial results or prevent fraud, and investor confidence and the market price of our stock may be adversely impacted.

Our reporting obligations as a public company will place a significant strain on our management, operational and financial resources and systems for the foreseeable future. If we fail to maintain an effective system of internal controls in the future, we may be unable to accurately report our financial results or prevent fraud and investor confidence and the market price of our stock may be adversely impacted.

We have limited international operation experience

We have very limited international operation experience and may encounter major difficulties in our international expansion, which may result in negative impact on our operation and financial performance.

The Company is not likely to hold annual shareholder meetings in the next few years.

Unless listed on a national exchange, the management does not expect to hold annual meetings of shareholders in the next few years, due to the expenses involved. The current members of the Board of Directors were appointed to that position by the previous directors. If other directors are added to the Board in the future, it is likely that the current directors will appoint them. As a result, the shareholders of the Company will have no effective means of exercising control over the operations of the Company.

Risks related to an investment in our common stock

Our senior executive officers have a large degree of control on us through their position and stock ownership and their interests may differ from other stockholders.

Our senior executive officers have large ownership interests in the Company. As a result, they will be able to influence the outcome of stockholder votes on various matters, including the election of directors and extraordinary corporate transactions such as business combinations. Their interests may differ from that of other stockholders.

We do not intend to pay cash dividends in the foreseeable future.

We currently intend to retain all future earnings for use in the operation and expansion of our business. We do not intend to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate. Should we decide in the future to do so, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries based in the PRC. Our operating subsidiaries, from time to time, may be subject to restrictions on its ability to make distributions to us, including restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions. See “Risks related to doing business in the People’s Republic of China” above.

15

There is currently no trading market for our common stock, and liquidity of shares of our common stock is limited.

Our shares of common stock are not registered under the securities laws of any state or other jurisdiction, and accordingly there is no public trading market for our common stock. Further, no public trading market is expected to develop in the foreseeable future unless and until the Company files a registration statement under the Securities Act of 1933, as amended (the “Securities Act”). Therefore, outstanding shares of our common stock cannot be offered, sold, pledged or otherwise transferred unless subsequently registered pursuant to, or exempt from registration under, the Securities Act and any other applicable federal or state securities laws or regulations. You may not be able to sell your shares due to the absence of an established trading market.

Compliance with the criteria for securing exemptions under federal securities laws and the securities laws of the various states is extremely complex, especially in respect of those exemptions affording flexibility and the elimination of trading restrictions in respect of securities received in exempt transactions and subsequently disposed of without registration under the Securities Act or state securities laws.

Our common stock is subject to the Penny Stock Regulations.

Our common stock is, and will continue to be subject to the SEC’s “penny stock” rules to the extent that the price remains less than $5.00. Those rules, which require delivery of a schedule explaining the penny stock market and the associated risks before any sale, may further limit your ability to sell your shares.

The SEC has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our common stock, when and if a trading market develops, may fall within the definition of penny stock and subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the brokerdealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our common stock and may affect the ability of investors to sell their common stock in the secondary market.

Our common stock is illiquid and subject to price volatility unrelated to our operations.

The market price of our common stock could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting our competitors or us. In addition, the stock market is subject to extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our common stock.

A large number of shares of common stock will be issuable for future sale which will dilute the ownership percentage of our current holders of common stock. The availability for public resale of those shares may depress our stock price.

Also as a result, there will be a significant number of new shares of common stock on the market in addition to the current public float. Sales of substantial amounts of common stock, or the perception that such sales could occur, and the existence of warrants to purchase shares of common stock at prices that may be below the then current market price of the common stock, could adversely affect the market price of our common stock and could impair our ability to raise capital through the sale of our equity securities.

Enforcement against us or our directors and officers may be difficult.

Because our principal assets are located outside of the U.S. and some or all our directors and officers, both present and future, reside outside of the U.S., it may be difficult for you to enforce your rights based on U.S. federal securities laws against us and our officers and some directors or to enforce a U.S. court judgment against us or them in the PRC.

16

In addition, our operating company is located in the PRC and substantially all of its assets are located outside of the U.S. It may therefore be difficult for investors in the U.S. to enforce their legal rights based on the civil liability provisions of the U.S. Federal securities laws against us in the courts of either the U.S. or the PRC and, even if civil judgments are obtained in U.S. courts, to enforce such judgments in PRC courts. Further, it is unclear if extradition treaties now in effect between the U.S. and the PRC would permit effective enforcement against us or our officers and directors of criminal penalties under the U.S. Federal securities laws or otherwise.

Future Issuance of Securities may dilute your ownership interest.

We may need to issue large amount of common stock and securities that may be superior in rights to or convertible into common stock, diluting your ownership interest in us.

Failure to absorb new acquisitions.

We have limited resources in terms of management and operation talents and do not have the needed Exchange and acquisition expertise and experience and may not be successful in identifying the right acquisition targets and successful consummate or digest such targets. If we fail, our business and financial results will be adversely affected.

Risks related to doing business in China

Our business operations are conducted entirely in China. Because China’s economy and its laws, regulations and policies are different from those typically found in the West and are continually changing, we will face risks including those summarized below.

China is a developing nation governed by a one-party government and may be more susceptible to political, economic, and social upheaval than other nations.

China is a developing country governed by a one-party government. China is also a country with an extremely large population, widening income gaps between rich and poor and between urban and rural residents, minority ethnic and religious populations, and growing access to information about the different social, economic, and political systems to be found in other countries. China has also experienced extremely rapid economic growth over the last decade, and its legal and regulatory systems have changed rapidly to accommodate this growth. These conditions make China unique and may make it susceptible to major structural changes. Such changes could include a reversal of China’s movement to encourage private economic activity, labor disruptions or other organized protests, nationalization of private businesses, internal conflicts between the police or military and the citizenry, and international political or military conflict. If any of these events were to occur, it could shut down China’s economy and cause us to temporarily or permanently cease operations.

The PRC’s laws, regulations and policies, and changes to them, may limit our ability to operate profitably or prevent us from operating at all.

Our facilities and mould processing centers, as well as our suppliers and the shoe producers on whom they depend, most of them are located in China. The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy, including the production, distribution and sale of our merchandise. In particular, we are subject to regulation by local and national branches of the Ministries of Commerce and Transportation, as well as the General Administration of Quality Supervision, the State Administration of Foreign Exchange, and other regulatory bodies. In order to operate under PRC law, we require valid licenses, certificates and permits, which must be renewed from time to time. If we were to fail to obtain the necessary renewals for any reason, including sudden or unexplained changes in local regulatory practice, we could be required to shut down all or part of our operations temporarily or permanently.

Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to agriculture, taxation, land use rights and other matters. Such changes could be made at the national or local level and in the form of: farm subsidies; corporate tax rates; employee benefits; leaseholder or land-use rights; enforceability of contracts; intellectual property; or retail pricing. The effects of such changes on our business cannot be predicted but could be significant.

17

All of our assets are located in China. So any dividends or proceeds from liquidation are subject to the approval of the relevant Chinese government agencies.

Our assets are located inside China. Under the laws governing foreign interested enterprises in China, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to both the relevant government agency’s approval and supervision as well the foreign exchange control. This may generate additional risk for our investors in case of dividend payment or liquidation.

Because our funds are held in banks which do not provide insurance, the failure of any bank in which we deposit our funds could affect our ability to continue in business.

Banks and other financial institutions in the China do not provide insurance for funds held on deposit. As a result, in the event of a bank failure, we may not have access to funds on deposit. Depending upon the amount of money we maintain in a bank that fails, our inability to have access to our cash could impair our operations, and, if we are not able to access funds to pay our suppliers, employees and other creditors, we may be unable to continue in business.

Anti-inflation measures may be ineffective or harm our ability to do business in China.

In recent years, the PRC government has instituted anti-inflationary measures to curb the risk of an overheated economy characterized by debilitating inflation. These measures have included devaluations of the renminbi, restrictions on the availability of domestic credit, and limited re-centralization of the approval process for some international transactions. These austerity measures may not succeed in slowing down the economy’s excessive expansion or control inflation, or they may slow the economy below a healthy growth rate and lead to economic stagnation or recession; in the worst-case scenario, the measures could slow the economy without curbing inflation. The PRC government could adopt additional measures to further combat inflation, including the establishment of price freezes or moratoriums certain projects or transactions. Such measures could harm the economy generally and hurt our business by limiting the income of our customers available to purchase our merchandise, by forcing us to lower our profit margins, and by limiting our ability to obtain credit or other financing to pursue our expansion plans or maintain our business.

Governmental control of currency conversions may affect the value of your investment.

All of our revenue is earned in renminbi, and any future restrictions on currency conversions may limit our ability to use revenue generated in renminbi to make dividend or other payments in U.S. dollars. Although the PRC government introduced regulations in 1996 to allow greater convertibility of the renminbi for current account transactions, significant restrictions still remain, including primarily the restriction that foreign-invested enterprises like us may buy, sell or remit foreign currencies only after providing valid commercial documents at a PRC banks specifically authorized to conduct foreign-exchange business.

In addition, conversion of renminbi for capital account items, including direct investment and loans, is subject to governmental approval in the PRC, and companies are required to open and maintain separate foreign-exchange accounts for capital account items. There is no guarantee that PRC regulatory authorities will not impose additional restrictions on the convertibility of the renminbi. Such restrictions could prevent us from distributing dividends and thereby reduce the value of our stock.

The fluctuation of the exchange rate of the renminbi against the dollar could reduce the value of your investment.

The value of our common stock will be affected by the foreign exchange rate between U.S. dollars and renminbi. For example, to the extent that we need to convert U.S. dollars we receive from an offering of our securities into renminbi for our operations, appreciation of the renminbi against the U.S. Dollar could reduce the value in renminbi of our funds. Conversely, if we decide to convert our renminbi into U.S. dollars for the purpose of declaring dividends on our common stock or for other business purposes and the U.S. dollar appreciates against the renminbi, the U.S. dollar equivalent of our earnings from The Company, our subsidiary in China, would be reduced. In addition, the depreciation of significant U.S. Dollar-denominated assets could result in a charge to our income statement and a reduction in the value of these assets.

On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the renminbi to the U.S. Dollar. Under the new policy, the renminbi is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy has resulted in an appreciation of the renminbi against the U.S. dollar of approximately 12% as of the date of this report. While the international reaction to the renminbi revaluation has generally been positive, there remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the renminbi against the U.S. Dollar.

18

We receive all of our revenues in renminbi. The PRC government imposes controls on the convertibility of renminbi into foreign currencies and, in certain cases, the remittance of currency out of the China. Shortages in the availability of foreign currency may restrict our ability to remit sufficient foreign currency to pay dividends, or otherwise satisfy foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from the transaction, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange (“SAFE”) by complying with certain procedural requirements. However, approval from appropriate governmental authorities is required where renminbi are to be converted into foreign currency and remitted out of the PRC to pay capital expenses, such as the repayment of bank loans denominated in foreign currencies.

The PRC government could also restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay certain expenses as they come due.

Recently-modified SAFE regulations may restrict our ability to remit profits out of China as dividends.

SAFE Regulations regarding offshore financing activities by PRC residents have recently undergone a number of changes which may increase the administrative burdens we face. The failure of our stockholders who are PRC residents to make any required applications and filings pursuant to these regulations may prevent us from being able to distribute profits and could expose us and our PRC-resident stockholders to liability under PRC law.

SAFE issued a public notice (the “October Notice”), effective as of November 1, 2005, and implementation rules in May 2007, which require registration with SAFE by the PRC-resident stockholders of any foreign holding company of a PRC entity. These regulations apply to our stockholders who are PRC residents. In the absence of such registration, the PRC entity cannot remit any of its profits out of the PRC as dividends or otherwise.

In the event that our PRC-resident stockholders have not followed the procedures required under the October Notice and its implementation rules, we could lose the ability to remit monies outside of the PRC and would therefore be unable to pay dividends or make other distributions, and we could face liability for evasion of foreign-exchange regulations. Such consequences could affect our good standing under PRC regulations and our ability to operate in the PRC, and could therefore diminish the value of your investment.

China’s legal and judicial system may not adequately protect our business and operations and the rights of foreign investors.