Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - PHOENIX COMPANIES INC/DE | pnx_8k.htm |

EXHIBIT 99.1

1

As of December 31, 2010

The Phoenix Companies, Inc.

Investment Portfolio Supplement

Investment Portfolio Supplement

2

Important disclosures

This presentation may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We intend for these

forward-looking statements to be covered by the safe harbor provisions of the federal securities laws relating to forward-looking statements. These forward-

looking statements include statements relating to trends in, or representing management’s beliefs about, our future transactions, strategies, operations and

financial results, and often contain words such as “will,” “anticipate,” “believe,” “plan,” “estimate,” “expect,” “intend,” “may,” “should” and other similar words or

expressions. Forward-looking statements are made based upon management’s current expectations and beliefs concerning trends and future developments

and their potential effects on us. They are not guarantees of future performance. Our actual business, financial condition and results of operations may differ

materially from those suggested by forward-looking statements as a result of risks and uncertainties, which include, among others: (i) unfavorable general

economic developments including, but not limited to, specific related factors such as the performance of the debt and equity markets and changes in interest

rates; (ii) the potential adverse affect of interest rate fluctuations on our business and results of operations; (iii) the effect of adverse capital and credit market

conditions on our ability to meet our liquidity needs, our access to capital and our cost of capital; (iv) changes in our investment valuations based on changes

in our valuation methodologies, estimations and assumptions; (v) the effect of guaranteed benefits within our products; (vi) potential exposure to unidentified or

unanticipated risk that could adversely affect our businesses or result in losses; (vii) the consequences related to variations in the amount of our statutory

capital due to factors beyond our control; (viii) the possibility that we not be successful in our efforts to implement a new business plan; (ix) the impact on our

results of operations and financial condition of any required increase in our reserves for future policyholder benefits and claims if such reserves prove to be

inadequate; (x) further downgrades in our debt or financial strength ratings; (xi) the possibility that mortality rates, persistency rates, funding levels or other

factors may differ significantly from our assumptions used in pricing products; (xii) the possibility of losses due to defaults by others including, but not limited to,

issuers of fixed income securities; (xiii) the availability, pricing and terms of reinsurance coverage generally and the inability or unwillingness of our reinsurers

to meet their obligations to us specifically; (xiv) our ability to attract and retain key personnel in a competitive environment; (xv) our dependence on third parties

to maintain critical business and administrative functions; (xvi) the strong competition we face in our business from banks, insurance companies and other

financial services firms; (xvii) our reliance, as a holding company, on dividends and other payments from our subsidiaries to meet our financial obligations and

pay future dividends, particularly since our insurance subsidiaries’ ability to pay dividends is subject to regulatory restrictions; (xviii) the potential need to fund

deficiencies in our closed block; (xix) tax developments that may affect us directly, or indirectly through the cost of, the demand for or profitability of our

products or services; (xx) the possibility that the actions and initiatives of the U.S. Government, including those that we elect to participate in, may not improve

adverse economic and market conditions generally or our business, financial condition and results of operations specifically; (xxi) legislative or regulatory

developments; (xxii) regulatory or legal actions; (xxiii) potential future material losses from our discontinued reinsurance business; (xxiv) changes in accounting

standards; (xxv) the potential impact of a material weakness in our internal control over financial reporting on the accuracy of our reported financial results,

investor confidence and our stock price;(xxvi) the risks related to a man-made or natural disaster; (xxvii) risks related to changing climate conditions; and

(xxviii) other risks and uncertainties described herein or in any of our filings with the SEC.

forward-looking statements to be covered by the safe harbor provisions of the federal securities laws relating to forward-looking statements. These forward-

looking statements include statements relating to trends in, or representing management’s beliefs about, our future transactions, strategies, operations and

financial results, and often contain words such as “will,” “anticipate,” “believe,” “plan,” “estimate,” “expect,” “intend,” “may,” “should” and other similar words or

expressions. Forward-looking statements are made based upon management’s current expectations and beliefs concerning trends and future developments

and their potential effects on us. They are not guarantees of future performance. Our actual business, financial condition and results of operations may differ

materially from those suggested by forward-looking statements as a result of risks and uncertainties, which include, among others: (i) unfavorable general

economic developments including, but not limited to, specific related factors such as the performance of the debt and equity markets and changes in interest

rates; (ii) the potential adverse affect of interest rate fluctuations on our business and results of operations; (iii) the effect of adverse capital and credit market

conditions on our ability to meet our liquidity needs, our access to capital and our cost of capital; (iv) changes in our investment valuations based on changes

in our valuation methodologies, estimations and assumptions; (v) the effect of guaranteed benefits within our products; (vi) potential exposure to unidentified or

unanticipated risk that could adversely affect our businesses or result in losses; (vii) the consequences related to variations in the amount of our statutory

capital due to factors beyond our control; (viii) the possibility that we not be successful in our efforts to implement a new business plan; (ix) the impact on our

results of operations and financial condition of any required increase in our reserves for future policyholder benefits and claims if such reserves prove to be

inadequate; (x) further downgrades in our debt or financial strength ratings; (xi) the possibility that mortality rates, persistency rates, funding levels or other

factors may differ significantly from our assumptions used in pricing products; (xii) the possibility of losses due to defaults by others including, but not limited to,

issuers of fixed income securities; (xiii) the availability, pricing and terms of reinsurance coverage generally and the inability or unwillingness of our reinsurers

to meet their obligations to us specifically; (xiv) our ability to attract and retain key personnel in a competitive environment; (xv) our dependence on third parties

to maintain critical business and administrative functions; (xvi) the strong competition we face in our business from banks, insurance companies and other

financial services firms; (xvii) our reliance, as a holding company, on dividends and other payments from our subsidiaries to meet our financial obligations and

pay future dividends, particularly since our insurance subsidiaries’ ability to pay dividends is subject to regulatory restrictions; (xviii) the potential need to fund

deficiencies in our closed block; (xix) tax developments that may affect us directly, or indirectly through the cost of, the demand for or profitability of our

products or services; (xx) the possibility that the actions and initiatives of the U.S. Government, including those that we elect to participate in, may not improve

adverse economic and market conditions generally or our business, financial condition and results of operations specifically; (xxi) legislative or regulatory

developments; (xxii) regulatory or legal actions; (xxiii) potential future material losses from our discontinued reinsurance business; (xxiv) changes in accounting

standards; (xxv) the potential impact of a material weakness in our internal control over financial reporting on the accuracy of our reported financial results,

investor confidence and our stock price;(xxvi) the risks related to a man-made or natural disaster; (xxvii) risks related to changing climate conditions; and

(xxviii) other risks and uncertainties described herein or in any of our filings with the SEC.

This information is provided as of December 31, 2010. Certain other factors which may impact our business, financial condition or results of operations or

which may cause actual results to differ from such forward-looking statements are discussed or included in our periodic reports filed with the SEC and are

available on our website at www.phoenixwm.com under “Investor Relations”. You are urged to carefully consider all such factors. We do not undertake or

plan to update or revise forward-looking statements to reflect actual results, changes in plans, assumptions, estimates or projections, or other circumstances

occurring after the date of this presentation, even if such results, changes or circumstances make it clear that any forward-looking information will not be

realized. If we make any future public statements or disclosures which modify or impact any of the forward-looking statements contained in or accompanying

this presentation, such statements or disclosures will be deemed to modify or supersede such statements in this presentation.

which may cause actual results to differ from such forward-looking statements are discussed or included in our periodic reports filed with the SEC and are

available on our website at www.phoenixwm.com under “Investor Relations”. You are urged to carefully consider all such factors. We do not undertake or

plan to update or revise forward-looking statements to reflect actual results, changes in plans, assumptions, estimates or projections, or other circumstances

occurring after the date of this presentation, even if such results, changes or circumstances make it clear that any forward-looking information will not be

realized. If we make any future public statements or disclosures which modify or impact any of the forward-looking statements contained in or accompanying

this presentation, such statements or disclosures will be deemed to modify or supersede such statements in this presentation.

3

Table of contents

4

Summary

> General account investment portfolio is well diversified and liquid; managed by a team with a

successful track record of investing over a variety of market cycles, following a disciplined monitoring

process

successful track record of investing over a variety of market cycles, following a disciplined monitoring

process

> 91% of bond investments are investment grade. Emphasis is on liquidity with 71% of bonds invested

in public securities

in public securities

> Strict limits on individual financial exposures that mitigate loss potential to any one particular entity; as

a result, there is limited exposure to the financial institutions that have been in the news

a result, there is limited exposure to the financial institutions that have been in the news

> Net unrealized gains of $266 million versus net unrealized losses of $325 million at year-end 2009

> Residential mortgage-backed securities (RMBS) exposure is high quality and diversified. Exposure is

concentrated in agency and prime-rated securities with only 3% of invested assets in Alt-A and

subprime investments

concentrated in agency and prime-rated securities with only 3% of invested assets in Alt-A and

subprime investments

> Commercial mortgage exposure is in highly rated commercial mortgage-backed securities with

minimal direct loan or real estate holdings

minimal direct loan or real estate holdings

> No subprime collateralized debt obligations (CDO) exposure. CDO holdings are backed by bank

loans, investment grade bonds and commercial mortgage-backed securities

loans, investment grade bonds and commercial mortgage-backed securities

> No credit default swap (CDS) exposure

As of December 31, 2010

5

Portfolio comprised

primarily of fixed income securities

primarily of fixed income securities

Bonds $10,894

76%

Policy Loans $2,386

17%

Total Invested Assets: $14.3 Billion

$ in millions

Market value as of December 31, 2010

6

Portfolio quality improved

Percentages based on GAAP Value

As of December 31, 2010

|

|

4Q09

|

1Q10

|

2Q10

|

3Q10

|

4Q10

|

|

Investment Grade Bonds

|

89.2%

|

89.9%

|

90.9%

|

91.0%

|

91.3%

|

|

Below Investment Grade (BIG) Bonds

|

10.8

|

10.1

|

9.1

|

9.0

|

8.7

|

|

Percentage of BIG in NAIC 3

|

57.9

|

53.8

|

55.1

|

59.0

|

49.5

|

|

Percentage of BIG in NAIC 4-6

|

42.1

|

46.2

|

44.9

|

41.0

|

50.5

|

|

Corporate

|

|

|

|

|

|

|

Investment Grade

|

89.6

|

90.3

|

91.0

|

91.1

|

91.2

|

|

Below Investment Grade

|

10.4

|

9.7

|

9.0

|

8.9

|

8.8

|

|

Structured

|

|

|

|

|

|

|

Investment Grade

|

88.6

|

89.6

|

90.7

|

91.0

|

91.3

|

|

Below Investment Grade

|

11.4

|

10.4

|

9.3

|

9.0

|

8.7

|

7

$ in millions

Market value as of December 31, 2010

1 Includes $216.1 million of Home Equity Asset Backed Securities also included in the RMBS exhibits

2 Includes $33.9 million of CMBS CDO’s also included in the CMBS exhibits

Bond portfolio diversified by sector

U.S. Corporates

58%

Foreign Corporates

7%

ABS 5%

Emerging Markets

3%

Below Investment Grade (BIG) Bonds

by Sector

RMBS

5%

|

As of December 31, 2010

|

Market Value |

% of Total |

|

Industrials

|

$2,443.2

|

22.4%

|

|

Residential MBS1

|

1,994.7

|

18.3

|

|

Foreign Corporates

|

1,590.9

|

14.6

|

|

Financials

|

1,467.5

|

13.5

|

|

Commercial MBS

|

1,148.4

|

10.5

|

|

U.S. Treasuries / Agencies

|

762.3

|

7.0

|

|

Utilities

|

493.3

|

4.5

|

|

Asset Backed Securities

|

430.0

|

4.0

|

|

CBO/CDO/CLO2

|

251.6

|

2.3

|

|

Municipals

|

218.7

|

2.0

|

|

Emerging Markets

|

93.2

|

0.9

|

|

Total

|

$10,893.8

|

|

Bonds by Rating

NAIC 1

58.9%

NAIC 2

32.4%

NAIC 3 & Lower

(BIG)

(BIG)

8.7%

CDO/CLO

18%

CMBS 4%

8

Diverse financial sector holdings

|

Sector

|

Book

Value

|

Market

Value

|

% General

Account |

% in Closed

Block |

|

Bank

|

$447.0

|

$436.4

|

3.1%

|

67.4%

|

|

Broker-Dealer

|

91.1

|

92.2

|

0.6

|

48.4

|

|

Commercial Finance

|

53.2

|

52.7

|

0.4

|

44.7

|

|

Consumer Finance

|

41.8

|

43.1

|

0.3

|

68.7

|

|

Diversified Financial

|

257.7

|

208.9

|

1.5

|

48.1

|

|

Insurance

|

347.1

|

361.1

|

2.5

|

65.8

|

|

Leasing/Rental

|

80.0

|

89.2

|

0.6

|

63.4

|

|

REITS

|

174.4

|

183.5

|

1.3

|

63.8

|

|

Project Finance

|

0.4

|

0.4

|

-

|

-

|

|

Total

|

$1,492.7

|

$1,467.5

|

10.3%

|

61.6%

|

$ in millions

As of December 31, 2010

Percentages based on market value

9

High quality

structured securities portfolio

structured securities portfolio

> Structured portfolio is 91% investment grade

> RMBS (46.5%) and CMBS (30.0%) dominate the structured portfolio

AAA

69.2%

B or less - 5.4%

BBB - 5.9%

AA - 6.4%

A - 9.8%

BB - 3.3%

$ in millions

Market value as of December 31, 2010, Quality rating breakdown based on NAIC ratings

1 Includes $33.9 million of CMBS CDOs

|

As of December 31, 2010

|

Market Value |

% of Total

|

|

Residential MBS

|

$ 1,778.6

|

46.5%

|

|

Commercial MBS

|

1,148.4

|

30.0

|

|

CBO/CDO/CLO1

|

251.6

|

6.6

|

|

Other ABS

|

221.8

|

5.8

|

|

Home Equity

|

216.1

|

5.7

|

|

Auto Loans

|

122.3

|

3.2

|

|

Aircraft Equipment Trust

|

47.6

|

1.2

|

|

Manufactured Housing

|

38.3

|

1.0

|

|

Total

|

$3,824.7

|

|

10

Moderation in credit impairments

GAAP Credit Impairments

|

|

4Q09

|

1Q10

|

2Q10

|

3Q10

|

4Q10

|

|

Prime RMBS

|

$0.6

|

$0.7

|

$1.9

|

-

|

$1.6

|

|

Alt-A RMBS

|

6.6

|

4.6

|

2.4

|

0.5

|

2.5

|

|

Subprime RMBS

|

0.2

|

0.1

|

-

|

-

|

1.5

|

|

CLO/CDO

|

3.8

|

5.5

|

3.4

|

3.6

|

3.5

|

|

CMBS

|

1.5

|

1.4

|

0.7

|

2.9

|

1.7

|

|

Corporate

|

15.0

|

1.9

|

1.7

|

1.1

|

-

|

|

Other ABS/MBS

|

4.5

|

-

|

2.1

|

3.7

|

-

|

|

Total Debt

|

$32.2

|

$14.2

|

$12.2

|

$11.8

|

$10.8

|

|

Schedule BA

|

0.4

|

-

|

-

|

-

|

-

|

|

Equity

|

1.7

|

0.3

|

0.2

|

0.1

|

-

|

|

Total Credit Impairments

|

$34.3

|

$14.5

|

$12.4

|

$11.9

|

$10.8

|

$ in millions

As of December 31, 2010

11

Portfolio in a gain position

$ in millions

1 All Other - Corporates, RMBS Agency, Other ABS, Foreign, US Government

|

|

December 31, 2009

|

December 31, 2010

|

Y/Y Change

|

|

RMBS Prime

|

$(74.1)

|

$(21.2)

|

$52.9

|

|

Subprime/Alt-A

|

(105.0)

|

(58.5)

|

46.5

|

|

CDO/CLO

|

(89.6)

|

(47.9)

|

41.7

|

|

CMBS

|

(49.8)

|

24.5

|

74.3

|

|

Financial

|

(144.1)

|

(25.2)

|

118.9

|

|

All Other High Yield

|

(41.7)

|

0.9

|

42.6

|

|

All Other1

|

179.5

|

393.5

|

214.0

|

|

Total

|

$(324.8)

|

$266.1

|

$590.9

|

12

Well constructed CMBS portfolio

Phoenix CMBS Portfolio

> High levels of credit enhancement

> Excellent credit characteristics vs.

market

market

> Avoided 2006 and 2007 aggressive

underwriting

underwriting

|

|

Market1

|

Phoenix

|

|

Weighted average credit

enhancement |

26%

|

29%

|

|

Weighted average credit

enhancement (U.S. Treasury defeasance adjusted) |

28%

|

34%

|

|

Interest Only (I/O) loans

|

67%

|

31%

|

|

Weighted average coupon

|

5.76%

|

6.32%

|

|

Weighted average loan age

|

63 months

|

89 months

|

|

60+ Delinquency Rate

|

8.0%

|

5.3%

|

As of December 31, 2010

1Sources: Barclays CMBS Index,Trepp, Bloomberg

13

J.P. Morgan Stress Loss Forecasts

(Conduit/Fusion)

Phoenix CMBS portfolio stress testing

|

Vintage

|

4Q10

|

|

2007

|

10.1%

|

|

2006

|

6.2

|

|

2005

|

4.5

|

|

2004

|

2.3

|

|

2003 and prior

|

2.7

|

Phoenix CMBS

Stress Test Results

Source: J.P. Morgan CRE Update January 19, 2011, Bloomberg

1 Coverage = Credit Enhancement/Deal Stress Loss

> 89.5% of the Phoenix CMBS portfolio can withstand >4.0x J.P. Morgan stress loss estimates

> PNX Portfolio Weighted Average Credit Enhancement is 29%

> PNX Portfolio Weighted Average Loss Estimate is 3.5%

PNX Conduit/Fusion Portfolio Weighted Average Coverage1 10.3x

|

Stress Loss Coverage1

|

|

|

≥ 4.0x

|

89.5%

|

|

≤ 4.0x

|

10.5

|

|

≤ 2.0x

|

0.7

|

|

≤ 1.0x

|

0.5

|

|

|

|

14

Highly rated, seasoned

CMBS portfolio

CMBS portfolio

> $1.2 billion in market value

> $145.2 million or 12.3% Government

guaranteed

guaranteed

> 79.7% AAA and 2.2% BB and below

> 77.3% 2005 and prior origination

> Only 3% in CMBS CDO’s

Market value as of December 31, 2010

Percentages based on market value

$ in millions

15

High quality, diversified RMBS portfolio

$ in millions

Market value as of December 31, 2010

|

Rating |

Book Value |

Market Value |

% General Account |

AAA |

AA |

A |

BBB |

BB &

Below |

|

Agency

|

$1,031.6

|

$1,066.2

|

7.5%

|

100.0%

|

-

|

-

|

-

|

-

|

|

Prime

|

527.1

|

505.9

|

3.5%

|

57.1%

|

11.6%

|

3.1%

|

1.9%

|

26.3%

|

|

Alt-A

|

290.2

|

254.3

|

1.8%

|

35.6%

|

21.5%

|

6.3%

|

6.9%

|

29.7%

|

|

Subprime

|

190.8

|

168.3

|

1.2%

|

56.4%

|

17.9%

|

-

|

7.7%

|

18.0%

|

|

Total

|

$2,039.7

|

$1,994.7

|

14.0%

|

77.2%

|

7.2%

|

1.6%

|

2.0%

|

12.0%

|

16

Well constructed RMBS portfolio

|

|

% of General

Account

|

% Rated

AAA & AA |

% of Portfolio

Originated in 2005 & Prior |

% of

Portfolio Backed by Fixed Rate Collateral |

% of Market

Backed by Fixed Rate Collateral |

|

Non-Agency

Prime |

3.5%

|

68.7%

|

81.1%

|

93.7%

|

47.0%

|

|

Alt-A

|

1.8

|

57.1

|

77.4

|

100.0

|

34.0

|

|

Subprime

|

1.2

|

74.3

|

69.0

|

89.4

|

31.0

|

Market value as of December 31, 2010

Source: JP Morgan MBS Research

17

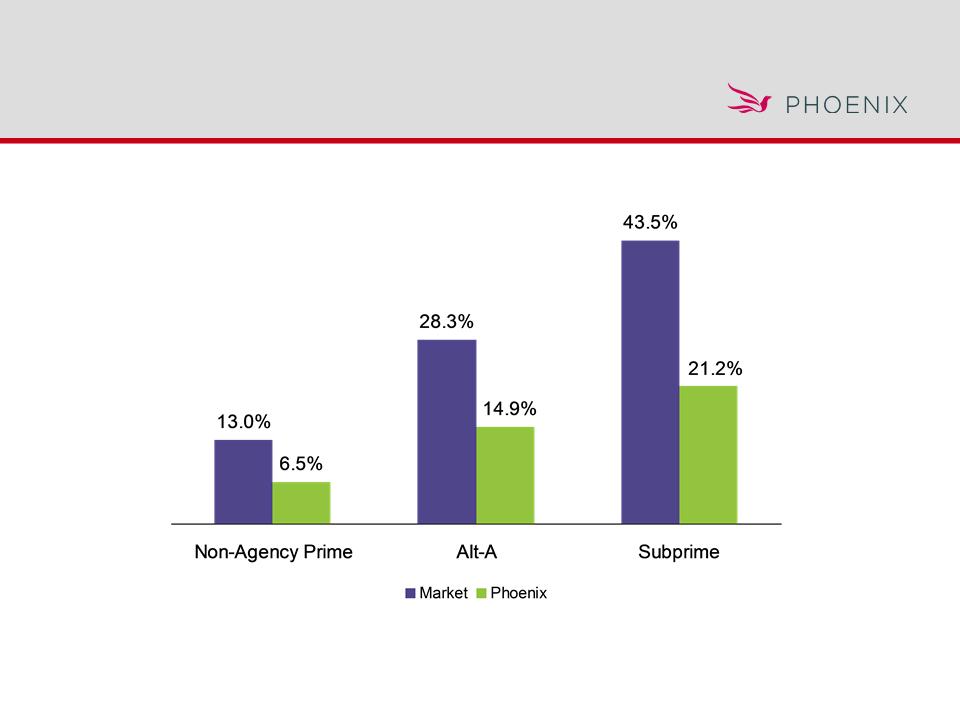

RMBS delinquencies

better than market

better than market

Market value as of December 31, 2010

Source: JP Morgan MBS Research 60+ day

18

High quality, seasoned

non-agency prime RMBS holdings

non-agency prime RMBS holdings

> $505.9 million market value

> 68.7% AAA and AA rated

> 81.1% 2005 and prior origination

> 93.7% fixed rate

$ in millions

As of December 31, 2010

19

Well constructed

non-agency prime RMBS portfolio

non-agency prime RMBS portfolio

As of December 31, 2010

Source: JP Morgan MBS Research - December 2010, Bloomberg

Market Phoenix

Weighted average credit enhancement 4.5% 10.1%

Weighted average 60+ day delinquent loan 13.0% 6.5%

Phoenix prime portfolio loss coverage: using 40% loss severity 0.87x 3.9x

20

Seasoned

non-agency Alt-A RMBS holdings

non-agency Alt-A RMBS holdings

> $254.3 million market value

> 57.1% AAA or AA rated

> 77.4% 2005 and prior originations

> Phoenix 60+ day delinquent 14.9% vs.

28.3% for Alt-A market

28.3% for Alt-A market

$ in millions

Market value as of December 31, 2010

21

Fixed-rate

non-agency Alt-A RMBS portfolio

non-agency Alt-A RMBS portfolio

As of December 31, 2010

Sources: JP Morgan MBS Research - December 2010

Option ARM 32% -

Alt-A ARM 34% -

Alt-A Fixed 34% 100%

60+ Delinquent 28.3% 14.9%

Alt-A Market Phoenix

22

High quality

non-agency subprime RMBS portfolio

non-agency subprime RMBS portfolio

> $168.3 million market value

> 74.3% rated AAA or AA

> Phoenix 60+ day delinquent

21.2% vs. 43.5% for the subprime

market

21.2% vs. 43.5% for the subprime

market

> Phoenix weighted average credit

support is 29.4%

support is 29.4%

$ in millions

Market value as of December 31, 2010

Source: JP Morgan MBS Research December 2010

23

Diversified CDO holdings

$ in millions

No affiliated CDO holdings as of December 31, 2010

Percentages based on market value

|

Collateral |

Book

Value |

Market

Value |

% General

Account |

AAA |

AA |

A |

BBB |

BB &

Below |

|

Bank Loans

|

$240.7

|

$213.9

|

1.5%

|

3.1%

|

3.2%

|

10.7%

|

21.3%

|

61.7%

|

|

Inv Grade Debt

|

4.5

|

3.8

|

-

|

-

|

13.0%

|

-

|

87.0%

|

-

|

|

CMBS

|

54.3

|

33.9

|

0.3%

|

10.6%

|

53.8%

|

6.3%

|

20.5%

|

8.8%

|

|

Total

|

$299.5

|

$251.6

|

1.8%

|

4.1%

|

10.2%

|

9.9%

|

22.1%

|

53.7%

|

24

Appendix

25

PLIC Closed Block investments

primarily fixed income

primarily fixed income

Bonds $6,385

79%

Policy Loans $1,341

16%

Invested Assets: $8.1 Billion

$ in millions

Market value as of December 31, 2010

26

PLIC Closed Block

portfolio high quality

portfolio high quality

Percentages based on GAAP Value

As of December 31, 2010

|

|

4Q09

|

1Q10

|

2Q10

|

3Q10

|

4Q10

|

|

Investment Grade Bonds

|

91.6%

|

92.0%

|

92.5%

|

92.6%

|

92.9%

|

|

Below Investment Grade (BIG) Bonds

|

8.4

|

8.0

|

7.5

|

7.4

|

7.1

|

|

Percentage of BIG in NAIC 3

|

64.3

|

62.1

|

62.6

|

67.3

|

59.4

|

|

Percentage of BIG in NAIC 4-6

|

35.7

|

37.9

|

37.4

|

32.7

|

40.6

|

|

Public Bonds

|

67.4

|

68.2

|

67.5

|

66.5

|

67.0

|

|

Private Bonds

|

32.6

|

31.8

|

32.5

|

33.5

|

33.0

|

27

PLIC Closed Block

portfolio diversified

portfolio diversified

U.S. Corporates

63%

Foreign Corporates

8%

ABS - 4%

Emerging Markets -5%

$ in millions

Market value as of December 31, 2010

1 Includes $35.1 million of Home Equity Asset Backed Securities

2 Includes $19.3 million of CMBS CDO’s

Below Investment Grade (BIG) Bonds

by Sector

|

Bond Portfolio

Phoenix Closed Block

|

|

|

|

As of December 31, 2010

|

|

|

|

Industrials

|

$1,623.5

|

25.4%

|

|

Foreign Corporates

|

994.4

|

15.6

|

|

Residential MBS1

|

982.8

|

15.4

|

|

Financials

|

903.7

|

14.2

|

|

Commercial MBS

|

712.4

|

11.2

|

|

U.S. Treasuries / Agencies

|

428.2

|

6.7

|

|

Utilities

|

324.4

|

5.1

|

|

Municipals

|

137.2

|

2.1

|

|

Asset Backed Securities

|

109.5

|

1.7

|

|

CBO/CDO/CLO’s2

|

98.2

|

1.5

|

|

Emerging Markets

|

71.1

|

1.1

|

|

Total

|

$6,385.4

|

100%

|

Bonds by Rating

NAIC 1

58.4%

NAIC 2

34.6%

NAIC 3 & Lower

7.0%

RMBS - 5%

CLO/CDO

12%

CMBS - 3%

28