Attached files

| file | filename |

|---|---|

| EX-3.3 - Tanke Biosciences Corp | e608029_ex3-3.htm |

| EX-3.2 - Tanke Biosciences Corp | e608029_ex3-2.htm |

| EX-4.1 - Tanke Biosciences Corp | e608029_ex4-1.htm |

| EX-4.3 - Tanke Biosciences Corp | e608029_ex4-3.htm |

| EX-4.2 - Tanke Biosciences Corp | e608029_ex4-2.htm |

| EX-99.3 - Tanke Biosciences Corp | e608029_ex99-3.htm |

| EX-10.1 - Tanke Biosciences Corp | e608029_ex10-1.htm |

| EX-10.2 - Tanke Biosciences Corp | e608029_ex10-2.htm |

| EX-10.9 - Tanke Biosciences Corp | e608029_ex10-9.htm |

| EX-10.6 - Tanke Biosciences Corp | e608029_ex10-6.htm |

| EX-10.8 - Tanke Biosciences Corp | e608029_ex10-8.htm |

| EX-99.1 - Tanke Biosciences Corp | e608029_ex99-1.htm |

| EX-99.2 - Tanke Biosciences Corp | e608029_ex99-2.htm |

| EX-10.3 - Tanke Biosciences Corp | e608029_ex10-3.htm |

| EX-10.5 - Tanke Biosciences Corp | e608029_ex10-5.htm |

| EX-10.7 - Tanke Biosciences Corp | e608029_ex10-7.htm |

| EX-10.4 - Tanke Biosciences Corp | e608029_ex10-4.htm |

| EX-10.10 - Tanke Biosciences Corp | e608029_ex10-10.htm |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

|

||

|

FORM 8-K

|

||

|

CURRENT REPORT

|

||

|

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

|

||

| Date of Report (Date of earliest event reported) February 9, 2011 | ||

|

Tanke Biosciences Corporation

|

||

|

(Exact name of registrant as specified in its charter)

|

||

|

Nevada

|

000-53529

|

26-3853855

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

Room 2801, East Tower of Hui Hao Building, No. 519 Machang Road, Pearl River New City, Guangzhou, People’s Republic of China

|

510627

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Registrant’s telephone number, including area code +86-20-38859025

|

|||

|

19 East 200 South, Suite #1080, Salt Lake City, Utah 84111

|

|||

|

(Former name or former address, if changed since last report.)

|

|||

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|||

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

||

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

||

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

||

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c))

|

||

1

EXPLANATORY NOTE

This Current Report on Form 8-K is being filed in connection with a series of transactions consummated by Tanke Biosciences Corporation (formerly known as Greyhound Commissary, Inc.) (the “Company”), and with certain events and actions taken by the Company.

This Current Report on Form 8-K includes the following items on Form 8-K:

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets

|

|

Item 3.02

|

Unregistered Sales of Equity Securities

|

|

Item 5.01

|

Changes in Control of Registrant

|

|

Item 5.02

|

Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers

|

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

|

|

Item 5.06

|

Change in Shell Company Status

|

|

Item 9.01

|

Financial Statements and Exhibits

|

When used in this Current Report on Form 8-K, the terms “we,” “us,” “our” and similar terminology reference to the Company.

Item 1.01 Entry into a Material Definitive Agreement

Securities Purchase Agreement

On February 9, 2011, in connection with the closing of the transactions described in Item 3.02 of this Current Report on Form 8-K (the “Private Placement”), Greyhound Commissary, Inc. entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with the purchasers identified on Schedule A thereto (each, including their respective successors and assigns, an “Investor” and collectively, the “Investors”) and, with respect to certain sections thereof, Euro Pacific Capital, Inc. (the “Lead Placement Agent”) and Newbridge Securities Corporation (the “Co-Placement Agent”), relating to a private placement by the Company of 6,669,627 units (the “Units”), with each Unit consisting of a $1.15 principal amount 8% Senior Convertible Note (each, a “Note”) and a Common Stock Purchase Warrant (each, a “Warrant”) to purchase one share of the Company’s common stock, par value $0.001 per share (the “Common Stock”) with an exercise price of $1.40 per share. The Private Placement was not a “public offering” as defined in Section 4(2) of the Securities Act of 1933, as amended (the “Securities Act”) and met the requirements to qualify for exemption under Regulation D promulgated under the Securities Act (“Regulation D”).

2

In addition to the other terms described in Item 3.02 of this Current Report on Form 8-K, pursuant to the Securities Purchase Agreement, the Company has agreed, among other things:

(a) that for so long as the Investors continue to hold at least a majority in principal amount of the outstanding Notes, the Lead Placement Agent shall be entitled to nominate one member to the Company’s board of directors, which member shall be an “independent” director as defined under Nasdaq Marketplace Rules;

(b) that during the six months following the closing of the Private Placement, the Company shall not issue any “Future Priced Securities” as such term is described by the rules and regulations of the Financial Industry Regulatory Authority (“FINRA”);

(c) to use its commercially reasonable best efforts to have its Common Stock listed or quoted for trading on any of the NYSE AMEX, the NASDAQ Global Market or the NASDAQ Capital Market as soon as is reasonably practicable following the date that the Company meets the requirements of any such trading markets;

(d) that within six (6) months of the closing of the Private Placement, the Company shall appoint to its board of directors individuals constituting a majority of “independent” directors (as defined under Nasdaq Marketplace rules), with one director designated by the Lead Placement Agent (who may qualify as one such independent director) and with at least two of such directors being fluent in English;

(e) that within six (6) months of the closing of the Private Placement, the Company shall enter into a twenty-four (24) month agreement with a new Chief Financial Officer of the Company who is reasonably satisfactory to the Lead Placement Agent and who is proficient in: (i) generally accepted accounting principles in the United States of America (“GAAP”); (ii) transactions similar to the ones contemplated by the Securities Purchase Agreement; and (iii) U.S. public company listings and the related filing and compliance requirements; and

(f) that within three (3) months of the closing of the Private Placement, the Company shall enter into a 12 month agreement with an investor and public relations firm that is reasonably satisfactory to the Lead Placement Agent.

Notes

On February 9, 2011, the Company offered and sold $7,670,071.50 worth of Notes convertible into up to 6,669,627 shares of our Common Stock, in conjunction with a purchase of the Units in the Private Placement. The Notes are payable 24 months from February 9, 2011 with an interest rate of 8% per annum payable semiannually in arrears. The Company shall place in escrow with Escrow, LLC (the “Escrow Agent”) an amount of the proceeds of the Private Placement equal to one semi-annual interest payment on the Notes to secure prompt interest payments. Until such time as 75% of the Notes are converted into shares of Common Stock, if such escrow is depleted in order to make interest payments, the Company will replenish such escrow amount. At the option of the holder, the Notes may be converted into Common Stock at a price of $1.15 per share, which is subject to customary weighted average and stock based anti-dilution protection. The issuance of the Notes was not registered under the Securities Act as such issuance was exempt from registration under Section 4(2) of the Securities Act and Regulation D.

3

The Notes contain customary events of default and affirmative and negative covenants of the Company, including negative covenants which restrict the Company’s ability to do the following (among other things) without the consent of the Lead Placement Agent, as representative of the Investors: (i) incur, or permit to exist, any indebtedness for borrowed money in excess of (A) US$3,000,000 during the twelve (12) month period beginning on February 9, 2011, or (B) US$5,000,000 during the two-year period beginning on February 9, 2011 and ending on February 9, 2013 (the maturity date of the Notes), except in the ordinary course of the Company’s business; (ii) lend or advance money, credit or property to or invest in (by capital contribution, loan, purchase or otherwise) any person or entity in excess of US$1,000,000 except: (A) investments in United States Government obligations, certificates of deposit of any banking institution with combined capital and surplus of at least $200,000,000; (B) accounts receivable arising out of sales in the ordinary course of business; (C) inter-company loans between and among the Company and its subsidiaries; and (D) the loan described under the heading “Certain Relationships and Related Transactions – Loans to Affiliates” under Item 2.01 of this Current Report on Form 8-K, which disclosure is incorporated herein by reference; (iii) pay dividends or make any other distribution on shares of the capital stock of the Company; (iv) create, assume or permit to exist, any lien on any of the Company’s property or assets now owned or hereafter acquired, subject to existing liens and certain exceptions; (v) assume guarantees, subject to certain exceptions; (vi) engage in “sale-leaseback” transactions, subject to certain exceptions; (vii) make capital expenditures in excess of US$5,000,000 in any fiscal year, subject to certain exceptions; and (viii) materially alter the Company’s business.

The above description of Notes is qualified in its entirety by reference to the actual agreement, a copy of which is filed as Exhibit 4.1 hereto and incorporated herein by reference.

Warrants

On February 9, 2011, the Company offered and sold Warrants to purchase 6,669,627 shares of Common Stock in conjunction with a purchase of the Units in the Private Placement. Each Warrant entitles the holder to purchase one share of our Common Stock. The Warrants will be exercisable in whole or in part, at an initial exercise price per share of $1.40, which is subject to customary weighted average and stock based anti-dilution protection. The Warrants may be exercised at any time upon the election of the holder, beginning on the date of issuance and ending of the third anniversary of the closing of the Private Placement. The issuance of the Warrants was not registered under the Securities Act as such issuance was exempt from registration under Section 4(2) of the Securities Act and Regulation D.

4

Upon the expiration of the Warrant exercise period, the Warrants will expire and become void. In order to exercise the Warrants, the Warrant must be surrendered at the office of the Warrant Agent (as defined in the Warrants) prior to the expiration of the Warrant exercise period, with the form of exercise appearing with the Warrant completed and executed as indicated, accompanied by payment of the full exercise price for the number of Warrants being exercised. Payment shall be by wire transfer or certified check payable to the Company. In the case of partial exercise, the Company will issue a new warrant to the exercising warrant holder, or assigns, evidencing the Warrants which remain unexercised.

In the event of our liquidation, dissolution or winding up, the holders of Warrants will not be entitled to participate in the distribution of our assets.

Holders of Warrants do not have voting, pre-emptive, subscription or other rights of stockholders in respect of the Warrants, nor shall the holders of the Warrants be entitled to receive dividends.

The above description of Warrants is qualified in its entirety by reference to the actual agreement, a copy of which is filed as Exhibit 4.2 hereto and incorporated herein by reference.

Agent Warrants

In connection with the Private Placement, on February 9, 2011, the Company issued to certain affiliates of the Lead Placement Agent three-year warrants (the “Agent Warrants”) to purchase an aggregate of 666,963 shares of Common Stock at an exercise price of $1.15 per share. The Agent Warrants also contain a cashless exercise option. The issuance of the Agent Warrants was not registered under the Securities Act. The issuance of the Agent Warrants was exempt from registration under Section 4(2) of the Securities Act.

The above description of Agent Warrants is qualified in its entirety by reference to the actual agreement, a copy of which is filed as Exhibit 4.3 hereto and incorporated herein by reference.

Registration Rights Agreement

On February 9, 2011, the Company entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with the Investors which sets forth the rights of the Investors to have their shares of Common Stock underlying the Notes and the Warrants (and certain other securities as described below) registered with the Securities and Exchange Commission (the “SEC”) for public resale.

Pursuant to the Registration Rights Agreement, the Company has agreed to file a Registration Statement on Form S-1 (the “Registration Statement”) with the SEC within 60 days of the closing of the Private Placement registering the total number of shares of Common Stock underlying the Units sold in the Private Placement (including such shares that are issuable upon exercise of the Warrants). In the event that the SEC provides comments pursuant to Rule 415 of the Securities Act, the Company shall cutback the number of shares it registers pursuant to the applicable SEC guidance. The Company has agreed to use its best efforts to have the Registration Statement declared effective within 160 days after the initial filing with the SEC (or, if the Registration Statement is not reviewed by the SEC, then the Company shall cause the Registration Statement to be declared effective within 5 business days of notification from the SEC that there will not be a review). The Company has also agreed to maintain the effectiveness of the Registration Statement until all of the securities covered by the Registration Statement may be sold by investors under Rule 144 of the Securities Act (“Rule 144”) without any restriction (including volume restrictions).

5

The Registration Rights Agreement provides that in the event the Registration Statement has not been filed or declared effective within the prescribed time period or if the Company has failed to maintain the effectiveness of the Registration Statement as required, the Company shall pay to the Investors liquidated damages equal to 1.0% of the amount invested for each subsequent 30-day period until the Company cures the failure to file, go effective or maintain effectiveness, as applicable, up to a maximum of 6.0%, and prorated for any period of less than 30 days.

Interest Escrow Agreement

On February 9, 2011, in connection with the Private Placement, the Company entered into an Escrow Agreement (the “Interest Escrow Agreement”) with the Lead Placement Agent and the Escrow Agent, as escrow agent. Pursuant to the terms of the Interest Escrow Agreement, the Company deposited into escrow an amount of proceeds of the Private Placement equal to one semi-annual interest payment on the Notes to secure prompt interest payments under the Notes. Until such time as 75% of the Notes are converted into shares of Common Stock, if such escrow is depleted in order to make interest payments, the Company has agreed to promptly replenish such escrow amount.

Securities Escrow Agreement

On February 9, 2011, in connection with the Private Placement, the Company entered into a Securities Escrow Agreement (the “Securities Escrow Agreement”) with the Lead Placement Agent, as agent, Golden Genesis Limited, a British Virgin Islands company (“Golden Genesis”) and the Escrow Agent, as escrow agent. Golden Genesis was the sole shareholder of China Flying Development Limited, a Hong Kong incorporated company (“China Flying”), which became a wholly-owned subsidiary of the Company under the share exchange (the “Share Exchange”) described in Item 2.01 of this Current Report on Form 8-K, pursuant to the Share Exchange Agreement, dated January 3, 2011 (the “Share Exchange Agreement”) and described in the Company’s Current Report on Form 8-K filed with the SEC on January 6, 2011.

6

Pursuant to the Securities Escrow Agreement, Golden Genesis will place in escrow 2,000,000 shares of Common Stock (the “Escrow Shares”), to be disbursed to either the Investors on a pro rata basis or to Golden Genesis based on the financial performance of Guangzhou Tanke Industry Co., Ltd. (“Tanke”), a company organized under the laws of the People’s Republic of China (“China” or the “PRC”) and the Company’s principal operating business through the VIE Agreements (as defined and more fully described in Item 2.01 of this Current Report on Form 8-K under the heading “Completion of Acquisition of Assets”). If the Company’s “Adjusted Income” (as defined below) for the year ending December 31, 2011 is (i) at least $4,652,410, then Golden Genesis shall receive an aggregate of one million (1,000,000) Escrow Shares or (ii) less than $4,652,410, then the Investors shall receive an aggregate of one million (1,000,000) Escrow Shares. If Tanke’s Adjusted Income for the year ending December 31, 2012 is (i) at least $7,571,111, then Golden Genesis shall receive an aggregate of one million (1,000,000) Escrow Shares or (ii) less than $7,571,111, then the Investors shall receive an aggregate of one million (1,000,000) Escrow Shares. For the purposes of the Securities Escrow Agreement, “Adjusted Income” means the sum of: (A) the Company’s net income; plus (B) any expense incurred in connection with the transactions contemplated by the Securities Purchase Agreement in connection with the Private Placement, including, without limitation, expenses related to the filing of a registration statement; plus (C) any depreciation and amortization expenses related to the expenses described in (B) above for the fiscal year ending December 31, 2011 or December 31, 2012 (as applicable), in each case as determined in accordance with GAAP, as reported in the Company’s Annual Report on Form 10-K as filed with the SEC.

7

Item 2.01Completion of Acquisition or Disposition of Assets

Completion of Acquisition of Assets

Pursuant to the Share Exchange Agreement, the Company acquired China Flying and its indirect, controlled subsidiary Tanke, a leading animal nutrition and innovative feed additive provider in China. The closing of the Share Exchange took place on February 9, 2011. On February 9, 2011, pursuant to the terms of the Share Exchange Agreement, the Company acquired all of the outstanding equity securities of China Flying (the “China Flying Shares”) from Golden Genesis, which was the sole shareholder of China Flying immediately prior to the closing of the Share Exchange, and Golden Genesis transferred and contributed all of its China Flying Shares to the Company. In exchange, the Company issued to Golden Genesis 10,758,000 newly issued shares of Common Stock. In addition, pursuant to the terms of the Share Exchange Agreement, the Company effected a 1 for 8.512 reverse stock split to modify the Company’s capital structure to accommodate the transactions contemplated by the Share Exchange and the Private Placement and to put in place an appropriate capital structure for the Company following the closing of the Share Exchange and the Private Placement. Such securities were not registered under the Securities Act. These securities qualified for exemption under Section 4(2) of the Securities Act since the issuance of securities by us did not involve a public offering.

China Flying owns 100% of the issued and outstanding capital stock of Guangzhou Kanghui Agricultural Technology Co., Ltd. (“Kanghui Agricultural” or the “WFOE”), a wholly foreign owned enterprise incorporated as a limited liability company under the laws of the PRC. On January 3, 2011, the WFOE entered into a series of variable interest entity contractual agreements (the “VIE Agreements”) with Tanke and the shareholders of Tanke, namely Mr. Guixiong Qiu (“Mr. Qiu”), Mr. Bi Gao (“Mr. Gao”), Ms. Xiuzhen Liang (“Ms. Liang”) and Mr. Bing Teng (“Mr. Teng”) (collectively referred to as the “Tanke Shareholders”) who are all PRC citizens. Pursuant to the VIE Agreements, Kanghui Agricultural effectively assumed management of the business activities of Tanke and has the right to appoint all executives and senior management and the members of the board of directors of Tanke. The VIE Agreements are comprised of a series of agreements, including a Consulting Services Agreement, Operating Agreement, Voting Rights Proxy Agreement, Equity Pledge Agreement and Option Agreement, through which Kanghui Agricultural has the right to advise, consult, manage and operate Tanke for an annual fee in the amount of Tanke’s yearly net profits after tax. Additionally, the Tanke Shareholders have pledged their rights, titles and equity interest in Tanke as security for Kanghui Agricultural to collect consulting and services fees provided to Tanke through an Equity Pledge Agreement. In order to further reinforce Kanghui Agricultural’s rights to control and operate Tanke, the Tanke Shareholders have granted Kanghui Agricultural an exclusive right and option to acquire all of their equity interests in Tanke through an Option Agreement. The terms of the VIE Agreements are more fully described below:

|

|

·

|

Consulting Services Agreement. Tanke and Kanghui Agricultural have entered into a Consulting Services Agreement which provides that Kanghui Agricultural will be the exclusive provider of entrusted management service to Tanke and Tanke will pay all of its net income based on the quarterly financial statements to Kanghui Agricultural for such services. Any such payment to Kanghui Agricultural from the Company would need to comply with applicable Chinese laws affecting payments from Chinese companies to non-Chinese companies. See “Risk Factors – Risks Associated With Doing Business in China.”

|

8

|

|

·

|

Equity Pledge Agreement. Kanghui Agricultural, Tanke and the Tanke Shareholders have entered into an Equity Pledge Agreement, pursuant to which each Tanke Shareholder has pledged all of his shares of Tanke to Kanghui Agricultural in order to guarantee cash-flow payments under the applicable Consulting Services Agreement. The Equity Pledge Agreement further entitles Kanghui Agricultural to collect dividends from Tanke during the term of the pledge.

|

|

|

·

|

Operating Agreement. Pursuant to the operating agreement among Kanghui Agricultural, Tanke and each Tanke Shareholder, Kanghui Agricultural provides guidance and instructions on Tanke’s daily operations and financial affairs. The Tanke Shareholders must designate the candidates recommended by Kanghui Agricultural as their representatives on their respective boards of directors. Kanghui Agricultural has the right to appoint senior executives of Tanke. In addition, Kanghui Agricultural agrees to guarantee Tanke’s performance under any agreements or arrangements relating to Tanke’s business arrangements with any third party. Tanke, in return, agrees to pledge its accounts receivable and all of its assets to Kanghui Agricultural. Moreover, Tanke agrees that without the prior consent of Kanghui Agricultural, Tanke will not engage in any transactions that could materially affect its assets, liabilities, rights or operations, including, without limitation, incurrence or assumption of any indebtedness, sale or purchase of any assets or rights, incurrence of any encumbrance on any of its assets or intellectual property rights in favor of a third party or transfer of any agreements relating to its business operation to any third party.

|

|

|

·

|

Option Agreement. Tanke, the Tanke Shareholders and Kanghui Agricultural have entered into an Option Agreement which provides that the Tanke Shareholders granted Kanghui Agricultural an exclusive right and option to acquire all of their equity interests in Tanke.

|

|

|

·

|

Voting Rights Proxy Agreement. Tanke, the Tanke Shareholders and Kanghui Agricultural entered into a Voting Rights Proxy Agreement which provides that the Tanke Shareholders irrevocably appoint the persons designated by Kanghui Agricultural with exclusive right to exercise the Tanke Shareholders’ voting rights.

|

As a result of the VIE Agreements described above, we have consolidated Tanke’s historical financial results in our financial statements as a variable interest entity pursuant to U.S. GAAP following the date of the agreements and combined such results prior to the date of the agreements.

9

We have been advised by PRC legal counsel Martin Hu & Partners LLP, in an opinion dated January 4, 2011, that: (1) our inner-PRC shareholding structure complies with PRC laws and regulations; (2) the contractual arrangements between Kanghui Agricultural, Tanke and the Tanke Shareholders are valid and binding on all parties to these arrangements and do not violate relevant PRC laws or regulations; (3) each of Kanghui Agricultural and Tanke has the requisite corporate power to own, lease and operate its properties, to enter into contracts and to conduct its business and (4) each of Kanghui Agricultural and Tanke is qualified to do business in the respective jurisdiction of its establishment.

In addition, on January 3, 2011, the Tanke Shareholders each entered into a call option agreement (the “Call Option Agreement”) with Golden Genesis, which became effective upon the closing of the Share Exchange. Under the Call Option Agreement, Golden Genesis shall transfer up to 100% of the shares of Common Stock that it receives in the Share Exchange within the next 3 years to the Tanke Shareholders for nominal consideration, resulting in the Tanke Shareholders owning a majority of the outstanding shares of the Common Stock. The Call Option Agreement provides that Golden Genesis shall not dispose of the respective portion of the shares of Common Stock without the Tanke Shareholders’ prior written consent.

Through Kanghui Agricultural and China Flying, the Company will operate and control Tanke as a result of the VIE Agreements. Control of Tanke was acquired through the VIE Agreements, rather than an acquisition of Tanke’s assets or equity, because: (i) the tax and other consequences of a share exchange with a foreign entity that result in the acquisition of a Chinese company are uncertain due to PRC laws that were effective on September 8, 2006 and (ii) if Tanke is not acquired via a share exchange transactions, PRC authorities may require it to be acquired for cash, however the Company was not able to raise a sufficient amount of cash to purchase Tanke.

The foregoing descriptions of the VIE Agreements and the Call Option Agreement, and the transactions contemplated thereby, are subject to the more detailed provisions set forth in the VIE Agreements, which are attached as Exhibits 10.5, 10.6, 10.7, 10.8, 10.9 and 10.10 to this Current Report on Form 8-K and which are incorporated herein by reference.

Pursuant to the Share Exchange Agreement, China Flying became a wholly-owned subsidiary of the Company. The board of directors and majority stockholder of the Company immediately prior to the closing of the Share Exchange approved the Share Exchange Agreement and the Share Exchange. The directors and shareholders of China Flying also approved the Share Exchange Agreement and the Share Exchange.

As a further condition of the closing of the Share Exchange, the officers and directors of the Company resigned and Mr. Qiu was appointed as the a new executive officer of the Company and also its sole director upon effectiveness of an information statement required by Rule 14f-1 (the “Information Statement”) promulgated under the Exchange Act of 1934, as amended (the “Exchange Act”).

10

The foregoing descriptions of the Share Exchange Agreement and the transactions contemplated thereby are subject to the more detailed provisions set forth in the Share Exchange Agreement, which is attached as exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on January 6, 2011. All references to the Share Exchange Agreement and to the exhibits to this Current Report on Form 8-K are qualified, in their entirety, by the text of such exhibits.

CAUTIONARY NOTE ON FORWARD LOOKING STATEMENTS

Certain information contained in this Current Report on Form 8-K include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The statements herein which are not historical reflect our current expectations and projections about the Company’s future results, performance, liquidity, financial condition, prospects and opportunities and are based upon information currently available to the Company and their management and their interpretation of what is believed to be significant factors affecting the businesses, including many assumptions regarding future events. Such forward-looking statements include statements regarding, among other things:

|

|

·

|

our ability to produce, market and generate sales of our products;

|

|

|

·

|

our ability to develop, acquire and/or introduce new products;

|

|

|

·

|

our projected future sales, profitability and other financial metrics;

|

|

|

·

|

our future financing plans;

|

|

|

·

|

our plans for expansion of our facilities;

|

|

|

·

|

our anticipated needs for working capital;

|

|

|

·

|

the anticipated trends in our industry;

|

|

|

·

|

our ability to expand our sales and marketing capability;

|

|

|

·

|

acquisitions of other companies or assets that we might undertake in the future;

|

|

|

·

|

our operations in China and the regulatory, economic and political conditions in China;

|

|

|

·

|

our ability as a U.S. company to operate our business in China through an indirect wholly-owned subsidiary; and

|

|

|

·

|

competition existing today or that will likely arise in the future.

|

11

Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “seek,” or “project” or the negative of these words or other variations on these words or comparable terminology. Actual results, performance, liquidity, financial condition and results of operations, prospects and opportunities could differ materially from those expressed in, or implied by, these forward-looking statements as a result of various risks, uncertainties and other factors, including the ability to raise sufficient capital to continue the Company’s operations. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this Current Report on Form 8-K generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Current Report on Form 8-K will in fact occur. Potential investors should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

Potential investors should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

The specific discussions herein about the Company include financial projections and future estimates and expectations about the Company’s business. The projections, estimates and expectations are presented in this Current Report on Form 8-K only as a guide about future possibilities and do not represent actual amounts or assured events. All the projections and estimates are based exclusively on the Company management’s own assessment of its business, the industry in which it works and the economy at large and other operational factors, including capital resources and liquidity, financial condition, fulfillment of contracts and opportunities. The actual results may differ significantly from the projections.

Potential investors should not make an investment decision based solely on the Company’s projections, estimates or expectations.

Business

Those statements in the following discussion that are not historical in nature should be considered to be forward looking statements that are inherently uncertain. Actual results and the timing of the events may differ materially from those contained in these forward looking statements due to a number of factors, including the disclosures set forth in this Item 2.01 to this Current Report on Form 8-K, under the headings “Cautionary Note on Forward Looking Statements” and “Risk Factors”, which disclosures are incorporated herein by reference. As a result of the Share Exchange and the VIE Agreements, the Company, through Kanghui Agricultural, its indirect wholly owned subsidiary, assumed management of the business activities of Tanke and has the right to appoint all executives and senior management and the members of the board of directors of Tanke. As used in this section, the terms “we”, “our”, “us” and the “Company” refer to the Company, our direct and indirect subsidiaries and Tanke, our principal operating business.

12

Company Background

The Company was organized on May 24, 1989 under the laws of the State of Idaho and was re-incorporated under the laws of the State of Nevada on November 1, 2007.

The Company was initially created to provide a variety of services related to the operation of a nearby greyhound dog-racing track. Following inception, Greyhound raised funds to assist it in providing food, shelter, healthcare and other services to animals used in the greyhound racing. Subsequently the track was closed and the business was curtailed. Since 1995, Greyhound has engaged in an ongoing search for suitable business opportunities, including a potential merger.

General

Through Tanke, our principal operating business, we are one of the leading animal nutrition and innovative feed additive providers in China. Our products are distinguished from traditional artificial feed additives in that they are environmentally-friendly and are designed to optimize the growth and health of livestock such as pigs and cattle, as well as farmed fish. One of our most popular products is an organic trace mineral additive that we believe is one of the few Chinese-developed organic products in the trace mineral market.

Our target customers are mid-to-large sized feed product factories and large scale producers. The market for our products is significant and growing, as China seeks to meet the demand of its over 1.3 billion citizens for safe and reasonably priced food. With feed additives used in China at less than half the rate of that of the United States and Europe, we are seeking to capitalize on a significant market opportunity as Chinese feed producers modernize and expand the use of modern and more effective additives.

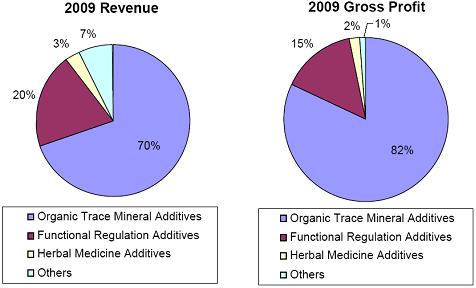

The Company currently produces 21 branded feed additives, with each brand available in seven different mixes that correspond to different stages of an animal’s life cycle. Our major products address most key market categories within China’s animal feed additive industry including: Organic Trace Mineral Additives, which in 2009 accounted for approximately 70% of our revenue, Feed Acidifiers and Flavor Enhancers, which accounted for approximately 20% of our revenue, and Herbal Medicine Additives, which accounted for approximately 3% of our revenue. Our extensive distribution network reaches China’s top 10 feed producers and the 500 largest animal farming operations. While the majority of our sales are domestic in the PRC, international sales, mainly in Southeast Asia, Latin American and other developing countries, currently account for approximately 5% of our total sales.

Currently, we estimate that we hold about 1% of the feed acidifier market in China and believe we are well positioned to take advantage of the changing marketplace and regulatory environment as the use of feed acidifiers increases.

13

Overview

Through Tanke, our principal operating business, the Company is engaged in the development, production, marketing and distribution of a broad range of innovative feed additive products that foster the growth of healthy and profitable animals. A PRC government certified hi-tech company, the Company’s headquarters are in Guangzhou and it operates in a modern 34,000 square-meter manufacturing facility in the Huadu Economic District, both of which are in Guangdong province. As the Chinese economy continues to evolve and prosper, the opportunity for technology companies like the Company should increase dramatically.

The Company’s feed additive products are distinguished from traditional artificial feed additives in that they are non-hazardous, environmentally friendly and safe for livestock and their human consumers, making them compatible with China's efforts to develop a safer food supply. Such feed additive products are environmentally friendly because animals that consume them produce less waste products than other animals and a decrease in the amount of waste produced is beneficial to the environment.

As a growing player in providing advanced, environmentally-friendly and innovative feed additives, the Company believes sales will rapidly increase as more large scale farms and feed processing and production companies in China seek “Pollution-Free” and “Green Food” certifications from the Chinese government. In addition, feed additives are utilized in China at less than half the rate of the United States and Europe, and the Company has a significant growth opportunity as Chinese farmers and ranchers include a greater amount of increasingly sophisticated additives in their feeds.

The Company’s major products address most key market categories within China’s animal feed additive industry, including:

|

|

·

|

Organic Trace Mineral Additives, which accounted for approximately 70% of the Company’s revenue in 2009;

|

|

|

·

|

Feed Acidifiers, Seasonings and Flavor Enhancers, which accounted for approximately 20% of the Company’s revenue in 2009; and

|

|

|

·

|

Herbal Medicine Additives, which account for approximately 3% of the Company’s revenue in 2009.

|

The Company’s extensive distribution network reaches China’s top 10 feed producers and the 500 largest animal farming operations. As a result of the Company’s diversified products and extensive distribution network, we believe the Company is ideally positioned to help meet China’s growing demand for safe and reasonably priced food.

14

From Tanke’s incorporation in April 1997, when it manufactured one product utilizing a small rented facility in Gaotang in the Guangdong province, Tanke has grown into one of China’s largest feed additive producers. As of December 31, 2009, the Company marketed 21 different brands of feed additives and had an aggregate production capacity of approximately 400 metric tons per week of feed additive, of which 250 metric tons are organic trace minerals. We estimate that we are currently operating at a blended average across our product lines of approximately 44% of our manufacturing capacity at our current facility. We expect our manufacturing output to increase in 2011 and beyond, and are thus seeking to acquire land for and to build a second facility, which is currently scheduled to be operational in the fourth quarter of 2011.

Currently, the Company plans to introduce two new products into the market in 2011. The first, CA-13, is antibiotic free and designed to enhance the breeding of early-wean piglets by improving their immune system and reducing the days needed for the production of fully-grown pigs. The second, a vitamin additive, enhances the effectiveness of the Company’s trace minerals by promoting greater growth, reducing animal stress and improving the immune system. We expect both products to enhance our future growth.

Overview of the Chinese Feed Additive Market

Over the past decade, as a result of a series of market-based reforms, China’s economy has experienced unprecedented growth, with an average annual GDP growth rate of over 10%. As China has become more prosperous, the rapid growth in per capita income and consumer choices has led to a dramatic improvement in living standards and dietary patterns. Chinese consumers have significantly increased their consumption of high-protein food such as meat and other livestock and in the place of traditional staple grain-based foods. This growing demand for high-protein foods has had a material impact on the growth of the feed additive market.

Beginning in the mid-1970s, in response to China’s increasing and diversifying food consumption, its domestic feed industry began to experience rapid development and transitioned into the world’s second largest feed producer behind the United States. According to IBIS, in 2014, projected animal feed production in China is expected to grow to 160 million tons from 110 million tons in 2009, a compound annual growth rate of 7.7%. Also, according to market research firm IBIS, in revenue terms, the Chinese feed market is expected to grow from annual sales of $40 billion in 2009 to $69 billion in 2014, a compound annual revenue growth rate of 11.4%.

In the past decade, feed producers have become more efficient, with new, high production mills replacing older, smaller mills. As part of their effort to improve the quality of agricultural output and the efficiency of animal production, commercial feed producers have increased their use of feed additives. According to the Chinese Ministry of Agriculture, the Chinese market for all feed additives in 2009 was $4.6 billion.

According to data published on the website of Chinafeed Industrial Information, China’s current annual consumption of feed additives as a percentage of total feed output measured in tonnage is only 2%, compared to 5% in developed countries. Of this 2%, more than 85% represents low-profit products like inorganic mineral materials, with the remaining 15% representing organic trace products, such as amino acids and vitamins, that have higher prices and profit margins. Over 70% of these higher-margin products are imported, creating a significant opportunity for domestic manufacturers, like the Company, to increase their market share. Additionally, while the United States and Western Europe have over 300 feed additive formulas approved for use, to date China has only approved approximately 200 feed additive formulas, of which most is imported. As a result of China’s approval of fewer feed additive formulas, there is an ample market opportunity for new Chinese-manufactured additives.

15

One of the primary components of the Company’s business is Feed Acidifiers and it has gained significant momentum in recent years as a substitute for growth promoters that rely on antibiotics as the primary ingredient. The desirability of Feed Acidifiers is a result of growing concerns about drug-resistant “superbugs” in humans and animals resulting from the indiscriminate use of antibiotics. The global feed industry has been under scrutiny for years for its use of antibiotics as growth promoters in the rearing process of livestock, prompting the European Union to ban the use of Antibiotic Growth Promoters (AGPs) in January 2006. The Chinese government is currently tightening the industry standard and may follow the EU’s lead to restrict or ban the use of AGPs. The Company’s Feed Acidifiers differ from other growth promoters because they contain alkaloids to stimulate acid production in an animal’s stomach, lowering the pH levels to improve overall animal health. Such Feed Acidifiers do not rely on antibiotics as a primary ingredient. Rather, the ingredients in the Company’s Feed Acidifiers comply with the more restrictive requirements of the EU and the increased regulation that the Company anticipates in the future from China’s regulatory authorities.

In response to quality control breakdowns from isolated Chinese manufacturers in 2007, in June, 2009, the Chinese Ministry of Agriculture announced Bulletin No. 1224 (the Safe Use of Feed Additive Specification), which tightened feed additive quality control standards by specifying “norms” of trace elements and other feed additives usage. The maximum normative amounts set by the Chinese government are required to be strictly followed and implemented. As a result of these regulations, the Company expects this new regulation to drive the market to shift from high dosage, low absorption rate inorganic products to low dosage, high absorption rate organic products.

As one of the pioneers in the organic trace minerals additive segment, Tanke, as a member of the Chinese Feed Association, participated in setting the national standards on the usage of organic trace minerals additives. As a result, we are well positioned to further expand our market position.

Competition in the Chinese Market

The Chinese feed additive market is highly fragmented, with approximately 2,500 feed additive companies nationwide and no participant having a greater than 1.2% market share. While many of the Company’s domestic competitors are smaller businesses that operate in relatively specialized niche product areas, the industry is in the process of transforming itself from small, family-based operations into large, enterprise based businesses.

Foreign firms are also attempting to gain a foothold in the Chinese feed additive market, but generally charge higher prices than those of domestic manufacturers.

16

The Company’s largest Chinese competitors include:

|

|

·

|

Changsha Xingjia Bio Tech Co., Ltd., which is engaged in developing, marketing and producing safe, environmental friendly trace mineral feed additives. Changsha offers compound acidifier, amino acid chelated trace elements, copper chloride and other products. Changsha has sales office nationwide and subsidiaries in Thailand and Singapore.

|

|

|

·

|

Debon Bio Tech Co., Ltd., which was established in 2004 and is a Sino-German joint venture engaged in feed additive development and raw material trading. Debon has a long term partnership with its German partner and imports piglet nutrition and feed additives from overseas.

|

The Company also competes with the following large international manufacturers:

|

|

·

|

Zinpro Corporation, a manufacturer of trace minerals. Zinpro offers iron, copper, manganese, zinc and cobalt products used in the dairy, beef, poultry, swine, and equine industries. Headquartered in Eden Prairie, Minnesota, Zinpro has sales offices in the United States, Canada, Mexico, the Netherlands, China, Japan, Thailand, Brazil, Australia and New Zealand.

|

|

|

·

|

Alltech Inc., an animal health and nutrition company. Alltech manufactures nutritional products and solutions for the feed industry. It provides natural feed ingredients and Sel-Plex organic selenium for use in animal species with selenium deficiencies for feed and food manufactures in North America, Latin America, the Asia-Pacific, Europe, the Middle East, and Africa. Alltech is headquartered in Nicholasville, Kentucky and has bioscience centers in the United States, Ireland, and Thailand.

|

Growth Strategy

The Company’s goal is to become the leading provider of feed additives in China. The Company’s primary growth strategy is as follows:

Strengthen our leading position in the organic trace mineral market and substantially increase our Chinese market share within the next three years.

In recent years, Chinese inorganic minerals have been linked to contamination by heavy metals and dioxins. As a result, farmers and feed producers are increasingly switching to organic trace minerals based on research that indicates that quality organic minerals are superior to inorganic minerals in bioavailability, health and performance.

As the largest organic trace minerals producer in China, accounting for approximately 6.6% of total production on an annual basis, the Company is ideally positioned to benefit from the substantial growth it anticipates in the organic trace mineral market. To meet the expected demand, we plan to build a second manufacturing facility that would double our organic trace mineral production capacity.

17

Expand sales of the Company’s products to more regions within China.

As of the end of 2009, the Company had sales representatives in six of the major agriculture centers in China, including China’s northeastern and southern regions. To expand our reach into China’s other regions, we intend to establish sales offices in the northern and central regions of China and hire 25 additional sales personnel in 2011.

Increase the Company’s production capacity

Our current production capacity is 400 metric tons per week and our current production capacity is 250 metric tons per week for organic trace minerals. We estimate we are currently operating at a blended average across our product lines of approximately 44% of our manufacturing capacity at our current facility. We expect our manufacturing output to increase in 2011 and beyond, and are thus seeking to acquire land for and to build a second facility, which is currently scheduled to be operational in the fourth quarter of 2011. To acquire this second facility, and as part of the Company’s expansion strategy, the Company has entered into a letter of intent to purchase a land use right in Qingyuan, Guangdong to build our second manufacturing facility. Upon the completion of the project, we plan to move our manufacturing of organic trace minerals from our existing manufacturing facility in Huadu to the new facility in Qingyuan. This significant evolution of the Company’s manufacturing structure is expected to allow us to devote the Qingyuan facility to our core business of organic trace minerals while providing sufficient production capacity at the Huadu facility for the production of our other products. The Company expects this new facility, when completed, to significantly increase our total production capacity on an annual basis.

Increase the Company’s investment in research and development.

To maintain a competitive advantage in the marketplace, we plan to devote greater resources to our in-house research and development team and to enhance and expand our collaborations with institutions and universities. Our in-house research team typically requires one to two years to develop a new product and bring it to market. We intend to enhance our trial testing program by acquiring a farm operation to streamline our testing.

Additionally, we plan to strengthen our collaboration with institutions and universities as part of our effort to stay on the cutting edge of the feed additive business. The Company believes that as the Chinese market continues to grow and mature, companies will face increasing competitive pressure both in the area of technology and talented personnel. Our partnership with institutions and universities will not only provide the Company with skilled human resources, but also will assist us in staying on the cutting edge of the industry. Currently, the majority of the Company’s research partners are located in Guangzhou, and the Company intends to establish similar cooperative relationships with schools in other regions.

18

Strengthen international sales.

We plan to increase our attendance at industry exhibitions worldwide to market our products to a broader market of potential customers. In our experience, participating in these exhibitions is an effective way to introduce the Company’s products overseas and develop new customers.

Competitive Strengths

We believe that the following competitive strengths have contributed to our current market position and enables us to capitalize on the growth opportunities in the feed additive market in China:

We have a leading market position in the organic trace mineral market.

We are the largest provider and producer of organic trace minerals in China with production capacity of 250 metric tons per week. We entered into a letter of intent to acquire land use rights in Qingyuan, Guangdong province, to build a second manufacturing facility, a project we expect to take one year. Upon the completion of this facility, we expect to double our production capacity of organic trace minerals.

We offer a diversified product portfolio.

Following the introduction of Tanke’s first flavor enhancer into the market in 1997, we have introduced a broad product portfolio to the market, including organic trace mineral, functional regulation additives and herbal medicine additives. Within each of these segments, we produce a diverse array of products.

We have strong research and development capabilities.

We have made significant investments in research and development. We focus our research and development efforts on creating new products with large potential markets and on improving existing technologies, both with a view towards increasing market share and growing the business.

We have built a reputation for exceptional quality.

Our customers depend on our products’ reputation for exceptional quality and uniformity. We have an ISO 9001/2000 International Quality Management System Certificate for our operations management system and GMP for our manufacturer compliance for animal drugs, certifying our commitment to the integrity of our products.

19

Our management team has extensive knowledge of, and experience in, the feed additive industry.

Our management team, led by Guixiong Qiu, Tanke’s founder and the Company’s Chief Executive Officer, match their academic backgrounds in agriculture and chemistry with extensive knowledge of the feed additive industry in China and a proven track record of developing and marketing quality feed additive products.

Products and Services

We currently market 21 different brands of feed additives at various price points to meet the demands of existing and prospective customers. Within each brand there are seven different mixes that correspond to the different growth stages of an animal’s life cycle. Our business focuses on four key business areas: organic trace minerals additives, functional regulation additives, herbal medicine additives and other. The following chart shows each segment’s contributions to fiscal 2009 net sales and gross profit.

Organic Trace Mineral Additives

We are China’s largest domestic provider of organic trace mineral additives, specializing in the development and production of chelated organic trace minerals additives. Our current trace mineral manufacturing facility is the largest chelating facility in China and has the capacity to produce approximately 250 metric tons of organic trace mineral per week.

Our total revenue for organic trace minerals in 2009 was approximately $8.5 million. Such revenue accounted for approximately 70% of our 2009 revenues and net sales and carried a gross profit margin of approximately 52%.

20

Minerals play an important role in the growth and development of fish, livestock, pigs and cattle and are routinely used by breeders to supplement their animals’ diets. Animals require two classes of minerals: major minerals, which include sodium, potassium, chloride, calcium, magnesium, phosphorus, and sulfur, and trace minerals, which include copper, iron, manganese, molybdenum, zinc, chromium, fluorine, selenium and silicon. Major and trace minerals are differentiated primarily by the amount of a particular mineral that an animal requires. Animals require a minimum of 100 milligrams per day of the major minerals to carry out normal bodily functions and less than 100 milligrams per day of trace minerals.

While major minerals are typically present in most feed products provided to animals, Chinese farmers and ranchers are placing an increasing emphasis on the consumption of trace minerals, which help the animal’s body perform its daily routines more efficiently.

Trace minerals are widely available as feed additives in two main forms: organic and inorganic. Although both forms are commonly used, important differences exist in their bioavailability and environmental impact. Organic trace minerals increase bioavailability, reducing feed costs and minimizing nutrient buildup in the soil. Environmentally, new restrictions are likely to be imposed on producers to reduce nutrient excretion, making the Company’s organic feed additives more appealing to breeders. The Company’s products are more appealing because they achieve similar production results to inorganic feed additives while requiring smaller amounts of trace materials.

Our organic trace minerals are marketed primarily in, but also outside of, China to large scale feed producers and farmers under the brand name “Qili”. Our principle organic trace minerals products are:

|

|

·

|

Iron glycine chelate (G/Fe-140);

|

|

|

·

|

Iron glycine chelate (G/Fe-185);

|

|

|

·

|

Zinc glycine chelate (G/Zn-220);

|

|

|

·

|

Manganese glycine chelate (G/Mn-220);

|

|

|

·

|

Copper glycine chelate (G/Cu-210);

|

|

|

·

|

Chromium glycine chelate (G/Cr-001);

|

|

|

·

|

Iron methionine chelate (M/Fe-155);

|

|

|

·

|

Zinc methionline chelate (M/Zn-190);

|

|

|

·

|

Manganese methionine chelate (M/Mn-155);

|

|

|

·

|

Copper methionine chelate (M/Cr-001);

|

|

|

·

|

Zinc lysine chelate (L/Zn-105);

|

|

|

·

|

Zinc lysine chelate (L/Zn-145); and

|

|

|

·

|

Copper lysine chelates (L/Cu-100).

|

Qili products provide the essential minerals (zinc, copper, manganese and chromium) and lysine, which is an amino acid essential to a nutritious livestock feed program. Such products provide nutritional balance for the animals in order for them to have a healthier life. Qili products also help animals absorb these essential minerals and lysine in order to slow the process by which nutrients pass through the animal.

21

We also produce and market multiple trace mineral premix products for livestock and poultry under the trademark “Qilimix,” which has been particularly successful in foreign markets. These products contain highly bio-available minerals and result in the lowest excretion of minerals into the environment, especially for high content copper and zinc. Qilimix products are used to improve the reproductive performance of sows and breeder poultry, the growth and reproductive performance of pigs and the quality and color of animal carcasses.

Functional Regulation Additives

We are the one of the leading developers and providers of functional regulation additives in China. According to the Chinese Ministry of Agriculture, the Chinese market for functional feed additives in 2009, including feed acidifiers and flavor enhancers, was $328 million. Our total revenues and net sales of functional feed additives in 2009 was $2.4 million, accounting for approximately 1% of China’s total production.

Sales from functional regulation additives represent approximately 20% of our 2009 revenues and net sales and carry a gross profit margin of approximately 35%.

Functional feed additives are widely used to enhance the properties of other products, improve feed efficiency and stimulate the rapid maturation of the immune system. We currently produce two types of functional regulation additives: feed acidifiers and flavor enhancers.

Feed Acidifiers

Feed acidifiers are used to prevent microbial degradation of raw materials or finished feeds and to maintain the quality of feed. We produce and market feed acidifiers under the trademark “Qilicid”. Qilicid products consist of alkaloids that stimulate acid production and lower pH levels, inhibiting the development of pathogenic bacteria in the stomach and stimulating endogenous pepsin activities in the stomach and enzyme production in the intestine.

Qilicid products slow the passage of the feed through the animal’s intestine, allowing ample time for digestion, increasing feed intake and nutritional efficiency, reducing undesired gut microorganisms, supporting endogenous digestive enzymes and improving animal growth performance.

Flavor Enhancers

Flavor enhancers are widely used throughout the world as an important agent in the production of blended and high-grade feed to ensure animals obtain the required nutrients and to improve feed efficiency. There are two types of flavor agents: aroma agents, which impart a pleasant scent to feed and come from the roots, stems, leaves, and fruits of natural plants and from artificial compounds, and taste agents, which include sweeteners, which improve the feed’s taste and promotes continuous eating and come from flavor agents, salty agents and other flavoring materials.

22

All flavor enhancers are used to improve feed palatability, enhance animal appetite and stimulate saliva, gastric and pancreatic juices and other digestive juice secretion and gastrointestinal motility and ultimately feed consumption and yield from production animals.

As animals grow, their nutritional needs change, requiring corresponding changes to feed. Such feed changes often result in reduced intake by animals accustomed to the flavor of prior feeds. Flavor agents can be mixed with different feeds to result in the same or similar flavor as previous feeds, which helps animals maintain their food intake and successfully switch to a new formula. Additionally, during periods of weaning and transportation, animals and fish normally reduce feed intake. Adding a flavor agent to blended feeds can help alleviate stress and unease, increasing feed consumption and ensuring that an animal obtains the nutrients it requires.

We produce and sell the following (non-sugar) natural sweeteners, feed flavor enhancers, and attractants for use with feed for pigs, piglets, fish and other aquatic animals under the trademark “Tankeball™” Functional Flavoring Series:

|

|

·

|

Tanksweet ST (a mixed sweetener designed to improve the palatability and acceptability of all pig feed);

|

|

|

·

|

Tankarom ST (a feed flavor enhancer and functional physiological regulator that assists animals in overcoming the negative effects of weaning, stress, disease, medications or mal-flavored feedstuffs);

|

|

|

·

|

Tankmix SA (a co-mixed product with sweetener and flavoring that makes feed more attractive);

|

|

|

·

|

Tankebaal sweet (a mixed sweetener to improve the palatability and acceptability of all pig feed);

|

|

|

·

|

Tankarom (a functional physiological regulator);

|

|

|

·

|

Fishy Spicy (an aroma agent added to fishmeal to enhance fishy taste, cover-up mal-flavors in feeds and improve the palatability of feed products);

|

|

|

·

|

Aquatic Lives’ Attractants (consisting of concentrated extracts from natural seafood and high efficient attractants rich in amino acids that improve the feed intake of fish); and

|

|

|

·

|

Kimyso™ (a micro-granulated solid dispersion Kitasamycin premix).

|

Herbal Medicine Additives

We have placed an emphasis on developing and promoting herbal medicine additives blended with feed products in China. Chinese herbal feed additives utilize traditional Chinese medicine theory to improve an animal’s digestion and appetite and to regulate the yin and yang balance of an animal’s health.

23

Herbal medicines come from plants, plant extracts, fungal and bee products, minerals, shells and certain animal parts. Compared to synthetic antibiotics or inorganic chemicals, these naturally-derived products are less toxic, residue free and thought to be ideal feed additives for animal consumption. Herbal Medicine Additives represent approximately 2.2% of our 2009 revenues and net sales and carry a gross profit margin of approximately 23.7%.

We produce and sell the following trademarked products in the Herbal Medicine Additives sector, all of which are derived from Chinese natural plants, herbs and minerals:

|

|

·

|

Extra-Health™ (improves animal immune system and functions);

|

|

|

·

|

Qilimix™(a natural feed additive for livestock and poultry designed to improve the reproductive and growth performance of farm animals); and

|

|

|

·

|

Recoccider™(a highly efficient anticoccidial premix containing Ethopabate and Diclazuril designed to inhibit DHSS and DHRS).

|

Our total revenue for Herbal Medicine Additives in 2009 was approximately $341,000. Such revenue accounted for approximately 3% of our total 2009 revenue, and carried a gross profit margin of approximately 31%.

In January of 2010, we successfully developed and introduced a new antioxidant with the active element extracted from an Asian tree vine, which can be used to maintain the quality of feed products. In the first nine months of 2010, we produced and delivered more than 20 tons of this new antioxidant product from sales to more than 30 customers, generating revenues and net sales of 4 million Renminbi (“RMB”) or approximately $588,235.30.

Other Revenues

We also engage in various businesses including the domestic distribution of raw materials and providing technical support and know-how to our customers. As one of the leading producers and distributors of feed additives in China, the Company is a well-respected brand and able to engage in certain distribution activities to other Chinese companies. In connection with this, the Company purchases raw materials from certain manufacturers and sells such materials domestically to other feed additive manufacturers. As a result of our well known brand and our great reputation, we are able to purchase raw material at a relatively lower price. Subsequently, we sell those raw materials to other customers at a premium.

Our total revenue for Other Revenue in 2009 was approximately $894,000. Such revenue accounted for approximately 7% of our total 2009 revenue, and carried a gross profit margin of approximately 7%. Revenue from raw material trading accounted for about 50% of Other Revenues.

24

In 2011, we intend to import dried distillers’ grains with soluble (DDGS) from North America. DDGS, a bi-product of ethanol production, is a high nutrient feed valued by the livestock industry. When ethanol factories manufacture ethanol, they use only starch from corn and grain sorghum. The remaining nutrients – protein, fiber and oil representing a third of the grain– are used to create DDGS. Because of the increased demand for ethanol, the production of DDGS is expected to double within the next several years, further increasing the quantity of DDGS available for use in livestock feeds.

As feed costs in China for breeders and broilers have reached record highs, there has been a gradual shift among breeders towards the use of alternative feedstuffs such as DDGS. Recognizing this trend, we plan to supply DDGS to mid- and large-size farmers and feed producers throughout China. We believe that importing DDGS and other similar products is a natural extension of our business of selling feed additives to producers. We anticipate significantly growing our raw materials importing business as Chinese demand grows and importation becomes simpler. We expect our raw materials importing business to eventually become a meaningful revenue contributor.

Marketing

The majority of our marketing in China is conducted through sales visits to feed producers, farmers and other potential customers. During these sales meetings, the Company’s sales team distributes marketing materials and shares its extensive knowledge on husbandry and cultivation of farm animals.

As part of our marketing effort, every two years, we co-sponsor the Chinese Academy’s international seminar on Animal Health Products and Feed Additives, inviting speakers and participants who are academic professionals, industry experts or key managers in the agriculture business. The seminar is designed to introduce recent developments and trends in the feed additive business and to provide a platform for increasing awareness of our products. Since beginning the seminar in 2002, it has become one of the important events in the industry and typically attracts more than five hundred professionals.

Outside of China, we market our products mainly through participation in industry exhibitions.

Sales and Distribution

Our target customers are mid-to-large sized feed product factories and large scale producers. These customers have substantial bargaining power and require the feed additive products that they use to meet the highest standards of quality, productivity and efficiency, which we believe gives us a competitive advantage over our smaller competitors. In total, we employ 43 sales or sales-related employees, including 21 in regional sales, 5 in distribution, 4 in the aquatic group, 4 in international sales, 3 in marketing and 6 in technical support.

As of December 31, 2009, we had one customer, Jin Yin Ka (Guangzhou) Biao-Tech Co., Ltd., that accounted for more than ten percent of its consolidated revenues, with such customer accounting for 15.28% of revenue.

25

We sell our products throughout China with a combination of our internal sales teams and a network of agents in 28 regions, including Guangdong, Sichuan, Shandong and Liaoning provinces, which have significant animal breeding industries. Presently, about 80% of our sales are generated through our internal sales force, with the remaining 20% via our agents. The Company currently has sales offices in the cities of Shengyang, Chengdu, Xiameng, Xi’an, Nanning and Zhengjiang.

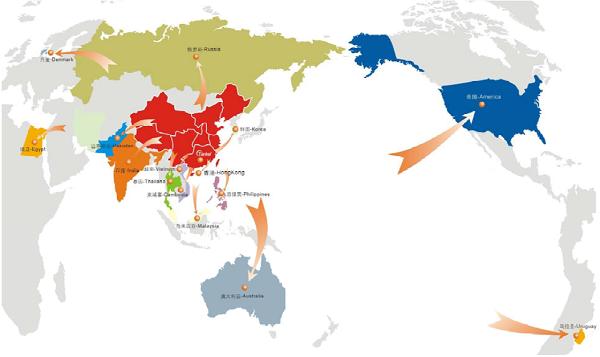

The maps below serve as a snapshot to demonstrate the diversified market regions of our products within China.

For the 2009 fiscal year, sales to our top 10 customers accounted for approximately 18.11% of our revenue with the top two largest customers (Guangdong Huanong Wens Animal Husbandry Co. and Wens Food Group) accounting for approximately 11% of our revenue.

The map below depicts the diversified international market regions where we presently sell our products or intend to expand our distribution in the future. While the vast majority of our sales are domestic, international sales, mainly in Southeast Asia, Latin America and other developing countries, currently account for approximately 5% of sales.

26

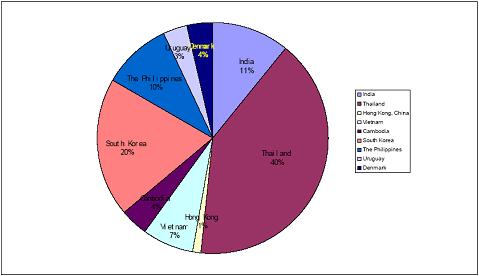

The following chart depicts the current distribution of our products outside of China.

Customer Service

Our service and support infrastructure quickly and efficiently provides clients with customized products, technical support and advice. We assign our technicians to prospective customers to conduct a thorough analysis of the customer’s needs, followed by a detailed customized product manual. While the manuals vary according to the specific product, they typically include a product introduction that includes nutrition facts, a user guide, expiration dates and storage and packaging information, among other things. For the large-scale farmer or feed producer, our team also provides training courses to help our customers understand our products and how to use them most effectively.

27

Upon the delivery of our products to new customers, we provide after-sales support, which not only serves to resolve any technical issues, but also helps identify other opportunities for increasing business with current customers. We utilize a multi-tiered product strategy pursuant to which we tailors our products to the needs and preferences of the feed market.

Raw Materials and Suppliers

The raw materials for our products include agricultural commodities and fine powders like amino acid, organic trace minerals and organic acid. Although most of our principal raw materials are widely available in China, the price for certain raw materials can fluctuate. We have adopted measures to reduce our risks in both raw material supply costs and availability, including establishing long-term relationships with suppliers and diversifying supply sources.

To assure the consistency of our raw material supplies, we source most of our materials from mid-to large size companies. Before making any purchase with a new vendor, we evaluate the vendor’s products and attempt to select the most reliable and reputable vendor. We regularly conduct similar evaluations throughout our purchasing process to ensure that we are purchasing high quality raw materials at competitive prices. Because we source our raw materials from several vendors, we are not dependent on any particular vendor or merchant as a sole provider for our raw materials.

Our top ten suppliers constitute 66.7% of our total raw material suppliers in 2009 and 51.37% in 2008. The following table identifies our top suppliers of our products regarding the amount obtained from each supplier equal or more than 10% of the total suppliers during the years ended December 31, 2009 and 2008:

|

2009

|

2008

|

|||||||||||||||

|

Suppliers

|

Amount

|

% of

|

Amount

|

% of

|

||||||||||||

|

|

(ton)

|

Total

|

($ ,000)

|

Total

|

||||||||||||

|

Shandong Baoyuan

|

550 | 10.00 | % | 398 | 10.41 | % | ||||||||||

|

Feicheng A Shi De

|

605 | 11.00 | % | 450 | 11.77 | % | ||||||||||

|

Shandong Kai Sheng

|

825 | 15.00 | % | 85 | 2.22 | % | ||||||||||

Research and Development

We are strongly committed to the development of new products and processes and the enhancement of our existing products and technology. We conduct research and development and acquire new technologies through our in-house research team in collaboration with various universities and research institutions and through technology acquisitions from third parties.

28

Our in-house development team consists of five PhD’s and over 30 researchers responsible for developing new products and responding to customer needs. The in-house team has contributed to the establishment of five national standards for feed additives, has applications pending for five Chinese patents covering synthetic methods for manufacturing additives and holds two Chinese patents covering new products, methodologies and machines used to mix and dry feed additives. We believe that our participation in the development of national standards provides us with an insight into Chinese regulators’ focus and a competitive advantage versus our competitors.

Our most recent in-house development is CA-13 (Weanling King), a new type of transitional feed for early-wean piglets. CA-13 is an antibiotic-free product that improves a piglet’s immune system while reducing the days needed for the production of finished pigs. The initial debut of CA-13 is scheduled in the beginning of 2011, with production expected to be fully operational in the second half of 2011.