Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - Aegean Earth & Marine CORP | a2201832zex-23_2.htm |

| EX-23.3 - EX-23.3 - Aegean Earth & Marine CORP | a2201832zex-23_3.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on February 9, 2011

Registration No. 333-170532

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HELLENIC SOLUTIONS CORPORATION

(Exact name of registrant as specified in its charter)

| Cayman Islands (State or other jurisdiction of incorporation or organization) |

1600 (Primary Standard Industrial Classification Code Number) |

N/A (I.R.S. Employer Identification No.) |

5, Ichous Str.—Galatsi

111 46 Athens, Greece

30-210-223-4533

(Address, including zip code, and telephone number,

including area code, of registrant's principal executive offices)

Dimitrios K. Vassilikos

5, Ichous Str.—Galatsi

111 46 Athens, Greece

30-210-223-4533

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

| Copies to: | ||

Yvan-Claude Pierre, Esq. Daniel I. Goldberg, Esq. William N. Haddad, Esq. DLA Piper LLP (US) 1251 Avenue of the Americas New York, NY 10020 Telephone: (212) 335-4500 Fax: (917) 778-8670 |

Christopher S. Auguste, Esq. Bill Huo, Esq. Ari Edelman, Esq. Kramer Levin Naftalis & Frankel LLP 1177 Avenue of the Americas New York, NY 10036 Telephone: (212) 715-9100 Fax: (212) 715-8000 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check one):

o Large accelerated filer |

o Accelerated filer | o Non-accelerated filer | ý Smaller reporting company |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) |

||

|---|---|---|---|---|

Ordinary Shares, par value $0.00345728 per share |

$30,000,000 | $2,139.00 | ||

|

||||

- (1)

- Estimated

solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended.

- (2)

- Includes

shares that the underwriter has the option to purchase to cover over-allotments, if any.

- (3)

- Previously paid.

The registrant hereby amends this registration statement on such date or date(s) as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the commission acting pursuant to said Section 8(a) may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION, DATED FEBRUARY 9, 2011 |

|

HELLENIC SOLUTIONS CORPORATION

Ordinary Shares

We are offering of our ordinary shares. Our ordinary shares are quoted on the OTC Bulletin Board, or OTCBB, under the symbol "AEGZF.OB." The last reported market price of our ordinary shares was $4.00 per share on October 25, 2010. Depending on the market price of our ordinary shares, we may effect a reverse stock split in order to increase our market price.

We have applied for listing of our ordinary shares on the NASDAQ Global Market and, if approved, our ordinary shares will trade under the symbol "HESC."

Investing in our ordinary shares involves a high degree of risk. See "Risk Factors" beginning on page 8 for certain factors relating to an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

||||

| |

Per Share |

Total |

||

|---|---|---|---|---|

Public offering price |

$ | $ | ||

Underwriting discounts and commissions(1) |

$ | $ | ||

Proceeds to us, before expenses |

$ | $ | ||

|

||||

- (1)

- See "Underwriting" for a description of compensation payable to the underwriter.

We have granted a 45 day option to Rodman & Renshaw, LLC, the underwriter, to purchase up to an additional ordinary shares from us on the same terms set forth above. If the underwriter exercises its right to purchase all of such additional ordinary shares, we estimate that we will receive gross proceeds of approximately million from the sale of the ordinary shares being offered and net proceeds of $ million after deducting approximately $ million for underwriting discounts and commissions and estimated offering expenses. The ordinary shares issuable upon exercise of the underwriter's option are identical to those offered by this prospectus and have been registered under the registration statement of which this prospectus forms a part.

The underwriter expects to deliver the ordinary shares to purchasers in the offering against payment in New York, New York on or about , 2011.

Rodman & Renshaw, LLC

The date of this prospectus is , 2011

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information other than that contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of its delivery or of any sale of our ordinary shares. This prospectus will be updated and, as updated, will be made available for delivery to the extent required by federal securities laws.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy the securities in any circumstance under which the offer or solicitation is unlawful. Neither the delivery of this prospectus nor any distribution of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus. This prospectus will be updated and updated prospectuses will be made available for delivery to the extent required by the federal securities laws.

i

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS AND

OTHER INFORMATION CONTAINED IN THIS PROSPECTUS

This prospectus contains forward-looking statements. Forward looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward looking statements involve risks and uncertainties and include statements regarding, among other things, our projected sales, profitability and cash flows, our growth strategies, anticipated trends in our industries, our future financing plans and our anticipated needs for working capital. They are generally identifiable by use of the words "may," "will," "should," "anticipate," "estimate," "plans," "potential," "projects," "continuing," "ongoing," "expects," "management believes," "we believe," "we intend" or the negative of these words or other variations on these words or comparable terminology. These statements may be found under the sections entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business," as well as in this prospectus generally. In particular, these include statements relating to future actions, prospective products or product approvals, future performance or results of current and anticipated products, sales efforts, expenses, and the outcome of contingencies such as legal proceedings and financial results.

Examples of forward-looking statements in this prospectus include, but are not limited to, our expectations regarding our business strategy, business prospects, operating results, working capital, liquidity, capital expenditure requirements and future acquisitions. Important assumptions relating to the forward-looking statements include, among others, assumptions regarding demand for our services, the continuing availability of European Union, or EU, grant funding, the timing and cost of capital expenditures, competitive conditions, general economic conditions and synergies relating to acquisitions, joint ventures and alliances. These statements are based on our management's expectations, beliefs and assumptions concerning future events affecting us, which in turn are based on currently available information. These assumptions could prove inaccurate. Although we believe that the estimates and projections reflected in the forward-looking statements are reasonable, our expectations may prove to be incorrect.

Important factors that could cause actual results to differ materially from the results and events anticipated or implied by such forward-looking statements include, but are not limited to:

- •

- our ability to obtain additional capital to pursue our business plan;

- •

- the continuing availability of EU grant funding;

- •

- the availability of bank guarantees or loan commitments from commercial lenders to our clients;

- •

- non-performance of suppliers on their sale commitments and clients on their purchase commitments;

- •

- adverse conditions in the industries in which our clients operate, including a continuation of the global recession;

- •

- our ability to manage growth;

- •

- our ability to integrate acquired businesses;

- •

- our ability to retain and attract senior management and other key employees;

- •

- changes in Greek or Cayman Islands tax laws;

- •

- increased levels of competition;

- •

- changes in political, economic or regulatory conditions generally and in the European markets in which we operate; and

ii

- •

- other risks, including those described in the "Risk Factors" discussion of this prospectus.

We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for us to predict all of those risks, nor can we assess the impact of all of those risks on our business or the extent to which any factor may cause actual results to differ materially from those contained in any forward-looking statement. The forward-looking statements in this prospectus are based on assumptions management believes are reasonable. However, due to the uncertainties associated with forward-looking statements, you should not place undue reliance on any forward-looking statements. Further, forward-looking statements speak only as of the date they are made, and unless required by law, we expressly disclaim any obligation or undertaking to publicly update any of them in light of new information, future events, or otherwise.

Currency

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. Our functional currency is the "Euro" or "€", and, unless otherwise noted, all U.S. dollar figures contained in this filing reflect the exchange rate between the U.S. dollar and the Euro on October 15, 2010 of €1 = $1.40 (according to xe.com). The U.S. dollar figures contained in our financial statements reflect the exchange rate between the U.S. dollar and the Euro as calculated in accordance with U.S. generally accepted accounting principles and described in the notes to the financial statements appearing elsewhere in this filing.

Over-Allotment Option

Unless otherwise indicated, information in this prospectus assumes that the underwriter does not exercise its option to purchase additional shares.

Share and Per Share Data

Unless otherwise indicated, information in this prospectus with respect to share and per share data reflects the completion of the May 2010 consolidation of our ordinary shares pursuant to which each 5.402 ordinary shares were consolidated into one ordinary share. Depending on the market price of our ordinary shares, we may effect a reverse stock split in order to increase our market price.

iii

This summary highlights selected information that is contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our ordinary shares. In this prospectus, unless otherwise indicated or the context otherwise requires, all references to the "Company," "we," "Hellenic", or "us" shall mean Hellenic Solutions Corporation together with our wholly owned subsidiaries, Aegean Earth and Marine S.A. and Temhka S.A. Specific discussions or comments relating only to our subsidiaries will reference "Aegean Earth S.A." or "Temhka S.A.," as applicable. You should read the entire prospectus carefully, including "Risk Factors" and the financial statements and related notes appearing elsewhere in this prospectus before making an investment decision.

Overview of Our Business

We are a leading designer, builder, refurbisher and outfitter of manufacturing facilities, specializing in the agricultural sector in Greece. Our clients utilize European Union, or EU, grants to help pay for these facilities. In order to obtain EU grants, we prepare a feasibility study and construction plan, and following approval by the relevant Greek governmental ministry, we design and build the facility.

For the year ended December 31, 2009, we generated $35.0 million in revenues and net profit of $3.2 million. Additionally, as of December 31, 2010, we had a total of €388 million (or $543.2 million) in projects that are in process, are in our backlog or in our pipeline and are expected to generate revenues during fiscal years 2011 through 2014. Of these, our projects in process were valued at €106.7 million (or $149.4 million), our backlog consisted of 20 contracts valued at €105.6 million (or $147.8 million), and our project pipeline consisted of 49 projects valued at €175.7 million (or $246.0 million). Backlog represents services that our clients have committed contractually to purchase from us, and for which full funding approval has been received from both the EU and a commercial banking source. Additionally, our project pipeline represents services that our clients have committed contractually to purchase from us, but for which final financing approval is being sought or is pending from either or both of the EU and a commercial banking source. Our clients are generally able to cancel or reduce projects that are in our backlog and project pipeline. Additionally, our clients may not receive full governmental approval for projects in our pipeline. The expected revenues for projects that are currently in our backlog and pipeline are not necessarily indicative of our future revenues and profits.

We provide the following services to our clients:

- •

- perform engineering and economic feasibility studies;

- •

- prepare EU grant applications for the facilities;

- •

- design building facilities;

- •

- design production lines and related equipment to be installed in a facility, and order the equipment based on our designs;

- •

- install or construct all facilities and equipment in conformance with the study, the plans and the specification and test

the final product to ensure workmanship according to the plans and specifications; and

- •

- conduct periodic follow-up inspections to ensure that the facility is performing at optimal conditions.

Industry and Market Overview

Revenues from the agricultural sector in Greece for 2009 accounted for 3.4% of the national GDP, or $11.3 billion. (Source: CIA The World Factbook updated September 16, 2010). We and our predecessor

1

companies have focused during the past 31 years on providing turnkey solutions to the agriculture sector in both primary processing and packaging. This focus has been supplemented by the implementation of the CSF program (originally established in 1986 and now into its fourth program), which provides our clients with approximately 50% of the costs associated with our facility design and construction services. We believe that we are the only company within Greece to provide clients with a full range of services related to the planning, organization of funding, and construction of processing and packaging facilities within the agricultural sector.

Challenges

To our knowledge, we are currently the only company within Greece to provide clients with a full range of services related to the planning, organization of funding, and construction of processing and packaging facilities within the agricultural sector, and as such we believe that we command a leading position in the industry that provides us with competitive advantages over other providers that offer only a subset of the services we provide. While there are other companies that each provides a particular subset of the services we offer, such as feasibility, economic and environmental studies, or architectural and engineering services, we believe that no other company in Greece offers the range of services we provide, from conducting the initial feasibility study, to advising on the grant process, and through the construction and outfitting of the final building. However, if such a firm does exist in the future, the unique position that we believe we currently hold could be challenged, and if such competitive efforts were successful, such competition could have a material impact on us by reducing our growth, revenues and profits. One of our top challenges is to remain the only company in our industry sector in Greece, and we plan to continue to strive to achieve this goal by maintaining our high levels of professionalism, dedication to client service and satisfaction, knowledge of the industry and latest developments, and quality of workmanship.

Our Competitive Strengths

Our competitive strengths are based on the following:

We have unmatched experience in the industry in which we operate in Greece. During the past 31 years, we and our predecessors have focused on providing turnkey solutions to the agriculture and green sectors in both primary processing and packaging. This focus has been aided by the EU Community Support Framework, or CSF, which is administered through the Greek Ministry of Agriculture, and which has direct access to €6.3 billion (or $8.8 billion) in current CSF funds allocated to the agricultural sector in Greece.

We have a successful track record for our past projects and a strong backlog and pipeline for future projects. We believe we are the first and only company in Greece offering turnkey advisory services, construction, operational solutions and financing to both the primary and processing segments of the agricultural industry. Since inception, we have successfully completed over 200 projects with no losses and over 67% of our current clients are repeat clients.

Our clients have been highly satisfied with our services. Over the past 31 years, we have continually provided innovative and cost effective solutions to benefit our clients. This is evidenced by the fact that over two-thirds of our current client base is comprised of repeat clients.

Our Business Strategy

The key elements of our business strategy are:

Execute successfully on our existing backlog and pipeline. We currently have projects in process, in our backlog and in our project pipeline that we will be working on, and generating revenues through

2

fiscal year 2014. We intend to work closely with our clients to execute on our existing projects to meet both their needs and our established standards of workmanship and professionalism.

Expand and diversify our target business. We are focused on growing and diversifying our backlog through increasing our relationships with existing clients and building relationships with new clients. We also continue to expand and enhance our business by acquiring and integrating new technology into our existing operations. For example, we have formed a green sector, and currently have 39 projects in our backlog and pipeline that fall within the green sector that are expected to generate a total of approximately €87.8 million (or $122.92 million) in revenues during fiscal 2011 through 2014. We expect to continue focusing on growing our green sector capabilities and taking on more green projects in the future.

Pursue selective acquisitions to increase our revenue. We may selectively acquire businesses operated by our existing suppliers and subcontractors. We believe these acquisitions will enable us to increase our revenue, improve our profitability and enhance our position in the marketplace.

Corporate History

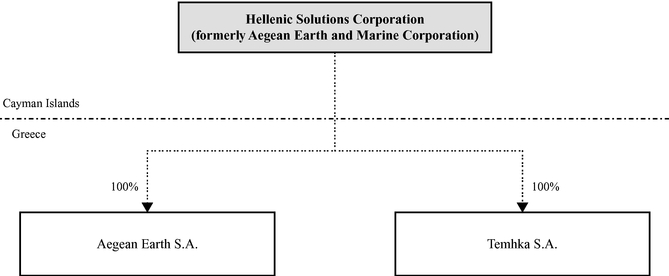

We were incorporated as an exempted company with limited liability under the laws of the Cayman Islands on March 10, 2006, and, prior to our acquisition of Aegean Earth S.A., we had no material assets and we had not generated revenues. Our operations consisted solely of attempting to identify, investigate and conduct due diligence on potential businesses for acquisition.

Aegean Earth S.A. was formed under the laws of Greece in July 2007, for the purpose of engaging in construction and development projects in Greece and surrounding countries. In January 2008, we changed our name from Tiger Growth Corporation to Aegean Earth and Marine Corporation. We acquired Aegean Earth S.A. from its shareholders in February 2008. Temhka S.A. and its predecessors have been operating in Greece since 1979 and we acquired Temhka S.A. from its shareholders in February 2010.

Temhka S.A. was formed under the laws of Greece as a Société Anonyme in December 2009 in anticipation of the closing of an investment transaction with Aegean Earth & Marine Corporation, the predecessor company to Hellenic Solutions Corporation. In preparing for the transaction, which ultimately closed on February 9, 2010, the business and relationships of the Stavros Mesazos Group of Companies were assigned and/or transferred, depending upon whether such relationship was with a customer, supplier, subcontractor or lender, to Temhka S.A. effective January 1, 2010. The Stavros Mesazos Group of Companies is the predecessor to Temhka S.A. and was formed by our founder, Stavros Ch. Mesazos, under the laws of Greece in 1979. The Stavros Mesazos Group of Companies developed over time into a designer, builder, remodeler and outfitter of manufacturing facilities, specializing in the agricultural sector in Greece. Through the development of a strong relationship with the Greek Ministry of Agriculture, which has direct access to the EU Community Support Funds, the Stavros Mesazos Group of Companies grew a niche operation that worked with its clients to secure EU, and deliver turn-key new, remodeled or refurbished facilities.

In March 2010, we completed a private placement with certain accredited investors pursuant to which we issued 3,000,001 ordinary shares on a post consolidation basis, as described below, for aggregate net proceeds of $4.5 million.

In May 2010, shareholder resolutions were passed to:

- •

- effect a consolidation of our ordinary shares pursuant to which each 5.402 ordinary shares were consolidated into one ordinary share;

3

- •

- increase our authorized ordinary shares to 100,000,000 with a nominal or par value of US$0.0034573 from 78,125,000

ordinary shares with a nominal or par value of US$0.00064; and

- •

- change our name to Hellenic Solutions Corporation.

Effective immediately after the consolidation and upon the conversion of all Series B Preference Shares issued to the former shareholders of Temhka S.A. into ordinary shares, there were a total of 21,133,481 ordinary shares issued and outstanding. In May 2010, we changed our name from Aegean Earth and Marine Corporation to Hellenic Solutions Corporation.

The following diagram illustrates our corporate structure as of the date of this prospectus:

Company Information

We are an exempted company incorporated with limited liability in the Cayman Islands. Our principal executive offices are located at 5, Ichous Str.—Galatsi, 111 46 Athens, Greece, and our telephone number is 30-210-223-4533. Our website is located at http://www.hellenicsolutions.com. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute part of this prospectus, and investors should not rely on any such information in deciding whether to purchase our ordinary shares.

4

Ordinary shares offered by us |

shares. | |

Ordinary shares outstanding after this offering |

shares. |

|

Over-allotment option |

We have granted the underwriter a 45-day option to purchase up to an additional ordinary shares from us at the public offering price less the underwriting discounts and commissions to cover over-allotments, if any, on the same terms as set forth in this prospectus. |

|

Use of proceeds |

We intend to use the net proceeds from this offering for working capital and other general corporate purposes, potential acquisitions and expansion of our market, as more fully discussed in the section entitled "Use of Proceeds" following this offering summary. |

|

Risk factors |

We are subject to a number of risks which you should be aware of before you buy our ordinary shares. The risks are discussed more fully in the section entitled "Risk Factors" following this offering summary. |

|

Stock symbol |

Our ordinary shares are quoted on the OTCBB under the symbol "AEGZF.OB" We have applied for quotation of our ordinary shares on the NASDAQ Global Market and, if approved, our ordinary shares will trade on the NASDAQ Global Market under the symbol "HESC" following this offering. |

The ordinary shares to be outstanding after this offering are based on 21,133,481 ordinary shares outstanding as of September 30, 2010 and excludes 3,000,001 ordinary shares reserved for issuance pursuant to outstanding warrants to purchase our ordinary shares as of October 15, 2010, with a weighted average exercise price of $3.00 per share.

Unless otherwise indicated, the information in this prospectus assumes no exercise of the underwriter's over-allotment option to purchase up to ordinary shares from us at the public offering price less the underwriting discount to cover over-allotments, if any.

All share and per share information concerning our ordinary shares reflects a 1-for-5.402 share consolidation which became effective in May 2010.

Depending on the market price of our ordinary shares, we may effect a reverse stock split in order to increase our market price.

5

SUMMARY CONSOLIDATED FINANCIAL INFORMATION

We have derived the summary consolidated statement of operations data for the years ended December 31, 2009 and 2008 from our audited consolidated financial statements included in this prospectus. We have derived the summary consolidated statement of operations data for the nine months ended September 30, 2010 and 2009 from our unaudited condensed consolidated financial statements included in this prospectus. You should read the summary consolidated financial data in conjunction with those financial statements and the accompanying notes and the section entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations" contained elsewhere in this prospectus. Our consolidated financial statements are prepared and presented in accordance with United States generally accepted accounting principles, or U.S. GAAP. Our consolidated financial statements have been prepared as if the current corporate structure had been in existence throughout the periods presented. The historical results presented below are not necessarily indicative of financial results to be achieved in future periods and are not necessarily indicative of results to be expected for any other period.

| |

Year Ended December 31, | Nine Months Ended September 30, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in U.S. dollars except per share data) |

2008 | 2009 | 2009 | 2010 | |||||||||

| |

|

|

|

(unaudited) |

|||||||||

Consolidated Statement of Operations Data: |

|||||||||||||

Revenues |

$ | 61,965,224 | $ | 34,980,864 | $ | 28,927,013 | $ | 54,224,847 | |||||

Less: Cost of revenues |

(54,341,895 | ) | (29,490,537 | ) | (24,872,916 | ) | (45,657,731 | ) | |||||

Gross profit |

7,623,329 | 5,500,327 | 4,054,097 | 8,567,116 | |||||||||

Expenses |

|||||||||||||

General and administrative expenses |

(1,306,282 | ) | (906,860 | ) | (366,530 | ) | (1,142,917 | ) | |||||

Income from operations |

6,317,047 | 4,593,467 | 3,687,567 | 7,424,199 | |||||||||

Currency Translation Gain |

36,573 | ||||||||||||

Interest expense |

(1,161,975 | ) | (713,738 | ) | (685,852 | ) | (389,874 | ) | |||||

Income before income taxes |

5,155,072 | 3,882,729 | 3,001,715 | 7,070,898 | |||||||||

Income tax expense |

(1,164,632 | ) | (698,891 | ) | (750,429 | ) | (1,789,473 | ) | |||||

Net income |

$ | 3,990,440 | $ | 3,183,838 | $ | 2,251,286 | $ | 5,281,425 | |||||

Net income per share—basic and diluted(1) |

$ | 0.23 | $ | 0.18 | $ | 0.13 | $ | 0.26 | |||||

Weighted average number of ordinary shares used in computing net income per share—basic and diluted(1) |

17,538,964 | 17,538,964 | 17,538,964 | 20,375,390 | |||||||||

- (1)

- We have presented net income per share and weighted average number of ordinary shares after giving retroactive effect to the reverse stock split and the conversion of the preferred stock that were completed on February 9, 2010 and May 21, 2010, respectively for all periods presented.

The following table presents consolidated balance sheet data as of September 30, 2010 (i) on an actual basis and (ii) on a pro forma basis to reflect the sale of ordinary shares in this offering by us at an assumed offering price of $ per share, the last reported sale price for our common

6

stock on 2011, as reported by the OTCBB, after deducting underwriting discounts and commissions and estimated offering expenses.

| |

As of September 30, 2010 |

||||||

|---|---|---|---|---|---|---|---|

| |

Actual | As Adjusted | |||||

| |

(unaudited) |

||||||

Consolidated Balance Sheet Data: |

|||||||

Cash and cash equivalents |

$ | 172,189 | |||||

Working capital |

18,117,031 | ||||||

Total assets |

59,172,928 | ||||||

Total liabilities |

42,290,133 | ||||||

Retained earnings |

12,535,566 | ||||||

Total shareholders' equity |

16,882,795 | ||||||

7

An investment in our ordinary shares involves a high degree of risk. You should carefully consider the following risk factors and the other information included herein before investing in our ordinary shares. If any of the following risks occur, our business, financial condition and operating results could be materially and adversely affected. In that case, the trading price of our ordinary shares could decline, and you could lose all of your investment.

Risks Related to our Business

We will require additional capital to pursue our business plan.

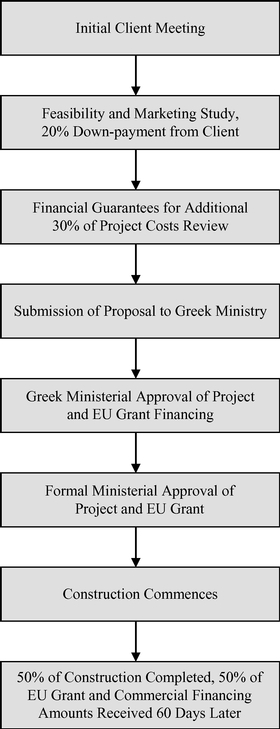

Our projects begin with a down payment from the client equal to 20% of the total project costs, plus evidence from the client that an additional 30% of the total project costs will be available in the form of bank guarantees or loan commitments from a third party lender. At such time as this 50% of the project costs has been secured, we then submit the project for EU grant approval. In most cases, we will not receive additional funds until 60 days after the completion of 50% of the project. Therefore, we must finance a significant portion of the expenses related to the construction until we receive payments due to us. We have financed our operations since inception through funds raised in private placements, loans from our founder and internally generated cash flows.

In February 2010, we completed a private placement in connection with our acquisition of Temhka S.A., pursuant to which we received approximately $4.5 million in gross proceeds. As a condition precedent, prior to the February 2010 closing, the founder of Temhka S.A., Stavros Ch. Mesazos, loaned $4.5 million to us. In addition, our founder has made interest-free loans to us in excess of $4.9 million from the date that we acquired Temhka S.A. through September 30, 2010. We have accumulated $12.5 million in retained earnings as of September 30, 2010. These amounts were utilized to fund our current operating and capital requirements. Accordingly, following the offering, we may need to obtain additional private or public financing to fund our operations, including debt or equity financing, and there can be no assurance that such financing will be available as needed or, if available, on terms favorable to us. Furthermore, debt financing, if available, will require payment of interest and may involve restrictive covenants that could impose limitations on our operating flexibility. There can be no assurance that additional funds will be available when and if needed from any source or, if available, will be available on terms that are acceptable to us. We may be required to pursue sources of additional capital through various means, including joint venture projects and debt or equity financings. Future financings through equity investments are likely to be dilutive to existing shareholders. Such additional equity securities may have rights, preferences or privileges that are senior to those of our existing ordinary shares. The terms of securities we may issue in future capital transactions may be more favorable for our subsequent investors. Newly issued securities may include preferences, superior voting rights, or may be issued with warrants or other derivative securities, which themselves may have additional dilutive effects. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. Our ability to obtain needed financing may be impaired by such factors as the capital markets, the lack of a market for our ordinary shares, and our lack of profitability, which could impact the availability or cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenue from operations, is not sufficient to satisfy our capital needs, we may be required to reduce operations.

Our revenue and profitability are heavily dependent upon the availability of EU grant funding.

Should EU grant funding not become available, it would materially adversely impact our revenue and profitability as such financing is integral to our business model. The EU program commenced in 1986 and provides to all member states of the EU the ability to obtain financing in the form of grants

8

that require no repayment by the grantee and are added to the capital base of the grantee as the project is completed. This program, entitled the Community Support Framework, or the CSF, is in its fourth iteration and accordingly is called the 4th CSF. The 4th CSF continues to commit funds through 2013 and flow funds to projects through 2015. This program is an integral part of the Growth and Stability program of the EU and the negotiations for the implementation of the 5th CSF are underway between the EU and the 27 member states of the EU. Any slow down or delay in the implementation of the CSF program by the Greek government would reduce our revenues and profitability. See "Management's Discussion and Analysis of Financial Condition and Results of Operation—Understanding the EU Community Support Framework."

If we are unable to finance our working capital, then our revenue and income may be reduced.

Due to the timing of the payments for projects from our customers, we must use working capital to cover the expenses of the project. Historically, we have generated working capital by selling equity, borrowing from our founder and borrowing from commercial banks. Since the financial crisis began in 2008, the availability of commercial bank financing has been severely limited. If we cannot obtain commercial credit financing, we may not have sufficient working capital to timely construct or complete the projects we undertake including projects in our backlog and pipeline. Any delay in the completion of our projects will delay payments from our customers. In addition, if we do not have sufficient working capital, we may not be able to accept new projects. We are pursuing alternative commercial bank facilities and are considering pursuing other financing arrangements in order to continue our business model; however, there is no such facility in place at this time and the unavailability of such a facility could have an adverse effect on our revenues and profits.

If our customers are unable to obtain adequate financing for their projects, then our revenue and income may be reduced.

Our customers are required to finance, or arrange third party financing, for up to approximately 50% of the project costs. Historically, this portion of the project costs has been financed by commercial bank loans. As a result of the financial crisis that began in 2008, the Greek financial system has been largely ineffective. The availability of commercial bank financing has been an integral part of our business model and the elimination of such financial support would damage our business. If our clients cannot obtain commercial credit financing or an alternative source of financing, then our clients will not receive the applicable CSF approval and the number of projects we can undertake will be reduced. The continued lack of commercial banking facilities to our clients could have an adverse effect on both our revenues and profitability.

We may not be able to effectively control and manage our growth and a failure to do so could adversely affect our operations and financial conditions.

Our revenue increased from $28.9 million for the nine months ended September 30, 2009, to $54.2 million during the nine months ended September 30, 2010. For the three months ended September 30, 2010, revenues totaled $19.7 million compared to $9.2 million for the three months ended September 30, 2009, an increase of approximately $10.5 million, or 47%. If we continue to experience an increase in demand for our services, we will need to expand our capabilities in order to meet these demands. We may face challenges in managing and financing the acquisition of additional companies to facilitate the planned vertical integration of our operations. This could put increased demands on our management team and may require us to hire additional executives to manage this growth. Our failure to address these increased demands could interrupt, delay or adversely affect our operations and cause construction backlogs, extend project completion times and contribute to added administrative inefficiencies.

9

Other challenges relating to the expansion and operation of our business include:

- •

- unanticipated costs;

- •

- diversion of management's attention from other business concerns;

- •

- potential adverse effects on existing business relationships with clients and suppliers;

- •

- obtaining sufficient working capital to support our expansion program;

- •

- maintaining the high quality of our workmanship;

- •

- completing projects on time;

- •

- completing projects within budgets;

- •

- maintaining our profit margins at projected levels;

- •

- maintaining adequate controls over expenses and accounting systems;

- •

- successfully integrating acquisitions into our corporate structure and operations;

- •

- anticipating and adapting to rules and regulatory changes or modifications that may be promulgated from time to time by

the EU or the Hellenic Republic, sometimes referred to as Greece in this prospectus, as such changes or modifications may affect our operations; and

- •

- being cognizant of any competitive entrants into our market and maintaining our exclusive position as the sole provider in Greece to provide the range of services we provide to our clients.

Even if we maintain our market share, and are able to increase our sales and/or access additional sources of funds, there may be a delay between the time that costs and expenses are incurred and the time when we recognize the benefits of such increased sales and/or access to other funds, which could also affect our cash flow, profitability and earnings.

We have a limited number of clients and the loss of one or more of these clients, or the cancellation of all or a portion of projects currently underway, could adversely affect our revenue and profitability.

We currently have projects in process, in our project backlog and in our project pipeline from 69 clients that are expected to generate revenues totaling €388 million (or $543.2 million) during fiscal years 2011 through 2014. Of these clients, 46 are repeat clients and 23 are new clients. Of the current projects under construction, two of these projects would account for over €34.6 million (or $48.44 million) of our future revenues. We do not anticipate that our dependence on a limited number of clients will continue in the future. However, if we are unable to decrease our dependence on a limited number of clients, such a concentration of our business could result in a decrease in our revenue or profit should any of these clients suffer adverse financial setbacks that might impact their ability to commence or finalize a project. Any of our client companies could suffer financial setbacks either resulting from or causing a loss of their respective market share. The reduction in revenue and profit from our clients could also have an adverse effect on our business in the form of reducing our revenues and reducing our profits.

Additionally, one or more of our clients could cancel all or a portion of a project that is currently underway, which could have an adverse effect on our business in the form of reducing our revenues and our profits. We base our planned operating expenses in part on our expectations of future revenue, and as a result, a significant portion of our expenses will be fixed in the short term. If revenue for a particular quarter is lower than we expect, we likely will be unable to proportionately reduce our operating expenses for that quarter, which would have a material adverse effect on our operating results for that quarter.

10

Our backlog and project pipeline are subject to reduction and cancellation.

Backlog represents services that our clients have committed by contract to purchase from us, and for which full funding approval has been received from both the EU and a commercial banking source, typically a bank located in Greece. Additionally, our project pipeline represents services that our clients have committed by contract to purchase from us, but for which final financing approval is being sought or is pending from either or both the EU or a commercial banking source. As of December 31, 2010, projects in our backlog were expected to generate revenues of approximately €105.6 million (or $147.84 million), and our project pipeline was expected to generate revenues of approximately €175.7 million (or $245.98 million) during fiscal years 2011 through 2014. Our clients are generally able to cancel or reduce projects that are in our backlog and project pipeline. Our backlog and project pipeline are subject to fluctuations as a result of project cancellations or an inability to obtain full governmental approval, and are not necessarily indicative of future sales. Moreover, cancellations of services or reductions of the types of services being purchased in existing contracts could substantially and materially reduce our backlog and/or project pipeline and, consequently, future revenues. Our failure to replace canceled or reduced backlog and project pipeline could result in lower revenues.

We have a small number of key suppliers for services, equipment and material for our clients' projects which could delay our completion of products and increase our expenses.

We currently have approximately 65 suppliers of services, goods and materials for our clients' projects. These services, goods and materials range from external economic consultants that advise us on our EU grant submittals, to architects and engineers that supplement our professional staff with specialty expertise on equipment design and manufacturing for the specialized packaging and processing equipment that we design to fit our clients' requirements and specification. Of these suppliers and consultants, 13 accounted for over €34 million (or $47.6 million) of billings in the past year. A financial setback or reversal to any of our consultants or suppliers of materials or technology could have a material adverse effect upon our revenues and profits. Delays due to financial problems, the global economic crisis, or as a result of shortages of supply or personnel of our key suppliers could materially adversely impact our business and profitability.

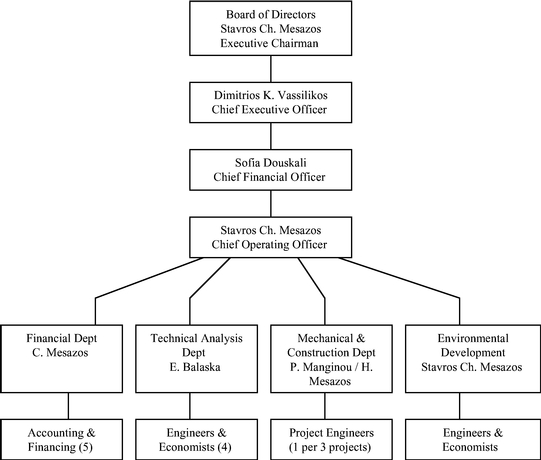

Our future success depends on retaining our existing key employees and the loss of any of them could adversely affect our future operations.

Our future success depends to a significant degree on the continued service of our executive officers and other key employees, particularly Stavros Ch. Mesazos, our Chief Operating Officer and Executive Chairman, and Dimitrios K. Vassilikos, our Chief Executive Officer. Messrs. Mesazos and Vassilikos have experience in, and knowledge of, the construction and agricultural processing industry in Greece and the loss of either or both of these individual's services could have a material adverse impact on our ability to compete in the industry in Greece. Further, while we have entered into employment contracts with each of Messrs. Mesazos and Vassilikos, no assurances can be given that we will be able to employ and/or keep Messrs. Mesazos and Vassilikos, or any of our other key employees. The loss of the services of any of our executive officers, or other key employees, could make it more difficult to successfully operate our business and pursue our growth strategy, which could have a material adverse effect on our results of operations. In addition, we do not currently have key person insurance on any of our employees.

Our operating results may fluctuate considerably on a quarterly basis. These fluctuations could have an adverse effect on the price of our ordinary shares.

Our results of operations have fluctuated in the past, and may continue to fluctuate, significantly on a quarterly basis as a result of a number of factors, many of which are beyond our control. Although many companies may encounter fluctuations in their results of operations, these fluctuations

11

are particularly relevant to us as a result of our historical and current reliance on a limited number of customers, the availability of EU grants and commercial financing in order to fund our projects, our relatively small size and the dynamics of operating a business in Greece. Factors that could cause our results of operations to fluctuate include, among others:

- •

- seasonal or periodic fluctuations in our clients' businesses, which could cause the timing of their engagement of our

services to fluctuate;

- •

- the average prices for our services, which are impacted by fluctuations in the raw materials, such as cement and steel,

and equipment we use in the planning and construction of facilities;

- •

- delivery delays, price fluctuations and shortages with respect to raw materials that we acquire from suppliers and

outsourced manufacturers;

- •

- the rate and cost at which we are able to expand our internal project development capacity to meet client demand and the

timeliness and success of these expansion efforts;

- •

- the loss of one or more key customers or the significant reduction or postponement of projects from these clients;

- •

- unplanned expenses incurred to address contingencies such as manufacturing failures, defects or downtime;

- •

- costs relating to acquisitions and investments;

- •

- the effects of the global economic downturn, and in Greece in particular, which has led to decreases in demand for our

services and which could continue or increase in severity;

- •

- geopolitical turmoil within Greece or the EU;

- •

- foreign currency fluctuations, particularly fluctuations in the exchange rates of the Euro and U.S. dollar;

- •

- our success in maintaining, establishing and expanding customer relationships;

- •

- our ability to successfully develop, introduce and sell new or enhanced services in a timely manner, and the amount and

timing of related research and development costs;

- •

- the timing of new product or technology announcements; and

- •

- introductions by our competitors and other developments in our competitive environment.

You should not rely on our results from any quarter as an indication of future performance. Quarterly variations in our operations could result in significant volatility in the market for our ordinary shares, and the market price for our ordinary shares might fall below the offering price.

Furthermore, the occurrence of any of the risks described above could result in long-term harm to our business, financial condition and operating results, especially if it continues for a period of time or is not mitigated in subsequent periods.

Since competition for highly skilled employees is intense, we may not be able to attract and retain the highly skilled employees we need to support our business and our expected growth.

As a result of the specialized and technical nature of our business, our future performance is largely dependent on the continued service of, and on our ability to attract and retain, qualified engineers, economists and technical personnel. Approximately 73% of our employees are economists, engineers or technicians, who have specialized experience and education. We compete with competitors and other employers for these qualified and experienced economists, engineers and technology professionals. Without sufficient numbers of skilled employees, our operations would suffer from,

12

among other things, deteriorating production standards and decreasing capacity utilization. Competition for such skilled personnel is intense, and replacing qualified employees is difficult. In order to effectively hire and retain a sufficient number of employees with the skills, experience and education that we require to operate and expand our business, we may be required to offer higher compensation and other benefits, which could materially and adversely affect our business, financial condition and results of operations. If we are unable to attract, retain and motivate our economists, engineers and technical personnel, our business and prospects could be materially and adversely affected. Furthermore, we may not be able to hire sufficient numbers of skilled and experienced employees to replace those who leave, and we may be unable to redeploy and retrain our professionals to keep pace with continuing changes in technology, evolving standards and changing customer demands, which could adversely affect our business and prospects.

Our quarterly operating results may vary from the actual payment stream we receive from the EU, the commercial banks and our clients.

Our clients, on average, pay 20% of the project cost from their own funds and an additional 30% of the project cost from either their own funds or commercial bank financing, or a combination thereof. The Central Bank of Greece, which has received CSF funds from the EU, pays the balance of the project costs through a grant, which is typically 50% of the total cost of the project, upon completion of 50% and 100% of the work. The client pays 20% of the project cost upfront, and must demonstrate to us and the Greek governmental ministry through either a bank loan commitment or guarantee, or other evidence that the client will be able to pay the other 30%, before the project can be submitted to the relevant governmental ministry for approval. After the initial 20% up-front payment, the remaining 80% of costs (consisting of funds from both the EU and the client) are paid to us in two installments, half of which is paid approximately 60 days after 50% of the work on the project has been completed and the remaining half of which is paid approximately 60 days after the completion of the project. The Central Bank of Greece does not pay any EU funds upfront. Our reporting periods for revenue and expenses and the resultant gross profit and net profits for the period are accounted for under the percentage completion method of accounting and may vary from the actual cash received during the period. Under the percentage completion method, the accounting is calculated on expenses incurred during the time period, and as a result, expenses may exceed actual billings generated, and would be reflected in our financial statements as "Expenses in Excess of Billings." Conversely, it is possible, though unlikely, that our revenue could exceed expenses incurred and would therefore be reflected in our financial statements as "Billings in Excess of Expenses."

Concerns over food safety and public health may affect our operations by causing our clients to experience increased costs for producing their food products.

Although we stringently monitor all events concerning food and food production in the European markets, our clients may experience some public scrutiny and oversight from relevant EU agencies concerning food production and packaging, which could increase their costs, or conversely, reduce their earnings, and reduce their ability to retain our services. An example was the 2009 occurrence of swine flu. Although neither we nor any of our clients were affected, we nevertheless continued to monitor these issues closely in order to intervene if necessary. There is no assurance that such monitoring or counteraction, if it occurred in the future, would be effective. If such actions by us or our clients were not effective, our revenues and earnings could be negatively impacted.

We may be subject to construction defect and product liability claims that could adversely affect our operations.

The construction business is subject to construction defect and product liability claims which are common in the construction industry and can be costly. Among the claims for which developers and

13

builders have financial exposure are property damage and related bodily injury claims. Damages awarded under these suits may include the costs of remediation, loss of property, and bodily injuries. In response to increased litigation, insurance underwriters have attempted to limit their risk by excluding coverage for certain claims associated with pollution and product and workmanship defects. We may be at risk of loss for bodily injury and property damage claims in amounts that exceed available limits on our comprehensive general liability policies. In addition, the costs of insuring against construction defect and product liability claims, if applicable, are high and the amount of coverage offered by insurance companies is limited. There can be no assurance that we will be able to continue to obtain insurance with respect to such claims, or that the coverage will not be restricted and become more costly. If we are not able to obtain adequate insurance, we may experience losses that could have a material adverse effect on our results of operations and financial condition.

We may be subject to warranty claims for workmanship claims over an extended period of time.

We may be required from time to time to repair buildings and equipment lines which we constructed entirely or in part. Historically, we conduct routine inspections of finished projects and the operational equipment. Although this has typically not been a part of our contractual agreements beyond a one (1) year period, we nonetheless periodically perform such inspections for a longer period of time, up to three or more years following the completion of a project in many cases. We cannot guarantee that, in the future, circumstances or incidents will not occur that will require us to extend such warranty periods as it pertains to our workmanship. We also cannot be assured that governmental rules and regulations may not require extended periods of warranty to our workmanship. In the event we experience such extensions of warranty periods, our business operations and financial condition could be materially adversely affected if significant repairs are required.

The relative lack of public company experience of our management team may put us at a competitive disadvantage.

Our management team lacks public company experience under the guidelines of the Securities and Exchange Commission, or the SEC, which could impair our ability to comply with legal and regulatory requirements such as those imposed by the Sarbanes-Oxley Act, or Sarbanes-Oxley. Aside from our Chief Executive Officer, Dimitrios K. Vassilikos, our senior management does not have experience operating in a publicly traded company environment. Mr. Vassilikos has had no experience with a company such as ours which is a fully reporting company under the rules and regulations of the SEC. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may be unable to implement programs and policies in an effective and timely manner that adequately respond to the increased legal, regulatory and reporting requirements associated with being a publicly traded company. Our failure to comply with all applicable requirements could lead to the imposition of fines and penalties, distract our management from attending to the administration and growth of our business, result in a loss of investor confidence in our financial reports and have an adverse effect on our business and stock price.

As a public company, we are obligated to maintain effective internal controls over financial reporting. Our internal controls may not be determined to be effective, which may adversely affect investor confidence in us and, as a result, decrease the value of our ordinary shares.

Although Greece has a full operating stock exchange, the Athens Exchange, it has not adopted management and financial reporting concepts and practices similar to those in the U.S. Consequently, we may have difficulty in hiring and retaining a sufficient number of qualified finance and management employees to work for us in Greece. If this were to occur, we may experience difficulty in establishing and maintaining accounting and financial controls, collecting financial data, budgeting, managing our funds and preparing financial statements, books of account and corporate records and instituting business practices that meet investors' expectations in the U.S.

14

Rules adopted by the SEC, pursuant to Section 404 of Sarbanes-Oxley, require annual assessment of our internal controls over financial reporting. The standards that must be met for management to assess the internal controls over financial reporting as effective are complex and require significant documentation, testing and possible remediation to meet the detailed standards. This assessment will need to include disclosure of any material weaknesses identified by our management in our internal controls over financial reporting. The process of compiling the system and processing documentation necessary to perform the evaluation needed to comply with Section 404 is costly and challenging. We may not be able to complete our evaluation, testing and any required remediation in a timely fashion. During the evaluation and testing process, if we identify one or more material weaknesses in our internal control over financial reporting, we will be unable to assert that our internal controls are effective. If we are unable to conclude that our internal control over financial reporting is effective, we could lose investor confidence in the accuracy and completeness of our financial reports, which could harm our business and cause the price of our ordinary shares to decline.

In connection with the audit of the financial statements for the Mesazos Group of Companies (the predecessors to Temhka S.A.) for the fiscal years ended December 31, 2009 and 2008, the auditors identified significant deficiencies in Temhka S.A.'s internal control over financial reporting, but these deficiencies did not rise to the level of a material weakness. Additionally, our management identified a material weakness in our internal control over financial reporting as of December 31, 2009, and concluded that our disclosure controls and procedures were ineffective as of March 31, 2010, and June 30, 2010. Management concluded that there was a material weakness in our internal controls because there was an insufficient number of personnel with appropriate technical accounting and SEC reporting expertise to adhere to certain control disciplines and to evaluate and properly record certain non-routine and complex transactions.

A significant deficiency is a deficiency, or combination of deficiencies, in internal control over financial reporting that is less severe than a material weakness, yet important enough to merit attention by those responsible for oversight of a company's financial reporting. A material weakness in internal control over financial reporting is a deficiency, or combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements would not be prevented or detected on a timely basis. If we fail to (1) remediate the significant deficiencies identified in Temhka S.A.'s internal control over financial reporting and integrate Temhka S.A.'s internal controls over financial reporting with ours, (2) maintain the adequacy of internal control over our financial reporting with regard to the financial condition and results of operations of Temhka S.A., or (3) remediate the material weakness identified in our internal controls over financial reporting, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 of Sarbanes Oxley, as such standards are modified, supplemented or amended from time to time. Also, such ineffective controls could impair our ability to report quarterly and annual financial results, or other information required to be disclosed, in a timely and accurate manner and could cause our financial reporting to be unreliable, leading to misinformation being disseminated to the public.

If our costs and demands upon management increase disproportionately to the growth of our business and revenue as a result of complying with the laws and regulations affecting public companies in the U.S., our operating results could be harmed.

As a public company, we will continue to incur significant legal, accounting, investor relations and other expenses, including costs associated with public company reporting requirements. We also have incurred, and will continue to incur, costs associated with current corporate governance requirements, including requirements under Section 404 and other provisions of Sarbanes Oxley, as well as rules implemented by the SEC and the stock exchange on which our ordinary shares are traded. The expenses incurred by public companies for reporting and corporate governance purposes have increased

15

dramatically over the past several years. These rules and regulations have increased our legal and financial compliance costs substantially and make some activities more time consuming and costly. If our costs and demands upon management increase disproportionately to the growth of our business and revenue, our operating results could be harmed.

Our future growth depends in part on our ability to make strategic acquisitions and investments and to establish and maintain strategic relationships. The failure to do so could have a material adverse effect on our market penetration, revenue growth and prospects.

As part of our plan to sustain and potentially increase business growth, we intend to make strategic acquisitions and investments and to establish and maintain joint ventures and strategic relationships with third parties. We may engage in such activities to gain expertise in certain production and logistical activities, access to raw materials or equipment and facilities. In addition, we may enter into strategic relationships with third parties to gain access to capital or funding for research and development programs, and commercialization activities, or to reduce the risk of developing and scaling-up for backlog and project pipeline.

Strategic acquisitions, investments, joint ventures and strategic relationships with third parties that we enter into may not be beneficial for our business. Furthermore, exploration into these transactions, whether or not actually consummated, could require us to incur significant expenses and could divert significant management time and attention from our existing business operations, which could harm the effective management of our business. This could have a material adverse effect on our market penetration, revenue growth and results of operations. In addition, strategic acquisitions, investments and relationships with third parties could subject us to a number of risks, including:

- •

- our inability to integrate new operations, products, personnel, services or technologies;

- •

- unforeseen or hidden liabilities, including exposure to lawsuits associated with newly acquired companies;

- •

- the diversion of resources from our existing businesses;

- •

- disagreement with joint venture or strategic relationship partners;

- •

- our inability to generate sufficient revenues to offset the costs and expenses of strategic acquisitions, investments,

joint venture formations, or other strategic relationships; and

- •

- potential loss of, or harm to, employees or customer relationships.

Any one or more of these events could impair our ability to manage our business, result in our failure to derive the intended benefits of the strategic acquisitions, investments, joint ventures or strategic relationships, result in us being unable to recover our investment in such initiatives or otherwise have a material adverse effect on our business, financial condition and results of operations.

Our success depends upon our ability to have projects successfully approved and completed in a timely manner, which involves a high degree of risk.

The construction business is subject to substantial risks, including, but not limited to, the ability to acquire favorable construction projects. Further, if we continue to be successful in securing favorable construction projects, our ability to successfully complete such construction projects is subject to a number of additional risks, including, but not limited to, availability and timely receipt of zoning and other regulatory approvals, compliance with local laws, availability of, and ability to obtain capital to fund projects, and potential equipment, raw material and labor shortages. These risks could result in substantial unanticipated delays or expenses and, under certain circumstances, could prevent the start or the completion of construction activities once undertaken, any one of which could have a material adverse effect on our financial condition and results of operations.

16

The construction business is subject to a number of risks outside of our control.

Factors which could adversely affect the construction industry, which are beyond our control, include but are not limited to:

- •

- the availability and cost of financing for our clients;

- •

- unfavorable interest rates and increases in inflation;

- •

- overbuilding or decreases in demand;

- •

- changes in national, regional and local economic conditions;

- •

- cost overruns, inclement weather, and labor or material shortages;

- •

- the impact of present or future environmental legislation, zoning laws and other regulations;

- •

- availability, delays and costs associated with obtaining permits, approvals or licenses necessary to develop property;

- •

- increases in taxes or fees;

- •

- availability of governmental funding;

- •

- local laws; and

- •

- labor problems, work stoppages, strikes and negotiations with unions.

All of the above mentioned risks are mitigated, eliminated or neutralized under our business model. Prior to commencing construction of any project, we complete a full feasibility study, including economic and market analysis, as well as analysis of local labor and civil restrictions and conditions. However, there can be no assurances that such risks can continue to be controlled in the future. In the event that we are unable to control or effectively eliminate these risks, such failure could have a material adverse effect on our revenues and earnings and thusly our share price for our ordinary shares.

Risks Related to Doing Business in Greece

We face the risk that changes in the policies of the Greek government could have a significant impact upon the business we may be able to conduct in Greece and the profitability of such business.

The Greek economy has been characterized by heavy government spending, a bloated public sector, rigid labor rules and an overly generous pension system. Efforts by the government to effect structural reforms have often faced opposition from Greece's powerful labor unions and the general public. Public debt, inflation and unemployment have been above the average for EU member states. Greece is a major beneficiary of EU aid and any reduction in such aid could adversely affect its economy.

Greece is prone to severe earthquakes, which have the potential to disrupt its economy. Greece's economy is dependent on the economies of other European nations. Many of these countries are members of the EU and are member states of the EU's Economic Monetary Union, or the EMU. The member states of the EU and EMU are heavily dependent on each other economically and politically.

We conduct all of our operations and generate our revenue in Greece. Accordingly, economic, political and legal developments in Greece will significantly affect our business, financial condition, results of operations and prospects. The Greek economy is being assisted by a financial aid package structured and implemented by the EU, the European Central Bank, or ECB, and the International Monetary Fund, or IMF. This package contains certain benchmarks and restrictive covenants and places great fiscal responsibility on the Greek government and population. These programs are expected to

17

transition the Greek economy from instability to stability and growth in the future. Although this plan and program is uncertain as to timing and outcome, should it not be successful, it could result in a slowing of the economy from its present status. While we believe that Greece will continue to strengthen its economic standing within the EU and abroad, we cannot assure you that this will be the case. Our interests may be adversely affected by any changes in policies of the Greek government, including, changes in laws, regulations or their interpretation, increased taxation, or disputes within the EU. Our revenues and profitability could be materially affected by any of these actions.

In September 2010, the IMF released its first report on the progress of the Greek government under the accord reached in May 2010 between Greece, the IMF, the EU and the ECB, referred to as the May Accord. The report stated that "...the program has made a strong start. End-June quantitative performance criteria have been met, led by forceful implementation of the fiscal program, and major reforms are ahead of schedule." (Source: IMF Greece First Review dated August 26, 2010). The report and analysis continued to state that, although a strong start has been made by the Greek government, there remains much to be accomplished to continue to meet the benchmarks as agreed in the May Accord. We continue to monitor these developments and signs of any adverse or positive occurrences. Although there have been no negative events that have impacted our core business to date, there is no assurance that, despite the assertions and efforts of the Greek government, there will not be any negative events or adverse setbacks in the future. Should any of these events occur, this could have a material adverse effect on our revenues and earnings.

The state of the political and economic environment in Greece significantly affects our performance as well as the market price of our ordinary shares. Consequently, an economic slowdown, a deterioration of conditions in Greece or other adverse changes affecting the Greek economy or the economies of other member states of the EU could adversely impact our business, financial condition, cash flows and results of operations. Moreover, the political environment both in Greece and in other countries in which we may elect to operate may be adversely affected by events outside our control, such as changes in government policies, EU directives, political instability or military action affecting Europe and/or other areas abroad and taxation and other political, economic or social developments in or affecting Greece and other EU Union member states.

Economic conditions in Greece have had and may continue to have an adverse effect on our clients and on our business.

Our business is concentrated in Greece. Greece has been the subject of intense scrutiny by the international financial community since October, 2009. Recent developments have included a financial aid package engineered by the EU, the IMF and the ECB in May 2010. This aid package imposes strict controls on the Greek government to, among other things, reduce spending, increase collections and revenues from all forms of taxation, including but not limited to, value added tax, or VAT, personal income tax, corporate income tax, property tax, food tax, fuel tax and taxes on other consumable items. This coordinated effort between the Greek government and the EU, IMF and ECB has met with some measured success since its implementation. This success is more fully reported in the IMF Greece First Review dated August 26, 2010. This report acknowledged that significant progress had been made by the Greek government to fulfill its commitments under the May Accord but it cautioned that there was much work remaining ahead in order to fully meet the covenants of such accord. There is no guarantee or assurance that such progress will continue. While we do not depend on government spending in Greece or receive any government subsidies, we are affected by the prevailing economic conditions that affect our clients. Should the recent progress falter or cease, Greece could suffer from high unemployment rates, declining consumer and business confidence, reduced consumer and business spending, and a worsening of conditions in the credit and capital markets. Should any of these events occur, this could have a material adverse effect on our revenues and earnings.

18