Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SIGMA ALDRICH CORP | d8k.htm |

| EX-99.1 - PRESS RELEASE - SIGMA ALDRICH CORP | dex991.htm |

Sigma-Aldrich Corporation

Q4 2010 Earnings Review & 2011 Outlook

•

Enabling Science to Improve the Quality of Life

Exhibit 99.2 |

2

2

Cautionary Statements

Our presentation today will include forward looking statements relating to the

Company’s future performance, goals, strategic actions and

initiatives

and

similar

intentions

and

beliefs,

including

expectations,

goals,

beliefs,

intentions

and

the

like

regarding

future

sales,

earnings,

free cash flow, share repurchases, acquisitions and other matters. These statements

are based on assumptions regarding Company operations, investments and

acquisitions and conditions in the markets the Company serves. We believe that these expectations are

reasonable

and

well-founded.

The

forward-looking

statements

in

this

presentation

are

subject

to

risks

and

uncertainties

including,

among

others, certain economic, political and technological factors. Actual results could

differ materially from those stated or implied during this review or

contained in other Company communications due to, but not limited to, such factors as (1) global economic conditions, (2)

changes in pricing and the competitive environment and the global demand for our

products, (3) fluctuations in foreign currency exchange rates, (4) changes

in research funding and the success of research and development activities, (5) failure of planned sales initiatives in our

Research and SAFC businesses, (6) dependence on uninterrupted manufacturing

operations, (7) failure to achieve planned cost reductions in global supply

chain initiatives and restructuring actions, (8) changes in the regulatory environment in which the Company operates, (9)

changes in worldwide tax rates or tax benefits from domestic and

international operations, including the matter described in Note 3–Income

Taxes–

to the Consolidated Financial Statements in the Company’s Form 10-Q

report for the quarter ended September 30, 2010, (10) exposure to

litigation, including product liability claims, (11) the ability to maintain

adequate quality standards, (12) reliance on third party package delivery

services, (13) an unanticipated increase in interest rates, (14) other changes in the business environment in which the

Company operates, and (15) the outcome of the outstanding matters described in Note

14-Contingent Liabilities and Commitments to the Consolidated Financial

Statements-in the Company’s Form 10-Q report for the quarter ended September 30, 2010. A further discussion of

risk factors can be found in Item 1A of part 2 of the Company’s Form 10-K

report for the year ended December 31, 2009 and the Company’s Form

8-K filed on October 25, 2010. The Company does not undertake any obligation to publicly update the matters covered in

this presentation.

With over 60% of sales denominated in currencies other than the U.S. dollar,

management uses currency-adjusted growth, and believes it is

useful

to

investors,

to

judge

the

Company’s

controllable,

local

currency

performance.

Organic

sales

growth

data

presented

in

this

review

is proforma

data and excludes currency impacts. The Company calculates the impact of changes

in foreign currency exchange rates by multiplying

current

period

activity

by

the

difference

between

current

period

exchange

rates

and

prior

period

exchange

rates.

The

result

is

the defined impact of changes in foreign currency exchange rates. While we are able

to report historical currency impacts after the fact, we are unable to

estimate changes that may occur later in 2011 to applicable exchange rates. Any significant changes in currency exchange

rates would likely have a significant impact on our reported growth rates due to

the volume of our sales denominated in foreign currencies. Management also

uses adjusted net income and EPS, adjusted operating income and operating income margins (excluding restructuring

and

impairment

costs)

and

free

cash

flow,

non-GAAP

measures,

to

judge

its

performance

and

ability

to

pursue

opportunities

that

enhance

shareholder value. Due to the uncertain timing of the future restructuring and

other extraordinary special changes, we are unable to include a 2011 diluted

GAAP EPS forecast or reconcile to our 2011 diluted adjusted EPS forecast or provide a reconciliation to corresponding

GAAP measures . Management believes this non-GAAP information is useful to

investors as well. Reconciliations of GAAP to non-GAAP

information

are

included

in

the

Company’s

February

9,

2011

earnings

release

posted

on

its

website,

www.sigma-aldrich.com,

and

in

the

Appendix –

Reconciliation of GAAP to non-GAAP Financial Measures beginning on Slide

17. |

3

Rakesh

Sachdev

President and CEO |

4

Strategic Priorities

•

Enhance Growth in our Core Research and SAFC Business

•

Focus on higher growth markets of:

–

Analytical Chemistry

–

Biology

–

Chemistry/Materials Science

•

Capitalize on our unique manufacturing capabilities and cGMP facilities in

SAFC •

Drive Operational Excellence

•

Continue to build upon the success of our global supply chain initiatives

•

Streamline manufacturing and distribution footprint

•

Expand global sourcing

•

Leverage Strong Cash Flow

•

Actively pursue “bolt-on”

acquisitions |

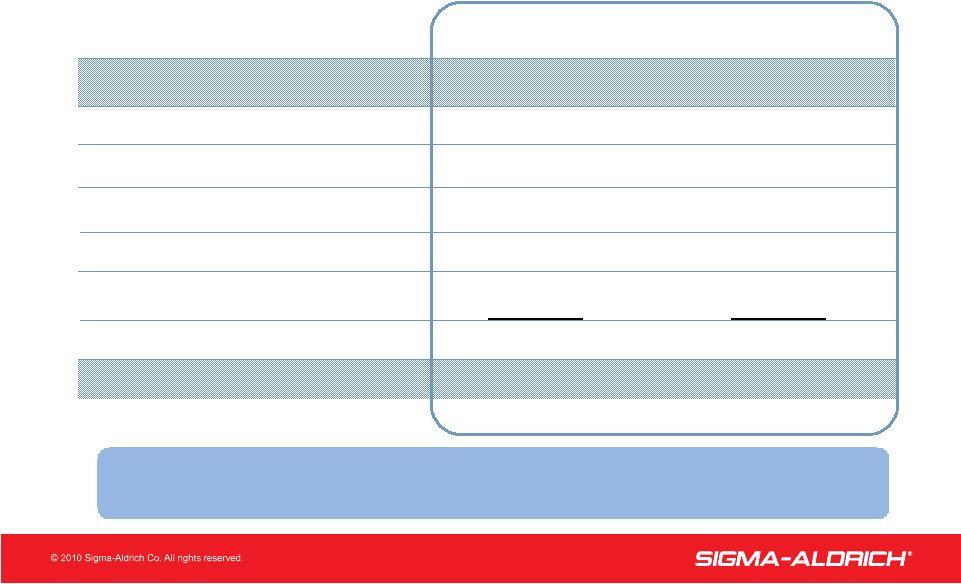

5

Fourth Quarter 2010

Financial Results

($ in millions, except per share amounts)

5

YEAR-OVER-YEAR

Q4 performance reflects sales growth for both

research and SAFC businesses

*Includes currency impact: Net Income –

$(2); Diluted EPS -

$(0.02)

As

Reported*

Q4 2010

Excluding

Restructuring &

Impairment Costs

As

Reported

Excluding

Restructuring &

Impairment Costs

Net Income

$94

$102

1%

3%

Diluted EPS

$0.76

$0.83

1%

4%

Free Cash Flow

$92

25%

Q4 2010

As

Reported

Excluding

Currency Impact

Sales

$582

2%

3%

YEAR-OVER-YEAR |

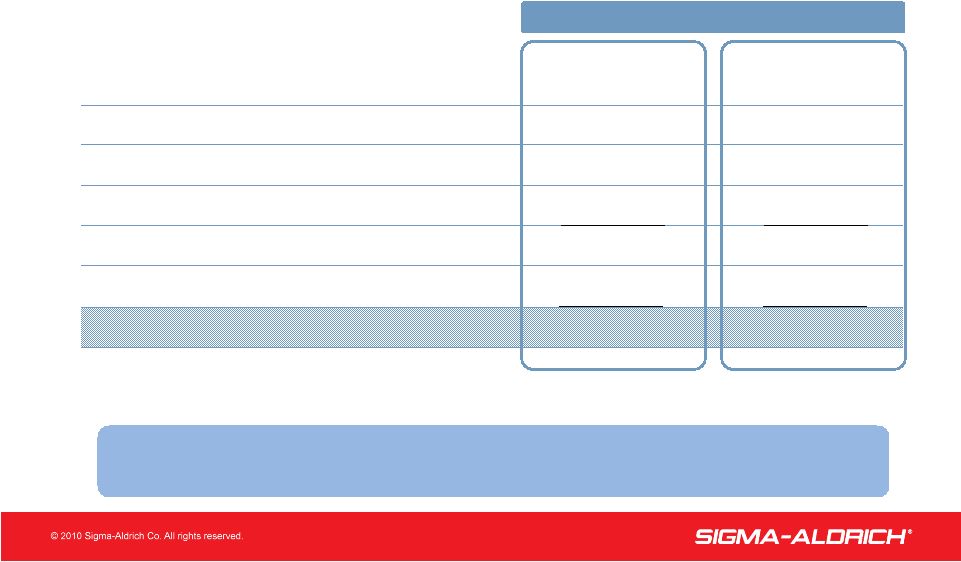

6

Full Year

2010

Financial Results

($ in millions, except per share amounts)

6

*Includes currency benefit: Net Income -

$15; Diluted EPS -

$0.12

YEAR-OVER-YEAR

As

Reported*

YTD 2010

Excluding

Restructuring &

Impairment Costs

As

Reported

Excluding

Restructuring &

Impairment Costs

Net Income

$384

$408

11%

16%

Diluted EPS

$3.12

$3.31

11%

16%

Free Cash Flow

$424

7%

2010

Year-to-Date

As

Reported

Excluding

Currency Impact

Sales

$2,271

6%

5%

YEAR-OVER-YEAR

Achieved new performance record in 2010 |

7

7

2010 Sales Growth

RESEARCH

72%

28%

SAFC

Sales Mix (YTD)

Total

Company

SAFC

Research

3%

4%

3%

4%

9%

5%

Full Year 2010/

Full Year 2009

Q4 2010/Q4 2009

Demand for research products continued to show growth.

SAFC sales set new quarterly high |

8

2010

operating

margins

reflect

impact

of

restructuring

costs

and

impairment

charge

8

Margin Analysis

PERCENTAGE OF SALES

22.3%

1.4

0.2

(1.3)

22.3%

2010: Operating Margin

S,G&A, R&D Expenses

Price

Volume/Mix/Productivity/Currency Impact

YTD

23.3%

1.9

0.2

(0.2)

24.3%

2009: Operating Margin

Q4

Restructuring Costs

(0.3)

(0.6)

Impairment Charge

-

(0.3) |

9

9

Free Cash Flow

(in millions)

2010

$ 384

93

17

29

523

(99)

$ 424

Net Income

Free Cash Flow

Net Cash Provided by Operating Activities

Less Capital Expenditures

Other

Changes in Performance Working Capital*

Depreciation & Amortization

2009

$347

92

57

20

516

(120)

$396

*Accounts

Receivable

+

Inventory

–

Accounts

Payable

YEAR ENDED DECEMBER 31

Free cash flow remains strong |

10

10

Fourth Quarter 2010 Highlights

Continued focus on long-term growth opportunities

•

End Markets

–

Improved Growth in Chemical Related Industrial Customers and Academic Customer

Sectors partially offset by challenges in Pharmaceutical sector

•

Life Science

–

Partnered with Autism Speaks to create genetically engineered knockout rats to

identify approaches for Autism treatment

–

Expanded availability of ZFN (Zinc Finger Nuclease) Technology based technology

for biopharmceutical

use

–

Successfully

“Knocked-in”

foreign

genes

in

rats

using

ZFN

Technology

–

Received

silver

medal

from

“The

Scientist”

for

genetically

modified

cell

lines

–

Added 1,700 new antibodies to increase offering to 40,000

•

Hitech

–

Added Nanosys

created silicon nanowires

to research product offering

–

Expanded capability in better high purity metals, metal salts, alloys and ceramics

for electronic applications

Highlights |

11

11

Q4 & YTD Sales Performance

Initiatives collectively on track with expectations

*Varies for individual product lines

See page 19 reconciling organic growth to reported growth

Q4

YTD

Innovation

Organic

Organic

•

Analytical, Biology, Materials Science Sales Growth

(2)-6%*

2-10%*

Geographic Growth

•

North America

4%

5%

•

Europe

(3)%

1%

•

Asia Pacific/Latin America

16%

15%

•

Focus Markets –

India, China, Brazil

23%

25%

SAFC Sales

•

Build on momentum in key product segments

4%

9%

eCommerce Sales

% of Research Sales

% of Research Sales

•

Research Sales via eCommerce channels

49%

48% |

12

0.64

0.58

0.52

0.46

0.42

0

0.1

0.2

0.3

0.4

0.5

0.6

2006

2007

2008

2009

2010

Profitable Growth

•

Demonstrated historical performance

•

Robust business model

DILUTED EARNINGS PER SHARE ($)

3.12

2.80

2.65

2.34

2.05

0.5

1.5

2.5

3.5

2006

2007

2008

2009

2010

ANNUAL DIVIDEND PER SHARE ($)

2,271

2,148

2,201

2,039

1,798

0

500

1,000

1,500

2,000

2,500

2006

2007

2008

2009

2010

REPORTED SALES $ IN MILLIONS

Continued a 36 year track record of annual increases in EPS and dividends

|

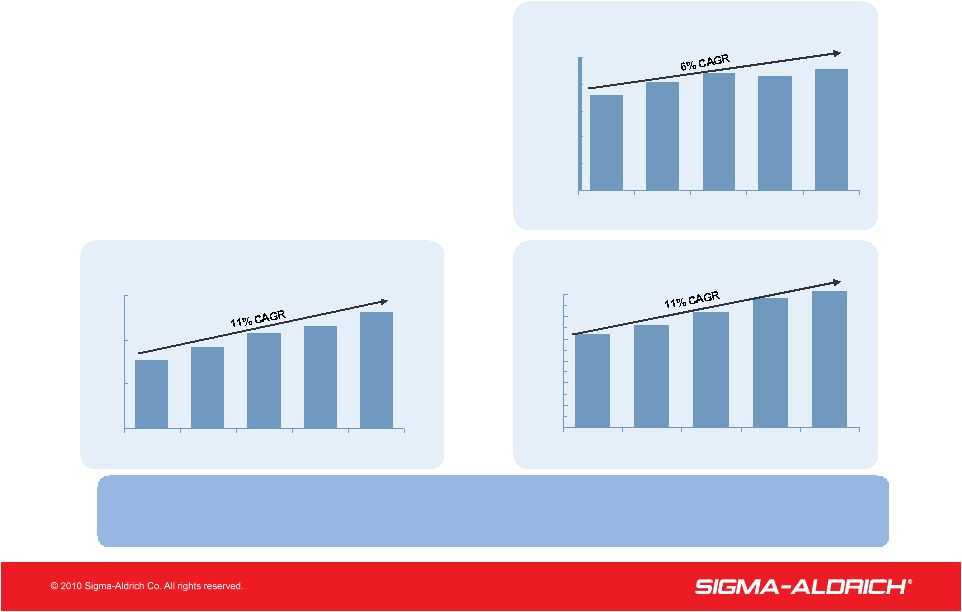

13

OPERATING CASH FLOW ($M)

523

516

404

417

330

0

100

200

300

400

500

600

2006

2007

2008

2009

2010

CAPITAL EXPENDITURES ($M)

99

120

90

78

75

0

50

100

150

2006

2007

2008

2009

2010

7% CAGR

Strong Cash Flow

Able to fund short and long term growth

FREE CASH FLOW ($M)

424

396

314

339

255

0

100

200

300

400

500

600

2006

2007

2008

2009

2010

Free cash flow is defined as cash flow from

operating activities less capital expenditures |

14

14

2011 Guidance

Organic Revenue Growth

Diluted Adjusted EPS*

Free Cash Flow

Mid-single digits

$3.45 to $3.60

>$375M

*Excludes any restructuring and other extraordinary special charges

|

15

2011

Outlook

–

Highlights

•

Sales

•

Research Products

•

Expanded Analytical Chemistry Portfolio

(Cerilliant and Research Technology Corporation)

•

More Biomolecules

(Antibodies, Proteins and Peptides)

•

Broader Zinc Finger offering

•

Expanded offering of genetically

modified cell lines

•

New capacity

–

India –

Packaging and distribution

–

China –

Quality Control and packaging

•

SAFC

•

New marketing campaign

•

Continued

strength

in

Hitech

sales

•

New Hitech manufacturing capacity in Taiwan

•

Improved sales to pharmaceutical customers

•

Performance

•

Stable operating margins

•

Strong free cash flow

•

Increased dividend |

16

16

QUESTIONS?

Sigma-Aldrich Corporation

Q4 2010 Earnings Review |

17

Appendix

Reconciliation of GAAP to Non-GAAP

Financial Measures |

18

Reconciliation of Reported Net Income to

Adjusted Net Income

2010

2009

2010

2009

Reported net income

94

$

93

$

0.76

$

0.75

$

Restructuring costs

8

6

0.07

0.05

Impairment charge

-

-

-

-

Adjusted net income

102

$

99

$

0.83

$

0.80

$

2010

2009

2010

2009

Reported net income

384

$

347

$

3.12

$

2.80

$

Restructuring costs

17

6

0.14

0.05

Impairment charge

7

-

0.05

-

Adjusted net income

408

$

353

$

3.31

$

2.85

$

Net Income

Diluted Earnings

December 31,

December 31,

(in millions)

Per Share

Three Months Ended

Three Months Ended

Net Income

Diluted Earnings

(in millions)

Per Share

Twelve Months Ended

Twelve Months Ended

December 31,

December 31, |

19

Reconciliation of Reported Sales Growth to

Adjusted (Organic) Sales Goal

Three Months Ended December 31, 2010

Reported

FX Impact

Organic

•

Analytical, Biology, Materials Science Sales Growth

(2)-6%*

(1)-0%*

(1)-6%*

Geographic Growth

•

North America

4%

–

4%

•

Europe

(9%)

(6%)

(3%)

•

Asia Pacific/Latin America

21%

5%

16%

•

Focus Markets –

India, China, Brazil

27%

4%

23%

Twelve Months Ended December 31, 2010

Reported

FX Impact

Organic

•

Analytical, Biology, Materials Science Sales Growth

2-12%*

0–2%*

2-10%*

Geographic Growth

•

North America

6%

1%

5%

•

Europe

(2)%

(3%)

1%

•

Asia Pacific/Latin America

23%

8%

15%

•

Focus Markets –

India, China, Brazil

31%

6%

25%

*Varies for individual product areas |

20

Reconciliation of Reported Sales Growth to Adjusted (Organic)

Sales Growth

Currency

Adjusted

Reported

Impact

(Organic)

Research Essentials

2%

(2%)

4%

Research Specialties

3%

(2%)

5%

Research Biotech

(2%)

-

(2%)

Research Chemicals

2%

(1%)

3%

SAFC

2%

(2%)

4%

Total Customer Sales

2%

(1%)

3%

Currency

Adjusted

Reported

Impact

(Organic)

Research Essentials

2%

-

2%

Research Specialties

6%

-

6%

Research Biotech

3%

1%

2%

Research Chemicals

4%

-

4%

SAFC

9%

-

9%

Total Customer Sales

6%

1%

5%

Three Months

Ended December 31, 2010

Twelve Months

Ended December 31, 2010 |

21

Reconciliation of Operating Cash Flow to Free Cash Flow

2010

2009

2010

2009

2008

2007

2006

Net cash provided by operating activities

126

$

154

$

523

$

516

$

404

$

417

$

330

$

Less: Capital expenditures

(34)

(32)

(99)

(120)

(90)

(78)

(75)

Free cash flow

92

$

122

$

424

$

396

$

314

$

339

$

255

$

December 31,

Twelve Months Ended

Three Months Ended

December 31,

In millions |