Attached files

| file | filename |

|---|---|

| 8-K - MCAFEE INC. 8-K - McAfee, Inc. | a6601964.htm |

| EX-99.1 - EXHIBIT 99.1 - McAfee, Inc. | a6601964_ex99-1.htm |

Exhibit 99.2

|

Fourth Quarter and Year End 2010 Management Commentary

CEO COMMENTARY FROM DAVE DEWALT

Executive Summary

It is my pleasure to report outstanding quarterly results and our full year 2010 accomplishments for McAfee. Over the last few years I have had the honor to lead a tremendous organization and our performance this year

reflects the continued hard work and dedication of the entire McAfee team.

Against the backdrop of a historic transition for McAfee, our fourth quarter and full year 2010 results beat records on several metrics; we delivered record revenue, deferred revenue, non-GAAP diluted earnings per

share and operating cash flow. Our performance accelerated throughout the year and we ended the fourth quarter achieving very strong record results. This performance is a testament to our strategy and reflects the

confidence our customers, partners and employees have in the proposed combination of McAfee and Intel. I’m very proud to be a part of this team and I believe McAfee is stronger than ever before.

Comparing 2010 to 2009 we achieved:

· Record sales orders, up 7%

· Record revenue of $2.1 billion, up 7% as reported and up 9% constant currency

· Record full year operating cash flow of $595 million dollars, up 20%

· Record non-GAAP diluted earnings per share of $2.57*, up 6% as reported and up 13% constant currency. GAAP diluted earnings per share were $1.17.

Comparing Q4 2010 to Q4 2009 we achieved:

· Record sales orders, up 5%

· Record revenue of $550 million, up 5% as reported and up 8% constant currency

· Record deferred revenue of $1.5 billion dollars, up 9% as reported and up 11% constant currency

· Record operating cash flow of $164 million dollars, up 13%

· Non-GAAP diluted earnings per share of $0.67*, up 4% as reported and up 15% constant currency. GAAP diluted earnings per share were $0.38.

Our Q4 and full year 2010 performance is clear evidence that our customers and partners understand and support our strategy of delivering innovative, holistic security risk management solutions. As I look back on 2010, I take deep pride in the impressive range of our accomplishments at McAfee including:

|

·

|

The announcement of our proposed merger with Intel in a deal valued at $7.7 billion, the fourth largest strategic cash acquisition in IT and the largest security acquisition ever.

|

|

·

|

We experienced a near doubling of our company from 2006 to 2010 as we expanded our primarily single product focus to a full suite of security solutions. We avoided the recessionary dips in financial performance that snagged many rapidly growing technology companies. McAfee’s corporate and consumer businesses set new sales records in 2010.

|

|

·

|

Over the last several months our global threat intelligence has detected unprecedented security threats, including Operation Aurora and Stuxnet. As a result we have pulled closer together with customers and partners in a trusted advisor role and elevated information security to the highest level of public sector and corporate organizations. These efforts translated into a record number of multi-million dollar transactions this year for McAfee with new and existing customers around the world.

|

|

·

|

We completed our tenth acquisition since acquiring SafeBoot in 2007. In 2010, McAfee successfully completed acquisitions of Trust Digital for enterprise mobile device management, tenCube and its WaveSecure mobile security service, and InternetSafety.com for parental web control solutions.

|

*Non-GAAP financial measures. See the reconciliation to the most directly comparable GAAP financial measure in the Appendix under Reconciliation of GAAP to Non-GAAP Financial Measures.

Fourth Quarter and Year-End 2010 Management Commentary 2

• Our technology was recognized for its excellence, vision, and execution in 2010:

|

–

|

Positioning as a leader in six of Gartner’s Magic Quadrants including Mobile Data Protection, Network Intrusion Prevention System Appliances, Content-Aware Data Loss Prevention, Secure E-mail Gateways, Secure Web Gateway, and Endpoint.

|

|

–

|

Positioning as a wave leader by Forrester Research for Data Leak Prevention Suites and Vulnerability Management.

|

|

–

|

Named a Finalist in 15 categories of SC Magazine 2011 Awards. With more nominations than any other vendor, McAfee leads global awards program with 12 “Readers Trust” nominations and three "Excellence" nominations. McAfee wins 2010 SC Magazine Awards in multiple categories.

|

|

–

|

Winning "Software of the Year 2010" Award for McAfee WaveSecure for Android by Softwareload, Deutsche Telekom’s software download portal.

|

|

–

|

Named one of CRN’s top 20 picks of the coolest cloud security vendors helping to foster the Software-as-a-Service (SaaS) phenomenon and drive it forward in 2010.

|

In 2010, McAfee demonstrated an unwavering dedication to protecting our customers and their digital assets. Teamwork and innovations produced business and financial results that lead the security marketplace and position us for future share gains and expanded opportunities.

McAfee 3.0 and Intel

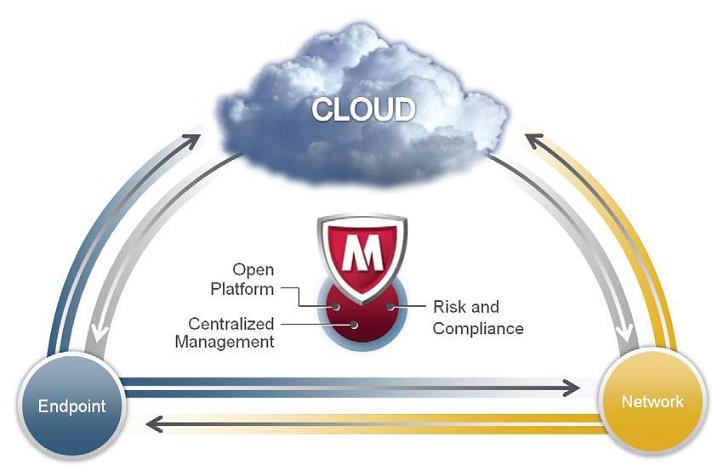

Over the last 4 years McAfee has strategically evolved from a leader in anti-virus protection to a powerful security solutions portfolio that spans the endpoint, network and cloud. Through organic growth and successful acquisitions, we have changed the way customers think about protecting their critical IT environments and become a strategic advisor. We are very proud that today our customer base includes 97% of the Fortune 100 largest companies in the world and millions of consumers world-wide.

Fourth Quarter and Year-End 2010 Management Commentary 3

Our vision for the future of security is “McAfee 3.0” – Security Connected and everywhere. We enter this phase in the Company’s history stronger than ever- with diversified revenue and customer bases, unparalleled global threat intelligence, the most robust portfolio of solutions, products and services in the security marketplace and the ~nest team in the technology industry.

In 2011 upon close of the proposed merger of Intel and McAfee we will operate as a wholly-owned subsidiary sustaining our focus on providing leading-edge security solutions, while gaining the benefits of Intel’s technology investments, market-reach, brand and global employee base.

This transaction fits perfectly with our vision of ubiquitous security and is expected to accelerate innovation at McAfee and ultimately make the digital world a safer place. Intel’s agreement to acquire McAfee underscores that security is a fundamental component of modern computing and it is increasingly relevant in a completely connected world. Providing protection to a rapidly expanding, heterogeneous world of connected devices

requires a fundamentally new approach to security. We continue to receive strong endorsements from our customers and have not seen any meaningful disruption to our business.

The proposed combination of Intel and McAfee will be about helping provide greater protection and efficiency to endpoint, mobile, and embedded devices by bringing software and silicon together. We are not moving away from our core security business of software-based endpoint protection and network security technologies but instead intend to improve security for all customers by providing integrated hardware and software solutions.

There are three critical areas of focus for the next generation of secure computing:

|

1)

|

Beyond the PC: Embedded Device Security. Devices such as copiers, smart meters, medical devices and others are increasingly connected and thus require optimized protection with a lower memory footprint and low CPU utilization, such as whitelisting.

|

|

2)

|

Security Moving Beyond the Operating System. We expect the combination of software and silicon to create the next generation of security technology, following a path similar to the one virtualization technology has taken over the past decade. McAfee and Intel have been working together for some time already and we look forward to introducing the first products from our strategic partnership this year.

|

|

3)

|

Mobile Security. Consumerization of IT is requiring enterprise IT to think about protecting their infrastructures in a totally new way and creating a need to be able to centrally manage an explosion of IP devices. The proliferation of tablets, smartphones and other devices have more consumers connected to the Internet than ever before and it’s growing at a rapid pace.

|

McAfee is well positioned to further expand our addressable security market and capitalize on these key trends as customers are looking to McAfee for trusted security solutions in these important and fast growing areas within IT. As we look towards the future with optimism, Jonathan has prepared a deeper look in our operational performance this quarter that provides a view into the drivers behind our financial and operational performance.

Fourth Quarter and Year-End 2010 Management Commentary 4

CFO COMMENTARY FROM JONATHAN CHADWICK

2010 Financial Summary*

|

FY 2010

($M)

|

As

Reported

|

Y/Y

Growth

|

Constant

Currency

|

Y/Y

Growth

|

||||||||

|

Non-GAAP Revenues

|

$2,071 | 7 | % | $2,100 | 9 | % | ||||||

|

Non-GAAP Net Income

|

$404 | 5 | % | $429 | 12 | % | ||||||

|

Deferred Revenue

|

$1,536 | 9 | % | $1,566 | 11 | % | ||||||

|

Non-GAAP EPS

|

$2.57 | 6 | % | $2.73 | 13 | % | ||||||

|

Operating Cash Flow

|

$595 | 20 | % | |||||||||

|

GAAP Revenues

|

$2,065 | 7 | % | $2,094 | 9 | % | ||||||

|

GAAP Net Income

|

$184 | 6 | % | $212 | 22 | % | ||||||

|

GAAP EPS

|

$1.17 | 7 | % | $1.34 | 23 | % | ||||||

2010 was a very successful year for McAfee. The demand for our security solutions resulted in record revenue of $2.1 billion, up 7% year over year as reported and up 9% constant currency. We drove growth in our corporate business from our endpoint, network security, risk and compliance and SaaS security offerings and our consumer business also had another very strong year. The strength of our product portfolio continues to be a significant competitive advantage in the marketplace and we exit the year with a fresh product cycle across the board.

2010 Non-GAAP net income reached $404 million up 5% year over year as reported and up 12% constant currency. Deferred revenue at the end of 2010 was a record $1.5 billion up 9% year over year as reported and up 11 % constant currency. Non-GAAP diluted earnings per share were a record $2.57, up 6% year over year as reported and up 13% constant currency. We are particularly pleased that our operating cash flow grew 20% in 2010 and we ended the year with $1.2 billion in cash and marketable securities.

2010 Foreign Exchange Impact Summary

In 2010, we experienced a significant challenge from foreign exchange headwinds on our operating plan and financial results. As a result we had significant negative impact to our revenue and profitability that required extra expense control diligence and operating plan adjustments throughout the course of the year. For the full year, the negative impact to our financial results was $29 million in revenue and over $0.16 in non-GAAP diluted earnings per share. GAAP-diluted earnings per share were negatively impacted by $0.18.

*Includes non-GAAP financial measures. See the reconciliation to the most directly comparable GAAP financial measure in the Appendix under Reconciliation of GAAP to Non-GAAP Financial Measures.

Fourth Quarter and Year-End 2010 Management Commentary 5

Q4 2010 Financial Summary*

|

|

||||||||||||

|

Q4 2010

($M)

|

As

Reported

|

Y/Y

Growth

|

Constant

Currency

|

Y/Y

Growth

|

||||||||

|

Revenues

|

$550 | 5 | % | $567 | 8 | % | ||||||

|

Non-GAAP Net Income

|

$105 | 2 | % | $153 | 13 | % | ||||||

|

Deferred Revenue

|

$1,536 | 9 | % | $1,566 | 11 | % | ||||||

|

Non-GAAP EPS

|

$0.67 | 4 | % | $0.74 | 15 | % | ||||||

|

Operating Cash Flow

|

$164 | 13 | % | |||||||||

|

GAAP Net Income

|

$61 | 11 | % | $75 | 37 | % | ||||||

|

GAAP EPS

|

$0.38 | 13 | % | $0.47 | 40 | % | ||||||

The fourth quarter was a solid finish to 2010 and our financial results reflect strong organic growth and focused execution. We achieved - and in many cases exceeded – the goals we set this quarter including record fourth quarter revenue, deferred revenue, non-GAAP diluted earnings per share and operating cash flow.

Fourth quarter revenue was a record $550 million, up 5% year over year as reported and up 8% constant currency. Our corporate and consumer businesses continue to take share and investments in improving our global reach are experiencing good traction.

Fourth quarter non-GAAP net income reached $105 million, up 2% year over year as reported and up 13% constant currency. Deferred revenue at the end of the quarter was a record $1.5 billion, up 9% year over year as reported and up 11% constant currency. We achieved record fourth quarter non-GAAP diluted earnings per share of $0.67, up 4% year over year as reported and up 15% constant currency.

During the fourth quarter, we saw a greater than forecasted negative foreign exchange impact from the strengthening in the US dollar. Using our rule of thumb we provided at the beginning of the quarter (see Appendix) we calculate an additional $0.01 negative impact to non-GAAP diluted earnings per share beyond what we had expected. In addition, we undertook investment efforts ahead of our planned merger with Intel of approximately $0.01. As a result, our fourth quarter included an additional negative $0.02 impact from foreign exchange and pre-merger investments from previous guidance.

Operating cash flow in the fourth quarter was $164 million, up 13% and ahead of our expectations. We ended the fourth quarter with cash and marketable securities of $1.2 billion, up 25% year over year.

Continued Sales and Revenue Momentum

The security issues customers are facing are a global problem and the demand for McAfee’s security solutions around the world continues to grow with sales orders in the quarter up 5% year over year constant currency. Total revenue in the fourth quarter was a record $550 million, up 5% year over year as reported and up 8% constant currency, slightly ahead of our expectations.

Fourth quarter North America revenue was $31 1 million, up 4% year over year as reported and up 5% constant currency, representing 57% of our total revenues. Growth in this region was driven primarily by strong results in our public sector, network security and consumer businesses. Fourth quarter International revenue was $238 million, up 5% year over year as reported and up 11% constant currency, representing 43% of our total revenues. During the quarter we experienced consistent strength in our international consumer business and strong corporate performance in Japan and Asia Pacific. I am also especially pleased to see the targeted efforts in improving our EMEA operations resulted in the corporate business stabilizing in the quarter.

Our corporate business continues to benefit from our unique ability to protect our customers’ critical IT infrastructures. Corporate revenue in the fourth quarter was $340 million, up 1 % as reported and up 4% constant currency.

*Includes non-GAAP financial measures. See the reconciliation to the most directly comparable GAAP financial measure in the Appendix under Reconciliation of GAAP to Non-GAAP Financial Measures.

Fourth Quarter and Year-End 2010 Management Commentary 6

I am pleased to report we had a record number of 42 sales orders over $1 million dollars, up 27% sequentially and also up 27% year over year with the average order size increasing approximately 17% year over year. 74% of these orders had multiple product elements from more than one of our business units which is up 7 percentage points year over year and a significant portion of each deal was from our portfolio of security products beyond our PC offerings. Total sales orders above $100,000 in the fourth quarter were 652 orders, up 24% sequentially and ~at year over year.

On a business unit level, our endpoint business and network business are the primary drivers of our product portfolio and we continue to gain market share against a broad spectrum of competitors. Fourth quarter network security revenue and sales orders were both up double digits year over year. This growth continues to be driven primarily by our very strong public sector business particularly in North America. TOPS node count grew over 35% in the fourth quarter with TOPS nodes now representing 65% of our total node count. Conversion rates have accelerated significantly during 2010.

We continue to see strong performance from our DLP and email and web SaaS solutions in our content security business while email and web gateway growth continues to reflect the transitions we’re seeing throughout the marketplace. Our governance, risk and compliance business had double digit year over year revenue and sales order growth in the fourth quarter reflecting the strong momentum we’ve seen in this business over the course of the year.

Overall these results reflect the leadership of our direct sales force and channel partners and the strength of our endpoint, network and cloud-based security solutions.

In the fourth quarter our consumer business continued to thrive and we had another quarter of record sales orders. Consumer revenue was a record $209 million, up 12% year over year as reported and up 14% constant currency.

Our PC OEM relationships and our broad portfolio of ISP, telecommunications, financials and portal partners continue to be solid profitable relationships for us. In the fourth quarter our direct online sales business had its 12th consecutive quarter of double digit, year over year growth with record sales of our premium total protection suite offering. During the quarter we signed 25 new or extended partnership agreements and launched a record number of new partner projects, reflecting the momentum we have in the consumer marketplace as a trusted security advisor. Overall, our consumer business margins continue to be very strong and have continued to expand over the last two years.

We also continue to gain traction with our mobility offerings. Our recently released Enterprise Mobility Management 9.5 software platform is now integrated with our ePO platform, providing customers with unified management of their endpoint, network and data security products. In Q4 we experienced over a million downloads of our Wave Secure mobile security service. We are very pleased with the results from these recent acquisitions.

Combined, our corporate business continued to capitalize on the momentum we built in 2010 and we have a very strong pipeline of multi-million dollar enterprise deals and our consumer business remains very strong with our diversified distribution model. Looking ahead, we believe we are well positioned to further expand our addressable markets and capitalize on key trends in mobile security and virtualization as our customers are looking to McAfee for trusted security solutions in these important areas.

Fourth Quarter and Year-End 2010 Management Commentary 7

Non-GAAP Gross Margin*

Non-GAAP gross profit margin for the fourth quarter was 76.2%, down approximately 90 basis points sequentially. GAAP gross profit margin for the fourth quarter was 72.3%. As a reminder, our product strategy encompasses a broad portfolio of offerings including software, hardware, services and cloud-based solutions The sequential margin decline we experienced in the fourth quarter was due to a few factors; strategic investments in our global infrastructure to support future growth, increased fulfillment and inventory costs and higher than expected hardware demand. Going forward we expect modest improvements in gross margins as a number of these impacts were specific to the fourth quarter.

Non-GAAP Operating Expenses*

Non-GAAP operating expenses in the fourth quarter were $281 million, essentially ~at year over year. GAAP operating expenses in the fourth quarter were $339 million. Non-GAAP operating expenses as a percentage of revenue in the fourth quarter were 51.1 %, down approximately 220 basis points year over year and reflecting a steady decline over the last eight quarters.

We remain focused on effectively managing our cost structure while continuing to invest in our business for future growth. In the fourth quarter we made infrastructure investments with a strong focus on innovation and quality in our research and development organization. As of December 31, 2010 we had 6,267 employees worldwide with 146 employees added in the fourth quarter in engineering resources, sales force and infrastructure capabilities. This increase represents our highest level of headcount investment over the last five quarters and reflects the prospects in the global security market and incremental opportunities we see ahead as a result of the Intel acquisition. Overall, these pre-merger investments had an additional $0.01 impact to non-GAAP diluted earnings per share than we previously guided.

Non-GAAP Operating Income and Non-GAAP Operating Margin*

In the fourth quarter non-GAAP operating income was $138 million, up 1% year over year as reported and up 12% constant currency. GAAP operating income in the fourth quarter was $59 million. Non-GAAP operating margin on a constant currency basis was 26.9%, up approximately 90 basis points year over year. Over the last 8 quarters we have achieved a 155 basis point improvement in our Non-GAAP Operating Margin on a constant currency basis reflecting strong operational expense control.

Balance Sheet and Cash Flow Items

In the fourth quarter we generated $164 million of operating cash flow, reflecting strong collections and coming in ahead of our forecast. In 2010 we generated $595 million in operating cash flow, up 20% over 2009. Cash and marketable securities at the end of the fourth quarter were over $1.2 billion, reflecting our strong operating cash flow performance. We acquired InternetSafety.com in the quarter and looking ahead we plan to continue with our strategy of acquiring small to medium sized companies. We did not repurchase stock in the fourth quarter due to our pending acquisition by Intel.

Net accounts receivable at quarter end were $348 million compared with $280 million sequentially and consistent with our higher sales bookings and days sales outstanding in the fourth quarter. Due to linearity in the quarter, DSO’s were 57 days for the fourth quarter compared to 48 days sequentially and 50 days in the fourth quarter of last year. We continue to be very pleased with the overall health of our receivables portfolio.

Deferred revenue at the end of Q4 was a record $1.5 billion dollars, up 9% year over year as reported and up 11% on a foreign currency adjusted basis. The composition of our deferred revenue balance at the end of the fourth quarter was 66% related to our corporate business and 34% to our consumer business. Approximately 76% of our fourth quarter revenue was from the balance sheet and approximately 87% was recurring in nature from services, support and subscriptions.

*Non-GAAP financial measures. See the reconciliation to the most directly comparable GAAP financial measure in the Appendix under Reconciliation of GAAP to Non-GAAP Financial Measures.

Fourth Quarter and Year-End 2010 Management Commentary 8

Long-Term Financial Performance

Over the last few years McAfee has been on a consistent and strong growth journey and we’ve worked hard to successfully strengthen our security solutions portfolio, expand our addressable markets, and integrate acquisitions. We remain on course for continued financial success in 2011 and beyond with a strong operational foundation, solid business pipeline and continued security marketplace leadership in key emerging markets such as embedded security, virtualization and mobility. As we prepare to join the Intel organization in 2011, we are very optimistic about McAfee’s near-term and longer-term prospects.

Looking Ahead: Accelerated Growth

McAfee offers a full complement of consumer and corporate security products, services and solutions, covering all the bases: endpoint, network and cloud. Our addressable market is growing, our strategy is working and our financial performance continues to be strong. Our future has never looked brighter, especially with the support of the proposed Intel acquisition.

We are confident that McAfee is aligned with the most critical trends in security and will benefit from being a trusted advisor with integrated solutions.

By continuing to integrate the three components of our security technology strategy -- endpoint, network and cloud – all connected and all leveraging the power of unrivaled McAfee Global Threat Intelligence-- we have an offering nobody can match. We have created a bridge from the PC centric world to a world where everything is digital and everything is connected. More importantly, we are continuing to gain mindshare in the marketplace by developing and acquiring the right technologies for where the security market is headed.

McAfee is in the middle of a very strong product cycle to expand our product portfolio that protects customers from consumers to enterprise, from network to endpoint, from individual PC’s to the cloud. We’ve got an incredible network of partners and alliances across our business, covering many key growth verticals including government, telecommunications and technology.

In closing, we hope you have a good understanding of the opportunity McAfee has and why we are very optimistic about our Company’s future with Intel. Over the past few years we have worked hard to dramatically expand the breadth of our product offerings and we have broadened our security footprint, to help customers respond whether on any kind of endpoint, the network or in the cloud and across the technology stack. This will only be accelerated by us joining the Intel family.

On behalf of the Executive Management team we want to thank our employees worldwide for their hard work and continued performance. The best is yet to come for McAfee.

|

Dave DeWalt

President & Chief Executive Officer

|

|

Jonathan Chadwick

Chief Financial Officer

|

Fourth Quarter and Year-End 2010 Management Commentary 9

Appendix

Forward-Looking Statements

This Fourth Quarter and Year-End 2010 Management Commentary contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include statements regarding the preliminary results for the quarter ended December 31, 2010 and for the full year. Forward-looking statements include statements about the timing and anticipated benefits of our pending acquisition by Intel and that we will operate as a wholly owned subsidiary of Intel following the closing. Forward-looking statements include our expectation for modest improvements in gross margins, our continuing investment in our business for future growth, our plan to continue with our strategy of acquiring small to medium sized companies, and our plans and expectations for continued financial success in 2011 and beyond. Forward-looking statements also include statements about the security market, including growth areas within the security market; statements about growth in the demand for and value of McAfee's security solutions; and statements about McAfee's strategy, market leadership and market positioning. Actual results could vary, perhaps materially, and the expected results may not occur. In particular, actual results are subject to other risks, including that the pendency of the acquisition by Intel could disrupt McAfee's business. In addition, McAfee may not achieve its planned revenue realization rates or sales targets, succeed in its efforts to grow its business or combat effectively the security threats of the future, leverage its relationships and opportunities to the degree expected or capture market share, notwithstanding related commitment or related investment. McAfee may not benefit from its acquisitions, strategic alliances or partnerships as anticipated; the company's product and service offerings may not continue to interoperate effectively with operating systems causing delayed or lost sales or increased expenses; the company may experience delays in product development or the release of previously announced products; the company may experience delayed or lost sales and revenue as a result of outages in integrated systems on which it is highly dependent; or the company may not satisfactorily anticipate or meet its customers' needs or expectations. Actual results are also subject to a number of other factors, including customer and distributor demand fluctuations, currency fluctuations, and macro and other economic conditions both in the United States and internationally, including the adverse global economic conditions. The forward-looking statements contained in this release are also subject to other risks and uncertainties, including those more fully described in McAfee's filings with the SEC including its quarterly report on Form 10-Q for the period ended September 30, 2010. McAfee does not undertake to update any forward looking statements.

|

Historical Exchange Rates

|

|

2008

|

2009

|

|

2010

|

|||||||||||||

|

Dec

|

Mar

|

Jun

|

Sep

|

Dec

|

Mar

|

Jun

|

Sep

|

Dec

|

||||||||

|

Weighted Average Rate

|

1.32 | 1.32 | 1.36 | 1.42 | 1.48 | 1.39 | 1.30 | 1.27 | 1.34 | |||||||

|

Ending Rate

|

1.40 | 1.33 | 1.40 | 1.46 | 1.44 | 1.35 | 1.22 | 1.36 | 1.34 |

Q4 2010 currency impact applying “rules of thumb” vs. actual impact (including all currencies)

| Q3 2010 FX Rate | Q4 2010 FX Rate | Difference |

“Rules of Thumb”

|

Actual

|

||||||||||

| ($/€) | ($/€) | ($/€) | FX Impact |

Impact

|

||||||||||

| Revenue | 1.27 | 1.34 | 0.07 | $10M | $14M | |||||||||

| EPS | 1.27 | 1.34 | 0.07 | 3.5 | ¢ | 2.9 | ¢ |

Q4 2010 guidance currency impact vs. Q4 2010 actual FX rates applying “rules of thumb”

|

Guided FX Rate

|

Actual FX Rate | Difference |

“Rules of Thumb”

|

|

||||||||||

| ($/€) | ($/€) | ($/€) | FX Impact |

|

||||||||||

| Revenue | 1.36 | 1.34 | (0.02 | ) | ($3M | ) | ||||||||

| EPS | 1.36 | 1.34 |

(0.02

|

) | 3.5 | ¢ |

|

MCAFEE, INC. AND SUBSIDIARIES

|

|||||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|||||||

|

(in thousands)

|

|||||||

|

(Unaudited)

|

|

December 31,

|

December 31,

|

|||||||

|

2010

|

2009

|

|||||||

|

Assets:

|

||||||||

|

Cash and marketable securities

|

$ | 1,183,529 | $ | 950,168 | ||||

|

Accounts receivable, net

|

348,254 | 294,315 | ||||||

|

Prepaid expenses, deferred costs of revenue and other current assets (A)

|

292,861 | 263,891 | ||||||

|

Property and equipment, net

|

167,194 | 133,016 | ||||||

|

Deferred income taxes

|

609,769 | 604,737 | ||||||

|

Goodwill, intangibles and other long-term assets, net (A)

|

1,630,745 | 1,717,059 | ||||||

|

Total assets

|

$ | 4,232,352 | $ | 3,963,186 | ||||

|

Liabilities:

|

||||||||

|

Accounts payable

|

$ | 71,349 | $ | 55,104 | ||||

|

Accrued liabilities

|

343,123 | 312,299 | ||||||

|

Deferred revenue (B)

|

1,536,266 | 1,407,473 | ||||||

|

Accrued taxes and other long-term liabilities

|

57,517 | 70,772 | ||||||

|

Total liabilities

|

2,008,255 | 1,845,648 | ||||||

|

Stockholders' Equity:

|

||||||||

|

Common stock

|

1,932 | 1,868 | ||||||

|

Treasury stock

|

(1,173,645 | ) | (845,118 | ) | ||||

|

Additional paid-in capital

|

2,507,457 | 2,251,916 | ||||||

|

Accumulated other comprehensive loss

|

(7,922 | ) | (3,291 | ) | ||||

|

Retained earnings

|

896,275 | 712,163 | ||||||

|

Total stockholders' equity

|

2,224,097 | 2,117,538 | ||||||

|

Total liabilities and stockholders' equity

|

$ | 4,232,352 | $ | 3,963,186 | ||||

|

(A)

|

Deferred costs of revenue and prepaid expenses primarily associated with revenue-sharing and

|

||||||

|

royalty arrangements were $292.0M and $271.8M as of December 31, 2010 and

|

|||||||

|

December 31, 2009, respectively.

|

|||||||

| (B) |

Short term and long term deferred revenue were $1,147.6M and $388.6M as of December 31, 2010 and $1,068.7M and $338.8M as of December 31, 2009, respectively.

|

||||||

|

|

|||||||

|

MCAFEE, INC. AND SUBSIDIARIES

|

|||||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

|

|||||||||||||

|

(in thousands, except per share data)

|

|||||||||||||

|

(Unaudited)

|

|

Three Months Ended

|

Twelve Months Ended

|

||||||||||||||||

|

December 31,

|

December 31,

|

||||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

||||||||||||||

|

Net revenue

|

$ | 549,564 | $ | 525,666 | $ | 2,064,807 | $ | 1,927,332 | |||||||||

|

Cost of net revenue (A) (B)

|

132,660 | 110,571 | 476,081 | 408,426 | |||||||||||||

|

Amortization of purchased technology

|

19,429 | 20,768 | 80,742 | 77,961 | |||||||||||||

|

Impact of signature file update

|

- | - | 725 | - | |||||||||||||

|

Gross profit

|

397,475 | 394,327 | 1,507,259 | 1,440,945 | |||||||||||||

|

Operating costs:

|

|||||||||||||||||

|

Research and development (A)

|

92,067 | 84,031 | 343,994 | 322,872 | |||||||||||||

|

Sales and marketing (A)

|

171,951 | 177,263 | 656,011 | 638,829 | |||||||||||||

|

General and administrative (A)

|

48,911 | 44,479 | 184,051 | 164,659 | |||||||||||||

|

Restructuring charges

|

15,404 | 2,911 | 41,683 | 13,830 | |||||||||||||

|

Amortization of intangibles

|

7,152 | 10,118 | 29,743 | 40,718 | |||||||||||||

|

Acquisition-related costs (benefits)

|

3,105 | (67 | ) | 16,598 | 31,731 | ||||||||||||

|

Litigation-related and other costs

|

- | 3,200 | 4,250 | 5,525 | |||||||||||||

|

Impact of signature file update

|

- | - | 1,093 | - | |||||||||||||

|

Loss on sale/disposal of assets and technology

|

157 | 236 | 414 | 474 | |||||||||||||

|

Total operating costs

|

338,747 | 322,171 | 1,277,837 | 1,218,638 | |||||||||||||

|

Income from operations

|

58,728 | 72,156 | 229,422 | 222,307 | |||||||||||||

|

Interest and other income (loss), net

|

376 | (623 | ) | 218 | 2,626 | ||||||||||||

|

Impairment of marketable securities

|

- | - | - | (710 | ) | ||||||||||||

|

Income before provision for income taxes

|

59,104 | 71,533 | 229,640 | 224,223 | |||||||||||||

|

Provision (benefit) for income taxes

|

(1,468 | ) | 17,011 | 45,528 | 50,803 | ||||||||||||

|

Net income

|

$ | 60,572 | $ | 54,522 | $ | 184,112 | $ | 173,420 | |||||||||

|

Net income per share - basic

|

$ | 0.39 | $ | 0.35 | $ | 1.19 | $ | 1.11 | |||||||||

|

Net income per share - diluted

|

$ | 0.38 | $ | 0.34 | $ | 1.17 | $ | 1.09 | |||||||||

|

Shares used in per share calculation - basic

|

154,819 | 157,820 | 154,936 | 156,144 | |||||||||||||

|

Shares used in per share calculation - diluted

|

157,893 | 161,032 | 157,385 | 158,988 | |||||||||||||

|

(A)

|

Stock-based compensation expense is included as follows:

|

||||||||||||||||

|

Cost of net revenue

|

$ | 2,011 | $ | 1,638 | $ | 7,655 | $ | 6,044 | |||||||||

|

Research and development

|

9,137 | 7,119 | 32,364 | 27,023 | |||||||||||||

|

Sales and marketing

|

12,009 | 10,848 | 48,945 | 47,689 | |||||||||||||

|

General and administrative

|

8,641 | 7,775 | 30,517 | 28,338 | |||||||||||||

| $ | 31,798 | $ | 27,380 | $ | 119,481 | $ | 109,094 | ||||||||||

|

(B)

|

In the twelve months ended December 31, 2009, cost of net revenue includes $2.7M of acquisition-related costs.

|

||||||||||||

|

MCAFEE, INC. AND SUBSIDIARIES

|

|||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|||

|

(in thousands)

|

|||

|

(Unaudited)

|

|

Twelve Months Ended

|

||||||||

|

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net income

|

$ | 184,112 | $ | 173,420 | ||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Depreciation and amortization

|

171,357 | 172,280 | ||||||

|

Stock-based compensation expense

|

119,481 | 103,036 | ||||||

|

Excess tax benefit from stock-based awards

|

(14,458 | ) | (10,215 | ) | ||||

|

Deferred income taxes

|

10,286 | 11,900 | ||||||

|

Non-cash restructuring charge

|

24,381 | 1,861 | ||||||

|

Impairment of marketable securities

|

- | 710 | ||||||

|

Other non-cash items

|

8,628 | 6,185 | ||||||

|

Changes in assets and liabilities, net of acquisitions:

|

||||||||

|

Accounts receivable, net

|

(63,668 | ) | 33,216 | |||||

|

Prepaid expenses, deferred costs of revenue, and other assets

|

(39,061 | ) | (98,608 | ) | ||||

|

Accounts payable

|

15,560 | 11,212 | ||||||

|

Accrued taxes and other liabilities

|

22,111 | (10,370 | ) | |||||

|

Deferred revenue

|

155,911 | 101,757 | ||||||

|

Net cash provided by operating activities

|

594,640 | 496,384 | ||||||

|

Cash flows from investing activities:

|

||||||||

|

Purchase of marketable securities

|

(654,313 | ) | (448,117 | ) | ||||

|

Proceeds from sales of marketable securities

|

161,432 | 50,623 | ||||||

|

Proceeds from maturities of marketable securities

|

322,498 | 239,323 | ||||||

|

Purchase of property and equipment

|

(86,905 | ) | (60,535 | ) | ||||

|

Acquisitions, net of cash acquired

|

(51,869 | ) | (171,618 | ) | ||||

|

Other investing activities

|

10,403 | 2,492 | ||||||

|

Net cash provided by (used in) investing activities

|

(298,754 | ) | (387,832 | ) | ||||

|

Cash flows from financing activities:

|

||||||||

|

Proceeds from issuance of common stock under our employee stock benefit plans

|

125,442 | 90,105 | ||||||

|

Excess tax benefit from stock-based awards

|

14,458 | 10,215 | ||||||

|

Repurchase of common stock

|

(328,527 | ) | (25,257 | ) | ||||

|

Bank borrowings

|

- | 100,000 | ||||||

|

Repayment of bank borrowings

|

- | (100,000 | ) | |||||

|

Payment of accrued purchase price and contingent consideration

|

(23,856 | ) | (4,949 | ) | ||||

|

Other financing activities

|

(3,157 | ) | - | |||||

|

Net cash (used in) provided by financing activities

|

(215,640 | ) | 70,114 | |||||

|

Effect of exchange rate fluctuations on cash

|

(18,964 | ) | 15,169 | |||||

|

Net increase in cash and cash equivalents

|

61,282 | 193,835 | ||||||

|

Cash and cash equivalents at beginning of period

|

677,137 | 483,302 | ||||||

|

Cash and cash equivalents at end of period

|

$ | 738,419 | $ | 677,137 | ||||

|

MCAFEE, INC. AND SUBSIDIARIES

|

|||||||||||

|

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

|

|||||||||||

|

(in thousands, except per share data)

|

|||||||||||

|

(Unaudited)

|

|

Three Months Ended

|

Twelve Months Ended

|

||||||||||||||||||

|

December 31,

|

December 31,

|

||||||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

||||||||||||||||

|

Net revenue:

|

|||||||||||||||||||

|

GAAP net revenue

|

$ | 549,564 | $ | 525,666 | $ | 2,064,807 | $ | 1,927,332 | |||||||||||

|

Impact of signature file update

|

(1 | ) | - | - | 6,105 | - | |||||||||||||

|

Non-GAAP net revenue

|

$ | 549,564 | $ | 525,666 | $ | 2,070,912 | $ | 1,927,332 | |||||||||||

|

Gross profit:

|

|||||||||||||||||||

|

GAAP gross profit

|

$ | 397,475 | $ | 394,327 | $ | 1,507,259 | $ | 1,440,945 | |||||||||||

|

Impact of signature file update

|

(1 | ) | - | - | 6,830 | - | |||||||||||||

|

Stock-based compensation expense

|

(2 | ) | 2,011 | 1,638 | 7,655 | 6,044 | |||||||||||||

|

Amortization of purchased technology

|

(3 | ) | 19,429 | 20,768 | 80,742 | 77,961 | |||||||||||||

|

Acquisition-related costs

|

- | - | 2,717 | ||||||||||||||||

|

Non-GAAP gross profit

|

$ | 418,915 | $ | 416,733 | $ | 1,602,486 | $ | 1,527,667 | |||||||||||

|

Operating income:

|

|||||||||||||||||||

|

GAAP operating income

|

$ | 58,728 | $ | 72,156 | $ | 229,422 | $ | 222,307 | |||||||||||

|

Impact of signature file update

|

(1 | ) | - | - | 7,923 | - | |||||||||||||

|

Stock-based compensation expense

|

(2 | ) | 31,798 | 27,380 | 119,481 | 109,094 | |||||||||||||

|

Amortization of purchased technology

|

(3 | ) | 19,429 | 20,768 | 80,742 | 77,961 | |||||||||||||

|

Amortization of intangibles

|

(3 | ) | 7,152 | 10,118 | 29,743 | 40,718 | |||||||||||||

|

Restructuring charges

|

(4 | ) | 15,404 | 2,911 | 41,683 | 13,830 | |||||||||||||

|

Acquisition-related costs (benefits)

|

(5 | ) | 3,105 | (67 | ) | 16,598 | 34,448 | ||||||||||||

|

Litigation-related and other costs

|

(6 | ) | - | 3,200 | 4,250 | 5,525 | |||||||||||||

|

Acquired intangible asset expensed to research in development

|

(7 | ) | 2,582 | - | 2,582 | - | |||||||||||||

|

Loss on sale/disposal of assets and technology

|

(8 | ) | 157 | 236 | 414 | 474 | |||||||||||||

|

Non-GAAP operating income

|

$ | 138,355 | $ | 136,702 | $ | 532,838 | $ | 504,357 | |||||||||||

|

Net income:

|

|||||||||||||||||||

|

GAAP net income

|

$ | 60,572 | $ | 54,522 | $ | 184,112 | $ | 173,420 | |||||||||||

|

Impact of signature file update

|

(1 | ) | - | - | 7,923 | - | |||||||||||||

|

Stock-based compensation expense

|

(2 | ) | 31,798 | 27,380 | 119,481 | 109,094 | |||||||||||||

|

Amortization of purchased technology

|

(3 | ) | 19,429 | 20,768 | 80,742 | 77,961 | |||||||||||||

|

Amortization of intangibles

|

(3 | ) | 7,152 | 10,118 | 29,743 | 40,718 | |||||||||||||

|

Restructuring charges

|

(4 | ) | 15,404 | 2,911 | 41,683 | 13,830 | |||||||||||||

|

Acquisition-related costs (benefits)

|

(5 | ) | 3,105 | (67 | ) | 16,598 | 34,448 | ||||||||||||

|

Litigation-related and other costs

|

(6 | ) | - | 3,200 | 4,250 | 5,525 | |||||||||||||

|

Acquired intangible asset expensed to research in development

|

(7 | ) | 2,582 | - | 2,582 | - | |||||||||||||

|

Loss on sale/disposal of assets and technology

|

(8 | ) | 157 | 236 | 414 | 474 | |||||||||||||

|

Marketable securities (accretion) impairment

|

(9 | ) | (348 | ) | (650 | ) | (1,499 | ) | 60 | ||||||||||

|

Provision (benefit) for income taxes

|

(10 | ) | (1,468 | ) | 17,011 | 45,528 | 50,803 | ||||||||||||

|

Non-GAAP income before provision for income taxes

|

138,383 | 135,429 | 531,557 | 506,333 | |||||||||||||||

|

Non-GAAP provision for income taxes

|

(11 | ) | 33,212 | 32,503 | 127,574 | 121,520 | |||||||||||||

|

Non-GAAP net income

|

$ | 105,171 | $ | 102,926 | $ | 403,983 | $ | 384,813 | |||||||||||

|

Net income per share - diluted: *

|

|||||||||||||||||||

|

GAAP net income per share - diluted

|

$ | 0.38 | $ | 0.34 | $ | 1.17 | $ | 1.09 | |||||||||||

|

Stock-based compensation expense per share

|

(2 | ) | 0.20 | 0.17 | 0.76 | 0.69 | |||||||||||||

|

Other adjustments per share

|

(1), (3 | )-(11) | 0.08 | 0.13 | 0.64 | 0.64 | |||||||||||||

|

Non-GAAP net income per share - diluted *

|

$ | 0.67 | $ | 0.64 | $ | 2.57 | $ | 2.42 | |||||||||||

|

Shares used to compute Non-GAAP net income per share - diluted

|

157,893 | 161,032 | 157,385 | 158,988 | |||||||||||||||

|

* Non-GAAP net income per share is computed independently for each period presented. The sum of GAAP net income per share

|

|||||||||||||||||||

|

and non-GAAP adjustments may not equal non-GAAP net income per share due to rounding differences.

|

|||||||||||||||||||

|

This presentation includes non-GAAP measures. Our non-GAAP measures are not meant to be considered in isolation or as a

|

|||||||||||||||||||

|

substitute for comparable GAAP measures, and should be read only in conjunction with our consolidated financial statements

|

|||||||||||||||||||

|

prepared in accordance with GAAP. For a detailed explanation of the adjustments made to comparable GAAP measures,

|

|||||||||||||||||||

|

the reasons why management uses these measures, the usefulness of these measures and the material limitations of these

|

|||||||||||||||||||

|

measures, see items (1) through (11).

|

|||||||||||||||||||

Items (1) through (11) on the “Reconciliation of GAAP to Non-GAAP Financial Measures” table are listed to the right of certain categories under “Net Revenue”, “Gross profit,” “Operating income,” “Net income” and “Net income per share - diluted” and correspond to the categories explained in further detail below under paragraphs (1) through (11).

The non-GAAP financial measures are non-GAAP net revenue, non-GAAP operating income, non-GAAP net income and non-GAAP net income per share — diluted, which adjust for the following items: the impact of signature file update, stock-based compensation expense, amortization of purchased technology and intangibles, restructuring charges, acquisition-related costs, loss on sale/disposal of assets and technology, litigation-related and other costs, marketable securities (accretion) impairment, income taxes and certain other items. We believe that the presentation of these non-GAAP financial measures is useful to investors, and such measures are used by our management, for the reasons associated with each of the adjusting items as described below:

|

|

(1)

|

Impact of signature file update primarily reflects the negative impact during the three months ended June 30, 2010, related to prior-period deferred revenue and additional costs incurred. The deferred revenue was originally scheduled to be recognized from the balance sheet and was delayed into future periods due to actions we took when providing customer care packages to our customers related to our release in April of an anti-virus signature file update that impacted some of our customers. We consider our operating results without this impact when evaluating our ongoing performance as we believe that the exclusion allows for more accurate comparisons of our financial results to previous periods. In addition, we believe it is useful to investors to understand the specific impact of the signature file update on our operating results.

|

|

|

(2)

|

Stock-based compensation expense consist of expense relating to stock-based awards issued to employees and outside directors including stock options, restricted stock awards and units, restricted stock units with performance-based vesting and our Employee Stock Purchase Plan. Because of varying available valuation methodologies, subjective assumptions and the variety of award types, the Company believes that the exclusion of stock-based compensation expense allows for more accurate comparisons of our operating results to our peer companies, and for a more accurate comparison of our financial results to previous periods. In addition, the Company believes it is useful to investors to understand the specific impact of stock-based compensation expense on our operating results.

|

|

|

(3)

|

Amortization of purchased technology and intangibles are non-cash charges that can be impacted by the timing and magnitude of our acquisitions. The Company considers its operating results without these charges when evaluating its ongoing performance and/or predicting its earnings trends, and therefore excludes such charges when presenting non-GAAP financial measures. The Company believes the assessment of its operations excluding these costs is relevant to its assessment of internal operations and comparisons to the performance of other companies in its industry.

|

|

|

(4)

|

Restructuring charges include excess facility and asset-related restructuring charges and severance costs resulting from reductions of personnel driven by modifications to the Company’s business strategy, such as acquisitions or divestitures. These costs may vary in size based on the Company’s restructuring plan. In addition, the Company’s assumptions are continually evaluated, which may increase or reduce the charges in a specific period. The Company’s management excludes these costs when evaluating its ongoing performance and/or predicting its earnings trends, and therefore excludes these charges when presenting non-GAAP financial measures.

|

|

|

(5)

|

Acquisition-related costs (benefits) include direct costs of the acquisition and expenses related to acquisition integration activities. Examples of costs directly related to an acquisition include transactions fees, due diligence costs, acquisition retention bonuses and severance, fair value adjustments related to contingent consideration, amounts or recoveries subject to escrow provisions, and certain legal costs related to acquired litigation. Additionally, we have included direct costs related to our pending acquisition by Intel. These expenses vary significantly in size and amount and are disregarded by the Company’s management when evaluating and predicting earnings trends because these charges are unique to specific acquisitions, and are therefore excluded by the Company when presenting non-GAAP financial measures.

|

|

|

(6)

|

Litigation-related and other costs are charges related to discrete and unusual events where the Company has incurred significant costs which, in the Company’s view, are not incurred in the ordinary course of operations. Examples of such charges include litigation and investigation-related charges. The Company’s management excludes these costs when evaluating its ongoing performance and/or predicting its earnings trends, and therefore excludes these charges when presenting non-GAAP financial measures. Further, the Company believes it is useful to investors to understand the specific impact of these charges on its operating results. In the third quarter of 2010, we combined the “Investigation-related and other costs” and “Legal settlements” line items which were previously reported separately into this line item for ease of presentation.

|

|

|

(7)

|

Acquired intangible asset expensed to research and development is related to the purchase of an intangible asset which was expensed to research and development. The Company’s management excludes this cost when evaluating its ongoing performance and/or predicting its earnings trends, and therefore excludes this cost when presenting non-GAAP financial measures. Further, the Company believes it is useful to investors to understand the specific impact of this cost on its operating results.

|

|

|

(8)

|

Loss on sale/disposal of assets and technology relate to the sale or disposal of assets of the Company. These losses or gains can vary significantly in size and amount. The Company’s management excludes these losses or gains when evaluating its ongoing performance and/or predicting its earnings trends, and therefore excludes these items when presenting non-GAAP financial measures. In addition, in periods where the Company realizes gains or incurs losses on the sale of assets and/or technology, the Company believes it is useful to investors to highlight the specific impact of these amounts on its operating results.

|

|

|

(9)

|

Marketable securities (accretion) impairment includes “other than temporary” declines in the fair value of our available-for-sale securities and subsequent recoveries of these losses. The Company’s management excludes these losses/income when evaluating the company’s ongoing performance and/or predicting earning trends, and therefore excludes these losses/income when presenting non-GAAP financial measures.

|

|

|

(10)

|

Provision for income taxes is our GAAP provision that must be added back to GAAP net income to reconcile to non-GAAP income before taxes.

|

|

|

(11)

|

Non-GAAP provision for income taxes reflects a 24% non-GAAP effective tax rate in 2010 and 2009 which is used by the Company’s management to calculate non-GAAP net income. For 2010 and 2009, management believed that the 24% effective tax rate was reflective of a long-term normalized tax rate under the global McAfee legal entity and tax structure as of the respective period end.

|

|

MCAFEE, INC. AND SUBSIDIARIES

|

|||||||||||||||||||||||||||

|

CONDENSED CONSOLIDATED GAAP REVENUE BY GEOGRAPHY

|

|||||||||||||||||||||||||||

|

(in thousands)

|

|||||||||||||||||||||||||||

|

(Unaudited)

|

|

Three Months Ended

|

Three Months Ended

|

Three Months Ended

|

Three Months Ended

|

Three Months Ended

|

Three Months Ended

|

||||||||||||||||||||||||||||||||||||||||||||

|

December 31, 2010

|

September 30, 2010

|

June 30, 2010

|

March 31, 2010

|

December 31, 2009

|

September 30, 2009

|

||||||||||||||||||||||||||||||||||||||||||||

|

McAfee North America

|

$ | 311,280 | 57 | % | $ | 312,279 | 60 | % | $ | 285,858 | 58 | % | $ | 284,197 | 57 | % | $ | 298,562 | 57 | % | $ | 273,464 | 56 | % | |||||||||||||||||||||||||

|

McAfee International

|

238,284 | 43 | % | 210,980 | 40 | % | 203,381 | 42 | % | 218,548 | 43 | % | 227,104 | 43 | % | 211,807 | 44 | % | |||||||||||||||||||||||||||||||

|

GAAP net revenue

|

$ | 549,564 | 100 | % | $ | 523,259 | 100 | % | $ | 489,239 | 100 | % | $ | 502,745 | 100 | % | $ | 525,666 | 100 | % | $ | 485,271 | 100 | % | |||||||||||||||||||||||||

|

McAfee North America

|

(1) | 2,893 | |||||||||||||||||||||||||||||||||||||||||||||||

|

McAfee International

|

(1) | 3,212 | |||||||||||||||||||||||||||||||||||||||||||||||

|

Non-GAAP adjustments

|

6,105 | ||||||||||||||||||||||||||||||||||||||||||||||||

|

McAfee North America

|

288,751 | 58 | % | ||||||||||||||||||||||||||||||||||||||||||||||

|

McAfee International

|

206,593 | 42 | % | ||||||||||||||||||||||||||||||||||||||||||||||

|

Non-GAAP net revenue

|

$ | 495,344 | 100 | % | |||||||||||||||||||||||||||||||||||||||||||||

|

This presentation includes a non-GAAP net revenue measure. Our non-GAAP net revenue measure is not meant to be considered in isolation or as a

|

|||||||||||||||||||||||||||

|

substitute for a comparable GAAP net revenue measure, and should be read only in conjunction with our consolidated financial statements

|

|||||||||||||||||||||||||||

|

prepared in accordance with GAAP. For a detailed explanation of the adjustment made to the comparable GAAP net revenue measure,

|

|||||||||||||||||||||||||||

|

the reasons why management uses this measure, the usefulness of this measure and the material limitations of this

|

|||||||||||||||||||||||||||

|

measure, see item (1) on the Reconciliation of GAAP to Non-GAAP Financial Measures.

|

|||||||||||||||||||||||||||

|

MCAFEE, INC. AND SUBSIDIARIES

|

||||||||||||||||||||||||||

|

CONDENSED CONSOLIDATED GAAP REVENUE BY PRODUCT GROUPS

|

||||||||||||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||||||||

|

(Unaudited)

|

|

Three Months Ended

|

Three Months Ended

|

Three Months Ended

|

Three Months Ended

|

Three Months Ended

|

Three Months Ended

|

||||||||||||||||||||||||||||||||||||||||||||

|

December 31, 2010

|

September 30, 2010

|

June 30, 2010

|

March 31, 2010

|

December 31, 2009

|

September 30, 2009

|

||||||||||||||||||||||||||||||||||||||||||||

|

McAfee Corporate

|

$ | 340,189 | 62 | % | $ | 323,897 | 62 | % | $ | 298,449 | 61 | % | $ | 312,507 | 62 | % | $ | 337,910 | 64 | % | $ | 308,573 | 64 | % | |||||||||||||||||||||||||

|

McAfee Consumer

|

209,375 | 38 | % | 199,362 | 38 | % | 190,790 | 39 | % | 190,238 | 38 | % | 187,756 | 36 | % | 176,698 | 36 | % | |||||||||||||||||||||||||||||||

|

GAAP net revenue

|

$ | 549,564 | 100 | % | $ | 523,259 | 100 | % | 489,239 | 100 | % | $ | 502,745 | 100 | % | $ | 525,666 | 100 | % | $ | 485,271 | 100 | % | ||||||||||||||||||||||||||

|

McAfee Corporate

|

(1) | 6,105 | |||||||||||||||||||||||||||||||||||||||||||||||

|

McAfee Consumer

|

(1) | - | |||||||||||||||||||||||||||||||||||||||||||||||

|

Non-GAAP adjustments

|

6,105 | ||||||||||||||||||||||||||||||||||||||||||||||||

|

McAfee Corporate

|

304,554 | 61 | % | ||||||||||||||||||||||||||||||||||||||||||||||

|

McAfee Consumer

|

190,790 | 39 | % | ||||||||||||||||||||||||||||||||||||||||||||||

|

Non-GAAP net revenue

|

$ | 495,344 | 100 | % | |||||||||||||||||||||||||||||||||||||||||||||

|

This presentation includes a non-GAAP net revenue measure. Our non-GAAP net revenue measure is not meant to be considered in isolation or as a

|

||||||||||||||||||||||||||

|

substitute for a comparable GAAP net revenue measure, and should be read only in conjunction with our consolidated financial statements

|

||||||||||||||||||||||||||

|

prepared in accordance with GAAP. For a detailed explanation of the adjustment made to the comparable GAAP net revenue measure,

|

||||||||||||||||||||||||||

|

the reasons why management uses this measure, the usefulness of this measure and the material limitations of this

|

||||||||||||||||||||||||||

|

measure, see item (1) on the Reconciliation of GAAP to Non-GAAP Financial Measures.

|

||||||||||||||||||||||||||

|