Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DELCATH SYSTEMS, INC. | form8k.htm |

Exhibit 99.1

Investor Presentation

February 2011

NASDAQ: DCTH

Concentrating the Power of Chemotherapy TM

2

Forward-looking Statements

This presentation contains forward-looking statements, within the meaning of federal

securities laws, related to future events and future financial performance which

include statements about our expectations, beliefs, plans, objectives, intentions,

goals, strategies, assumptions and other statements that are not historical facts.

Forward-looking statements are subject to known and unknown risks and

uncertainties and are based on potentially inaccurate assumptions, which could

cause actual results to differ materially from expected results, performance or

achievements expressed or implied by statements made herein. Our actual results

could differ materially from those anticipated in forward-looking statements for many

reasons, including, the progress of our research and development programs and

future clinical trials; acceptance of our New Drug Application by the FDA and

approval thereof, acceptance of our CE mark Technical File by our Notified Body and

approval thereof; our ability to successfully commercialize the Delcath

Chemosaturation System in the United States and foreign markets and any

corresponding revenue, our ability to enter into distribution and strategic alliances in

the US and foreign markets and any corresponding revenue, the actions of

regulatory authorities; our ability to obtain reimbursement coverage for the

Chemosaturation System; overall economic conditions; the availability of capital;

and other factors described in the section entitled ‘‘Risk Factors’’ in our most recent

Annual Report on Form 10-K and the Quarterly Reports on Form 10-Q that we file

with the Securities and Exchange Commission.

securities laws, related to future events and future financial performance which

include statements about our expectations, beliefs, plans, objectives, intentions,

goals, strategies, assumptions and other statements that are not historical facts.

Forward-looking statements are subject to known and unknown risks and

uncertainties and are based on potentially inaccurate assumptions, which could

cause actual results to differ materially from expected results, performance or

achievements expressed or implied by statements made herein. Our actual results

could differ materially from those anticipated in forward-looking statements for many

reasons, including, the progress of our research and development programs and

future clinical trials; acceptance of our New Drug Application by the FDA and

approval thereof, acceptance of our CE mark Technical File by our Notified Body and

approval thereof; our ability to successfully commercialize the Delcath

Chemosaturation System in the United States and foreign markets and any

corresponding revenue, our ability to enter into distribution and strategic alliances in

the US and foreign markets and any corresponding revenue, the actions of

regulatory authorities; our ability to obtain reimbursement coverage for the

Chemosaturation System; overall economic conditions; the availability of capital;

and other factors described in the section entitled ‘‘Risk Factors’’ in our most recent

Annual Report on Form 10-K and the Quarterly Reports on Form 10-Q that we file

with the Securities and Exchange Commission.

3

Company Highlights

§ Focused on making established chemotherapeutic drugs work better in target organs

§ Chemosaturation delivers ultra-high dose chemotherapy to the liver

§ Successful Phase III trial results reported

§ Filed NDA for orphan drug and delivery apparatus and CE Mark for device

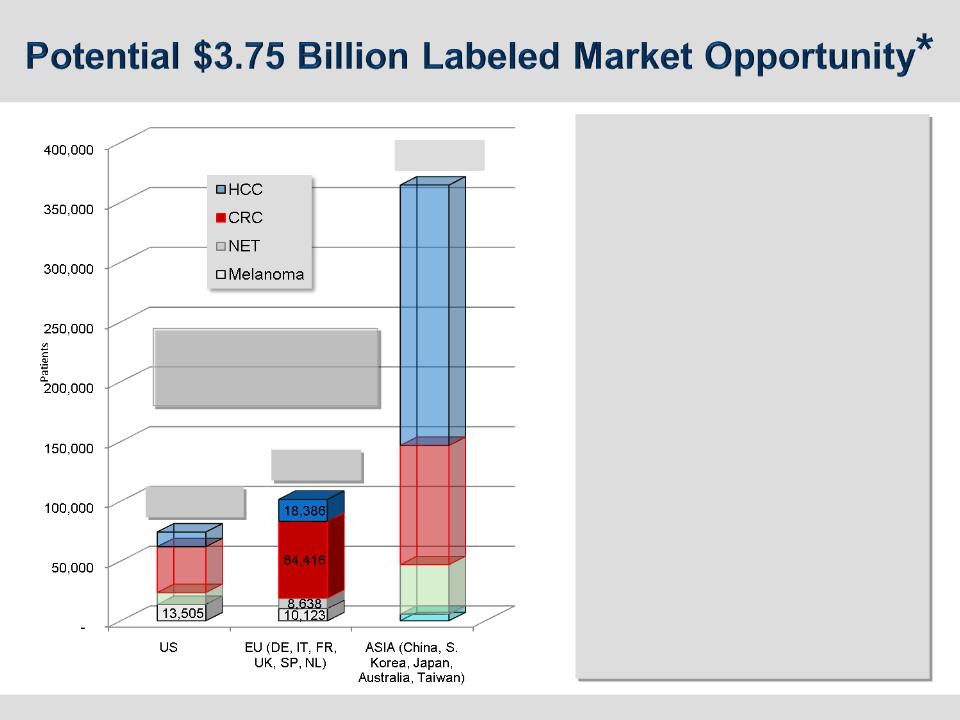

§ Positioned to address $3.0 billion European labeled market opportunity

§ Positioned to address $675 million US labeled market opportunity

§ Issued patents and orphan drug designations create competitive barriers

§ Deep and experienced management team

Concentrating the Power of Chemotherapy

4

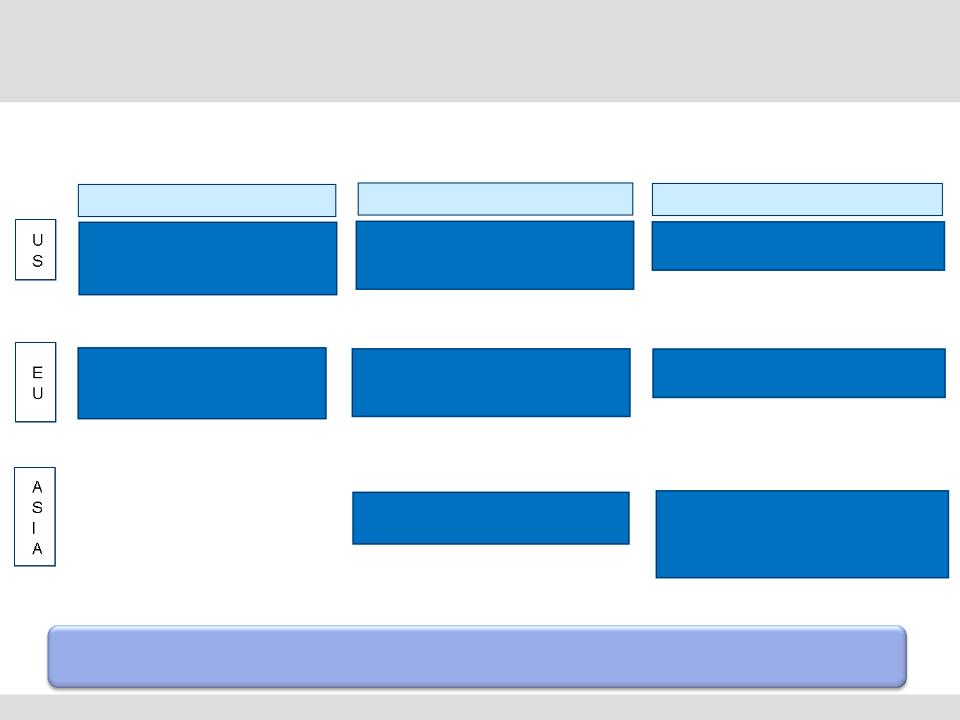

• Seeking initial indication for

Melanoma liver mets in USA

Melanoma liver mets in USA

• Seeking general indication in

EU for delivery of melphalan

to the liver permits physican

use on a broad range of liver

cancers

EU for delivery of melphalan

to the liver permits physican

use on a broad range of liver

cancers

• Asia potentially requires long

term clinical development

pathway

term clinical development

pathway

• Australia- Niche opportunity

(high melanoma incidence) -

device approval following EU

CE Mark

(high melanoma incidence) -

device approval following EU

CE Mark

• Significant potential label

expansion opportunity

expansion opportunity

Transparent Areas

Represent Potential

Additional Indications

Represent Potential

Additional Indications

13,505**

101,563

355,712

*TPM Total Potential Market

**TPM for potential U.S. labeled indications only

Spectrum of Liver Cancer Treatments

Existing Treatments Involve Significant Limitations

Type of Treatment

Advantages

Disadvantages

Systemic

ü

Non

-

invasive

ü

Repeatable

-

Systemic toxicities

-

Limited efficacy in liver

Regional

(

e.g.

,

IHP)

ü

Therapeutic effect

ü

Targeted

-

Invasive/limited repeatability

-

Multiple treatments are

required

Focal

ü

Isolated removal of tumor

-

90% unresectable

-

Invasive and/or limited

repeatability

6

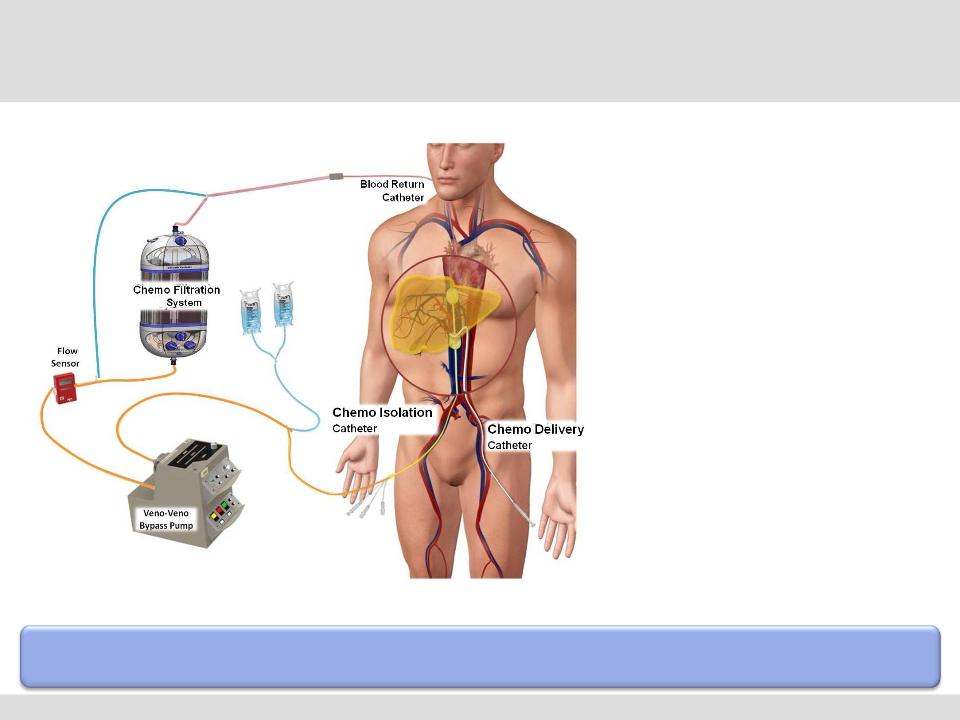

Advantages of

Chemosaturation

Chemosaturation

§ ISOLATION

§ Treats entire liver

§ SATURATION

§ Allows for ~ 100x

effective dose

escalation of drug

agents at tumor site

effective dose

escalation of drug

agents at tumor site

§ FILTRATION

§ Controls systemic

toxicities

toxicities

The Delcath Chemosaturation System

Note: Image not to scale.

Converts Traumatic Open Surgery to Minimally Invasive, Repeatable Procedure

7

Melphalan Dosing & Background

§ Well understood, dose dependant, tumor preferential, alkylating cytotoxic agent that

demonstrates no hepatic toxicity

demonstrates no hepatic toxicity

§ Manageable systemic toxicities associated with Neutropenia and Cytopenia

§ Drug dosing over 10x higher than FDA-approved dose via systemic IV chemotherapy

§ Dose delivered to tumor is approximately 100x higher than that of systemic IV

chemotherapy

chemotherapy

A Great Drug For Liver Cancer Therapy

Type

Dosing (mg/kg)

Multiple Myeloma (label)

0.25

Chemoembolization

0.6

2

Surgical Isolated Hepatic Perfusion (IHP)

1.5

0

Myeloablation

2.50

-

3.50

Chemosaturation (PHP)

3.00

8

What Chemosaturation Offers

Attractive Clinical and Economic Proposition For Patient and Providers

Patients:

• Significant improvement in disease control in the liver compared to standard

of care in patients with unresectable hepatic melanoma mets

of care in patients with unresectable hepatic melanoma mets

• Manageable systemic toxicities

• Time, so that primary cancers can continue to be treated

Physicians:

• Novel, targeted liver directed treatment to complement other cancer therapies

• Repeatable, percutaneous procedure

• Ability to treat the entire liver, including both visible and micro tumors

• Ability to continue treating patients for extra-hepatic disease

9

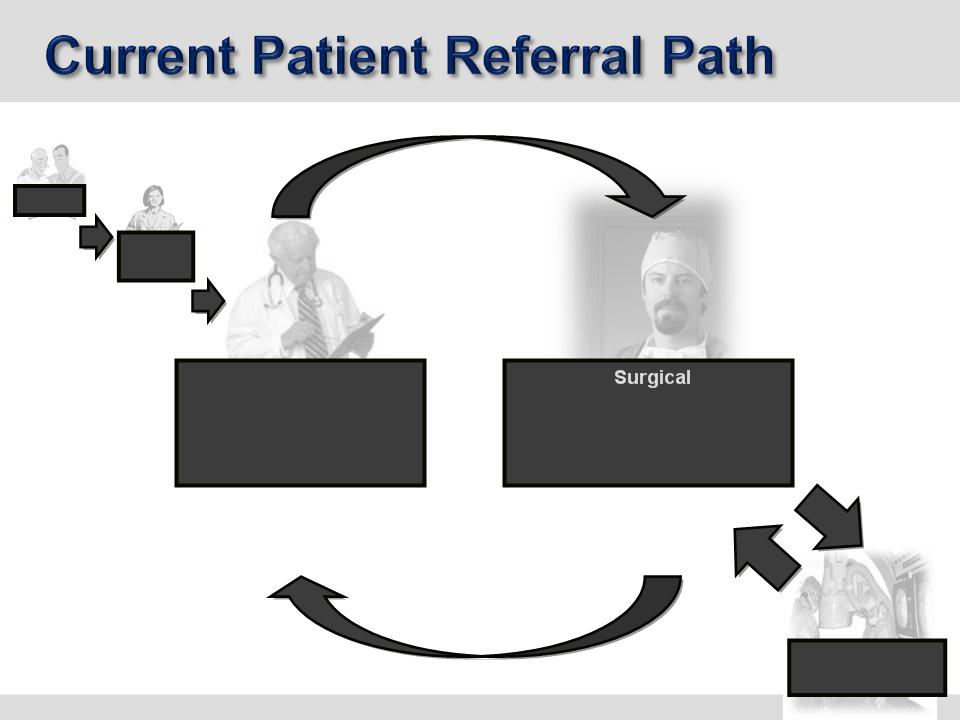

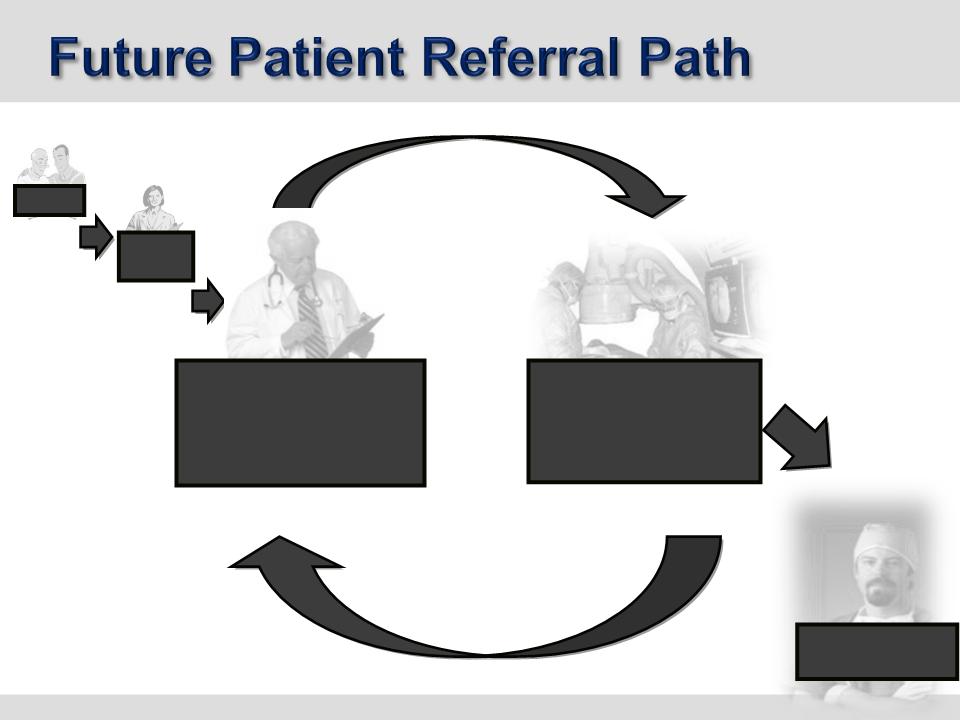

Interventional

Radiologist

Patient

Primary

Care

Medical

Oncologist

Offers systemic therapy to

treat Cancer

treat Cancer

Surgical

Oncologist

Offers resection or other focal

therapy to treat cancer in Liver

therapy to treat cancer in Liver

Transferred for

chemosaturation

chemosaturation

Diagnosis of

Cancer

Identification of liver

involvement

involvement

with no improvement

from systemic

therapy

from systemic

therapy

When liver disease is

controlled, patients return to

the Medical Oncologist for

additional systemic therapy

controlled, patients return to

the Medical Oncologist for

additional systemic therapy

10

Interventional

Radiologist

Offers Chemosaturation

therapy

therapy

Patient

Primary

Care

Surgical

Oncologist

Diagnosis of

Cancer

Cancer

Resection

Medical

Oncologist

Offers systemic therapy to

treat cancer

treat cancer

Identification of liver

involvement

involvement

with no improvement

from systemic

therapy

from systemic

therapy

When liver disease is

controlled, patients return to

the Medical Oncologist for

additional systemic therapy

controlled, patients return to

the Medical Oncologist for

additional systemic therapy

11

Summary of Phase III Results

§ Primary endpoint exceeded

§ Secondary endpoints support results

§ OS cohort analysis - favorable

§ Safety profile - expected and consistent with

currently approved labeling for melphalan

currently approved labeling for melphalan

Trial Outcomes Favorable and Consistent with Special Protocol Assessment

12

Phase III Clinical Trial Design

Randomized to CS

92 patients: ocular

or cutaneous melanoma

CS/Melphalan

Treat every 4 weeks x 4 rounds

(responders can receive up to 6 rounds)

Best Alternative Care (BAC)

Investigator and patient decision

(any and all treatments)

Cross-over

Primary Trial Endpoint

§ Statistically significant difference in Hepatic

Progression Free Survival (“hPFS”): p < 0.05

Progression Free Survival (“hPFS”): p < 0.05

§ Over 80% of Oncologic drugs approved by FDA

between 2005 - 2007 on endpoints other than

overall survival

between 2005 - 2007 on endpoints other than

overall survival

Modeled hPFS for Trial Success:

7.73 months (CS)

vs.

4 months (BAC)

Secondary Trial Endpoints

§ Hepatic response and duration of hepatic response

§ Overall response and duration of overall response

§ Overall Survival - Diluted by Cross Over

§ SAP calls for analysis of various patient cohorts

Fully Powered, 93 Patient, Randomized, Multi-Center NCI Led Study

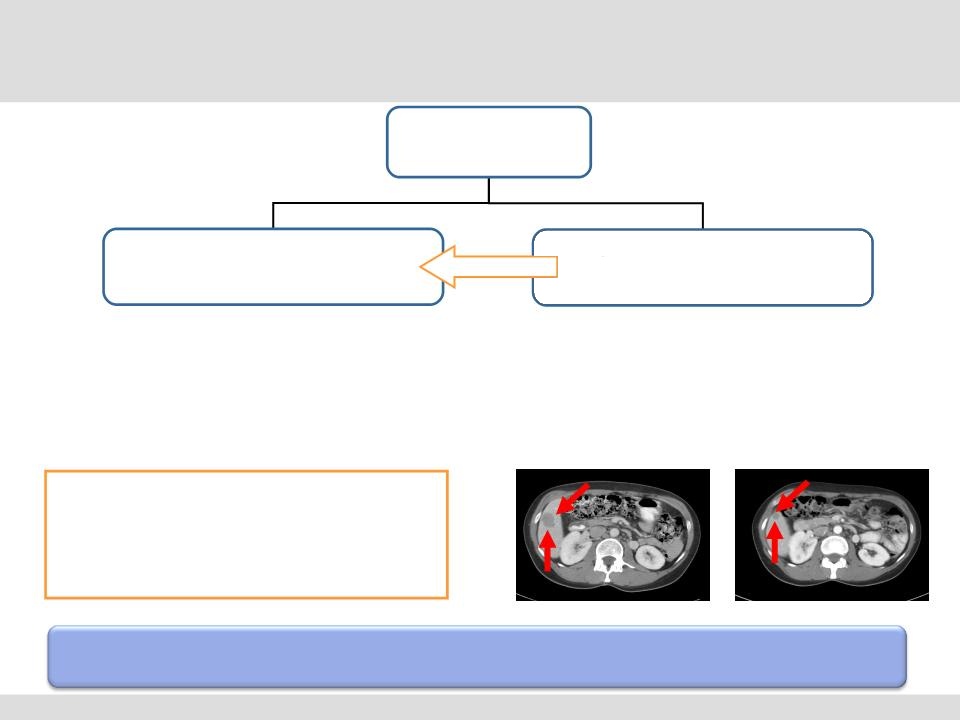

Pre-CS (Baseline)

Post-CS (22+ Months)

Hepatic Response - Metastatic Melanoma

13

ASCO Presentation of Phase III Clinical Trial Results

§ Trial results exceed primary endpoint expectations; p value = 0.001

§ Treatment arm shows 5x median hPFS compared to control arm

§ CS/PHP median hPFS of 245 days compared to 49 days for BAC

§ Hazard Ratio = .301

§ Patients failed prior therapies (radiation, chemo, immuno, image guided local)

§ 90% Ocular, 10% Cutaneous - No difference in response

§ Overall PFS 186 vs. 46 days for BAC

§ 34% response rate for CS/PHP compared to 2% for BAC

§ 52% stable disease for CS/PHP compared to 27% for BAC

§ 86% overall clinical benefit (CR + PR + SD)

Strong Clinical Trial Results

14

ASCO Presentation of Phase III Clinical Trial (cont.)

§ Majority of BAC patients crossed over and obtained similar response from treatment

§ Total 93 patient trial - 10 months median OS vs. 4 months expected 1 (due to cross over provision, most

patients received PHP/CS treatment)

patients received PHP/CS treatment)

§ OS cohort analysis - all positive trends

a) Median survival of 298 days for treatment arm compared to 124 in non-cross over BAC patients

b) Median survival of 398 days for BAC cross Over patients vs. 124 non-cross over BAC patients

§ OS Secondary endpoint - No difference in Kaplan-Meier curves(due to cross over treatment response)

§ Safety profile as expected - in line with current FDA approved labeling for IV administration of Melphalan

and Phase I CS/PHP study results

and Phase I CS/PHP study results

a) Treatment related Deaths:

§ 3/40 patients (7.5%) 3/116 procedures (2.6%)

§ Neutropenic Sepsis (n=2) 5%, Hepatic Failure (n=1) 2.5% (95% tumor burden)

§ Current approved labeling for Melphalan - 3% to 10% mortality rate.

b) Instituting REMS (Risk Evaluation & Mitigation Strategy) to address proper management associated with safe

use.

use.

Encouraging Survival Data With Expected Safety Profile

1 Source: Unger et. al. Cancer 2001;91: 1148

15

Phase I/II NCI Trials - Neuroendocrine

Neuroendocrine Tumor Trial Results (n=23)*

Promising Initial Response Rate in Attractive Market

Pre-CS

(Baseline)

Post-CS #2

(+4 Months)

Post-CS #1

(+6 Weeks)

*Presentation at American Hepato-Pancreato-Biliary Association 2008 annual meeting

Number (n)

Carcinoid

3

Pancreatic Islet Cell

17

Not Evaluable

(Toxicity

, Incomplete Treatment

Orthotopic

L

iver

T

ransplantation

)

4

Progressive Disease

1

Minor Response

/

Stable

D

isease

3

Partial Response (30.0%

-

99.0% Tumor Reduction)

13

Complete Response (No Evidence of Disease)

2

Objective Tumor Response

15

Objective Tumor Response Rate

79%

Duration (months)

Median Hepatic PFS

39

Overall Survival After

CS

40

16

Product Development Pipeline

Robust Development Program Planned

• Melanoma liver mets

• Proprietary drug-melphalan &

apparatus

apparatus

• All liver cancers - melphalan

• Class III device

• 3rd party melphalan

• Additional drugs

• Other organs

• Broaden label

• Other liver cancers - melphalan

• Apparatus improvements

Initial Opportunity

Near Term (< 5 years)

Intermediate Term (> 5 years)

• Primary liver cancer (HCC)

• Drug-melphalan & apparatus

• Proprietary melphalan drug

approval

approval

• Apparatus improvements

• Additional drugs

• Other organs

• Broaden label

• Other liver cancers - melphalan

• Additional drugs

• Other organs

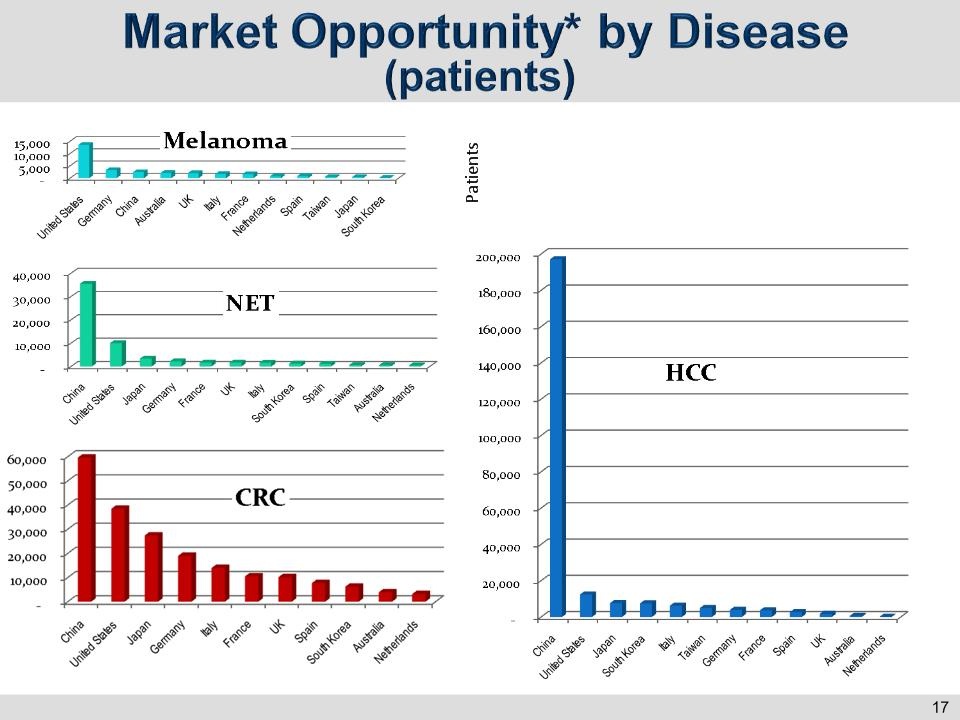

• US - largest opportunity for Melanoma

• China - largest opportunity for HCC

• CRC - largest opportunity worldwide

*TPM Total Potential Market

§ CE Mark approval in EU-covers 29 countries

§ 14 Countries currently have Melphalan for

injection commercially available

injection commercially available

§ Belgium (BE), Czech Republic (CZ), Germany (DE), Estonia (EE), Spain (ES), France

(FR), Ireland (IE), Italy (IT), Lithuania (LT), Luxembourg (LU), Netherlands (NL), Sweden

(SE), Slovakia (SK), United Kingdom (UK).

(FR), Ireland (IE), Italy (IT), Lithuania (LT), Luxembourg (LU), Netherlands (NL), Sweden

(SE), Slovakia (SK), United Kingdom (UK).

§ 6 initial target countries (DE, UK, FR, IT, SP, NL)

represent 89% of total potential market

represent 89% of total potential market

Germany

(Direct)

UK

(Direct)

France

(Indirect)

Italy

(Indirect)

Spain

(Indirect)

Netherlands

(Direct)

Total Potential

(patients)

Potential Market

($ millions)1,2,3

Total Potential Market #Patients

Ocular Melanoma

Cutaneous Melanoma

403

2,834

296

1,735

294

1,314

284

1,398

197

628

79

662

1,553

8,571

$46.6

CRC

18,978

10,155

10,490

13,952

7,694

3,151

64,420

$257.1

$1,932.6

$551.6

$259.2

HCC (Primary)

3,941

1,734

3,645

6,253

2,616

197

18,386

NET

2,168

1,624

1,645

1,579

1,185

438

8,639

TOTAL

25,087

13,513

15,780

21,784

11,495

3,786

91,445

$3,047.1

Europe is Potential $3.0 Billion Market Opportunity for Device Only

1. Assumes 2.5 treatments per patient

2. Assumes ASP of $12K (device only)

3. Assumes mix of direct sales and distributors

Germany

(Direct)

UK

(Direct)

France

(Indirect)

Italy

(Indirect)

Spain

(Indirect)

Netherlands

(Direct)

Total Potential

(patients)

Potential Market

($ millions)1,2,3

Total Potential Market #Patients

Ocular Melanoma

403

296

294

284

197

79

1,553

Cutaneous Melanoma

2,834

1,735

1,314

1,398

628

662

8.571

$62.1

$342.8

$2,576.8

$735.5

$345.6

CRC

HCC (Primary)

18,978

3,941

10,155

1,734

10,490

3,645

13,952

6,253

7,694

2,616

3,151

197

64,420

18,386

NET

2,168

1,624

1,645

1,579

1,185

438

8,639

TOTAL

25,087

13,513

15,780

21,784

11,495

3,786

91,445

$4,062.8

1. Assumes 2.5 treatments per patient

2. Assumes ASP of $16K, when Delcath branded melphalan is available

3. Assumes mix of direct sales and distributors

Europe Represents Potential $4.1 Billion Market Opportunity

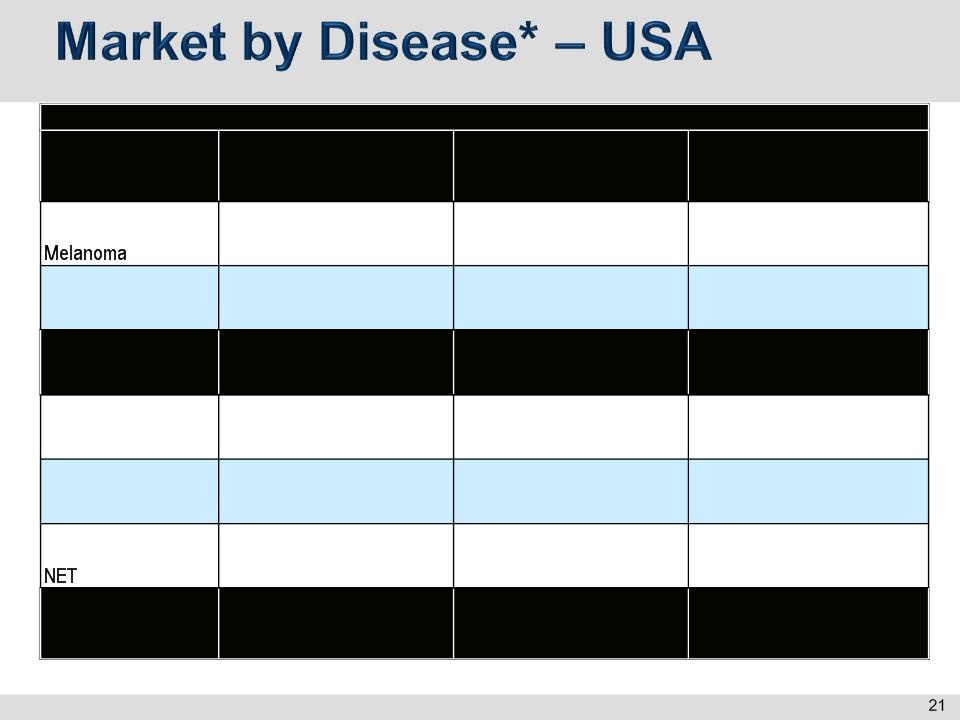

Liver Metastasis

Potential Market

# Patients

Potential Market

# Procedures

(Avg 2.5/patient)

Potential Market ($MM)

$20K ASP **

Ocular

1,622

4,055

$81.1

Cutaneous

Melanoma

11,883

29,708

$594.2

TOTAL MELANOMA

(Initial Expected Label)

13,505

33,763

$675.3

CRC

38,423

96,057

$1,921.1

HCC (Primary)

12,386

30,964

$619.3

9,986

24,965

$499.3

TOTAL OTHER

(Potential Label

Expansion)

Expansion)

60,794

151,985

$3,039.7

*TPM Total Potential Market

** Estimated ASP

China

(Drug)

S. Korea

(Drug)

Japan

(Device)

Taiwan

(Drug)

Australia

(Device)

Total Potential

(patients)

Potential

Market 1,2,3,4

Market 1,2,3,4

HCC (Primary)

197,082

7,486

7,625

4,945

604

217,742

$4,899.2

CRC

59,644

6,219

27,396

2,762

3,891

99,912

$2,248.0

NET

35,503

1,275

3,355

608

562

41,303

$929.3

Ocular Melanoma

1,760

66

175

31

96

2,128

$47.9

Cutaneous

Melanoma

Melanoma

667

74

238

429

1,996

3,404

$76.6

OTHER TOTAL

292,229

14,980

38,376

8,315

5,057

358,957

$8,201.0

1. Assumes 2.5 treatments per patient

2. Assumes ASP of $9K

3. Assumes mix of systems with and without Delcath branded melphalan

4. Assumes sales by distributors

Asia Represents Potential $8.2 Billion Market Opportunity

Reimbursement Strategy

Reimbursement is a Multi-Faceted Work in Progress

• Have retained leading reimbursement consultants

• Seek chemosaturation specific codes in U.S.:

Physician:

§ While undergoing FDA review, apply for CPT Category III code

§ Convert the Category III code to Category I following FDA approval

Hospital:

§ Apply for new ICD-9/10 procedure code to capture full procedure of

hepatic isolation and chemosaturation

hepatic isolation and chemosaturation

§ Request new DRG based on costs above those of existing DRGs and

clinical dissimilarity to other hepatic procedures in current DRGs

clinical dissimilarity to other hepatic procedures in current DRGs

• Europe: developing plans for initial focus countries

Three-Pronged Business Strategy

Commercialization

§ Gain regulatory approval

• Goal: receive CE approval for Class III device mid 2011

• Goal: receive FDA approval for drug and delivery system mid 2011

• Goal: receive EU approval for proprietary drug 2014

§ Build out direct specialty sales force for U.S.

§ Direct and Distribution partners OUS

Pursue Asian Strategic Alliances

§ Chi-Fu Trading Company Ltd. signed 2/9/2010 for Taiwan

§ Proprietary drug and delivery apparatus approval for HCC

Establish U.S. and EU Pharma Alliances

§ Co-develop and fund additional indications for Delcath Chemosaturation

System™

System™

Combination of Direct Sales Model, Partnerships & Distributors

2011 European Commercialization

§ Initially Target 6 Markets

§ 7 Sales territories initially to cover UK, Germany, Netherlands (Sales

and Medical Science Liaisons)

and Medical Science Liaisons)

§ Distributors in Spain, Italy, & France

§ 5 Clinical Specialists to support site initiations and training

§ Establish EU Centers of Excellence for Training and Support

Direct Sales Model in Northern Europe & Distributors in Southern Europe

2011 US Commercialization

§ Initial focus on top 50 cancer centers and referring community

hospitals

hospitals

§ 12 Sales & Medical Science Liaison territories ultimately

expanding to as many as 60 territories as revenues ramp

expanding to as many as 60 territories as revenues ramp

§ 5 Clinical Specialists to support site initiation and training

§ Utilize top centers from Phase III trial as Centers of Excellence

for training and support

for training and support

Direct Sales Model in the United States Focused on Leading Cancer Centers

Intellectual Property

Patent Protection

§ 7 issued U.S. patents, 10 foreign patents issued and 4 pending

§ Primary device patent set to expire August 2016

§ Post FDA approval up to 5 years of patent extension possible

FDA Protection

§ Orphan Drug Designation granted for melphalan in the treatment of ocular

melanoma, cutaneous melanoma and metastatic neuroendocrine tumors, as well as

for doxorubicin in the treatment of HCC

melanoma, cutaneous melanoma and metastatic neuroendocrine tumors, as well as

for doxorubicin in the treatment of HCC

§ Additional Orphan Drug applications to be filed for other drugs and indications,

including HCC and CRC

including HCC and CRC

Multiple Levels of Protection

Significant Combination Product Approval and Commercialization Experience

Deep and Experienced Management Team

Executive

Title

Prior Affiliation

(s)

Years of

Experience

Eamonn Hobbs

President and CEO

AngioDynamics

, E

-

Z

-

EM

30

David McDonald

CFO

AngioDynamics, RBC Capital Markets

2

8

Krishna Kandarpa, M.D., Ph.D.

CMO and EVP, R&D

Harvard, MIT, Cornell, UMass

3

7

Agu

stin Gago

EVP, Global Sales &

Marketing

AngioDynamics, E

-

Z

-

EM

2

9

Peter Graham

, J.D.

EVP & General Counsel

Bracco, E

-

Z

-

EM

1

6

John Purpura

EVP, Regulatory Affairs &

Quality Assurance

E

-

Z

-

EM,

S

anofi

-

A

ventis

2

7

Bill Appling

S

VP

Operations & Medical

Device R&D

AngioDynamics

25

Bernie Tyrrell

SVP N. American Sales &

Marketing

Epicept

, Otsuka,

Astra Zeneca,

Johnson &

Johnson, Eli Lilly

33

Dan Johnston

, Ph.D.

VP, Pharma R&D

Pfizer, Wyeth

10

Financials

Financial Summary

Financial & Operating Overview

§ Follow On Offerings: Raised ~ $70 million in last twelve months

§ Burn Rate: Approximately $2.2 million/month

§ Cash: ~ $54.1 million at September 31, 2010

§ Debt: None

§ Shares Out: 42.9 million (49.3 million fully diluted*)

§ Institutional Ownership: ~ 21% at September 30, 2010

§ Market Capitalization: ~ $406 million as of January 31, 2011

§ Avg. Daily Volume (3 mos) ~ 906,000

* As of January 31, 2011 fully diluted includes an additional 3.8 million options at $4.98, 2.5 million warrants at $3.51, and 134,257 unvested restricted shares.

Capital Structure Strengthened Significantly in 2010

Company Highlights

§ Focused on making established chemotherapeutic drugs work better in target organs

§ Chemosaturation delivers ultra-high dose chemotherapy to the liver

§ Successful Phase III trial results reported

§ Filed NDA for orphan drug and delivery apparatus and CE Mark for device

§ Positioned to address $3.0 billion European labeled market opportunity

§ Positioned to address $675 million US labeled market opportunity

§ Issued patents and orphan drug designations create competitive barriers

§ Deep and experienced management team

Concentrating the Power of Chemotherapy

Appendix I. - Delcath Sources for Market Estimates

American Cancer Society. Cancer Facts & Figures 2010. Atlanta: American Cancer Society; 2010.

Alexander, Richard H., David L. Bartlett, and Steven K. Libutti. "Current Status of Isolated Hepatic Perfusion With or Without Tumor

Necrosis Factor for the Treatment of Unresectable Cancers Confined to the Liver." The Oncologist 5 (2000): 416-24.

Necrosis Factor for the Treatment of Unresectable Cancers Confined to the Liver." The Oncologist 5 (2000): 416-24.

Blake, Simon P., Karen Weisinger, Michael B. Atkins, and Vassilios Raptopoulos. "Liver Metastases from Melanoma: Detection with

Multiphasic Contrast Enhanced CT." Radiology 213 (1999): 92-96. Print

Multiphasic Contrast Enhanced CT." Radiology 213 (1999): 92-96. Print

Ferlay J, Shin HR, Bray F, Forman D, Mathers C and Parkin DM.

GLOBOCAN 2008, Cancer Incidence and Mortality Worldwide: IARC CancerBase No. 10 [Internet].

Lyon, France: International Agency for Research on Cancer; 2010. Available from: http://globocan.iarc.fr

GLOBOCAN 2008, Cancer Incidence and Mortality Worldwide: IARC CancerBase No. 10 [Internet].

Lyon, France: International Agency for Research on Cancer; 2010. Available from: http://globocan.iarc.fr

Nawaz Khan, Ali, Sumaira MacDonald, Ajay Pankhania and David Sherlock. "Liver, Metastases: [Print] - EMedicine Radiology."

Liver, Metastases. EMedicine - Medical Reference, 10 Feb. 2009. Web. <http://emedicine.medscape.com/article/369936-print>.

Liver, Metastases. EMedicine - Medical Reference, 10 Feb. 2009. Web. <http://emedicine.medscape.com/article/369936-print>.

Neuroendocrine Tumors. Practice Guidelines in Oncology- v.2.2009. National Comprehensive Cancer Network (NCCN). 2009.

Pawlik, Timothy M., Daria Zorzi, Eddie K. Abdalla, Bryan M. Clary, Jeffrey E. Gershenwald, Merrick I. Ross, Thomas A. Aloia,

Steven A. Curley, Luis H. Camacho, Lorenzo Capussotti, Dominique Elias, and Jean-Nicolas Vauthey. "Hepatic Resection for

Metastatic Melanoma: Distinct Patterns of Recurrence and Prognosis for Ocular Versus Cutaneous Disease." Annals of Surgical

Oncology 13.5 (2006): 712-20.

Steven A. Curley, Luis H. Camacho, Lorenzo Capussotti, Dominique Elias, and Jean-Nicolas Vauthey. "Hepatic Resection for

Metastatic Melanoma: Distinct Patterns of Recurrence and Prognosis for Ocular Versus Cutaneous Disease." Annals of Surgical

Oncology 13.5 (2006): 712-20.