Attached files

| file | filename |

|---|---|

| 8-K - BLUEGREEN VACATIONS CORP | i00048_bxg-8k.htm |

Statements in this presentation may constitute forward looking statements and are made pursuant to the Safe Harbor Provision of the Private Securities Litigation Reform Act of 1995. Forward looking statements are based largely on expectations and are subject to a number of risks and uncertainties including but not limited to the risks and uncertainties associated with economic, credit market, competitive and other factors affecting the Company and its operations, markets, products and services, as well as the risk that the Company may not be able to refinance or restructure outstanding debt; the Company’s strategic initiatives are not maintained successfully, do not have the expected impact on the Company’s financial position, results or operations, liquidity, and credit prospects; the performance of the Company’s vacation ownership notes receivable may continue to deteriorate in the future; the Company may not be in a position to draw down on its existing credit lines or may be unable to renew, extend or replace such lines of credit; the Company may require new credit lines to provide liquidity for its operations, including facilities to sell or finance its notes receivable; the Company may not be able to obtain or diversify its liquidity sources; the Company many not be able to successfully securitize additional timeshare loans or obtain adequate receivable-backed credit facilities in the future; real estate inventories, notes receivable, retained interests in notes receivable sold or other assets will be determined to be impaired in the future; risks relating to pending or future litigation, claims and assessments; sales and marketing strategies related to Resorts and Communities properties may not be successful; retail prices and homesite yields for Communities properties may be below the Company’s estimates; marketing costs will increase and not result in increased sales; sales to existing owners will not continue at current levels; fee-based service initiatives may not be successful; deferred sales may not be recognized to the extent or at the time anticipated; consolidation of special-purpose finance entities will result in different adjustments and charges than anticipated; and the risks and other factors detailed in the Company’s SEC filings, including its most recent Annual Report on Form 10-K filed on March 31, 2010 and Form 10-Q filed on November 10, 2010.

Safe Harbor

Leading international leisure/hospitality management & marketing

company.

4TH

Largest (1)

publicly-held timeshare operator with desirable vertical

integration.

Flexible Vacation Club product with broad national footprint, which

diversifies risk.

Strong emphasis on customer experience.

Attractive demographic profile.

Successfully executing core strategy of growing its base of recurring,

Fee-Based

Service revenues.

Experienced management team, successfully navigating the recent

recession/credit

crisis.

In 2009, improved operating/investing cash flows by $275.6 million.

Company Profile

(1) Based on VOI Sales

Bluegreen Resorts

Vacation Ownership Interests sold through

real-estate based Bluegreen Vacation

Club®

More than 160,000 owners in the Bluegreen

Vacation Club

56 in-network resorts, near “drive-to”

vacation destinations and Aruba

Access to 21 Shell Vacations Club Resorts

through “Select Connections”

partnership

Bluegreen Vacation Club

Vacation Ownership with Flexibility, Quality and Value

Owners get the flexibility of stays at any of 56 in-network resorts a points-based

reservation system, not an internal exchange.

Owners receive an annual or biennial allotment of vacation points that are used as

internal “currency” for vacation lodging.

While Owners hold a beneficial ownership in a deeded real estate timeshare interest in

a

specific resort (held in trust on their behalf), that resort is irrelevant to their use rights

beyond the number of vacation points

associated with that timeshare interest.

Reservations can be for

as little as two nights. Every resort, every season, every unit size and

every day of the week has a set

“cost” denominated in points.

No per-stay charges.

Ability to use additional “Bonus Time” nights for cash, if so desired.

Owners can also access over 4,000 participating timeshare resorts in over 100

countries through Resort

Condominiums International, LLC, the world’s largest timeshare exchange network.

Through Bluegreen’s Traveler Plus program, Owners receive access to discount

vacation benefits

including hotels, rental cars and cruises. Owners can also use their vacation points for certain of these

benefits. Owners receive the first year of Traveler Plus with their membership and then can renew

annually for an additional fee.

Quality vacation experiences in spacious, fully appointed accommodations in a

wide variety of

destinations to suit Owners’ desires. A variety of unit sizes allow Owners to only “spend” the

amount

of points they need for their space needs on a particular vacation – studios up to five bedroom homes.

Strong value proposition, as timeshare interests in the Club are owned in

perpetuity and the typical

purchase price generally reflects a fraction of what Owners have already determined to be their lifetime

lodging expenditure.

Bluegreen Vacation Club

Vacation Ownership with Flexibility, Quality and Value (cont.)

Benefits for Bluegreen Vacation Club Owners

FREEDOM & FLEXIBILITY: “It’s

freedom, it’s

flexibility; it’s very

affordable!”

— Sheri L.

CUSTOMER SERVICE: “All we have

to do is call Bluegreen and

they set

everything up for us.”

— The Davis Family

CLUB BENEFITS: “We purchased

Bluegreen Ownership because we

get so many options.”

— The

Alvarado Family

Hotel Room vs. Timeshare Vacation Home

Typical Hotel Room

Typical Bluegreen Resort Villa

1 Bedroom

1 Bathroom

400 Sq. Ft.

2 Bedrooms

2 Bathrooms

Living Area

Full Kitchen

Washer/Dryer

1,100+ Sq. Ft.

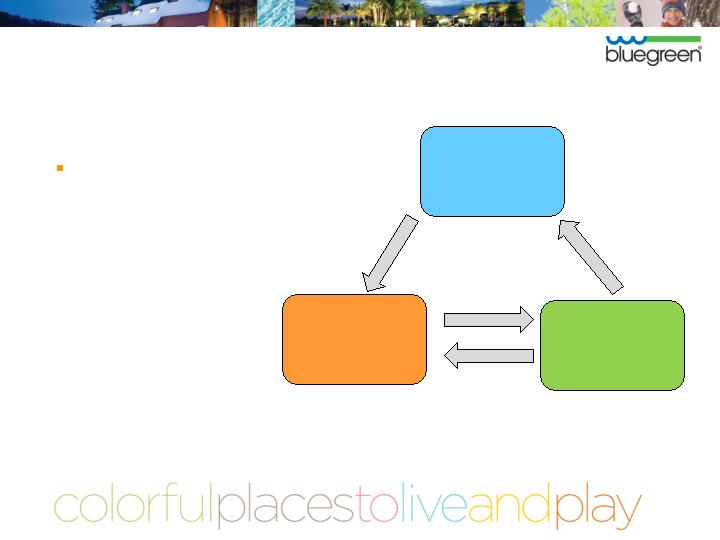

Unique Club

Configuration

Bluegreen Vacation Club-

‘Trust’ architecture allows

for the retention of

voting

rights once inventory is

sold, perpetual

management control, and

allows for recovery of the

underlying collateral

for

non-performing consumer

loans or assessments

without necessity of

judicial foreclosure

process.

Purchaser

Bluegreen

Vacation

Club Trust

1.

Promissory Note

2.

Deed To Timeshare

3.

Mortgage

4.

Owner Beneficiary Rights

1

2

3

4

Advantages of Vacation Club to Bluegreen

Distribution Channel – Not limited to typical constraints of selling real estate at a

single site location. Instead, through the Club any approved inventory can be

sold at most of our sales

offices.

Long-term relationship with customer – Our agreement to manage the Club

enables us

to ensure a consistent service experience for our owners in addition

to providing us with a recurring management

fee.

Long-term relationship with resorts – The property management agreements we

have with homeowners’ associations in Club resorts allows us to ensure that

owners receive consistent high

quality vacation experiences at all of our resorts.

Similar to the vacation club management agreement, our property

management

agreements also provide us with a recurring source of cash-based income.

The typical sales objections regarding inventory mix are reduced by

allowing the sales team to focus on the Club structure and the

network of

resort opportunities and not just a single site location.

Based on consumers being geographically diverse, regional credit risk in

the Bluegreen mortgage portfolio is mitigated.

Sales team quality and career paths are enhanced due to continuance of

sales beyond typical sellout.

Advantages of Vacation Club to Bluegreen (cont)

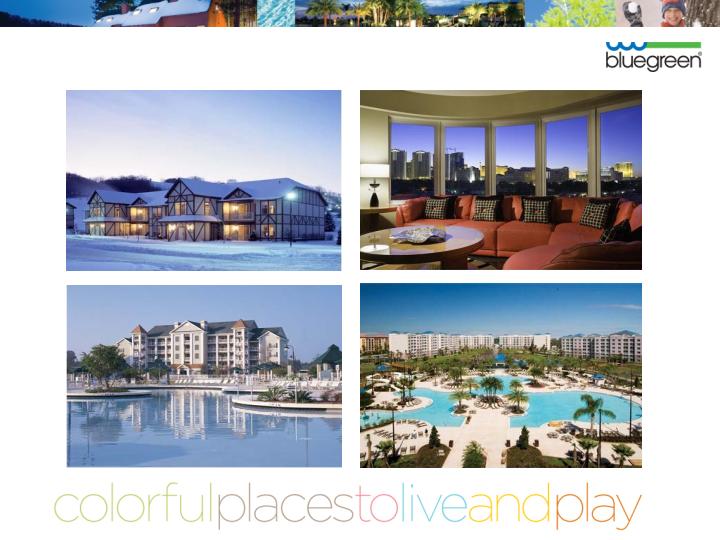

Bluegreen Resorts

Mountain Run at Boyne, Boyne Falls Michigan

Club 36, Las Vegas, Nevada

Grande Villas at World Golf Village, St. Augustine, Florida

The Fountains, Orlando, Florida

Bluegreen Resorts

La Cabana, Oranjestad, Aruba

MountainLoft, Gatlinburg, Tennessee

Wilderness Club at Big Cedar, Ridgedale, Missouri

Shenandoah Crossing, Gordonsville, Virgina

Strategic Marketing Alliance –

Bass Pro Shops®

Strategically aligned partnership since 2000

Access to over 100 million store visitors per year

Mini-vacation sales in 51 Bass Pro Locations

Access to Bass Pro’s catalogs, web site and other lead

generation opportunities

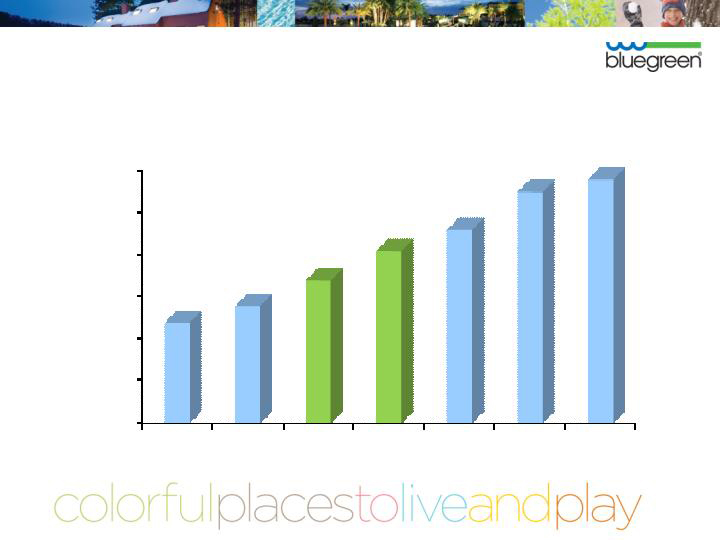

Additional Sales to Existing Owner Base

0

10

20

30

40

50

60

2004

2005

2006

2007

2008

2009

YTD Sept

2010

28%

34%

41%

46%

24%

58%

55%

Average income: $80,000

Age: 44-55

Marital Status: 84% Married

Average initial purchase: $13,205

Number of persons per vacation ownership trip: 2.79

Number of nights per stay: 4.23

The Bluegreen Owner

Fee-Based Services

A customized suite of timeshare services and product offerings for third-party

property owners/developers, lenders and

investors.

Services are based on Bluegreen’s core competencies in:

Sales & Marketing

Property Management

Risk management

Title & Escrow

Design & Development

Mortgage Servicing

Allows third-party property owners/developers to lever off of the benefits of the

Bluegreen Vacation Club product and sales

distribution platform.

Cash business, which requires little if any capital expenditure by Bluegreen.

Expands the offerings of the Bluegreen Vacation Club.

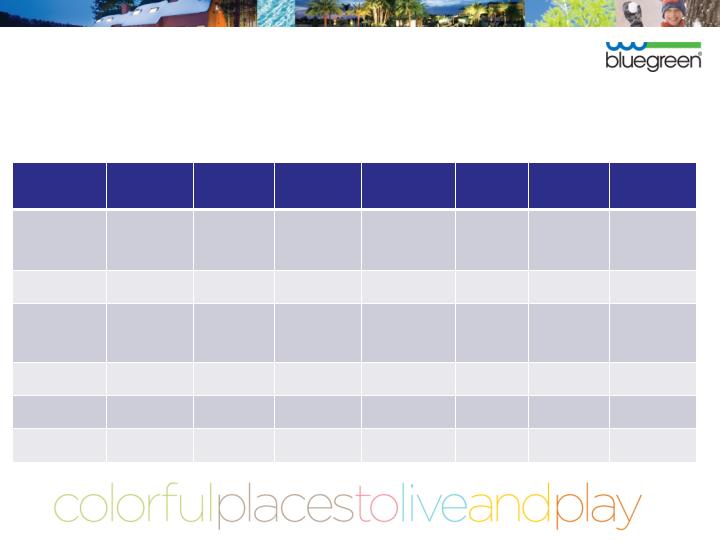

Fee-Based Services

A

B

C

D

E

F

G

Location

Williamsburg,

Virginia

Cape Cod,

Mass.

Nassau,

Bahamas

Lincoln,

New Hampshire

Peoria,

Arizona

Fort Pierce,

Florida

Cape Cod,

Mass.

Sales &

Marketing

X

X

X

X

X

X

Property Mgmt

Services/ Risk

Mgmt

X

X

X

X

X

X

X

Title & Escrow

X

X

X

X

X

X

Design &

Development

X

X

Mortgage

Servicing

X

Service

Contract

Timeshare Industry: Impact of Liquidity Crisis

Despite robust sales, most timeshare companies have taken measures

to downsize. Bluegreen was proactively the first amongst the

larger

entities in the space to make such changes.

Lack of securitization activity, not lack of consumer demand, was the

primary driver of Bluegreen’s actions.

Industry-wide impact, including:

Wyndham

Starwood

Marriott

Bluegreen

Goals of Bluegreen’s 2008/2009 Strategic Initiatives

Significantly reduced our timeshare sales operations in an attempt to

reduce our sales pace to our known receivable financing

capacity and

projected cash sales;

Emphasizing cash-based businesses in our sales, resort management

and finance operations;

Minimizing the cash requirements of Bluegreen Communities;

Reducing overhead and increasing efficiencies;

Minimizing capital spending;

Continuing to provide a high level of quality vacation experiences and

customer service to our VOI owners;

Begin migration to “capital-light” fee-based model; and

Generating cash and income.

($ in millions)

System Wide VOI Sales (a)

(a)

Excludes estimated uncollectable VOI notes receivable and gain on sales of notes receivable. Includes sales

made on behalf of fee-based

service clients.

$0

$100

$200

$300

$400

$500

$600

2007

2008

2009

YTD Q3 2009

YTD Q3 2010

$496

$265

$182

$226

$476

Sales Mix By Payment Type

2008

2009

YTD

Sept 2010

Cash at Close (1)

13%

24%

28%

30-Day Cash-outs

11%

21%

21%

Sales realized in cash in 30 days (1)

24%

45%

49%

(1)

Includes both 100% cash sales and down payments.

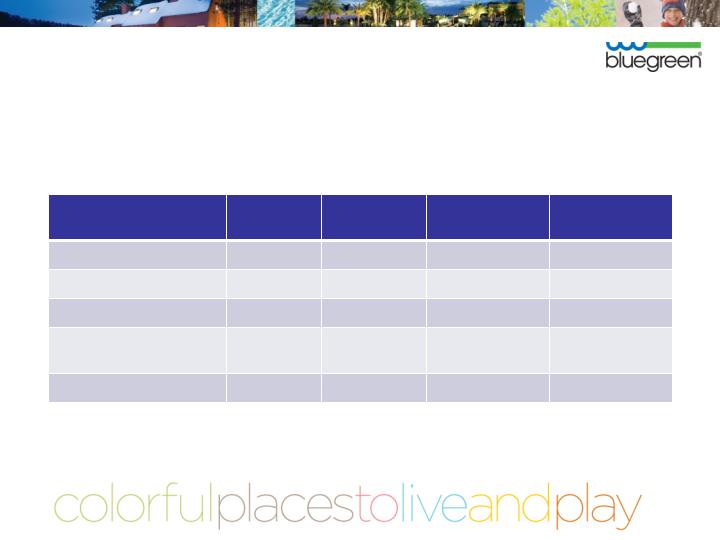

Headcount

As of 9/30/08

As of 1/31/09

As of 12/31/10

Resorts

(Excluding Management)

3,897

1,154

1,650

Resorts Management

1,761

1,618

1,828

Communities

342

221

88

Corporate Support

396

243

259

Total

6,396

3,236

3,825

Resorts Segment Operating Profit (1)(2)

(1)

Operating profit prior to the allocation of corporate overhead, interest income, other income (expense), interest expense, income taxes, minority

interest, and cumulative effect of

change in accounting principle. Pro forma adjustments by year as noted below.

(2)

Reflects impact of SFAS No. 152, however includes pro forma adjustments to exclude gain on sale of notes receivable of $39.4 million, $8.2

million and $0 in 2007, 2008, and 2009

respectively, and $37.8 million of adjustment to allowance for loan losses for prior period sales in YTD Q3 2010.

($ in millions)

$0

$10

$20

$30

$40

$50

$32

$24

$39

$38

$54

Reduce Capital Expenditures

($ in millions)

2008

2009

Reduction %

YTD *

Sept 2010

Inventory Spending:

Resorts

$ 119

$ 26

(78)%

$ 11

Communities

40

6

(85)%

5

PP&E and

Other Cap Ex

29

8

(72)%

2

Total:

$ 188

$ 40

(79)%

$ 18

* Approximate

Results of 2008/2009

Strategic Initiatives 12/31/09

Increased operating/investing cash flow by over $275 million (2009 vs.

2008).

Repaid over $49 million under lines-of-credit and notes payable.

Generated Resorts Field Operating Profit of $37.7 million (16% of sales;

2009) vs. $38.8 million** (8% of sales, 2008), despite almost a 50%

decrease in sales.

Generated positive cash flow from Bluegreen Communities.

Successfully launched “capital-light” fee-based service business model.

Successfully extended over $200 million in debt obligations.

** Excluding $8.2 million gain on sale of receivables from 2008 securitization.

Results of 2008/2009

Strategic Initiatives 9/30/10

Generated operating/investing cash flow of over $123

million (YTD

Sept 2010).

Repaid over $38

million under lines-of-credit and notes payable and a

net reduction of $61

million of amounts outstanding under receivable-

backed credit facilities-securitizations.

Generated Resorts Field Operating Profit of $54 million** (24% of

sales; YTD Sept

2010) vs. $32 million (18% of sales, YTD

Sept 2009).

Generated $87

million of revenue under “capital-light” fee-based

service business model.

** Excluding $37.8 million adjustment to allowance for loan losses for prior period sales.

In-house servicing of all

receivables; servicing is

centralized at our Boca Raton,

FL headquarters.

Loans Serviced on LSAMS

(Loan Servicing and Accounting

Management System).

Bluegreen has been servicing

loans for over 20 years. Our

Mortgage management team has

a combined 132 years of

servicing experience, with an

average tenure of 15 years with

Bluegreen.

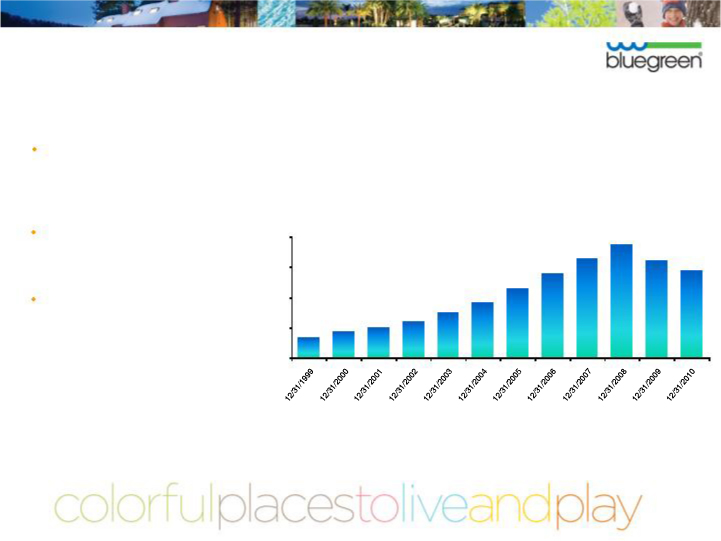

Notes Receivable Outstanding

(Resorts and Communities)

(in millions)

Receivables Financing Program

$171

$218

$250

$300

$371

$460

$569

$699

$823

$932

$803

$719

$0

$250

$500

$750

$1,000

How Bluegreen VOI Buyers Finance Their Purchase

*Dollar amount rounded to the nearest whole dollar.

**Note: Based on average household income of $80,000 for timeshare buyers.

Purchase Price of a Typical Vacation Ownership Interest:

$13,200 100%

Cash Down Payment:

($ 1,320) (10%)

Amount Financed:

$11,880 90%

Terms of Typical Financing:

Term / Amortization:

10 years

Fixed Interest Rate:

16.99%

Monthly Payment:

$ 206*

Annual Maintenance Fee/ Club Dues:

$ 661

Annual Cost During Financing Period:

$ 3,138* (3.9% of Income**)

Annual Cost After Financing Period:

$ 661 (0.8% of Income**)

Bluegreen Resorts

Credit Underwriting Standards

1994 – 2008: 10% Down Payment; No other credit verification

Effective December 15, 2008: Implemented FICO® Score-Based

Standards to determine if credit will be offered and if so on what

terms:

*No reduction of interest rate

FICO ®

Minimum Down Payment %

X > = 600

10%

500 - 599

20% *

X < = 499

100%

*No reduction of interest rate

Effective January 1, 2010 Bluegreen implemented an additional,

more stringent, FICO® Score-Based Standard:

Bluegreen Resorts

Credit Underwriting Standards

FICO ®

Minimum Down Payment %

X > = 600

10%

575 - 599

20% *

X < = 574

100%

*In the event a borrower goes off of pre-authorized checking, the interest rate will increase by 1%.

Interest Rates

VOI RATES & TERMS

HISTORICAL

Int. Rate w/o

Down Payment Int. Rate Auto-Debit Max Term

10%

15.90%* 16.90% 10 years

20%

12.90%* 13.90% 10 years

50%

8.25% 8.25% 1 year

VOI RATES & TERMS

EFFECTIVE 11/01/08

Int. Rate w/o

Down Payment Int. Rate Auto-Debit Max Term

10%

16.99%* 17.99% 10 years

20%

15.99%* 16.99% 10 years

10%

15.99%* 16.99% 5/7 years

50%

9.99% 9.99% 1 year

BXG VOI receivables have historically yielded significant interest income; in

November 2008 we implemented a revised interest rate program for new

obligors which has increased the WAC (on non-50/50 loans

originated in 2009

and through December 2010) to approximately 16.14%; by way of comparison,

the YTD WAC for similar loans

originated in 2008 through October 2008 was

approximately 14.94%.

Portfolio Statistics

Post – 1/1/10 Loans

Weighted Average FICO®

(Highest Obligor)

728(1)

Weighted Average Interest

Rate

16.1%

(1)

After allowing for settling due to 30 day payoffs; loans without a FICO® score removed, FICO® is from point of sale.

Bluegreen VOI Loan Payment Methods

As of December 2010

Each sale facility/securitization/hypothecation has a separate,

dedicated lockbox.

There is a daily automated, repetitive wire to the paying agent/lender

for each sale facility/securitization/hypothecation.

PAC/ACH/Automated

86.4%

Coupon Book

13.6%

Total

100.0%

Bluegreen’s Previous Receivables Purchase

Facilities and Term Securitizations

There has never been a principal or interest payment delinquency or default under any of these facilities.

Purchase Facility/Term Securitization

Note Amount

1998 GE Purchase Facility

$100.0 MM

2000 GE Purchase Facility

$ 90.0 MM

2001-A ING Purchase Facility

$125.0 MM

2002-A Term Securitization

$170.2 MM

2004-A GE Purchase Facility

$ 38.6 MM

2004-B Term Securitization

$156.6 MM

2004-C BB&T Purchase Facility

$140.0 MM

2005-A Term Securitization

$203.8 MM

2006-A GE Purchase Facility

$125.0 MM

2006-B Term Securitization

$139.2 MM

2007-A Term Securitization

$177.0 MM

2008-A Term Securitization

$ 60.0 MM

2010 BB&T Purchase Facility

$ 75.0 MM

BXG Legacy 2010 Securitization

$ 27.0 MM

2010-A Term Securitization

$107.6 MM

Quorum Federal Credit Union Purchase Facility

$ 20.0 MM

Total

$ 1.8 Billion

Typical Collection Process - VOI

10 Days – Telephone contact initiated on delinquent accounts when an

account is as

few as 10 days past due

30 Days – Letter mailed advising the borrower (if a U.S. resident) that if the

loan is

not brought current, the delinquency will be reported to the credit reporting agencies

(telephone contact continues)

60 Days – “Lock-out” letter mailed, return receipt requested and

regular mail,

advising that the borrower cannot use any accommodations until the delinquency is

cured (telephone contact continues)

90 Days – “Notice of Intent to Cancel Membership” mailed,

return receipt requested

and regular mail, which informs the borrower that unless the delinquency is cured

within 30 days, the borrower will forfeit ownership (telephone contact

continues)

Approximately 120 Days – Termination letter mailed, return receipt

requested and

regular mail, advising the borrower that the owner’s beneficial rights in the Bluegreen

Vacation Club have been terminated

The VOI is placed back into inventory for resale to a new purchaser

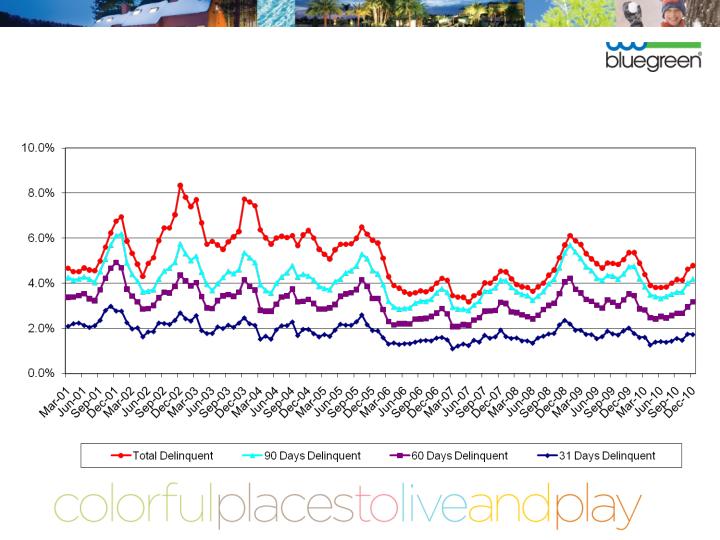

VOI Portfolio Performance

* In the event a borrower goes off of pre-authorized checking, the interest rate will increase by 1%.

Unlike floating rate residential mortgage loans (many of which have

“teaser” rates), the monthly payment for

Bluegreen’s borrowers does not

change over the life of the loan.*

The average monthly payment (approximately $200) for Bluegreen’s

borrowers is much less than a typical mortgage payment.

The vast majority of Bluegreen’s borrowers are on PAC.

Geographical diversity of obligors, few foreign obligors.

Bluegreen’s collectors have an average of 9.75 years of collections

experience. Our collections team is incentivized

through a performance-

based compensation program.

In addition, Bluegreen implemented FICO® score-based credit

requirements on 12/15/08 and further raised such guidelines on

1/1/10.

Portfolio Performance

Percentage of

outstanding loans

Percentage of outstanding

principal balance over 30 days past due

Originations Pre-12/15/08

(loans not credit scored at origination)

73%

5.30%

Originations Post-12/15/08

(loans must meet minimum FICO® requirements)

27%

3.35%

Total

100%

4.77%

2008/2009/2010 Originations - VOI Default Comparison

Percentage defaulted

Loans originated 1/1/08 – 12/14/08

11.45% (as of 12/31/09)

Loans originated 12/15/08 – 12/31/09

6.01% (as of 12/31/10)

Loans originated 1/1/10 – 12/31/10

0.39% * (as of 12/31/10, 1 st year)

VOI Delinquency Breakdown: As of December 31, 2010

* Estimated

Bluegreen Communities

Direct-to-consumer sales of

residential homesites

Deed restricted communities

“Exurbia” in southeastern and

southwestern United States

Certain properties include golf

courses designed by PGA

champions

Primarily a cash business

Pre-sales possible through

combination of bonding to completion

and corporate guaranty

Bluegreen Communities Strategic Initiatives

Consolidated field operations, thereby eliminating sales, construction and/or

administrative activities at 12 locations.

Eliminated those advertising programs which we believe have become less effective,

and focus primarily on internet marketing

campaigns.

Eliminated over 70% of our sales, marketing, development and administrative

associates.

As we have completed development of phases of our communities, development

expenditures in 2009 were materially below

expenditures in 2008.

Pursue opportunities to use our core competencies to provide services to third-

parties on a fee basis in the areas of:

asset management

market research

other real estate consulting services

Goal: Strive to operate Bluegreen Communities minimizing cash requirements until

market conditions provide other

opportunities.

Unrestricted Cash

( $ in millions)

* Excludes $55.0 million held to extinguish Senior Secured Notes in 4/08

*

($ in millions)

Operating/Investing Cash Flows (a)

(a) Investing cash flows primarily consist of cash received from retained interests in notes receivable sold, net of purchases of property and equipment.

-

$250

-

$210

-

$170

-

$130

-

$90

-

$50

-

$10

$30

$70

$110

2006

2007

2008

2009

YTD Q3

2009

YTD Q3

2010

$12.9

$(1.6)

$(212.7)

$62.9

$26.8

$123.4

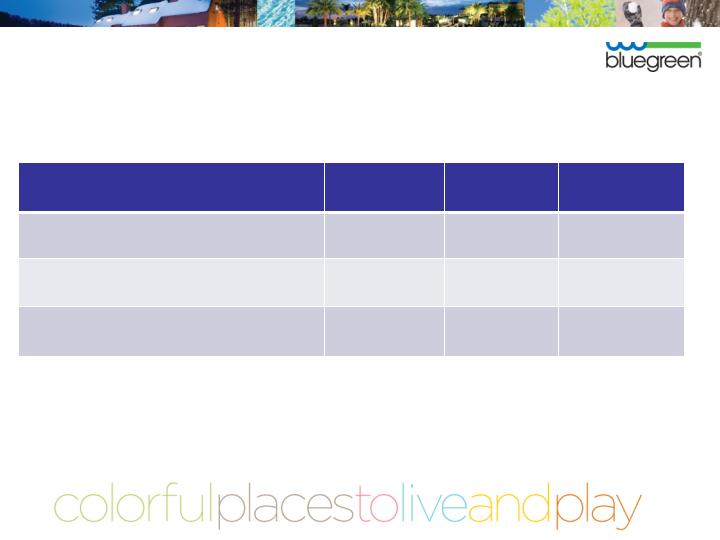

Credit Facilities

($ in thousands)

As of December 31, 2010

A.

Facility amount is revolving, so additional availability is generated as the principal balance amortizes, subject to eligible collateral and/or other terms and conditions.

B.

On-balance sheet, non-recourse (except for representations and warranties).

C.

In Legal documentation. Have already executed commitment.

D.

Big Cedar JV borrowings only.

E.

Received term sheet. Subject to credit approval. Maximum additional borrowing = $5 million.

Lender

Type

Revolving

Advance Period

Expiration

Legal Final

Maturity

Facility

Amount

Amount

Outstanding

Amount

Available

Resorts Division

BB&T

Receivables Purchase Facility

12/17/2011

9/5/2023

$ 75,000

$ 0

$ 75,000

(A)(B)

Quorum

Receivables Purchase Facility

12/22/2011

12/30/2030

20,000

109

19,891

(B)

NBA

Receivable Hypothecation Facility

6/30/2011

6/29/2018

20,000

18,350

1,650

(D) E)

Liberty

Receivable Hypothecation Facility

2/2013

2/2016

60,000

49,285

10,715

(A)(C)

$107,256

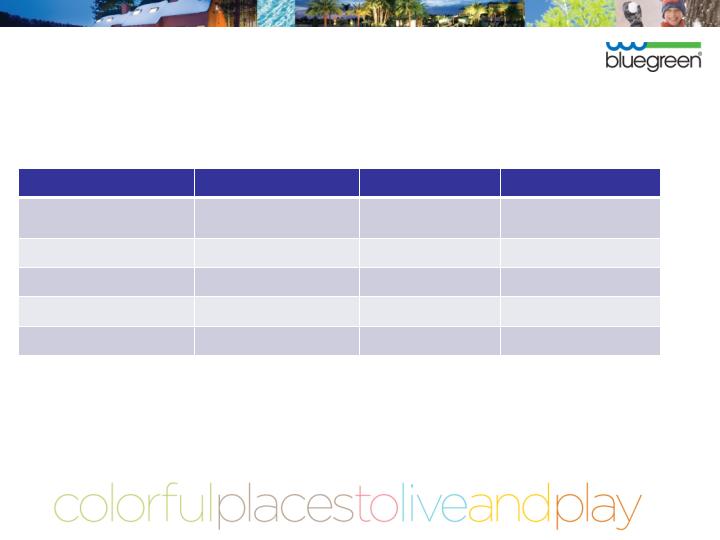

Contractual Debt Maturities

As of September 30, 2010

( $ in millions)

Debt

Less Than

1-3

4-5

After 5

Balance

1 Year

Years

Years

Years

9/30/10

Receivable Backed Notes (Recourse)

$ 4

$ -

$ 75

$ 70

$ 149

Lines of Credit & Notes Payable

32

112

1

3

148

Jr Subordinated Debentures

-

-

-

111

111

Subtotal – Recourse Debt

36

112

76

184

407

Non-Recourse Receivable – Backed Notes

-

-

-

444

444

Total

$ 36

$ 112

$ 76

$ 628

$ 851

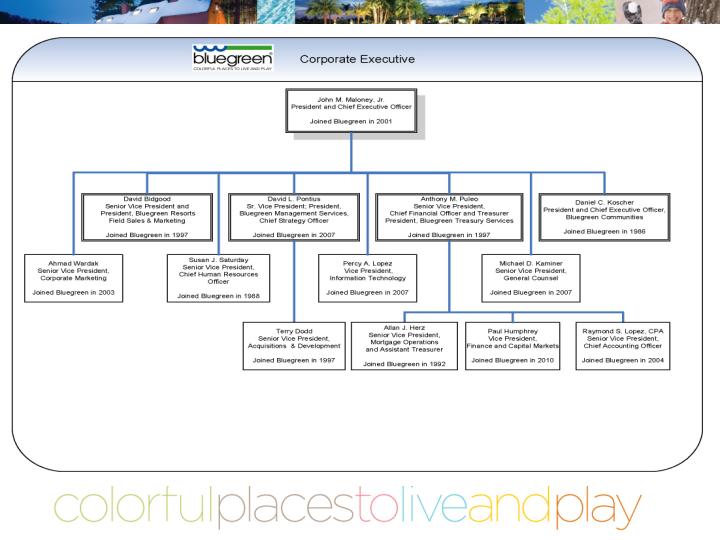

John M. Maloney, Jr.

President and Chief Executive Officer

John M. Maloney, Jr. joined us in 2001 as Senior Vice President of Operations and Business Development for Bluegreen Resorts. In May 2002, Mr. Maloney was named our Senior Vice President of the Company and President of Bluegreen Resorts and he was appointed Executive Vice President and Chief Operating Officer in November 2005. Effective January 2007, Mr. Maloney was appointed President and Chief Executive Officer. Prior to Bluegreen, Mr. Maloney served in various positions with ClubCorp, most recently as the Senior Vice President of Sales and Marketing for the Owners Club by ClubCorp, and held various positions with Hilton Grand Vacations Company, most recently as the Director of Sales and Marketing for the South Florida area.

Anthony M. Puleo

Senior Vice President, Chief Financial

Officer and Treasurer

Anthony M. Puleo joined us in 1997 as Chief Accounting Officer. Mr. Puleo was elected Vice President in 1998 and Senior Vice President in 2004. Mr. Puleo served as Interim Chief Financial Officer from April through August 2005. In August 2005, he was elected Chief Financial Officer and Treasurer. From December 1990 through October 1997, Mr. Puleo held various positions with Ernst & Young LLP, most recently serving as a Senior Manager in the Assurance and Advisory Business Services group. Mr. Puleo holds a B.B.A. in Accounting and is a Certified Public Accountant.

David Bidgood

Senior Vice President; President,

Bluegreen Resorts

Field Sales & Marketing

David Bidgood joined us in 1997 as Vice President for Bluegreen’s Midwest Region and the Senior Vice President for the Midwest and Tennessee Region with Bluegreen’s acquisition of RDI. In December 2000, Mr. Bidgood was promoted to Senior Vice President, National Sales Director Bluegreen Resorts Division. In 2007, Mr. Bidgood was promoted to Executive Vice President of National Sales and Marketing and became an officer of Bluegreen Corporation. In December 2008, Mr. Bidgood was appointed President, Bluegreen Resorts Field Sales & Marketing. Prior to joining Bluegreen, Mr. Bidgood held a variety of positions and has been involved in all aspects of resort development.

David L. Pontius

Senior Vice President; President,

Bluegreen Management Services,

Chief Strategy Officer

David L. Pontius joined us in 2007 as Senior Vice President and President, Bluegreen Resorts. In December 2008 Mr. Pontius was appointed President of Resorts Management Services and in 2010 Chief Strategy Officer. From 2002-2007, Mr. Pontius worked at Wyndham Vacation Ownership, Inc. and its sister company RCI Global Vacation Network (RCI). From 2006-2007, he served as Executive Vice President, Hospitality, Strategic Planning and Chief Customer Officer at Wyndham Vacation Ownership. From 2002-2006, Mr. Pontius served as President and CEO of RCI North America. From 1996-2002, Mr. Pontius served in positions of increasing responsibilities at Hilton Grand Vacations where he finished as Senior Vice President of Operations. From 1992- 1996, Mr. Pontius served as Chief Operating Officer of Vacation Internationale, one of the pioneer companies in timesharing and points-based clubs.

Allan J. Herz

Senior Vice President, Mortgage

Operations and Assistant Treasurer

Allan J. Herz joined us in 1992 and was named Director of Mortgage Operations in September 1992. Mr. Herz was elected Vice President in 1993 and Senior Vice President in 2004. In 2007, he was also appointed Assistant Treasurer. From 1982 to 1992, Mr. Herz worked for AmeriFirst Federal Savings Bank based in Miami, Florida. During his 10-year tenure with the bank, he held various lending positions, the most recent being Division Vice President in Consumer Lending. Mr. Herz holds a B.B.A. and an M.B.A.

Paul Humphrey

Vice President, Finance and Capital

Markets

Paul Humphrey began working with us in 2009 and in 2010 became our Vice President, Finance and Capital Markets. He is also the Chief Investment Officer of Stratstone Advisors and has an extensive finance background in securitization execution and performance analysis. Prior to joining Stratstone, Mr. Humphrey worked for over 14 years in the ABS/MBS product groups at Salomon Brothers/Citigroup and CS First Boston where he successfully developed financing alternatives for multiple consumer asset classes such as timeshare, manufactured housing and non-agency mortgage. Mr. Humphrey began his career at CS First Boston in 1993 with his focus including collateral and structural loan analysis for consumer loan securitizations.

Daniel C. Koscher

Senior Vice President; President and

Chief Executive Officer of Bluegreen

Communities

Daniel C. Koscher joined us in 1986. During his tenure, he has served in various financial management positions including Chief Accounting Officer and Vice President and Director of Planning/Budgeting. In 1996, he became Senior Vice President of the Company and President of Bluegreen Communities. In November 2005, Mr. Koscher was elected Chief Executive Officer of Bluegreen Communities. Mr. Koscher holds an M.B.A. along with a B.B.A. in Accounting and is a Registered Resort Professional.

Ahmad Wardak

Senior Vice President, Corporate

Marketing

Ahmad Wardak joined Bluegreen in 2003 and served in various management positions, most recently as Senior Vice President, Chief Administration Officer. As Senior Vice President, Corporate Marketing, Mr. Wardak works closely with our Field Sales and Marketing organization and leads Bluegreen’s expansion of new marketing alliances and oversees a digital marketing group to leverage the web and other interactive channels. Mr. Wardak began his career with Ernst & Young, LLP. Mr. Wardak holds his B.S.

Susan J. Saturday

Senior Vice President and

Chief Human Resources Officer

Susan J. Saturday joined us in 1988. During her tenure, she has held various management positions with us including Assistant to the Chief Financial Officer, Divisional Controller and Director of Accounting. In 1995, she was elected Vice President and Director of Human Resources and Administration. In 2004, Ms. Saturday was elected Senior Vice President and Chief Human Resources Officer. From 1983 to 1988, Ms. Saturday was employed by General Electric Company in various financial management positions including the corporate audit staff. Ms. Saturday holds a B.B.A. in Accounting and an M.S. in Human Resource Management.

Raymond S. Lopez

Senior Vice President,

Chief Accounting Officer

Raymond S. Lopez joined us in 2004 as Controller. In 2005 he was appointed Vice President and Chief Accounting Officer. In 2008 Mr. Lopez was appointed Senior Vice President and Chief Accounting Officer. Prior to joining Bluegreen, Mr. Lopez served as Manager of External Reporting for Office Depot, Inc. and as a Senior Auditor with Arthur Andersen LLP, respectively. Mr. Lopez is a Certified Public Accountant and holds a B.S. in Accounting.

Percy Lopez

Vice President,

Information Technology

Percy Lopez joined us in 2007 as Vice President, Application Systems. In 2010, he was elected Vice President, Information Technology to oversee all of the company’s technology initiatives. From March 1990 through March 2007 Mr. Lopez was employed by Royal Caribbean Cruises Ltd. where he held various positions within the Information Technology department, most recently serving as Director of CRM. Mr. Lopez holds a B.S in Computer Science.

Michael D. Kaminer

Senior Vice President,

General Counsel and Assistant Secretary

Michael D. Kaminer joined Bluegreen in November of 2007 as Vice President and Assistant General Counsel. Mr. Kaminer served as our Acting General Counsel since April of 2008, overseeing all aspects of our Legal Department. In 2010 Michael was appointed Senior Vice President, General Counsel and Assistant Secretary. Prior to coming to Bluegreen, Mr. Kaminer was Vice President and Associate General Counsel at WCI Communities, Inc. from January 2003 to October of 2007. Prior to that time, Mr. Kaminer was a Shareholder with the law firm of Akerman Senterfitt, resident in the firm’s Fort Lauderdale, Florida office. He received his undergraduate degree in History from Duke University and his law degree, with Honors, from the University of Florida.

Terry Dodd

Senior Vice President,

Acquisitions & Development

Terry Dodd joined Bluegreen in 1997 as the Vice President of Inventory Management. In 2001, he was promoted to Senior Vice President-Club Operations/Program Development. In 2008 he assumed the responsibility for all Acquisition and Development activities within Bluegreen Resorts and in 2009 added development of the Company’s Fee-Based-Services business. He began his career in 1992, serving as Director with RDI Resort Services Corporation in Fort Myers, FL. In 1993 Terry’s responsibilities shifted to the development and implementation of the RDI Vacation Club, the first multi-site points-based Vacation Club successfully registered in the state of Florida.