Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - AMERICAN APPAREL, INC | exhibit321200910ka.htm |

| EX-31.1 - EXHIBIT 31.1 - AMERICAN APPAREL, INC | exhibit311200910ka.htm |

| EX-31.2 - EXHIBIT 31.2 - AMERICAN APPAREL, INC | exhibit312200910ka.htm |

| EX-32.2 - EXHIBIT 32.2 - AMERICAN APPAREL, INC | exhibit322200910ka.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________

FORM 10-K/A

Amendment No. 4

__________________________________________________

(Mark One)

x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2009

or

o | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number 001-32697

__________________________________________________

American Apparel, Inc.

(Exact name of registrant as specified in its charter)

_________________________________________________

Delaware | 20-3200601 | |

(State of Incorporation) | (I.R.S. Employer Identification No.) |

747 Warehouse Street

Los Angeles, California 90021-1106

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code: (213) 488-0226

__________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, par value $.0001 per share | NYSE Amex | |

(Title of Each Class) | (Name of Each Exchange on Which Registered) |

__________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes c No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes c No x

Indicate by check mark whether registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No c

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes c No c

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “accelerated filer”, “large accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer c | Accelerated filer x | Non-accelerated filer c | Smaller reporting company c |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes c No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2009 was approximately $258,562,875 based upon the closing price of the common stock on such date as reported by the NYSE Amex.

The number of shares of the registrant’s common stock outstanding as of March 19, 2010 was 71,338,750.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report incorporates information by reference from the registrant's definitive Proxy Statement for its Annual Meeting of Stockholders that was filed with the United States Securities and Exchange Commission (the "SEC") on October 15, 2010.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Amendment No.4 to our Annual Report on Form 10-K/A, including the documents incorporated by reference herein, contains forward-looking statements within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements in this Annual Report on Form 10-K/A other than statements of historical fact are “forward-looking statements” for purposes of these provisions. Statements that include the use of terminology such as “may,” “will,” “expects,” “believes,” “plans,” “estimates,” “potential,” or “continue,” or the negative thereof or other and similar expressions are forward-looking statements. In addition, in some cases, you can identify forward-looking statements by words or phrases such as “trend,” “potential,” “opportunity,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions.

Any statements that refer to projections of our future financial performance, our anticipated growth and trends in our business, our goals, strategies, focuses and plans, and other characterizations of future events or circumstances, including statements expressing general expectations or beliefs, whether positive or negative, about future operating results or the development of our products, and any statement of assumptions underlying any of the foregoing are forward-looking statements. Forward-looking statements in this report may include, without limitation, statements about:

• | future financial condition and operating results; |

• | our ability to remain in compliance with financial covenants under our financing arrangements; |

• | our plan to make continued investments in advertising and marketing; |

• | our growth, expansion and acquisition prospects and strategies, the success of such strategies, and the benefits we believe can be derived from such strategies; |

• | the outcome of litigation matters; |

• | our intellectual property rights and those of others, including actual or potential competitors; |

• | our personnel, consultants, and collaborators; |

• | operations outside the United States; |

• | economic and political conditions; |

• | overall industry and market performance; |

• | the impact of accounting pronouncements; |

• | management’s goals and plans for future operations; and |

• | other assumptions described in this Annual Report on Form 10-K/A underlying or relating to any forward-looking statements. |

The forward-looking statements in this report speak only as of the date of this report and caution should be taken not to place undue reliance on any such forward-looking statements, which are qualified in their entirety by this cautionary statement. Forward-looking statements are subject to numerous assumptions, events, risks, uncertainties and other factors, including those that may be outside of our control and that change over time. As a result, actual results and/or the timing of events could differ materially from those expressed in or implied by the forward-looking statements and future results could differ materially from historical performance. Such assumptions, events, risks, uncertainties and other factors include, among others, those described in this Amendment No. 4 to our Annual Report on Form 10-K/A, those contained under the heading, "Risk Factors," contained in Item 1A of American Apparel, Inc.'s Annual Report on Form 10-K for the year ended December 31, 2009 which was originally filed with the SEC on March 31, 2010, as well as in other reports and documents we file with the SEC and include, without limitation, the following:

• | changes in the level of consumer spending or preferences or demand for our products; |

• | disruptions in the global financial markets; |

• | consequences of our significant indebtedness, including our ability to comply with our debt agreements and generate cash flow to service our debt; |

• | the highly competitive and evolving nature of our business in the U.S. and internationally; |

• | our ability to manage our growth and expansion both in the U.S. and internationally; |

• | retailer consolidation and intensity of competition, both domestic and foreign, from other apparel providers; |

• | technological changes in manufacturing, wholesaling, or retailing; |

• | risks that our suppliers and distributors may not timely produce or deliver our products; |

• | loss or reduction in sales to our wholesale or retail customers or financial nonperformance by our wholesale customers; |

• | the adoption of new accounting pronouncements or changes in interpretations of accounting principles; |

• | changes in consumer spending patterns and overall levels of consumer spending; |

• | the availability of store locations at appropriate terms and our ability to identify and negotiate new store locations effectively and to open new stores and expand internationally; |

• | ability to attract customers to our stores; |

• | seasonality and fluctuations in comparable store sales and margins; |

• | our ability to successfully implement its strategic, operating and personnel initiatives; |

• | our ability to maintain the value and image of our brand and protect our intellectual property rights; |

• | changes in the cost of materials and labor; |

• | location of our facilities in the same geographic area; |

• | our relationships with our lenders and our ability to comply with the terms of our existing debt facilities; |

• | adverse changes in our credit ratings and any related impact on financing costs and structure; |

• | risks associated with our foreign operations and foreign supply sources, such as disruption of markets, changes in import and export laws, currency restrictions and currency exchange rate fluctuations; |

• | continued compliance with U.S. and foreign government regulations, legislation and regulatory environments, including environmental, immigration, labor and occupational health and safety laws and regulations; |

• | the risk that information technology systems changes may disrupt our supply chain or operations; |

• | our ability to upgrade our information technology infrastructure and other risks associated with the systems that operate our online retail operations; |

• | litigation and other inquiries and investigations, including the risk that we or our officers will not be successful in defending any proceedings, lawsuits, disputes, claims or audits; |

• | ability to effectively manage inventory and inventory reserves; |

• | changes in key personnel, our ability to hire and retain key personnel, and our relationship with our employees; |

• | material weaknesses in internal controls; |

• | costs as a result of operating as a public company; and |

• | general economic conditions, including increases in interest rates, geopolitical events, other regulatory changes and inflation or deflation. |

All forward-looking statements included in this document are made as of the date hereof, based on information available to us as of the date hereof, and we assume no obligation to update any forward-looking statement.

American Apparel, Inc.

ANNUAL REPORT ON FORM 10-K/A

FOR THE YEAR ENDED DECEMBER 31, 2009

TABLE OF CONTENTS

EXPLANATORY NOTE | 1 | ||||

PART II | 2 | ||||

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 2 | |||

Item 6. | Selected Financial Data | 4 | |||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 7 | |||

Item 7A. | Quantitative and Qualitative Disclosures and Market Risks | 24 | |||

Item 8. | Financial Statements and Supplementary Data | 27 | |||

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosures | 61 | |||

Item 9A. | Controls and Procedures | 62 | |||

PART IV | 66 | ||||

Item 15. | Exhibits and Financial Statement Schedules | 66 | |||

EXPLANATORY NOTE

The Annual Report on Form 10-K for the year ended December 31, 2009 (the “Original Filing”) of American Apparel, Inc. and its subsidiaries (collectively, “the Company”) was filed with the SEC on March 31, 2010 and amended by Amendments No. 1, 2 and 3 which were filed with the SEC (“Amendments No. 1, 2 and 3” and, together with the Original Filing, the “Prior Filings”). As described in the Company's Current Report on Form 8-K filed on December 21, 2010, the Audit Committee of the Company received notice from Deloitte & Touche LLP ("Deloitte") stating that Deloitte had concluded that Deloitte's report on the Company's previously issued consolidated financial statements as of and for the year ended December 31, 2009 (the "2009 financials"), including Deloitte's report on internal control over financial reporting at December 31, 2009, including in the Original Filing (such reports, collectively, the "Deloitte Reports"), should not be relied upon or associated with the 2009 financials. This Amendment No. 4 on Form 10-K/A (this “Amendment”) is being filed for the purpose of removing the Deloitte Reports and labeling the 2009 financials as "unaudited." As a result, the consolidated financial statements for the year ended December 31, 2009 included in this Amendment No. 4 are unaudited.

The Company plans to file another amendment to the Annual Report for the year ended December 31, 2009, once a new report on internal control over financial reporting at December 31, 2009 and a new audit report on the 2009 financials are available from the Company's current auditors, for the purpose of filing those reports and, at such time, the notation that the 2009 financials are "unaudited" would be removed.

Except for the matters described above and related updates in Item 9, the Original Filing has not been amended, updated or otherwise modified. The Original Filing, as amended by this Amendment, continues to speak as of the date of the Original Filing and does not reflect events occurring after the filing of the Original Filing or update or otherwise modify any related or other disclosures, including forward-looking statements. Accordingly, this Amendment should be read in conjunction with our other filings made with the SEC subsequent to the filing of the Original Filing.

The filing of this Amendment No. 4 is not an admission that the Original Filing or Amendment No. 1, 2 and 3 to the Original Filing, when filed, included any untrue statement of a material fact or omitted to state a material fact necessary to make the statements therein not misleading.

PART II

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market Information

The principal market on which our common stock is traded is the NYSE Amex. Our common stock is traded under the symbol APP. Our units (the “Endeavor Units”) and warrants (the “Endeavor Warrants”), which were issued in the initial public offering of Endeavor Acquisition Corp., traded on the American Stock Exchange (now the NYSE Amex) under the symbols APP-U and APP-WS, respectively, until March 7, 2008, when all outstanding Endeavor Warrants were redeemed.

Each Endeavor Unit was comprised of one share of common stock and one Endeavor Warrant. Prior to the Acquisition, the Endeavor Units, common stock and Endeavor Warrants were traded on the American Stock Exchange (now the NYSE Amex) under the symbols EDA-U, EDA and EDA-WT, respectively. The Endeavor Units commenced trading on the NYSE Amex on December 16, 2005, and the common stock and Endeavor Warrants commenced trading on March 6, 2006.

The following table sets forth the range of high and low sales prices for the Endeavor Units, our common stock and the Endeavor Warrants for the periods indicated.

Common Stock | Units | Warrants | ||||||||||||||||||||||

High | Low | High | Low | High | Low | |||||||||||||||||||

2008: | ||||||||||||||||||||||||

Fourth Quarter | $ | 8.45 | $ | 1.55 | $ | — | $ | — | $ | — | $ | — | ||||||||||||

Third Quarter | 10.05 | 5.48 | — | — | — | — | ||||||||||||||||||

Second Quarter | 9.97 | 5.90 | — | — | — | — | ||||||||||||||||||

First Quarter | 14.45 | 8.50 | 17.78 | 17.78 | 6.00 | 5.90 | ||||||||||||||||||

2009: | ||||||||||||||||||||||||

Fourth Quarter | $ | 3.55 | $ | 2.42 | ||||||||||||||||||||

Third Quarter | 4.20 | 2.80 | ||||||||||||||||||||||

Second Quarter | 6.97 | 2.66 | ||||||||||||||||||||||

First Quarter | 3.70 | 1.20 | ||||||||||||||||||||||

Holders

On March 30, 2010 there were 1,385 recordholders and approximately 10,006 beneficial holders of our common stock.

Dividends

As a public company, we have not paid any cash dividends. Certain cash dividends and distributions were paid by Old American Apparel to its principal stockholders prior to becoming a public company. We intend to continue to retain earnings for use in the operation and expansion of our business and, therefore, do not anticipate paying any cash dividends in the foreseeable future. In addition, restrictions imposed by our debt instruments significantly restrict us from making dividends or distributions to shareholders.

Units, Common Shares and Warrants

The Endeavor Warrants and common stock comprising the Endeavor Units became separately tradable on March 7, 2006. Each Endeavor Warrant entitled the holder to purchase from American Apparel one share of American Apparel common stock at an exercise price of $6.00. On February 6, 2008 we called for redemption, and on March 7, 2008 redeemed all of our issued and outstanding Endeavor Warrants. Prior to the redemption date of March 7, 2008, 16,153 of the 16,165 Endeavor Warrants outstanding at December 31, 2007 were

exercised. The remaining 12 Endeavor Warrants were redeemed by us at a price of $.01 per Warrant. As a result, the Endeavor Units and the Endeavor Warrants ceased to be outstanding and ceased to be registered, pursuant to Section 12(b) on March 7, 2008.

On December 19, 2008, in connection with an extension of the SOF Credit Agreement, we issued the SOF Warrants. On March 13, 2009, in connection with the Lion financing, we issued the Lion Warrants. The warrants were issued to SOF and

Lion in private placements exempt from registration pursuant to Section 4(2) of the Securities Act of 1933, as amended.

The SOF Credit Agreement provided that if we failed to raise $16 million of financing by March 13, 2009, we would be required to issue to SOF an additional warrant to purchase two million shares of Company common stock at an exercise price of $2.00 per share and on other terms substantially identical to the terms of the SOF warrant issued to SOF in December 2008 in connection with the extension of the SOF Credit Agreement. As a result of the repayment in full of the SOF Credit Agreement with the proceeds of the loans under the Lion Credit Agreement, we were not required to issue to SOF the additional warrant.

For further discussion, including of proceeds received from exercise of warrants see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources”.

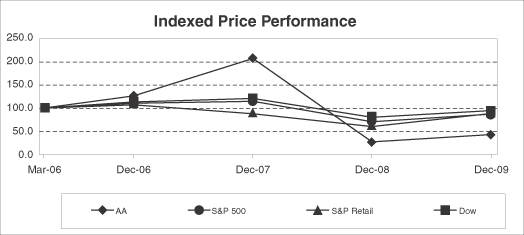

Stock Price Performance Graph

The graph below compares the cumulative total return of our common stock from March 7, 2006 through December 31, 2009 with the cumulative total return of companies comprising the Dow Jones Industrial Average, the S&P Retail Index, and the S&P500. The graph plots the growth in value of an initial investment of $100 in each of our common stock, the Dow Jones Industrial Average, the S&P Retail Index, and the S&P500 over the indicated time periods, assuming reinvestment of all dividends, if any, paid on the securities. We have not paid any cash dividends and, therefore, the cumulative total return calculation for us is based solely upon stock price appreciation and not upon reinvestment of cash dividends. The stock price performance shown on the graph is not necessarily indicative of future price performance.

Dates | American Apparel | S&P Retail | S&P 500 | Dow | ||||||||

March 7, 2006 | 100.00 | 100.00 | 100.00 | 100.00 | ||||||||

December 29, 2006 | 126.76 | 107.30 | 110.96 | 113.73 | ||||||||

December 31, 2007 | 206.90 | 88.11 | 114.87 | 121.04 | ||||||||

December 31, 2008 | 27.45 | 60.02 | 70.66 | 80.09 | ||||||||

December 31, 2009 | 42.76 | 88.37 | 87.24 | 95.16 | ||||||||

Item 6. | Selected Financial Data |

The selected historical financial data presented below under the heading “Selected Statement of Operations Data” and “Per Share Data” for the year ended December 31, 2009 and the selected historical financial data presented below under the heading “Balance Sheet Data” as of December 31, 2009 have been derived from the unaudited consolidated financial statements included elsewhere in this Annual Report on Form 10-K/A. The selected historical financial data presented below under the heading “Selected Statement of Operations Data” and “Per Share Data” for the years ended December 31, 2008 and 2007 and the selected historical financial data presented below under the heading “Balance Sheet Data” as of December 31, 2008 have been derived from, and are qualified by reference to, the audited consolidated financial statements included elsewhere in this Annual Report on Form 10-K/A. The selected historical financial data presented below under the heading “Selected Statement of Operations Data” and “Per Share Data” for the years ended December 31, 2006 and 2005 and the selected historical financial data presented below under the heading “Balance Sheet Data” as of December 31, 2007, 2006 and 2005 have been derived from, and are qualified by reference to, our audited consolidated financial statements which are not included in this Annual Report on Form 10-K/A.

On December 21, 2005, Endeavor Acquisition Corp. consummated its initial public offering, and on December 18, 2006, entered into an Agreement and Plan of Reorganization, amended November 7, 2007, with American Apparel, Inc., a California corporation (“Old American Apparel”), and its affiliated companies. Endeavor Acquisition Corp. consummated the acquisition of Old American Apparel and its affiliated companies on December 12, 2007 (the “Acquisition”) and changed its name to American Apparel, Inc. The Acquisition was accounted for as a reverse merger (“Merger”) and recapitalization for financial reporting purposes. Accordingly, for accounting and financial purposes, Endeavor Acquisition Corp. was treated as the acquired company, and Old American Apparel was treated as the acquiring company. Accordingly, the historical financial information for periods and dates prior to December 12, 2007, is that of Old American Apparel, and its affiliated companies.

The data set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Consolidated Financial Statements and notes included elsewhere in this Annual Report on Form 10-K/A.

Year Ended December 31, | ||||||||||||||||||||

2009 (unaudited) | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||

(In Thousands Except Per Share Data) | ||||||||||||||||||||

Selected Statement of Operations Data: | ||||||||||||||||||||

Net sales | $ | 558,775 | $ | 545,050 | $ | 387,044 | $ | 284,966 | $ | 201,450 | ||||||||||

Gross profit (5) | $ | 319,912 | $ | 294,421 | $ | 213,368 | $ | 145,636 | $ | 101,688 | ||||||||||

Income from Operations | $ | 24,415 | $ | 36,064 | $ | 31,122 | $ | 10,572 | $ | 10,782 | ||||||||||

Net Income (Loss) | $ | 1,112 | $ | 14,112 | $ | 15,478 | $ | (1,606 | ) | $ | 3,487 | |||||||||

Pro forma Net Income—conversion to C Corporation for tax purposes (unaudited) (3) | n/a | n/a | $ | 9,457 | $ | 257 | $ | 3,121 | ||||||||||||

Cash Distributions/Dividends Paid (1) | $ | — | $ | — | $ | 22,147 | $ | 696 | $ | 1,793 | ||||||||||

Per Share Data (2) | ||||||||||||||||||||

Net Earnings (Loss) per share—basic | $ | 0.02 | $ | 0.20 | $ | 0.32 | $ | (0.03 | ) | $ | 0.07 | |||||||||

Net Earnings (Loss) per share—diluted | $ | 0.01 | $ | 0.20 | $ | 0.31 | $ | (0.03 | ) | $ | 0.07 | |||||||||

Pro forma Net Earnings per share—conversion to C Corporation for tax purposes (unaudited)—basic (3) | n/a | n/a | $ | 0.19 | $ | 0.01 | $ | 0.06 | ||||||||||||

Pro forma Net Earnings per share—conversion to C Corporation for tax (unaudited) purposes—diluted (3) | n/a | n/a | $ | 0.19 | $ | 0.01 | $ | 0.06 | ||||||||||||

Weighted—average number of shares—basic | 71,026 | 69,490 | 48,890 | 48,390 | 48,390 | |||||||||||||||

Weighted—average number of shares—diluted | 76,864 | 70,317 | 49,414 | 48,390 | 48,390 | |||||||||||||||

Dividends Paid (1) | $ | — | $ | — | $ | 0.45 | $ | 0.01 | $ | 0.04 | ||||||||||

Balance Sheet Data (4) | ||||||||||||||||||||

Total Assets (5) | $ | 327,579 | $ | 333,609 | $ | 233,350 | $ | 163,056 | $ | 124,226 | ||||||||||

Working Capital (5) | $ | 121,423 | $ | 83,069 | $ | 2,120 | $ | 38,559 | $ | 40,880 | ||||||||||

Total Long Term Debt Less Current Maturities | $ | 71,372 | $ | 72,328 | $ | 10,744 | $ | 75,546 | $ | 65,365 | ||||||||||

Stockholders’ Equity | $ | 157,341 | $ | 136,412 | $ | 61,821 | $ | 12,973 | $ | 14,918 | ||||||||||

(1) | Dividends paid represent cash dividends paid by Old American Apparel to its stockholders prior to becoming a public company. We do not anticipate paying any cash dividends in the foreseeable future. |

(2) | The effect of the Merger has been given retroactive application in the earnings per share (“EPS”) calculation. The common stock issued and outstanding with respect to the pre-Merger stockholders of American Apparel, Inc. has been included in the EPS calculation since the Closing date of the Merger. All of American Apparel, Inc.’s outstanding warrants (the “Endeavor Warrants”) which were issued in the initial public offering of Endeavor Acquisition Corp. and underwriter’s purchase option are reflected in the diluted EPS calculation, using the treasury stock method, commencing with the Closing date of the Merger. |

(3) | As a result of the Merger, Old American Apparel was required to convert from a Subchapter S Corporation to a C Corporation as of the Closing on December 12, 2007. As a Subchapter S Corporation, U.S. federal and certain state income taxes were the responsibility of the entity’s stockholders. Accordingly, the income taxes were not reflected in the entity’s financial statements. The result of this conversion was to recognize deferred tax assets and liabilities from the expected tax consequences of temporary differences between the book and tax basis of the entity’s assets and liabilities at the date of conversion into a taxable entity. This resulted in a deferred tax benefit of $6,205 being recognized and included in the 2007 tax (benefit). |

The unaudited pro forma computation of income tax included in the Consolidated Statements of Operations presented elsewhere in this Form 10-K/A, represents the tax effects that would have been reported had Old American Apparel been subject to U.S. federal and state income taxes as a corporation for the year ended December 31, 2007. Pro forma taxes are based upon the statutory income tax rates and adjustments to income for estimated permanent differences occurring during each period. Actual rates and expenses could have differed had Old American Apparel actually been subject to U.S. federal and state income taxes for all periods presented. Therefore, the unaudited pro forma amounts for net earnings per share are for informational purposes only and are intended to be indicative of the results of operations had Old American Apparel been subject to U.S. federal and state income taxes as a corporation for the year ended December 31, 2007. |

(4) | Dov Charney, a 50% owner of Old American Apparel’s common stock and 100% owner of American Apparel Canada Wholesale, Inc. and American Apparel Canada Retail, Inc.’s (collectively, the “CI Companies”) common stock and current Chief Executive Office of the Company received from American Apparel, Inc. 37,258 shares of its common stock in exchange for his ownership interest in Old American Apparel and CI Companies. The other 50% owner of Old American Apparel’s Common Stock, Sang Ho Lim, received $67,903 for his ownership interest, the equivalent of 11,132 shares of common stock. |

Immediately prior to the closing of the Merger, American Apparel, Inc. had 19,933 shares of Common stock outstanding with a net tangible book value of $121,589, net of $5,494 of transaction costs. The net tangible book value consisted of cash of $123,000, a tax liability of $1,406 and accrued expenses of $5. The net cash proceeds were used as follows: $67,903 was paid to Sang Ho Lim, $15,764 was paid to Dov Charney and Sang Ho Lim as a Company distribution to settle their estimated personal income tax liabilities as a result of Old American Apparel’s subchapter S Corporation status, $13,323 was used to repay related party and third party debt, and $26,010 was available for working capital. |

(5) | Certain amounts have been reclassified in fiscal 2008 and 2007 as disclosed in Note 3, Classification and Adjustments, in the Notes to the consolidated financial statements included elsewhere in this Form 10-K/A. |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

You should read the following discussion together with Part II, Item 6 “Selected Financial Data” and our consolidated financial statements and the related notes thereto included in Item 8 “Financial Statements and Supplementary Data.” In addition to historical consolidated financial information, this discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Actual results could differ from these expectations as a result of factors including those described under Item 1A, “Risk Factors,” “Special Note Regarding Forward-Looking Statements” and elsewhere in this Annual Report on Form 10-K/A.

Overview

We are a vertically-integrated manufacturer, distributor, and retailer of branded fashion basic apparel. We design, manufacture and sell clothing for women, men, children and pets through retail, wholesale and online distribution channels. As of December 31, 2009, we operated 281 retail stores in 20 countries. Our wholesale business is a leading supplier of T-shirts and other casual wear to screen printers and distributors. We also operate an online retail e-commerce website at www.americanapparel.com where we sell our clothing directly to consumers.

We conduct our primary manufacturing operations out of an 800,000 square foot facility in the warehouse district of downtown Los Angeles, California. The facility houses our executive offices, as well as cutting, sewing, warehousing, and distribution operations. We conduct knitting operations in Los Angeles and Garden Grove, California, which produce a majority of the fabric we use in our products. We also operate dye houses that currently provide dyeing and finishing services for nearly all of the raw fabric used in production. We operate a dyeing and finishing facility in Hawthorne, California, which provides fabric dyeing and finishing services. We operate a garment dyeing and finishing facility, acquired in December 2007 and located in South Gate, California, which is used in cutting, sewing, dyeing and finishing garments. We operate a fabric dyeing and finishing facility, acquired in May 2008 and located in Garden Grove, California, which has been expanded to including knitting and cutting and sewing operations. Because we manufacture domestically and are vertically integrated, we believe this enables us to more quickly respond to customer demand and to changing fashion trends and to closely monitor product quality. Our products are noted for their quality and fit, and together with our distinctive branding these attributes have differentiated our products in the marketplace.

We report the following four operating segments: U.S. Wholesale, U.S. Retail, Canada, and International. We believe this method of segment reporting reflects both the way our business segments are managed and the way the performance of each segment is evaluated. The U.S. Wholesale segment consists of our wholesale operations and our online consumer operations in the U.S. The U.S. Retail segment consists of our retail store operations in the United States, which were comprised of 160 retail stores as of December 31, 2009. The Canada segment consists of our retail, wholesale and online consumer operations in Canada. As of December 31, 2009, the retail operations in the Canada segment were comprised of 40 retail stores The International segment consists of our retail, wholesale and online consumer operations outside of the United States. and Canada. As of December 31, 2009, the retail operations in the International segment were comprised of 81 retail stores in the following 18 countries: the United Kingdom, Ireland, Austria, Belgium, France, Germany, Italy, the Netherlands, Spain, Sweden, Switzerland, Israel, Australia, Brazil, Mexico, Japan, South Korea, and China.

The results of the respective business segments exclude unallocated corporate expenses, which consist of our shared overhead costs. These costs are presented separately and generally include, among other things, corporate costs such as human resources, legal, finance, information technology, accounting, and executive compensation.

During the period from January 1, 2007 through December 31, 2009, we increased the number of retail stores in the U.S. Retail segment from 93 to 160, increased the number of retail stores in the Canada segment from 26 to 40 and increased the number of retail stores in the International segment from 28 to 81. The following table details, by segment, the growth in retail store count during the years ended December 31, 2009, 2008 and 2007

Stores Opened by Year

United States | Canada | International | Total | |||||||||

Stores open as of December 31, 2006 | 93 | 26 | 28 | 147 | ||||||||

2007 | ||||||||||||

Opened | 13 | 5 | 20 | 38 | ||||||||

Closed | (1 | ) | (1 | ) | (1 | ) | (3 | ) | ||||

Stores open as of December 31, 2007 | 105 | 30 | 47 | 182 | ||||||||

2008 | ||||||||||||

Opened | 44 | 8 | 29 | 81 | ||||||||

Closed | (1 | ) | (1 | ) | (1 | ) | (3 | ) | ||||

Stores open as of December 31, 2008 | 148 | 37 | 75 | 260 | ||||||||

2009 | ||||||||||||

Opened | 15 | 5 | 8 | 28 | ||||||||

Closed | (3 | ) | (2 | ) | (2 | ) | (7 | ) | ||||

Stores open of December 31, 2009 | 160 | 40 | 81 | 281 | ||||||||

Comparable Store Sales

The table below shows the (decrease) increase in comparable store sales for our retail stores, by quarter for the years ended December 31, 2009, 2008 and 2007, including the number of retail stores included in the comparison at the end of each period.

For the Quarter Ended | |||||||||||||||

March 31 | June 30 | September 30 | December 31 | Full year | |||||||||||

2009 | (7 | )% | (10 | )% | (16 | )% | (7 | )% | (10 | )% | |||||

Number of Stores | 169 | 175 | 200 | 235 | |||||||||||

2008 | 36 | % | 23 | % | 24 | % | 11 | % | 22 | % | |||||

Number of Stores | 140 | 145 | 150 | 162 | |||||||||||

2007 | 17 | % | 24 | % | 27 | % | 40 | % | 29 | % | |||||

Number of Stores | 104 | 119 | 131 | 138 | |||||||||||

Executive Summary

For the year ended December 31, 2009, we reported net sales of $558.8 million, an increase of $13.8 million, or 2.5%, over the $545.1 million reported for the year ended December 31, 2008. Gross margin increased to 57.3% for the year ended December 31, 2009 compared to 54.0% for the year ended December 31, 2008. The increase in gross margin was due to a favorable shift in mix from wholesale towards retail sales, as retail sales generate a higher gross margin. This increase was partially offset due to an increase in inventory costs caused by a reduction in labor efficiency in the second half of 2009 and a continued shift in production mix towards more complex retail styles. Operating expenses increased $37.1 million, or 14.4%, to $295.5 million for the year ended December 31, 2009 as compared to $258.4 million for the year ended December 31, 2008. Interest expense increased $8.7 million to $22.6 million for the year ended December 31, 2009, as compared to $13.9 million for the year ended December 31, 2008. Net income for the year ended December 31, 2009 decreased to $1.1 million compared to $14.1 million for the year ended December 31, 2008.

On December 30, 2009, our Canadian company replaced its secure revolving credit facility of C$4.0 million with an increased revolving credit facility of C$11.0 million from Bank of Montreal. As of December 31, 2009, C$8.5 million was available on the facility.

During April 2009, we successfully completed the second phase of the implementation of our Enterprise Resources Planning (“ERP”) system, which included the system conversions for our sales and distribution operations and financial accounting and reporting for the U.S. Wholesale segment. Previously, in April 2008, we successfully completed the first phase of the implementation of the ERP system, which included the conversion of our systems for manufacturing and warehouse operations, inventory management and control, and wholesale operations. We expect that the modules in the second phase of the implementation of the ERP system will enable us to better manage our distribution activities and wholesale financial reporting and further improve our ability to manage inventory levels.

On March 13, 2009, we entered into a private financing agreement with Lion Capital LLP (“Lion”) for $80.0 million in secured second lien notes with a maturity of December 31, 2013 and detachable warrants. The majority of the financing proceeds were used to retire the existing second lien credit facility with SOF Investment, L.P. – Private IV (“SOF”). The remainder of the proceeds was used to reduce the outstanding balance under our U.S. revolving credit facility, repay a portion of a related-party note, pay fees and expenses related to the financing, and for general working capital.

Results of Operations

Year Ended December 31, 2009 compared to Year Ended December 31, 2008

(Dollars in Thousands)

2009 (unaudited) | 2008 | |||||||||||||

Amount | % of Net Sales | Amount | % of Net Sales | |||||||||||

Net sales | $ | 558,775 | 100.0 | % | $ | 545,050 | 100.0 | % | ||||||

Cost of sales | 238,863 | 42.7 | % | 250,629 | 46.0 | % | ||||||||

Gross profit | 319,912 | 57.3 | % | 294,421 | 54.0 | % | ||||||||

Operating expenses | 295,497 | 52.9 | % | 258,357 | 47.4 | % | ||||||||

Income from operations | 24,415 | 4.4 | % | 36,064 | 6.6 | % | ||||||||

Interest expense | 22,627 | 4.0 | % | 13,921 | 2.6 | % | ||||||||

Foreign currency transaction (gain) loss | (2,920 | ) | (0.5 | )% | 621 | 0.1 | % | |||||||

Other (income) expense | (220 | ) | — | % | 155 | — | % | |||||||

Income before income taxes | 4,928 | 0.9 | % | 21,367 | 3.9 | % | ||||||||

Income tax provision | 3,816 | 0.7 | % | 7,255 | 1.3 | % | ||||||||

Net income | $ | 1,112 | 0.2 | % | $ | 14,112 | 2.6 | % | ||||||

Net sales:

The following table sets forth our net sales by business segment for the year ended December 31, 2009 as compared to the year ended December 31, 2008 (dollars in thousands):

2009 (unaudited) | 2008 | ||||||||||||||||||||

Amount | % of Net Sales | Amount | % of Net Sales | Change | % Change | ||||||||||||||||

U.S. Wholesale | $ | 141,521 | 25.3 | % | $ | 162,668 | 29.8 | % | $ | (21,147 | ) | (13.0 | )% | ||||||||

U.S. Retail | 191,325 | 34.2 | % | 168,653 | 31.0 | % | 22,672 | 13.4 | % | ||||||||||||

Canada | 68,983 | 12.3 | % | 67,280 | 12.3 | % | 1,703 | 2.5 | % | ||||||||||||

International | 156,946 | 28.2 | % | 146,449 | 26.9 | % | 10,497 | 7.2 | % | ||||||||||||

Total net sales | $ | 558,775 | 100.0 | % | $ | 545,050 | 100.0 | % | $ | 13,725 | 2.5 | % | |||||||||

Net sales increased $13.7 million, or 2.5%, to $558.8 million for the year ended December 31, 2009 as compared with $545.1 million for the year ended December 31, 2008. The increase in net sales was primarily driven by 21 new retail stores opened through our U.S., Canadian and International retail operations net of seven store closures. This increase was partially offset by a decline in net sales from our U.S Wholesale segment, and the wholesale operations of our Canada and International segments. Additionally, our net sales results were negatively impacted as a result of the U.S. dollar appreciating against the local currencies of our international retail stores. On a constant currency basis, net sales would have been $16.7 million greater than reported for the year ended December 31, 2009.

U.S. Wholesale: Total net sales for our U.S. Wholesale segment decreased $21.1 million, or 13.0%, to $141.5 million for the year ended December 31, 2009 as compared to $162.7 million for the year ended December 31, 2008. Net sales to wholesale customers (excluding online consumer sales) decreased $18.9 million, or 13.8%, to $118.2 million for the year ended December 31, 2009 as compared to $137.2 million for the year ended December 31, 2008. This decrease was primarily caused by difficult economic conditions for our wholesale customers, especially for private label and manufacturer customers, who significantly reduced their order volumes. Online consumer sales decreased $2.2 million, or 8.6%, to $23.3 million for the year ended December 31, 2009, as compared to $25.5 million for the year ended December 31, 2008. The decrease in online consumer sales was primarily due to a significant reduction in online advertising and the cannibalization of online sales as a

result of operating additional retail locations.

U.S. Retail: Net sales for the U.S. Retail segment increased $22.7 million, or 13.4%, to $191.3 million for the year ended December 31, 2009 as compared to $168.7 million for the year ended December 31, 2008. The increase was primarily caused by $14.5 million of incremental net sales contributed by the 15 new retail stores opened in key markets within the U.S. during 2009. The increase was partially offset by a $24.8 million, or 16%, decline in net sales from same store sales for the year ended December 31, 2009. Since December 31, 2008 we opened 15 new retail stores, while closing three and the number of stores in operation increased from 148 to 160.

Canada: Total net sales for our Canada segment increased $1.7 million, or 2.5%, to $69.0 million for the year ended December 31, 2009 as compared to $67.3 million for the year ended December 31, 2008. Net sales to retail customers increased $3.1 million, or 5.9% to $56.0 million for the year ended December 31, 2009 compared to $52.9 million for the year ended December 31, 2008. The increase was primarily caused by $3.3 million of incremental net sales contributed by the five new retail stores opened in key markets within Canada during 2009. The increase was partially offset by a $2.4 million, or 5%, decline in same store sales for the year ended December 31, 2009. Since December 31, 2008 we opened 5 new retail stores, while closing two and the number of stores in operation increased from 37 to 40.

Net sales to wholesale customers decreased $1.3 million, or 10% to $11.4 million for the year ended December 31, 2009 as compared to $12.7 million for the year ended December 31, 2008. This decrease was primarily caused by difficult economic conditions for our wholesale customers, especially for private label and manufacturer customers, who significantly reduced their order volumes. Online sales decreased $0.1 million, or 7.6%, to $1.6 million for the year ended December 31, 2009 as compared to $1.7 million for the year ended December 31, 2008.

Additionally, the value of a U.S. dollar against the Canadian dollar increased during the year ended December 31, 2009 resulting in a $4.9 million decline in net sales on a constant currency basis.

International: Total net sales for the International segment increased $10.5 million, or 7.2%, to $156.9 million for the year ended December 31, 2009 as compared to $146.4 million for the year ended December 31, 2008. Net sales to retail customers increased $12.3 million, or 10.3% to $132.1 million for the year ended December 31, 2009 as compared to $119.7 million for the year ended December 31, 2008. The increase was primarily caused by $6.0 million of incremental net sales contributed by the eight new retail stores opened in key markets during 2009. The increase was partially offset by a 4% decline in same store sales for the year ended

December 31, 2009. Since December 31, 2008, we opened 8 new retail stores, while closing two and the number of stores in operation increased from 75 to 81.

Net sales to wholesale customers decreased $2.1 million, or 14.8%, to $12.4 for the year ended December 31, 2009 as compared to $14.5 million for the year ended December 31, 2008. This decrease was primarily caused by difficult economic conditions for our wholesale customers, especially for private label and manufacturer customers, who significantly reduced their order volumes. Online net sales increased $0.3 million, or 2.4% to $12.5 million for the year ended December 31, 2009 as compared to $12.2 million for the year ended December 31, 2008.

Additionally, the value of a U.S. dollar against the local currencies of our international retail stores increased during the period resulting in an $11.8 million decline in net sales on a constant currency basis

Cost of sales: Cost of sales as a percentage of net sales was 42.7% and 46.0% for the years ended December 31, 2009 and 2008, respectively. Cost of sales for 2008 was impacted by $13.2 million, or 2.4%, as a percentage of sales, in stock based compensation expense relating to the award of approximately 1.9 million shares of common stock to our manufacturing employees (the “2008 Grant”) during the third quarter of 2008. On a comparative basis, excluding the impact of the 2008 Grant, our cost of sales as a percentage of net sales decreased from 43.6% for the year ended December 31, 2008 to 42.7% for the year ended December 31, 2009. Cost of sales was impacted by a shift in mix from wholesale to retail sales, as retail increased from 62.6% of total net sales in 2008 to 67.9% of total net sales in 2009. The favorable impact from the shift in mix was partially offset by the negative impact of the appreciation of the U.S. dollar versus foreign currencies for the full year 2009 relative to the full year 2008. Additionally, cost of sales was also negatively impacted by lower capacity utilization of our manufacturing facilities in the first half of 2009, and the substantial reduction in manufacturing efficiency experienced in the fourth quarter of 2009 at our production facilities.

Gross profit: Gross margin for 2009 was 57.3% as compared to 54.0%, or 56.4% excluding the impact of the 2008 Grant, in 2008. The increase in gross margin was due to a favorable shift in mix from wholesale towards retail sales, as retail sales generate a higher gross margin. This increase was partially offset due to an increase in inventory costs caused by a reduction in labor efficiency in the second half of 2009 and a continued shift in production mix towards more complex retail styles. We expect that the effects of lower production efficiency will continue into 2010.

Operating expenses: The following table sets forth our operating expenses for the year ended December 31, 2009 as compared to December 31, 2008 (dollars in thousands):

2009 (unaudited) | 2008 | ||||||||||||||||||||

Amount | % of Net Sales | Amount | % of Net Sales | Change | % Change | ||||||||||||||||

Selling | $ | 183,113 | 32.8 | % | $ | 168,516 | 30.9 | % | $ | 14,597 | 8.7 | % | |||||||||

Warehouse and distribution | 15,405 | 2.8 | % | 15,606 | 2.9 | % | (201 | ) | (1.3 | )% | |||||||||||

General and administrative | 96,979 | 17.3 | % | 74,235 | 13.6 | % | 22,744 | 30.6 | % | ||||||||||||

Total operating expenses | $ | 295,497 | 52.9 | % | $ | 258,357 | 47.4 | % | $ | 37,140 | 14.4 | % | |||||||||

Operating expenses: Operating expenses increased $37.1 million, or 14.4%, to $295.5 million for the year ended December 31, 2009 as compared to $258.4 million for the year ended December 31, 2008. The increase in operating expenses was primarily caused by increased occupancy, payroll, and depreciation expenses incurred as a result of operating an additional 21 net stores at the end of 2009 compared to the end of 2008, as well as due to the full year impact of increased operating expenses from the additional 78 net new stores opened in 2008. Operating expenses were also higher in 2009 due to $3.3 million in non-cash retail store impairment charges recorded in 2009 compared to $0.6 million in 2008. Pre-opening expenses for retail stores were $2.4 million in 2009 versus $10.3 million in 2008.

Selling expenses: Selling expenses together with unallocated corporate selling, advertising and promotion expenses, for the year ended December 31, 2009, increased $14.6 million, or 8.7%, to $183.1 for the year ended December 31, 2009 as compared to $168.5 for the year ended December 31, 2008. Specifically, rent and occupancy costs increased $18.3 million and payroll and benefit costs increased $5.5 million. The increase in payroll costs was a result of higher staffing costs required to support the increased number of stores in operation compared to in the prior year.

Increases in rent and occupancy costs and payroll and benefit costs were partially offset by decreases in advertising, trade show and catalog expenses. Advertising, trade show and catalog costs included in selling expenses for the year ended December 31, 2009 were $15.4 million, or 2.8% of net sales, as compared with $25.0 million, or 4.5% of net sales, for the year ended December 31, 2008. The decrease of $9.6 million was mainly due to a reduction in discretionary expenses to promote new store openings and to promote our products through print publications, magazines, trade shows, catalogs and online media.

Pre-opening expenses for the U.S. Retail segment totaled $2.3 million for the year ended December 31, 2009, associated with the opening of 15 new retail stores, as compared with $5.8 million for the year ended December 31, 2008. Pre-opening expenses in the Canada and International segments totaled $1.6 million for the year ended December 31, 2009, associated with the opening of 13 new retail stores, as compared with $4.5 million for the year ended December 31, 2008. Pre-opening expenses include costs related to opening new stores such as materials, pre-opening labor and training; utilities, travel, and IT labor costs. The decrease in pre-opening expenses from the prior year was due to the larger number of stores in the process of being opened in prior year.

Warehouse and distribution expenses: Warehouse and distribution expenses decreased $0.2 million, or 1.3%, to $15.4 million for the year ended December 31, 2009 as compared to $15.6 million for the year ended December 31, 2008. These expenses represented 2.8% and 2.9% of the total net sales for the years ended December 31, 2009 and 2008, respectively. The warehouse and distribution expense was consistent with prior year.

General and administrative expenses: General and administrative (“G&A”) expenses increased $22.7 million, or 30.6%, to $97.0 million for the year ended December 31, 2009, as compared to $74.2 million for the year ended December 31, 2008. G&A expenses represented 17.4% and 13.6% of total net sales for the years ended December 31, 2009 and 2008, respectively. G&A expenses increased by $7.5 million due to higher depreciation charges, and $4.1 million due to an increase in salaries, wages and benefits, primarily associated with an increased number of retail stores in operation during the year ended December 31, 2009 as compared to year ended December 31, 2008. An additional $5.1 million of the increase in G&A was due to higher professional fees related to accounting and legal services, $1.6 million related to bonuses and director stock grants and an increase of $3.0 million in fixed asset impairment charges related to underperforming retail stores scheduled for closure.

Interest expense: The major components of interest expense for the year ended December 31, 2009 consisted of interest on our revolving line of credit, loans from our CEO and unrelated parties, capital leases and our term loans. Interest rates on our various debt facilities and capital leases ranged from 5.7% to 19.3% during the year ended December 31, 2009 and 6.2% to 26.0% during the year ended December 31, 2008. Interest expense increased $8.7 million to $22.6 million for the year ended December 31, 2009, as compared to $13.9 million for the year ended December 31, 2008. Interest expense represented 4.0% and 2.6% of the total net sales for the years ended December 31, 2009 and 2008, respectively. The net increase in interest

expense was primarily attributable to the amortization of debt discount, deferred financing costs and higher borrowings under the Lion Credit Agreement as compared to our previous second lien credit facility. Additionally, $0.9 million of bank audit fees are included in interest expense for the year ended December 31, 2009, whereas no such fees were incurred in the prior year.

Other (income) expense: Other income was $(3.1) million for the year ended December 31, 2009 as compared to other expense of $0.8 million for the year ended December 31, 2008. Other income represented

(0.6%) of the total net sales for the year ended December 31, 2009 as compared to other expense which represented 0.1% of the total net sales for the year ended December 31, 2008. The large change from other expense in 2008 to other income primarily relates to $2.9 million of foreign currency transaction gain.

Additionally, the value of a U.S. dollar against the Canadian dollar increased during the year ended December 31, 2009 resulting in a $4.9 million decline in net sales on a constant currency basis.

Income tax provision: Income taxes decreased $3.5 million to a $3.8 million income tax provision for the year ended December 31, 2009, as compared to a $7.3 million income tax provision for the year ended December 31, 2008. The decrease was due to the decline in income before taxes for the year ended December 31, 2009 as compared to the year ended December 31, 2008. The effective income tax rate for the year ended December 31, 2009 was 77.4% as compared to 34% for the year ended December 31, 2008. The significant increase in the effective income tax rate for the year ended December 31, 2009 compared to prior year was primarily due to the establishment of valuation allowances against certain foreign net operating losses and the establishment of certain liabilities related to uncertain tax positions raised in connection with certain income tax audits. We expect our effective income tax rate in 2010 to return to a percentage consistent with previous years.

We file income tax returns for various states and foreign jurisdictions. Where applicable, we provide for state and foreign taxes at the applicable statutory state and country rates multiplied by pre-tax income.

Net income: Our net income for the year ended December 31, 2009 decreased $13.0 million to $1.1 million compared to $14.1 million for the year ended December 31, 2008 as a result of the various factors described above.

Year Ended December 31, 2008 compared to Year Ended December 31, 2007

(Dollars in Thousands)

2008 | 2007 | |||||||||||||

Amount | % of Net Sales | Amount | % of Net Sales | |||||||||||

Net sales | $ | 545,050 | 100.0 | % | $ | 387,044 | 100.0 | % | ||||||

Cost of sales | 250,629 | 46.0 | % | 173,676 | 44.9 | % | ||||||||

Gross profit | 294,421 | 54.0 | % | 213,368 | 55.1 | % | ||||||||

Operating expenses | 258,357 | 47.4 | % | 182,246 | 47.1 | % | ||||||||

Income from operations | 36,064 | 6.6 | % | 31,122 | 8.0 | % | ||||||||

Interest expense | 13,921 | 2.6 | % | 17,541 | 4.5 | % | ||||||||

Foreign currency transaction loss (gain) | 621 | 0.1 | % | (722 | ) | (0.2 | )% | |||||||

Other expense (income) | 155 | — | % | (980 | ) | (0.3 | )% | |||||||

Income before income taxes | 21,367 | 3.9 | % | 15,283 | 3.9 | % | ||||||||

Income tax provision (benefit) | 7,255 | 1.3 | % | (195 | ) | (0.1 | )% | |||||||

Net income | $ | 14,112 | 2.6 | % | $ | 15,478 | 4.0 | % | ||||||

Pro forma Computation Related to Conversion to C Corporation for income tax purposes (unaudited) for the year ended December 31, 2007 (dollars in thousands):

Historical income before taxes | $ | 15,283 | 3.9 | % | |||

Pro forma provision for income taxes | 5,826 | 1.5 | % | ||||

Pro forma net income | $ | 9,457 | 2.4 | % | |||

Net sales:

The following table sets forth our net sales by business segment for the year ended December 31, 2008 as compared to

the year ended December 31, 2007 (dollars in thousands):

2008 | 2007 | Change | % Change | ||||||||||||||||||

Amount | % of Net Sales | Amount | % of Net Sales | ||||||||||||||||||

U.S. Wholesale | $ | 162,668 | 29.8 | % | $ | 144,478 | 37.3 | % | $ | 18,190 | 12.6 | % | |||||||||

U.S. Retail | 168,653 | 31.0 | % | 115,615 | 29.9 | % | 53,038 | 45.9 | % | ||||||||||||

Canada | 67,280 | 12.3 | % | 42,407 | 11.0 | % | 24,873 | 58.7 | % | ||||||||||||

International | 146,449 | 26.9 | % | 84,544 | 21.8 | % | 61,905 | 73.2 | % | ||||||||||||

Total net sales | $ | 545,050 | 100.0 | % | $ | 387,044 | 100.0 | % | $ | 158,006 | 40.8 | % | |||||||||

One significant factor contributing to the overall growth in net sales was the expansion of our international operations, as evidenced by the opening of 29 international retail stores with one store closing during the year ended December 31, 2008. In our Canada segment, during the year ended December 31, 2008, 8 retail stores were opened and one store was closed. Additionally, during the same period 44 retail stores were opened and one retail store was closed in our U.S. Retail business segment. Also of primary significance to the expansion of American Apparel’s retail business in the U.S. was our increased focus on building brand awareness and targeted advertising campaigns as further described below;

Net sales increased $158.0 million, or 40.8%, from $387.0 million for the year ended December 31, 2007 to $545.0 million for the year ended December 31, 2008.

U.S. Wholesale: Net sales for our U.S. Wholesale segment increased $18.2 million, or 12.6%, from $144.5 million for the year ended December 31, 2007 to $162.7 million for the year ended December 31, 2008. This increase was primarily due to an increase in online sales due to strategic advertising and increased brand awareness. Third party wholesale and online sales increased from $125.8 million and $18.7 million in 2007 to $137.2 million and $25.5 million in 2008, respectively. One of the primary drivers behind the increase in U.S. Wholesale sales was the ability to meet customer demands through increased stock of inventory on hand. During most of 2008, we continued to increase our production in order to meet customer demand during the peak sales season.

U.S. Retail: Net sales for our U.S. Retail segment increased $53.0 million, or 45.9%, from $115.6 million for the year ended December 31, 2007 to $168.7 million for the year ended December 31, 2008. Growth was fueled by the addition of retail stores in key markets within the U.S. in 2008 which contributed incremental sales of $30.4 million over the prior year, as well as a 20.7% increase of $22.6 million in comparable store sales in 2008 compared to 2007. Same-store sales are calculated as the sales increase over the previous year for stores that have been open for more than twelve months. As of December 31, 2008, the number of open stores was 148, while as of December 31, 2007, the number of open stores was 105.

Canada: Net sales for our Canada segment increased $24.9 million, or 58.7%, from $42.4 million for the year ended December 31, 2007 to $67.3 million for the year ended December 31, 2008. This was a result of the addition of retail stores in key markets within Canada which contributed incremental sales of $13.8 million of the prior year, as well as a 37.7% increase of $11.1 million in same store sales in 2008 compared to 2007. The number of open retail stores increased to 37 retail stores as of December 31, 2008 from 30 retail stores as of December 31, 2007. The increase in comparable store sales was primarily the result of increased brand awareness and higher sales volumes. Canada wholesale and online sales volume was consistent with the prior year.

International: Net sales for our International segment increased $61.9 million, or 73.2%, from $84.5 million for the year ended December 31, 2007 to $146.4 million for the year ended December 31, 2008. This

increase was primarily due to the net increase of 28 retail stores in the international segment which contributed incremental sales of $61.9 million over the prior year, from 47 retail stores as of December 31, 2007 to 75 retail stores as of December 31, 2008. Comparable store sales in the International segment increased 18.3% or $11.7 million for the year ended December 31, 2008 as compared to the year ended December 31, 2007. During 2008, we opened 29 new stores in Australia, Belgium, Brazil, China, France, Germany, Israel, Italy, Japan, Korea, Mexico, Netherlands, Spain, Switzerland and the United Kingdom. During the year ended December 31, 2008, approximately $14.5 million and $12.2 million of sales were generated by wholesale and online sales, respectively, compared with $12.6 million and $6.6 million for wholesale and online sales, respectively, for the year ended December 31, 2007.

Cost of sales: Cost of sales as a percentage of net sales was 46.0% and 44.9% for the years ended December 31, 2008 and 2007, respectively. The increase was primarily due to the recording $12.1 million of share based compensation expense related to the stock award of approximately 1.9 million shares of common stock to manufacturing employees on August 14, 2008 and $1.1 million of employer related payroll taxes related to the stock grant in cost of sales for the year ended

December 31, 2008. The $13.2 million of expenses related to the stock award increased our cost of sales as a percentage of net sales by 2.4%. Excluding the impact of the aforementioned expenses related to the stock award, our cost of sales as a percentage of net sales decreased from 44.3% for the year ended December 31, 2007 to 43.6% for the year ended December 31, 2008. This decrease in cost of sales as a percentage of net sales was primarily due to the change in the overall sales mix during the year ended December 31, 2008 which included a higher level of retail sales as a result of the expansion of the retail business in the U.S. Retail, Canada, and International segments which generate higher gross margins than the U.S. Wholesale segment.

To supplement our in-house production capacity in December 2007, we acquired a new garment dyeing and finishing facility in South Gate, California, which began operations in 2008. The new dyeing and finishing facility is capable of dyeing completely sewn garments and the purchase of these assets added garment dyeing capability to our production process. The new facility began production in January 2008 and will further enhance our capability for in-house quality control. This acquisition included the assumption of the lease for the facility as well as the purchase of all of the tangible personal property at the plant. Startup expenses typically associated with manufacturing at new facilities resulted in approximately $0.9 million of charges in cost of sales, attributable largely to the fact that, at this location, we began to manufacture certain denim based new styles which are more costly to manufacture. The $0.9 million of additional cost of sales charges represents approximately 1.2% of the total increase in cost of sales.

To further supplement our in-house production capacity, in May 2008, we acquired an existing fabric dyeing and finishing facility in Garden Grove, California. In addition to providing substantial new dyeing capacity, the facility has available production space in which our added knitting capacity. The facility was formerly a contract dyeing vendor for our, and operations were not interrupted by the acquisition.

Gross profit: Gross profit percentage decreased from 55.1% of net sales for the year ended December 31, 2007 to 54.0% of net sales for the year ended December 31, 2008. Gross margin was negatively impacted by the $13.2 million of expenses from the stock award to manufacturing employees, including related employer payroll taxes of $1.1 million. The $13.2 million of expenses decreased our gross margin by 2.4%. Excluding the impact of the aforementioned expenses related to the stock award, our gross margin for the year ended December 31, 2008 increased from 55.1% for the year ended December 31, 2007 to 56.4% for the year ended December 31, 2008. This increase in our gross margin was primarily due to an increase in the mix of sales coming from retail sales versus wholesale, along with an increase in online consumer sales. As the price of our products have remained relatively consistent in recent history, with no immediate plan to make changes, fluctuations in gross profit are primarily impacted by our sales mix and any production variances that are allocated to cost of sales. This benefit was partially offset by the hiring of a significant number of new manufacturing employees to support increased production.

Operating expenses: The following table sets forth our operating expenses for the year ended December 31, 2008 as compared to December 31, 2007 (dollars in thousands).

2008 | 2007 | Change | % Change | ||||||||||||||||||

Amount | % of Net Sales | Amount | % of Net Sales | ||||||||||||||||||

Selling | $ | 168,516 | 30.9 | % | $ | 115,602 | 29.9 | % | $ | 52,914 | 45.8 | % | |||||||||

Warehouse and distribution | 15,606 | 2.9 | % | 10,663 | 2.8 | % | 4,943 | 46.4 | % | ||||||||||||

General and administrative | 74,235 | 13.6 | % | 55,981 | 14.4 | % | 18,254 | 32.6 | % | ||||||||||||

Total operating expenses | $ | 258,357 | 47.4 | % | $ | 182,246 | 47.1 | % | $ | 76,111 | 41.8 | % | |||||||||

Operating expenses: Operating expenses increased from $182.2 million for the year ended December 31, 2007 to $258.4 million for the year ended December 31, 2008, an increase of $76.1 million or 41.8%. Operating expenses include:

Selling expenses: Selling expenses together with unallocated corporate selling, advertising and promotion expenses, for the year ended December 31, 2008, were $168.5 million, which represented 30.9% of net sales, as compared to $115.6 million for the year ended December 31, 2007, which represented 29.9% of net sales. Increases in selling expenses are due to the increase in worldwide retail store locations as well as the strategic promotional advertising of our products throughout all of its segments.

Advertising costs attributable as selling expenses for the year ended December 31, 2008 were $18.4 million, representing 3.4% of net sales, compared with $12.7 million, or 3.3% of net sales, for the year ended December 31, 2007. Advertising costs increased $5.7 million mainly due to expenses incurred to promote new store openings and to promote our brand and products, primarily online, but also through print media.

The number of open stores increased from 182 as of December 31, 2007 to 260 as of December 31, 2008, resulting in an

increase in rent and occupancy costs of $19.4 million during the year ended December 31, 2008 compared to the prior year. Payroll costs increased from $48.4 million for the year ended December 31, 2007 to $69.3 million for the year ended December 31, 2008, for an increase of $20.9 million. This increase in payroll costs was a result of increased staffing levels to support the increased number of stores and higher sales volumes at existing stores. We also increased compensation to certain valued employees, as we believe that we must provide competitive compensation opportunities to attract, motivate and retain qualified employees.

Costs related to preparing for opening new stores include materials, pre-opening labor and training, utilities, travel, rent and IT labor and costs. Pre-opening costs for the U.S. Retail segment were $5.8 million for the year ended December 31, 2008 compared to $1.3 million for the year ended December 31, 2007. The Canadian segment had a total of $0.5 million in pre-opening expenses for the year ended December 31, 2008 compared to no pre-opening expenses for the year ended December 31, 2007. There was a total of $4.0 million in pre-opening expenses in the International segment for the year ended December 31, 2008 compared to $3.9 million for the year ended December 31, 2007.

Warehouse and distribution expenses: Warehouse and distribution expenses for the year ended December 31, 2008 were $15.6 million as compared to $10.7 million for the year ended December 31, 2007, an increase of $4.9 million or 46.4%. These expenses represented 2.9% and 2.8%, respectively, of the total net sales for the years ended December 31, 2008 and 2007. The increase in warehouse and distribution expense is attributable to increases of $4.1 million in staffing expenses necessary to support increased volume and sales growth, primarily in the retail business.

General and administrative expenses: General and administrative expenses for the year ended December 31, 2008 were $74.2 million, as compared to $56.0 million for the year ended December 31, 2007, an increase of $18.2 million or 32.6%. General and administrative expenses represented 13.6% and 14.5% of total net sales for the years ended December 31, 2008 and 2007, respectively.

General and administrative expenses increased by approximately $7.5 million due to an increase in corporate overhead and $13.4 million due to growth in the administrative structure required to support the growth in our retail business in the U.S. Retail, Canada and International segments. The total number of retail stores increased from 182 opened stores at December 31, 2007 to 260 opened stores at December 31, 2008.

Corporate overhead expenses for the year ended December 31, 2008 increased to $37.2 million, as compared to $29.7 million for the year ended December 31, 2007, an increase of $7.5 million. The increase in corporate overhead expenses was the result of additional expenses for higher salaries and payroll related expenses and professional fees due to increased staffing and the regulatory environment of operating as a public company in 2008. Of the $7.5 million increase in corporate expenses, professional and consulting fees increased by $5.8 million and the remaining $1.7 million increase was primarily due to an increase in information technology and web development expenses. Professional and consulting fees were $12.3 million and $6.5 million for the years ended December 31, 2008 and 2007, respectively. The $5.8 million increase in professional and consulting fees primarily related to an increase of $2.5 million in accounting fees directly related to public company reporting and compliance requirements, $1.9 million in legal fees and $1.4 million in consulting fees related to review work required under the Sarbanes-Oxley Act of 2002 and other initiatives.

Interest expense: The major components of interest expense for the year ended December 31, 2008, consisted of interest on the outstanding revolving credit facility, loans from related and unrelated parties and the term loan facility with SOF. We used proceeds from the exercise of the warrants in the first quarter of 2008 to reduce the level of debt outstanding. The reduction in the level of debt resulted in a $3.6 million decrease in interest expense from $17.5 million for the year ended December 31, 2007 to $13.9 million for the year ended December 31, 2008. Interest rates on debt ranged from 6% to 21% during the year ended December 31, 2008, compared to 4.6% to 24% for the year ended December 31, 2007. Interest expense represented 2.6% and 4.5% of the total net sales for the years ended December 31, 2008 and 2007, respectively. The net decrease in interest expense was also attributable to the decreased LIBOR rate in the year ended December 31, 2008. Interest expense also included approximately $0.5 million of loan fees, relating to renegotiating the terms of our Credit Agreement.

Other expense (income): Other expense was $0.2 million for the year ended December 31, 2008 as compared to other income of $1.0 million for the year ended December 31, 2007. The increase in other (income) expense is attributable to tariff charges assessed and prior uncollected receivables. Other expense represented 0.0% of the total net sales for the year ended December 31, 2008 as compared to other income which represented (0.3%) of the total net sales for the year ended December 31, 2007.

Income tax provision (benefit): Income tax provision increased from $0.2 million benefit for the year ended December 31, 2007 to $7.3 million expense for the year ended December 31, 2008.

Prior to July 1, 2004, Old American Apparel operated as a C corporation under U.S. tax law. Effective July 1, 2004, the

stockholders elected to be taxed under Subchapter S of the Internal Revenue Code (the “S Corporation Election”). During the period of the S Corporation Election, federal income taxes and certain state taxes were the responsibility of Old American Apparel’s stockholders. The S Corporation Election terminated with the consummation of the Acquisition on December 12, 2007. As a result of the change of Old American Apparel’s S corporation status for U.S. tax purposes to the C corporation status on December 12, 2007, the deferred tax assets and liabilities were adjusted to reflect the change in federal and state tax rates applicable to C corporations.

We file income tax returns for various states and foreign jurisdictions. Where applicable, we provide for state and foreign taxes at the applicable statutory state and country rates multiplied by pre-tax income.

Net income: Our net income for the year ended December 31, 2008 decreased by approximately $1.4 million to $14.1 million compared to $15.5 million for the year ended December 31, 2007 as a result of the various factors described above.

Liquidity and Capital Resources

Over the past years, our growth has been funded through a combination of borrowings from related and unrelated parties, bank debt and lease financing, and proceeds from the exercise of warrants. Our principal liquidity requirements are for working capital and capital expenditures. We fund our liquidity requirements primarily through cash on hand, cash flow from operations, if any, and borrowings from revolving credit facilities, related party notes from our CEO and term loans under the Lion Credit Agreement. We generate cash primarily through the sale of our products manufactured by us at our retail stores and through our wholesale operations. Primary uses of cash are for the purchase of raw materials, payment to our manufacturing employees and retail employees, retail store opening costs and the payment of rent for retail stores. We believe that cash on hand, future funds from operations and borrowing from revolving credit facilities will be sufficient to fund our cash requirements for the next twelve months. There is no assurance, however, that we will be able to generate sufficient cash flow or that we will be able to maintain our ability to borrow under our revolving credit facilities.

As of December 31, 2009, we had (i) approximately $9.0 million in cash, (ii) $41.2 million available and $6.3 million outstanding under the BofA Credit Agreement, and (iii) $65.6 million of borrowings outstanding under the Lion Credit Agreement, net of discount, and including accrued paid-in-kind interest of $6.1 million. See “Debt Agreements” below for an overview of the BofA Credit Agreement, the Lion Credit Agreement and our other debt agreements.

Cash Flow Overview for the years ended December 31, 2009, 2008 and 2007 is as follows (dollars in thousands):

2009 (unaudited) | 2008 | 2007 | ||||||||||

Net cash provided by (used in): | ||||||||||||

Operating activities | $ | 45,203 | $ | 18,886 | $ | (6,496 | ) | |||||

Investing activities | (20,889 | ) | (69,865 | ) | (22,737 | ) | ||||||

Financing activities | (25,471 | ) | 41,171 | 44,530 | ||||||||

Effect of foreign exchange rate changes on cash | (1,165 | ) | 1,884 | 215 | ||||||||

Net (decrease) increase in cash | $ | (2,322 | ) | $ | (7,924 | ) | $ | 15,512 | ||||

Cash Flow Overview

Year Ended December 31, 2009 (unaudited)

For the year ended December 31, 2009, cash provided by operations was $45.2 million. This was a result of net income of $1.1 million, non-cash expenses of $46.1 million (primarily depreciation and amortization, stock-based compensation, deferred income taxes, deferred rent expense and bad debt recovery) an increase in accrued expenses and other liabilities of $13.9 million and a decrease in inventory of $10.7 million, offset by the decrease in accounts payable of $10.3 million and a decrease in income tax payable of $9.9 million. The decrease in inventory levels during 2009 included a reduction in raw material purchases and moderated production in order to maintain lower levels of inventory in response to the declining economic environment and a projected decrease in demand from wholesale customers.