Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 3, 2011

NEW AMERICA ENERGY CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 000-54243 | N/A |

| (State or other jurisdiction of | (Commission File Number) | (I.R.S. Employer Identification |

| incorporation) | No.) |

5614C Burbank Street SE,

Calgary, Alberta, T2H

1Z4

(Address of principal executive offices)

800-508-6149

(Registrant’s telephone number, including area code)

____________________________________________________

(Registrant’s former name, address and telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

TABLE OF CONTENTS

1

Item 1.01 Entry

into Material Definitive Agreement

Item

2.01 Completion of Acquisition or

Disposition of Assets.

Item 3.02

Unregistered Sales of Equity Securities.

As used in this Current Report on Form 8-K, unless otherwise stated, all references to the “Company”, “we,” “our” and “us” refer to New America Energy Corp.

Property Rights Acquisition

On February 3, 2011 we entered into and closed property acquisition agreements with First Liberty Power Inc., and GeoXplor Inc. Copies of these agreement are filed as exhibits to this 8-K. Pursuant to the terms of the agreements, we acquired an option, as well as exploration rights, in certain unpatented mining claims located in Southern Utah which we refer to the “Uravan Property”. The Uravan Property is further described below, in the section titled “Description of Property”. Pursuant to the terms of the agreements, we agreed to provide the following payments and other consideration to the two parties:

To FLPC:

- $10,000 on the execution of the agreement; $33,333 within 120 days of the execution of the agreement; $33,333 within 240 days of the execution of the agreement; and $33,334 within 360 days of the execution of the agreement;

- 500,000 shares of our common stock (already issued); and

- A 0.5% net smelter royalty on all net revenue derived from production from the Uravan Property.

To GeoXplor:

- $50,000 on February 28, 2011; $50,000 on May 31, 2011; $100,000 on the 1st year anniversary of the agreement; $100,000 on the 2nd year anniversary of the agreement; $100,000 on the 3rd year anniversary of the agreement; and $100,000 on the 4th year anniversary of the agreement;

- 500,000 shares of our common stock on execution of the agreement (already issued); 250,000 shares of our common stock on or before the date one year from the date of the agreement; 250,000 shares of our common stock on or before the date two years from the date of the agreement; and 250,000 shares of our common stock on or before the date three years from the date of the agreement; and

- A 2.5% net smelter royalty on all net revenue derived from production from the Uravan Property.

If we are unable to make any of the share issuances or payments under the agreements with GeoXplor and FLPC, the property rights would revert to FLPC who would be responsible for payments to GeoXplor.

Description of Business

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. To the extent that any statements made in this report contain information that is not historical, these statements are essentially forward-looking. Forward-looking statements can be identified by the use of words such as “expects”, “plans”, “may,”, “anticipates”, “believes”, “should”, “intends”, “estimates”, and other words of similar meaning. These statements are subject to risks and uncertainties that cannot be predicted or quantified and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, our ability to raise additional capital to finance our activities; the effectiveness, profitability and marketability of our products; legal and regulatory risks associated with the share exchange; the future trading of our common stock; our ability to operate as a public company; our ability to protect our proprietary information; general economic and business conditions; the volatility of our operating results and financial condition; our ability to attract or retain qualified senior management personnel and research and development staff; and other risks detailed from time to time in our filings with the Securities and Exchange Commission (the “SEC”), or otherwise.

2

Information regarding market and industry statistics contained in this report is included based on information available to us that we believe is accurate. It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic analysis. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. We do not undertake any obligation to publicly update any forward-looking statements. As a result, investors should not place undue reliance on these forward-looking statements.

Overview

We were incorporated as “Atheron Inc.” in the State of Nevada on May 8, 2006. On November 5, 2010 we underwent a change of control and on November 15, 2010 we changed our name to New America Energy Corp., and began looking for opportunities to acquire exploration stage oil and gas or mineral properties. Also on November 15, 2010 we effected a split of our issued and outstanding common shares on a 25 for 1 basis. We maintain our business offices at 5614C Burbank Road SE, Calgary, Alberta, T2H 1Z4 and our telephone number is 800-508-6149.

Previous Business

Before we went through a change of control and business focus, we engaged in the business of developing a technology for ethanol-methanol gasoline which is prepared from light, oil, naphtha, straight-run gasoline and key additives. Since our inception, we had been attempting to raise money to complete our product, but have not been able to secure the funds necessary to do so. The lack of funds and the present economy have prevented that from happening. As we have been unable to raise the capital necessary to develop and market our Product, we began a search for other business opportunities which may benefit our shareholders and allow us to raise capital and operate.

Current Business

Shortly after changing out business focus to exploration stage properties, we identified an opportunity to acquire the Uravan Property from FLPC and GeoXplor. We entered into the agreement with the two parties on February 3, 2011 and will now undertake exploration operations on the Uravan Property. Further details on our property and our exploration plans can be found in the section titled “Description of Property”.

Market, Customers and Distribution Methods

Although there can be no assurance, large and well capitalized markets are readily available for all metals and precious metals throughout the world. A very sophisticated futures market for the pricing and delivery of future production also exists. The price for metals is affected by a number of global factors, including economic strength and resultant demand for metals for production, fluctuating supplies, mining activities and production by others in the industry, and new and or reduced uses for subject metals.

3

The mining industry is highly speculative and of a very high risk nature. As such, mining activities involve a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Few mining projects actually become operating mines.

The mining industry is subject to a number of factors, including intense industry competition, high susceptibility to economic conditions (such as price of metal, foreign currency exchange rates, and capital and operating costs), and political conditions (which could affect such things as import and export regulations, foreign ownership restrictions). Furthermore, the mining activities are subject to all hazards incidental to mineral exploration, development and production, as well as risk of damage from earthquakes, any of which could result in work stoppages, damage to or loss of property and equipment and possible environmental damage. Hazards such as unusual or unexpected geological formations and other conditions are also involved in mineral exploration and development.

Competition

The mineral exploration industry is highly competitive. We are a new exploration stage company and have a weak competitive position in the industry. We compete with junior and senior mineral exploration companies, independent producers and institutional and individual investors who are actively seeking to acquire mineral exploration properties throughout the world together with the equipment, labor and materials required to operate on those properties. Competition for the acquisition of mineral exploration interests is intense with many mineral exploration leases or concessions available in a competitive bidding process in which we may lack the technological information or expertise available to other bidders.

Many of the mineral exploration companies with which we compete for financing and for the acquisition of mineral exploration properties have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquiring mineral exploration interests of merit or on exploring or developing their mineral exploration properties. This advantage could enable our competitors to acquire mineral exploration properties of greater quality and interest to prospective investors who may choose to finance their additional exploration and development. Such competition could adversely impact our ability to attain the financing necessary for us to acquire further mineral exploration interests or explore and develop our current or future mineral exploration properties.

We also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to invest in such companies. The presence of competing junior mineral exploration companies may impact our ability to raise additional capital in order to fund our acquisition or exploration programs if investors perceive that investments in our competitors are more attractive based on the merit of their mineral exploration properties or the price of the investment opportunity. In addition, we compete with both junior and senior mineral exploration companies for available resources, including, but not limited to, professional geologists, land specialists, engineers, camp staff, helicopters, float planes, mineral exploration supplies and drill rigs.

General competitive conditions may be substantially affected by various forms of energy legislation and/or regulation introduced from time to time by the governments of the United States and other countries, as well as factors beyond our control, including international political conditions, overall levels of supply and demand for mineral exploration.

In the face of competition, we may not be successful in acquiring, exploring or developing profitable mineral properties or interests, and we cannot give any assurance that suitable oil and gas properties or interests will be available for our acquisition, exploration or development. Despite this, we hope to compete successfully in the mineral exploration industry by:

4

-

keeping our costs low;

-

relying on the strength of our management’s contacts; and

-

using our size and experience to our advantage by adapting quickly to changing market conditions or responding swiftly to potential opportunities.

Intellectual Property

We have not filed for any protection of our trademark, and we do not have any other intellectual property.

Research and Development

We did not incur any research and development expenses during the period from May 8, 2006 (inception) to our fiscal year ended August 31, 2010.

Reports to Security Holders

We are subject to the reporting and other requirements of the Exchange Act and we intend to furnish our shareholders annual reports containing financial statements audited by our independent registered public accounting firm and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year. After the effectiveness of this Registration Statement we will begin filing Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K with the Securities and Exchange Commission in order to meet our timely and continuous disclosure requirements. We may also file additional documents with the Commission if they become necessary in the course of our company’s operations.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Government Regulations

Any operations at the Uravan Property will be subject to various federal and state laws and regulations in the United States which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We will be required to obtain those licenses, permits or other authorizations currently required to conduct exploration and other programs. There are no current orders or directions relating to us or the Uravan Property with respect to the foregoing laws and regulations. Such compliance may include feasibility studies on the surface impact of our proposed operations, costs associated with minimizing surface impact, water treatment and protection, reclamation activities, including rehabilitation of various sites, on-going efforts at alleviating the mining impact on wildlife and permits or bonds as may be required to ensure our compliance with applicable regulations. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide to not proceed with exploration, development, or mining operations on any of our mineral properties. We are not presently aware of any specific material environmental constraints affecting our properties that would preclude the economic development or operation of property in the United States.

5

The U.S. Forest Service requires that mining operations on lands subject to its regulation obtain an approved plan of operations subject to environmental impact evaluation under the National Environmental Policy Act. Any significant modifications to the plan of operations may require the completion of an environmental assessment or Environmental Impact Statement prior to approval. Mining companies must post a bond or other surety to guarantee the cost of post-mining reclamation. These requirements could add significant additional cost and delays to any mining project undertaken by us.

Under the U.S. Resource Conservation and Recovery Act, mining companies may incur costs for generating, transporting, treating, storing, or disposing of hazardous waste, as well as for closure and post-closure maintenance once they have completed mining activities on a property. Any future mining operations at the Uravan Property may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, storage facilities, and the use of mobile sources such as trucks and heavy construction equipment which are subject to review, monitoring and/or control requirements under the Federal Clean Air Act and state air quality laws. Permitting rules may impose limitations on our production levels or create additional capital expenditures for pollution control in order to comply with the rules.

The U.S. Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended ("CERCLA"), imposes strict joint and several liability on parties associated with releases or threats of releases of hazardous substances. Those liable groups include, among others, the current owners and operators of facilities which release hazardous substances into the environment and past owners and operators of properties who owned such properties at the time the disposal of the hazardous substances occurred. This liability could include the cost of removal or remediation of the release and damages for injury to the surrounding property. We cannot predict the potential for future CERCLA liability with respect to the Uravan Property or surrounding areas.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Employees

As of February 3, 2011 we did not have any employees. Rick Walchuk, our sole director and officer spends about 20 hours per week on our operations on a consulting basis.

6

Description of Property

We currently rent an office totaling approximately 200 square feet in area and is donated free of charge by our sole director and officer. Our office is located at 5614C Burbank Street SE, Calgary, Alberta, T2H 1Z4. Our telephone number is 1-800-508-6419.

Uravan Property

Location and Access

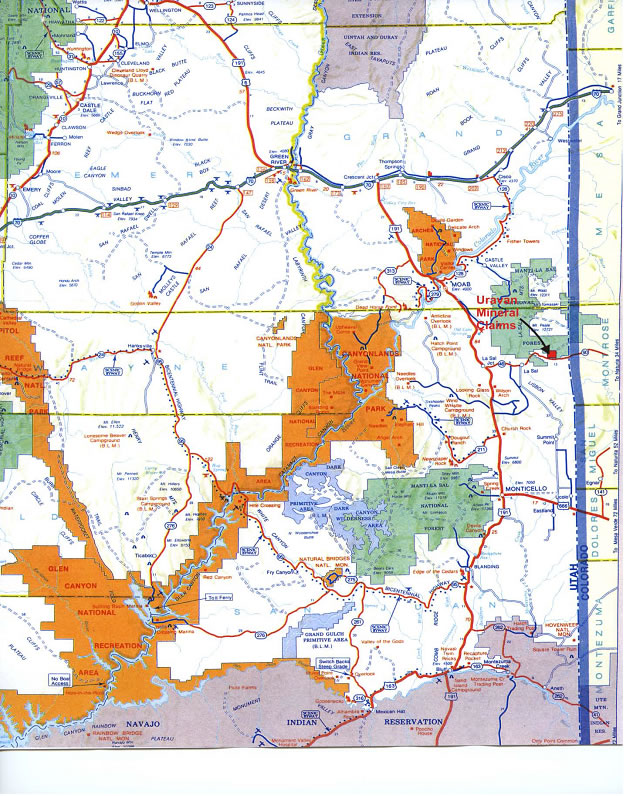

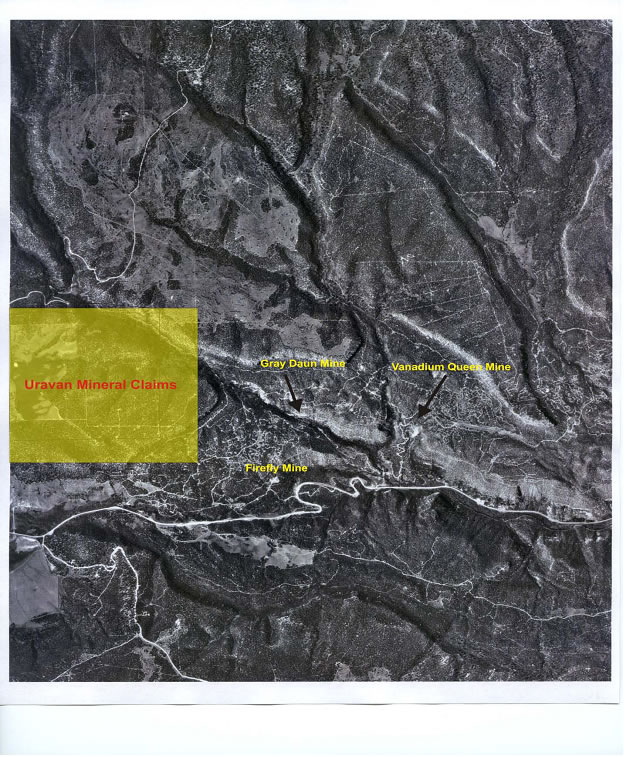

The sixty-six (66) Vanadium-Uranium mineral lode claims which make up the Uravan Property are located in the northeast corner of San Juan County approximately 40 miles southeast of Moab, Utah. The area is sparsely populated with a small village of La Sal, Utah, about 10 miles west of the claim block. Utah Highway 46, an all-weather paved road provides access to the southern region of the mineral claims. A network of forests roads, drill access roads and jeep trails make most of the claim block accessible year around.

The climate of San Juan County is semi-arid with minor precipitation. The average annual precipitation is 12.83 inches with an average snowfall of 44.5 inches. The snowfalls during November to May occasionally reach 15 inches or more. The Uravan Property is located in the high desert ecosystem with erosional landscape exposing the sandstone formations. Deep canyons with canyon walls composed of alternating erosion-resistant benches and highly erodible slopes, and broad flat benches are the predominate landscape features. Vegetation consists of greasewood, salt bush, rabbit bush with willows and cottonwood in the drainage area.

7

8

9

Ownership Interest

On February 3, 2011 we entered into and closed property acquisition agreements with First Liberty Power Inc., and GeoXplor Inc. Copies of these agreements are filed as exhibits to this 8-K. Pursuant to the terms of the agreements, we acquired an option, as well as exploration rights, to the “Uravan Property”. The Uravan Property is further described below, in the section titled “Description of Property”. Pursuant to the terms of the agreements, we agreed to provide the following payments and other consideration to the two parties:

To FLPC:

- $10,000 on the execution of the agreement; $33,333 within 120 days of the execution of the agreement; $33,333 within 240 days of the execution of the agreement; and $33,334 within 360 days of the execution of the agreement;

- 500,000 shares of our common stock (already issued); and

- A 0.5% net smelter royalty on all net revenue derived from production from the Uravan Property.

To GeoXplor:

- $50,000 on February 28, 2011; $50,000 on May 31, 2011; $100,000 on the 1st year anniversary of the agreement; $100,000 on the 2nd year anniversary of the agreement; $100,000 on the 3rd year anniversary of the agreement; and $100,000 on the 4th year anniversary of the agreement;

- 500,000 shares of our common stock on execution of the agreement (already issued); 250,000 shares of our common stock on or before the date one year from the date of the agreement; 250,000 shares of our common stock on or before the date two years from the date of the agreement; and 250,000 shares of our common stock on or before the date three years from the date of the agreement; and

- A 2.5% net smelter royalty on all net revenue derived from production from the Uravan Property.

If we are unable to make any of the share issuances or payments under the agreements with GeoXplor and FLPC, the property rights would revert to FLPC who would be responsible for payments to GeoXplor.

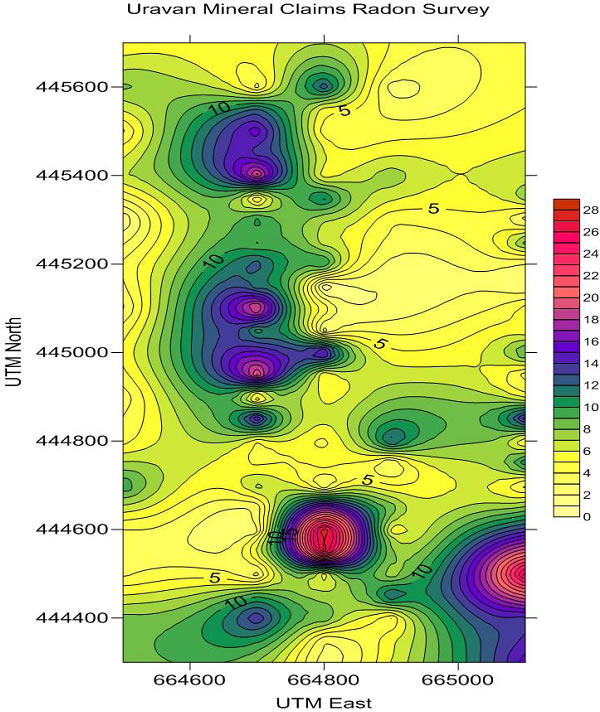

History of Operations

A radon survey was completed on the Uravan Property during September, 2009. The theory of radon soil surveys is based on the element radon which is a radioactive daughter product of uranium decay. Radon is produced by the radioactive decay of radium, a product of uranium and thorium decay in rocks and soils. Theoretically, radon-222 concentrations in soil should be directly related to the uranium content of the minerals in the soil and rocks. Radon is a daughter product of uranium-238 and a non-reactive, highly mobile gas that migrates away from the site of its uranium parent by diffusion and advection along joints, faults, and intergranular permeable pathways.

The magnitude of a radon anomaly associated with a parent concentration of uranium will be due to the size and grade of the parent body. Dispersion and dilution along the pathways to the surface increase the size of the radon footprint but also reduce the magnitude. The location of the anomaly relative to the uranium body will be strongly influenced by the orientation of the pathways to the surface.

The radon survey uses a system that measures the radon by utilizing an ion chamber with electrically charged Teflon, called an electret, located inside an electrically conducting plastic chamber of known air volume. The electrets serve as a source of high voltage needed for the chamber to operate as an ion chamber. It also serves as a sensor for the measurement of ionization in air. The ions produced inside the sensitive volume of the chamber are collected by the electrets causing a depletion of charge. The measurement of the depleted charge during the exposure period is a measure of integrated ionization during the measurement period. The electrets charge is read before and after the exposure using a specially built non-contact electret voltage reader.

10

The Uravan Property radon survey consisted of 101 readings with a minimum reading of 0.35 and a maximum reading of 27.75. The median reading was 6.75 with a midrange of 14.05. The grid results were then contoured and presented in the attached report. Proposed drill locations have also been located and presented on attached map.

11

12

Present Condition and Plan of Exploration

The Uravan Property currently requires further exploration to delineate potential ore bodies and analyze the commercialization potential. Currently the property is at a grass roots stage and does not contain any exploration or production equipment.

Our current plan of exploration for the property, assuming that we are able to raise the capital required to undertake this activity, is as follows:

| Description | ||

| of Phase of | Description of Exploration Work Required | Estimated |

| Exploration | Expenses ($) | |

| 1) Detailed Geological Mapping | $25,000 | |

| Phase 1 | 2) Additional Radon Survey | $75,000 |

| 3) 10,000 foot drill program | $220,000 |

All costs and timings are estimates only, and these may change dramatically depending on unforeseen circumstances arising at each stage of the exploration program and the amount of financing available to us. There can be no assurance that we will be able to raise the funds required to perform this work, or any funds at all.

Geology

The Uravan Property is located within the Colorado Plateau near the Utah-Colorado border. The Colorado Plateau is a broad area of regional uplift consisting mainly of flat-lying Paleozoic, Mesozoic and Cenozoic sedimentary rocks. The strata is gently folded and faulted by uplift, intrusion and collapse of plastic evaporite formations on the east and by intrusion of laccolithic complexes now composing the La Sal Mountains on the west.

The uranium-vanadium deposits in the La Sal quadrangle occur in the uppermost sandstone of the Salt Wash Member of the Morrison Formation. The ore bearing sandstone range in thickness from a few feet to 100 feet. The sandstone is a medium to fine grained quartzose inter-bedded with siltstone and mudstone. Near the uranium-vanadium mineralization, the sandstone is white, light gray or light brown, and the siltstone and mudstone are usually light green or gray green.

The uranium-vanadium deposits mined in the nearby producing mines occur in the uppermost sandstone beds within the Salt Wash member of the Morrison Formation. This unit is commonly called the ore-bearing sandstone or third rim in reference to its position above the Entrada Sandstone.

The ore-bearing sandstone is composed of a single broad lens of cross-laminated sandstone ranging from 0 to 30 feet in thickness. In others area it is composed of overlapping sandstone lenses which have a combined thickness of 30 to 100 feet. The cross-laminated sandstone appears to have been deposited in a flood-plain environment. Scour and fill bedding consisting of cross-bedded sandstone lenses truncated by and direct contact with other truncated lenses separated by thin discontinuous mudstone lenses or mudstone conglomerate. Fragments of fossil wood are abundant in the scour and fill beds and occur either along the bedding planes or in pot like masses called “trash pockets”.

13

Index of Geologic Terms

| Term | Definition |

| Cenozoic |

the most recent era of geologic time, beginning about 65 million years ago, during which modern plants and animals evolved |

| Entrada Sandstone |

a formation that is spread across the U.S. states of Wyoming, Colorado, northwest New Mexico, northeast Arizona and southeast Utah. Part of the Colorado Plateau, this formation was deposited during the Jurassic period sometime between 180 and 140 million years ago in various environments, including: tidal mudflats, beaches and sand dunes |

| Evaporate |

Refers to any of a variety of individual minerals found in the sedimentary deposit of soluble salts that results from the evaporation of water |

| Laccolithic |

a massive intrusion of igneous rock between beds of sedimentary rock, creating a dome-shaped structure |

| Mesozoic |

the era of geologic time, 248 million to 65 million years ago, during which dinosaurs, birds, and flowering plants first appeared |

| Mudstone |

a gray sedimentary rock formed from mud, similar to shale but with less developed lamination |

| Paleozoic |

the era of geologic time, about 570 million to 248 million years ago, during which fish, insects, amphibians, reptiles, and land plants first appeared |

| Quartzose |

Sandstone consisting of more than 95% clear quartz grains and less than 5% matrix. Also known as quartz sandstone |

| Sandstone |

a sedimentary rock made up of particles of sand bound together with a mineral cement. |

| Siltstone |

a form of fine-grained sandstone consisting of compressed silt |

| Strata |

a layer of rock or soil with internally consistent characteristics that distinguish it from other layers. Each layer is generally one of a number of parallel layers that lie one upon another, laid down by natural forces. They may extend over hundreds of thousands of square kilometers of the Earth's surface. Strata are typically seen as bands of different colored or differently structured material exposed in cliffs, road cuts, quarries, and river banks. Individual bands may vary in thickness from a few millimeters to a kilometer or more. Each band represents a specific mode of deposition: river silt, beach sand, coal swamp, sand dune, lava bed, etc |

14

Financial Information

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the financial statements of New America Energy Corp., including the notes thereto, appearing elsewhere in this report. The discussion of results, causes and trends should not be construed to imply any conclusion that these results or trends will necessarily continue into the future. All references to currency in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section are to U.S. dollars, unless otherwise noted.

Results of Operations for the Years Ended August 31, 2010 and 2009, and for the period from Inception until August 31, 2010

We have not earned any revenues since our inception on May 8, 2006. We do not anticipate earning revenues until we are able to realize on our exploration properties either in the form of production or sale revenue.

We incurred operating expenses in the amount of $10,842 for the year ended August 31, 2010, compared with $10,000 for the year ended August 31, 2009. The entire amount for both periods was attributable to professional fees. We have incurred total operating expenses of $98,827 from inception on May 8, 2006 through August 31, 2010. The entire $98,827 was attributable to professional fees. We anticipate our operating expenses will increase as we undertake our plan of operations and exploration on the Uravan Property.

We incurred a net loss of $10,842 for the year ended August 31, 2010, compared with $10,000 for the year ended August 31, 2009. We incurred a total net loss of $98,827 from inception on May 8, 2006 through August 31, 2010. Our losses for all periods are attributable to operating expenses together with a lack of any revenues.

Results of Operations for the Quarter ended November 30, 2010 and 2009

We incurred operating expenses in the amount of $2,787 for the three month period ended November 30, 2010, compared with $2,000 for the three month period ended November 30, 2009. The entire amount for both periods was attributable to professional fees. We anticipate our operating expenses will increase as we undertake our plan of operations and exploration on the Uravan Property.

We incurred a net loss of $2,787 for the three month period ended November 30, 2010, compared with $2,000 for the three month period ended November 30, 2009. Our losses for all periods are attributable to operating expenses together with a lack of any revenues.

Liquidity and Capital Resources

As of November 30, 2010, we had total current assets of $0 cash. Our total current liabilities as of November 30, 2010 were $3,629. This amount consists entirely of accounts payable. On November 5, 2010, a loan of $54,985 was forgiven as part of the change of control transaction. We had working capital deficit of ($3,629) as of November 30, 2010. Subsequent to November 30, 2010, we completed a private placement in the amount of $60,000 for working capital purposes.

Operating activities used $97,985 in cash for the period from inception (May 8, 2006) to November 30, 2010. Our net loss of $101,614 for this period was the major component of our negative operating cash flow, which included $3,629 in accrued expenses. We primarily relied on cash from the sale of our common stock and loans to fund our operations during the period ended November 30, 2010. Financing Activities generated $97,985 in cash for the period from inception (May 8, 2006) to November 30, 2010. This consisted of $43,000 in proceeds from sales of common stock and $54,985 in loans from a related party.

15

We estimate that our expenses over the next 12 months (beginning February 2011) will be approximately $615,000 as described in the table below. These estimates may change significantly depending on the nature of our future business activities and our ability to raise capital from shareholders or other sources.

Description |

Estimated Completion Date |

Estimated Expenses ($) | |

| Legal and accounting fees | 12 months | 50,000 | |

| Exploration Expenses | 12 months | 320,000 | |

| Management and operating costs | 12 months | 100,000 | |

| Salaries and consulting fees | 12 months | 60,000 | |

| Fixed asset purchases | 12 months | 10,000 | |

| General and administrative expenses | 12 months | 75,000 | |

| Total | 615,000 |

We intend to meet our cash requirements for the next 12 months through a combination of debt financing and equity financing by way of private placements. We currently do not have any arrangements in place to complete any private placement financings and there is no assurance that we will be successful in completing any private placement or debt financings. However, there is no assurance that any such financing will be available or if available, on terms that will be acceptable to us. We may not raise sufficient funds to fully carry out our business plan.

Share Cancellation

On December 23, 2010 Mr. Walchuk, our sole director and officer as well as our majority shareholder agreed to cancel 5,000,000 shares of our common stock held by him. The cancellation was made in order to make our company more attractive for potential business combinations or share based acquisitions.

Share Sale

On December 23, 2010 we also closed a private placement of 200,000 shares of our common stock at $0.30 per share for total proceeds of $60,000. The shares were purchased by one non-US investor under exemptions from registration found in Regulation S of the Securities Act of 1933, as amended.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

16

Inflation

The effect of inflation on our revenues and operating results has not been significant.

Critical Accounting Policies

Our financial statements are affected by the accounting policies used and the estimates and assumptions made by management during their preparation. A complete listing of these policies is included in Note 2 of the notes to our financial statements for the years ended August 31, 2010 and 2009. We have identified below the accounting policies that are of particular importance in the presentation of our financial position, results of operations and cash flows, and which require the application of significant judgment by management.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Basic loss per share

Basic loss per share has been calculated based on the weighted average number of shares of common stock outstanding during the period.

Development Stage Company

The accompanying financial statements have been prepared in accordance with generally accepted accounting principles related to development-stage companies. A development-stage company is one in which planned principal operations have not commenced or if its operations have commenced, there has been no significant revenues there from.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth the ownership, as of February 3, 2011, of our common stock by each of our directors, by all of our executive officers and directors as a group and by each person known to us who is the beneficial owner of more than 5% of any class of our securities. As of February 3, 2011, there were 49,950,000 shares of our common stock issued and outstanding. All persons named have sole or shared voting and investment control with respect to the shares, except as otherwise noted. The number of shares described below includes shares which the beneficial owner described has the right to acquire within 60 days of the date of this Form 8-K.

17

| Title of Class | Name and Address of Beneficial Owner |

Amount and |

Percent of Class (1) |

| Common Stock |

Rick Walchuk (2)

Kolokotroni 2A, Paleo Faliro 17563, Athens, Greece |

26,250,000 | 53% |

| All Officers and Directors as a Group | 26,250,0000 | 53% |

| (1) |

Based on 49,950,000 issued and outstanding shares of our common stock as of February 3, 2011. |

| (2) |

Rick Walchuk is our President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Secretary, Treasurer and director. |

Changes in Control

As of February 3, 2011 we had no pension plans or compensatory plans or other arrangements which provide compensation in the event of termination of employment or a change in our control.

Directors and Executive Officers

Directors and Officers

Our Articles state that our authorized number of directors shall be not less than one and shall be set by resolution of our Board of Directors. Our Board of Directors has fixed the number of directors at one, and we currently have one director.

Our current director and officer is:

| Name | Age | Position | |

| Rick Walchuk | 54 |

President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer Secretary, Treasurer, and Director. |

Our Director will serve in that capacity until our next annual shareholder meeting or until their successors are elected and qualified. Officers hold their positions at the will of our Board of Directors. There are no arrangements, agreements or understandings between non-management security holders and management under which non-management security holders may directly or indirectly participate in or influence the management of our affairs.

18

Rick Walchuk, President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer Secretary, Treasurer and Director

Mr. Rick Walchuk, 54, attended the University of Saskatchewan, College of Commerce, Saskatoon Campus. From 1980 until March 2004 Mr. Walchuk was employed as a financial advisor in Alberta, Canada. In April 2004 Mr. Walchuk was appointed as the CEO of a startup biotech company in Athens, Greece, a position he held until July 2004. Mr. Walchuk then served as a consultant to various public companies until December 2006, when he joined Bruca Trading Ltd., a private consulting company in Athens, Greece. Since March 14, 2007, Mr. Walchuk has acted as the director, President and CEO of Viosolar Inc., a company engaged in the construction, management and operation of solar parks in Greece and throughout other South and South Eastern European Union countries. Mr. Walchuk was chosen to be our directors due to his extensive background in venture capital, investor relations and corporate governance.

There have been no transactions between the Company and Mr. Walchuk since the Company’s last fiscal year which would be required to be reported herein. Viosolar Inc., a company for which Mr. Walchuk acts as director, President and CEO has a class of securities registered under Section 12 of the Exchange Act.

Other Directorships

Other than as disclosed above, during the last 5 years, none of our directors held any other directorships in any company with a class of securities registered pursuant to section 12 of the Exchange Act or subject to the requirements of section 15(d) of such Act or any company registered as an investment company under the Investment Company Act of 1940.

Board of Directors and Director Nominees

Since our Board of Directors does not include a majority of independent directors, the decisions of the Board regarding director nominees are made by persons who have an interest in the outcome of the determination. The Board will consider candidates for directors proposed by security holders, although no formal procedures for submitting candidates have been adopted. Unless otherwise determined, at any time not less than 90 days prior to the next annual Board meeting at which a slate of director nominees is adopted, the Board will accept written submissions from proposed nominees that include the name, address and telephone number of the proposed nominee; a brief statement of the nominee’s qualifications to serve as a director; and a statement as to why the security holder submitting the proposed nominee believes that the nomination would be in the best interests of our security holders. If the proposed nominee is not the same person as the security holder submitting the name of the nominee, a letter from the nominee agreeing to the submission of his or her name for consideration should be provided at the time of submission. The letter should be accompanied by a résumé supporting the nominee's qualifications to serve on the Board, as well as a list of references.

The Board identifies director nominees through a combination of referrals from different people, including management, existing Board members and security holders. Once a candidate has been identified, the Board reviews the individual's experience and background and may discuss the proposed nominee with the source of the recommendation. If the Board believes it to be appropriate, Board members may meet with the proposed nominee before making a final determination whether to include the proposed nominee as a member of the slate of director nominees submitted to security holders for election to the Board.

19

Conflicts of Interest

Our directors are not obligated to commit their full time and attention to our business and, accordingly, they may encounter a conflict of interest in allocating their time between our operations and those of other businesses. In the course of their other business activities, they may become aware of investment and business opportunities which may be appropriate for presentation to us as well as other entities to which they owe a fiduciary duty. As a result, they may have conflicts of interest in determining to which entity a particular business opportunity should be presented. They may also in the future become affiliated with entities that are engaged in business activities similar to those we intend to conduct.

In general, officers and directors of a corporation are required to present business opportunities to the corporation if:

-

the corporation could financially undertake the opportunity;

-

the opportunity is within the corporation’s line of business; and

-

it would be unfair to the corporation and its stockholders not to bring the opportunity to the attention of the corporation.

We have adopted a code of ethics that obligates our directors, officers and employees to disclose potential conflicts of interest and prohibits those persons from engaging in such transactions without our consent.

Significant Employees

Other than as described above, we do not expect any other individuals to make a significant contribution to our business.

Legal Proceedings

To the best of our knowledge, none of our directors or executive officers has, during the past ten years:

-

been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offences);

-

had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time;

-

been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity;

-

been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated;

20

-

been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

-

been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

Except as set forth in our discussion below in “Certain Relationships and Related Transactions, and Director Independence – Transactions with Related Persons,” none of our directors, director nominees or executive officers has been involved in any transactions with us or any of our directors, executive officers, affiliates or associates which are required to be disclosed pursuant to the rules and regulations of the SEC.

Audit Committee and Charter

We do not currently have an audit committee.

Code of Ethics

We have not yet adopted a corporate code of ethics. When we do adopt a code of ethics, we will announce it via the filing of a current report on form 8-K.

Family Relationships

There are no family relationships among our officers, directors, or persons nominated for such positions.

Executive Compensation

The following summary compensation table sets forth the total annual compensation paid or accrued by us to or for the account of our principal executive officer during the last completed fiscal year and each other executive officer whose total compensation exceeded $100,000 in either of the last two fiscal years:

Summary Compensation Table (1)

| Name and Principal Position |

Year | Salary ($) |

Total ($) |

| Susanna Hilario, Former President, Chief Executive Officer, Principal Executive Officer, Chief Financial Officer, Principal Financial Officer, Principal Accounting Officer and Director |

2010 | 0 | 0 |

| 2009 | |||

| Rey Supera, Former CTO, Director |

2010 | 0 | 0 |

| 2009 |

21

| (1) |

We have omitted certain columns in the summary compensation table pursuant to Item 402(a)(5) of Regulation S-K as no compensation was awarded to, earned by, or paid to any of the executive officers or directors required to be reported in that table or column in any fiscal year covered by that table. |

Option Grants

As of the date of this report we had not granted any options or stock appreciation rights to our named executive officers or directors.

Management Agreements

We entered into a management agreement with Mr. Walchuk on January 14, 2011. Pursuant to the terms of the agreement, we will pay Mr. Walchuk $2,500 a month for services performed as an officer of our company. The term of the agreement is 3 years and the effective date was set as November 1, 2010.

Compensation of Directors

Our directors did not receive any compensation for their services as directors from our inception to the date of this report. We have no formal plan for compensating our directors for their services in the future in their capacity as directors, although such directors are expected in the future to receive options to purchase shares of our common stock as awarded by our Board of Directors or by any compensation committee that may be established.

Pension, Retirement or Similar Benefit Plans

There are no arrangements or plans in which we provide pension, retirement or similar benefits to our directors or executive officers. We have no material bonus or profit sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options may be granted at the discretion of the Board of Directors or a committee thereof.

Compensation Committee

We do not currently have a compensation committee of the Board of Directors or a committee performing similar functions. The Board of Directors as a whole participates in the consideration of executive officer and director compensation.

Certain Relationships and Related Transactions, and Director Independence

On December 23, 2010 Mr. Walchuk, our sole director and officer as well as our majority shareholder agreed to cancel 5,000,000 shares of our common stock held by him. The cancellation was made in order to make our company more attractive for potential business combinations or share based acquisitions.

22

We entered into a management agreement with Mr. Walchuk on January 14, 2011. Pursuant to the terms of the agreement, we will pay Mr. Walchuk $2,500 a month for services performed as an officer of our company. The term of the agreement is 3 years and the effective date was set as November 1, 2010.

On November 5, 2010, Rick Walchuk, the sole director and officer of our company, acquired a total of 31,250,000 shares of our common stock from Susanna Hilario and Rey V. Supera, our former directors and officers, in a private transaction for an aggregate total of $50,000. The funds used for this share purchase were Mr. Walchuk’s personal funds.

As part of the sale of their shares Ms. Hilario and Mr. Supera agreed to extinguish all debts owed to them by us.

There have been no other transactions since the beginning of our last fiscal year or any currently proposed transactions in which we are, or plan to be, a participant and the amount involved exceeds $120,000 or one percent of the average of our total assets at year end for the last two completed fiscal years, and in which any related person had or will have a direct or indirect material interest.

Director Independence

Our securities are quoted on the OTC Bulletin Board which does not have any director independence requirements. Once we engage further directors and officers, we plan to develop a definition of independence and scrutinize our Board of Directors with regard to this definition.

Legal Proceedings

We are not aware of any material pending legal proceedings to which we are a party or of which our property is the subject. We also know of no proceedings to which any of our directors, officers or affiliates, or any registered or beneficial holders of more than 5% of any class of our securities, or any associate of any such director, officer, affiliate or security holder are an adverse party or have a material interest adverse to us.

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

Market Information

Our common stock is not traded on any exchange. Our common stock is quoted on OTC Bulletin Board, under the trading symbol “NECA”. We cannot assure you that there will be a market in the future for our common stock.

OTC Bulletin Board securities are not listed and traded on the floor of an organized national or regional stock exchange. Instead, OTC Bulletin Board securities transactions are conducted through a telephone and computer network connecting dealers. OTC Bulletin Board issuers are traditionally smaller companies that do not meet the financial and other listing requirements of a national or regional stock exchange.

There have only been three days during which trades in our common stock occurred since we received our quotation on the OTC Bulletin Board. On November 3, 2010 shares of our common stock traded at $0.13 per, November 30, 2010 shares of our common stock traded at $0.50 per share and on January 18, 2011 shares of our common stock traded at $0.50 per share.

23

Holders

As of the date of this report there were 32 holders of record of our common stock.

Dividends

To date, we have not paid dividends on shares of our common stock and we do not expect to declare or pay dividends on shares of our common stock in the foreseeable future. The payment of any dividends will depend upon our future earnings, if any, our financial condition, and other factors deemed relevant by our Board of Directors.

Equity Compensation Plans

As of the date of this report we did not have any equity compensation plans.

24

Recent Sales of Unregistered Securities

During the last three years, we completed the following sales of unregistered securities:

-

On February 3, 2011 we issued 500,000 shares each to GeoXplor and FLPC pursuant to the property acquisition agreement with these two parties. These shares were issued without a prospectus in reliance on exemptions from registration found in Section 4(2) of the Securities Act of 1933.

-

On December 23, 2010 we issued 200,000 shares of our common stock at $0.30 per share for total proceeds of $60,000. The shares were purchased by one non-US investor under exemptions from registration found in Regulation S of the Securities Act of 1933, as amended.

-

On May 31, 2006, we accepted subscription agreements for sale of 53,750,000 shares (2,150,000 pre-split) shares our common stock, having a par value of $0.001 per share, at the offering price of $0.02 per share for gross offering proceeds of $43,000, in offshore transactions pursuant to Regulation S of the Securities Act. We completed the offering pursuant to Regulation S of the Securities Act. Each purchaser represented to us that he was a non-US person as defined in Regulation S. We did not engage in a distribution of this offering in the United States. Each purchaser represented his intention to acquire the securities for investment only and not with a view toward distribution. Each investor was given adequate access to sufficient information about us to make an informed investment decision. None of the securities were sold through an underwriter and accordingly, there were no underwriting discounts or commissions involved.

Since our inception we have made no purchases of our equity securities.

Description of Registrant’s Securities to be Registered

Our authorized capital stock consists of 75,000,000 shares of common stock, $0.001 par value.

Common Stock

As of the date of this report we had 49,950,000 shares of our common stock issued and outstanding.

Holders of our common stock have no preemptive rights to purchase additional shares of common stock or other subscription rights. Our common stock carries no conversion rights and is not subject to redemption or to any sinking fund provisions. All shares of our common stock are entitled to share equally in dividends from sources legally available, when, as and if declared by our Board of Directors, and upon our liquidation or dissolution, whether voluntary or involuntary, to share equally in our assets available for distribution to our security holders.

Our Board of Directors is authorized to issue additional shares of our common stock not to exceed the amount authorized by our Articles of Incorporation, on such terms and conditions and for such consideration as our Board may deem appropriate without further security holder action.

25

Voting Rights

Each holder of our common stock is entitled to one vote per share on all matters on which such stockholders are entitled to vote. Since the shares of our common stock do not have cumulative voting rights, the holders of more than 50% of the shares voting for the election of directors can elect all the directors if they choose to do so and, in such event, the holders of the remaining shares will not be able to elect any person to our Board of Directors.

Dividend Policy

Holders of our common stock are entitled to dividends if declared by our Board of Directors out of funds legally available for the payment of dividends. From our inception to February 3, 2011 we did not declare any dividends.

We do not intend to issue any cash dividends in the future. We intend to retain earnings, if any, to finance the development and expansion of our business. However, it is possible that our management may decide to declare a stock dividend in the future. Our future dividend policy will be subject to the discretion of our Board of Directors and will be contingent upon future earnings, if any, our financial condition, our capital requirements, general business conditions and other factors.

Indemnification of Directors and Officers

The only statute, charter provision, bylaw, contract, or other arrangement under which any controlling person, director or officer of us is insured or indemnified in any manner against any liability which he may incur in his capacity as such, is as follows:

- Chapter 78 of the Nevada Revised Statutes (the “NRS”).

Nevada Revised Statutes

Section 78.138 of the NRS provides for immunity of directors from monetary liability, except in certain enumerated circumstances, as follows:

“Except as otherwise provided in NRS 35.230, 90.660, 91.250, 452.200, 452.270, 668.045 and 694A.030, or unless the Articles of Incorporation or an amendment thereto, in each case filed on or after October 1, 2003, provide for greater individual liability, a director or officer is not individually liable to the corporation or its stockholders or creditors for any damages as a result of any act or failure to act in his capacity as a director or officer unless it is proven that:

| (a) |

his act or failure to act constituted a breach of his fiduciary duties as a director or officer; and |

| (b) |

his breach of those duties involved intentional misconduct, fraud or a knowing violation of law.” |

Section 78.5702 of the NRS provides as follows:

| 1. |

A corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in the right of the corporation, by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with the action, suit or proceeding if he: |

26

| (a) |

is not liable pursuant to NRS 78.138; or | |

| (b) |

acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. | |

| 2. |

A corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses, including amounts paid in settlement and attorneys’ fees actually and reasonably incurred by him in connection with the defense or settlement of the action or suit if he: | |

| (a) |

is not liable pursuant to NRS 78.138; or | |

| (b) |

acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation. | |

To the extent that a director, officer, employee or agent of a corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding referred to in subsections 1 and 2, or in defense of any claim, issue or matter therein, the corporation shall indemnify him against expenses, including attorneys’ fees, actually and reasonably incurred by him in connection with the defense.

27

Financial Statements and Supplementary Data

NEW AMERICA ENERGY CORP

(FORMERLY: ATHERON, INC)

(A DEVELOPMENT STAGE COMPANY)

For the period ended

November 30, 2010

| F-1 | Balance Sheets |

| F-2 | Statements of Operations |

| F-3 | Statement of Changes in Stockholders’ Deficit |

| F-4 | Statements of Cash Flows |

| F-5 | Notes to Financial Statements |

ATHERON, INC.

(A DEVELOPMENT STAGE COMPANY)

Years Ended August 31, 2010 and August 31, 2009

| F-8 | |

| F-9 | |

| F-10 | |

| F-11 |

Statement of Stockholders’ Deficit for period from inception to August 31, 2010; |

| F-12 | |

| F-13 |

28

NEW AMERICA ENERGY CORP

(FORMERLY: ATHERON, INC)

(A DEVELOPMENT STAGE COMPANY)

BALANCE SHEETS

As of November 30, 2010 and August 31, 2010

| November 30, | August 31, | |||||

| 2009 | 2010 | |||||

| (unaudited) | (derived from | |||||

| audited) | ||||||

| ASSETS | ||||||

| Current Assets | ||||||

| Cash and equivalents | $ | 0 | $ | 0 | ||

| TOTAL ASSETS | $ | 0 | $ | 0 | ||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||

| Current Liabilities | ||||||

| Accounts payable and accrued expenses | $ | 1,129 | $ | 842 | ||

| Accounts payable – related parties | 2,500 | - | ||||

| Loan payable - related party | 0 | 54,985 | ||||

| Total Liabilities | 3,629 | 55,827 | ||||

| Stockholders’ Deficit | ||||||

| Common Stock, $.001 par value, 75,000,000 shares

authorized, 53,750,000 shares issued and outstanding |

53,750 | 2,150 | ||||

| Additional paid-in capital | 44,235 | 40,850 | ||||

| Deficit accumulated during the development stage | (101,614 | ) | (98,827 | ) | ||

| Total stockholders’ deficit | (3,629 | ) | (55,827 | ) | ||

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | $ | 0 | $ | 0 | ||

See accompanying notes to the interim financial statements

F-1

NEW AMERICA ENERGY CORP

(FORMERLY: ATHERON, INC)

(A DEVELOPMENT STAGE COMPANY)

STATEMENTS OF OPERATIONS

(unaudited)

Three Months Ended November 30, 2010 and 2009

Period from May 8, 2006 (Inception) to November 30, 2010

| Period from | |||||||||

| May 8, 2006 | |||||||||

| Three Months Ended | (Inception) to | ||||||||

| November 30, | November 30, | ||||||||

| 2010 | 2009 | 2010 | |||||||

| Revenues | $ | 0 | $ | 0 | $ | 0 | |||

| General and administrative expenses: | |||||||||

| Professional fees | 2,787 | 2,000 | 101,614 | ||||||

| Net Loss | $ | (2,787 | ) | $ | 2,000 | $ | (101,614 | ) | |

| Net loss per share: | |||||||||

| Basic and diluted | $ | (0.00 | ) | $ | (0.00 | ) | |||

| Weighted average shares outstanding: | |||||||||

| Basic and diluted | 53,750,000 | 53,750,000 | |||||||

See accompanying notes to the interim financial statements

F-2

NEW AMERICA ENERGY CORP

(FORMERLY: ATHERON, INC)

(A DEVELOPMENT STAGE COMPANY)

STATEMENT OF CHANGES IN STOCKHOLDERS’ DEFICIT (unaudited)

Period from May 8, 2006 (Inception) to November 30, 2010

| Deficit | |||||||||||||||

| accumulated | |||||||||||||||

| Additional | during the | ||||||||||||||

| Common stock | paid-in | development | |||||||||||||

| Shares | Amount | capital | stage | Total | |||||||||||

| Issuance of common stock for cash @$.001 | 53,750,000 | $ | 2,150 | $ | 40,850 | $ | $ | 43,000 | |||||||

| Net loss for the period ended August 31, 2006 | (43,985 | ) | (43,985 | ) | |||||||||||

| Balance, August 31, 2006 | 53,750,000 | 2,150 | 40,850 | (43,985 | ) | (985 | ) | ||||||||

| Net loss for the year ended August 31, 2007 | (25,000 | ) | (25,000 | ) | |||||||||||

| Balance, August 31, 2007 | 53,750,000 | 2,150 | 40,850 | (68,985 | ) | (25,985 | ) | ||||||||

| Net loss for the year ended August 31, 2008 | - | (9,000 | ) | (9,000 | ) | ||||||||||

| Balance, August 31, 2008 | 53,750,000 | 2,150 | 40,850 | (77,985 | ) | (34,985 | ) | ||||||||

| Net loss for year ended August 31, 2009 | - | (10,000 | ) | (10,000 | ) | ||||||||||

| Balance, August 31, 2009 | 53,750,000 | 2,150 | 40,850 | (87,985 | ) | (44,985 | ) | ||||||||

| Net loss for year ended August 31, 2010 | - | (10,842 | ) | (10,842 | ) | ||||||||||

| Balance, August 31, 2010 | 53,750,000 | 2,150 | 40,850 | (98,827 | ) | (55,827 | ) | ||||||||

| Stock Split | - | 51,600 | (51,600 | ) | - | - | |||||||||

| Related parties loan forgiven | - | - | 54,985 | - | 54,985 | ||||||||||

| Net loss for the period | - | - | - | (2,787 | ) | (2,787 | ) | ||||||||

| Balance, November 30, 2010 | 53,750,000 | $ | 53,750 | $ | 44,235 | $ | (101,614 | ) | $ | (3,629 | ) | ||||

See accompanying notes to the interim financial statements

F-3

NEW AMERICA ENERGY CORP

(FORMERLY: ATHERON, INC)

(A DEVELOPMENT STAGE COMPANY)

STATEMENTS OF CASH FLOWS

(unaudited)

Three Months Ended November 30, 2010 and 2009

Period from May 8, 2006 (Inception) to November 30, 2010

| Period From | |||||||||

| May 8, 2006 | |||||||||

| Three Months Ended | (Inception) to | ||||||||

| November 30, | November 30, | ||||||||

| 2010 | 2009 | 2010 | |||||||

| Cash Flows From Operating Activities | |||||||||

| Net loss | $ | (2,787 | ) | $ | (2,000 | ) | $ | (101,614 | ) |

| Change in non-cash working capital items | |||||||||

| Accounts payable | 2,787 | 3,629 | |||||||

| Cash Flows Used by Operating Activities | 0 | (2,000 | ) | (97,985 | ) | ||||

| Cash Flows From Financing Activities | |||||||||

| Proceeds from sales of common stock | 0 | 0 | 43,000 | ||||||

| Loan from related party | 0 | 2,000 | 54,985 | ||||||

| Cash Flows Provided By Financing Activities | 0 | 2,000 | 97,985 | ||||||

| Net Increase In Cash | 0 | 0 | 0 | ||||||

| Cash, beginning of period | 0 | 0 | 0 | ||||||

| Cash, end of period | $ | 0 | $ | 0 | $ | 0 | |||

| Supplemental Cash Flow Information | |||||||||

| Interest paid | |||||||||

| Income taxes paid | $ | 0 | $ | 0 | $ | 0 | |||

| $ | 0 | $ | 0 | $ | 0 | ||||

| Supplemental non-cash financing activity: | |||||||||

| Related party loan forgiven as additional paid in capital | $ | (54,985 | ) | $ | 0 | $ | (54,985 | ) | |

See accompanying notes to the interim financial statements

F-4

NEW AMERICA ENERGY CORP

(FORMERLY: ATHERON, INC)

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL

STATEMENTS

NOVEMBER 30, 2010

NOTE 1 – SUMMARY OF ACCOUNTING POLICIES

Nature of Business

New America Energy Corp (formerly “Atheron, Inc.) was incorporated in Nevada on May 8, 2006. It is a development stage company located in Makati City 1235, Philippines. New America Energy Corp is developing technology for ethanol-methanol gasoline. It operates out of office space owned by a director and stockholder of the Company. The facilities are provided at no charge. There can be no assurances that the facilities will continue to be provided at no charge in the future.

On November 5, 2010, the Company’s sole director approved a name change to New America Energy Corp. and a twenty-five (25) new for one (1) old forward stock split of the Company’s issued and outstanding shares of common stock, such that its issued and outstanding shares of common stock increased from 2,150,000 to 53,750,000. This forward split will not affect the number of the Company’s authorized common shares, which has been set at 75,000,000.

On November 16, 2010, the Nevada Secretary of State accepted for filing of a Certificate of Amendment, wherein we have effected an amendment to the Company’s Articles of Incorporation to change our name from Atheron Inc. to New America Energy.

The forward stock split and name change has become effective with the Over-the-Counter Bulletin Board at the opening of trading on December 1, 2010 under the Company’s new symbol “NECA”. Our new CUSIP number is 641872106.

The effect of the stock split has been recognized retroactively in the stockholders’ equity accounts as of May 8, 2006, the date of our inception, and in all shares and per share data in the financial statements.

Development Stage Company

The accompanying financial statements have been prepared in accordance with generally accepted accounting principles related to development-stage companies. A development-stage company is one in which planned principal operations have not commenced or if its operations have commenced, there has been no significant revenues there from.

Basis of Presentation

Certain information and footnote disclosures normally included in annual financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted. We believe that the disclosures are adequate to make the financial information presented not misleading. These condensed financial statements should be read in conjunction with the audited consolidated financial statements and the notes thereto for the year ended August 31, 2010. All adjustments were of a normal recurring nature unless otherwise disclosed. In the opinion of management, all adjustments necessary for a fair statement of the results of operations for the interim period have been included. The results of operations for such interim periods are not necessarily indicative of the results for the full year.

Cash and Cash Equivalents

We consider all highly liquid investments with maturities of three months or less to be cash equivalents. At November 30, 2010 and August 31, 2010 the Company had $0 of cash.

Fair Value of Financial Instruments

New America Energy Corp’s financial instruments consist of cash and cash equivalents and a loan payable to a related party. The carrying amount of these financial instruments approximates fair value due either to length of maturity or interest rates that approximate prevailing market rates unless otherwise disclosed in these financial statements.

F-5

NEW AMERICA ENERGY CORP

(FORMERLY: ATHERON, INC)

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL

STATEMENTS

November 30, 2009

NOTE 1 – SUMMARY OF ACCOUNTING POLICIES (continued)

Income Taxes

Income taxes are computed using the asset and liability method. Under the asset and liability method, deferred income tax assets and liabilities are determined based on the differences between the financial reporting and tax bases of assets and liabilities and are measured using the currently enacted tax rates and laws. A valuation allowance is provided for the amount of deferred tax assets that, based on available evidence, are not expected to be realized.

Basic Loss Per Share

Basic loss per share has been calculated based on the weighted average number of shares of common stock outstanding during the period.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Recent Accounting Pronouncements

The Company does not expect the adoption of recently issued accounting pronouncements to have a significant impact on the Company’s results of operations, financial position or cash flow.

NOTE 2 – RELATED PARTY TRANSACTIONS

The Company received loans totaling $54,985 for working capital from a shareholder and officer of the Company. The loans were unsecured, non-interest bearing and due upon demand.

On November 5, 2010, the loans owned to a related party were forgiven and were recorded as additional paid-in-capital.

On November 1, 2010, the Company entered into a three-years consulting agreement with the Company’s sole director. Under the terms of agreement, the consultant shall be paid $2,500 a month, payable on the 1st of each month, pursuant to the services to be rendered by the consultant. During the three month period ended November 30, 2010, the Company did not make any cash payments, leaving an amount of $2,500 in the balance sheets as accounts payable – related party.

NOTE 3 – LIQUIDITY AND GOING CONCERN

We have negative working capital, and incurred losses since inception, and have not yet received revenues from sales of products or services. These factors create substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustment that might be necessary if the Company is unable to continue as a going concern.

The ability of New America Energy Corp to continue as a going concern is dependent on the Company generating cash from the sale of its common stock and/or obtaining debt financing and attaining future profitable operations. Management’s plans include selling its equity securities and obtaining debt financing to fund its capital requirement and ongoing operations; however, there can be no assurance the Company will be successful in these efforts.

F-6

NEW AMERICA ENERGY CORP

(FORMERLY: ATHERON, INC)

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL

STATEMENTS

November 30, 2009

NOTE 4 – SUBSEQUENT EVENTS

On December 23, 2010, the Company’s sole director cancelled and returned to treasury 5,000,000 post split common shares.

Management has evaluated subsequent events through the date on which the financial statements were submitted to the Securities and Exchange Commission and has determined it does not have any additional material subsequent events to disclose.

F-7

|

Silberstein Ungar, PLLC CPAs and Business Advisors |

| Phone (248) 203-0080 |

| Fax (248) 281-0940 |

| 30600 Telegraph Road, Suite 2175 |

| Bingham Farms, MI 48025-4586 |

| www.sucpas.com |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors

Atheron, Inc.

Makati City 1235, Philippines

We have audited the accompanying balance sheets of Atheron, Inc. (a development stage company) as of August 31, 2010 and 2009 and the related statements of operations, stockholders’ deficit and cash flows for the periods then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.