Attached files

| file | filename |

|---|---|

| EX-32.1 - Qornerstone Inc. | v209881_ex32-1.htm |

| EX-31.2 - Qornerstone Inc. | v209881_ex31-2.htm |

| EX-32.2 - Qornerstone Inc. | v209881_ex32-2.htm |

| EX-31.1 - Qornerstone Inc. | v209881_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q/A-1

|

x

|

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

quarterly period ended October 31,

2009.

or

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT OF

1934

|

For the

transition period from to

to ___________________

Commission

File Number : 000-52945

TECHMEDIA ADVERTISING,

INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

98-0540833

|

|

(State

or other jurisdiction of incorporation or

organization) |

(I.R.S.

Employer Identification No.)

|

|

c/o

62 Upper Cross Street,

#04-01 Singapore

(Address

of principal executive offices)

|

058353

(Zip

Code)

|

011-65-65323001

(Registrant’s

telephone number, including area code)

N/A

(Former

name, former address and former fiscal year, if changed since last

report)

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

x

Yes ¨ No

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

¨

Yes ¨ No

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large

accelerated filer

|

¨

|

Accelerated

filer

|

¨

|

|

|

Non-accelerated

filer

|

¨ (Do not check if

a smaller reporting company)

|

Smaller

reporting company

|

x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

¨

Yes x No

APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS

DURING THE PRECEDING FIVE YEARS:

Indicate

by check mark whether the registrant has filed all documents and reports

required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act

of 1934 subsequent to the distribution of securities under a plan confirmed by a

court.

¨

Yes ¨ No

APPLICABLE

ONLY TO CORPORATE ISSUERS:

Indicate

the number of shares outstanding of each of the issuer’s classes of common

stock, as of the latest practicable date: 47,294,000 shares of $0.001

par value common stock as of December 11, 2009.

TABLE OF

CONTENTS

|

EXPLANATORY

NOTE

|

3

|

|

USE

OF NAMES

|

3

|

|

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

|

3

|

|

PART

I – FINANCIAL INFORMATION

|

3

|

|

Item

1. Financial Statements

|

3

|

|

Item

2. Management’s Discussion and Analysis of Financial Condition and Results

of Operations

|

4

|

|

Item

3. Quantitative and Qualitative Disclosures About Market

Risk.

|

9

|

|

Item

4T. Controls and Procedures.

|

9

|

|

PART

II - OTHER INFORMATION

|

9

|

|

Item

1. Legal Proceedings

|

9

|

|

Item

1A. Risk Factors

|

9

|

|

Item

2. Unregistered Sales of Equity Securities and Use of

Proceeds

|

10

|

|

Item

3. Defaults upon Senior Securities

|

10

|

|

Item

4. Submission of Matters to a Vote of Security Holders

|

10

|

|

Item

5. Other Information

|

10

|

|

Item

6. Exhibits

|

10

|

2

EXPLANATORY

NOTE

On

December 10, 2010, the Board of Directors of the Company determined that the

unaudited consolidated financial statements for the period ended October 31,

2009, should be restated as a result of material misstatements. The

determination to restate the unaudited consolidated financial statements was

made in connection with management’s assessment of accounting errors it

discovered in connection with the preparation of the audited consolidated

financial statements for the year ended July 31, 2010. For the period

ended October 31, 2009, the Company recorded stock-based compensation related to

stock options issued to employees and non-employees at a value of $2.22 per

share of common stock underlying each stock option when the fair market value of

such underlying shares should have been valued at $1.00 per share resulting in

an overstatement of expense and additional paid-in capital of $343,022 for the

period. Management also determined that for the same period a payment

for consulting services in the amount of $93,808 was incorrectly reported as an

offset to additional paid-in capital, and should have been reported as a

consulting fee expense in the unaudited consolidated financial statements

resulting in an understatement of expense by $93,808. Lastly,

reclassifications of depreciation expense of $6 and consulting fees of $175,000

from management fees were also made to correct the presentation of such

expenses. Such reclassifications did not have an impact on the net

(loss) for the period. The Company corrected the errors by decreasing

additional paid-in capital by $249,214, stock-based compensation expense by

$343,022, and increased consulting fees by $93,808. The adjustments

had an impact of decreasing the net (loss) for the period by

$249,214. (Loss) per share – basic and diluted for the period

decreased from $(0.03) per share to $(0.02) per share.

USE

OF NAMES

In this

quarterly report, the terms “TechMedia,” “Company,” “we,” or “our,” unless the

context otherwise requires, mean TechMedia Advertising, Inc. and its

subsidiaries.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

quarterly report on Form 10-Q and other reports that we file with the SEC

contain statements that are considered forward-looking

statements. Forward-looking statements give the Company’s current

expectations, plans, objectives, assumptions or forecasts of future

events. All statements other than statements of current or historical

fact contained in this quarterly report, including statements regarding the

Company’s future financial position, business strategy, budgets, projected costs

and plans and objectives of management for future operations, are

forward-looking statements. In some cases, you can identify

forward-looking statements by terminology such as “anticipate,” “estimate,”

“plans,” “potential,” “projects,” “ongoing,” “expects,” “management believes,”

“we believe,” “we intend,” and similar expressions. These statements

are based on the Company’s current plans and are subject to risks and

uncertainties, and as such the Company’s actual future activities and results of

operations may be materially different from those set forth in the forward

looking statements. Any or all of the forward-looking statements in

this quarterly report may turn out to be inaccurate and as such, you should not

place undue reliance on these forward-looking statements. The Company

has based these forward-looking statements largely on its current expectations

and projections about future events and financial trends that it believes may

affect its financial condition, results of operations, business strategy and

financial needs. The forward-looking statements can be affected by

inaccurate assumptions or by known or unknown risks, uncertainties and

assumptions due to a number of factors, including:

|

·

|

dependence

on key personnel;

|

|

·

|

competitive

factors;

|

|

·

|

the

operation of our business; and

|

|

·

|

general

economic conditions in the United States and

India.

|

These

forward-looking statements speak only as of the date on which they are made, and

except to the extent required by federal securities laws, we undertake no

obligation to update any forward-looking statements to reflect events or

circumstances after the date on which the statement is made or to reflect the

occurrence of unanticipated events. In addition, we cannot assess the

impact of each factor on our business or the extent to which any factor, or

combination of factors, may cause actual results to differ materially from those

contained in any forward-looking statements. All subsequent written

and oral forward-looking statements attributable to the Company or persons

acting on its behalf are expressly qualified in their entirety by the cautionary

statements contained in this quarterly report.

PART

I – FINANCIAL INFORMATION

ITEM

1. FINANCIAL STATEMENTS

These

unaudited financial statements have been prepared in accordance with accounting

principles generally accepted in the United States of America for interim

financial information and the SEC instructions to Form 10-Q. In the

opinion of management, all adjustments considered necessary for a fair

presentation have been included. Operating results for the interim

period ended October 31, 2009, are not necessarily indicative of the results

that can be expected for the full year.

3

TECHMEDIA

ADVERTISING, INC.

(A

DEVELOPMENT STAGE COMPANY)

INDEX

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

|

Restated

Consolidated Financial Statements-

|

|

|

Consolidated

Balance Sheets as of October 31, 2009, and July 31, 2008

|

F-2

|

|

Consolidated

Statements of Operations and Comprehensive (Loss) for the

Three Months Ended October 31, 2009, and 2008, and Cumulative

from Inception

|

F-3

|

|

Consolidated

Statements of Cash Flows for the Three Months

Ended October 31, 2009, and 2008, and Cumulative from

Inception

|

F-4

|

|

Notes

to Consolidated Financial Statements October 31, 2009, and

2008

|

F-5

|

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

CONSOLIDATED

BALANCE SHEETS (RESTATED) (NOTES 2 AND 3)

AS

OF OCTOBER 31, 2009, AND JULY 31, 2008

(Unaudited)

|

October 31,

|

July 31,

|

|||||||

|

2009

|

2009

|

|||||||

|

(Restated)

|

||||||||

|

ASSETS

|

||||||||

|

Current

Assets:

|

||||||||

|

Cash

and cash equivalents

|

$ | 2,206,074 | $ | 2,784,198 | ||||

|

Accounts

receivable - Related Parties

|

||||||||

|

Note

Note receivable

|

- | 350,000 | ||||||

|

Advance

|

85,000 | 85,000 | ||||||

|

Interest

|

- | 1,545 | ||||||

|

Total

accounts receivable - Related parties

|

85,000 | 436,545 | ||||||

|

Prepaid

consulting fees and rent expense

|

106,874 | 93,808 | ||||||

|

Total

current assets

|

2,397,948 | 3,314,551 | ||||||

|

Property

and Equipment:

|

||||||||

|

Computer

equipment and peripherals

|

7,445 | 3,000 | ||||||

| 7,445 | 3,000 | |||||||

|

Less

- Accumulated depreciation and amortization

|

(1,494 | ) | (750 | ) | ||||

|

Net

property and equipment

|

5,951 | 2,250 | ||||||

|

Other

Assets:

|

||||||||

|

Deferred

acquisition costs

|

- | 13,000 | ||||||

|

Goodwill

|

6,717 | - | ||||||

|

Total

other assets

|

6,717 | 13,000 | ||||||

|

Total

Assets

|

$ | 2,410,616 | $ | 3,329,801 | ||||

|

LIABILITIES AND STOCKHOLDERS'

EQUITY

|

||||||||

|

Current

Liabilities:

|

||||||||

|

Accounts

payable - Trade

|

$ | 19,191 | $ | 3,658 | ||||

|

Accrued

liabilities

|

53,067 | 20,529 | ||||||

|

Due

to Director and stockholder

|

19,475 | 500 | ||||||

|

Total

current liabilities

|

91,733 | 24,687 | ||||||

|

Total

liabilities

|

91,733 | 24,687 | ||||||

|

Commitments

and Contingencies

|

||||||||

|

Stockholders'

Equity:

|

||||||||

|

Common

stock, par value $0.001 per share; 1,100,000,000 shares authorized;

47,294,000 and 44,919,000 shares issued and outstanding in October 2009,

and July 2009, respectively

|

47,294 | 44,919 | ||||||

|

Additional

paid-in capital

|

3,271,422 | 1,234,006 | ||||||

|

Common

stock subscribed

|

- | 2,275,000 | ||||||

|

Accumulated

other comprehensive (loss)

|

(746 | ) | - | |||||

|

(Deficit)

accumulated during the development stage

|

(999,087 | ) | (248,811 | ) | ||||

|

Total

stockholders' equity

|

2,318,883 | 3,305,114 | ||||||

|

Total

Liabilities and Stockholders' Equity

|

$ | 2,410,616 | $ | 3,329,801 | ||||

The

accompanying notes to consolidated financial statements are

an

integral part of these consolidated balance sheets.

F-2

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

CONSOLIDATED

STATEMENTS OF OPERATIONS AND

COMPREHENSIVE

(LOSS) (RESTATED) (NOTES 2 AND 3)

FOR

THE THREE MONTHS ENDED OCTOBER 31, 2009, AND 2008, AND

CUMULATIVE

FROM INCEPTION (JANUARY 30, 2007)

THROUGH

OCTOBER 31, 2009

(Unaudited)

|

Three Months Ended

|

Cumulative

|

|||||||||||

|

October 31,

|

From

|

|||||||||||

|

2009

|

2008

|

Inception

|

||||||||||

|

(Restated)

|

(Restated)

|

|||||||||||

|

Revenues

|

$ | - | $ | - | $ | - | ||||||

|

Expenses:

|

||||||||||||

|

General

and administrative-

|

||||||||||||

|

Stock-based

compensation

|

241,570 | - | 241,570 | |||||||||

|

Legal

and accounting fees

|

132,672 | 1,500 | 135,222 | |||||||||

|

Management

fee

|

20,012 | 374 | 23,088 | |||||||||

|

Consulting

fee

|

368,866 | - | 368,866 | |||||||||

|

Salary

|

66,006 | - | 66,006 | |||||||||

|

Travel

|

62,235 | - | 62,235 | |||||||||

|

Professional

fee

|

28,695 | - | 28,695 | |||||||||

|

Office

supplies & expenses

|

30,917 | - | 31,071 | |||||||||

|

Others

|

21,873 | - | 29,349 | |||||||||

|

Office

rent

|

11,581 | 672 | 11,581 | |||||||||

|

Depreciation

and amortization

|

744 | 425 | 744 | |||||||||

|

Advertising

fee

|

660 | - | 660 | |||||||||

|

Total

general and administrative expenses

|

985,831 | 2,971 | 999,087 | |||||||||

|

(Loss)

from Operations

|

(985,831 | ) | (2,971 | ) | (999,087 | ) | ||||||

|

Other

Income (Expense)

|

- | - | - | |||||||||

|

Provision

for income taxes

|

- | - | - | |||||||||

|

Net

(Loss)

|

$ | (985,831 | ) | $ | (2,971 | ) | $ | (999,087 | ) | |||

|

Comprehensive

(Loss):

|

||||||||||||

|

Foreign

currency translation

|

(268 | ) | - | (746 | ) | |||||||

|

Total

Comprensive (Loss)

|

$ | (986,099 | ) | $ | (2,971 | ) | $ | (999,833 | ) | |||

|

(Loss)

Per Common Share:

|

||||||||||||

|

(Loss)

per common share - Basic and Diluted

|

$ | (0.02 | ) | $ | (0.00 | ) | ||||||

|

Weighted

Average Number of Common Shares

|

||||||||||||

|

Outstanding

- Basic and Diluted

|

46,970,902 | 43,120,000 | ||||||||||

The

accompanying notes to consolidated financial statements are

an

integral part of these consolidated statements.

F-3

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

CONSOLIDATED

STATEMENTS OF CASH FLOWS (RESTATED) (NOTE 2)

FOR

THE THREE MONTHS ENDED OCTOBER 31, 2009, AND 2008, AND

CUMULATIVE

FROM INCEPTION (JANUARY 30, 2007)

THROUGH

OCTOBER 31, 2009 (NOTE 3)

(Unaudited)

|

Three

Months Ended

|

Cumulative

|

|||||||||||

|

October

31,

|

From

|

|||||||||||

|

2009

|

2008

|

Inception

|

||||||||||

|

(Restated)

|

(Restated)

|

|||||||||||

|

Operating

Activities:

|

||||||||||||

|

Net

(loss)

|

$ | (985,831 | ) | $ | (13,528 | ) | $ | (999,087 | ) | |||

|

Adjustments

to reconcile net (loss) to net cash

(used in) operating

activities:

|

||||||||||||

|

Stock-based

compensation

|

241,570 | - | 241,570 | |||||||||

|

Depreciation

and amortization

|

744 | 283 | 1,494 | |||||||||

|

Common

stock issued for consulting services

|

16,667 | - | 16,667 | |||||||||

|

Recapitalization

from reverse merger

|

235,555 | - | 235,555 | |||||||||

|

Changes

in assets and liabilities-

|

||||||||||||

|

Accounts

receivable

|

- | - | - | |||||||||

|

Prepaid

consulting fees and rent

|

(20,292 | ) | 499 | (147,113 | ) | |||||||

|

Accounts

payable - Trade

|

15,533 | 75 | 19,191 | |||||||||

|

Accrued

liabilities

|

13,605 | (1,750 | ) | 53,067 | ||||||||

|

Net

Cash (Used in) Operating Activities

|

(482,449 | ) | (14,421 | ) | (578,656 | ) | ||||||

|

Investing

Activities:

|

||||||||||||

|

Cash

acquired in business combination

|

200,161 | - | - | |||||||||

|

Website

development costs

|

- | (5,100 | ) | (5,100 | ) | |||||||

|

Purchase

of computers and peripherals

|

(286 | ) | - | (7,445 | ) | |||||||

|

Net

Cash (Used in) Investing Activities

|

199,875 | (5,100 | ) | (12,545 | ) | |||||||

|

Financing

Activities:

|

||||||||||||

|

Issuance

of common stock for cash

|

- | - | 3,662,250 | |||||||||

|

Due

from TechMedia Singapore - Related Party

|

- | - | (85,000 | ) | ||||||||

|

Loan

to TechMedia India - Related Party

|

(85,000 | ) | - | (435,000 | ) | |||||||

|

Payments

of finder's fee

|

(227,500 | ) | - | (362,425 | ) | |||||||

|

Due

to Director and stockholder

|

17,696 | - | 18,196 | |||||||||

|

Net

Cash (Used in) Provided by Financing Activities

|

(294,804 | ) | - | 2,798,021 | ||||||||

|

Effect

of Exchange Rate Changes on Cash and Cash Equivalents

|

(746 | ) | - | (746 | ) | |||||||

|

Net

(Decrease) Increase in Cash and Cash Equivalents

|

(578,124 | ) | (19,521 | ) | 2,206,074 | |||||||

|

Cash

and Cash Equivalents - Beginning of Period

|

2,784,198 | 38,131 | - | |||||||||

|

Cash

and Cash Equivalents - End of Period

|

$ | 2,206,074 | $ | 18,610 | $ | 2,206,074 | ||||||

|

Supplemental

Disclosure of Cash Flow Information:

|

- | |||||||||||

|

Cash

paid during the period for:

|

||||||||||||

|

Interest

|

$ | - | $ | - | ||||||||

|

Income

taxes

|

$ | - | $ | - | ||||||||

In

January 2009, the former Director, president, and stockholder of the Company

waived the repayment of a loan and forgave the Company of the $14,600 debt. The

amount of forgiven debt of the repayment of $14,600 was considered as an

addition to paid-in capital in the accompanying balance sheet as of July 31,

2009.

On

September 17, 2009, the Company issued 100,000 shares to a consulting company

for certain financial advisory and research services which will be performed

over a one-year period. The services were valued at $100,000.

The

accompanying notes to consolidated financial statements are

an integral part of these consolidated

statements

F-4

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

(1) Summary

of Significant Accounting Policies

Basis

of Presentation and Organization

TechMedia

Advertising, Inc. (formerly “Ultra Care, Inc.”) (“TechMedia” or the “Company”)

is a Nevada corporation in the development stage. The Company was

incorporated on January 30, 2007. The original business plan of the

Company was to service the healthcare industry and provide prospective employers

with reliable recruitment, screening, and placement services by developing an

innovative web-based service to match foreign-based nurses who are looking to

work in the United States and Canada with healthcare employers located in the

United States and Canada. The Company adopted a new business plan in

2009. The new business plan of the Company entails the entry into the

streaming digital media advertising business in India through an operating

entity established in that country. The accompanying consolidated

financial statements of were prepared from the accounts of the Company and its

wholly owned subsidiaries under the accrual basis of accounting.

In

addition, in March 2007, the Company commenced a capital formation activity

through a Private Placement Offering (“PPO”), exempt from registration under the

Securities Act of 1933, to raise up to $38,000 through the issuance 16,720,000

shares (post forward stock split) of its common stock, par value $0.001 per

share, at an offering price of approximately $0.002 per share. As of

July 31, 2007, the Company closed the PPO and received proceeds of

$38,000.

Further,

on November 7, 2007, the Company filed a Registration Statement on Form SB-2

with the SEC to register 16,720,000 shares (post forward stock split) of its

common stock for selling stockholders. The Registration Statement was

declared effective by the SEC on November 30, 2007. The Company will

not receive any of the proceeds of this registration activity once the shares of

common stock are sold.

On

January 28, 2009, the Company filed Articles of Merger in the State of Nevada

with its wholly owned subsidiary, TechMedia Advertising, Inc., in order to

affect a name change from Ultra Care, Inc. to TechMedia Advertising,

Inc. The name change was effective with the State of Nevada and FINRA

on February 17, 2009.

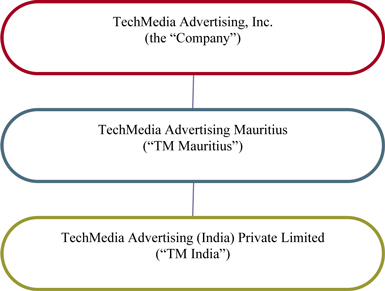

On July

27, 2009, the Company entered into a share exchange agreement (the “Exchange

Agreement”) with TechMedia Advertising Mauritius (“TM Mauritius”) and all of the

shareholders of TM Mauritius (the “Sellers”), whereby, at closing, the Company

will acquire all of the issued and outstanding shares in the capital of TM

Mauritius from the Sellers in exchange for the issuance of 24,000,000 shares of

Common Stock to the Sellers on a pro rata basis in accordance with each Seller’s

percentage ownership in TM Mauritius. TM Mauritius is the sole

beneficial owner TechMedia Advertising (India) Private Limited (“TM India”), a

company organized under the laws of India, which is engaged in the initial

stages of selling outdoor advertising on billboards and digital signs in India

located in high traffic locations. Such locations range from

transportation vehicles, commercial buildings, to supermarkets and restaurants,

by forming a partnership with media space owners.

F-5

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

TM

Mauritius was incorporated pursuant to the laws of Mauritius on March 11,

2009. At the time of closing of the Exchange Agreement, the Company

will be the sole shareholder of TM Mauritius. On June 22, 2009, TM

Mauritius acquired sole beneficial ownership of TM India through an exchange of

four ordinary shares of capital stock of TM Mauritius for 1,000 shares of

paid-up capital stock of TM India.

TM India

was incorporated pursuant to the laws of India on December 27,

2007. Since its incorporation, TM India has been involved in

investigating, researching, and establishing relationships in the media industry

in India.

On August

6, 2009, the Exchange Agreement closed and as a result, TM Mauritius became a

wholly owned subsidiary of the Company. As a result of the closing of

the Exchange Agreement, the Sellers collectively own 24,000,000 shares of common

stock of the Company as follows: 9,600,000 shares of common stock are owned by

OneMedia Limited (21.4 percent of the issued and outstanding); 7,200,000 shares

of common stock of the Company are owned by Ternes Capital Ltd. (16.0 percent of

the issued and outstanding); and 7,200,000 shares of common stock of the Company

are owned by Johnny Lian Tian Yong (16.0 percent of the issued and outstanding),

which constitutes in aggregate 53.4 percent of the issued and outstanding shares

of common stock of the Company.

Subsequent

to the closing of the Exchange Agreement, the business of the Company is

conducted through its subsidiary, TM Mauritius, which is pursuing its

advertising business plan through a new joint venture company in India, as well

as through TM India.

On June

15, 2009, TM Mauritius was assigned TechMedia Advertising Singapore Pte. Ltd.’s

rights and obligations under the Summary of Terms of Investment with respect to

a joint venture arrangement for operating the business of installing,

commissioning, maintaining and commercializing mobile digital advertising

platforms in public commuter transports such as buses and trains in India (the

“JV Business”), which was entered into between TechMedia Advertising Singapore

Pte. Ltd., a company incorporated under the laws of Singapore, and Peacock Media

Ltd. (“PML”), a company incorporated under the laws of India, on December 19,

2008.

On

October 22, 2009, the Company through its wholly owned subsidiary, TM Mauritius,

entered into a Joint Venture Development and Operating Agreement (the “JV

Agreement”) with PML. In accordance with the JV Agreement, TM Mauritius and PML

will form a new private India company (the “JV Company”) where TM Mauritius will

own 85% and PML will own 15%. The JV Company will operate the business of

displaying mobile digital advertising platforms in public transportation

vehicles such as long-distance buses and trains in India (the “Business”). The

newly-fitted buses and trains will display third party commercial contents and

advertisements for a fee.

F-6

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

Unaudited

Interim Consolidated Financial Statements

The

accompanying consolidated financial statements of the Company as of October 31,

2009, and July 31, 2009, and for the three months ended October 31, 2009, and

2008, and cumulative from inception are unaudited. However, in the

opinion of management, the accompanying consolidated financial statements

include all adjustments, consisting only of normal recurring adjustments,

necessary to present fairly the Company’s consolidated financial position as of

October 31, 2009, July 31, 2009, and the results of its operations and its cash

flows for the three months ended October 31, 2009, and 2008. These

results are not necessarily indicative of the results expected for the fiscal

year ending July 31, 2010. The accompanying consolidated financial

statements and notes thereto do not reflect all disclosures required under

accounting principles generally accepted in the United States of

America. Refer to the Company’s audited financial statements as of

July 31, 2009, filed with the SEC on October 20, 2009, for additional

information, including significant accounting policies.

Cash and Cash

Equivalents

For

purposes of reporting within the statements of cash flows, the Company considers

all cash on hand, cash accounts not subject to withdrawal restrictions or

penalties, and all highly liquid debt instruments purchased with a maturity of

three months or less to be cash and cash equivalents.

Revenue

Recognition

The

Company is in the development stage and has yet to realize revenues from planned

operations. Once the Company has commenced planned operations, it

will recognize revenues when completion of its advertising services has occurred

provided there is persuasive evidence of an agreement, acceptance has been

approved by its customers, the fee is fixed or determinable based on the

completion of stated terms and conditions, and collection of any related

receivable is probable.

Property and

equipment

Property

and equipment are recorded at historical cost. Minor additions and

renewals are expensed in the year incurred. Major additions and

renewals are capitalized and depreciated over their estimated useful

lives. When property and equipment are retired or otherwise disposed

of, the cost and accumulated depreciation or amortization are removed from the

accounts and any resulting gain or loss is included in the results of operations

for the respective period. The Company uses the straight-line method

of depreciation. The estimated useful life of property and equipment

is as follows:

|

Computer

equipment and peripherals

|

3

years

|

F-7

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

Income

(Loss) Per Common Share

Basic

income (loss) per share is computed by dividing the net loss attributable to the

common stockholders by the weighted average number of shares of common stock

outstanding during the period. Diluted income (loss) per share is

computed similar to basic loss per share except that the denominator is

increased to include the number of additional common shares that would have been

outstanding if the potential common shares had been issued and if the additional

common shares were dilutive. There were no dilutive financial

instruments issued or outstanding for the three months ended October 31, 2009,

and 2008.

Deferred

Offering Costs

The

Company defers as other assets the direct incremental costs of raising capital

until such time as the offering is completed. At the time of the

completion of the offering, the costs are charged against the capital

raised. Should the offering be terminated, deferred offering costs

are charged to operations during the period in which the offering is

terminated. As of October 31, 2009, and July 31, 2009, the Company

had not incurred any deferred offering costs.

Deferred

Acquisition Costs

The

Company defers as other assets the direct incremental costs of acquiring a

company until such time as the acquisition is completed. At the time

of the completion of the acquisition, the costs are charged against the goodwill

of the acquired company. Should the acquisition be terminated,

deferred acquisition costs are charged to operations during the period in which

the agreement is terminated. As of October 31, 2009, and July 31,

2009, the Company recorded $0 and $13,000 of deferred acquisition costs,

respectively.

Income

Taxes

The

Company accounts for income taxes pursuant to SFAS No. 109, Accounting for Income Taxes

(“SFAS No. 109”). Under SFAS No. 109, deferred tax assets and

liabilities are determined based on temporary differences between the bases of

certain assets and liabilities for income tax and financial reporting

purposes. The deferred tax assets and liabilities are classified

according to the financial statement classification of the assets and

liabilities generating the differences.

The

Company maintains a valuation allowance with respect to deferred tax

assets. The Company establishes a valuation allowance based upon the

potential likelihood of realizing the deferred tax asset and taking into

consideration the Company’s financial position and results of operations for the

current period. Future realization of the deferred tax benefit

depends on the existence of sufficient taxable income within the carryforward

period under the Federal tax laws.

Changes

in circumstances, such as the Company generating taxable income, could cause a

change in judgment about the realizability of the related deferred tax

asset. Any change in the valuation allowance will be included in

income in the year of the change in estimate.

F-8

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

Concentration of

Risk

As of

October 31, 2009, and July 31, 2009, the Company maintained its cash accounts at

two commercial banks. The balance in each account was subject to FDIC

coverage up to $250,000.

Fair

Value of Financial Instruments

The

Company estimates the fair value of financial instruments using the available

market information and valuation methods. Considerable judgment is

required in estimating fair value. Accordingly, the estimates of fair

value may not be indicative of the amounts the Company could realize in a

current market exchange. As of October 31, 2009, and July 31, 2009,

the carrying value of the Company’s financial instruments approximated fair

value due to the short-term maturity of these instruments.

Common Stock Registration

Expenses

The

Company considers incremental costs and expenses related to the registration of

equity securities with the SEC, whether by contractual arrangement as of a

certain date or by demand, to be unrelated to original issuance

transactions. As such, subsequent registration costs and expenses are

reflected in the accompanying consolidated financial statements as general and

administrative expenses, and are expensed as incurred.

Lease

Obligations

All

noncancellable leases with an initial term greater than one year are categorized

as either capital or operating leases. Asset recorded under capital

leases are amortized according to the methods employed for property and

equipment or over the term of the related lease, if shorter.

Estimates

The

accompanying consolidated financial statements are prepared on the basis of

accounting principles generally accepted in the United States of

America. The preparation of financial statements in conformity with

generally accepted accounting principles requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities as of

October 31, 2009, and July 31, 2009, and expenses for the three months ended

October 31, 2009, and 2008, and cumulative from inception. Actual

results could differ from those estimates made by management.

F-9

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

(2) Development

Stage Activities and Going Concern

The

Company is currently in the development stage. The original business

plan of the Company was to service the healthcare industry and provide

prospective employers with reliable recruitment, screening, and placement

services by developing an innovative web-based service to match foreign-based

nurses who are looking to work in the United States and Canada with healthcare

employers located in the United States and Canada. The Company

adopted a new business plan in 2009. The new business plan of the

Company entails the entry into the streaming digital media advertising business

in India through an operating entity established in that country.

During

the period from January 30, 2007, through October 31, 2009, the Company was

organized and incorporated, conducted various capital formation activities

through the sale of its common stock, completed a software development activity,

and entered into an Exchange Agreement for the acquisition of all of the issued

and outstanding shares in the capital of TM Mauritius. On November 7,

2007, the Company filed a Registration Statement on Form SB-2 with the SEC to

register 16,720,000 shares (post forward stock split) of its common stock for

selling stockholders. The Registration Statement was declared

effective by the SEC on November 30, 2007. The Company will not

receive any of the proceeds of this registration activity once the shares of

common stock are sold. The Company also intends to conduct additional

capital formation activities through the issuance of its common stock and to

further conduct its operations.

While

management of the Company believes that the Company will be successful in its

planned operating activities under its new business plan, there can be no

assurance that it will be successful in the development of its planned

advertising services such that it will generate sufficient revenues to earn a

profit or sustain its operations.

The

accompanying consolidated financial statements have been prepared in conformity

with accounting principles generally accepted in the United States of America,

which contemplate continuation of the Company as a going concern. The

Company has not established any source of revenue to cover its operating costs,

and as such, has incurred an operating loss since inception. Further,

as of October 31, 2009, and July 31, 2009, the cash resources of the Company

were insufficient to meet its planned business objectives. These and

other factors raise substantial doubt about the Company’s ability to continue as

a going concern. The accompanying consolidated financial statements

do not include any adjustments to reflect the possible future effects on the

recoverability and classification of assets or the amounts and classification of

liabilities that may result from the possible inability of the Company to

continue as a going concern.

|

(3)

|

Restatement

|

On

December 10, 2010, the Board of Directors of the Company determined that the

unaudited consolidated financial statements for the period ended October 31,

2009, should be restated as a result of material misstatements. The

determination to restate the unaudited consolidated financial statements was

made in connection with management’s assessment of accounting errors it

discovered in connection with the preparation of the audited consolidated

financial statements for the year ended July 31, 2010. For the period

ended October 31, 2009, the Company recorded stock-based compensation related to

stock options issued to employees and non-employees at a value of $2.22 per

share of common stock underlying each stock option when the fair market value of

such underlying shares should have been valued at $1.00 per share resulting in

an overstatement of expense and additional paid-in capital of $343,022 for the

period. Management also determined that for the same period a payment

for consulting services in the amount of $93,808 was incorrectly reported as an

offset to additional paid-in capital, and should have been reported as a

consulting fee expense in the unaudited consolidated financial statements

resulting in an understatement of expense by $93,808. Lastly,

reclassifications of depreciation expense of $6 and consulting fees of $175,000

from management fees were also made to correct the presentation of such

expenses. Such reclassifications did not have an impact on the net

(loss) for the period. The Company corrected the errors by decreasing

additional paid-in capital by $249,214, stock-based compensation expense by

$343,022, and increased consulting fees by $93,808. The adjustments

had an impact of decreasing the net (loss) for the period by

$249,214. (Loss) per share – basic and diluted for the period

decreased from $(0.03) per share to $(0.02) per share.

F-10

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

|

(4)

|

Change

in Management

|

On

September 9, 2008, Mr. Clifford Belgica resigned as the Company’s President,

Chief Executive Officer, and Director. On the same date, Mr. Denver

Melchor resigned as the Company’s Treasurer, Secretary, Chief Financial Officer,

and Director. The Company appointed Mr. Van Clayton A. Pagaduan to

the offices of President, Treasurer, Secretary, and Chief Financial

Officer. The former officers and Directors also sold their interests

in the Company of 26,400,000 shares (post forward stock split) of common stock

to Mr. Van Clayton A. Pagaduan, which resulted in a change of beneficial

ownership in securities.

On

January 15, 2009, Mr. Van Clayton A. Pagaduan resigned from the offices of

President, Treasurer, Secretary, Chief Financial Officer, and

Director. On same date, Mr. Alan Goh was appointed as President,

Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer, and a

Director of the Company. Mr. Pagaduan also sold his interest in the

Company of 26,400,000 shares (post forward stock split) of common stock to Mr.

Goh, which resulted in a change of beneficial ownership in

securities.

On August

6, 2009, and in accordance with the Exchange Agreement, Mr. Alan Goh, the

current President, CEO, CFO, Secretary and Treasurer and a Director, resigned as

the Company’s President, CEO, CFO and Treasurer (remaining as the Secretary and

a Director) and Mr. Johnny Lian Tian Yong was appointed as the President, CEO,

Chairman and a director of the Company. Mr. Ratner Vellu was also

appointed as a Director of the Company, and Mr. William Goh Han Tiang was

appointed as the Treasurer and a Director of the Company. However,

the appointment of Messrs. Johnny Lian Tian Yong, Ratner Vellu and William Goh

Han Tiang as Directors of the Company, will not become effective until August

14, 2009, which is 10 days after the filing date of a Schedule 14F-1 Information

Statement with the Securities and Exchange Commission and the transmission of

notification to all shareholders of record of common stock of the Company who

would be entitled to vote at a meeting for election of Directors.

F-11

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

|

(5)

|

Loan

from Related Party

|

As of

October 31, 2009, a loan from an individual who is an employee of a subsidiary

of the Company amounted to $19,475 (October 31, 2008 - $0). The loan

was provided for working capital purposes, and is unsecured, non-interest

bearing, and has no terms for repayment.

|

(6)

|

Common

Stock

|

The

Company was originally authorized to issue 50,000,000 shares of $0.001 par value

common stock. All shares of common stock have equal voting rights,

are non-assessable, and have one vote per share. Voting rights are

not cumulative and, therefore, the holders of more than 50 percent of the common

stock could, if they choose to do so, elect all of the Directors of the

Company.

Effective

February 17, 2009, the Company completed a twenty-two (22) for one (1) forward

stock split of its authorized, issued, and outstanding common

stock. As a result, the authorized capital of the Company has

increased from 50,000,000 shares of common stock with a par value of $0.001 to

1,100,000,000 shares of common stock with a par value of $0.001, and

correspondingly, its issued and outstanding capital increased from 1,960,000

shares of common stock to 43,120,000 shares of common stock. The

accompanying consolidated financial statements and related notes thereto have

been adjusted accordingly to reflect this forward stock split.

On

January 30, 2007, the Company issued 26,400,000 (post forward stock split)

shares of its common stock to its Directors and officers at par value for cash

proceeds of $12,000.

In March

2007, the Company commenced a capital formation activity through a PPO, exempt

from registration under the Securities Act of 1933, to raise up to $38,000

through the issuance 16,720,000 (post forward stock split) shares of its common

stock, par value $0.001 per share, at an offering price of approximately $0.002

per share. As of July 31, 2007, the Company fully subscribed the PPO,

and received proceeds of $38,000. The Company accepted subscriptions

from 38 foreign, non-affiliated investors.

In

addition, on November 7, 2007, the Company filed a Registration Statement on

Form SB-2 with the SEC to register 16,720,000 (post forward stock split) shares

of its common stock for selling stockholders. The Registration

Statement was declared effective by the SEC on November 30, 2007. The

Company will not receive any of the proceeds of this registration activity once

the shares of common stock are sold.

On June

8, 2009, the Company issued 145,000 shares of its common stock to four

individuals due to the closing of the private placement of its common stock at

$0.75 per share for total gross proceeds of $108,750.

On June

8, 2009, the Company issued 1,654,000 shares of its common stock to 11

individuals and entities due to the closing of the private placement of its

common stock at $0.75 per unit for total gross proceeds of

$1,240,500.

F-12

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

In

connection with the issuance of the 145,000 shares and the 1,654,000 shares of

its common stock, described above, the Company paid a finder’s fee of $134,925

to an unrelated third party.

On July

27, 2009, the Company entered into an Exchange Agreement with TM Mauritius, a

company organized under the laws of Mauritius, and all the Sellers of TM

Mauritius, whereby the Company agreed to acquire all of the issued and

outstanding shares in the capital of TM Mauritius from the Sellers in exchange

for the issuance of 24,000,000 shares of Common Stock of the Company to the

Sellers on a pro rata basis in accordance with each Seller’s percentage

ownership in TM Mauritius. The Exchange Agreement is set to close on

or before August 5, 2009. As of July 31, 2009, the Exchange Agreement

has not been closed and no shares related to the Exchange Agreement had been

issued.

Concurrently

with the closing of the Exchange Agreement, by a letter agreement entered into

on July 30, 2009 (the “Letter Agreement”), between the Company and Alan Goh, Mr.

Alan Goh agreed to cancel 24,000,000 shares of the 26,400,000 shares of common

stock of the Company registered in his name. As of July 31, 2009, the

Exchange Agreement has not been closed and Mr. Alan Goh had not cancelled his

24,000,000 shares.

On August

12, 2009, the Company issued 2,275,000 shares of common stock to 37 individuals

due to the closing of private placement at $1.00 per unit for total gross

proceeds of $2,275,000. Each unit consists of one share of common

stock of the Company, and one-half of one share purchase warrant, with each

whole warrant entitling the holder to purchase one additional share of the

Company’s common stock at $2.00 per warrant share until two years from the date

of issuance of the share purchase warrants. The Company paid a finder’s

fee of $227,500 to an unrelated third party.

On

September 17, 2009, the Company issued 100,000 shares to Emissary Capital Group,

LLC (“Emissary Capital”) in accordance with the terms of the Financial Advisory

Agreement, dated September 2, 2009, entered into between the Company and

Emissary Capital. Emissary Capital will provide certain financial

advisory and research services for the Company. The fair value of the

services was valued at $100,000.

As of

October 31, 2009, there were 47,294,000 shares of common stock issued and

outstanding.

|

(7)

|

Common

Stock Options

|

On August

31, 2009, the Board of Directors unanimously approved and adopted a stock option

and incentive plan (the “2009 Stock Option and Incentive Plan”). The purpose of

the 2009 Stock Option and Incentive Plan is to advance the directors’ interests

and the shareholders’ interests by affording the Company’s key personnel an

opportunity for investment in the Company and the incentive advantages inherent

in stock ownership in the Company. Pursuant to the provisions of the 2009 Stock

Option and Incentive Plan, stock options, stock awards, cash awards or other

incentives (the “Stock Options and Incentives”) will be granted only to our key

personnel, generally defined as a person designated by the Board of Directors

upon whose judgment, initiative and efforts we may rely including any director,

officer, employee, consultant or advisor of the Company.

F-13

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

On August

31, 2009, the Board of Directors unanimously approved and granted in aggregate

1,900,000 stock options to certain directors, officers and consultants of the

Company having an exercise price of $2.22 per share and an expiry date of five

years from the date of grant. These stock options have vesting provisions of 10%

on the date of grant and 10% on the last day of each month thereafter beginning

on September 30, 2009.

The fair

value of each option granted has been estimated on the date of grant using the

Black-Scholes pricing model, using the following assumptions:

|

October

31, 2009

|

October

31, 2008

|

|||||||

|

Five

Year Risk Free Interest Rate

|

2.39 | % | - | |||||

|

Dividend

Yield

|

0.00 | % | - | |||||

|

Volatility

|

70.96 | % | - | |||||

|

Average

Expected Term (Years to Exercise)

|

5 | - | ||||||

A summary

of the status of options granted as of October 31, 2009 is as

follows:

|

For The Period Ended

October 31, 2009

|

||||||||

|

Shares

|

Weighted

Average

Exercise

Price

|

|||||||

|

Outstanding

at August 31, 2009

|

- | - | ||||||

|

Granted

|

1,900,000 | $ | 2.22 | |||||

|

Exercised

|

- | - | ||||||

|

Forfeited

|

- | - | ||||||

|

Expired

|

- | - | ||||||

|

Outstanding

at October 31, 2009

|

1,900,000 | $ | 2.22 | |||||

|

Exercisable

at October 31, 2009

|

570,000 | $ | 2.22 | |||||

F-14

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

A summary

of the status of options outstanding as of October 31, 2009, is presented

below:

|

Options Outstanding

|

Options Exercisable

|

|||||||||||||||||||||

|

Range

of

Exercise

prices

|

Number

Outstanding

|

Weighted

Average

Remaining

Life

(Years)

|

Weighted

Average

Exercise

Price

|

Number

exercisable

|

Weighted

Average

Exercise

Price

|

|||||||||||||||||

| $ | 2.22 | 1,900,000 | 4.83 | $ | 2.22 | 570,000 | $ | 2.22 | ||||||||||||||

The

weighted average grant date fair value of options granted during the three

months ended October 31, 2009, was $0.42. The compensation

expense for the three months ended October 31, 2009, totaled

$241,570.

|

(8)

|

Income

Taxes

|

The

provision (benefit) for income taxes for the three months ended October 31,

2009, and 2008, was as follows (using a 15 percent effective Federal income tax

rate):

|

Three Months Ended

|

||||||||

|

October 31,

|

||||||||

|

2009

|

2008

|

|||||||

|

Current

Tax Provision:

|

||||||||

|

Federal-

|

||||||||

|

Taxable

income

|

$ | - | $ | - | ||||

|

Total

current tax provision

|

$ | - | $ | - | ||||

|

Deferred

Tax Provision:

|

||||||||

|

Federal-

|

||||||||

|

Loss

carryforwards

|

$ | 147,875 | $ | 446 | ||||

|

Change

in valuation allowance

|

(147,875 | ) | (446 | ) | ||||

|

Total

deferred tax provision

|

$ | - | $ | - | ||||

The

Company had deferred income tax assets as of October 31, 2009, and July 31,

2009, as follows:

|

As of

|

As of

|

|||||||

|

October 31,

|

July 31,

|

|||||||

|

2009

|

2009

|

|||||||

|

Loss

carryforwards

|

$ | 149,863 | $ | 37,322 | ||||

|

Less

- Valuation allowance

|

(149,863 | ) | (37,322 | ) | ||||

|

Total

net deferred tax assets

|

$ | - | $ | - | ||||

F-15

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

As of

October 31, 2009, the Company had net operating loss carryforwards for income

tax reporting purposes of approximately $999,087 (July 31, 2009 - $248,811) that

may be offset against future taxable income. The net operating loss

carryforwards will begin to expire in the year 2029. Current tax laws

limit the amount of loss available to be offset against future taxable income

when a substantial change in ownership occurs or a change in the nature of the

business. Therefore, the amount available to offset future taxable

income may be limited.

No tax

benefit has been reported in the accompanying consolidated financial statements

for the realization of loss carryforwards, as the Company believes there is high

probability that the carryforwards will not be utilized in the foreseeable

future. Accordingly, the potential tax benefits of the loss

carryforwards are offset by a valuation allowance of the same

amount.

|

(9)

|

Related

Party Transactions

|

As

described in Note 5, on January 30, 2007, the Company issued 26,400,000 shares

(post forward stock split) of its common stock to its Directors and officers at

par value for cash proceeds of $12,000. As described in Note 3, on

September 9, 2008, these Directors and officers resigned from the

Company. These former officers and Directors sold their interests in

the Company amounting to 26,400,000 shares (post forward stock split) of common

stock to the newly appointed Director and officer of the Company.

As

described in Note 4, as of October 31, 2009, the Company owed $0 (October 31,

2008 - $14,600) to an individual who is a former Director, president, and

stockholder of the Company. The loan was provided for working capital

purposes; and was unsecured, non-interest bearing, and had no terms for

repayment. In January 2009, the former Director, president, and

stockholder of the Company waived this loan and forgave the Company of the

$14,600 debt.

On April

27, 2009, the Company and TM India signed a loan agreement. TechMedia

agreed to loan to TM India the principle amount of up to $1,000,000 for the

purpose of financing the company with such funds being used to equip buses in

India under the business arrangement between the company and Peacock Media

Ltd. The loan is bearing an annual interest rate at 3 percent and

will be due and payable one year from the date of agreement. On

August 6, the Company becomes the owner of TM India through TM Mauritius, such

loan were treated as an inter-corporate loan. As of October 31, 2009,

TechMedia had transferred $450,000 to TM India.

The

Company also loaned to TechMedia Advertising Singapore Pte. Ltd., a related

party entity, the amount of $85,000 for working capital

purposes. This loan is unsecured, non-interest bearing, and has no

terms for repayment.

On

October 22, 2009, the Company entered into a Corporate Consulting Services

Agreement with Johnny Lian Tian Yong having an effective date of September 1,

2009, whereby Mr. Lian will act as the President and CEO of the Company, assist

the Company with establishing and maintaining proper internal financial controls

and procedures, provide managerial advice and assist the Company with its

management and business operations, policy development and reporting

requirements for a term of two years ending September 1, 2011 in exchange for

the Company paying Mr. Lian US$12,000 per month payable on the last day of each

month.

F-16

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

In

addition, on October 22, 2009, the Company entered into a Corporate Consulting

Services Agreement with William Goh Han Tiang having an effective date of

September 1, 2009, whereby Mr. Goh will act as the Company’s Treasurer, assist

the Company’s President, CEO and principal accounting officer with establishing

and maintaining proper internal financial controls and procedures, provide

managerial advice and assist the Company with its management and business

operations, policy development and reporting requirements for a term of two

years ending September 1, 2011 in exchange for the Company paying Mr. Goh

US$8,000 per month payable on the last day of each month.

Furthermore,

on October 22, 2009, the Company entered into a Consulting Services Agreement

with Ratner Vellu having an effective date of September 1, 2009, whereby Mr.

Vellu will assist the Company in its business development and provide consulting

services to the Company in the areas of corporate finance and development

strategy for a term of two years ending September 1, 2011 in exchange for the

Company paying Mr. Vellu US$8,000 per month payable on the last day of each

month.

On

November 30, 2009, the Company entered into a Corporate Consulting Services

Agreement with Cher (Alan) Kian Goh having an effective date of October 1, 2009,

whereby Mr. Alan Goh will act as the Secretary of the Company and will provide

various consulting services to the Company as the Company’s board of directors

reasonably requests for a term of two years ending October 1, 2011, in exchange

for the Company paying Mr. Alan Goh US$3,500 per month payable on the last day

of each month.

|

(10)

|

Commitments

and Contingencies

|

On July

27, 2009, the Company entered into an Exchange Agreement with TM Mauritius, and

all the shareholders of TM Mauritius as Sellers, whereby the Company agreed to

acquire all of the issued and outstanding shares in the capital of TM Mauritius

from the Sellers in exchange for the issuance of 24,000,000 shares of Common

Stock of the Company to the Sellers on a pro rata basis in accordance with each

Seller’s percentage ownership in TM Mauritius.

On

September 17, 2009, the Company issued 100,000 shares to Emissary Capital in

accordance with the terms of the Financial Advisory Agreement, dated September

2, 2009, entered into between the Company and Emissary

Capital. Emissary Capital will provide certain financial advisory and

research services for the Company. The fair value of the services was

valued at $100,000.

On

October 22, 2009, the Company through its wholly owned subsidiary, TM Mauritius,

entered into a Joint Venture Development and Operating Agreement (the “JV

Agreement”) with PML. In accordance with the JV Agreement, TM Mauritius and PML

will form a new private India company (the “JV Company”) where TM Mauritius will

own 85% and PML will own 15%. The JV Company will operate the business of

displaying mobile digital advertising platforms in public transportation

vehicles such as long-distance buses and trains in India (the “Business”). The

newly-fitted buses and trains will display third party commercial contents and

advertisements for a fee.

F-17

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

Under the

JV Agreement, PML will assign to the JV Company the exclusive rights to use the

license to operate the Business on 10,392 long distance buses within the Tamil

Nadu State, where PML has a 5 year exclusive license. The initial Board of

Directors of the JV Company will be comprised of two nominees from PML, Messrs.

Sandeep Chawla and Kuljit Suri, and three nominees from TMM, Messrs. Johnny

Lian, Ratner Vellu and William Goh. The Company will on a commercially

reasonable best effort basis raise up to US$25,000,000 which it anticipates

lending in certain tranches through TMM to the JV Company over the first 5 years

of the JV Company’s business, which is the initial intended working capital

required to install, commission, maintain and commercialize mobile digital

advertising platforms onto buses and trains and operate the Business. Out of the

US$25,000,000, US$5,000,000 is to be set aside as a contingency fund for the JV

Company’s working capital needs. During the first year of incorporation of the

JV Company, TM Mauritius is to advance US$12,270,000 to the JV Company with the

first US$1,000,000 to be provided by October 31, 2009 and a subsequent amount of

US$4,000,000 to be provided as soon as certain expenses have been incurred by

PML and certified by TM Mauritius. Additional amounts of US$1,932,500 are to be

advanced by TM Mauritius to the JV Company on a yearly basis thereafter,

however, the Board of the JV Company may determine to reduce or eliminate such

additional capital contributions by TM Mauritius depending on the amount of

revenues produced by the JV Company available to satisfy the required working

capital.

|

(11)

|

Recent

Accounting Pronouncements

|

In March

2008, the FASB issued FASB Statement No. 161, “Disclosures about Derivative

Instruments and Hedging Activities – an amendment of FASB Statement 133”

(“SFAS No. 161”). SFAS No. 161 enhances required disclosures

regarding derivatives and hedging activities, including enhanced disclosures

regarding how: (a) an entity uses derivative instruments; (b)

derivative instruments and related hedged items are accounted for under SFAS No.

133, “Accounting for

Derivative Instruments and Hedging Activities”; and (c) derivative

instruments and related hedged items affect an entity’s financial position,

financial performance, and cash flows. Specifically, SFAS No. 161

requires:

|

|

-

|

disclosure

of the objectives for using derivative instruments in terms of underlying

risk and accounting designation;

|

|

|

-

|

disclosure

of the fair values of derivative instruments and their gains and losses in

a tabular format;

|

|

|

-

|

disclosure

of information about credit-risk-related contingent features;

and

|

|

|

-

|

cross-reference

from the derivative footnote to other footnotes in which

derivative-related information is

disclosed.

|

F-18

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

SFAS No.

161 is effective for fiscal years and interim periods beginning after November

15, 2008. Earlier application is encouraged. The

management of TechMedia does not expect the adoption of this pronouncement to

have a material impact on its financial statements.

In May

2008, the FASB issued FASB Statement No. 162, “The Hierarchy of Generally Accepted

Accounting Principles” (“SFAS No. 162”). SFAS No. 162 is

intended to improve financial reporting by identifying a consistent framework,

or hierarchy, for selecting accounting principles to be used in preparing

financial statements that are presented in conformity with U.S. generally

accepted accounting principles (“GAAP”) for nongovernmental

entities.

Prior to

the issuance of SFAS No. 162, GAAP hierarchy was defined in the American

Institute of Certified Public Accountants (“AICPA”) Statement on Auditing

Standards, “The Meaning of

Present Fairly in Conformity with Generally Accept Accounting Principles”

(“SAS No. 69”). SAS No. 69 has been criticized because it is directed

to the auditor rather than the entity. SFAS No. 162 addresses these

issues by establishing that the GAAP hierarchy should be directed to entities

because it is the entity (not the auditor) that is responsible for selecting

accounting principles for financial statements that are presented in conformity

with GAAP.

The

sources of accounting principles that are generally accepted are categorized in

descending order as follows:

|

a)

|

FASB

Statements of Financial Accounting Standards and Interpretations, FASB

Statement 133 Implementation Issues, FASB Staff Positions, and American

Institute of Certified Public Accountants (AICPA) Accounting Research

Bulletins and Accounting Principles Board Opinions that are not superseded

by actions of the FASB.

|

|

b)

|

FASB

Technical Bulletins and, if cleared by the FASB, AICPA Industry Audit and

Accounting Guides and Statements of

Position.

|

|

c)

|

AICPA

Accounting Standards Executive Committee Practice Bulletins that have been

cleared by the FASB, consensus positions of the FASB Emerging Issues Task

Force (EITF), and the Topics discussed in Appendix D of EITF Abstracts

(EITF D-Topics).

|

|

d)

|

Implementation

guides (Q&As) published by the FASB staff, AICPA Accounting

Interpretations, AICPA Industry Audit and Accounting Guides and Statements

of Position not cleared by the FASB, and practices that are widely

recognized and prevalent either generally or in the

industry.

|

SFAS No.

162 is effective 60 days following the SEC’s approval of the Public Company

Accounting Oversight Board amendment to its authoritative

literature. It is only effective for nongovernmental entities;

therefore, the GAAP hierarchy will remain in SAS No. 69 for state and local

governmental entities and federal governmental entities. The

management of TechMedia does not expect the adoption of this pronouncement to

have a material impact on its financial statements.

F-19

TECHMEDIA

ADVERTISING, INC. AND SUBSIDIARIES

(A

DEVELOPMENT STAGE COMPANY)

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS (RESTATED)

OCTOBER

31, 2009, AND 2008

(Unaudited)

In May

2008, the FASB issued FASB Statement No. 163, “Accounting for Financial Guarantee

Insurance Contracts” (“SFAS No. 163”). SFAS No. 163 clarifies

how FASB Statement No. 60, “Accounting and Reporting by

Insurance Enterprises” (“SFAS No. 60”), applies to financial guarantee

insurance contracts issued by insurance enterprises, including the recognition

and measurement of premium revenue and claim liabilities. It also

requires expanded disclosures about financial guarantee insurance

contracts.

The

accounting and disclosure requirements of SFAS No. 163 are intended to improve

the comparability and quality of information provided to users of financial

statements by creating consistency. Diversity exists in practice in

accounting for financial guarantee insurance contracts by insurance enterprises

under SFAS No. 60, “Accounting

and Reporting by Insurance Enterprises.” That diversity

results in inconsistencies in the recognition and measurement of claim

liabilities because of differing views about when a loss has been incurred under

FASB Statement No. 5, “Accounting for Contingencies”

(“SFAS No. 5”). SFAS No. 163 requires that an insurance enterprise

recognize a claim liability prior to an event of default when there is evidence

that credit deterioration has occurred in an insured financial

obligation. It also requires disclosure about (a) the risk-management

activities used by an insurance enterprise to evaluate credit deterioration in

its insured financial obligations and (b) the insurance enterprise’s

surveillance or watch list.

SFAS No.

163 is effective for financial statements issued for fiscal years beginning

after December 15, 2008, and all interim periods within those fiscal years,

except for disclosures about the insurance enterprise’s risk-management

activities. Disclosures about the insurance enterprise’s

risk-management activities are effective the first period beginning after

issuance of SFAS No. 163. Except for those disclosures, earlier

application is not permitted. The management of TechMedia does not

expect the adoption of this pronouncement to have material impact on its

financial statements.

On May

22, 2009, the FASB issued FASB Statement No. 164, “Not-for-Profit Entities: Mergers and

Acquisitions” (“SFAS No. 164”). Statement 164 is intended to

improve the relevance, representational faithfulness, and comparability of the

information that a not-for-profit entity provides in its financial reports about

a combination with one or more other not-for-profit entities, businesses, or

nonprofit activities. To accomplish that, this Statement establishes

principles and requirements for how a not-for-profit entity:

|

|

a.

|

Determines

whether a combination is a merger or an

acquisition.

|

|

|

b.

|

Applies

the carryover method in accounting for a

merger.

|

|

|

c.

|

Applies