Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - SUNOCO INC | dex991.htm |

| 8-K - SUNOCO INC--FORM 8-K - SUNOCO INC | d8k.htm |

4Q10 Earnings Conference Call

February 3, 2011

Exhibit 99.2 |

2

Safe Harbor Statement

This slide presentation should be reviewed in conjunction with Sunoco’s Fourth Quarter 2010

earnings conference call held on February 3, 2011 at 5:30 p.m. ET. You may listen to the audio

portion of the conference call on the website or an audio recording will be available after the

call’s completion by calling 1-800-294-0344 and entering conference ID #2345946.

Statements in this presentation that are not historical facts are forward-looking statements

intended to be covered by the safe harbor provisions of Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking

statements are based upon assumptions by Sunoco concerning future conditions, any or all of which ultimately

may prove to be inaccurate, and upon the current knowledge, beliefs and expectations of Sunoco

management. These forward-looking statements are not guarantees of future

performance. Forward-looking statements are inherently uncertain and involve significant risks and

uncertainties that could cause actual results to differ materially from those described during

this presentation. Such risks and uncertainties include economic, business, competitive

and/or regulatory factors affecting Sunoco's business, as well as uncertainties related to the outcomes

of pending or future litigation. In accordance with the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995, Sunoco has included in its Annual Report on Form

10-K for the year ended December 31, 2009, and in its subsequent Form 10-Q and Form

8-K filings, cautionary language identifying important factors (though not necessarily all such factors) that

could cause future outcomes to differ materially from those set forth in the forward-looking

statements. For more information concerning these factors, see Sunoco's Securities and

Exchange Commission filings, available on Sunoco's website at www.SunocoInc.com. Sunoco

expressly disclaims any obligation to update or alter its forward-looking statements, whether as

a result of new information, future events or otherwise.

This presentation includes certain non-GAAP financial measures intended to supplement, not

substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to

GAAP financial measures are provided in the Appendix at the end of the presentation.

Investors are urged to consider carefully the comparable GAAP measures and the reconciliations

to those measures provided in the Appendix, or on our website at www.SunocoInc.com. |

3

4Q10 Results

After-tax income before special items of

$13MM* ($0.11/share diluted),

pretax

loss of $2MM*

Retail contributed $1MM pretax in a period of rising crude prices

Logistics delivered strong results with pretax income of $37MM

SunCoke earned

$25MM pretax

Refining & Supply (R&S) reported a pretax loss of $17MM

as operational

issues hindered performance

* For

reconciliation

to

Net

Income

(Loss),

see

Slides

18

and

19.

Special

Items

in

4Q10

include

a

net

gain of $74MM after-tax.

Summary |

4

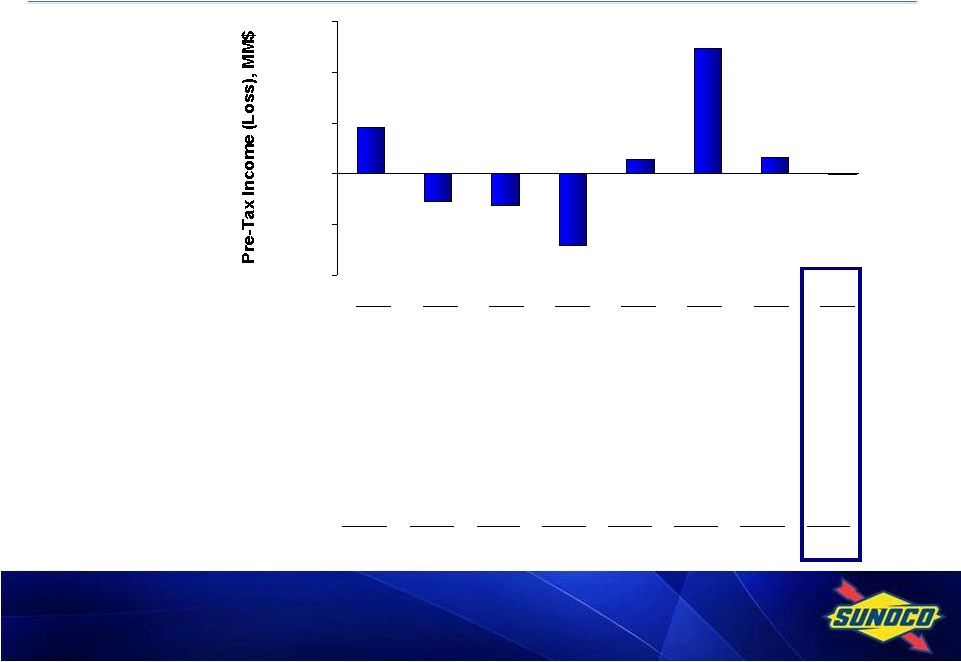

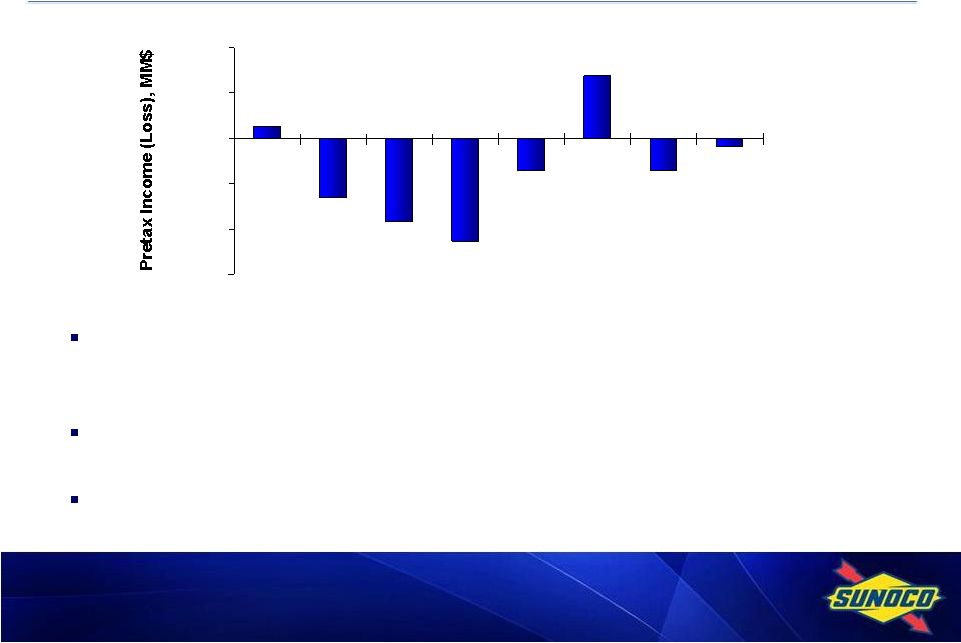

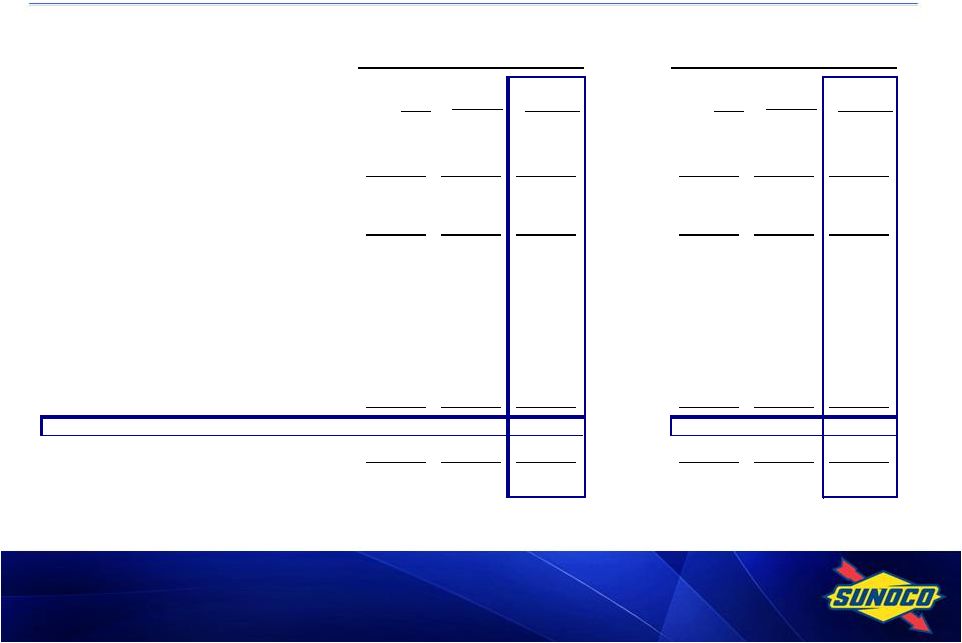

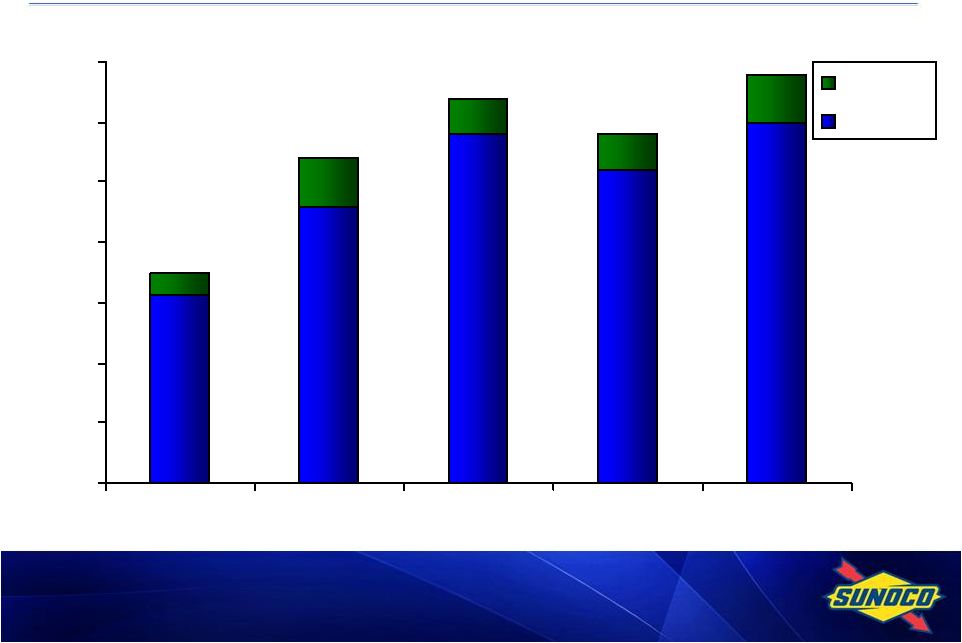

Pretax Income (Loss) Before Special Items*, MM$

(2)

33

247

29

(141)

(62)

(54)

90

($200)

($100)

$0

$100

$200

$300

* Pretax Income (Loss) Before Special Items. For reconciliation to Net Income

(Loss), see Slide 19. 1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

Refining & Supply

Continuing Operations

26

(130)

(182)

(227)

(70)

138

(70)

(17)

Discontinued Tulsa Operations

15

(10)

-

-

-

-

-

-

Retail Marketing

9

18

83

36

34

73

68

1

Logistics

48

41

30

33

27

30

42

37

Coke

33

61

47

52

51

56

44

25

Chemicals

Continuing Operations

(17)

(6)

(4)

6

5

7

5

6

Discontinued Polypropylene Operations

11

6

2

3

33

-

-

-

Corporate Expenses

(18)

(15)

(18)

(16)

(23)

(30)

(28)

(27)

Net Financing Expenses & Other

(17)

(19)

(20)

(28)

(28)

(27)

(28)

(27)

Pre-Tax Income (Loss) Before Special Items

90

(54)

(62)

(141)

29

247

33

(2) |

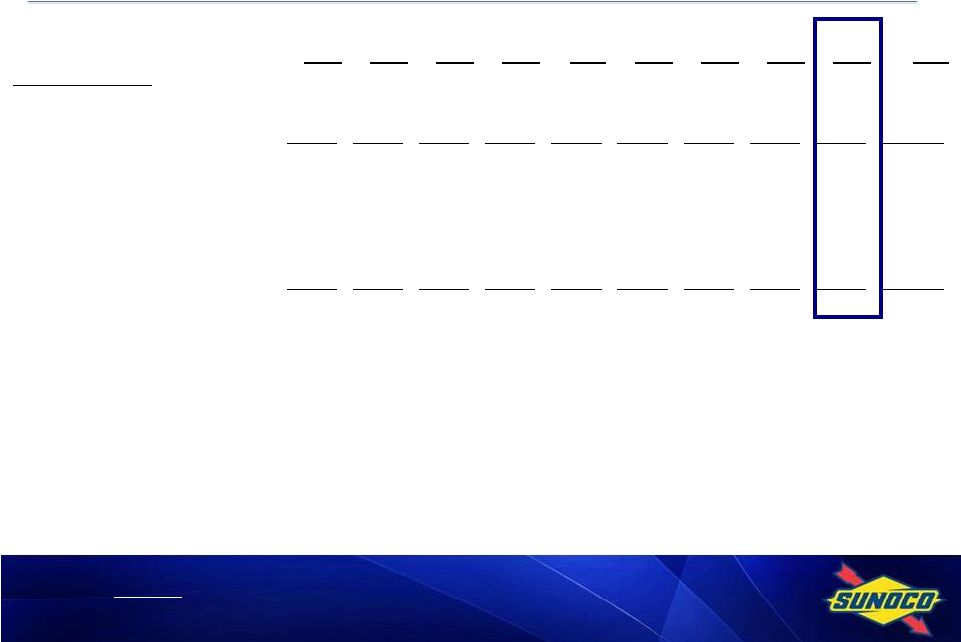

5

R&S EBITDA vs. Capital, MM$

4Q10

4Q09

Variance

2010

2009

Variance

Pretax Loss

(17)

(227)

210

(19)

(508)

489

DD&A

64

66

(2)

263

279

(16)

EBITDA

47

(161)

208

244

(229)

473

Capex*

(47)

(50)

3

(223)

(369)

146

* Excludes Biofuels growth capital.

While the refining environment remains challenging, we have made

progress

with

our

initiatives

around

reliability,

cost

structure

and

margin

capture, as shown by the year over year improvement in EBITDA

generation and efficiency of capital spending |

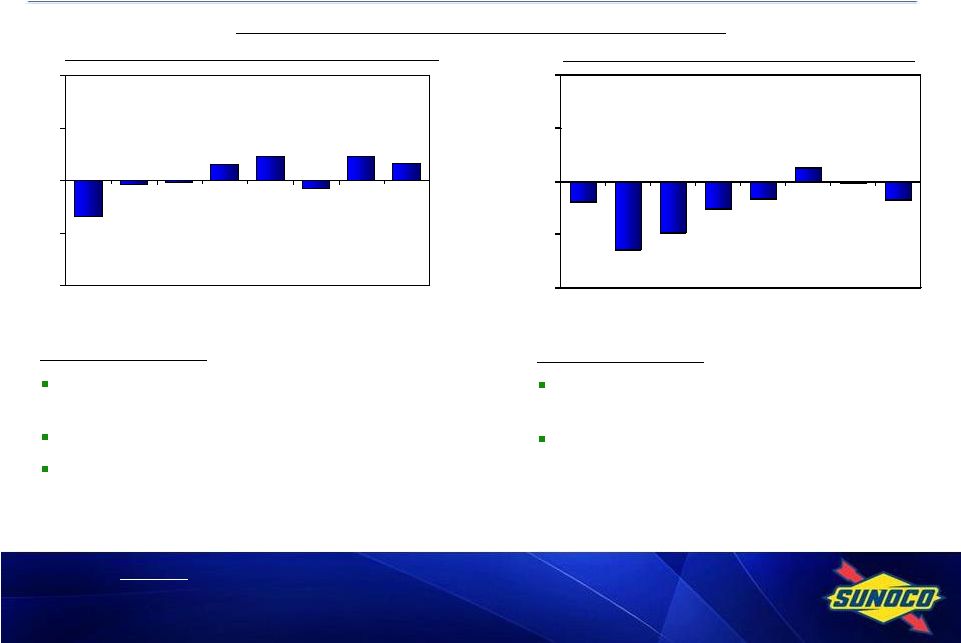

6

Retail Marketing –

Pretax Earnings of

$1MM

Margins challenged by rising crude and wholesale prices

throughout the quarter

4Q same site volumes higher than prior year for gasoline (1.8%) &

distillate (7%)

Logistics –

Pretax Earnings of $37MM

Strong performance from Sunoco Logistics Partners L.P. (NYSE:

SXL); Earnings helped by 2009 and 2010 acquisitions and

contango profits

Coke –

Pretax Earnings of $25MM

Full year after-tax income of $132MM in line with guidance

* Pretax Business Unit Income Before Special Items, excluding income attributable

to non-controlling interests. For reconciliation to Net Income (Loss),

see Slide 19. Retail, Logistics & Coke Income* -

4Q10 |

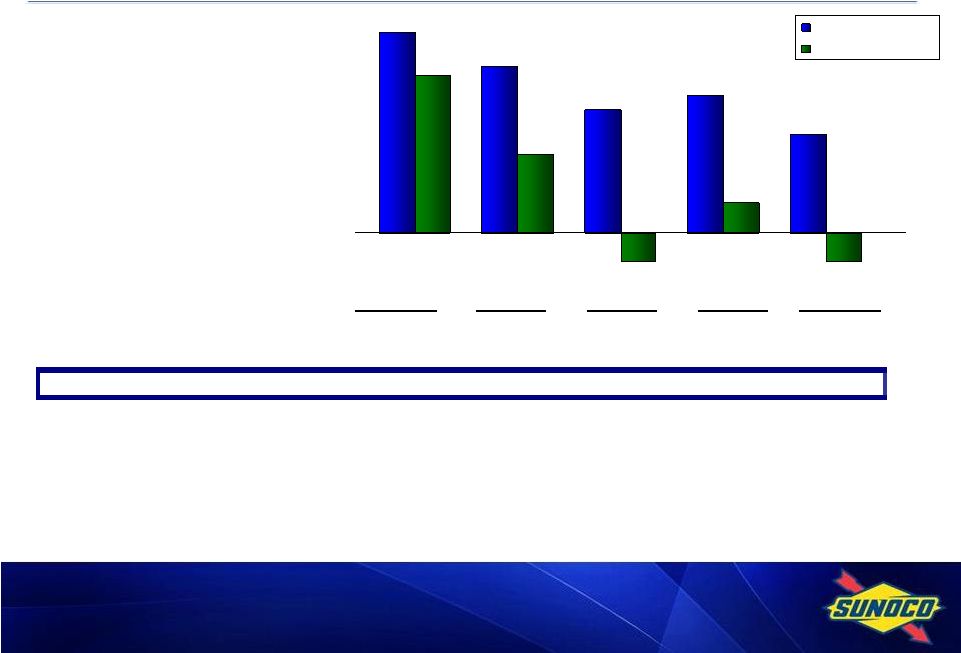

7

Northeast market margins improved from 3Q but region still challenged by

excess supply and depressed demand; rising crude prices further challenged

margin capture

Near break-even in 4Q better than last year by $210 MM, helped by improved

market

but

also

actions

on

operations,

cost

structure

and

margin

capture

Market is expected to remain challenging with continued economic

weakness

and additional global supply => we remain focused on fundamentals

Refining & Supply -

4Q10 Pretax Income*, MM$

* Pretax Business Unit Income Before Special Items, excluding discontinued Tulsa

refining operations. For reconciliation of Pretax Income (Loss) and Net

Income (Loss), see Slides 18 and 19. (17)

(70)

138

(70)

(227)

(182)

(130)

26

($300)

($200)

($100)

$0

$100

$200

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10 |

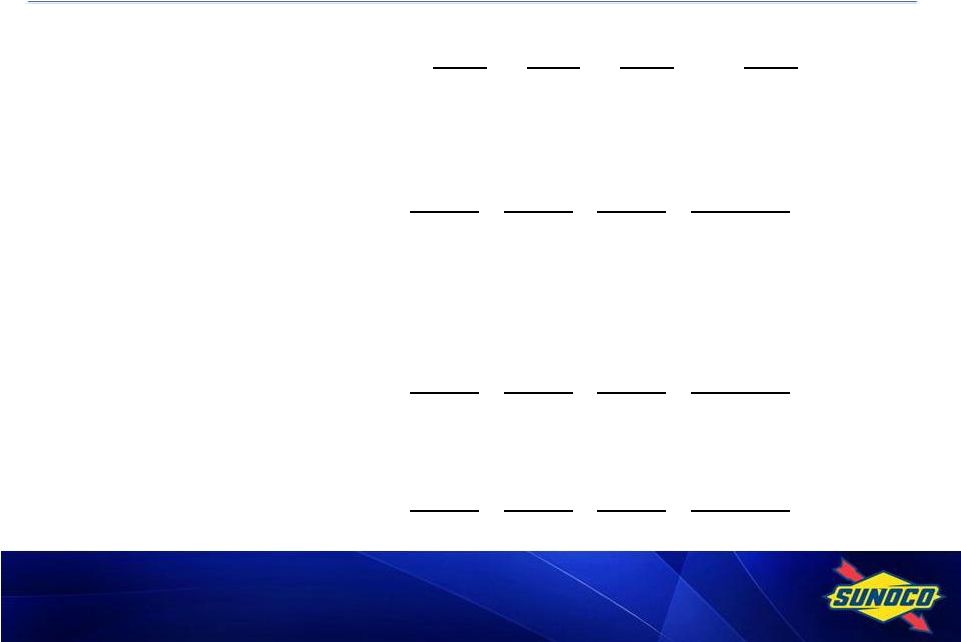

8

* Excludes discontinued Tulsa refining operations.

** R&S Weighted

Benchmark. For calculation, see Slide 28.

Realized R&S Margin vs. Benchmark**, $/B

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

2Q10

3Q10

4Q10

FY10

Refining & Supply

Realized Margin *

6.33

3.65

2.72

1.96

3.66

4.08

7.34

3.88

4.77

5.04

Weighted Benchmark **

5.71

6.05

4.57

3.59

4.98

5.67

6.51

4.87

6.11

5.79

Differential

0.62

(2.40)

(1.85)

(1.63)

(1.32)

(1.59)

0.83

(0.99)

(1.34)

(0.75)

Margin Capture Rate

111%

60%

60%

55%

73%

72%

113%

80%

78%

87%

Actual vs. Weighted Benchmark:

Crude

1.40

0.18

0.10

(0.61)

0.27

(0.92)

0.33

(0.92)

(0.65)

(0.49)

Product

(0.78)

(2.58)

(1.95)

(1.02)

(1.59)

(0.67)

0.50

(0.07)

(0.69)

(0.26)

Differential

0.62

(2.40)

(1.85)

(1.63)

(1.32)

(1.59)

0.83

(0.99)

(1.34)

(0.75) |

9

0.65

0.92

(0.33)

0.61

0.92

(0.10)

(0.18)

(1.40)

-4.00

-2.00

0.00

2.00

4.00

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

Crude Cost vs. Weighted Benchmark

(0.69)

(0.07)

0.50

(0.67)

(1.02)

(1.95)

(2.58)

(0.78)

-4.00

-2.00

0.00

2.00

4.00

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

Products vs. Weighted Benchmark

Total

Refining

&

Supply

(excluding

Tulsa)

* R&S Weighted

Benchmark. For calculation, see Slide 28.

4Q10 Comments:

Timing

hit

of

~$.50/B

due

to

rising

crude

prices

for second consecutive quarter

Toledo

diffs

better

than

3Q

Transportation costs higher than benchmark

4Q10 Comments:

Realizations impacted by lack of ratability

connected to reliability issues

Better than 4Q09 with improved distillate

cracks and upgraded product mix

Realized R&S Margin vs. Benchmark*, $/B |

10

Sunoco and SXL Cash Flow, MM$

SUN

SUN

SXL

(ex SXL)

Sunoco

SXL

(ex SXL)

Sunoco

Cash from ops ex working capital

83

395

478

284

1,227*

1,511

Working capital

158

141

299

33

150

183

Cash flow from operations

241

536

777

317

1,377

1,694

Capital expenditures

(70)

(207)

(277)

(426)

(614)

(1,040)

Free cash flow

171

329

500

(109)

763

654

Divestments

-

27

27

-

393

393

Dividends to Sunoco shareholders

-

(19)

(19)

-

(73)

(73)

Distributions & other

(29)

(3)

(32)

(102)

(21)

(123)

SXL equity issue/sale, & GP contribution

-

-

-

147

142

289

SXL dividends to Sunoco

(23)

23

-

(91)

91

-

SXL dividends to Sunoco for IDR reset

-

-

-

(201)

201

-

Sunoco loan to SXL

-

-

-

100

(100)

-

Net cash flow before net debt activity

119

357

476

(256)

1,396

1,140

Net debt activity

(119)

-

(119)

256

(288)

(32)

Net increase in cash & cash equivalents

-

357

357

-

1,108

1,108

4Q10

2010

* Includes

$394MM

related

to

tax

refund

received

in

1Q10

(included

within

working

capital

in

Consolidated

Statement of Cash Flows). |

11

12/31/09

3/31/10

6/30/10

9/30/10

12/31/10

Sunoco (ex-SXL)*

32%

16%

-6%

6%

-6%

SXL

50%

63%

65%

61%

59%

Consolidated**

41%

34%

25%

28%

20%

Sunoco Net Debt/(Cash)

1,223

498

(153)

173

(182)

SXL Net Debt***

866

1,139

1,211

1,346

1,227

Consolidated Net Debt,

2,089

1,637

1,058

1,419

945

Total Cash, MM$

377

812

1,462

1,129

1,485

34%

25%

28%

20%

6%

-6%

41%

-6%

16%

32%

Consolidated

Sunoco (ex-SXL)

* Proforma.

** Sunoco

Revolver

Covenant

basis.

For

calculation,

see

Slides

23

and

24.

*** Includes intercompany loan due to Sunoco from SXL at 12/31/2010 which is

eliminated in consolidation. Net Debt-to-Capital Ratio, %

|

12

Capital Program by Business Unit, MM$

Proj

2008

2009

2010

2011

Refining & Supply

652

369

223

135-145*

Chemicals

49

35

20

25

Retail Marketing

128

80

99

115-125

Coke

16

30

43

75

845

514

385

350-370

Growth:

Coke

296

199

180

214

Biofuels - Fulton

-

11

24

-

Retail Marketing

-

-

25

-

1,141

724

614

564-584

Logistics - Maintenance

27

32

37

45

Logistics - Growth***

303

193

389

100-150

1,471

949

1,040

709-779

*

Assumes

close

of

Toledo

refinery

sale

in

1Q2011

and

excludes

Marcus

Hook

consent

decree

capital

that

may

be

delayed

as

a result of discussions with government environmental authorities.

* * Includes

$162MM

for

Middletown

coke

plant,

$40MM

for

Harold

Keene

coal

acquisition

and

$12MM

for coal expansion.

*** Logistics Growth excludes significant acquisitions and Project

Mariner. ** |

13

SunCoke Financial Summary

Total SunCoke Energy, $MM

2007

2008

2009

2010

EBITDA

34

160

226

225

Less: Depreciation

20

25

33

49

Less: Income Tax

3

46

73

63

Plus: Tax Credits

18

16

19

19

Plus: Granite City one-time tax credit

-

-

41

-

Net Income

29

105

180

132

Capital Spending

(221)

(312)

(229)

(223)

2010 earnings of $132MM after-tax in line with guidance of $125MM to $140MM

Earnings were lower in 2H 2010 due to lower coal blend price and

higher spending

SunCoke EBITDA > capital spending in 2010 and working capital benefits generated

incremental cash flow |

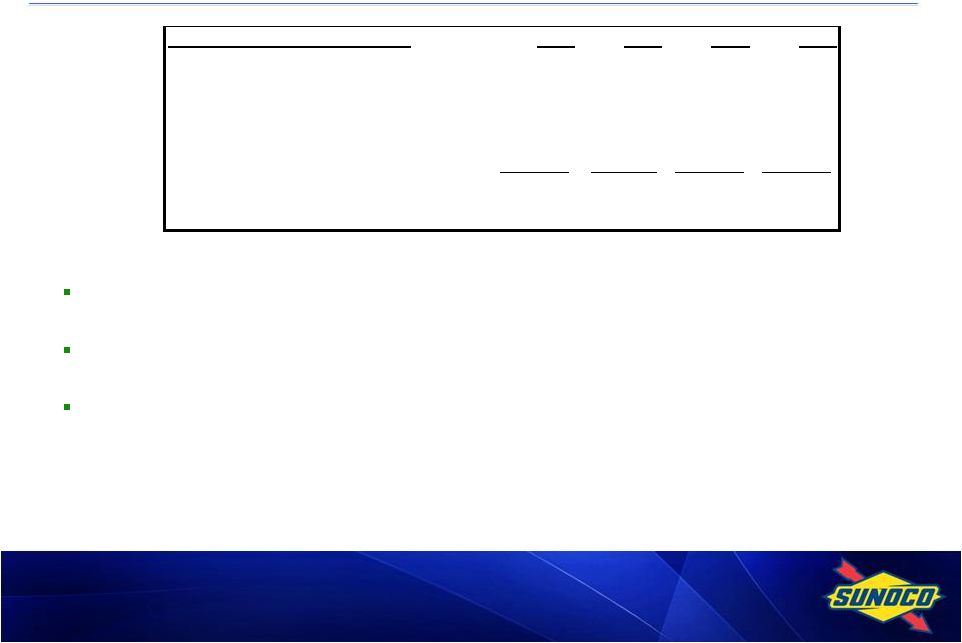

14

SunCoke 2011 and Forward

Settlement reached with ArcelorMittal

regarding coke pricing in Jewell contract

Guidance:

2010 ACT

2011

2012**

EBITDA

$225MM

$165MM -

$200MM

$280MM -

$320MM

Net Income*

$132MM

$90MM -

$115MM

$160MM -

$180MM

Coal price

~$130

~$165

~$175

Guidance Includes:

ArcelorMittal

settlement effective 1/1/2011

Transition & stand-alone costs starting in 2011

Full

Year

of

Gateway

operations

in

2011;

full

Year

of

Middletown

operations

starting

in

2012

Previously announced Jewell coal expansion

Middletown Project Completion estimated for late second half 2011

* Excludes any potential financing costs associated with separation of

SunCoke. ** Uses a coal price assumption of $175 per ton. No coal purchases

or sales have been contracted yet for 2012. |

15

Refining

& Supply

1,100

Chemicals

690

Logistics

1,070

Will create two well-positioned businesses:

Leading high-quality metallurgical coke manufacturer with operations in the

U.S. and abroad

Streamlined fuels business that is better positioned to become the premier

provider of transportation fuels in its markets

Enhances both businesses and allows each to pursue more

focused strategic plan

Fritz Henderson hired to lead SunCoke; will be CEO after

separation

Private letter ruling filed in late October 2010

Unlocking Shareholder Value via SunCoke Separation |

16

Market remains challenging, but we continue to execute our strategy

Profitable in 2010 on strength of retail, logistics and coke operations

Strong balance sheet provides flexibility

~$1.4 B swing in 2010 to net cash position

Recent growth

SXL growth capital ~ $400 MM in 2010; Ohio Turnpike & Garden State

Parkway; 25 stations in upstate New York; new distributors; Harold Keene

coal Refining still faces challenging market, but year-over-year

improvement reflects continued focus on margin capture, cost reduction, and

reliability/utilization Focused on fundamentals

Improve margin capture

Lower our break-even cost per barrel

Run safely and reliably at optimal capacity utilization; match product yield to

demand Balance sheet: High cash balance provides strategic flexibility

Positioning for future success

Become premier provider of transportation fuels in our markets

Grow through Retail and SXL

Achieve sustainably lower cost structure

Separation of SunCoke Energy remains a priority

Key Takeaways |

Appendix |

18

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

2Q10

3Q10

4Q10

FY10

Refining & Supply

Continuing Operations

14

(77)

(118)

(135)

(316)

(42)

86

(44)

(8)

(8)

Discontinued Tulsa Operations

9

(6)

-

-

3

-

-

-

-

-

Retail Marketing

6

10

49

21

86

21

45

41

3

110

Logistics

30

26

19

22

97

17

20

26

23

86

Coke

25

42

35

78

180

37

41

33

21

132

Chemicals

Continuing Operations

(12)

(3)

(2)

4

(13)

3

5

3

4

15

Discontinued Polypropylene Operations

8

3

1

2

14

21

-

-

-

21

Corporate Expenses

(11)

(15)

(6)

(6)

(38)

(23)

(20)

(17)

(13)

(73)

Net Financing Expenses & Other

(10)

(11)

(12)

(17)

(50)

(17)

(19)

(15)

(17)

(68)

Income (Loss) Before Special Items

59

(31)

(34)

(31)

(37)

17

158

27

13

215

Special Items

(47)

(24)

(278)

57

(292)

(80)

(13)

38

74

19

Net Income (Loss) attributable to

Sunoco shareholders

12

(55)

(312)

26

(329)

(63)

145

65

87

234

EPS, $/Share (diluted)

Income (Loss) Before Special Items

0.50

(0.27)

(0.29)

(0.27)

(0.32)

0.14

1.31

0.22

0.11

1.79

Net Income (Loss) attributable to

Sunoco shareholders

0.10

(0.47)

(2.67)

0.22

(2.81)

(0.53)

1.20

0.54

0.72

1.95

Earnings Profile, MM$ After-Tax |

19

Earnings Profile, MM$ Pretax

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

2Q10

3Q10

4Q10

FY10

Refining & Supply

Continuing Operations

26

(130)

(182)

(227)

(513)

(70)

138

(70)

(17)

(19)

Discontinued Tulsa Operations

15

(10)

-

-

5

-

-

-

-

-

Retail Marketing

9

18

83

36

146

34

73

68

1

176

Logistics

48

41

30

33

152

27

30

42

37

136

Coke

33

61

47

52

193

51

56

44

25

176

Chemicals

Continuing Operations

(17)

(6)

(4)

6

(21)

5

7

5

6

23

Discontinued Polypropylene Operations

11

6

2

3

22

33

-

-

-

33

Corporate Expenses

(18)

(15)

(18)

(16)

(67)

(23)

(30)

(28)

(27)

(108)

Net Financing Expenses & Other

(17)

(19)

(20)

(28)

(84)

(28)

(27)

(28)

(27)

(110)

Pretax Income (Loss) Before Special Items

90

(54)

(62)

(141)

(167)

29

247

33

(2)

307

Pretax Special Items

(79)

(41)

(467)

94

(493)

(214)

(22)

62

123

(51)

Pretax Income (Loss)

11

(95)

(529)

(47)

(660)

(185)

225

95

121

256

Income Tax Expense (Benefit)

(1)

(40)

(217)

(73)

(331)

(122)

80

30

34

22

Net Income (Loss) attributable

to Sunoco

shareholders 12

(55)

(312)

26

(329)

(63)

145

65

87

234

|

20

* Excludes discontinued Tulsa refining operations.

** Excludes discontinued polypropylene operations.

Key Indicators

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

2Q10

3Q10

4Q10

FY10

Realized

Margin

Indicators

Refining & Supply, $/B*

6.33

3.65

2.72

1.96

3.66

4.08

7.34

3.88

4.77

5.04

Retail Marketing, cpg

Gasoline

6.4

7.0

13.0

8.8

8.9

8.9

11.5

10.5

6.6

9.4

Distillate

24.5

12.0

11.7

7.9

14.8

8.0

9.0

7.8

5.6

7.6

Chemicals, cpp**

6.6

8.2

7.3

9.7

8.0

9.9

8.9

7.6

9.1

8.8

Market

Indicators

Dated Brent Crude Oil, $/B

44.40

58.79

68.27

74.56

61.51

76.24

78.30

76.86

86.48

79.47

Natural Gas, $/DT

4.48

3.81

3.44

4.92

4.16

5.04

4.34

4.23

3.97

4.40 |

21

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

2Q10

3Q10

4Q10

FY10

Total Refining & Supply *

627

644

613

617

625

533

618

632

572

589

76

78

74

85

78

79

92

94

85

87

689

720

669

682

690

591

664

682

634

643

62

66

62

62

252

53

61

62

58

234

* Excludes discontinued Tulsa refining operations.

Key Volume Indicators –

Refining & Supply |

22

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

2Q10

3Q10

4Q10

FY10

Retail Marketing

Gasoline Sales, MM Gal

1,066

1,147

1,140

1,108

4,461

1,026

1,130

1,171

1,171

4,498

Middle Distillate Sales, MM Gal

138

116

114

95

463

91

114

117

110

432

Total Sales, MM Gal

1,204

1,263

1,254

1,203

4,924

1,117

1,244

1,288

1,281

4,930

Gasoline and Diesel Throughput

143

153

156

153

151

147

159

148

161

156

(Company-Owned or Leased Outlets)

(M Gal/Site/Month)

Merchandise Sales (M$/Store/Month)

79

94

99

91

90

87

101

103

92

96

Chemicals*

Phenol and Related Sales, MM#

407

427

483

457

1,774

449

554

567

582

2,152

Coke

Production, M Tons:

United States

681

694

715

778

2,868

841

883

953

916

3,593

Brazil

280

279

321

383

1,263

413

422

431

370

1,636

* Excludes discontinued polypropylene operations.

Key Volume Indicators –

Retail, Chemicals, Coke |

23

*

Represents intercompany loan due to Sunoco from SXL which is eliminated in

consolidation. **

Represents Partners’

Capital for SXL and Shareholders’

Equity for Sunoco.

*** The

Net

Debt

/

Capital

ratio

is

used

by

Sunoco

management

in

its

internal

financial

analysis

and

by

investors

and

creditors in the assessment of Sunoco’s financial position.

**** Capital excludes noncontrolling interests.

Financial Ratios, MM$ except ratios

Proforma

Proforma

SUN

SUN

SXL

(ex SXL)

Sunoco

SXL

(ex SXL)

Sunoco

Debt

1,248

1,299

2,547

1,129

1,300

2,429

Intercompany Debt*

100

-

-

100

-

-

Plus: Debt Guarantees

-

1

1

-

1

1

Less: Cash

(2)

(1,127)

(1,129)

(2)

(1,483)

(1,485)

Net Debt

1,346

173

1,419

1,227

(182)

945

Equity**

958

2,920

2,920

965

3,046

3,046

SXL Noncontrolling

Interest

-

-

689

-

-

692

Capital

2,304

3,093

5,028

2,192

2,864

4,683

Net Debt / Capital (Sunoco

Revolver Covenant Basis)***

N/A

6%

28%

N/A

-6%

20%

Debt / Capital (GAAP Basis) ****

61%

31%

47%

59%

30%

44%

9/30/2010

12/31/2010 |

24

*

Represents

Partners’

Capital

for

SXL

and

Shareholders’

Equity

for

Sunoco.

** The Net Debt / Capital ratio is used by Sunoco management in its internal

financial analysis and by investors and creditors in the assessment of

Sunoco’s financial position. *** Capital excludes noncontrolling

interests. Financial Ratios, MM$ except ratios

Proforma

Proforma

Proforma

SUN

SUN

SUN

SXL

(ex SXL)

Sunoco

SXL

(ex SXL)

Sunoco

SXL

(ex SXL)

Sunoco

Debt

868

1,596

2,464

1,141

1,306

2,447

1,213

1,306

2,519

Plus: Debt Guarantees

-

2

2

-

2

2

-

1

1

Less: Cash

(2)

(375)

(377)

(2)

(810)

(812)

(2)

(1,460)

(1,462)

Net Debt

866

1,223

2,089

1,139

498

1,637

1,211

(153)

1,058

Equity*

862

2,557

2,557

657

2,712

2,712

664

2,831

2,831

SXL Noncontrolling

Interest

-

-

488

-

-

414

-

-

418

Capital

1,728

3,780

5,134

1,796

3,210

4,763

1,875

2,678

4,307

Net Debt / Capital (Sunoco

Revolver Covenant Basis)**

N/A

32%

41%

N/A

16%

34%

N/A

-6%

25%

Debt / Capital (GAAP Basis) ***

50%

38%

49%

63%

33%

47%

65%

32%

47%

12/31/2009

3/31/2010

6/30/2010 |

25

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

12/31/2009

3/31/2010

6/30/2010

9/30/2010

12/31/2010

SXL

Sunoco

* Includes cash and cash equivalents of $0.4B, $0.8B, $1.5B, $1.1B, and $1.5B

at 12/31/09, 3/31/10, 6/30/10, 9/30/10, and 12/31/10 respectively.

Liquidity*, B$

1.7

2.7

3.2

2.9

3.4 |

26

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

2Q10

3Q10

4Q10

FY10

Total Refining & Supply *

Net Production, MB/D

689.1

720.2

669.2

681.7

689.9

590.5

664.2

681.5

633.9

642.8

Gasoline

51%

51%

52%

53%

52%

52%

52%

52%

54%

52%

Middle Distillates

34%

32%

33%

32%

32%

34%

37%

37%

35%

36%

Residual Fuel

9%

9%

9%

8%

9%

6%

6%

5%

4%

5%

Petrochemicals

3%

4%

4%

4%

4%

4%

3%

4%

4%

4%

Other

8%

9%

7%

8%

8%

9%

7%

7%

8%

8%

Less Refinery Fuel

-5%

-5%

-5%

-5%

-5%

-5%

-5%

-5%

-5%

-5%

* Excludes discontinued Tulsa refining operations.

Refining & Supply –

Products Manufactured |

27

* Excludes discontinued Tulsa refining operations.

Refining & Supply –

Gasoline and Distillate Production

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

2Q10

3Q10

4Q10

FY10

Total Refining & Supply

*

Gasoline Production, MB/D

350.0

370.3

346.0

365.5

357.9

306.3

343.1

357.9

339.9

337.0

RFG

46%

46%

55%

45%

48%

47%

48%

43%

45%

46%

Conventional

54%

54%

45%

55%

52%

53%

52%

57%

55%

54%

Distillate Production, MB/D

233.4

229.5

219.3

219.3

225.3

202.4

244.5

250.1

225.1

230.6

On-Road Diesel Fuel

47%

53%

56%

52%

52%

53%

66%

62%

52%

59%

Heating Oil / Off-Road Diesel

30%

22%

23%

25%

25%

28%

15%

18%

25%

21%

Jet Fuel

20%

23%

19%

21%

21%

17%

19%

19%

21%

19%

Kerosene/Other

3%

2%

2%

2%

2%

2%

0%

1%

2%

1% |

28

Toledo 4-3-1 Benchmark

4 WTI Crude: NYMEX Futures Close + $2.00 for transportation*

3 Unleaded Gasoline: Chicago Pipeline Platt’s Low

1 Distillate: 50% ULSD Chicago Pipeline Platt’s Low

50% Jet Gulf Coast Pipe Platt’s Low**

Northeast 6-3-2-1 Value-Added Benchmark

6 Dated Brent Crude: Platt’s Mid + $2.25 for transportation*

3 Gasoline: 50% Unleaded RBOB NY Harbor Barge Platt's Low

50% Unleaded Regular Gasoline NY Harbor Barge Platt's Low

2 Distillate: 55% ULSD NY Harbor Barge Platt's Low

20% Jet/Kero NY Harbor Barge Platt's Low

25% No.2 Fuel Oil NY Harbor Barge Platt's Low

1 No. 6 0.3% Sulfur High Pour Resid: NY Harbor Barge Platt’s Low

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

2Q10

3Q10

4Q10

FY10

Northeast 6-3-2-1

Value-Added Benchmark

5.32

5.23

4.10

3.85

4.62

6.09

5.91

4.22

6.05

5.57

Toledo 4-3-1

Benchmark

7.28

9.36

6.41

2.56

6.40

3.99

8.89

7.50

6.33

6.68

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

2Q10

3Q10

4Q10

FY10

Northeast 6-3-2-1

at 80% weight

4.26

4.18

3.28

3.08

3.70

4.87

4.73

3.37

4.84

4.46

Toledo 4-3-1

at 20% weight

1.45

1.87

1.29

0.51

1.28

0.80

1.78

1.50

1.27

1.33

R&S Weighted Benchmark

5.71

6.05

4.57

3.59

4.98

5.67

6.51

4.87

6.11

5.79

* Benchmarks were updated in 1Q10 to reflect higher market crude transportation

costs and all prior periods were restated for these new transportation

costs. ** The Toledo benchmark was updated effective 1/1/2010 to include the

US Gulf Coast Jet component. However, prior to 2010, the benchmarks

were not restated for this change due to immateriality. Sunoco Refining

Weighted Benchmark Margin, $/B |

29

Media releases and SEC filings are available

on

our

website

at

www.SunocoInc.com

Contact for more information:

Clare McGrory

(215) 977-6764

For More Information |