Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mastercard Inc | d8k.htm |

| EX-99.1 - PRESS RELEASE OF MASTERCARD INCORPORATED, DATED FEBRUARY 3, 2011 - Mastercard Inc | dex991.htm |

Exhibit 99.2

MasterCard Incorporated

Fourth-Quarter and Full-Year 2010 Financial Results Conference Call

February 3, 2011

Business Update

Operational Overview

Regulatory Update

Business Highlights

2

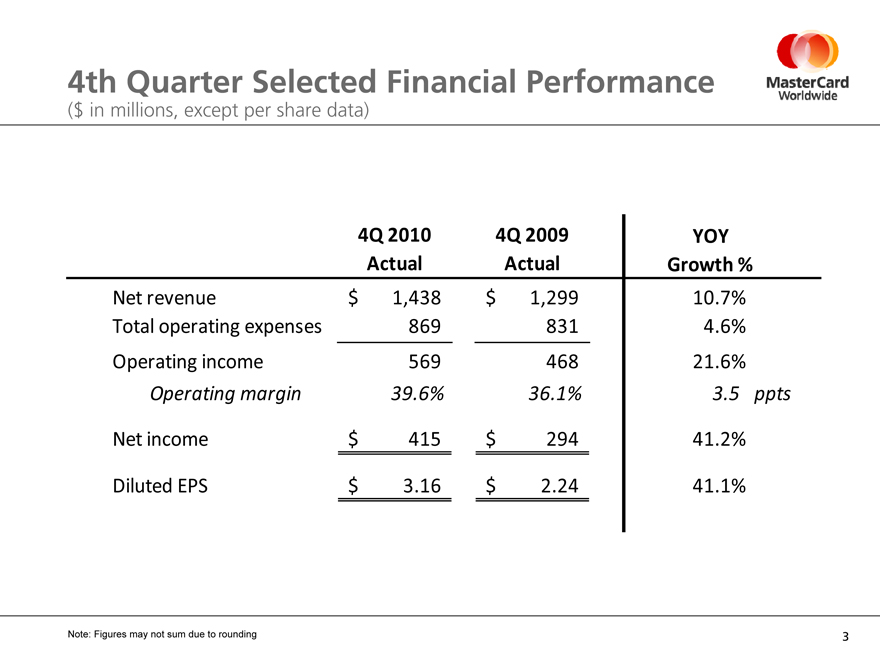

4th Quarter Selected Financial Performance

($ in millions, except per share data)

4Q 2010 4Q 2009 YOY

Actual Actual Growth %

Net revenue $ 1,438 $ 1,299 10.7%

Total operating expenses 869 831 4.6%

Operating income 569 468 21.6%

Operating margin 39.6% 36.1% 3.5 ppts

Net income $ 415 $ 294 41.2%

Diluted EPS $ 3.16 $ 2.24 41.1%

Note: Figures may not sum due to rounding

3

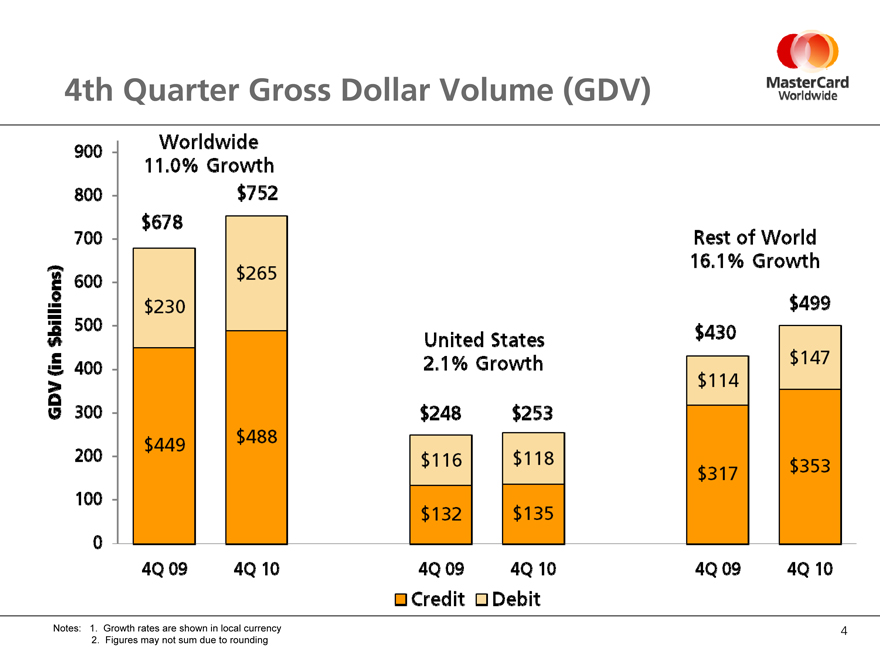

4th Quarter Gross Dollar Volume (GDV)

900

800

700

600

500

400

300

200

100

0

4Q 09

4Q 10

Worldwide 11.0% Growth

$678

$752

$230

$265

$449

$488

United States 2.1% Growth

$248

$253

$132

$135

$116

$118

4Q 09

4Q 10

Rest of World 16.1% Growth

$430

$499

$317

$353

$114

$147

4Q 09

4Q 10

Credit

Debit

GDV (in $billions)

Notes: 1. Growth rates are shown in local currency

2. Figures may not sum due to rounding

4

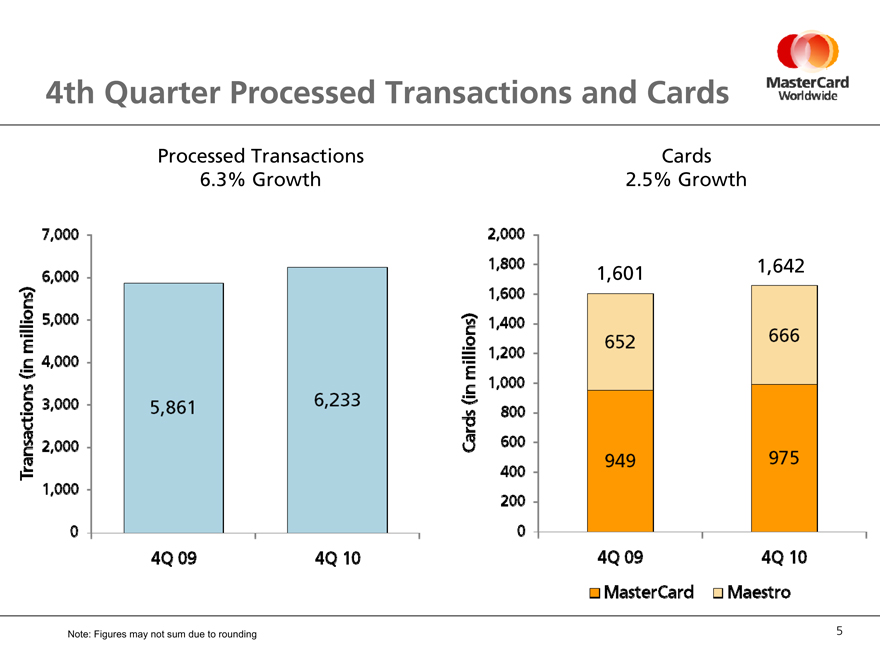

4th Quarter Processed Transactions and Cards

Processed Transactions 6.3% Growth

Transactions (in million)

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

5,861

6,233

4Q 09

4Q 10

2,000

1,800

1,600

1,400

1,200

1,000

800

600

400

200

0

Cards 2.5% Growth

1,601

1,642

652

666

949

975

4Q 09

4Q 10

MasterCard

Maestro

Cards (in millions)

Note: Figures may not sum due to rounding

5

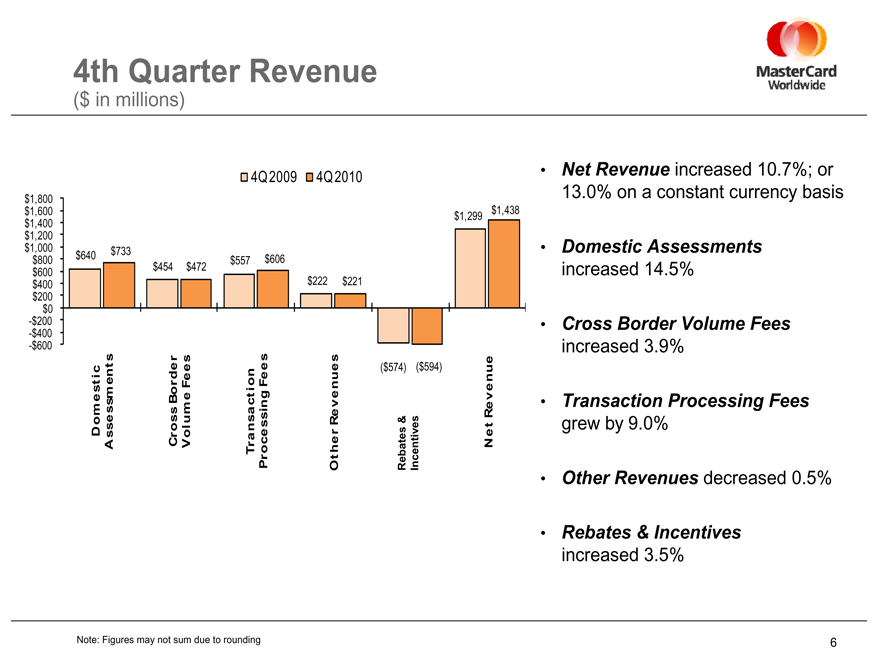

4th Quarter Revenue

($ in millions)

$1,800 $1,600 $1,400 $1,200 $1,000 $800 $600 $400 $200 $0

-$200

-$400

-$600

4Q 2009 4Q 2010

$640 $733 $557 $606 $454 $472 $222 $221

$1,438 $1,299

($574) ($594)

Net Revenue increased 10.7%; or 13.0% on a constant currency basis

Domestic Assessments increased 14.5%

Cross Border Volume Fees increased 3.9%

Transaction Processing Fees grew by 9.0%

Other Revenues decreased 0.5%

Rebates & Incentives increased 3.5%

Domestic Assessments

Cross Border Volume Fees

Transaction Processing Fees

Other Revenues

Rebates & Incentives

Net Revenue

Note: Figures may not sum due to rounding

6

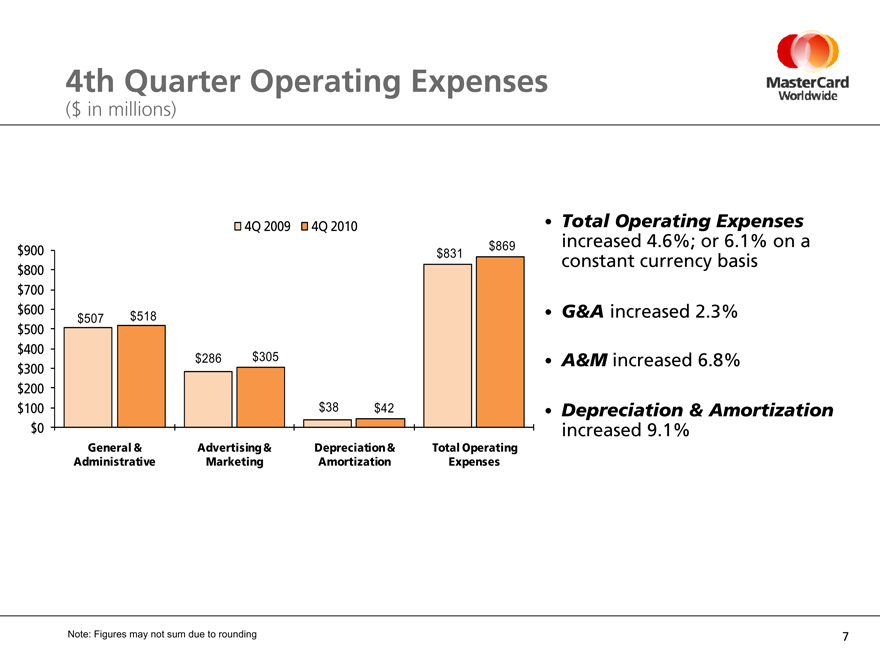

4th Quarter Operating Expenses

($ in millions)

$900 $800 $700 $600 $500 $400 $300 $200 $100 $0

$507 $518

4Q 2009 4Q 2010

$286 $305

$38 $42

$869 $831

General & Administrative

Advertising & Marketing

Depreciation & Amortization

Total Operating Expenses

Total Operating Expenses increased 4.6%; or 6.1% on a constant currency basis

G&A increased 2.3%

A&M increased 6.8%

Depreciation & Amortization increased 9.1%

Note: Figures may not sum due to rounding

7

Full-Year 2010 Highlights

Achieved net revenue of $5.5 billion

Growth of 8.6%, or 9.5% on a constant currency basis Increased operating income by 21.8%

Operating margin of 49.7% Delivered net income of $1.8 billion

Growth of 26.2%, or 27.9% on a constant currency basis Diluted EPS of $14.05

8

4th Quarter 2010 Cash Flow Statement and Balance Sheet Highlights

Generated $670 million in cash flow from operations for the quarter ended 12/31/2010

Cash, cash equivalents and other liquid investments of $4.2 billion at 12/31/2010

9

Looking Ahead

Business update through January 28

Thoughts for 2011

Long-term objectives: 2011-2013

10

MasterCard

Worldwide

The Heart of Commerce TM

11

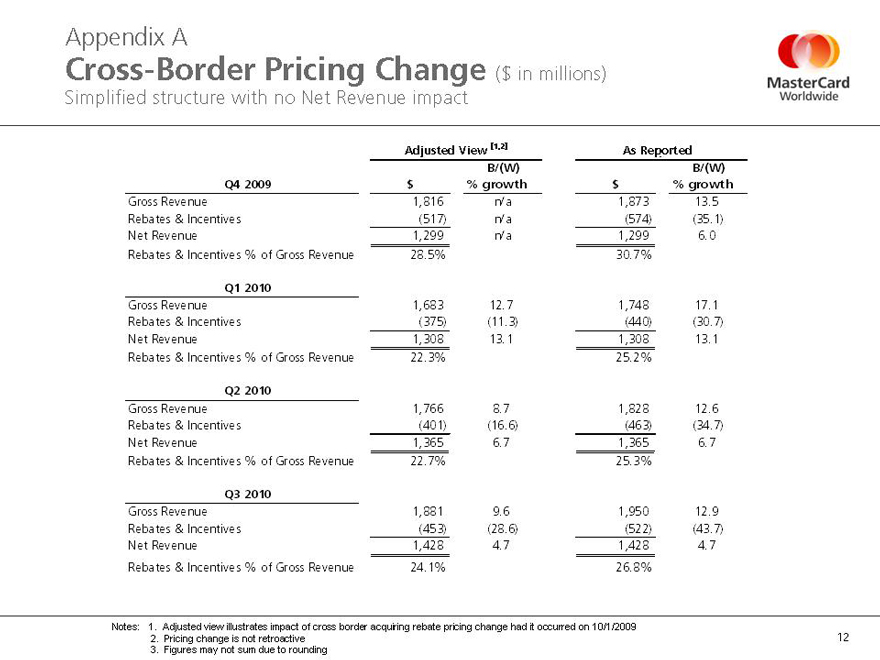

Appendix A

Cross-Border Pricing Change ($ in millions)

($ in millions) Simplified structure with no Net Revenue impact

Adjusted View [1,2] As Reported

B/(W) B/(W)

Q4 2009 $% growth $% growth

Gross Revenue 1,816 n/a 1,873 13.5

Rebates & Incentives(517) n/a(574)(35.1)

Net Revenue 1,299 n/a 1,299 6.0

Rebates & Incentives % of Gross Revenue 28.5% 30.7%

Q1 2010

Gross Revenue 1,683 12.7 1,748 17.1

Rebates & Incentives(375)(11.3)(440)(30.7)

Net Revenue 1,308 13.1 1,308 13.1

Rebates & Incentives % of Gross Revenue 22.3% 25.2%

Q2 2010

Gross Revenue 1,766 8.7 1,828 12.6

Rebates & Incentives(401)(16.6)(463)(34.7)

Net Revenue 1,365 6.7 1,365 6.7

Rebates & Incentives % of Gross Revenue 22.7% 25.3%

Q3 2010

Gross Revenue 1,881 9.6 1,950 12.9

Rebates & Incentives (453) (28.6) (522) (43.7)

Net Revenue 1,428 4.7 1,428 4.7

Rebates & Incentives % of Gross Revenue 24.1% 26.8%

Notes: 1. Adjusted view illustrates impact of cross border acquiring rebate pricing change had it occurred on 10/1/2009

2. Pricing change is not retroactive

3. Figures may not sum due to rounding

12

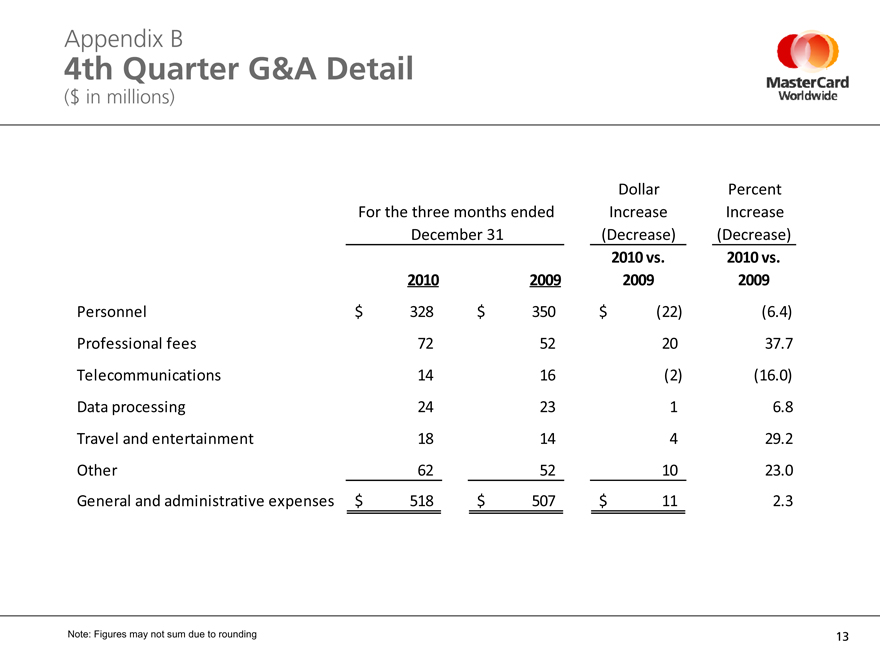

Appendix B

4th Quarter G&A Detail

($ in millions)

Dollar Percent

For the three months ended Increase Increase

December 31 (Decrease)(Decrease)

2010 vs. 2010 vs.

2010 2009 2009 2009

Personnel $ 328 $350 $ (22)(6.4)

Professional fees 72 52 20 37.7

Telecommunications 14 16(2)(16.0)

Data processing 24 23 1 6.8

Travel and entertainment 18 14 4 29.2

Other 62 52 10 23.0

General and administrative expenses $ 518 $507 $ 11 2.3

Note: Figures may not sum due to rounding

13