Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GEORESOURCES INC | d8k.htm |

GeoResources, Inc

Corporate Profile

February 2011

Exhibit 99.1 |

2

Forward-Looking Statements

Information included herein contains forward-looking statements that involve

significant risks and uncertainties, including our need to replace

production and acquire or develop additional oil and gas reserves, intense

competition in the oil and

gas

industry,

our

dependence

on

our

management,

volatile

oil

and

gas

prices and costs, uncertain effects of hedging activities and uncertainties of our

oil and gas estimates of proved reserves and reserve potential, all of which

may be substantial. In addition, past performance is no guarantee of

future performance

or

results.

All

statements

or

estimates

made

by

the

Company,

other than statements of historical fact, related to matters that may or will occur

in the future are forward-looking statements.

Readers are encouraged to read our December 31, 2009 Annual Report on

Form 10-K and Form 10-K/A and any and all of our other documents filed with

the SEC regarding information about GeoResources

for meaningful cautionary

language in respect of the forward-looking statements herein. Interested

persons are able to obtain free copies of filings containing information

about GeoResources, without charge, at the SEC’s

internet site (http://www.sec.gov).

There is no duty to update the statements herein. |

3

Corporate Highlights

Value Creation

Significant Bakken

and Eagle Ford upside

Strategically located in high rate of return resource plays

High level of operating control

Significant Bakken

Exposure

32,500 net operated acres

13,500 net non-operated acres

46,000 TOTAL ACRES

Continually Leasing

Rapidly expanding Eagle Ford Position

21,000 net acres

Commitment for additional leasing

Solid Proved Reserve and Production

Base

24

Mmboe

proved

reserves

(1)

(as

of

7/1/10)

are 56% oil

5,088 BOE/d average YTD Sept 2010

(1)

Does not include interests in affiliated partnerships. Reserves based on strip

pricing as of 6/30/10. See Additional Disclosures in Appendix. |

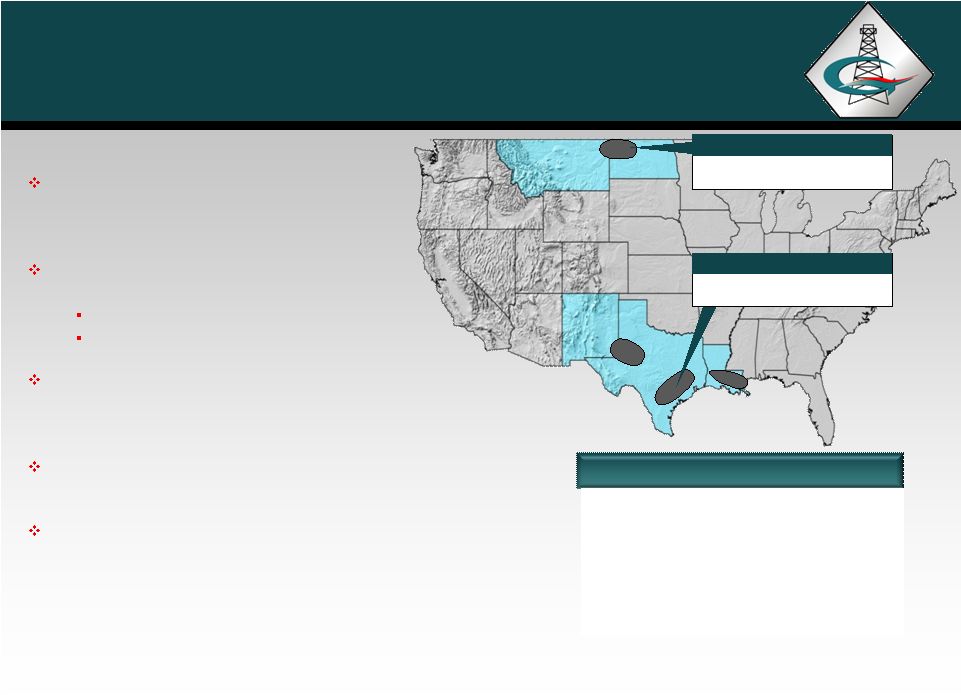

Company Overview

(1)

As of July 1, 2010. Excludes interests in two affiliated partnerships. Reserves

based on strip pricing at 7/1/10. See Additional Disclosures in

Appendix. (2)

Represents the Company’s average production rate for the nine months ending

September 30, 2010. (3)

Acreage information estimated as of December 31, 2010.

(4)

EBITDAX

is

a

non-GAAP

financial

measure.

Please

see

Appendix

for

a

definition

of

EBITDAX

and

a

reconciliation to net

income.

Bakken

46,000 net acres

Company Highlights

(1,2,3)

Independent oil and natural gas

company focused in the Southwest,

Gulf Coast and Williston Basin

Significant upside potential through

growing positions in liquids-rich shales:

Bakken

–

46,000 net acres

Eagle Ford –

21,000 net acres

Nearly 60% of current production is oil

and expected to increase through near-

term development

Operate approximately 80% of proved

reserves

Last Quarter Annualized September 30,

2010

EBITDAX

of

$71

million

(4)

Eagle Ford

21,000 net acres

4

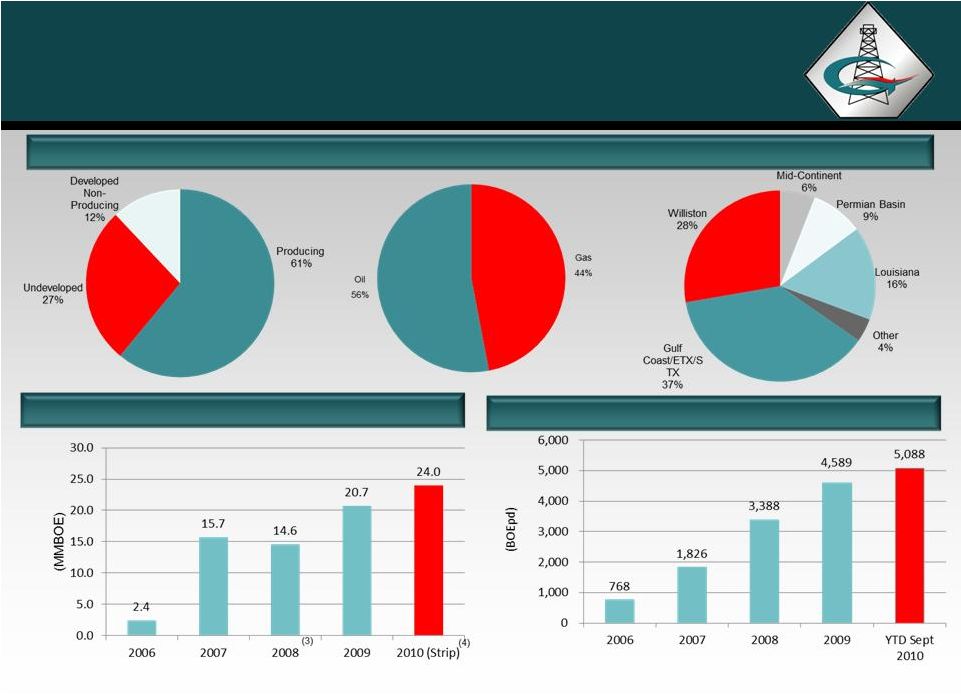

Proved Reserves (MMBOE)

24.0

Oil (reserves)

56%

Proved Developed

73%

Production (Boepd)

5,088

Oil (production)

56%

Operated

80%

Net Acreage

269,770 |

5

Proved Reserves (MMBOE)

(2)

Average Daily Production (BOEpd)

Reserves and Production

Current

Proved

Reserves

–

24.0

MMBOE

(1)

(1) As

of

July

1,

2010.

Excludes

partnership

interests.

(2)

2006

–

2009

proved

reserves

based

on

SEC

guidelines.

(3) 2008 Reserves reflect lower prices and divestitures. (4)

7/1/10 reserves based on NYMEX strip as of 6/30/10. See Additional Disclosures in Appendix. |

Oil Weighted

Development

GeoResources Asset Overview |

7

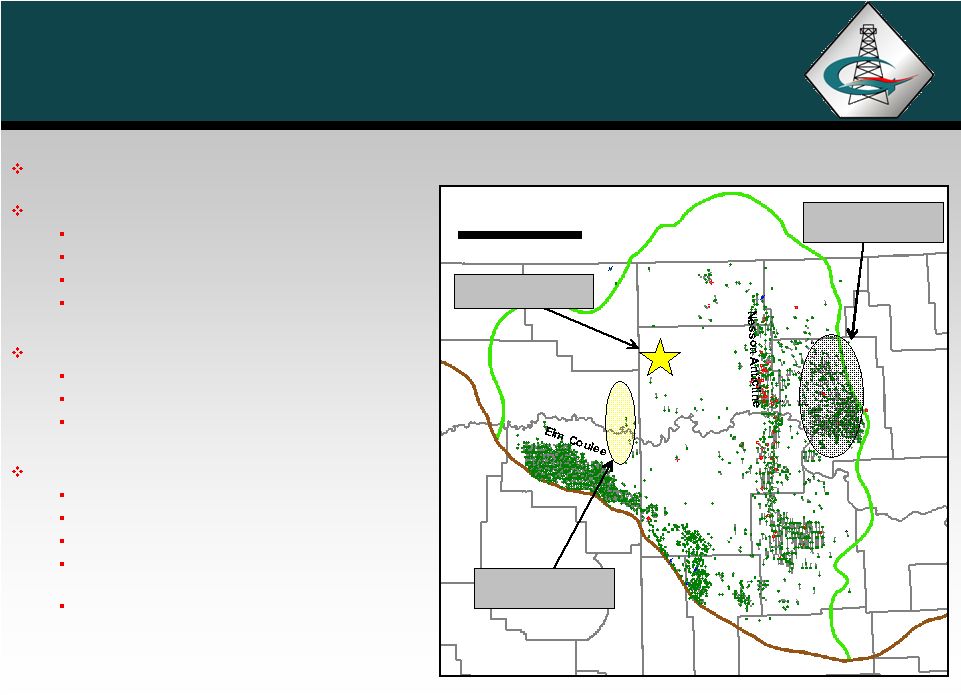

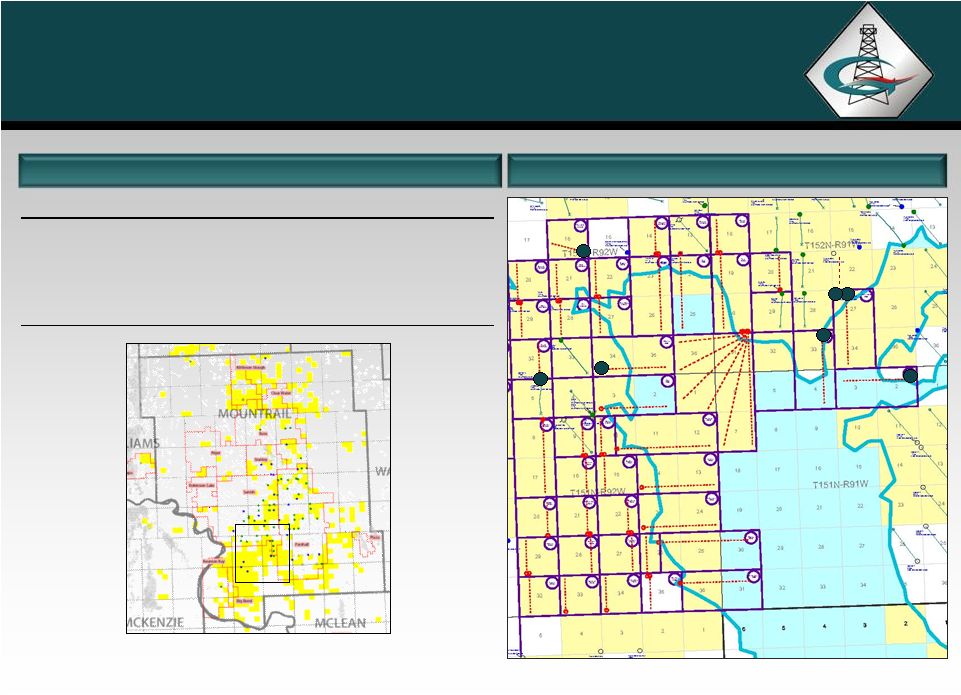

Bakken Shale Overview

46,000 Net Acres in the Bakken

Bakken Operated Project

24,000 net acres in Williams County, ND

Retained 47.5% WI and operations

Drilling started in September 2010

Lease in 82 drilling units (1,280 acres)

Bakken Non-Operated Project

Partnered with Slawson Exploration Company

13,000 net acres in Mountrail County, ND

Currently, four rigs operating by Slawson

Eastern Montana

9,000 net acres in Roosevelt/Richland Co., MT

7,500 operated / 1,500 non-operated acres

16 operated 1,280 acre units

Participating with Slawson in the Renegade 1-

10H & Battalion 1-3H with 25% WI

Participating with Brigham in the Swindle 16-9

#1H with a 9.3% WI

CANADA

ND

MT

50 miles

Williams

County

Parshall

Sanish

7

Roosevelt

County

Note: Information, except for map, as of December 31, 2010. Red/green symbols

in map depict permitted or drilled locations. Non-Operated

Project

Operated Project

Eastern

Montana Project |

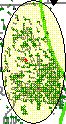

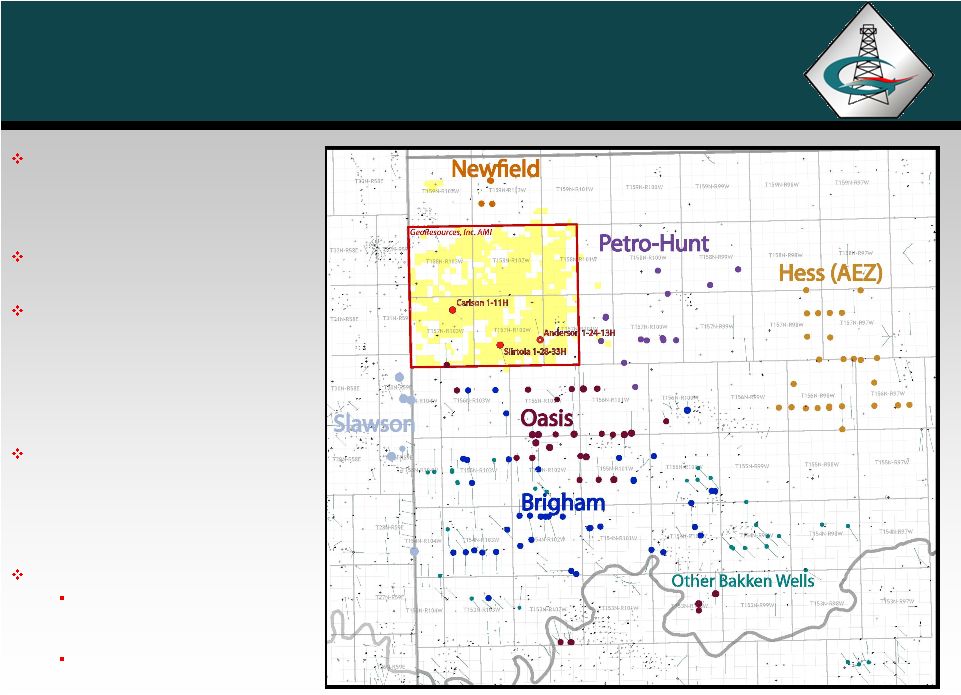

8

Bakken Shale -

Non-operated

Bakken Shale

Note: Yellow-highlighted areas represent the Company’s acreage

position. Partnered with experienced operator -

Slawson Exploration

13,000 net acres with working interests

ranging from 10% to 18%

Slawson has four rigs running currently and

has drilled over 75 wells

Additional opportunities:

Slawson and others evaluating

appropriate Bakken spacing and infill

drilling with several drilling units

containing second wells

Slawson evaluating Three Forks

potential with one producer and one

well waiting to frac

Encouraging offset Three Forks results

by EOG and Whiting where GEOI has

minor WI

8

Note: Information, except for map, as of December 31, 2010.

|

Note:

Information as of December 31, 2010. Yellow-highlighted areas in maps represent the Company’s acreage position.

(1)

Initial Production

(bopd)

(24

hour

rate)

is

defined

as

the

peak

oil

volume

produced

on

a

daily

basis

through

permanent

production

facilities

that

occur

within

the

first

few

days

of

initial

production

from

the well.

(2)

Cannonball

Federal

#1-27-34H

had

only

half

of

the

frac

completed.

Remaining

stages

to

be

completed

at

a

later

date.

(3)

Jericho

Federal

#2-5H-TF

had

less

than

50%

of

the

stages

frac’d

correctly

due

to

mechanical

problems

with

the

stimulation

sleeves.

Bakken

Shale -

Non-operated Activity

Mountrail County Sample 2010 Wells

6

7

4

2

5

3

1

Non-Operated 2010 Sample Drilling Results

9

Map

#

Well Name

Spacing

(Acres)

Frac

Stages

24-hour IP

(1)

Bbls/d

30 Day Avg.

Bbls/d

60 Day Avg.

Bbls/d

1

Atlantis Federal #1-34-35H

1,280

40

1,424

1,179

1,018

2

Cannonball Federal #1-27-34H

(2)

1,280

19

1,517

871

637

3

Jericho #2-5H-TF

(3)

640

21

310

235

203

4

Lunker

Federal #1-33-4H

1,280

40

650

356

413

5

Sauger

Federal #1-22H

640

21

1,597

1,231

1,020

6

Tarantula #1-16H

640

21

1,010

623

494

7

Shad Federal #1-2-3H

1,280

41

1,034

569

471 |

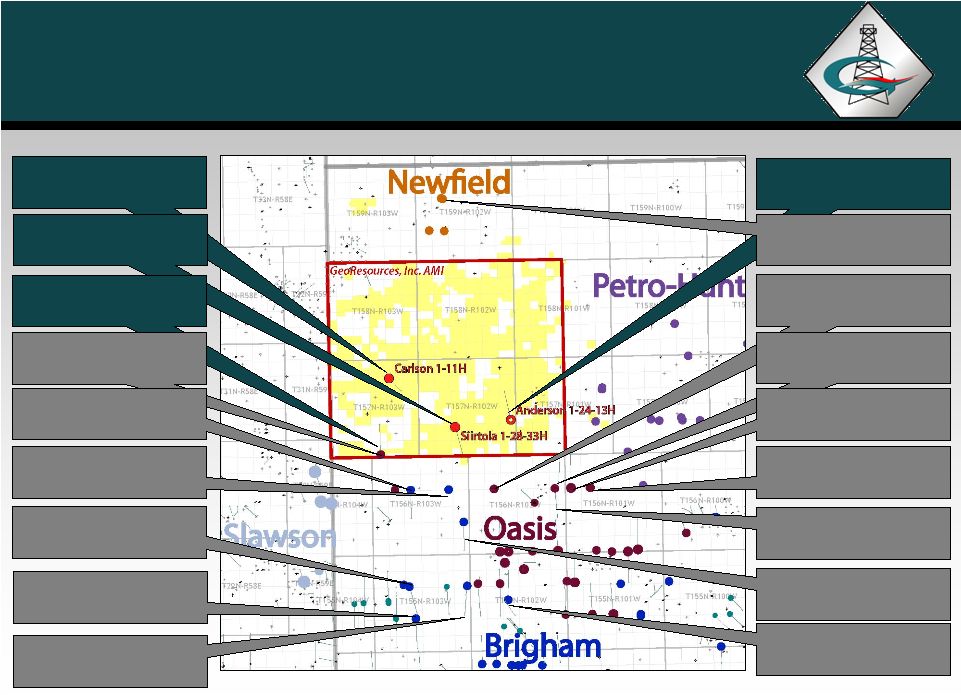

Bakken Shale -

Operated

24,000 Net Acres with 47.5% WI

and operations in Williams

County

Interests in 82 spacing units

First well, Carlson #1-11H (640

acre unit, short lateral) on

production at an IP of 685 bopd

and an estimated completed

well cost of $5.6 million

Second and third wells are 1280

units with long laterals; both are

waiting on frac; Siirtola 1-28-

33H, Anderson 1-24-13H

Positive Offsetting Activity

9 nearest southern offsets

have NDIC-reported initial

rates of 972-1,947 BOPD

4-5 rigs drilling within or

offsetting our AMI

10 |

Bakken Shale -

Activity

11

11

Carlson 1-11H

IP: 685 Bo/d

(640 ac. unit -

short lateral)

Anderson 1-24-13H

Est. Frac in March 2011

Siirtola 1-28-33H

Est. Frac in February 2011

NFX: Christensen 159-102-17-

20-1H

Drilling

BEXP: Sukut 28-33

IP: 1,959 Boe/d

OAS: Grimstvedt 42-34H

Waiting on Compl. Results

GEOI WI = 3.3%

BEXP: Lee 16-21

IP: 1,544 Boe/d

OAS: Somerset 5602 12-17H

IP = 1,109 Boe/d,

Ellis 12-17H = 1,057 Boe/d

BEXP: Kalil Farm 14-23H &

McMaster 14-23H

Waiting on Compl. Results

OAS: Bean 5703-42-34

Waiting on Completion

Results

BEXP: Arnson 13-24

IP: 1,339 Boe/d

BEXP: BCD Farms 16-21

IP: 1,776 Boe/d

BEXP: Strand 16-9

IP: 2,265 Boe/d

OAS: Njos Federal

IP: 2,080 Boe/d

BEXP: Kalil 25-36#1H

IP: 1,586 Boe/d

OAS: Baffin 5601 12-18H

Drilling

OAS: Devon 5601 12-17H &

Glover 5601 12-17H

Waiting on Compl. Results

OAS: Sandaker 11-13H

IP: 1,407 Boe/d

Note: Carlson 1-11H well is the only 640 acre unit, short lateral well

referenced on the map. |

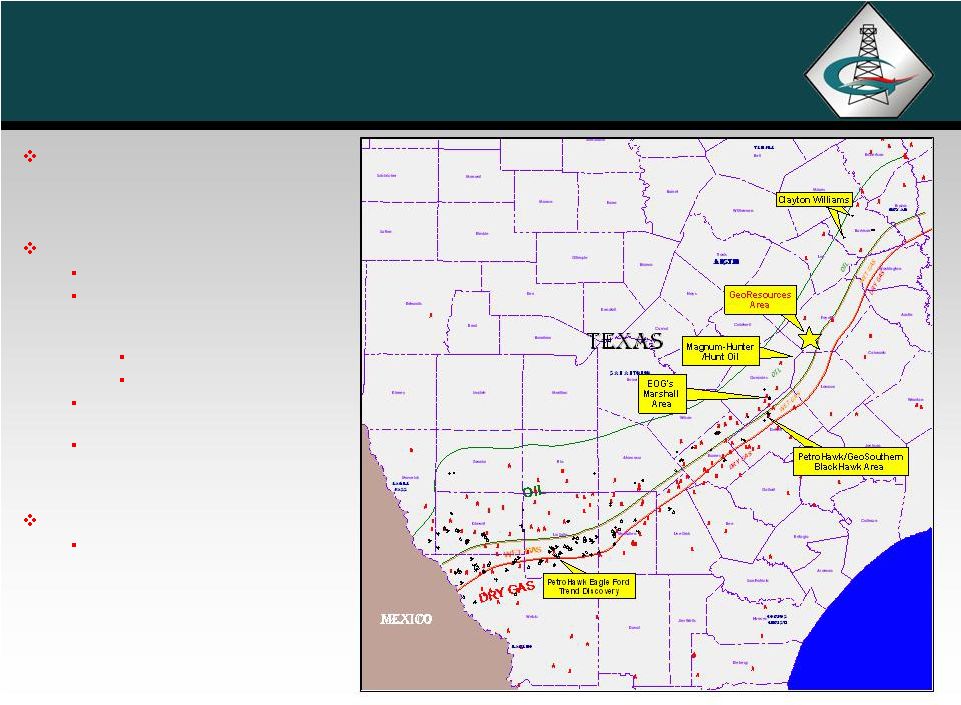

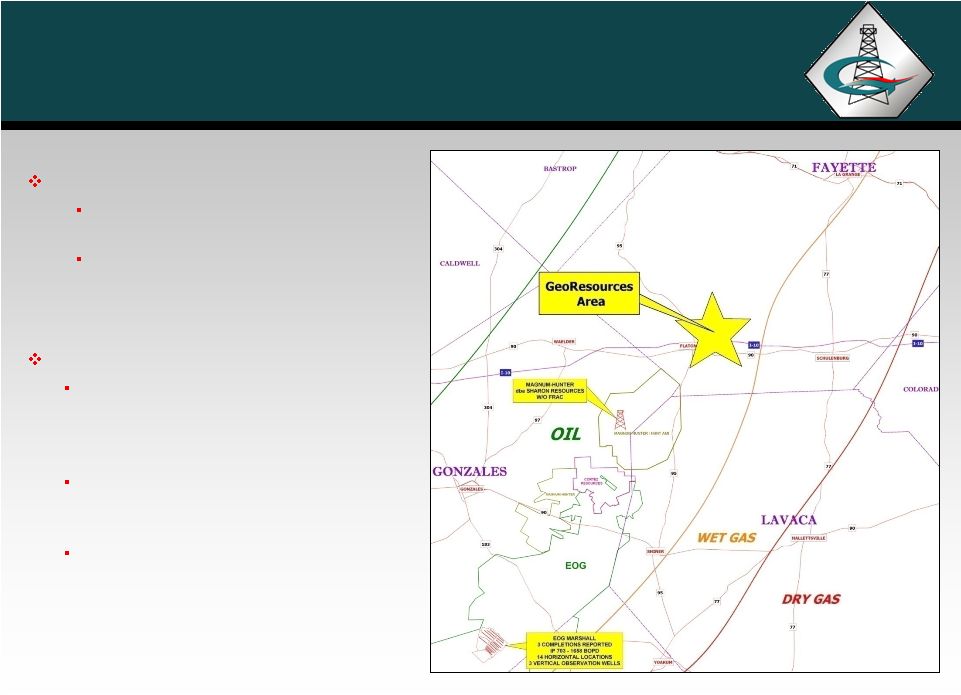

Eagle Ford Shale

12

Eagle Ford Acreage has

increased to 21,000 net acres

Eagle Ford AMI

South West Fayette County

Ramshorn

Investments, Inc., an

affiliate of Nabors Industries, Ltd.

purchased a 50% interest

Made upfront cash payment

Will fund six horizontal wells

GEOI retains 50% WI and

operations

Joint commitment for additional

leasing

Eagle Ford Expansion

Acquired additional acreage in

Atascosa, Gonzales, & McMullen

counties

Note: Information, except for map, as of December 31, 2010.

GULF OF MEXICO |

Eagle

Ford Shale 13

Volatile oil / gas condensate window

On strike with operator activity in

Gonzales Co.

Spud first well in Fayette County,

Flatonia East Unit #1-H, on January

10, 2011

Positive offset operator activity

Magnum Hunter has completed two

wells in Gonzales Co. with Initial

Production (IP) from 600 boepd to

1,335 boepd.

EOG has multiple completions in

Gonzales Co. with IPs ranging from

700 to 2,000 bopd.

Clayton Williams has completed 3 wells

to the NE with a 4th well completing

located in Burleson and Lee Co. IPs

range from 234 to 492 bopd. |

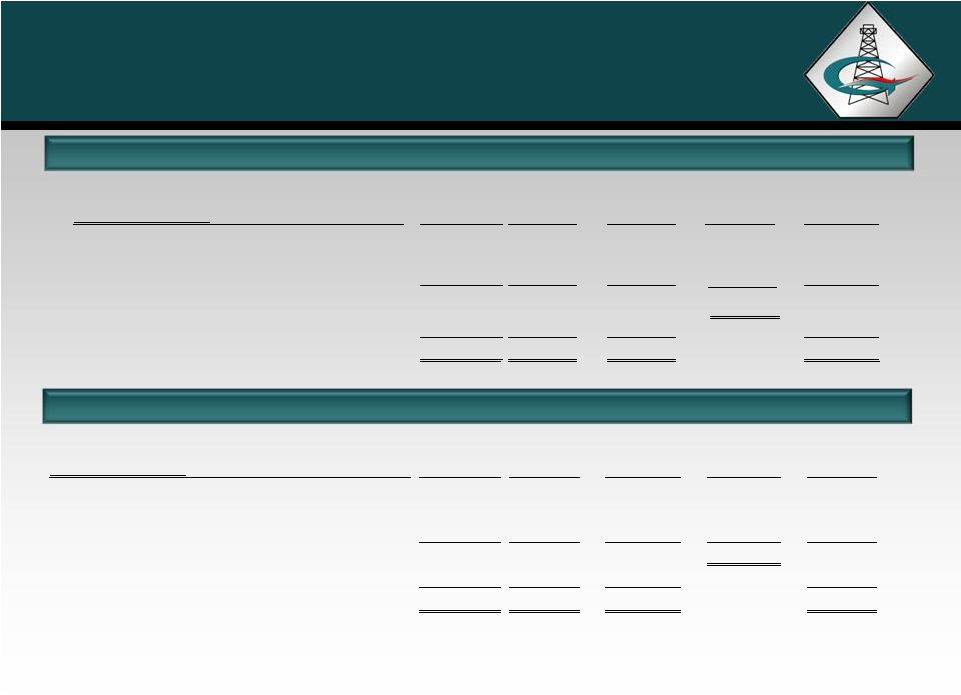

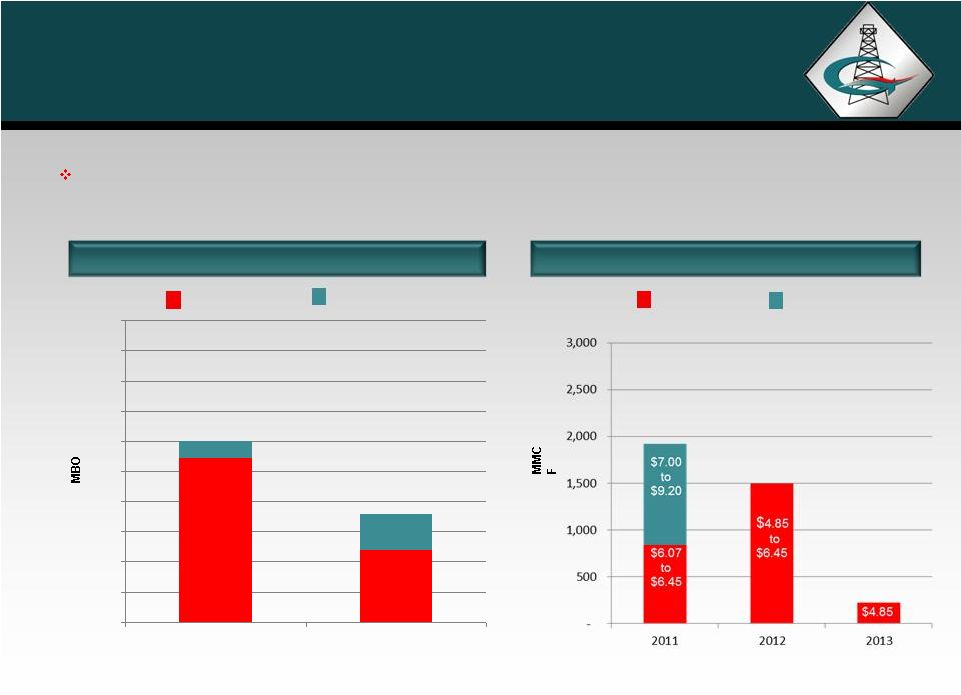

Development Economics

Development Economics

(2)

(1)

Assumes Bakken

and Eagle Ford oil differentials of 15% and 5%, respectively. Natural gas

price held constant at $5/Mcf. (2)

EUR

refers

to

management’s

internal

estimates

of

reserves

potentially

recoverable

from

producing

wells.

These

EURs

are

not

classified

as

Proved

Reserves

under

the

SEC

definitions

and

as

such

are

not

included

in

the

current

reserve

report.

14

Bakken

Shale (Williams Co., North Dakota)

Eagle Ford Shale (Fayette Co., Texas)

350 MBO EUR

500 MBO EUR

700 MBO EUR

350 MBOE EUR

500 MBOE EUR

Well Assumptions

Drill & Completion cost ($M$)

$6,500

$6,500

$6,500

$7,000

$7,000

Lateral Length (feet)

10,000

10,000

10,000

5,000

5,000

WI

100%

100%

100%

100%

100%

NRI

80%

80%

80%

82.5%

82.5%

IP (Bopd)

500

800

1,100

500

1,000

Econ. @ $80/Bbl and $5/Mcf

(1)

NPV @ 10%

$2,812

$7,667

$12,034

$4,784

$10,591

IRR

25%

72%

89%

45%

237%

Payout (yrs)

3.0

1.3

1.2

1.8

0.9

ROI

2.2

3.3

4.9

2.4

3.5

Price

Sensitivity

(IRR)

(1)

$90/Bbl (WTI)

34%

91%

150%

57%

337%

$80/Bbl (WTI)

25%

72%

89%

45%

237%

$70/Bbl (WTI)

18%

55%

69%

33%

111%

$60/Bbl (WTI)

12%

40%

52%

23%

69% |

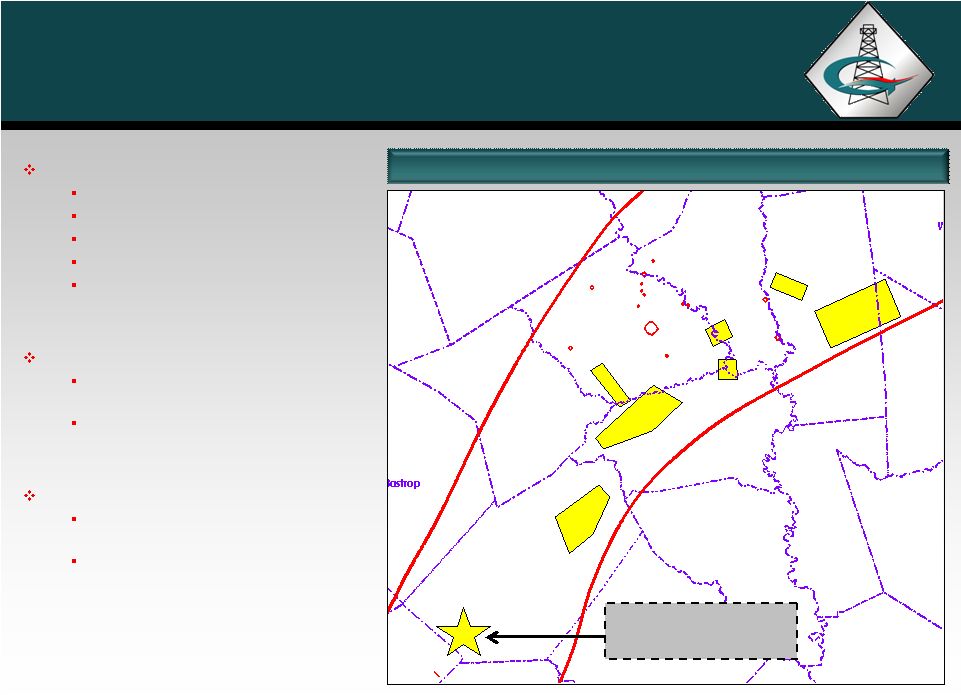

Additional Assets |

16

Giddings Field –

Austin Chalk

29,000 net acres

16 wells drilled

–

100% success

20 additional drilling locations

WI ranges from 37%

-

53%

Operating control

Majority of acreage Held-by-

Production

Eastern Giddings Development Area

Eastern acreage in Grimes and

Montgomery Counties is dry gas

Western acreage is liquids-rich gas

and condensate

Additional Upside Includes:

Eagle Ford, Georgetown and

Yegua

potential

Rate increase potential from slick

water fracture stimulations

16

APACHE

APACHE

APACHE

APACHE

APACHE

CWEI

CWEI

MAGNUM-HUNTER

Lee

Washington

Waller

Fayette

Austin

Colorado

Milam

Brazos

Grimes

Burleson

Giddings Field Acreage

Eagle Ford Area of

Mutual Interest |

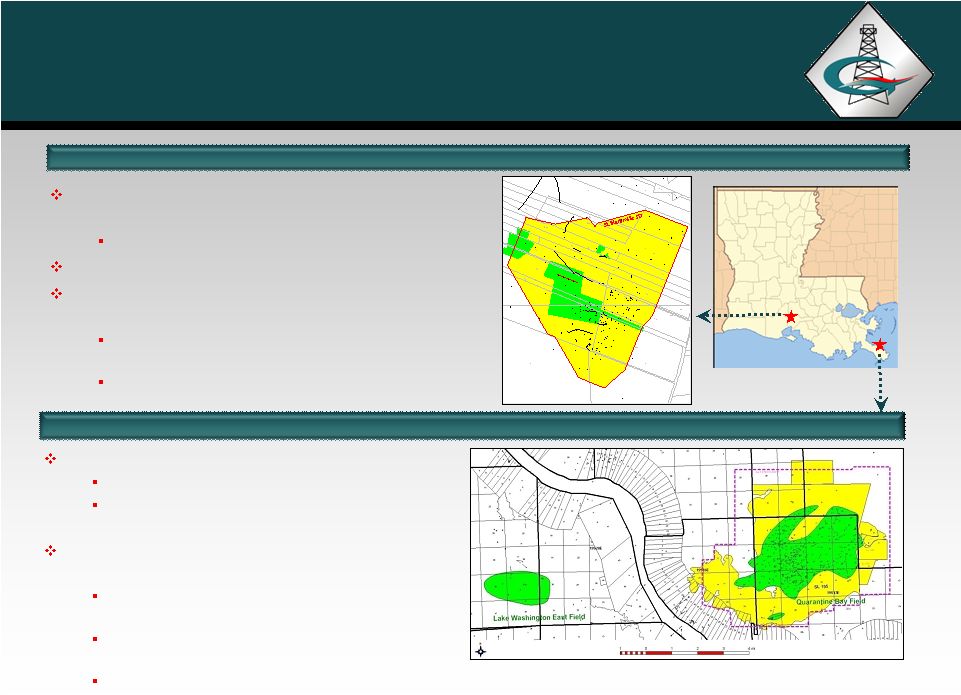

Louisiana -

Louisiana -

St. Martinville

St. Martinville

& Quarantine Bay

& Quarantine Bay

2,585 net acres of HBP or leased (yellow),

534 net acres of owned minerals (green)

Average WI of 97% and NRI of 91%

November 2010 cash flow over $200,000

Multiple exploration and development

objectives from 3,000’

–

10,000’

Cumulative shallow production of 15.2

MMBO and 16.6 BCFG

Cumulative production over 125 Bcfe

at

10,000’

LOUISIANA

Quarantine Bay Field

St. Martinville

Field

14,000 gross acres (13,000 HBP)

33% WI below major field plays

Cumulative production of 180 MMBO and 285

BCF

Significant deep exploration potential (11-

25,000’); plus sub-salt potential

Pelican prospect: 1.3 MMBO + 10 BCFG at

~11,500’

Prospect DN: 16.0 MMBO + 40 BCFG at

~16,500’

Additional deeper prospects

126

1

1

1

2

3

4

5

3-1

2

1

1

2

1

1

2

1

2

3

3

3ST1

2

1

1

2

1

1

1

1

1

2

1

1

1

2

31

1

51

3

4

1

4111

211

1

1

131

221

1

1

1

1B

6A

1211

3

3

21

4

1

1

4

1

51

31

2

¹

1

1

9A

14A

15A

11A32A

10A

13A4A

12A17A24A46A

3A1A37A

5A

16A37A

7A

21

4C

1

2

1

3

1

2

2

1

1

1

5

7D

6D

8A

6

1

2

1

3

7

5

4

1C

1

1D

11²

¹

1

2A

18A31A

19A

1

20A

21A

22A

1

1

2

23A

1

8

9

3

2

10

11

1

3

¹1²

12

13

1

1

25A

1

2

3

1

14

4

15

16

1

1

2

17

6

1

6

2

18

1

234

3

19

¹

1E

20

4

26A39A

2

27A

¹234

28A

1

5E

21

2

1

29A

8D

1

1

2

30A

1

1D

²

²34

9D

33A

6

22

1

34A

35A

7

8

1

10D

4

38A

41A

36A

40A

1

5

7

42A

43A

1

1

7

8

9

2E

44A

1

1

45A

5

1

1

1

47A(2)

¹

6

48A52A

49A

50A

54

1

51A

1

²

7

53

1

A-53

17 |

Financial Overview |

Development Program

Project

Budgeted

Comments

Bakken

Operated

$29.5

18 wells + completions

of 2010 drilling

Non-Operated

21.0

Slawson 3 rig program

+ minor interest wells

Eagle Ford

15.8

6 Carried Interest wells

+ 7 additional wells

Giddings & LA

16.1

Giddings = 3 wells

LA = 8 wells

Acreage & Seismic

25.0

Other

6.6

Non-Operated Drilling

+ Operations Capital

TOTAL

$114.0

2011 Capital Budget

Budget recently increased to take

advantage of leasing success and strong

project inventory

2011 budget increased from $88 MM to

$114 MM

2012 budget estimated at $173 MM

Current project allocations favor lower-risk,

high cash flow oil projects

Project inventory allows flexibility

Weighted towards oil and liquids

Oil and gas projects in inventory

Exploration and development projects in

inventory

Held by long-term leases or production

Capital Allocations

($ in millions)

19 |

Debt / EBITDAX

EBITDAX

20

Can fund current CapEx

with cash flow and debt capacity

Conservative use of leverage to maintain strong balance sheet

$145 Million borrowing base

EBITDAX

(1)

:

3rd Quarter = $17.7 Million

YTD 2010 = $53.3 Million

Annualized = $71.0 Million

Total debt of $87.0 million December 2010.

No debt after January 2011 Equity Raise.

Strong Financial Position

($ in millions)

(1) EBITDAX is a non-GAAP financial measure. See reconciliation of net

income to EBITDAX following in Appendix. (2) December 2010 debt / Annualized 2010 EBITDAX.

(2) |

Investment Highlights

Value Creation

Significant upside through Bakken

and Eagle Ford shale positions

Bakken

Shale

-

46,000

net

acres

Eagle

Ford

Shale

-

21,000

net

acres

Ongoing leasing program to further expand acreage

Solid proved reserve and production base

24

MMBOE

of

proved

reserves

(1)

with

bias

towards

liquids

High level of operating control

Additional upside identified in conventional assets

Strong financial position to execute development plans

Significant free cash flow from existing assets to invest in shale

development Unlevered balance sheet post offering

Experienced management and technical staff with large ownership stake

Successful track record of creating value and liquidity for shareholders

Board and management own approximately 21% of the company

(1)

Does not include interests in affiliated partnerships. Reserves based on strip

pricing as of 6/30/10. See Additional Disclosures in Appendix. 21

Cost effective operator with significant operating experience in unconventional resource plays

|

Appendix |

23

Management History

2004-

2007

Southern Bay Energy, LLC

Gulf Coast, Permian Basin

REVERSE MERGED INTO

GEORESOURCES, INC.

2000-2007

Chandler Energy, LLC

Williston Basin, Rockies

ACQUIRED BY

GEORESOURCES, INC.

1988-2000

Chandler Company

Rockies, Williston Basin

MERGED INTO

SHENANDOAH THEN SOLD

TO QUESTAR

1992-1996

Hampton Resources Corp

Gulf Coast

SOLD TO BELLWETHER

EXPLORATION

Preferred investors –

30% IRR

Initial investors –

7x return

1997-2001

Texoil

Inc.

Gulf Coast, Permian Basin

SOLD TO OCEAN ENERGY

Preferred investors –

2.5x return

Follow-on investors –

3x return

Initial investors –

10x return

2001-2004

AROC Inc.

Gulf Coast, Permian Basin, Mid-Con.

DISTRESSED ENTITY LIQUIDATED

FOR BENEFIT OF INITIAL

SHAREHOLDERS

Preferred

investors

–

17% IRR

Initial

investors

–

4x return

Track record of profitability and liquidity

Extensive industry and financial relationships

Significant technical and financial experience

Long-term repeat shareholders

Cohesive management and technical staff

Team has been together for up to 21

years through multiple entities |

Proved

Reserves

–

SEC Pricing at 7/1/10

Proved Reserves -

Strip Pricing at 7/1/10

24

Proved Reserves

(1)

($ in millions)

Oil

Gas

Total

% of

Corporate Interests

MMBO

BCF

MMBOE

Total

PV-10

PDP

8.3

37.4

14.6

60.8%

$246.0

PDNP

2.1

5.4

3.0

12.5%

63.0

PUD

3.1

20.3

6.4

26.7%

74.8

Total Proved Corporate Interests

13.5

63.1

24.0

100.0%

383.8

Partnership Interests

0.1

9.1

1.6

16.8

Total Proved Corporate and Partnerships

13.6

72.2

25.6

$400.6

24

(1) As of July 1, 2010. PV-10% is a non-GAAP financial measure.

See reconciliation of SEC PV 10% to standardized measure in Appendix. See Additional Disclosures in Appendix.

($ in millions)

Oil

Gas

Total

% of

Corporate Interests

MMBO

BCF

MMBOE

Total

PV-10

PDP

8.4

35.1

14.2

61.5%

$209.9

PDNP

2.1

5.0

3.0

13.0%

54.3

PUD

3.0

17.0

5.9

25.5%

54.9

Total Proved Corporate Interests

13.5

57.1

23.1

100.0%

319.1

Partnership Interests

0.1

8.0

1.4

11.2

Total Proved Corporate and Partnerships

13.6

65.1

24.5

$330.2 |

Natural Gas Hedges

Oil Hedges

Hedge Portfolio

GEOI uses commodity price risk management in order to execute its business plan

throughout commodity price cycles.

Swaps

Swaps

Collar

25

0

100

200

300

400

500

600

700

800

900

1000

2011

2012

$74.37

to

$88.45

$86.85

to

$87.22

$85.00 to

$106.08

Collar

$85 .00 to

$110.00 |

26

Operating Performance

Historical Operating Data

Nine Months 2010

3rd Qtr. 2010

2009

2008

Key Data:

Average realized oil price ($/Bbl)

70.51

$

70.43

$

61.09

$

82.42

$

Avg. realized natural gas price ($/Mcf)

5.39

$

5.74

$

3.97

$

8.12

$

Oil production (MBbl)

780

276

851

743

Natural gas production (MMcf)

3,656

1,076

4,944

2,962

(millions except for per share amounts)

Total revenue

79.9

$

26.9

$

80.4

$

94.6

$

Net income before tax

27.4

$

10.3

$

14.8

$

21.3

$

Net income after tax

18.2

$

7.6

$

9.8

$

13.5

$

Earnings per share (diluted)

0.90

$

0.38

$

0.59

$

0.86

$

EBITDAX

(1)

53.2

$

17.7

$

48.2

$

54.2

$

26

(1) EBITDAX is a non-GAAP financial measure. See reconciliation of

net income to EBITDAX in Appendix. |

As used herein,

EBITDAX is calculated as earnings before interest, income taxes, depreciation, depletion and amortization, and exploration expense and further

excludes non-cash compensation, impairments, hedge ineffectiveness and income or loss on

derivative contracts. EBITDAX should not be considered as an alternative to net income (as an

indicator of operating performance) or as an alternative to cash flow (as a measure of liquidity or ability to service debt obligations)

and is not in accordance with, nor superior to, generally accepted accounting principles(GAAP), but

provides additional information for evaluation of our operating performance.

27

EBITDAX Reconciliation

27

Nine Months

3rd Qtr.

Years Ended December 31,

(in millions)

2010

2010

2009

2008

Net income

18.2

7.6

9.8

13.5

Add back:

Interest expense

3.9

1.4

5.0

4.8

Income taxes

9.3

2.6

5.1

7.8

Depreciation, depletion and amortization

18.5

6.2

22.4

16.0

Hedge and derivative contracts

(1.0)

(0.6)

0.3

0.4

Noncash compensation

0.8

0.3

1.4

0.7

Exploration and impairments

3.5

0.2

4.2

10.9

EBITDAX

53.2

17.7

48.2

54.1

$

$

$

$

$

$

$

$ |

Standardized Measure

SEC PV-10 Reconciliation to Standardized Measure

(1)

(1)

PV-10%

is

not

a

measure

of

financial

or

operating

performance

under

GAAP,

nor

should

it

be

considered

in

isolation

or

as

a

substitute

for

the

standardized

measure

of

discounted

future

net

cash

flows

as

defined

under

GAAP.

Our

calculations

of

PV-10%

and

standardized

measure

of

discounted

future

net

cash

flows

at

July1,

2010

are

based

on

our

internal

reserve

estimates,

which

have

not been reviewed or audited by our independent reserve engineers.

(2)

Through two affiliated partnerships.

($ in millions)

7/1/2010

Direct interest in oil and gas reserves:

Present value of estimated future net revenues (PV-10%)

$319.1

Future income taxes at 10%

(77.6)

Standardized measure of discounted future net cash flows

$241.5

Indirect

interest

in

oil

and

gas

reserves:

(2)

Present value of estimated future net reserves (PV-10%)

$11.2

Future income taxes at 10%

(3.9)

Standardized measure of discounted future net cash flows

$7.3 |

29

Additional Disclosures

29 |