Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bristow Group Inc | d8k.htm |

Third Quarter FY 2011 Earnings Presentation

Bristow Group Inc.

February 3, 2011

Exhibit 99.1 |

Third quarter earnings call agenda

•

Introduction

(Linda

McNeill,

Investor

Relations

Manager)

•

CEO

Remarks

(Bill

Chiles,

President

and

CEO)

•

Financial

highlights

(Jonathan

Baliff,

SVP

and

CFO)

•

Operational

highlights

(Bill

Chiles,

President

and

CEO)

•

Questions

and

answers

2 |

Forward-looking statements

This

presentation

may

contain

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-looking

statements

include

statements

about

our

future

business,

operations,

capital

expenditures,

fleet

composition,

capabilities

and

results;

modeling

information,

expected

operating

margins

and

other

financial

projections;

plans,

strategies

and

objectives

of

our

management,

including

our

plans

and

strategies

to

grow

earnings

and

our

business,

our

general

strategy

going

forward

and

our

business

model;

expected

actions

by

us

and

by

third

parties,

including

our

customers,

competitors

and

regulators;

our

use

of

excess

cash;

the

valuation

of

our

company

and

its

valuation

relative

to

relevant

financial

indices;

assumptions

underlying

or

relating

to

any

of

the

foregoing,

including

assumptions

regarding

factors

impacting

our

business,

financial

results

and

industry;

and

other

matters.

Our

forward-looking

statements

reflect

our

views

and

assumptions

on

the

date

of

this

presentation

regarding

future

events

and

operating

performance.

They

involve

known

and

unknown

risks,

uncertainties

and

other

factors,

many

of

which

may

be

beyond

our

control,

that

may

cause

actual

results

to

differ

materially

from

any

future

results,

performance

or

achievements

expressed

or

implied

by

the

forward-looking

statements.

These

risks,

uncertainties

and

other

factors

include

those

discussed

under

the

captions

“Risk

Factors”

and

“Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operations”

in

our

Annual

Report

on

Form

10-K

for

the

year

ended

March

31,

2010

and

Quarterly

Report

on

Form

10-Q

for

the

quarter

ended

December

31,

2010.

We

do

not

undertake

any

obligation,

other

than

as

required

by

law,

to

update

or

revise

any

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise.

3 |

Chief Executive comments

Bill

Chiles,

President

and

CEO |

5

Operational safety review

Air Accident Rate* per 100,000 Flight Hours

(Fiscal Year)

1.17

0.78

0.78

0.00

0.53

0.00

0.00

1.00

2.00

2006

2007

2008

2009

2010

2011 YTD

FY11 Total Reportable Injury Rate per

200,000 manhours (cumulative)

0.32

0.16

0.52

0.40

0.32

0.39

0.33

0.34

0.34

0.00

0.50

1.00

A

M

J

J

A

S

O

N

D

J

F

M

FY11 Lost Work Case Rate per 200,000

manhours (cumulative)

0.00

0.00

0.21

0.16

0.13

0.16

0.14

0.13

0.15

0.00

0.50

A

M

J

J

A

S

O

N

D

J

F

M

* Includes commercial operations only |

3Q

FY2011 highlights 6

•

YTD Earnings per share of $2.77

•

19.4% increase from 9 months ended 3QFY10

•

YTD Operating income of $139.9M

•

1.3% increase from 9 months ended 3QFY10

•

YTD EBITDA of $200M

•

Relatively flat from 9 months ended 3QFY10

•

Improving margins for most of our business units with strength in Europe, West

Africa and Other International.

•

Tax benefit in 3Q FY2011 primarily due to reversal of deferred tax balances

recorded in prior fiscal years ($0.45 and $0.47 EPS benefit in 3Q and YTD).

•

No aircraft sales.

•

3Q Earnings per share of $1.13

•

6.6% increase from 2QFY11

•

52.7% increase from 3QFY10

•

3Q Operating income of $46.6M

•

12.9% decrease from 2QFY11

•

17.4% increase 3QFY10

•

3Q EBITDA of $65.6M

•

12% decrease from 2QFY11

•

1.8% increase from 3QFY10 |

•

Oil price strength continues for multiple reasons

•

Overall international Exploration & Production (E&P) capital

expenditure and operating expenditure growth

•

Recovered in calendar 2010, modest in 2011, and expanding in 2012

•

Balanced across non-U.S. geographies although U.S. is challenged

•

International deepwater exhibiting particularly robust activity

•

This E&P confidence is reflected in improved helicopter tender

activity, principally for FY 2012/2013 work

•

Although

activity

and

prospects

are

improving,

there

is

softness

in

aftermarket

for

helicopters

Current market environment

7 |

Operational performance highlights

•

Europe

Revenue is higher year over year due to better contracting with better operational

margins due to efficiency gains and higher equity earnings

•

West Africa

Revenue down, but margins are intact through lower costs even though the lost

contract is not fully offset yet.

•

Australia

Revenue increased year over year; however, the competition refocused in recognition

of the increase in medium/long term opportunities. Higher compensation costs

drove lower EBITDA. •

Other International

Lider

performing well with cash dividend paid; however, near term still materializing at

a slower pace. Offset by brisk improvement in

other countries. Reduction in Mexico exposure with HC

restructuring. •

North America

Year

over

year

improvement

in

a

challenging

environment

with

sequential

weakness

intra

year.

8 |

9

Consolidated Fleet Changes as of December 31, 2010

(1) Includes aircraft sales, net lease returns/commencements and operated

returns Q1 FY2011

Q2 FY2011

Q3 FY2011

Total

Fleet Count Beginning Period

390

384

379

390

Delivered

Agusta AW 139

1

1

2

4

Sikorsky S-92

1

1

Added

1

1

3

5

Removed

(1)

(7)

(6)

(4)

(17)

Total

384

379

378

378

|

Financial highlights

Jonathan

Baliff,

SVP

and

CFO |

Financial highlights –

Earnings per share summary

3Q FY10 to 3Q FY11 bridge

9 months Q3 FY10 to 9 months Q3 FY11 bridge

11

$0.74

$1.00

$1.21

$1.13

$1.13

$0.74

$0.26

$0.46

$0.25

$0.08

Q3FY2010

Operations

Taxes

Corporate and Other

FX Changes

Q3FY2011

$2.32

$2.63

$2.82

$2.77

$2.77

$2.32

$0.31

$0.68

$0.49

$0.05

9 Mos FY2010

Operations

Taxes

Corporate and Other

FX Changes

9 Mos FY2011 |

Financial highlights –

EBITDA summary

3Q FY10 to 3Q FY11 bridge

12

9 months Q3 FY10 to 9 months Q3 FY11 bridge

$64.4

$69.6

$65.6

$65.6

$64.4

$12.4

$7.2

$4.0

Q3FY2010

Operations

Corporate and Other

FX Changes

Q3FY2011

$220.7

$204.6

$200.0

$200.0

$200.2

$20.5

$16.1

$4.6

9 Mos FY2010

Operations

Corporate and Other

FX Changes

9 Mos FY2011 |

($101)

($122)

($61)

($43)

($51)

$9

($45)

($24)

($4)

$9

($13)

Q1FY09

Q2FY09

Q3FY09

Q4FY09

Q1FY10

Q2FY10

Q3FY10

Q4FY10

Q1FY11

Q2FY11

Q3FY11

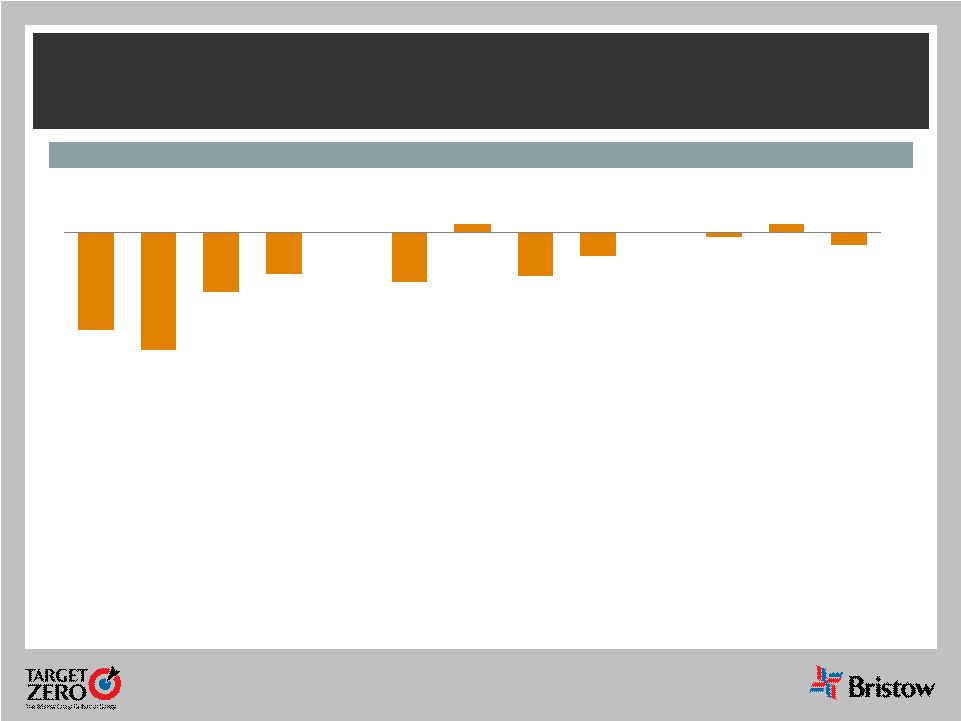

Historical cash flow from operations less all capex

13

Historical cash flow from operations less capex

($ millions)

•

Historically, Bristow has employed cash flow from operations with growth capital

expenditures •

Driven by fleet modernization catch-up with transitioning to new technology

medium and large aircraft.

•

Non-discretionary (aircraft maintenance and facilities) capital expenditures

have been far lower as a percentage of growth capital expenditures

•

In the future, we do not see the same level of capital spending in as short a

period of time |

Our

new $375 million secured bank credit facility aligns well with our financial

strategy •

$175 million 5-year revolver and $200 million 5-year term loan with a

$100 million accordion feature

•

Term loan proceeds and revolver borrowings were used to repay $230

million 6 1/8% senior notes due 2013 on December 23, 2010; revolver

also used for general corporate purposes

•

Initial borrowing margin is LIBOR + 2.50%, but reverse flexing to 2.375%

after June 30, 2011 financials are provided to lenders

•

Leverage ratio pricing grid

•

Additional indebtedness subject to financial covenants

•

Enhanced capability for dividends and stock repurchases

•

Incurred one time charge of 11 cents due to early retirement

•

~$7 million pre-tax expected annual cash interest savings

at current LIBOR levels

14 |

Total

capitalization $2.2 billion

(December 31, 2010)

$1.5 billion

Equity

Prudent balance sheet management

15

•

Cash on hand at December 31, 2010: $100.9 million

•

YTD FY11 EBITDAR

1

of $204.4 million

•

Undrawn borrowing capacity ($132 million revolving credit

facility)

•

Total liquidity

3

: $232.9 million

$726 million

Debt

Liquidity

1)

Earnings before interest, tax, depreciation, amortization and aircraft rental

expense 2)

Reconciliation in Appendix. Adjusted debt includes balance sheet debt,

unfunded pension liability and NPV of helicopter leases

3)

Total liquidity calculated as undrawn borrowing capacity plus cash on hand

Capital Structure

•

$175 million Revolver November 2015

•

$8 million in short-term borrowings and current portion of debt

•

$717.5 million in long-term debt

•

36

million shares of common stock

Leverage ratios

•

Adjusted Debt to Total Capital 37.4%

2

•

Adjusted Debt to EBITDAR 3.23:12 |

Other financial information and guidance revisions

•

Capital allocation framework

•

Prudent balance sheet management is a core principle

•

Total liquidity maintained at $200-$250 million

•

Best risk/return opportunities attract Bristow capital

•

Balance shareholder return between capital appreciation

and regular return of

capital

•

Modeling information

•

Tax 17% –

21% (assuming revenue earned in the same regions and same mix)

•

SG & A Expense ~ $125-130 million

•

Depreciation and amortization expense ~ $85 million

•

Interest expense ~ $30-35 million

16 |

Operational highlights

Bill

Chiles,

President

and

CEO |

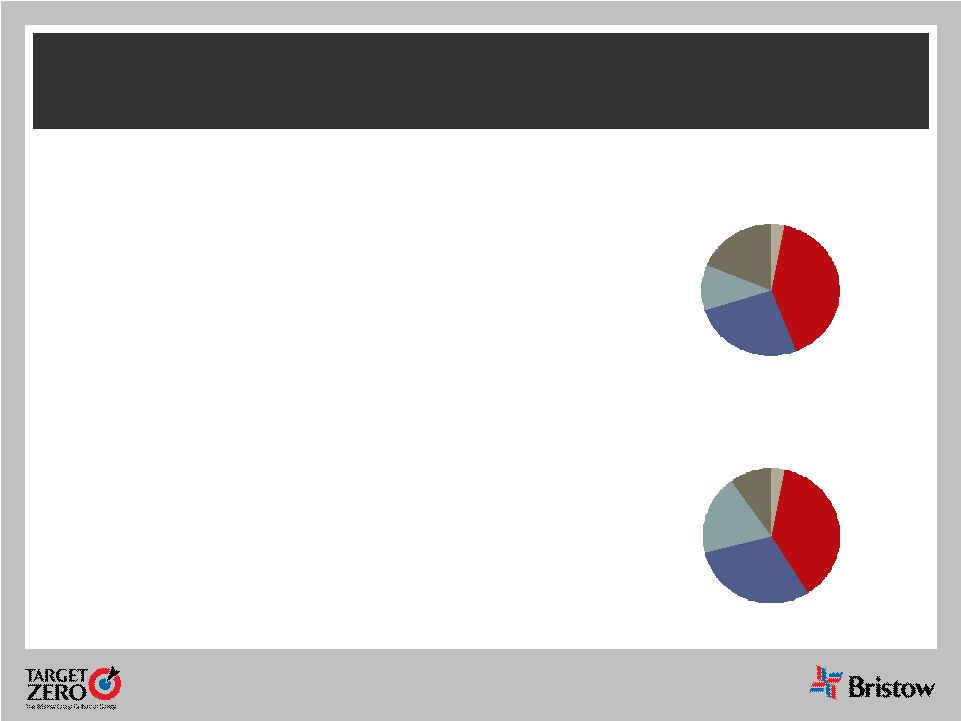

Quarterly changes

Quarter on quarter changes:

•

3%

increase

in

the

operating

income

in

Europe

is

due

to

higher

equity

earnings

from

our

military

training

unconsolidated

affiliate,

price

escalations

and

renegotiated

rates.

We

added

three

new

clients

since

the

prior

year

quarter

•

4%

decrease

in

the

operating

income

in

West

Africa

reflects

the

loss

of

a

major

client

in

this

market.

However,

lower

operating

expense

combined

with

the

addition

of

new

contracts lessened the impact

•

8%

decrease

in

the

operating

income

in

Australia

is

an

impact

of

higher

compensation

and

increased

depreciation

expense

•

9%

increase

in

the

operating

income

(from

$5.2M

to

$11.6M

Q

over

Q)

for

Other

International

Business

Unit

as

a

result

of

increased

revenue

in

Brazil,

the

Baltic

Sea,

Suriname,

Ghana

and

Russia.

•

No

change

in

the

operating

income

quarter

over

quarter

in

North

America

18

Operating Income* Q3 FY2011

North

America

3%

Europe

41%

West Africa

26%

Australia

11%

Other

International

19%

Operating Income* Q3 FY2010

North

America

3%

Europe

38%

West Africa

30%

Australia

19%

Other

International

10%

Operating income for Q3 2011 is $46.6M

Operating income for Q3 2010 is $39.7M

*

Excludes centralized operations, corporate, gain on sale of assets, and Bristow

Academy |

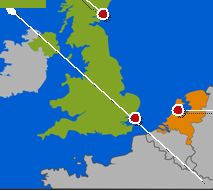

Europe (EBU)

UK

Netherlands

Norway

Norwich

Aberdeen

Scasta

Stavanger

Den Helder

Bergen

Hammerfest

•

Europe represents 42% of total revenue in Q3

FY11 and 41% of operating income

•

Operating margin 19.6% vs. 16.1% in prior year

quarter

•

Increase in activity with three new client

contracts commencing

•

Operational disruption due to severe weather in

December

•

FBH, unconsolidated JV, military training -

higher

equity earnings

•

Outlook:

•

Several major tender outstanding in UK,

Norway and Denmark for FY13

•

SAR-H award delayed

Operating margins expected for FY11 to

be ~ high teens

19 |

West

Africa (WASBU) Nigeria

Lagos

Escravos

Port Harcourt

Warri

Eket

Calabar

20

•

Nigeria represents 17% of total revenue in Q3 FY11

and 26% of operating income

•

Operating margin 29.8% in Q3 FY11 vs. 25.5% Q3

prior year

•

Revenue of $53.7M decreased from $58.7M

•

Operating income of $16M increased from $14.9M

•

Lower operating expense

•

Increased competition and new entrants

Outlook:

•

Awaiting results of recent tenders

Operating margins expected in FY11 to be

~ mid twenties |

Karratha

Exmouth

Learmonth

Varanus Is

Barrow Is

Australia (AUSBU)

Australia

Perth

Dongara

Essendon

Tooradin

Broome

Truscott

Darwin

BDI provide support

to the Republic of

Singapore Air Force

Oakey

•

Australia represented 13% of total revenue in

Q3 FY11 and 11% of operating income

•

Operating margin 17.2% vs. 24.5% for the prior

year quarter

•

Revenue of $41.4M increased from $38.2M

•

Operating income declined from $9.4M to

$7.1M

•

Higher compensation costs

•

Older under utilized aircraft to be sold or

redeployed

•

Outlook:

Increased competition in market place; loss of

Woodside as of May 31, 2011

Operating margins expected for FY11

to be ~ mid teens

21 |

Other International (OIBU)

Consolidated in OIBU

Unconsolidated Affiliate

•

OIBU represented 13% of total revenue and 19% of

operating income for Q3FY11

•

Operating margin was 27.7% vs. 15.5% for the prior

year quarter

•

Revenue increased to $41.9 from $33.3M

•

Operating income to $11.6M from $5.2M

•

Increased revenue from Brazil, the Baltic Sea,

Suriname, Ghana and Russia

•

Brazil -

Lider: paid previously mentioned dividend

for 2009 of $1.4M, $0.8M net (7/12’s of the year)

•

Lider EBITDA was R$26M reias, which is in line

with previously stated run rate of R$8-10M

reias/month

•

Reducing exposure in Mexico

Outlook:

•

Tender activity in Ghana, Equatorial Guinea and

Libya

•

PAS dividend of $2.5 million expected in March

2011

Expect operating margins in FY11 to be

~high teens to lower twenties

22 |

North America (NABU)

•

Represented 15% of total revenue and 3% of

operating income in Q3 FY11

•

Operating margin of 4.2% for Q3 FY11 up from

3.3% for the prior year quarter

•

Revenue of $45.6M flat from $45.7M

•

Operating income of $1.9M vs. $1.5M

•

Gulf of Mexico

•

Continues to be in a state of flux and

challenging market

•

Continues to redeploy aircraft to other

regions of the world

•

1 aircraft currently working for BP, down

from 3 at December 31 and 5 as of

September 30

Expect operating margins for FY11 to

be single digit for the rest of the year

23 |

Summary

24

Open for Q and A

Bristow continues to deliver on our FY2011 promises with

third quarter earnings performance improving both year

over year and sequentially. Our medium to long term

outlook remains strong given better market dynamics |

Appendix

25 |

Organizational Chart -

as of December 31, 2010

Bristow

NABU

15

%*

U

.

S

.

GoM

–

89

/

7

Trinidad

–

8

/

1

Alaska

–

15

/

3

Mexico

–

21

/

5

Brazil

–

6

/

9

Lider

-

76

HC

-

12

UK

–

38

/

3

Netherlands

–

6

/

1

Norway

–

12

/

3

FBH

-

63

Nigeria

–

46

/

10

Australia

–

35

/

8

Other

–

10

/

1

Russia

–

7

/

3

Egypt

–

–

/

–

India

–

2

/

2

Turkmenistan

–

2

/

1

PAS

-

45

AUSBU

13

%

EBU

39

%

Florida

–

56

/

1

Louisiana

–

12

/

1

California

–

6

/

1

U

.

K

.

–

3

/

1

Malaysia

–

4

/

2

WASBU

17

%

OIBU

14

%

BRS Academy

2

%

Business

Unit

(*

%

of

FY10

Revenues)

Corporate

Region -

# of Aircraft / # of Bases

Joint

Venture

(No.

of

aircraft)

Key

Operated Aircraft

Bristow owns and/or operates

378 aircraft as of December 31,

2010

Affiliated Aircraft

Bristow affiliates and joint

ventures operate 196 aircraft

as of December 31, 2010

26 |

Aircraft Fleet –

Medium and Large

As of December 31, 2010

Next Generation Aircraft

Mature Aircraft Models

Medium capacity 12-16 passengers

Large capacity 18-25 passengers

Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

27

Medium Helicopters

AW139

12

Twin Turbine

7

4

11

-

Bell 212

12

Twin Turbine

3

22

25

-

Bell 412

13

Twin Turbine

40

46

86

-

EC155

13

Twin Turbine

4

-

4

-

Sikorsky S-76 A/A++

12

Twin Turbine

21

8

29

-

Sikorsky S-76 C/C++

12

Twin Turbine

51

25

76

3

126

105

231

3

Large Helicopters

AS332L Super Puma

18

Twin Turbine

30

-

30

-

Bell 214ST

18

Twin Turbine

3

-

3

-

EC225

25

Twin Turbine

15

-

15

3

Mil MI 8

20

Twin Turbine

7

-

7

-

Sikorsky S-61

18

Twin Turbine

2

-

2

-

Sikorsky S-92

19

Twin Turbine

23

1

24

3

80

1

81

6 |

Aircraft Fleet –

Small, Training and Fixed

As of December 31, 2010 (continued)

Next Generation Aircraft

Mature Aircraft Models

Small capacity 4-7 passengers

Training capacity 2-6 passengers

28

Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Small Helicopters

Bell 206B

4

Turbine

2

2

4

-

Bell 206 L-3

6

Turbine

5

6

11

-

Bell 206 L-4

6

Turbine

31

2

33

-

Bell 407

6

Turbine

44

1

45

-

BK 117

7

Twin Turbine

2

-

2

-

BO-105

4

Twin Turbine

2

-

2

-

EC135

7

Twin Turbine

6

3

9

-

AS350

4

Turbine

-

36

36

-

Agusta 109

8

Twin Turbine

-

3

3

-

92

53

145

-

Training Helicopters

AS355

4

Twin Turbine

3

-

3

-

Bell 206B

6

Single Engine

9

-

9

-

Robinson R22

2

Piston

11

-

11

-

Robinson R44

2

Piston

2

-

2

-

Sikorsky 300CB/Cbi

2

Piston

51

-

51

-

Fixed Wing

1

-

1

-

77

-

77

-

-

Fixed Wing

3

37

40

-

Total

378

196

574

9 |

EBITDA and EBITDAR Reconciliations

29

($ in millions)

2000

2001

2002

2003

2004

Income from continuing operations

$8.8

$27.9

$42.5

$40.3

$49.6

Income tax expense

3.8

13.3

19.1

17.5

18.5

Interest expense

18.5

18.4

15.8

14.9

16.8

Depreciation and amortization

32.0

33.1

33.9

37.5

39.4

EBITDA Subtotal

63.1

92.7

111.4

110.2

124.3

Aircraft rental expense

–

–

–

–

–

EBITDAR

$63.1

$92.7

$111.4

$110.2

$124.3

($ in millions)

2005

2006

2007

2008

2009

2010

Income from continuing operations

$49.2

$54.5

$72.5

$107.7

$125.5

$113.5

Income tax expense

$20.4

$14.7

$38.8

$44.5

$50.5

$29.0

Interest expense

$15.7

$14.7

$10.9

$23.8

$35.1

$42.4

Depreciation and amortization

40.5

42.1

42.5

54.1

65.5

74.7

EBITDA Subtotal

125.8

125.9

164.7

230.1

276.7

259.6

Aircraft rental expense

–

2.1

6.3

6.3

8.2

9.1

EBITDAR

$125.8

$128.0

$171.0

$236.4

$284.9

$268.7

March 31,

March 31,

($ in millions)

YTD FY10

YTD FY11

Income from continuing operations

$84.8

$102.1

Income tax expense

26.4

0.0

Interest expense

31.6

36.3

Depreciation and amortization

57.3

61.6

EBITDA Subtotal

200.2

200.0

Aircraft rental expense

7.0

4.4

EBITDAR

$207.2

$204.4

December 31, |

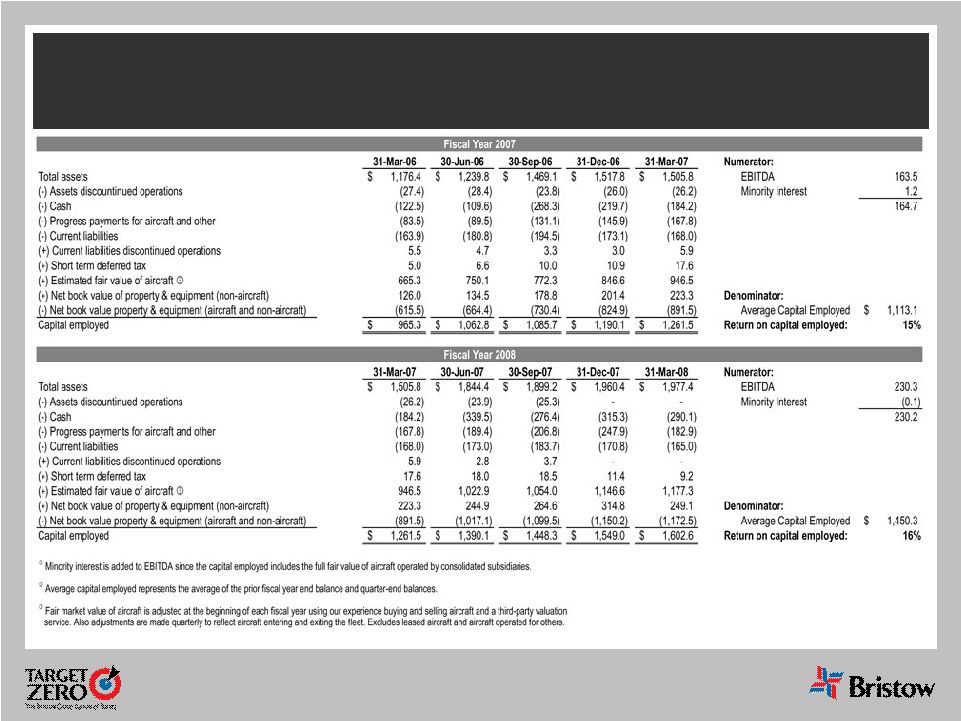

ROCE Reconciliation

30 |

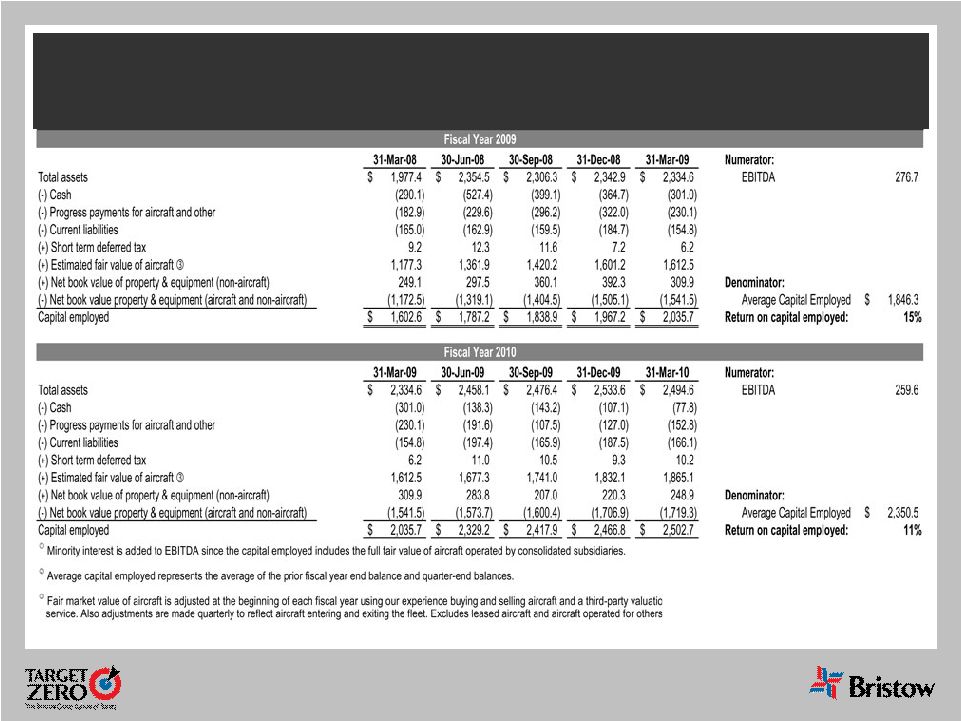

ROCE Reconciliation

31 |

ROCE Reconciliation

32 |

Leverage Reconciliation

33

Debt

Investment

Capital

Leverage

(a)

(b)

(c) = (a) + (b)

(a) / (c)

As of December 31, 2010

725.5

$

1,476.1

$

2,201.6

$

33.0%

Adjust for:

Unfunded Pension Liability

112.2

112.2

NPV of GE and Norsk Lease Obligations

42.6

42.6

Adjusted

880.3

$

(d)

1,476.1

$

2,356.4

$

37.4%

Calculation of debt to EBITDAR multiple

EBITDAR:

FY 2011

272.5

$

(e)

Annualized

363.4

$

= (d) / (e)

3.23:1 |

Bristow Group Inc. (NYSE: BRS)

2000 West Sam Houston Parkway South

Suite 1700, Houston, Texas 77042

t

713.267.7600

f

713.267.7620

bristowgroup.com/investorrelations

Contact Us

34 |