Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kraton Corp | d8k.htm |

Exhibit 99.1

SUPPLEMENT DISCLOSURE

February 2, 2011

Unless we indicate otherwise or the context requires:

| • | “Kraton,” “our company,” “we,” “our,” “ours,” and “us” refer to Kraton Polymers LLC and its consolidated subsidiaries; |

| • | “Kraton Capital” refers to Kraton Polymers Capital Corporation, a wholly owned subsidiary of Kraton Polymers LLC; |

| • | “Kraton Performance Polymers” and “Parent” refer to Kraton Performance Polymers, Inc.; and |

| • | the “SBC industry” refers to the elastomeric styrenic block copolymers industry and does not include the high styrene or rigid SBC business. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements made in this Supplement Disclosure contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. Forward-looking statements are often characterized by the use of words such as “believes,” “estimates,” “expects,” “projects,” “may,” “intends,” “plans” or “anticipates,” or by discussions of strategy, plans or intentions. Such forward-looking statements involve known and unknown risks, uncertainties, assumptions and other important factors that could cause the actual results, performance or our achievements, or industry results, to differ materially from historical results, any future results or performance or achievements expressed or implied by such forward-looking statements. There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained herein.

There may be other factors of which we are currently unaware or that we deem immaterial that may cause our actual results to differ materially from the expectations we express in our forward-looking statements. Although we believe the assumptions underlying our forward-looking statements are reasonable, any of these assumptions, and, therefore, also the forward-looking statements based on these assumptions could themselves prove to be inaccurate.

Forward-looking statements are based on current plans, estimates, assumptions and projections, and therefore you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update them publicly in light of new information or future events.

If any of these trends, risks, assumptions or uncertainties actually occurs or continues, our business, financial condition or operating results could be materially adversely affected, the trading prices of our securities could decline and you could lose all or part of your investment. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Recent Developments

Expected 2010 Results. We currently expect that our fourth quarter 2010 revenue will be between $285.0 million and $290.0 million and accordingly expect our full-year 2010 revenue to be between $1,225.3 million and $1,230.3 million. We currently expect that our fourth quarter 2010 net income will be between $10.0 million and $11.0 million and Adjusted EBITDA will be between $34.0 million and $35.0 million, and accordingly, expect our full year 2010 net income to be between $96.4 million and $97.4 million and Adjusted EBITDA to be between $194.6 million and $195.6 million. Adjusted EBITDA includes the spread between the first-in, first-out (FIFO) basis of accounting and the estimated current replacement cost basis, which is expected to result in a negative impact to Adjusted EBITDA of approximately $5.5 million to $6.0 million in the fourth quarter of 2010 compared to a positive impact of $13.3 million in the fourth quarter of 2009 and a positive impact of approximately $14.2 million to $14.7 million for our full year 2010 compared to a negative impact of $17.6 million for our fiscal year 2009. We present Adjusted EBITDA as a supplemental measure of our performance and because we believe it provides additional and helpful information to investors and other interested parties evaluating our performance. We prepare Adjusted EBITDA by adjusting EBITDA to eliminate the impact of a number of items we do not consider indicative of our ongoing operating performance.

We can give no assurance that our outlook for any of the metrics disclosed above will prove to be correct. Estimates of results are inherently uncertain and subject to change. Actual results remain subject to the completion of management’s and the audit committee’s review, as well as the year-end audit by our registered independent public accountants.

2

General

Our Company

We believe we are the world’s leading producer of styrenic block copolymers (SBCs) as measured by 2009 sales revenue. We market our products under the widely recognized Kraton® brand. SBCs are highly-engineered synthetic elastomers that we invented and commercialized over almost 50 years ago, which enhance the performance of numerous end use products, imparting greater flexibility, resilience, strength, durability and processability. We focus on the end use markets we believe offer the highest growth potential and greatest opportunity to differentiate our products from competing products. Within these end use markets, we believe that we provide our customers with a broad portfolio of highly-engineered and value-enhancing polymers that are critical to the performance of our customers’ products. We seek to maximize the value of our product portfolio by introducing innovations that command premium pricing and by consistently upgrading from lower margin products. As the industry leader, we believe we maintain significant competitive advantages, including an almost 50-year proven track record of innovation; world-class technical expertise; customer, geographical and end use market diversity; and industry-leading customer service capabilities. These advantages are supported by a global infrastructure and a long history of successful capital investments and operational excellence.

Our SBC products are found in many everyday applications, including disposable baby diapers, the rubberized grips of toothbrushes, razor blades, power tools and in asphalt formulations used to pave roads. We believe that there are many untapped uses for our products, and we will continue to develop new applications for SBCs. We also develop, manufacture and market niche, non-SBC products that we believe have high growth potential, such as isoprene rubber latex, or IRL. IRL is a highly-engineered, reliable synthetic substitute for natural rubber latex. We believe the versatility of IRL offers significant opportunities for new, high-margin applications. Our IRL products, which are used in applications such as surgical gloves and condoms, have not been found to contain the proteins present in natural latex and are, therefore, not known to cause allergies. We believe we produce the highest purity IRL globally and that we are the only significant third-party supplier of the product. Our IRL business has grown at a compound annual growth rate of 28.8%, based on revenues, from 2007 to 2009.

We currently offer approximately 800 products to more than 700 customers in over 60 countries worldwide, and we manufacture our polymers at five manufacturing facilities on four continents, including our flagship plant in Belpre, Ohio, the most diversified SBC plant in the world. The plant in Japan is operated by an unconsolidated manufacturing joint venture. Our products are typically developed using our proprietary, and in many cases patent-protected, technology and require significant engineering, testing and certification. In 2010, we were awarded 81 patents for new products or applications and at December 31, 2010, we had approximately 1,053 granted patents and approximately 349 pending patent applications. We are widely regarded as the industry’s leading innovator and cost-efficient manufacturer in our end use markets. We work closely with our customers to design products that meet application-specific performance and quality requirements. We expect these innovations to drive our organic growth, sustain our leadership position, expand our market share, improve our margins and produce a high return on invested capital. For example, in 2008, we developed a family of environmentally-friendly products as an alternative to materials like polyvinyl chloride, or PVC, for medical packaging applications and wire and cable applications in electronics and automobiles.

Over the past several years, we have implemented a range of strategic initiatives designed to enhance our profitability and end use market position. These include fixed asset investments to expand our capacity in high value products, to enhance productivity at our existing facilities and to significantly reduce our fixed cost structure through head count reductions, system upgrades and closure of our high-cost facility in Pernis, the Netherlands. During this period, we have shifted our portfolio to higher-margin products, substantially exited

3

low-margin businesses such as footwear and implemented smart pricing strategies that have improved our overall margins and return on invested capital. We believe these initiatives provide us with a strong platform to drive growth, create significant operating leverage and position us to benefit from volume recovery in our end use markets.

We believe that starting in late 2008 the global economic downturn, and associated reduction in customer and end-user inventory levels, caused an unprecedented slowdown across the industry. We experienced a decline in sales volume across all of our end use markets, including the traditionally more stable consumer and medical applications. We believe that a significant factor in this decline was inventory de-stocking. Our first and second quarter 2009 sales volumes were 39% and 24%, respectively, less than our sales volumes in the comparable 2008 quarters. The trend began to reverse itself in June 2009, as demand patterns began to shift towards recovery such that our third quarter 2009 sales volume was 10% less than the sales volume in the third quarter of 2008 and our fourth quarter 2009 sales volume was 16% above the sales volume in the fourth quarter of 2008. More recently, we have seen demand returning to more normal levels, with first nine months 2010 sales volume up 20.4% compared to the first nine months of 2009.

Corporate History

Prior to February 28, 2001, we operated as a number of business units as a part of Shell Chemicals and did not exist as a stand-alone entity. On February 28, 2001, Ripplewood Chemical Holding LLC, or Ripplewood Chemical, acquired us from Shell Chemicals through a master sale agreement. On December 23, 2003, Polymer Holdings acquired all of Kraton’s outstanding equity interests from Ripplewood Chemical. Prior to the initial public offering and related reorganization transactions described below, we were an indirect wholly-owned subsidiary of TJ Chemical Holdings LLC, or TJ Chemical, and were indirectly owned by TPG and JPMP, and certain members of our management.

Initial Public Offering

Our business is conducted through Kraton and its consolidated subsidiaries. Prior to its initial public offering, Kraton’s parent company was Polymer Holdings LLC, a Delaware limited liability company. On December 16, 2009, Polymer Holdings was converted from a Delaware limited liability company to a Delaware corporation and renamed Kraton Performance Polymers, Inc., which remains Kraton’s parent company. In addition, prior to the closing of the initial public offering, TJ Chemical was merged into (and did not survive the merger with) Kraton. Trading in the common stock of Kraton Performance Polymers on the New York Stock Exchange commenced on December 17, 2009 under the symbol “KRA.” On December 22, 2009, Kraton Performance Polymers completed the initial public offering. Including 887,082 shares issued on January 7, 2010 following the exercise of the underwriters’ over-allotment option, the aggregate shares issued in connection with the initial public offering amounted to 11,181,200 shares, at a price of $13.50 per share, and the net proceeds after the underwriting discounts and commissions and fees and expenses amounted to approximately $137.4 million. We used $100.0 million of the net proceeds to prepay outstanding indebtedness, approximately $7.7 million for strategic capital projects, such as alternative production capabilities for IR, the development of additional capacity in our IRL business, continuation of our upgrade of certain systems and operating controls at our Belpre, Ohio facility, and approximately $29.7 million for general corporate purposes. Except with respect to proceeds used to repay debt, the foregoing amounts reflect reasonable estimates of our use of the net proceeds of the offering.

Secondary Public Offering

On September 29, 2010, two of our affiliates, TPG and JPMP, completed a public offering of 8,000,000 shares of Kraton Performance Polymers common stock. Including 1,200,000 shares of common stock sold on October 4, 2010, following the full exercise of the underwriters’ option to purchase additional shares to cover over-allotments, the aggregate shares sold by the affiliates of TPG and JPMP in the secondary public offering

4

was 9,200,000 shares, at a price of $26.50 per share. We did not receive any proceeds from the offering, and the total number of shares of common stock outstanding did not change as a result of this offering. Following the secondary public offering, TPG owned approximately 19.21% of common stock and JPMP owned approximately 12.81% of common stock, and together TPG and JPMP own approximately 32.02% of common stock.

Our Competitive Strengths

We believe the following competitive strengths help us to sustain our market leadership position and contribute to our ability to generate superior margins and strong cash flow. We expect these strengths to support our growth in the future:

The Market Leader in SBCs

We believe we hold the number one global market position, based on 2009 sales revenue, in each of our four core end use markets, with sales of approximately $920.4 million and sales volumes of approximately 260.3 kilotons, excluding by-products, for the year ended December 31, 2009. We generated approximately 96% of our 2009 product sales revenue in our core end use markets. Our Belpre, Ohio facility is the most diversified SBC plant in the world, and we believe our Wesseling, Germany, facility is world scale and cost efficient. As the pioneer of SBCs over almost 50 years ago, we believe our Kraton® brand is widely recognized for our industry leadership, and we are particularly well regarded for our process technology expertise and long track record of market-driven innovation.

Growth Through Innovation and Technological Know-how

SBC production and product development require complex and specific expertise, which we believe many of our competitors are unable to replicate. As the industry pioneer, Kraton maintains a constant focus on enhancing the value-added attributes of our products and on developing new applications for SBCs. At December 31, 2010, we had approximately 1,053 granted patents and approximately 349 pending patent applications. Our “Vision 20/20” program targets generating 20% of sales revenues from new products or applications introduced in the prior five years. In 2009 and for the nine months ended September 30, 2010, we generated 12.4% and 13.0%, respectively, of our sales from innovation driven revenue. We believe that our new product innovation will allow us to drive increases in our volume, expand unit contribution margins and increase our customers’ reliance on Kraton’s products and technical expertise. For example, for the twelve months ended December 31, 2009, our Emerging Businesses end use market, which includes IR and IRL, represented 7.0% of sales revenues. Furthermore, our IRL business has grown at a compound annual growth rate of 28.8%, based on sales revenues, from 2007 to 2009 and is earning a unit contribution margin in excess of the company as a whole.

Diverse Global Manufacturing Capabilities and End Use Market Exposures

We operate manufacturing facilities on four continents producing what we believe to be the highest quality grades available of USBCs, HSBCs, and high purity IRL. We believe we are the only SBC producer with this breadth of technical capabilities and global footprint, selling approximately 800 products in over 60 countries. Since 2003, we have successfully completed plant expansions totaling 60 kilotons of capacity at a total cost of less than $50 million, giving us a total capacity of approximately 420 kilotons. Our manufacturing and product footprint allow revenue diversity, both geographically and by end use market. We believe our scale and footprint make us an attractive customer for our monomer suppliers, which in turn, allows us to offer a high degree of supply security to customers.

5

|

|

|

Source: Management Estimates

Long Standing, Strong Customer Relationships Supported by Leading Service-Offering

We sell our products to over 700 customers, many of which we have had relationships with for 15 years or more. Our customers are broad-based, with no single customer accounting for more than 5% of our sales revenue in 2009 (our top 10 customers represented 26% of sales revenue in 2009). Our customers’ manufacturing processes are typically calibrated to the performance specifications of our products. Given the technical expertise and investment required to develop these formulations and the lead times required to replace them, we believe our customers face high switching costs. We believe our customers view our products as being high value-added, even though our products generally represent a small proportion of the overall cost of the finished product. Leveraging our global infrastructure, we believe we offer our customers a best-in-class service level that aligns us to their respective business models, through “on demand” order delivery and product development specifically designed for each customer’s needs.

Experienced Management Team with a Track Record of Growth and Productivity Improvements

Our senior management team has an average industry experience of approximately 25 years, most of which has been with some of the world’s leading companies, including Koch Industries, Hoechst AG and Chevron Phillips Chemical. Since early 2008, when the current executive team was put in place, we have instituted a number of strategic initiatives designed to enhance productivity, reduce costs and capital intensity, expand margins and drive innovation-led growth.

Our Business Strategy

Building on these competitive strengths, we are focused on achieving profitable top-line growth and improving margins through the introduction of highly-engineered, high value-added products to drive strong and sustainable cash flow.

Drive Growth and Margin Expansion Through Innovation

We have an almost 50-year track record of innovation dating back to our development of the first SBCs. Our research and development effort is focused on end use markets and new product developments that we believe offer high growth as well as opportunities to develop highly-differentiated products for our customers, thus yielding higher margin potential. We work very closely with our long standing customer base to produce

6

products that address their specific technical requirements. For example, to address an industry trend to provide an alternative to PVC in applications such as medical packaging and wire and cable, we have developed and commercialized a series of custom-designed polymers and compounds. In addition to this innovation-led growth, we believe that there are a number of end use market dynamics that will also drive growth in our business such as the general demand by customers for higher value-added product performance characteristics.

Pursue “Smart Pricing”

In late 2007, we undertook a comprehensive review of our entire product portfolio, including both product-specific and customer-specific profitability analyses. As a result, we took a variety of actions including reducing or eliminating our exposure to lower margin business and increasing our prices to reflect the significant value-added benefits of our products to our customers’ products. For example, since the end of 2007, we have increased our unit contribution margins by approximately 50%. We will continue to pursue pricing strategies that reflect the contribution to the end product of our high value and complex product offerings for which limited substitutes exist.

Invest in Key Growth Initiatives

We expect 2010 capital expenditures will be approximately $55.0 million. Included in our 2010 capital expenditure estimate is approximately $9.0 million for the second phase of the Belpre systems and control upgrades, approximately $13.0 million to replace IR production from our Pernis facility, approximately $5.0 million for the IRL expansion and approximately $5.0 million for building upgrades at our Belpre facility. Through the nine months ended September 30, 2010, capital expenditures were $32.3 million.

Continue to Pursue Operational Efficiencies

We have a history of implementing continuous process and cost improvement plans that have resulted in a significant reduction in our cost position and an improvement in the way we run our business. Since the beginning of 2007, we have implemented cost saving initiatives that have reduced costs by over $55 million, on an annual basis. For example, these initiatives include (i) programs to streamline our operations and lower staffing levels reducing our costs by approximately $25 million, (ii) the shutdown of SIS production in our Pernis facility in 2008 resulting in annual cost savings of $10 million, (iii) ERP related cost reductions resulting in annual savings of $5 million. In addition, as of December 31, 2009 we shut down IR production in our Pernis facility, which we expect will result in annual cost savings of approximately $12.0 million beginning in January 2010.

In connection with the exit from Pernis, we incurred approximately $11.0 million in asset retirement obligations, restructuring costs and write-downs during 2009. Prior to the exit, we manufactured IR at the Pernis facility. We are transferring IR production to our Belpre, Ohio, facility at an estimated capital cost of $27.0 million. We currently expect this project will be completed by mid-2011. We plan to satisfy customer demand for IR with inventory currently on hand and we believe the cash flow from the sale of IR inventory will likely mitigate a significant portion of the cash requirements for the alternative capacity.

Through these actions, we have created substantial operating leverage in our business model. We believe this demonstrates our management team’s ability to successfully manage the business in a downturn and position us for significant growth and margin expansion in a global economic recovery.

7

New Innovations

In 2010, we announced the following product innovations.

Consistent with our strategy, we believe that we continue to lead SBC innovation as evidenced by numerous developments announced across several of our core end use markets throughout the nine months ended September 30, 2010. Below are our most recently announced product innovations.

| • | In August 2010, we announced that our roof coating formulation containing Kraton G1643 exceeds requirements in the ASTM International D6083 standard specification recognized in the elastomeric roof coating market. ASTM D6083 is an industry standard that establishes minimum performance levels in the following areas: viscosity, weight and volume solids; mechanical properties; adhesion; low temperature flexibility after accelerated weathering; tear resistance; permeation and water swelling; and fungi resistance. This gives innovators an opportunity to more effectively compare polymer-to-polymer for roof coating formulations. This SBC-based polymer has a proven track record of improving the performance of roof coatings because it adds superior water resistance, improved adhesion, and increased elongation to formulations. It can be used to help lower volatile organic compounds (VOCs) in a solvented formulation, which have significant vapor pressures that can affect the environment and human health. In addition, our tested formulation can be used under the EPA’s regulation for thermoplastic rubber coatings and mastic. A roof coating formulation containing Kraton G1643 can reduce total cost of installation and provide fast cure coatings that will work better in cold, humid, or wet conditions. Elastomeric roof coatings made with Kraton polymers will stand up better to ponding water, and provide excellent adhesion to all types of roofing substrates. Roof coatings made with Kraton G1643 are an excellent choice for low slope roofs, or high traffic areas, and will provide excellent reflectance to reduce energy costs, and extend the life of the roof. |

| • | In July 2010, we announced the addition of Kraton D1183 BT, a new SIS grade, to our line of polymers for use in applications where softness, ease-in-processing, and high temperature resistance are essential. Kraton D1183 BT is suitable for use in many adhesive applications including thermal printing labels, high temperature resistant labels, elastic labels and diaper tabs. It is an excellent choice for adhesives in hygiene applications and its shear strength is particularly good at 37 degrees Celsius. Moreover, it offers economically attractive adhesive formulations, and gives formulators the ability to dilute it further to obtain equivalent performance levels of competing products, which can result in cost-savings. It can also achieve significantly higher cohesive strength and higher temperature resistance without the use of expensive endblock resins. Therefore, Kraton D1183 BT is not only economically attractive, but also substantially stronger and offers a wider formulating space. Prior to the commercialization of Kraton D1183 BT, innovators used low-coupled SIS block copolymers to impart softness to end-products. Although they offered improved adhesion on open and porous substrates and good label die-cutting performance, they often lacked cohesion, which hampered their use in applications where higher shear and temperature resistance was required. In comparison, Kraton D1183 BT is a 40% diblock SIS, which shows superior performance to low-coupled SIS block copolymers and is therefore the polymer of choice for these applications. |

| • | In May 2010, we announced the addition of DX405 to our product line of polymers for Adhesives, Sealants, and Coatings. This technology will allow our customers to more efficiently and expediently manufacture products that are stronger and softer. DX405 has a low styrene content, which promotes ease of processing, low viscosity, and the attainment of lower application temperatures. This adds efficiency and simplification to the manufacturing process, which shortens batch times, increases extrusion rates and improves productivity. DX405 has a wide formulation window and its versatility makes it suitable for solvent-based compositions, hot melt adhesives, and sealant applications. It can be formulated with other polymers, resins, fillers, pigments, oils, thickeners, waxes and stabilizers to obtain a desired balance of properties. |

8

Products

Our Kraton polymer products are high performance elastomers, which are engineered for a wide range of end use applications. Our products possess a combination of high strength and low viscosity, which facilitates ease of processing at elevated temperatures and high processing speeds. Our products can be processed in a variety of manufacturing applications, including injection molding, blow molding, compression molding, extrusion, hot melt and solution applied coatings.

We offer our customers a broad portfolio of products that includes approximately 200 core commercial grades of SBCs. We believe that the diversity and depth of our product portfolio is unmatched in the industry, serving the widest set of applications within each end use.

While we organize our commercial activities around our four core end uses, we manufacture our products along five primary product lines based upon polymer chemistry and process technologies: (1) USBCs; (2) HSBCs; (3) IR; (4) IRL; and (5) Compounds. The majority of worldwide SBC capacity is dedicated to the production of USBCs, which are primarily used in the Paving and Roofing, Adhesives, Sealants and Coatings and Footwear end use applications. HSBCs, which are significantly more complex and capital-intensive to manufacture than USBCs, are primarily used in higher value-added end uses, including soft touch and flexible materials, personal hygiene products, medical products, automotive components and certain adhesives and sealant applications. The following product summaries highlight our portfolio of product grades, their key performance characteristics and selected applications:

HSBCs. We developed the first HSBC polymers in the late 1960s for use in production of soft, strong compounds for handles and grips and elastic components in diapers. As of December 31, 2010, our HSBC product portfolio includes approximately 106 commercial grades of products. Our technical expertise in HSBC manufacturing and our history of HSBC innovation have led to what we believe is a number one market share of HSBC sales in terms of industry sales revenue. HSBC products are significantly more complex to produce than USBC products and, as a result, generally command selling prices that are significantly higher than those for USBCs and generate higher margins. Sales of HSBC products comprised 34%, 31% and 32% of our total sales revenue (which excludes by-product sales) in 2009, 2008 and 2007, respectively, and 30.0% and 32.0% for the three and nine months ended September 30, 2010, respectively.

HSBC products impart higher performance characteristics than USBC products including: color range and stability; resistance to ultraviolet light; processing stability and viscosity; and elevated temperature resistance. HSBCs are primarily used in our Advanced Materials and our Adhesives, Sealants and Coatings end use markets to impart improved performance characteristics such as: (1) stretch properties in disposable diapers and adult incontinence products; (2) soft feel in numerous consumer products such as razor blades, power tools and automobile internals; (3) impact resistance for demanding engineering plastic applications; (4) flexibility for wire and cable plastic outer layers; and (5) improved flow characteristics for many industrial and consumer sealants lubricating fluids.

USBCs. We developed the first USBC polymers in 1964. Our flagship Belpre, Ohio site, the first dedicated block copolymer plant, was built in 1971. As of December 31, 2010, our USBC product portfolio includes approximately 146 commercial grades of products. We believe we hold the number one market share of USBC sales, excluding footwear, in terms of industry sales revenue. USBC comprised 66%, 69% and 68% of our total sales revenue (which excludes by-product sales) in 2009, 2008 and 2007, respectively, and 70.0% and 68.0% for the three and nine months ended September 30, 2010, respectively.

USBCs are used in all our end use markets in a range of products to impart desirable characteristics, such as: (1) resistance to temperature and weather extremes in roads and roofing; (2) resistance to cracking, reduced sound transmission and better drainage in porous road surfaces; (3) impact resistance for consumer plastics; and (4) increased processing flexibility in adhesive applications, such as packaging tapes and labels, and materials used in disposable diapers. As with SBCs in general, USBCs are most often blended with substrates to impart the aforementioned performance enhancements. We made the strategic decision to largely exit the less attractive footwear market and focus our resources on the greater value proposition offered by the remaining end uses for our USBC products.

9

IR. Isoprene Rubber (formed from polymerizing isoprene) is a line of high purity isoprene rubber products and is a non-SBC product. These products combine the key qualities of natural rubber, such as good mechanical properties and hysteresis, with superior features such as high purity, excellent clarity, good flow, low gel content, no nitrosamines and no natural rubber proteins. Our IR polymers are available as bales of rubber or as latex. IR polymers are useful in the production of medical products, adhesives, tackifiers, paints, coatings and photo-resistors. We include IR in our USBC product line.

IRL. Isoprene Rubber Latex (emulsion of IR in water) is a substitute for natural rubber latex, particularly in applications with high purity requirements, such as medical, healthcare, personal care and food contact operations. Our IRL is unique polyisoprene latex with controlled structure and low chemical impurity levels manufactured through an anionic polymerization process followed by a proprietary latex processing step, both of which were developed by us. IRL is durable, tear resistant, soft, transparent and odorless. In addition, the synthetic material has unparalleled consistency, and it is non-allergenic, providing a distinct property advantage over natural rubber latex. We include IRL in our USBC product line.

Compounds. Our Compounds are a mixture of Kraton polymers and other polymers, resins, oils or fillers to enhance the final properties for processing. Compounds cover a wide range of polymers tailored to meet specific customer needs in consumer and industrial applications. Compounds can be formulated so that they can be extruded, injection molded, foamed, etc. to meet the final application requirements. These products are primarily used in soft-touch grips, sporting equipment, automotive components and personal care products. Compounds comprised 3.0%, 3.0% and 3.0% of our total sales revenue in 2009, 2008 and 2007, respectively, and 2.3%, and 2.4% for the three and nine months ended September 30, 2010, respectively. Compounds are included in our USBC and HSBC product lines, as appropriate.

10

Our End Use Markets

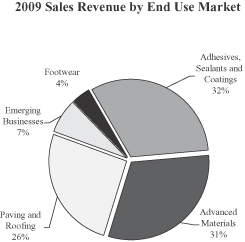

We have aligned our commercial activities to serve four core end use markets that we believe have the highest growth and profitability potential: (1) Advanced Materials; (2) Adhesives, Sealants and Coatings; (3) Paving and Roofing; and (4) Emerging Businesses. The following table describes our four core end use markets and other end use markets, and their approximate relative sizes:

| End Use Markets |

Revenue Mix (1) |

Our End Use Market Position (2) |

Our End Use Market Share (2) |

Our Relative End Use Market Share (3) |

Industry Compound Annual Growth Rate (4) |

Selected Applications/Products | ||||||||||||||||

| Advanced Materials |

31 | % | #1 | 36 | % | 2.0X | 7.4 | % | • Soft touch for consumer products (tooth brushes and razor blades) and power tools • Impact resistant engineering plastics • Automotive components • Elastic films for disposable diapers and adult incontinence branded products • Skin care products and lotions • Disposable food packaging • Medical packaging films and tubing, often as alternatives to PVC | |||||||||||||

| Adhesives, Sealants and Coatings |

32 | % | #1 | 34 | % | 1.9X | 5.9 | % | • Tapes and labels • Non-woven and industrial adhesives • Industrial and consumer weather sealants | |||||||||||||

| Paving and Roofing |

26 | % | #1 | 24 | % | 1.6X | 6.5 | % | • Asphalt modification for performance roadways • Asphalt modification for roofing felts and shingles | |||||||||||||

| Emerging Businesses (5) |

7 | % | N/A | N/A | N/A | 26.8 | % | • Surgical gloves • Condoms | ||||||||||||||

| Other Markets (6) |

4 | % | N/A | N/A | N/A | N/A | • Lubricants and fuel additives • High styrenics packaging • Footwear | |||||||||||||||

| (1) | Based on 2009 sales of $920.4 million (excludes by-product sales which are reported as other revenues). |

| (2) | Management estimates, based on 2009 sales. |

| (3) | Management estimates, versus next largest competitor based on 2009 sales. |

11

| (4) | Management estimates of volume growth, 2001 to 2009, except for Emerging Businesses, which is 2005 to 2009. |

| (5) | The Emerging Businesses end use market includes our IR and IRL business. We believe that we are the only major third-party supplier of IR and IRL, and therefore end use market position, end use market share and relative end use market share metrics are not meaningful. |

| (6) | Our Other Markets end use market is not directly comparable to our four core end use markets because it includes a mix of products ranging from lubricants and fuel additives to high styrenics packaging to footwear products. Therefore, we cannot estimate end use market position, end use market share, relative end use market share or industry compound annual growth rate. |

Advanced Materials. Through sales of HSBC, USBC and IR products, as well as certain compounded products, we maintain a leading position in the global Advanced Materials end use market.

In the Advanced Materials end use market, our products compete against a wide variety of chemical and non-chemical alternatives, including thermoplastic vulcanizates, ethylene propylene diene monomer rubber, known as EPDM, thermoplastic polyolefin elastomers and thermoplastic polyurethanes, known as TPUs. The choice between these materials is influenced by performance characteristics, ease of use, desired aesthetics and total end-product cost. In addition, competing materials include spandex, natural rubber, polyvinyl chloride polymers and compounds, polyolefins, polyethylene terephthalate, known as PET, nylon and polycarbonate, based on performance, ease of use, desired aesthetics and total end-product cost.

Advanced Materials polymers and compounds from Kraton are used in a range of diverse applications, many of which require customized formulations, product testing with long lead time approvals, and production evaluations for specific end use customers and applications. As such, customer loyalty tends to be strongest in this end use market, helped in part by the fact that many of the applications are patent protected. The degree of complexity in the manufacturing of these products and the attractive value proposition for our customers drives higher sustainable margins for this end use market.

We believe our Advanced Materials’ growth is driven by customers’ desire for improved product flexibility and resilience, impact resistance, moisture resistance and aesthetics (clarity and feel) in consumer products, medical products, packaging and automotive components. In addition, due to health and recycling (or “green”) concerns, one trend that is particularly a focus for our company is in providing alternative solutions to PVC in a number of demanding medical (blood and intravenous bags, tubes and stoppers) and electronic (wire and cable outer layer) applications.

A differentiating driver for our expected Advanced Materials’ growth is our unique ability to design and manufacture certain custom compound formulations. One specific example is Kraton compounds that provide critical stretch performance for the infant care (diaper) and adult incontinence markets.

Revenue from Advanced Materials represented 31%, 30% and 32% of total sales revenue (which excludes by-product sales) in 2009, 2008 and 2007, respectively, and 27.5% and 30.1% for the three and nine months ended September 30, 2010, respectively.

Adhesives, Sealants and Coatings. Through sales of HSBC, USBC and certain IR products, we continue to hold a leading position in the global Adhesives, Sealants and Coatings end use market.

In the Adhesives, Sealants and Coatings end use market, SBC products primarily compete with acrylics, silicones, solvent-based rubber systems and thermoplastic polyolefin elastomers. The choice between these materials is influenced by bond strength, specific adhesion, consistent performance to specification, processing speed, hot-melt application, resistance to water and total end-product cost.

12

Our Adhesives, Sealants and Coatings polymers are used in a number of demanding applications such as: adhesives for diapers and hygiene products; sealants for construction and automotive applications; and adhesives for tapes and labels. Our coatings polymers have expanded into the high growth market of elastomeric white roof coatings. The coating provides not only weather resistance but improved energy efficiency reducing solar absorption on bitumen based industrial roofs. We expect our growth to be supported by the continuing substitution of adhesives for mechanical fastening systems and the growing demand within developing countries for disposable hygiene products that contain adhesives and sealants.

Another significant growth application for our SBCs is for tapes and labels. In both solvent-based and hot-melt forms, Kraton SBCs impart water resistance, color stability, strong bonding characteristics, high cohesive strength, good ultraviolet light resistance, heat stability and long shelf life. Specifically, the pressure sensitive label market continues to expand using SBC technology at the expense of paper labels, driven by cost reduction and higher consumer market appeal. In addition, our SBCs’ compatibility with many other formulating ingredients and their suitability for hot-melt systems are major factors in demand growth. Furthermore, we believe our blend of new styrene-isoprene-butadiene-styrene (SIBS) and styrene-butadiene-styrene (SBS) polymers with rosin ester tackifying resins can produce a tape with properties similar to a traditional styrene-isoprene-styrene (SIS) hydrocarbon resin formulation, but with cost savings of 10% to 20%. We have expanded our offering of formulated compounds for adhesive films that protect LCD panels and consumer appliances providing improved adhesive performance with no residue or haze after removal. Both applications are growing rapidly in Asia and South America as SBC based technology penetrates preferentially versus acrylic based films. In 2008, we largely exited the increasingly commoditized portions of the tape and label business, choosing to refocus our development and manufacturing capacity on higher value-added and more proprietary products. Our history of innovation in the Adhesives, Sealants and Coatings end use market has allowed us to capitalize on our unique product offerings, significantly enhancing the value of this end use market to the business.

Revenue from Adhesives, Sealants and Coatings represented 32%, 32% and 31% of total sales revenue (which excludes by-product sales) in 2009, 2008 and 2007, respectively, and 32.2% and 32.4% for the three and nine months ended September 30, 2010, respectively.

Paving and Roofing. Through sales of primarily USBC products, we maintained a leading market position in 2009 of the global asphalt modification SBC industry.

We believe that our sales into the Paving and Roofing end use market will see meaningful growth driven by an overall volume recovery to a level more in line with historical norms, improvement in roofing demand including re-stocking of depleted roofing supply chains, continued penetration of polymer modified road surfaces, and the impact of government programs associated with infrastructure spending in the United States and Europe. In the United States specifically, the American Recovery and Reinvestment Act of 2009 provides $6.9 billion in 2010 for incremental Federal Highway Administration funding (25% of the $27.5 billion in total committed to highway construction). We believe that the American Recovery and Reinvestment Act of 2009 could yield additional demand for our products.

The addition of our SBS in asphalt greatly improves the strength and elasticity of asphalt-based paving compositions over an extended temperature range, thus increasing resistance to wear, rutting and cracking. In roofing applications, SBS-modified asphalt produces stronger and more durable felts and shingles, thus reducing the possibility of damage from weather, ice and water build-up and again extending service life.

We believe our growth in the Paving and Roofing end use market will benefit from new products we have recently introduced, and those that are currently under development, to respond to industry trends for elevated polymer content roads and surfaces, over-lay compatibility with concrete systems, and general environmental awareness (for example, road construction emissions).

13

Revenue from Paving and Roofing represented 26%, 31% and 30% of total sales revenue (which excludes by-product sales) in 2009, 2008 and 2007, respectively, and 33.1% and 29.8% for the three and nine months ended September 30, 2010, respectively.

Emerging Businesses. We use this end use to commercialize and manage innovations that are outside of our current end use organizational structure. For example, IR is a line of high purity isoprene rubber products that combines the key qualities of natural rubber, such as good mechanical properties and hysteresis, with superior features such as high purity, excellent clarity, good flow, low gel content, no nitrosamines and no natural rubber proteins. IR polymers in general are used in high volume, lower value-added applications such as tire rubber. However, we focus our unique IR polymers, produced using state-of-the-art nanotechnology, in more demanding applications such as medical products, adhesives and tackifiers, paints, coatings and photo-resistors. Approximately half of our current IR production is converted into IRL (emulsion of IR in water), a substitute for natural rubber latex, particularly in applications with high purity requirements, such as medical, healthcare, personal care and food contact applications. IRL is durable, tear resistant, soft, transparent and odorless. Most importantly, IRL is non-allergenic for both doctor and patient, providing a distinct property advantage over natural rubber latex.

IRL is predominately used in the synthetic surgical gloves and condoms markets. Our IRL business has grown at a compound annual growth rate of 28.8%, based on revenues, from 2007 to 2009. The combination of increasing demand, favorable market dynamics and competitive differentiation make this a key product offering for us. We currently anticipate growth to continue for the foreseeable future, and will likely need to add capacity to our global supply system.

In addition to IRL, we believe we have a robust portfolio of innovations at various stages of development and commercialization that we believe will fuel our future growth. One such example is our Nexar™ family of membrane polymers for water filtration and breathable fabrics.

Revenue from Emerging Businesses represented 7%, 3% and 2% of total sales revenue (which excludes by-product sales) in 2009, 2008 and 2007, respectively, and 5.8% and 5.5% for the three and nine months ended September 30, 2010, respectively.

Research, Development and Technology

Our research and development program is designed to develop new products and applications, provide technical service to customers, develop and optimize process technology and assist in marketing new products. We spent $20.4 million, $26.4 million and $24.0 million for research and development for the years ended December 31, 2009, 2008 and 2007, respectively. From time to time, we also engage in customer-sponsored research projects, with spending of approximately $1.0 million a year for the three-year period ended December 31, 2009. As of December 31, 2009, approximately 94 personnel are dedicated to this critical business activity.

Our research and development activities are primarily conducted in laboratories in Houston, Texas and Amsterdam, the Netherlands. We also own a laboratory in Paulinia, Brazil, that provides technical services to our South American customers. Our application and technical service laboratories in Shanghai, China and Tsukuba, Japan provide support to our Asian customers. In addition, we have technical service staff located in Mont St. Guibert, Belgium.

Our experienced, knowledgeable professionals perform product research using extensive scientific application equipment located at our Houston and Amsterdam research and development facilities. Our Houston laboratory also includes a comprehensive pilot plant for a number of uses. In early 2009, we moved into a new Houston research and technology service facility. The new facility is expected to yield cost savings when compared with our previous facilities leased at Shell Chemicals’ Westhollow location in Houston. The new

14

facility is designed specifically to enhance the effectiveness of our research and technology service team. At both of our major research and development facilities, we produce new Kraton product samples for our customers and provide guidance to our manufacturing organization. In addition, we also use our pilot plant to test new raw materials and new process technologies in order to improve the manufacturing performance of our products. Application equipment is used in all of our research and technical service labs to evaluate polymers and compounds to determine optimal formulations.

Since the introduction of SBCs in the mid-1960s, we have experienced strong demand for the development of new products that utilize the enhancing properties offered by our polymers. We believe we have a strong new product pipeline to take advantage of many new opportunities. As a proven product innovator, we will continue to employ our product knowledge and technical expertise to provide application-based solutions for our customers’ highly specialized needs. This can include modifications to current products as well as significant new innovations aimed at displacing more expensive, less efficient product solutions in the marketplace.

Sales and Marketing

Our business is predominantly based on a short sales cycle. We sell our products through a number of channels including a direct sales force, marketing representatives and distributors. The majority of our products are sold through our direct sales force. In countries where we generate substantial revenues, our sales force is organized by end use market in order to meet the specific needs of our customers. In geographic areas where it is not efficient for us to organize our sales force by end use market, we may use one sales team to service all end use markets.

In smaller markets, we often use marketing representatives who act as independent contractors to sell our products. In addition, we use distributors to service our smaller customers in all regions. Distributors sell a wide variety of products, which allows smaller customers to obtain multiple products from one source. In addition to our long- term relationships with distributors in North America and Europe, we have established relationships with a wide network of distributors in Latin America and the Asia Pacific region. We have transferred some existing small customers to distributors, and are working to transfer others, to free up our sales force to focus on more substantial opportunities.

Our sales force, distributors and agents interact with our customers to provide both product advice and technical assistance. In general, they arrange and coordinate contact between our customers and our research and development personnel to provide quality control and new product solutions. Our close interaction with our customers has allowed us to develop and maintain strong customer relationships. In addition, we focus our sales efforts on those customers who value the quality of our products, service and technical support.

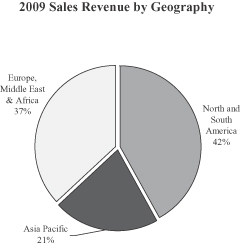

Total operating revenues from our operations outside the United States were approximately 67%, 66% and 66% of our total operating revenues in the years ended December 31, 2009, 2008 and 2007, respectively. Direct sales we make outside of the United States are generally priced in local currencies and can be subject to currency exchange fluctuations when reported in our consolidated financial statements, which are maintained in U.S. dollars in accordance with GAAP. For geographic reporting, revenues are attributed to the geographic location in which the customers’ facilities are located. We generated 42% of our 2009 sales from customers located in the Americas, 37% in Europe, the Middle East and Africa and 21% in the Asia Pacific region. See Note 13 to our consolidated financial statements for geographic reporting for total operating revenues and long-lived assets as of and for the years ended December 31, 2009, 2008 and 2007.

Sources and Availability of Raw Materials

We use three monomers as our primary raw materials in the manufacture of our products: styrene, butadiene and isoprene. These monomers together represented approximately 43%, 49% and 51% of our total cost of goods sold for years ended December 31, 2009, 2008 and 2007, respectively, and 56% and 43% for the nine months ended September 30, 2010 and 2009, respectively. The cost of these monomers has generally

15

correlated with changes in crude oil prices. Prices have fluctuated significantly due to global supply and demand and global economic conditions. During 2009, styrene pricing increased from lows in the first quarter of 2009 trending higher through the second half of 2009. Styrene pricing remained volatile in 2010 with prices up in the first half of 2010, declining in the third quarter, then rising to a higher level in the fourth quarter. Butadiene pricing also increased from the lows of the first quarter of 2009 and stabilized during the third quarter of 2009. During 2010, butadiene pricing increased into the third quarter before declining in the fourth quarter. In 2009, spot isoprene prices were volatile in the first half of the year, but prices stabilized during the third quarter of 2009 before trending higher in late 2009. Spot isoprene pricing continued to increase through the first half of 2010 before declining in the second half due to improved supply/demand. Overall, monomer pricing in the fourth quarter of 2010 was comparable to the third quarter of 2010, and average monomer costs in 2010 were up significantly compared to 2009.

We believe our contractual and other arrangements with suppliers of styrene, butadiene and isoprene provide an adequate supply of raw materials at competitive, market-based prices. We can provide no assurances that contract suppliers will not terminate these contracts at the expiration of their contract terms, that we will be able to obtain substitute arrangements on comparable terms, or that we generally will be able to source raw materials on an economic basis in the future.

Styrene, butadiene and isoprene used by our U.S. and European facilities are predominantly supplied by a portfolio of suppliers under long-term supply contracts with various expiration dates. For our U.S. facilities, we also procure a substantial amount of isoprene from a variety of suppliers from Russia, China and Japan. These purchases include both spot and contract arrangements. We generally contract with them on a short-term basis, although the number of such contracts has been increasing since 2008.

In January 2009, the U.S. operations of LyondellBasell, along with one of its European-holding companies, Basell Germany Holdings GmbH, filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code. Its Chapter 11 reorganization plan was confirmed by the bankruptcy court in April 2010, and LyondellBasell has emerged from bankruptcy. LyondellBasell is one of our major suppliers of raw materials in Europe and also operates our facilities at Berre, France, and Wesseling, Germany. We cannot accurately predict the effect, if any, that LyondellBasell’s emergence from bankruptcy will have upon our business, or our relationships with LyondellBasell. To date, these proceedings have resulted in no significant changes in our commercial relationship with LyondellBasell.

In Japan, butadiene and isoprene supplies for our joint venture facility are supplied under our joint venture agreement, where our partner supplies our necessary requirements. Styrene in Japan is sourced from local third-party suppliers. Our facility in Paulinia, Brazil, generally purchases all of its raw materials from local third-party suppliers.

Styrene. Styrene is available on the global petrochemical market with approximately 11 producers located in the Americas, 12 producers located in Europe and 41 producers located in Asia. The top five producers worldwide are: Shell Chemicals, LyondellBasell, Dow Chemical Company, BASF and Total, which collectively account for approximately one-third of global capacity. Styrene prices are primarily driven by worldwide supply and demand and the cost of ethylene and benzene and are influenced by prevailing crude oil and natural gas prices. Styrene pricing increased from lows in the first quarter of 2009 into the third quarter but increased in late 2009 following some declines early in the fourth quarter of 2009. Styrene pricing has remained volatile in 2010 with prices up in the first half of 2010, declining in the third quarter, then rising to a higher level in the fourth quarter.

We satisfy our styrene requirements in the United States pursuant to several purchase agreements with maturities up to the end of 2011, subject to renewal conditions. As contracts expire, we cannot give assurances that we will obtain new long-term supply agreements or that the terms of any such agreements will be on terms favorable to us, and as a consequence, our future acquisition costs for styrene may therefore increase.

16

For our agreements covering our manufacturing facility in the United States, the price we pay for styrene varies with the published prices of styrene and/or the raw materials used to produce styrene. The price we pay for styrene under our agreements covering France and Germany reflects market conditions and varies with factors including the published prices for styrene.

Butadiene. Butadiene is available on the global petrochemical market with approximately eight producers in the Americas, 19 producers in Western Europe and 38 producers located in Asia. Prices for butadiene reflect worldwide supply and demand and prevailing crude oil and ethylene prices.

We believe our contractual and other arrangements with our suppliers will generally provide adequate supplies of butadiene at competitive prices to support our current sales levels. Growth in the production of our products that require butadiene could be limited by our ability to source additional butadiene at competitive prices.

We currently source butadiene in the United States pursuant to several contractual arrangements with maturities up to the end of 2012, subject to renewal conditions. Our U.S. butadiene purchases vary with the published prices for butadiene on world markets. We have supplemented our requirements by spot supply as needed. No assurances can be given that any other agreement(s) will be entered into or as to the volumes or terms of any such agreement(s).

We currently source our butadiene in Europe pursuant to contracts with LyondellBasell. The contract covering Germany will expire on December 31, 2040, and will be renewed automatically at the conclusion of the current term unless terminated with prior written notice by either party. The contract covering France expired effective December 31, 2008. We are presently acquiring butadiene in France from LyondellBasell under interim agreements, pending resolution of an agreed arbitration between the parties to determine, among other matters, the effect of a term sheet previously reached between the parties that had been governing Butadiene purchases by us from LyondellBasell at our Berre facility from January 2009 until September 2010. In this regard, we can provide no assurance as to the nature of any final arrangement whereby we will continue to purchase butadiene from LyondellBasell at our Berre facility, including, without limitation, the volumes, prices or terms of sale that would be applicable to any such final arrangement. The price we pay for butadiene under our arrangements or agreements covering France and Germany vary based upon the published price for butadiene, the amount of butadiene purchased during the preceding calendar year and/or the cost of butadiene manufactured. In Brazil, butadiene is obtained from a local third-party source. In Kashima, Japan, a majority of our butadiene needs are sourced from JSR on a commercial supply basis. As contracts expire, we cannot give assurances that we will obtain new long-term supply agreements, or that the terms of any such agreements will be on terms favorable to us, and as a consequence, our future acquisition costs for butadiene may therefore increase.

Isoprene. Isoprene is primarily produced and consumed captively by manufacturers for the production of IR, which is primarily used in the manufacture of rubber tires. As a result, there is limited non-captive isoprene available in the market place. Prices for isoprene are determined by the supply and prices of natural and synthetic rubber, crude oil and natural gas prices, and existing supply and demand in the market. In 2009, spot isoprene prices were volatile in the first half of the year, but prices stabilized during the third quarter of 2009 before trending higher in late 2009. The increase was largely driven by the reduced availability of raw materials for isoprene extraction. Spot isoprene pricing continued to increase through the first half of 2010 before declining in the second half due to improved supply/demand. The economic advantage of lighter feeds for ethylene plants reduced the manufacture of by-products, including crude isoprene. Spot isoprene pricing continued to increase through the first half of 2010 before declining in the second half due to improved supply/demand.

We source our global isoprene requirements through several contractual arrangements. We also purchase additional supplies of isoprene from various suppliers at prevailing market price. In Kashima, Japan, the

17

majority of our isoprene needs are sourced from JSR on a commercial supply basis and from alternative suppliers as needed. As contracts expire, we may not be able to obtain new long-term supply agreements and the terms of any such agreement may not be on terms favorable to us.

We have historically had adequate supplies of isoprene. However, we have periodically experienced periods of limited supply due to operational problems at key producers, or as was the case during 2008, due to limited availability of crude raw materials for the isoprene extraction units. During these periods, we are normally able to meet most of our needs by acquiring relatively expensive isoprene from other suppliers. After an initial improvement in supply availability in 2008, isoprene availability was reduced for most of 2008. In response, we were forced to allocate SIS supplies. Similarly, supply constraints in 2009 limited isoprene purchases under some of our existing contracts. We satisfied our requirements by supplementing purchases from a variety of other suppliers. Going forward, we believe our contractual arrangements with several suppliers as well as spot arrangements and longstanding relationships with other third-party suppliers of isoprene, will generally provide adequate future supplies of isoprene at competitive prices to support our current sales levels. Growth in the production of our products that require isoprene could be limited by our ability to source additional isoprene at competitive prices, and we can give no guarantees or assurances in this regard.

Competition

We compete with other SBC product and non-SBC product producers primarily on the basis of price, breadth of product availability, product quality and speed of service from order to delivery. We believe our customers also base their supply decisions on the ability to design and produce custom products and the availability of technical support.

SBC Industry. Our most significant competitors in the SBC industry are: Asahi Chemical, Chi Mei, Dexco Polymers, Dynasol Elastomers, Kuraray, Korea Kumho P.C., Lee Chang Yung, LG Chemical, Polimeri Europa, Sinopec, Taiwan Synthetic Rubber Corporation and Zeon Corporation. Generally, however, individual competitors do not compete in each of our end use markets. Rather, there are different competitors in each of our end use markets indicative of the depth and breadth of our product offering.

Product Substitution. We also compete against a broad range of alternative, non-SBC products within each end use market.

In the Advanced Materials end use market, our products compete against a wide variety of chemical and non-chemical alternatives, including thermoplastic vulcanizates, ethylene propylene diene monomer rubber, known as EPDM, thermoplastic polyolefin elastomers and thermoplastic polyurethanes, known as TPUs. The choice between these materials is influenced by performance characteristics, ease of use, desired aesthetics and total end-product cost. In addition, competing materials include spandex, natural rubber, polyvinyl chloride polymers and compounds, polyolefins, polyethylene terephthalate, known as PET, nylon and polycarbonate, based on performance, ease of use, desired aesthetics and total end-product cost.

In the Adhesives, Sealants and Coatings end use market, the primary product alternatives include acrylic polymers, silicones, solvent-based natural rubber systems and metallocene polyolefins.

In the Paving and Roofing end use market, the primary product substitute for roofing is atactic polypropylene, whereas for road surfaces it is styrene butadiene rubber, or SBR. Customers also have a choice to use unmodified asphalts.

Operating and Other Agreements

Operating Agreements. Shell Nederland Refinery operated our manufacturing facility located in Pernis, the Netherlands.

18

On January 18, 2010, consistent with our announcement in the third quarter of 2009 of our intent to exit our Pernis facility, our indirect, wholly-owned subsidiary Kraton Polymers Nederland BV, or Kraton Netherlands, agreed to terminate the following material definitive agreements relating to the operation of the Pernis facility and transfer the site back to its owner:

| • | First Amended and Restated Site Services, Utilities, Materials and Facilities Agreement between Kraton Netherlands and Shell Nederland Raffinaderij BV (“SNR”) dated 28 February 2001; and |

| • | First Amended and Restated Site Services, Utilities, Materials and Facilities Agreement between Kraton Netherlands and Shell Nederland Chemie BV (“SNC,” and together with SNR, the “Shell Entities”) dated 28 February 2001. |

Production at the Pernis facility ceased December 31, 2009 and actual termination of these agreements became effective on March 31, 2010.

LyondellBasell operates our manufacturing facility located in Berre, France. This facility is situated on a major LyondellBasell refinery and petrochemical site at which other third party tenants also own facilities. LyondellBasell charges us fees based on certain costs incurred in connection with operating and maintaining this facility, including the direct and indirect costs of employees and subcontractors, reasonable insurance costs, certain taxes imposed on LyondellBasell (other than income taxes) and depreciation and capital charges on certain assets. Pursuant to the agreement, LyondellBasell employs and provides all staff, other than certain plant managers, assistant plant managers and technical personnel whom we may appoint. The agreement has an initial term of 20 years, beginning in February 2001, and thereafter will automatically renew indefinitely for consecutive five-year periods. Either party may terminate the agreement (totally or partially) under various circumstances, including if such party ceases its operations at the facility and provides 18 months prior written notice; or if any of the services, utilities, materials and facilities agreements have been terminated, and the terminating party provides notice as required by such agreement.

Pursuant to an agreement dated March 31, 2000, LyondellBasell operates and provides certain services, materials and utilities required to operate our manufacturing facility in Wesseling, Germany. We pay LyondellBasell a monthly fee, as well as costs incurred by LyondellBasell in providing the various services, even if the facility fails to produce any output (whether or not due to events within LyondellBasell’s control), and even if we reject some or all output. This agreement has an initial term of 40 years and will automatically renew subject to five years prior written notice of non-renewal. This agreement will terminate at any earlier date as of which the facility can no longer operate in a safe and efficient manner.

Site Services, Utilities, Materials and Facilities Agreements. LyondellBasell, through local operating affiliates, provides various site services, utilities, materials and facilities for the Berre, France, and Wesseling, Germany, manufacturing sites. Generally these services, utilities, materials and facilities are provided by LyondellBasell on either a long-term basis, short-term basis or a sole-supplier basis. Items provided on a sole-supplier basis may not be terminated except upon termination of the applicable agreement in its entirety. Items provided on a long-term or short-term basis may be terminated individually under certain circumstances.

Information Systems

We utilize ERP software systems to support each of our facilities worldwide. In 2009, we upgraded our ERP software systems utilizing a single global system and implementing best practices for our industry. For Europe and the United States we completed this upgrade in August 2009, and for Brazil and Asia we completed this upgrade in October 2009. In addition to providing increased reliability, we estimate ongoing cost savings of $5.0 million to $10.0 million per annum will be achieved as a result of the new ERP system. These systems are being supported by internal resources. We also have in place a laboratory quality assurance system, including bar code based material management systems and manufacturing systems. An annual disaster recovery exercise is performed on critical systems utilizing third-party data centers.

19

Patents, Trademarks, Copyrights and Other Intellectual Property Rights

We rely on a variety of intellectual property rights to conduct our business, including patents, trademarks and trade secrets. As of December 31, 2010, approximately one-third of our patent portfolio (349 of 1,053) consisted of patent applications (the majority of which were filed after 2003). In light of the fact that patents are generally in effect for a period of 20 years as of the filing date, this means that a significant portion of the portfolio would remain in effect for a long period (assuming most of these applications will be granted). The granted patents and the applications cover both the United States and foreign countries. We do not expect that the expiration of any single patent or specific group of patents would have a material impact on our business. Our material trademarks will remain in effect unless we decide to abandon any of them, subject to possible third-party claims challenging our rights. Similarly, our trade secrets will preserve their status as such for as long as they are the subject of reasonable efforts, on our part, to maintain their secrecy. Since January 2003, we have filed 112 new patent applications with filings in the United States and many foreign countries. A significant number of patents in our patent portfolio were acquired from Shell Chemicals. Shell Chemicals retained for itself fully-transferable and exclusive licenses for their use outside of the elastomers field, as well as fully-transferable, non-exclusive licenses within the field of elastomers for certain limited uses in non-competing activities. Shell Chemicals is permitted to sublicense these rights. Shell Chemicals also retains the right to enforce these patents outside the elastomers field and recover any damages resulting from these actions. Shell Chemicals may engage in or be the owner of a business that manufactures and/or sells elastomers in the elastomers field, so long as they do not use patent rights or technical knowledge exclusively licensed to us.

As a general matter, our trade names are protected by trademark laws. Our SBC products are marketed under the trademark “Kraton,” “Elexar” and “Giving Innovators Their Edge,” which are registered, and “Nexar” and “Cariflex,” for which registration is pending, in the United States and in many other countries.

In our almost 50 years in the SBC business, we have accumulated a substantial amount of technical and business expertise. Our expertise includes: product development, design and formulation, information relating to the applications in which our products are used, process and manufacturing technology, including the process and design information used in the operation, maintenance and debottlenecking of our manufacturing facilities, and the technical service that we provide to our customers. Extensive discussions are held with customers and potential customers to define their market needs and product application opportunities. Where necessary, we have implemented trade secret protection for our technical knowledge through non-analysis, secrecy and related agreements.

Employees

We had approximately 872 full-time employees at September 30, 2010. In addition, approximately 175 LyondellBasell manufacturing employees operate our manufacturing facilities and provide maintenance services in Europe under various operating and services arrangements. See “—Operating and Other Agreements.” None of our employees in the United States are subject to collective bargaining agreements. In Europe, Brazil and Japan, a significant number of our employees are in arrangements similar to collective bargaining arrangements. We believe our relationships with our employees continue to be good.

Environmental Regulation

Our operations in the United States and abroad are subject to a wide range of environmental laws and regulations at the national, state and local levels. These laws and regulations govern, among other things, air emissions, wastewater discharges, solid and hazardous waste management, site remediation programs and chemical use and management.

Pursuant to these laws and regulations, our facilities are required to obtain and comply with a wide variety of environmental permits for different aspects of their operations. Generally, many of these environmental laws and regulations are becoming increasingly stringent and the cost of compliance with these various requirements can be expected to increase over time.

20

Management believes that we are in material compliance with all current environmental laws and regulations. We currently estimate that any expenses incurred in maintaining compliance with these requirements will not materially affect our results of operations or cause us to exceed our level of anticipated capital expenditures. However, we cannot give assurances that regulatory requirements or permit conditions will not change, and we cannot predict the aggregate costs of additional measures that may be required to maintain compliance as a result of such changes or expenses.

Environmental laws and regulations in various jurisdictions also establish programs and, in some instances, obligations to clean up contamination from current or historic operations. Under some circumstances, the current owner or operator of a site can be held responsible for remediation of past contamination regardless of fault and regardless of whether the activity was legal at the time that it occurred. Evaluating and estimating the potential liability related to site remediation projects is a difficult undertaking, and several of our facilities have been affected by contamination from historic operations.

Our Belpre, Ohio, facility is the subject of a site investigation and remediation program administered by the Environmental Protection Agency pursuant to the Resource Conservation and Recovery Act. In March 1997, Shell Chemicals entered into a consent order to investigate and remediate areas of contamination on and adjacent to the site. In March 2003, we joined Shell Chemicals in signing a new consent order that required additional remediation and assessment of various areas of contamination and continues to require groundwater-monitoring and reporting. Shell Chemicals continues to take the lead in this program, has posted financial assurance of $5.2 million for the work required under the consent order and has also indemnified us for the work required under this program, subject to the condition that we provide notice on or prior to February 28, 2021. In turn, we have agreed with Shell Chemicals that we will, for a fee, provide certain services related to the remediation program. We have agreed with Shell Chemicals that we will pay up to $100,000 per year for the groundwater monitoring associated with the 2003 consent order.