Attached files

| file | filename |

|---|---|

| EX-10.15 - ZAPNAPS, INC. | v209446_ex10-15.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

(Amendment No.

2)

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 22, 2010

FUSIONTECH,

INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-53837

|

26-1250093

|

||

|

(State

or other Jurisdiction of

|

(Commission

File Number)

|

(IRS

Employer Identification No.)

|

||

|

Incorporation)

|

|

No.

26 Gaoneng Street, High Tech Zone, Dalian,

Liaoning

Province, China

|

116025

|

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (86)

0411-84799486

No.

8 Mingshui Road

Changchun,

Jilin Province, China 130000

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

|

¨

|

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

¨

|

Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

¨

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

¨

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Throughout this

Current Report on Form 8-K, we will refer to FusionTech, Inc. as

“FusionTech,” the “Company,”

“we,” “us” and “our.”

Item

1.01 Entry into a Material Definitive Agreement.

On

November 22, 2010, FusionTech, Inc., a Nevada corporation (the “Company”),

entered into and consummated a series of agreements that resulted in the

acquisition by the Company of all of the ownership interests of Dalian Heavy

Mining Equipment Manufacturing Co., Ltd. (“Dalian”), a foreign joint venture

company organized under the laws of the People’s Republic of China

(“PRC”).

The

acquisition of Dalian’s ownership interests was accomplished pursuant to the

terms of a Share Exchange Agreement and Plan of Reorganization, dated November

22, 2010 (the “Share Exchange Agreement”), by and between Dalian, its owners,

and the Company. Pursuant

to the Share Exchange Agreement, we acquired 100% of Dalian from the owners of

Dalian in exchange for the issuance of 24,990,000 shares of our common stock

(the “Share Exchange”). The owners also agreed pursuant to the Share Exchange to

make such administrative filings in the PRC as necessary to record the transfer

of ownership of Dalian to the Company as a wholly foreign owned enterprise.

Concurrent with the closing of the transactions contemplated by the Share

Exchange Agreement and as a condition thereof, we entered into an agreement with

Mr. David Lu, our Chief Executive Officer and Director prior to the Share

Exchange and acquisition by the Company of Dalian, pursuant to which he returned

80,000,000 shares of our common stock to us for cancellation. Mr. Lu received

compensation of $80,000 from us for the cancellation of his shares of our common

stock. Upon completion of the foregoing Share Exchange transactions, we had

29,390,000 shares of common stock issued and outstanding. For accounting

purposes, the Share Exchange transaction was treated as a reverse acquisition

and recapitalization of Dalian because, prior to the transaction, the Company

was a non-operating public shell and, subsequent to the transaction, Dalian’s

owners beneficially owned a majority of the outstanding Common Stock of the

Company and will exercise significant influence over the operating and financial

policies of the consolidated entity. We have no other operations or businesses

other than those acquired in the Dalian acquisition.

We issued

the shares of common stock to the owners of Dalian in reliance upon the

exemption from registration provided by Regulation S under the Securities Act of

1933, as amended (the “Securities Act”).

Item

2.01 Completion of Acquisition or Disposition of Assets.

We refer

to Item 1.01 above, “Entry into a Material Definitive Agreement,” and

incorporate the contents of that section herein, as if fully set forth under

this Section 2.01.

Description

of Our Company

Historical

Business

Prior to

the transaction described in Item 1.01 above, we were a development stage

company with no revenues and no operations that intended to produce mini-paper

towels.

We were

incorporated in the State of Nevada on October 10, 2007, under the name ZapNaps,

Inc. by Ms. Peggy Lalor, our former President and Director. On

December 3, 2007, we issued 10,000,000 shares of our common stock to Ms. Lalor

at $.001 per share for $10,000, representing Ms. Lalor’s initial investment in

the Company.

On May 7,

2010 Ms. Lalor sold 10,000,000 shares of the Company’s common stock to Mr. David

Lu for $40,000, in a private transaction exempt from registration under the

Securities Act of 1933, as amended. Concurrently, Ms. Lalor resigned from her

positions with the Company, and Mr. Lu was appointed as President, Chief

Executive Officer, Chief Financial Officer, Treasurer, Secretary and Director of

the Company.

In

anticipation of the Share Exchange and related transactions described in Item

1.01 above, on October 28, 2010 we changed our name from ZapNaps, Inc. to

FusionTech, Inc. through a merger with our wholly-owned non-operational

subsidiary, FusionTech, Inc., which was established to change the Company’s name

as permitted under Nevada Law. We also authorized an increase in our authorized

shares of common stock from 75,000,000 to 100,000,000, effective November 1,

2010, and an 8-for-1 forward split of our common stock, effective November 12,

2010. Prior to the forward split we had 10,550,000 shares of our common stock

outstanding, and after giving effect to the forward split, we had 84,400,000

shares of our common stock outstanding immediately preceding the Share Exchange.

We authorized the increase in authorized shares and forward stock split to

provide a sufficient number of shares to accommodate the trading of our common

stock in the OTC marketplace after the acquisition of Dalian.

On

November 22, 2010 we entered into the Share Exchange Agreement and related

transactions described in Item 1.01 above, resulting in our acquisition of all

of the ownership interests of Dalian.

Our

common stock trades on the OTC Bulletin Board under the symbol “ZPNP.”

1

Description

of FusionTech

We design

and manufacture clean technology (“CleanTech”) industrial machinery used in the

coking process, a critical but traditionally highly pollutive step in the

production of crude steel. Our products are sold to large and medium size steel

mills and coking plants in China who use or are planning to use the coke dry

quenching (“CDQ”) method of coking, a more environmentally friendly and energy

conservative method of coking as compared to the traditional coke wet quenching

method.

We

currently design and manufacture CDQ transport cars used in complete CDQ systems

and CleanTech coke oven products such as coke oven elevators, smoke transfer

machines, and coal cleaning machines. These CleanTech coke oven products are

used for maintaining coke ovens and reducing the amount of pollution they

emit. Since 1992, Dalian has also designed and manufactured core coke

oven products such as coke drums, coke drum carriers, wet quenching cars, coal

freight cars, coke guide cars, and coke pushers. These core coke oven products

are necessary components for all coke oven systems.

In the

second quarter of 2011, we plan to provide our proprietary steel plate fusion

services (“Steel Plate Fusion”) to a large steel plate manufacturer in northern

China, Minmetals Yingkou Medium Plate Co., Ltd. (“Minmetals Yingkou”). Minmetals

Yingkou is an established steel plate manufacturer in China with over 30 years

of experience in producing steel plates. It is a subsidiary of the reputable

China Minmetals Corporation, a Fortune Global 500 Company based in China

focusing on the development and production of metals and minerals.

On June

2, 1010, we entered into a non-exclusive strategic agreement, as amended on

August 9, 2010, with Minmetals Yinkgou to produce fused metal slabs using our

Steel Plate Fusion services from raw metal slabs produced by Minmetals Yingkou.

Minmetals Yingkou will manufacture finished steel plates from our fused metal

slabs for sale to their customers. The agreement provides for the production of

200,000 tons of steel plates per year, adjustable based on market demand up to a

goal of 500,000 tons per year. We will receive a processing fee based on the

size, type and market demand of each ton of fused metal slabs

produced.

We

believe that Steel Plate Fusion is a next generation technology that is superior

in both cost and efficiency to conventional methods used to manufacture clad

metal plates and extra-thick carbon steel plates. Steel Plate Fusion uses an

electron beam welding machine in a vacuum chamber and a proprietary process of

surface treatment and manipulation of pressure and temperature of the fusion

process to fuse together metal slabs that can be hot rolled/compressed to

produce:

|

|

·

|

clad

metal plates (“clad metal plates”), manufactured by fusing two dissimilar

metal plates such as stainless steel plates and carbon steel plates (“clad

steel plates”). Clad steel plates offer a more economical alternative to

pure stainless steel plates since they combine inexpensive carbon steel

and stainless steel. In addition, clad steel plates provide similar

functionalities as stainless steel plates and can be used in similar

industrial applications. Clad steel plates are used and highly demanded in

heavy industrial applications such as the construction of ships, piping,

nuclear reactors, pressure vessels, heat exchangers, power generation

equipment, and coking equipment, all of which require the anti-corrosive

properties of clad steel plates.

|

|

|

·

|

specialty

extra-thick carbon steel plates (“extra-thick carbon steel plates”), more

than 80 millimeters thick, used and highly demanded in heavy industrial

applications such as the construction of large ships, bridges, buildings,

metallurgical equipment, mining equipment, and power generation equipment,

all of which require the strength of extra-thick carbon steel plates of

certain standards and

specifications.

|

We

operate through Dalian, our subsidiary organized under the laws of the People’s

Republic of China (“PRC”). Our principal executive offices are located at No.

26, Gaoneng Street, High Tech Zone, Dalian, Liaoning Province, China 116025. Our

phone number is (86) 0411-84799486 and our website address is www.cleanfusiontech.com.

Clean

Coking and Related Products

FusionTech

designs and manufactures a wide variety of CleanTech coke oven products

including coke dry quenching (“CDQ”) transport cars, coke oven elevators, smoke

transfer machines, and coal cleaning machines. FusionTech also designs and

manufactures core coke oven products including wet quenching cars, coal freight

cars, coke guide cars, and coke pushers. FusionTech’s products are sold to the

China domestic steel and coking industries and have significant CleanTech

applications including use in complete CDQ systems. A complete CDQ system can

recycle the wasted heat produced during the coking process to generate

electricity and/or steam. CDQ systems are being phased into the coking process

in the China steel and coke industries because of these environmental and energy

conservation benefits. Additionally, PRC regulations set forth by the Ministry

of Industry and Information Technology (“MIIT”) now require all newly

constructed or reconstructed coke ovens to be accompanied by the installation of

a CDQ system. (1)

2

Industry

Overview

China is

the world’s largest steel producer and is projected to further expand its output

as domestic demand for the metal grows. According to statistics

released on the World Steel Association website, www.worldsteel.org, China

accounted for 47% of the world’s total crude steel output in 2009 and is on pace

to produce a record 600 million metric tons in 2010. As the China domestic steel

industry expands, environmental issues related to its production have become

more pressing. Within China’s industrial sector the steel industry accounts for

15% of aggregate energy consumption, 14% of aggregate wastewater production, and

17% of aggregate solid waste emission. (1)

The processes of smelting, coking, and steel casting,

contribute in excess of 70% of the total pollution and energy consumed within

the steel industry itself.(1)

Coking is

the process by which coke is produced, a basic raw material used in the

production of iron. Coking involves baking coal at extremely high temperatures

in an oxygen-free oven (“coke oven”) and then rapidly cooling it. In the

conventional cooling process, the hot coke is cooled by drenching it with cold

water (“coke wet quenching”). Cooling the coke in this manner emits noxious

gases and the heat energy contained in the hot coke is lost. The modern CDQ

system cools the coke by circulating an inert gas in an enclosed heat exchange

system. This process reduces the harmful environmental effects associated with

the conventional cooling process as water is not contaminated with toxic

pollutants nor are air pollutants released.

CDQ

systems also promote renewable energy production as the wasted heat is recycled

to generate electricity. Compared to the coke wet quenching process, a steel

mill using two CDQ systems can produce approximately 167 gigawatt hours of

electricity from waste heat annually, saving approximately $9.2 million each

year on electricity costs, saving approximately 3.7 million tons of water, and

reducing its carbon dioxide emissions by approximately 130,000 metric tons.(2)

The PRC

government identified the steel industry as one of its primary targets for

pollution reduction in its 11th Five

Year Plan. In July 2010 China’s MIIT, to reduce emissions in the steel industry,

mandated that China’s existing steel mills consolidate to form larger more

efficient mills. Currently China’s steel industry includes many small steel

mills that use outdated technology. As steel industry consolidation progresses

in China, larger steel mills have sought to produce higher quality steel more

efficiently through the use of production methods which reduce environmental

impact.

In July

2010, China’s MIIT also mandated that the construction of new coke ovens or the

reconstruction of old coke ovens be accompanied by the installation of a

complete CDQ system. MIIT has targeted 90% of coking output by large and medium

size steel mills and coking plants, and 40% of coking output from the entire

coking industry, to be produced using the CDQ method before 2013. (1)

(1)

Source: PRC Ministry of Industry and Information Technology “Steel and Coking

Industry CDQ Technology Marketing and Implementation Plan” January 20,

2010.

(2) United

Nations Framework Convention on Climate Change: Baotou Iron & Steel CDQ and

Waste Heat Utilization for Electricity Generation Project, 03/08/2007, and

“CDQ-Modern coking technology,” by Anhui Vocational College of Metallurgy and

Technology. Assumptions made in calculations: Steel mill using two CDQ systems,

each with 125 tons/hour coal capacity and 15 megawatt electricity generating

capacity, and $0.055/kilowatt hour (based on average cost per KWH paid by

Huaneng in 2009).

3

Products

CDQ

Transport Cars

We design

and manufacture CDQ transport cars that are key components to a complete CDQ

system.

|

A

complete CDQ system requires two CDQ transport cars, three coke drums, and

three coke drum carriers. A coke drum carrier is a long flatcar that runs

along a railway and is used to hold a coke drum, a large cylindrical

container made of metal used to hold coke. The CDQ transport car is a

powered locomotive engine that connects to the drum carrier and pulls it

along the railway from the coke oven to the CDQ machine for processing. An

operator controls the speed of the car from a control room located on top

of the CDQ transport car.

FusionTech

manufactures CDQ transport cars by welding together steel plates to form

the car’s structure and then integrating electronic components such as

engines, wheels, and mechanical controls. Manufacture of CDQ transport

cars requires advanced technical knowledge as CDQ transport cars must be

acutely responsive to an operator’s commands to ensure the CDQ transport

car stops at a precise location where dangerous hot coke can be loaded and

unloaded safely. Management believes that FusionTech’s CDQ transport cars

are known in the coking industry for their high quality and competitive

pricing.

|

CDQ Transport Car for 6.25m Coke

Oven

Source: The

Company

|

The

primary markets for FusionTech’s CDQ transport cars are new steel mills and

coking plants in the China domestic market and existing steel mills and coking

plants being modernized or seeking replacements for existing CDQ transport cars.

Management estimates that CDQ transport cars have a useful life expectancy of

approximately ten years.

|

Coke

Oven Elevator

We

design and manufacture coke oven elevators used to repair damages and

prevent toxic leaks as part of coke oven maintenance.

According

to the U.S. Department of Energy, the largest environmental issue with the

steelmaking process is the carburizing of coal into coke for use in the

iron-making process.(3)

Coke ovens, in addition to emitting dust and particulate emissions,

produce noxius gases including nitrogen oxide, carbon monoxide, and carbon

dioxide. The

PRC government has stated publicly that it plans to respond to these

environmental issues by including new pollutants such as nitrogen oxide in

its emission control list in China’s 12th

Five Year Plan.(4)

We believe the demand for coke oven maintenance products will

increase as a result of the inclusion of these pollutants, and that our

coke oven elevators are well-suited to meet this demand.

|

Source: The

Company

|

Coke oven

elevators are used to transport workers to the top of a coke oven where they can

repair damages and inspect for signs of toxic leaks. Regular coke oven

maintenance is one of the primary ways pollution emission can be controlled

during the coking process. We are one of the few manufacturers in

China for coke oven elevators that attach to coke ovens 7 meters and 7.63 meters

in height. Management believes that FusionTech’s coke oven elevators for these

specifications are of superior quality as our elevators are powered by an

internal battery rather than diesel fuel. Additionally, demand for coke oven

elevators with these specifications is increasing due to the government directed

consolidation of the China steel industry. As small inefficient steel mills and

coking plants are closed and integrated into larger operations, all

reconstructed coke ovens or newly installed coke ovens will likely exceed 5.5

meters in height to take advantage of the increased production efficiencies a

larger coke oven provides. When a coke oven higher than 6 meters high is

installed, an area adjacent to the coke oven is typically reserved for the

installation of a coke oven elevator which can help reduce pollution emission

and maintain the coke oven for optimal performance.

(3) United

States Department of Energy. “Steel Industry Technology Roadmap.” December 2001.

Available at

http://www1.eere.energy.gov/industry/steel/roadmap.html.

(4) Jing,

Li. “New pollution reduction targets listed.” China

Daily. January 26, 2010.

4

We sell

our coke oven elevators to new steel mills and coking plants in China and to

steel mills and coking plants that are replacing and/or reconstructing old coke

oven elevators. Management estimates that CDQ transport cars have a useful life

expectancy of approximately ten years.

Production

We

manufacture our CleanTech coke oven products and core coke oven products in our

three facilities in Liaoning Province, China. We base our production schedule on

customer orders and schedule deliveries on a just-in-time basis. Our

manufacturing operations principally involve the welding together of large steel

plates and the integration of electronic components. It takes us approximately

three months to design a CDQ transport car according to our customers’

specifications, and approximately another three months to manufacture. Coke oven

elevators can be designed and manufactured within three months. We received ISO

9001:2008 Quality Management System certification in January 2008, which

certification demonstrates our adherence to formalized business processes and

the ability to consistently produce products meeting customer requirements. We

have implemented comprehensive quality control procedures, including

non-destructive tests for defect detection conducted by our own quality control

group consisting of 10 employees.

Sales and

Marketing

We employ

approximately 10 sales people, all of whom are full-time employees of the

Company, to sell and market our products directly to customers. Our sales people

also engage in bidding for specific projects and maintain our relationships with

long-term clients. We currently sell our products directly to large and medium

scale China domestic steel mills and coking plants, and through four general

contractors that are hired by steel mills and coking plants to install complete

CDQ systems. We fund our marketing costs through our working

capital.

Suppliers

Our

principal raw material purchases include carbon steel, stainless steel, and

mechanical and electrical components. We have several suppliers for each of the

materials we use to manufacture our products. We believe we will be able to

obtain an adequate supply of steel and mechanical and electrical components to

meet our manufacturing requirements. We maintain a good business relationship

with all of our suppliers.

Customers

Our

customer base for our coking products includes large and medium scale steel

mills and coking plants in China. We sell our products either directly to these

steel mills and coking plants or through four general contractors in China of

CDQ systems. We believe we have strong business relationships with these four

general contractors, ACRE Coking and Refractory Engineering Consulting

Corporation Co., Ltd., Sinosteel Equipment and Engineering Co., Ltd.,

China-Japan Energy and Environment Engineering Technology Co., Ltd., and Jinan

Iron and Steel Corp.

In 2009,

our three largest customers, ACRE Coking and Refractory Engineering Consulting

Corporation, Co., Ltd., Sinosteel Equipment and Engineering Co., Ltd., and Jinan

Iron and Steel Corp., accounted for approximately 32%, 28%, and 8%,

respectively, of our total revenues.

For the

nine months ended September 30, 2010, our three largest customers, ACRE Coking

and Refractory Engineering Consulting Corporation, Co., Ltd., Jinan Iron and

Steel Corp., and Sinosteel Equipment and Engineering Co. Ltd., accounted for

approximately 38%, 28%, and 22%, respectively, of our total

revenues.

We do not

have any material contracts with any of our customers with respect to our clean

coking and related products business. We execute standard sales contracts and

purchase orders in the ordinary course of business, forms of which provided by

our major customers, for the clean coking and related products we

manufacture.

Intellectual

Property

We rely

on the patent laws in China, along with confidentiality procedures and

contractual provisions, to protect our intellectual property and maintain our

competitive edge in the marketplace. We own seven patents, three for different

models of our CDQ transport cars, one for our coke oven elevator, one for our

coal cleaning machine, one for our steel belt feeding roller, and one for our

smoke transfer car. One of our CDQ transport car patents will expire

in 2016 and two will expire in 2017. Our coke oven elevator patent will expire

in 2019, our coal cleaning machine patent will expire in 2018, and our steel

belt feeding roller and smoke transfer car patents will expire in

2020.

5

The

applications for all of our patents were filed in the Company’s name and have

been solely owned by the Company since the date of their initial grant. As we

continue to develop our CleanTech coke oven products we will apply for new

patents to protect our innovations. We have also executed non-disclosure

agreements with key employees to protect our patents and other trade secrets

related to our business.

Competition

Our

coking products compete against both China domestic manufacturers and

international manufacturers. The manufacturing industry for coking

products in China is highly fragmented with many different manufacturers holding

small shares of the total market. Our primary international competitors for our

CDQ transport cars are Nippon Steel Corporation and Schalke GmbH. Our deep

industry expertise for the past 18 years has allowed us to successfully design

and manufacture products that we believe meet the demand and satisfaction of our

clients. We believe we have strong relationships with our existing customer base

and that our products are recognized for their high quality and innovation. Many

of our competitors have manufacturing operations that span many different heavy

machinery industries, and as a result they may have larger operations and

greater financial resources than us. We plan to remain competitive by continuing

to market our eighteen year operating history, our reputation for superior

products, by funding research and development to improve our current line of

CleanTech coke oven products, and by focusing on developing new innovative

products that focus on environmental conservation.

|

|

·

|

Proprietary product

designs - We own seven different patents including three for

different models of our CDQ transport

cars.

|

|

|

·

|

Award winning technology

– We designed and manufactured a CDQ transport car which was an integral

component of a major CDQ project commenced in 2004 in Maanshan, China.

This CDQ project received the Metallurgical Technology First Class Award

from the China Iron and Steel Association and the Chinese Society for

Metals in 2005. In 2009 this CDQ project also received the National

Science and Technology Second Class

Award.

|

|

|

·

|

Strong business

relationships – We have strong business relationships with the four

CDQ general contractors who are believed within the industry to occupy the

majority of the domestic China CDQ market. Management believes its

relationships with these contractors will continue, providing the Company

with a valuable and growing distribution channel for its CleanTech coke

oven products.

|

|

|

·

|

Industry Experience – We

have an eighteen year operating history and are led by our Chief Executive

Officer, Mr. Lixin Wang, who has over thirty years of metallurgical, heavy

machinery, and coke industry experience. At our inception in

1992 we only manufactured traditional core coke oven products. In 2002 we

were able to successfully expand our product offerings to include coke dry

quenching products.

|

|

|

·

|

Customer Service – We

work closely with our customers to design and manufacture products to

their custom specifications. Our technical staff provides onsite guidance

through the installation process.

|

Seasonality

We

typically experience stronger sales in the third and fourth quarters of our

fiscal year ending December 31st.

General contractors of CDQ systems, coking plants, and steel mills typically

place their orders with us at the beginning of each fiscal year. We typically

ship these orders and record our revenues in the second half of our fiscal

year.

Employees

As of

November 22, 2010 we had a total of 160 employees, all of who work for us

full-time. We plan to hire an additional 100 employees, who will work for us

full-time, by the end of 2011. We believe that relations with our employees are

satisfactory and retention has been stable. We enter into standard labor

contracts with our employees as required by the PRC government and adhere to

state and provincial employment regulations. We provide our employees with all

social insurance as required by state and provincial laws, including pension,

unemployment, basic medical and workplace injury insurance. These state mandated

programs are sponsored by state and provincial governments. We do not maintain

any material Company-sponsored benefit programs for our executive officers or

other employees. We have no collective bargaining agreements with our

employees.

6

Planned

Expansion: Steel Plate Fusion

In the

second quarter of 2011, we plan to expand our existing operations to offer our

proprietary Steel Plate Fusion services to China steel plate manufacturers of

clad metal plates and extra-thick carbon steel plates.

Clad

metal plates is a general term used to describe metal plates composed of two

dissimilar metals. For example, a clad metal plate may combine stainless and

carbon steel, titanium and steel, aluminum and steel, or nickel and steel. Our

Steel Plate Fusion services will be initially used in the production of clad

steel plates, composed of stainless and carbon steel. However, management

believes that Steel Plate Fusion can be used to manufacture all types of clad

metal plates.

A clad

steel plate is a composite steel plate manufactured by bonding stainless steel

with carbon steel. Currently the most common method of producing clad steel

plates in China is through the use of a technique called explosion welding. Clad

steel plates have the structural strength of carbon steel and the anticorrosive

and heat resistant properties of stainless steel, but are less costly than pure

stainless steel plates because they combine cheaper carbon steel with stainless

steel. In addition, clad steel plates provide similar functionalities

as stainless steel plates and can be used for similar industrial applications.

Clad steel plates have widespread industry applications, especially in areas of

rapid growth in China. Clad steel plates are used in heavy industrial

applications such as in the construction of ships, piping, nuclear reactors,

pressure vessels, heat exchangers, power generation equipment, and coking

equipment, all of which require the anti-corrosive and heat resistant properties

of clad steel plates.

An

extra-thick carbon steel plate is a steel plate over 80 millimeters thick and is

currently manufactured in China through either mold casting or electroslag

remelting. Extra-thick carbon steel plates are also used in heavy industrial

applications such as in the construction of ships, bridges, buildings,

metallurgical equipment, mining equipment, and power generation equipment, all

of which require the strength and endurance of extra-thick carbon steel plates

of certain standards and specifications.

China’s

growing demand for steel is reflected in the China domestic clad steel plate and

extra-thick carbon steel plate market. The market demand for clad steel plates

is estimated to have been 2.4 million tons or $6.1 billion in 2010.

The demand for clad steel plates is expected to grow to 8.5 million tons or $22

billion by 2015. The market demand for extra-thick carbon steel plates, or

carbon steel plates that exceed 80 millimeters in thickness, is estimated

to have been 8.2 million tons or $9 billion in 2010. By 2015, demand

is expected to increase to 26 million tons or $28.7 billion. 5

We

believe Steel Plate Fusion will transform the way clad steel plates and

extra-thick carbon steel plates are made in China as it is a unique and

innovative method of production that will offer significant cost savings and

production efficiencies to China steel plate manufacturers who currently use

conventional methods.

Conventional Production

Methods

Clad

Steel Plates

Conventional

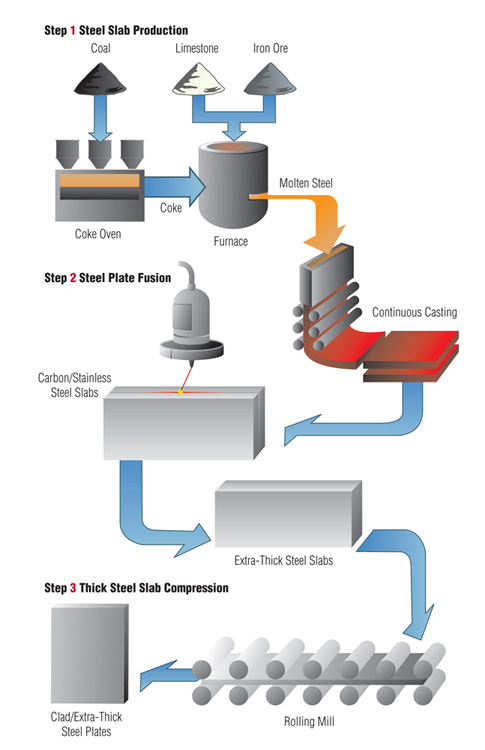

clad steel plate manufacturing occurs through a three step process:

|

|

1.

|

Continuous

casting - Molten steel is solidified into a thick rectangular slab through

a process known as continuous casting, a low-cost and efficient mass

production method of producing high quality carbon and stainless steel

slabs.

|

|

|

2.

|

The

resulting carbon and stainless steel slabs are hot rolled/compressed

through a steel rolling mill which flattens the slabs into rectangular

carbon and stainless steel plates.

|

|

|

3.

|

The

stainless steel plate is then welded to the carbon steel plate through a

technique known as explosion welding. Explosion welding uses force

generated from controlled explosions to weld together two dissimilar metal

plates. It is the most commonly used method of welding together metal

plates in China.

|

The end

product is a clad steel plate which is comprised of a carbon steel plate and an

anti-corrosive layer of a stainless steel plate. Explosion welding can be

extremely dangerous as the use of explosives to weld together metal plates is an

inherently dangerous activity. Additionally, the explosions used to weld the

plates together can often produce unwanted bubbles on the outer surface of the

plate. These bubbles must be manually corrected, requiring significant time and

expense on the part of the steel plate manufacturer.

(5)

Source: Zero Power Intelligence Research “China Thick Steel Plate Industry

Research and Analysis” 2010. (the “Steel Plate

Report”)

7

Extra-Thick

Carbon Steel Plates

Extra-thick

carbon steel plates are conventionally manufactured through either one of two

processes, mold casting or electroslag remelting.

|

|

1.

|

Mold

Casting - Molten steel is poured into a rectangular cast and cooled within

the cast until it solidifies. The resultant thick steel slab is compressed

through a steel rolling mill to produce an extra-thick carbon steel plate.

Mold casting is currently the most commonly used method to produce

extra-thick carbon steel plates in

China.

|

|

|

2.

|

Electroslag

Remelting (ESR) – Molten steel is solidified into a thick rectangular slab

through continuous casting and then remelted in a metal mold. Once the

remelted slab is cooled and solidified within the mold, it is compressed

through a steel rolling mill to produce an extra-thick carbon steel plate.

ESR is used instead of mold casting for certain industry applications that

require higher quality plates because it produces an extra-thick carbon

steel plate with fewer flaws. However, ESR is costlier than mold casting

because the steel is melted twice and the rejection rate for the final

steel plate is higher.

|

Management

believes that Steel Plate Fusion services are a more cost effective and

efficient method to produce extra-thick carbon steel plates. Steel Plate Fusion

uses continuous casting in the production of extra-thick carbon steel plates

while mold casting can not be processed in this fashion. Continuous casting is

generally accepted as the cheapest and most efficient method for producing metal

slabs up to a certain thickness and also produces a higher quality end product.

Steel Plate Fusion does not require the added step of remelting the solidified

metal slab prior to compression in the steel rolling mill as does electroslag

remelting, thereby saving time and expense in the production

process.

Steel Plate

Fusion

Steel

Plate Fusion is our proprietary technology that we believe is the first and only

of its kind in China. We plan to offer Steel Plate Fusion as a value added

service to steel plate manufacturers in China. We believe Steel Plate Fusion

will be in high demand as it will lower production costs and improve

efficiencies in the manufacture of clad and extra-thick carbon steel plates in

China.

Steel

Plate Fusion uses electron-beam welding technology as part of its proprietary

process, which includes the manipulation of pressure and temperature during the

fusion process, to fuse together large metal slabs used in the production of

clad steel plates and extra-thick carbon steel plates. Electron-beam welding is

a fusion welding process that was first developed in 1958 to weld together

component parts used in modern technology such as jet engines, electric motors,

and automobiles. Electron-beam welding employs a high-velocity electron beam in

a vacuum to fuse together desired components. Through research and development,

FusionTech modified traditional electron beam welding technology so it could be

used to fuse together large metal slabs to produce clad steel plates or

extra-thick carbon steel plates. Management believes that Steel Plate Fusion

will be a cheaper, faster, and higher yielding method by which to produce clad

steel plates and extra-thick carbon steel plates in China, as compared to

conventional methods of production.

8

To

manufacture clad steel plates and extra-thick carbon steel plates through Steel

Plate Fusion, coal, limestone and iron ore are first processed by a blast

furnace to produce molten steel. The molten steel is then transformed into

rectangular steel slabs through the continuous casting process. After the slabs

have cooled and solidified, a truck transports the steel slabs to our processing

facilities which are adjacent to the steel plate manufacturing plant. At our

facility our staff mounts the rectangular steel slabs and fuses them together

using Steel Plate Fusion. The fused slab is then transported back to the steel

plate manufacturer where it is heated and compressed through a steel rolling

mill to produce the final clad steel or extra-thick carbon steel

plate.

During

our testing of Steel Plate Fusion we successfully produced clad steel plates and

extra-thick carbon steel plates in the facilities of a large steel manufacturer

in China. Microscopic and x-ray testing of the steel slabs fused together

through Steel Plate Fusion exceeded the stringent testing standards required by

steel plate manufacturers who produce clad steel plates and extra-thick carbon

steel plates. According to our tests, the final clad steel plates and

extra-thick carbon steel plates produced through Steel Plate Fusion are of

higher quality than those produced through explosion welding or mold casting

respectively. The clad steel plates produced through Steel Plate Fusion were

free of air bubbles often present in clad steel plates manufactured through

explosion welding. Additionally, we were able to produce extra-thick carbon

steel plates thicker than 100 millimeters and with an overall lower rejection

rate than plates produced through mold casting or electroslag

remelting.

Steel Plate Fusion

Intellectual Property

We filed

an application for an invention patent covering Steel Plate Fusion in China on

September 13, 2010. If the invention patent is granted, it will be solely owned

by the Company. The

invention patent offers stronger protection for new technological processes than

the more commonly used utility patent. If granted, the invention patent will

prevent competitors from utilizing our patented technology for a period of

twenty years as compared to only ten years for a utility patent. We strongly

believe that the application for the invention patent will be approved as no

other company in China uses technology similar to the technology utilized in our

Steel Plate Fusion process for which we have applied for patent

protection.

9

Although

the application process takes approximately eighteen months to complete, the

filing of an invention patent in China grants the applicant temporary protection

during this time. Should any competitor in China seek to use the technology for

which we have applied for patent protection in their own operations, FusionTech

intends

to protect its rights to the fullest extent permissible under the

law.

The

operation of Steel Plate Fusion requires specific skills and operational

knowledge to prevent defects in production and waste of expensive raw materials.

We will protect our operational knowledge of Steel Plate Fusion as a trade

secret. FusionTech plans to implement confidentiality procedures and contractual

provisions with its employees who work with proprietary

information related to Steel Plate Fusion as

production begins. Steel plate manufacturers who work with

FusionTech will also be required to follow strict confidentiality procedures

with respect to Steel Plate Fusion. We believe these steps will adequately

protect our proprietary knowledge of the operational and technical aspects of

Steel Plate Fusion.

Potential

Customers

We

believe our customer base for Steel Plate Fusion will be medium and large-scale

steel plate manufacturers across China who produce clad steel plates and

extra-thick carbon steel plates. We believe that the cost and efficiency

advantages Steel Plate Fusion has over conventional methods of clad and

extra-thick carbon steel plate production will help drive demand for our

services.

We plan

to market our Steel Plate Fusion technology directly to steel plate

manufacturers across China through our existing sales team for our CleanTech

coke oven products. We believe that our pre-existing relationships with steel

manufacturers formed through the sale of our coking products will provide

avenues for marketing and selling the Steel Plate Fusion value added

service.

In the

second quarter of 2011, we plan to provide Steel Plate Fusion to a large steel

plate manufacturer in northern China, Minmetals Yingkou. Minmetals Yingkou is an

established steel plate manufacturer in China with over 30 years of experience

in producing steel plates. It is a subsidiary of the reputable China Minmetals

Corporation, a Fortune Global 500 Company based in China focusing on the

development and production of metals and minerals.

FusionTech

is currently constructing a Steel Plate Fusion processing facility adjacent to

Minmetals Yingkou’s steel plate production facilities. Minmetals Yingkou will

produce carbon and stainless steel slabs using its own continuous casting

system, and the slabs will then be sent to the adjacent FusionTech processing

facility to be fused together using Steel Plate Fusion. These fused metal slabs

will then be sent back to the Minmetals Yingkou steel plate production

facilities where they will be compressed in Minmetals Yingkou’s rolling

machinery to produce finished clad steel plates and extra-thick carbon steel

plates. The Company plans to hire an additional 70 employees to work in the

Steel Plate Fusion processing facility in Yingkou.

Minmetals

Yingkou will be responsible for selling the steel plates to their customers.

Minmetals Yingkou, an established and reputable steel plate manufacturer in

China, plans to use its existing wide distribution network and customer

relationships to sell and market the clad and

extra-thick steel plates manufactured using Steel Plate Fusion. Our

agreement with Minmetals Yingkou provides for the production of 200,000 tons of

steel plates per year, adjustable based on market demand up to a goal of 500,000

tons per year. We will receive a processing fee based on the size, type and

market demand of each ton of fused metal slabs produced. We believe

that Steel Plate Fusion will begin generating revenues by the third quarter of

2011.

FusionTech

plans to use a similar business model with other medium and large-scale steel

plate manufacturers across China. We believe this model of expansion, where we

build processing factories adjacent to major China steel plate manufacturers and

charge a value added fee, will provide us with a first mover advantage

and discourage potential competitors from entering our newly created

market.

Steel Plate Fusion Business

Strategy

We

believe that we are the only company in China to offer Steel Plate Fusion as a

method of producing clad steel plates and extra-thick carbon steel plates. We

believe that the production efficiencies and cost savings offered by Steel Plate

Fusion will enable us to successfully compete in a market dominated by less

efficient and more costly production methods. We plan to remain competitive by

vigorously protecting our intellectual property and heavily marketing our Steel

Plate Fusion technology as the low-cost, higher efficiency alternative to

conventional production methods for clad steel plates and extra-thick carbon

steel plates.

|

|

·

|

First mover advantage

–We believe our Steel Plate Fusion services will be successful because

FusionTech is the only company to offer this low cost and high efficiency

method of producing clad steel plates and extra-thick carbon steel plates

in China, the market demand for which are expected to grow in the next

five years by 262% and 217% respectively, according to the Steel Plate

Report.

|

10

|

|

·

|

Established barriers to

entry – The high research and development costs necessary to

develop Steel Plate Fusion technology discourages competitors from

entering our newly created market. FusionTech has also applied for an

invention patent for Steel Plate Fusion which, if granted, will provide

legal protection for our proprietary technology for twenty

years. We believe that the invention patent will be approved.

Additionally, we believe our model of expansion will strengthen our

presence throughout different areas of China. The construction of

processing facilities adjacent to steel plate manufacturers will also

create strong barriers to entry and discourage potential

competitors.

|

|

|

·

|

Significant costs savings and

higher efficiencies over existing technologies – Based on our

testing of Steel Plate Fusion, management estimates that Steel Plate

Fusion technology will save steel plate manufacturers considerable costs,

time, resources, and help to expand production output of both clad steel

plates and extra-thick carbon steel

plates.

|

|

|

·

|

Asset-light, value added

service business model - As management

plans to pursue a strategy where clients pay FusionTech for its Steel

Plate Fusion services rather than for final steel plates produced,

FusionTech will not invest in expensive continuous casting and steel

rolling equipment in order to earn revenues from Steel Plate Fusion. We

believe this is a superior business model as compared to producing clad

steel plates and extra-thick carbon steel plates which require high

capital expenditures for steel slab production and their subsequent

compression through hot rolling. We also plan to leverage the existing

distribution network and customer base of Minmetals Yingkou for steel

plates to expand steel plate production using our Steel Plate Fusion

technology.

|

Research

and Development

We spent

$88,604 on research and development in 2008 and $140,700 in 2009. For

the nine months ended September 30, 2010, we spent $162,185. We estimate that

we spent an additional $58,660 on research and development in the fourth

quarter of 2010. We continue to evaluate opportunities to develop new products

and will increase or decrease expenditures for research and development

accordingly.

Governmental

and Environmental Regulation

Environmental

Matters

We are

subject to the National Environmental Protection Law of the PRC as well as local

laws regarding pollutant discharge, air, water and noise pollution, with which

we comply. Neither

the manufacturing of our coke oven products nor the fusion of steel plates using

our Steel Plate Fusion technology generates any material air emission, waste

water discharge, solid waste or noise pollution. As such, we do not

currently incur any material costs in order to comply with applicable

environmental laws.

We are

not subject to any other government regulations that would require us to obtain

a special license or approval from the PRC government to operate our coke oven

products business or Steel Plate Fusion services.

M&A

Rules

On August

8, 2006, six PRC regulatory agencies, namely, the PRC Ministry of Commerce, or

MOFCOM, the State Assets Supervision and Administration Commission, or SASAC,

the State Administration for Taxation, the State Administration for Industry and

Commerce, the China Securities Regulatory Commission, or CSRC, and SAFE jointly

adopted the Regulations on Mergers and Acquisitions of Domestic Enterprises by

Foreign Investors, which became effective on September 8, 2006, and was amended

by MOFCOM on June 22, 2009 (the “M&A Rules”). According to Rule 52 of the

M&A Rules and Guidance Manual on Administration of Entry of Foreign

Investment, as amended, issued by the Department of Foreign Investment

Administration of the Ministry of Commerce in December 2008, conversion from a

joint venture enterprise to a wholly owned foreign entity by way of equity

transfer from a Chinese party to a foreign shareholder or investor, shall not be

subject to the M&A Rules.

The

M&A Rules require offshore companies formed for overseas listing purposes

through acquisitions of PRC domestic companies and controlled by PRC Operating

Companies or individuals to obtain the approval of the CSRC prior to the public

listing of their securities on an overseas stock exchange. On September 21,

2006, pursuant to the M&A Rules and other PRC Laws, the CSRC published on

its official website relevant guidance with respect to the listing and trading

of PRC domestic enterprises’ securities on overseas stock exchanges (“Related

Clarifications”), including a list of application materials regarding the

listing on overseas stock exchanges by special purpose vehicles. However, the

CSRC currently has not issued any definitive rule concerning whether the

transactions effected by the overseas listing would be subject to the M&A

Rules and Related Clarifications. Article 238 of the PRC Securities Law also

provides that any domestic enterprise that directly or indirectly issues any

securities abroad or lists its securities abroad for trading shall be subject to

the approval of the securities regulatory authority under the State Council

according to the relevant provisions of the State Council.

11

The

M&A Rules do not have express provisions in terms of penalties for failure

to obtain CSRC approval prior to the public listing of our securities. However,

there are substantial uncertainties regarding the interpretation, application

and enforcement of the above rules, and CSRC has yet to promulgate any written

provisions or formally to declare or state whether the overseas listing of a

PRC-related company similar to ours is subject to the approval of CSRC. Any

violation of these rules could result in fines and other penalties on our

operations in China, restrictions or limitations on remitting dividends outside

of China, and other forms of sanctions that may cause a material and adverse

effect to our business, operations and financial conditions.

Notwithstanding

the foregoing, we have been advised by our PRC counsel that the M&A Rules

did not apply to our share exchange transaction. The share exchange did not

require CSRC approval because we were not a special purpose vehicle formed or

controlled by PRC Operating Companies or PRC individuals and because our foreign

ownership of Dalian is qualified as a foreign joint venture, it is not subject

to the M&A Rules.

Foreign

Investment in PRC Operating Companies

The

Foreign Investment Industrial Catalogue jointly issued by MOFCOM and the

National Development and Reform Commission (“NDRC”) in 2007 classified various

industries/business into three different categories: (i) encouraged for foreign

investment; (ii) restricted to foreign investment; and (iii) prohibited from

foreign investment. For any industry/business not covered by any of these three

categories, they will be deemed industries/business permitted to have foreign

investment. Except for those expressly provided restrictions, encouraged and

permitted industries/business are usually 100% open to foreign investment and

ownership. With regard to those industries/business restricted to or prohibited

from foreign investment, there is always a limitation on foreign investment and

ownership. The reason that our business is not subject to limitation on foreign

investment and ownership is as follows:

(i) Our business, including the

proposed steel plate fusion services, falls under the class which is

encouraged for foreigninvestment and open to 100%

foreign investment and ownership; and

(ii) our

business does not fall under the industry categories that are restricted to, or

prohibited from foreign investment.

Properties

Our

principal executive offices and our designing and manufacturing facilities for

our CleanTech coke oven products and core coke oven products are located in

Liaoning Province, China. We lease four buildings in and around Dalian including

our office headquarters and three separate manufacturing

facilities. We believe these three manufacturing facilities are

adequate for our current coke oven products business as they have an estimated

annual production capacity of 150 units.

Our

office headquarters is located at No. 26 Gaoneng Street, High Tech Zone, Dalian,

Liaoning Province, China, and is approximately 1,600 square meters. Our lease

for this premise commenced on February 1, 2010 and will expire on February 1,

2011. We will pay a total of approximately $39,706 during the one year lease

term. We plan to renew this lease prior to its

expiration.

Our first

manufacturing facility is located in the city of Wafangdian, approximately 75

miles from Dalian, and is approximately 2,500 square meters. Our lease for this

premise commenced on November 1, 2008 and will expire October 31, 2013. The

leased premise includes a bridge crane and crane arm we use in our manufacturing

operations, and the surrounding 13 acres of land. We pay approximately $67,650

yearly for this facility.

Our

second manufacturing facility is located in the city of Wafangdian and is

approximately 2,000 square meters. Our lease on this premise commenced on

January 1, 2010 and will expire January 1, 2013. The leased premise

includes a bridge crane we use in our manufacturing operations. We

pay approximately $53,000 yearly for this facility.

Our third

manufacturing facility is located near the city of Dalian and is approximately

3,600 square meters. Our lease on this premise commenced

on August 10, 2010 and will expire August 10, 2012. The leased premise includes

a 64 square meter office and two bridge cranes we use in our manufacturing

operations. We pay approximately $88,235 yearly for this facility.

We are in

the process of obtaining the land-use rights from the PRC government for 100

acres of land in Liaoning Province, where we have begun construction of a

processing facility for Steel Plate Fusion. Based on our communications with the

Management Committee of Laobian Industrial Park, the local authority charged

with administering the land, we expect to receive the land-use rights by

February 2011. The foundation for the Steel Plate Fusion facility has been

completed, and we expect construction to be completed and the facility to be

fully functional in time to commence our Steel Plate Fusion operation in the

second quarter of 2011. The facility is expected to be approximately

40,000 square meters with an

estimated annual production capacity of 200,000 tons of fused metal slabs,

expandable with the purchase of additional equipment up to 800,000

tons.

We are in

the process of obtaining the land-use rights from the PRC government for 132

acres of land located in Liaoning Province, China. We are planning to build

manufacturing facilities for our coke oven products business on this land;

although no specific arrangements or plans have been made to

date. Based on our communications with the Zhuanghe Port Industrial

Zone Management Committee, the local authority charged with administering the

land, we expect to receive the land-use rights by February

2011.

12

Legal

Proceedings

FusionTech

may occasionally become involved in various lawsuits and legal proceedings

arising in the ordinary course of business. Litigation is subject to inherent

uncertainties and an adverse result in these or other matters that may arise

from time to time may have an adverse affect on our business, financial

conditions or operating results. FusionTech is currently not aware of any such

legal proceedings or claims that will have, individually or in the aggregate, a

material adverse affect on our business, financial condition or operating

results.

Risk

Factors

Risks

Related to Our Business

Our

plans for growth rely on a new business that we have not yet commenced. This

line of business will be critical to our success in the future, and if it is

unsuccessful our potential for growth may be adversely affected.

Steel

Plate Fusion is a new service offered by the Company that will commence

operations in the second quarter of 2011. While we have already signed an

agreement with a large steel plate manufacturer in China to provide these

services, we have not yet commenced mass production at any

facility. We cannot assure you that large scale production will be

profitable or that the production techniques we use will be suitable for mass

production. Moreover, while during the testing of Steel Plate Fusion we

successfully produced clad and extra-thick carbon steel plates and the final

produced steel plates met or exceeded the quality standards required by our

customer, we cannot assure you that we will be able to maintain such standards

when we commence mass production. Therefore we cannot assure you that Steel

Plate Fusion will be a profitable line of business and will ultimately succeed

as currently planned. Any significant setback in our plans for Steel Plate

Fusion may adversely affect our future profitability and potential for

growth.

We

may need additional capital to execute our business plan and fund operations and

may not be able to obtain such capital on acceptable terms or at

all.

In

connection with the planned expansion of our business to offer Steel Plate

Fusion services we will likely require additional capital to fund our operations

of approximately $9 million in 2011. Management anticipates that our existing

capital resources and cash flows from operations and current short-term bank

loans will be adequate to satisfy our liquidity requirements for our current

business for the next 12 months. However, if available liquidity is not

sufficient to meet our plans for expansion, current operating expenses and loan

obligations as they come due, our plans include pursuing alternative financing

arrangements. Our ability to obtain additional capital on acceptable terms or at

all is subject to a variety of uncertainties, including:

|

|

§

|

investors’ perceptions of, and

demand for, companies in our

industry;

|

|

|

§

|

investors’ perceptions of, and

demand for, companies operating in

China;

|

|

|

§

|

conditions of the United States

and other capital markets in which we may seek to raise

funds;

|

|

|

§

|

our future results of operations,

financial condition and cash

flows;

|

|

|

§

|

governmental regulation of

foreign investment in companies in particular

countries;

|

|

|

§

|

economic, political and other

conditions in the United States, China, and other countries;

and

|

|

|

§

|

governmental policies relating to

foreign currency borrowings.

|

We may be

required to pursue sources of additional capital through various means,

including joint venture projects and debt or equity financings. There is no

assurance we will be successful in locating a suitable financing transaction in

a timely fashion or at all. In addition, there is no assurance we will obtain

the capital we require by any other means. Future financings through equity

investments are likely to be dilutive to our existing shareholders. Also, the

terms of securities we may issue in future capital transactions may be more

favorable for our new investors. Newly issued securities may include preferences

or superior voting rights, be combined with the issuance of warrants or other

derivative securities, or be the issuances of incentive awards under equity

employee incentive plans, which may have additional dilutive effects.

Furthermore, we may incur substantial costs in pursuing future capital and

financing, including investment banking fees, legal fees, accounting fees,

printing and distribution expenses and other costs. We may also be required to

recognize non-cash expenses in connection with certain securities we may issue,

such as convertible notes and warrants, which will adversely impact our

financial condition.

13

If we

cannot raise additional funds on favorable terms or at all, we may not be able

to carry out all or parts of our strategy to maintain our growth and

competitiveness or to fund our operations. If the amount of capital we are able

to raise from financing activities, together with our revenues from operations,

is not sufficient to satisfy our capital needs, even to the extent that we

reduce our operations accordingly, we may be required to cease

operations.

We

are a major purchaser of certain raw materials that we use in the manufacturing

process of our clean coking and related products, and price changes for the

commodities we depend on may adversely affect our profitability.

The

Company’s largest raw materials purchases consist of stainless steel and carbon

steel. As such, fluctuations in the price of steel in the China domestic market

will have an impact on the Company’s operating costs and related profits.

International steel prices were lower in 2009 than in 2008, but prices have

increased in 2010 along with the general economic recovery. The iron ore import

price in China has also increased since 2009, which will impact the price and

volume of steel produced by the China domestic steel industry.

Our

profitability depends in part upon the margin between the cost to us of certain

raw materials, such as stainless steel and carbon steel, used in the

manufacturing process, as well as our fabrication costs associated with

converting such raw materials into assembled products, compared to the selling

price of our products, and the overall supply of raw materials. It is our

intention to base the selling prices of our products in part upon the associated

raw materials costs to us. However, we may not be able to pass all increases in

raw material costs and ancillary acquisition costs associated with taking

possession of the raw materials through to our customers. Although we are

currently able to obtain adequate supplies of raw materials, it is impossible to

predict future availability or pricing. The inability to offset price increases

of raw materials by sufficient product price increases, and our inability to

obtain raw materials, would have a material adverse effect on our consolidated

financial condition, results of operations and cash flows.

The

Company does not engage in hedging transactions to protect against raw material

fluctuations, but attempts to mitigate the short-term risks of price swings by

purchasing raw materials in advance.

We

derive a substantial part of our revenues from a few major customers. If we lose

any of these customers or they reduce the amount of business they do with us,

our revenues may be seriously affected.

Our three

largest customers accounted for approximately 68% of total sales for the fiscal

year ended December 31, 2009, and our largest customer accounted for

approximately 32% of total sales in the fiscal year ended December 31, 2009. Our

three largest customers accounted for approximately 88% of total sales for the

nine months ended September 30, 2010, and our largest customer accounted for

approximately 38% of total sales for the nine months ended September 30, 2010.

These customers may not maintain the same volume of business with us in the

future. If we lose any of these customers or they reduce the amount of business

they do with us, our revenues and profitability may be seriously affected. We do

not foresee our relying on these same customers for revenue generation as we

introduce new product lines, new generations of existing product lines, and

expand our business to include Steel Plate Fusion services. We cannot be

assured, however, that we will be able to successfully introduce new products or

services.

In

addition, we currently only have one prospective customer, Mimnetals Yingkou,

for our Steel Plate Fusion services. Our success in developing the Steel Plate

Fusion business depends, in part, upon our delivery of products to our customer

that meets their specifications in a timely, cost-effective manner. If we are

unable to deliver products in this manner this customer could terminate our

relationship, which would adversely affect our plans for growth. We cannot

assure you that we will be able to diversify our services by entering into

relationships with steel plate manufacturers in the future.

We

may lose customers for our traditional coke oven products due to consolidation

of the steel industry in China.

We

currently sell our traditional coke oven products to a number of medium size

steel mills and coking plants in China. If these medium size steel mills and

coking plants are forced to close or consolidate with larger operations, we may

lose them as our customers. While we believe that consolidation of the steel

industry in China will increase the demand for our clean coking products as

larger steel mills and coking plants with greater capital resources are formed,

there are no guarantees that we will be able to successfully retain these larger

steel mills and coking plants as our customers.

The

steel industry is cyclical in nature and is subject to the fluctuations of the

global economy, a downturn in which could adversely affect our revenues and the

profitability of our planned expansion into Steel Plate Fusion.

Our clean

coking and related products are used by large and medium size steel mills and

coking plants in China whose businesses are dependent on the strength of the

global steel industry. Any drop in the demand for steel due to global economic

factors may cause these steel mills and coking plants to reduce their level of

capital expenditures which in turn could adversely affect our revenues from our

coke oven products. Such an occurrence may also negatively affect the

profitability of our planned expansion into Steel Plate Fusion.

14

If

we are not able to manage our growth, we may not be profitable.

Our

continued success will depend on our ability to expand and manage our operations

and facilities. There can be no assurance we will be able to manage our growth,

meet the staffing requirements for our current or planned business or

successfully assimilate and train new employees. In addition, to manage our

growth effectively, we may be required to expand our management base and enhance

our operating and financial systems. If we continue to grow, there can be no

assurance the management skills and systems currently in place will be adequate.

Moreover, there can be no assurance we will be able to manage any additional

growth effectively. Failure to achieve any of these goals could have a material

adverse effect on our business, financial condition or results of

operations.

Our

accounts receivables remain outstanding for a significant period of time, which

has a negative impact on our cash flow and liquidity.

Our

agreements with our customers related to our clean coking and related products

generally provide that approximately 30% of the purchase price is due upon the

placement of an order, 30% when the manufacturing process is substantially

complete and 30% upon customer acceptance of the product. As a common practice

in the manufacturing business in China, payment of the final 10% of the purchase

price is due no later than the termination date of our warranty period, which

is typically a negotiated term of up to 12 to 18 months from the

acceptance date. Sales revenue, including the final 10% of the purchase price,

is recognized after delivery is complete, customer acceptance of the product

occurs and collectability is reasonably assured. Payments

received before satisfaction of all relevant criteria for revenue recognition

are recorded as unearned revenue.

We

may experience material disruptions to our operations.

We depend

upon three facilities to operate our business. While we seek to operate our

facilities in compliance with applicable rules and regulations and take measures

to minimize the risks of disruption at our facilities, a material disruption at

one of our facilities could prevent us from meeting customer demand, reduce our

sales and/or negatively impact our financial results. Any of our facilities, or

any of our machines within an otherwise operational facility, could cease

operations unexpectedly due to a number of events, including: prolonged power

failures; equipment failures; disruptions in the transportation infrastructure

including roads, bridges, railroad tracks; and fires, floods, earthquakes, acts

of war, or other catastrophes.

We

cannot be certain our innovations and marketing successes will

continue.

We

believe our past performance has been based on, and our future success will

depend, in part, upon our ability to continue to improve our existing products

through product innovation and to develop, market and produce new products and

services. We cannot assure you that we will be successful in introducing,

marketing and producing any new products or services, or that we will develop

and introduce in a timely manner innovations to our existing products which

satisfy customer needs or achieve market acceptance. Our failure to develop new

products or services and introduce them successfully and in a timely manner

could harm our ability to grow our business and could have a material adverse

effect on our business, results of operations and financial

condition.

The

technology used in our products and services may not satisfy the changing needs

of our customers.

While we

believe we have hired or engaged personnel who have the experience and ability

necessary to keep pace with advances in technology, and while we continue to

seek out and develop “next generation” technology through our research and

development efforts, there is no guarantee we will be able to keep pace with

technological developments and market demands in our target industries and

markets. Although certain technologies in the industries we occupy are well

established, we believe our future success depends in part on our ability to

enhance our existing products and develop new products and services in order to

continue to meet customer demands. With any technology, including the technology

of our current and proposed products and services, there are risks that the

technology may not address successfully all of our customers’ needs. Moreover,

our customers’ needs may change or vary. This may affect the ability of our

present or proposed products and services to address all of our customers’

ultimate technology needs in an economically feasible manner, which could have a

material adverse affect on our business.

15

We

may not be able to keep pace with competition in our industry.

Our clean coking and related products