Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VALLEY NATIONAL BANCORP | d8k.htm |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

Investor Presentation

Exhibit 99.1 |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

2

Information For Investors And Shareholders

This presentation contains forward-looking statements concerning Valley’s future

business outlook, financial condition and operating results. Readers are advised not to

place undue reliance on these forward-looking statements as they are influenced by

certain risk factors and unpredictable events. The

foregoing

contains

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Such

statements

are

not

historical

facts

and

include

expressions

about

management’s

confidence

and

strategies

and

management’s

expectations

about

new

and

existing

programs

and

products,

relationships,

opportunities,

taxation,

technology

and

market

conditions.

These

statements

may

be

identified

by

such

forward-looking

terminology

as

“will,”

“may,”

“expect,”

“believe,”

“view,”

“opportunity,”

“should,”

“allow,”

“continues,”

“reflects,”

“typically,”

“usually,”

“anticipate,”

or

similar

statements

or

variations

of

such

terms.

Such

forward-looking

statements

involve

certain

risks

and

uncertainties.

Actual

results

may

differ

materially

from

such

forward-looking

statements.

Factors

that

may

cause

actual

results

to

differ

materially

from

those

contemplated

by

such

forward-looking

statements

include,

but

are

not

limited

to

those

factors

disclosed

in

Valley’s

Current

Report

on

Form

8-K

filed

on

January

27,

2011,

Quarterly

Report

on

Form

10-Q

for

the

quarter

ended

September

30,

2010

and

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2009.

Valley disclaims any obligation to update or revise forward-looking statements for any

reason. |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

3

Valley National Bank Today

About Valley

Regional Bank Holding Company

Approximately $14.1 Billion in

Assets

Headquartered in Wayne, New

Jersey

40

th

Largest

United

States

Chartered

Commercial

Bank

Largest

Commercial

Bank

Headquartered

in

New

Jersey

Operates 198 Branches in 134

Communities Serving 14 counties

throughout Northern and Central

New Jersey, Manhattan, Brooklyn

and Queens

Traded on the NYSE (VLY)

Significant Attributes

Consistent Shareholder Returns

Focus on Credit Quality

Conservative Strategies

Affluent and Heavily Populated

Footprint

Strong Customer Service

Experienced Senior and Executive

Management |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

4

Management Approach

Large percentage of retail ownership

Long-term investment approach

Focus on cash and stock dividends

Large insider ownership, family members, retired

employees and retired directors

Market Cap of $2.3 Billion

Approximately 238 institutional holders

37.32% of total outstanding shares

Source: Bloomberg as of 1/25/11

Large Bank that Operates and Feels Like a Small Closely Held Company

|

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

5

Footprint & Demographics

Valley’s Emerging NJ Market

Valley’s Core NJ Market

Branches Under Construction

Current Branches

Valley’s Core New Jersey Market

Total Market Deposits -

$126.6 billion

Market Average Deposits per Branch $77.1 million

Existing

Valley

Branches

–

131

Branches

Under

Construction

–

1

Valley’s

Market

Share

–

6.63%

Valley’s Emerging New Jersey Market

Total Market Deposits -

$66.3billion

Market Average Deposits per Branch $67.7million

Existing

Valley

Branches

–

38

Branches

Under

Construction

–

1

Valley’s

Market

Share

–

1.59%

Headquarters

Region

Population

Median HH

Income

Total Market

Deposits

Valley’s NJ Marketplace

5.9 million

$75,917

$193 billion

Balance of NJ Marketplace

2.9 million

$66,868

$64 billion

NJ Total

8.8 million

$72,891

$257 billion

Valley’s NJ Marketplace

Demographic Data from SNL Financial Inc. as of 6/2010 Valley Branch data as of

6/30/2010 |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

6

Footprint & Demographics

Valley’s Emerging Manhattan Market

Total Market Deposits -

$480.9 billion

Market Average Deposits per Branch $639.5 million

Existing Valley Branches –

16

Valley’s Market Share –

0.28%

Valley’s Emerging Queens Market

Total Market Deposits -

$47.9 billion

Market Average Deposits per Branch $100.0 million

Existing Valley Branches –

5

Valley’s Market Share –

0.17%

Valley’s Emerging Brooklyn/Kings Market

Total Market Deposits -

$36.2 billion

Market Average Deposits per Branch $93.3 million

Existing Valley Branches –

8

Branches Under Construction -

1

Valley’s Market Share –

0.58%

Region

Population

Median HH

Income

Total Market

Deposits

Valley’s NY Marketplace

6.5 million

$55,730

$565 billion

Balance of NY Marketplace

13.0 million

$63,930

$330 billion

NY Total

19.5 million

$61,195

$895 billion

Valley’s Emerging NYC Markets

Branches Under Construction

Current Branches

Valley’s NY Marketplace

Demographic Data from SNL Financial Inc. as of 6/2010 Valley Branch data as of

6/30/2010 |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

7

Centralized & Efficient Operations

Single core data processing system

Last 3 bank acquisitions were converted within 90

days of transaction completion date

Centralized, in-house back office operations

All 198 branches operate within a 60 mile radius of

Headquarters

Approximately 2,700 FTE employees

12/31/2007

12/31/2008

12/31/2009

12/31/2010

FTE Employees

2,562

2,783

2,727

2,720

# of Branch Offices

176

195

197

198

Employees / Offices

14.56

14.27

13.84

13.74 |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

8

Non-Interest Exp / Total Assets

Source –

SNL Financial |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

9

Valley’s 4Q 2010 Highlights

Credit Quality

Total 30+ day delinquencies were 1.77% of entire loan portfolio

Total non-accrual loans remained unchanged during 4Q at 1.12% of total loans

Out of approximately 22,000 residential mortgages and home equity loans only 253

loans were past due 30 days

or more at December 31, 2010

Net charge-offs were $4.3 million or 0.18% of average total loans on an annualized

basis Allowance for non-covered loan losses as a percentage of non-covered

loans increased to 1.31% from 1.09% at December 21, 2009.

Net Income

4Q net income available to common shareholders was $38.2 million

($0.24 Diluted EPS)

Capital

Continued strong capital ratios

Tangible Common Equity to Risk-Weighted Assets of 9.10%

Tier 1 Common Capital of 9.25%

Tier I Ratio of 10.94%

Tier II Ratio of 12.91% |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

10

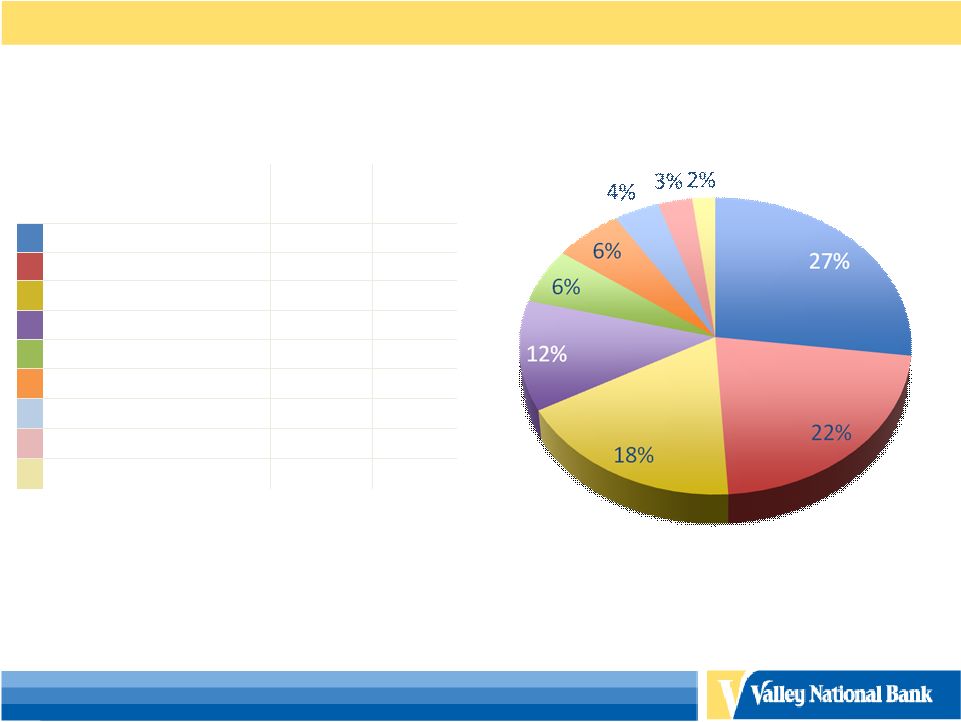

Asset and Loan Composition

Total Assets = $14.1 Billion

As of 12/31/10

Non-Covered Loans (Gross) = $9.0 Billion

*Other Assets includes bank owned branch locations carried at a

cost estimated by management to be significantly less than the

current market value. |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

11

Total Commercial Real Estate -

$3.3 Billion

(Non-Covered Loans)

As of 12/31/10

Primary Property

Type

$ Amount

(Millions)

% of

Total

Average

LTV

Retail

880

27%

50%

Industrial

653

20%

52%

Office

428

13%

54%

Mixed Use

372

11%

44%

Apartments

335

10%

52%

Healthcare

236

7%

61%

Specialty

211

7%

49%

Residential

79

2%

49%

Land Loans

65

2%

67%

Other

25

1%

50%

Diversified Commercial Real Estate Portfolio

-Average LTV based on current balances and most recent appraised value

-The total CRE loan balance is based on Valley’s internal loan hierarchy

structure and does not reflect loan classifications reported in Valley’s SEC

and bank regulatory reports.

-The chart above does not include $388 million in construction loans.

|

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

12

Total Retail Property Types -

$880 Million

(Non-Covered Loans)

Retail Property Type

% of

Total

Average

LTV

Multi-Tenanted -

Anchor

27%

49%

Single Tenant

22%

51%

Multi-Tenanted -

No Anchor

18%

54%

Auto Dealership

12%

51%

Private & Public Clubs

6%

31%

Food Establishments

6%

53%

Private Education Facilities

4%

51%

Entertainment Facilities

3%

42%

Auto Servicing

2%

51%

As of 12/31/10

Retail Composition of Commercial Real Estate

-Average LTV based on current balances and most recent appraised value

-The chart above does not include construction loans. |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

13

As of 12/31/10

Construction Loan Composition

Total (Non-Covered) Construction Loans -

$388 Million

Primary Property Type

$ Amount

(Millions)

% of

Total

Residential

160

41%

Retail

53

14%

Land Loans

49

13%

Mixed Use

43

11%

Apartments

26

7%

Other

18

5%

Office

12

3%

Healthcare

12

3%

Specialty

10

2%

Industrial

5

1%

-Construction loan balance is based on Valley’s internal loan hierarchy

structure and does not reflect loan classifications reported in Valley’s SEC

and bank regulatory reports. |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

14

Loan Quality 1992 –

4Q 2010

Source –

FDIC

*Non-Current Loans: Loans and leases 90 days or more past due plus loans in non

accrual status, as a percent of gross loans and leases. |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

15

Loan Quality 1992 –

4Q 2010

Source –

FDIC

*Non-Current Loans: Loans and leases 90 days or more past due plus loans in non

accrual status, as a percent of gross loans and leases. |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

16

Loan Quality 1992 –

4Q 2010

Source –

FDIC

*Non-Current Loans: Loans and leases 90 days or more past due plus loans in non

accrual status, as a percent of gross loans and leases. |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

17

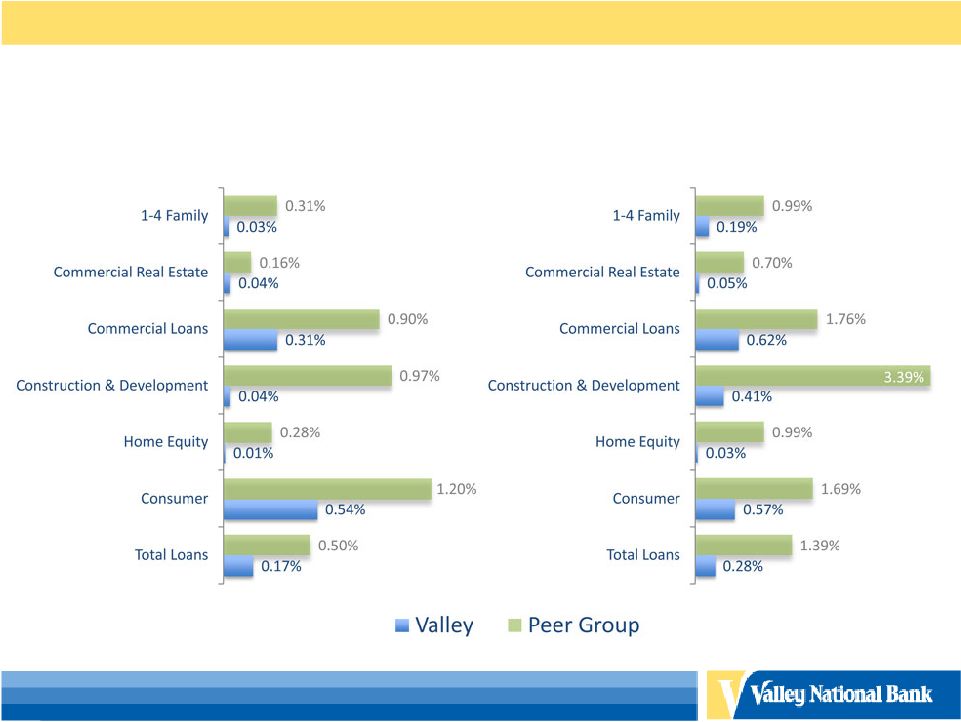

Net Charge-offs to Average Loans

Source -

SNL Financial As of 1/2610

Peer group consists of banks with total assets between $3 billion and $50 billion.

2003 -

2009

2010 |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

18

Investment Portfolio

2010

Investment Types

2007

33%

GSE MBS (GNMA)

3%

21%

GSE MBS (FNMA/FHLMC)

49%

13%

Trust Preferred

12%

10%

State, County & Municipals

7%

9%

US Treasury

0%

7%

Other

7%

4%

Corporate Debt

17%

3%

Private Label MBS

5%

$3.0 Billion

Investment Portfolio

$3.1 Billion

As of 12/31/10 and 12/31/07

Duration of MBS Securities

1.69 Years

2.64 Years |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

19

Securities by Investment Grade

AAA Rated 69%

AA Rated 6%

A Rated 4%

BBB Rated 6%

Non Investment Grade 4%

Not Rated 11%

As of 12/31/10 |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

20

Deposits and Borrowings Composition

Total Liabilities = $12.8 Billion

As of 12/31/10

Total Deposits = $9.4 Billion |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

21

Equity Composition / Ratios*

Total Tier II Equity = $1.3 Billion

As of 12/31/10

Significant unrealized gain on facilities, referenced in slide 10,

not incorporated in capital ratios reflected above.

*Non-GAAP reconciliations shown on slide 24.

Capital Ratios

As of

12/31/2010

“Well

Capitalized”

Tangible Common Equity /

Tangible Assets

6.90%

N/A

Tangible Common Equity /

Risk-Weighted Assets

9.10%

N/A

Tier I

10.94%

6.00%

Tier II

12.91%

10.00%

Leverage

8.31%

5.00%

Book Value

$8.02

N/A

Tangible Book Value

$5.89

N/A |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

22

Shareholder Returns

(1) All per share amounts have been adjusted retroactively for stock

splits and stock dividends during the periods presented. (2) Net income

includes other-than-temporary impairment charges on investment securities totaling $2.9 million, $4.0 million,

$49.9 million, and $10.4 million, net of tax benefit, for years ended

December 31, 2010, 2009, 2008, and 2007, respectively. Historical Financial Data

(1) (Dollars in millions, except for share data)

2010

14,144

$

131.2

$

$0.81

0.93

%

10.32

%

$0.72

5/10 -

5%

Stock Dividend

2009

14,284

116.1

0.64

0.81

8.64

0.72

5/09 -

5%

Stock Dividend

2008

14,718

93.6

0.64

0.69

8.74

0.73

5/08 -

5%

Stock Dividend

2007

12,749

153.2

1.10

1.25

16.43

0.72

5/07 -

5%

Stock Dividend

2006

12,395

163.7

1.15

1.33

17.24

0.70

5/06 -

5%

Stock Dividend

2005

12,436

163.4

1.17

1.39

19.17

0.69

5/05 -

5%

Stock Dividend

2004

10,763

154.4

1.16

1.51

22.77

0.66

5/04 -

5%

Stock Dividend

2003

9,873

153.4

1.15

1.63

24.21

0.63

5/03 -

5%

Stock Dividend

2002

9,148

154.6

1.12

1.78

23.59

0.60

5/02 -

5:4

Stock Split

2001

8,590

135.2

0.94

1.68

19.70

0.56

5/01 -

5%

Stock Dividend

2000

6,426

106.8

0.90

1.72

20.28

0.53

5/00 -

5%

Stock Dividend

1999

6,360

106.3

0.85

1.75

18.35

0.50

5/99 -

5%

Stock Dividend

1998

5,541

97.3

0.82

1.82

18.47

0.45

5/98 -

5:4

Stock Split

1997

5,091

85.0

0.75

1.67

18.88

0.40

5/97 -

5%

Stock Dividend

1996

4,687

67.5

0.66

1.47

17.23

0.35

5/96 -

5%

Stock Dividend

1995

4,586

62.6

0.60

1.40

16.60

0.34

5/95 -

5%

Stock Dividend

1994

3,744

59.0

0.66

1.60

20.03

0.32

5/94 -

10%

Stock Dividend

1993

3,605

56.4

0.65

1.62

21.42

0.25

4/93 -

5:4

Stock Split

1992

3,357

43.4

0.50

1.36

19.17

0.22

4/92 -

3:2

Stock Split

1991

3,055

31.7

0.37

1.29

15.40

0.21

1990

2,149

28.6

0.33

1.44

14.54

0.21

Period End

Total Assets

Net Income

(2)

Common Stock Splits and Dividends

Diluted

Earnings Per

Common

Share

Return on

Average

Assets

Return on

Average

Equity

Cash Dividends

Declared Per

Common Share |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

23

For More Information

Log onto our web site: www.valleynationalbank.com

E-mail requests to: dgrenz@valleynationalbank.com

Call Shareholder Relations at: (973) 305-3380

Write to: Valley National Bank

1455 Valley Road

Wayne, New Jersey 07470

Attn: Dianne M. Grenz, First Senior Vice President

Director of Marketing, Shareholder & Public Relations

Log onto our website above or www.sec.gov to obtain free copies of

documents filed by Valley with the SEC |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

24

12/31/2010

Non-GAAP Disclosure Reconciliations

($ in Thousands)

Total Assets

$14,143,826

Less: Goodwill & Other Intangible Assets

(343,541)

Total Tangible Assets (TA)

$13,800,285

Total Equity

$1,295,205

Less: Goodwill & Other Intangible Assets

(343,541)

Total Tangible Common Equity (TCE)

$951,664

Risk Weighted Assets (RWA)

$10,453,352

Ratios

TCE / TA

6.90%

TCE / RWA

9.10%

Tier

I

Common

Ratio

(Tier

1

common

/RWA)

9.25%

Tier I

(Total Tier I / RWA)

10.94%

Tier II

(Total Tier II / RWA)

12.91%

Total Equity

$1,295,205

Less: Net unrealized gains on securities available

for sale

(13,950)

Plus: Accumulated net losses on cash flow

hedges, net of tax

708

Plus: Pension liability adjustment, net of tax

18,398

Less: Goodwill

(317,891)

Less: Other disallowed intangible assets

(15,455)

Tier I Common Capital

$967,015

Plus: Trust preferred securities

176,313

Total Tier I Capital

$1,143,328

Plus: Allowance for credit losses

$126,504

Plus: Qualifying sub debt

$80,000

Total Tier II Capital

$1,349,832 |

©

2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

25

Common Shares Outstanding

161,460,596

Shareholders’

Equity

$1,295,205

Less: Goodwill and Other Intangible

Assets

(343,541)

Tangible Shareholders’

Equity

$951,664

Tangible Book Value

$5.89

12/31/2010

Non-GAAP Disclosure Reconciliations

($ in Thousands) |