Attached files

| file | filename |

|---|---|

| 8-K - ANR 8K 01-31-2011 - Alpha Natural Resources, Inc. | anr8k01312011.htm |

| EX-2.1 - EXHIBIT 2.1 AGREEMENT AND PLAN OF MERGER - Alpha Natural Resources, Inc. | exhibit21.htm |

| EX-99.1 - EXHIBIT 99.1 01-29-2011 PRESS RELEASE - Alpha Natural Resources, Inc. | exhibit991.htm |

| EX-99.3 - EXHIBIT 99.3 JOINT INVESTOR PRESENTATION - Alpha Natural Resources, Inc. | exhibit993.htm |

Exhibit 99.2

January 29, 2011

An Important Message to All Employees

From Kevin Crutchfield, Kurt Kost and Mike Quillen

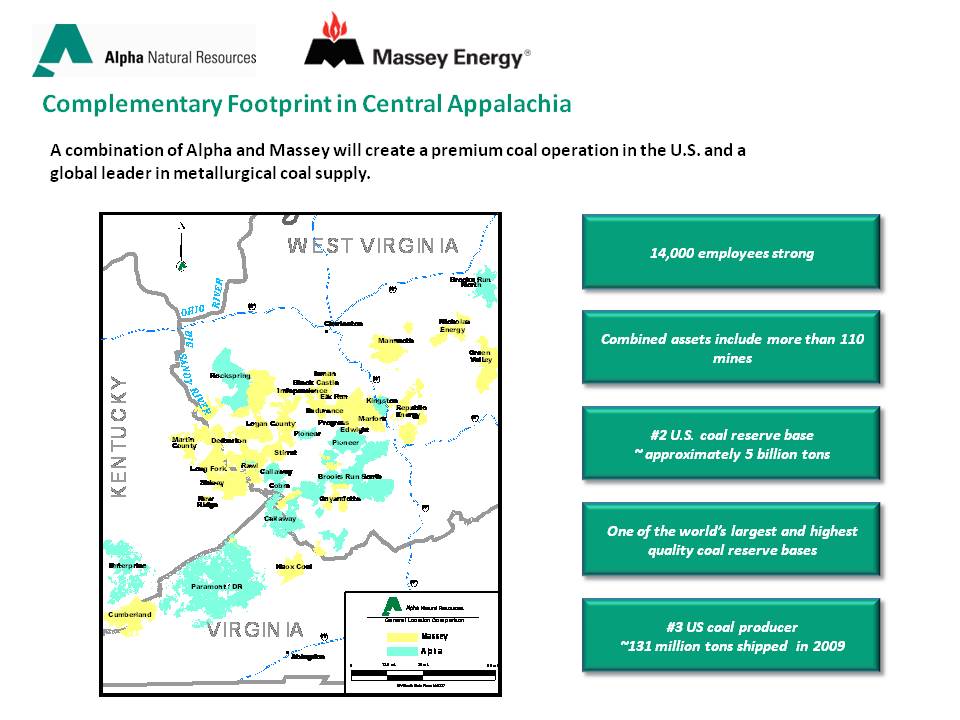

This afternoon, Alpha announced that we have agreed to acquire Massey Energy in a move that would make us America’s largest supplier of metallurgical coal to the world’s steel industry and a premier supplier of thermal coal to U.S. utilities. A copy of the press release, a map of Central Appalachia operations and a brief question-and-answer document is attached for your convenience.

Alpha has long recognized the value that this combination can create. Alpha and Massey are a clear strategic fit – geographically, operationally and financially. Both of us have deep roots in Central Appalachia and considerable experience: we know how to mine coal in this region and mine it well. Upon completion of the transaction, we will have an enviable network of high quality reserves, surface and underground mines, preparation facilities and logistics resources. We will have a wide range of quality metallurgical and steam products and a customer base that spans the globe. Our combination will create long-term benefits for both organizations and their employees.

For our own employees and operations, acquiring Massey will greatly extend our reserve life (we will be #2 in coal reserves in the U.S.) and give us tremendous flexibility in our mining and sales planning. It will mean greater opportunities for our employees within a larger network of operations (more than110 mines combined). It will mean a stronger organization with more capabilities and resources to withstand the many challenges facing the coal industry today. For the employees of both organizations, it represents an opportunity to be a world-class coal producer with an unparalleled commitment to Running Right – especially when it comes to protecting the safety and health of employees and respecting the environment. For our communities, it represents jobs, enhanced stability and better economic prospects long term.

Granted, Massey has faced a number of big challenges recently. In no way does that take away from the fact that Massey employees are hard-working, highly experienced and driven to succeed. We believe that our Running Right philosophy will help them flourish even more within Alpha, because they come to an organization that strives to involve and empower people at all levels. Combined, we will be a force of approximately 14,000 people dedicated to powering the world through the energy of our people. The work to bring both organizations together will be well worth it.

This afternoon’s announcement is just the first step of the process. We expect the transaction to close in mid-2011, but first we must complete certain regulatory approvals and customary closing conditions. So until closing it is important that we remember we are still separate companies. We will conduct business as usual and we will continue to compete with Massey like we would any other company. As we move through the process, we can assure you that we will make every effort to communicate regularly to tell you as much as we can, as soon as we can. We will be setting aside a special section on AlphaNet where information on the transaction will be posted. In the meantime we hope you will stay focused and – most importantly – operate safely, stay focused and keep Running Right.

One important closing comment: it is critical that all communications on this matter be limited to Alpha’s senior management team and our advisors. We respectfully ask you not to discuss this matter with the media or anybody else outside of Alpha. If you need to communicate with anybody at Massey in your normal course of business or at gatherings, please decline to comment or speculate on the transaction. If you receive any inquiries for further information regarding the transaction or if you have any questions about communicating with people outside of Alpha, please direct them to our Corporate Communications Department (alphacorporatecommunications@alphanr.com).

We encourage you to tune in to our investor webcast Monday morning, which starts at 8:00 a.m. ET. You can access it by going to the Investor section of our web site (http://alnr.client.shareholder.com).

Thank you for your attention and continued support.

Sincerely,

/s/ Kevin Crutchfield /s/ Kurt Kost /s/ Mike Quillen

Chief Executive Officer President Chairman

Attachments: Press release

FAQ

Map of operations

Forward Looking Statements

Information set forth herein contains "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995, which involve a number of risks and uncertainties. Alpha and Massey caution readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information. Such forward-looking statements include, but are not limited to, statements about the benefits of the business combination transaction involving Alpha and Massey, including future financial and operating results, the combined company’s plans, objectives, expectations (financial or otherwise) and intentions and other statements that are not historical facts.

The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the ability to obtain regulatory approvals of the transaction on the proposed terms and schedule; the failure of Alpha or Massey stockholders to approve the transaction; the outcome of pending or potential litigation or governmental investigations; the risk that the businesses will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; uncertainty of the expected financial performance of Alpha following completion of the proposed transaction; Alpha’s ability to achieve the cost savings and synergies contemplated by the proposed transaction within the expected time frame; disruption from the proposed transaction making it more difficult to maintain relationships with customers, employees or suppliers; the calculations of, and factors that may impact the calculations of, the acquisition price in connection with the proposed merger and the allocation of such acquisition price to the net assets acquired in accordance with applicable accounting rules and methodologies; general economic conditions that are less favorable than expected; changes in, renewal of and acquiring new long term coal supply arrangements; and competition in coal markets. Additional information and other factors are contained in Alpha’s and Massey’s filings with the Securities and Exchange Commission (the “SEC”), including Alpha’s and Massey’s Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other SEC filings, which are available at the SEC’s web site http://www.sec.gov. Alpha and Massey disclaim any obligation to update and revise statements contained in these materials based on new information or otherwise.

Important Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

In connection with the proposed merger, Alpha will file with the SEC a registration statement on Form S-4 that will include a preliminary joint proxy statement/prospectus regarding the proposed merger. After the registration statement has been declared effective by the SEC, a definitive joint proxy statement/prospectus will be mailed to Alpha and Massey stockholders in connection with the proposed merger. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE MERGER FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. You may obtain a copy of the joint proxy statement/prospectus (when available) and other related documents filed by Alpha and Massey with the SEC regarding the proposed merger as well as other filings containing information, free of charge, through the web site maintained by the SEC at www.sec.gov, by directing a request to Alpha’s Investor Relations department at Alpha Natural Resources, Inc., One Alpha Place, P.O. Box 2345, Abingdon, Virginia 24212, Attn: Investor Relations, to D.F. King & Co., Inc., 48 Wall Street, 22nd Floor, New York, New York 10005 or to Massey’s Investor Relations department at, (804) 788 - 1824 or by email to Investor@masseyenergyco.com. Copies of the joint proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus can also be obtained, when available, without charge, from Alpha’s website at www.alphanr.com under the heading “Investor Relations” and then under the heading “SEC Filings” and Massey’s website at www.masseyenergyco.com under the heading “Investors” and then under the heading “SEC Filings”.

Participants in Solicitation

Alpha, Massey and their respective directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies in favor of the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of proxies in favor of the proposed merger will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You can find information about Alpha’s and Massey’s directors and executive officers in their respective definitive proxy statements filed with the SEC on March 30, 2010 and April 16, 2010, respectively. You can obtain free copies of these documents from Alpha or Massey using the contact information above.

###

Questions and Answers

1. Why is Alpha acquiring Massey now?

This is truly a transformational deal for Alpha. With Massey, we will become the third largest U.S. producer by sales volume and we’ll have one of the world's largest, highest-quality metallurgical reserve coal bases. We will have nearly 14,000 people dedicated to making Alpha the best coal company in America. Being a bigger organization will set us up to pursue further growth opportunities we expect. It will also enable us to better deal with a tough regulatory landscape, and reinforce strong standards in safety and environmental excellence.

2. Why does this make sense for Alpha?

This transaction represents a tremendous opportunity for both Alpha and Massey to create a new industry leader. Alpha and Massey are logical partners – geographically, operationally and financially. We’re neighbors: both of us have deep roots and operating experience in Appalachia and are committed to bringing economic benefits to the region. We have the right management team to combine and run these assets and, thanks to all of you, a strong track record of successfully integrating merged or acquired mining companies. This will be Alpha’s 11th merger or acquisition since we were founded less than 10 years ago.

3. How will the combined companies move forward from the Upper Big Branch mine accident that happened last year?

The accident at Upper Big Branch last April was a heart-wrenching time for miners everywhere. Our thoughts continue to go out to the miners’ families, and we can only hope that time will mend the pain they’re suffering. We can’t turn back time, but we can take the best of what we have learned through our Running Right safety process and instill those values and best practices in Massey’s mining operations.

4. How will this acquisition affect me?

This deal should create a number of long-term benefits for employees in both organizations, and benefits for other stakeholders too. For employees of Alpha’s affiliates, it represents greater longevity of reserve life – a critically important move for us since coal reserves in Central Appalachia have been in constant decline. There should be greater opportunities for people within a larger network of operations – we will have more than 100 mines combined. For both organizations’ employees, it creates an opportunity to be a world class coal producer with an unparalleled commitment to Running Right – particularly when it comes to safety and the environment. For our communities, it means enhanced stability, well-paying jobs and better economic prospects long term. And for our customers, it means a better, stronger and more diversified supplier.

5. How will the combined company be integrated? Are there many overlaps?

Having been through the Foundation integration recently, we have a proven and tested model for smoothly integrating large companies. Moreover, what we learned from that integration will help make the process with Massey even smoother. Until we get deep into that process and learn more about how Massey runs its business, it’s just too early at this point to talk specifically about how the integration process might impact individuals. Our focus right now is on getting the transaction approved by regulatory agencies and approved by both companies’ stockholders, and also preparing for the integration. We have small teams working on this now and you’ll hear more about what they’re doing in the weeks ahead. It is important to stress that this proposed transaction is primarily about growth. We think highly of Massey’s miners. They’re skilled, dedicated and innovative. We are convinced that they will benefit greatly from the expanded opportunities and resources available to them as part of a larger and stronger organization, with greater long-term growth prospects.

6. Will the combined company’s headquarters still be in Abingdon, VA?

Yes, headquarters will remain in the Abingdon, Virginia area. A new building was already underway in nearby Bristol, Virginia before this deal was announced. At this time we also plan to retain an office in Richmond, Virginia, where Massey is currently headquartered.

7. What happens between now and the close of the transaction?

At this point, the best and most important thing for all of us to do is to remain focused on business as usual…and most importantly on being safe. Until the transaction closes, we will continue to operate as independent companies. We should do everything we can to ensure that we don’t miss a beat in delivering on our commitments to customers. It may take some time to clear the normal regulatory and other hurdles, and both companies still have to schedule and hold a shareholder vote to approve the deal.

8. What’s the timing of this deal being completed?

Right now we think the transaction should close in mid-2011. We will keep you informed of major developments throughout this process.

9. Should I start working with my counterparts at Massey?

No. While a few small teams have started planning and will be in discussions with their counterparts at Massey, we cannot implement the true integration process until after the transaction closes. Until that time, it is important for all of us to remember that we will still operate as independent companies.

10. What should we be telling other people?

It is critical that all communications on this matter be limited to Alpha’s senior management team and our advisors. We respectfully ask you not to discuss this matter with the media or anybody else outside of Alpha. If you need to communicate with anybody at Massey in your normal course of business or at gatherings, please decline to comment or speculate on the transaction. If you receive any inquiries for further information regarding the transaction or if you have any questions about communicating with people outside of Alpha, please direct them to our Corporate Communications Department (alphacorporatecommunications@alphanr.com).

11. Who should I contact if I have additional questions? Where can I find more information about this transaction?

Communications will be ongoing, both leading up to the closing date and after the closing date. If you have other questions that are not answered here, contact alphacorporatecommunications@alphanr.com.

Forward Looking Statements

Information set forth herein contains "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995, which involve a number of risks and uncertainties. Alpha and Massey caution readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information. Such forward-looking statements include, but are not limited to, statements about the benefits of the business combination transaction involving Alpha and Massey, including future financial and operating results, the combined company’s plans, objectives, expectations (financial or otherwise) and intentions and other statements that are not historical facts.

The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the ability to obtain regulatory approvals of the transaction on the proposed terms and schedule; the failure of Alpha or Massey stockholders to approve the transaction; the outcome of pending or potential litigation or governmental investigations; the risk that the businesses will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; uncertainty of the expected financial performance of Alpha following completion of the proposed transaction; Alpha’s ability to achieve the cost savings and synergies contemplated by the proposed transaction within the expected time frame; disruption from the proposed transaction making it more difficult to maintain relationships with customers, employees or suppliers; the calculations of, and factors that may impact the calculations of, the acquisition price in connection with the proposed merger and the allocation of such acquisition price to the net assets acquired in accordance with applicable accounting rules and methodologies; general economic conditions that are less favorable than expected; changes in, renewal of and acquiring new long term coal supply arrangements; and competition in coal markets. Additional information and other factors are contained in Alpha’s and Massey’s filings with the Securities and Exchange Commission (the “SEC”), including Alpha’s and Massey’s Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other SEC filings, which are available at the SEC’s web site http://www.sec.gov. Alpha and Massey disclaim any obligation to update and revise statements contained in these materials based on new information or otherwise.

Important Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

In connection with the proposed merger, Alpha will file with the SEC a registration statement on Form S-4 that will include a preliminary joint proxy statement/prospectus regarding the proposed merger. After the registration statement has been declared effective by the SEC, a definitive joint proxy statement/prospectus will be mailed to Alpha and Massey stockholders in connection with the proposed merger. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE MERGER FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. You may obtain a copy of the joint proxy statement/prospectus (when available) and other related documents filed by Alpha and Massey with the SEC regarding the proposed merger as well as other filings containing information, free of charge, through the web site maintained by the SEC at www.sec.gov, by directing a request to Alpha’s Investor Relations department at Alpha Natural Resources, Inc., One Alpha Place, P.O. Box 2345, Abingdon, Virginia 24212, Attn: Investor Relations, to D.F. King & Co., Inc., 48 Wall Street, 22nd Floor, New York, New York 10005 or to Massey’s Investor Relations department at, (804) 788 - 1824 or by email to Investor@masseyenergyco.com. Copies of the joint proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus can also be obtained, when available, without charge, from Alpha’s website at www.alphanr.com under the heading “Investor Relations” and then under the heading “SEC Filings” and Massey’s website at www.masseyenergyco.com under the heading “Investors” and then under the heading “SEC Filings”.

Participants in Solicitation

Alpha, Massey and their respective directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies in favor of the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of proxies in favor of the proposed merger will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You can find information about Alpha’s and Massey’s directors and executive officers in their respective definitive proxy statements filed with the SEC on March 30, 2010 and April 16, 2010, respectively. You can obtain free copies of these documents from Alpha or Massey using the contact information above.

Forward Looking Statements

Information set forth herein contains "forward-looking statements" as defined in the Private Securities Litigation Reform Act of1995, which involve a number of risks and uncertainties.Alpha and Massey caution readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information.Such forward-looking statements include, but are not limited to, statements about the benefits of the business combination transaction involving Alpha and Massey, including future financial and operating results, the combined company’s plans, objectives, expectations (financial or otherwise) and intentions and other statements that are not historical facts.

The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the ability to obtain regulatory approvals of the transaction on the proposed terms and schedule; the failure of Alpha or Massey stockholders to approve the transaction; the outcome of pending or potential litigation or governmental investigations; the risk that the businesses willnot be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; uncertainty of the expected financial performance of Alpha following completion of the proposed transaction; Alpha’s ability to achieve the cost savings and synergies contemplated by the proposed transaction within the expected time frame; disruption from the proposed transaction making it more difficult to maintain relationships with customers, employees or suppliers; the calculations of, and factors that may impact the calculations of, the acquisitionprice in connection with the proposed merger and the allocation of such acquisition price to the net assets acquired in accordance with applicable accounting rules and methodologies; general economic conditions that are less favorable than expected; changes in, renewal of and acquiring new long term coal supply arrangements; and competition in coal markets. Additional information and other factors are contained in Alpha’s and Massey’s filings with the Securities and Exchange Commission (the “SEC”), including Alpha’s and Massey’s Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other SEC filings, which are available at the SEC’s web site http://www.sec.gov.Alpha and Massey disclaim any obligation to update and revise statements contained in these materials basedon new information or otherwise.

Important Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

In connection with the proposed merger, Alpha will file with the SEC a registration statement on Form S-4 that will include a preliminary joint proxy statement/prospectus regarding the proposed merger. After the registration statement has been declared effective by the SEC, a definitive joint proxy statement/prospectus will be mailed to Alpha and Massey stockholders in connection with the proposed merger.INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE MERGER FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.You may obtain a copy of the joint proxy statement/prospectus (when available) and other related documents filed by Alpha and Massey with the SEC regarding the proposed merger as well as other filings containing information, free of charge, through the web site maintained by the SEC at www.sec.gov, by directing a request to Alpha’s Investor Relations department at Alpha Natural Resources, Inc., One Alpha Place, P.O. Box 2345, Abingdon, Virginia24212, Attn: Investor Relations, to D.F. King & Co., Inc., 48 Wall Street, 22nd Floor, New York, New York 10005 or to Massey’s Investor Relations department at, (804) 788 -1824 or by email to Investor@masseyenergyco.com. Copies of the joint proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus can also be obtained, when available, without charge, from Alpha’s website at www.alphanr.com under the heading “Investor Relations” and then under the heading “SEC Filings” and Massey’s website at www.masseyenergyco.com under the heading “Investors” and then under the heading “SEC Filings”.

Participants in Solicitation

Alpha, Massey and their respective directors, executive officers and certain other members of management and employees may bedeemed to be participants in the solicitation of proxies in favor of the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of proxies in favor of the proposed merger will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You can find information about Alpha’s and Massey’s directors and executive officers in theirrespective definitive proxy statements filed with the SEC on March 30, 2010 and April 16, 2010, respectively. You can obtain free copies of these documents from Alpha or Massey using the contact information above.