Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SUSQUEHANNA BANCSHARES INC | d8k.htm |

| EX-2.1 - MERGER AGREEMENT - SUSQUEHANNA BANCSHARES INC | dex21.htm |

| EX-99.1 - PRESS RELEASE - SUSQUEHANNA BANCSHARES INC | dex991.htm |

1

Strategic acquisition

of Abington Bancorp

January 27, 2011 |

Forward-looking statements

Forward-looking statements

During the course of this conference call, we may make projections and other

forward-looking statements regarding events, the future financial performance

of

Susquehanna

and

the

impact

of

the

acquisition

on

Susquehanna,

and

its

business and financial operations. We wish to caution you that these

forward- looking statements may differ materially from actual results

due to a number of

risks and uncertainties. For a more detailed description of the

factors that may

affect Susquehanna’s operating results, we refer you to our filings with the

Securities & Exchange Commission, including our quarterly report

on Form 10-

Q for the quarter ended September 30, 2010, and our annual report on Form

10-K for the year ended December 31, 2009. Susquehanna assumes no

obligation to update the forward-looking statements made during this

presentation.

For more information, please visit our Web site at:

www.susquehanna.net

2 |

Transaction highlights

Transaction highlights

Strong Strategic

Rationale

Attractive Financial

Returns

Low Risk

Low-risk fill-in acquisition of an in-market community bank in

Montgomery and Bucks counties

—

Adds 20 branches and $900mm of deposits; no branch overlap

Strengthens presence in attractive Montgomery and Delaware counties and provides

entry into Bucks County

—

Top

10

market

share

in

Montgomery

County

–

20

th

wealthiest

in

U.S.

—

3 counties rank among top 5 highest HHI in PA

Tremendous opportunity for deposit, loan and fee income growth

—

Wealth management and insurance subsidiaries (Valley Forge, Stratton, and

Addis) located in Montgomery County with strong customer contacts

—

Expand Susquehanna’s in-market mortgage origination capability

—

Potential for commercial loan growth

20% IRR

100bps accretive to Tier I common at close

Breakeven to 2012 EPS, without considering benefits of excess capital

Comprehensive due diligence process

In-market transaction with similar demographics

Proven track record of integrating acquisitions

3 |

Consideration:

100% Stock

Stock consideration at a fixed exchange ratio of 1.3200x of

Susquehanna common stock for each share of Abington

Transaction value:¹

$268mm

Price per share:¹

$12.80 / Premium to closing price 10.3%

Board composition:

ABBC receives 1 seat on the pro forma 15 member Board of

Directors

Due diligence:

Completed

Management

Bob White (CEO) will take a senior leadership role in Delaware

Valley division and be appointed to a Susquehanna Board

position

Required approval:

Regulatory approval required for both companies

Shareholder approval required for both companies

Termination fee:

$11.0mm

Anticipated closing:

3Q2011

Transaction overview

Transaction overview

4

1

As of January 26

th

, 2011; based on diluted shares of 20.9mm |

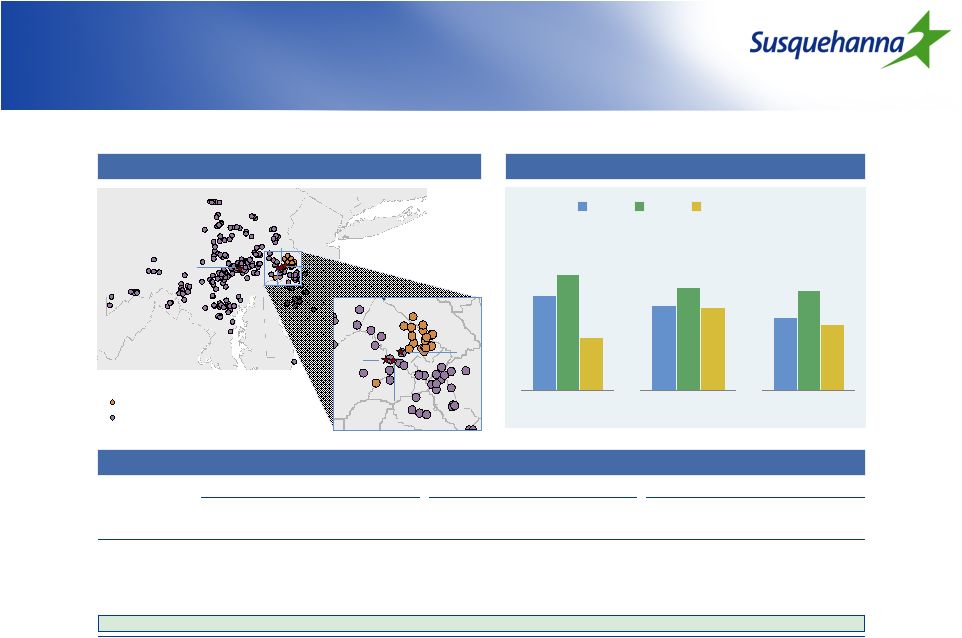

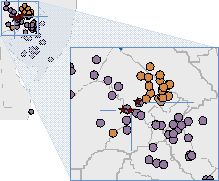

Expands

Susquehanna into attractive markets

Expands Susquehanna into attractive

markets

SUSQ

ABBC

Projected population

change 2010-2015

Pennsylvania

Projected HH income

change 2010-2015

Median HH income

2010 ($000)

Source: SNL Financial

Note: Branch and deposit data as of June 2010

0.9%

1.1%

0.5%

13.3%

16.4%

13.6%

$52.7

$79.7

$58.6

ABBC (20 branches)

SUSQ (221 branches)

NJ

DE

PA

VA

WV

MD

Bucks

Montgomery

Chester

Philadelphia

Delaware

Susquehanna

Bank

Valley

Forge

Addis

Group

Stratton Management

Susquehanna

Abington

Pro forma

Deposit mkt

Deposit mkt

Deposit mkt

Market

Deposits

share

Market

Deposits

share

Market

Deposits

share

rank

Branches

($mm)

(%)

rank

Branches

($mm)

(%)

rank

Branches

($mm)

(%)

Montgomery, PA

18

6

$271

1.2%

8

14

$728

3.3%

7

20

$999

4.6%

Bucks, PA

-

-

-

-

22

5

155

1.1%

22

5

155

1.1%

Delaware, PA

16

3

138

1.2%

29

1

31

0.3%

14

4

169

1.5%

All other counties

212

8,723

0

0

212

8,723

Pro forma franchise

221

$9,132

20

$913

241

$10,045

5

S.M

A.G

V.F

SUSQ / ABBC branch map

Susquehanna Demographics

Pro forma market share by county |

Improved scale in Pennsylvania

Improved scale in Pennsylvania

Deposits

Dep. Market share

Rank

Name

Branches

($mm)

(%)

1

PNC

512

$58,206

20.4%

2

Wells Fargo

293

37,198

13.0%

3

Royal Bank of Scotland

385

22,214

7.8%

4

Toronto-Dominion

94

9,632

3.4%

5

Banco Santander

170

8,722

3.1%

6

M&T

208

8,385

2.9%

7

Bank of America

104

7,530

2.6%

8

Bank of New York Mellon

6

7,382

2.6%

9

Fulton

138

7,137

2.5%

10

First Niagara

149

6,909

2.4%

11

F.N.B.

238

6,866

2.4%

12

Pro forma

166

6,646

2.3%

12

National Penn

130

6,365

2.2%

13

Susquehanna

146

5,733

2.0%

14

Northwest Bancshares

142

5,019

1.8%

15

First Commonwealth

115

4,750

1.7%

34

Abington

20

913

0.3%

Source: SNL Financial

Note: Deposit data as of June 30, 2010

6

Rank

Name

Branches

Deposits

($000)

Dep. Market share

(%)

1

Wells Fargo

43

$3,865,720

17.56

2

Royal Bank of Scotland

44

2,709,841

12.31

3

Toronto-Dominion

24

2,515,432

11.42

4

PNC

27

1,761,413

8.00

5

First Niagara

34

1,604,457

7.29

6

Univest Corp. of Pennsylvania

21

1,260,512

5.73

7

Pro Forma

20

998,739

4.52

7

Firstrust Savings

7

758,387

3.44

8

Abington

14

727,541

3.30

9

Banco Santander

18

667,191

3.03

10

Bryn Mawr

5

600,401

2.73

11

Bank of America

24

571,458

2.60

12

National Penn

11

518,420

2.35

13

Harleysville

7

515,641

2.34

14

Royal Bancshares of PA

6

427,010

1.94

15

Beneficial Mutual (MHC)

9

406,490

1.85

18

Susquehanna (PA)

6

271,198

1.22

Rank

Name

Branches

Deposits

($000)

Dep. Market share

(%)

1

Wells Fargo

36

$3,018,692

20.87

2

Toronto-Dominion

19

1,679,284

11.61

3

Royal Bank of Scotland

22

1,282,006

8.86

4

PNC

17

865,227

5.98

5

FSB Mutual Holdings

12

700,691

4.84

6

FNB Bancorp

16

632,592

4.37

7

Banco Santander

9

588,628

4.07

8

Bank of America

12

518,472

3.58

9

First FS&LA of Bucks County

10

467,897

3.23

10

QNB Corp.

8

452,037

3.12

11

National Penn

11

431,046

2.98

12

First Niagara

10

379,987

2.63

13

Fulton

6

373,195

2.58

14

Univest Corp. of Pennsylvania

19

359,174

2.48

15

Firstrust Savings

5

279,495

1.93

22

Abington

5

154,664

1.07

Delaware

County

pro

forma

ranked

14

th

, with 4

branches and $169mm deposits

3

rd

largest independent bank headquartered in Pennsylvania

Deposit market share in Pennsylvania

Deposit market share in Montgomery, PA

Deposit market share in Bucks, PA |

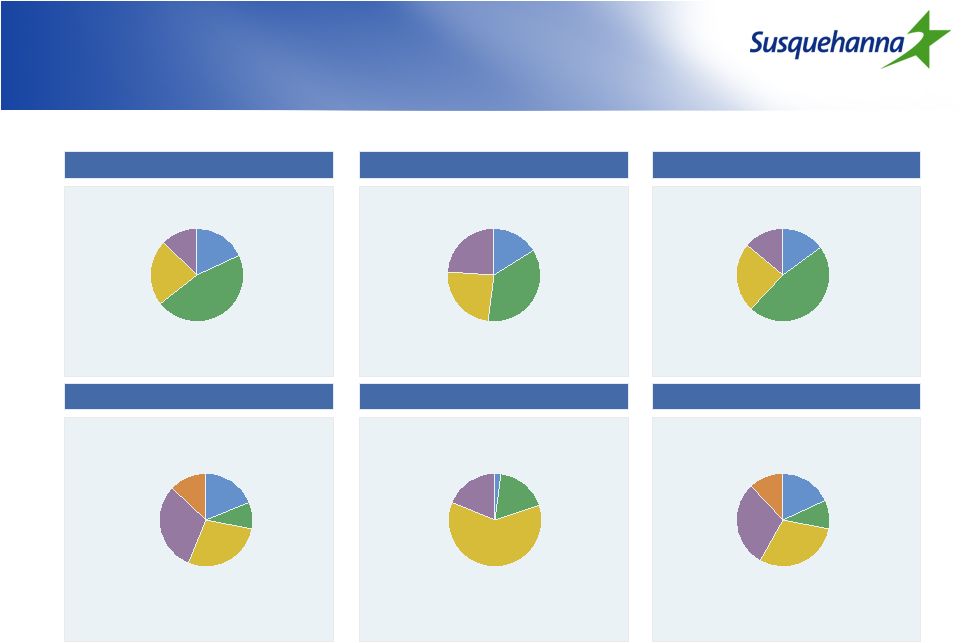

Pro

forma loan and deposit composition

Pro forma loan and deposit

composition

Total deposits = $9,191mm

Cost of int. bearing deposits = 1.13%

Total deposits = $900mm

Cost of int. bearing deposits = 1.51%

Total deposits = $10,091mm

+

=

Total loans = $9,633mm

Yield = 5.55%

Loans / deposits = 105%

Source: SNL Financial; Financial data as of December 31, 2010

Retail time

24%

MMDA & Savings

48%

Jumbo time

13%

Transaction

15%

Retail time

24%

MMDA & Savings

36%

Jumbo time

24%

Transaction

16%

Retail time

24%

MMDA & Savings

47%

Jumbo time

14%

Transaction

15%

Commercial financial &

agriculture

19%

Real estate -

commercial

31%

Consumer & leases

13%

Real estate -

residential

28%

Total loans = $701mm

Yield = 5.45%

Loans / deposits = 78%

Commercial financial &

agriculture

2%

Real estate -

Commercial

19%

Real estate -

construction

18%

Real estate -

residential

61%

Total loans = $10,334mm

Loans / deposits = 102%

Commercial financial &

agriculture

18%

Real estate -

construction

10%

Real estate -

residential

30%

Consumer & leases

12%

Real estate -

commercial

30%

Real estate -

construction

9%

SUSQ deposits

ABBC deposits

Pro forma deposits

SUSQ loans

ABBC loans

Pro forma loans

+

=

7 |

Pro-forma financial impact

Pro-forma financial impact

Attractive

financial

returns:

20% IRR

60 bps accretive to TCE and 100bps to Tier I common

Breakeven

accretive

in

2012

without

considering

any

benefit

from

excess

capital

Tangible book value dilution less than 2%

Strong

pro-forma

capital

position

(approximately

$95mm

capital

accretive):

Assumptions:

Cost savings of $8.1mm or 31%¹, phased in 50% in 2011 and 100% in 2012

One time pre-tax restructuring charge of $21mm

CDI of 1.5%, amortized straight-line over 10 years; goodwill of approximately

$66mm 8

12/31/2010

Actual (%)

Pro forma (%)

TCE/TA

7.6%

8.2%

Tier I common

9.6%

10.6%

Tier I

12.7%

13.5%

¹

Excluding stock based compensation expenses, core cost synergies are approximately

24% of non interest expenses |

Financial impact –

cost saves

Financial impact –

cost saves

($mm)

Cost savings are approximately 31% of non-interest expense¹

No branch closures are assumed

Compensation and Benefits

$5.2

Systems and technology

1.8

Professional fees

0.8

Marketing & other

0.3

Total cost saves (pre-tax)

$8.1

One-time restructuring charge (pre-tax)

$21.2

9

¹

Excluding stock based compensation expenses, core cost synergies are approximately

24% of non interest expenses |

Comprehensive due diligence

Comprehensive due diligence

10

Extensive

bottoms

–

up

diligence

approach

Comprehensive loan review completed by our credit team

—

Analyzed underwriting standards and credit files

—

Reviewed Top 25 relationships

—

100% of substandard loans over $1mm

—

100% of other real estate owned (OREO)

—

Analyzed 40% of residential mortgage portfolio, and applied Susquehanna’s

risk rating method to determine marks Total loans

Credit mark

($mm)

$mm

$mm

% of loans

Real Estate Residential

$393

$1

0.4%

Real Estate Commercial

141

11

8.0%

Construction Loans

108

17

15.3%

Consumer Loans

41

1

2.5%

Commercial & Industrial Loans

17

1

5.4%

Total loans

$701

$31

4.4%

2008 - Q4'2010 Losses (NCO's)¹

$27

3.9%

Cumulative losses through cycle (since 2008)¹

$58

8.5%

¹ As a % of 2007 gross loans |

Pricing metrics

Pricing metrics

11

Based on Jan. 26, 2011

(Announcement date)

Based on Jan. 25, 2011

1 day

1 day

5 - day average

Deal price per share ($)

$12.80

$13.04

$13.16

Implied premium (%)

10.3%

13.8%

14.8%

Price / 4Q net income annualized (incl. synergies)¹

20.5x

20.9x

21.1x

Price / Tangible book value

1.22x

1.24x

1.25x

Price / Adjusted tangible book value²

1.33x

1.35x

1.37x

Core deposit premium³

8.2%

9.0%

9.4%

Memo:

Susquehanna price per share ($)

$9.70

$9.88

$9.97

Financial information as of December 31, 2010

¹Include $8.1mm of pre-tax synergies

²Adjusted for credit marks of $31mm and loan loss reserve of $4mm

³ Core deposits of $680 excludes time deposits >$100mm |

Summary

Summary

12

Low-risk, fill-in transaction expanding Susquehanna’s footprint into

highly attractive demographic markets

Significant opportunity for deposit, loan, and fee income generation

by delivering on Susquehanna’s full-service platform to wealthy

markets

Capital accretive transaction; potential to drive earnings accretion

through deployment of excess capital |

13

4

th

Quarter earnings update |

14

Questions & answers |