Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Pure Pharmaceuticals CORP | exhibit32-1.htm |

| EX-31.1 - CERTIFICATION - Pure Pharmaceuticals CORP | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

[ x ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2010

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to ______________

PURE MINERALS, INC.

(Exact

name of registrant as specified in its charter)

PURE PHARMACEUTICALS CORP.

(Former name of

registrant)

| Nevada | 000-52885 | 45-0476087 |

| (State or other jurisdiction | (Commission File Number) | (IRS Employer Identification No.) |

| of incorporation) |

| 1200 McGill College Avenue, Suite 2050, | |

| Montreal, Quebec, Canada | H3B 4G7 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (514)

397-2683

P.O. Box 55, 1594 Stone Mill Park, Bellona,

New York 14415

(Former name or former address, if changed

since last report.)

Securities Registered Pursuant to Section 12(b) of the Act: None

Name of Each Exchange on Which Registered: None

Securities Registered Pursuant to Section 12(g) of the Act:

Common Stock, $0.001 Par Value

Title of

Class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ]No [ x ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.Yes[ ]No [ x ]

2

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ x ]No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best or registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.[ x ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [ x ] |

| (Do not check if smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes [ x ]No [ ]

The Registrant's revenue for the fiscal year ended September 30, 2009 was $8,310.

As of January 12, 2011, the aggregate market value of the shares of common stock held by non-affiliates of the Registrant issued and outstanding on such date was approximately $130,000 based on the price that the shares of common stock were sold to such non-affiliates.

As of January 12, 2011, the Registrant had 12,600,000 shares of common stock, $0.001 par value, outstanding. Effective as of January 17, 2011, as a result of a one for 84 reverse stock split, the number of shares of common stock will be 150,000 shares.

3

TABLE OF CONTENTS

4

| ITEM 1. | BUSINESS. |

Forward Looking Statements.

This Annual Report on Form 10-K contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements reflect management's current views and expectations with respect to its business, strategies, products, future results and events and financial performance. All statements made in this Annual Report other than statements of historical fact, including statements that address operating performance, events or developments that management expects or anticipates will or may occur in the future, including statements related to distributor channels, volume growth, revenues, profitability, new products, adequacy of funds from operations, statements expressing general optimism about future operating results and non-historical information, are forward-looking statements. In particular, the words "believe," "expect," "intend," "anticipate," "estimate," "may," "will," variations of such words, and similar expressions, identify forward-looking statements, but are not the exclusive means of identifying such statements, and their absence does not mean that the statement is not forward-looking. These forward-looking statements are subject to certain risks and uncertainties, including those discussed below. Our actual results, performance or achievements could differ materially from historical results as well as those expressed in, anticipated or implied by these forward-looking statements. We do not undertake any obligation to revise these forward-looking statements to reflect any future events or circumstances.

Readers should not place undue reliance on these forward-looking statements, which are based on management's current expectations and projections about future events, are not guarantees of future performance, are subject to risks, uncertainties and assumptions (including those described below) and apply only as of the date of this Annual Report. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

In this Annual Report on Form 10-K, the terms "we," "us," "our," the "Company", and the "Registrant" refer to Pure Minerals Inc. unless the context indicates otherwise.

Description of Business

On June 13, 2010, Pure Pharmaceuticals Corp., a Nevada corporation (the “Company”), entered into a share exchange agreement (the “Share Exchange Agreement”) with the shareholders of 7167415 Canada Inc (“7167415”). Pursuant to the Share Exchange Agreement, subject to the satisfaction of a number of conditions, all of the outstanding shares of 7167415 were to be acquired by the Company, with 71674105 continuing as a wholly-owned subsidiary of the Company (the “Share Exchange”). In connection with the Share Exchange, the Company agreed to acquire100% of the outstanding capital stock of 7167415 in exchange for preferred shares of a subsidiary of the Company exchangeable for 7,350,000 shares of the Company’s common stock. Among the conditions to the closing was 7167415 acquiring certain mining claims in the Belleterre region of Quebec. The parties expect that all of the conditions to closing of the Share Exchange Agreement will be satisfied in the next several days and the parties will proceed to close the Share Exchange. In connection with the Share Exchange the Company agreed to change its name to Pure Minerals, Inc.

As a result of the Share Exchange, the stockholders of 7167415 control approximately 98% of the Company’s outstanding common stock, holding 7,350,000 of the 7,500,000 outstanding shares (after giving effect to a 84 for one reverse stock split), and 7167415 is considered the accounting acquirer in the Share Exchange. The Company was a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) immediately prior to the Share Exchange. As a result of the Share Exchange, the Company’s operations are now focused in exploration for minerals on the Company’s properties in Quebec, Canada. Consequently, the Company believes that the Share Exchange has caused the Company to cease being a shell company as it no longer has nominal operations.

5

In addition, pursuant to the Share Exchange Agreement, Roger Gordon submitted his resignation as an officer and director of the Company and Charlie Lee as Secretary and Principal Financial Officer of the Company, and Nicolas Matossian and Charles Buisson will be appointed to serve as members of the board of directors of the Company, all of which will be effective following the expiration of the ten day period following the mailing of the information statement required by Rule 14f-1 under the Exchange Act. Upon the consummation of the Share Exchange, Roger Gordon resigned as President and Chief Executive Officer, Nicolas Matossian was appointed to serve as Chief Executive Officer, President and Chief Financial Officer of the Company, and Joseph P. Galda was elected Corporate Secretary.

Pure Pharmaceuticals was incorporated in the State of Nevada on September 24, 2004. Prior to the transaction with 7167415, we were in the business of seeking business opportunities in the area of expertise of the Company's principal stockholder, Mr. Roger Gordon, being biological and/or medical products for animal use. The Company operated in the field of generic animal health and nutrition products, specifically medicated feed additives (MFAs). Due the extraordinary circumstances facing the world economy in 2008, and its particular effects on the MFA industry, the Company discontinued its prior operations and began exploring its options for any strategies which will maximize shareholder value. As a result of this review, the Board determined to enter into the Share Exchange Agreement with the shareholders of 71674105. 7167415 was formed as a Canadian Federally-incorporated company on May 4, 2009. Our principal executive offices are located at 2050- 1200 McGill College Avenue, Montreal, Quebec, Canada H3B 4G7. Our telephone number is 514-397-2683.

We are in the business of mineral exploration and development. We have acquired or entered into agreements to acquire 54 mineral claims in North Western Quebec covering approximately 7900 acres in the Temiscamingue region. These claims contain several mineralizations worthy of further exploration or of development. According to geological exploration previously done by prior owners on our claims, several showings and anomalies indicate a potential for gold, platinum, uranium, nickel and rare earths. In addition a number of kimberlitic pipes (diamond bearing) have been identified which warrant further work. Lastly, the Company’s claims contain a large diabase (granite deposit) reportedly containing up to 9 million cubic meters of black and compact granite (nero canadiensis). In May 2010, following preliminary research, 7167415 acquired an additional 15 claims, principally to cover the hinge of a major anomaly detected on our claims.

In addition, pursuant to a claims transfer agreement, we have obtained the rights to 20 claims covering approximately 4sq.kms in the Eau Jaune Property ,located in the eastern part of the north polycyclic volcanic zone that joins together the Matagami and Chibougamau mining camps in Quebec. The claims constitute approximately two thirds of a larger parcel that was subject to a 2007 technical report under Canada National Instrument 43-101. Over 10,000 meters of diamond drilling have been recorded on this property. Past exploration work has demonstrated the presence of gold mineralization such as the Robinson showing. Historical drill core intersections with significant gold values and the recognition on several outcrops of shear zone-hosted quartz veins accompanied by intense carbonate alteration and gold values suggest that the area has the potential to host a more extensive gold bearing mineralizing system. There is continued activity on adjoining claims and in the immediate area. The Company plans to undertake a program of exploration on its claims based on an analysis of historical results and current outlook.

Furthermore, in May of 2010, 7167415 entered into an option agreement to acquire up to 80% of a 21sq. km. set of claims, part of which have been previously explored by Shell Minerals. The results identified the presence of zinc, silver and barite in one anomaly. In June the Company initiated its exploration program on the property with a gravimetric study which covered the area near the Shell work. The initial results indicate up to 3 anomalies similar to the one drilled by Shell. The Company will carry out further gravimetric work and drilling on the detected anomalies to prove up the presence of additional reserves and the existence of MVTs (Mississippi Valley Types).

An exploration program of our mineral claims is required before a final determination as to their viability can be made. The existence of commercially exploitable mineral deposits in our mineral claims is unknown at the present time and we will not be able to ascertain such information until we receive and evaluate the results of our exploration programs.

6

Properties of 7167415

7167415 has acquired a 100% interest in two large sets of mineral claims in the Province of Quebec, Canada. 7167415 has not yet commissioned geological or technical reports on these properties and can give no data or other assurances regarding their value or exploration potential at this time. 7167415 plans to obtain independent reports regarding these properties in the near future. The following is a brief description of the Quebec properties and 7167415’s plans for conducting initial surveying and sampling on these claims:

Temiscamingue Property (Belleterre)

The Temiscamingue property is located in northwest Quebec, 115 kilometers south of Rouyn Noranda and six kilometers south of the town of Belleterre. The project is accessible via regional and logging roads. Government regional stream sediment survey have identified many anomalies in the area. The property is strategically located between the claims of Superior Diamonds (adjacent to the north) where new kimberlites have recently been discovered and the property of Aurizon Mines (adjacent to the south) which has reported as much as 100 grams of gold per ton during till sampling with the objective of identifying the gold dispersion trains previously outlined. The Company has acquired a 100% undivided interest of 7900 acres in this mineral rich Temiscamingue region.

The property is eight kilometers south of the Belleterre Mine, a gold mine that was closed in 1989 due to a labor dispute, and is expected to reopen in 2011.

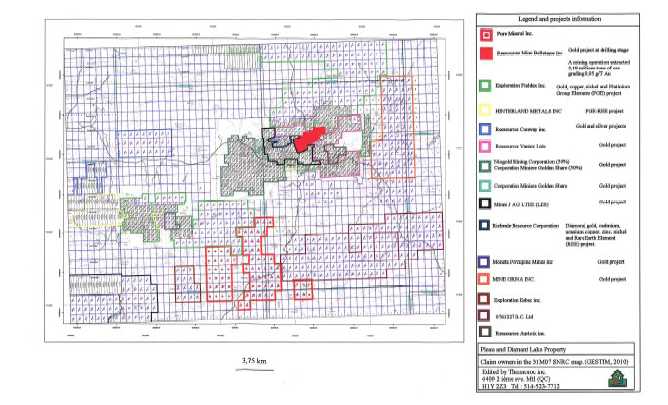

The following illustration sets forth the location of 7167415’s claims and the activities of other companies known to 7167415’s management to be operating in the region:

Pleau and Diamant Lake Property

7

The Pleau and Diamant Lake property claims consist of 54 mining titles covering 3,387.2 hectares. The property is located in the south-west portion of the SNRC-31M/07 grid. Since the original acquisition, additional claims have been acquired.

With the addition of the 15 claims pending and the new claim necessary to register 7167415, the Pleau and Diamant lake property will consist of 69 mining titles covering 4,263.2 hectares, representing an addition of 876 hectares (8,76 km2) and it represent a 25% land increase. The property is located in south-west portion of the SNRC-31M/07 grid.

Eau Jaune Property

The Eau Jaune property is located 25km southwest of Chibougamau, Quebec and is readily accessible by four wheel drive pickup via a secondary gravel road. The nearby town of Chibougamau provides all amenities, including daily scheduled flights to and from Montreal and mining/exploration supplies. A railroad connects the town of Chapais nearby to the town of Chibougamau and south to Lac St-Jean.

The property has been the subject of sporadic exploration since the 1950’s. Exploration work, consisting of more than 10,000 metres of diamond drilling on the property, has demonstrated the presence of gold mineralization, such as the Robinson showing. Historical drill core intersections with significant gold values and the recognition on several outcrops of sheer zone-hosted quartz veins accompanied by intense carbonate alteration and gold values suggest that the area has the potential to host a more extensive gold-bearing mineralization system.

In 2008, work carried on the property by a prior owner included linecutting, a complementary magnetic ground survey, a geological mapping program, an inventory and maintenance of available drill core, a litho structural study and a drill core re-examination and sampling.

The Eaune Jaune property was acquired in December 2010 for $25,000 in cash and 50,000 shares of the Company’s common stock.

Description of Exploration Program

There are two simultaneous phases to 7167415’s proposed exploration program; firstly 7167415 will delineate the extent and quality of the granite dyke (diabase) with a view to determine its economic and commercial feasibility. 7167415 has engaged an independent geologist to prepare a reserve report for the diabase. There are several operating and marketing avenues open in the conventional quarrying and cutting of blocks. To that effect 7167415 will seek to ally itself with one or more major operator / marketer by way of a joint venture or other supply/operating arrangements.

In its other phase, 7167415 will retain the services of independent geologists to prepare a proposal for exploration work and costing out of the exploration work program. The exploration program will extend to the further work required for a better assessment of the Kimberlites, the gold, platinum and uranium showings. This work will define the priorities and financing needs for a full exploration program which the Company intends to fund through a subsequent flow through share issue.

Exploration Budget

| Phase I (Granite) | |||

| Preparation of Reserve Report | $ | 35,000 | |

| Drilling | $ | 50,000 | |

| Mineral Sampling/Cutting | $ | 50,000 | |

| Phase I Total | $ | 135,000 | |

| Phase II (Other Mineral Exploration) |

8

| Airbone Magnetic Survey and Analysis | $ | 400,000 | |

| Ground Geophysics (IP, EM and Mag) | $ | 250,000 | |

| Diamond Drilling (3000 m.) | $ | 350,000 | |

| Project Management and Reporting | $ | 125,000 | |

| Phase II Total | $ | 1,125,000 | |

| Project Total | $ | 1,260,000 |

Regional Geology

The Superior Province is the largest Archean craton in the world, half of which is located in Québec. This craton is a highly prospective region for kimberlite exploration, meeting all four criteria for hosting economic grades of diamond-bearing kimberlite: 1) the presence of an Archean craton; 2) the refractive, relatively cool and low-density peridotitic root of the craton has been insulated against reheating and excessive tectonic reworking; 3) the presence of major tectonic structures; and 4) association of diamonds with other intrusive rocks. Four kimberlite fields have been identified in Québec, the Temiscamingue Field being one of these.

Local Geology

The Property over thrusts two geological structural provinces, intruded by granite-granodiorite-mafic and ultramafic rocks all faulted and sheared. Fault sets and lineaments intersect the Structural Thrust Front. It is on the Central-median ridge of the “Temiscamingue Lake Rift” and on the strike of many Diamond Kimberlite occurrences.

Stream sediment geochemistry points to strong anomalies for Gold, Nickel, Uranium, and Rare Earth Elements and many circular shape magnetic anomalies to be tested for their Kimberlitic potential. Seven of the Company’s claims were staked in 2006 specifically to cover a large double anomaly of uranium which represents the sixth highest content among the 1113 samples deposited with the Ministry of Natural Resources for the area.

| ITEM 1A. | RISK FACTORS. |

An investment in our common stock involves a number of very significant risks. You should carefully consider the risks described below and the other information in this Annual Report before deciding whether to purchase our shares of common stock.

Our business, financial condition, results of operations and cash flow, could be materially adversely affected by any of these risks. The value of our shares of common stock could decline due to any of these risks, and you may lose all or part of your investment.

This Annual Report also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below.

We may experience difficulty raising additional capital, which could result in the failure of our business.

We currently have limited operations and revenues. Our current operating funds are not sufficient to fund the costs of implementing our entire business plan, including our exploration plan as of September 30, 2010, we had cash in the amount of $9,412. We will need to obtain additional financing in order to implement our business plan.

9

We do not currently have any arrangements for obtaining such financing. Obtaining additional financing will be subject to a number of factors, including general market conditions. These factors may make the timing, amount, terms or conditions of additional financing unfavorable from the Company's standpoint. If we do not obtain a sufficient amount of additional financing, our business could fail.

We have a going concern opinion from our auditors, indicating the possibility that we may not be able to continue to operate without adequate financing.

The Independent Auditor's Report to our audited financial statements for the year ended September 30, 2010 included in this Annual Report indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Such factors identified in the report include that we need to generate profitable operations and are in need of obtaining adequate financing. If we are not able to continue as a going concern, it is likely that investors will lose all or a part of their investment.

Additional capital raised through the sale of share capital will cause dilution to our existing shareholders.

The most likely source of additional capital presently available to us is through the sale of equity capital. Any sale of equity capital will result in dilution to our existing shareholders. As a result, our net income per share, if any, could decrease in future periods, and the market price of our common stock could decline.

The perceived risk of dilution may cause our stockholders to sell their shares, which would contribute to a downward movement in the stock price of our common stock. Moreover, the perceived risk of dilution and the resulting downward pressure on our stock price could encourage investors to engage in short sales of our common stock. By increasing the number of shares offered for sale, material amounts of short selling could further contribute to progressive price declines in our common stock.

If an active trading market for our common stock does not develop, shareholders may be unable to sell their shares.

Although we are reporting company and our common stock is quoted on the OTC Bulletin Board there is currently no active trading market for our common stock. There can be no assurance that an established trading market will develop or that a liquid market for our common stock will be available in the future. If no active trading market develops for our shares of common stock or there is insufficient liquidity in the shares, it will be difficult for shareholders to sell their stock, if at all.

Trading on the OTC Bulletin may be volatile and sporadic, which could depress the market price of our common stock and make it difficult for shareholders to sell their shares.

Trading in stock quoted on the OTC Bulletin Board is often thin and characterized by wide fluctuations in trading prices due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market for our common stock for reasons unrelated to operating performance.

We are subject to penny stock rules and shareholders therefore may find it more difficult to sell their shares.

Our shares of common stock constitute penny stock under the Securities Exchange Act of 1934, as amended, referred to as the "Exchange Act". The classification of penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, thus limiting investment liquidity. Any broker-dealer engaged by a purchaser for the purpose of selling his or her shares in the Company will be subject to rules 15g-1 through 15g-10 of the Exchange Act, which provide, among other things, that a broker-dealer deliver a standardized risk disclosure document prepared by the Securities and Exchange Commission, referred to as the "SEC", prior to a transaction in a penny stock, provide details of its compensation in a sale of penny stock and provide monthly statements showing the market value of each penny stock held in a customer's account. Rather than complying with these rules, some broker-dealers may refuse to sell our shares on behalf of a purchaser, which may limit the purchaser's ability to sell the shares.

10

We could terminate our SEC Registration, which could cause our Common Stock to be de-listed from the OTC Bulletin Board.

Although the Company currently has no intention to de-register its common stock under the Exchange Act, there can be no assurance that the Company may not do so at some point in the future. If the Company were to take such action, it could inhibit the ability of the Company's shareholders to trade the shares in the open market, thereby severely limiting the liquidity of such shares. Furthermore, if we were to de-register, we would no longer be required to file annual and quarterly reports with the SEC and would no longer be subject to various substantive requirements of SEC regulations. Termination of our SEC registration would reduce the amount of information available to investors about of the Company and may cause our common stock to be de-listed from the OTC Bulletin Board. In addition, investors would not have the protections of certain SEC regulations to which we would no longer be subject.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS. |

We currently do not have any unresolved staff comments.

| ITEM 2. | PROPERTIES. |

See Item 1

| ITEM 3. | LEGAL PROCEEDINGS. |

We are not currently a party to any legal proceedings.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

The following matters were approved by the shareholders of the Company at a Special Meeting of Shareholders held on June 23, 2010:

| 1) |

An amendment to the Company’s Articles of Incorporation to effect a reverse stock split of 84 to 1, without changing the authorized capital thereof. | |

| 2) |

An amendment to the Company’s Articles of Incorporation to change the name of the Company to “Pure Minerals, Inc.” |

11

Each of these items were approved by a vote of 6,500,000, or approximately 52% in favor, and none opposed with no abstentions. The Articles of Amendment to effect these changes will be filed immediately prior to the closing of the Share Exchange with 7167415.

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Market Information. There is currently no public trading market for our common stock. There can be no assurance that an established trading market will develop or that a liquid market for our common stock will be available in the future. The Company has not granted any common stock options or warrants since inception.

Holders of our Common Stock. As at January 14, 2011, there were approximately 52 holders of record of our common stock and a total of 12,600,000 (pre-reverse stock split) shares of common stock were outstanding.

Dividend Policy. Since our inception, we have not declared nor paid any cash dividends on our common stock and we do not anticipate paying any cash dividends in the foreseeable future. Our current policy is to retain any earnings in order to finance the expansion of our operations. The Company's Board of directors (the "Board") will determine future declarations and payments of dividends, if any, in light of the then-current conditions they deem relevant and in accordance with applicable corporate law.

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends if, after giving effect to the distribution of the dividend:

| 1. |

We would not be able to pay our debts as they become due in the usual course of business; or | |

| 2. |

Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

Equity Compensation Plans. To date we have not adopted any equity compensation plans.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers. We did not purchase any of our shares of common stock or other securities during our fiscal year ended September 30, 2010.

| ITEM 6. | SELECTED FINANCIAL DATA |

| ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION. |

Results of Operations for the Year ended September 30, 2010

We had net revenue in the amount of $nil for the fiscal year ended September 30, 2010. We incurred expenses in the amount of $97,179 for the year ended September 30, 2010. Our net loss for the year ended September 30, 2010 was $97,179. As at September 30, 2010 we had cash of $9,412 and working capital deficiency of $49,439.

12

Results of Operations for the Year ended September 30, 2009

We had other income in the amount of $8,310 for the fiscal year ended September 30, 2009. We incurred expenses in the amount of $47,836 for the year ended September 30, 2009. Our net loss for the year ended September 30, 2009 was $39,526. As at September 30, 2009 we had cash of $8,573 and working capital deficiency of $22,198.

2009 was a challenging year for the company. As a result of activities early in the 2009 fiscal year the company was able to sell it’s remaining inventory to suitable clients. Management believes that its inability to generate greater sales is attributable to the high price of maize and soybeans, which are two of the largest cost component of feed. Maize prices have increased dramatically in the last 12 months from its historic averages. There are many factors driving the price of maize higher, including its use as an emerging fuel (ethanol). This significant jump in prices have forced upward "at the gate" prices for poultry in cities such as Toronto where from the period of January to June 2009, prices for poultry had increased 10.6% from $1.29 to $1.43/kilogram. The sale of the inventory was treated as incidental revenue and as a result, recorded as other income.

Our officers and directors provided all the labor necessary to effect our business plan at no charge (see "Executive Compensation") as we had no employees during the period.

Liquidity and Capital Resources

Our cash reserves are not sufficient to meet our funding needs beyond the next twelve-month period. As a result, we will need to seek additional funding in the near future. We currently do not have a specific plan for obtaining such funding, however, we anticipate that any additional funding will be in the form of equity financing from the sale of our common stock. We currently do not have any arrangements in place for any future equity financing. We may also seek to obtain short-term loans from our directors, although no such arrangements have as yet been made. There can be no assurance that we will able to raise sufficient funding from the sale of our common stock or through director loans to meet our funding needs after the next 12 months.

There are two simultaneous phases to 7167415’s proposed exploration program; firstly 7167415 will delineate the extent and quality of the granite dyke (diabase) with a view to determine its economic and commercial feasibility. 7167415 has engaged an independent geologist to prepare a reserve report for the diabase. There are several operating and marketing avenues open in the conventional quarrying and cutting of blocks. To that effect 7167415 will seek to ally itself with one or more major operator / marketer by way of a joint venture or other supply/operating arrangements.

In its other phase, 7167415 will retain the services of

independent geologists to prepare a proposal for exploration work and costing

out of the exploration work program. The exploration program will extend to the

further work required for a better assessment of the Kimberlites, the gold,

platinum and uranium showings. This work will define the priorities and

financing needs for a full exploration program which the Company intends to fund

through a subsequent flow through share issue.

13

| Exploration Budget | |||

| Phase I (Granite) | |||

| Preparation of Reserve Report | $ | 35,000 | |

| Drilling | $ | 50,000 | |

| Mineral Sampling/Cutting | $ | 50,000 | |

| $ | 135,000 | ||

| Phase II (Other Mineral Exploration) | |||

| Airbone Magnetic Survey and Analysis | $ | 400,000 | |

| Ground Geophysics (IP, EM and Mag) | $ | 250,000 | |

| Diamond Drilling (3000 m.) | $ | 350,000 | |

| Project Management and Reporting | $ | 125,000 | |

| $ | 1,125,000 | ||

| Project Total | $ | 1,260,000 |

The Independent Auditor's Report to our audited financial statements for the period ended September 30, 2010 indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Such factors identified in the report include that we need to generate profitable operations and are in need of obtaining adequate financing. For these and other related reasons our auditors believe that there is substantial doubt that we will be able to continue as a going concern. See "Risk Factors".

Off-Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the small business issuer's financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

| ITEM 8. | FINANCIAL STATEMENTS. |

[Financial Statements follow, beginning on next page]

14

PURE MINERALS, INC.

(Formerly Pure Pharmaceuticals Corporation)

(An Exploration Stage Company)

FINANCIAL STATEMENTS

SEPTEMBER 30, 2010

15

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders and Board of Directors of Pure Minerals, Inc. (Formerly Pure Pharmaceuticals Corporation.)

We have audited the accompanying balance sheets of Pure Minerals, Inc. (an exploration stage company) as of September 30, 2010 and 2009, and the statements of operations, cash flows and stockholders’ deficit for the years then ended and the period from September 24, 2004 (Inception) to September 30, 2010. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, these financial statements present fairly, in all material respects, the financial position of the Company as of September 30, 2010 and 2009, and the results of its operations and cash flows for the years then ended and the period from September 24, 2004 (Inception) to September 30, 2010 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company is in the development stage and has incurred losses since inception and has limited working capital available raising substantial doubt about the Company’s ability to continue as a going concern. The ability of the Company to continue as a going concern is dependent on raising capital to fund its business and ultimately to attain profitable operations. Management’s plans in regard to these matters are described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| DALE MATHESON CARR-HILTON LABONTE LLP |

| CHARTERED ACCOUNTANTS |

| Vancouver, Canada |

| January 21, 2010 |

| PURE MINERALS, INC. |

| (Formerly Pure Pharmaceuticals Corporation) |

| (An Exploration Stage Company) |

| BALANCE SHEETS |

| September | September | |||||

| 30, 2010 | 30, 2009 | |||||

| - $ - | - $ - | |||||

| Assets | ||||||

| Current | ||||||

| Cash | 9,412 | 8,573 | ||||

| 9,412 | 8,573 | |||||

| Liabilities | ||||||

| Current | ||||||

| Accounts payable and accrued liabilities | 58,851 | 30,771 | ||||

| Long- term loans (Note 3) | - | 59,314 | ||||

| 58,851 | 90,085 | |||||

| Stockholders’ Deficit | ||||||

| Common Stock (Note 4) | ||||||

| Authorized: 100,000,000 common shares with a par value of $0.001 |

||||||

| Issued and Outstanding: 150,000 (September 30, 2009 – 150,000) common shares |

150 |

150 |

||||

| Additional paid in capital | 335,541 | 203,850 | ||||

| Accumulated other comprehensive income | - | 2,439 | ||||

| Deficit accumulated during the exploration stage | (385,130 | ) | (287,951 | ) | ||

| (49,439 | ) | (81,512 | ) | |||

| 9,412 | 8,573 |

Going Concern (Note 1)

Subsequent event (Note 7)

– See Accompanying Notes –

17

| PURE MINERALS, INC. |

| (Formerly Pure Pharmaceuticals Corporation) |

| (An Exploration Stage Company) |

| STATEMENTS OF OPERATIONS |

| Cumulative | |||||||||

| from | |||||||||

| September 24, | |||||||||

| 2004 | |||||||||

| (Inception) to | |||||||||

| Year ended September 30, | September 30, | ||||||||

| 2010 | 2009 | 2010 | |||||||

| - $ - | - $ - | - $ - | |||||||

| Expenses | |||||||||

| Financing fees | - | - | 5,600 | ||||||

| General and administrative | 94,318 | 43,912 | 378,343 | ||||||

| Interest on long term loans (Note 3) | 2,861 | 3,924 | 6,785 | ||||||

| Write-down of inventory | - | - | 5,130 | ||||||

| 97,179 | 47,836 | (395,858 | ) | ||||||

| Net loss before other income | (97,179 | ) | (47,836 | ) | (395,858 | ) | |||

| Other income | - | 8,310 | 10,728 | ||||||

| Net loss | (97,179 | ) | (39,526 | ) | (385,130 | ) | |||

| Loss per share – basic and diluted | (0.65 | ) | (0.26 | ) | |||||

| Weighted average number of common shares outstanding – basic and diluted | 150,000 | 150,000 | |||||||

– See Accompanying Notes –

| PURE MINERALS, INC. |

| (Formerly Pure Pharmaceuticals Corporation) |

| (An Exploration Stage Company) |

| STATEMENTS OF CASH FLOWS |

| Cumulative from | |||||||||

| September 24, 2004 | |||||||||

| (Inception) to | |||||||||

| Year ended September 30, | September 30, | ||||||||

| 2010 | 2009 | 2010 | |||||||

| - $ - | - $ - | - $ - | |||||||

| Cash Flows From Operating Activities | |||||||||

| Net loss | (97,179 | ) | (39,526 | ) | (385,130 | ) | |||

| Non-cash items: | |||||||||

| Accrued interest on long term loan | - | 3,924 | 3,924 | ||||||

| Donated capital | 9,600 | 9,600 | 57,600 | ||||||

| Write down of inventory | - | - | 5,130 | ||||||

| Change in non-cash working capital items: | |||||||||

| Inventory | - | - | (5,130 | ) | |||||

| Accounts payable and accrued liabilities | 28,080 | (15,442 | ) | 58,851 | |||||

| Net cash used in operating activities | (59,499 | ) | (41,444 | ) | (264,755 | ) | |||

| Cash Flows From Financing Activities | |||||||||

| Proceeds (Repayments) from long-term loans | (59,314 | ) | 15,390 | (3,924 | ) | ||||

| Donated capital | 122,091 | 20,000 | 142,091 | ||||||

| Capital stock issued for cash | - | - | 136,000 | ||||||

| Net cash provided by financing activities | 62,777 | 35,390 | 274,167 | ||||||

| Effect of exchange rate changes | (2,439 | ) | 2,168 | - | |||||

| Increase (Decrease) In Cash | 839 | (3,886 | ) | 9,412 | |||||

| Cash, beginning | 8,573 | 12,459 | - | ||||||

| Cash, ending | 9,412 | 8,573 | 9,412 | ||||||

| Supplementary Cash Flow Information: | |||||||||

| Cash paid for: | |||||||||

| Interest | 6,785 | - | 6,785 | ||||||

| Income taxes | - | - | - | ||||||

– See Accompanying Notes –

19

| PURE MINERALS, INC. |

| (Formerly Pure Pharmaceuticals Corporation) |

| (An Exploration Stage Company) |

| STATEMENT OF STOCKHOLDERS’ DEFICIT |

| PERIOD FROM SEPTEMBER 24, 2004 (INCEPTION) TO SEPTEMBER 30, 2010 |

| Accumulated | Deficit Accumulated |

||||||||||||||||||||

| Additional | Share | Other | During the | ||||||||||||||||||

| Common Shares | Paid-in | Subscriptions | Comprehensive | Exploration | |||||||||||||||||

| Number | Par Value | Capital | Receivable | Income (loss) | Stage | Total | |||||||||||||||

| $ | $ | $ | $ | $ | $ | ||||||||||||||||

| Balance, September 24, 2004 | |||||||||||||||||||||

| (Date of Inception) | - | - | - | - | - | - | - | ||||||||||||||

| Net loss for the period | - | - | - | - | - | - | - | ||||||||||||||

| Balance, September 30, 2004 | - | - | - | - | - | - | - | ||||||||||||||

| Shares issued for cash: | |||||||||||||||||||||

| – January 2005, at $0.001 | 71,428 | 71 | 5,929 | - | - | - | 6,000 | ||||||||||||||

| – January 2005, at $0.01 | 59,524 | 60 | 49,940 | - | - | - | 50,000 | ||||||||||||||

| – March 2005, at $0.05 | 19,048 | 19 | 79,981 | (8,000 | ) | - | - | 72,000 | |||||||||||||

| Donated capital | - | - | 9,600 | - | - | - | 9,600 | ||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | (559 | ) | - | (559 | ) | ||||||||||||

| Net loss | - | - | - | - | - | (64,441 | ) | (64,441 | ) | ||||||||||||

| Balance, September 30, 2005 | 150,000 | 150 | 145,450 | (8,000 | ) | (559 | ) | (64,441 | ) | 72,600 | |||||||||||

| Share subscriptions received | - | - | - | 6,000 | - | - | 6,000 | ||||||||||||||

| Donated capital | - | - | 9,600 | - | - | - | 9,600 | ||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | 455 | - | 455 | ||||||||||||||

| Net loss | - | - | - | - | - | (52,963 | ) | (52,963 | ) | ||||||||||||

| Balance, September 30, 2006 | 150,000 | 150 | 155,050 | (2,000 | ) | (104 | ) | (117,404 | ) | 35,692 | |||||||||||

| Donated capital | - | - | 9,600 | - | - | - | 9,600 | ||||||||||||||

| Share subscriptions received | - | - | - | 2,000 | - | - | 2,000 | ||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | 704 | - | 704 | ||||||||||||||

| Net loss | - | - | - | - | - | (62,468 | ) | (62,468 | ) | ||||||||||||

| Balance, September 30, 2007 | 150,000 | 150 | 164,650 | - | 600 | (179,872 | ) | (14,472 | ) | ||||||||||||

| Donated capital | - | - | 9,600 | - | - | - | 9,600 | ||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | (329 | ) | - | (329 | ) | ||||||||||||

| Net loss | - | - | - | - | - | (68,553 | ) | (68,553 | ) | ||||||||||||

| Balance, September 30, 2008 | 150,000 | 150 | 174,250 | - | 271 | (248,425 | ) | (73,754 | ) | ||||||||||||

| Donated capital | - | - | 29,600 | - | - | - | 29,600 | ||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | 2,168 | - | 2,168 | ||||||||||||||

| Net loss | - | - | - | - | - | (39,526 | ) | (39,526 | ) | ||||||||||||

| Balance, September 30, 2009 | 150,000 | 150 | 203,850 | - | 2,439 | (287,951 | ) | (81,512 | ) | ||||||||||||

| Donated capital | - | - | 131,691 | - | - | - | 131,691 | ||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | (2,439 | ) | - | (2,439 | ) | ||||||||||||

| Net loss | - | - | - | - | - | (97,179 | ) | (97,179 | ) | ||||||||||||

| Balance, September 30, 2010 | 150,000 | 150 | 335,541 | - | - | (385,130 | ) | (49,439 | ) | ||||||||||||

20

| PURE MINERALS, INC. |

| (Formerly Pure Pharmaceuticals Corporation) |

| (An Exploration Stage Company) |

| NOTES TO FINANCIAL STATEMENTS |

| SEPTEMBER 30, 2010 |

| 1. | NATURE AND CONTINUANCE OF OPERATIONS |

| The Company was incorporated in the State of Nevada on September 24, 2004. The Company initially operated in the animal health products industry focusing on generic medicated feed-additive pharmaceuticals that foster health in food producing animals. During the year ended September 30, 2010, the Company changed its business to the exploration and development of mineral properties. In conjunction with the change in business, the Company changed its name from Pure Pharmaceuticals Corporation to Pure Minerals, Inc. on June 26, 2010. |

|

| Going Concern |

|

| These financial statements have been prepared on a going concern basis. The Company has incurred losses since inception through September 30, 2010, resulting in an accumulated deficit of $385,130 and further losses are anticipated in the development of its business raising substantial doubt about the Company’s ability to continue as a going concern. Its ability to continue as a going concern is dependent upon the ability of the Company to generate profitable operations in the future and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management has plans to seek additional capital through a private placement of its common stock and loans. These financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue. |

|

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| Basis of Presentation |

|

| The financial statements of the Company have been prepared in accordance with generally accepted accounting principles (“GAAP”) in the United States of America and are presented in US dollars. |

|

| Comparative Figures |

|

| Certain prior year comparatives have been reclassified to conform to the current year’s presentation. |

|

| Foreign Currency Translation |

|

| Foreign denominated monetary assets and liabilities are translated to their United States dollar equivalents using foreign exchange rates which prevailed at the balance sheet date. Revenue and expenses are translated at average rates of exchange during the period. Related translation adjustments are reported as a separate component of stockholders' equity, whereas gains or losses resulting from foreign currency transactions are included in results of operations. |

|

| Mineral Property Costs |

|

| Mineral property acquisition costs are capitalized as incurred. Mineral property exploration costs are expensed as incurred until such time as economic reserves are quantified. Mineral properties are reviewed for impairment whenever events and changes in circumstances indicate that the carrying amount may be impaired. In performing the review for impairment, the Company estimates the future cash flows expected to result from use of the asset or its eventual disposition. If the fair value exceeds the carrying value and impairment loss is recognized. |

21

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

|

| Exploration Stage Company |

||

| The Company is considered to be in the exploration stage. |

||

| Use of Estimates and Assumptions |

||

| The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company's estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected. The most significant estimates with regard to these financial statements relate to deferred income tax amounts, rates and timing of the reversal of income tax differences. |

||

| Net Loss per Share |

||

| Basic loss per share is computed by dividing net loss available to common shareholders by the weighted average number of outstanding common shares during the period. Diluted loss per share gives effect to all dilutive potential common shares outstanding during the period. Dilutive loss per share excludes all potential common shares if their effect is anti-dilutive. Because the Company does not have any potentially dilutive securities, diluted loss per share is equal to basic loss per share. |

||

| Financial Instruments |

||

| The fair value of the Company's financial instruments, consisting of cash, accounts payable, and long term loans, are estimated to be equal to their carrying value. It is management's opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments. |

||

| Income Taxes |

||

| Deferred income taxes are provided for tax effects of temporary differences between the tax basis of assets and liabilities and their reported amounts in the financial statements. The Company uses the liability method to account for income taxes, which requires deferred taxes to be recorded at the statutory rate expected to be in effect when the taxes are paid. Valuation allowances are provided for a deferred tax asset when it is more likely than not that such asset will not be realized. |

||

| Management evaluates tax positions taken or expected to be taken in a tax return. The evaluation of a tax position includes a determination of whether such a tax position should be recognized in the financial statements. A tax position should only be recognized if the Company determines that it is more likely than not that the tax position will be sustained upon examination by the tax authorities, based upon the technical merits of the position. For those tax positions that should be recognized, the measurement of a tax position is determined as being the largest amount of benefit that is greater than fifty percent likely of being realized upon ultimate settlement. |

||

22

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

| Stock-based Compensation |

|

| The Company accounts for stock based compensation arrangements using a fair value method and records such expense on a straight-line basis over the vesting period. |

|

| Recent Accounting Pronouncements |

|

| Recent pronouncements issued by Financial Accounting Standards Board (“FASB”) or other authoritative standards groups with future effective dates are either not applicable or are no expected to be significant to the financial statements of the Company. |

|

| 3. | LONG TERM LOANS |

| On May 16, 2008, the Company received a loan of $40,000 from a third party. The loan was unsecured and would mature three years from the date of the loan. The interest rate was 8% per annum, due on each anniversary of the loan. The loan balance including accrued interest of $2,717 was fully repaid on March 1, 2010. |

|

| On February 28, 2009, the Company received a loan of $15,390 (CAD $16,500) from a third party. The loan was unsecured and matured three years from the date of the loan. The interest rate was 8% per annum, due on each anniversary of the loan. The loan balance including accrued interest of $144 was fully repaid on November 6, 2009. |

|

| 4. | COMMON STOCK |

| The total number of authorized common stock that may be issued by the Company is 100,000,000 shares of stock with a par value of $0.001 per share. |

|

| During the year ended September 30, 2010, the Company completed an 84 for one (84:1) reverse stock split of its common shares. All shares and per share information in these financial statements has been retro-actively restated for all periods presented to give effect to this reverse stock split. |

|

| The Company has not granted any common stock options or warrants since inception. |

|

| 5. | RELATED PARTY TRANSACTIONS |

| The Company leased office space from a director of the Company and the lease expired on September 24, 2010. The Company records an equivalent fair value of $800 per month as donated capital. |

|

| All related party transactions are in the normal course of operations and are measured at the exchange amount, which is the amount of consideration established and agreed to by the related parties. |

23

| 6. | INCOME TAXES |

| As of September 30, 2010, the Company has estimated tax loss carry forwards for tax purposes of approximately $327,000 (2009: $240,000), which would expire over time by 2030. These amounts may be applied against future federal taxable income. Utilization of these carry forwards is dependent on the Company generating sufficient future taxable income to offset the losses. Future tax benefits which may arise as a result of these losses have not been recognized in these financial statements, as their realization has not been determined to be more likely than not to occur. |

|

| The actual income tax provision differs from the expected amount calculated by applying the statutory income tax rate to the Company’s loss before income taxes. The components of these differences are as follows: |

| September 30, | |||||||

| 2010 | 2009 | ||||||

| $ | $ | ||||||

| Loss before income tax | (97,179 | ) | (39,526 | ) | |||

| Statutory tax rate | 35.00% | 35.00% | |||||

| Expected tax recovery | (34,013 | ) | (13,834 | ) | |||

| Decrease resulting from: | |||||||

| Amounts not deductible for tax | 3,360 | 3,360 | |||||

| Unrecognized loss carry forward applied | 30,653 | 10,474 | |||||

| Income tax provision | - | - | |||||

The Company’s tax-effected deferred tax asset is estimated as follows:

| September 30, | |||||||

| 2010 | 2009 | ||||||

| $ | $ | ||||||

| Net future tax impact from operating loss carry forwards | 114,627 | 83,974 | |||||

| Valuation allowance | (114,627 | ) | (83,974 | ) | |||

| Net deferred tax asset | - | - | |||||

| 7. | PLANNED ACQUISITION |

| On June 14, 2010, the Company entered into a share exchange agreement (the “Share Exchange Agreement”) with the shareholders of 7167415 Canada Inc. (“7167415”), a privately owned, unrelated mineral exploration company that owns mining claims in the Province of Quebec, Canada Pursuant to the Share Exchange Agreement, all of the outstanding shares of 7167415 will be acquired by a newly incorporated subsidiary of the Company, (the “Share Exchange”). In connection with the Share Exchange, the Company will acquire 100% of the outstanding capital stock of 7167415 and the stockholders of 7167415 will receive preferred shares of a newly incorporated subsidiary exchangeable into 7,350,000 shares of the Company’s common stock. As a result of the Share Exchange, the stockholders of 7167415 will control approximately 98% of the Company’s outstanding common stock. As at financial statement filing date, the Share Exchange Agreement had not closed. |

|

| During the year ended September 30, 2010, the Company received $122,091 from 7167415 to repay long-term loans and to fund operating expenses. These funds were donated to the Company and the Company has no obligation to repay these funds. Accordingly, the $122,091 was recorded as additional paid in capital. |

24

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. |

None.

| ITEM 9A. | CONTROLS AND PROCEDURES. |

Evaluation of Disclosure Controls and Procedures. The Company's Management under the supervision and with the participation of the Principal Executive Officer and the Principal Financial Officer are responsible for establishing and maintaining "disclosure controls and procedures" (as defined in the Exchange Act) for the Company. Based on their evaluation of the Company's disclosure controls and procedures as of September 30, 2010, the Company's Management has concluded that the Company's disclosure controls and procedures were not effective due to the lack of segregation of duties to ensure that the information required to be disclosed by the Company under the Exchange Act was recorded, processed, summarized and reported within the time periods specified in the Exchange Act and accumulated and communicated to the Company's Management, including the Principal Executive Officer and the Principal Financial Officer, to allow timely decisions regarding required disclosure.

Changes in Internal Control over Financial Reporting. During the last quarter of the Company's fiscal year ended September 30, 2010, there were no changes in the Company's internal control over financial reporting during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial reporting.

Limitations on the Effectiveness of Controls. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues, if any, within a company have been detected. The Company's disclosure controls and procedures are designed to provide reasonable assurance of achieving their objectives, and the Principal Executive Officer and the Principal Financial Officer have concluded that these controls and procedures are effective at the "reasonable assurance" level.

| ITEM 9A(T). | CONTROLS AND PROCEDURES. |

Not applicable.

| ITEM 9B. | OTHER INFORMATION. |

None.

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE. |

Each director is elected by our shareholders to hold office for the terms specified in the Articles of Incorporation, and until their successors have been elected as provided in the Articles of Incorporation or until removed from office in accordance with our Bylaws. We currently have two directors, Dr. Nicolas Matossian and Charles Buisson who was elected to serve in such capacity until his successor shall have been duly elected and qualified. Each of our officers is appointed by the Board and serves until he or she is removed from office.

25

The name, age and position of our present officers and director are set forth below:

| Name | Age | Position(s) | Term as Director |

| Nicolas Matossian |

70 |

President, Principal

Executive Officer, Acting CFO and director |

Indefinite |

| Charles Buisson |

Director |

Indefinite

|

The following provides certain background information about each of our current director and officers:

Nicolas Matossian PhD, Chairman and CEO, Acting CFO

Dr. Matossian has extensive experience in the resource industry, including the mineral and petroleum industries where he has headed numerous private and public companies and limited partnerships, as well as owning or controlling private companies that are active in mineral and petroleum exploration. Dr. Matossian serves and has served on the Board of several public companies, listed on Canadian, US, Asian and UK exchanges. He was the COO and director of International Chemalloy Corp, a major producer of cesium and tantalum, and he was instrumental in assembling the Red Lake area claims for Consolidated Goldfields. In addition, until 1999 Dr. Matossian was President/COO and director of Cedar Group a Public U.S. holding company for Mc Connell Dowell Group (Australia), Davie Shipbuilding, Dominion Bridge Inc, Steen Corporation (pipeline) and Unimetric Mfg Corp. Previously, he was the CEO and managing partner of Grey Horse Resources, Great West Oil and Gas Co. and Rosebud River Gas Transmission. Dr. Matossian has worked as a consultant for the Federal Government and for the governments of BC, Alberta, NWT, Manitoba, Quebec, New Brunswick and Nova Scotia. Dr. Matossian received his Bachelor of Arts from McGill University and received his MBA from Harvard University and received his PhD in Economics from McGill University.

Charles Buisson, Director

Mr. Charles Buisson has extensive international management and administration expertise dealing with planning and profitability models. As President of CB International he was responsible for the commercial management of enterprises, marketing, development and computerized control and procedures. From 1998 to 2001 he was the Managing Director of ICT Group, a company providing international construction technology for large scale projects. Mr. Buisson is currently the owner and CEO of Globe Asphalte a rapidly expending construction services company. Mr. Buisson has been instrumental in assembling and analyzing the Company’s mineral claims and maintains valuable relations with the Quebec Department of Mines. Mr. Buisson received his Bachelor of Business Administration degree from the University of Lyon, France, as well as Masters in Marketing and Administration from the University of Lyon. Significant Employees. Other than our executive officers listed above, we do not have any significant employees.

Family Relationships. There are no family relationships among our directors or officers.

Involvement in Certain Legal Proceedings. Our directors, executive officers and control persons have not been involved in any of the following events during the past five years:

| 1. |

any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; | |

| 2. |

any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); | |

| 3. |

being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

26

| 4. |

being found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

Code of Ethics.To date, due to our limited operating history, the Board has not adopted a Code of Ethics.

Nomination Process. As of September 30, 2010, we did not effect any material changes to the procedures by which our shareholders may recommend nominees to the Board.

Audit Committee Financial Expert. At this time, given our stage of development, we do not have an audit committee financial expert serving on the Board and the Board as a whole serves as our audit committee.

Section 16(a) Beneficial Ownership Reporting Compliance. Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who beneficially own more than 10% of our equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors and greater than 10% shareholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file. Based on our review of the copies of such forms we received, we believe that during the fiscal year ended September 30, 2010 all such filing requirements applicable to our officers and directors were complied with.

| ITEM 11. | EXECUTIVE COMPENSATION. |

Our officers have received no compensation for their services to us to date. We do not have any form of stock option or equity incentive plan. As such, there were no outstanding equity awards at the end of our fiscal year ended September 30, 2010. In addition, we have not entered into any employment or consulting agreements with our officers. We have not compensated and have no arrangements to compensate our directors for their services to us. Members of management shall be paid a commensurate salary once the Company becomes profitable.

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. |

The following table sets forth, as at January 12, 2010, the total number of shares owned beneficially by each holder of five percent of our outstanding common stock. No other shareholders presently own five percent or more of our total outstanding shares.

| Name and Address of | Amount and Nature of | ||

| Title of Class | Beneficial Owner | Beneficial Owner | Percentage of Class |

| Common |

Roger Gordon, P.O. Box 55 1594 Stone Mill Park Bellona, NY 14415 |

3,750,000 (Direct)

|

29.8% |

| Common |

Charlie Lee, P.O. Box 55 1594 Stone Mill Park Bellona, NY 14415 |

2,250,000 (Direct)

|

17.9%

|

27

Dr. Matossian and Mr. Buisson do not own any shares of common stock but in connection with the share exchange with 7167415 they beneficially own 3,240,009 and 386,317 (post-split) shares which may be acquired upon exchangeable shares, respectively

Changes in Control. We are unaware of any contract, or other arrangement or provision of our Articles, the operation of which may at any subsequent date result in a change in control of the Company.

Equity Compensation Plans. To date we have not adopted any equity compensation plans.

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE. |

None of the following persons has had, since the date of our incorporation, any material interest, direct or indirect, in any transaction with us or in any presently proposed transaction that has or will materially affect us:

- Any director or officer;

- Any person who beneficially owns, directly or indirectly, shares carrying more than 5% of the voting rights attached to our outstanding shares of common stock;

- Any promoter; and

- Any member of the immediate family of any of the foregoing persons.

Director Independence

We have determined that none of the Company's directors qualify as an independent director as the term independent is used in NASDAQ Marketplace Rule 4200(a)(15).

| ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

The following sets forth information regarding the amount billed to us by our independent auditors in the fiscal periods indicated for the following fees and services:

Audit Fees

The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are as follows: (i) for the fiscal year ending September 30, 2010: US$ 10,000 (estimate) and (ii) for the fiscal year ending September 30, 2009: US$ 7,500.

Audit-Related Fees

The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit or review of the registrant’s financial statements and are not reported under the previous item, Item 9(e)(1) of Schedule 14A, are as follows: (i) for the fiscal year ending September 30, 2010: US$8,500 and (ii) for the fiscal year ending September 30, 2009: US$8,500. The nature of these audit-related services was primarily comprised of a review of the quarterly financial statements.

Tax Fees

The Company was billed $1,250in the fiscal year ended September 30, 2010 for tax compliance services rendered to the Company.

28

All Other Fees

Apart from as disclosed above, there were no other fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in Items 9(e)(1) through 9(e)(3) of Schedule 14A.

Policy on Pre-Approval of Services Performed by Independent Auditors

The Board acts as our audit committee, and it is the Board's policy to pre-approve all audit and permissible non-audit services performed by the independent auditors. We approved all services that our independent accountants provided to us in the past two fiscal years.

| ITEM 15. | EXHIBITS AND FINANCIAL STATEMENTS SCHEDULES |

| Exhibit No. | Description |

| 3.1 | Articles of Incorporation(1) |

| 3.2 | Bylaws(1) |

| 31.1 | Rule 13a-14(a)/15(d)-14(a) Certification of Principal Executive Officer and Acting Chief Financial Officer. |

| 32.1 | 18 U.S.C. Section 1350 Certifications of Chief Executive Officer and Acting Chief Financial Officer. |

| _______________________ | |

| (1) | Filed as an exhibit to our Registration Statement on Form SB-2 filed with the SEC on June 1, 2006. |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

PURE MINERALS, INC.

| By: | s/s Nicolas Matossian | |

| Nicolas Matossian | ||

| President, Principal Executive Officer and Director |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | s/s Nicolas Matossian | |

| Nicolas Matossian | ||

| President, Principal Executive Officer and Director, Acting CFO |

Date: January 21, 2011

| By: | /s/ Charles Buisson | |

| Charles Buisson, Director | ||

| Date: January 21, 2011 | ||