Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kraton Corp | d8k.htm |

Lenders’

Presentation

–

January

2011

Exhibit 99.1 |

2

Forward-Looking Statement Disclaimer

This presentation may include “forward-looking statements”

that reflect our plans, beliefs, expectations and current views with respect to,

among other things, future events and financial performance.

Forward-looking statements are often characterized by the use of words such as

“believes,” “estimates,” “expects,”

“projects,” “may,” “intends,” “plans” or “anticipates,” or by discussions of strategy, plans or intentions. All

forward-looking statements in this presentation are made based on

management's current expectations and estimates, which involve risks,

uncertainties and other factors that could cause actual results to differ

materially from those expressed in forward-looking statements. Readers

are cautioned not to place undue reliance on forward-looking

statements. These risks and uncertainties are more fully described in “Part I.

Item 1A. Risk Factors” contained in our Annual Report on 10-K,

as filed with the Securities and Exchange Commission and as subsequently

updated in our Quarterly Reports on Form 10-Q, and include risks

related to: conditions in the global economy and capital markets; our

reliance on LyondellBasell Industries for the provision of significant

operating and other services; the failure of our raw materials suppliers to

perform their obligations under long-term supply agreements, or our

inability to replace or renew these agreements when they expire;

limitations in the availability of raw materials we need to produce our

products in the amounts or at the prices necessary for us to effectively

and profitably operate our business; competition in our end-use

markets, by other producers of SBCs and by producers of products that can be

substituted for our products; our ability to produce and commercialize

technological innovations; our ability to protect our intellectual

property, on which our business is substantially dependent; infringement

of our products on the intellectual property rights of others;

seasonality in our Paving and Roofing business; financial and operating

constraints related to our substantial level of indebtedness; product

liability claims and other lawsuits arising from environmental damage or

personal injuries associated with chemical manufacturing; political

and economic risks in the various countries in which we operate; the

inherently hazardous nature of chemical manufacturing; health, safety

and environmental laws, including laws that govern our employees’

exposure to chemicals deemed harmful to humans; regulation of our

customers, which could affect the demand for our products or result in

increased compliance costs; international trade, export control,

antitrust, zoning and occupancy and labor and employment laws that could

require us to modify our current business practices and incur

increased costs; our relationship with our employees; loss of key

personnel or our inability to attract and retain new qualified personnel;

fluctuations in currency exchange rates ; the fact that we do not enter

into long-term contracts with our customers; a decrease in the fair value

of our pension assets, which could require us to materially increase

future funding of the pension plan; and concentration of ownership among

our principal stockholder, which may prevent new investors from

influencing significant corporate decisions. We assume no obligation to

update such information. Further information concerning issues that could

materially affect financial performance related to forward looking

statements can be found in our periodic filings with the Securities and

Exchange Commission. |

3

GAAP Disclaimer

This presentation includes the use of both GAAP (generally accepted accounting

principles) and non-GAAP financial measures. The non-GAAP financial measures are

EBITDA and Adjusted EBITDA. The most directly comparable GAAP financial measure

is net income/loss. A reconciliation of the non-GAAP financial measures used in this

presentation to the most directly comparable GAAP measure is included herein. We

consider EBITDA and Adjusted EBITDA important supplemental measures of our

performance and believe they are frequently used by investors and other interested

parties in the evaluation of companies in our industry. EBITDA and Adjusted EBITDA

have limitations as analytical tools and should not be considered in isolation or as a

substitute for analysis of our results under GAAP in the United States. |

4

Presenters

Kevin Fogarty

President and Chief Executive Officer

Steve Tremblay

Chief Financial Officer |

5

Agenda

Business and Industry Overview

Financial Overview

Proposed Transaction Overview |

Business and Industry

Overview |

7

Experienced Leadership Team

Name

Title

Previous Experience

Years

Industry

Experience

Dan Smith

Chairman of the

Board

Lyondell

40

Kevin Fogarty

President & CEO

Koch (Invista)

19

Steve Tremblay

Chief Financial

Officer

Vertis

15

Lothar

Freund

Research &

Technical Services

Hoechst AG (Invista)

21

Gene Shiels

Director –

Investor

Relations

Baker Hughes

7

Scott Lee

Vice President –

Operations

Shell Chemical Co.

26 |

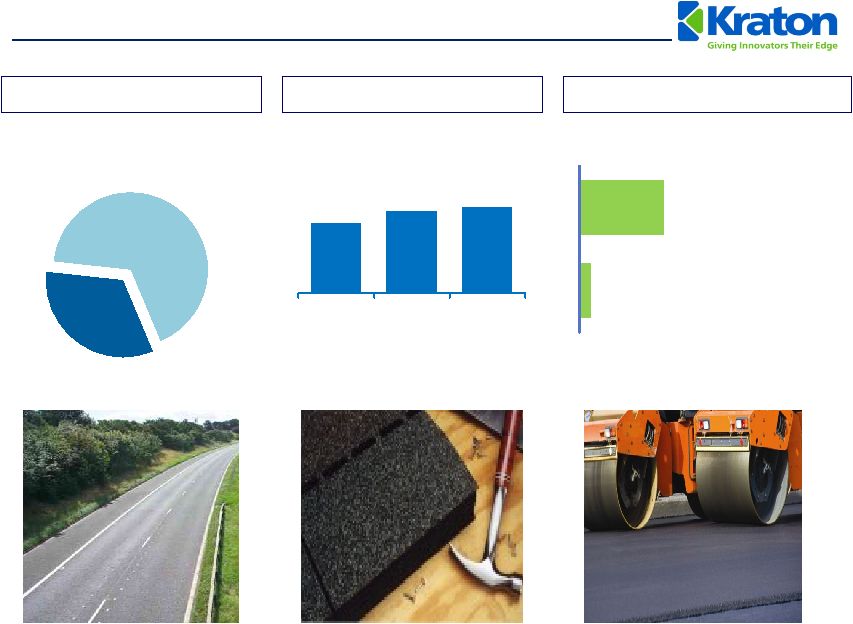

8

37%

21%

42%

4%

7%

31%

26%

32%

Kraton

Overview

We

invented

and

commercialized

Styrenic

Block

Copolymer (SBC) technology nearly 50 years ago

We believe that we hold #1 market share positions in each

of our end-use markets providing industrial, consumer and

geographical diversification that is second to none

We design and manufacture customized SBC polymer and

compound solutions to meet our leading customers’

specific innovation needs

We produce the following:

•

Unhydrogenated

Styrenic

Block

Copolymers

(USBC’s)

•

Hydrogenated

Styrenic

Block

Copolymers

(HSBC’s)

•

Isoprene Rubber and Isoprene Rubber Latex

We currently offer approximately 800 products to more

than 700 customers, in over 60 countries

We employ approximately 830 people in 9 locations in all

major regions of the world

TTM revenue ended September 30, 2010 of $1,191 million

and

Adjusted

EBITDA

(1)

of

$196

million;

16.4%

margin

(1)

Adjusted EBITDA is GAAP EBITDA excluding sponsor fees, restructuring and related charges, non-cash

expenses, and the gain on extinguishment of debt.

(2)

Management Estimates.

2009

Revenue

by

End-Use

(2)

2009

Revenue

by

Geography

(2)

North and

South

America

Europe,

Middle

East &

Africa

Asia Pacific

Paving and

Roofing

Adhesives,

Sealants and

Coatings

Other

Emerging

Businesses

Advanced

Materials

Clear SBC Market Leader Globally |

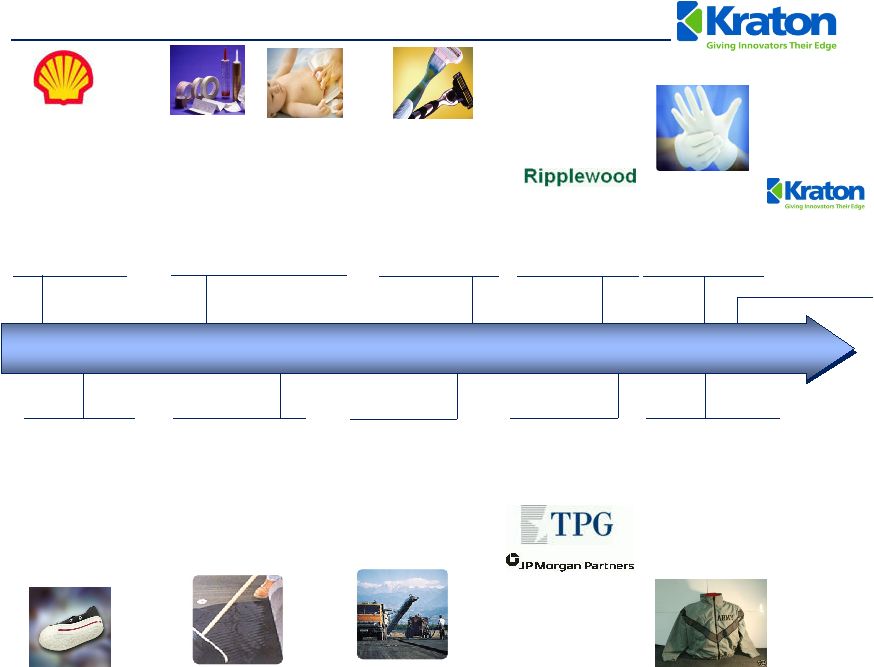

9

Soft touch

overmolding

has

become a value-added

market trend that has

revolutionized a broad

spectrum of end-use

products from

automotive to sporting

goods.

In the late 1960s SBCs

began use in

hot melts for packaging tape, labels,

and diaper spray adhesives.

Kraton

G polymers, SBCs

with

hydrogenated midblocks, were also

introduced for use in production of

soft, strong compounds for handles

and grips, elastic components in

diapers, etc.

Shell Chemicals scientists

develop first styrenic

block co-polymers in

1961, making amazingly

strong elastomers

which

required no vulcanization,

but could be molded into

different shapes with heat

(thermoplastic).

Kraton’s

History is the History of the SBC Industry

Kraton

spun out of

Shell Chemicals and

acquired by

Ripplewood

Holdings

in 2001

Developed

hypoallergenic

synthetic latex

for surgical

gloves and

condoms.

In 1964, Kraton

produced the first

Kraton

D polymers and

SBS compounds for

footwear applications.

The first dedicated

block copolymer plant

was built by Shell in

Belpre, Ohio in 1971.

Use of SBS in roofs

didn’t take off until the

70’s in Europe and the

early 1980’s in the US.

Stronger and more

flexible roofing felt

made from SBS

modified asphalts took

hold in the market.

Kraton

acquired by

TPG Capital and J.P.

Morgan Partners in

2003

Road technologies

shifted in the early

1990s leading to

dramatic increases in

the use of SBS

modified asphalts,

especially for climates

with large temperature

swings.

Developed NEXAR high

ion-flux polymers as

coating on top-end fabric &

membranes. Applications

include military uniforms,

athletic apparel, chemical

protective suits, water

filtration, etc.

1960

1970

1980

1990

2000

2010

Initial Public

Offering on the

New York Stock

Exchange |

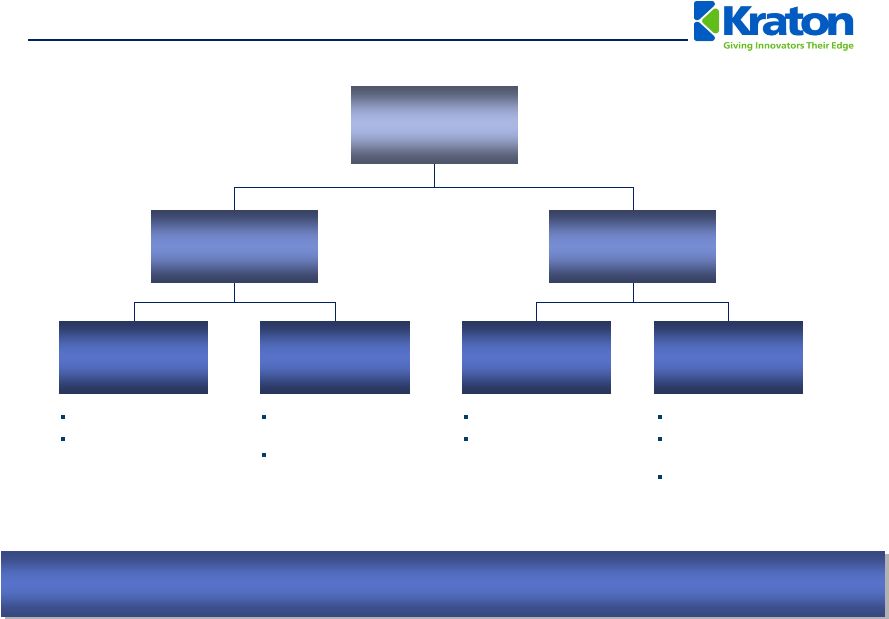

10

SBCs

are Engineered to Meet Customer Needs

Primary Raw

Materials

Products

Customer Value

End-Use Applications

Styrene

Unhydrogenated

SBCs

SBS

SIS

SIBS

Butadiene

Isoprene

Hydrogenated

SBCs

SEBS

SEPS

Isoprene Rubber

and Latex

Compounds

Paving

Roofing

Personal Care

Tapes

Formulators

Labels & Printing

Compounds

Packaging

Auto

Lubricants

Medical

Stretch

Soft-Touch

Adhesion

Strength

Durability

Thickening

Compatibility

Clarity

Recyclability

Kraton

is the only provider of these value components across all products touching

a wide array of applications |

11

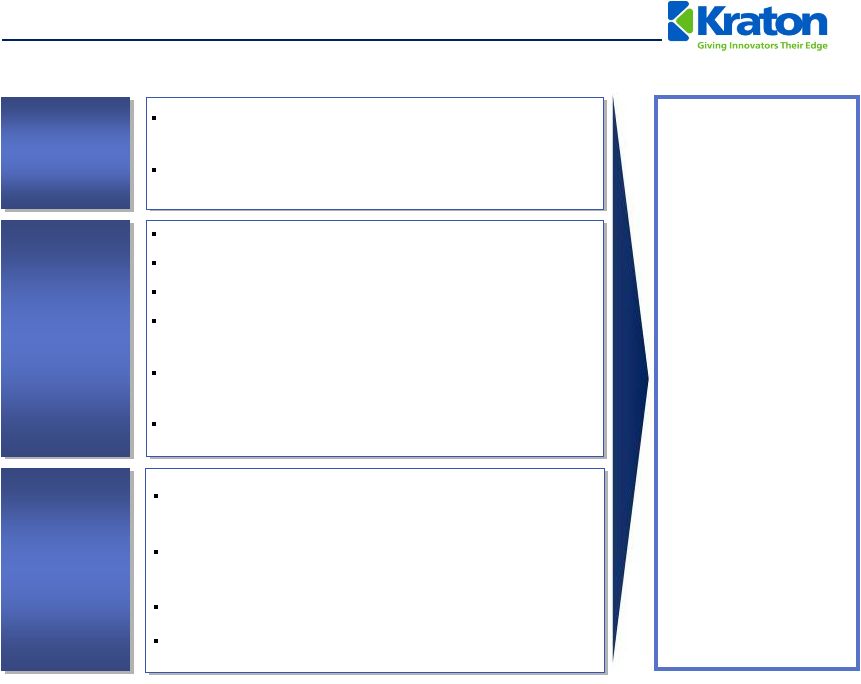

Investment Highlights

Leadership

Clear leader in the fast growing, attractive SBC market

More

than

1.6x

the

size

of

our

largest

competitor

in

each

of

our

end-use

markets

The only producer with a global footprint and service capabilities

Innovation-

Driven Top-

Line Growth

Most-productive innovator of new SBC polymers

Successfully leveraging product knowledge and technical expertise to commercialize

next generation of innovative solutions

Earnings

Growth

Driven by compelling organic growth platforms, expanding presence in Asia, sustained

volume growth and new product introductions

Margin

enhancement

through

continued

“Smart

Pricing”

strategy

and

innovation

Created meaningful operating leverage through significant improvement in cost structure

Investing

capital

in

high-return

projects

–

driving

profitable

growth

in

key

products

and

geographies

Experience

Strong leadership team demonstrating continuous improvement in productivity,

innovation and margin improvement

High

Barriers to

Entry

Patented technology, custom designed product, process excellence, global reach

and customer relationships create strong competitive position that cannot be

matched by existing or potential competitors

Competitive position allows for price leadership

Best-in-class service levels: 100% of products delivered on-demand on-time

|

12

SBCs

Enhance Performance Attributes

Durability

Elasticity

Impact

Soft Touch

Clarity

Adhesion

We are a Highly Engineered, Performance Materials Business

Recyclable |

13

Before Kraton

After Kraton

Kraton

Makes Products Perform Better

Stretch in legs only

(Spandex)

Not a fitted garment

High leakage rate

Overall improvement in stretch

(where it’s needed)

Better fit

Low leakage rate

Kraton

market share: 50%

2001

–

2009

CAGR:

11.5%

Kraton

material as % of Diaper cost: <2%

Phthalate plasticizers are

used to make PVC soft

but they can leach from

finished products and

create health concerns

Limited recyclability

PVCs

are unsafe when

burned or incinerated

improperly

Environmentally

friendly

–

100%

recyclable

Kraton

imparts softness, toughness and clarity

Plasticizer & chlorine free

Kraton

material as % of finished product cost: <5% |

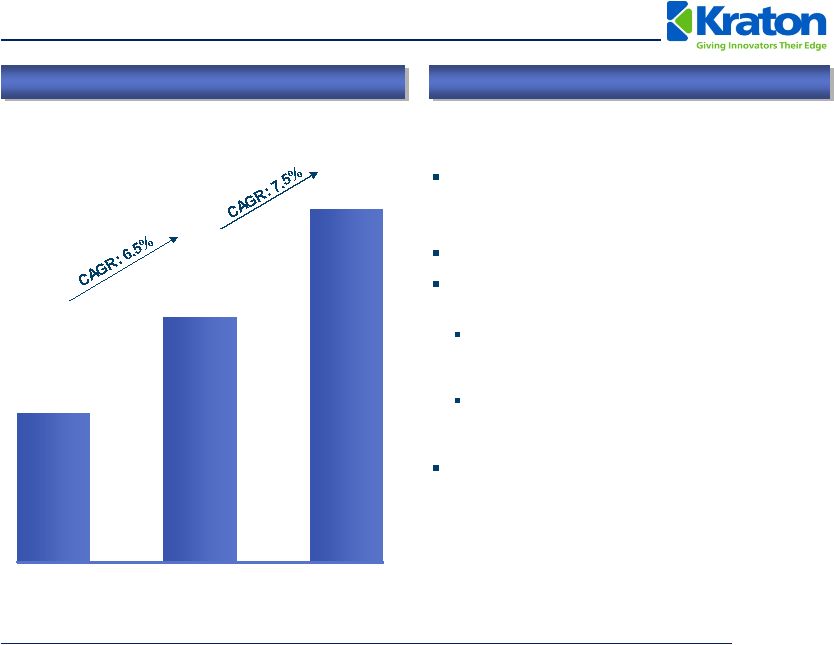

14

SBCs

are a Growth Industry

SBC Industry Volume (kT)

(1)

SBCs

Grow Faster Than GDP

Adoption

and

penetration

of

SBCs

into

new

applications and end-markets lead to industry

growth of ~2x GDP

Growing demand from emerging economies

Innovation and new SBC product

introductions

End-use application growth (e.g., PVC

alternatives for wire & cable and medical

applications such as IV bags, etc.)

Growing demand for environmentally friendly and

greener alternatives in electronics, medical and

baby care markets

Low cost relative to value added /

performance with limited substitution risk

675

1,112

1,599

2001

2009

2014

(1)

Management estimates. Excludes footwear end-use in which Kraton does not actively compete.

|

16

Global SBC Industry

Kraton

believes it is better positioned than the industry in HSBCs, which have higher performance

characteristics, are significantly more complex to produce and generate higher margins

SBC Industry

Market Size: 1,400kT

(~$3.3 billion)

USBC Production

(Unhydrogenated

Styrenic

Block Copolymers)

HSBC Production

(Hydrogenated Styrenic

Block Copolymers)

SBS

(Styrene-Butadiene-

Styrene)

SIS

(Styrene-Isoprene-

Styrene)

SEBS

(Styrene-Ethylene-

Butylene-Styrene)

SEPS

(Styrene-Ethylene-

Propylene-Styrene)

Paving and Roofing

Footwear

Adhesives, Sealants

and Coatings

Advanced Materials

Advanced Materials

Adhesives, Sealants

and Coatings

Lubricant Additives

Adhesives, Sealants

and Coatings

Advanced Materials

% Industry

% Kraton

2009 Revenue

66%

34%

Kraton

Industry

79%

21%

Source: Kraton Management and SRI Consulting.

Note: Blue percentages correspond to industry split and red percentages represent estimated Kraton

split. |

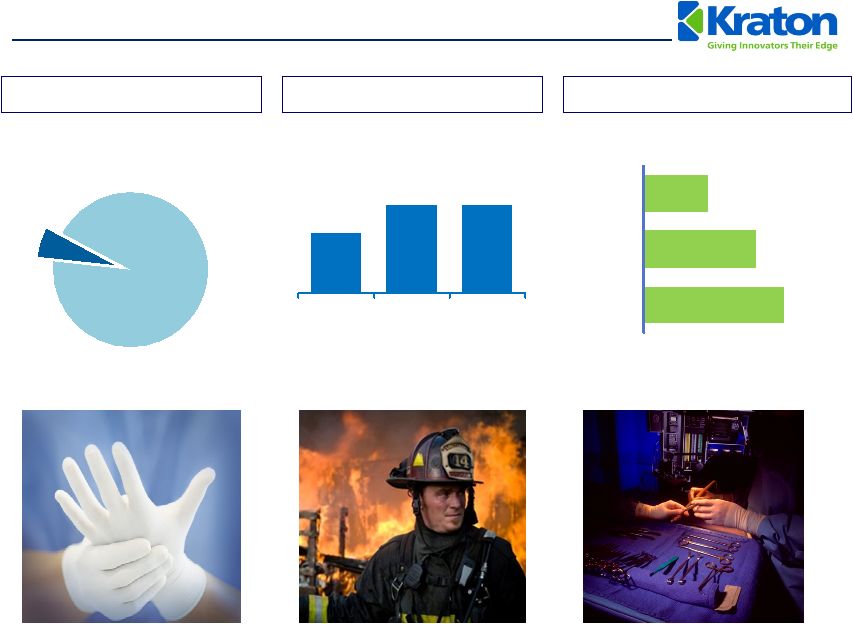

Clear Leader in

Attractive Markets Market Position

2009 Revenue

(1)

Adhesives, Sealants,

and Coatings

Advanced Materials

Paving and Roofing

Emerging Businesses

(4)

#1 Market Position and More than 1.6x the Size of Our Closest Competitors

Growth

(2)

Kraton

Market

Share Relative

To #2

Competion

(3)

Top 4 Market

Share

Source:

Management estimates.

(1)

Based on 2009 sales of $920 million (excludes by-product sales

which are reported as other revenues). (2) Industry volume growth from

2001-2009, Emerging Businesses growth rate refers to Kraton’s Isoprene Rubber (“IR”) and Isoprene Rubber Latex (“IRL”) growth from 2005-2009.

(3)

Management’s estimates vs. next largest competitor based on 2009

sales. (4)

The Emerging Businesses end-use market includes our IR and IRL

business. We believe that we are the only major third-party supplier of IR and IRL, and therefore end-use market share

metrics are not meaningful.

32%

5.9%

#1

1.9x

74%

77%

2.0x

#1

#1

1.6x

63%

100%

N/A

N/A

31%

7.4%

26%

6.5%

26.8%

7%

17 |

18

Sustainable Competitive Advantages

Almost 50 years of process know-how and

expertise

Performance-critical products and manufacturing

complexity

Technical

Barriers

Globally

recognized

brand

–

Kraton

®

Industry-leading R&D infrastructure

Global low-cost manufacturing footprint

Significant regulatory hurdles / barriers to new

manufacturing sites

Stable raw material base with multiple sources of

supply and contracts / relationships

Collaborative

customer

relationships

–

15+

years

with majority; sole source with several customers

Infrastructure

Barriers

Superior and

Innovative

Products

+

High Customer

Switching Costs

+

Long-Term

Customers

Relationships

=

Leading

Market Position

Products designed collaboratively to meet

specific customer needs / applications

Preferred partner based on manufacturing

consistency and process know-how

Ongoing technical service offering

100% of products offered with no lead times

High

Value

Added |

19

Europe

Asia

NA

Total

HSBC

3

1

3

7

SBS

4

3

6

13

SIS

4

2

1

7

USBC

1

–

–

1

Total

12

6

10

28

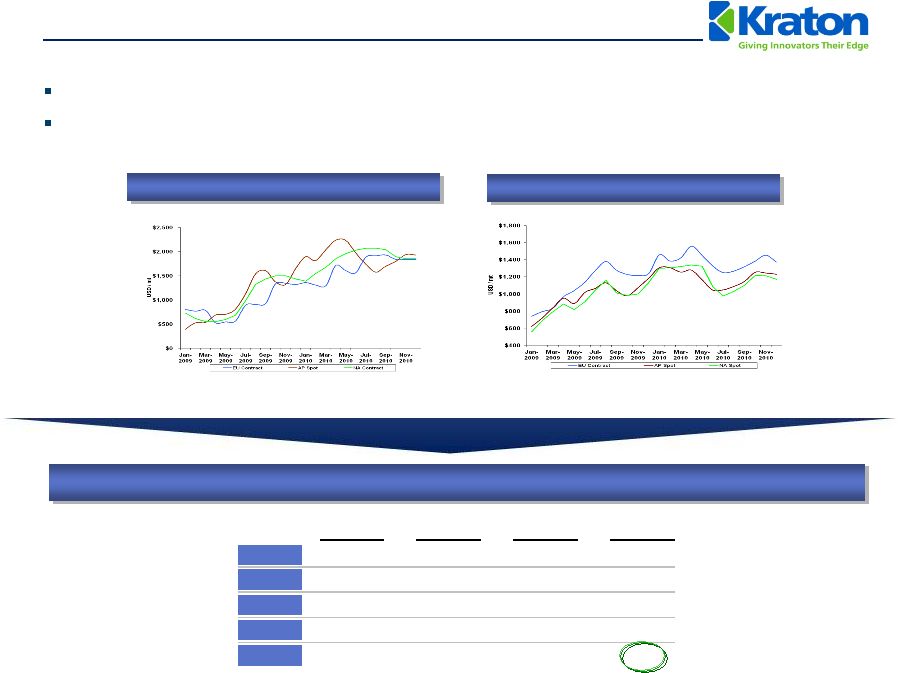

Proven Ability to Manage Input Volatility

Consultant forecasts calling for relatively flat energy and monomer costs in 2011

Should monomers be more volatile, Kraton

will execute its demonstrated core competence of managing

volatility in monomer costs

Price Increases Since IPO –

December 2009

Styrene

Butadiene

Source: Wall Street research |

20

Unparalleled Global Manufacturing and Service Capability

Plant

Capacity (kT)

Products

Focus

Belpre, OH

189

HSBC, USBC

World-scale HSBC (low cost), product breadth, N. American market

Paulinia, Brazil

28

USBC, IR Latex

Mercosur

tariff region, USBC, IR Latex global market

Berre, France

87

HSBC, USBC

Product breadth, European market

Wesseling, Germany

95

USBC

World-scale USBC, low cost

Kashima, Japan

22

USBC

Asian Market

Belpre, Ohio U.S.

Manufacturing

Facility

Global Headquarters

Houston, Texas U.S.

Innovation Center

Paulinia, Brazil

Manufacturing Facility

Innovation Center

Mont St. Guibert,

Belgium

Technical Service

Office

Wesseling,

Germany

Manufacturing

Facility

Kashima, Japan

Manufacturing

Joint Venture

Berre, France

Manufacturing

Facility

Amsterdam

The Netherlands

European Headquarters /

Innovation Center

Shanghai, China

Customer Service

and Technical

Center

Tsukuba, Japan

Innovation

Center |

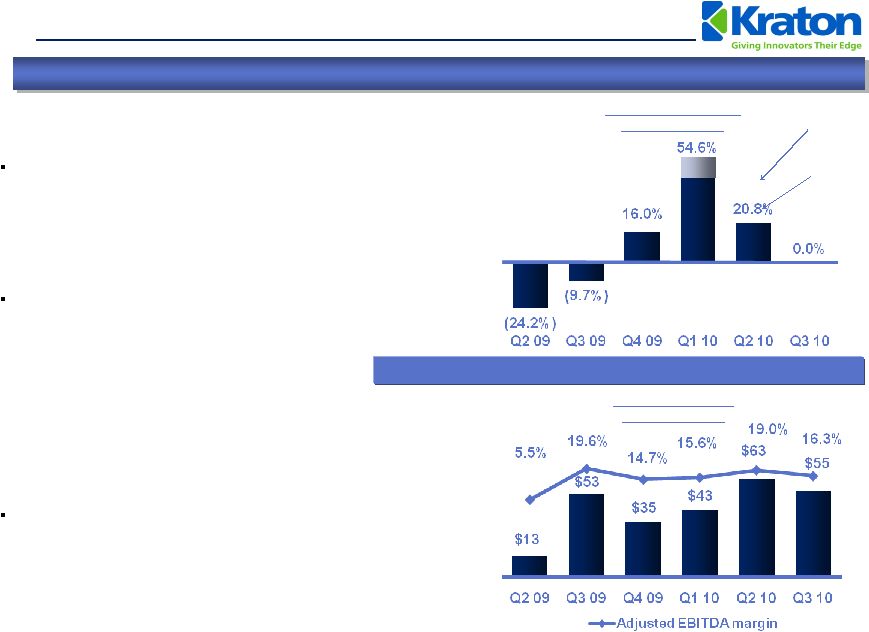

21

Adjusted EBITDA

(1)

(US$ in millions)

Strong Business Momentum: Q3 2010

(1)

Adjusted EBITDA is GAAP EBITDA excluding sponsor fees, restructuring and related charges, non-cash

expenses, and the gain on extinguishment of debt

Sales volumes recovering from lows in

late 2008 and first half 2009

Strong earnings momentum resulting

from volume recovery, increased

adoption of Kraton

products and cost

leverage

Focus on margin expansion through

“Smart Pricing”

and innovation

programs

Profit growth through focused strategy, volume recovery, cost reduction and product innovation

12.1%

Estimated “One-time”

Growth

Core Growth

Year-on-Year Change

in Sales Volume

Volume (kT)

71 81

61

73

86 81 |

22

Conservative Capital Structure

Superior profitability and industry leading margins

Growth through re-investment in existing business

Support market-driven research and development

High-return capital spending projects

Strategic M&A opportunities that build technology and market portfolio

Acquisition criteria:

Consistent with existing capabilities / core competencies

Accretive to earnings within first year

No near-term plans to initiate dividend or share repurchases until current

capital plan completed

Kraton

is focused on maintaining a conservative capital structure

Financial

Objectives

and Future

Uses of Cash |

23

Majority of top customers have 15+ year relationship

Blue chip customer base in the consumer products, packaging,

medical supplies, construction and textile industries

Several key customer relationships are sole source

Well diversified customer base

Long-Standing and Collaborative Customer Relationships

High

Quality

Customer

Base

74%

26%

2009 Revenues by Customer

~700

Customers

Top 10 |

24

20%

13%

12%

14%

13%

11%

6%

2005

2006

2007

2008

2009

Q3

2010

TTM

Target

Profit Growth Through Innovation

Approximately 1,000 patents

granted and 381 pending

Innovation continuously

repositions sales mix, improves

margins and drives growth

Step-change advancement of

Big 6 Innovation Priorities

Wire and cable solutions

Elastic nonwovens

NEXAR™

membrane

technology

Oilfield service applications

Protective films

Automotive soft skin solutions

Innovation

Share

of

Total

Revenue

(%)

(1)

(1)

Innovation revenue defined as revenues of new products (e.g., new polymer, new application of an

existing polymer or new step out production technology) introduced within the last 5

years. Vision 20/20: 20% of revenue at 20% margin premium

Increased in Period of

Strong Volume

Growth in Base

Business |

25

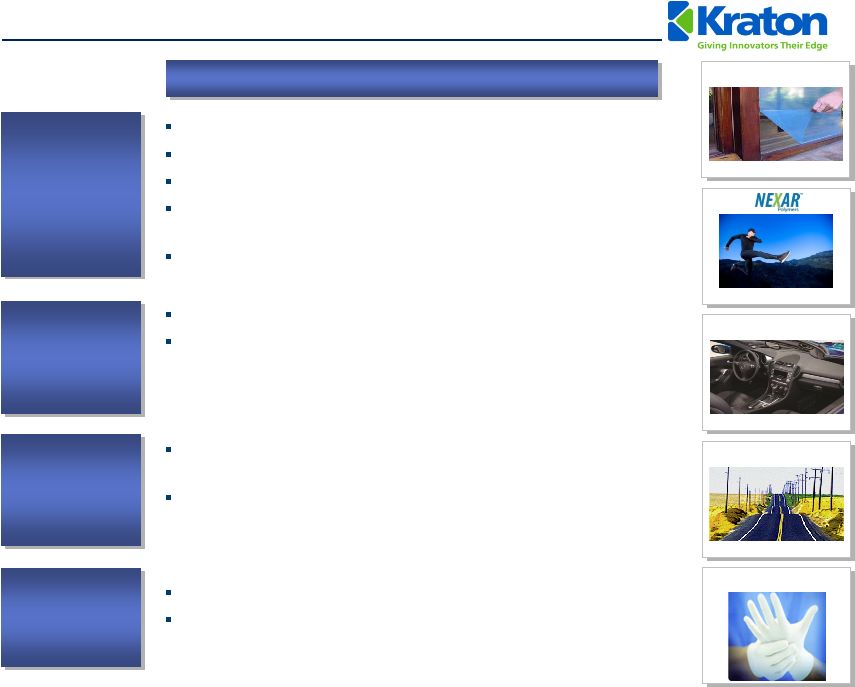

Compelling Organic Growth Platforms

Advanced

Materials

Adhesives,

Sealants &

Coatings

Paving and

Roofing

Emerging markets growth

Expansion into new and differentiated markets, such as

protective films, oilfield service applications, spray and

extrusion coatings, hot melt adhesives, elastic adhesives,

labels and sealant applications

Superior performing SBS modified emulsions for

asphalt

modification

Low VOC roof coating formulations for superior water

resistance, improved adhesion and reduced installation cost

“Green”

PVC alternatives to the wire and cable industry

Enabling technology for high performance fabric solutions

“Soft Touch”

covers and solutions to the automotive industry

NEXAR

®

–

high-end membrane technology markets for

performance clothing, HVAC applications and fuel cells

Co-extrusion technology for surface protection

Applications

Isoprene

Rubber Latex

Medical

applications

–

surgical

gloves

Material

substitution

–

condoms

HiMA

Protective Films

Soft Skins

IRL Gloves |

26

Innovation-led Top Line Growth

Tremendous growth

Rapidly capture share from $2.2 billion

natural rubber latex industry

Margins well in excess of rest of business

Leading producer in the market

Challenging process technology to

replicate for competitors and new

entrants

Commenced capacity expansion of

Paulinia, Brazil facility

Total planned IRL capacity expansion

of 33%

Case Study: IR Latex and IR Revenue Growth

Key Attributes

$15

$22

$23

$35

$76

$61

2005

2006

2007

2008

2009

Q3 2010

TTM

(US$ in millions) |

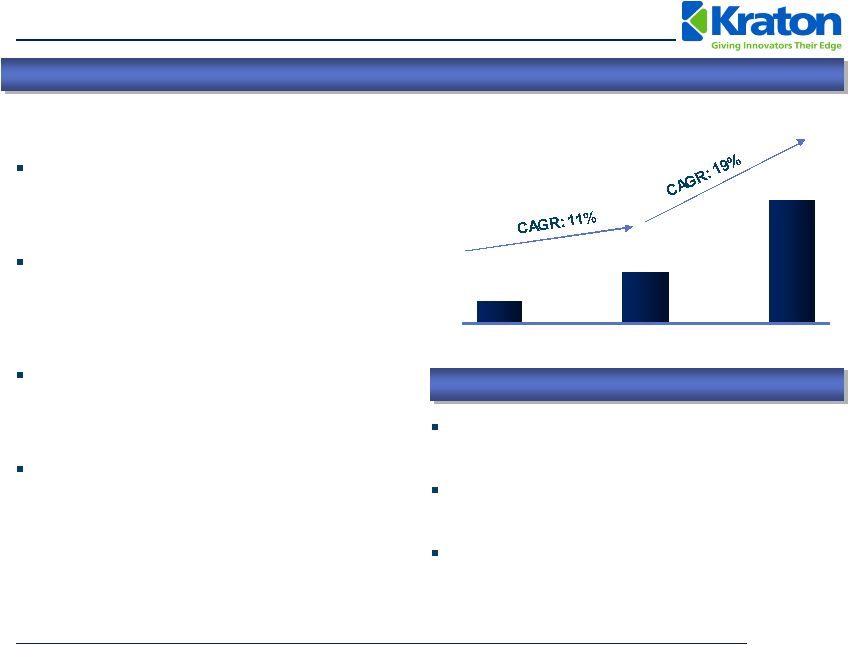

27

27

62

149

2001

2009

2014

Investing for Growth In Asia

Asia Pacific SBC market –

53% of

global SBC consumption by volume in

2009

(1)

YTD September 2010, Asia Pacific

accounted for 20% of our total

revenue, with 46% derived from higher

margin HSBC products

In 2010 relocated Shanghai, China

office to a new facility (double the size

of the previous location)

Expanded warehouse capacity in

Shanghai Waigaoqiao

Free Trade

Zone

Proposed HSBC expansion in Asia

Forecast strong worldwide growth in HSBC

driven by innovation

Initiated project assessment for a new 30 kT

per year HSBC plant in Asia

Site selection by early 2011 with start-up

planned for second half of 2013

Asia is an important component of Kraton’s

growth strategy

Asian HSBC Industry Demand Trends (kT)

(1)

Management estimates. Includes SBC consumption for footwear, a market

in which Kraton does not actively compete. |

Financial

Overview |

29

Update

on

2010

Business

Priorities

–

Q3

2010

Innovation-led Top-line

Growth

Capital Investment

Realizing benefits from ERP implementation

IR and IRL projects continue on plan; operational mid-

2011

Belpre DCS project progressing well

Actively engaged in evaluation of alternatives for

additional HSBC capacity

Earnings Growth

Net Income was $28 million, up $6 million from Q3 2009

Pace of raw material price increases moderated from

second quarter 2010

Adjusted EBITDA of $55 million

TTM Adjusted EBITDA margin on sales revenue of 16%

29

TTM vitality index 13%

Good momentum in PVC alternatives for wire & cable

and medical applications

Pipeline includes Soft Skins in automotive applications,

Cariflex

TM

IR products and advances in protective films |

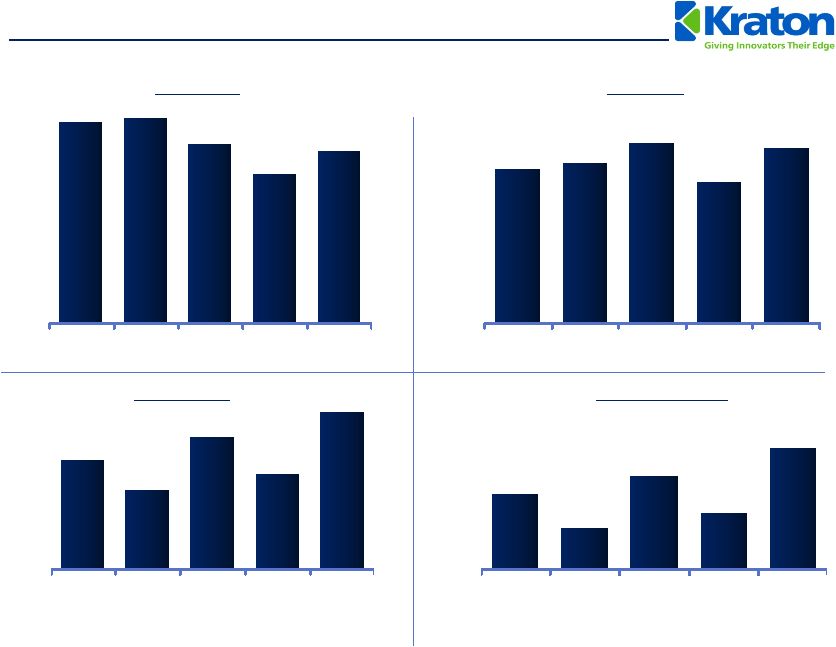

30

Historical Financial

Summary

Volume (kT)

Revenue

(1)

Gross Profit

(2)

Adjusted EBITDA

(3)

(US$ in millions)

(1)

Includes by-product revenue.

(2)

Adjusted for restructuring charges

(3)

Adjusted EBITDA is GAAP EBITDA excluding sponsor fees, restructuring and related charges, non-cash

expenses, and the gain on extinguishment of debt. $210

$255

$302

$153

$182

2006

2007

2008

2009

Q3 10

TTM

$122

$68

$152

$91

$196

2006

2007

2008

2009

Q3 10

TTM

352

358

313

301

260

2006

2007

2008

2009

Q3 10

TTM

Margin:

20.0% 14.1% 20.8% 18.8%

25.4%

Margin:

11.6% 6.3% 12.4% 9.4%

16.4%

$1,048

$1,226

$1,191

$1,090

$968

2006

2007

2008

2009

Q3 10

TTM |

31

Attractive Free Cash Flow Dynamics

$196 million of TTM September 30, 2010 Adjusted EBITDA

(1)

Meaningful

operating

leverage

–

$55

million

of

annualized

net

cost

reduction since 2007

Favorable demand drivers will drive strong volume growth

Attractive

Earnings

Power

Drivers of Free Cash Flow

$15 million historical average annual maintenance capex

Low Level of

Maintenance

Capex

$78 million of cash at September 30, 2010

Net Debt-to-Cap ratio of 40% at September 30, 2010, with Net Debt to

September 30, 2010 TTM Adjusted EBITDA of 1.56x

Capital

Structure

Near-term cash tax rate of 10% -

13%

$331 million NOL balance as of December 31, 2009

Low Cash

Tax Rate

Reduced quantity of finished goods inventory by nearly 20% excluding

isoprene rubber build, since year end 2006

Minimal impact on service levels

Target working capital (excl. cash) as % of revenue of ~25%

Moderate

Working

Capital Needs

(1)

Adjusted EBITDA is GAAP EBITDA excluding sponsor fees, restructuring and related charges, non-cash

expenses, and the gain on extinguishment of debt. |

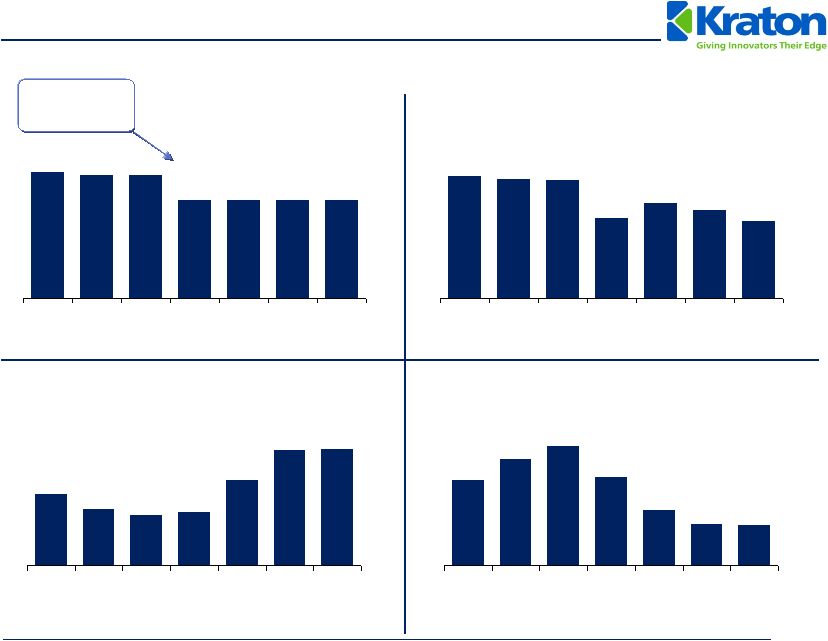

TTM

Adjusted EBITDA (2)

$120

$95

$85

$91

$144

$194

$196

3/09

6/09

9/09

12/09

3/10

6/10

9/10

32

Gross Debt

(1)

$497

$486

$486

$385

$388

$386

$385

3/09

6/09

9/09

12/09

3/10

6/10

9/10

Net Debt

(1)

$484

$469

$463

$316

$376

$347

$306

3/09

6/09

9/09

12/09

3/10

6/10

9/10

Leverage Ratio

(3)

4.1x

5.1x

5.7x

4.2x

2.7x

2.0x

2.0x

3/09

6/09

9/09

12/09

3/10

6/10

9/10

Earnings Growth and Deleveraging

(US$ in millions)

Proceeds

from IPO

(1)

Gross Debt and Net Debt include insurance note payable.

(2)

Adjusted EBITDA is GAAP EBITDA excluding management fees, restructuring

and related charges, non-cash expenses, and the gain on extinguishment of debt.

(3)

Leverage ratio is calculated by dividing total Gross Debt by TTM

Adjusted EBITDA. |

33

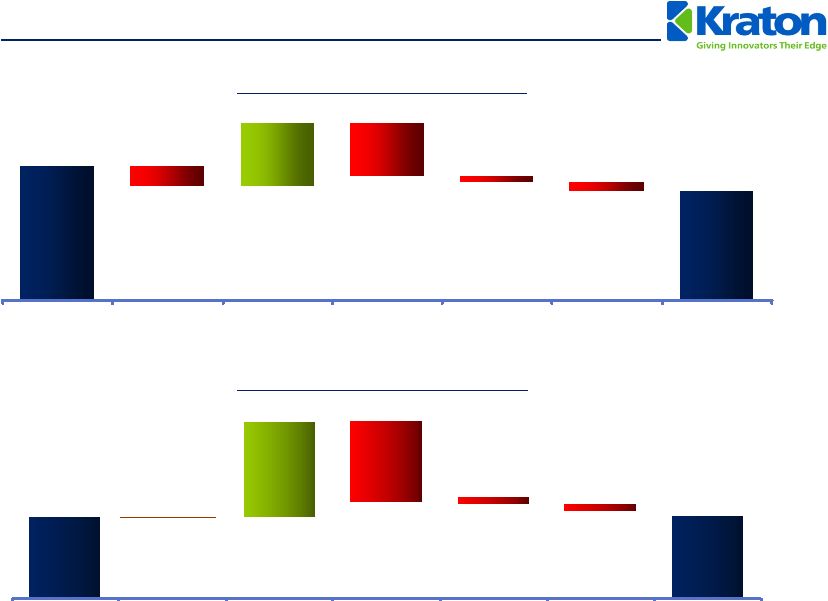

$63

$55

$20

($2)

($3)

($17)

($6)

Q2 2010

Volume

Price

COGS

R&D / SG&A

FX / Other

Q3 2010

Q3 2010 Adjusted EBITDA Walks

Adjusted EBITDA

(1)

–

Q3 2010 vs. Q2 2010

Adjusted EBITDA

(1)

–

Q3 2010 vs. Q3 2009

(US$ in millions)

(1)

Adjusted EBITDA is GAAP EBITDA excluding sponsor fees, restructuring and related charges, non-cash

expenses, and the gain on extinguishment of debt. $53

$55

$76

$-

($66)

($4)

($4)

Q3 2009

Volume

Price

COGS

R&D / SG&A

FX / Other

Q3 2010 |

34

Expertise in market and application development, high quality manufacturing, customer service

offering, and core end-use focus

Provide application-based solutions to meet customers’

needs

Commercialize

next

generation

of

innovations,

e.g.,

Nexar™

non-woven

and

industrial

fibers,

oilfield service applications, protective films, etc.

Margin enhancement by improving or eliminating marginally profitable products

Extract value for complexity

Continue to identify opportunities to contract with key customers

Proactively manage raw material price volatility

Debottleneck capacity and improve assets

Polyisoprene

rubber

(IR)

expansion

at

Belpre,

Ohio

and

Isoprene

rubber

latex

(IRL)

capacity

expansion at Paulinia, Brazil

Evaluating options for additional HSBC capacity in Asia

Identify / pursue opportunities for cost reduction and productivity improvement

Execute on new IR manufacturing capacity at Belpre

Leverage

Leadership

Position

Drive Growth

Through

Innovation

Continue

Smart Pricing

Invest in

Growth and

Infrastructure

Continuous

Productivity

Improvement

Go-Forward Business Strategy

Capital

Structure

Conservative approach to excess cash flow

Maintain flexibility to complete capital plans

Focus on improving ratings profile |

Proposed Transaction

Overview |

36

Proposed Transaction Overview

Kraton

intends to execute a comprehensive refinancing of its capital structure in February

2011 (assuming continued favorable capital market conditions).

Our objective is to raise a total of $550 million of debt financing ($400 million funded at

close): •

$150

million

in

undrawn

5-year

revolver.

•

$200 million in a 5-year Term Loan A.

•

$200 million in 8-year Senior Unsecured Notes.

The net proceeds of the financing will be used to redeem existing indebtedness including

Senior Notes, Discount Notes and Term Debt due 2013 and 2014.

The

redemption

of

the

Senior

Notes

due

2014

is

to

take

place

via

a

tender

offer.

Refinancing our capital structure today ensures:

•

Attractive low cost rate environment.

•

Extended maturity profile from 2013/2014 to 2016/2019.

•

Significant liquidity enhancement from $80 million cash flow revolver to $150 million cash

flow revolver. |

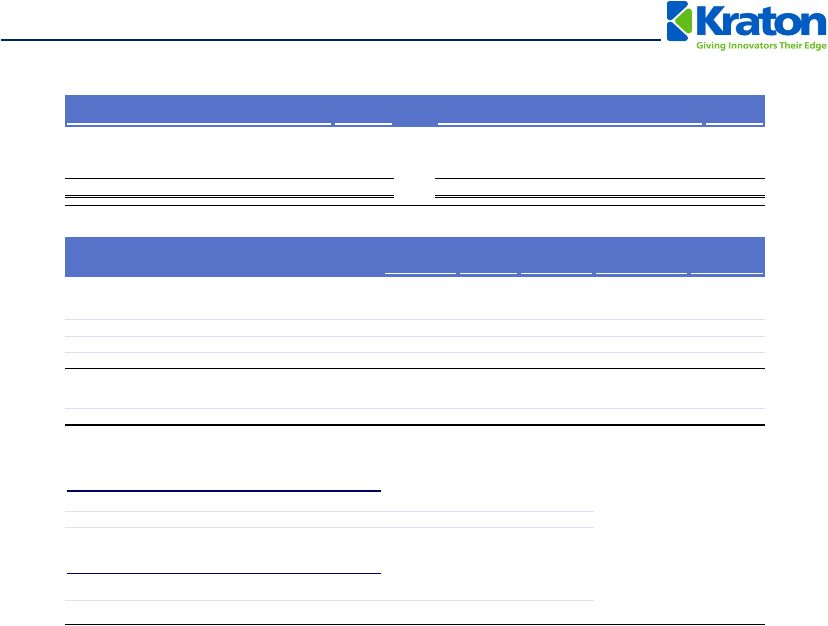

37

Proposed Sources & Uses and Pro Forma Capitalization

($ in millions)

Sources of Funds

$

Uses of Funds

$

New Revolver ($150)

$0

Refinancing of Existing Debt

$383

New Term Loan A

200

Fees & Expenses

17

New Senior Unsecured Notes

200

Total Sources

$400

Total Uses

$400

Pro Forma

% of

($ in millions)

9/30/2010

Adj.

9/30/2010

Total Debt

xEBITDA

Cash

$78

$0

$78

Existing Revolver ($80)

--

--

New Revolver ($150)

--

--

--

Existing Term Loan

220

(220)

--

New Term Loan A

--

200

200

1.02x

Total Senior Secured Debt

$220

$200

50.0%

1.02x

New Sr. Uns. Notes

--

200

200

1.02x

Existing Sr. Sub. Notes

163

(163)

--

Total Debt

$383

$400

100.0%

2.04x

Net Debt

305

322

Adjusted EBITDA

$196

$196

Total Interest Expense

28

26

Capital Expenditures

50

50

Adjusted EBITDA / Total Interest Expense

7.08x

7.61x

(Adjusted EBITDA - Capex) / Total Interest Expense

5.28x

5.68x

TTM 9/30/10 Pro Forma Financials

Pro Forma Credit Statistics |

38

Proposed Summary of Terms and Conditions

Borrower:

Kraton Polymers LLC (the “Borrower”)

Facilities:

$350 million Senior Secured Credit Facilities

$150 million Revolving Credit Facility

$200 million Term Loan A

Guarantors:

Kraton Performance Polymers, Inc. and all existing and future direct and indirect

material domestic subsidiaries of the Borrower

Security:

Maturity:

Revolver: 5.0 years

Term Loan A: 5.0 years

Pricing:

Revolver: To be announced (grid based on Consolidate Net Leverage Ratio)

Term Loan A: To be announced

Revolver Commitment Fee:

TBD (grid based)

Amortization:

Revolver: None

Term Loan A: 5%, 5%, 7.5%, 10%, 72.5%

Incremental Facilities:

$125 million (subject to a maximum Consolidated Net Leverage Ratio)

Optional Prepayments:

Anytime at par

Mandatory Prepayments :

100% asset sales

100% debt issuance (Above a Maximum Pro Forma Consolidated Net Leverage

Ratio) 50% excess cash flow (with step downs to 25% and 0% based on a

Consolidated Net Leverage Ratio) Financial Covenants:

Consolidated Net Leverage Ratio

Consolidated Net Interest Coverage Ratio

Maximum Capital Expenditures

First priority lien on substantially all tangible and intangible assets and capital stock of the

Borrower and the Guarantors, as well as 65% of the equity interests in first-tier

material foreign subsidiaries |

Appendix

|

Adhesives, Sealants and

Coatings End Use Review 32%

TTM Revenue Profile

Change in Sales Revenue

40

Q3 2010 vs. Q3 2009

Q3 2010 vs. Q2 2010

End Use Revenue

US $ in millions

ASC

$83

$104

$108

0

50

100

150

Q3 09

Q2 10

Q3 10

4%

30% |

27%

Advanced Materials End Use Review

41

TTM Revenue Profile

Change in Sales Revenue

End Use Revenue

Change in Sales Revenue

US $ in millions

AM

Q3 2010 vs. Q3 2009

Q3 2010 vs. Q2 2010

$82

$98

$92

0

50

100

150

Q3 09

Q2 10

Q3 10

(6)%

12% |

42

33%

P&R

22%

3%

$91

$107

$111

Q3 09

Q2 10

Q3 10

Paving and Roofing End-Use Review

TTM Revenue Profile

Change in Sales Revenue

End-Use Revenue

US $ in Millions

Q3 2010 vs. Q3 2009

Q3 2010 vs. Q2 2010 |

43

6%

EB

$35

$61

$76

2009

2008

Q3 2010

$13

$19

$19

Q3 09

Q2 10

Q3 10

Emerging Businesses End-Use Review

TTM Revenue Profile

TTM Sales Revenue

End-Use Revenue

US $ in Millions

US $ in Millions |

44

Reconciliation of Net Income / (Loss) to EBITDA

and Adjusted EBITDA

(US$ in millions)

(1)

The EBITDA measure is used by management to evaluate operating performance. Management believes that

EBITDA is useful to investors because it is frequently used by investors and other interested

parties

in

the

evaluation

of

companies

in

our

industry.

EBITDA

is

not

a

recognized

term

under

GAAP

and

does

not

purport

to

be

an

alternative

to

net

income

(loss)

as

an

indicator

of

operating

performance

or

to cash flows from operating activities as a measure of liquidity. Since not all companies use

identical calculations, this presentation of EBITDA may not be comparable to other similarly titled measures of

other companies. Additionally, EBITDA is not intended to be a measure of free cash flow for

management’s discretionary use, as it does not consider certain cash requirements such as interest payments,

tax payments and debt service requirements.

(2)

Adjusted EBITDA is EBITDA excluding management fees, restructuring and related charges, non-cash

expenses, and the gain on extinguishment of debt. Quarterly

Trailing Twelve Months

Q1 08

Q2 08

Q3 08

Q4 08

Q1 09

Q2 09

Q3 09

Q4 09

Q1 10

Q2 10

Q3 10

Q1 09

Q2 09

Q3 09

Q4 09

Q1 10

Q2 10

Q3 10

Net income

($9)

$10

$35

($7)

($17)

($4)

$22

($2)

$20

$39

$28

$21

$7

($6)

($0)

$36

$79

$85

Interest expense, net

10

9

8

9

9

8

8

9

6

6

6

35

34

34

34

31

30

28

Income tax expense

(0)

3

5

1

0

1

(2)

(1)

4

5

5

9

7

1

(1)

3

7

13

Depreciation and amortization

15

13

13

12

13

13

17

25

11

12

13

51

51

54

67

65

65

61

EBITDA

$16

$35

$61

$16

$5

$17

$45

$32

$41

$62

$52

$117

$98

$83

$99

$135

$180

$187

Sponsor fees and expenses

$1

$1

$1

$1

$1

$1

$1

$1

$0

$0

$0

$2

$2

$2

$2

$2

$1

$1

Restructuring and related charges

6

2

2

4

1

0

6

2

0

1

2

9

7

12

10

9

9

5

Other non-cash expenses

1

0

0

9

3

(1)

2

0

1

0

1

12

12

13

5

3

4

3

Gain in extinguishment of debt

0

0

0

0

(20)

(4)

0

0

0

0

0

(20)

(24)

(24)

(24)

(4)

0

0

Adjusted EBITDA

$23

$38

$63

$29

($10)

$13

$53

$35

$43

$63

$55

$120

$95

$85

$91

$144

$194

$196

Year Ended December 31,

2006

2007

2008

2009

Net income

($34)

($44)

$28

($0)

Interest expense, net

67

43

37

34

Income tax expense

30

6

8

(1)

Depreciation and amortization

44

52

53

67

EBITDA

$106

$58

$127

$99

Sponsor fees and expenses

$2

$2

$2

$2

Restructuring and related charges

11

6

14

10

Other non-cash expenses

3

3

10

5

Gain in extinguishment of debt

0

0

0

(24)

Adjusted EBITDA

$122

$68

$152

$91

(1)

(1)

(2)

(2) |