Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF INDEPENDENT CERTIFIED AUDITOR - China BCT Pharmacy Group, Inc. | fs1a9ex23i_chinabct.htm |

| EX-10.64 - ENTRUSTMENT AGREEMENT - China BCT Pharmacy Group, Inc. | fs1a9ex10lxiv_chinabct.htm |

Registration No. 333-165161

SECURITIES AND EXCHANGE COMMISSION

|

AMENDMENT NO. 9 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

CHINA BCT PHARMACY GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

5912

|

20-8067060

|

||

|

(State or other Jurisdiction of Incorporation)

|

(Primary Standard Classification Code)

|

(IRS Employer Identification No.)

|

No. 102, Chengzhan Road

Liuzhou City, Guangxi Province, P.R.C. 545007

Tel.: (86) 772-363-8318

(Address and Telephone Number of Registrant’s Principal

Executive Offices and Principal Place of Business)

Corporation Service Company

2711 Centerville Road Suite 400

Wilmington, Delaware 19808

(Name, Address and Telephone Number of Agent for Service)

Copies of communications to:

Thomas Wardell, Esq.

McKenna Long & Aldridge LLP

303 Peachtree Street

Atlanta, Georgia 30308

Tel No.: (404) 527-4990

Fax No.: (404) 527-8890

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective. If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. T

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer £

|

Non-accelerated filer £

|

Accelerated filer £

|

Smaller reporting company S

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class Of Securities to be Registered

|

Amount to be Registered

|

Proposed Maximum Aggregate Offering Price per share

|

Proposed Maximum Aggregate Offering Price

|

Amount of Registration Fee

|

||||||||||||

|

Common stock, $0.001 par value per share

|

3,519,340

|

(1)

|

$

|

2.00

|

(2)

|

$

|

7,038,680

|

$

|

501.86

|

|||||||

|

Common stock, $0.001 par value per share, issuable upon exercise of investor warrants

|

1,759,301

|

$

|

3.81

|

(3)

|

$

|

6,702,937

|

$

|

477.92

|

||||||||

|

Common stock, $0.001 par value per share, issuable upon exercise of co-placement agent warrants

|

351,934

|

(4)

|

$

|

3.05

|

(5)

|

$

|

1,073,399

|

$

|

76.53

|

|||||||

|

Total

|

5,630,575

|

(6)

|

$

|

14,815,016

|

$

|

1,056.31

|

(7)

|

|||||||||

(1) Represents the total number of shares of common stock issued to 135 investors in the registrant’s private placement of 893.91 units. Each unit consists of (i) 3,937 shares of common stock, and (ii) a warrant to purchase 1,968 shares of common stock at an exercise price of $3.81 per share.

(2) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457. Although there is an established public trading market for our common stock on the Over-the-Counter Bulletin Board (the “OTCBB”), the trading has been limited. Accordingly, the proposed maximum offering price is based on the market price of our shares of common stock on March 2, 2010.

(3) Represents the number of shares of common stock issuable upon exercise of the investor warrants at an exercise price of $3.81 per share.

(4) Calculated pursuant to Rule 457(g).

(5) Represents the number of shares of common stock issuable upon exercise of the co-placement agent warrants at an exercise price of $3.05 per share.

(6) In the event that the total number of shares of common stock registered herein (the “Registrable Securities”) exceeds the limitation set forth pursuant to Rule 415, the number of Registrable Securities to be registered herein will be reduced first by the Registrable Securities owned by the co-placement agents and second, on a pro rata basis, among the investors based on the total number of unregistered shares of common stock underlying the investor warrants on a fully-diluted basis.

(7) A fee of $1,191.81 was previously paid with the initial filing.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SUCH SECTION 8(a), MAY DETERMINE.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission (“SEC”) is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Subject to completion, dated January 25, 2011

CHINA BCT PHARMACY GROUP, INC.

5,630,575 Shares of Common Stock

This prospectus relates to the resale by the selling stockholders identified in this prospectus of up to 5,630,575 shares (the “Shares”) of our common stock, par value $0.001 per share, including (i) 3,519,340 shares of our common stock currently issued and outstanding, (ii) 1,759,301 shares of common stock issuable upon exercise of warrants issued to our investors (the “Investor Warrants”), and (iii) 351,934 shares of our common stock issuable upon exercise of the warrants issued to our co-placement agents in the private placement (the “Agent Warrants” and, together with the Investors Warrants, the “Warrants”). The Shares were issued to the selling stockholders in private placement transactions which were exempt from the registration and prospectus delivery requirements of the Securities Act of 1933, as amended.

The selling stockholders may offer all or part of their Shares for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. We will not receive any of the proceeds from the Shares by the selling stockholders, but we will receive funds from the exercise of the Warrants if and when those Warrants are exercised on a cash exercise basis. However, there is no assurance that such Warrants will be exercised. In addition, we will not receive any additional proceeds to the extent the Warrants are exercised on a cashless exercise basis. We are paying all of the registration expenses incurred in connection with the registration of the Shares, but we will not pay any of the selling commissions, brokerage fees and related expenses.

Our common stock is quoted on the OTCBB under the symbol “CNBI”. On January 21, 2011 , the last reported sale of our common stock quoted on the OTCBB was $ 2.75 per share.

The selling stockholders, and any broker-dealer executing sell orders on behalf of the selling stockholders, may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended. Commissions received by any broker-dealer may be deemed underwriting commissions under the Securities Act of 1933, as amended.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 6 to read about factors you should consider before investing in shares of our common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMITTEE NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Date of This Prospectus is __________, 201 1

TABLE OF CONTENTS

Page No.

|

1

|

|

|

7

|

|

|

21

|

|

|

21

|

|

|

39

|

|

|

56

|

|

|

58

|

|

|

58

|

|

|

64

|

|

|

64

|

|

|

85

|

|

|

87

|

|

|

90

|

|

|

97

|

|

|

98

|

|

|

104

|

|

|

108

|

|

|

112

|

|

|

112

|

|

|

112

|

|

|

113

|

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the common stock. You should carefully read the entire prospectus, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements before making an investment decision.

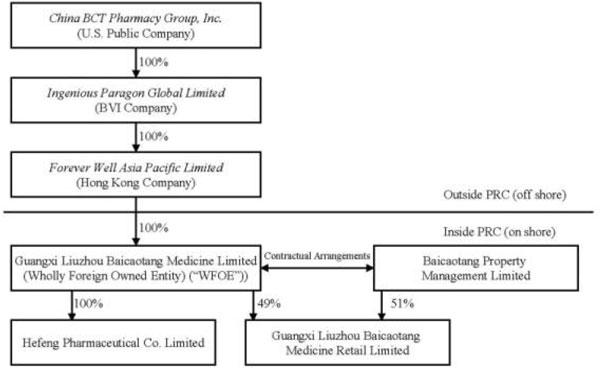

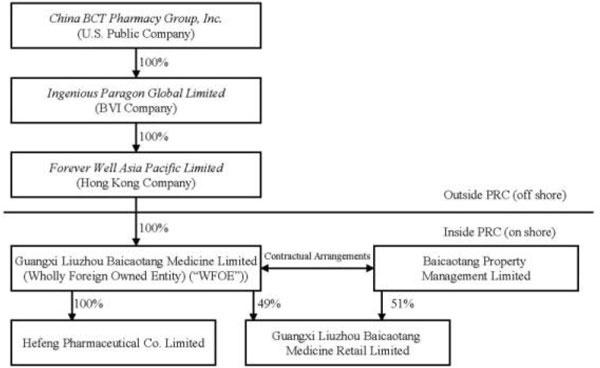

References in this prospectus to the “PRC” or “China” are to the People’s Republic of China. Except as otherwise specifically stated or unless the context otherwise requires, the terms “Company,” “we,” “us” and “our” refer to collectively (i) China BCT Pharmacy Group, Inc. (f/k/a China Baicaotang Medicine Limited), a corporation incorporated in the State of Delaware; (ii) Ingenious Paragon Global Limited (“Ingenious”), a British Virgin Islands company which is a wholly-owned subsidiary; (iii) Forever Well Asia Pacific Limited (“Forever Well”), a Hong Kong company which is a wholly-owned subsidiary of Ingenious; (iv) Guangxi Liuzhou Baicaotang Medicine Limited (“Liuzhou BCT”), a PRC wholly foreign-owned enterprise (“WFOE”) which is a wholly-owned subsidiary of Forever Well; (v) Hefeng Pharmaceutical Co. Limited (“Hefeng Pharmaceutical”), a PRC company which is a wholly-owned subsidiary of Liuzhou BCT; and (vi) Guangxi Liuzhou Baicaotang Medicine Retail Limited (“BCT Retail”), a PRC company of which 49% of its registered capital was contributed by Liuzhou BCT and 51% of its registered capital was contributed by Baicaotang Property Management Limited (“Property Management”), an affiliated company.

References to BCT Retail’s “registered capital” are to the equity of BCT Retail, which under PRC law is measured not in terms of shares owned but in terms of the amount of capital that has been or will be contributed to a company by a particular shareholder or all shareholders. The portion of a limited liability company’s total capital contributed by a particular shareholder represents that shareholder’s ownership of the company and the total amount of capital contributed by all shareholders is the company’s total equity. Capital contributions are made to a company by deposits into a dedicated account in the company’s name, which the company may access in order to meet its financial needs. When a company’s accountant certifies to PRC authorities that a capital contribution has been made and the company has received the necessary government permission to increase its contributed capital, the capital contribution is registered with regulatory authorities and becomes a part of the company’s “registered capital.”

Business Overview

We are engaged in pharmaceutical distribution, retail pharmacy and manufacturing of pharmaceuticals through our three subsidiaries Liuzhou BCT, Hefeng Pharmaceutical, and BCT Retail, each of which is located in Guangxi Province, China.

We have integrated operations in the following business segments:

|

●

|

Pharmaceutical distribution.

|

Pharmaceutical distribution is our principal business. We conduct our wholesale business through Liuzhou BCT by purchasing from pharmaceutical product suppliers and then distributing the products to our wholesale customers, including hospitals, retail drug stores, other pharmaceutical wholesalers, clinics, medical centers, and individuals. Our pharmaceutical distribution business is focused on the market of Guangxi province, which includes major cities such as Nanning, Liuzhou and Guilin, and which has approximately 50 million people. We operate a large regional wholesale pharmaceutical networks in Guangxi province supported by strategically placed warehouse facilities. For the year ended December 31, 2009, revenue generated from our pharmaceutical distribution segment was $97.1 million, or 71.4% of our total revenues for the year. For the nine months ended September 30, 2010 our pharmaceutical distribution segment accounted for approximately 70.6% of our total revenue after elimination of inter-segment sales.

1

We distribute over 8,000 products from nearly 4,000 suppliers through our wholesale distribution in compliance with applicable PRC regulations. Hefeng Pharmaceutical, which is one of our wholly owned subsidiaries, is also one of our suppliers. In 2009 revenue derived from the distribution of third-party products constituted 99% of our pharmaceutical distribution segment revenue.

PRC rules and regulations require most public hospitals and healthcare institutions to purchase medicines from pharmaceutical distributors through a centralized tendering process, which includes the implementation of government-mandated price controls. The manufacturers of provincial catalog medicines that are on the hospitals’ formularies are invited to bid and participate in the centralized tendering process, which they must do directly. The bidding process covers multiple categories of medicines used by the hospitals. A duly organized committee of pharmaceutical and clinical medical experts is responsible for bid evaluations. Selection is based on a number of factors, including bid price, quality, clinical effectiveness, and manufacturer’s reputation and service. The supply of a particular type of medicine is generally made on a non-exclusive basis by multiple manufacturers and distributors. We typically advise and assist pharmaceutical manufacturers in the hospital tendering process and distribute products of pharmaceutical manufacturers upon purchase orders being made by the hospitals after the bidding process.

The Guangxi centralized-online tendering system was started in 2006, and in 2009 the tendering started to be applied also under the New Rural Co-operative Health Insurance Plan. At the first tendering in 2009 we were awarded distribution rights for six counties and townships under the New Rural Co-operative Health Insurance Plan, including Liuzhou, Yizhou, Lipu, Gongchen, Luzhai Laibin and Heshan, and were selected as one of two exclusive distributors for these territories.

|

●

|

Retail pharmacy.

|

Established in 2001, BCT Retail operates a large regional pharmaceutical retail network in Guangxi province, consisting of 137 directly owned retail stores in Guangxi province under the registered name “Baicaotang 百草堂.” Our retail stores provide convenient, high quality and professional pharmaceutical services and supply a wide variety of medicines, including western medicine, traditional Chinese medicine (“TCM”), dried Chinese herbal medicine, roughly processed Chinese herbal medicine, family planning products, and seasonal medicine. Among the 137 stores, there are 26 stores that are medi-care qualified stores, where customers are able to make their purchases either by cash or by using their medi-care insurance card for payment. For the year ended December 31, 2009, revenue generated from our retail pharmacy segment was $31.2 million, or 22.9% of our total revenues for the year. For the nine months ended September 30, 2010 our retail pharmacy segment accounted for approximately 23.9% of our total revenue after elimination of inter-segment sales.

|

●

|

Manufacturing of pharmaceuticals.

|

Hefeng Pharmaceutical has a manufacturing facility on approximately 40,000 square meters of land and manufactures four types of products:

|

●

|

A Chinese herbal medicine abstraction unit for raw material and medicine paste with 670 tons of annual abstraction capacity (Maximum daily unit production: 2.5 tons per day; maximum days of operation per year: 270 days);

|

|

●

|

A granular formulation unit with an annual production capacity of 0.25 billion packages (Maximum daily unit production: 768,960 packages per day; maximum days of operation per year: 324 days);

|

|

●

|

A pill formulation unit with an annual production capacity of 0.36 billion pills (Maximum daily unit production: 1,252,800 pieces per day; maximum days of operation per annum: 288 days), and

|

|

●

|

A liquid formulation unit with an annual production capacity of 0.1 billion injections (Maximum daily unit production : 347,500 pieces per day; maximum days of operation per annum : 288 days).

|

Hefeng Pharmaceutical produces and sells pharmaceutical products under the registered name “Asio (亚太)” including: traditional anti-inflammatory and antibacterial drugs, cancer treatment drugs, cardio-vascular disease drugs and hepatitis drugs. Hefeng Pharmaceutical’s best-selling products include:

2

|

●

|

Tabellae Sarcandrae, a TCM drug that has similar anti-inflammatory and antibacterial effects as anti-biotics in Western medicine;

|

|

●

|

Corydalis Saxicola Bunting (Yanhuanglian), an important component in various hepatitis prescriptions in TCM;

|

|

●

|

Hydroxycamptotbecine Injection, which is used to treat cancers such as carcinoma ventricui, carcinoma hepatitis and colon cancer;

|

|

●

|

Ethacridine Lactate Injection which is used for second trimester pregnancy termination from week 12-26; and

|

|

●

|

Levodopa, a TCM drug that is used to treat stiffness, tremors, spasms and poor muscle control related to Parkinson’s disease.

|

In addition, Hefeng Pharmaceutical collaborates with several renowned medical research universities in China to continuously improve its raw material abstraction efficiency and production process, and to develop alternative formulas for existing drugs. For the year ended December 31, 2009, revenue generated from our manufacturing segment was $7.7 million, or 5.7% of our total revenues for the year. For the nine months ended September 30, 2010, our manufacturing segment accounted for approximately 5.5% of our total revenue after elimination of inter-segment sales.

The growth profile of Guangxi province is based on the following three factors:

|

●

|

According to data published by the National Bureau of Statistics, Guangxi Province’s GDP was RMB770 billion ($112 billion) in 2009. GDP per capita in Guangxi Province was RMB15,821 ($2,316) in 2009 as compared with GDP per capita of RMB42,141 ($6,169) in the coastal regions (including Fujian Province, Guangdong Province, Hainan Province, Jiangsu Province, Shandong Province, Shanghai, and Zhejiang Province). In 2009 Guangxi Province’s GDP growth rate was 13.9% as compared to an average GDP growth rate of 10.7% in the coastal regions in 2009. In 2009 Guangxi Province had a population of 48.16 million. In 2009 the population growth rate of Guangxi Province was 7.2% as compared with a population growth rate of 5.17% in the coastal regions. (See http://www.stats.gov.cn/tjsj/ndsj/2009/indexch.htm).

|

|

●

|

the inflation rate in China in 2010 is projected to be 3.5% to 4% based upon the World Bank “China Quarterly Update” from March 17, 2010.

(See http://siteresources.worldbank.org/CHINAEXTN/ Resources/318949-1268688634523/CQU_march2010.pdf). , and

|

|

●

|

the general pharmaceutical industry growth rate resulting from the RMB850 billion healthcare reform bill passed by the Chinese government.

|

Corporate Structure and History

We were originally incorporated in the State of Delaware on November 30, 2006 under the name Purden Lake Resource Corp. to engage in the acquisition, exploration and development of natural resource properties. Prior to December 23, 2009 we were a blank check company with nominal assets. We changed our name to China Baicaotang Medicine Limited on December 24, 2009 and to China BCT Pharmacy Group, Inc. on March 25, 2010.

3

Corporate Structure

Our wholly-owned subsidiary, Ingenious is a British Virgin Islands corporation that owns 100% of the issued and outstanding capital stock of Forever Well, a Hong Kong company. Forever Well is the sole shareholder of Liuzhou BCT, a PRC wholly foreign-owned enterprise. Liuzhou BCT contributed 100% of the registered capital of Hefeng Pharmaceutical and 49% of the registered capital of BCT Retail. The remaining 51% of the registered capital of BCT Retail was contributed by Property Management, an affiliate of Liuzhou BCT.

We do not have direct 100% ownership interest in BCT Retail due to the restriction of foreign investment in pharmacy chains with 30 or more drugstores. We have entered into contractual arrangements with Property Management pursuant to which we loaned money equal to 51% of the registered capital of BCT Retail to the shareholders of Property Management and such Property Management shareholders pledged their 51% equity interests in BCT Retail. In addition, pursuant to a Proxy Agreement we entered into with Property Management, we effectively control BCT Retail and therefore, have consolidated BCT Retail with China BCT Pharmacy, Group and its subsidiaries.

The chart below illustrates the current structure of the Company:

Reorganization

In 2008, the shareholders of Liuzhou BCT (the “Liuzhou BCT Shareholders”) and Xiaoyan Zhang, our CFO, developed a restructuring plan for Liuzhou BCT to obtain the benefits available to a U.S. public company (the “Restructuring”). The first step was for Forever Well to acquire 100% of the equity interests of Liuzhou BCT and its subsidiaries (the “PRC Operating Companies”).

In this step, Forever Well, a Hong Kong company formed by Mr. Ping-Ki Yue, was to acquire the PRC Operating Companies. The second step in the Restructuring was for Ingenious, which was 100% owned by Ms Zhang, to acquire Forever Well and the third step was for Ingenious to enter into and complete a transaction with a U.S. public reporting company whereby that company would acquire Ingenious.

The first step was completed in conjunction with the second step so that as the PRC Companies became subsidiaries of Forever Well, Forever Well was acquired by Ingenious. As part of the second step of the Restructuring, the Liuzhou BCT Shareholders entered into an earn-in agreement (the “Earn-In Agreement”) which provided the Liuzhou BCT Shareholders with a process under which they could purchase for a nominal amount the shares of common stock held by Ms. Zhang.

Under the Earn-In Agreement, Ms. Zhang holds legal title to the shares for the five-year term of the agreement or until the shares have been purchased by the Liuzhou BCT Shareholders. Thereafter, the shares can only be transferred upon the agreement of both Ms. Zhang and the Liuzhou BCT Shareholders. For the term of the Earn-In Agreement or until the shares are purchased by the Liuzhou BCT Shareholders, Ms. Zhang holds all of the governance rights with respect to the shares.

4

After completion of the first and second steps in the Restructuring, the parties concluded that they needed another agreement to complete the Earn-In Agreement and the restructuring process. They therefore entered into the so-called "entrust shareholding" agreements with respect to each of the first and second steps; they made these agreements effective as of the effective date of the first and second steps. These agreements recited that a third-party would maintain the governance rights and economic benefits of the Liuzhou BCT Shareholders during the period of the Earn-In Agreement. The two entrust shareholding agreements were identical except that the third party in the first was Mr. Ping Ki Yue and in the second was Ms. Zhang. The first agreement had been supplanted by the second even at the time it was signed. Under the second agreement, Ms. Zhang, as owner of the shares, had all voting power and, upon notice from her with respect to a matter, the former shareholders might choose to express a preference as to how she would vote the shares; the agreement also confirmed that the former shareholders’ economic interest in the shares was preserved as in the Earn-In Agreement.

These agreements were in fact never utilized and the parties determined that they had been mistaken in their decision to create them and that the Earn-In Agreement expresses entirely the parties’ relationship with respect to the shares and with each other. Representatives of the Liuzhou BCT Shareholders hold the majority of seats on the board of the Company. The Earn-In Agreement reflects the intent and purpose of the parties in undertaking and accomplishing the Restructuring. And following the accomplishment of the third step in the Restructuring, the Earn-In Agreement is the operative agreement for all purposes with respect to the relationship of the Liuzhou BCT Shareholders to the Company. The parties having recognized the mistake, for all of these reasons, the entrust shareholding agreements were rescinded as of their effective dates and the Earn-In Agreement governs the rights of the Liuzhou BCT Shareholders with respect to the shares held by Ms. Zhang.

Under the Earn-in Agreement, Ms. Zhang has legal title to the shares and there are no limits on her voting rights with respect to the shares. Under the Earn-In Agreement, the Liuzhou BCT Shareholders have the right to obtain the economic benefits of the shares by purchasing the shares upon the Company's attaining the low financial thresholds in the agreement which trigger their purchase rights. Ms. Zhang also has no authority to transfer the shares. This can only be done with the agreement of the Liuzhou BCT Shareholders. Therefore, were the Company not to attain the thresholds that have been placed in the Earn-In Agreement, we anticipate that the agreement would be further modified to establish thresholds that were or are attainable.

On December 30, 2009, the goal of the Restructuring was realized when we took the third step and entered into a share exchange agreement with Ingenious, pursuant to which we acquired 100% of the equity of Ingenious in exchange for the issuance of an aggregate of 32,000,000 shares of our common stock to Ms. Zhang and to certain former Liuzhou BCT Shareholders (the “Share Exchange”). As of the date of this prospectus, Ms. Zhang owns 58.9% of our common stock although, as a consequence of the Earn-In Agreement ownership of these shares also resides in the Liuzhou BCT Shareholders. As a result of this transaction, we are a holding company which, through our direct and indirect ownership of Ingenious, Forever Well, Liuzhou BCT, Hefeng Pharmaceutical, and BCT Retail, now has operations based in the PRC.

Private Placement

On October 23, 2009, we entered into a subscription agreement (the “Subscription Agreement”) with certain investors (the “Investors”) for the sale of up to an aggregate of 1,147 units (the “Units”) in a private placement (the “Private Placement”). Simultaneously with the closing of the Share Exchange, we completed the initial closing of the Private Placement of approximately $6.3 million or 632.3 Units (the “Initial Closing”). Upon the Initial Closing, we issued an aggregate of 2,489,370 shares of our common stock and Investor Warrants exercisable for up to 1,244,368 shares of our common stock at an exercise price of $3.81 per share. In addition, in connection with the Initial Closing of the Private Placement, we issued Agent Warrants to the placement agents (the “Co-Placement Agents”) that are exercisable for 248,937 shares of our common stock at an exercise price of $3.05 per share. The funds were held with Signature Bank, acting as escrow agent, and were released to us upon the consummation of the Initial Closing. The closing of the Share Exchange was a condition precedent to the closing of the Private Placement.

On February 1, 2010, we completed the second closing of the Private Placement of approximately $2.6 million (the “Second Closing”) of 261.61 Units, consisting of an aggregate of 1,029,970 shares of our common stock and Investor Warrants exercisable for 514,933 shares of our common stock at an exercise price of $3.81. In connection with the Second Closing, we issued Agent Warrants to the Co-Placement Agents that are exercisable for 102,997 shares of our common stock at an exercise price of $3.05 per share on a cash or cashless basis. The funds were held with Signature Bank, acting as escrow agent, and were released to us upon the consummation of the Second Closing.

We entered into a placement agency agreement (the “Placement Agent Agreement”) with the Co-Placement Agents on October 21, 2009 whereby the Co-Placement Agents received as compensation for acting as placement agent in the Private Placement (i) a total cash fee and a non-accountable marketing allowance in the amount of approximately $0.86 million; and (ii) Agent Warrants to purchase up to 302,521 shares of common stock. Pursuant to participating agent agreements by and among Charles Vista, LLC, May Davis and American Capital, Charles Vista, LLC received as compensation for acting as a sub-agent in the Private Placement (i) a cash fee in the amount of approximately $0.22 million; and (ii) Agent Warrants to purchase up to 49,413 shares of common stock at an exercise price of $3.65 per share. The Co-Placement Agents were responsible for raising the minimum offering amount of $5,820,000 of Units and were compensated as set forth above.

Agreement to Sell Preferred Shares

On January 18, 2011, the Company entered into an agreement (the “Preferred Purchase Agreement”) with Milestone Longcheng Limited (“Milestone”) pursuant to which Milestone will purchase 9,375,000 shares of the Company’s Series A Convertible Preferred Shares, par value $.001 per share (the “Preferred Shares”), for an aggregate purchase price of $30 million. The Preferred Shares carry a dividend of 5% and are convertible initially into an equal number of shares of our Common Stock at an initial conversion price of $3.20 per share. The transaction is subject to a number of closing conditions, including the completion of the amendment of our Certificate of Incorporation to increase our authorized capital to 170 million shares of capital stock consisting of 150 million shares of Common Stock (an increase of 50 million shares) and 20 million shares of blank-check preferred stock which our board of directors will have the authority to issue (the “Amendment”) and the filing of the Amendment and of the Certificate of Designation adopting the terms of the Preferred Shares. All necessary board and stockholder action to approve adoption of the Amendment have been taken and the Amendment will be complete upon filing with the Delaware Secretary of State which will occur 20 days after the mailing to our stockholders of an information statement pursuant to Section 14(c) of the Exchange Act. We filed this information statement with the SEC on January 18, 2011 and will mail it at the earliest date available in accordance with provisions of Section 14(c) and the regulations thereunder. The board has also approved the Certificate of Designation, subject to the filing of the Amendment. The Certificate of Designation will be filed after the filing of the Amendment in connection with the closing of the sale of the Preferred Shares.

5

In connection with this transaction, the Company and Milestone also entered into a registration rights agreement and, with certain of the Company’s principal stockholders, a shareholders agreement. The registration rights agreement provides for registration under the Securities Act of 1933, under various circumstances, of the shares of Common Stock into which the Preferred Shares can be converted. Under the Preferred Purchase Agreement, Milestone (or successor holders of the Preferred Shares) will have the right to name one director and to recommend an additional independent director to the Company’s board of directors, which we expect will be increased to seven directors after closing of the transaction. The Purchase Agreement also provides that Milestone (or successor holders) will have consent rights with respect to certain operating matters. The shareholders agreement provides limitations on the rights of the principal shareholders to engage in competing businesses in the event that they are no longer employed with the Company and also provides a process for their sale of their shares, including first offering them to the holders of the Preferred Shares and co-sale rights of the holders. Under the Certificate of Designation, the holders of Preferred Shares have pre-emptive rights with respect to future offerings and have voting rights with the Common Stock as well as separate voting rights with respect to certain extraordinary transactions. After issuance, the Preferred Shares will represent 18.5% of the outstanding share capital of the Company. These shares, together with the shares of Common Stock owned by Ms. Zhang (representing approximately 44.3% of the outstanding share capital after this transaction) will hold the majority voting interest in the Company. The principal agreements with respect to this transaction have been filed as exhibits to our report on Form 8-K describing the transaction and filed with the SEC on January 18, 2011. We anticipate that the transaction will be closed approximately 30 days after signing or as soon there after as we and Milestone determine.

Where You Can Find Us

Our principal executive office is located at No. 102 Chengzhan Road, Liuzhou City, Guangxi province, China and our telephone number is (86) 772-363-8318. Our corporate website is www.china-bct.com. Information contained on, or accessed through our website is not intended to constitute and shall not be deemed to constitute part of this prospectus.

The Offering

|

Common stock offered by selling stockholders

|

5,630,575 shares of common stock. This includes (i) 3,519,340 shares of our issued and outstanding common stock; (ii) 1,759,301 shares of common stock issuable upon exercise of outstanding Investor Warrants; and (iii) 351,934 shares of common stock issuable upon exercise of outstanding Agent Warrants.

|

|

Common stock outstanding before the offering

|

38,154,340 shares of common stock as of December 29 , 2010.

|

|

Common stock outstanding after the offering

|

40,230,575 shares.

|

|

(assuming full exercise of all of the Warrants)

|

|

|

Terms of the Offering

|

The selling stockholders will determine when and how they will sell the common stock offered in this prospectus.

|

|

Termination of the Offering

|

The offering will conclude upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) such time as all of the common stock becomes eligible for resale without volume limitations pursuant to Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”), or any other rule of similar effect.

|

|

Use of proceeds

|

We are not selling any shares of the common stock covered by this prospectus, and, as a result, will not receive any proceeds from this offering. We may, however, receive proceeds in the event that some or all of the Warrants held by the selling stockholders are exercised for cash. However, there is no assurance that such Warrants will be exercised. In addition, we will not receive any additional proceeds to the extent the Warrants are exercised on a cashless exercise basis. To the extent that the selling stockholders exercise in cash all of the Warrants, we would receive approximately $7,776,336 in the aggregate from such exercise. The proceeds from the cash exercise of such Warrants, if any, will be used by us for working capital and other general corporate purposes.

|

|

OTCBB Trading Symbol

|

CNBI.OB

|

|

Risk Factors

|

The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 6.

|

6

Risks Relating to Our Business

OUR OPERATING HISTORY MAY NOT SERVE AS AN ADEQUATE BASIS TO JUDGE OUR FUTURE PROSPECTS AND RESULTS OF OPERATIONS.

Our operating history may not provide a meaningful basis on which to evaluate our business. We cannot assure you that we will maintain our profitability or that we will not incur net losses in the future. We expect that our operating expenses will increase as we expand. Any significant failure to realize anticipated revenue growth could result in significant operating losses.

WE MAY BE UNABLE TO COMPETE SUCCESSFULLY AGAINST NEW AND EXISTING COMPETITORS.

The major market for our products and business operations is the cities, villages and towns of Guangxi province. We may face increasing competition in the future as we expand our business in Guangxi province and our adjacent provinces. As we expand our operations in wholesale and retail distribution and manufacture of pharmaceutical products, we will encounter competition from other companies existing in our target markets, such as Sinopharma and Liuzhou Medical and Pharmaceutical Limited in the pharmaceutical distribution area, Shenzhen Accordance Pharmacy Chain Store and Hunan Laobaixing Pharmacy Chain in the retail area and Harbin Pharmaceutical Group, Guangdong Boluo Xianfeng Pharmaceutical Group and Jiangsu Chia Tai Tianqing Pharmaceutical and Sixth Pharma Factory in the manufacturing area, and may face future competition from new foreign and domestic competitors entering the pharmaceutical promotion and distribution market in China. Our current and future competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional and distribution activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. Competition could reduce our market share or force us to lower our prices to unprofitable levels.

OUR CURRENT BUSINESS OPERATIONS RELY HEAVILY UPON MR. HUI TIAN TANG, OUR CHIEF EXECUTIVE OFFICER AND CHAIRMAN, AND ADDING OTHER KEY EMPLOYEES ARE ESSENTIAL TO GROWING OUR BUSINESS.

We have been heavily dependent upon the expertise and management of Mr. Hui Tian Tang, our Chairman and Chief Executive Officer, and his continued services. The loss of Mr. Tang’s services could seriously interrupt our business operations. Although we have entered into an employment contract with Mr. Tang, pursuant to which Mr. Tang agrees to serve as our full time Chief Executive Officer, and Mr. Tang has not indicated any intention of leaving us, the loss of his service for any reason could have a very negative impact on our ability to fulfill our business plan. In addition, we face competition for attracting skilled personnel. If we fail to attract and retain qualified personnel to meet current and future needs, this could slow our ability to grow our business, which could result in a decrease in market share.

THE LIMITED PUBLIC COMPANY EXPERIENCE OF OUR MANAGEMENT TEAM COULD ADVERSELY IMPACT OUR ABILITY TO COMPLY WITH THE REPORTING REQUIREMENTS OF U.S. SECURITIES LAWS.

Our management team has limited public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. Our senior management has never had sole responsibility for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement programs and policies in an effective and timely manner that adequately respond to such increased legal, regulatory compliance and reporting requirements, including the establishing and maintaining internal controls over financial reporting. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting requirements of the Securities Exchange Act of 1934 (the “Exchange Act”), which is necessary to maintain our public company status. If we were to fail to fulfill those obligations, our ability to continue as a U.S. public company would be in jeopardy in which event you could lose your entire investment in our company.

7

IF WE NEED ADDITIONAL CAPITAL TO FUND OUR GROWING OPERATIONS, WE MAY NOT BE ABLE TO OBTAIN SUFFICIENT CAPITAL AND MAY BE FORCED TO LIMIT THE SCOPE OF OUR OPERATIONS.

In connection with our growth strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the release of competitive products by our competition; (iii) the level of our investment in research and development; and (iv) the amount of our capital expenditures, including acquisitions. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

If we cannot obtain additional funding, we may be required to: (i) limit our investments in research and development; (ii) limit our marketing efforts; and (iii) decrease or eliminate capital expenditures. Such reductions could materially adversely affect our business and our ability to compete.

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are acceptable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to our common stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

IF WE FAIL TO INCREASE OUR BRAND RECOGNITION, WE MAY FACE DIFFICULTY IN OBTAINING NEW CUSTOMERS AND BUSINESS PARTNERS.

We believe that establishing, maintaining and enhancing our brand in a cost-effective manner is critical to achieving widespread acceptance of our current and future services and is an important element in our effort to increase our customer base and obtain new business partners. We believe that the importance of brand recognition will increase as competition in our market develops. Some of our potential competitors already have well-established brands in the pharmaceutical promotion and distribution industry. Successful promotion of our brand will depend largely on our ability to maintain a sizeable and active customer base, our marketing efforts and our ability to provide reliable and useful services at competitive prices. Brand promotion activities may not yield increased revenue, and even if they do, any increased revenue may not offset the expenses we incur in building our brand. If we fail to successfully promote and maintain our brand, or if we incur substantial expenses in an unsuccessful attempt to promote and maintain our brand, we may fail to attract enough new customers or retain our existing customers to the extent necessary to realize a sufficient return on our brand-building efforts, in which case our business, operating results and financial condition would be materially adversely affected.

AS A DISTRIBUTOR AND MANUFACTURER OF PHARMACEUTICAL PRODUCTS, WE ARE EXPOSED TO INHERENT RISKS RELATING TO PRODUCT LIABILITY AND PERSONAL INJURY CLAIMS.

Pharmacies are exposed to risks inherent in the manufacturing and distribution of pharmaceutical and other healthcare products, such as with respect to improper filling of prescriptions, labeling of prescriptions, adequacy of warnings, unintentional distribution of counterfeit drugs. In addition, product liability claims may be asserted against us with respect to any of the products we sell and as a retailer, we are required to pay for damages for any successful product liability claim against us, although we may have the right under applicable PRC laws, rules and regulations to recover from the relevant manufacturer for compensation we paid to our customers in connection with a product liability claim. We may also be obligated to recall affected products. If we are found liable for product liability claims, we could be required to pay substantial monetary damages. Furthermore, even if we successfully defend ourselves against this type of claim, we could be required to spend significant management, financial and other resources, which could disrupt our business, and our reputation as well as our brand name may also suffer. We, like many other similar companies in China, do not carry product liability insurance. As a result, any imposition of product liability could materially harm our business, financial condition and results of operations. In addition, we do not have any business interruption insurance due to the limited coverage of any business interruption insurance in China, and as a result, any business disruption or natural disaster could severely disrupt our business and operations and significantly decrease our revenue and profitability.

8

THE RETAIL PRICES OF SOME OF OUR PRODUCTS ARE SUBJECT TO CONTROL, INCLUDING PERIODIC DOWNWARD ADJUSTMENT, BY PRC GOVERNMENTAL AUTHORITIES.

A number of our pharmaceutical products, primarily those included in the national and provincial medical insurance catalogs, are subject to price controls in the form of fixed retail prices or retail price ceilings. Approximately 60% to 70% of our total retail sales are subject to these price controls. In addition, the retail prices of these products are also subject to periodic downward adjustments as the PRC governmental authorities seek to make pharmaceutical products more affordable to the general public. Since May 1998, the relevant PRC governmental authorities have ordered price reductions of thousands of pharmaceutical products. The latest price reduction occurred in October 2008 and affected 1,357 different pharmaceutical products. Any future price controls or government mandated price reductions may have a material adverse affect on our financial condition and results of operations, including significantly reducing our revenue and profitability.

THE AVERAGE NUMBER OF DAYS DURING WHICH OUR ACCOUNTS RECEIVABLE ARE OUTSTANDING HAS INCREASED WHICH MAY NEGATIVELY AFFECT OUR BALANCE SHEET AND OUR ABILITY TO COLLECT OUR RECEIVABLES AND FUND OUR OPERATIONS AND.

Across all of our pharmaceutical, distributing and manufacturing segments the numbers of days during which our receivables are outstanding has increased significantly in 2009 and in 2010. In the pharmaceutical distribution segment we are obtaining a greater percentage of revenue from hospitals and community health centers who traditionally have a slower payment cycle. In our manufacturing segment, we have also experienced an increase in the days during which our receivables are outstanding, because we have extended more generous credit terms to certain of our customers based upon their history with us and in view of the overall financial crisis. If this slower time to collection should result in an inability to collect a greater percentage of our receivables than previously, the result would be a decrease in the cash available to fund our operations as well as an increase in reserves for receivables which would reduce their value on our balance sheet.

WE MAY BE SUBJECT TO FINES AND PENALTIES IF WE FAIL TO COMPLY WITH THE APPLICABLE PRC LAWS AND REGULATIONS GOVERNING SALES OF MEDICINES UNDER THE PRC NATIONAL MEDICAL INSURANCE PROGRAM.

Eligible participants in the PRC national medical insurance program, mainly consisting of urban residents in China, are entitled to buy medicines using their medical insurance cards in an authorized pharmacy, provided that the medicines they purchase have been included in the national or provincial medical insurance catalogs. The pharmacy, in turn, obtains reimbursement from the relevant government social security bureaus. Moreover, the applicable PRC laws, rules and regulations prohibit pharmacies from selling goods other than pre-approved medicines when purchases are made with medical insurance cards, as well as providing cash to the customer for the medical insurance card. We have established procedures to prohibit our drugstores from selling unauthorized goods to customers who make purchases with medical insurance cards. However, we cannot assure you that those procedures will be strictly followed by all of our employees in all of our stores. If we fail to observe the above laws, rules and regulations with respect to purchases made with medical insurance cards, we may be fined and our qualification for selling medicines included in the national or provincial medical insurance catalogs may be withdrawn by competent authorities.

OUR RETAIL OPERATIONS REQUIRE A NUMBER OF PERMITS AND LICENSES IN ORDER TO CARRY ON THEIR BUSINESS.

Drugstores in China are required to obtain certain permits and licenses from various PRC governmental authorities, including GSP certification. We are also required to obtain food hygiene certificates for the distribution of nutritional supplements and food products other than medicine. We cannot assure you that we can maintain all required licenses, permits and certifications to carry on our business at all times, and from time to time we may have not been in compliance with all such required licenses, permits and certifications. Moreover, these licenses, permits and certifications are subject to periodic renewal and/or reassessment by the relevant PRC governmental authorities and the standards of such renewal or reassessment may change from time to time. We intend to apply for the renewal of these licenses, permits and certifications when required by then applicable laws and regulations. Any failure by us to obtain and maintain all licenses, permits and certifications necessary to carry on our business at any time could have a material adverse effect on our business, financial condition and results of operations. In addition, any inability to renew these licenses, permits and certifications could severely disrupt our business, and prevent us from continuing to carry on our business. Any changes in the standards used by governmental authorities in considering whether to renew or reassess our business licenses, permits and certifications, as well as any enactment of new regulations that may restrict the conduct of our business, may also decrease our revenue and/or increase our costs and materially reduce our profitability and prospects. Furthermore, if the interpretation or implementation of existing laws and regulations changes or if new regulations come into effect requiring us to obtain any additional licenses, permits or certifications that were previously not required to operate our existing businesses, we cannot assure you that we may successfully obtain such licenses, permits or certifications.

9

WE MAY HAVE DIFFICULTY DEFENDING OUR INTELLECTUAL PROPERTY RIGHTS FROM INFRINGEMENT RESULTING IN LAWSUITS REQUIRING US TO DEVOTE FINANCIAL AND MANAGEMENT RESOURCES THAT WOULD HAVE A NEGATIVE IMPACT ON OUR OPERATING RESULTS.

We regard our trademarks and other similar intellectual properties as critical to our success. We rely on trademark and other similar intellectual properties, as well as confidentiality and license agreements with certain of our employees, customers and others to protect our proprietary rights. We have received trademark registration for certain of our products in the PRC. No assurance can be given that our licenses will not be challenged, invalidated, infringed or circumvented, or that our intellectual property rights will provide competitive advantages to us. There can be no assurance that we will be able to obtain a license from a third-party technology that we may need to conduct our business or that such technology can be licensed at a reasonable cost.

Presently, we sell our products mainly in PRC. To date, no trademark or patent filings have been made other than in PRC. To the extent that we market our products in other countries, we may have to take additional action to protect our intellectual property. The measures we take to protect our proprietary rights may be inadequate and we cannot give you any assurance that our competitors will not independently develop formulations and processes that are substantially equivalent or superior to our own or copy our products.

WE MAY BE ADVERSELY AFFECTED BY COMPLEXITY, UNCERTAINTIES AND CHANGES IN CHINESE REGULATION OF DRUGSTORES AND THE PRACTICE OF MEDICINE.

The Chinese government regulates drugstores, including foreign ownership, and the licensing and permit requirements. These laws and regulations are relatively new and evolving, and their interpretation and enforcement involve significant uncertainty. As a result, in certain circumstances it may be difficult to determine what actions or omissions may be deemed to be a violation of applicable laws and regulations. Issues, risks and uncertainties relating to Chinese government regulation of the industry include the following:

|

●

|

We only have 49% ownership interest in BCT Retail. We are not able to own 100% interest in BCT Retail due to the restriction of foreign investment in pharmacy chains with 30 or more drugstores and foreign ownership of medical practices. If the Chinese government challenges our control of BCT Retail through contractual relationships, our business could be harmed; and

|

|

●

|

uncertainties relating to the regulation of drugstores, including evolving licensing practices, means that permits, licenses or operations at our company may be subject to challenge. This may disrupt our business, or subject us to sanctions, requirements to increase capital or other conditions or enforcement, or compromise enforceability of related contractual arrangements, which could materially and adversely affect our business, financial condition and results of operations.

|

THERE IS NO ASSURANCE THAT WE WILL PAY DIVIDENDS TO SHAREHOLDERS IN THE FUTURE.

Although Liuzhou BCT, our wholly owned subsidiary, declared and paid to its then existing shareholders cash dividends in the amount of $6,940,000 and $2,044,056 for the years ended December 31, 2008 and 2007, respectively, our board of directors does not intend to distribute dividends in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

10

WE MAY INCUR SIGNIFICANT COSTS TO ENSURE COMPLIANCE WITH UNITED STATES CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Risks Related to Our Corporate Structure

WE CONTROL BCT RETAIL THROUGH A SERIES OF CONTRACTUAL ARRANGEMENTS, WHICH MAY NOT BE AS EFFECTIVE IN PROVIDING CONTROL OVER THE ENTITY AS DIRECT OWNERSHIP AND MAY BE DIFFICULT TO ENFORCE.

We operate our retail pharmacy business in the PRC through BCT Retail which holds the licenses, approvals and assets necessary to operate our retail pharmacy business in the PRC. We have a 49% minority equity ownership interest in BCT Retail and rely on contractual arrangements with Property management that allow us to substantially control and operate BCT Retail. These contractual arrangements may not be as effective as direct ownership in providing control over BCT Retail because BCT Retail or its shareholders could breach the arrangements.

Our contractual arrangements with BCT Retail are governed by PRC law and provide for the resolution of disputes through arbitration in the PRC. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. If BCT Retail or its shareholders fail to perform their respective obligations under these contractual arrangements, we may have to

|

●

|

incur substantial costs to enforce such arrangements, and

|

|

●

|

rely on legal remedies under PRC law, including seeking specific performance or injunctive relief, and claiming damages.

|

The legal environment in the PRC is not as developed as in the United States and uncertainties in the Chinese legal system could limit our ability to enforce these contractual arrangements. In the event that we are unable to enforce these contractual arrangements, our business, financial condition and results of operations could be materially and adversely affected.

IF THE PRC GOVERNMENT DETERMINES THAT THE CONTRACTUAL ARRANGEMENTS THROUGH WHICH WE CONTROL BCT RETAIL DO NOT COMPLY WITH APPLICABLE REGULATIONS, OUR BUSINESS COULD BE ADVERSELY AFFECTED.

Although we believe our contractual relationships through which we control BCT Retail comply with current licensing, registration and regulatory requirements of the PRC, we cannot assure you that the PRC government would agree, or that new and burdensome regulations will not be adopted in the future. If the PRC government determines that our structure or operating arrangements do not comply with applicable law, it could revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, require us to restructure our operations, impose additional conditions or requirements with which we may not be able to comply, impose restrictions on our business operations or on our customers, or take other regulatory or enforcement actions against us that could be harmful to our business.

11

Risks Relating to the People’s Republic of China

THE SALES PRICES OF SOME MEDICINES ARE CURRENTLY CONTROLLED BY THE CHINESE GOVERNMENT AND THAT MAY ADVERSELY AFFECT OUR BUSINESS.

Prices paid by end consumers for many of our medicines are regulated by PRC’s State Development and Reform Commission. PRC justifies its need to control the drug prices on the basis that, at present, only employees at state or private companies have health insurance. About 900 million rural Chinese people and 35 million urban unemployed Chinese people lack insurance coverage and cannot afford expensive drugs. Our future profitability might suffer if a significant portion of our revenues were to be derived from products whose final selling prices were state-controlled and if those prices were held at levels close to or below our cost of sales.

SALES OF OUR PRODUCTS COULD BE HARMED BY THE WIDESPREAD PRESENCE OF COUNTERFEIT MEDICATION IN PRC NEGATIVELY IMPACTING OUR PROFITABILITY.

Chinese counterfeiting of pharmaceuticals and other products affecting public health has grown in tandem with counterfeiting and piracy of goods such as brand-name clothing, compact discs and computer software. This situation negatively affects China Baicaotang and other major domestic and foreign drug manufacturers in PRC, especially for products marketed through the over the counter rather than hospital channel. With the expansion of our business and increased recognition of our brand name, such risks may increase. Currently, active pharmaceutical ingredients are governed only by chemical regulations. Our ability to increase sales as rapidly as we would like, and our profitability, could be affected if this problem persists or worsens.

SUBSTANTIALLY ALL OF OUR OPERATING ASSETS ARE LOCATED IN CHINA AND SUBSTANTIALLY ALL OF OUR REVENUE WILL BE DERIVED FROM OUR OPERATIONS IN CHINA SO OUR BUSINESS, RESULTS OF OPERATIONS AND PROSPECTS ARE SUBJECT TO THE ECONOMIC, POLITICAL AND LEGAL POLICIES, DEVELOPMENTS AND CONDITIONS IN CHINA.

The PRC’s economic, political and social conditions, as well as government policies, could impair our business. The PRC economy differs from the economies of most developed countries in many respects. China’s GDP has grown consistently since 1978 (National Bureau of Statistics of China). However, we cannot assure you that such growth will be sustained in the future. If, in the future, China’s economy experiences a downturn or grows at a slower rate than expected, there may be less demand for spending in certain industries. A decrease in demand for spending in certain industries could impair our ability to remain profitable. The PRC’s economic growth has been uneven, both geographically and among various sectors of the economy. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall PRC economy, but may have a negative effect on us. For example, our financial condition and results of operations may be hindered by PRC government control over capital investments or changes in tax regulations.

The PRC economy has been transitioning from a planned economy to a more market-oriented economy. Although in recent years the PRC government has implemented measures emphasizing the use of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. It also exercises significant control over PRC economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

12

IF THE MINISTRY OF COMMERCE, OR MOFCOM, CHINA SECURITIES REGULATORY COMMISSION, OR CSRC, OR ANOTHER PRC REGULATORY AGENCY, DETERMINES THAT MOFCOM AND CSRC APPROVAL OF OUR MERGER WAS REQUIRED OR IF OTHER REGULATORY OBLIGATIONS ARE IMPOSED UPON US, WE MAY INCUR SANCTIONS, PENALTIES OR ADDITIONAL COSTS WHICH WOULD DAMAGE OUR BUSINESS.

On August 8, 2006, six PRC regulatory agencies, including the MOFCOM and the CSRC, promulgated the Rules on Acquisition of Domestic Enterprises by Foreign Investors, or the M&A Rules, a new regulation with respect to the mergers and acquisitions of domestic enterprises by foreign investors that became effective on September 8, 2006. Article 11 of the New M&A Rules requires when a domestic company, enterprise or natural person uses an offshore company legally established or controlled by the domestic company, enterprise or natural person to engage in the merger and acquisition of a related domestic company, the application must be submitted to MOFCOM for approval. Article 40 of the New M&A Rules requires that an offshore special purpose vehicle formed for overseas listing purposes and controlled directly or indirectly by PRC companies or individuals should obtain the approval of the CSRC prior to the listing and trading of such offshore special purpose vehicle’s securities on an overseas stock exchange, especially in the event that the offshore special purpose vehicle acquires shares of or equity interests in the PRC companies in exchange for the shares of offshore companies. Article 39 of the New M&A Rules defines an offshore special purpose vehicle as an offshore company directly or indirectly controlled by a PRC domestic company or natural person for the purpose of the offshore listing of their equity interests in the domestic company. On September 21, 2006, the CSRC published on its official website procedures and filing requirements for offshore special purpose vehicles seeking CSRC approval of their overseas listings.

We believe, based on the opinion of our PRC legal counsel, Broad & Bright Law Firm, that MOFCOM and CSRC approvals were not required for our merger transaction or for the listing and trading of our securities on a trading market because we are not an offshore special purpose vehicle that is directly or indirectly controlled by PRC companies or individuals. Although the merger and acquisition regulations provide specific requirements and procedures, there are still many ambiguities in the meaning of many provisions. Further regulations are anticipated in the future, but until there has been clarification either by pronouncements, regulation or practice, there is some uncertainty in the scope of the regulations and the regulators have wide latitude in the enforcement of the regulations and approval of transactions. If the MOFCOM, CSRC or another PRC regulatory agency subsequently determines that the MOFCOM and CSRC approvals were required, we may face sanctions by the MOFCOM, CSRC or another PRC regulatory agency. If this happens, these regulatory agencies may impose fines and penalties on our operations in China, limit our operating privileges in China, delay or restrict the repatriation of the net proceeds (after the payment of fees and expenses in connection with the Private Placement) received by us from the Private Placement into China, restrict or prohibit payment or remittance of dividends paid by Liuzhou BCT, or take other actions that could damage our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our securities.

THE NEW M&A REGULATIONS ESTABLISH MORE COMPLEX PROCEDURES FOR SOME ACQUISITIONS OF CHINESE COMPANIES BY FOREIGN INVESTORS, WHICH COULD MAKE IT MORE DIFFICULT FOR US TO PURSUE GROWTH THROUGH ACQUISITION IN CHINA.

The New M&A Rules establish additional procedures and requirements that could make some acquisitions of PRC companies by foreign investors, such as ours, more time-consuming and complex, including requirements in some instances that the approval of the Ministry of Commerce shall be required for transactions involving the shares of an offshore listed company being used as the acquisition consideration by foreign investors. In the future, we may grow our business in part by acquiring complementary businesses. Complying with the requirements of the New M&A Rules to complete such transactions could be time-consuming, and any required approval processes, including obtaining approval from the Ministry of Commerce, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

13

IF THE PRC IMPOSES RESTRICTIONS DESIGNED TO REDUCE INFLATION, FUTURE ECONOMIC GROWTH IN THE PRC COULD BE SEVERELY CURTAILED WHICH COULD HURT OUR BUSINESS AND PROFITABILITY.

While the economy of the PRC has experienced rapid growth, this growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth often can lead to growth in the supply of money and rising inflation. In order to control inflation in the past, the PRC has imposed controls on bank credits, limits on loans for fixed assets and restrictions on state bank lending. Imposition of similar restrictions may lead to a slowing of economic growth, a decrease in demand for our products and generally damage our business and profitability.

FLUCTUATIONS IN EXCHANGE RATES COULD HARM OUR BUSINESS AND THE VALUE OF OUR SECURITIES.

The value of our ordinary shares will be indirectly affected by the foreign exchange rate between U.S. dollars and RMB and between those currencies and other currencies in which our sales may be denominated. Because substantially all of our earnings and cash assets are denominated in RMB and the net proceeds (after the payment of fees and expenses in connection with the Private Placement) received by us from the Private Placement will be denominated and our financial results are reported in U.S. dollars, fluctuations in the exchange rate between the U.S. dollar and the RMB will affect the relative purchasing power of these proceeds, our balance sheet and our earnings per share in U.S. dollars following this offering. In addition, appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future. Since July 2005, the RMB has not been pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

EXCHANGE CONTROLS THAT EXIST IN THE PRC MAY LIMIT OUR ABILITY TO UTILIZE OUR CASH FLOW EFFECTIVELY.

We are subject to the PRC’s rules and regulations on currency conversion. In the PRC, the State Administration for Foreign Exchange, or SAFE, regulates the conversion between Renminbi and foreign currencies. Currently, foreign investment enterprises, or FIEs, are required to apply to the SAFE for “Foreign Exchange Registration Certificates for FIEs.” As a result of our ownership of Liuzhou BCT, Liuzhou BCT is a FIE. With such registration certificates, which need to be renewed annually, FIEs are allowed to open foreign currency accounts including a “current account” and “capital account.” Currency conversion within the scope of the “current account,” such as remittance of foreign currencies for payment of dividends, can be effected without requiring the approval of the SAFE. However, conversion of currency in the “capital account,” including capital items such as direct foreign investment, loans and securities, still require approval of the SAFE. Further, any capital contributions to Liuzhou BCT by its offshore shareholder must be approved by the Ministry of Commerce in China or its local counterpart. We cannot assure you that the PRC regulatory authorities will not impose further restrictions on the convertibility of the Renminbi. Any future restrictions on currency exchanges may limit our ability to use our cash flow for the distribution of dividends to our shareholders or to fund operations it may have outside of the PRC.

14

In August 2008, SAFE promulgated Circular 142, a notice regulating the conversion by FIEs of foreign currency into Renminbi by restricting how the converted Renminbi may be used. Circular 142 requires that Renminbi converted from the foreign currency-dominated capital of a FIE may only be used for purposes within the business scope approved by the applicable government authority and may not be used for equity investments within the PRC unless specifically provided for otherwise. In addition, SAFE strengthened its oversight over the flow and use of Renminbi funds converted from the foreign currency-dominated capital of a FIE. The use of such Renminbi may not be changed without approval from SAFE, and may not be used to repay Renminbi loans if the proceeds of such loans have not yet been used. Violations of Circular 142 may result in severe penalties, including substantial fines as set forth in the SAFE rules.

PRC REGULATIONS RELATING TO THE ESTABLISHMENT OF OFFSHORE SPECIAL PURPOSE COMPANIES BY PRC RESIDENTS MAY SUBJECT OUR PRC RESIDENT SHAREHOLDERS TO PERSONAL LIABILITY AND LIMIT OUR ABILITY TO INJECT CAPITAL INTO OUR PRC SUBSIDIARIES, LIMIT OUR PRC SUBSIDIARIES’ ABILITY TO DISTRIBUTE PROFITS TO US, OR OTHERWISE ADVERSELY AFFECT US.

SAFE issued a public notice in October 2005, or the SAFE notice, requiring PRC residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of PRC companies, referred to in the notice as an “offshore special purpose company.” PRC residents that are shareholders of offshore special purpose companies established before November 1, 2005 were required to register with the local SAFE branch before March 31, 2006.The failure of our beneficial owners to timely amend their SAFE registrations pursuant to the SAFE notice or the failure of future beneficial owners of our company who are PRC residents to comply with the registration procedures set forth in the SAFE notice may subject such beneficial owners to fines and legal sanctions and may also limit our ability to contribute additional capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute dividends to our company or otherwise adversely affect our business.

BECAUSE CHINESE LAW GOVERNS MANY OF OUR MATERIAL AGREEMENTS, WE MAY NOT BE ABLE TO ENFORCE OUR RIGHTS WITHIN THE PRC OR ELSEWHERE, WHICH COULD RESULT IN A SIGNIFICANT LOSS OF BUSINESS, BUSINESS OPPORTUNITIES OR CAPITAL.

Chinese law governs many of our material agreements, some of which may be with Chinese governmental agencies. We cannot assure you that we will be able to enforce any of our material agreements or that remedies will be available outside of the PRC. The system of laws and the enforcement of existing laws and contracts in the PRC may not be as certain in implementation and interpretation as in the United States. The Chinese judiciary is relatively inexperienced in enforcing corporate and commercial law, leading to a higher than usual degree of uncertainty as to the outcome of any litigation. The inability to enforce or obtain a remedy under any of our future agreements could result in a significant loss of business, business opportunities or capital.

BECAUSE OUR FUNDS ARE HELD IN BANKS IN UNINSURED PRC BANK ACCOUNTS, THE FAILURE OF ANY BANK IN WHICH WE DEPOSIT OUR FUNDS COULD AFFECT OUR ABILITY TO CONTINUE IN BUSINESS.

Funds on deposit at banks and other financial institutions in the PRC are often uninsured. A significant portion of our assets are in the form of cash deposited with banks in the PRC, and in the event of a bank failure, we may not have access to our funds on deposit. Depending upon the amount of money we maintain in a bank that fails, our inability to have access to our cash could impair our operations, and, if we are not able to access funds to pay our suppliers, employees and other creditors, we may be unable to continue in business.

15