Attached files

Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

| For the year ended November 30, 2010 | Commission File Number 1-15147 |

OMNOVA Solutions Inc.

(Exact name of registrant as specified in its charter)

| Ohio | 34-1897652 | |

| (State of Incorporation) | (I.R.S. Employer Identification No.) | |

| 175 Ghent Road, Fairlawn, Ohio | 44333-3300 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code (330) 869-4200

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value 10¢ per share |

The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, interactive data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes ¨ No ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (check one):

| Large accelerated filer ¨ |

Accelerated filer þ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12-b of the Exchange Act) Yes ¨ No þ

The aggregate market value of the voting stock held by nonaffiliates of the registrant was $348,991,721 based on the closing price per share of $8.03 on May 28, 2010, the last business day of the registrant’s most recently completed second quarter.

As of January 18, 2011, there were 45,001,085 outstanding shares of the Company’s Common Stock, 10¢ par value.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the 2011 Proxy Statement of OMNOVA Solutions Inc. are incorporated into Part III of this Report.

Table of Contents

OMNOVA Solutions Inc.

Annual Report on Form 10-K

For the Year Ended November 30, 2010

Table of Contents

PART I

| Item 1. | Business |

Introduction

OMNOVA Solutions Inc. (referred to in this report as OMNOVA Solutions, OMNOVA, the Company, we or our) became an independent publicly-traded company on October 1, 1999, when it was spun-off by GenCorp Inc., the former parent company. OMNOVA Solutions is incorporated under the laws of the State of Ohio, and its headquarters is located at 175 Ghent Road, Fairlawn, Ohio 44333.

OMNOVA Solutions is an innovator of emulsion polymers, specialty chemicals and decorative and functional surfaces for a variety of commercial, industrial and residential end uses. Our products provide a variety of important functional and aesthetic benefits to hundreds of products that people use daily. We hold leading positions in key market categories, which have been built through innovative products, customized product solutions, strong technical expertise, well-established distribution channels, recognized brands and long-standing customer relationships. We utilize 16 strategically located manufacturing, technical and other facilities in North America, Europe and Asia to service our broad customer base.

OMNOVA operates two business segments: Performance Chemicals and Decorative Products. Of our 2010 net sales, 62% were derived from the Performance Chemicals segment and 38% were derived from the Decorative Products segment. Financial information relating to the Company’s business segments is set forth in Note O to the Consolidated Financial Statements of this report.

Performance Chemicals

Background

Our Performance Chemicals segment began in 1952 as part of GenCorp (then known as The General Tire & Rubber Company). Initially, the business focused on the manufacture of styrene butadiene latex for the paper industry and styrene butadiene vinyl pyridine latex for tire cord adhesives in a single facility in Mogadore, Ohio. Since that time, the business has grown through internal development and acquisitions to include global manufacturing capabilities and numerous chemistries and product applications.

Products

OMNOVA Solutions’ Performance Chemicals segment produces a broad range of emulsion polymers and specialty chemicals based primarily on styrene butadiene (SB), styrene butadiene acrylonitrile (SBA), styrene butadiene vinyl pyridine, polyvinyl acetate, acrylic, styrene acrylic, vinyl acrylic, glyoxal, fluorochemical and hollow plastic pigment chemistries. We are North America’s second largest producer of SB latex and a leading supplier of SB latex to the paper and specialty markets. We operate well maintained, strategically located, cost competitive production facilities. Our custom-formulated products are tailored for coatings, binders and adhesives, which are used in paper, carpet, nonwovens, construction, oil/gas drilling services, adhesives, tape, tire cord, floor polish, textiles, graphic arts, plastic parts, bio-based polymers and various other specialty applications. Our products provide a variety of functional properties to enhance our customers’ products, including greater strength, adhesion, dimensional stability, water resistance, flow and leveling, improved processibility and enhanced appearance. Our Performance Chemicals segment is recognized for its core capabilities in emulsion polymerization and emulsion polymer technology and for its ability to rapidly develop and deliver highly customized products that provide innovative and value-added solutions to customers.

1

Table of Contents

The following table shows major Performance Chemicals products, end-use applications and brand names:

| Product Category |

% of Performance Chemicals Fiscal 2010 Net Sales |

Primary Products |

End-use Applications |

Brand Names | ||||

| Paper and Carpet Chemicals | 62.5% | SB and SBA latex coating binders, carpet backing binders and paper chemicals including crosslinkers, lubricants, other coating additives and hollow plastic pigments | Magazines, catalogs, direct mail advertising, brochures and printed reports, specialty papers, food cartons, household and other consumer and industrial packaging, and residential and commercial carpet | GENCAL, GENFLO, GENCRYL, GENCRYL PT, NOVAGREEN, REACTOPAQUE, SUNKOTE, SUNBOND, SUNKEM, UNIQ-PRINT, SEQUABOND, SUNREZ, SEQUAREZ, OMNABLOC, OMNAGLIDE, OMNATUF | ||||

| Specialty Chemicals |

37.5% | SB, SBA, styrene butadiene vinyl pyridine, acrylic, vinyl acrylic, styrene acrylic, and polyvinyl acetate emulsion polymers, glyoxal resins, silicone emulsions, polyethylene resins, fluorochemicals and fluorosurfactants | Nonwovens (such as hygiene products, engine filters, roofing mat and scrub pads), construction, adhesives, masking tapes, tire cord, floor polish, textiles, graphic arts, oil/gas drilling services and plastic part coatings | GENFLO, GENCRYL, GENTAC, OMNAGLO, OMNAPEL, SEQUABOND, SUNCRYL, SECOAT, SECRYL, MOR-GLO, MOR-SHINE, MOR-FLO, NOVACRYL, ACRYGEN, MYKON, PERMAFRESH, SEQUAPEL, POLYFOX, X-CAPE, GENGLAZE, MYKOSOFT, MYKOSIL, NOVANE, GENCEAL | ||||

Paper and Carpet Chemicals. OMNOVA is a leading North American supplier of custom-formulated SB and SBA latex and hollow plastic pigments for paper and paperboard coatings. In addition, we produce a broad variety of specialty chemical additives for coating applications in the paper industry. Our commitment to product innovation has enhanced our market position by creating products for the paper industry that improve the printability, strength, gloss, opacity, and moisture resistance of coated papers and paperboard. Applications for our products include paper and paperboard coatings used in magazines, catalogs, direct mail advertising, brochures and printed reports, specialty papers, food cartons and household and other consumer and industrial packaging.

OMNOVA is also a leading North American supplier of custom-formulated SB latex used as carpet backing binders. Our products for the carpet industry secure carpet fibers to the carpet backing and adhere the primary backing to the secondary backing and meet the stringent manufacturing, environmental, odor, flammability and flexible installation requirements of our customers. Our strong historic position in residential carpeting has been enhanced by new products to serve that market as well as innovations in commercial carpet backing binders that provide moisture barrier properties, enabling the replacement of higher-cost polyurethane binders. Sales of our Paper and Carpet Chemicals products represented 39.0% of our consolidated net sales for 2010, 35.8% of our consolidated net sales for 2009 and 38.8% of our consolidated net sales for 2008.

Specialty Chemicals. OMNOVA is a leading North American supplier of specialty polymers and chemicals for a variety of product categories. Applications for our specialty polymers and chemicals include nonwovens (such as hygiene products,

2

Table of Contents

engine filters, roofing mat, scrub pads), floor polish, tape, adhesives, tire cord, textiles, construction, oil/gas drilling services, plastic part coatings and ink coating additives. Our focus is on developing unique products and custom applications that address specific customer needs, including enhanced functionality, improved environmental performance and lower cost through improved processibility and product substitution for higher-cost materials. Sales of our Specialty Chemicals products represented 23.4% of our consolidated net sales for 2010, and 21.2% for 2009 and 2008.

Markets and Customers

The paper coating and carpet backing product lines are highly competitive based on quality, customer service, product performance, price, field technical support and product innovations. Major paper and carpet customers include NewPage, Verso, Shaw Industries, Sappi and Beaulieu. The specialties product line includes many product categories such as tire cord adhesives, components for hygiene products and roofing mat that are performance driven where product innovation, technical service and application support are key competitive differentiators. Major specialty chemical customers include Sherwin Williams, PGI, Freudenburg, Hyosung, Shurtape, Xerox and Fiberweb.

Marketing and Distribution

Our Performance Chemicals segment primarily sells its products directly to manufacturers through dedicated internal marketing, sales and technical service teams focused on providing highly responsive customized solutions to targeted markets and industries.

Competition

Performance Chemicals competes with several large chemical companies including Styron and BASF. Performance Chemicals also competes with a variety of other suppliers of specialty chemicals including Lubrizol, Wacker, Celanese, Dow, and Arkema. Depending on the products involved and markets served, the basis of competition varies and may include price, quality, customer and technical service, product performance and innovation and industry reputation. Overall, our Performance Chemicals segment regards its products to be competitive in its major categories and we believe that we are a leader in several North American categories, including SB and SBA latex paper coatings and carpet backing binders, nonwoven SB binders, SB vinyl pyridine, tire cord adhesives, floor care polymers and polymers used in the manufacturing of masking and other tapes.

Decorative Products

Background

Our Decorative Products segment began in 1945 when GenCorp (then known as The General Tire & Rubber Company) purchased a coated fabrics manufacturing facility located in Jeannette, Pennsylvania from the Pennsylvania Rubber Company. Since that time, the business has grown through internal development and acquisitions to include four domestic and five international manufacturing sites and a wide range of decorative and functional surfacing products.

In 1999 and 2000, the business established manufacturing joint ventures in Thailand and China with an affiliate of Thailand-based Charoen Pokphand Group to expand its coated fabrics and performance film capabilities into the Asia Pacific region and provide expanded product lines to North America and Europe. The Company held a 50.1% interest in each joint venture. During the first quarter of 2008, OMNOVA acquired the remaining equity interests in these joint ventures, which are now wholly-owned subsidiaries of the Company.

Products

Our Decorative Products segment develops, designs, produces and markets a broad line of functional and decorative surfacing products, including coated fabrics, commercial wallcoverings, vinyl, paper and specialty laminates and performance films. These products are used in numerous applications, including commercial building refurbishment, remodeling and new construction; residential cabinets, flooring and furnishings; retail display; transportation markets

3

Table of Contents

including busses and mass transit, marine, motorcycle and automotive; recreational vehicles; manufactured housing; medical devices and products; and a variety of industrial film applications. Our core competencies in design, coating, compounding, calendering, casting, printing and embossing enable us to develop unique, aesthetically pleasing decorative surfaces that have functional properties, such as cleanability, durability and scratch and stain resistance, that address specific customer needs. We have strong color and design capabilities, an extensive design library covering a broad range of patterns, textures and colors, and strong product formulation and coating and processing capabilities. Together these capabilities provide our products with the functionality and aesthetics that add value for our customers. In addition, our broad range of products, global presence and end-use applications gives us economies of scale in sourcing, manufacturing, design, sales and marketing, product and process development.

The following table shows the products that our Decorative Products segment develops, designs, produces and markets.

| Product Category |

% of Decorative Products Fiscal 2010 Net Sales |

Primary Products |

End-use Applications |

Brand Names | ||||

| Commercial Wallcovering, Coated Fabrics | 69.1% | Vinyl and non-vinyl nanofiber based wallcoverings, recyclable and 30% recycled content wallcovering, customized wall murals; vinyl and urethane coated fabrics | Decorative and protective wall and seating surfacing for offices, hotels, hospital and health care facilities, stores, schools, restaurants and public buildings; decorative and protective surfacing for transportation and marine seating, automotive soft top covers, commercial and residential furniture, performance fabrics for numerous applications including medical products | BOLTA, ESSEX, GENON, TOWER, MURASPEC, MUREK, VIEWNIQUE, DIVERSIWALL, ECORE, RECORE, BOLTAFLEX, BOLTASOFT, NAUTOLEX, PREFIXX, PREVAILL | ||||

| Laminates and Performance Films | 30.9% | Vinyl, paper and specialty laminates; performance films | Decorative and protective surfacing for kitchen and bath cabinets, manufactured housing recreational vehicle interiors, flooring, commercial and residential furniture, retail display fixtures, home furnishings and consumer electronics, performance films for pool liners, banners, tents, ceiling tiles and medical products | PREEMPT, RADIANCE, SURF(X) 3D, DESIGN4, EFX, DURAMAX | ||||

4

Table of Contents

Commercial Wallcovering, Coated Fabrics. OMNOVA Solutions is a leading North American, European and Asian supplier of wallcoverings and coated fabrics used in commercial applications. Our commercial wallcoverings are recognized for their leading color and designs as well as their strength, durability and cleanability. Our wallcoverings, in addition to their aesthetic appeal, reduce repair and maintenance costs for building owners by protecting wall surfaces and having longer useful lives as compared to paint and paper wallcoverings. Applications for our commercial wallcoverings include refurbishment and new construction for the commercial office, hospitality, health care, retail, education and restaurant markets.

OMNOVA’s commercial wallcovering product lines include a broad range of fabric-backed vinyl, paper-backed vinyl and nanofiber based wallcoverings. Our extensive styling and design library covers a broad range of styles, patterns, textures and colors, both traditional and contemporary. In addition to strong internal and external resources in design capabilities, strengths include a reputation for product durability and quality, a global distribution network, an extensive emboss and print roll library, strong brands, custom design and manufacturing capability and long-term customer relationships.

OMNOVA Solutions is a leading North American and Asian supplier of vinyl and urethane coated fabrics and performance fabrics for commercial, residential, transportation and medical applications. Our durable coated fabrics are well-suited for demanding, high-use environments and offer a cost effective alternative to other surfacing materials, such as leather and textile fabrics. Applications for our coated fabrics include transportation seating (automotive OEM, bus and other mass transit, marine and motorcycle), automotive soft tops, automotive aftermarket applications, contract and medical furniture and product fabric applications. Sales of our commercial wallcovering and coated fabrics products represented 26.0% of our consolidated net sales for 2010, 31.3% for 2009 and 29.0% for 2008.

In late 2008, OMNOVA Solutions introduced RECORE® Recycled Wall Technology—the “best in class” recycled commercial wallcovering platform for wallcoverings that look, perform and hang like traditional vinyl wallcoverings and feature a guaranteed minimum 30% recycled content. All new designs introduced in the leading OMNOVA brands—Bolta®, Essex™, Genon® and Tower®—feature RECORE® Recycled Wall Technology. OMNOVA also offers wallcoverings featuring ECORE® Advanced Wall Technology, a non-PVC construction for architects and designers seeking alternatives to vinyl. In addition, both RECORE® and ECORE® qualify for critical points in building projects seeking LEED (Leadership in Energy and Environmental Design) certification as a part of the U.S. Green Building Council’s sustainable building initiative. These innovations further enhance OMNOVA’s leadership position for both branded and private label offerings while meeting the growing demand for sustainable products.

Laminates and Performance Films. OMNOVA Solutions is a leading North American supplier of vinyl and paper laminates and performance films. Our laminates are used as alternatives to wood, paint, stone, stainless steel and high-pressure laminates in markets where durability, design and cost are key requirements. We provide our customers with a broad range of designs and textures as well as proprietary coating technology that provides enhanced durability and scratch and stain resistance. Applications for our laminates include kitchen and bath cabinets, manufactured housing and recreational vehicle interiors, flooring, commercial and residential furniture, retail display fixtures, home furnishings, and consumer electronics. Performance film applications include banners, tents, medical products, pool liners, movie screens and shower pan liners.

A key strength of our laminates business is our coating technology, including ultraviolet, melamine, urethane, thermal cured and others, which provides durable finishes for high-wear applications. In addition, our laminates business has differentiated itself in the market as a single-source supplier of integrated vinyl and paper laminate designs for the furniture and cabinet industries by building a unique library of matched vinyl and paper laminate designs with a variety of patterns and textures, and developing rapid make-to-order production capabilities. We also offer SURF(X)® 3D Laminates for multi-dimensional applications for the office and health care furniture and retail display fixture markets. These laminates offer a cost effective alternative to high pressure laminates and provide furniture makers with design flexibility in rounded surfaces, eliminating the need for unsightly and expensive edge-banding and providing enhanced cleanability/disinfection. Sales of our Laminates and Performance Films products represented 11.6% of our consolidated net sales for 2010, 11.7% for 2009 and 11.0% for 2008.

5

Table of Contents

Markets and Customers

We believe that our Decorative Products segment is a leader in its targeted product categories. The coated fabrics, commercial wallcovering, laminates and performance films businesses are highly competitive based on decorative content, functional performance, price, quality, customer service, global capability, brand name recognition, distribution networks and reputation. Decorative Products markets its products under numerous brand names to different industries. Certain of our better-known customers in this segment include Steelcase, Armstrong, CGT, BYD, Ashley Furniture, Patrick Industries, Herculite and Masco.

Marketing and Distribution

Our Decorative Products segment distributes its products through a variety of channels. Commercial wallcovering products are marketed primarily through independent distributors to building owners, contractors, architects, interior designers and other specifiers. Several of our distributors are national in scope, providing us with the capability to cost-effectively market products to both regional and national commercial customers. Coated fabrics, laminates and performance films are sold directly and through agents to manufacturers of cabinets, furniture, seating, health care and medical components, and other products. Many of our Decorative Products segment’s products have strong, well-recognized brand names that are promoted through trade shows, industry periodicals, our website (www.omnova.com) and other media.

Competition

OMNOVA’s Decorative Products segment competes with numerous companies, many of which focus on only one product line and/or market and are smaller and privately-owned. Competitors include:

| • | Commercial Wallcovering and Coated Fabrics—RJF International, US Vinyl, J. Josephson, Vescom, Laminating Surfaces, Morbern, China General, Uniroyal and Spradling International |

| • | Laminates and Performance Films—Chiyoda Gravure, Dai Nippon Printing, Toppan Printing, Renolit Corporation, LG ChemAmerica, Riken USA Corporation and Spartech Industries |

International Operations

Net sales from our foreign operations were $180.5 million in 2010, $166.5 million in 2009 and $170.4 million in 2008. These net sales represented 21.3% of our total net sales in 2010, 23.9% of our total net sales in 2009 and 19.6% of our total net sales in 2008. Long-lived assets primarily consist of net property, plant and equipment and net intangibles. Long-lived assets of our foreign operations totaled $39.3 million at November 30, 2010 and $41.4 million at November 30, 2009. Our consolidated long-lived assets totaled $137.3 million at November 30, 2010 and $146.3 million at November 30, 2009.

In a subsequent event which will be reflected in fiscal 2011 results, on December 9, 2010, the Company completed the acquisition of all the outstanding shares of Eliokem International SAS (“Eliokem”) from AXA Investment Managers Private Equity Europe and the other holders of equity securities of Eliokem. Eliokem is a worldwide manufacturer of specialty chemicals used in a diverse range of niche applications including coating resins, elastomeric modifiers, antioxidants, oilfield chemicals and latices for specialty applications. Eliokem is headquartered in Villejust, France and has manufacturing facilities located in France, China, India and the United States. Eliokem’s 2010 sales were $288.0 million.

In January 2008, the Company completed the acquisition of the minority interests in its joint venture businesses, Decorative Products (Singapore) Pte. Ltd. (“DPS”), a Singapore limited company and CPPC—Decorative Products Co., Ltd. (“CPD”), a Thailand limited company. DPS is a holding company which owns 100% of both CG-OMNOVA Decorative Products (Shanghai) Co., Ltd. (“CGO”) and OMNOVA Decorative Products (Taicang) Co., Ltd. (“Taicang”). Both CGO and Taicang are registered and incorporated in the Peoples Republic of China. The minority interests of both DPS and CPD, representing approximately 49.9% of their respective registered equity, was acquired from CPPC Public Company Limited. The acquisition was effective December 31, 2007.

6

Table of Contents

Intellectual Property

We regard patents, trademarks, copyrights and other intellectual property as important to our success, and we rely on them in the United States and foreign countries to protect our investments in products and technology. Our patents expire at various times, but we believe that the loss or expiration of any individual patent would not materially affect our business. We, like any other company, may be subject to claims of alleged infringement of the patents, trademarks and other intellectual property rights of third parties from time to time in the ordinary course of business.

Seasonal Factors

We historically experience stronger sales and income in our second, third and fourth quarters, comprised of the three-month periods ending May 31, August 31 and November 30. Our performance in the first quarter (December through February) has historically been weaker due to generally lower levels of customer manufacturing, construction and refurbishment activities during the holidays and cold weather months.

Environmental Matters

Our business operations, like those of other companies in the industries in which we operate, are subject to numerous federal, state, local and foreign environmental laws and regulations. These laws and regulations not only affect our current operations, but also could impose liability on us for past operations that were conducted in compliance with then applicable laws and regulations. For further discussion of capital and noncapital expenditures for environmental compliance, please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Environmental Matters” on page 36 of this report, which is incorporated herein by reference.

Employees

At November 30, 2010, the Company employed approximately 2,430 employees at offices, plants and other facilities located principally throughout the United States, United Kingdom, China and Thailand. Approximately 14% or 350 of the Company’s employees are covered by collective bargaining agreements in the United States. In March 2010, the Company and its Calhoun, Georgia employees represented by Local 1876, Southern Region of Workers United, SEIU, agreed to a new three year contract. On May 20, 2010, the approximately 180 Columbus, Mississippi employees represented by United Steelworkers Local #748-L voted against ratification of a new contract proposal and subsequently went on strike on May 21, 2010. Initially, the Company’s salaried workforce and contract labor operated the plant, meeting customers’ requirements. During the fourth quarter of 2010, the Company began transitioning from contract labor to locally hired replacement employees. The Company incurred strike-related costs of $5.5 million in 2010, of which $3.3 million was included in cost of goods sold and $2.2 million included in other expense (income). Strike-related costs peaked in July 2010 and have declined significantly since then. In the fourth quarter of 2010, strike-related costs were $1.2 million, compared to $3.9 million in the third quarter of 2010. The Company generally would describe its relationship with employees as good even though its union-represented Columbus, Mississippi employees chose to go on strike.

Raw Materials

Our Performance Chemicals segment utilizes a variety of raw materials, primarily monomers, in the manufacture of our products, all of which are generally available from multiple suppliers. Monomer costs are a major component of the emulsion polymers produced by this segment. Key monomers include styrene, butadiene, acrylates, acrylonitrile, vinyl acetate and vinyl pyridine. These monomers represented approximately 76% of Performance Chemicals’ total raw materials purchased on a dollar basis in 2010 for this segment.

Our Decorative Products segment utilizes a variety of raw materials that are generally available from multiple suppliers. Key raw materials include polyvinyl chloride (PVC) resins, textiles, plasticizers, paper and titanium dioxide. PVC resins, plasticizers and textiles represented approximately 73% of Decorative Products’ total raw materials purchased on a dollar basis in 2010 for this segment.

The cost of these raw materials has a significant impact on our profitability. We generally attempt to respond to raw material cost increases through productivity programs and, as needed, price increases to our customers. The success of

7

Table of Contents

attempted price increases depends on a variety of factors including the specific market application and competitive environment. Under certain circumstances, we are not able to pass along the increase. In addition, if accepted by customers, price increases generally lag the increase in raw material costs. During the second half of 2008, the Company’s Performance Chemicals segment was successful in enhancing its index pricing through which styrene and butadiene raw materials cost increases are passed on to customers. Index pricing applies to approximately 65% of Performance Chemicals sales.

Research and Development

The OMNOVA Solutions technology centers in Akron, Ohio, Chester, South Carolina, Shanghai, China and Rayong, Thailand support research and development efforts across our businesses and complement the resources focused on innovation in each of our segments. Our efforts are focused on developing new applications with our base technologies, enhancing the functionality of our products in existing applications as well as developing new product and technology platforms.

Our research and development expenses were $8.8 million in 2010, $8.2 million in 2009 and $10.3 million in 2008. Research and development expenses include the costs of technical activities that are useful in developing new products, services, processes or techniques, as well as those expenses for technical activities that may significantly improve existing products or processes. Information relating to research and development expense is set forth in Note A to the Consolidated Financial Statements of this report.

Available Information

Our website is located at www.omnova.com. We make available free of charge on our website all materials that we file electronically with the Securities and Exchange Commission, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports, as soon as reasonably practicable after we electronically file or furnish such materials to the SEC. The OMNOVA Solutions Business Conduct Policies and Corporate Governance Guidelines and charters for the Audit Committee and Compensation and Corporate Governance Committee of the OMNOVA Solutions Board of Directors are also available on our website and in print to any shareholder who requests a copy. All requests must be made in writing, addressed to OMNOVA Solutions Inc., Attn: Secretary, 175 Ghent Road, Fairlawn, Ohio 44333-3300.

| Item 1A. | Risk Factors |

This Annual Report includes “forward-looking statements” as defined by federal securities laws. These statements, as well as any verbal statements by the Company related to this Annual Report are intended to qualify for the protections afforded forward-looking statements under the Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect management’s current expectation, judgment, belief, assumption, estimate or forecast about future events, circumstances or results and may address business conditions and prospects, strategy, capital structure, sales, profits, earnings, markets, products, technology, operations, customers, raw materials, financial condition, and accounting policies among other matters. Words such as, but not limited to, “will,” “may,” “should,” “projects,” “forecasts,” “seeks,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” “optimistic,” “likely,” “would,” “could,” and similar expressions or phrases identify forward-looking statements.

All forward-looking statements involve risks and uncertainties. Many risks and uncertainties are inherent in business generally and the markets in which the Company operates or proposes to operate. Other risks and uncertainties are more specific to the Company’s businesses including businesses the Company acquires. The occurrence of risks and uncertainties, and the impact of such occurrences, is often not predictable or within the Company’s control. Such impacts may adversely affect the Company’s results and, in some cases, such effect could be material. Certain risks and uncertainties facing the Company are described below or elsewhere in this Annual Report.

All written and verbal forward-looking statements attributable to the Company or any person acting on the Company’s behalf are expressly qualified in their entirety by the risks, uncertainties and cautionary statements contained herein. Any forward-looking statement speaks only as of the date on which such statement is made, and the Company undertakes no

8

Table of Contents

obligation, and specifically declines any obligation, other than that imposed by law, to publicly update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Risks and uncertainties that may cause actual results to differ materially from expected results include, among others:

We are exposed to general economic, business and industry conditions. A significant or prolonged downturn could adversely affect demand for our products.

We are exposed to general economic, business and industry conditions, both in the United States and in global markets. A significant or prolonged economic downturn could have the potential to adversely affect the demand for our products and our results.

Raw material prices and availability have a significant impact on our profitability. If raw material prices increase, and we cannot pass those price increases on to our customers, or we cannot obtain sufficient raw materials in a timely manner, our results could be adversely affected.

The principal raw materials that we use in our business are derived from petrochemicals and chemical feedstocks. Specifically, Performance Chemicals uses monomers such as styrene, butadiene, and acrylates extensively in its products, and Decorative Products uses PVC, plasticizer and Ti02 extensively in its products. If we are unable to pass along increased raw material prices to our customers, our results could be adversely affected. The cost of these raw materials has a significant impact on our profitability. The prices of many of these raw materials are cyclical and volatile. Supply and demand factors, which are beyond our control, generally affect the price of our raw materials. While we generally attempt to pass along increased raw material prices on to our customers in the form of price increases, historically there has been a time delay between increased raw material prices and our ability to increase the prices of our products. Additionally, we may not be able to increase the prices of our products due to competitive pricing pressure and other factors.

We generally have multiple global sources of supply for our raw materials. However, in some cases there are a limited number of suppliers that are capable of delivering raw materials that meet our standards. Further industry consolidation may limit the number of these suppliers. Various factors, including feed stock shortages, production disruptions, the financial stability of our suppliers, and supplier commitments to others have reduced and eliminated, and in the future may reduce or eliminate, the availability of certain raw materials. Shortages could occur in the future. Additionally, disruptions in transportation could delay receipt of raw materials. If our supply of raw materials is reduced, disrupted or delayed, our results could be adversely affected.

Consolidation of our customers and competitors has created increased pricing pressure. If we are required to reduce our prices to remain competitive, this could adversely affect our results.

We face continued pricing pressure from our customers and competitors. Customers frequently seek price reductions and customer consolidation in certain markets has created customers with greater purchasing power. Additionally, consolidation among our competitors has created competitors with greater financial and other resources. If we are required to reduce prices to compete and we cannot improve operating efficiencies and reduce expenditures to offset such price decreases, our results could be adversely affected.

Our sales and profitability depend on our ability to continue to develop new products that appeal to customers. If we are unable to develop new products, our results could be adversely affected.

It is important for our business to have the ability to develop, introduce, sell and support cost effective new products and technologies on a timely basis. If we fail to develop and deploy new cost effective products and technologies on a timely basis, our products may no longer be competitive and our results could be adversely affected.

We are exposed to credit risk from our customers.

If our customers, and in particular, large customers, are unable to timely pay amounts due to us, it may adversely affect our results and cash flows and our ability to remain in compliance with our credit facilities.

9

Table of Contents

A significant portion of Performance Chemicals sales is concentrated among several large customers.

Our Performance Chemicals segment has several large customers who account for a significant portion of Performance Chemicals’ total sales. The loss of, or a significant reduction in purchases by, any one of these large customers could adversely affect our results.

Our customers and suppliers may not be able to compete against increased foreign competition which could adversely affect the demand for our products, the cost of our raw materials and our results.

Our United States and European customers and suppliers are subject to increasing foreign competition. If the demand for products manufactured in those regions declines then the demand for our products manufactured in those regions could decline, adversely affecting our results.

Our business could be adversely affected by risks typically encountered by international operations.

We conduct our business in many countries outside of the United States and are subject to risks associated with international operations, including the following:

| • | fluctuations in currency exchange rates; |

| • | transportation delays and interruptions; |

| • | political and economic instability and disruptions; |

| • | the imposition of duties and tariffs; |

| • | import and export controls; |

| • | government control of capital transactions, including the borrowing of funds for operations or the expatriation of cash; |

| • | the risks of divergent business expectations or cultural incompatibility; |

| • | difficulties in staffing and managing multi-national operations; |

| • | limitations on our ability to enforce legal rights and remedies; |

| • | more stringent environmental, health and safety laws and regulations; and |

| • | potentially adverse tax consequences. |

Any of these events could adversely affect our international operations and our results. These risks may intensify given Eliokem’s substantial international operations.

Our business is subject to the risks associated with the use of chemicals.

We are subject to risks associated with chemical use including explosions, fires, leaks, discharges, inclement weather, natural disasters, mechanical failure, unscheduled downtime, transportation interruption and acts of God. The occurrence of these risks may result in operating disruptions at our facilities and could adversely affect our results.

We may be unable to achieve, or may be delayed in achieving, our goals under certain cost reduction measures, which could adversely affect our results.

We have and are undertaking operational excellence processes using LEAN SixSigma, global supply chain management, Enterprise Resource Planning (ERP) and other initiatives in an effort to improve efficiencies and lower our cost structure. If we are unable to achieve, or if we meet unexpected delays in achieving our goals, our results could be adversely affected. Additionally, even if we achieve these goals, we may not receive the expected financial benefits of these goals, or the costs of implementing these initiatives could exceed the benefits of these initiatives.

10

Table of Contents

From time to time, we participate in joint ventures whose success depends on performance of a joint venture partner. The failure of a partner to fulfill its obligations could adversely affect our results and require us to dedicate additional resources to these joint ventures.

From time to time, we participate in joint ventures. The nature of a joint venture requires us to share control with unaffiliated third parties. If our joint venture partners do not fulfill their obligations, the affected joint venture may not be able to operate according to its business plan. In that case, our results could be adversely affected or we may be required to increase our level of commitment to the joint venture. Also, differences in views among joint venture participants could result in delayed decisions or failures to agree on major issues. If these differences cause the joint ventures to deviate from their business plans, our results could be adversely affected.

We may not be able to identify or complete transactions with attractive acquisition candidates, which could adversely affect our business strategy.

As part of our business strategy, we have pursued, and may continue to pursue, targeted acquisition opportunities that we believe would complement our business. We may not be successful in consummating any acquisition, which could adversely affect our business strategy.

We may not be able to successfully integrate acquisitions, including Eliokem, into our operations, which could adversely affect our business.

The integration of acquisitions into our operations involves a number of risks, including:

| • | difficulty integrating operations and personnel at different locations; |

| • | diversion of management attention; |

| • | potential disruption of ongoing business because of the unknown reactions to the combination of OMNOVA and the acquisition by customers, suppliers and other key constituencies; |

| • | difficulties in assimilating the technologies and products of the acquisition; |

| • | inability to retain key personnel; |

| • | inability to successfully incorporate acquired business components with our existing operational and accounting infrastructure; |

| • | difficulty in expanding product manufacturing to new sites; and |

| • | inability to maintain uniform standards, controls, procedures and policies. |

If we are unable to effectively integrate operations and personnel in a timely and efficient manner after an acquisition is completed, we may not realize the financial or other benefits expected from the acquisition. Failure to overcome these risks or any other problems encountered in connection with the acquisition could slow our growth or lower the quality of our products, which could reduce customer demand and adversely affect our results.

The occurrence or threat of extraordinary events, including natural disasters, political disruptions, domestic and international terrorist attacks and acts of war, could significantly decrease demand for our products.

Extraordinary events, including natural disasters, political disruptions, domestic and international terrorist attacks and acts of war could adversely affect the economy generally, our business and operations specifically, and the demand for our products. The occurrence of extraordinary events cannot be predicted and their occurrence could adversely affect our results.

Extensive governmental regulations impact our operations and assets, and compliance with these regulations could adversely affect our results.

Our business operations are subject to numerous foreign, federal, state and local regulations which may have a significant effect on the costs of operations including extensive environmental, health and safety regulations.

11

Table of Contents

We are and expect to continue to be subject to increasingly stringent environmental and health and safety laws and regulations. Non-compliance with these requirements may result in significant fines or penalties, or limitations on our operations. Such regulation could also restrict or prohibit the use of key raw materials or the sale of our products. Significant restrictions on or the prohibition of the use of key raw materials or the sale of our products could adversely affect our results. Certain environmental requirements provide for strict and, under certain circumstances, joint and several liability for investigation and remediation of releases of regulated materials into the environment at or from properties owned or operated by us or our predecessors (including Eliokem) or at or from properties where substances were sent for off-site treatment or disposal. It is difficult to predict the future interpretation and development of environmental and health and safety laws and regulations or their impact on our future results. Continued compliance could result in significant increases in capital expenditures and operating costs. Any increase in these costs, or unanticipated liabilities arising out of a release of regulated materials by us or our predecessors (including Eliokem) or out of a discovery of previously unknown conditions, more aggressive enforcement actions or new requirements, could adversely affect our results. Additionally, any such increase in costs or unanticipated liabilities may exceed our reserves, which could adversely affect our results.

Capital expenditures could be higher than expected.

Unanticipated maintenance issues, changes in government regulations, or significant technology shifts could result in higher than anticipated capital expenditures, which could impact our debt and cash flows.

Because we maintain a self-insured health care plan for our employees, increases in health care costs could adversely affect our results.

We maintain a self-insured health care plan for certain of our employees and certain retirees under which we generally share the cost of health care with our employees and retirees. Health care costs have been escalating over the past decade. Accordingly, as general health care costs increase, our health care expenses may also increase. Such increase in costs could adversely affect our results.

Some of our employees are covered by collective bargaining agreements. The failure to renew any of those agreements on terms acceptable to us could increase cost or result in a prolonged work stoppage, which could adversely affect our results.

Approximately 350 or about 14% of our United States employees are covered by collective bargaining agreements of which approximately 100 employees are covered by agreements that expire within the next 12 months. On May 20, 2010, approximately 180 Columbus, Mississippi employees represented by United Steelworkers Local #748-L voted against ratification of a new contract proposal and subsequently went on strike on May 21, 2010. There can be no assurance that any of our collective bargaining agreements, including the agreement covering our employees in Columbus, Mississippi, will be renewed on similar terms or renegotiated on terms acceptable to us. Any prolonged work stoppages in one or more of our facilities could adversely affect our results. The Company has continued operating the Columbus, Mississippi facility using salaried employees and locally hired replacement employees with no disruption of service to our customers.

Our pension plan is underfunded, requiring company contributions.

The amount of these contributions depends on plan performance, interest rates, pension funding legislation and other factors. We currently anticipate that we will be required under the Pension Protection Act of 2006 to make a contribution to our pension plan in 2011 of approximately $2.8 million. In addition, we cannot predict whether changing conditions including interest rates, pension assets performance, discount rates, government regulation or other factors will require us to make contributions in excess of our current expectations. Additionally, we may not have the funds necessary to meet future minimum pension funding requirements.

Failure to protect intellectual property could adversely affect our results.

For certain products we rely on trademark, trade secret, patent and copyright laws to protect our intellectual property. We cannot be sure that these intellectual property rights will be successfully asserted in the future or that they will not be

12

Table of Contents

invalidated or circumvented. In addition, laws of some foreign countries in which our products are or may be sold do not protect our intellectual property rights to the same extent as the laws of the United States. The failure or inability of us to protect our proprietary information could make us less competitive and could adversely affect our results.

From time to time, we may be subject to claims or allegations that we infringe or misappropriate the intellectual property of third parties. Defending against such claims is costly and intellectual property litigation often involves complex questions of law, and facts and results are unpredictable. We may be forced to acquire rights to such third-party intellectual property on unfavorable terms (if rights are made available at all), pay damages, modify accused products to be non-infringing and/or stop selling the applicable product. Regardless of the outcome, defending against allegations of intellectual property infringement or misappropriation can divert the time and attention of management. Any of the foregoing could have a negative effect on our competitiveness and our results.

We could be subject to an adverse litigation judgment or settlement which could adversely affect our results.

From time to time, we are subject to various claims, proceedings and lawsuits related to products, services, contracts, employment, environmental, safety, intellectual property and other matters arising out of our business or that of our predecessors (including Eliokem). The ultimate resolution of such claims, proceedings, and lawsuits is inherently unpredictable and, as a result, our estimates of liability, if any, are subject to change and actual results may materially differ from our estimates. In addition, if there is an unfavorable resolution of a matter, there could be a material adverse effect on our financial condition, results of operations or cash flows depending on the amount of such resolution in comparison to our financial condition, results of operations and cash flows in the period in which such resolution occurs. Moreover, there can be no assurance that we will have any or adequate insurance coverage to protect us from any adverse resolution.

We maintain cash balances in foreign financial institutions.

While we monitor the financial institutions that we maintain accounts with, we cannot be assured that we would be able to recover our funds in the event that the financial institution would fail. In addition, we may be limited by foreign governments in the amount and timing of funds to be repatriated from foreign financial institutions. As a result, this could adversely affect our ability to fund normal operations, capital expenditures, or service debt.

Our substantial debt could adversely affect our financial health and prevent us from fulfilling our obligations.

We have substantial debt and, as a result, significant debt service obligations. Our substantial debt could:

| • | make it more difficult for us to satisfy our obligations with respect to the notes, the term loan and the revolving credit facility; |

| • | increase our vulnerability to general adverse economic and industry conditions, including interest rate fluctuations, because a portion of our borrowings, including those under the term loan and the revolving credit facility, are at variable rates of interest; |

| • | require us to dedicate a substantial portion of our cash flow from operations to payments on our debt, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions, joint ventures, pension contributions and investments and other general corporate purposes; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and the product categories in which we participate; |

| • | limit our ability to obtain additional debt or equity financing due to applicable financial and restrictive covenants in our debt agreements; |

| • | place us at a competitive disadvantage compared to our competitors that have less debt. |

Our ability to make scheduled payments on or to refinance our debt obligations and to fund planned capital expenditures and expansion efforts and any acquisitions we may make in the future depends on our ability to generate cash

13

Table of Contents

in the future and our financial condition and operating performance, which are subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We could be required to obtain the consent of the lenders under our new term loan and our new revolving credit facility to refinance material portions of our debt, including the notes. We may not be able to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our debt.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital or restructure or refinance our debt. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. If our operating results and available cash are insufficient to meet our debt service obligations, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. We may not be able to consummate those dispositions or to obtain the proceeds that we could realize from them, and these proceeds may not be adequate to meet any debt service obligations then due. Additionally, the agreements governing our term loan and our revolving credit facility and the indenture governing the notes will limit the use of the proceeds from any disposition; as a result, we may not be allowed, under these documents, to use proceeds from such dispositions to satisfy all current debt service obligations. Further, we may need to refinance all or a portion of our debt on or before maturity, and we cannot assure that we will be able to refinance any of our debt on commercially reasonable terms or at all.

Despite our current debt levels, we and our subsidiaries may still incur significant additional debt. Incurring more debt could increase the risks associated with our substantial debt.

We and our subsidiaries may be able to incur substantial additional debt, including additional secured debt, in the future. The terms of the note indenture restrict, and the agreements governing our new term loan and our new revolving credit facility restrict, but will not completely prohibit, us from incurring substantial additional debt. In addition, the note indenture will allow us to issue additional notes under certain circumstances, which will also be guaranteed by our domestic subsidiaries. The note indenture will also allow us to incur certain other additional secured debt. Non-guarantor subsidiaries, which includes our foreign subsidiaries may incur additional debt under the note indenture, which debt (as well as other liabilities at any such subsidiary) would be structurally senior to the notes. In addition, the note indenture will not prevent us from incurring certain other liabilities that do not constitute indebtedness (as defined in the note indenture). If new debt or other liabilities are added to our current debt levels, the related risks that we and our subsidiaries now face could intensify.

The indenture governing the notes and the agreements governing our term loan and our revolving credit facility will impose significant operating and financial restrictions on us and our subsidiaries, which may prevent us from capitalizing on business opportunities.

The agreements governing our term loan and our revolving credit facility and the indenture governing the notes impose significant operating and financial restrictions on us. These restrictions limit our ability, among other things, to:

| • | incur additional debt or issue certain disqualified stock and preferred stock; |

| • | pay dividends or certain other distributions on our capital stock or repurchase our capital stock; |

| • | make certain investments or other restricted payments; |

| • | place restrictions on the ability of our restricted subsidiaries to pay dividends or make other payments to us; |

| • | engage in transactions with affiliates; |

| • | sell certain assets or merge with or into other companies; |

| • | enter into sale and leaseback transactions; |

| • | guarantee debt; |

| • | create liens; and |

| • | enter into unrelated businesses. |

14

Table of Contents

Our term loan and revolving credit facility will require us to meet certain financial covenants, including covenants relating to senior net debt leverage, minimum excess availability and a springing minimum fixed charge coverage ratio if average excess availability falls below a certain level.

As a result of these covenants and restrictions, we could be limited in how we conduct our business and we may be unable to raise additional debt or equity financing to compete effectively or to take advantage of new business opportunities. The terms of any future debt we may incur could include more restrictive covenants. We cannot assure you that we will be able to maintain compliance with these covenants in the future and, if we fail to do so, that we will be able to obtain waivers from the lenders and/or amend the covenants.

There will be limitations on our ability to incur the full $100.0 million of commitments under our revolving credit facility. Borrowings under our new revolving credit facility will be limited by a specified borrowing base consisting of a percentage of eligible accounts receivable and inventory, less customary reserves. In addition, under our new revolving credit facility, a quarterly fixed charge maintenance covenant would become applicable if average excess availability under our credit facility is less than $25.0 million during any fiscal quarter. If the covenant trigger were to occur, the Company would be required to satisfy and maintain on the last day of each fiscal quarter a fixed charge coverage ratio of at least 1.1x for the last twelve-month period. Our ability to meet the required fixed charge coverage ratio can be affected by events beyond our control, and we cannot assure that we will meet this ratio. A breach of any of these covenants could result in a default under our new revolving credit facility.

Moreover, our new revolving credit facility provides the lenders considerable discretion to impose reserves, which could materially impair the amount of borrowings that would otherwise be available to us. There can be no assurance that the lenders under our new revolving credit facility will not impose such actions during the term of our new revolving credit facility and further, were they to do so, the resulting impact of this action could materially and adversely impair our ability to make interest payments on the notes.

| Item 1B. | Unresolved Staff Comments |

Not Applicable

15

Table of Contents

| Item 2. | Properties |

The Company’s significant operating, manufacturing, distribution, research, design and/or sales and marketing facilities are set forth below:

| Corporate Headquarters: |

||||

| OMNOVA Solutions Inc. *175 Ghent Road Fairlawn, OH |

OMNOVA Solutions Technology Center 2990 Gilchrist Road Akron, OH | |||

| Performance Chemicals: |

||||

| Headquarters: *175 Ghent Road Fairlawn, OH |

Sales/Manufacturing/Technical/Distribution: Akron, OH Calhoun, GA Chester, SC Fitchburg, MA Green Bay, WI *Hertfordshire, England Mogadore, OH *Shanghai, China | |||

| Decorative Products: |

||||

| Headquarters: *175 Ghent Rd Fairlawn, OH |

Manufacturing Facilities: Auburn, PA Columbus, MS Jeannette, PA Kent, England Monroe, NC *Rayong, Thailand Shanghai, China Taicang, China |

Sales/Marketing/Design/Distribution: Akron, OH *Asnieres, France *Bangkok, Thailand *Dubai, UAE *Hertfordshire, England *Rayong, Thailand *Shanghai, China *Warsaw, Poland | ||

| * | An asterisk next to a facility listed above indicates that it is a leased property. |

For a further discussion of our leased properties, please refer to Note M to the Consolidated Financial Statements of this report.

During 2010, we generally made effective use of our productive capacity. We believe that the quality and productive capacity of our properties are sufficient to maintain our competitive position for the foreseeable future.

Additionally, as a result of the Eliokem acquisition in December 2010, the Company acquired Eliokem manufacturing facilities located in LeHavre, France; Akron, Ohio, USA; Ningbo, China; Caojing, China, and Valia, India, as well as the leased headquarters of Eliokem located in Villejust, France.

| Item 3. | Legal Proceedings |

From time to time, the Company is subject to various claims, proceedings and lawsuits related to products, services, contracts, employment, environmental, safety, intellectual property and other matters. The ultimate resolution of such claims, proceedings, and lawsuits is inherently unpredictable and, as a result, the Company’s estimates of liability, if any, are subject to change. Actual results may materially differ from the Company’s estimates and an unfavorable resolution of any matter could have a material adverse effect on the financial condition, results of operations and/or cash flows of the Company. However, subject to the above and taking into account such amounts, if any, as are accrued from time to time on the Company’s balance sheet, the Company does not believe, based on the information currently available to it, that the

16

Table of Contents

ultimate resolution of these matters will have a material effect on the consolidated financial condition, results of operations or cash flows of the Company.

| Item 4. | Submission of Matters to a Vote of Security Holders |

No matters were submitted to a vote of OMNOVA Solutions’ security holders, through the solicitation of proxies or otherwise, during the quarter ended November 30, 2010.

| Item 4A. | Executive Officers of the Registrant |

The following information is given as of January 18, 2010, and except as otherwise indicated, each individual has held the same office during the preceding five-year period.

Kevin M. McMullen, age 50, Chairman of the Board, Chief Executive Officer and President of the Company since February 2001. Prior to that, Mr. McMullen served as Chief Executive Officer and President of the Company from December 2000 and as a Director from March 2000. From January 2000 until December 2000, Mr. McMullen served as President and Chief Operating Officer of the Company, and from September 1999 to January 2000, Mr. McMullen served as Vice President of the Company and President, Decorative & Building Products. Previously, Mr. McMullen was Vice President of GenCorp Inc. and President of GenCorp’s Decorative & Building Products business unit from September 1996 until the spin-off of OMNOVA Solutions in October 1999. Prior to that, Mr. McMullen was General Manager of General Electric Corporation’s Commercial & Industrial Lighting business from 1993 to 1996 and General Manager of General Electric Lighting’s Business Development and Strategic Planning activities from 1991 to 1993. Mr. McMullen was a management consultant with McKinsey & Co. from 1985 to 1991.

Michael E. Hicks, age 52, Senior Vice President and Chief Financial Officer of OMNOVA Solutions Inc. since its formation. Prior to the spin-off of OMNOVA Solutions in October 1999, Mr. Hicks served as Senior Vice President, Chief Financial Officer and Treasurer of GenCorp Inc. from February 1999 and as Treasurer of GenCorp from September 1994 to February 1999.

James C. LeMay, age 54, Senior Vice President, Business Development; General Counsel of OMNOVA Solutions Inc. since December 1, 2000; previously Senior Vice President, Law and General Counsel of OMNOVA Solutions Inc. since its formation. Prior to the spin-off of OMNOVA Solutions in October 1999, Mr. LeMay served as Assistant General Counsel of GenCorp Inc. from May 1997, and as Senior Counsel of GenCorp from May 1990 to May 1997.

Douglas E. Wenger, age 54, Senior Vice President and Chief Information Officer of the Company since November 2001. Prior to joining OMNOVA in October 2001, Mr. Wenger served as Director, Global I/T Strategy and Architecture from 2000 until 2001; as Global Program Director, Enterprise Business Applications from 1996 until 2000; Director, Business Information Development, Worldwide Research & Development from 1993 until 1996; and as Director, North American Information Systems and Database Development from 1991 until 1993, in each case for Kellogg Company, a manufacturer and marketer of ready-to-eat cereal and convenience foods.

James J. Hohman, age 62, Vice President of the Company since November 2001 and President, Performance Chemicals since February 2005; President, Paper & Carpet Chemicals from December 2000 until February 2005; Vice President, Specialty Chemicals from March 2000 until November 2000; and Vice President, Paper Chemicals from the spin-off of the Company from GenCorp Inc. in October 1999 until March 2000. Prior to the spin-off, Mr. Hohman served for GenCorp Inc. as Vice President, Paper Chemicals from November 1998 until October 1999 and as Director, Strategic Business Development, Performance Chemicals business unit from March 1996 until October 1998. Previously, Mr. Hohman held several key business and marketing management positions at BP Chemicals from 1982 until 1996, most recently serving as General Manager, Barex Resins.

Robert H. Coleman, age 56, President, Decorative Products since July 2003. Prior to joining OMNOVA, Mr. Coleman served as Vice President and General Manager, Graphics North America from 2000 until 2002; as Vice President and General

17

Table of Contents

Manager, Fasson Roll, Europe from 1997 until 2000; as Vice President and General Manager, Packaging and Product Identification Sector in 1997; and as Vice President and General Manager, Fasson Films Division from 1993 until 1997, in each case for Avery Dennison Corporation, Pasadena, California (a manufacturer of pressure-sensitive adhesives and materials and consumer and converted products).

Jay T. Austin, age 54, Vice President, Global Sourcing and Logistics, of the Company since December 2010. Prior to that he had served as Vice President, Strategic Sourcing for OMNOVA Solutions since August 2008. Prior to joining the Company, Mr. Austin had served as Vice President of Global Procurement for ICI Paints (a leading international paint business) since March 2006 and, prior to that, as Director of Purchasing, North America for The Glidden Company, a division of ICI Paints, since July 2002.

The Company’s executive officers generally hold terms of office of one year and/or until their successors are elected.

18

Table of Contents

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The Company’s common stock is listed on the New York Stock Exchange and trades under the symbol OMN. At November 30, 2010, there were 8,084 holders of record of the Company’s common stock. Information regarding the high and low quarterly sales prices of the Company’s common stock is contained in the Quarterly Financial Data (Unaudited) which appears on page 84 of this report and is incorporated herein by reference. The Company has not declared a dividend since 2001.

Information concerning long-term debt appears in Note K to the Consolidated Financial Statements and is incorporated herein by reference.

Information concerning securities authorized for issuance under the Company’s equity compensation plans is set forth in Equity Compensation Plan Information of Item 12 in this Annual Report on page 86 and is incorporated herein by reference.

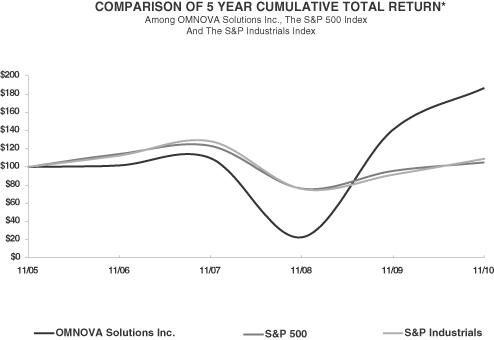

The following graph compares the cumulative five year total return provided shareholders on OMNOVA Solutions Inc.’s common stock relative to the cumulative total returns of the S&P 500 index and the S&P Industrials index. An investment of $100 (with reinvestment of all dividends) is assumed to have been made in our common stock and in each of the indexes on 11/30/2005 and its relative performance is tracked through 11/30/2010.

*The stock price performance included in this graph is not necessarily indicative of future stock price performance.

19

Table of Contents

| Item 6. | Selected Financial Data |

The following table sets forth the Company’s selected historical financial data. The selected historical financial data as of November 30, 2010, 2009, 2008, 2007, 2006 and for each of the five years in the period ended November 30, 2010 are derived from the Company’s audited consolidated financial statements.

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| (Dollars in millions, except per share data) | ||||||||||||||||||||

| Statement of operations data: |

||||||||||||||||||||

| Net Sales |

$ | 846.2 | $ | 696.4 | $ | 869.4 | $ | 745.5 | $ | 699.1 | ||||||||||

| Cost of goods sold(1) |

684.8 | 536.7 | 731.4 | 605.2 | 549.2 | |||||||||||||||

| Gross profit |

161.4 | 159.7 | 138.0 | 140.3 | 149.9 | |||||||||||||||

| Selling, general and administrative |

99.6 | 99.9 | 104.8 | 99.1 | 105.6 | |||||||||||||||

| Depreciation and amortization |

20.6 | 22.9 | 23.9 | 20.1 | 20.2 | |||||||||||||||

| Indefinite lived trademark impairments(2) |

— | — | — | — | 1.0 | |||||||||||||||

| Fixed asset impairment(3) |

6.2 | 1.1 | — | — | .1 | |||||||||||||||

| Restructuring and severance(4) |

.6 | 2.1 | .6 | 1.0 | 1.3 | |||||||||||||||

| Interest expense |

8.7 | 8.1 | 13.0 | 16.5 | 21.3 | |||||||||||||||

| Equity (earnings) loss in affiliates |

— | — | (.2 | ) | (1.2 | ) | (2.3 | ) | ||||||||||||

| Debt offering and redemption expense(5) |

— | — | — | 12.4 | — | |||||||||||||||

| Acquisition and integration related expense(6) |

5.5 | — | — | — | — | |||||||||||||||

| Other (income) expense, net(1)(8) |

1.7 | (2.3 | ) | (2.1 | ) | (.7 | ) | (.6 | ) | |||||||||||

| 142.9 | 131.8 | 140.0 | 147.2 | 146.6 | ||||||||||||||||

| Income (loss) from continuing operations before income taxes |

18.5 | 27.9 | (2.0 | ) | (6.9 | ) | 3.3 | |||||||||||||

| Income tax expense (benefit)(9) |

(89.4 | ) | 1.7 | .2 | .1 | .1 | ||||||||||||||

| Income (loss) from continuing operations |

107.9 | 26.2 | (2.2 | ) | (7.0 | ) | 3.2 | |||||||||||||

| Discontinued Operations, net of tax: |

||||||||||||||||||||

| Income (loss) from operations |

— | — | — | .3 | (.1 | ) | ||||||||||||||

| Gain on sale |

— | — | — | — | 18.2 | |||||||||||||||

| Income from discontinued operations |

— | — | — | .3 | 18.1 | |||||||||||||||

| Net income (loss) |

$ | 107.9 | $ | 26.2 | $ | (2.2 | ) | $ | (6.7 | ) | $ | 21.3 | ||||||||

| Basic income (loss) per share: |

||||||||||||||||||||

| Income (loss) from continuing operations |

$ | 2.42 | $ | .59 | $ | (.05 | ) | $ | (.17 | ) | $ | .08 | ||||||||

| Income from discontinued operations |

— | — | — | .01 | .44 | |||||||||||||||

| Net income (loss) per share |

$ | 2.42 | $ | .59 | $ | (.05 | ) | $ | (.16 | ) | $ | .52 | ||||||||

| Diluted income (loss) per share: |

||||||||||||||||||||

| Income (loss) from continuing operations |

$ | 2.40 | $ | .59 | $ | (.05 | ) | $ | (.17 | ) | $ | .08 | ||||||||

| Income from discontinued operations |

— | — | — | .01 | .43 | |||||||||||||||

| Net income (loss) per share |

$ | 2.40 | $ | .59 | $ | (.05 | ) | $ | (.16 | ) | $ | .51 | ||||||||

| General: |

||||||||||||||||||||

| Capital expenditures |

$ | 14.8 | $ | 10.4 | $ | 14.8 | $ | 16.2 | $ | 13.0 | ||||||||||

| Total assets |

$ | 726.0 | $ | 338.0 | $ | 351.6 | $ | 326.4 | $ | 338.9 | ||||||||||

| Long-term debt(7) |

$ | 389.4 | $ | 140.8 | $ | 182.1 | $ | 144.6 | $ | 165.0 | ||||||||||

| Cash(7) |

$ | 328.7 | $ | 41.5 | $ | 17.4 | $ | 12.6 | $ | 26.4 | ||||||||||

| (1) | During 2010, the Company recognized strike-related costs of $5.5 million of which $3.3 million is recorded in cost of products sold and $2.2 million is recorded in other (income) expense. |

| (2) | During 2006, the Company recorded indefinite-lived intangible asset impairment charges of $1.0 million. |

| (3) | During 2010, the Company recorded asset impairment charges of $6.2 million to write-down machinery and equipment at its Columbus, Mississippi plant to fair value. During 2009, the Company recorded asset impairment charges of $1.1 million related to assets that would no longer be utilized due to moving certain production to other facilities. |

20

Table of Contents

| (4) | Restructuring and severance consisted primarily of severance costs of $0.6 million in 2010, $2.1 million in 2009, costs for the closure of an extrusion facility and severance costs in 2008, severance costs in 2007, severance costs and asset write-downs and costs for the closure of a European sales office in 2006. |

| (5) | On May 22, 2007, the Company entered into a $150 million Term Loan Credit Agreement (“Term Loan”). Proceeds of the Term Loan, along with cash and other resources of the Company were used to redeem the Company’s $165 Million 11 1/4% Senior Secured Notes. Additionally, the Company paid $9.8 million in premium and tender fees and wrote off $2.6 million of deferred financing costs. |

| (6) | During 2010, the Company recognized acquisition and integration costs of $5.5 million related to the pending purchase of Eliokem International SAS, which was acquired on December 9, 2010. |

| (7) | During 2010, in connection with the pending acquisition of Eliokem International SAS, the Company issued $250 million of Senior Notes, the proceeds of which were held in escrow as of November 30, 2010, and subsequently used on December 9, 2010 to fund the acquisition. |

| (8) | During 2010, the Company recorded a charge of $9.2 million for a fair value adjustment on a foreign currency collar and recorded a gain of $9.7 million from the dissolution of a joint venture marketing alliance |

| (9) | During 2010, the Company reversed a significant portion of its deferred tax valuation allowance of $98.2 million. |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Overview