Attached files

| file | filename |

|---|---|

| EX-1.1 - China For-Gen Corp. | v208850_ex1-1.htm |

| EX-23.1 - China For-Gen Corp. | v208850_ex23-1.htm |

|

As

filed with the Securities and Exchange Commission on January 24,

2011

|

Registration

No. 333-166868

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

AMENDMENT

NO. 7 TO

FORM

S-1/A

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

CHINA

FOR-GEN CORP.

(Exact

name of registrant as specified in its charter)

Delaware

(State

or other jurisdiction of incorporation or organization)

800

(Primary

Standard Industrial Classification Code Number)

11-3840621

(IRS

Employer Identification No.)

Tengao

District, Haicheng City

Liaoning

Province, P.R.China 114000

+0412-2988160

( Address, including zip code, and

telephone number,

including area code, of

registrant’ s principal

executive offices )

Sherry

Li

c/o

China For-Gen Corp.

87

Dennis Street

Garden

City Park, NY 11040

(212)

240-0707

(Name,

address, including zip code, and telephone number,

including

area code, of agent for service)

|

Copies to

:

|

Copies to

:

|

|

|

Barry

I. Grossman, Esq.

|

Mitchell

Nussbaum, Esq.

|

|

|

Adam

Mimeles, Esq.

|

Giovanni

Caruso, Esq.

|

|

|

Ellenoff

Grossman & Schole LLP

|

Loeb

& Loeb LLP

|

|

|

150

East 42 nd

Street

|

345

Park Avenue

|

|

|

New

York, NY 10017

|

New

York, NY 10154

|

|

|

Tel:

(212) 370-1300

|

Tel:

(212) 407-4159

|

|

|

Fax:

(212) 370-7889

|

Fax:

(212) 407-4990

|

Approximate date of commencement of

proposed sale to the public : As soon as practicable after the

Registration Statement has been declared effective.

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the

following box: x

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. ¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. ¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. ¨

Indicate by check

mark whether the registrant is a large accelerated filer, an accelerated filer,

a non-accelerated filer, or a smaller reporting company. See the definitions of

“large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer ¨

|

Accelerated

filer ¨

|

|

Non-accelerated filer (Do not check if a smaller

reporting company) ¨

|

Smaller reporting company

x

|

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be registered

|

Amount to be

Registered(1)(4)

|

Proposed

maximum

offering

price per

share(1)

|

Proposed

maximum

aggregate

offering price

(1)

|

Amount of

registration

fee

|

||||||||||||

|

Common

stock, par value $0.001 per share

|

4,600,000

|

(2)

|

$

|

6.00

|

$

|

27,600,000

|

$

|

3,204.36

|

||||||||

|

Common

stock, par value $0.001 per share (3)

|

8,068,698

|

6.00

|

48,412,188

|

5,620.66

|

||||||||||||

|

Total

|

12,668,698

|

6.00

|

$

|

76,012,188

|

$

|

8,825.02

|

(5)

|

|||||||||

|

(1)

|

The registration fee for

securities to be offered by the Registrant is based on an estimate of the

Proposed Maximum Aggregate Offering Price of the securities, and such

estimate is solely for the purpose of calculating the registration fee

pursuant to Rule 457(o). Includes shares which the underwriter has

the option to purchase to cover

over-allotments.

|

|

(2)

|

Includes 600,000 shares of common

stock, which may be sold upon exercise of a 45-day option granted to the

Underwriter to cover over-allotments if

any.

|

|

(3)

|

Reflects shares of common stock

being registered for resale by the selling stockholders set forth

herein.

|

|

(4)

|

Pursuant to Rule 416, this

registration statement also covers such number of additional ordinary

shares to prevent dilution resulting from stock splits, stock dividends

and similar

transactions.

|

|

(5)

|

Previously

paid.

|

The

Registrant amends this registration statement on such date or dates as may be

necessary to delay its effective date until the Registrant shall file a further

amendment which specifically states that this registration statement shall

hereafter become effective in accordance with Section 8(a) of the Securities Act

of 1933, or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to Section 8(a),

may determine.

Explanatory

Note

This

Registration Statement contains two prospectuses, as set forth

below.

|

|

·

|

Public

Offering Prospectus

. A prospectus to be used for the public offering by the Registrant

of up to 4,000,000 shares of the Registrant’s common stock (in addition,

up to 600,000 shares of the Registrant’s common stock may be sold upon

exercise of the underwriters’ over-allotment option (the “Public Offering

Prospectus”) through the underwriter named on the cover page of the Public

Offering Prospectus.

|

|

|

·

|

Resale

Prospectus . A

prospectus to be used for the resale by the selling stockholders set forth

therein of an aggregate of 8,068,698 of the Registrant’s common stock, of

which 2,370,947 are currently issued and outstanding and 5,697,751 are

issuable upon (i) conversion of outstanding preferred stock and

convertible promissory notes and (ii) exercise of outstanding warrants

(the “Resale Prospectus”).

|

The

Resale Prospectus is substantively identical to the Public Offering Prospectus,

except for the following principal points:

|

|

·

|

they contain different outside

and inside front covers and back

covers;

|

|

|

·

|

they contain different offering

sections than in the Prospectus Summary section beginning on page 1 (page

SS-1);

|

|

|

·

|

they contain different Use of

Proceeds sections (page

SS-1);

|

|

|

·

|

a Selling Stockholders section is

included in the Resale Prospectus (page

SS-2);

|

|

|

·

|

references in the Public Offering

Prospectus to the Resale Prospectus will be deleted from the Resale

Prospectus;

|

|

|

·

|

the Underwriting section from the

Public Offering Prospectus on page 77 is deleted from the Resale

Prospectus and a Plan of Distribution is inserted in its place (page

SS-5); and

|

|

|

·

|

the Legal Matters section in the

Resale Prospectus on page SS-6 deletes the reference to counsel for the

underwriters.

|

The

Registrant has included in this Registration Statement a set of alternate pages

after the back cover page of the Public Offering Prospectus (the “Alternate

Pages”) to reflect the foregoing differences in the Resale Prospectus as

compared to the Public Offering Prospectus. The Public Offering Prospectus will

exclude the Alternate Pages and will be used for the public offering by the

Registrant. The Resale Prospectus will be substantively identical to the Public

Offering Prospectus except for the addition or substitution of the Alternate

Pages and will be used for the resale offering by the selling

stockholders.

2

The

information in this preliminary prospectus is not complete and may be changed.

We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This preliminary prospectus is

not an offer to sell these securities and is not soliciting an offer to buy

these securities in any state where the offer or sale is not

permitted.

|

Preliminary

Prospectus

|

Subject

To Completion, Dated [ ],

2011

|

CHINA

FOR-GEN CORP.

4,000,000 SHARES OF COMMON STOCK

We are

offering 4,000,000 shares of common stock, $0.001 par value per

share. Prior to this offering, there has been no public market for our

securities. The public offering price of the shares was determined by

negotiation between us and the underwriters.

The

maximum public offering price of the common stock is expected to be not

less than $4 and not more than $6 per share. We intend to apply to

have our shares listed on the NYSE AMEX Stock Exchange concurrent with this

offering.

The

purchase of the securities involves a high degree of risk. See section

entitled “Risk Factors” beginning on page 8.

|

Per Share

|

Total

|

|||||||

|

Public

offering price

|

$

|

4.00

– 6.00*

|

$

|

16,000,000 – 24,000,000

|

||||

|

Underwriting

discounts and commissions

|

$

|

0.32

– 0.48

|

$

|

1,280,000

– 1,920,000

|

||||

|

Non-

accountable expense (1)

|

$

|

0.04

– 0.06

|

$

|

160,000

– 21,840,000

|

||||

|

Proceeds,

to China For-Gen Corp.

|

$

|

3.64

– 5.46

|

$

|

14,560,000

– 21,840,000

|

||||

____________________________________

* The

range of the maximum offering price is based on bona fide estimate pursuant to

Item 501(b)(3) of Regulation S-K.

(1) The

non-accountable expense allowance of 1.0% of the gross proceeds of the offering

is not payable with respect to the shares sold upon exercise of the

underwriters’ over-allotment option.

The

underwriters have a 45-day option to purchase up to 600,000 additional

shares of common stock from us solely to cover over-allotments, if

any.

The

underwriters expect to deliver the shares to purchasers on or about [

], 2011.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission

has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal

offense.

Maxim

Group LLC

The

date of this prospectus is [ ],

2011

3

TABLE

OF CONTENTS

|

Prospectus

Summary

|

6

|

|

The

Offering

|

9

|

|

Risk

Factors

|

12

|

|

Cautionary

Note Regarding Forward-Looking Statements and Other Information

Contained in this Prospectus

|

27

|

|

Use

of Proceeds

|

27

|

|

Dividend

Policy

|

28

|

|

Capitalization

|

29

|

|

Market

Price of and Dividends of Common Equity and Related Stockholder

Matters

|

30

|

|

Determination

of Offering Price

|

30

|

|

Dilution

|

31

|

|

Exchange

Rate Information

|

32

|

|

Selected

Consolidated Financial and Operating Data

|

33

|

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

34

|

|

Industry

Overview

|

43

|

|

Business

|

49

|

|

Facilities

|

51

|

|

Legal

Proceedings

|

56

|

|

Our

History and Corporate Structure

|

58

|

|

Directors

and Executive Officers

|

61

|

|

Executive

Compensation

|

64

|

|

Security

Ownership of Certain Beneficial Owners and Management

|

65

|

|

Certain

Relationships and Related Transactions

|

66

|

|

Description

of Our Securities

|

67

|

|

Shares

Eligible for Future Sale

|

69

|

|

Material

PRC Income Tax Considerations

|

70

|

|

Underwriting

|

72

|

|

Transfer

Agent and Registrar

|

76

|

|

Legal

Matters

|

76

|

|

Experts

|

76

|

|

Interests

of Named Experts and Counsel

|

76

|

|

Service

of Process and Enforcement of Judgments

|

76

|

|

Where

You Can Find More Information

|

77

|

|

Disclosure

of Commission Position on Indemnification for Securities Act

Liabilities

|

78

|

|

Index

to Financial Statements

|

F-1

|

4

ABOUT

THIS PROSPECTUS

You

should rely only on the information contained in this prospectus. We have not

authorized anyone to provide you with any information or to make any

representations about us, the securities or any matter discussed in this

prospectus, other than the information and representations contained in this

prospectus. If any other information or representation is given or made,

such information or representation may not be relied upon as having been

authorized by us.

The

information contained in this prospectus is accurate only as of the date of this

prospectus, regardless of the time of delivery of this prospectus or of any sale

of our common stock. Neither the delivery of this prospectus nor any

distribution of securities in accordance with this prospectus shall, under any

circumstances, imply that there has been no change in our affairs since the date

of this prospectus. This prospectus will be updated and updated prospectuses

made available for delivery to the extent required by the federal securities

laws.

5

PROSPECTUS

SUMMARY

This

summary highlights selected information appearing elsewhere in this prospectus.

While this summary highlights what we consider to be the most important

information about us, you should carefully read this prospectus and the

registration statement of which this prospectus is a part in their entirety

before investing in our securities, especially the risks of investing in our

securities, which we discuss later in the section of this prospectus

entitled “Risk Factors,” and our consolidated financial statements and

related notes beginning on page F-1.

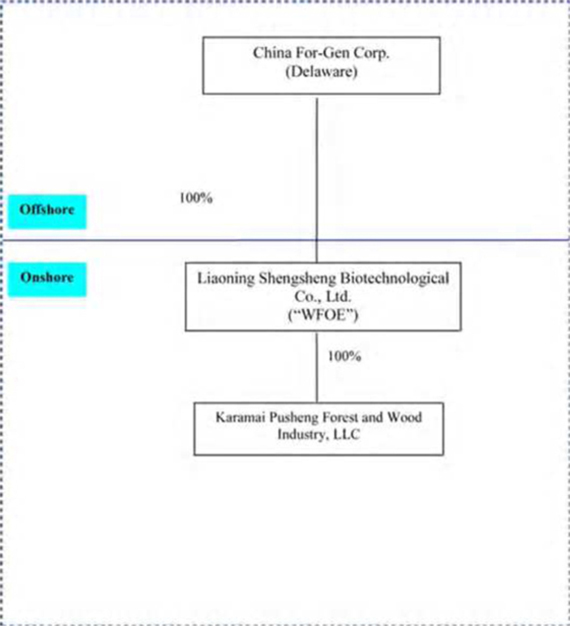

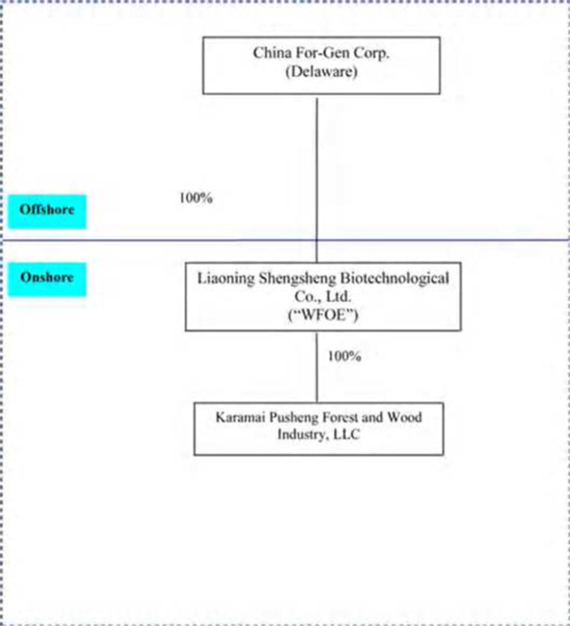

Unless

otherwise specified or required by context, references to “we,” “our,” “us” and

the “Company” refer collectively to China For-Gen Corp., a Delaware corporation

(“China For-Gen”), and the subsidiaries of China For-Gen Corp., which are (i)

Liaoning Shengsheng Biotechnological Co., Ltd., a PRC company formerly known as

Anshan Xinfang Gardening Limited Company (“Liaoning Shengsheng” or the “WFOE”),

which is wholly owned by China For-Gen, and (ii) Karamai Pusheng Forest and Wood

Industry, LLC, a PRC limited liability company (“Pusheng”), which is wholly

owned by Liaoning Shengsheng Biotechnological Co., Ltd. For convenience, certain

amounts in Chinese Renminbi (“RMB”) have been converted to United States dollars

at an exchange rate in effect at the date of the related financial

statements. Assets and liabilities are translated at the exchange rate as

of balance sheet date. Income and expenditures are translated at the average

exchange rate of the period.

This

prospectus assumes the over-allotment has not been exercised, unless otherwise

indicated. Share numbers included herein reflect the 1:1.5 reverse stock

split of all of the Company’s outstanding common stock, which occurred on May

12, 2010, unless otherwise indicated.

Our

Company

China

For-Gen Corp. is a Delaware corporation formed on February 26, 2008 solely

for the purpose of acquiring all of the equity interests of Liaoning Shengsheng,

a company incorporated in the People’s Republic of China (“China” or the “PRC”)

on November 24, 2000. Since its inception, Liaoning Shengsheng has been an

agricultural and forestry company engaged in the breeding, cloning and sale of

plant seedlings and specialized transgenic plant seedlings, and the research and

development of seedling breeding technologies.

The

Company’s primary product is fast growing poplar saplings, which are grown in

the far northwest regions of China, in Xinjiang province near the city of

Karamai. The Company grows two distinct types of poplar saplings:

Shengsheng No. 1 and Shengsheng No. 2. Each product is separated into 5

different subcategories (1-5 years old trees) according to their age.

These varieties of poplar trees have been genetically modified for faster

growth, pest resistance, low water requirements and high fiber strength.

The poplar seedlings mature in 3-5 years instead of the normal maturation time

of 13-15 years. The saplings are sold primarily to distributors who then

resell our products to independent third parties for various uses, including

re-forestation in western China. As of December 31, 2009, our plantations

under management had an area of approximately 8,900 mu in Xinjiang

Province. Internally generated cash flow and the potential capital from

this offering are expected to finance the Company’s operations and future

business plans, all as set forth herein . For its 2009 fiscal year, the

Company’s two major clients were Karamai Teng Lin Farming Co., Ltd. and Liaoning

Dongran Landscape Engineering Co., Ltd. (each of which are independent third

party distributors), contributing 53.37% and 29.94%, respectively, of the

Company’s 2009 revenues. Through the first three quarters of the Company’s

fiscal 2010 year, these clients accounted for 62% and 30%, respectively, of the

Company’s revenues.

The

Company is growing in the forestry/lumber industry. The majority of revenues

currently come from the sale of poplar saplings. For the calendar year

ended 2009 the Company generated $23,615,957 in revenue and $12,795,675 in net

income versus 2008 revenue of $22,146,254 and net income of $6,688,771.

For the nine months ended September 30, 2010, the Company generated revenues of

$16,288,827 and net income of $9,833,662 versus $12,922,412 and $4,670,646,

respectively, during the first nine months of 2009.

Our

Industry

Due

to increasing demand, China can no longer rely on importing timber to meet its

needs. The “2009

National Forestry Economy Performance” from the State Forestry Administration

(SFA) of the PRC, estimated the value of China’s forestry industry output in

2009 amounted to RMB 1.58 trillion (approximately $2.3 billion), up

approximately 10% from 2008, but grew at a slower pace than in prior

years. According to Zhang Jianlong, deputy administrator of the SFA,

China’s total timber consumption will increase to between 457 and 477

million m 3 by

2020. Additionally, Mr. Zhang of the SFA believes it is urgent to

promote domestic timber supply, allocate new land areas for wood and timber

production and improve forest management.

According

to the latest national forest inventory released by the SFA of the PRC on

January 28, 2010, China’s total forest cover is 195 million hectares, accounting

for 20% of China’s total land area, with 13.7 billion m 3 standing

wood stock volume. In recent years, China has been aggressive in its

reforestation efforts and conversion of agricultural land to forests through the

implementation of its National Forest Protection Program.

6

Domestic

consumption of timber and wood products is expected to grow between 2010 and

2012 in line with social and economic development. The National Plan for

Conservation and Utilization of Forest Land projects China’s forestry area will

reach 223 million hectares and standing wood stock will reach 15.8 billion m

3 by

2020.

Competitive

Strengths

While the

Chinese forestry industry is highly competitive, we believe that the following

strengths give us a competitive edge:

|

|

·

|

our proprietary technology allows

us to breed faster growing, disease resistant

trees;

|

|

|

·

|

our ability to select, culture

and grow our nursery stock and to scale these processes as our production

capacity increases ;

|

|

|

·

|

we have strategically located

production bases;

|

|

|

·

|

our expansion strategy seeks to

create a vertically integrated operator in our industry , handling all

aspects of forest, lumber and wood production, from seedling production

and plantation, through growth management and harvesting, to lumber

processing and production and sale of MDF and other wood products ;

and

|

|

|

·

|

we have an experienced management

team.

|

Strategies

Our goal

is to become a vertically integrated operator in the lumber and wood products

industry. To achieve our goals, we intend to:

|

|

·

|

expand existing seedling

operations and plantations;

|

|

|

·

|

develop new

plantations;

|

|

|

·

|

enter the lumber processing and

manufacturing market through potential acquisitions;

and

|

|

|

·

|

enter into manufacturing and

production of medium density fiberboard

(MDF);

|

Funds

from this offering should accelerate our business strategy. We further

anticipate that internally generated cash flow over the next 18 months will help

complement and finance our growth plans. A more detailed description of

our business and strategy is located in the “Description of Business”

section.

Risks

and Challenges

Our

business is subject to numerous risks, as more fully described in the section

entitled “Risk Factors” immediately following this prospectus summary.

These include:

|

|

·

|

our dependence on poplar saplings

and trees;

|

|

|

·

|

extreme weather conditions,

natural disasters and potential impacts on our

plantations;

|

|

|

·

|

political issues associated with

doing business inside the

PRC;

|

|

|

·

|

inflationary pressures and

potential adverse impact on our prices inside the PRC;

and

|

|

|

·

|

our ability to comply with U.S.

public reporting requirements, including maintenance of an effective

system of internal controls over financial

reporting.

|

Structure

In

connection with the acquisition of the WFOE, certain officers and directors of

Lioaning Shengsheng (the “Call Option Stockholders”) entered into a call option

agreement (the “Call Option Agreement”) with Ms. Sherry Li (“Ms. Li”), then the

sole officer, director and shareholder of China For-Gen, wherein Ms. Li agreed

to transfer 12,000,000 shares of Company common stock to the Call Option

Stockholders after our initial public offering. The call option may be

exercised by the Call Option Stockholders for nominal consideration of $0.001

per share (the “Call Option”). The Call Option Agreement provides that Ms.

Li may not dispose of any China For-Gen shares owned by her without the prior

written consent of the Call Option Stockholders. The Call Option Agreement

was amended and restated in its entirety on May 12, 2010 to comply with PRC

laws, including, without limitation, laws with respect to acquisitions by

foreign entities and ownership by PRC citizens in a foreign enterprise (the

“Amended Call Option Agreement”). The percentage ownership of the Company

to be granted to the Call Option Stockholders remains unchanged. On

December 31, 2010, the Call Option Stockholders exercised their rights under the

Amended Call Option Agreement with respect to 50% of the shares an d they have

indicated that they intend to exercise their rights with respect to the

remaining 50% on or by December 31, 2011. Upon exercise of the Call

Option, neither the ownership structure of the Company nor the number of shares

of Company common stock outstanding changed or will change from the current

structure as the shares underlying the Call Option are currently issued and

outstanding and beneficially owned by the Call Option Stockholders. Please

see the section titled “ Security Ownership of Certa

in Beneficial Owners and

Management ” on page 59 for the percentage ownership of Company common

stock owned by the Call Option Stockholders.

7

Our post

initial public offering organization structure is summarized below:

8

Company

Information

Our

executive offices are located at Tengao District, Haicheng City, Liaoning

Province, PRC 114000 and our telephone number is 0412-2988160. The website of

our primary operating subsidiary is http://www.biosheng.com. Information

contained on or accessed through our website is not intended to constitute and

shall not be deemed to constitute part of this prospectus.

THE

OFFERING

|

Securities

offered:

|

4,000,000

shares of common stock, with an over-allotment option for an additional

600,000 shares, plus an additional 8,068,698 shares to be registered by

the selling stockholders listed herein.

|

|

|

Common

stock outstanding before the offering:

|

14,270,948

shares

|

|

|

Common

stock to be outstanding after the offering:

|

18,870,948

shares (1)

|

|

|

Offering

price:

|

The

maximum public offering price of the common stock is expected to be

not less than $4 and not more than $6 per

share.

|

|

|

Use

of proceeds:

|

We

intend to use the net proceeds from the offering substantially as

follows:

|

|

|

·

approximately $3.18 million to pay the remaining unpaid purchase price to

the original Liaoning Shengsheng shareholders (the “Shengsheng

Shareholders”) who shall immediately transfer such amount to Liaoning

Shengsheng for working capital purposes, which may include acquisitions in

the ordinary course of business; and

|

||

|

·

approximately $5.03 million to expand and construct our Karamai MDF

production facilities; and

|

||

|

·

approximately $3-$5 million to pay the balance for the acquisition of

Beijisong, with the final price to be determined by an appraisal of

Beijisong to be conducted in early 2011 (as set forth herein). This

estimate is based in part on our estimation that (i) Beijisong owns net

assets worth not more than $6.6 million, (ii) we are only purchasing 80%

of Beijisong, (iii) we have already paid $877,693 for such acquisition and

(iv) we may also purchase additional raw materials owned by Beijisong;

and

|

||

|

·

approximately $2.64 million to pay for the acquisition of Yuying (as set

forth herein); and

|

||

|

·

approximately $1.5 million to be used as working capital for Beijisong and

Yuying after their respective acquisitions; and

|

||

|

·

approximately $2.0 million for transaction expenses related to this

offering; and

|

||

|

·

approximately $1.0 million for an escrow account to fund the initial

expenses of being a public company; and

|

||

|

·

the remaining balance to expand our poplar seedling business and for

working capital and general corporate purposes.

|

||

|

The

amount and timing of our actual expenditures will depend on numerous

factors, including the status of our acquisition and development efforts,

sales and marketing activities, and the amount of cash generated or used

by our operations. We may find it necessary or advisable to use

portions of the proceeds for other purposes, and we will have broad

discretion in the application of the net proceeds. Additionally, we may

choose to expand our current business through acquisition of complimentary

businesses using cash or shares, as set forth herein. However, we

have not entered into any negotiations, agreements or commitments with

respect to any such acquisitions at this time. See the section of this

prospectus entitled “Use of Proceeds” for more information on

the use of proceeds.

|

||

|

The

$1,000,000 escrow account established to fund the initial expenses of

being a public company will be controlled by the Company and funds shall

be disbursed as and when needed for, among other things, legal and

accounting fees, insurance and directors’

compensation.

|

9

|

Risk

factors:

|

Investing

in our securities involves a high degree of risk. As an investor you

should be able to bear a complete loss of your investment. You should

carefully consider the information set forth in the section of this

prospectus entitled “Risk Factors.”

|

|

|

Listing

|

We

intend to apply to have our common stock listed on the NYSE AMEX under the

symbol CFG.

|

(1)

The number of shares of common stock to be outstanding immediately after this

offering is based on 14,270,948 shares of common stock outstanding as of January

24, 2011 and includes (i) 600,000 shares, which may be sold upon exercise of a

45-day option granted to the underwrit er to cover over-allotments and (ii)

416,667 shares issued in January, 2010 upon cashless exercise of the warrants

issued in our May 30, 2008 private placement, but excludes:

|

|

·

|

444,119 shares of our common

stock issuable upon conversion of Series A Convertible Preferred Stock

issued May 30, 2008;

|

|

|

·

|

5,186,965 shares of common

stock issuable upon the conversion of those certain convertible

promissory notes and warrants issued pursuant to the Note Purchase

Agreement between us and certain investors dated February 12, 2010 and

August 10, 2010; and

|

|

|

·

|

66,667 shares of common stock

issuable upon the conversion of warrant issued to an

investor.

|

10

SUMMARY

CONSOLIDATED FINANCIAL AND OPERATING DATA

The

following table is derived from and summarizes the relevant financial data for

our business and should be read in conjunction with our audited financial

statements and the related notes, which are included elsewhere in this

prospectus and which account for the 1:1.5 reverse stock split of all of the

Company’s outstanding common stock, which occurred on May 12, 2010.

|

Year ended

|

Year ended

|

Nine months

Ended

|

Nine months

Ended

|

|||||||||||||

|

December 31,

|

December 31,

|

September 30,

|

September 30,

|

|||||||||||||

|

2009

|

2008

|

2010

|

2009

|

|||||||||||||

|

Sales

revenues

|

$

|

23,615,957

|

$

|

22,146,254

|

$

|

16,288,827

|

$

|

12,922,412

|

||||||||

|

Cost

of goods sold

|

$

|

6,351,073

|

$

|

10,428,042

|

$

|

3,485,125

|

$

|

5,201,809

|

||||||||

|

Gross

profit

|

$

|

17,264,884

|

$

|

11,718,212

|

$

|

12,803,702

|

$

|

7,720,603

|

||||||||

|

Operating

expenses

|

||||||||||||||||

|

Selling

expense

|

$

|

3,561,550

|

$

|

4,206,849

|

$

|

1,729,768

|

$

|

2,562,828

|

||||||||

|

General

and administrative expenses

|

$

|

912,870

|

$

|

830,813

|

$

|

1,019,482

|

$

|

491,064

|

||||||||

|

Total

operating expenses

|

$

|

4,474,020

|

$

|

5,037,662

|

$

|

2,749,250

|

$

|

3,053,892

|

||||||||

|

Net

operating income

|

$

|

12,790,464

|

$

|

6,680,550

|

$

|

10,054,452

|

$

|

4,666,711

|

||||||||

|

Other

income (expense)

|

||||||||||||||||

|

Interest

income

|

$

|

5,211

|

$

|

8,221

|

$

|

7,793

|

$

|

4,180

|

||||||||

|

Gain

on change of fair value of derivative liabilities

|

$

|

149,644

|

-

|

|||||||||||||

|

Interest

expense

|

$

|

(376,623

|

)

|

-

|

||||||||||||

|

Other

expense

|

$

|

(1,514

|

)

|

(245

|

)

|

|||||||||||

|

Total

other income (expense)

|

$

|

5,211

|

$

|

8,221

|

$

|

(220,790

|

)

|

$

|

3,935

|

|||||||

|

Net

income before taxes

|

$

|

12,796,075

|

$

|

6,688,771

|

$

|

9,833,662

|

$

|

4,670,646

|

||||||||

|

Taxes

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||||

|

Net

income

|

$

|

12,795,675

|

$

|

6,688,771

|

$

|

9,833,662

|

$

|

4,670,646

|

||||||||

|

Foreign

Currency Translation Adjustment

|

$

|

34,412

|

$

|

1,138,567

|

$

|

843,976

|

$

|

(3,026

|

)

|

|||||||

|

Comprehensive

Income

|

$

|

12,830,087

|

$

|

7,827,338

|

$

|

10,677,638

|

$

|

4,667,620

|

||||||||

|

Balance Sheet Data (at end of Period)

|

December 31

|

September 30,

|

||||||||||

|

2009

|

2008

|

2010

|

||||||||||

|

Cash

|

$

|

843,358

|

$

|

612,971

|

$

|

8,689,839

|

||||||

|

Total

Current Assets

|

$

|

28,258,086

|

$

|

21,552,444

|

$

|

34,459,079

|

||||||

|

Total

Assets

|

$

|

30,981,287

|

$

|

24,529,932

|

$

|

40,293,467

|

||||||

|

Total

Liabilities

|

$

|

1,556,016

|

$

|

1,796,182

|

$

|

4,277,596

|

||||||

|

Total

Stockholder's Equity

|

$

|

29,424,671

|

$

|

22,733,750

|

$

|

36,015,871

|

||||||

|

Total

Liabilities & Shareholder's Equity

|

$

|

30,981,287

|

$

|

24,529,932

|

$

|

40,293,467

|

||||||

11

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. You should

carefully consider the risks described below and the other information contained

in this prospectus before deciding to invest in our common stock. Our business,

financial condition or results of operations could be materially adversely

affected by any of these risks. The trading price of our securities could

decline due to any of these risks, and you may lose all or part of your

investment.

Risks

Associated With Our Business

Our

limited operating history may not serve as an adequate basis to judge our future

prospects and results of operations.

We have

only limited audited financial results on which you can evaluate us and our

operations. We have operated our business in our current corporate

structure only since April 2000 and are subject to, and may be

unable to address, the risks typically encountered by companies operating in a

rapidly evolving marketplace, including those risks relating to:

|

|

·

|

the failure to develop brand name

recognition and reputation;

|

|

|

·

|

the failure to achieve market

acceptance of our products;

|

|

|

·

|

an inability to grow and adapt

our business and technology to evolving consumer

demand.

|

If we are

unable to address any or all of these or related risks, our business and results

of operations may be materially and adversely affected.

Our operating

results may fluctuate, which makes our results difficult to predict and could

cause our results to fall short of expectations .

Our

operating results may fluctuate as a result of a number of factors, many outside

of our control. As a result, comparing our operating results on a

period-to-period basis may not be meaningful, and you should not rely on our

past results as an indication of our future performance. Our quarterly,

year-to-date and annual expenses as a percentage of our revenues may differ

significantly from our historical or projected rates. Because our business

is changing and evolving, our historical operating results may not be useful to

you in predicting our future operating results.

Our

operating results in future quarters may fall below expectations. Any of these

events could cause our stock price to fall. Each of the risk factors listed

in this prospectus, as well as the following factors, may affect

our operating results:

|

|

·

|

our ability to continue to

develop fast growing poplar

saplings;

|

|

|

·

|

the results of the implementation

of our intended business

plan;

|

|

|

·

|

the quality of our

products;

|

|

|

·

|

our ability to generate

revenue;

|

|

|

·

|

the amount and timing of

operating costs and capital expenditures related to the maintenance and

expansion of our businesses, operations and

infrastructure;

|

|

|

·

|

our focus on long-term goals over

short-term results; and

|

|

|

·

|

our ability to keep our

facilities operational at a reasonable

cost.

|

We

are dependent on a single product for substantially all of our

revenues.

Our

revenues are substantially dependent on our fast growing poplar saplings, which

account for 99% of our business revenue. These trees are grown in the far

northwest regions of China, in Xinjiang province near the city of Karamai and we

grow two distinct types of poplar saplings: Shengsheng No. 1 and Shengsheng No.

2. No assurances can be given that customers and potential customers will

continue to seek our genetically modified poplar saplings. For example,

other products may be introduced into the marketplace which our customers prefer

or there may be other reasons, many of which are expected to be beyond our

control, for a switch away from our products. In the event sales of our

saplings decrease, our revenue, results of operations and future growth

prospects can be expected to be materially harmed. Accordingly, unless and

until we diversify and expand our product offerings, our future success will

significantly depend upon our genetically modified poplar saplings.

12

Because

of the capital-intensive nature of our business, we may have to incur additional

indebtedness or issue new equity securities, and if we are not able to obtain

additional capital our ability to operate or expand our business may be impaired

and our results of operations could be adversely affected.

We

require significant levels of capital to acquire additional forest area, to

finance the development of our facilities and for the construction and

acquisition of new facilities, and we therefore expect we will need additional

capital, over and above what we raise in this offering, to fund our future

growth. If cash from available sources is insufficient or unavailable due

to restrictive credit markets, or if cash is used for unanticipated needs, we

may require additional capital sooner than anticipated. Our ability to obtain

additional capital on acceptable terms or at all is subject to a variety of

uncertainties, including:

|

|

·

|

investors’ perceptions of, and

demand for, companies in the Chinese timber

industry;

|

|

|

·

|

investors’ perceptions of, and

demand for, companies operating in

China;

|

|

|

·

|

conditions of the U.S. and other

capital markets in which we may seek to raise

funds;

|

|

|

·

|

our future results of operations,

financial condition and cash

flows;

|

|

|

·

|

governmental regulation of

foreign investment in China;

|

|

|

·

|

economic, political and other

conditions in the United States, China, and other countries;

and

|

|

|

·

|

governmental policies relating to

foreign currency borrowings.

|

|

|

·

|

In the event we are required or

choose to raise additional funds, we may be unable to do so on favorable

terms or at all.

|

We may be

required to pursue sources of additional capital through various means,

including joint venture projects and debt or equity financings. There is

no assurance we will be able to secure suitable financing in a timely fashion or

at all. In addition, there is no assurance we will be able to obtain the

capital we require by any other means. Future financings through equity

investments are likely to be dilutive to our existing stockholders. Also,

the terms of securities we may issue in future capital transactions may be more

favorable for our new investors. Newly issued securities may include

preferences, superior voting rights, the issuance of warrants or other

derivative securities, and the issuances of incentive awards under equity

employee incentive plans, which may have additional dilutive effects.

Further, we may incur substantial costs in pursuing future capital and/or

financing, including investment banking fees, legal fees, accounting fees,

printing and distribution expenses and other costs. We may also be

required to recognize non-cash expenses in connection with certain securities we

may issue, such as convertible promissory notes and warrants, which will

adversely impact our financial condition.

If we

cannot raise additional funds on favorable terms or at all, we may not be able

to carry out all or parts of our strategy to maintain our growth and

competitiveness or to fund our operations. If the amount of capital we are

able to raise from financing activities, together with our revenues from

operations, is not sufficient to satisfy our capital needs, even to the extent

that we reduce our operations accordingly, we may be required to cease

operations.

Our

revenues are highly dependent on a limited number of customers and the loss of

any one of our major customers could materially and adversely affect our growth

and our revenues.

During

the years ended December 31, 2009 and 2008, our two largest customers

collectively accounted for 87% and 69%, respectively, of our accounts receivable

and 81% and 94% of total sales, respectively. As a result of our

reliance on a limited number of customers, we may face pricing and other

competitive pressures which may have a material adverse effect on our growth and

our revenues. We do not have an exclusivity arrangement with any of our

customers. In addition, there are a number of factors, other than our

performance, that could cause the loss of a customer or a substantial reduction

in revenue from any single customer and that may not be predictable. For

example, the government could determine not to make utilization of forestry

resources a high priority or may reduce the sale and license of forestry

resources to private businesses. The loss of any one of our major

customers can be expected to result in a decrease in our sales volume and could

materially adversely affect our growth and our revenues. Moreover, the

loss of any one of our major customers could require us to layoff employees,

which in turn could make it more difficult for us to attract and retain

professionals in the future, which could further materially adversely affect our

growth and our revenues. If our customers seek to negotiate their

agreements on terms less favorable to us and we accept such unfavorable terms,

such unfavorable terms may have a material adverse effect on our business,

financial condition and results of operations. Accordingly, unless and

until we diversify and expand our customer base, our future success will

significantly depend upon the timing and volume of business from our largest

customers.

13

We

do not have any current sales contracts with our customers.

All of

our sales contracts are seasonal in nature and are generally valid for less than

nine months. We customarily execute contracts in the late summer or early

fall. Such contracts typically require performance by all parties not later than

May, at which time the contracts terminate. Accordingly, as of the

date hereof, we do not have sales contracts with any of our customers, and there

is no assurance that our customers will enter into new agreements with us in the

future. Failure to enter into any such contracts would significantly

reduce our revenue.

We

may not be able to attract and retain a sufficient number of clients to maintain

or expand our business.

Our

business depends on our ability to attract and retain clients, and we cannot

assure you that our marketing efforts will lead to more companies purchasing our

genetically modified saplings. In the event we are successful in acquiring

additional forest area, in developing our timber processing operations or in our

manufacturing of MDF, we will need to find substantial sources of revenue for

each of these business operations as well. There are numerous factors that

could lead to a decline in business or a failure to obtain clients for our

expanded operations, including general economic conditions, market maturity or

saturation, a decline in our ability to deliver quality products at a

competitive price, direct and indirect competition and a decline in the demand

for timber and manufactured wood products. Any decrease in our client base

or any failure to attract clients to our new businesses may adversely impact our

operating margins and future growth prospects.

If

we do not continue to develop new products or if our products do not continue to

appeal to the market, we may not remain competitive, and our revenues and

operating results could suffer.

The

genetically modified saplings that we offer are subject to changing customer

demands. Our future operational and financial performance depends on our ability

to develop and market new services and products and to enhance our existing

services and products, each on a timely basis to respond to new and evolving

customer demands, to achieve market acceptance and keep pace with new

developments. We may be unable to develop, introduce on a timely basis (or

at all) or market any new or enhanced services or products, and we cannot assure

you that any new or enhanced services or products will appeal to the

market. Our failure to develop new services and products and to enhance

our existing services and products or the failure of our services and products

to continue to appeal to the market could have an adverse impact on our

business, financial condition, results of operations and future operating

prospects.

We

may be unable to make acquisitions or enter into joint ventures, which could

impair our growth prospects, and we may be unable integrate, operate or realize

the anticipated benefits of such businesses.

As part

of our growth strategy, we intend to pursue selected acquisitions or joint

ventures. We cannot assure you we will be able to effect these transactions on

commercially reasonable terms, or at all. Any future acquisitions or joint

ventures may require access to additional capital, and we cannot assure you we

will have access to such capital on commercially reasonable terms, or at all.

Even if we enter into these transactions, we may not realize the benefits we

anticipate or we may experience difficulties in integrating any acquired

companies and products into our existing business; attrition of key personnel

from acquired businesses; significant charges or expenses; higher costs of

integration than we anticipate; or unforeseen operating difficulties that

require significant financial and managerial resources that would otherwise be

available for the ongoing development or expansion of our existing

operations.

Consummating

these transactions could also result in the incurrence of additional debt and

related interest expense, as well as unforeseen contingent liabilities, all of

which could have a material adverse effect on our business, financial condition

or results of operations. We may also issue additional equity in connection with

these transactions, which would dilute our existing stockholders.

We

may not obtain the government approvals necessary to build our planned

manufacturing facility in Karamai, which could impair our future growth

prospects.

Karamai,

China is located in Xinjiang Province. Local lumber supply is imported

from other provinces and countries and the resulting transportation costs makes

the final product very expensive. In order to reduce this cost, the

Karamai city government established a new fast-growing forest base of 100,000 mu

(one mu is equal to 1/6 of one acre) for industrial use located in Xinjiang

province. On November 1, 2005, the Karamai Developing Planning Commission

approved Pusheng to establish an MDF facility capable of producing 80,000 cubic

meters of MDF using poplar and other trees provided from this fast-growing

forest base. However, this government approval to build the plant has

expired. While we believe Pusheng will receive the proper government

approvals and permits necessary to build the facility at such time as we are

ready to do so, no assurances thereof can be given. In the event we are

unable to obtain the necessary government approvals, our expansion plans may be

harmed and accordingly, our future growth prospects may be more limited

than if we were to receive such approval.

14

We

face competition from other research and development companies and timber

processing companies which could erode our market share, brand recognition and

profitability.

We face

formidable competition in every aspect of our business, and particularly from

other timber processors and wood products manufacturers. Our competitors

may be better capitalized, have more experience and have more established or

deeper relationships with relevant government authorities, vendors, suppliers,

distributors or customers than us. Our competitors may make acquisitions

or invest more aggressively in marketing or product development. We cannot

assure you our competitors will not attempt to copy our business model, or

portions thereof, and that this will not erode our market share and brand

recognition, and impair our growth rate and profitability. If our

competitors are able to provide similar or better services and products than

ours, we could experience a significant decline in revenue. Any such

decline could negatively affect our profitability and future growth prospects.

Third

parties may infringe on our brand and other intellectual property rights, and we

may be unable to protect ourselves against such infringement for competitive and

legal reasons, any of which could have a material adverse impact on our

business.

We do not

currently hold any registered trademarks or patents for our products, names or

symbols. Moreover, intellectual property rights and related laws in China are

still developing, and there are uncertainties involved in the protection and the

enforcement of such rights. There is a risk that third parties may

infringe on, misappropriate or misuse our brand and other intellectual property

rights. If we are unable to protect or enforce our intellectual property

rights, the value of our brand, services and products could be diminished and

our business may suffer. Our precautions may not prevent misappropriation

of our intellectual property. Any legal action that we may bring to protect our

brand and other intellectual property may not achieve the desired results, may

be very expensive and could divert management’s attention from other business

concerns.

Our

failure to protect our intellectual property rights under applicable law could

lead to the loss of a competitive advantage that could not be compensated by our

damages award.

We

may be sued by third parties who claim that our products, and formulations,

methods of manufacture or methods of use infringe on their intellectual property

rights.

We may be

exposed to future litigation by third parties based on claims that our

technologies, processes, formulations, methods or products infringe the

intellectual property rights of others or that we have misappropriated the trade

secrets of others. Any litigation or claims against us, whether or not

valid, would result in substantial costs, could place a significant strain on

our financial and human resources and could harm our reputation. Such a

situation may force us to do one or more of the following:

|

|

·

|

incur significant costs in legal

expenses for defending against an intellectual property infringement

suit;

|

|

|

·

|

cease selling, making, importing,

incorporating or using one or more or all of our technologies and/or

formulations or products that incorporate the challenged intellectual

property, which would adversely affect our

revenue;

|

|

|

·

|

obtain a license from the holder

of the infringed intellectual property right, which license may be costly

or may not be available on reasonable terms, if at all;

or

|

|

|

·

|

redesign our formulations or

products, which would be costly and

time-consuming.

|

Moreover,

the possibility exists that a patent could be issued that would cover one or

more of our products, requiring us to defend a patent infringement suit or

necessitating a patent validity challenge that would be costly, time consuming

and possibly unsuccessful. If a lawsuit were to be filed against us for patent

infringement, we would incur significant legal costs to defend

ourselves.

If

we fail to effectively manage our anticipated growth, our business and operating

results could be adversely effected.

We intend

to pursue a strategy of growth and expansion that is expected to place strain on

our management personnel, systems and resources. To accommodate our

intended growth, we anticipate that we will need to implement a variety of new

and upgraded research and development, manufacturing and processing and other

operational facilities, as well as financial systems, procedures and

controls and the improvement of our accounting and other internal management

systems, all of which require substantial management efforts and financial

resources. We will also need to continue to expand, train, manage and

motivate our workforce, and develop and manage our relationships with our

existing and target client base. All of these endeavors will require

substantial management effort and skills, and the incurrence of additional

expenditures. We cannot assure you we will be able to efficiently or

effectively implement our growth strategies and manage the growth of our

operations, and any failure to do so may limit our future growth and hamper our

business strategy.

We

depend on key personnel and our business may be severely disrupted if we lose

the services of our key executives and employees.

Our

future prospects are heavily dependent upon the continued service of our key

executives, particularly Mr. Baoquan Wang, our President and Chairman, and a

major shareholder of our company. We rely on his expertise in our business

operations, and on the personal relationships he has with the relevant

regulatory authorities, customers and suppliers. On January 1, 2010

we renewed employment agreements with our key officers through December 31,

2012, but we have not entered into non-competition or non-solicitation

agreements with our officers. If one or more of our key executives and employees

are unable or unwilling to continue in their present positions, we may not be

able to replace them easily and our business may be severely disrupted. In

addition, if any of our key executives or employees joins a competitor or forms

a competing company, we may lose customers and suppliers and incur additional

expenses to recruit and train personnel. Further, we do not maintain key-man

life insurance for any of our key executives.

15

We

rely on highly skilled personnel and if we are unable to retain or motivate key

personnel or hire qualified personnel, we may not be able to grow

effectively.

Our

performance largely depends on the talents and efforts of highly skilled

individuals. Our continued ability to compete effectively depends on our

ability to attract, retain and motivate our existing personnel. The market

for highly skilled personnel is highly competitive as a result of the limited

availability of such personnel. The inability to hire or retain such qualified

personnel may hinder our ability to implement our business strategy and may harm

our business.

We

rely on third party service or product providers and research partners and the

failure of these third parties to deliver high level of service and support

required in our business or the loss of a relationship with them will adversely

impact our business and future operating prospects.

Our

ability to increase sales, retain current and future memberships and strengthen

our brand will depend in part upon our relationships with third parties,

including the various government agencies that purchase our services. The

termination of these relationships could lead to the loss of a competitive

advantage or even the loss of customers and revenue. Moreover, if such

third parties are unable to satisfy their commitments to us, our business would

also be adversely affected. Additionally, due to our association with such

third parties, poor performance by our strategic partners outside of their

relationship with us, a decline in the quality of the products supplied by them

or deterioration of their reputation or other negative publicity about them

could adversely impact our reputation and business performance.

Because

we may not be able to obtain business insurance in the PRC, we may not be

protected from risks that are customarily covered by insurance in the United

States.

Business

insurance is not readily available in the PRC and we may suffer a loss of a type

which would normally be covered by insurance in the United States, such as

business interruption insurance and third party liability insurance to cover

claims related to personal injury, or property damage arising from

accidents during our operations. We would incur significant expenses in both

defending any action and in paying any claims that result from a settlement or

judgment. We have not obtained fire or casualty insurance, and there is no

insurance coverage for our equipment, furniture and buildings in China.

Any losses incurred by us will have to be borne by us without any assistance,

and we may not have sufficient capital to cover material damage to, or the loss

of, our facility due to fire, severe weather, flood or other cause, and such

damage or loss would have a material adverse effect on our financial condition,

business and prospects.

We

could be subject to claims related to health or safety risks.

Our

timber harvesting, processing and manufacturing business, if and when entered

into, may pose potential health or safety risks to our employees and there is a

risk that claims will be asserted against us for injury or death. Personal

injury claims and lawsuits can result in significant legal defense costs,

settlement amounts and awards, and could have an adverse effect on our business,

financial condition and result of operations or cash flow. In addition to

the risks of liability exposure and increased costs of defense, claims may

produce publicity that could hurt our reputation and business.

If we fail to

establish and maintain an effective system of internal controls, we may not be

able to report our financial results accurately or to prevent fraud. Any

inability to report and file our financial results accurately and timely could

harm our business and adversely impact the trading price of our common

stock .

We are

required to establish and maintain internal controls over financial reporting,

disclosure controls, and to comply with other requirements of the Sarbanes-Oxley

Act of 2002 (the “Sarbanes-Oxley Act”) and the rules promulgated by the SEC

thereunder. Our management, including our Chief Executive Officer and Chief

Financial Officer, cannot guarantee that our internal controls and disclosure

controls will prevent all possible errors or all fraud. A control system, no

matter how well conceived and operated, can provide only reasonable, not

absolute, assurance that the objectives of the control system are met. In

addition, the design of a control system must reflect the fact that there are

resource constraints and the benefit of controls must be relative to their

costs. Because of the inherent limitations in all control systems, no system of

controls can provide absolute assurance that all control issues and instances of

fraud, if any, within our company have been detected. These inherent limitations

include the realities that judgments in decision-making can be faulty and that

breakdowns can occur because of simple error or mistake. Further, controls can

be circumvented by individual acts of some persons, by collusion of two or more

persons, or by management override of the controls. The design of any system of

controls also is based in part upon certain assumptions about the likelihood of

future events, and there can be no assurance that any design will succeed in

achieving its stated goals under all potential future conditions. Over time, a

control may become inadequate because of changes in conditions or the degree of

compliance with policies or procedures may deteriorate. Because of inherent

limitations in a cost-effective control system, misstatements due to error or

fraud may occur and may not be detected.

As of

September 30, 2010, our management has not conducted a comprehensive review to

determine whether our internal control over financial reporting has significant

deficiencies. However, we lack sufficient personnel with the appropriate

level of knowledge, experience and training in the application of US generally

accepted accounting principles (“GAAP”) standards, especially related to

complicated accounting issues. This could cause us to be unable to

fully identify and resolve certain accounting and disclosure issues that could

lead to a failure to maintain effective controls over preparation, review and

approval of certain significant account reconciliation from Chinese GAAP to US

GAAP and necessary journal entries. We have a relatively complicated corporate

structure, which consists of multiple facilities and subsidiaries. The

relatively small number of professionals we employ in our bookkeeping and

accounting functions prevents us from appropriate segregating duties within our

internal control system. The inadequate segregation of duties is a

weakness because it could lead to the untimely identification and resolution of

accounting and disclosure matters or could lead to a failure to perform timely

and effective reviews.

16

To date,

we have not determined whether our internal controls over financial reporting

are sufficient, nor have we undertaken any remedial steps to remedy the

deficiencies set forth above. In the event our review demonstrates further

internal control deficiencies, any remedial measures we undertake may be

insufficient to address our material weaknesses, and there can be no assurance

that significant deficiencies or material weaknesses in our internal controls

over financial reporting will not be identified or occur in the future. If

additional material weaknesses or significant deficiencies in our internal

controls are discovered or occur in the future, we may fail to meet our future

reporting obligations on a timely basis, our consolidated financial statements

may contain material misstatements, we may be required to again restate our

prior period financial results, we may be subject to litigation and/or

regulatory proceedings, and our business and operating results may be

harmed.

The

legal requirements associated with being a public company, including those

contained in and issued under the Sarbanes-Oxley Act, may make it difficult for

us to retain or attract qualified officers and directors, which could adversely

affect the management of our business and our ability to obtain or retain

listing of our common stock.

We may be

unable to attract and retain qualified officers, directors and members of our

board of directors and committees required to provide for our effective

management because of the rules and regulations that govern publicly held

companies, including, but not limited to, certifications by principal executive

officers. The actual and perceived personal risks associated with

compliance with the Sarbanes-Oxley Act and other public company requirements may

deter qualified individuals from accepting roles as directors and executive

officers. Further, the requirements for board or committee membership,

particularly with respect to an individual’s independence and level of

experience in finance and accounting matters, may make it difficult to attract

and retain qualified board members. If we are unable to attract and retain

qualified officers and directors, the management of our business and our ability

to obtain or retain the listing of our common stock on any stock exchange

(assuming we are able to obtain such listing) could be adversely

affected.

Our

business will suffer if we cannot obtain, maintain or renew necessary permits or

licenses.

All PRC

enterprises in the timber industry are required to obtain from various PRC

governmental authorities certain permits and licenses, including, without

limitation, a License of Forest Seed Distribution, a License of Forest Seed

Production and an Urban Landscaping Enterprise Qualification Certificate.

We have obtained permits and licenses required for Forest Seed Distribution and

Production and Urban Landscaping. Failure to obtain all necessary

approvals/permits may subject us to various penalties, such as fines or being

required to vacate from the facilities where we currently operate our business

or even cease operations.

These

permits and licenses are subject to periodic renewal and/or reassessment by the

relevant PRC government authorities and the standards of compliance required in

relation thereto may from time to time be subject to change. We intend to apply

for renewal and/or reassessment of such permits and licenses when required by

applicable laws and regulations; however, we cannot assure you we can obtain,

maintain or renew the permits and licenses or accomplish the reassessment of

such permits and licenses in a timely manner. Any changes in compliance

standards, or any new laws or regulations that may prohibit or render it more

restrictive for us to conduct our business or increase our compliance costs may

adversely affect our operations or profitability. Any failure by us to obtain,

maintain or renew the licenses, permits and approvals, may have a material

adverse effect on the operation of our business. In addition, we may not be able

to carry on business without such permits and licenses being renewed and/or

reassessed.

There

are unique risks in the MDF industry that we may not face in the seedling and

harvesting industries.

In

addition to investing in the construction of manufacturing facilities, there are

also other investments related to land acquisition, environmental impact

assessment, infrastructure construction, transportation, product and

environmental testing and quality assurance, among others. Accordingly,

entering the MDF processing industry involves financial risks and unique

obstacles than the other industries in which we are already active, i.e. the

forestry and seedling industries.

Risks

Relating to the Our Corporate Structure

We

are a holding company that depends on cash flow from its subsidiaries to meet

our obligations.

We are a

holding company with no material assets other than the stock of Liaoning

Shengsheng, which conducts all our operations. We currently expect that

the earnings and cash flow of Liaoning Shengsheng will primarily be retained and

used for their continued business operations.

17

Our

controlling shareholder has potential conflicts of interest with our company

which may adversely affect our business.

Mr.

Baoquan Wang is our primary controlling shareholder as well as our chairman and

president. Given his significant interest in our company, there is a risk

that when conflicts of interest arise, Mr. Wang will not act completely in the

best interests of our stockholders (as opposed to his personal interest) or that

conflicts of interests will be resolved in our favor.

Additionally,

in the event you believe your rights have been infringed under the securities

laws or otherwise as a result of any one of the circumstances described above,