Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Aptalis Pharma Inc | d8k.htm |

EXHIBIT 99.1

Summary of Anticipated Acquisition Benefits

We believe the acquisition of Eurand will enable us to (i) leverage the combination of two leading specialty pharmaceutical players; (ii) expand our gastroenterology product portfolio through the addition of ZENPEP; (iii) meaningfully diversify our business; (iv) provide us with a proprietary R&D growth engine and technology platforms supported by an extensive patent portfolio; and (v) expand our geographic and manufacturing footprint.

We believe that the acquisition of Eurand will provide us with several strategic and financial benefits, including the following:

| • | Meaningfully diversify our revenues and expand our product offering by the addition of Eurand’s pharmaceutical technologies business and ZENPEP (Pancrelipase) Delayed-Release Capsules, a leading high-growth PEP currently marketed by Eurand in the United States: |

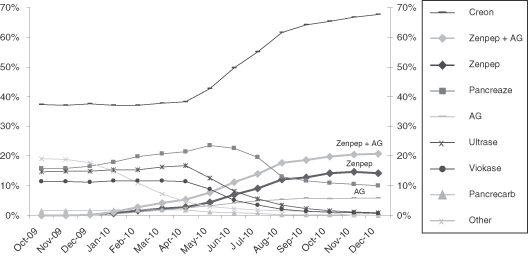

| • | As one of only three FDA approved PEPs on the market, the ZENPEP franchise has successfully captured approximately 20% of the U.S. pancrelipase prescription market share as of December 31, 2010, according to IMS data. |

| • | In addition to the current FDA guidelines requiring that all pancrelipase products be subject to the NDA pathway to regulatory approval, ZENPEP was granted regulatory exclusivity as an NCE through August 2014. Furthermore, it is anticipated to maintain patent exclusivity at least through 2028 in the United States. |

| PEP Market Share(1) |

|

|

Source: IMS Health.

(1) Represents TRx market share. |

| • | Create significant synergy opportunities. We previously identified significant cost-saving opportunities with respect to Axcan. In addition, we have identified further cost synergies expected to be achieved in connection with the acquisition of Eurand. In total, we expect to achieve approximately $54.0 million in pre-tax cost-savings. We expect to realize these cost-savings by eliminating certain costs from a number of operating functions, including those reflected in Cost of Goods Sold, Research and Development, Sales and Marketing and General and Administrative (see footnote h to the Adjusted EBITDA reconciliation table included in footnote 3 to “Summary Historical Consolidated and Unaudited Pro Forma Condensed Consolidated Financial Data”); |

| • | Add proprietary R&D capabilities, pharmaceutical technologies and a patent portfolio. Eurand offers 3 pharmaceutical formulation platforms, 8 technologies, and has approximately 350 issued patents and 350 pending applications; |

| • | Increase operating leverage through a combination of higher top-line growth and margin expansion; |

| • | Enhance organic growth and maintain strong free cash flow; and |

| • | Leverage the combined company’s GI presence. |

The combined company will be led by seasoned Axcan management and operational teams with a long track record of successfully growing acquired products, and enhanced by Eurand leadership, with successful records of delivering top and bottom line growth. We believe that the addition of members of Eurand’s commercial team and portfolio of products should enable us to increase operating leverage and accelerate the launch of ZENPEP into U.S. and European markets.

The Transactions

On November 30, 2010, Axcan Holdings Inc., a Delaware corporation and indirect parent company of the Issuer (“Holdings”), and Axcan Pharma Holding B.V., a Dutch private limited liability company and wholly-owned indirect subsidiary of the Issuer (“Axcan AcquisitionCo”), entered into a Share Purchase Agreement, which was subsequently amended by Amendment No. 1 to Share Purchase Agreement, dated as of December 16, 2010 (as amended from time to time, the “Share Purchase Agreement”), with Eurand, pursuant to which Axcan AcquisitionCo has agreed to commence a tender offer (the “Offer”) to acquire all of the outstanding ordinary shares of Eurand, par value €0.01 per share (the “Eurand Shares”), for a purchase price of $12.00 per share in cash (the “Per Share Offer Price”), or approximately $586.5 million in the aggregate on a fully-diluted basis.

Axcan AcquisitionCo commenced the Offer on December 21, 2010. The Offer was initially scheduled to expire on January 21, 2011, but has been extended until 12:00 midnight (New York City time) on February 3, 2011. It may be, and, upon Eurand’s request, is required to be, further extended if at any scheduled expiration time of the Offer any of the conditions to the closing of the Offer has not been satisfied or waived and under certain other circumstances.

The closing of the Offer is subject to a number of conditions, including the tender of a minimum of 80% of Eurand Shares, receipt of antitrust approvals (which have now been obtained) and other customary closing conditions. The 80% threshold may be reduced to a percentage threshold of at least 50.1% of Eurand Shares by agreement of the parties to the Share Purchase Agreement. Certain significant shareholders and senior management who own approximately an aggregate of 54.6% and 3.7% of the Eurand Shares, respectively, have entered into agreements pursuant to which they are obligated, subject to the provisions of those agreements, to tender their Eurand Shares into the Offer.

Upon the closing of the Offer, Eurand will become a majority-owned indirect subsidiary of the Issuer. At or in connection with the closing of the Offer, Axcan AcquisitionCo (or one or more of Axcan AcquisitionCo and other direct or indirect subsidiaries of the Issuer) (such applicable entity or entities, “Axcan SPV”) will acquire from Eurand substantially all of Eurand’s assets, including the capital stock of Eurand’s direct and indirect U.S. and foreign subsidiaries, in exchange for a seller note in an amount equal to the product of the number of all outstanding Eurand Shares at the closing of the Offer multiplied by the Per Share Offer Price. Substantially contemporaneously therewith, Axcan SPV will, directly or indirectly, transfer the capital stock of former Eurand U.S. subsidiaries to the Issuer.

Following the closing of the Offer, Axcan AcquisitionCo will provide for a subsequent Offer period of at least ten business days. Upon expiration of the subsequent Offer period, Axcan AcquisitionCo will repay the seller note in an amount (the “Remaining Shareholder Cash”) equal to the number of outstanding Eurand Shares that remain untendered following the expiration of the subsequent Offer period multiplied by the Per Share Offer Price. Thereafter, Eurand will hold no assets other than the Remaining Shareholder Cash and the seller note. Eurand will then be dissolved, the seller note will be extinguished, and the Remaining Shareholder Cash will be distributed to the Eurand shareholders who have not tendered their shares pursuant to the Offer or during the subsequent Offer period. The seller note will be distributed to Axcan AcquisitionCo as part of the dissolution of Eurand and then cancelled.

In order to finance the acquisition, investment funds affiliated with TPG Capital (the “Sponsors”) and certain co-investors (the “co-investors”) will directly or indirectly make cash equity contributions to the Issuer and/or its direct or indirect subsidiaries in an aggregate amount of no less than 22.5% of the amount necessary to purchase all Eurand Shares pursuant to the Offer, assuming 100% Eurand Shares are tendered at the Per Share Offer Price, and we are issuing the Secured Notes and entering into a $225 million senior secured term loan facility (as described elsewhere in this report under “Description of Other Indebtedness—Amended and Restated Senior Secured Credit Facilities”). We will use the proceeds of these equity and debt financings, together with cash on hand of Axcan and Eurand, to fund the acquisition, to repay Eurand’s debt, to repay the outstanding term loan portion of our existing senior secured credit facilities and to pay related fees and expenses.

We refer to the acquisition of Eurand described above and the related transactions, including the offer and sale of the Secured Notes, the Offer, the execution of our amended and restated senior secured credit facilities and any borrowings thereunder, the equity investment by the Sponsors and the co-investors, and the payment of any related fees and expenses as the “Transactions.”

Summary Historical Consolidated and

Unaudited Pro Forma Condensed Consolidated Financial Data

The following summary historical consolidated financial data for each of the years in the three-year period ended September 30, 2010 and as of September 30, 2009 and 2010 have been derived from our audited consolidated financial statements. The summary historical consolidated financial data as of February 25, 2008 (Predecessor) and September 30, 2008 (Successor) has been derived from audited consolidated financial statements. The audited consolidated financial statements for each of the years in the three-year period ended September 30, 2010 and as of September 30, 2009 and 2010 have been audited by Raymond Chabot Grant Thornton LLP, an independent registered public accounting firm. Historical results are not necessarily indicative of the results to be expected for future periods.

The summary unaudited pro forma condensed consolidated financial data as of and for the twelve-month period ended September 30, 2010 has been prepared to give effect to the Transactions in the manner described under “Unaudited Pro Forma Condensed Consolidated Financial Statements” and the notes thereto as if they had closed on October 1, 2009 in the case of the summary unaudited pro forma condensed consolidated statement of operations data, and on September 30, 2010 in the case of the summary unaudited pro forma condensed consolidated balance sheet data. The pro forma adjustments related to the Transactions are preliminary and are based upon available information and certain assumptions that we believe are reasonable. The actual adjustments will be made as of the closing date of the Transactions (the “Closing Date”) and may differ from those reflected in the summary unaudited pro forma condensed consolidated financial data presented below. Such differences may be material. Furthermore, as we expect to continue to obtain additional information to assist in determining the fair value of the net assets acquired as a result of the Transactions, such estimates may be revised in future periods during the measurement period permitted under U.S. GAAP (up to one year from the date of the closing of the Transactions). Any such revisions may materially affect the presentation of our consolidated financial data. The summary unaudited pro forma condensed consolidated financial data is for illustrative and informational purposes only and do not purport to represent what our results of operations, balance sheet data or other financial information actually would have been if the Transactions had actually closed on the dates indicated, and such data do not purport to project the results of operations for any future period or as of any future date.

The financial information presented for the Predecessor is the financial information for Axcan Pharma Inc. and its consolidated subsidiaries and the financial information presented for the Successor is the financial information for Axcan Intermediate Holdings Inc. and its consolidated subsidiaries.

The summary historical consolidated and unaudited pro forma condensed consolidated financial data should be read in conjunction with “The Transactions” and “Unaudited Pro Forma Condensed Consolidated Financial Statements” appearing elsewhere in this report and Axcan’s and Eurand’s audited and unaudited consolidated financial statements and related notes included in their respective filings with the SEC.

| Predecessor | Successor | |||||||||||||||||||||||

| October 1, 2007 through February 25, |

February 26, through |

Fiscal Years Ended September 30, |

Pro Forma Twelve-Month Period Ended September 30, |

|||||||||||||||||||||

| 2008 | 2008 | 2009 | 2010 | 2010(8) | ||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| ($ in thousands) | ($ in thousands) | |||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||

| Net product sales |

$ | 158,579 | $ | 223,179 | $ | 409,826 | $ | 354,587 | (7) | $ | 503,998 | |||||||||||||

| Other revenue |

— | — | 7,113 | — | — | |||||||||||||||||||

| Total revenue |

158,579 | 223,179 | 416,939 | 354,587 | 503,998 | |||||||||||||||||||

| Cost of goods sold(1) |

38,739 | 77,227 | 103,023 | 130,915 | 139,102 | |||||||||||||||||||

| Selling and administrative expenses(1)(2) |

76,198 | 88,246 | 122,942 | 115,033 | 181,868 | |||||||||||||||||||

| Management fees |

— | 99 | 5,351 | 4,412 | 4,368 | |||||||||||||||||||

| Research and development expenses(1) |

10,256 | 17,768 | 36,037 | 31,715 | 59,718 | |||||||||||||||||||

| Depreciation and amortization |

9,595 | 35,579 | 60,305 | 61,011 | 94,884 | |||||||||||||||||||

| Acquired in-process research |

— | 272,400 | — | 7,948 | 7,948 | |||||||||||||||||||

| Impairment of intangible assets and goodwill |

— | — | 55,665 | 107,158 | 107,158 | |||||||||||||||||||

| Other expenses |

— | — | — | — | 1,250 | |||||||||||||||||||

| Operating income (loss) |

23,791 | (268,140 | ) | 33,616 | (103,605 | ) | (92,298 | ) | ||||||||||||||||

| Financial expenses |

262 | 41,513 | 69,809 | 64,956 | 93,356 | |||||||||||||||||||

| Interest income |

(5,440 | ) | (808 | ) | (389 | ) | (688 | ) | (161 | ) | ||||||||||||||

| Other income |

— | — | (3,500 | ) | (9,704 | ) | (9,704 | ) | ||||||||||||||||

| Loss (gain) on foreign currencies |

(198 | ) | (1,841 | ) | (328 | ) | 1,247 | 339 | ||||||||||||||||

| Income (loss) before income taxes |

29,167 | (307,004 | ) | (31,976 | ) | (159,416 | ) | (176,128 | ) | |||||||||||||||

| Income taxes (benefit) |

12,042 | (17,740 | ) | (24,082 | ) | 10,950 | 1,238 | |||||||||||||||||

| Net income (loss) |

$ | 17,125 | $ | (289,264 | ) | $ | (7,894 | ) | $ | (170,366 | ) | $ | (177,366 | ) | ||||||||||

| Balance Sheet Data (at period end): |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 348,791 | $ | 56,105 | $ | 126,435 | $ | 161,503 | $ | 11,031 | ||||||||||||||

| Short-term investments, available for sale |

— | — | — | — | 25,214 | |||||||||||||||||||

| Total current assets |

471,170 | 176,980 | 250,682 | 226,749 | 164,643 | |||||||||||||||||||

| Total assets |

902,384 | 944,812 | 914,602 | 713,177 | 1,268,037 | |||||||||||||||||||

| Total short-term borrowings |

373 | 10,938 | 30,708 | 13,163 | 2,250 | |||||||||||||||||||

| Total debt |

441 | 622,184 | 613,294 | 594,475 | 909,265 | |||||||||||||||||||

| Total current liabilities |

166,456 | 99,300 | 121,022 | 111,329 | 131,385 | |||||||||||||||||||

| Total liabilities |

206,983 | 779,142 | 750,838 | 734,209 | 1,163,565 | |||||||||||||||||||

| Total shareholders’ equity (deficit) |

695,401 | 165,670 | 163,764 | (21,032 | ) | 104,472 | ||||||||||||||||||

| Statement of Cash Flows Data: |

||||||||||||||||||||||||

| Net cash from (used in): |

||||||||||||||||||||||||

| Operating activities |

$ | 73,245 | $ | (47,512 | ) | $ | 92,382 | $ | 63,120 | — | ||||||||||||||

| Investing activities |

126,630 | (961,556 | ) | (10,600 | ) | (6,058 | ) | — | ||||||||||||||||

| Financing activities |

(31,243 | ) | 1,066,053 | (11,594 | ) | (21,338 | ) | — | ||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||

| EBITDA(3) |

33,584 | (230,720 | ) | 97,749 | (34,137 | ) | 11,951 | |||||||||||||||||

| Adjusted EBITDA(3) |

70,119 | 84,539 | 172,828 | 162,397 | 218,391 | |||||||||||||||||||

| Cash interest expense(4) |

83,623 | |||||||||||||||||||||||

| Ratio of pro forma Adjusted EBITDA to pro forma cash interest expense(3)(4) |

2.61 | x | ||||||||||||||||||||||

| Ratio of pro forma secured debt to pro forma Adjusted EBITDA(3)(5) |

3.10 | x | ||||||||||||||||||||||

| Ratio of pro forma total debt to pro forma Adjusted EBITDA(3)(6) |

4.15 | x | ||||||||||||||||||||||

| (1) | Exclusive of depreciation and amortization. |

| (2) | Amounts shown for the fiscal year ended September 30, 2007, five-month period ended February 25, 2008, seven-month period ended September 30, 2008, and for the fiscal year ended September 30, 2009 include expenses related to the February 2008 acquisition of Axcan Pharma Inc. Amount shown for the fiscal year ended September 30, 2010 includes reorganization, special projects and due diligence costs. |

| (3) | EBITDA and Adjusted EBITDA are both non-U.S. GAAP financial measures and are presented in this report because our management considers them important supplemental measures of our performance and believes that they are frequently used by interested parties in the evaluation of companies in the industry. EBITDA, as we use it, is net income before financial expenses, interest income, income taxes and depreciation and amortization. We believe that the presentation of EBITDA enhances an investor’s understanding of our financial performance. We believe that EBITDA is a useful financial metric to assess our operating performance from period to period by excluding certain items that we believe are not representative of our core business. The term EBITDA is not defined under U.S. GAAP, and EBITDA is not a measure of net income, operating income or any other performance measure derived in accordance with U.S. GAAP, and is subject to important limitations. Adjusted EBITDA, as we use it, is EBITDA adjusted to exclude certain non-cash charges, unusual or non-recurring items and other adjustments set forth below. We believe that the inclusion of supplementary adjustments applied to EBITDA in presenting Adjusted EBITDA are appropriate to provide additional information to investors about certain material non-cash items and unusual or non-recurring items that we do not expect to continue in the future and to provide additional information with respect to our ability to meet our future debt service requirements. Adjusted EBITDA is not a measure of net income, operating income or any other performance measure derived in accordance with U.S. GAAP, and is subject to important limitations. EBITDA and Adjusted EBITDA have limitations as an analytical tool, and they should not be considered in isolation, or as substitutes for analysis of our results as reported under U.S. GAAP. Some of these limitations are: |

| • | EBITDA and Adjusted EBITDA do not reflect all cash expenditures, future requirements for capital expenditures, or contractual commitments; |

| • | EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, working capital needs; |

| • | EBITDA and Adjusted EBITDA do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; |

| • | Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements; |

| • | Adjusted EBITDA reflects additional adjustments as provided below; and |

| • | Other companies in our industry may calculate EBITDA and Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. |

Because of these limitations, EBITDA and Adjusted EBITDA should not be considered as measures of discretionary cash available to us to invest in our business. Our management compensates for these limitations by relying primarily on the U.S. GAAP results and using EBITDA and Adjusted EBITDA as supplemental information. A reconciliation of net income under U.S. GAAP to EBITDA and from EBITDA to Adjusted EBITDA is presented below for the periods indicated:

| Predecessor | Successor | |||||||||||||||||||

| October 1, 2007 through February 25, |

February 26, 2008 through September 30, |

Fiscal Years Ended September 30, |

Pro Forma Twelve-Month Period Ended September 30, |

|||||||||||||||||

| 2008 | 2008 | 2009 | 2010 | 2010 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| ($ in thousands) | ($ in thousands) | |||||||||||||||||||

| Net income to EBITDA: |

||||||||||||||||||||

| Net income (loss) |

$ | 17,125 | $ | (289,264 | ) | $ | (7,894 | ) | $ | (170,366 | ) | $ | (177,366 | ) | ||||||

| Financial expenses |

262 | 41,513 | 69,809 | 64,956 | 93,356 | |||||||||||||||

| Interest income |

(5,440 | ) | (808 | ) | (389 | ) | (688 | ) | (161 | ) | ||||||||||

| Income taxes expense (benefit) |

12,042 | (17,740 | ) | (24,082 | ) | 10,950 | 1,238 | |||||||||||||

| Depreciation and amortization |

9,595 | 35,579 | 60,305 | 61,011 | 94,884 | |||||||||||||||

| EBITDA |

$ | 33,584 | $ | (230,720 | ) | $ | 97,749 | $ | (34,137 | ) | $ | 11,951 | ||||||||

| Predecessor | Successor | |||||||||||||||||||

| October 1, 2007 through February 25, |

February 26, 2008 through September 30, |

Fiscal Years Ended September 30, |

Pro Forma Twelve-Month Period Ended September 30, |

|||||||||||||||||

| 2008 | 2008 | 2009 | 2010 | 2010 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| ($ in thousands) | ($ in thousands) | |||||||||||||||||||

| EBITDA to Adjusted EBITDA |

||||||||||||||||||||

| EBITDA |

$ | 33,584 | $ | (230,720 | ) | $ | 97,749 | $ | (34,137 | ) | 11,951 | |||||||||

| Transaction, integration refinancing costs and other payments to third parties(a) |

26,489 | 12,603 | 7,891 | 9,058 | 7,988 | |||||||||||||||

| Management Fees(b) |

— | 99 | 5,351 | 4,412 | 4,368 | |||||||||||||||

| Stock-based compensation expense excluding impact of the unapproved PEPs event(c) |

10,046 | 7,443 | 6,172 | 4,540 | 8,301 | |||||||||||||||

| Impairment of intangible assets and goodwill related to the unapproved PEPs event(d) |

— | — | — | 107,158 | 107,158 | |||||||||||||||

| Partial write-down of intangible assets(e) |

— | — | 55,665 | — | — | |||||||||||||||

| Other adjustments related to the unapproved PEPs event(f) |

— | — | — | 63,418 | 20,977 | |||||||||||||||

| Acquired in-process research |

— | 272,400 | — | 7,948 | 7,948 | |||||||||||||||

| Loss of disposal and write-down of assets |

— | — | — | — | — | |||||||||||||||

| Inventories stepped-up value expensed(g) |

— | 22,714 | — | — | — | |||||||||||||||

| Run-rate synergies(h) |

— | — | — | — | 54,400 | |||||||||||||||

| Revenue recognition(i) |

— | — | — | — | (4,700 | ) | ||||||||||||||

| Adjusted EBITDA |

$ | 70,119 | $ | 84,539 | $ | 172,828 | $ | 162,397 | $ | 218,391 | ||||||||||

| (a) | Represents integration and refinancing costs as well as due diligence costs related to certain non-recurring transactions, certain payments to third parties in respect of research and development milestones and certain other progress payments as defined within our existing credit agreement, which is expected to be amended and restated at the closing of the Transactions. |

| (b) | Represents management fees and other charges associated with the Management Services Agreement with TPG Capital. |

| (c) | Represents stock-based employee compensation expense under the provisions of FASB guidance, excluding the impact of the unapproved PEPs event. |

| (d) | Intangible assets and goodwill impairment charges related to the unapproved PEPs event. See our Annual Report on Form 10-K for the fiscal year ended September 30, 2010, which was previously filed with the SEC, under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation.” |

| (e) | Partial write-down of intangible assets related to URSO products. |

| (f) | Adjustments and other charges related to the unapproved PEPs event, including an additional product returns and other sales deduction provision of $23.4 million during the fiscal year ended September 30, 2010, inventory net realizable value and accrual for purchases and other materials and supply commitments of $44.9 million during the fiscal year ended September 30, 2010, and a stock-based compensation recovery of $4.9 million during the fiscal year ended September 30, 2010. |

| (g) | Represents inventories stepped-up value, arising from the February 2008 Transactions, expensed as acquired inventory is sold. |

| (h) | Represents cost-savings we currently expect to achieve as a result of the acquisition of Eurand and other restructuring initiatives we have undertaken or expect to undertake. We estimate that we will realize approximately $54 million of pre-tax acquisition related and other cost-savings by the end of fiscal year 2013. While the full amount of such cost-savings are not expected to be realized for several years, we expect that we will take actions to achieve a substantial majority of these cost-savings within the next twelve months, and then begin to realize related savings thereafter. We expect to realize approximately $50 million of these cost-savings prior to the end of fiscal year 2012. We anticipate that we will incur a total of approximately $50 million of costs to achieve these cost-savings, including costs for severance and other restructuring. We expect to incur a majority of these costs during fiscal year 2011. |

We expect approximately $42 million of these savings to result from reductions in the size of our workforce and approximately $12 million of these savings from non-workforce related savings. With respect to headcount-related savings, we have not identified particular individuals that will be terminated, but have rather identified the areas of cost-savings described above, and calculated cost-savings based on the average fully loaded compensation cost per employee in the areas that we expect to reduce.

In order to identify areas for potential savings, we have undertaken the following efforts:

| • | our senior management and functional area leaders worked with third party consultants to review functional areas across our operations both on a standalone basis and on a combined basis with Eurand and conducted a staffing analysis across Axcan and Eurand via site visits, a review of organization charts, including a review of titles, positions and management layers, and a series of meetings with Eurand management team members; |

| • | Axcan senior management team members conducted an analysis assessing areas of duplication and projected growth, determining projected synergy levels from the perspective of both senior management and functional area leaders; |

| • | we retained a recognized consulting firm to benchmark our projected organizational size and structure against similarly sized pharmaceutical companies, as well as similarly sized companies in other industries; and |

| • | with respect to non-headcount savings, we conducted an analysis of indirect expenses associated with the combined workforce, including the portion to be reduced, as well as opportunities for reductions in discretionary spending and the elimination of certain Eurand public company costs. |

Through this process, we identified cost-savings in all operating functions including executive management, finance, supply chain, manufacturing, human resources, information technology, business development, legal, research and development and sales and marketing. As a result we expect savings to be reflected in Cost of Goods Sold, Research and Development, Sales and Marketing and General and Administrative.

The actual relative proportion of synergies achieved through workforce reductions and non-headcount savings could differ materially from these estimates. Actual cost-savings, the costs required to realize the cost-savings and the source of the cost-savings could differ materially from these estimates, and we cannot assure you that we will achieve the full amount of cost-savings on the schedule anticipated or at all.

| (i) | Represents year-to-date impact of changing accounting policies from the “sell-through” method to the “sell-in” method as well as adjustments for differing accounting policies between Eurand and Axcan. |

| (4) | Pro forma cash interest expense for the twelve-month period ended September 30, 2010 represents pro forma finance expense, less amortization of deferred financing costs. |

| (5) | Pro forma total secured debt represents the existing secured notes, the new senior secured term loan facility and the Secured Notes. |

| (6) | Pro forma total debt represents the existing secured notes, the existing senior unsecured notes, the new senior secured term loan facility and the Secured Notes. |

| (7) | The decrease in the fiscal year ended September 30, 2010 compared to the fiscal year ended September 30, 2009 is mainly due to the effects of the unapproved PEPs event, as a result of which we ceased distribution of ULTRASE and VIOKASE, and includes a $23.4 million sales deduction reserve as described further in our filings with the SEC. |

| (8) | Reflects the pro forma effects of the Transactions as further discussed in “Unaudited Pro Forma Condensed Consolidated Financial Statements.” |

CAPITALIZATION

The following table sets forth our cash, cash equivalents and short-term investments and capitalization as of September 30, 2010 on an actual basis and as adjusted to reflect the Transactions, as if the Transactions had closed on that date. You should read this table in conjunction with “The Transactions,” “Unaudited Pro Forma Condensed Consolidated Financial Statements,” “Description of Other Indebtedness” and Axcan’s and Eurand’s audited and unaudited consolidated financial statements and related notes included in their respective filings with the SEC.

| As of September 30, 2010 | ||||||||

| Actual | As Adjusted | |||||||

| (in millions) | ||||||||

| Cash and short-term investments(1) |

$ | 161.5 | $ | 36.2 | ||||

| Debt: |

||||||||

| Senior secured credit facilities: |

||||||||

| Existing term loan facility(2) |

135.2 | — | ||||||

| Existing revolving credit facility(3) |

— | — | ||||||

| New term loan facility(4) |

— | 225.0 | ||||||

| New revolving credit facility(5) |

— | — | ||||||

| Secured Notes (6) |

— | 225.0 | ||||||

| Existing secured notes(7) |

226.2 | 226.2 | ||||||

| Existing senior unsecured notes(8) |

233.1 | 233.1 | ||||||

| Total debt |

594.5 | 909.3 | ||||||

| Shareholder’s equity |

(21.0 | ) | 104.5 | |||||

| Total capitalization |

$ | 573.5 | $ | 1,013.8 | ||||

| (1) | Represents cash, cash equivalents and short-term investments of Axcan and Eurand as of September 30, 2010. In the first quarter of fiscal 2011, we used $13.2 million of cash to prepay a part of the indebtedness outstanding under the term loan portion of our existing senior secured credit facilities; the table above does not give effect to this payment. To the extent there is any available cash on hand over and above our estimated minimum operating cash requirements, we expect to use all or a portion of such available cash to fund the consummation of the Transactions, which will reduce the cash equity investment by the Sponsors and the co-investors and the amount of cash presented above. |

| (2) | Indebtedness outstanding including accrued interest and unamortized issue discount) under the term loan portion of our existing senior secured credit facilities, which will be paid off on the Closing Date. |

| (3) | Our existing senior secured revolving credit facility will be effectively replaced by our new senior secured revolving credit facility on the Closing Date. |

| (4) | Represents the proceeds of the $225 million senior secured term loan facility we expect to enter into on the Closing Date, without giving effect to any original issue discount. |

| (5) | On the Closing Date, we expect to enter into a senior secured revolving credit facility in an aggregate principal amount of at least $115 million, which will effectively replace our existing senior secured credit revolving credit facility. Based on expected cash levels, we do not expect to draw on our new senior secured revolving credit facility at the closing of the Transactions, other than for amounts required to finance any original issue discounts and fees and expenses related to the Transactions. |

| (6) | Represents $225.0 million aggregate principal amount of the Secured Notes. |

| (7) | Represents outstanding indebtedness consisting of our 9.25% senior secured notes due March 1, 2015 net of unamortized original issue discount. |

| (8) | Represents outstanding indebtedness consisting of our 12.75% senior unsecured notes due March 2016 net of unamortized original issue discount. |

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The following unaudited pro forma condensed consolidated financial statements give effect to the Transactions on the basis described below.

The unaudited pro forma condensed consolidated financial statements have been prepared based on certain pro forma adjustments to Axcan’s and Eurand’s historical financial statements, using (1) the audited consolidated financial statements of Axcan as of and for the year ended September 30, 2010 included in their respective filings with the SEC, (2) the audited consolidated financial statements of Eurand for the fiscal year ended December 31, 2009 and the unaudited consolidated financial statements of Eurand for the nine months ended September 30, 2009 and 2010 included in its filings with the SEC, (3) the preliminary purchase price allocation of the Eurand acquisition, a summary of which is included in Note B to the unaudited pro forma condensed consolidated balance sheet, and (4) the assumptions and adjustments described in the notes accompanying these unaudited pro forma condensed consolidated financial statements. The unaudited pro forma condensed consolidated balance sheet as of September 30, 2010 has been prepared as if the Transactions had closed as of that date. The unaudited pro forma condensed consolidated statement of operations for the year ended September 30, 2010 has been prepared as if the Transactions had occurred on October 1, 2009.

The historical financial statements of Eurand are presented in Euro. For the purposes of presenting the unaudited pro forma consolidated financial statements, the balance sheet of Eurand at September 30, 2010 has been translated into U.S. dollars using an exchange rate of one Euro to 1.360 U.S. dollars. The historical information of Eurand for the twelve months ended September 30, 2010 has been derived by taking its historical audited statement of operations for the year ended December 31, 2009, plus its historical unaudited statement of operations for the nine months ended September 30, 2010, less its historical unaudited statement of operations for the nine months ended September 30, 2009. Such derived statements of operations of Eurand for the 12 months ended September 30, 2010 have been translated into U.S. dollars at the average rate of one Euro to 1.356 U.S. dollars.

The unaudited pro forma adjustments are based upon available information and certain assumptions that we believe are reasonable under the circumstances. All pro forma adjustments and their underlying assumptions are described more fully in the notes to our unaudited pro forma condensed consolidated financial statements. The unaudited pro forma condensed consolidated financial statements are presented for informational purposes only. The unaudited pro forma condensed consolidated financial statements do not purport to represent what our results of operations or financial condition would have been had the Transactions actually closed on the dates indicated and they do not purport to project our results of operations or financial condition for any future period or as of any future date. The unaudited pro forma condensed consolidated financial statements should be read in conjunction with the information contained in “The Transactions” and our and Eurand’s audited and unaudited consolidated financial statements and related notes thereto appearing in their respective filings with the SEC.

The Transactions will be accounted for using the acquisition accounting method pursuant to FASB Accounting Standards Codification 805, “Business Combinations.” The pro forma information presented, including allocations of the purchase price, is based on preliminary estimates of the fair values of assets to be acquired and liabilities to be assumed, available information and assumptions and will be revised as additional information becomes available. The actual adjustments to our consolidated financial statements upon the closing of the Transactions will depend on a number of factors, including additional information available and our net assets on the Closing Date of the Transactions, which may change as a result of final valuations of certain of our assets, including inventory and intangible assets. Therefore, the actual adjustments will differ from the pro forma adjustments, and the differences may be material.

The final purchase price allocation is dependent on, among other things, the finalization of asset and liability valuations. As of the date of this report, we have not completed the valuation studies necessary to estimate the fair values of the assets we expect to acquire and liabilities we expect to assume and the related allocation of purchase price. We have allocated the total estimated purchase price, calculated as described in Note B under “Notes to Unaudited Pro Forma Condensed Consolidated Balance Sheet,” to the assets to be acquired and liabilities to be assumed based on preliminary estimates of their fair values. A final determination of these fair values will reflect our consideration of a final valuation. This final valuation will be based on the actual net tangible and intangible assets that will exist as of the Closing Date of the Transactions. Any final adjustment will change the allocations of purchase price, which could affect the fair value assigned to the assets and liabilities and could result in a change to the consolidated financial statements, including a change to goodwill. Such change could be material.

The unaudited pro forma condensed consolidated statements of operations do not reflect non-recurring charges that have been or will be incurred in connection with the Transactions, including (i) certain non-recurring advisory and legal costs already incurred or still to be incurred in connection with the Transactions of approximately $22.4 million, (ii) inventory write-up in purchase accounting of approximately $3.8 million and associated effect on cost of goods sold, (iii) certain payments of approximately $4.4 million to employees and management of Eurand under change-in-control and retention agreements, (iv) bridge facility commitment fees of approximately $7.8 million, (v) charges of approximately $8.9 million related to the write-off of deferred financing costs and original issue discount associated with borrowings that will be extinguished and (vi) significant one-time charges we will incur as we seek to realize any cost-savings expected to be achieved as a result of the acquisition. These amounts are before the consideration of potentially associated tax effects. Furthermore, we may enter into certain stock-based or other compensation arrangements with members of the Eurand management team and employees following the Transactions, which are not reflected in the pro forma consolidated financial statements. The terms of such arrangements, if any, have not been determined and, accordingly, the unaudited pro forma condensed consolidated financial statements do not include any effects of such potential arrangements. In addition, the unaudited pro forma condensed consolidated financial statements do not reflect any effects arising from potential changes in functional currency for certain subsidiaries due to changes in organizational structure and financing in connection with the Transactions.

AXCAN INTERMEDIATE HOLDINGS INC.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

AS OF SEPTEMBER 30, 2010

| Historical Axcan |

Historical Eurand |

Pro

Forma Adjustments |

Pro Forma Axcan |

|||||||||||||

| (in thousands) | ||||||||||||||||

| Assets |

||||||||||||||||

| Current assets |

||||||||||||||||

| Cash and cash equivalents |

$ | 161,503 | $ | 37,880 | $ | (188,352 | )(A) | $ | 11,031 | |||||||

| Short-term investments, available for sale |

— | 25,214 | — | 25,214 | ||||||||||||

| Accounts receivable, net |

32,379 | 27,412 | — | 59,791 | ||||||||||||

| Accounts receivable from parent company |

487 | — | — | 487 | ||||||||||||

| Incomes taxes receivable |

2,906 | — | — | 2,906 | ||||||||||||

| Inventories |

23,866 | 21,885 | 3,755 | (B) | 49,506 | |||||||||||

| Prepaid expenses and deposit |

3,277 | 7,664 | — | 10,941 | ||||||||||||

| Deferred income taxes |

2,331 | 2,436 | — | 4,767 | ||||||||||||

| Total current assets |

226,749 | 122,491 | (184,597 | ) | 164,643 | |||||||||||

| Property, plant and equipment, net |

35,777 | 46,843 | 8,714 | (B) | 91,334 | |||||||||||

| Intangible assets, net |

347,962 | 7,630 | 433,657 | (B) | 789,249 | |||||||||||

| Goodwill, net |

73,540 | 37,638 | 67,573 | (B) | 178,751 | |||||||||||

| Deferred debt issue expenses |

20,443 | — | 14,502 | (A) | 34,945 | |||||||||||

| Deferred income taxes |

8,706 | 371 | — | 9,077 | ||||||||||||

| Other investments |

— | 38 | — | 38 | ||||||||||||

| Total Assets |

713,177 | 215,011 | 339,849 | 1,268,037 | ||||||||||||

| Liabilities |

||||||||||||||||

| Current liabilities |

||||||||||||||||

| Accounts payable and accrued liabilities |

94,673 | 9,150 | (7,962 | )(B) | 95,861 | |||||||||||

| Income taxes payable |

3,446 | 831 | — | 4,277 | ||||||||||||

| Installments on long-term debt |

13,163 | 1,360 | (12,273 | )(A) | 2,250 | |||||||||||

| Accrued expenses and other current liabilities |

— | 28,829 | (291 | )(B) | 28,538 | |||||||||||

| Deferred income taxes |

47 | 412 | — | 459 | ||||||||||||

| Total current liabilities |

111,329 | 40,582 | (20,526 | ) | 131,385 | |||||||||||

| Employees severance indemnities |

— | 5,270 | — | 5,270 | ||||||||||||

| New senior secured facilities |

— | — | 222,750 | (A) | 222,750 | |||||||||||

| New Senior Secured Notes |

— | — | 225,000 | (A) | 225,000 | |||||||||||

| Existing Senior Secured Notes |

226,171 | — | — | 226,171 | ||||||||||||

| Existing Senior Unsecured Notes |

233,094 | — | — | 233,094 | ||||||||||||

| Other long-term debt |

122,047 | 2,380 | (124,427 | )(A) | — | |||||||||||

| Other long-term liabilities |

10,028 | 4,398 | — | 14,426 | ||||||||||||

| Deferred income taxes |

31,540 | 4,749 | 69,180 | (B) | 105,469 | |||||||||||

| Total liabilities |

734,209 | 57,379 | 371,977 | 1,163,565 | ||||||||||||

| Shareholders’ equity (deficiency) |

(21,032 | ) | 157,632 | (32,128 | ) | 104,472 | ||||||||||

| Total liabilities & shareholders’ equity (deficiency) |

$ | 713,177 | $ | 215,011 | $ | 339,849 | $ | 1,268,037 | ||||||||

See Accompanying Notes to Unaudited Pro Forma Condensed Consolidated Balance Sheet.

AXCAN INTERMEDIATE HOLDINGS INC.

NOTES TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

The unaudited pro forma condensed consolidated balance sheet as of September 30, 2010 reflects the following pro forma adjustments as further described below:

| (A) | The unaudited pro forma condensed consolidated balance sheet gives effect to the following pro forma adjustments related to the Transaction and reflects the related issuance of debt consisting of the Secured Notes, payment of acquisition consideration and the repayment of certain debt of Axcan and Eurand. This pro forma condensed consolidated balance sheet gives effect to the Transaction as if it occurred on September 30, 2010. |

The following table summarizes the estimated sources and uses of funds for the Transaction assuming the closing occurred as of September 30, 2010. Actual amounts at closing may differ:

| Sources of funds (in millions) |

||||

| Cash on hand(1) |

$ | 188.4 | ||

| Amended and restated senior secured credit facilities: |

||||

| Term loan facility(2) |

225.0 | |||

| Revolving credit facility(3) |

— | |||

| Secured Notes(4) |

225.0 | |||

| Equity contribution(5) |

145.0 | |||

| Total sources of funds |

$ | 783.4 | ||

| Uses of funds (in millions) |

||||

| Equity purchase price(6) |

$ | 586.5 | ||

| Payoff of Axcan debt(7) |

138.8 | |||

| Payoff of Eurand debt(8) |

3.7 | |||

| Fees and expenses(9) |

54.4 | |||

| Total uses of funds |

$ | 783.4 | ||

| (1) | We intend to apply substantially all unrestricted cash and cash equivalents available on the Closing Date to fund the payment of a portion of the consideration for the Transactions, other than an amount that we intend to retain and use for working capital purposes. Amount shown represents cash, cash equivalents and short-term investments of Axcan and Eurand as of September 30, 2010. In the first quarter of fiscal 2011, we used $13.2 million of cash to prepay a part of the indebtedness outstanding under the term loan portion of our existing senior secured credit facilities; the table above does not give effect to this payment. To the extent there is any available cash on hand over and above our estimated minimum operating cash requirements, we expect to use all or a portion of such available cash to fund the consummation of the Transactions, which will reduce the cash equity investment by the Sponsors and the co-investors. |

| (2) | Represents the proceeds of the $225 million senior secured term loan facility we expect to enter into on the Closing Date, without giving effect to any original issue discount. |

| (3) | On the Closing Date, we expect to enter into a senior secured revolving credit facility in an aggregate principal amount of at least $115 million. Based on expected cash levels, we do not expect to draw on the senior secured revolving credit facility at the closing of the Transactions, other than for amounts required to finance any original issue discounts and fees and expenses related to the Transactions. |

| (4) | Represents the proceeds received on $225 million aggregate principal amount of the Secured Notes, without giving effect to any original issue discount. |

| (5) | Represents the sum of cash equity contributions in the Issuer and/or its direct or indirect subsidiaries as of the closing of the Transactions, which is expected to be comprised of equity provided directly or indirectly by the |

| Sponsors and the co-investors. The equity contribution by the Sponsors and the co-investors will constitute at least 22.5% of the aggregate amount necessary to purchase all eligible outstanding shares of Eurand at the purchase price specified in our tender offer for Eurand’s shares. |

| (6) | Represents the aggregate amount of the purchase price of $12.00 per share for all eligible shares of Eurand outstanding as of September 30, 2010. |

| (7) | Represents funds used to repay indebtedness outstanding (including accrued interest and unamortized original issue discount) under the term loan portion of our existing senior secured credit facilities. |

| (8) | Represents funds used to repay Eurand’s indebtedness outstanding (including accrued interest) under its 2010 unsecured loan agreement based on U.S. dollar/euro exchange rate of 1.360:1 as of September 30, 2010. |

| (9) | Reflects estimated fees, expenses and other costs incurred in connection with the Transactions, including placement and financing fees, advisory fees, transaction fees paid to TPG Capital, change-in-control payments and other transaction costs and professional fees. All fees, expenses and other costs are estimates and actual amounts may differ from those set forth in this report. |

| (B) | The Transaction will be accounted for using the acquisition method of accounting in accordance with the accounting guidance for business combinations and noncontrolling interests. We assume the acquisition of Eurand as described under “The Transactions.” The accounting standards require the estimated acquisition consideration to be allocated to assets, including indentified intangible assets, which will be amortized over the respective useful lives for those deemed to have finite lives, and liabilities based on their estimated fair values. The pro forma adjustments have been based on a preliminary estimate of fair value by management. The final purchase price allocation may include an adjustment of the total consideration paid at closing, as well as adjustments for any non-controlling interest, changes in the value of inventory, property, plant and equipment, goodwill and identified intangible assets, with the assistance of an outside appraisal to be performed shortly after the completion of the Transaction. The following table sets forth the preliminary allocation of consideration: |

| (in thousands) | ||||

| Purchase consideration |

$ | 586.5 | ||

| Historical net book value of net assets acquired |

157.6 | |||

| Less: Pre-closing expenses to be recorded |

16.0 | |||

| Less: Axcan-related deferred revenue |

(0.3 | ) | ||

| Less: Goodwill previously recorded |

37.6 | |||

| Historical net book value of net assets acquired, as adjusted |

104.3 | |||

| Initial excess purchase price over historical net book value of net assets acquired |

482.2 | |||

| Purchase accounting adjustments: |

||||

| Increase in inventory(i) |

3.8 | |||

| Increase in Intangible assets(ii) |

433.7 | |||

| Increase in Property Plant and Equipment(iii) |

8.7 | |||

| Change in Deferred income taxes(iv) |

(69.2 | ) | ||

| Less: Total purchase accounting adjustments |

377.0 | |||

| Pro forma goodwill |

$ | 105.2 | ||

| (i) | Reflects the adjustment of historical inventories to their estimated fair value. This inventory adjustment will result in a charge included in cost of sales in the three to six months subsequent to the consummation of the Transactions during which the related inventories are sold. Due to its non-recurring impact, the detriment to cost of sales is not reflected in the unaudited pro forma combined condensed statement of operations. |

| (ii) | The preliminary estimated fair values and useful lives for identifiable intangible assets are included in the table below: |

| Estimated Average Useful Lives |

Estimated Fair Value |

Historical Value |

Pro forma Adjustment |

|||||||||||||

| (years) | ($ in thousands) | |||||||||||||||

| Definite-lived intangible assets |

16.72 | $ | 441,264 | $ | 7,630 | $ | 433,634 | |||||||||

| Indefinite-lived intangible assets |

N/A | 23 | — | 23 | ||||||||||||

| Total |

$ | 441,287 | $ | 7,630 | $ | 433,657 | ||||||||||

| (iii) | Represents the preliminary estimated fair value adjustment for property plan and equipment, primarily related to machinery and equipment. |

| (iv) | Represents the estimated impact on deferred income tax balances, net of valuation allowances, resulting from the pro forma purchase accounting adjustments at the applicable rate for the respective jurisdictions. |

AXCAN INTERMEDIATE HOLDINGS INC.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2010

| Historical Axcan |

Historical Eurand |

Pro Forma Adjustments |

Pro Forma Axcan |

|||||||||||||

| (in thousands) | ||||||||||||||||

| Total revenue |

$ | 354,587 | $ | 184,377 | $ | (34,966 | )(A) | $ | 503,998 | |||||||

| Cost of goods sold |

130,915 | 81,901 | (73,714 | )(A), (B) | 139,102 | |||||||||||

| Selling and administrative expenses |

115,033 | 69,923 | (3,088 | )(B), (C) | 181,868 | |||||||||||

| Management fees |

4,412 | — | (44 | )(D) | 4,368 | |||||||||||

| Research and development expenses |

31,715 | 29,886 | (1,883 | )(B), (C) | 59,718 | |||||||||||

| Acquired in-process research |

7,948 | — | — | 7,948 | ||||||||||||

| Depreciation and amortization |

61,011 | 1,706 | 32,167 | (B), (E) | 94,884 | |||||||||||

| Impairment of intangible assets and goodwill |

107,158 | — | — | 107,158 | ||||||||||||

| Other expenses |

— | 1,250 | — | 1,250 | ||||||||||||

| Operating income |

(103,605 | ) | (289 | ) | 11,596 | (92,298 | ) | |||||||||

| Financial expenses |

64,956 | 57 | 28,343 | (F) | 93,356 | |||||||||||

| Interest income |

(688 | ) | (195 | ) | 722 | (G) | (161 | ) | ||||||||

| Other income |

(9,704 | ) | — | — | (9,704 | ) | ||||||||||

| Loss (gain) on foreign currency |

1,247 | (908 | ) | — | 339 | |||||||||||

| Income (loss) before income taxes |

(159,416 | ) | 757 | (17,469 | ) | (176,128 | ) | |||||||||

| Income taxes |

10,950 | 2,710 | (12,422 | )(H) | 1,238 | |||||||||||

| Net loss |

$ | (170,366 | ) | $ | (1,953 | ) | $ | (5,047 | ) | $ | (177,366 | ) | ||||

See Accompanying Notes to Unaudited Pro Forma Condensed Consolidated Statement of Income.

AXCAN INTERMEDIATE HOLDINGS INC.

NOTES TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

The unaudited pro forma condensed consolidated statements of operations reflect the results for the Company for the fiscal year ended September 30, 2010.

| (A) | Represents the elimination of $35.0 million of product sales and royalties between Eurand and Axcan, an elimination of Axcan’s cost of sales for Eurand-sourced inventories of $22.1 million, and the elimination of certain PEP-related charges stemming from intercompany transactions. |

| (B) | Represents reclassification of Eurand’s depreciation expense to conform to Axcan accounting policies. |

| (C) | Represents the elimination of $2.6 million of expenses that have been incurred in historical periods in connection with the Transaction that will not have a continuing impact. |

| (D) | Reflects the change in the annual management fee to be paid to TPG Capital in accordance with the existing management agreement as a result of the change in the Pro Forma Adjusted EBITDA. |

| (E) | Represents the pro forma adjustment to depreciation and amortization due to the purchase accounting and the resulting step-up in the values of certain previously recorded intangible assets and tangible assets and the recognition of additional intangible assets (in thousands): |

| 12 months period Ended on September 30, 2010 |

||||||||||||

| Amortization | Depreciation | Total | ||||||||||

| Pro forma |

27,562 | 6,311 | 33,873 | |||||||||

| Historical—Eurand |

1,706 | 8,582 | 10,288 | |||||||||

| Pro forma adjustment |

25,856 | (2,271 | ) | 23,585 | ||||||||

| (F) | Represents pro forma interest expense resulting from our new capital structure upon consummation of the Transaction, using an assumed interest rate of 8.00% for the Secured Notes (in thousands): |

| Fiscal Year Ended September 30, 2010 |

||||

| Secured Notes (1) |

$ | 18,000 | ||

| Existing senior secured notes(2) |

21,090 | |||

| Existing senior unsecured notes(3) |

29,963 | |||

| Amended and restated senior secured credit facilities: |

||||

| Term loan facility(4) |

14,570 | |||

| Revolving credit facility(5) |

863 | |||

| Amortization of debt issuance costs and issuance discount(6) |

8,870 | |||

| Total pro forma interest expense |

93,356 | |||

| Less: Historical interest expense |

65,013 | |||

| Pro forma adjustment |

$ | 28,343 | ||

| (1) | Represents pro forma interest expense based on an assumed interest rate of 8.00% for the senior secured notes. |

| (2) | Represents interest expense on our existing 9.25% senior secured notes due March 1, 2015. |

| (3) | Represents interest expense on our existing 12.75% senior unsecured notes due March 2016. |

| (4) | Represents pro forma interest expense for our new senior secured term loan facility based on an interest rate of 6.50%. Interest is based on the higher of LIBOR or 1.50% plus 500 basis points. |

| (5) | Represents pro forma interest expense based on an interest rate of LIBOR plus 4.5% for the senior secured revolving credit facility and a commitment fee of 0.75% for the unused portion of such facility. The unaudited pro forma statements of operations assume that we do not draw any amounts from this revolving credit facility during the periods presented. |

| (6) | Represents non-cash interest expense related to estimated capitalized debt issuance costs and original issuance discount that are being amortized over the term of the related facilities, including seven years for the Secured Notes, six years for the new senior secured term loan facility and 4.25 years for the new senior secured revolving credit facility. |

Above pro forma financial expenses do not include an original issuance discount on the Secured Notes and our senior secured term loan facility. A change in discount or premium of 1% would affect our annual interest expense by approximately $0.7 million. Furthermore, to the extent LIBOR is above 1.50%, a change in LIBOR of 0.125%-point would change our interest expenses by $0.3 million.

| (G) | Reflects an adjustment to eliminate interest income that would not have been earned due to lower pro forma cash and cash equivalents. |

| (H) | Represents the estimated tax effects of the Transactions, including: |

| • | The estimated tax effects of the pro forma purchase accounting adjustments described above, measured at the applicable rate for the respective jurisdictions; and |

| • | The expected benefit of certain intragroup debt restructurings and agreements, net of associated valuation allowances. |

The pro forma effective tax rate differs from the statutory rate due to the relatively large impact of actual permanent differences on relatively small pro forma income before tax, valuation allowances on deferred tax assets in certain jurisdictions, and the expected impact of foreign withholding taxes upon repatriation of foreign earnings.

DESCRIPTION OF OTHER INDEBTEDNESS

Amended and Restated Senior Secured Credit Facilities

Overview

In connection with the Transactions, we will enter into an amended and restated credit agreement and related security and other agreements for (i) a senior secured revolving credit facility in an aggregate principal amount of at least $115 million (which we refer to in this report as our “senior secured revolving credit facility”) and (ii) a $225 million senior secured term loan facility (which we refer to in this report as our “senior secured term loan facility”) with Bank of America, N.A., as administrative and collateral agent, Merrill Lynch, Pierce, Fenner & Smith Incorporated, RBC Capital Markets, LLC, HSBC Securities (USA) Inc. and Barclays Capital, each as joint lead arranger and joint bookrunner, RBC Capital Markets, LLC, as syndication agent, and Barclays Bank PLC and HSBC Bank USA, N.A., as co-documentation agents, which we refer to collectively in this report as our amended and restated senior secured credit facilities. A portion of the senior secured term loan facility may be borrowed by Axcan US Partnership 1 LP.

Based on expected cash levels, we do not expect to draw on our senior secured revolving credit facility at the closing of the Transactions, other than for amounts required to finance any original issue discounts and fees and expenses related to the Transactions. We will borrow the full amount available under our senior secured term loan facility at the closing of the Transactions. The senior secured credit facility will include a sub-facility for letters of credit and a sub-facility for borrowings on same-day notice, referred to as the swingline loans.

Our amended and restated senior secured credit facilities will provide that we will have the right at any time to increase the revolving commitments or enter into additional term loans subject to certain conditions and limitations, including compliance with certain financial ratio covenants including that the senior secured leverage ratio shall not exceed 3.5:1 on a pro forma basis. The lenders under our amended and restated senior secured credit facilities will not be under any obligation to provide any such additional loans or commitments.

Interest Rate and Fees

Borrowings under our senior secured revolving credit facility will bear interest at a rate per annum equal to an applicable margin plus, at our option, either (1) a base rate determined by reference to the highest of (a) the prime rate of Bank of America, N.A., (b) the federal funds effective rate plus 1/2 of 1.00% and (c) the one-month LIBOR rate plus 1.00% or (2) a LIBOR rate determined by reference to the costs of funds for U.S. dollar deposits for the interest period relevant to such borrowing adjusted for certain additional costs. The initial applicable margins for borrowings with respect to existing revolving credit commitments extended or issued pursuant to the senior secured revolving credit facility, which we refer to in this report as extended commitments, under our senior secured revolving credit facility is expected to be 3.50% with respect to base rate borrowings and 4.50% with respect to LIBOR borrowings, which rate may be reduced based on our achievement of certain specified leverage ratios. The applicable margins for loans in respect of existing revolving credit commitments that were not extended pursuant to the senior secured revolving credit facility (which we refer to as the un-extended commitments) will continue to be determined based on our leverage ratio from time to time, and on the closing date are expected to be 2.50% with respect to base rate borrowings and 3.50% with respect to LIBOR borrowings.

In addition to paying interest on outstanding principal under our senior secured revolving credit facility, we will be required to pay a commitment fee to the lenders (a) in respect of the unutilized extended commitments thereunder at an initial rate equal to 0.75% per annum and (b) in respect of the unutilized unextended commitments thereunder at an initial rate equal to 0.50% per annum, in each case subject to reduction based on our achievement of certain specified ratios. We also will pay customary letter of credit and agency fees.

Borrowings under our senior secured term loan facility will bear interest at a rate per annum equal to an applicable margin plus, at our option, either (1) a base rate determined by reference to the highest of (a) the prime rate of Bank of America, N.A., (b) the federal funds effective rate plus 1/2 of 1.00% and (c) the one-month LIBOR rate plus 1.00% or (2) a LIBOR rate determined by reference to the costs of funds for U.S. dollar deposits for the interest period relevant to such borrowing adjusted for certain additional costs. The applicable margin for borrowings under our senior secured term loan facility will be set at rates to be agreed. In addition, the LIBOR rate

for borrowings under our senior secured term loan facility will be subject to a floor to be agreed. In connection with our amended and restated senior secured credit facilities, the Issuer may enter into a series of interest swap agreements to fix the interest rates on a portion of the borrowings under the senior secured term loan facility.

Mandatory Repayments

Our senior secured term loan facility will require us to prepay outstanding term loans, subject to certain exceptions, with: (1) 100% of the net cash proceeds of any incurrence of debt other than debt permitted under our amended and restated senior secured credit facilities, (2) commencing with the first fiscal year ended after the Closing Date, 50% (which percentage will be reduced if our senior secured leverage ratio is less than certain specified ratios) of our annual excess cash flow (as defined in the credit agreement governing our senior secured term loan facility), and (3) 100% of the net cash proceeds of all non-ordinary course asset sales or other dispositions of property (including casualty events) by us or by our subsidiaries, subject to reinvestment rights and certain other exceptions.

Voluntary Repayments

We may voluntarily prepay outstanding loans under our senior secured revolving credit facility at any time without premium or penalty, other than customary “breakage” costs with respect to LIBOR loans. We may voluntarily prepay outstanding loans under our senior secured term loan facility at any time with a prepayment premium of 1.00% of the amount prepaid upon any such prepayment on or prior to the first anniversary of the closing date of the facility.

Final Maturity and Amortization

The principal amount of the outstanding loans under our senior secured revolving credit facility will be due and payable (x) in respect of extended commitments on November 30, 2014, which is the date that is 91 days prior to the scheduled maturity date of the existing secured notes (as defined below), provided that the maturity of the senior secured revolving credit facility shall be automatically extended to the fifth anniversary of the Closing Date if $50.0 million or less in aggregate principal amount of the existing secured notes is outstanding on such date, in each case with respect to commitments which are extended and (y) in respect of unextended commitments, February 25, 2014.

The principal amount of our new senior secured term loan facility amortizes in equal quarterly installments in aggregate annual amounts equal to 1% of the original principal amount of the senior secured term loan facility. The principal amount outstanding of the loans under our new senior secured term loan facility will be due and payable on the sixth anniversary of the Closing Date.

Guarantees and Security

All obligations under our amended and restated senior secured credit facilities will continue to be unconditionally guaranteed jointly and severally on a senior basis by our direct parent, Axcan MidCo Inc., and each of our existing and certain of our subsequently acquired or organized direct or indirect wholly-owned domestic subsidiaries and certain wholly-owned foreign subsidiaries (in each case with certain agreed-upon exceptions), which are referred to herein as our subsidiary guarantors.

All obligations under our amended and restated senior secured credit facilities, and the guarantees of those obligations, will be secured, subject to certain exceptions, by substantially all of our assets and the assets of our parent and our subsidiary guarantors, including:

| • | a first-priority pledge of 100% of our capital stock and certain of the capital stock held by us or any subsidiary guarantor (which pledge, in the case of any foreign subsidiary (with certain agreed-upon exceptions) or of any U.S. subsidiary that holds capital stock of a foreign subsidiary and is a disregarded entity for U.S. federal income tax purposes, is limited to 65% of the voting stock of such subsidiary), in each case excluding any interests in joint ventures to the extent such a pledge would violate the governing documents thereof; and |

| • | a first-priority security interest in, and mortgages on, substantially all other tangible and intangible assets of us, our parent and each subsidiary guarantor (subject to certain exceptions). |

Certain Covenants and Events of Default

Our senior secured revolving credit facility will contain a number of covenants that, among other things and subject to certain exceptions, will restrict our ability and the ability of our restricted subsidiaries to:

| • | incur additional indebtedness; |

| • | pay dividends on our capital stock or redeem, repurchase or retire our capital stock or other indebtedness; |

| • | make investments, loans, advances and acquisitions; |

| • | create restrictions on the payment of dividends or other amounts to us from our restricted subsidiaries; |

| • | engage in transactions with our affiliates; |

| • | sell assets, including capital stock of our subsidiaries; |

| • | consolidate or merge; and |

| • | create liens. |

In addition, solely with respect to the senior secured revolving credit facility, the credit agreement will require us to comply with certain financial ratio maintenance covenants with respect to total leverage and interest coverage.

The credit agreement governing our amended and restated senior secured credit facilities will also contain certain customary affirmative covenants and events of default.