Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Rock-Tenn CO | d8k.htm |

Acquisition of

Smurfit-Stone Container Corporation

January 24, 2011

Exhibit 99.1 |

2

Cautionary Statement Regarding Forward-Looking

Information

This document contains forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements are

typically identified by words or phrases such as “may,” “will,” “anticipate,” “estimate,” “expect,”

“project,” “intend,” “plan,” “believe,”

“target,” “forecast,” and other words and terms of similar meaning. Forward-looking

statements involve estimates, expectations, projections, goals, forecasts, assumptions,

risks and uncertainties. RockTenn cautions readers that any

forward-looking statement is not a guarantee of future performance and that actual results could differ

materially from those contained in the forward-looking statement. Such

forward-looking statements include, but are not limited to, statements

regarding the anticipated closing date of the transaction, the successful closing of the transaction and the

integration of Smurfit-Stone as well as opportunities for operational improvement

including but not limited to cost reduction and capital investment, the

strategic opportunity and perceived value to RockTenn and shareholders of the transaction, the

opportunity to recognize benefits from Smurfit-Stone’s NOLs, the

transaction’s impact on, among other things, RockTenn’s business mix,

margins, transitional costs and integration to achieve the synergies and the timing of such costs and synergies

and earnings. With respect to these statements, RockTenn and Smurfit-Stone have

made assumptions regarding, among other things, whether and when the proposed

transaction will be approved; whether and when the proposed transaction will close; the

availability of financing on satisfactory terms; the amount of debt RockTenn will

assume; the results and impacts of the acquisition; preliminary purchase price

allocations which may include material adjustments to the preliminary fair values of the

acquired assets and liabilities; economic, competitive and market conditions generally;

volumes and price levels of purchases by customers; competitive conditions in

RockTenn and Smurfit-Stone’s businesses and possible adverse actions of our

respective customers, competitors and suppliers. Further, Rock-Tenn and

Smurfit-Stone’s businesses are subject to a number of general risks

that would affect any such forward-looking statements including, among others, decreases in demand for their

products; increases in energy, raw materials, shipping and capital equipment costs;

reduced supply of raw materials; fluctuations in selling prices and volumes;

intense competition; the potential loss of certain customers; and adverse changes in

general market and industry conditions. Such risks and other factors that may impact

management’s assumptions are more particularly described in RockTenn and

Smurfit-Stone’s filings with the Securities and Exchange Commission, including under

the caption “Business – Forward-Looking Information” and “Risk

Factors” in RockTenn’s Annual Report on Form 10-K for the most

recently ended fiscal year and “Business – Risk Factors” and “Forward-Looking Information” in Smurfit-Stone’s Annual

Report on Form 10-K for the most recently ended fiscal year. The information

contained herein speaks as of the date hereof and neither RockTenn nor

Smurfit-Stone have or undertake any obligation to update or revise its forward-looking statements,

whether as a result of new information, future events or otherwise.

|

3

Additional Information

Additional Information and Where to Find It

In connection with the proposed transaction, RockTenn and Smurfit-Stone will be

filing documents with the Securities and Exchange Commission (the

“SEC”), including the filing by RockTenn of a registration statement on Form S-4 that will include a

joint proxy statement of RockTenn and Smurfit-Stone that also constitutes a

prospectus of RockTenn. RockTenn and Smurfit- Stone stockholders are

urged to read the registration statement on Form S-4 and the related joint proxy statement/prospectus

when they become available, as well as other documents filed with the SEC, because they

will contain important information. The final joint proxy statement/prospectus

will be mailed to stockholders of RockTenn and stockholders of Smurfit-Stone.

Investors and security holders may obtain free copies of these documents (when they are

available) and other documents filed with the SEC at the SEC’s web site at

www.sec.gov, or by contacting RockTenn Investor Relations at (678) 291-7901 or

Smurfit-Stone Investor Relations at (314) 656-5553 or Smurfit-Stone Media

Relations at (314) 656-5827. Participants in the Merger Solicitation

RockTenn, Smurfit-Stone and their respective directors, executive officers and

other members of management and employees may be deemed to be participants in

the solicitation of proxies in respect of the transaction. Information concerning

RockTenn’s executive officers and directors is set forth in its definitive proxy

statement filed with the SEC on December 17, 2010. Information concerning

Smurfit-Stone’s executive officers and directors is set forth in its annual report on Form 10-K for

the year ended December 31, 2009, which was filed with the SEC on March 2, 2010,

and in its current report on Form 8-K filed on July 7, 2010.

Additional information regarding the interests of participants of RockTenn and Smurfit-Stone in the solicitation

of proxies in respect of the transaction will be included in the above-referenced

registration statement on Form S-4 and joint proxy statement/prospectus when

it becomes available. You can obtain free copies of these documents from RockTenn and

Smurfit-Stone using the contact information above. |

Transaction Overview

4

RockTenn has agreed to acquire Smurfit-Stone Container Corporation, the

second-largest North American containerboard and corrugated container

manufacturer

–

Combined pro forma company total net sales exceeding $9 billion and Pro Forma

Adjusted EBITDA of $1.34

billion

(1)

, pre-synergies

Purchase price of $35/share, payable 50% in cash and 50% in RockTenn shares

Total purchase consideration of $5.0 billion, including Smurfit-Stone net debt of

$0.7 billion at 12/31/10 and after-tax unfunded pension liability of $0.7

billion –

Purchase price is 6.1 times Q4 2010 annualized Adjusted EBITDA of $820

million

Estimated credit agreement leverage ratio of 2.76 times funded debt at close

Transaction is accretive to RockTenn shareholders on a pro forma

historical basis

–

accretion of 16.5% per diluted RockTenn share

(1)

(1)

Pro Forma Adjusted EBITDA is RockTenn LTM 12/31/10 Credit Agreement EBITDA plus

annualized Smurfit-Stone Adjusted EBITDA for three months ended

12/31/2010 |

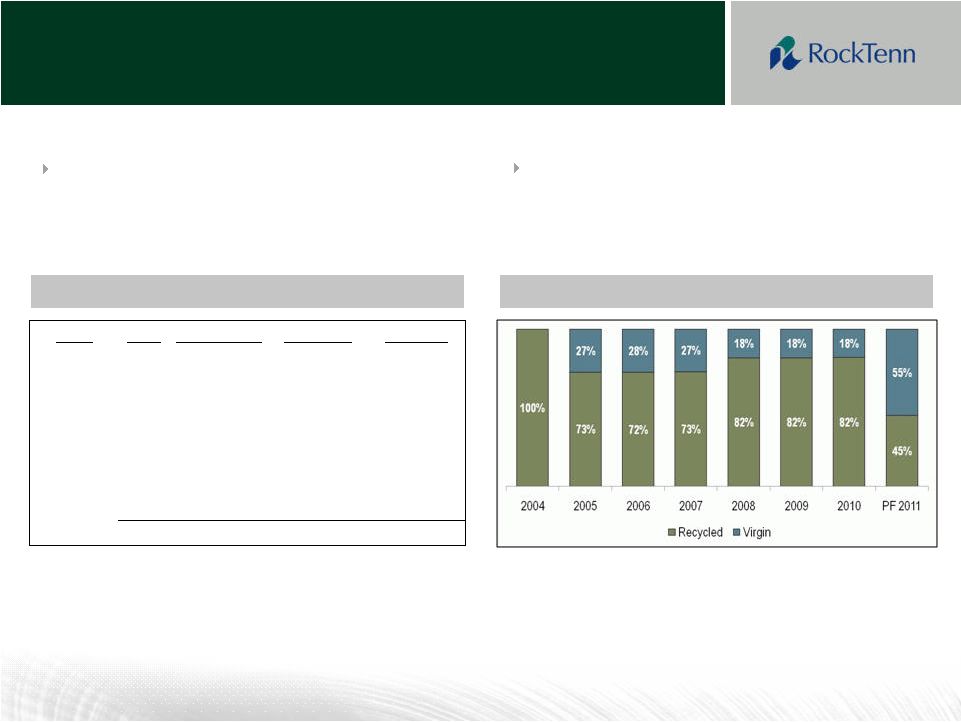

The New

RockTenn 5

Segment EBITDA Mix

Paperboard Capacity Mix

Segment Sales Mix

Total Segment EBITDA: $337m

(Quarter ended 12/31/10)

(1)

Total Capacity: 9.4 million tons

Fiber Mix

(2)

:

55% virgin

45% recycled

Total Segment Sales: $2.4B

(Quarter ended 12/31/10)

(1)

(1)

Segment sales and segment EBITDA assume 100% of Smurfit-Stone sales and Adjusted

EBITDA are reported in RockTenn’s Corrugated Packaging segment (2) Virgin containerboard includes some recycled fiber input

|

Compelling Strategic Acquisition

Containerboard has become a very good business

US virgin containerboard is a highly strategic global asset

Smurfit-Stone’s assets are much lower cost than before their

transformation Ample opportunities to improve cost position through continued

transformation of box plant system and investments in mills

Estimated annual transaction synergies run rate of $150 million within 24

months after transaction close

6

RockTenn’s customer-focused value approach to the market, disciplined execution

and record of continuous operational and administrative excellence provide broad

runway for operational gains |

7

Acquisition Consistent with RockTenn’s

Core

Business Principles

7

7

Providing superior paperboard, packaging and marketing

solutions for consumer products companies at very low

costs

RockTenn‘s

expanded network of mills and converting plants are

cost-competitive with new opportunities to further optimize the

combined system

Investing for competitive advantage

RockTenn’s

and Smurfit-Stone’s assets are well-capitalized, with

significant identified opportunities for further profit-improving

investments

Maximizing the efficiency of our manufacturing processes

by optimizing economies of scale

Acquisition results in increase in economies of scale

Systematically improving processes and reducing costs

throughout the Company

Acquisition

combines

RockTenn’s

Six

Sigma

continuous

improvement method with Smurfit-Stone’s Lean Manufacturing

method to further optimize manufacturing and administrative

processes

Seeking acquisitions that can dramatically improve the

business

Acquisition brings increased scale and strong nationwide customer

relationships

and

rebalances

RockTenn’s

fiber

sourcing

RockTenn

will be the most respected company in our business by: |

Transaction Highlights

8

Consideration

Fixed ratio of 0.30605 RKT shares per SSCC share plus $17.50 in cash per SSCC

share Ownership

56% RockTenn / 44% Smurfit-Stone

Refinance of Existing

Smurfit-Stone Debt

Refinance of Smurfit-Stone debt (estimated $745 million at 12/31/10, after giving

effect to $449 million in Smurfit-Stone cash)

Synergies

$150 million of annual run-rate synergies, to be achieved within 24 months of

close Board of Directors

13 Directors - 10 from RockTenn / 3 from Smurfit-Stone

Senior Leadership Team

James A. Rubright - Chairman, CEO

Steven C. Voorhees - EVP, CAO and CFO

James B. Porter III - EVP, Corrugated Packaging

Headquarters

Corporate HQ in Norcross, GA

Transaction Close

Expected in the second calendar quarter of 2011, subject to shareholder vote and

customary approvals

Financing

Committed financing from Wells Fargo, Rabobank, and SunTrust

|

9

North American Containerboard Demand

North American Containerboard Production Capacity

North American Containerboard Inventory Levels

Source: RISI

Strong North American Containerboard Fundamentals

NA Containerboard Capacity Change and Operating Rate |

77%

74%

55%

30%

29%

15%

23%

26%

45%

70%

71%

85%

Africa

North

America

Oceania

Latin

America

Europe

Asia

Virgin

Recycled

North American Containerboard Is Low-cost in the World

Market

10

Global Capacity by Fiber Type

Global Containerboard Cost Per Ton by Region

North America holds a cost advantage versus other regions

Significant share of global market capacity is recycled, and that share is expected to

grow $279

$292

$302

$320

$320

$383

Oceania

North

America

Latin

America

Africa

Europe

Asia

Source: RISI

Total Capacity

1.5

2.5

8.0

29.3

46.1

37.4

Capacity (mm tons) |

Grade

#PMs

Recycled Tons

Virgin Tons

Total Tons

Linerboard

15

528,000

4,174,000

4,702,000

Medium

12

1,584,000

1,190,000

2,774,000

SBS

2

-

475,000

475,000

CRB

7

620,000

-

620,000

URB

6

380,000

-

380,000

Pulp

2

-

375,000

375,000

Kraft

1

-

79,000

79,000

Total

45

3,112,000

6,293,000

9,405,000

Diversified Containerboard and Paperboard Mill System

11

Rebalancing RockTenn’s

fiber sourcing to

55% virgin / 45% recycled

45 paper machines across 25 mills,

producing the most attractive grades of

containerboard and paperboard

Fiber Mix

Mill Capacity by Grade

Note: Some virgin containerboard is manufactured with some recycled content

|

12

Containerboard Footprint

RockTenn

Box Plants

RockTenn

Mills

Smurfit-Stone Box Plants

Smurfit-Stone Mills

Not shown: 3 Smurfit-Stone box plants in Mexico and 1 in Puerto Rico

Hodge,

LA

Kraft Linerboard

Capacity: 808,000 tons

Panama

City,

FL

Kraft Linerboard

Capacity: 337,000 tons

Hardwood Market Pulp

Capacity: 275,000 tons

Seminole,

FL

Recycled Medium

Capacity: 200,000 tons

Recycled Linerboard

Capacity: 388,000 tons

Fernandina

Beach,

FL

Kraft Linerboard

Capacity: 930,000 tons

Stevenson,

AL

Semi-Chemical Medium

Capacity: 885,000 tons

Florence,

SC

Kraft Linerboard

Capacity: 683,000 tons

Hopewell,

VA

Kraft Linerboard

Capacity: 443,000 tons

West

Point,

VA

Kraft Linerboard

Capacity: 309,000 tons

White Top Linerboard

Capacity: 399,000 tons

Recycled Medium

Capacity: 184,000 tons

Uncasville,

CT

Recycled Linerboard

Capacity: 165,000 tons

Coshocton, OH

Semi-Chemical Medium

Capacity: 305,000 tons

Solvay, NY

Recycled Linerboard

Capacity: 600,000 tons

Recycled Medium

Capacity: 200,000 tons

St. Paul, MN

Recycled Medium

Capacity: 200,000 tons

Matane,

QC

Semi-Chemical Medium

Capacity: 176,000 tons

La Tuque, QC

White Top Linerboard

Capacity: 345,000 tons

SBS

Capacity: 131,000 tons |

Combined business has predominately first, second and third quartile

containerboard assets

–

Smurfit-Stone

has

closed

8

mills

2005

-

present

Smurfit-Stone

has

taken

out

significant

costs

over

the

last

three

years,

with

further

improvements ahead

Well-capitalized, Low-cost Containerboard

Manufacturing Assets

13

$293/ton

Industry Average

Source: Q3 2010 RISI and company data

Note: La Tuque bleached liner/SBS mill not shown on cost curve chart

Containerboard

Cost

Curve

–

Sep

Qtr

2010

-

50

100

150

200

250

300

350

400

450

500 |

14

RockTenn’s

Bleached Paperboard and Coated Recycled Board

Low-cost Capacity

Source: RISI, Folding Carton Grade only

RISI

Bleached

Board

Cost

Curve

–

Sep

Qtr

2010

RISI CRB Cost Curve –

Sep Qtr 2010

Source: RISI |

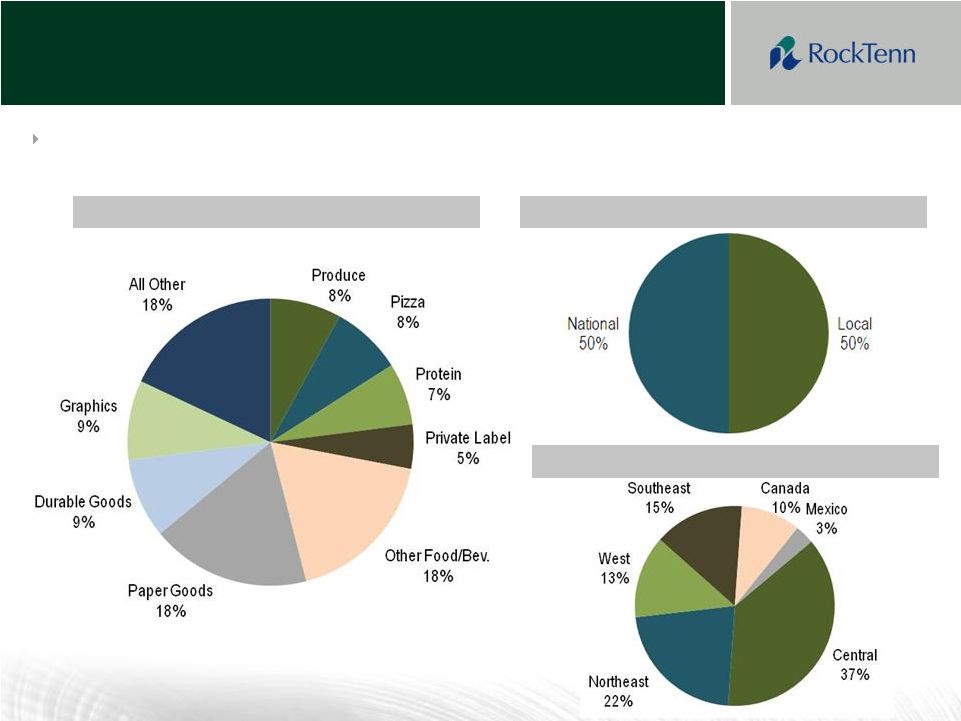

15

Smurfit-Stone Customer Overview

Container Sales by Account Type

Container Sales by Region

Container Sales by End-Use Segment

Smurfit-Stone container plant customer base is

geographically diverse, with 46% of sales from

the food and beverage segment |

Smurfit-Stone Container Plant Investments and Results

16

The Smurfit-Stone corrugated box plant has

been consolidated with over $550 million of

capital invested since 2007

Targeted investments to:

–

Increase throughput and capacity –

29%

increase in plant throughput since 2005

–

Reduce number of facilities (53 closed

since 2006), headcount (down 42% since

2006) and conversion costs (down 18%

since 2008)

–

Achieve sustainable improvement in

earnings

As a result, total conversion cost per ton is

down 10% compared to 2009

277

298

269

Container Plant Conversion Costs

(7.6%)

2.9%

Source: FBA and company estimates

Total conversion cost per ton is now 3% lower

than the FBA industry average for 2009 |

17

Improving Container Plant Metrics

31.6

4.60

3.12

40.6

26.1

Up 56%

Up 31%

Down 18%

Smurfit-Stone container plants are more efficient and lower cost than perceived

|

Significant Targeted Synergies

18

–

Box plant optimization

–

Logistics optimization

Manufacturing Optimization

Purchasing, Fiber Sourcing and Transportation

Corporate Overhead

–

Public company costs

–

Management and facility integration

–

IT integration

–

Economies of scale

–

Alignment and optimization

Annual

Synergies

($m)

Manufacturing

Optimization

Purchasing, Fiber

Sourcing, and

Transportation

Corporate

Overhead

$0

$50

$100

$150

$200 |

19

19

Smurfit-Stone’s corrugated assets will be combined with RockTenn’s

corrugated assets under

the leadership of Jim Porter with a four-pronged integration strategy:

•

Complete the box plant consolidation and optimization strategy initiated by SSCC

management

•

Opportunities to invest capital in the mill system and optimize the footprint to

reduce cost and maximize production efficiency

•

Apply the RockTenn

management model to the box plant system, driving product

innovation, customer satisfaction and low-cost manufacturing while maximizing

sales revenue

•

Consolidate

the

divisional

entity

into

one

RockTenn

headquarters

located

in

Norcross,

GA

Administrative integration to be led by Steve Voorhees, who led the successful Gulf

States and Southern Container integrations

Integration Strategy |

Smurfit-Stone Pension Overview

20

Pension Asset and Liability Overview

Projected Pension Expense and Contributions

Smurfit-Stone Projected Pending Funding Status, Expense and Cash Contributions

(Represents United States and Canadian Defined Benefit Pension Plans)

For the Periods Ending 12/31

2011

2012

2013

2014

Underfunded Amount

($1,004)

($702)

($402)

($122)

Funded %

73%

81%

89%

97%

2011

2012

2013

2014

GAAP Pension Expense

$42

$30

$9

($8)

Cash Contributions

$122

$323

$338

$348

12/31/2010

Projected Benefit Obligation

$3,862

Asset Values

$2,730

Unfunded Amount

$1,132

Funded Ratio

71%

Discount Rate (US)

5.32%

Discount Rate (Canada)

5.15%

Rate of Return Assumption (US)

7.75%

Rate of Return Assumption (Canada)

6.30% |

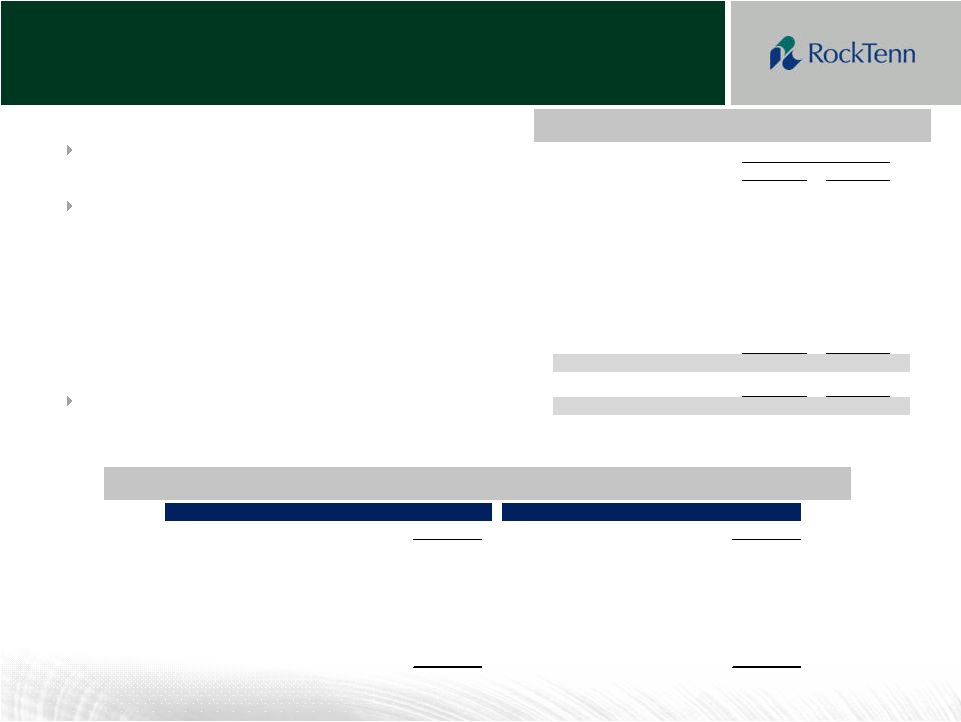

Financing Overview and Capitalization Table

Wells

Fargo,

SunTrust

and

Rabobank

are

providing $3.7 billion to fund the transaction

Commitment is structured as a senior credit facility

in three tranches:

–

$1.2 billion Revolving Credit Facility and

$1.25 billion Term Loan A, both with a five

year maturity

–

$1.25 billion Term Loan B with a six year

maturity

Capital structure includes estimated $500 million

liquidity at closing

Capitalization Table

Sources & Uses

21

(millions)

Amount

Amount

New Equity issued

1,768

Purchase of Smurfit-Stone Equity

3,536

Smurfit-Stone Existing Cash

442

Retirement of Smurfit-Stone Debt

1,156

$1.2B New Revolver

632

Retirement of RockTenn Debt

469

New Term Loan A

1,250

Financing Fees

89

New Term Loan B

1,250

Executive Contract Payments

42

Smurfit-Stone Transaction Costs

30

RockTenn Transaction Costs

20

Total Sources

5,342

Total Uses

5,342

Sources of Funds

Uses of Funds

(millions)

Actual

%

$1.2 billion Revolver

631.9

$

9.6

%

Term Loan A

1,250.0

19.0

Term Loan B

1,250.0

19.0

2011 Notes

154.7

2.4

2013 Notes

80.5

1.2

Receivables due 2012

0.0

0.0

Other Secured Debt

36.1

0.5

2016 Notes

300.0

$

4.6

%

Other

-

-

Total Net Debt

3,703.2

$

56.3

%

Shareholders' Equity

2,877.8

43.7

Total Capitalization

6,581.0

$

100.0

%

Pro Forma Adjusted EBITDA

(1)

1,341.6

$

Pro Forma Leverage Ratio

2.76x

Capitalization at Close

(1)

Pro Forma Adjusted EBITDA is RockTenn LTM 12/31/10 Credit Agreement EBITDA plus

annualized Smurfit-Stone Adjusted EBITDA for three months ended

12/31/201010 |

Conclusion

Combined RockTenn

and Smurfit-Stone

–

#2 producer of containerboard in North America

–

#2 producer of coated recycled board in North America

–

Management team with strong record of shareholder value creation

and excellent

record of integrating acquisitions

–

The mix of fiber inputs is 55% virgin fiber and 45% recycled fiber

–

Expands geographic footprint to the Midwest and West Coast

–

Conservative capital structure with significant liquidity at close

–

Opportunity to improve results through cost reduction and capital investment

22

We believe the acquisition of Smurfit-Stone represents a significant

opportunity

to

continue

our

track

record

of

creating

shareholder

value |

23

EBITDA Definitions

Pro Forma Adjusted EBITDA (as defined)

Pro

Forma

Adjusted

EBITDA

is

calculated

as

the

sum

of

RockTenn’s

Credit

Agreement

EBITDA

and

Smurfit-Stone’s

Adjusted

EBITDA plus pro forma adjustments consistent with the two.

Credit Agreement EBITDA

RockTenn’s

“Credit

Agreement

EBITDA”

is

calculated

in

accordance

with

the

definition

contained

in

our

existing

Senior

Credit

Facility. Credit Agreement EBITDA is generally defined as Consolidated Net Income plus:

consolidated interest expense, income taxes of the consolidated companies

determined in accordance with GAAP, depreciation and amortization expense of the

consolidated companies determined in accordance with GAAP, certain non-cash and

cash charges incurred, and charges taken resulting

from

the

impact

of

changes

to

accounting

rules

related

to

the

expensing

of

stock

options.

Smurfit-Stone’s Adjusted EBITDA

Smurfit-Stone’s EBITDA is generally defined as Net income plus: interest

expense, income taxes, interest expense, net and depreciation, depletion and

amortization. Adjusted EBITDA is defined as EBITDA adjusted for reorganization items, restructuring

charges and gain or loss on disposal of assets. |