Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PNC FINANCIAL SERVICES GROUP, INC. | d8k.htm |

| EX-99.1 - FINANCIAL SUPPLEMENT (UNAUDITED) FOR FOURTH QUARTER - PNC FINANCIAL SERVICES GROUP, INC. | dex991.htm |

The PNC

Financial Services Group, Inc. Fourth Quarter and Full Year 2010

Earnings Conference Call

January 20, 2011

Exhibit 99.2 |

2

Cautionary Statement Regarding Forward-Looking

Information and Adjusted Information

This

presentation

includes

“snapshot”

information

about

PNC

used

by

way

of

illustration.

It

is

not

intended

as

a

full

business

or

financial

review

and

should

be

viewed

in

the

context

of

all

of

the

information

made

available

by

PNC

in

its

SEC

filings.

The

presentation

also

contains

forward-looking

statements

regarding

our

outlook

or

expectations

relating

to

PNC’s

future

business,

operations,

financial

condition,

financial

performance,

capital

and

liquidity

levels,

and

asset

quality.

Forward-looking

statements

are

necessarily

subject

to

numerous

assumptions,

risks

and

uncertainties,

which

change

over

time.

The

forward-looking

statements

in

this

presentation

are

qualified

by

the

factors

affecting

forward-looking

statements

identified

in

the

more

detailed

Cautionary

Statement

included

in

the

Appendix,

which

is

included

in

the

version

of

the

presentation

materials

posted

on

our

corporate

website

at

www.pnc.com/investorevents.

We

provide

greater

detail

regarding

some

of

these

factors

in

our

2009

Form

10-K

and

2010

Form

10-Qs,

including

in

the

Risk

Factors

and

Risk

Management

sections

of

those

reports,

and

in

our

subsequent

SEC

filings

(accessible

on

the

SEC’s

website

at

www.sec.gov

and

on

or

through

our

corporate

website

at

www.pnc.com/secfilings).

We

have

included

web

addresses

here

and

elsewhere

in

this

presentation

as

inactive

textual

references

only.

Information

on

these

websites

is

not

part

of

this

presentation.

Future

events

or

circumstances

may

change

our

outlook

or

expectations

and

may

also

affect

the

nature

of

the

assumptions,

risks

and

uncertainties

to

which

our

forward-looking

statements

are

subject.

The

forward-looking

statements

in

this

presentation

speak

only

as

of

the

date

of

this

presentation.

We

do

not

assume

any

duty

and

do

not

undertake

to

update

those

statements.

In

this

presentation,

we

will

sometimes

refer

to

adjusted

results

to

help

illustrate

the

impact

of

certain

types

of

items,

such

as

our

third

quarter

2010

gain

related

to

the

sale

of

PNC

Global

Investment

Servicing

Inc.

(“GIS”),

the

acceleration

of

accretion

of

the

remaining

issuance

discount

on

our

TARP

preferred

stock

in

connection

with

the

first

quarter

2010

redemption

of

such

stock,

our

fourth

quarter

2009

gain

related

to

BlackRock’s

acquisition

of

Barclays

Global

Investors

(the

“BLK/BGI

gain”),

our

fourth

quarter

2008

conforming

provision

for

credit

losses

for

National

City,

and

other

National

City

integration

costs

in

the

2010

and

2009

periods.

This

information

supplements

our

results

as

reported

in

accordance

with

GAAP

and

should

not

be

viewed

in

isolation

from,

or

a

substitute

for,

our

GAAP

results.

We

believe

that

this

additional

information

and

the

reconciliations

we

provide

may

be

useful

to

investors,

analysts,

regulators

and

others

as

they

evaluate

the

impact

of

these

respective

items

on

our

results

for

the

periods

presented

due

to

the

extent

to

which

the

items

are

not

indicative

of

our

ongoing

operations.

We

may

also

provide

information

on

pretax

pre-

provision

earnings

(total

revenue

less

noninterest

expense),

as

we

believe

that

pretax

pre-provision

earnings,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

evaluate

the

ability

to

provide

for

credit

costs

through

operations.

Where

applicable,

we

provide

GAAP

reconciliations

for

such

additional

information.

In

certain

discussions,

we

may

also

provide

information

on

yields

and

margins

for

all

interest-earning

assets

calculated

using

net

interest

income

on

a

taxable-equivalent

basis

by

increasing

the

interest

income

earned

on

tax-exempt

assets

to

make

it

fully

equivalent

to

interest

income

earned

on

taxable

investments.

We

believe

this

adjustment

may

be

useful

when

comparing

yields

and

margins

for

all

earning

assets.

We

may

also

use

annualized,

proforma,

estimated

or

third

party

numbers

for

illustrative

or

comparative

purposes

only.

These

may

not

reflect

actual

results.

This

presentation

may

also

include

discussion

of

other

non-GAAP

financial

measures,

which,

to

the

extent

not

so

qualified

therein

or

in

the

Appendix,

is

qualified

by

GAAP

reconciliation

information

available

on

our

corporate

website

at

www.pnc.com

under

“About

PNC–Investor

Relations.” |

3

Today’s Discussion

2010 strategic achievements

Business highlights

Key financial take-aways

Summary and 2011 expectations

PNC Continues to Build a Great Company.

PNC Continues to Build a Great Company. |

4

2010 Strategic Highlights

Grew our businesses and delivered record net income in 2010

Transitioned to a higher quality balance sheet

Improved our Tier 1 capital ratios to record levels

Implemented the PNC sales and service model

Exceeded our original acquisition-related cost savings target

Actively managed our risk positions toward a moderate profile

Exceptional achievements in a challenging environment

6.0%

9.8%²

Tier 1 common ratio

Diluted EPS

Return on avg assets

Net income

As reported

$4.36

$5.74

.87%

1.28%

$2.4 billion

$3.4 billion

2009

2010

Diluted EPS

Return on avg assets

Net income

As adjusted¹

$3.45

$6.07

.72%

1.25%

$2.0 billion

$3.3 billion

2009

2010

Amounts are as of or for the year ended December 31. (1) 2010 adjusted for the after-tax

gain on the sale of GIS and the impact of the accelerated accretion of the remaining

issuance discount in connection with the redemption of our TARP preferred stock. 2009 adjusted for the

after-tax BLK/BGI gain. Both periods adjusted for after-tax integration costs. Further

information is provided in the Appendix. (2) Estimated. PNC Is Positioned to Deliver

Even Greater Shareholder Value. PNC Is Positioned to Deliver Even Greater Shareholder

Value. |

5

Strong 2010 Business Results Contributed to

Record Performance

(1) Represents consolidated PNC amounts.

Retail Banking

Grew checking relationships by

75,000 during the year

Online bill payment active

customers up 25% from 4Q09

High customer and employee

engagement

Corporate & Institutional Banking

Added record number of new clients

FY10

treasury

management

1

revenue

up 8% vs. 2009

FY10

capital

markets

1

revenue

up

16% year over year

Asset Management

Record high client acquisition and

client satisfaction

Assets under management up

$5 billion from 4Q09

Assets under administration over

$210 billion

Residential Mortgage

Realigned the business to PNC’s model

FY10 servicing fees up 9% year over

year

FY10 noninterest expenses down 11%

from 2009 |

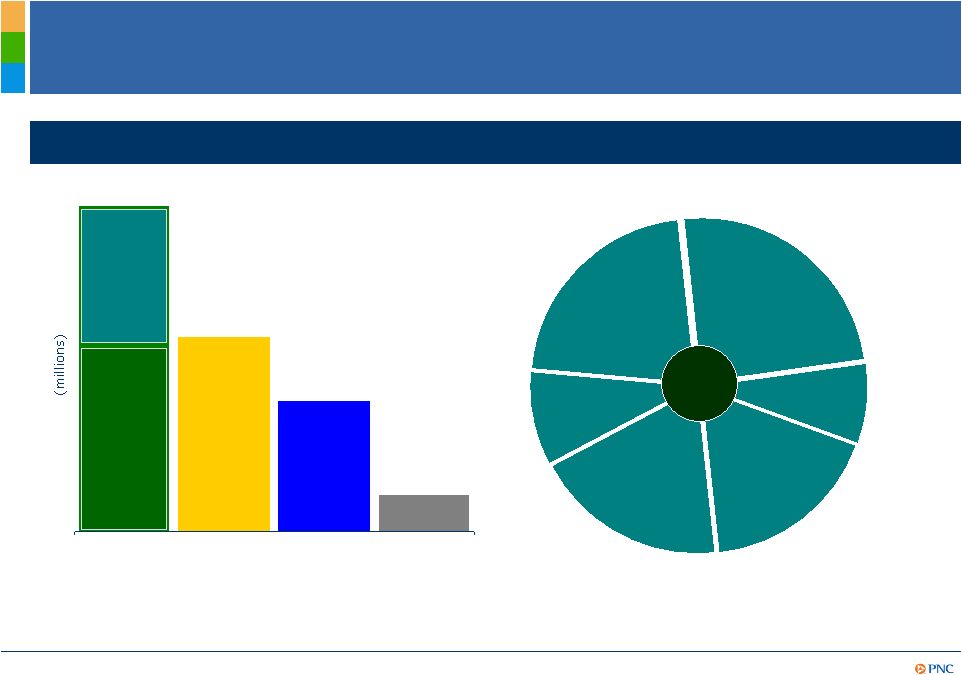

6

2010 sales up 16% vs. 2009

2H10 sales up 17% vs. 1H10

100% of markets exceeded 2010 goal

2010 sales up 26% vs. 2009

2H10 sales up 58% vs. 1H10

90% of markets exceeded 2010 goal

Strong Sales Momentum Across the Franchise

Corporate

Banking

Wealth

Management

Institutional

Investments

Commercial

Banking

Sales contribution by region

2010 annualized

Products

Eastern

markets

56%

(vs. 58% in 2009)

Western

markets

44%

(vs. 42% in 2009)

2010 franchise sales up 20% vs. 2009 |

7

Key Financial Take-Aways

$1.60

$1.50

4Q10

$6.07

$5.74

FY10

$1.56

$2.07

3Q10

Strong

earnings

$3.45

$4.36

FY09

Adjusted

earnings

per

diluted

share

1,2

Reported earnings per diluted share

17.2%

16.0%

21.4%

15.4%

Return

on

Tier

1

common

capital

4

$56.29

4Q10

$56.29

FY10

$55.91

3Q10

Improved

valuation

drivers

$47.68

FY09

Book

value

per

common

share

5

3.82%

4.14%

3.96%

3.93%

Net interest margin

2.17%

3.03%

3.10%

3.15%

Provision-adjusted

net

interest

margin³

44%

4Q10

39%

FY10

38%

3Q10

Improved

earnings

drivers

44%

FY09

Noninterest income to total revenue

(1)

3Q10

and

FY10

adjusted

for

the

after-tax

gain

on

the

sale

of

GIS.

FY09

adjusted

for

the

after-tax

BLK/BGI

gain.

All

periods

adjusted

for

after-tax

integration

costs.

(2)

FY10

adjusted

for

the

impact

of

the

accelerated

accretion

of

the

remaining

issuance

discount

in

connection

with

the

redemption

of

our

TARP

preferred

stock

in

1Q10.

(3)

Net

interest

margin

less

(annualized

provision/average

interest-earning

assets).

(4)

4Q10

and

FY10

tier

1

common

capital

are

estimated.

Return

on

tier

1

common

capital

calculated

as

annualized

net

income

divided

by

tier

1

common

capital.

(5)

At

period

end.

Further

information

related

to

(1),

(2),

(3)

and

(4)

is

provided

in

the

Appendix. |

8

A Higher Quality, Differentiated Balance Sheet

$260.1

29.4

.6

50.9

179.2

51.0

$128.2

$260.1

46.5

150.1

$63.5

Sept. 30,

2010

$264.3

29.6

.6

50.7

183.4

48.7

$134.7

$264.3

49.4

150.6

$64.3

Dec. 31,

2010

7.8

Preferred equity

$269.9

Total liabilities and equity

53.2

Borrowed funds, other

186.9

Total deposits

22.0

Common equity

60.7

Retail CDs, time, savings

$126.2

Transaction deposits

56.4

Other assets

157.5

Total loans

$269.9

Total assets

$56.0

Dec. 31,

2009

Investment securities

Category (billions)

Growth in high quality, short-

duration securities

Loan balances appear to be

stabilizing

Continued growth in

transaction deposits while

reducing higher cost brokered

and retail CDs

Core funded –

loans to deposits

ratio of 82%

Significant improvement in

common equity

Highlights |

9

Credit Quality Improvement

Accruing

loans

past

due

1,2

(1)

Loans

acquired

from

National

City

that

were

impaired

are

not

included

as

they

were

recorded

at

estimated

fair

value

when

acquired

and

are

currently

considered

performing

loans

due

to

the

accretion

of

interest

in

purchase

accounting.

(2)

Excludes

loans

that

are

government

insured/guaranteed,

primarily

residential

mortgages.

(3)

Does

not

include

loans

held

for

sale

or

foreclosed

and

other

assets.

$2.5

$1.9

$1.4

$1.4

$.8

$.6

$.6

$.5

1Q10

2Q10

3Q10

4Q10

30-89 Days

90 Days +

Provision for credit losses

$751

$823

$486

$442

1Q10

2Q10

3Q10

4Q10

Net charge-offs

$691

$840

$614

$791

1Q10

2Q10

3Q10

4Q10

Nonperforming

loans

1,3

$5.8

$5.1

$4.8

$4.5

1Q10

2Q10

3Q10

4Q10 |

10

Relatively Stable Net Interest Income and

Provision-Adjusted Net Interest Margin¹

$2.0

$1.9

$1.9

$1.9

$.3

$.3

$.5

$.4

NII

$2.4

$2.4

$2.2

1Q10

2Q10

3Q10

$227

$225

$224

$224

NII excluding purchase accounting accretion

Impact of purchase accounting accretion

Average interest-earning assets

4Q10

$2.2

3.96%

4.35%

3.93%

4.24%

2.88%

3.15%

3.10%

2.90%

1Q10

2Q10

3Q10

4Q10

Net interest margin

Provision-adjusted

NIM

1

(1)

Net

interest

margin

less

(annualized

provision/average

interest-earning

assets).

PNC

believes

that

provision-adjusted

net

interest

margin,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

evaluate

the

amount

of

credit

related

risk

associated

with

interest-earning

assets.

Further

information is provided in the Appendix.

Provision

.8

.8

.5

.4

NII less

provision

$1.6

$1.6

$1.7

$1.8 |

11

Strong Pretax Pre-Provision Earnings¹

from Diverse

Revenue Streams and Well-Controlled Expenses

(1) Total revenue less noninterest expense. PNC believes that pretax, pre-provision

earnings, a non-GAAP measure, is useful as a tool to help evaluate our ability to

provide for credit costs through operations. Further information is provided in the Appendix.

$3,903

$2,340

$1,563

$442

Net

interest

income

56%

Non-

interest

income

44%

Total

revenue

Noninterest

expense

Pretax

pre-

provision

earnings¹

Provision

Three months ended December 31, 2010

Asset

management

Consumer

services

Corporate

services

Residential

mortgage

Deposit

service

charges

18%

19%

9%

22%

8%

Other

24%

$1.7B

Noninterest income |

12

Improved Capital and Solid Returns

Ratios and book value per common share as of quarter end. (1) Estimated. (2) Return on tier 1

common capital calculated as annualized net income divided by tier 1 common capital.

All periods adjusted for after-tax integration costs. 3Q10 also adjusted for the after-tax gain on the

sale of GIS. Unadjusted, the return on Tier 1 common for 1Q10, 2Q10, 3Q10 and 4Q10 was 15.5%,

17.7%, 21.4%, and 15.4%, respectively. Further information is provided in the

Appendix. Tier 1 ratio

Tier 1 common ratio

7.9%

8.3%

9.6%

9.8%

1Q10

2Q10

3Q10

4Q10

Adjusted return on Tier 1 common²

Book value per common share

$50.32

$52.77

$55.91

$56.29

1Q10

2Q10

3Q10

4Q10

10.3%

10.7%

11.9%

12.1%

1Q10

2Q10

3Q10

4Q10

17.2%

19.2%

16.2%

16.3%

1Q10

2Q10

3Q10

4Q10

1

1

1 |

13

PNC Is Well Positioned to Capture

Growth Opportunities

Time

Disciplined

expense

management

Growth

through

execution

Growth

through

lending

Growth

through

innovation

Growth

through

market share

Credit quality

improvement

Capital

management

Higher

interest rates

Non-distressed loan contraction beginning to level off

Balance sheet remains well-positioned for rising rates

Continuous improvement culture in place

across franchise

PNC’s outlook

Continued low cost deposit growth expected

Credit metrics expected to continue to improve with a

stable to improving economy

Proven products growing with more

in pipeline

Strong sales, cross-sell and client

acquisition momentum |

14

Cautionary Statement Regarding Forward-Looking

Information

Appendix

This

presentation

includes

“snapshot”

information

about

PNC

used

by

way

of

illustration

and

is

not

intended

as

a

full

business

or

financial

review.

It

should

not

be

viewed

in

isolation

but

rather

in

the

context

of

all

of

the

information

made

available

by

PNC

in

its

SEC

filings.

We

also

make

statements

in

this

presentation,

and

we

may

from

time

to

time

make

other

statements,

regarding

our

outlook

or

expectations

for

earnings,

revenues,

expenses,

capital

levels,

liquidity

levels,

asset

quality

and/or

other

matters

regarding

or

affecting

PNC

that

are

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act.

Forward-looking

statements

are

typically

identified

by

words

such

as

“believe,”

“plan,”

“expect,”

“anticipate,”

“intend,”

“outlook,”

“estimate,”

“forecast,”

“will,”

“should,”

“project,”

“goal”

and

other

similar

words

and

expressions.

Forward-looking

statements

are

subject

to

numerous

assumptions,

risks

and

uncertainties,

which

change

over

time.

Forward-looking

statements

speak

only

as

of

the

date

they

are

made.

We

do

not

assume

any

duty

and

do

not

undertake

to

update

our

forward-

looking

statements.

Actual

results

or

future

events

could

differ,

possibly

materially,

from

those

that

we

anticipated

in

our

forward-looking

statements,

and

future

results

could

differ

materially

from

our

historical

performance.

Our

forward-looking

statements

are

subject

to

the

following

principal

risks

and

uncertainties.

We

provide

greater

detail

regarding

some

of

these

factors

in

our

2009

Form

10-K

and

2010

Form

10-Qs,

including

in

the

Risk

Factors

and

Risk

Management

sections

of

those

reports,

and

in

our

subsequent

SEC

filings.

Our

forward-looking

statements

may

also

be

subject

to

other

risks

and

uncertainties,

including

those

that

we

may

discuss

elsewhere

in

this

presentation

or

in

our

filings

with

the

SEC,

accessible

on

the

SEC’s

website

at

www.sec.gov

and

on

or

through

our

corporate

website

at

www.pnc.com/secfilings.

We

have

included

these

web

addresses

as

inactive

textual

references

only.

Information

on

these

websites

is

not

part

of

this document.

•Our

businesses

and

financial

results

are

affected

by

business

and

economic

conditions,

both

generally

and

specifically

in

the

principal

markets

in

which

we

operate.

In

particular,

our

businesses

and

financial

results

may

be

impacted

by:

o

Changes

in

interest

rates

and

valuations

in

the

debt,

equity

and

other

financial

markets.

o

Disruptions

in

the

liquidity

and

other

functioning

of

financial

markets,

including

such

disruptions

in

the

markets

for

real

estate

and

other

assets

commonly

securing

financial

products.

o

Actions

by

the

Federal

Reserve

and

other

government

agencies,

including

those

that

impact

money

supply

and

market

interest

rates.

o

Changes

in

our

customers’,

suppliers’

and

other

counterparties’

performance

in

general

and

their

creditworthiness

in

particular.

o

A

slowing

or

failure

of

the

moderate

economic

recovery

that

began

in

mid-2009

and

continued

throughout

2010.

o

Continued

effects

of

the

aftermath

of

recessionary

conditions

and

the

uneven

spread

of

the

positive

impacts

of

the

recovery

on

the

economy

in

general

and

our

customers

in

particular,

including

adverse

impact

on

loan

utilization

rates

as

well

as

delinquencies,

defaults

and

customer

ability

to

meet

credit

obligations.

o

Changes

in

levels

of

unemployment.

o

Changes

in

customer

preferences

and

behavior,

whether

as

a

result

of

changing

business

and

economic

conditions,

climate-related

physical

changes

or

legislative

and

regulatory

initiatives,

or

other

factors.

•Turbulence

in

significant

portions

of

the

US

and

global

financial

markets

could

impact

our

performance,

both

directly

by

affecting

our

revenues

and

the

value

of

our

assets

and

liabilities

and

indirectly

by

affecting

our

counterparties

and

the

economy

generally. |

15

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

•We

will

be

impacted

by

the

extensive

reforms

provided

for

in

the

Dodd-Frank

Wall

Street

Reform

and

Consumer

Protection

Act

(“Dodd-Frank

Act”)

and

ongoing

reforms

impacting

the

financial

institution

industry

generally.

Further,

as

much

of

the

Dodd-Frank

Act

will

require

the

adoption

of

implementing

regulations

by

a

number

of

different

regulatory

bodies,

the

precise

nature,

extent

and

timing

of

many

of

these

reforms

and

the

impact

on us is still uncertain.

•Financial

industry

restructuring

in

the

current

environment

could

also

impact

our

business

and

financial

performance

as

a

result

of

changes

in

the

creditworthiness

and

performance

of

our

counterparties

and

by

changes

in

the

competitive

and

regulatory

landscape.

•Our

results

depend

on

our

ability

to

manage

current

elevated

levels

of

impaired

assets.

•Given

current

economic

and

financial

market

conditions,

our

forward-looking

financial

statements

are

subject

to

the

risk

that

these

conditions

will

be

substantially

different

than

we

are

currently

expecting.

These

statements

are

based

on

our

current

view

that

the

moderate

economic

recovery

that

began

in

mid-2009

and

continued

throughout

2010

will

slowly

gather

enough

momentum

in

2011

to

lower

the

unemployment

rate

amidst

continued

low interest rates.

•Legal

and

regulatory

developments

could

have

an

impact

on

our

ability

to

operate

our

businesses

or

our

financial

condition

or

results

of

operations

or

our

competitive

position

or

reputation.

Reputational

impacts,

in

turn,

could

affect

matters

such

as

business

generation

and

retention,

our

ability

to

attract

and

retain

management,

liquidity,

and

funding.

These

legal

and

regulatory

developments

could

include:

o

Changes

resulting

from

legislative

and

regulatory

responses

to

the

current

economic

and

financial

industry

environment.

o

Other

legislative

and

regulatory

reforms,

including

broad-based

restructuring

of

financial

industry

regulation

(such

as

that

under

the

Dodd-Frank

Act)

as

well

as

changes

to

laws

and

regulations

involving

tax,

pension,

bankruptcy,

consumer

protection,

and

other

aspects

of

the

financial

institution industry.

o

Unfavorable

resolution

of

legal

proceedings

or

other

claims

and

regulatory

and

other

governmental

investigations

or

other

inquiries.

In

addition

to

matters

relating

to

PNC’s

business

and

activities,

such

matters

may

also

include

proceedings,

claims,

investigations,

or

inquiries

relating

to

pre-acquisition

business

and

activities

of

acquired

companies,

such

as

National

City.

o

The

results

of

the

regulatory

examination

and

supervision

process,

including

our

failure

to

satisfy

the

requirements

of

agreements

with

governmental agencies.

o

Changes in accounting policies and principles.

o

Changes

resulting

from

legislative

and

regulatory

initiatives

relating

to

climate

change

that

have

or

may

have

a

negative

impact

on

our

customers’

demand for or use of our products and services in general and their creditworthiness in

particular. o

Changes

to

regulations

governing

bank

capital,

including

as

a

result

of

the

Dodd-Frank

Act

and

of

the

so-called

“Basel

III”

initiatives.

•Our

business

and

operating

results

are

affected

by

our

ability

to

identify

and

effectively

manage

risks

inherent

in

our

businesses,

including,

where

appropriate,

through

the

effective

use

of

third-party

insurance,

derivatives,

and

capital

management

techniques,

and

by

our

ability

to

meet

evolving

regulatory capital standards.

•The

adequacy

of

our

intellectual

property

protection,

and

the

extent

of

any

costs

associated

with

obtaining

rights

in

intellectual

property

claimed

by

others, can impact our business and operating results.

•Our

ability

to

anticipate

and

respond

to

technological

changes

can

have

an

impact

on

our

ability

to

respond

to

customer

needs

and

to

meet

competitive demands.

•Our

ability

to

implement

our

business

initiatives

and

strategies

could

affect

our

financial

performance

over

the

next

several

years.

•Competition

can

have

an

impact

on

customer

acquisition,

growth

and

retention,

as

well

as

on

our

credit

spreads

and

product

pricing,

which

can

affect

market share, deposits and revenues. |

16

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

•Our

business

and

operating

results

can

also

be

affected

by

widespread

disasters,

terrorist

activities

or

international

hostilities,

either

as

a

result

of

the

impact

on

the

economy

and

capital

and

other

financial

markets

generally

or

on

us

or

on

our

customers,

suppliers

or

other

counterparties

specifically.

•Also,

risks

and

uncertainties

that

could

affect

the

results

anticipated

in

forward-looking

statements

or

from

historical

performance

relating

to

our

equity

interest

in

BlackRock,

Inc.

are

discussed

in

more

detail

in

BlackRock’s

filings

with

the

SEC,

including

in

the

Risk

Factors

sections

of

BlackRock’s

reports.

BlackRock’s

SEC

filings

are

accessible

on

the

SEC’s

website

and

on

or

through

BlackRock’s

website

at

www.blackrock.com.

This

material is referenced for informational purposes only and should not be deemed to constitute

a part of this document. We

grow

our

business

in

part

by

acquiring

from

time

to

time

other

financial

services

companies.

Acquisitions

present

us

with

risks

in

addition

to

those

presented

by

the

nature

of

the

business

acquired.

These

include

risks

and

uncertainties

related

both

to

the

acquisition

transactions

themselves and to the integration of the acquired businesses into PNC after closing.

Acquisitions

may

be

substantially

more

expensive

to

complete

(including

unanticipated

costs

incurred

in

connection

with

the

integration

of

the

acquired

company)

and

the

anticipated

benefits

(including

anticipated

cost

savings

and

strategic

gains)

may

be

significantly

harder

or

take

longer

to

achieve

than

expected.

Acquisitions

may

involve

our

entry

into

new

businesses

or

new

geographic

or

other

markets,

and

these

situations

also

present risks resulting from our inexperience in those new areas.

As

a

regulated

financial

institution,

our

pursuit

of

attractive

acquisition

opportunities

could

be

negatively

impacted

due

to

regulatory

delays

or

other

regulatory

issues.

In

addition,

regulatory

and/or

legal

issues

relating

to

the

pre-acquisition

operations

of

an

acquired

business

may

cause

reputational

harm

to

PNC

following

the

acquisition

and

integration

of

the

acquired

business

into

ours

and

may

result

in

additional

future

costs

or

regulatory limitations arising as a result of those issues.

Any

annualized,

proforma,

estimated,

third

party

or

consensus

numbers

in

this

presentation

are

used

for

illustrative

or

comparative

purposes

only

and

may

not

reflect

actual

results.

Any

consensus

earnings

estimates

are

calculated

based

on

the

earnings

projections

made

by

analysts

who

cover

that

company.

The

analysts’

opinions,

estimates

or

forecasts

(and

therefore

the

consensus

earnings

estimates)

are

theirs

alone,

are

not

those

of

PNC

or

its

management,

and

may

not

reflect

PNC’s

or

other

company’s

actual

or

anticipated

results. |

17

Non-GAAP to GAAP Reconcilement

Appendix

In millions except per share data

Adjustments,

pretax

Income taxes

(benefit)

1

Net income

Net income

attributable to

common

shareholders

Diluted EPS

from net

income

Average

Assets

Return on

Avg. Assets

Net income, diluted EPS, and return on avg. assets, as reported

$820

$798

$1.50

Reported net income, if annualized

$3,253

$263,558

1.23%

Adjustment:

Integration costs

$78

($27)

51

51

.10

Net income, diluted EPS, and return on avg. assets, as adjusted

$871

$849

$1.60

Net income, as adjusted, if annualized

$3,454

$263,558

1.31%

In millions except per share data

Adjustments,

pretax

Income taxes

(benefit)

1

Net income

Net income

attributable to

common

shareholders

Diluted EPS

from net

income

Net income and diluted EPS, as reported

$1,103

$1,094

$2.07

Adjustments:

Gain on sale of GIS

($639)

$311

(328)

(328)

(.62)

Integration costs

96

(34)

62

62

.11

Net income and diluted EPS, as adjusted

$837

$828

$1.56

In millions except per share data

Adjustments,

pretax

Income taxes

(benefit)

1

Net income

Net income

attributable to

common

shareholders

Diluted EPS

from net

income

Net income and diluted EPS, as reported

$1,107

$1,011

$2.17

Adjustments:

Gain on BlackRock/BGI transaction

($1,076)

$389

(687)

(687)

(1.49)

Integration costs

155

(54)

101

101

.22

Net income and diluted EPS, as adjusted

$521

$425

$.90

For the three months ended December 31, 2010

For the three months ended September 30, 2010

For the three months ended December 31, 2009

PNC

believes

that

information

adjusted

for

the

impact

of

certain

items

may

be

useful

due

to

the

extent

to

which

the

items

are

not

indicative

of

our

ongoing

operations.

(1) Calculated using a marginal federal income tax rate of 35% and includes applicable income

tax adjustments. The after-tax gain on the sale of GIS and the after-tax gain

on the BlackRock/BGI transaction also reflect the impact of state income taxes. |

18

Non-GAAP to GAAP Reconcilement

Appendix

In millions except per share data

Adjustments,

pretax

Income taxes

(benefit)

1

Net income

Net income

attributable to

common

shareholders

Diluted EPS

from net

income

Average

Assets

Return on

Avg. Assets

Net income, diluted EPS, and return on avg. assets, as reported

$3,397

$3,011

$5.74

$264,902

1.28%

Adjustments:

Gain on sale of GIS

($639)

$311

(328)

(328)

(.63)

Integration costs

387

(136)

251

251

.48

TARP preferred stock accelerated discount accretion²

250

.48

Net income, diluted EPS, and return on avg. assets, as adjusted

$3,320

$3,184

$6.07

$264,902

1.25%

In millions except per share data

Adjustments,

pretax

Income taxes

(benefit)

1

Net income

Net income

attributable to

common

shareholders

Diluted EPS

from net

income

Average

Assets

Return on

Avg. Assets

Net income, diluted EPS, and return on avg. assets, as reported

$2,403

$2,003

$4.36

$276,876

0.87%

Adjustments:

Gain on BlackRock/BGI transaction

($1,076)

$389

(687)

(687)

(1.51)

Integration costs

421

(147)

274

274

.60

Net income, diluted EPS, and return on avg. assets, as adjusted

$1,990

$1,590

$3.45

$276,876

0.72%

PNC

believes

that

information

adjusted

for

the

impact

of

certain

items

may

be

useful

due

to

the

extent

to

which

the

items

are

not

indicative

of

our

ongoing

operations.

(1)

Calculated

using

a

marginal

federal

income

tax

rate

of

35%

and

includes

applicable

income

tax

adjustments.

The

after-tax

gain

on

the

sale

of

GIS

and

the

after-tax

gain

on the BlackRock/BGI transaction also reflect the impact of state income taxes.

(2) Represents accelerated accretion of the remaining issuance discount on redemption of the

preferred stock in February 2010. For the year ended December 31, 2010

For the year ended December 31, 2009 |

19

Non-GAAP to GAAP Reconcilement

Appendix

For the three months ended

$ in millions

Dec. 31, 2010

Sept. 30, 2010

June 30, 2010

Mar. 31, 2010

Dec. 31, 2009

Net interest margin, as reported

3.93%

3.96%

4.35%

4.24%

4.05%

Provision for credit losses

$442

$486

$823

$751

$1,049

Avg. interest earning assets

$223,795

$223,677

$224,580

$226,992

$230,998

Annualized provision/Avg. interest earning assets

0.78%

0.86%

1.47%

1.34%

1.80%

Provision-adjusted net interest margin (1)

3.15%

3.10%

2.88%

2.90%

2.25%

For the year ended

$ in millions

Dec. 31, 2010

Dec. 31, 2009

Net interest margin, as reported

4.14%

3.82%

Provision for credit losses

$2,502

$3,930

Avg. interest earning assets

$224,749

$238,487

Annualized provision/Avg. interest earning assets

1.11%

1.65%

Provision-adjusted net interest margin (1)

3.03%

2.17%

PNC

believes

that

provision-adjusted

net

interest

margin,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

evaluate

the

amount

of

credit

related

risk

associated with interest-earning assets.

(1) The adjustment represents annualized provision for credit losses divided by average

interest-earning assets. For the three months ended

In millions

Dec. 31, 2010

Sept. 30, 2010

June 30, 2010

Mar. 31, 2010

Dec. 31, 2009

Total revenue

$3,903

$3,598

$3,912

$3,763

$4,886

Noninterest expense

2,340

2,158

2,002

2,113

2,209

Pretax pre-provision earnings

$1,563

$1,440

$1,910

$1,650

$2,677

For the year ended

In millions

Dec. 31, 2010

Dec. 31, 2009

Total revenue

$15,176

$16,228

Noninterest expense

8,613

9,073

Pretax pre-provision earnings

$6,563

$7,155

PNC

believes

that

pretax

pre-provision

earnings,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

evaluate

the

ability

to

provide

for

credit

costs through operations. Total revenue and noninterest expense are both from continuing

operations on our consolidated income statement. |

20

Non-GAAP to GAAP Reconcilement

Appendix

As of or for the three months ended

In millions

Dec. 31, 2010

Sept. 30, 2010

June 30, 2010

Mar. 31, 2010

Tier 1 common capital

$21,191

$20,437

$18,173

$17,562

Reported net income

820

1,103

803

671

Reported net income, if annualized

3,253

4,376

3,221

2,721

Adjustments:

After-tax gain on sale of GIS

-

(328)

After-tax impact of integration costs

51

62

65

73

Adjusted net income

$871

$837

$868

$744

Adjusted net income, if annualized

3,454

3,321

3,482

3,017

Return on tier 1 common capital

15.4%

21.4%

17.7%

15.5%

Adjusted return on tier 1 common capital

16.3%

16.2%

19.2%

17.2%

As of or for the year ended

In millions

Dec. 31, 2010

Dec. 31, 2009

Tier 1 common capital

$21,191

$13,941

Reported net income

3,397

2,403

Adjustments:

After-tax gain on BlackRock/BGI transaction

-

(687)

After-tax gain on sale of GIS

(328)

-

After-tax impact of integration costs

251

274

Adjusted net income

$3,320

$1,990

Return on tier 1 common capital

16.0%

17.2%

Adjusted return on tier 1 common capital

15.7%

14.3%

PNC

believes

that

return

on

tier

1

common

capital

is

useful

as

a

tool

to

help

measure

and

assess

a

company's

use

of

common

equity

and

that

such

information

adjusted

for

the

impact

of

the

BLK/BGI

and

GIS

gains

and

integration

costs

may

be

useful

due

to

the

extent

to

which

those

items

are

not

indicative

of

our

ongoing

operations.

After-tax

adjustments

are

calculated

using

a

marginal

federal

income

tax

rate

of

35%

and

include

applicable

income

tax

adjustments.

The

after-tax

gain

on

the

sale

of

GIS

and

the

after-

tax

BLK/BGI

gain

also

reflect

the

impact

of

state

income

taxes.

Pretax

amounts

and

tax

benefit

for

all

adjustments

other

than

first

and

second

quarters

of

2010

are

shown

on

slides

18

and

19.

Integration

costs

for

1Q10

are

$113

million

pretax

with

tax

benefit

of

$40 million; integration costs for 2Q10 are $100 million pretax with tax benefit of $35

million. |

21

Peer Group of Banks

Appendix

The PNC Financial Services Group, Inc.

PNC

BB&T Corporation

BBT

Bank of America Corporation

BAC

Capital One Financial, Inc.

COF

Comerica Inc.

CMA

Fifth Third Bancorp

FITB

JPMorgan Chase

JPM

KeyCorp

KEY

M&T Bank

MTB

Regions Financial Corporation

RF

SunTrust Banks, Inc.

STI

U.S. Bancorp

USB

Wells Fargo & Co.

WFC

Ticker |