Attached files

| file | filename |

|---|---|

| EX-5.1 - LEGAL OPINION - Home Bistro, Inc. /NV/ | fs1a20111ex5i_apps.htm |

| EX-23.1 - ACCOUNTANTS CONSENT - Home Bistro, Inc. /NV/ | fs1a20111ex23i_apps.htm |

| EX-10.6 - TERMS OF ORAL AGREEMENT - Home Bistro, Inc. /NV/ | fs1a20111ex10vi_apps.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

AMENDMENT NO .2 TO

FORM S-1

|

||

| REGISTRATION STATEMENT | ||

|

UNDER

|

||

|

THE SECURITIES ACT OF 1933

|

||

APPS GENIUS CORP

(Exact Name of Registrant in its Charter)

|

Nevada

|

7374 |

27-1517938

|

||

|

(State or other Jurisdiction of Incorporation)

|

(Primary Standard Industrial Classification Code)

|

(IRS Employer Identification No.)

|

||

APPS GENIUS CORP

157 Broad Street, Suite 303

Red Bank, NJ 07701

Tel.: (732) 530-1267

(Address and Telephone Number of Registrant’s Principal

Executive Offices and Principal Place of Business)

(Name, Address and Telephone Number of Agent for Service)

Copies of communications to:

Gregg E. Jaclin, Esq.

Anslow & Jaclin, LLP

195 Route 9 South, Suite204

Manalapan, NJ 07726

Tel. No.: (732) 409-1212

Fax No.: (732) 577-1188

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective. If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class Of Securities to be Registered

|

Amount to be

Registered

|

Proposed Maximum

Aggregate Offering

Price per share

|

Proposed Maximum

Aggregate

Offering Price

|

Amount of

Registration fee

|

||||||||||||

|

Common Stock, $0.001 par value per share

|

8,936,400

|

$

|

0.25

|

$

|

2,234,100

|

$

|

159.29

|

|||||||||

(1) This Registration Statement covers the resale by our selling shareholders of up to 8,936,400 shares of common stock previously issued to such selling shareholders.

(2) The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o). Our common stock is not traded on any national exchange and in accordance with Rule 457; the offering price was determined by the price of the shares that were sold to our shareholders in a private placement memorandum. The price of $0.25 is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTCBB at which time the shares may be sold at prevailing market prices or privately negotiated prices. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority, which operates the OTC Bulletin Board, nor can there be any assurance that such an application for quotation will be approved.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SUCH SECTION 8(a), MAY DETERMINE.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission (“SEC”) is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Subject to completion, dated January _, 2011

APPS GENIUS CORP

8,936,400 SHARES OF COMMON STOCK

The selling security holders named in this prospectus are offering all of the shares of common stock offered through this prospectus. We will not receive any proceeds from the sale of the common stock covered by this prospectus.

Our common stock is presently not traded on any market or securities exchange. The selling security holders have not engaged any underwriter in connection with the sale of their shares of common stock. Common stock being registered in this registration statement may be sold by selling security holders at a fixed price of $0.25 per share until our common stock is quoted on the OTC Bulletin Board (“OTCBB”) and thereafter at a prevailing market prices or privately negotiated prices or in transactions that are not in the public market. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority (“FINRA”), which operates the OTCBB, nor can there be any assurance that such an application for quotation will be approved. We have agreed to bear the expenses relating to the registration of the shares of the selling security holders.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 3 to read about factors you should consider before buying shares of our common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Date of This Prospectus is: January __, 2011

TABLE OF CONTENTS

|

PAGE

|

|

|

1

|

|

|

2

|

|

|

3

|

|

|

7

|

|

|

7

|

|

|

8

|

|

|

8

|

|

|

10

|

|

|

11

|

|

|

11

|

|

|

12

|

|

|

15

|

|

|

15

|

|

|

16

|

|

|

F-

|

|

|

17

|

|

|

17

|

|

| 23 | |

| Directors, Executive Officers, Promoters and Control Persons | 24 |

|

24

|

|

|

25

|

|

|

26

|

ITEM 3. Summary Information, Risk Factors and Ratio of Earnings to Fixed Charges

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the common stock. You should carefully read the entire prospectus, including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements, before making an investment decision. In this Prospectus, the terms “Apps Genius,” “Company,” “we,” “us” and “our” refer to Apps Genius Corp.

Overview

We were incorporated in the State of Nevada on December 17, 2009 as Apps Genius Corp.

Apps Genius’ principal business is focused on creating innovative social games and mobile applications that let you play together with real-world friends and family using the currently available infrastructure built by both social and mobile networks. Our cross-platform gaming and mobile applications allow users to play and interact with multiple people on multiple networks whether or not they have a preexisting relationship with them. Our Social Gaming and Mobile App technology allows users and players to reach across the multiple networks into a virtual application or gaming environment. Additionally, we have developed unique player incentive platforms that allow users to share in the success of the game or application. Currently we are developing our platform for Facebook, MySpace, iPhone and Android.

Where You Can Find Us

Our principal executive office is located at 157 Broad Street, Suite 303, Red Bank, New Jersey 07701 and our telephone number is (732) 530-1267.

The Offering

|

Common stock offered by selling security holders

|

8,936,400 shares of common stock. This number represents 35% of our current outstanding common stock (1).

|

|

|

Common stock outstanding before the offering

|

25,596,400

|

|

|

Common stock outstanding after the offering

|

25,596,400 common shares as of January 18, 2011 .

|

|

|

Terms of the Offering

|

The selling security holders will determine when and how they will sell the common stock offered in this prospectus.

|

|

|

Termination of the Offering

|

The offering will conclude upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) such time as all of the common stock becomes eligible for resale without volume limitations pursuant to Rule 144 under the Securities Act, or any other rule of similar effect.

|

|

|

Use of proceeds

|

We are not selling any shares of the common stock covered by this prospectus.

|

|

|

Risk Factors

|

The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 3.

|

|

(1) Based on 25,596,400 shares of common stock outstanding as of January 18, 2011 .

The following summary financial data should be read in conjunction with “Management’s Discussion and Analysis,” “Plan of Operation” and the Financial Statements and Notes thereto, included elsewhere in this prospectus. The statement of operations and balance sheet data from inception December 17, 2009 through December 31, 2009 are derived from our audited financial statements and the statement of operations and balance sheet data for the nine months ended September 30, 2010 are derived from our unaudited interim financial statements. The data set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our financial statements and the related notes included in this prospectus.

|

For the Period from December 17, 2009 (Inception) to

December 31, 2009

|

For the Nine

Months Ended September 30, 2010

|

|||||||

|

STATEMENT OF OPERATIONS:

|

||||||||

|

Net Revenues

|

$ | - | $ | 11,724 | ||||

|

Operating Expenses:

|

||||||||

|

Research and development

|

- | 296,314 | ||||||

|

Administrative compensation

|

23,420 | 52,208 | ||||||

|

Professional fees

|

13,700 | 37,545 | ||||||

|

General and administrative

|

257 | 48,113 | ||||||

|

Total Operating Expenses

|

37,377 | 434,180 | ||||||

|

Loss From Operations

|

(37,377 | ) | (422,456 | ) | ||||

|

Other Income:

|

||||||||

|

Interest income

|

- | 670 | ||||||

|

Net Loss

|

$ | (37,377 | ) | $ | (421,786 | ) | ||

|

Net Loss Per Common Share

|

||||||||

|

Basic and Diluted

|

$ | - | $ | (0.02 | ) | |||

|

Weighted Average Common Share Shares Outstanding

|

||||||||

|

Basic and Diluted

|

12,574,286 | 24,348,630 | ||||||

|

BALANCE SHEETS

|

||||||||

|

|

December 31. 2009

|

September 30, 2010

|

||||||

| Cash | $ |

40,100

|

$ |

248,824

|

||||

|

Total Current Assets

|

40,100 | 258,623 | ||||||

|

Total Asset

|

41,000 | 264,710 | ||||||

|

Total Liabilities

|

33,357 | 8,253 | ||||||

|

Total Stockholders’ Equity

|

7,643 | 256,457 | ||||||

The shares of our common stock being offered for resale by the selling security holders are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested in the common stock. Before purchasing any of the shares of common stock, you should carefully consider the following factors relating to our business and prospects. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, you may lose all or part of your investment. You should carefully consider the risks described below and the other information in this process before investing in our common stock.

Risks Related to Our Business

OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM HAS EXPRESSED SUBSTANTIAL DOUBT AS TO OUR ABILITY TO CONTINUE AS A GOING CONCERN.

Based on our financial history since inception, our independent registered public accounting firm has expressed substantial doubt as to our ability to continue as a going concern. We are a development stage company that has generated very little revenue; Specifically the Company, while in the development stage, is proceeding with its business plan by seeking smaller projects to build customers and a basis for leads and referrals. The Company has taken certain steps in furtherance of this business plan including completing 2 small projects. If we cannot obtain sufficient funding, we may have to delay the implementation of our business strategy.

WE HAVE LIMITED OPERATING HISTORY AND FACE MANY OF THE RISKS AND DIFFICULTIES FREQUENTLY ENCOUNTERED BY DEVELOPMENT STAGE COMPANY.

We are a development stage company, and to date, our development efforts have been focused primarily on the development and marketing of our business model. We have limited operating history for investors to evaluate the potential of our business development. We have not built our customer base and our brand name. In addition, we also face many of the risks and difficulties inherent in gaining market share as a new company:

· Develop effective business plan;

· Meet customer standard;

· Attain customer loyalty;

· Develop and upgrade our service;

Our future will depend on our ability to bring our service to the market place, which requires careful planning of providing a product that meets customer standards without incurring unnecessary cost and expense.

WE NEED ADDITIONAL CAPITAL TO DEVELOP OUR BUSINESS.

The development of our services will require the commitment of substantial resources to implement our business plan. Currently, we have no established bank-financing arrangements. Therefore, it is likely we would need to seek additional financing through subsequent future private offering of our equity securities, or through strategic partnerships and other arrangements with corporate partners. We have no current plans for additional financing.

We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us. The sale of additional equity securities will result in dilution to our stockholders. The occurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financing covenants that would restrict our operations. If adequate additional financing is not available on acceptable terms, we may not be able to implement our business development plan or continue our business operations.

IF OUR GAMES FAIL TO GAIN MARKET ACCEPTANCE, WE MAY NOT HAVE SUFFICIENT CAPITAL TO PAY OUR EXPENSES AND TO CONTINUE TO OPERATE.

Our ultimate success will depend on generating revenues from game play purchases, advertising, and affiliate programs. We have no direct advertising sales of our own. All of our advertising revenue is dependent on independent third parties. As a result, if we do not generate enough users, we may be unable to generate sufficient revenues for our games. We may not achieve and sustain market acceptance sufficient to generate revenues to cover our costs and allow us to become profitable or even continue to operate.

WE OPERATE IN A HIGHLY COMPETITIVE INDUSTRY AND COMPETE AGAINST MANY LARGE COMPANIES WHICH COULD HARM OUR BUSINESS.

Many companies worldwide are dedicated to social gaming and similar services related to social gaming. We expect more companies to enter this industry. Our competitors vary in size from small companies to very large companies with dominant market shares and substantial financial resources. The Company’s games will be in competition with these companies, such as Zynga, Electronic Arts, Playdom, and others. Many of our competitors have significantly greater financial, marketing and development resources than we have. As a result, we may not be able to devote adequate resources to develop, acquire or license new technologies, undertake extensive marketing campaigns, adopt aggressive pricing policies or adequately compensate our developers to the same degree as certain of our competitors. As social games in many of our proposed markets are relatively new and rapidly evolving, our current or future competitors may compete more successfully as the industry matures. In particular, any of our competitors may offer products and services that have significant performance, price, creativity and/or other advantages over our games and technologies. These products and services may significantly affect the demand for our services. In addition, any of our current or future competitors may be acquired by, receive investments from or enter into other strategic relationships with larger, longer-established and better-financed companies and therefore obtain significantly greater financial, marketing and technology licensing and development resources than we have. If we are unable to compete effectively in our principal markets, our business, financial condition and results of operations could be materially and adversely affected.

UNEXPECTED NETWORK INTERUPTIONS, SECURITY BREACHES OR COMPUTER VIRUS ATTACKS COULD HARM OUR BUSINESS.

The Company may be required to develop and maintain a substantial computer network infrastructure in order to protect our games and proprietary technologies. Any failure to maintain satisfactory performance, reliability, security and availability of such network infrastructure, whether maintained by us or by third parties, may cause significant harm to our ability to attract and maintain users for our services. Major risks relating to any such future network infrastructure include:

|

•

|

any breakdowns or system failures, including from fire, flood, earthquake, typhoon or other natural disasters, power loss or telecommunications failure, resulting in a sustained shutdown of all or a material portion of our servers; and

|

|

|

•

|

any security breach caused by hacking, loss or corruption of data or malfunctions of software, hardware or other computer equipment, and the inadvertent transmission of computer viruses.

|

Any of the foregoing factors could reduce a future users’ satisfaction, harm our business and reputation, have a material adverse effect on our financial condition and results of operations and result in the loss of an investor’s entire investment.

WE RELY UPON A THIRD PARTY TO PROVIDE WEB HOSTING AND NETWORKING FOR OUR GAMES AND DISRUPTION IN THESE SERVICES COULD HARM OUR BUSINESS.

We utilize Amazon.com, a third party hosting and networking provider, to host our web services, including games and other proprietary technologies. If disruptions or capacity constraints occur, the Company may have no means of replacing these services, on a timely basis or at all. This could cause a material adverse condition for our operations and financial earnings.

WE MAY INCUR SIGNIFICANT COSTS TO BE A PUBLIC COMPANY TO ENSURE COMPLIANCE WITH U.S. CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS AND WE MAY NOT BE ABLE TO ABSORB SUCH COSTS.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition, we may not be able to absorb these costs of being a public company which will negatively affect our business operations.

OUR FUTURE SUCCESS IS DEPENDENT, IN PART, ON THE PERFORMANCE AND CONTINUED SERVICE OF ADAM KOTKIN AND ADAM WASSERMAN, OUR OFFICERS AND DIRECTORS.

We are presently dependent to a great extent upon the experience, abilities and continued services of Adam Kotkin, our Chief Executive Officer and Adam Wasserman, our Chief Financial Officer. The loss of services of any of the management staff could have a material adverse effect on our business, financial condition or results of operation.

OUR CHIEF EXECUTIVE OFFICER AND CHAIRMAN OF THE BOARD OF DIRECTORS, ADAM KOTKIN, IS ALSO CHIEF OPERATING OFFICER OF PEOPLESTRING CORPORATION, WHICH MAY CREATE A POTENTIAL CONFLICT OF INTEREST.

Our future ability to execute our business plan depends upon the continued service of our executive officers, including Adam Kotkin, Chief Executive Officer, and Adam Wasserman, our Chief Financial Officer Adam Kotkin is also the chief operating officer of PeopleString Corporation and as such may be limited in the amount of time they can devote to the Company. However, he plans on devoting a minimum of twenty hours per week to the Company. We currently do not have any employment agreements with our key personnel. If we lost the services of one or more of our key personnel, or if one or more of our executive officers or employees joined a competitor or otherwise competed with us, our business may be adversely affected. In particular, the services of key members of our research and development team would be difficult to replace. We cannot assure that we will be able to retain or replace our key personnel. On all matters where a conflict of interest may occur or a decision needs to be made between PeopleString and Apps Genius Corp. Adam Kotkin will recuse himself from all decisions regarding PeopleString, deferring to the remaining officers and directors of PeopleString.

PeopleString Corporation is a social networking company with a multi-tiered affiliate program that shares revenue generated through the social network with PeopleString’s users in which Adam M. Kotkin is the Chief Operating Officer and a Director. Apps Genius Corp has and is continuing to utilize PeopleString’s social network as a promotional tool for its games.

OUR KEY PERSONNEL MAY PROVIDE ONLY LIMITED AMOUNTS OF TIME TO OUR BUSINESS, WHICH MAY CAUSE OUR BUSINESS TO FAIL.

Our future ability to execute our business plan depends upon the continued service of our executive officers, Adam M. Kotkin, our Chief Executive Officer and Chairman, Adam Wasserman, Chief Financial Officer, and other key technology, marketing, sales and support personnel or other employees. Mr. Kotkin is also the Chief Operating Officer of PeopleString Corporation and Mr. Wasserman is chief executive officer of CFO Oncall, Inc. and CFO Oncall Asia, Inc. (collectively “CFO Oncall”), where he owns 80% and 60% of such businesses, respectively. All compensation paid to Mr. Wasserman is paid to CFO Oncall, Inc. CFO Oncall, Inc. provides chief financial officer services to various companies. Mr. Wasserman also serves as chief financial officer of Gold Horse International, Inc, and Transax International, Inc. He is also a director of China Direct Industries, Inc. since January 2010 and Bohai Pharmaceuticals Group, Inc. since July 12, 2010. In addition to Mr. Wasserman’s time, CFO Oncall has full-time dedicated, professional employees that also assist Mr. Wasserman with our Company’s financial matters and communication needs. As such, they may be limited in the amount of time they can devote to the Company. However, they plan on devoting a minimum of twenty hours per weeks to the Company. We currently do not have any employment agreements with our key personnel. However, key technology support personnel are required to enter into a non-disclosure and non-competition agreement with Apps Genius, which provides, among other things, that the employee will not compete with us or solicit any of our customers or employees for a period of one year after his or her employment terminates for any reason. If we lost the services of one or more of our key personnel, or if one or more of our executive officers or employees joined a competitor or otherwise competed with us, our business may be adversely affected. In particular, the services of key members of our research and development team would be difficult to replace. We cannot assure that we will be able to retain or replace our key personnel.

OUR LACK OF PATENT AND/OR COPYRIGHT PROTECTION AND ANY UNAUTHORIZED USE OF THE GAMES AND/OR PROPRIETARY TECHNOLOGIES BY THIRD PARTIES MAY HARM OUR BUSINESS.

We have filed a provisional patent application; however, as of the date of this filing, we have not received a patent and/or copyright protection for our games, planned proprietary technologies and/or planned products. Presently we intend to rely on trade secret protection and/or confidentiality agreements with our key technology support personnel, customers, business partners and others to protect our intellectual property rights. Despite certain precautions taken by us, it may be possible for third parties to obtain and use our intellectual property without authorization. This risk may be increased due to the lack of any patent and/or copyright protection. If any of our proprietary rights are misappropriated or we are forced to defend our intellectual property rights, we will have to incur substantial costs. Such litigation could result in substantial costs and diversion of our resources, including diverting the time and effort of our senior management, and could disrupt our business, as well as have a material adverse effect on our business, prospects, financial condition and results of operations. Management will from time to time determine whether applying for patent and copyright protection is appropriate for us. We have no guarantee that, if filed, any applications will be granted or, if awarded, whether they will offer us any meaningful protection from other companies in our business. Furthermore, any patent or copyrights that we may be granted may be held by a court to infringe on the intellectual property rights of others and subject us to awards for damages.

WE MAY BE SUBJECT TO CLAIMS WITH RESPECT TO THE INFRINGEMENT OF INTELLECTUAL PROPERTY RIGHT OF OTHERS, WHICH COULD RESULT IN SUBSTANTIAL COSTS AND DIVERSION OF OUR FINANCIAL AND MANAGEMENT RESOURCES TO DEFEND SUCH CLAIMS AND/OR LAWSUITS AGAINST US AND COULD HARM OUR BUSINESS.

We cannot be certain that our games and proprietary technologies will not infringe upon patents, copyrights or other intellectual property rights held by third parties. While we know of no basis for any claims of this type, the existence of and ownership of intellectual property can be difficult to verify and we have not made an exhaustive search of all patent filings. Additionally, most patent applications are kept confidential for twelve to eighteen months, or longer, and we would not be able to be aware of potentially conflicting claims that they make. We may become subject to legal proceedings and claims from time to time relating to the intellectual property of others in the ordinary course of our business. If we are found to have violated the intellectual property rights of others, we may be enjoined from using such intellectual property, and we may incur licensing fees or be forced to develop alternative technology or obtain other licenses. In addition, we may incur substantial expenses in defending against these third party infringement claims and be diverted from devoting time to our business and operational issues, regardless of the merits of any such claim. Successful infringement or licensing claims against us may result in substantial monetary damages, which may materially disrupt the conduct of our business and have a material adverse effect on our reputation, business, financial condition and results of operations.

Risk Related To Our Capital Stock

WE MAY NEVER PAY ANY DIVIDENDS TO SHAREHOLDERS.

We have never declared or paid any cash dividends or distributions on our capital stock. We currently intend to retain our future earnings, if any, to support operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

OUR ARTICLES OF INCORPORATION PROVIDE FOR INDEMNIFICATION OF OFFICERS AND DIRECTORS AT OUR EXPENSE AND LIMIT THEIR LIABILITY WHICH MAY RESULT IN A MAJOR COST TO US AND HURT THE INTERESTS OF OUR SHAREHOLDERS BECAUSE CORPORATE RESOURCES MAY BE EXPENDED FOR THE BENEFIT OF OFFICERS AND/OR DIRECTORS.

Our articles of incorporation and applicable Nevada law provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney’s fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities on our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such person’s written promise to repay us if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us which we will be unable to recoup.

We have been advised that, in the opinion of the SEC, indemnification for liabilities arising under federal securities laws is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification for liabilities arising under federal securities laws, other than the payment by us of expenses incurred or paid by a director, officer or controlling person in the successful defense of any action, suit or proceeding, is asserted by a director, officer or controlling person in connection with the securities being registered, we will (unless in the opinion of our counsel, the matter has been settled by controlling precedent) submit to a court of appropriate jurisdiction, the question whether indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue. The legal process relating to this matter if it were to occur is likely to be very costly and may result in us receiving negative publicity, either of which factors is likely to materially reduce the market and price for our shares, if such a market ever develops.

THE OFFERING PRICE OF THE COMMON STOCK WAS DETERMINED BASED ON THE PRICE OF OUR PRIVATE OFFERING, AND THEREFORE SHOULD NOT BE USED AS AN INDICATOR OF THE FUTURE MARKET PRICE OF THE SECURITIES. THEREFORE, THE OFFERING PRICE BEARS NO RELATIONSHIP TO OUR ACTUAL VALUE, AND MAY MAKE OUR SHARES DIFFICULT TO SELL.

Since our shares are not listed or quoted on any exchange or quotation system, the offering price of $0.25 per share for the shares of common stock was determined based on the price of our private offering. The facts considered in determining the offering price were our financial condition and prospects, our limited operating history and the general condition of the securities market. The offering price bears no relationship to the book value, assets or earnings of our company or any other recognized criteria of value. The offering price should not be regarded as an indicator of the future market price of the securities.

YOU WILL EXPERIENCE DILUTION OF YOUR OWNERSHIP INTEREST BECAUSE OF THE FUTURE ISSUANCE OF ADDITIONAL SHARES OF OUR COMMON STOCK AND OUR PREFERRED STOCK.

In the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests of our present stockholders. We are currently authorized to issue an aggregate of 120,000,000 shares of capital stock consisting of 100,000,000 shares of common stock, par value $0.001 per share, and 20,000,000 shares of preferred stock, par value $0.001 per share.

We may also issue additional shares of our common stock or other securities that are convertible into or exercisable for common stock in connection with hiring or retaining employees or consultants, future acquisitions, future sales of our securities for capital raising purposes, or for other business purposes. The future issuance of any such additional shares of our common stock or other securities may create downward pressure on the trading price of our common stock. There can be no assurance that we will not be required to issue additional shares, warrants or other convertible securities in the future in conjunction with hiring or retaining employees or consultants, future acquisitions, future sales of our securities for capital raising purposes or for other business purposes, including at a price (or exercise prices) below the price at which shares of our common stock will be quoted on the OTCBB.

OUR COMMON STOCK IS CONSIDERED A PENNY STOCK, WHICH MAY BE SUBJECT TO RESTRICTIONS ON MARKETABILITY, SO YOU MAY NOT BE ABLE TO SELL YOUR SHARES.

If our common stock becomes tradable in the secondary market, we will be subject to the penny stock rules adopted by the Securities and Exchange Commission that require brokers to provide extensive disclosure to their customers prior to executing trades in penny stocks. These disclosure requirements may cause a reduction in the trading activity of our common stock, which in all likelihood would make it difficult for our shareholders to sell their securities.

Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The broker-dealer must also make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security that becomes subject to the penny stock rules. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in our securities, which could severely limit the market price and liquidity of our securities. These requirements may restrict the ability of broker-dealers to sell our common stock and may affect your ability to resell our common stock.

THERE IS NO ASSURANCE OF A PUBLIC MARKET OR THAT OUR COMMON STOCK WILL EVER TRADE ON A RECOGNIZED EXCHANGE. THEREFORE, YOU MAY BE UNABLE TO LIQUIDATE YOUR INVESTMENT IN OUR STOCK.

There is no established public trading market for our common stock. Our shares have not been listed or quoted on any exchange or quotation system. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTCBB, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this report, including in the documents incorporated by reference into this report, includes some statement that are not purely historical and that are “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements regarding our and their management’s expectations, hopes, beliefs, intentions or strategies regarding the future, including our financial condition, results of operations. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,” “should,” “would” and similar expressions, or the negatives of such terms, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this report are based on current expectations and beliefs concerning future developments and the potential effects on the parties and the transaction. There can be no assurance that future developments actually affecting us will be those anticipated. These that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including the following forward-looking statements involve a number of risks, uncertainties (some of which are beyond the parties’ control) or other assumptions.

We will not receive any proceeds from the sale of common stock by the selling security holders. All of the net proceeds from the sale of our common stock will go to the selling security holders as described below in the sections entitled “Selling Security Holders” and “Plan of Distribution”. We have agreed to bear the expenses relating to the registration of the common stock for the selling security holders.

Determination of Offering Price

Since our common stock is not listed or quoted on any exchange or quotation system, the offering price of the shares of common stock was determined by the price of the common stock that was sold to our security holders pursuant to an exemption under Section 4(2) of the Securities Act of 1933 and Rule 506 of Regulation D promulgated under the Securities Act of 1933.

The offering price of the shares of our common stock does not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value. The facts considered in determining the offering price were our financial condition and prospects, our limited operating history and the general condition of the securities market.

Although our common stock is not listed on a public exchange, we will be filing to obtain a quotation on the OTCBB concurrently with the filing of this prospectus. In order to be quoted on the OTCBB, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTC Bulletin Board, nor can there be any assurance that such an application for quotation will be approved.

In addition, there is no assurance that our common stock will trade at market prices in excess of the initial offering price as prices for the common stock in any public market which may develop will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity.

The common stock to be sold by the selling shareholders as provided in the “Selling Security Holders” section is common stock that is currently issued. Accordingly, there will be no dilution to our existing shareholders.

The common shares being offered for resale by the selling security holders consist of 8,936,400 shares of our common stock held by 53 shareholders. Such shareholders include: (i) the holders of 10,700,000 shares sold in our private offering pursuant to Regulation D Rule 506 completed in December 2009 at an offering price of $0.002 (of which 50% of those shares are being registered herein); (ii) the holders of 2,086,400 shares sold in our private offering pursuant to Regulation D Rule 506 completed in March 2010 at an offering price of $0.25; (iii) the holders of 1,000,000 shares sold in our private offering pursuant to Regulation D Rule 506 completed in July 2010 at an offering price of $0.15; (iv) the holders of 100,000 shares issued to Anslow & Jaclin, LLP and their associates for services rendered; and (v) 400,000 shares issued to Gerald Kotkin, father of Adam Kotkin who was issued shares as a founder of the Company for services provided to the company.

The following table sets forth the names of the selling security holders, the number of shares of common stock beneficially owned by each of the selling stockholders as of January 18, 2011 and the number of shares of common stock being offered by the selling stockholders. The shares being offered hereby are being registered to permit public secondary trading, and the selling stockholders may offer all or part of the shares for resale from time to time. However, the selling stockholders are under no obligation to sell all or any portion of such shares nor are the selling stockholders obligated to sell any shares immediately upon effectiveness of this prospectus. All information with respect to share ownership has been furnished by the selling stockholders.

|

Name

|

Shares Beneficially Owned Prior to Offering

|

Shares to be Offered

|

Amount Beneficially Owned After Offering

|

Percent Beneficially Owned After Offering

|

||||

|

Gerald Kotkin (1)

|

800,000

|

400,000

|

400,000

|

1.56

|

||||

|

Pat Ceci

|

1,000,000

|

500,000

|

500,000

|

1.95

|

||||

|

Darin Myman

|

500,000

|

250,000

|

250,000

|

*

|

||||

|

FJD Holdings, LLC (2)

|

1,500,000

|

1,250,000

|

250,000

|

*

|

||||

|

The David Rosenberg Trust (3)

|

1,000,000

|

500,000

|

500,000

|

1.95

|

||||

|

Gem Funding LLC

|

2,500,000

|

1,250,000

|

1,250,000

|

4.88

|

||||

|

Mel Schlossberg

|

600,000

|

300,000

|

300,000

|

1.17

|

||||

|

Robb Knie

|

2,300,000

|

1,150,000

|

1,150,000

|

4.49

|

||||

|

Francine Knie

|

1,070,000

|

535,000

|

535,000

|

2.09

|

||||

|

Wendy O'Connor

|

730,000

|

365,000

|

365,000

|

1.43

|

||||

|

Momona Capital (4)

|

500,000

|

250,000

|

250,000

|

*

|

||||

|

Luca Del Mastro

|

2,000

|

2,000

|

0

|

*

|

||||

|

Peter Bekelis

|

2,000

|

2,000

|

0

|

*

|

||||

|

Matthew Stillo

|

2,000

|

2,000

|

0

|

*

|

||||

|

Jonathan Diego Guajala

|

1,200

|

1,200

|

0

|

*

|

|

Santo Cristiano

|

2,000

|

2,000

|

0

|

*

|

||||

|

Anthony Amaral

|

1,000

|

1,000

|

0

|

*

|

||||

|

Franca Servello

|

4,000

|

4,000

|

0

|

*

|

||||

|

Joseph Rizzuto

|

3,000

|

3,000

|

0

|

*

|

||||

|

Gianfranco Cristiano

|

2,000

|

2,000

|

0

|

*

|

||||

|

Jimmy Mavrakakis

|

4,000

|

4,000

|

0

|

*

|

||||

|

Nicola Vetere

|

4,000

|

4,000

|

0

|

*

|

||||

|

Leonardo Santos

|

2,000

|

2,000

|

0

|

*

|

||||

|

Stephen Montesano

|

2,000

|

2,000

|

0

|

*

|

||||

|

Emerald Brokalakis

|

2,000

|

2,000

|

0

|

*

|

||||

|

Constantine D. Mavrakakis

|

4,000

|

4,000

|

0

|

*

|

||||

|

Angelo Raso

|

2,400

|

2,400

|

0

|

*

|

||||

|

Geraldo Raso

|

2,000

|

2,000

|

0

|

*

|

||||

|

Michael Joseph Raso

|

1,600

|

1,600

|

0

|

*

|

||||

|

Stefania Rizzuto

|

3,600

|

3,600

|

0

|

*

|

||||

|

Michele Giannantonio and Elisabeth Ceci, JTWRS

|

2,800

|

2,800

|

0

|

*

|

||||

|

Amanda Ida Ceci

|

4,000

|

4,000

|

0

|

*

|

||||

|

Emilio Nigro

|

2,000

|

2,000

|

0

|

*

|

||||

|

Peter Dimakos

|

3,200

|

3,200

|

0

|

*

|

||||

|

Domenico Zaccardelli

|

4,000

|

4,000

|

0

|

*

|

||||

|

Vicki D. Burkholder

|

1,600

|

1,600

|

0

|

*

|

||||

|

Pedro Paiva

|

1,600

|

1,600

|

0

|

*

|

||||

|

Bruno Costa

|

2,000

|

2,000

|

0

|

*

|

||||

|

Domenico Ceci

|

2,800

|

2,800

|

0

|

*

|

||||

|

Gianluca Saggese

|

1,200

|

1,200

|

0

|

*

|

||||

|

Mark Anthony Mazzei

|

3,200

|

3,200

|

0

|

*

|

||||

|

Kathy Mazzei

|

3,200

|

3,200

|

0

|

*

|

||||

|

Rosaria Rosso

|

2,000

|

2,000

|

0

|

*

|

||||

|

Francesco Rosso

|

4,000

|

4,000

|

0

|

*

|

||||

|

Theofanis Goboitsios

|

2,000

|

2,000

|

0

|

*

|

||||

|

Alpha Capital Anstalt (5)

|

1,000,000

|

1,000,000

|

0

|

*

|

||||

|

James J. Pallotta

|

1,000,000

|

1,000,000

|

0

|

*

|

||||

|

Richard Anslow

|

42,000

|

42,000

|

0

|

*

|

||||

|

Gregg Jaclin

|

28,000

|

28,000

|

0

|

*

|

||||

|

Eric Stein

|

12,500

|

12,500

|

0

|

*

|

||||

|

Gary Eaton

|

12,500

|

12,500

|

0

|

*

|

||||

|

Donna Bonfiglio

|

5,000

|

5,000

|

0

|

*

|

(1) Gerald Kotkin is the father of Adam Kotkin, our Chief Executive Officer.

(2) Frank D’Agostino is the principal of FJD Holding, LLC, Frank D’Agostino acting alone has voting and dispositive power over the shares owned by FJD Holding, LLC.

(2) Mitch Schlossberg is the principal of The David Rosenberg Trust. Mitch Schlossberg acting alone has voting and dispositive power over the shares owned by The David Rosenberg Trust. The beneficial owners of the David Rosenberg Trust are Robert Rosenberg and Natalie Schlossberg. Natalie Schlossberg is the wife of Mel Schlossberg, who owns 600,000 shares.

(3) Corie Schlossberg is the principal of Gem Funding, LLC. Corie Schlossberg acting alone has voting and dispositive power over the shares owned by Gem Funding LLC. Corie Schlossberg is the daughter of Mel and Natalie Schlossberg.

(4) Arie Rabinowitz is the principal of Momona Capital. Arie Rabinowitz acting alone has voting and dispositive power over the shares owned by Momona Capital.

(5) Konrad Ackerman is the Director of Alpha Capital Anstalt. Konrad Ackerman acting alone has voting and dispositive power over the shares owned by Alpha Capital Anstalt.

There are no agreements between the company and any selling shareholder pursuant to which the shares subject to this registration statement were issued.

None of the selling shareholders or their beneficial owners:

|

-

|

has had a material relationship with us other than as a shareholder at any time within the past three years; or

|

|

-

|

has ever been one of our officers or directors or an officer or director of our predecessors or affiliates

|

|

-

|

are broker-dealers or affiliated with broker-dealers.

|

The selling security holders may sell some or all of their shares at a fixed price of $0.25 per share until our shares are quoted on the OTCBB and thereafter at prevailing market prices or privately negotiated prices. Prior to being quoted on the OTC Bulletin Board, shareholders may sell their shares in private transactions to other individuals. Although our common stock is not listed on a public exchange, we will be filing to obtain a quotation on the OTCBB concurrently with the filing of this prospectus. In order to be quoted on the OTC Bulletin Board, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTC Bulletin Board, nor can there be any assurance that such an application for quotation will be approved. However, sales by selling security holder must be made at the fixed price of $0.25 until a market develops for the stock.

Once a market has developed for our common stock, the shares may be sold or distributed from time to time by the selling stockholders, who may be deemed to be underwriters, directly to one or more purchasers or through brokers or dealers who act solely as agents, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at negotiated prices or at fixed prices, which may be changed. The distribution of the shares may be effected in one or more of the following methods:

|

●

|

ordinary brokers transactions, which may include long or short sales,

|

|

●

|

transactions involving cross or block trades on any securities or market where our common stock is trading, market where our common stock is trading,

|

|

●

|

through direct sales to purchasers or sales effected through agents,

|

|

●

|

through transactions in options, swaps or other derivatives (whether exchange listed of otherwise), or exchange listed or otherwise), or

|

|

●

|

any combination of the foregoing.

|

In addition, the selling stockholders may enter into hedging transactions with broker-dealers who may engage in short sales, if short sales were permitted, of shares in the course of hedging the positions they assume with the selling stockholders. The selling stockholders may also enter into option or other transactions with broker-dealers that require the delivery by such broker-dealers of the shares, which shares may be resold thereafter pursuant to this prospectus. To our best knowledge, none of the selling security holders are broker-dealers or affiliates of broker dealers.

We will advise the selling security holders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of the selling security holders and their affiliates. In addition, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling security holders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling security holders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

Brokers, dealers, or agents participating in the distribution of the shares may receive compensation in the form of discounts, concessions or commissions from the selling stockholders and/or the purchasers of shares for whom such broker-dealers may act as agent or to whom they may sell as principal, or both (which compensation as to a particular broker-dealer may be in excess of customary commissions). Neither the selling stockholders nor we can presently estimate the amount of such compensation. We know of no existing arrangements between the selling stockholders and any other stockholder, broker, dealer or agent relating to the sale or distribution of the shares. We will not receive any proceeds from the sale of the shares of the selling security holders pursuant to this prospectus. We have agreed to bear the expenses of the registration of the shares, including legal and accounting fees, and such expenses are estimated to be approximately $30,000.

Notwithstanding anything set forth herein, no FINRA member will charge commissions that exceed 8% of the total proceeds of the offering.

Description of Securities to be Registered

General

We are authorized to issue an aggregate number of 120,000,000 shares of capital stock, of which 100,000,000 shares are common stock, $0.001 par value per share, and 20,000,000 shares of preferred stock, $0.001 par value per share authorized.

Common Stock

We are authorized to issue 100,000,000 shares of common stock, $0.001 par value per share. Currently we have 25,596,400 shares of common stock issued and outstanding.

Each share of common stock shall have one (1) vote per share for all purpose. Our common stock does not provide a preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights. Our common stock holders are not entitled to cumulative voting for election of Board of Directors.

Preferred Stock

We are authorized to issue 20,000,000 shares of preferred stock, $0.001 par value per share. Currently, no shares of our preferred stock have been designated any rights and we have no shares of preferred stock issued and outstanding.

Dividends

We have not paid any cash dividends to our shareholders. The declaration of any future cash dividends is at the discretion of our board of directors and depends upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Warrants

There are no outstanding warrants to purchase our securities.

Options

There are no outstanding options to purchase our securities.

Transfer Agent and Registrar

Currently we do not have a stock transfer agent. However, upon filing this Registration Statement, we do intend to engage a transfer agent to issue physical certificates to our shareholders.

Interests of Named Experts and Counsel

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Anslow & Jaclin, LLP located at 195 Route 9 South, Suite 204, Manalapan, NJ 07726 will pass on the validity of the common stock being offered pursuant to this registration statement. Additionally, as part of its compensation, Anslow & Jaclin, LLP and its associates received an aggregate of 100,000 shares of common stock that are being registered in this Registration Statement.

The financial statements as of December 31, 2009 and for the period from December 17, 2009 (inception) to December 31, 2009 included in this prospectus and the registration statement have been audited by Salberg & Company, P.A., an independent registered public accounting firm, to the extent and for the periods set forth in their report appearing elsewhere herein and in the registration statement, and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

Information about the Registrant

Overview

Apps Genius Corp, develops markets, publishes and distributes social games and software applications that consumers can use on a variety of platforms. The platforms include social networks, wireless devices such as cellular phones and smart phones including the Apple iPhone™) and standalone websites. To date, we have released several applications including ‘My Mad Millions’, a game application for Facebook™, Drama Llama, an application for Facebook™, ‘Slap a Friend’, a game application for the Apple Iphone™, Bed Bug Alert, a utility application for Apple Iphone™ and Crazy Dream Application for Facebook™. Apps Genius Corp’s goal is to develop and publish new titles on a recurring basis that are based on the same property and gaming platform. Examples of this franchise approach are the two games that we currently have under development that both utilize the same underlying platform, My Mad Millions and Rock The House. A core focus of our Social Gaming and Mobile Application development is to allow users and players to reach across different networks into a virtual application or gaming environment such as Facebook, MySpace, Iphone and Android and be able to play games and use applications from all users no matter what environment they are using the application in.

The three key philosophies that are incorporated into each of our gaming titles are:

1. Make players feel like they’re playing with their real friends

2. Offer ways for players to express their personality, and

3. Provide a fantasy world environment that allows players to roll play as if they are living as a rock star or a multimillionaire.

Allowing players to go cross platform to invite their friends to their social gaming or mobile application experience creates the personalization necessary to create loyal and addicted users. Further integration with wireless devices widens the reach and increases time played and revenue opportunities.

Revenue Model

We monetize our social games through virtual currencies through Gwallet and SRPoints and banner ads through Cubics.com, a division of AdKnowledge. Our mobile applications are monetized by either charging fees for downloading through the Itunes Apple Store or by offering free applications with banner advertising supplied by Cubics.

Virtual Currency

Some of our Social Games contain a virtual currency or points system. One such example is in our game “My Mad Millions” we issue “MMM Points” to our users that allow users to level up and gain special privileges. Users collect points by moving through the levels, buying them or completing offers from third-party advertisers that convert into points or virtual currency. For example, your users can now purchase “My Mad Millions points” directly using their mobile phone or through their PayPal account, credit card account and Amazon Payments account. They can also earn points by completing surveys, completing deals, or watching videos. When users make a purchase, complete a survey or purchase “My Mad Million” points directly, they get points in the game and can use them to level up or gain special privileges as they see fit.

Web Advertising

AppsGenius also uses its site to advertise for other companies. We have entered into agreements with three companies where we agree to place banners or ads on our website. We receive a cash payment from the advertiser when a purchase is completed. We currently have marketing relationships with both gWallet, Inc. and SRPoints (part of Adknowledge) to provide a private label virtual currency system as well as third-party marketing offers.

We have an agreement with KITN Media, Inc. whereby we have agreed to post banners and ads on our website that are provided by KITN. KITN has agreed to pay us for any clicks that originate at our website and result in revenue. A copy of this agreement is attached hereto as Exhibit 10.1. We have not placed any of the banners or ads on our site and it remains within our discretion whether we decide to place the banners or ads on our site.

We have also entered into an agreement with gWallet, Inc. Pursuant to this Agreement, gWallet agrees to publish and attract users to My Mad Millions. gWallet will be paid 10% for any direct revenue and 30% for any indirect revenue that is generated through gWallet's services. A copy of the agreement with gWallet is attached hereto as Exhibit 10.2.

We have also entered into an agreement with Cubics.com. Pursuant to this Agreement, we agree to download ads and banners from Cubics.com and we display them on our website. Cubics.com then pays us at least $0.05 for every click that occurs on an ad or banner displayed on the Company’s website. A copy of the agreement with cubics.com is attached hereto as Exhibit 10.3.

Social Network Space

Our games work as applications on social networking service site platforms. Users can install the games on their pages and the games then use the platform application programming interfaces to obtain social graph information (e.g. lists of friends) from their accounts. This information is used by players on the social network to invite friends and other on-line users to play the game or to notify players that a friend has logged on or reached a certain milestone in a particular game.

The games incorporate the social aspect of their host services by allowing users to group together in “crews” or “families” (depending on the type of game). Many games give bonuses to players with larger lists of game-specific friends, and some features of their games are unavailable to users with small networks.

Business Model

Our business is supported in two manners: via partner businesses and direct credit card payments. Several of our games will require an “Energy” characteristic to play. Engaging in “Missions”, a core feature of many games, consume a certain amount of energy. After expending energy, it slowly replenishes to the character's maximum limit. This can take minutes or several hours (energy replenishes whether or not players are logged into the game). After energy is replenished, players can engage in additional missions. Waiting for energy to replenish is a significant limiting factor in the games. Their support mechanisms take advantage of this.

Our games will link to offers from a number of partners. Players can accept credit card offers, take surveys or buy services from our partners in order to obtain game credits, which allow them to replenish their character's energy or traded for other various virtual goods.

Players may also purchase game credits directly from us via credit card or PayPal. From within the game, players can purchase the points for a fee: USD$5.00 for 20 game credits, for example.

Games Offered by Apps Genius

Currently we offer 5 games for users to download and play. The following is a description of each game that we offer:

My Mad Millions (Released October 13, 2010):

My Mad Millions is a new social game application currently available on Facebook and MySpace. Players have to spend $300,000,000 in a virtual environment living the life of the rich and famous. The objective of the game is to spend all $300,000,000 without having any assets at the end. Players advance in the game while interacting with their friends by completing missions and spending virtual money for themselves and their friends by renting mansions, yachts, exotic cars, private jets, and thousands of other luxuries. Players also compete to lose money by buying virtual stocks in the stock market, betting in virtual casinos, and betting on current sporting events in the game. Players can interact with each other, buy gifts for their friends, invite others to join their entourage, and hire them as employees to spend more money and spend it faster.

My Mad Millions creates a real-life and unique experience for players by using real images and prices of actual items that an individual with $300,000,000 may want to buy and could afford.

(The above picture depicts one of the shopping sprees in My Mad Millions where you rent a Yacht, hire a captain and choose a crew.)

Bed Bug Alert (Released October 20, 2010)

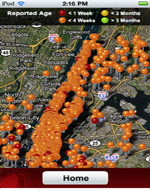

Bed Bug Alert has been released for use on the Apple iPhone and available through the Apple iTunes Store for $1.95, Bed Bug Alert allows users to geolocate reported sightings of bed bugs throughout the world. Data is received from several sources including media reports of bed bug sightings and outbreaks, user reported data and through combing through health department and building department websites throughout the United States. Bed Bug Alert has been featured on various media outlets including the New York Times, USA Today, NBC and ABC.

(The above picture is a snapshot of the screen a Bed Bug Alert user will see on an iPhone that has located all reported sightings of Bed Bugs in New York, New York.)

Crazy Dream (Released March 30, 2010)

Crazy Dreams has been released as a game for use on Facebook. Crazy Dreams is a collective tell-your-own adventure story where users begin, continue and elaborate on social stories. A user can begin by starting to tell a story or dream and then their Facebook friends can continue the story, indefinitely. Combining multiple people’s thoughts, ideas and input into one story is a way that Crazy Dreams is developing social networking to now include social story telling.

(The above picture is the dream of one of our users. The user started the dream and it is now awaiting input from another user to continue the dream. The whole dream is the combination of all the different users inputs into one storyline.)

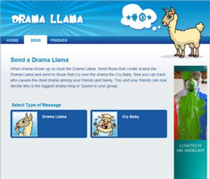

Drama Llama (Released September 19, 2010)

Drama Llama has been released on Facebook. Drama Llama allows friends to post pictures and comments on friend’s walls containing either the Drama Llama or a Cry Baby pictorial. The posts alert all users friends that the user has drama in their life or they are being a Cry Baby about something. Drama Llama is meant to be a fun way of calling out the cry babies and drama kings or queens of your friends.

(The above picture is a screenshot of the screen where a user chooses whether they want to send the Drama Llama or the Cry Baby to their friends.)

Slap a Friend (Released March 12, 2010)

Slap a Friend is a fun way to take a picture of a friend. The application allows users to virtually toss a friend around and even throw objects at them. A user can post a friend’s picture and then throw object, such as, virtual baseballs, sticks and weights, at the picture. Slap a Friend is available either as a free advertising version monetized through Cubics.com or as a paid version for sale for $0.99 through the Apple ITunes store for use on the iPhone and iPad.

(Picture of the Box Arena in Slap a Friend. The items at the bottom picture depict a few of the ways you can ‘slap your friend’. The face of the character can be user customized with a facial shot of one of their friends.)

Agreement with Apple to Download Applications

We have an agreement with Apple to provide our applications to its users for download to iTunes, iPhones and other Apple products. In connection with the Agreement, Apple is entitled to 30% of any revenue generated for each application or program that is downloaded to an Apple device by an Apple user. Currently, we offer two products through the Apple Agreement: (i) Slap-A-Friend; and (ii) Bed Bug Alert. A copy of the Apple Agreement is attached hereto as Exhibit 10.4.

Trademarks

In June 2008, we filed a trademark application for My Mad Millions with the United States Patent & Trademark Office under Class 9 (interactive games) and Class 41 (entertainment services). We have not filed any other trademarks but may, in the future, determine it is advisable to file trademarks for our other interactive, online applications and games.

Employees

As of January 18, 2011 , we have four full time employees and two part time employees in addition to our Chief Executive Officer and Chief Financial Officer.

Our principal executive office is located at 157 Broad Street, Suite 303, Red Bank, New Jersey 07701, and our telephone number is (732) 530-1267. We lease our office space and pay a monthly rent of $1,100. The lease terminates on May 31, 2011.

From time to time, we may become involved in various lawsuits and legal proceedings, which arise, in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

There is presently no public market for our shares of common stock. We anticipate applying for quoting of our common stock on the OTCBB upon the effectiveness of the registration statement of which this prospectus forms apart. However, we can provide no assurance that our shares of common stock will be quoted on the OTCBB or, if quoted, that a public market will materialize.

Holders of Capital Stock

As of the date of this registration statement, we had 63 holders of our common stock.

Rule 144 Shares

As of the date of this registration statement, we do not have any shares of our common stock that are currently available for sale to the public in accordance with the volume and trading limitations of Rule 144.

Stock Option Grants

On September 22, 2010, we adopted the Apps Genius Equity Incentive Plan. The purpose of the plan is to attract and retain qualified persons upon whom our sustained progress, growth and profitability depend, to motivate these persons to achieve long-term company goals and to more closely align these persons' interests with those of our other shareholders by providing them with a proprietary interest in our growth and performance. Our executive officers, employees, consultants and non-employee directors are eligible to participate in the plan. 5,000,000 shares of our common stock have been reserved for issuance under the Equity Incentive Plan. A copy of the Equity Incentive Plan is attached hereto as Exhibit 10.5. No options have been granted as of the date of this registration statement.

(A DEVELOPMENT STAGE COMPANY)

FINANCIAL STATEMENTS

December 31, 2009

APPS GENIUS CORP

(A DEVELOPMENT STAGE COMPANY)

FINANCIAL STATEMENTS

December 31, 2009

CONTENTS

| Report of Independent Registered Public Accounting Firm | F-2 |

| Financial Statements: | |

| Balance Sheet - As of December 31, 2009 | F-3 |

| Statement of Operations - | |

| For the Period from December 17, 2009 (Inception) to December 31, 2009 | F-4 |

| Statement of Changes in Stockholders’ Equity - | |

| For the Period from December 17, 2009 (Inception) to December 31, 2009 | F-5 |

| Statement of Cash Flows – | |

| For the Period from December 17, 2009 (Inception) to December 31, 2009 | F-6 |

| Notes to Financial Statements | F-7 to F-15 |

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of:

Apps Genius Corp

We have audited the accompanying balance sheet of Apps Genius Corp (a development stage company) as of December 31, 2009 and the related statements of operations, changes in stockholders' equity, and cash flows for the period from December 17, 2009 (inception) to December 31, 2009. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Apps Genius Corp as of December 31, 2009 and the results of its operations and its cash flows, for the period from December 17, 2009 (inception) to December 31, 2009, in conformity with accounting principles generally accepted in the United States of America.