Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - SHFL entertainment Inc. | shuffle_8k-010711.htm |

| EX-99.1 - RESIGNATION LETTER - SHFL entertainment Inc. | ex99-1.htm |

Exhibit 10.1

SEVERANCE AGREEMENT AND GENERAL RELEASE

This Severance and Release Agreement (“Agreement”) is made and entered into as of January 7, 2011 (the “Effective Date”) between PHILLIP PECKMAN (“Peckman”) and SHUFFLE MASTER, INC. ("SMI") (sometimes referred to collectively as the “Parties” or individually as a “Party”).

RECITALS

A. Peckman has been a member of the Board of Directors of SMI since June 5, 2007.

B. Peckman was, for most of the years spent as a member of the Board of Directors, an independent member of the Board, the Chairman of the Board of Directors and was on the Audit Committee, the Compensation Committee and the Governance Committee.

C. By agreement ("CEO Agreement") dated May 3, 2010 but effective April 26, 2010, Peckman was appointed by SMI as the Interim Chief Executive Officer ("CEO"), which meant that he could no longer serve as an "independent" member of the Board. Thus, in conjunction with the May 3, 2010 agreement Peckman resigned as Chairman of the Board of Directors and resigned from the Audit Committee, the Compensation Committee and the Governance Committee.

D. Peckman has tendered his resignation from the Board of Directors, a copy of which resignation is attached as Exhibit A.

E. In recognition of the Board's appreciation for Peckman's services as a member of the Board and as CEO, and in consideration for their respective commitments set forth in this Agreement, the parties hereby agree as follows.

AGREEMENT

In consideration of the mutual promises and covenants contained in this Agreement, and other good and valuable consideration, the receipt and adequacy of which is hereby acknowledged by the Parties, Peckman and SMI hereby agree as follows:

|

|

1.

|

PECKMAN'S DEPARTURE FROM SMI.

|

(a) Peckman agrees to remain a member of the Board of Directors until January 7, 2011.

(b) Upon the execution of this Agreement, SMI will issue a press release substantially in the form attached hereto as Exhibit B. In addition, SMI agrees that, upon the filing of any Securities and Exchange Commission Form 8-K regarding Peckman's departure from the Board of Directors, it shall attach thereto a copy of Peckman's resignation letter, attached hereto as Exhibit A.

(c) Peckman resigns as Director effective January 7, 2011, and SMI accepts this resignation.

|

|

2.

|

COMPENSATION TO PECKMAN.

|

(a) Based upon his performance as a member and Chairman of the Board of Directors and as CEO, and in accordance with paragraph 4 of the CEO Agreement, SMI agrees to pay Peckman a bonus of $129,000.00, payable within ten (10) business days following Peckman's execution of this Agreement; provided, he has not revoked his execution by that time.

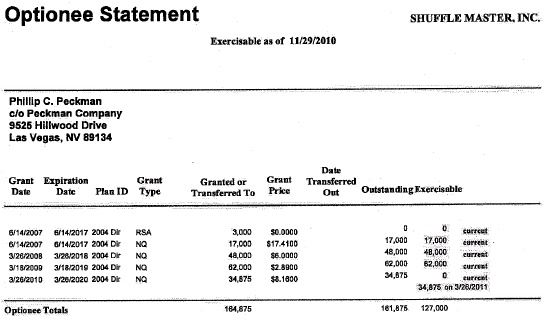

(b) All stock options issued to Peckman (listed on Exhibit C) shall become vested (if they are not already) as of the Effective Date and upon exercise, the underlying shares shall immediately become fully tradable on the open market.

(c) Peckman shall be available to provide information, respond to inquiries, and provide advice and counsel and other assistance to SMI at the request of SMI on a non-exclusive basis for a period of nine (9) months from the date hereof in exchange for compensation of $96,000, payable within ten (10) business days following Peckman's execution of this Agreement; provided, he has not revoked his execution by that time.

|

|

3.

|

CONFIDENTIALITY AND NON-DISPARAGEMENT.

|

(a) The parties acknowledge that this agreement must be disclosed in compliance with SMI’s public reporting and gaming regulatory obligations.

(b) The Parties on behalf of themselves and Affiliates (as defined in paragraph 4(a) below) agree that they will refrain from voluntarily commenting on any matters released pursuant to paragraph 4(a) below. The Parties acknowledge that this provision does not preclude them from addressing a lawful inquiry from any regulatory, legislative or governmental body or agency. In addition thereto neither Party including its Affiliates shall make any statement, comment or representation that disparages, defames or otherwise reflects negatively upon the other Party's business practices, products, services, officers, directors, employees or general business reputation. This commitment by each Party and its Affiliates shall continue indefinitely and shall not expire for any reason.

- 2 -

|

|

4.

|

GENERAL RELEASE.

|

(a) Each Party, on behalf of himself or itself and, if they exist, any of his or its family, heirs, assigns, executors, administrators, Board members, managers, employees and agents, past and present (collectively, the “Affiliates”), hereby fully and without limitation release, covenant not to sue and forever discharge the other Party and his or its, if they exist, spouse, parent companies, subsidiaries, affiliated entities, directors, officers, shareholders, employees, attorneys, insurers, agents, predecessors and successors, past and present (collectively, the “Releasees”), both individually and collectively, from any and all rights, claims, demands, liabilities, actions, causes of action, suits, damages, losses, debts, attorney’s fees, costs, and expenses, of whatever nature, whether those claims are known or unknown, fixed or contingent, suspected or unsuspected (“Claims”) that either Party or its Affiliates now have, or may ever have, against any other Party arising out of, or related in any way to Peckman's services to SMI as a member and/or Chairman of the Board of Directors, as a member of any committee on the Board of Directors, or as CEO and any act, omission, or transaction of or by any of the Parties released occurring on or before the date this Agreement is fully executed by both parties.

(b) Both Parties acknowledge that they may later discover material facts in addition to, or different from, those which he or it now knows or believes to be true with respect to any circumstances surrounding this Agreement and each Party nevertheless intends to fully, finally and forever settle and release all claims, disputes and differences between them. The releases provided in this Agreement shall remain in full effect notwithstanding the discovery or existence of any additional or different facts or circumstances or any such future events, circumstances or conditions.

|

|

5.

|

INDEMNIFICATION.

|

Nothing herein shall abrogate or limit in any way Peckman’s rights to indemnification or insurance coverage arising out of his roles as an executive officer or director of SMI, including, coverage under any applicable policy of directors and officers liability insurance, errors and omissions insurance, indemnification agreements to which he is a party, provisions of the SMI’s articles of incorporation or bylaws or under applicable statutory law.

- 3 -

|

|

6.

|

Covenant Not to Sue.

|

Peckman understands that this Agreement, and the releases contained herein, are subject to the terms of the Older Workers Benefit Protection Act of 1990 (the "OWBPA"). The OWBPA provides that an individual cannot waive a right or claim under the Age Discrimination in Employment Act (the "ADEA") unless the waiver is knowing and voluntary. In compliance with the OWBPA, Peckman hereby acknowledges and agrees that he has executed this Agreement voluntarily, and with full knowledge of its consequences. In addition, Peckman hereby acknowledges and agrees as follows:

(a) this Agreement has been written in a manner that is calculated to be understood, and is understood, by Peckman;

(b) the release provisions of this Agreement apply to any rights Peckman may have under the ADEA, including the right to file a lawsuit in state or federal court for age discrimination in violation of the ADEA;

(c) the release provisions of this Agreement do not apply to any rights or claims Peckman may have under the ADEA that arise after the Effective Date of this Agreement;

(d) SMI does not have a preexisting duty to provide Peckman with the payments identified in Section 2(b) and 2(c);

(e) Peckman has been advised and given the opportunity to consult with an attorney, and has consulted with an attorney to the extent he wished to do so, prior to executing this Agreement;

(f) Peckman has had a period of at least 21 days to consider this Agreement; and

(g) Peckman has the right to revoke this Agreement within seven days after its execution. To revoke this Agreement, Peckman shall send written notice by the time period noted above by fax to Dawn Hinman, Interim General Counsel, fax: 702-270-5326. Peckman acknowledges and agrees that, to the extent he revokes this Agreement as permitted under this Section 6, he shall not be entitled to receive any of the payments described in Section 2(b) and 2(c).

|

|

7.

|

WARRANTIES AND REPRESENTATIONS.

|

Each Party to this Agreement represents and warrants that he/it has not assigned or transferred any interest in any Claims he/it has or may have against any of the Releasees, and further represents and warrants that he/it has the authority to enter into this Agreement and to bind all his/its Affiliates or persons and entities claiming through him/it.

- 4 -

|

|

8.

|

NON-ADMISSION OF LIABILITY.

|

The actions of the Parties to negotiate and enter into this Agreement, whether it is executed or not, shall not be regarded or relied upon the other Party or by any third party as an admission of liability or wrongdoing by either of the Parties to this Agreement.

|

|

9.

|

INTEGRATION AND MODIFICATIONS.

|

This Agreement constitutes an integrated written contract expressing the entire agreement of the Parties with respect to the subject matter hereof and it may be modified only by a written instrument that is signed by both Parties with the same degree of formality as those signatures affixed hereto.

|

|

10.

|

AMBIGUITIES.

|

The terms of this Agreement have been reviewed and negotiated by the Parties and their counsel. Accordingly, the Parties expressly waive any common law or statutory rule of construction that ambiguities should be construed against the drafter of this Agreement. The language of this Agreement shall be construed according to its fair meaning.

|

|

11.

|

CHOICE OF LAW AND VENUE.

|

This Agreement shall be governed by and interpreted in accordance with the laws of the State of Nevada, including all matters of construction, validity, performance, and enforcement, without regard to Nevada’s rules regarding conflicts of law. The Parties further agree, covenant and represent that, to the extent any legal action, litigation or proceedings arise out of or relate in any way to this Agreement including, without limitation, any legal action or proceeding to enforce the terms of this Agreement or for breach of this Agreement, such legal action, litigation or other proceedings shall be conducted exclusively in Las Vegas, Nevada.

|

|

12.

|

ATTORNEYS' FEES AND COSTS.

|

In any action or proceeding to enforce the terms of this Agreement or to redress any breach or threatened breach of this Agreement, the prevailing party shall be entitled to recover as damages its attorney’s fees and costs incurred, whether or not the action is reduced to judgment.

- 5 -

|

|

13.

|

SEVERABILITY.

|

Each and every provision of this Agreement shall be considered severable, except for the release provisions of Paragraph 4 of this Agreement (“General Release"). If a court of competent jurisdiction rules that the releases contained in Paragraph 4, or any part thereof, are illegal, invalid, or unenforceable, then this Agreement shall become null and void. If any provision of this Agreement (other than the releases contained in Paragraph 4) is declared illegal, invalid, or unenforceable for any reason, that provision shall remain in effect to the extent allowed by law, and all of the remaining provisions of this Agreement shall remain in full force and effect.

|

|

14.

|

CAPTIONS.

|

The captions and paragraph numbers in this Agreement are inserted for the reader’s convenience, and in no way define, limit, construe, or describe the scope or intent of the provisions of this Agreement.

|

|

15.

|

COUNTERPARTS.

|

This Agreement may be executed in counterparts, and when each Party has signed and delivered at least one such counterpart, each counterpart shall be deemed an original, and, when taken together with other signed counterparts, shall constitute one agreement, which shall be binding upon and effective as to all parties.

|

|

16.

|

WAIVER.

|

The failure or delay on the part of either Party to exercise any right, remedy, power or privilege under this Agreement shall not operate as a waiver of that right, remedy, power or privilege for future events. No waiver of any right, remedy, power or privilege by either Party with respect to any particular occurrence shall be construed as a waiver by that Party of such a right, remedy, power or privilege with respect to any other occurrence.

|

|

17.

|

ADVICE OF COUNSEL.

|

Both Parties acknowledge that they have been advised by counsel as to the meaning of this Agreement.

- 6 -

|

|

18.

|

VOLUNTARY NATURE OF AGREEMENT.

|

Both Parties represent that he/it have carefully read this Agreement and fully understand all of its terms, that he/it has consulted with his/its own attorney about this Agreement and that he/it is signing this Agreement freely and voluntarily without coercion or duress of any kind and with full knowledge of the Agreement's terms and conditions.

IN WITNESS WHEREOF, this Agreement has been duly executed and delivered by the Parties to be effective as of the Effective Date.

|

PHILLIP PECKMAN

|

|||

| /s/ Phillip Peckman | |||

| SHUFFLE MASTER, INC. | |||

| By: | /s/ David Lopez | ||

| Its: | Interim CEO | ||

- 7 -

EXHIBIT A

RESIGNATION LETTER OF PHIL PECKMAN

Gentlemen:

It is with great ambivalence that I announce my resignation as a member of the Board of Directors, and any other positions that I may still hold with Shuffle Master, Inc., effective January 7, 2011. Since I became a Board member on June 5, 2007, I have worked with many other good people to help guide this company through some very difficult times. I am very proud of the accomplishments we have made thus far and believe the company is in a much better position. We have streamlined production, standardized financial reporting, renegotiated long term debt on favorable terms and increased profitability.

On one hand I am saddened to part ways with such a company and such people with whom I have had the privilege to work. On the other hand, I am excited and eager to commence my transition to other businesses and opportunities. Some of these opportunities are still confidential but I am very excited about the prospect of continued active participation in the management of successful businesses.

I wish all of you the best.

EXHIBIT B

PRESS RELEASE

Shuffle Master, Inc. (NASDAQ Global Select market: SHFL) ("SMI" or the "Company") announced today that Phillip Peckman, whose tenure as Interim CEO of the Company recently ended has also now resigned as a member of the Board of Directors of the Company. Mr. Peckman has decided to pursue other business opportunities and to concentrate his efforts in those endeavors. He has been a member of the Board of Directors of SMI since June 5, 2007 and resigned from the Board of Directors on January 7, 2011.

In addition, SMI announced that Mr. Peckman will be available to provide consulting to the Company for an additional nine months following his departure from the Board.

Garry W. Saunders, the Chairman of the Board of SMI, stated: "The Board deeply appreciates Phillip Peckman's service both as a Board member and as an Interim Chief Executive Officer during an important time for the Company." Mr. Peckman was recently replaced as Interim CEO by David Lopez, the Company's Chief Operating Officer.

About Shuffle Master, Inc.

Shuffle Master, Inc. is a gaming supply company specializing in providing its casino customers with improved profitability, productivity and security, as well as popular and cutting-edge gaming entertainment content, through value-add products in four distinct categories: Utility products which include automatic card shuffler, roulette chip sorters and intelligent table system modules, Proprietary Table Games which includes live games, side bets and progressives, Electronic Table Systems which include various e-Table game platforms and Electronic Gaming Machines which include traditional video slot machines for select markets. The Company is included in the S&P Smallcap 600 Index. Information about the Company and its products can be found on the Internet at www.shufflemaster.com.

Forward Looking Statements

This release contains forward-looking statements that are based on management's current beliefs and expectations about future events, as well as on assumptions made by and information available to management. The Company considers such statements to be made under the safe harbor created by the federal securities laws to which it is subject, and assumes no obligation to update or supplement such statements. Forward-looking statements reflect and are subject to risks and uncertainties that could cause actual results to differ materially from expectations. Risk factors that could cause actual results to differ materially from expectations include, but are not limited to, the following: the Company's intellectual property or products may be infringed, misappropriated, invalid, or unenforceable, or subject to claims of infringement, invalidity or unenforceability, or insufficient to cover competitors' products; the gaming industry is highly regulated and the Company must adhere to various regulations and maintain its licenses to continue its operations; the search for and possible transition to a new chief executive officer could be disruptive to the Company's business or simply unsuccessful; the Company's ability to implement its ongoing strategic plan successfully is subject to many factors, some of which are beyond the Company's control; litigation may subject the Company to significant legal expenses, damages and liability; the Company's products currently in development may not achieve commercial success; the Company competes in a single industry, and its business would suffer if its products become obsolete or demand for them decreases; any disruption in the Company's manufacturing processes or significant increases in manufacturing costs could adversely affect its business; the products in each of our segments may experience losses due to technical difficulties or fraudulent activities; the Company operates in a very competitive business environment; the Company is dependent on the success of its customers and is subject to industry fluctuations; risks that impact the Company's customers may impact the Company; certain market risks may affect the Company's business, results of operations and prospects; a continued downturn in general worldwide economic conditions or in the gaming industry or a reduction in demand for gaming may adversely affect the Company's results of operations; the Company's domestic and global growth and ability to access capital markets are subject to a number of economic risks; economic, political, legal and other risks associated with the Company's international sales and operations could adversely affect its operating results; changes in gaming regulations or laws; the Company is exposed to foreign currency risk; the Company could face considerable business and financial risk in implementing acquisitions; if the Company's products contain defects, its reputation could be harmed and its results of operations adversely affected; the Company may be unable to adequately comply with public reporting requirements; the Company's continued compliance with its financial covenants in its senior secured credit facility is subject to many factors, some of which are beyond the Company's control; the restrictive covenants in the agreement governing the Company's senior secured credit facility may limit its ability to finance future operations or capital needs or engage in other business activities that may be in its interest; and the Company's business is subject to quarterly fluctuation. Additional information on these and other risk factors that could potentially affect the Company's financial results may be found in documents filed by the Company with the Securities and Exchange Commission, including the Company's current reports on Form 8-K, quarterly reports on Form 10-Q and its latest annual report on Form 10-K.

SOURCE: Shuffle Master, Inc.

Shuffle Master, Inc.

Julia Boguslawski

Investor Relations/

Corporate Communications

ph: (702) 897-7150

fax: (702) 270-5161

or

David Lopez, Interim CEO

Linster W. Fox, CFO

ph: (702) 897-7150

fax: (702) 270-5161

EXHIBIT C

STOCK OPTIONS