Attached files

| file | filename |

|---|---|

| EX-14 - ALTEROLA BIOTECH INC. | v208051_ex14.htm |

| EX-23.1 - ALTEROLA BIOTECH INC. | v208051_ex23-1.htm |

| EX-32.1 - ALTEROLA BIOTECH INC. | v208051_ex32-1.htm |

| EX-31.2 - ALTEROLA BIOTECH INC. | v208051_ex31-2.htm |

| EX-32.2 - ALTEROLA BIOTECH INC. | v208051_ex32-2.htm |

| EX-31.1 - ALTEROLA BIOTECH INC. | v208051_ex31-1.htm |

| EX-21.1 - ALTEROLA BIOTECH INC. | v208051_ex21-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

Form

10-K

(Mark

one)

|

x

|

Annual Report

Under Section 13 or 15(d) of The Securities Exchange Act of

1934

|

For the

fiscal year ended September 30, 2010

|

¨

|

Transition Report Under Section

13 or 15(d) of The Securities Exchange Act of

1934

|

For the

transition period from ______________ to _____________

Alterola Biotech

Inc.

(Exact

Name of Registrant as Specified in Its Charter)

|

Nevada

|

333-156091

|

N/A

|

||

|

(State or other jurisdiction

of

incorporation)

|

(Commission

File

Number)

|

(IRS

Employer

Identification

No.)

|

|

228

Hamilton Avenue, 3rd Floor

Palo

Alto, California

|

94301

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: +45-8842 9181

Securities

registered pursuant to Section 12 (b) of the Act - None

Securities

registered pursuant to Section 12(g) of the Act: - None

Indicate

by check mark if the registrant is a well known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes

¨ No

x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Exchange Act.

Yes x No

¨

Indicate

by check mark whether the registrant has (1) filed all reports required to be

filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or

for such shorter period the Company was required to file such reports), and (2)

has been subject to such filing requirements for the past 90

days.

Yes x No

¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of the registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of large accelerated filer”, accelerated filer” and smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer ¨

|

Accelerated

filer

|

¨

|

|

|

Non-accelerated

filer ¨

|

Smaller

reporting

company

|

x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act):

Yes

x No

¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes

¨ No

¨

The

aggregate market value of the outstanding common stock, other than shares held

by persons who may be deemed affiliates of the registrant, computed by reference

to the closing sales price for the Registrant’s Common Stock on December 1,

2010, as reported on the OTC Bulletin Board, was not applicable as the Common

Stock was not quoted on the OTC Bulletin Board at that time.

As of

January 10, 2011, there were 92,980,000 shares of Common Stock issued and

outstanding.

Index

to Contents

|

Page Number

|

||||

|

Part

I

|

||||

|

Item

1

|

Business

|

3

|

||

|

Item

1A

|

Risk

Factors

|

7

|

||

|

Item

1B

|

Unresolved

Staff Comments

|

11

|

||

|

Item

2

|

Properties

|

11

|

||

|

Item

3

|

Legal

Proceedings

|

11

|

||

|

Item

4

|

Submission

of Matters to a Vote of Security Holders

|

11

|

||

|

Part

II

|

||||

|

Item

5

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

11

|

||

|

Item

6

|

Selected

Financial Data

|

12

|

||

|

Item

7

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

12

|

||

|

Item

7A

|

Quantitative

and Qualitative Disclosures About Market Risk

|

14

|

||

|

Item

8

|

Financial

Statements and Supplementary Data

|

15

|

||

|

Item

9

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

15

|

||

|

Item 9A

|

Controls

and Procedures

|

15

|

||

|

Item 9B

|

Other

Information

|

16

|

||

|

Part III

|

||||

|

Item

10

|

Directors,

Executive Officers and Corporate Governance

|

16

|

||

|

Item

11

|

Executive

Compensation

|

17

|

||

|

Item

12

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

18

|

||

|

Item

13

|

Certain

Relationships and Related Transactions, and Director

Independence

|

19

|

||

|

Item

14

|

Principal

Accountant Fees and Services

|

20

|

||

|

Part

IV

|

||||

|

Item

15

|

Exhibits

and Financial Statement Schedules

|

20

|

||

|

Signatures

|

|

22

|

||

Caution

Regarding Forward-Looking Information

Certain

statements contained in this annual filing, including, without limitation,

statements containing the words "believes", "anticipates", "expects", “intend”,

“estimate”, “plan” and words of similar import, constitute forward-looking

statements. Such forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause the actual results, performance

or achievements of the Company, or industry results, to be materially different

from any future results, performance or achievements expressed or implied by

such forward-looking statements.

Forward-looking

statements are based on our current expectations and assumptions regarding our

business, potential target businesses, the economy and other future conditions.

Because forward-looking statements relate to the future, by their nature, they

are subject to inherent uncertainties, risks and changes in circumstances that

are difficult to predict. Our actual results may differ materially from those

contemplated by the forward-looking statements. We caution you therefore that

you should not rely on any of these forward-looking statements as statements of

historical fact or as guarantees or assurances of future performance. Important

factors that could cause actual results to differ materially from those in the

forward-looking statements include changes in local, regional, national or

global political, economic, business, competitive, market (supply and demand)

and regulatory conditions and the following:

2

|

|

•

|

our

status as a development stage

company;

|

|

|

•

|

removal

of our securities from OTC Bulletin Board quotation system, or the ability

to have our securities quoted on OTC Bulletin Board or listed on another

exchange following our business

combination;

|

|

|

•

|

conflicts

of interest of our officers and

directors;

|

|

|

•

|

potential

current or future affiliations of our officers and directors with

competing businesses;

|

|

|

•

|

our

ability to obtain additional financing if

necessary;

|

|

|

•

|

the

control by our existing stockholders of a substantial interest in

us;

|

|

|

•

|

our

being deemed an investment company;

|

|

|

•

|

our

dependence on our key personnel;

|

|

|

•

|

business

and market outlook;

|

|

|

•

|

future

effective tax rates; and

|

|

|

•

|

compliance

with applicable laws.

|

These

risks and others described under “Risk Factors” are not exhaustive.

Given

these uncertainties, readers of this Form 10-K and investors are cautioned not

to place undue reliance on such forward-looking statements. The Company

disclaims any obligation to update any such factors or to publicly announce the

result of any revisions to any of the forward-looking statements contained

herein to reflect future events or developments.

PART

I

Item

1 - Business

General

Alterola

Biotech Inc. (“Alterola”, the “Company”, “we”, “us” or “our”) was incorporated

in the State of Nevada on July 21, 2008 under the name “Jedediah Resources

Corp.” We are a development stage company. The Company’s

fiscal year-end is September 30.

The

Company was formed for the purpose of acquiring exploration and development

stage mineral properties. On October 1, 2008, the Company

incorporated JRE Exploration Ltd (“JRE”), a wholly owned subsidiary in Canada

for the purpose of holding its Canadian mineral claims. On May 3,

2010, the Company changed its focus to the development of intellectual property

and accordingly sold JRE to Ola Juvkam-Wold (“Juvkam-Wold”), the former

chief executive officer of the Company. In keeping with the change of business

focus, on July 9, 2010 the Company changed its name to Alterola Biotech

Inc.

Prior to

May 3, 2010, we were in the business of mineral exploration. On May

3, 2010, the Company entered into a Stock Purchase Agreement (“Stock Purchase

Agreement”) and General Release and Settlement Agreement (“Release and

Settlement”) with Juvkam-Wold who was then the chief executive officer and

a director of the Company. Pursuant to the Stock Purchase Agreement,

Juvkam-Wold agreed to transfer all 55,000,000 shares of common stock of the

Company (“Common Stock”) owned by him to the Company in consideration for all

the issued and outstanding stock of JRE, and the cancellation of all debt owed

by JRE to the Company. Pursuant to the Release and Settlement,

Juvkam-Wold released the Company from any and all claims Juvkam-Wold may have

against the Company or its affiliates. Simultaneously with the

consummation of the Stock Purchase Agreement, Juvkam-Wold resigned from his

positions as Chief Executive Officer of the Company and as a member of the

Board.

On May 3,

2010, we entered into an Intellectual Property Assignment Agreement (“IP

Agreement”) with Mr. Soren Nielsen, our Chief Executive Officer, President and

sole director (“Nielsen”), pursuant to which Nielsen transferred his right,

title and interest in all intellectual property relating to certain chewing gum

compositions having appetite suppressant activity (“the Intellectual Property”

or “IP”) to the Company in consideration for the issuance of 55,000,000 newly

issued shares of Common Stock. Following the acquisition of the IP we

changed our business direction and are now pursuing the development of a chewing

gum with nutraceutical delivery

properties. The term nutraceutical combines the words ‘nutrition’ and

‘pharmaceutical’ and refers to food or food products that provide health and

medical benefits, including the prevention and treatment of

disease.

3

Effective

July 9, 2010, the Company’s Board of Directors authorized a 10 for 1 forward

stock split of the issued and outstanding Common Stock. The

authorized number of common shares was increased from 90,000,000 to 140,000,000

with a par value of $0.001 per share. The number of authorized shares

of preferred stock remained unchanged at 10,000,000 with a par value of $0.001

per share.

Subsequent

to the September 30 fiscal year end, on November 17, 2010, Nielsen entered into

a stock cancellation agreement with the Company whereby 40,000,000 shares of

Common Stock were returned to treasury and cancelled. In

consideration the Company will issue to Nielsen options to acquire Common Stock

pursuant to a stock option plan which the Company intends to adopt in the future

on such terms as determined by the Company’s Board of Directors. In

accordance with SAB Topic 4-C, the Company recorded the cancellation

retroactively as of September 30, 2010, as a reduction to the par value of

common stock with a corresponding increase to additional paid-in

capital.

On

December 21, 2010, the Company issued 250,000 shares at $0.20 for aggregate

proceeds of $50,000.

Overview

and Plan of Operation

Alterola

owns IP in the field of medicament-containing chewing gums for the treatment of

obesity and eating disorders and is in the process of drafting and filing

patents to protect the IP initially in Europe and the United States. The Company

may seek IP protection in other jurisdictions in the

future. Medicament refers to something that treats or prevents or

alleviates the symptoms of disease.

Our

business plan is to establish partnerships with laboratory testing outsourcing

partners (LTO’s) to create and develop nutraceutical patents and concepts based

on expert knowledge of active ingredients, and chewing gum with a taste and

texture on par with traditional confectionery products. The concept areas which

Alterola will focus on in the primary stage are gum products where the

ingredients are already FDA approved, which we expect will hasten FDA approval

and shorten the time to market of Alterola; gum products. Alterola is focusing

on seven new product developments which are in the areas of:

|

|

1.

|

Treatment

of mild depression

|

|

|

2.

|

Immune

defense

|

|

|

3.

|

Pick

me up gum/Energy boost

|

|

|

4.

|

Motion

sickness treatment

|

|

|

5.

|

Vitamins

C delivery

|

|

|

6.

|

Vitamin

B12 delivery

|

|

|

7.

|

Vitamin

D delivery

|

Alterola

is currently in discussion with a number of LTO’s as potential partners for

development in the above - listed product areas. Alterola has identified the

active ingredients for each product area and the LTO’s will measure the amount

of ingredients required and test the timing of release of the active

ingredients. They will also test the taste and shelf life of the products. We

intend to select LTO’s based upon their pricing, availability and

timing.

It is

intended that the gum will be branded under the brands DR GUM and

HERBAGUM. Alterola expects to have the first products available for

consumers in 2011 in North America, Europe and Asia. There may also be an

opportunity to ‘white label’ the gum products and allow the major gum companies

to sell generic versions of the products under their own brands.

To take

the products to market Alterola will need to complete a three phase process

including product development, product production and product

distribution.

Phase

One (Product Development)

In this

phase, we will work with LTO’s to develop new products. We expect it will take

approximately 6-9 per product months to complete lab testing and get to the

production stage.

We have

identified the active ingredients for those products we intend to develop

initially in the areas of stress relief and weight loss and we are in

negotiations with LTO’s. To complete phase one, we will need a finished product

from the LTO which has been fully tested by their labs. We expect

this will take 6-9 months and we are awaiting pricing terms from the various

LTO’s we have met with. We believe the major hurdle to completing product

development is our ability to raise funds. We believe the cost of

product development to bring each product through the LTO development stage is

approximately $25,000 based on discussions with prospective LTOs. We

anticipate raising such capital through the private placement of our equity or

debt securities. However, there is no assurance we will be able to

raise sufficient capital on favorable terms, or at all. If we

consummate private placements of our securities, our current warrant and stock

holders would experience dilution.

4

Phase

Two (Product Production)

To take

the products to production our board will consult with nutritionists and other

industry professionals to determine the best methodology. Alterola is in

discussion with possible nutraceutical manufacturers and will select production

partners able to manufacture our gum products for the market in commercial

volumes. The source of raw materials and location of manufacture will

most likely be China or Malaysia. We have identified several potential partners

who can deliver materials in volumes to meet our demands and we do not

anticipate any problems with obtaining the required supply. At this

time we have not signed any binding agreements so we cannot identify suppliers

until such time as we have signed final agreements. We anticipate that we would

initially produce 500,000 gum packs each containing 10 pieces of gum and we will

need approximately $150,000 to produce 500,000 gum packs. The costs outlined are

based upon initial discussions and quotations from product manufacturers and we

anticipate that the cost for each product will be relatively

constant.

As of the

date of this report, there have been discussions with several manufacturers who

we believe can produce the products at commercial levels at a reasonable cost,

and we are confident there are a number of suitable partners for manufacture of

our intended gum products. Until we have signed

with the LTO and have developed, tested and received such governmental and other

approvals as necessary for our products, there is no value in signing the

production agreements as this will put an undue financial burden on the Company

before we are ready for the manufacturing stage. We believe one of the hurdles

to realizing our business plan is being a small company amongst the major gum

producers, and that manufacturers may consider our products as competitive,

which may limit our ability to work with those manufacturers that have

experience in this area but already have pre-existing relationships with the

major gum producers and manufacturers. However, we believe our niche

positioning and willingness to ‘white label’ products should minimize this

risk. We believe our membership with the ingredient suppliers will

help facilitate in the creation of joint ventures with major gum producers and

could help to expedite our products entry to market; international association

of chewing gum manufacturers and ingredient suppliers. Funding

production will require a significant investment of cash which we do not

currently have. We anticipate raising capital through equity or debt financings

but there are no assurances we will be successful in raising sufficient capital

to finance our business plan on acceptable terms or at all.

Phase

Three (Distribution)

Alterola

is in discussion with distributors for the gum products mentioned above, selling

to both the online and retail markets. Alterola expects to have an agreement in

place with distributors when the products are ready for

production. There is no assurance that Alterola will be able to

capture any portion of the gum market.

We have

identified numerous online distributors worldwide with specific access to sales

channels in the areas of health foods, well being products and alternative

remedies, all of which we believe are the proper channels to market our initial

seven product areas. We have also identified two offline distributors in the US

with access to direct marketing and retail distribution, and one in

Scandinavia. We are continuing to research further distribution

partners to ensure the Company has the best routes to market upon completion of

our products. We expect additional capital will be needed to secure initial

orders, set up an information technology system and consummate and increase

sales and marketing for the initial product launch. We intend to raise

additional capital to complete the distribution of our products and we

anticipate that we will need $200,000 for this phase. We may not be

able to raise sufficient capital on favorable terms or at all.

During

the next 12 months Alterola intends to partner up with between two to three LTO

partners in development of the IP and partner up with international and/or local

manufacturers of nutraceuticals to produce the gum products. Finally, we intend

to find local and global distribution partners for online and local sales. With

the anticipated development of these partnerships, Alterola seeks to be able to

provide an end-to-end supply chain for our gum products.

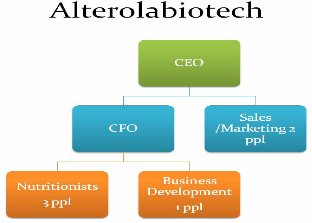

Employees

To

achieve our business plan over the next 12 months, we will need to appoint

professional management and advisors to the Company’s board of directors and we

anticipate an organizational structure as below will be

required:

5

At this

time we have insufficient funds to hire the professionals we require to execute

our business plan, and we will require substantial additional funding in order

to undertake the commercialization of our products. In the next 12 months, we

anticipate spending approximately $500,000 on business expenses, including fees

payable in connection with complying with our Securities and Exchange Commission

(“SEC”) reporting obligations. The risky nature of this enterprise and lack of

tangible assets other than our IP places debt financing beyond the

credit-worthiness required by most banks or typical investors of corporate debt

until such time as an economically viable commercial product can be

demonstrated. We cannot provide investors with any assurances on our ability to

raise funding for the Company, however, we aim to raise sufficient funding

through equity or debt financing and advances from related parties to fund all

of our anticipated expenses. We do not have any arrangements in place for

any financing at this time. Currently there are no full time or part

time employees.

Competition

The

chewing gum and Nutraceutical businesses are highly

competitive. Many of our competitors have substantially greater financial,

marketing, personnel and other resources than we do. The principal methods of

competition include brand recognition, price and price promotion, new product

introductions, packaging changes, distribution methods, and advertising. We will

also compete for distributors, shelf space and customers primarily with other

gum companies. We believe our main competitors are Gumlink and

Wrigley.

Government

Regulation

At this

time, our products are not at the manufacturing stage so we are not subject to

government regulation. However, once production begins we will need

to ensure that only safe and approved ingredients are used in the manufacturing

of the chewing gum. We must ensure quality controls are in place during all

phases of production to ensure that the ingredients and the end products comply

with the requirements and limits set by regulatory authorities. As our products

will be manufactured by third party suppliers who already produce gum products,

we believe their systems and procedures are already substantially compliant with

regulations. In addition to confirming this and monitoring the

manufacturing process, Alterola will ensure that all ingredients are sourced

from reputable suppliers and that controls are in place to ensure high quality

production processes are followed.

The

ingredients we plan to use in our gum products fall under the GRAS (Generally

Regarded As Safe) Regulations of the FDA. Under Sections 201(s) and

409 of the Federal Food, Drug, and Cosmetic Act (the Act), any substance that is

intentionally added to food is a food additive, is subject to premarket review

and approval by the FDA, unless the substance is generally recognized, among

qualified experts, as having been adequately shown to be safe under the

conditions of its intended use, or unless the use of the substance is otherwise

excluded from the definition of a food additive. Upon producing

commercial ready products, we will need to follow the FDA GRAS process to obtain

clearance for the sale of our products. The GRAS clearance process typically

takes 180 days but there is no guarantee that the notice process will not take

longer than anticipated or that the final gum products will be recognized under

the GRAS regulations.

A patent

application for chewing gum having appetite suppressant qualities has been filed

with the relevant US and UK intellectual property offices. At this time, the

patents are pending approval.

Research

and Development

Approximately

2,200 hours in the aggregate have been spent on research and development during

the previous two years.

6

Item

1A - Risk Factors

RISKS

RELATED TO OUR BUSINESS

We

are still in an early stage of development and have a limited history of

operations.

We were

founded in 2008 and changed our business focus in 2010 from mining to the

development of a chewing gum with nutraceutical delivery properties and

have only recently commenced operations under our new business plan. We expect

to incur losses in the future as we implement our business plans and improve our

development production, distribution, sales and marketing capabilities. We

cannot anticipate when, or if, we will generate adequate revenues to achieve

positive cash flow or profitability.

The

success of our business depends on our ability to successfully develop and

commercialize our intellectual property relating to certain chewing gum

compositions having appetite suppressant activity.

The

success of our chewing gum business is dependent upon our ability to develop

final products that receive market acceptance, sell and distribute our products

and overcome all production issues related to high-volume

production. All we have at this time is intellectual property

relating to certain chewing gum compositions having appetite suppressant

activity properties. If we are unable to accomplish these

developmental milestones our business will be adversely affected and we may not

realize any profit from our operations.

If

we are unable to develop and commercialize our products within our anticipated

time frame we will not be able to generate any sales or revenues and may be

forced to cease operations.

Although

we anticipate we will develop products and commercialize our intellectual

property within the time frame set forth herein, we may not be able to meet our

timeline and it may take significantly longer for us to develop and

commercialize our products. If we are unable to timely bring our

products to market, we will not generate any revenue or make any sales and our

future operating prospects may be materially harmed.

We

face substantial capital requirements that we may not be able to satisfy, and

which may cause us to delay, scale back or eliminate some or all of our existing

development or future business initiatives, and which creates substantial doubt

as to our ability to fund future operations and continue as a going

concern.

We are

engaged in developing a nutraceutical chewing

gum. Our operating and capital requirements in connection with

planned development, testing, production, distribution, sales and marketing

activities will be significant. We are not currently generating any revenues

from operations to fund these activities and are dependent on the receipt of

funding from cash raised in equity and debt financings to continue with our

business plan. We currently do not have any commitment for such financing. No

assurance can be given that we will be successful in obtaining additional

financing under terms acceptable to us or in amounts sufficient to fund our

operating activities. The funds that we may raise, if any, may not allow us to

maintain our current and planned operations and such additional financing could

result in the dilution of shareholders’ percentage interests in the Company. If

we are unable to obtain additional capital, we may be required to delay, scale

back or eliminate some or all of our development of existing or future business

initiatives, and therefore there is substantial doubt as to the Company’s

ability to fund future operations and continue as a going concern.

The

chewing gum business is highly competitive.

The

chewing gum and nutraceutical businesses are highly

competitive. Many of our competitors have substantially greater financial,

marketing, personnel and other resources than we do. The principal methods of

competition include brand recognition, price, new product introductions,

packaging changes, distribution methods and advertising. We will also compete

for distributors, shelf space and customers primarily with other gum

companies.

We

compete in an industry that is brand-conscious, so brand name recognition and

acceptance of our products are critical to our success.

Our

business is substantially dependent upon awareness and market acceptance of our

products and brands by our targeted consumers. Our chewing gum products are too

early in the product development cycle to determine whether they will achieve

and maintain satisfactory levels of acceptance by independent distributors and

retail consumers. We believe that the success of our product name brands will

also be substantially dependent upon acceptance of our product name brands.

Accordingly, any failure of our brands to achieve, maintain or increase

acceptance or market penetration would likely have a material adverse affect on

our revenues and financial results.

7

We compete in an industry

characterized by rapid changes in consumer preferences and public perception, so

our ability to develop new products to satisfy consumers’ changing preferences

will determine our long-term success.

Our

future success will depend, in part, upon our ability to develop and introduce

different and innovative chewing gum products. In order to achieve and expand

our market share, we must continue to develop and introduce various products,

although there can be no assurance of our ability to do so. Product lifecycles

for chewing gum brands and/or products and/or packages may be limited to a few

years before consumers’ preferences change. There is no assurance that we will

be able to develop and produce a product that achieves acceptance in the market

place and will become profitable for us. Our inability to respond to

changes in consumer preferences can be expected to harm our results of

operations and future growth.

We

may face risks associated with product liability claims and product

recalls.

We may

experience product liability litigation and product recalls arising from

defectively manufactured products or packaging. We expect to obtain and maintain

product liability insurance insuring our operations from any claims associated

with product liability in an amount that will be sufficient to protect us.

Although we expect to have product liability insurance, we may not have

insurance coverage sufficient in amount and scope against potential liabilities

or the claims may be excluded from coverage under the terms of the policy.

Furthermore, product liability insurance is becoming increasingly expensive. As

a result, we may not be able to obtain sufficient amounts of insurance coverage,

obtain additional insurance when needed, or obtain insurance at a reasonable

cost, which could prevent or inhibit the commercialization of our products. If

we are sued for any injury caused by our products, our liability could equal a

material portion, or even exceed, our total assets. Any claims against us,

regardless of their merit or eventual outcome, could have a detrimental effect

upon our business, operating results and financial condition. We do

not maintain product recall insurance. In the event we were to experience

product liability or product recall claims, our business operations and

financial condition could be materially and adversely affected.

If

we are not able to retain the full time services of Soren Nielsen, it will be

more difficult for us to manage our operations and our operating performance

could suffer.

Our

business is dependent, to a large extent, upon the services of Soren Nielsen,

our President, Chief Executive Officer and Chairman of the Board. We do not have

a written employment agreement with Mr. Nielsen. In addition, we do not maintain

key person life insurance on Mr. Nielsen. Therefore, in the event of the loss or

unavailability of Mr. Nielsen, there can be no assurance that we would be able

to locate in a timely manner or employ qualified personnel to replace him. The

loss of the services of Mr. Nielsen or our failure to attract and retain other

key personnel over time would jeopardize our ability to execute our business

plan and could have a material adverse effect on our business, results of

operations and financial condition.

Future

financings could adversely affect common stock ownership interest and rights in

comparison with those of other security holders.

Our board

of directors has the power to issue additional shares of common or preferred

stock without stockholder approval. If additional funds are raised through the

issuance of equity or convertible debt securities, the percentage ownership of

our existing stockholders will be reduced, and these newly issued securities may

have rights, preferences or privileges senior to those of existing

stockholders. If we issue any additional common stock or securities

convertible into common stock, such issuance will reduce the proportionate

ownership and voting power of each other stockholder. In addition, such stock

issuances might result in a reduction of the book value of our common

stock.

The

manufacturing process we expect to use is not patented.

None of

the manufacturing processes we expect to use in producing our products are

subject to a patent or similar intellectual property protection. Although we are

in the process of obtaining intellectual property protection for our various

chewing gum products and their component parts, invention, currently our only

protection against a third party using our recipes and processes is

confidentiality agreements we expect to enter into with the companies that

produce our products and with our employees who have knowledge of such

processes. If our competitors develop substantially equivalent proprietary

information or otherwise obtain access to our knowledge, we will have greater

difficulty in competing with them for business, and creating our market

share.

Our

intellectual property patent pending does not assure that competitors or others

cannot eventually develop chewing gum similar or superior to the products we

expect to manufacture.

We regard

our intellectual property as critical to our future success. Our patents are

pending with the U.S. Patent and Trademark Office and the UK Intellectual

Property Office. We attempt to protect such property with registered

and common law protections, restrictions on disclosure and other actions to

prevent infringement. We believe product packages and artwork will be

important to our success and we would take action to protect against imitation

of our packaging and trade dress and to protect our trademarks and copyrights,

as necessary. We also expect to rely on a combination of laws and contractual

restrictions, such as confidentiality agreements, to establish and protect our

proprietary rights, trade dress and trade secrets. However, laws and contractual

restrictions may not be sufficient to protect the exclusivity of our

intellectual property rights, trade dress or trade secrets.

8

We cannot

be certain that any of our intellectual property will be granted a patent or if

they are so granted that such patent will provide meaningful protection. The

status of patents involves complex legal and factual questions and the breadth

of claims issued is uncertain. Accordingly, there can be no assurance any

patents that may be issued to us in the future will afford protection against

competitors with similar intellectual property. In addition, no assurances can

be given that patents to be issued in the future to us will not be infringed

upon, reverse engineered or designed around by others or that others will not

obtain patents that we would need to license reverse engineer or design around.

If future patents containing broad claims are upheld by the courts, the holders

of such patents could require other companies, which could potentially include

us, to obtain intellectual property licenses from them or else to reverse

engineer or design around those patents. If we are found to be infringing upon

third-party patents, there can be no assurance that we would be able to design

around or reverse engineer such patents or that any necessary licenses would be

available on reasonable terms, if at all.

There can

be no assurance that other third parties will not infringe or misappropriate our

trademarks and similar proprietary rights. We could incur substantial costs in

defending ourselves and potentially others in litigation or prosecuting

infringement claims against third parties. If the outcome of any such litigation

were unfavorable to us, our business, financial condition and results of

operations could be seriously impacted. If we lose some or all of our

intellectual property rights, our business may be materially and adversely

affected.

In

addition to patent protection, we will rely on the law of unfair competition and

trade secrets to protect our proprietary rights. We consider several elements of

our product design and production process to be trade secrets. We attempt to

protect our trade secrets and other proprietary information through agreements

with employees, consultants, subcontractors, customers and suppliers,

enforcement of state and federal statutory and common law, and other security

measures. However, third parties may independently develop substantially

equivalent proprietary information and techniques, or otherwise gain access to

our trade secrets or disclose such technology, which could have a detrimental

effect on our business, results of operations and financial condition. We cannot

be certain that our efforts to vigorously protect our rights will always be

successful.

We

may not be able to establish and manage our operations effectively.

We

commenced operations under our new business model in 2010 and anticipate rapid

growth in the future. We are in the process of establishing our business

capabilities in order to finalize the development and production of our products

and introduce our products and capture market opportunities. As we continue to

grow, we must continue to improve our operational and financial systems,

procedures and controls. In order to fund our on-going operations and our future

growth, we need to have sufficient internal sources of liquidity or access to

additional financing from external sources. Furthermore, our management will be

required to maintain and strengthen our relationships with our future LTO’s,

distributors, customers, suppliers and other third parties. As a result, our

anticipated expansion will place significant strains on our management

personnel, systems and resources. We also will need to further strengthen our

internal control and compliance functions to ensure that we will be able to

comply with our legal and contractual obligations and minimize our operational

and compliance risks. Our current and planned operations, personnel, systems,

internal procedures and controls may not be adequate to support our future

growth. If we are unable to manage our growth effectively, we may not be able to

take advantage of market opportunities, execute our business strategies or

respond to competitive pressures.

We

expect to depend on third parties to supply key raw materials to us. Failure to

obtain a sufficient supply of these raw materials in a timely fashion and at

reasonable costs could significantly delay or cancel our production and

shipments, which would have a material adverse impact on our ability to generate

revenue.

We expect

to purchase certain key raw materials from domestic and foreign suppliers on the

basis of purchase orders. We may not be able to obtain sufficient supply of

these raw materials from our suppliers or establish alternate suppliers in a

timely fashion or at a reasonable cost, or these raw materials may not comply

with our specifications. Our failure to secure a sufficient supply of

key raw materials would result in a significant delay or cancellation in our

production and shipments. Failure to obtain a sufficient supply of these raw

materials at a reasonable cost could harm our revenue, gross profit margins and

future growth prospects.

Fluctuations

in prices and availability of raw materials could increase our costs or cause

delays in shipments, which would adversely impact our business and results of

operations.

Our

operating results could be adversely affected by increases in the cost of raw

materials. If we are not been able to fully offset the effects of higher costs

of raw materials through price increases to customers or by way of productivity

improvements, our net profit will be harmed.

We

will be dependent on third-party manufacturers to create our products. If these

factories fail to properly follow the manufacturing process, resulting in

defective gum products, our reputation could be severely damaged and our sales

could be materially and adversely affected.

We expect

third party manufacturers to manufacture our chewing gum products. If

these third-party manufacturers fail to manufacture in accordance with our

specifications, our products will not gain widespread acceptance and our

reputation could be severely damaged. In addition, if these manufacturers are

unable to produce a sufficient number of products and we cannot timely find

qualified alternative manufacturers, our sales and results of operations could

be materially and adversely affected.

9

We

expect to rely on third parties whose operations are outside our

control.

We expect

to rely on arrangements with third-party manufacturers, suppliers, distributors,

shippers and carriers for production, shipment, storage and sales of our

products. As a result, we may be subject to disruptions and increased costs due

to factors that are beyond our control, including operational issues of those

third parties, labor strikes, inclement weather, natural disasters and rapidly

increasing fuel costs. If the services of any of these third parties become

unsatisfactory, we may experience delays in meeting our customers’ product

demands and we may not be able to find a suitable replacement on a timely basis

or on commercially reasonable terms or at all. Any failure of operations at any

such third parties’ business may harm our revenue and our future operating

prospects, damage our reputation and could cause us to lose

customers.

The

success of our business depends on our ability to attract, train and retain

highly skilled employees and key personnel.

Because

of the specialized nature of our business, we must attract, train and retain a

workforce comprised of highly skilled employees and other key personnel. As we

are commencing operations and expect our business to grow rapidly, our ability

to train and integrate new employees into our operations may not meet the

requirements of our growing business. Our failure to attract, train or retain

highly skilled employees and other key personnel in numbers that are sufficient

to satisfy our needs would materially and adversely affect our

business.

Risks

Concerning our Securities

Our

common stock has a limited trading market.

While our

common stock is currently quoted on the Pink Sheets under the symbol

PINK:ALTA, an active trading market has not developed and we do not have a

significant public float. In the absence of an active trading market,

you may have difficulty buying and selling or obtaining market quotations for

our stock, the market visibility for our stock may be limited, and the lack of

visibility for our common stock may have a depressive effect on the market price

for our common stock.

Preferred

Stock may limit financing and business combination opportunities.

Our

ability to issue 10,000,000 shares of preferred stock (none of which are

currently outstanding) may limit our ability to obtain debt or equity financing

as well as impede our potential takeover, which takeover may be in the best

interest of stockholders. Our ability to issue these authorized but unissued

securities may also negatively impact our ability to raise additional capital

through the sale of our debt or equity securities.

Failure

to achieve and maintain effective internal controls in accordance with Section

404 of the Sarbanes-Oxley Act could have a material adverse effect on our

business and operating results. In addition, current and potential

stockholders could lose confidence in our financial reporting, which could have

a material adverse effect on our stock price.

Effective

internal controls are necessary for us to provide reliable financial reports and

effectively prevent financial fraud. We are required to document and test our

internal control procedures in order to satisfy the requirements of Section 404

of the Sarbanes-Oxley Act, which requires annual management assessments of the

effectiveness of our internal controls over financial reporting for the year

ending September 30, 2010. During the course of our testing, we may

identify deficiencies which we may not be able to remediate in time to meet the

deadline imposed by the Sarbanes-Oxley Act for compliance with the requirements

of Section 404. In addition, if we fail to maintain the adequacy of our internal

controls, as such standards are modified, supplemented or amended from time to

time, we may not be able to ensure that we can conclude on an ongoing basis that

we have effective internal controls over financial reporting in accordance with

Section 404 of the Sarbanes-Oxley Act. Failure to achieve and maintain an

effective internal control environment could also cause investors to lose

confidence in our reported financial information, which could have a material

adverse effect on our stock price.

We

are likely to remain subject to “penny stock” regulation and as a consequence

there are additional sales practice requirements and additional warning issued

by the SEC.

As long

as the trading price of our common stock is below $5.00 per share, the

open-market trading of our common stock will be subject to the “penny stock”

rules of the SEC. The “penny stock” rules impose additional sales practice

requirements on broker-dealers who sell securities to persons other than

established customers and accredited investors (generally those with assets in

excess of $1,000,000 or annual income exceeding $200,000 or $300,000 together

with their spouse). For transactions covered by these rules, the broker-dealer

must make a special suitability determination for the purchase of securities and

have received the purchaser’s written consent to the transaction before the

purchase. Additionally, for any transaction involving a penny stock, unless

exempt, the broker-dealer must deliver, before the transaction, a disclosure

schedule prescribed by the SEC relating to the penny stock market. The

broker-dealer also must disclose the commissions payable to both the

broker-dealer and the registered representative and current quotations for the

securities. Finally, monthly statements must be sent disclosing recent price

information on the limited market in penny stocks. These additional burdens

imposed on broker-dealers may restrict the ability of broker-dealers to sell the

common stock and may affect a stockholder’s ability to resell the common

stock.

10

There can

be no assurance that our common stock will qualify for exemption from the “penny

stock” rules. In any event, even if our common stock is exempt from such rules,

we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the

SEC the authority to restrict any person from participating in a distribution of

a “penny stock” if the SEC finds that such a restriction would be in the public

interest.

Stockholders

should be aware that, according to SEC Release No. 34-29093, the market for

penny stocks has suffered in recent years from patterns of fraud and abuse. Such

patterns include (i) control of the market for the security by one or a few

broker-dealers that are often related to the promoter or issuer; (ii)

manipulation of prices through prearranged matching of purchases and sales and

false and misleading press releases; (iii) boiler room practices involving

high-pressure sales tactics and unrealistic price projections by inexperienced

sales persons; (iv) excessive and undisclosed bid-ask differential and markups

by selling broker-dealers; and (v) the wholesale dumping of the same securities

by promoters and broker-dealers after prices have been manipulated to a desired

level, along with the resulting inevitable collapse of those prices and with

consequent investor losses. Our management is aware of the abuses that have

occurred historically in the penny stock market.

Item

1B—Unresolved Staff Comments

None

Item

2 - Properties

The

Company currently maintains a mailing address and rents virtual office

facilities at 228 Hamilton Avenue - 3rd Floor Palo Alto, CA 94301. The Company’s

telephone number there is (650) 209-8084. We also have a rented

office in Denmark at Birkedommervej 30, 2400 Kobenhagen, Denmark.

Item

3 - Legal Proceedings

The

Company and its properties are not a party or subject to any pending legal

proceedings, and no such proceedings are known to be contemplated.

Item

4 - Submission of Matters to a Vote of Security Holders

None.

PART

II

Item

5 - Market for the Registrant’s Common Equity, Related Stockholder Matters and

Issuer Purchases of Equity Securities

Market

for Trading and Eligibility for Future Sale

The

Company’s common stock is currently being quoted on the Pink Sheets under the

trading symbol is PINK:ALTA. Until September 21, 2010, our common stock was

listed for quotation on the Over-the-Counter Bulletin Board under the symbol

OTC:JEDE. As of September 21, 2010, our common stock failed to comply

with Rule 15c2-11 and was delisted to the Pink Sheets. On November 1,

2010, our trading symbol changed to “ALTA.” The following tables set

forth, for the calendar quarter indicated, the range of high and low bid

information for our common stock as reported on the OTC Bulletin

Board. Trading in the common stock on the OTCBB and Pink Sheets has

been limited and sporadic and the quotations set forth below are not necessarily

indicative of actual market conditions. Further, the quotations

merely reflect the prices at which transactions were proposed, and do not

necessarily represent actual transactions.

|

High

|

Low

|

|||||||

|

2010

by Quarter

|

||||||||

|

July

1, 2010 - September 30, 2010

|

$ | 0.25 | $ | 0.10 | ||||

|

April

1, 2010 – June 30, 2010

|

$ | N/A | $ | N/A | ||||

|

January,

2010 - March 31, 2010

|

$ | N/A | $ | N/A | ||||

|

October

1, 2009 - December 31, 2009

|

$ | N/A | N/A | |||||

|

2009

by Quarter

|

||||||||

|

July

1, 2009 - September 30, 2009

|

$ | N/A | N/A | |||||

|

April

1, 2009 – June 30, 2009

|

$ | N/A | $ | N/A | ||||

|

January,

2009 - March 31, 2009

|

$ | N/A | $ | N/A | ||||

|

October

1, 2008 - December 31, 2008

|

$ | N/A | N/A | |||||

11

Holders

As of

January 10, 2011, there were 92,980,000 shares of our common stock outstanding

held by approximately 45 stockholders of record. The number of our

stockholders of record excludes any estimate by us of the number of beneficial

owners of shares held in street name, the accuracy of which cannot be

guaranteed.

Dividend

Policy

We have

not paid any cash dividends on our common stock to date, and we have no

intention of paying cash dividends in the foreseeable future. Whether we will

declare and pay dividends in the future will be determined by our board of

directors at their discretion, subject to certain limitations imposed under the

Nevada Corporations Law. The timing, amount and form of dividends, if

any, will depend on, among other things, our results of operations, financial

condition, cash requirements and other factors deemed relevant by our board of

directors.

Recent

Sales of Unregistered Securities

On

December 21, 2010, we consummated the first closing of 250,000 shares of common

stock of the Company for a purchase price of $0.20 per share for an aggregate of

$50,000 in a private placement of a minimum of 200,000 and a maximum of

2,000,000 shares of our common stock. The issuance was exempt

pursuant to Section 4(2) of the Securities Act of 1933, as amended, and/or Rule

506 promulgated thereunder or Regulation S as it applies to non-U.S.

Persons.

On July

23, 2010, we entered into a $50,000 unsecured convertible promissory note (the

“Promissory Note”) with Paramount Trading Company Inc. (the

“Lender”). Under the terms of the Promissory Note, the Lender will

receive the principal amount of $50,000, plus interest at the rate of 12% per

annum, on July 24, 2011; provided, however, the Lender shall have the right to

convert all, or any portion, of the outstanding principal plus all accrued

interest into a number of fully paid and non-assessable whole shares of the

Company's common stock as derived from the fair market value of the Company’s

common stock at the time of exercise. The Promissory Note may be prepaid by the

Company at any time without penalty or premium. The issuance was exempt pursuant

to Section 4(2) of the Securities Act of 1933, as amended, and/or Rule 506

promulgated thereunder.

On May 3,

2010, we issued to Mr. Nielsen 55,000,000 shares of our common stock in exchange

for Mr. Nielsen having transferred his right, title and interest in all

intellectual property relating to certain chewing gum compositions having

appetite suppressant activity. The issuance was exempt pursuant to Section 4(2)

of the Securities Act of 1933, as amended, and/or Rule 506 promulgated

thereunder.

On

January 5, 2010, we issued 33,330,000 shares of our common stock to Murrayfield

Limited in a private transaction for $50,000. The issuance was exempt

pursuant to Section 4(2) of the Securities Act of 1933, as amended, and/or Rule

506 promulgated thereunder.

Repurchases

of Equity Security

None

Item

6 - Selected Financial Data

Not

applicable.

Item

7 - Management’s Discussion and Analysis of Financial Condition and Results of

Operations

(1) Caution

Regarding Forward-Looking Information

Certain

statements contained in this annual filing, including, without limitation,

statements containing the words "believes", "anticipates", "expects", “intend”,

“estimate”, “plan” and words of similar import, constitute forward-looking

statements. Such forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause the actual results, performance

or achievements of the Company, or industry results, to be materially different

from any future results, performance or achievements expressed or implied by

such forward-looking statements.

12

Forward-looking

statements are based on our current expectations and assumptions regarding our

business, potential target businesses, the economy and other future conditions.

Because forward-looking statements relate to the future, by their nature, they

are subject to inherent uncertainties, risks and changes in circumstances that

are difficult to predict. Our actual results may differ materially from those

contemplated by the forward-looking statements. We caution you therefore that

you should not rely on any of these forward-looking statements as statements of

historical fact or as guarantees or assurances of future performance. Important

factors that could cause actual results to differ materially from those in the

forward-looking statements include changes in local, regional, national or

global political, economic, business, competitive, market (supply and demand)

and regulatory conditions and the following:

|

|

•

|

our

status as a development stage

company;

|

|

|

•

|

conflicts

of interest of our officers and

directors;

|

|

|

•

|

our

ability to obtain additional financing if

necessary;

|

|

|

•

|

our

dependence on our key personnel;

|

|

|

•

|

business

and market outlook;

|

|

|

•

|

future

effective tax rates; and

|

|

|

•

|

compliance

with applicable laws.

|

These

risks and others described under “Risk Factors” are not exhaustive.

Given

these uncertainties, readers of this Form 10-K and investors are cautioned not

to place undue reliance on such forward-looking statements. The Company

disclaims any obligation to update any such factors or to publicly announce the

result of any revisions to any of the forward-looking statements contained

herein to reflect future events or developments.

Results

of Operations

We have

generated no revenue to date since inception and we do not anticipate earning

revenues until such time that we enter into contract for the purchase of our

chewing gum products. We have recently begun the development stage of

our business and we can provide no assurance that we will be able to develop,

produce or sell commercial gum compositions. The ingredients

Alterola expects to be developing will have documented effect on the treatments

in focus. If the products have proven active composition, we will seek to

enter into commercial production.

We

incurred operating expenses from operations in the amount of $66,169 for the

three months ended September 30, 2010, compared with $12,745 for the comparative

period of 2009. Our expenses for the three months ended September 30, 2010

increased from the same period largely as a result of the change in business

direction which significantly increased legal fees and the concentration on the

commercialization of our Nutraceutical gum IP. We anticipate that

future operating expenses will continue to increase as a result of

commercializing the Nutraceutical gum IP. There will be significant investment

required to develop, produce and distribute the gum products. We

incurred operating expenses from operations in the amount of $126,781 for the

year ended September 30, 2010, compared with $97,328 for the year ended

September 30, 2009.

The main

reasons for the change in expenses incurred from operations for the year ended

September 30, 2010 compared to the prior year were: an increase in accounting

and audit fees to $41,156 (2009- $31,895), and an increase in legal fees to

$38,759 (2009 - $27,064) due to the Company entering into a monthly legal

services agreement rather than paying per diem. Transfer and filing fees

increased to $3,456 (2009 - $3,405). Consulting fees increased to $9,930

(2009 - $4,000) and management fees increased to $19,900 (2009 - $12,000) as a

result of a change in management and the board of directors in May

2010. Travel expenses increased to $6,700 (2009 - $270) due to

our CEO Soren Nielsen making business trips to Singapore, Denmark, Norway, Basle

and Malaysia in order to meet with potential partners, suppliers, manufacturers

and other complimentary businesses to further Alterola’s endeavors; Rent

increased to $2,888 (2009 - $nil) as a result of opening corporate offices in

Copenhagen, Denmark. Communication costs increased to $1,212 (2009 -

$nil) also as a result of opening the office in Copenhagen. Mineral

property option and exploration costs decreased to $1,866 (2009 - $18,007) as a

result of the change in business focus of the Company. Other expenses

incurred were relatively unchanged period to period. We would expect that legal,

accounting, consulting and management fees will increase in the future as a

result of working toward the commercialization of our gum products. We

anticipate adding new staff to our organization and working with consultants to

execute our business plan.

We

incurred operating expenses of $256,550 in the period from July 21, 2008 (Date

of Inception) through September 30, 2010. The operating expenses

consisted primarily of accounting and audit expenses of $73,801, legal fees of

$69,335; management fees of $34,134; consulting fees of $13,930; mineral

property option and exploration costs of $19,873; transfer and filing fees of

$6,861; stock based compensation of $26,000; travel of $6,970; rent of $2,888;

communication costs of $1,212; interest on notes payable of $2,090 and bank

charges of $1,217.

13

We

recorded a net loss of $66,169 for the three months ended September 30, 2010,

compared with $12,745 for the comparative period in 2009. We recorded

a net loss of $128,871 for the year ended September 30, 2010, compared with loss

of $97,238 for the year ended September 30, 2009. We also have

incurred accumulated losses of $258,640 for the period from July 21, 2008 (Date

of Inception) until September 30, 2010. The changes in the net loss between the

periods can be attributed to the change of business direction and focus on the

commercialization of our IP. The focus on creating a commercial gum product will

require significant future investment and will likely result in further net

losses during the development, production and distribution phases.

Liquidity

and Capital Resources

As of

September 30, 2010, we had total current assets of $528. We had

$85,750 in current liabilities as of September 30, 2010. Thus, we had a negative

working capital balance of $85,222 as of September 30, 2010.

At

September 30, 2009, our previous year end, we had current assets of $7,224,

current liabilities of $2,375 and thus we had a working capital balance of

$4,849 at September 30, 2009.

During

the year ended September 30, 2010, the Company issued 33,330,000 shares of

common stock for $0.0015 for gross proceeds of $50,000.

The

Company also raised an additional $30,000 by way of a promissory note, and a

further $50,000 by issuing convertible promissory notes during the year ended

September 30, 2010.

Our

assets changed during the period due to the disposal of our mining operations

and acquisition of the Nutraceutical gum IP. We anticipate that continuing

the commercialization of the gum products and receiving patent protection for

our IP will increase the value of our assets. Our current cash reserve is not

sufficient to continue operations for more than 6 months and we will need to

raise additional capital to execute on our business plan. We expect to raise

additional capital to fund our operations until the point at which we can

commercialize our products and reach operating profitability. In the short term,

we will also rely on related party advances to cover the cost of operations

until we are able to consummate a private placement of our equity securities,

although no related parties are required to or have presently agreed to advance

such funds. There are no assurances that we will be successful in closing

a private placement or related party advances, and this poses a significant risk

to our continuing operations.

We have

not attained profitable operations and are dependent upon obtaining financing to

pursue significant IP development activities beyond those planned for the

current fiscal year.

Off

Balance Sheet Arrangements

As of

September 30, 2010, there were no off balance sheet arrangements.

Going

Concern

These

financial statements have been prepared in accordance with generally accepted

accounting principles applicable to a going concern, which assumes that the

Company will be able to meet its obligations and continue its operations for its

next twelve months. Realization values may be substantially different

from carrying values as shown and these financial statements do not give effect

to adjustments that would be necessary to the carrying values and classification

of assets and liabilities should the Company be unable to continue as a going

concern. At September 30, 2010, the Company has negative working

capital of $85,222, has yet to achieve profitable operations, has accumulated

losses of $258,640 since its inception (July 21, 2008) and expects to incur

further losses in the development of its business, all of which casts

substantial doubt about the Company’s ability to continue as a going

concern.

The

Company’s ability to continue as a going concern is dependent upon its ability

to generate future profitable operations and/or to obtain the necessary

financing from shareholders or other sources to meet its obligations and repay

its liabilities arising from normal business operations when they become

due. Management has no formal plan in place to address this concern

but considers that the Company will be able to obtain additional funds by equity

or debt financing and/or related party advances, however there is no assurance

of additional funding being available or on acceptable terms, if at

all.

Item 7A - Quantitative and

Qualitative Disclosures about Market Risk

We are a

“smaller reporting company” as defined by Regulation S-K and as such, are not

required to provide the information contained in this item pursuant to

Regulation S-K.

14

Item

8 - Financial Statements and Supplementary Data

The

required financial statements begin on page F-1 of this document.

Item

9 - Changes in and Disagreements with Accountants on Accounting and Financial

Disclosure

During

the Company’s fiscal years ended September 30, 2009 and 2008, and through July

22, 2010, there were no disagreements with BDO Canada on any matter of

accounting principles or practices, financial statement disclosure, or auditing

scope and procedure, which disagreements, if not resolved to the satisfaction of

BDO Canada, would have caused BDO Canada to make reference thereto in its

reports on the financial statements. The Company engaged De Joya

Griffith & Company, LLC (“De Joya”) as its auditors as of July 23,

2010. As of July 23, 2010 and through the date of this Annual Report,

there have been no disagreements with De Joya on any matter of accounting

principles or practices, financial statement disclosure, or auditing scope and

procedure, which disagreements, if not resolved to the satisfaction of De Joya,

would have caused De Joya to make reference thereto in its reports on the

financial statements.

Item

9A - Controls and Procedures

Disclosure

Controls and Procedures. Our management, under the supervision and with

the participation of our certifying officer, who is our sole officer and acts as

our chief executive officer and chief financial officer, (the “Certifying

Officer”) has evaluated the effectiveness of our disclosure controls and

procedures as defined in Rules 13a-15 promulgated under the Exchange Act as of

the end of the period covered by this Annual Report. Based on such evaluation,

our Certifying Officer has concluded that, as of the end of the period covered

by this Annual Report, our disclosure controls and procedures were not

effective. Disclosure controls and procedures are controls and procedures

designed to ensure that information required to be disclosed in our reports

filed or submitted under the Exchange Act is recorded, processed, summarized and

reported within the time periods specified in the SEC’s rules and forms and

include controls and procedures designed to ensure that information we are

required to disclose in such reports is accumulated and communicated to

management, including our Certifying Officer, as appropriate to allow timely

decisions regarding required disclosure.

Management’s

Annual Report on Internal Control over Financial Reporting. Management is

responsible for establishing and maintaining adequate internal control over

financial reporting, as such term is defined in Rule 13a-15(f) of the Exchange

Act.

Internal

control over financial reporting is defined under the Exchange Act as a process

designed by, or under the supervision of, our Certifying Officer and effected by

our board of directors, management and other personnel, to provide reasonable

assurance regarding the reliability of financial reporting and the preparation

of financial statements for external purposes in accordance with generally

accepted accounting principles and includes those policies and procedures

that:

|

|

Pertain

to the maintenance of records that in reasonable detail accurately and

fairly reflect the transactions and dispositions of our

assets;

|

|

|

Provide

reasonable assurance that transactions are recorded as necessary to permit

preparation of financial statements in accordance with generally accepted

accounting principles, and that our receipts and expenditures are being

made only in accordance with authorizations of our management and

directors; and

|

|

|

Provide

reasonable assurance regarding prevention or timely detection of

unauthorized acquisition, use or disposition of our assets that could have

a material effect on the financial

statements.

|

Because

of its inherent limitation, internal control over financial reporting may not

prevent or detect misstatements. Also, projections of any evaluations of

effectiveness to future periods are subject to the risk that controls may become

inadequate because of changes in conditions, or that the degree of compliance

with the policies and procedures may deteriorate. Accordingly, even an effective

system of internal control over financial reporting will provide only reasonable

assurance with respect to financial statement preparation.

Our

management, with the participation of our Certifying Officer, evaluated the

effectiveness of the Company’s internal control over financial reporting as of

September 30, 2010. In making this assessment, our management used the criteria

set forth by the Committee of Sponsoring Organizations of the Treadway

Commission in Internal Control - Integrated Framework. Based on this evaluation

and those criteria, our management, with the participation of our Certifying

Officer, concluded that, as of September 30, 2010, our internal control over

financial reporting were not effective based on management’s identification of