Attached files

| file | filename |

|---|---|

| EX-31.2 - China Polypeptide Group, Inc. | v208015_ex31-2.htm |

| EX-32.2 - China Polypeptide Group, Inc. | v208015_ex32-2.htm |

| EX-31.1 - China Polypeptide Group, Inc. | v208015_ex31-1.htm |

| EX-32.1 - China Polypeptide Group, Inc. | v208015_ex32-1.htm |

| EX-10.13 - China Polypeptide Group, Inc. | v208015_ex10-13.htm |

| EX-10.17 - China Polypeptide Group, Inc. | v208015_ex10-17.htm |

| EX-10.15 - China Polypeptide Group, Inc. | v208015_ex10-15.htm |

| EX-10.16 - China Polypeptide Group, Inc. | v208015_ex10-16.htm |

| EX-10.14 - China Polypeptide Group, Inc. | v208015_ex10-14.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

x ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

fiscal year ended: September 30,

2010

¨ TRANSITION REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

transition period from ____________ to _____________

Commission

File No. 333-151148

CHINA

POLYPEPTIDE GROUP, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

20-8731646

|

|

(State or other jurisdiction of incorporation or

organization)

|

(I.R.S. Employer Identification No.)

|

No.

11 Jiangda Road

Jianghan

Economic Development Zone

Wuhan

430023

People’s

Republic of China

(Address of principal executive offices)

(86)

27 8351-8396

(Registrant’s telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which

registered

|

|

|

None

|

None

|

Securities

registered pursuant to Section 12(g) of the Exchange Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes ¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90

days.

Yes x No ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Website, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K.

x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large

Accelerated Filer ¨

|

Accelerated

Filer ¨

|

|

Non-Accelerated

Filer ¨ (Do not check

if a smaller reporting company)

|

Smaller

reporting company x

|

Indicate

by check mark whether registrant is a shell company (as defined in Rule 12b-2 of

the Act).

Yes ¨ No x

As of

March 31, 2010 (the last business day of the registrant’s most recently

completed second fiscal quarter), the aggregate market value of the shares of

the registrant’s common stock held by non-affiliates (based upon the closing

price of such shares as quoted on the OTC Bulletin Board maintained by the

Financial Industry Regulatory Authority) was approximately $207,863. Shares of

the registrant’s common stock held by each executive officer and director and

each by each person who owns 10% or more of the outstanding common stock have

been excluded from the calculation in that such persons may be deemed to be

affiliates of the registrant. This determination of affiliate status is not

necessarily a conclusive determination for other purposes.

There

were a total of 11,939,967 shares of the registrant’s common stock outstanding

as of January 12, 2011.

None.

CHINA

POLYPEPTIDE GROUP, INC.

Annual

Report on FORM 10-K

For the Fiscal

Year Ended September 30, 2010

TABLE

OF CONTENTS

|

PART

I

|

|||

|

Item

1.

|

Business.

|

2

|

|

|

Item

1A.

|

Risk

Factors.

|

15

|

|

|

Item

1B.

|

Unresolved

Staff Comments.

|

28

|

|

|

Item

2.

|

Properties.

|

29

|

|

|

Item

3.

|

Legal

Proceedings.

|

29

|

|

|

Item

4.

|

(Removed

and Reserved).

|

29

|

|

|

PART

II

|

|||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities.

|

29

|

|

|

Item

6.

|

Selected

Financial Data.

|

30

|

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.

|

30

|

|

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk.

|

38

|

|

|

Item

8.

|

Financial

Statements and Supplementary Data.

|

38

|

|

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure.

|

38

|

|

|

Item

9A.

|

Controls

and Procedures.

|

38

|

|

|

Item

9B.

|

Other

Information.

|

40

|

|

|

PART

III

|

|||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance.

|

40

|

|

|

Item

11.

|

Executive

Compensation.

|

42

|

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters.

|

44

|

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence.

|

45

|

|

|

Item

14.

|

Principal

Accounting Fees and Services.

|

47

|

|

|

PART

IV

|

|||

|

Item

15.

|

Exhibits,

Financial Statement Schedules.

|

47

|

|

Special

Note Regarding Forward Looking Statements

In addition to historical

information, this report contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. We use words such as “believe,”

“expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,”

“aim,” “will” or similar expressions which are intended to identify

forward-looking statements. Such statements include, among others, those

concerning market and industry segment growth and demand and acceptance of new

and existing products; any projections of sales, earnings, revenue, margins or

other financial items; any statements of the plans, strategies and objectives of

management for future operations; and any statements regarding future economic

conditions or performance, as well as all assumptions, expectations,

predictions, intentions or beliefs about future events. You are cautioned that

any such forward-looking statements are not guarantees of future performance and

involve risks and uncertainties, including those identified in Item 1A, “Risk

Factors” included herein, as well as assumptions, which, if they were to ever

materialize or prove incorrect, could cause the results of the Company to differ

materially from those expressed or implied by such forward-looking

statements.

Although

we believe the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, level of activity, performance,

or achievements. Moreover, neither we nor any other person assumes

responsibility for the accuracy or completeness of any of these forward-looking

statements. You should not rely upon forward-looking statements as predictions

of future events. We are under no duty to update any of these forward-looking

statements after the date of this report to conform our prior statements to

actual results or revised expectations.

Use

of Terms

Except as

otherwise indicated by the context, references in this report to:

|

|

·

|

“Company,”

“we,” “us” and “our” are to the combined business of China Polypeptide

Group, Inc., a Delaware corporation, and its subsidiaries: Cantix,

Moneyeasy, Tallyho, Wuhan Anti-Aging, Hopsun and

Xingpu;

|

|

|

·

|

“Cantix”

are to our wholly-owned direct subsidiary, Cantix International Limited, a

British Virgin Islands limited

company;

|

|

|

·

|

“Moneyeasy”

are to our wholly-owned indirect subsidiary, Moneyeasy Industries Limited,

a Hong Kong limited company;

|

|

|

·

|

“Tallyho”

are to our wholly-owned indirect subsidiary, Wuhan Tallyho Biological

Product Co., Ltd., a PRC limited

company;

|

|

|

·

|

“Wuhan

Anti-Aging” or “Anti-Aging”

are to our wholly-owned indirect subsidiary, Wuhan

Polypeptide Anti-Aging Research & Development Co., Ltd., a PRC limited

company;

|

|

|

·

|

“Hopsun”

are to our wholly-owned indirect subsidiary, Guangdong Hopsun Polypeptide

Biological Technology Co., Ltd., a PRC limited

company;

|

|

|

·

|

“Xingpu”

are to our variable interest entity (VIE) indirect subsidiary, Guangdong

Xingpu Polypeptide Research Co., Ltd., a PRC limited

company;

|

|

|

·

|

“SEC”

are to the United States Securities and Exchange

Commission;

|

|

|

·

|

“Securities

Act” are to the Securities Act of 1933, as amended, and “Exchange Act” are

to the Securities Exchange Act of 1934, as

amended.

|

|

|

·

|

“China,”

“Chinese” and “PRC” are to People’s Republic of

China;

|

|

|

·

|

“BVI”

are to the British Virgin Islands;

|

|

|

·

|

“Hong

Kong” are to the Hong Kong Special Administrative Region of the People’s

Republic of China;

|

|

|

·

|

“RMB”

are to Renminbi, the legal currency of China;

and

|

|

|

·

|

“U.S.

dollar,” “$” and “US$” are to the legal currency of the United

States.

|

1

PART

I

|

ITEM

1.

|

BUSINESS.

|

Through

our operating subsidiaries in China, we are engaged in the research,

development, production and sale of polypeptide-based nutritional supplements,

health foods, functional foods, nutricosmetics products and other related health

and wellness products. We believe we are one of the leading providers of

polypeptide-based health and wellness products in China.

Polypeptides

are small molecular structures consisting of 10-50 amino acids and have been

found to have high nutritional value and support body functions such as

regulating immunological functions. We focus on enzyme engineering in order to

produce micromolecular protein structures in the form of certain functional

peptides for use as nutritional ingredients, additives and supplements. We have

developed over 70 different types of polypeptide-based nutritional products. Our

key products include Polypeptide Protein Powder, which has been approved by the

PRC State Food and Drug Administration, or SFDA, and Shenguo Polypeptide

Capsules, which has been approved by the relevant health administration

authority of Hubei province and is in the process of gaining SFDA approval.

Other functional polypeptide-based nutritional supplement products include lipid

lowering soy peptide products. These products are manufactured using our

proprietary processing methods.

We

believe that, in China and internationally, we are one of the few companies that

have combined strong research and development capabilities, modernized

manufacturing facilities, a series of high quality diversified nutritional

products, superior customer services and competitive prices for

polypeptide-based products. According to the Polypeptide Industry Competitive

Landscape and Investment Strategy Research Report (2009-2012) by the Chinese

Industry Consulting Network, we are one of the largest companies focusing on

developing, producing and marketing polypeptide-based products in

China.

Our

products are primarily manufactured in our owned and operated

production facilities located on 16,477 square meters of land in the Hannan

Economic Development Zone in Wuhan, China which are planned to be further

expanded. Some of our nutritional supplements and personal care products are

manufactured for us through contractual relationships with other manufacturing

companies, in accordance with our own proprietary formulations. Our products

currently being marketed and sold in China have been tested and approved by the

relevant Chinese governmental hygiene and safety agencies such as the local

bureaus of Ministry of Health and the SFDA, where necessary. Our research and

development efforts are conducted in three different R&D centers from basic

peptide research to anti-aging focused applied research and related product

development in Wuhan, China.

Our

products are sold to customers both in China and internationally, with China

currently being the primary market, through a combined network of sales

personnel in our headquarters and throughout our branch sales offices in 15

provinces in China, wholesalers, distributors and private labeled

partners.

History

and Corporate Structure

China

Polypeptide Group, Inc., formerly known as Hamptons Extreme, Inc., was

incorporated under the laws of the State of Delaware in March 2007. The Company

was formed to engage in the design, manufacturing, distribution and marketing of

surfboards and related equipment. Prior to the reverse acquisition described

below, the Company was considered to be a development stage company with no

material assets or operations and had generated no revenues since its inception.

On July

28, 2008, China Polypeptide Group, Ltd., or CPG, our former parent company,

completed a reverse acquisition transaction through a share exchange with

Ablepeak International Limited, or Ablepeak, a British Virgin Islands company,

and Cantix, whereby CPG issued 55,487,956 shares of its common stock to Ablepeak

in exchange for all of the issued and outstanding capital stock of Cantix.

Cantix thereby became CPG’s wholly-owned subsidiary and Ablepeak became CPG’s

controlling stockholder.

2

On

November 13, 2009, we completed a reverse acquisition of Cantix whereby we

issued to CPG 1,100,000 shares of our common stock, constituting approximately

88% of our then issued and outstanding shares of common stock, in exchange for

all of the issued and outstanding capital stock of Cantix. Cantix thereby became

our wholly-owned subsidiary and its four direct and indirect subsidiaries,

Moneyeasy, Tallyho, Wuhan Anti-Aging and Hopsun, became our indirect

subsidiaries. As a result of the reverse acquisition, our principal business

became the business of Cantix, which, through its PRC-based indirect operating

subsidiaries, Tallyho, Hopsun and Wuhan Anti-Aging, engages in the research and

development, manufacturing, sales and marketing of polypeptide-based nutritional

supplements and health foods.

Cantix

was incorporated in the BVI as a startup stage company on January 29, 2007.

Moneyeasy is a Hong Kong business organization that was incorporated as a

startup stage company on August 25, 2006. Tallyho was organized under the laws

of the PRC on November 28, 1996 under the name of Wuhan Xinrongxin Biological

Product Co., Ltd. The name was changed to its current name on January 6, 1999.

Tallyho’s scope of business includes research and development, production and

sale of biological and nutritional supplements. Tallyho’s business license is

valid through December 24, 2037. Wuhan Anti-Aging was organized under the laws

of the PRC on June 27, 2007. Its primary business is research and development of

protein and polypeptide anti-aging biological products, sales and distribution

of developed products. Wuhan Anti-Aging’s business license is valid through June

13, 2037.

On

November 5, 2007, Moneyeasy entered into an equity purchase agreement to acquire

all the equity interest of Tallyho for RMB 40,230,000 (approximately

$5,854,361). An Approval for Establishment of Enterprise with Investments from

Taiwan, Hong Kong, Macao and Overseas Chinese was issued by the People’s

Government of Wuhan Municipality on November 27, 2007, in connection with

Moneyeasy’s acquisition of Tallyho. The transaction was also approved by the

Wuhan City Bureau of Commerce, subject to the PRC Regulations on Merger with and

Acquisition of Domestic Enterprises by Foreign Investors, which require the

equity interest transfer price to be paid in full by a date certain (July 26,

2008), or in the absence of such express date, within one (1) year commencing

from the issuance of the new business license. On March 25, 2008, a renewed

Business License was issued by the Wuhan Administration for Industry and

Commerce, and Tallyho was converted into a wholly foreign owned

enterprise.

On

December 18, 2007, Moneyeasy entered into another equity purchase agreement to

acquire all the capital of Wuhan Anti-Aging for RMB 8,000,000 (approximately

$1,045,246). Wuhan Anti-Aging received the Certificate of Approval issued by the

People’s Government of Wuhan Municipality on December 29, 2007, and a renewed

Business License from the Wuhan Administration for Industry and Commerce on

January 3, 2008. The acquisition was approved by the Wuhan City Bureau of

Commerce, subject to the PRC Regulations on Merger with and Acquisition of

Domestic Enterprises by Foreign Investors. In this case, the Wuhan City Bureau

of Commerce did not specify an exact date on which the full purchase price was

to be paid for the transferred equity. As such, Moneyeasy was not required to

pay the full purchase price under the agreement for one (1) year, commencing

from the issue of the new business license (i.e. January 2, 2009). By October

30, 2009, Moneyeasy had paid the full purchase price.

On

November 13, 2007, Tallyho established its operating PRC subsidiary, Hopsun and

contributed RMB 14,000,000 (approximately $2,008,227). Hopsun specializes in

service-based sales of health and anti-aging products.

Effective

September 28, 2010, Hopsun entered into a series of contractual arrangements

with Xingpu and its shareholders, Mr. Dongliang Chen, the Company’s Chief

Executive Officer and Board Chairman, and Mr. Shengfan Yan, the Company’s

President and Director, pursuant to which Xingpu became the Company’s variable

interest entity, or VIE. The VIE agreements include an exclusive business

cooperation agreement, through which Hopsun has the right to advise, consult

with, manage and operate Xingpu, and to collect fees based on its profits.

Xingpu's shareholders have also granted their voting rights over Xingpu to

Hopsun. In order to further reinforce Hopsun's rights to control and operate

Xingpu, Xingpu and its shareholders have granted Hopsun the exclusive right and

option to acquire all of their equity interests in Xingpu. Further, Xingpu’s

shareholders have pledged all of their rights, titles and interests in Xingpu to

Hopsun. In accordance with Accounting Standards Codification (“ASC”) Topic 810

and its related subtopics (formerly FASB Interpretation No. 46R, Consolidation

of Variable Interest Entities), Xingpu is now a VIE of the Company and the

Company is the primary beneficiary of Xingpu through Hopsun.

Xingpu is

a development stage company established on March 2, 2010. Its registered capital

is RMB 200,000,000 (approximately $29,255,164), of which RMB 40,000,000

(approximately $5,851,033) was contributed as of September 30, 2010. Xinpu’s

current purpose is to develop the Company’s regional headquarters and its

research and development center. The shareholders of Xingpu each hold a 50%

equity interest in Xingpu.

3

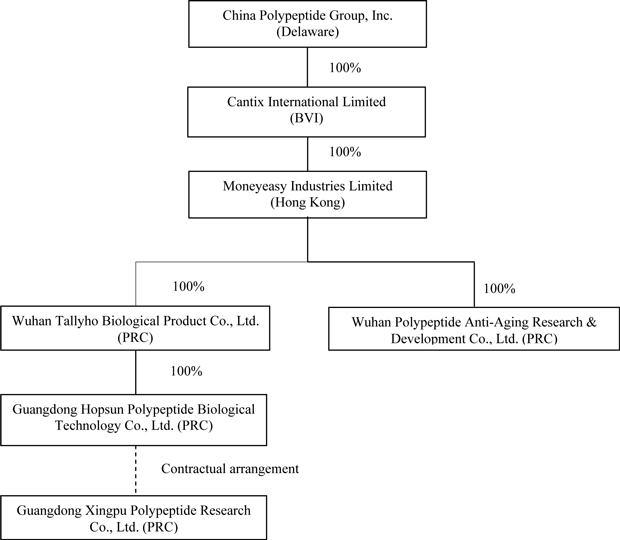

The

following chart reflects our organizational structure as of the date of this

annual report:

Our

Industry

Our

products are targeted for use in the anti-aging and health and wellness markets

and specifically, the nutraceutical (or the nutritional supplements) market, the

cosmetics market and other healthcare markets with a primary geographical focus

in China.

China’s

Economy

Despite

the global economic downturn and fluctuation, China’s economy has outpaced the

economy of many other countries and has seen a GDP growth rate of 8.7% for 2009.

According to the latest statistics, China’s economic growth was 10.6% during the

first 9 months of 2010 and according to a quarterly update report issued by the

World Bank in November 2010, China’s annual economic growth is expected to reach

10% for 2010, fuelled by a transformed growth model featuring less

government-led investment, a recovery in exports and solid domestic consumption.

The Chinese government has put increasing emphasis on domestic consumption to

support further economic growth and recognized it as an import area for economic

transformation. China’s retail sales in 2009 rose 16.9% in real terms, adjusted

for inflation, to approximately US$1.84 trillion and continued to grow 18.3%

year over year during the first 9 months of 2010. As a result of the continued

economic growth, the disposal incomes of Chinese people have kept rising and the

wealthy population has been increasing. We believe that this has led to

increasing awareness of the quality of living and health and driven the demand

for the types of products that we develop and offer.

4

The

Anti-aging Market

We

believe that, in view of the world demographic trends, anti-aging products and

services have become one of the most important and fastest growing areas across

the medical, cosmetic, nutraceutical and other related industries.

According

to a report by the United Nations, the number of seniors over 65 years old has

been increasing at an annual rate of 2.5% in recent years. Statistics and

predictions from the World Health Organization estimate that the elderly

population will reach two billion by 2050. According to the China National

Committee for Aging, an inter-ministry aging matter focused agency under the

State Council of China, the number of seniors over 60 years old reached 167

million by the end of 2009, representing more than 12% in the total population

of China. At an annual growth rate of more than 3% in recent years, China has

become the country with the largest aging population in the world.

A

nationwide nutrition and health status survey conducted by the Ministry of

Health of China which was issued in October 2004 disclosed that the number of

residents in China with chronic non-communicable diseases had been rising

rapidly as a result of unhealthy lifestyle. For example, the prevalence of

hypertension was increasing and the number of hypertension patients amounted to

over 160 million patients, an increase of 31% compared to that of 1991 when the

last same nationwide survey was conducted. The report also showed that chronic

diseases replaced infectious diseases as a major cause of death of residence in

China. The chronic non-communicable diseases are aging effects. The trends of

younger people getting such diseases has also led to increasing anti-aging needs

among middle-aged or even young people in China in recent years.

We

believe that due to lifestyle changes, deterioration of the environment,

increasing life expectancy of Chinese citizens, increasing awareness of quality

of life and health, the demands for anti-aging products such as nutritional

supplements, health foods and cosmetics products, are growing in China. Such

trends have the following characteristics:

|

|

a)

|

expansion

from wealthy population to massive

population;

|

|

|

b)

|

expansion

from aging people to younger

people;

|

|

|

c)

|

extension

from traditional products to new technology

products;

|

|

|

d)

|

migration

of focus from post-disease medical treatments to preventive treatments;

and

|

|

|

e)

|

change

from primary medicine taking to nutritional adjustments both inside and

outside the body.

|

The

Nutraceutical (or Nutritional Supplements) Market

According

to the China Health Care Association, or CHCA, a national association under the

Ministry of Health of China, a nutraceutical market research report released at

the Natural Products Expo West held in Anaheim, California in March 2010,

estimated the size of the nutraceutical market in China to reach US$13.4 billion

in 2009. As a result, China has exceed Japan to be the second largest country

market, following the U.S. Further, pursuant to other releases of CHCA, it is

estimated that the annual growth rate of health supplement consumption by

Chinese people in recent years lies between 15% and 30%, much higher than the

growth in developed countries.

Based on

our review of the experience of other developed countries, when per capita GDP

reaches $1,500 to $3,000, the nutraceutical industry will emerge and closely

follow the country’s economic growth. China’s per capita GDP exceeded $3,000 in

2008 to reach $3,260 and amounted to approximately $3,500 in 2009. The

nutraceutical industry in China has entered into a fast growing stage. Based on

the current growth rate, it is estimated that by 2010, there would be almost 20

cities of an aggregate 100 million in population with per capita GDP exceeding

$10,000. With increasing awareness of living and health quality and the growing

level of disposable income, people in these Chinese cities and other high income

regions present a very appealing market for nutraceutical companies such as

ours. We believe that we will be competitive in this market due to our unique

competitive advantages and our offering of quality products that are favored by

the market.

The

Cosmetic Market

The

cosmetics products industry has been one of the fastest growing industries in

China. According to an investment analysis and forecast report on the Chinese

cosmetics market issued by Chinese Investment Consultants, a leading Chinese

industry research institution, in 2008, the sales of the cosmetics market

increased annually by more than 20% in the past 10 years. It is expected that

the annual sales of cosmetics products would amount to approximately RMB 80

billion with an annual growth of 8.9% in 2010 and reach approximately RMB 110

billion in 2015 with an average annual growth 6.22%.

5

We

believe collagen products will be a major growth segment within the cosmetics

market in China in the next few years. According to a market research report on

collagen in China, it is forecasted that consumption of collagen products in

China will grow as fast as 20% annually. Taiwan pioneers mainland China in using

collagen products with annual consumption of more than NT40 billion ($1.24

billion). We believe that collagen-based nutricosmetics products that contain

small molecular weight collagen, such as Collagen Tripeptide, or CTP, will stand

out from other collagen products in such a trend. We have developed our

proprietary CTP technology and built one of the largest state-of-the-art CTP

production facilities in Asia to capitalize this market

opportunity.

Our

Competitive Strengths

We

believe that our competitive strengths include the following:

|

|

·

|

Advanced

polypeptide technology and research and development capabilities.

We have been researching and developing polypeptides since 1996. Our core

research team’s polypeptide research experience averages over 20 years. We

believe we are one of the leading companies developing polypeptide

technologies in China. For example, our company was the main institution

appointed to set the first peptide-related national standard, i.e., “Soy

Peptides Powder” (GB/T22492-2008) issued by the General Administration of

Quality Supervision, Inspection and Quarantine of China and the National

Standardization Administration of China. In addition, the Collagen

Tripeptide project conducted by our Company won Second Prize at the

Governmental Science and Technology Award given by the Wuhan Municipal

Government in December 2008, and the Polypeptide Beauty-slimming Capsule

product developed by our Company won the Technology Advancement Award in

October 2003 by the Organization Committee of the Third China

International Healthcare Festival. Our Research Center of Peptide

Materials, Anti-aging Research & Development Center and Applied

Research Center of Polypeptide-based Functional Food and Cosmetic have

gathered excellent researchers and scientists in the respective research

areas. We have three patents of invention and have applied for an

additional twelve patents with State Intellectual Property Office of The

PRC.

|

|

|

·

|

Experience

in the production of functional peptides. Unlike our competitors,

which offer soy and animal based peptide products, we provide a wide range

of functional peptide products that are extracted from many different

natural protein ingredients with our proprietary bio-engineering

technologies. Functional polypeptides create functional proteins which

shape themselves in stable, distinctive and discrete structure to perform

specific functions in the body. We believe our technologies and know-how

in the production of functional peptides allow us to produce products that

provide more body regulating and enhancement functions for consumers of

varying age groups and different health needs. We have developed over 70

kinds of functional polypeptide products, which provide a variety of

benefits such as basic nutrition, health-care and anti-aging

benefits.

|

|

|

·

|

Well known

brand names. We believe that two of our trademarks, “Tallyho” and

“Puzhongren” have achieved strong name recognition in local markets. The

provinces of Hubei and Guangdong issued us certificates recognizing these

two brands as “famous brands.” We believe that recognition of “Tallyho”

and “Puzhongren” brand names helps drive the sales of our products and

facilitates acceptance and market penetration of our new products. In

order to protect and enhance our “Tallyho” and “Puzhongren” brand names,

we rely on stringent quality control and our ongoing marketing,

advertising and public relations efforts and continue to stress the

quality, safety and innovativeness of our products. We believe that brand

awareness in our target markets and dedicated distribution channels, will

enable us to leverage goodwill from our brands into future

growth.

|

|

|

·

|

Proven and

stable management team. Our management team has a proven track

record of successful management and has a great deal of experience in the

nutritional supplement and anti-aging industry and business development.

Our management team is led by Dongliang Chen, who became our Chief

Executive Officer in November, 2009, after spending thirteen

years with one of our subsidiaries, Tallyho, where he most recently served

as the Chairman of the Board and Chief Executive Officer. Mr. Chen is the

inventor of two key patents, and the author of a number of science and

biology educational books on polypeptides. Since joining our Company, Mr.

Chen has assembled a team of experienced executives, including: Mr.

Shengfan Yan, our President, who has worked in the nutritional supplements

and related industries in China for over 15 years and has abundant

experience in sales and marketing of nutraceutical products; Mr. Richard

Liu, our Chief Financial Officer, who has over 12 years of experience in

accounting and financial management, including financial executive

experience with publicly-traded companies; Ms. Lirong Hu, our Treasurer,

who brings more than 25 years of accounting and financial management

experience to the Company; Mr. Jun Li, our Company Secretary, who brings

over 15 years of corporate and business development experience in

nutritional supplements and food industries in China. Our core management

and operation team at our operating subsidiaries have been stable and

working together for over 8

years.

|

6

|

|

·

|

Integrated

sales channel. We have a diversified sales network that allows us

to effectively market our products and services to our customers. Our

sales and marketing teams currently consist of approximately 256 full-time

employees and over 300 part-time employees. We sell our end-consumer

products at our community shops or customer service stations and we

usually organize events or seminars at which we provide complimentary

nutrition and anti-aging consultation. Our sales offices, community shops

and customer service stations are strategically located in densely

populated residential areas, within or near local shopping destinations or

in other easy access locations. Our customers place orders for our

products with our own sales staff at our sales locations and we deliver

the products directly to them or purchase them at our community shops. Our

sales network currently covers 15 provinces in China. We also use

third-party distributors to sell our end-consumer products to the selected

local markets. In addition, we leverage on our strong research and product

capabilities to develop and sell polypeptide ingredients and semi-final

products to other nutraceutical, food and cosmetics companies under the

OEM/ODM model, which we referred to as Project

Sales.

|

|

|

·

|

Productive

technology equipment and the advantage of processing technique. Our

products are produced in our own production facilities using modern

production lines, techniques and equipment. Our production facilities are

Good Manufacturing Practice, or GMP, certified for manufacturing health

foods and have the ISO 9001:2000 quality management system certification

and the Hazard Analysis and Critical Control Point, or HACCP, food safety

certification. We believe that our production facilities are satisfactory

for our current production needs but we are preparing to increase capacity

in the future.

|

Our

Growth Strategy

We are

committed to growing our business in the coming years. We will implement the

following strategic plans to take advantage of industry opportunities and our

competitive strengths:

|

|

·

|

Enhance

marking efforts. We plan to enhance our marketing and promotional

campaigns and increase advertisements to strengthen the market awareness

of our brands through both traditional and online media. We also plan to

leverage on more innovative and efficient marketing partners to expand our

market reach, especially for our new products targeted at the middle-aged

to youth markets. We intend to position ourselves as the market thought

leader in the polypeptide product category in China and plan to expand

into new overseas markets for functional polypeptide

products.

|

|

|

·

|

Introduce

new products. We plan to develop new polypeptide technologies and

products according to our market intelligence feedbacks, supported by our

strong research and product development capabilities, with a focus on

products with anti-aging functions that could maintain the health of the

middle and old aged people, ameliorate age related disease and improve

life quality, and the products that delay senility of skin and body,

maintain vigor of the middle aged and the youth. We also plan to develop

new prevalent nutraceutical and nutricosmetics products from our

proprietary functional peptide ingredients such as Collagen Tripeptide,

skin longevity factor peptide, corn peptide, etc. targeted at the

middle-aged to youth markets.

|

|

|

·

|

Further

expand our distribution network to increase the prevalence of our

products. We plan to continue to enhance and expand our

service-based sales network, in both existing and new regional markets,

and the third-party distributor network in selected local markets which

are not adequately covered by our own sales force. We plan to convert and

expand selected community shops or customer service stations into

exclusive shops at highly populated locations to gain additional sales

growth points. We also plan to expand the existing sales network of

functional polypeptide ingredients and OEM/ODM products to supply to more

major nutraceutical, food and cosmetics

partners.

|

In

addition to our organic growth strategies, we also intend to support and

accelerate our growth through acquisitions of potential target companies with

complementary strengths which can create synergies with our existing operations,

product offerings and technologies.

7

Our

Products

We have

developed over 70 different types of polypeptide-based nutritional products. Our

key products include Polypeptide Protein Powder, which has been approved by the

SFDA, and Shenguo Polypeptide Capsules, which has been approved by the relevant

health administration authority of Hubei province and is in the process of

gaining SFDA approval. Other functional polypeptide-based nutritional supplement

products include lipid lowering soy peptide products. These products are

manufactured using our proprietary processing methods.

Polypeptides

are small molecular structures consisting of 10-50 amino acids that have been

found to have nutritional value and support body functions such as regulating

immunological functions. We focus on enzyme engineering in order to produce

micromolecular protein structures in the form of certain functional peptides for

use as nutritional ingredients, additives and supplements.

Research

studies conducted by scientists at Hanyang University in Korea, the University

of Milan and the University of California (Davis), found that soy protein

peptide extracted from certain soybeans could inhibit the growth of metastatic

tumor cells, that the addition of soy protein to the diet could have the effect

of lowering total cholesterol concentrations in the body, and that soybean

peptide may prevent cancer from occurring in cultured cells and animals.

Polypeptide can be extracted from the tissues and organs of animals and plants

and processed in powder, capsule/tablet or injection form for internal use, or

as creams and lotions for topical use. Our polypeptide-based products are

produced in powder, capsule/tablet and liquid forms. Different combination of

polypeptides may be combined with other nutritional factors to form different

products with different benefits.

We have

built our reputation on developing formulas that blend the best of nature with

innovative techniques from nutrition science, to appeal to the growing base of

consumers desiring a healthier lifestyle and seeking differentiated nutritional

supplement and health food products. Our products are manufactured using our

proprietary processing methods.

Our

products can be divided into three (3) categories according to their service

target and functional features: (i) Functional Peptide Ingredients Products;

(ii) Polypeptide-based Healthy Foods and (iii) Polypeptide-based Special

Nutritional Foods.

Functional

Peptide Ingredient Products

Functional

peptide ingredient products are peptide-based ingredients which perform certain

physiological functions including regulating immunological functions, reducing

cholesterol, etc. We produce twelve (12) different functional peptide ingredient

products that we supply to other food, nutritional supplement, medicine and

cosmetics manufacturers. Our functional peptide ingredient products are used in

a variety of products ranging from nutritional supplements to skincare

products.

Polypeptide-based

Health Foods

Polypeptide-based

health foods are edible products with specific health care functions. Included

in this category is one of our key products, Polypeptide Protein Powder. These

products are verified, approved and licensed by SFDA. We produce three

polypeptide-based health food products and mainly sell them under our own brands

primarily through Hopsun’s nationwide sales network.

The

following is a brief description of our domestic polypeptide health food

products:

|

|

·

|

PZR

Protein Powder, which is marketed as a supplement to strengthen the immune

system;

|

|

|

·

|

Tallyho

Ziqing Soft Capsule, which is marketed as a supplement to aid in the

regulation of blood fat; and Anya

Taihe Slimming Capsule, which is marketed as a weight management

supplement.

|

8

Polypeptide-based

Special Nutritional Foods

Polypeptide-based

special nutritional foods are edible products with what we believe to have

special nutritional features which we develop for sale either directly to

consumers or to other nutraceutical distributors and marketers under an OEM/ODM

arrangement. Included in this category are some of our other key products,

Shenguo (Holy Fruit) Polypeptide Capsule, Hebaisui (Crane Longevity) Polypeptide

Tablet, Yanbaimei (All Charming Beauty) Polypeptide Tablet. We produce over

sixty different polypeptide-based special nutritional food products. Certain of

these products are sold under our own brands through Hopsun’s nationwide sales

network. We also sell these off-the-shelf products with our formula and

standards to other healthy food or nutraceutical companies, most of which are

primarily distribution or marketing companies with little development and

manufacturing capacities, under an ODM arrangement. In addition, we also utilize

the traditional OEM model to manufacture specific products according to formula

and the standards provided to us by our customers.

We are

developing orally administrated skin care and anti-aging nutritional products,

or nutricosmetics products, targeted at middle aged and young customers based on

new polypeptide ingredients such as Collagen Tripeptide, or CTP, which is

becoming very popular as a nutricosmetics supplement among young and middle aged

women in China and Asia.

Manufacturing

Our

products are primarily manufactured in our owned and operated production

facilities on a 16,477 square meter site located in the Hannan Economic

Development Zone, Wuhan City, Hubei Province, China. Upon the full commissioning

of our newly built start-of-the-art facilities in July 2010, we have a

designated production capacity of 1,000 tons of protein powder per annum, a

Collagen Tripeptide designated production capacity of 300 tons of polypeptide

ingredient per annum, a designated production capacity of 300 million of

capsule/tablet per annum. We are planning for further expansion of our

manufacturing capabilities for CTP ingredient and oral liquid form products to

meet the increasing market demands in the next few years. Our production facilities are

GMP certified for manufacturing health foods and have the ISO 9001:2000 quality

management system certification and the HACCP food safety

certification.

Some of

our nutritional supplements and personal care products are manufactured for us

through contractual relationships with other manufacturing companies, in

accordance with our own proprietary formulations. We work closely with such

production facilities in an effort to achieve the highest quality standards and

product availability.

Raw

Materials and Suppliers

Raw

materials for our products come from natural animal and vegetable proteins. For

example, collagen peptides and Collagen Tripeptides are extracted from marine

fish such as tilapia, soybean polypeptide products come from soybeans, albumin

polypeptide comes from eggs, and peanut peptides and corn peptides are taken

from peanuts and corn.

Raw

materials used in our products and our product packing materials are developed

in accordance with established criteria, including national standards, industry

standards, and enterprise standards. For products to be exported, international

standards must be followed.

Our

suppliers of raw materials and packing materials must provide us with the

following certificates of qualifications: production licenses, sanitary licenses

and other necessary certificates issued by relevant governmental authorities,

product quality standards, product test reports and certificates of conformance

of products.

Personnel

from our quality control department check all incoming raw materials against

specifications provided by the producers. Both the raw materials and its

packaging are inspected, and after this inspection, raw materials are sampled

according to national standards on sampling and are sent to our center test

room. Visual inspection, physical, chemical and hygiene tests are conducted

according to relevant standards. We submit items we are unable to test to

national test institutions for testing. Raw materials that fail testing are

returned to the suppliers and if we return a supplier’s raw materials twice,

they are no longer used by us.

We

currently maintain a sufficient supply of main raw materials for approximately

seven days of production. Prices for some of our key input materials, such as

soybean, eggs, herbs and packaging materials are increasing. However, we are

confident we can offset these increases with our cost reduction programs and by

raising the prices of our products.

The table

below lists as of September 30, 2010, the suppliers who supply more than 5% of

our products, raw materials and services, showing the cumulative dollar amount

of raw materials purchased from them during the 2010 fiscal year, and the

percentage of raw materials purchased from each supplier as compared to

procurement of all raw materials.

9

|

Rank

|

Supplier

|

Cumulative

Amount Purchased

(USD)

|

Percentage

of Total

Purchases

|

|||||||

|

1

|

Shandong

Linyi Shansong Biological Product Co., Ltd.

|

507,483 | 38 | % | ||||||

|

2

|

Hubei

Shenzhou Scientific, Industrial and Trading Development Co.,

Ltd.

|

145,420 | 9 | % | ||||||

|

3

|

Shenzhen

Jiuzhou Penda Can Manufactring Co., Ltd.

|

119,529 | 8 | % | ||||||

|

4

|

JiangXi

Cosen Biochemical Co., Ltd.

|

109,868 | 7 | % | ||||||

|

5

|

Bozhou

Zhigang Chinese Herb Distribution Center

|

108,925 | 7 | % | ||||||

Our

Customers

Our

products are sold to consumers both in China and internationally, with China

currently being the primary market, through a combined network of sales

personnel in our headquarters and throughout our branch sales offices in 15

provinces in China, and through third-party wholesalers, distributors and

private labeled partners.

The

geographic distribution of our customer base in China as of September 30, 2010

is as depicted in the table below:

|

Area

|

%

of Customers

|

|||

|

Southeast

|

30 | % | ||

|

South

|

19 | % | ||

|

East

|

19 | % | ||

|

North

|

15 | % | ||

|

Northeast

|

7 | % | ||

|

West

|

5 | % | ||

|

Middle

|

4 | % | ||

The

largest customers of ours by sales revenues are usually our local wholesalers,

distributors and private labeled partners. During the fiscal year ended

September 30, 2010, our six largest customers were Shenyang Zhongpu

Biological Product Co., Ltd., Nanjing Puhangtianqu Commercial Trading Co., Ltd.,

Chongqing Xinmi Commercial Trading Co., Ltd., Suzhou Qiqi Trading Co., Ltd.,

Kunming Youkun Commercial Trading Co., Ltd. and

Zhengzhou

Dinggeng Commercial Trading Co.,

Ltd..

In the aggregate, these customers accounted for

approximately $5.5 million, or 15%, of our total sales revenue in

2010.

We intend

to export our Collagen Tripeptide product to Japan. This product has passed a

qualification inspection and has been approved and certified by the Ministry of

Health, Labour and Welfare of Japan. We have appointed a Japanese professional

who has rich experience in the cosmetic and health food markets in Japan to help

us penetrate into the Japanese market and we have developed good relationships

with a number of relevant corporations in Japan.

Our

Sales and Marketing Efforts

We are

committed to building and expanding our sales network, customer base and brand

loyalty by providing a diverse portfolio of high quality polypeptide-based

health and wellness products. The breadth of our product offerings enables our

sales team and our distributors to sell a comprehensive package of nutritional

supplements and health foods that provide a variety of benefits, from

anti-oxidants to weight management and nutrition. Many of our product

formulations have been in existence for years and achieve good market acceptance

and loyalty. However, we continually review, and if necessary, improve our

product formulations based upon developments in nutritional science. We believe

that the longevity and variety in our product portfolio could significantly

enhance our sale effectiveness to expand our business.

We have a

diversified sales network allowing us to effectively market products and

services to our customers. Our sales and marketing department currently consists

of approximately 256 full-time employees and over 300 part-time employees. For

our own brand end consumer products, in addition to sales efforts conducted

directly by our internal sales team and other employees, we also use wholesalers

and distributors. We sell our own brand end consumer products from our

nationwide branch sales network, at community shops or customer service

stations, at exclusive shops, etc. and we usually organize promotional events or

informative seminars at which we provide complimentary nutrition and anti-aging

consultation, under the guidance and control of our consumer sales operation

headquarters in Guangzhou, i.e., Hopsun. These programs target specific consumer

market segments, such as women, men or children, as well as weight-management

customers and individuals seeking to enhance their overall well-being. Our

branch sales offices, service stations and exclusive shops are strategically

located in residential areas of high density, within or near local shopping

destinations and in other easy access locations. Our customers place orders for

our products with our own sales staff at our sales locations and we deliver the

products directly to them or purchase them at our community shops. Our

nationwide sales network covers 15 provinces in China. We also use third-party

distributors to sell our end-consumer products to the selected local markets. We

plan to expand our sales network or partner with more local wholesalers and

distributors to cover more Chinese cities.

10

The sales

team in our Wuhan office oversees sales of our ingredient and OEM/ODM products.

They provide one-stop-shop professional services from product formulation design

to packaging and marketing strategy for our enterprise customers.

Traditional

Sales Methods

We market

and sell some of our products under our own brand names to consumers through

regional dealers and network agents. In addition, we also provide manufacturing

services where we are contracted to manufacture products for third parties

either according to formulas and standards provided to us by such third parties

or according to our formula and standards for sale under our customers’ brand

names.

Innovative

Sales Methods

We have

developed two new sales models: project-based sales model and service-oriented

sales model. Currently, about 83% of our sales are derived through our

service-oriented model. We are also working to develop other sales channels as

well.

The

service-oriented sales model is a sales model through which we work to establish

strong relationships with customers by providing a series of value-added

services such as: health consultation and education services, psychological

counseling services, and physical examination services, among other services. We

believe that providing these services will help us establish brand image,

promote our products, convey product efficacy and benefits, and thus stimulate

demands and increase sales of our products.

The

project-based sales model is a sales model used in connection with the

manufacturing services we provide to customers. In the project-based sales

model, we define each customer’s business as one project, and provide each

customer with project-based one-stop-shop services, including market

consultation, technical demonstration, market positioning, product development,

manufacturing, test and evaluation, market access consultation, package design,

market planning, marketing and after-sale service. We work to assist our

customers in making reasonable use of polypeptide ingredients to develop

products and promote growth of the customer’s market. We believe that by working

to increase our contract manufacturing customer’s sales, sales of our

polypeptide ingredients will increase as well.

Our

Competition

We

believe that the nutraceutical or nutritional supplement business, both within

PRC and globally, is highly fragmented and intensely competitive. In our

industry, we compete based upon product quality, product cost, ability to

produce a diverse range of products and logistical capabilities. Many of our

competitors, both domestic and international, have greater research and

development capabilities and financial, scientific, manufacturing, marketing and

sales resources than we do. Although our marketing and sales efforts of

polypeptide-based products are limited as compared to our competition, we

believe that we have a competitive advantage due to the price and quality of our

products and our ability to produce a diverse range of products and customer

services.

Internationally,

there are companies that apply polypeptide technology in developing new drugs,

but we believe there are few companies that apply polypeptide technology to the

nutritional supplement field. We believe that in China, we are one of the

largest companies focusing on developing, producing and marketing functional

peptide nutritional products. We believe the other companies that sell

polypeptide products are either small size companies or large nutritional

products companies with only small percentage of revenue deriving from

polypeptide products.

11

Our

Research and Development Efforts

We

conduct our research and development efforts independently at our research and

development facilities in Wuhan, China. Our research and development department

is responsible for developing advanced technologies and new polypeptide based

products and for training and testing. As of September 30, 2010, we have a total

of thirty-six research personnel, including retired senior researchers who serve

as consultants for us, two with doctorate degrees and six with master degrees.

The rest are college graduates. Among the research personnel, twelve people are

of senior researcher level, four people are of intermediate researcher level,

and eleven people are of assistant researcher level.

Research

Centers

We have

set up the following three research and development centers.

Research Center of Peptides

Materials. This research center was set up in 1998. The primary purpose

of this research center is to (i) study the methods and conditions of extracting

polypeptides from animals and plants, (ii) test and measure the functional

polypeptides’ physiological regulation functions on humans, and (iii) test the

physical and chemical indicators, from both basic and applied research and

development perspective.

Anti-aging Research &

Development Center. This center was set up in 2007. The center engages in

the research and development of anti-aging products and pilot plant test work.

This center focuses on developing new products with anti-aging functions (such

as Shengguo polypeptide capsule, youth vigor tablet) through screening of

special antioxidants and research of combination of special antioxidants with

the polypeptide materials.

Applied Research Center of

Polypeptide-based Functional Foods & Cosmetics. This center was set

up in 2008 and is primarily engaged in (i) the study and application of

polypeptide-based functional foods & cosmetics, (ii) the development of new

products that are anti-aging and capable of ameliorating fundamental nourishment

supply & health conditions, and (iii) improvement and innovation of

functional food production & processing methods.

Research

Group

We employ

a group of senior in-service professionals in above research centers, most of

who are experts in the polypeptide industry. The leading researchers include

follows:

|

Name

|

Title

|

Specialty

|

||

|

Wang

Ajing

|

Distinguished

Professor

|

Biochemistry

|

||

|

Sun

Xiufa

|

Chief

Scientist

|

Biochemistry

|

||

|

Xia

Wenshui

|

Chief

Scientist

|

Food

Engineering

|

||

|

Mo

Zhaohui

|

Chief

Engineer

|

Processing

Technology

|

||

|

Ji

Jinlin

|

Researcher

|

Electrophorisis,

Chromatography, High Efficiently Liquid Chromatographym,

etc.

|

||

|

Yu

Chenggao

|

Researcher

|

Physiology

and Nutrition

|

During

the fiscal years ended on September 30, 2010 and 2009, we incurred $311,226 and

$ 285,496, respectively, in research and development expenses with respect to

our polypeptide-based products.

Our

Intellectual Property

The

continued success of our business is dependent on our intellectual property

portfolio consisting of registered trademarks, design patents and utility

patents related to our products.

We

currently have three patents which have been granted by the State Intellectual

Property Office of the PRC. The first, for a “processing method of soy

polypeptide dry powder with the function of blood lipid lowering,” expires in

December 2020, the second, for a “processing method of non-bitter soy

polypeptide powder,” expires in May 2022 and the third, for a “processing method

of coleseed peptide with direct enzymolysis of colza meal,” expires in April

2030. We have also applied for an addition twelve patents, which are still in

process.

12

We also

have registered trademarks for “Tallyho”, “AnErYa,” “TuoNiAoMoLiJian” and

“PuZhongRen.”

In

addition, we protect our know-how technologies through confidentiality

agreements we entered into with our key employees that have access to our know

how information among our management members and in our research and production

departments.

Our

Employees

As of

September 30, 2010, we had approximately 455 full-time employees and 300

part-time employees. The following table sets forth the number of our full-time

employees by function:

|

Function

|

Number

|

|

|

Executive

|

5

|

|

|

Administrative

|

19

|

|

|

Sales

and Marketing

|

256

|

|

|

Research

and Development

|

25

|

|

|

Production

|

98

|

|

|

Accounting*

|

52

|

* Including the accounting staff at our sales branches.

Our

ability to achieve our operational and financial objectives depends in part upon

our ability to retain key technical, marketing and operations personnel, and to

attract new employees as required to support growth. Working capital constraints

may impair our ability to retain and attract the staff needed to maintain

current operations and meet the needs of anticipated growth.

In

addition, we rely on consultants to a significant extent to supplement our

regular employee staff in certain key functional areas and to support management

in the execution of our business strategy. These consultants are independent

contractors. There can be no assurance that, if one or more of the consultants

were to terminate their services, we would be able to identify suitable

replacements. Failure to do so could materially and adversely affect our

operating and financial results.

As

required by applicable Chinese law, we have entered into employment contracts

with all of our officers, managers and employees. The remuneration payable to

employees includes basic salaries and allowances. In addition, our employees in

China participate in a state pension scheme organized by Chinese municipal and

provincial governments. We are required to contribute to the scheme at a rate of

28% of the average city monthly salary. In addition, we are required by Chinese

law to cover employees in China with various types of social insurance. We have

purchased social insurance for all of full time our employees.

We

believe that our relationship with our employees is good. We have not

experienced any significant problems or disruption to our operations due to

labor disputes, nor have we experienced any difficulties in recruitment and

retention of experienced staff.

Environmental

Matters

Our

manufacturing facilities are subject to various pollution control regulations

with respect to noise, water and air pollution and the disposal of waste and

hazardous materials. We are also subject to periodic inspections by local

environmental protection authorities. Our operating subsidiaries have received

certifications from the relevant PRC government agencies in charge of

environmental protection indicating that our business operations are in material

compliance with the relevant PRC environmental laws and regulations. We are not

currently subject to any pending actions alleging any violations of applicable

PRC environmental laws.

13

Regulation

General

Regulation of Business

Polypeptide

based products are classified under PRC laws into three categories, based on

potential uses, and each category is subject to separate PRC laws and

regulations. All our polypeptide products must obtain approvals from local

administration authority of health, prior to distribution to customers.

Additionally, for those health food products, we are required to obtain approval

from the SFDA before we can make specific claims regarding the health benefits

of the product. Currently, all of our products have received local

administration authority of health approvals and may be distributed to

customers.

If our

polypeptide products are sold for further food manufacturing, they are

considered to be food additives under the relevant PRC laws and regulations, and

the Company is required to obtain two licenses prior to the distribution of such

products to customers: the Food Hygiene License issued by the relevant local

administration authority of health and the Food Production License issued by the

provincial branch of the General Administration of Quality Supervision,

Inspection and Quarantine, or the Quality Administration. We have obtained both

the Food Hygiene License issued by the Hubei Ministry of Health and the Food

Production License issued by the provincial Quality Administration.

Taxation

On March

16, 2007, the National People’s Congress of China passed a new Enterprise Income

Tax Law, or EIT Law, and on November 28, 2007, the State Council of China passed

its implementing rules, which took effect on January 1, 2008. Before the

implementation of the EIT Law, foreign invested enterprises, or FIEs,

established in the PRC, unless granted preferential tax treatments by the PRC

government, were generally subject to an enterprise income tax, or EIT, rate of

33.0%, which included a 30.0% state income tax and a 3.0% local income tax. The

EIT Law and its implementing rules impose a unified EIT of 25.0% on all

domestic-invested enterprises and FIEs, unless they qualify under certain

limited exceptions. Despite these changes, the EIT Law gives FIEs established

before March 16, 2007, or Old FIEs, a five-year grandfather period during which

they can continue to enjoy their existing preferential tax treatments. During

this five-year grandfather period, the Old FIEs which enjoyed tax rates lower

than 25% under the original EIT law will be subject to gradually increased EIT

rates over a 5-year period until their tax rate reaches 25%. In addition, the

Old FIEs that are eligible for other preferential tax treatments by the PRC

government under the original EIT law are allowed to continue enjoying their

preference until these preferential treatment periods expire.

In

addition to the changes to the current tax structure, under the EIT Law, an

enterprise established outside of China with “de facto management bodies” within

China is considered a resident enterprise and will normally be subject to an EIT

of 25% on its global income. The implementing rules define the term “de facto

management bodies” as “an establishment that exercises, in substance, overall

management and control over the production, business, personnel, accounting,

etc., of a Chinese enterprise.” If the PRC tax authorities subsequently

determine that we should be classified as a resident enterprise, then our

organization's global income will be subject to PRC income tax of 25%. For

detailed discussion of PRC tax issues related to resident enterprise status, see

Item 1A, “Risk Factors – Risks Related to Doing Business in China – Under the

Enterprise Income Tax Law, we may be classified as a ‘resident enterprise' of

China. Such classification will likely result in unfavorable tax consequences to

us and our non-PRC stockholders.

In

addition, the EIT Law and its implementing rules generally provide that a 10%

withholding tax applies to China-sourced income derived by non-resident

enterprises for PRC enterprise income tax purposes unless the jurisdiction of

incorporation of such enterprises’ shareholder has a tax treaty with China that

provides for a different withholding arrangement. Tallyho and Wuhan Anti-Aging

are considered FIEs and are directly held by our subsidiary in Hong Kong.

According to a 2006 tax treaty between the Mainland and Hong Kong, dividends

payable by an FIE in China to the company in Hong Kong who directly holds at

least 25% of the equity interests in the FIE will be subject to a no more than

5% withholding tax. We expect that such 5% withholding tax will apply to

dividends paid to Moneyeasy by Tallyho and Wuhan Anti-Aging, but this treatment

will depend on our status as a non-resident enterprise.

14

Foreign

Currency Exchange

Substantially,

all of our sales revenue and expenses are denominated in RMB. Under the PRC

foreign currency exchange regulations applicable to us, RMB is convertible for

current account items, including the distribution of dividends, interest

payments, trade and service-related foreign exchange transactions. Currently,

our PRC operating subsidiaries may purchase foreign currencies for settlement of

current account transactions, including payments of dividends to us, without the

approval of the PRC State Administration of Foreign Exchange, or SAFE, by

complying with certain procedural requirements. Conversion of RMB for capital

account items, such as direct investment, loan, security investment and

repatriation of investment, however, is still subject to the approval of SAFE.

In particular, if our PRC operating subsidiaries borrow foreign currency through

loans from us or other foreign lenders, these loans must be registered with

SAFE, and if we finance the subsidiaries by means of additional capital

contributions, these capital contributions must be approved by certain

government authorities, including the PRC Ministry of Commerce, or MOFCOM, or

their respective local branches. These limitations could affect our PRC

operating subsidiaries’ ability to obtain foreign exchange through debt or

equity financing.

Dividend

Distributions

Our

revenues are earned by our PRC subsidiaries. However, PRC regulations restrict

the ability of our PRC subsidiaries to make dividends and other payments to

their offshore parent company. PRC legal restrictions permit payments of

dividend by our PRC subsidiaries only out of their accumulated after-tax

profits, if any, determined in accordance with PRC accounting standards and

regulations. Each of our PRC subsidiaries is also required under PRC laws and

regulations to allocate at least 10% of our annual after-tax profits determined

in accordance with PRC GAAP to a statutory general reserve fund until the

amounts in such fund reaches 50% of its registered capital. These reserves are

not distributable as cash dividends. Our PRC subsidiaries have the discretion to

allocate a portion of their after-tax profits to staff welfare and bonus funds,

which may not be distributed to equity owners except in the event of

liquidation.

The

Company intends on reinvesting profits, if any, and does not intend on making

cash distributions of dividends in the near future.

|

RISK

FACTORS.

|

RISKS

RELATED TO OUR BUSINESS

Our

operations, sales, profit and cash flow will be adversely affected if our

polypeptide products fail inspection or are delayed by regulators.

We are

responsible for product testing in our own facility for polypeptide products

sold in China and each batch of our products requires inspection by our Quality

Control center prior to shipment to our customers. The results of product

testing is recorded and approved by the local Quality and Technical Supervision

Department, and such testing must be in accordance with the national quality

standards issued by the National Standardization Administration of China and the

relevant industry quality standards where applicable, which require testing of

such factors including, but not limited to, appearance, packing capacity,

thermal stability, PH value, protein content and percentage of purity of the

product. Government regulators routinely inspect samples from each batch of our

polypeptide products and for export products, e.g., a sample of each shipment is

tested by the China Entry/Exit Inspection and Quality department. In the event that the

regulators delay the approval of our products, change the requirements in such a

way that we are unable to comply with those requirements, or require our other

products to be inspected by regulators before we can ship them to our customers,

our operations, sales, profit and cash flow will be adversely

affected.

15