Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Swisher Hygiene Inc. | d8k.htm |

SWISHER

HYGIENE Company Overview

JANUARY 2011

13

th

ANNUAL ICR XCHANGE

Exhibit 99.1 |

Forward-Looking Information

The presentation and financial information included in this presentation contain forecasts,

projections and other forward-looking information regarding Swisher Hygiene, its

business and prospects. This forward-looking information is based on

management assumptions and expectations, and are subject to risks, uncertainties, and

other factors that may cause actual results and performance to materially differ from

results or performance expressed or implied by the forward-looking statements. A description of

these

factors

can

be

found

in

our

Registration

Statement

on

Form

10,

as

amended

to

date,

and

our

other

filings with the Securities and Exchange Commission ("SEC") available at

www.sec.gov. Swisher Hygiene undertakes no obligation to publicly revise these

forward-looking statements. 2 |

–

Swisher Hygiene provides cleaning and sanitizing products and services to

commercial customers in North America and ten international markets

–

Our solutions are designed to promote superior cleanliness and sanitation

–

Our goal is to enhance safety, satisfaction and well-being of employees and

patrons

3

Who We Are

Focus on Hygiene |

Corporate

Strengths Distinct Business Advantages Drive Success

Attractive Business Model

–

Solutions provider with full range of products and services

–

Recurring revenue business

–

Product line provides points of competitive differentiation

–

Nation-wide service capability

–

Low cost provider

–

Gross margins and route margins that are attractive

Established Brand Identity

–

Widely recognized as “hygiene experts”

–

Providing regular, ongoing service to more than 35,000

customers

–

Operating for more than 25 years

4 |

Industry Itself

is Widely Followed –

Large, attractive, addressable market

–

Publicly traded competitors enjoy significant valuation multiples

–

Established patterns of consistent revenue and earnings growth

–

Industry economics generate significant earnings and cash flow

Business is Scalable

–National platform allows growth through corporate accounts and large distributors

–Heavy investment and integration cost to build national platform

is substantially

behind us

–Significant excess route capacity

–Corporate overhead is highly leverageable

and scalable

–Large number of tuck-in acquisitions available at reasonable EBITDA multiples

5

Corporate Strengths

Distinct Industry Characteristics Drive Success |

H. Wayne

Huizenga – Chairman

Legendary entrepreneur, builder of four Fortune 500 companies:

–

Waste Management

–

AutoNation

–

Blockbuster Entertainment Group

–

Republic Services

Steve Berrard

–

CEO

–Co-CEO of AutoNation

–President and CEO of Blockbuster Entertainment Group

Thomas Byrne –

COO

–Vice-chairman of Blockbuster Entertainment Group

–Director of several leading consumer and business service firms

Thomas Aucamp

–

EVP

–Vice president of corporate development and strategic planning for Blockbuster

Entertainment Group

Jeffrey Rhodes –

SVP of Operations

–

Vice president of distributor sales and corporate accounts for JohnsonDiversey

Supported by a management, operations and sales organization with managers

and staff from leading national and regional chemical and facility service

providers

6

Corporate Strengths

Management Experiences Drive Success |

Investment

and Emergence 2004 -

2011

7 |

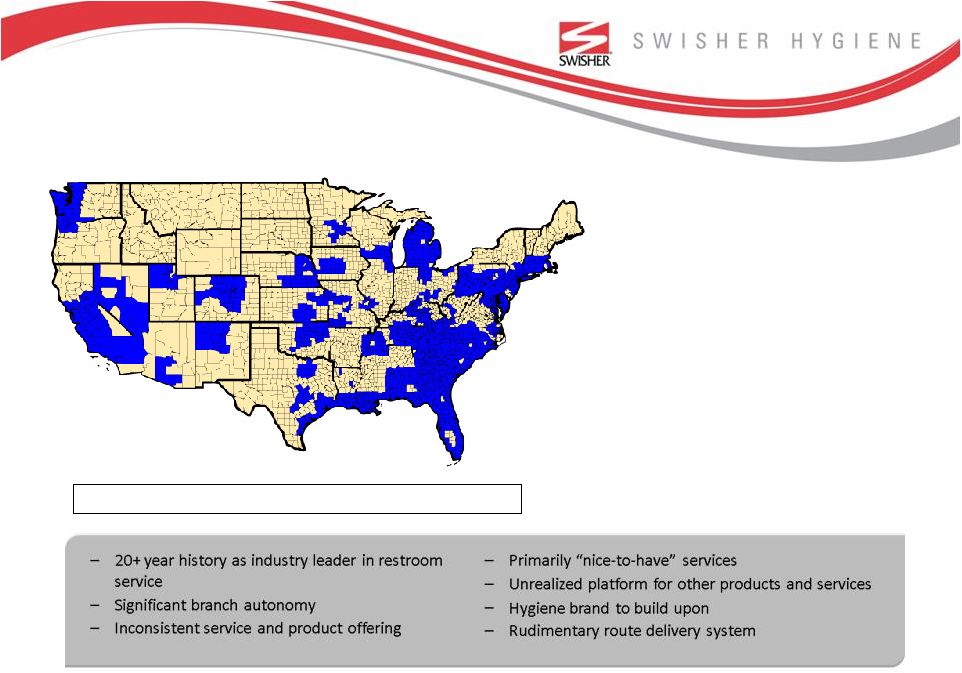

Swisher in

2004 Hygiene Services Franchisor

Franchised System

•

93 domestic franchisees

•

No company-owned locations

•

Regional coverage

8

Franchise

Company-Owned

No Service

No Service |

LEGACY SWISHER

BUSINESS Restroom Services

Hygiene Expertise

Soap and Paper Products

National Infrastructure

2005 –

2009

Building a Unique Business Model

FACILITY SERVICE

Front-of-House Services

Rental Products

Route Model

CHEMICAL COMPANIES

Back-of-House Services

Chemical Expertise

Distributor Partnerships

9 |

Expanded

Paper

Options

Soap

Conversion

& Dust

Control

Chemical

Launch

Laundry

Launch &

Chemical

Expansion

Chemical Expansion

with Corporate Account

Emphasis

2005

2006

2007

2008

2009/10

Five primary changes:

•Repurchased 90% of domestic

franchisees •Replaced all

management systems •Added

vans and upgraded facilities •Added industry experience •Expanded product line to front-of-house and

back-of-house

2005 –

2009

Building the Infrastructure

10 |

2010

Going Public

•

Announced CoolBrands

International merger in August 2010, a TSX-listed

company

-

Provided the company with US$60 million in cash

-

Enabled Swisher to enter the public market

-

Transaction closed November 2010

•

Filed Form 10 and Form S-1 with SEC to become a U.S. reporting company

-

Intent

is

to

list

shares

on

a

U.S.

exchange

•

Began making strategic acquisitions in key markets:

-

Toronto

-

Florida

-

Calgary

-

Pacific Northwest

-

Edmonton

-

Great Plains

-

Vancouver

•

Expanded distributor relationships with strategic partnerships

-

Cheney

Brothers,

11

largest

US

foodservice

distributor

11

th |

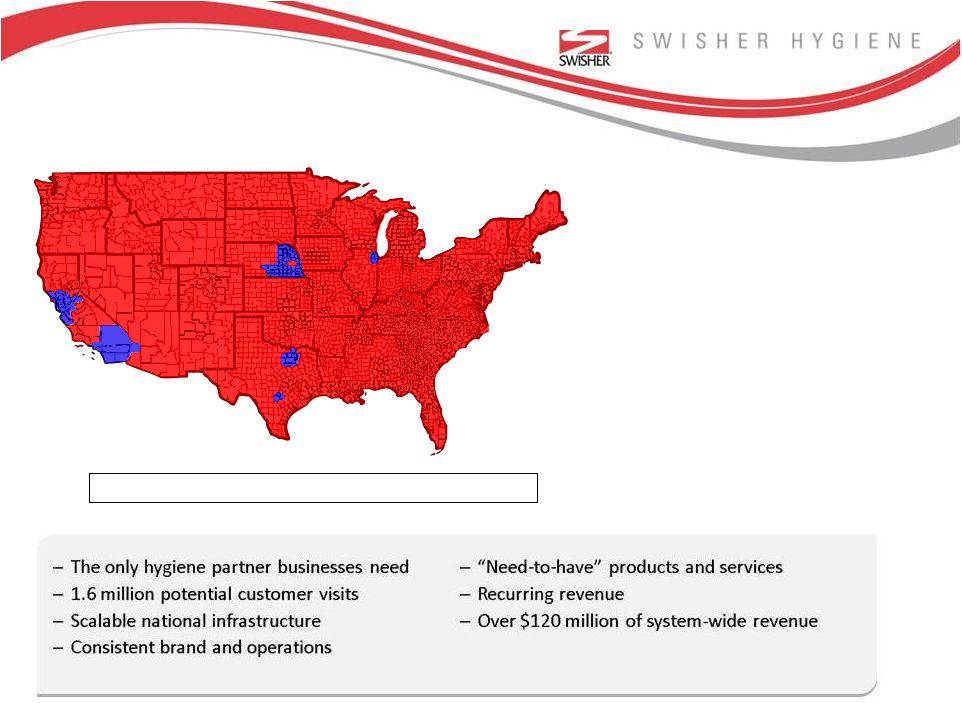

Swisher in

2011 Full Service Solutions Provider

Company System

–

68 company branches

–

11 franchisees

–

Weekly service coverage to

90% of US population

–

Licensees in 10 countries

12

Franchise

Company-Owned

No Service

No Service |

Today and

Tomorrow Swisher’s Corporate Position Now and Moving Forward

13 |

Average savings of 20%

Ongoing expert service

Flexible scheduling

Multiple delivery options Extensive training

Chemical Program

Full Product Range with Frequent Service

Warewashing

•Detergents, sanitizers

and related chemicals

•Formulations for

automatic and manual

systems

•Machines available

for purchase, rental or

lease

Cleaning

Chemicals

•Full selection

•Value-priced

•Highly efficient

•Available as ready-to-

use and as

concentrates

Hand Care

•Offering Purell®

and

custom branded

formulations

•Products available for

foodservice environments

and general surface use

•Personal protection

products available

Laundry

•Detergents, softeners

and related products

•Formulations for

commercial and

residential-style

machines

Specialty

•Broad range of

products

•Formulations for

specific use in

industrial, automotive,

healthcare, institutional

and other settings

14 |

Facility

Service Program Focused on Rental and Service

Germicide Mist

& Odor Control

•Powerful odor control

systems

•Full-facility misting of

all surfaces

•Use of proven

disinfectant

•Kill wide range of

contamination

Hygiene

Service

•Highly trained

technicians

•Proprietary

techniques •Weekly

service •Personal

attention Paper

Products

•Premium and

economy products

•Hand towels

•Toilet tissue

•Wipers

•Attractive, rugged

dispensers

Power Washing

•High power

sanitizing

•Floor-to-ceiling

treatment

•Address key touch

points

•Restore facilities to

outstanding condition

Mat, Mop and

Towel Service

•Carpet, scraper and

logo mats

•Mops and frames

•Bar towels, aprons and

related products

•Guaranteed service

and outstanding pricing

15

Weekly expert service

Customized fulfillment

First-quality products

Low, consistent pricing |

Our

Differentiation Comprehensive Range of Products

16

Restroom Hygiene Service

Germicidal Misting

Power Washing

Paper Program

Hand Care Program

Dust Control Programs

Bar Towels & Aprons

Cleaning Chemicals

Warewashing

Program

Laundry Program

Green Soap, Paper & Chemicals

Specialty Chemicals

Product/Service

Uniform Co.

Chemical Co.

Swisher |

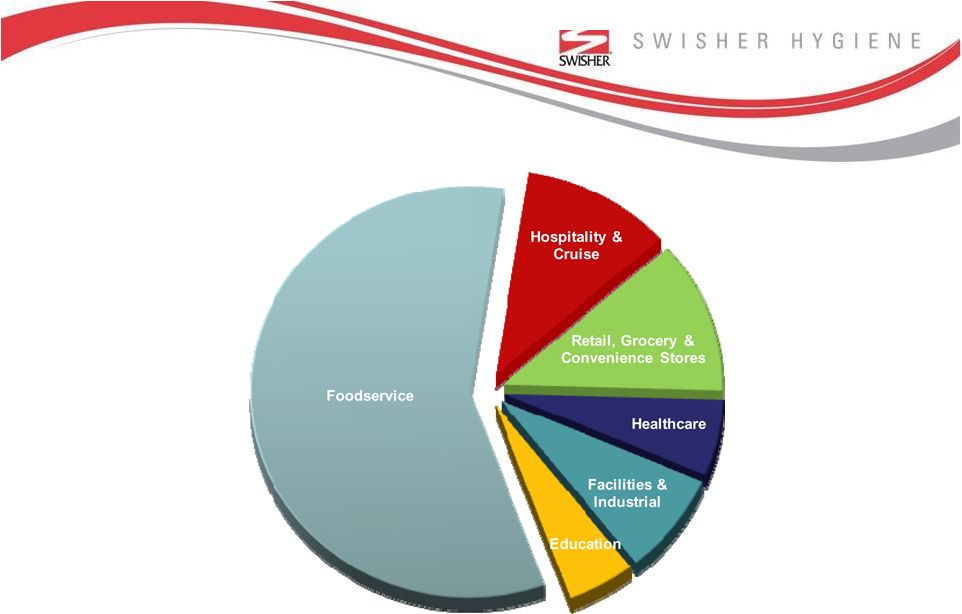

Customer

Mix Broad Range of Industries

17 |

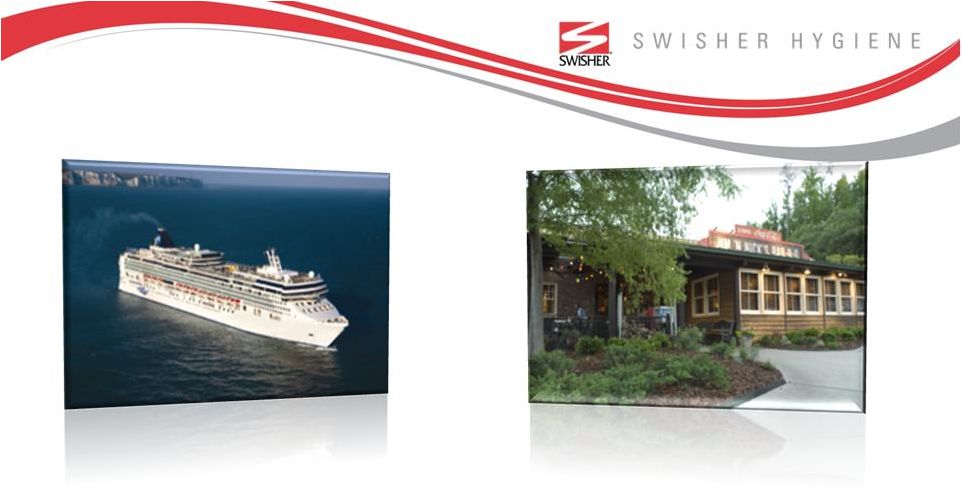

Customer

Examples What Full Service Means

Major Cruise Line

Regional Foodservice

Chain

Weekly service to growing

regional restaurant chain

–

Foodservice chemicals

–

Cleaning chemicals

–

Dish machines

–

Water filtration

–

Hand care

–

Hygiene and power-washing svc.

Weekly service to major cruise

line with ships across the globe

–

Foodservice chemicals

–

Housekeeping chemicals

–

Laundry chemicals

–

Chemical and soap dispensing

equipment

–

Water filtration

18 |

Significant

Potential The Right Market, Model and Method for Success

19 |

Market

Size Large Addressable Market

Current Addressable U.S. &

Canadian Market -

$36.8 Billion

Commercial Cleaning

Chemical Market –

$17.9 Billion

Fragmented market with 2/3 split among retailers

and small independent chemical companies

20

* Primarily

through 3rd party distributors |

Market

Drivers Long-term Market Growth

HYGIENE

FOOD SAFETY

ECONOMICS

•

Greater public

awareness

•

Media attention

•

Internet increases

immediacy

•

Increased legislation

•

Frequent outbreaks

•

Susceptible food

supply

•

Increased liability

•

Stricter food and

health codes

•

Broad economic

pressures

•

Ongoing cost

containment

•

Recession

•

Sustainability

21 |

22

Nine Months 2010 vs. 2009

Returning to Revenue Growth, Investing

for Future Profits

US$ in millions

Nine months

ended Sept.

30, 2010

Nine months

ended Sept.

30, 2009

% change

Revenue

46.0

$

41.7

$

10%

Cost of Sales

16.9

16.3

4%

Gross Margin

29.1

25.4

15%

Route Expenses

9.9

9.2

8%

Route Margin

19.2

16.2

19%

SG&A

20.9

17.1

22%

Depr.& Amort.

3.4

3.7

-8%

Operating Loss

(5.1)

$

(4.6)

$

NM

(excl. merger-related exp.)

EBITDA

(1.7)

$

(0.9)

$

NM |

Growth

Potential Strategies for Consistent Growth

23

FIELD SALES

•Direct and with distribution

partners

•Partnership with Bunzl USA,

$8 billion re-distributor

•Targeted to leverage excess

local route capacity

CORPORATE ACCOUNTS

•Dedicated team with prior

industry experience

•Significant pipeline of multi- unit prospects and tests

•Drives national and regional

volume

CURRENT CUSTOMERS

•Opportunity to triple revenue

per customer

•Drives revenue per route

ACQUISITIONS

•Highly fragmented market

with hundreds of

opportunities

•Reasonable acquisition

multiples

•Synergies in purchasing,

routing and office expenses |

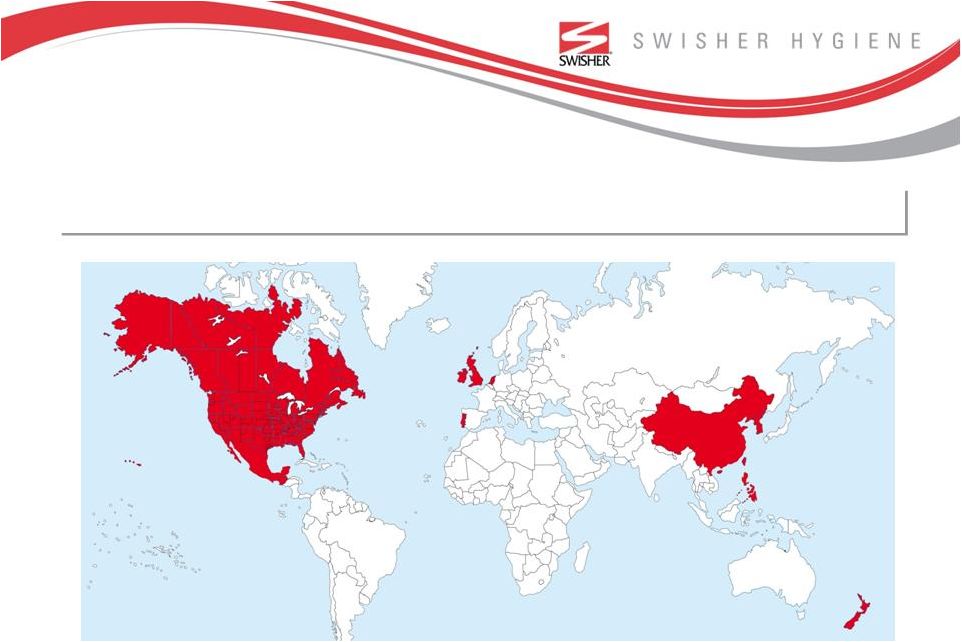

Growth

Strategy In International Markets

24

Significant opportunity also exists for growth in worldwide markets

|

Summary

Strong Foundation for Success

–

Attractive business model

–

Sustainable competitive difference

–

Not dependent on a single product line

–

Fixed costs already in place

–

Widely followed industry

–

Established brand

–

Large growing market which allows for:

–

Significant revenue and earnings growth

–

Considerable number of tuck-in acquisitions

–

Continual leverage of existing infrastructure

increases margins

–

Target route margins above 45%

–

Target EBITDA margins of 15%

–

Proven management team

25 |