Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ORTHOVITA INC | d8k.htm |

2011

Corporate Presentation

: VITA

Exhibit 99.1 |

2

This presentation contains forward-looking statements by Orthovita regarding our

current expectations of future events that involve risks and uncertainties,

including without limitation, our VITOSS

™

, VITAGEL

™

, VITASURE

™

and CORTOSS

™

products and other aspects of our business.

Such statements are based on our current expectations and are subject to a number of

substantial risks and uncertainties that could cause actual results or

timeliness to differ materially from those addressed in the forward-looking

statements. Factors that may cause such a difference include, but are not

limited to, our dependence on the commercial success of our approved products, the need

to maintain regulatory approvals to sell our products, our ability to manage commercial

scale manufacturing capability and capacity, our success in expanding our

commercial product portfolio and distribution channel,

competition and other risk factors listed from time to time in reports filed by

Orthovita

with

the

Securities

and

Exchange

Commission,

including

but

not

limited

to

risks

described

in

our

most

recently

filed

Form

10-K

under

the

caption

“Risk

Factors.”

Further

information

about

these

and

other

relevant

risks

and

uncertainties

may

be

found

in

Orthovita’s

filings

with

the

Commission, all of which are available from the Commission as well as from Orthovita

upon request. Orthovita undertakes no obligation to publicly update any

forward-looking statements. Safe Harbor Statement

|

Positioned to be a leading provider of novel,

well researched Orthobiologics

and Biosurgery

technologies for patients, surgeons and hospitals.

Positioned to be a leading provider of novel,

well researched Orthobiologics

and Biosurgery

technologies for patients, surgeons and hospitals. |

Key

Investment Considerations Strong Market Shares in Orthobiologics

and Biosurgery

Market

leader

in

synthetic

bone

graft

substitute

market

with

33%

share

Solid #3 position in hemostasis

biosurgery

market with opportunity to grow

Products differentiated by extensive research and data with clinical value

propositions based on solid evidence-based medicine

Fully integrated operation for developing and manufacturing proprietary

biomaterials Commercial Capability

The

only

direct

sales

force

solely

focused

on

orthobiologics

and

biosurgery

80 to 85 direct sales representatives augmented by agents and distributors in

U.S.

10 direct sales representatives in U.K.; distributors in other OUS markets

Growth Opportunities

Aggressive product lifecycle management

Opportunities to expand product usage outside of traditional spine market

OUS expansion efforts

Direct selling organizations in select countries/expand distribution to new

countries

Active new product pipeline development program

Incorporate current proprietary technologies into new product categories

|

5 |

US Bone Grafting

Market 2010 - 1.7 MM Procedures

*Millennium Research Group: US Markets for Orthopedic Biomaterials 2010

DBM

BMPs

Other Synthetics

Stem Cells

Autograft

Allograft Chips |

7

US

Synthetic

Bone

Graft

Substitute

Market

2010

–

~$150mm

ApaTech

Medtronic Spine

*Millennium Research Group: Leading Competitors in the Global Synthetic

BGS Market 2010

Mastergraft

33%

16%

13%

35%

Synthes

10%

All Other

Synthetic BGSs |

8

Vitoss

Bone

Graft

Substitute

–

Value

Proposition

Eliminates risks associated with autograft, allograft and BMPs

Provides

all

three

key

components

for

bone

regeneration

*

:

Scaffold

–

Cells

-

Signals

Broadest product range in category

Equivalent

efficacy

to

autograft,

the

gold

standard

*

Multiple new product opportunities to speed bone

regeneration vs

standard Vitoss

*

When used as directed with BMA |

9

The most pre-clinical and clinical research of any product in its class

Vitoss Comparative Effectiveness |

10

Vitoss Franchise Market Leadership

Early

Market

Entry

–

January

2002

Over 300,000 implantations

Most extensive bibliography in

its class

Covers majority of non-

structural bone grafting

indications

20 studies in spine with 800

patients

Extend Reach into BMP Market

Demonstrated effectiveness

with lower procedural cost

Vitoss BA2X enhances

conversion rationale

Leader in technology innovation |

Fusion Product Pipeline

Vitoss

BA2X

BMA Concentration**

Vitoss

BA Bimodal**

Vitoss

Platform

Development

Preclinical

Clinical

Regulatory

Bioactive Inter-body device**

BA PEEK –

New Platform

Preclinical

Clinical

Regulatory

$1.6B Bone Graft Market

$2.5B Inter-body Fusion Market ~$1B PEEK

FDA Cleared; Expected

Q1/11 Launch

In FDA discussion

File 510(k) Q1/11*

Development

*Obtain clarity on regulatory pathway, IDE requirement

**Device has not received regulatory clearance or approval

|

Vitoss

BA Bimodal

More Bioactivity

–

After immersion in simulated

body fluid for 7 days, shows

greater surface area coverage

of calcium phosphate*.

*

Calcium phosphate coverage (bioactivity) is

indicative of ability for in

vivo bone

bonding

More Ion Release

–

Dissolution studies

show faster release of

sodium and silicon

ions after 21 days

exposure to

physiologic conditions.

BA Foam

Bimodal |

Bioactive PEEK

(Cervical Interbody Fusion Device in

development phase) |

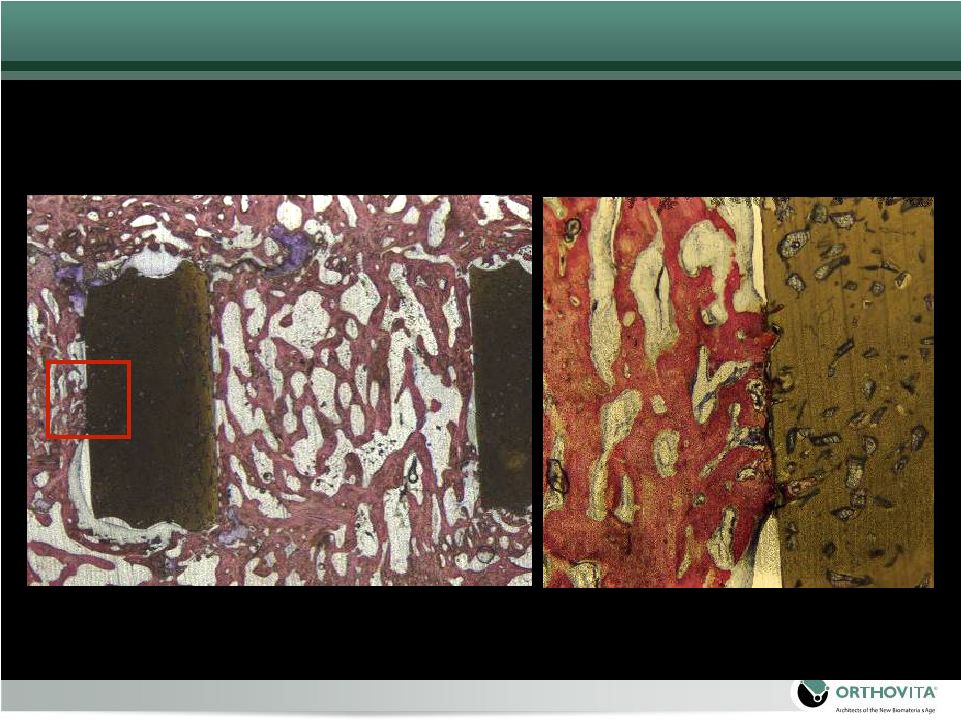

Pre-clinical In vivo Study-Bone Bonding at 6 months

BA PEEK w/ BA Foam

Zoom section

T |

Vitoss

Strategy

Position Vitoss

BA and BA2X as premium products with strong

value proposition compared to BMP

Aggressively price Vitoss

classic and morsel products to better

access price-sensitive end of market

Develop Vitoss

Bone Graft Systems Approach

Broaden portfolio of bone graft products to address hospitals’

desire for fewer vendors

Expand sales reach outside of spine

Revision total joints

Extremities, especially foot and ankle

Trauma and tumor |

16 |

17

Floseal

®

Tisseel

®

Coseal

®

Surgiflo™

Evicel™

Bioglue

®

Hemostase™

Orthovita Hemostat Market 2008 –

$500 Million

*2008,

Millennium

Research

Group

“US

Market

for

Surgical

Hemostats,

Internal

Tissue

Sealants

and

Adhesion

Barriers,

2008";

Cryolife

2008 Year End

Earnings.

Orthovita has distribution rights for Vitasure

in spine and orthopedic applications.

Baxter

Cryolife

Ethicon

Platelet Gels |

Controls Bleeding, Facilitates Healing:

Only

hemostat

with

the

combination

of

microfibrillar

collagen,

thrombin

and

the

patient’s

own

plasma;

supports

hemostasis

and

fibroblast attachment

Knee

Arthroplasty

Research:

Less drainage, reduced transfusion

Animal Research:

Less adhesions, faster healing

18

Hemostasis

Franchise

–

Value

Proposition

Safety:

Plant based technology eliminates many of the safety issues

associated with thrombin based competitors (FloSeal, Baxter)

Ease-of-Use:

Always ready, easy-to-use, and inexpensive

Vitagel Surgical Hemostat

Vitasure

Absorbable Hemostat |

Pipeline Delivery -

Biosurgery

New delivery system

Flowable

hemostat (OV

collagen)

VitaPrep™

plasma device

Surgical Hemostats*

Preclinical

Clinical

Regulatory

>$500M Hemostasis

Market (>60% flowable)

$2B+ Soft-tissue Market

*These devices have not received regulatory clearance or approval

Expected 2H 2011 Launch

Expected 1H 2012 Launch

FDA IDE filing planned for Q4 2011

Development |

Bone

Marrow

Concentration

–

Vector

for

cross

selling

Establishes

a

key

cross-selling

linkage

between

Vitoss

and

Vitagel

platforms

Installed base of centrifuges used for for

Vitagel

and Vitoss

(marrow).

Dual utilization within OR increases visibility and efficiency.

In development; no regulatory clearance has been obtained.

|

Biosurgery

Strategy

Leverage and cross-sell into all Vitoss

hospital accounts

Access via existing relationships in spine/ortho

New marketing materials directed to other specialties

Ob/Gyn, vascular, joint surgeries

Leverage

“facilitates

healing”

claim

Hire biosurgery

specialist sales reps in high potential markets

Improve manufacturing efficiencies and gross margins

Better sourcing of key raw materials

Develop

additional

biosurgery

products

to

leverage

collagen

facility

Developing a flowable

hemostat to access a significant market

segment and leverage collagen facility |

22 |

23

Cortoss Bone Augmentation Material

An injectable, bioactive

composite that mimics the

mechanical properties of

human cortical bone

First FDA-cleared alternative

to polymethylmethacrylate

(PMMA) cement for use in

vertebral augmentation

procedure

Indicated for the fixation of

pathological fractures of the

vertebral body using vertebral

augmentation

Patent protected to 2022 |

Cortoss

Strategy

Develop kyphoplasty cavity creation devices

Aliquot Directional Bone Tamp, then Aliquot Balloon Tamp

Provide complete offering for physician and facility preference

Develop new indications for Cortoss

material

Targeting neuro/ortho

applications in the inpatient OR for sales force

synergy

Cranioplasty

first target indication, ongoing discussions with FDA

Add independent agents for outpatient/IR market

Different focus and call pattern than is optimal for our DSR’s Enhance focus and specialization

within sales force |

Pipeline

Delivery

-

Fixation

Label expansion 1: cranial

repair**

Aliquot Balloon Bone Tamp**

Aliquot Directional Bone Tamp*

Cortoss

Pipeline

Preclinical

Clinical

Regulatory

$500M VCF Market

$500M

“Outside

of

VCF”

Markets

including…

$100M + Cranial repair market

* Class I exempt device

**These devices have not received regulatory clearance or approval

Expected launch 1H 2011

Regulatory clearance

expected 1H 2012

Regulatory clearance

expected 1H 2012

Development |

Aliquot Directional Bone Tamp

The Aliquot Directional Bone Tamp is intended to create preferential flow

channels in existing spinal bone structure prior to a vertebral augmentation

procedure. These channels can provide directional filling of bone cement.

Aliquot Directional Bone Tamp

X-rays from device verification

testing in sheep spine |

Inflatable Bone Tamp

A balloon catheter that will allow

customers to perform balloon-assisted

vertebroplasty with Cortoss

bone

cement.

Cavity

creation

device

-

balloons |

Differentiating

Core

Capabilities

–

R&D

and

Manufacturing

Fully integrated development engine

In-house

capabilities

from

concept

through

commercial

manufacturing of

highly complex biomaterials products

Scientists and engineers with focus in biomaterials, bioengineering

and chemistry

Special expertise in ceramics, polymers, composites, collagen protein

World class aseptic manufacturing facility

High level clean room and isolators for sterile manufacture and fill

Manufacture of complex biomaterials products which cannot be terminally

sterilized

2010

FDA

clearance

of

only

pepsinized

collagen

facility

in

U.S.

Ultra pure, bovine-derived collagen

All manufacturing capability is highly scalable without additional

investment |

Vitagel

Aseptic

Manufacturing

-

Isolator |

Orthovita Collagen Extraction Facility |

Differentiating

Core

Capabilities

–

Commercial

Organization

Hybrid U.S. Sales Organization

Highly

focused

orthobiologics

and

biosurgery

sales

organization

Strong command and control of 80 to 85 direct sales

representatives

Extend revenue base with low risk from 60+ distributors and

agents

Cross selling opportunity

Adjacent specialized selling opportunity

Commercial Expansion in OUS Markets

Strong results from 2009 launch of direct sales force in U.K.

In process of selecting next direct market

NEW OUS leadership focused on expanding current network of

distributors to high growth markets |

32

Financial Overview |

33

Financial Summary

1

2007

Net

loss

includes

a

$16.6mm

charge

for

the

repurchase

of

a

royalty

obligation

Dollars in Millions

2007

2008

2009

2010 Guidance

Sales

Gross Margin

SG&A Expense

R&D Expense

Operating Loss

Net Loss

Cash at September

30, 2010

$58.0

$76.9

65%

66%

68%

$92.9

$94.0 to $96.0

$(1.0) to $(2.0)

$44.6

$6.4

$(13.7)

$(29.9)

$(10.8)

$(9.2)

$6.7

$53.5

$57.2

$6.8

$(1.1)

$(3.9)

$20.9

1 |

THANK

YOU |