Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NAUTILUS, INC. | d8k.htm |

ICR 13

Annual XChange

Conference

January 12, 2011

Exhibit 99.1

th |

Safe Harbor

Statement 2

This document and the presentation of which it forms a part includes forward-looking

statements (statements which are not historical facts) within the meaning of the

Private Securities Litigation Reform Act of 1995, including any statements concerning management's expectation of

improvement in consumer credit approval rates, continued correlation of credit approval rates

and direct sales and anticipated or possible improvements in direct sales and results

of operations. Factors that could cause Nautilus, Inc. actual results to differ materially from

these forward-looking statements include availability and price of media time consistent

with our cost and audience profile standards, our ability to continue to reduce

operating costs, a further decline in consumer spending due to unfavorable economic conditions, a change in

the availability of credit for our customers who finance their purchases, our ability to

effectively develop, market and sell future products, the impact that delisting or

potential delisting of our common stock from the New York Stock Exchange may have on our customer and

supplier relationships and reputation, our ability to get foreign-sourced product through

customs in a timely manner, our ability to protect our intellectual property,

introduction of lower-priced competing products, unpredictable events and circumstances relating to

international operations including our use of foreign manufacturers, government regulatory

action and general economic conditions. Additional assumptions, risks and

uncertainties are described in detail in our registration statements, reports and other filings with the Securities

and Exchange Commission, including the "Risk Factors" set forth in our Annual Report

on Form 10-K, as supplemented by our quarterly reports on Form 10-Q. Such

filings are available on our website or at www.sec.gov. You are cautioned that such statements are not guarantees of future

performance. Actual results may differ materially from those set forth in the

forward-looking statements. We undertake no obligation to publicly update or revise

forward-looking statements to reflect subsequent events or circumstances. |

Introduction

•

Nautilus is a provider of fitness equipment in the consumer health and wellness

industry

•

The company was founded in 1986 as Bowflex

of America

–

Bowflex

direct marketing on TV started in 1993

•

Expanded into commercial health club market via acquisition of Nautilus, Inc. in 1999

•

Further expanded into consumer retail market in 2001

–

Acquisition of Schwinn

Fitness in 2001

–

Added Bowflex

and Nautilus branded strength and cardio products to the retail

mix

•

Economic downturn in 2008/2009 negatively affected consumer discretionary

purchases

•

Restructured in 2009-2010 to refocus on the consumer segment

-

Direct to consumer via TV / Internet

-

Retail via both traditional store placement and leading e-commerce sites

3 |

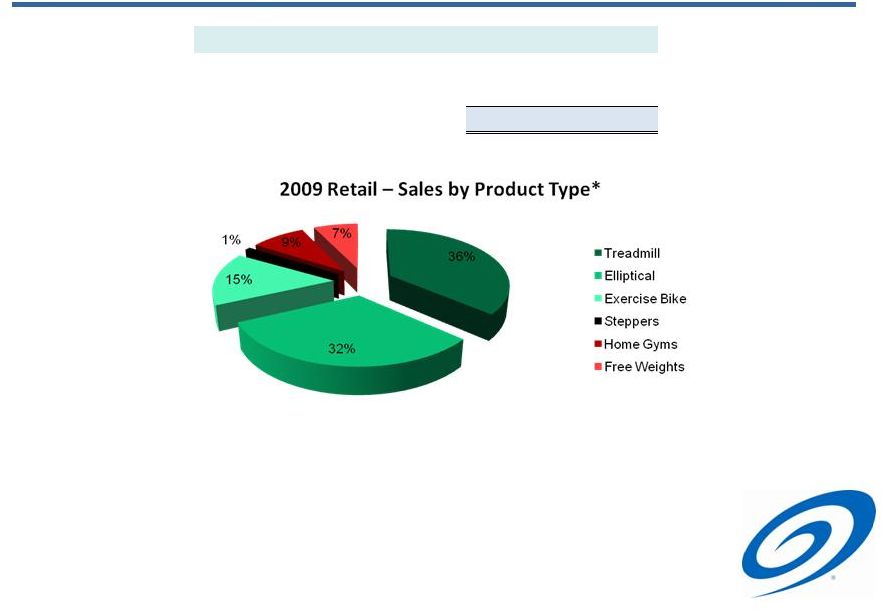

Fitness Equipment

Market •

Cardio machines constitute 84% of retail equipment sales in the major categories

2009 Consumer Fitness Equipment Market Size

Retail (Wholesale)*

$3.2B

Direct to Consumer**

$1B

Total

$4.2B

4

*Source: SGMA 2010 – Tracking the Fitness Movement Annual Report

**Source: TouchPoint Communications 2009 Media Survey and Nautilus internal

research |

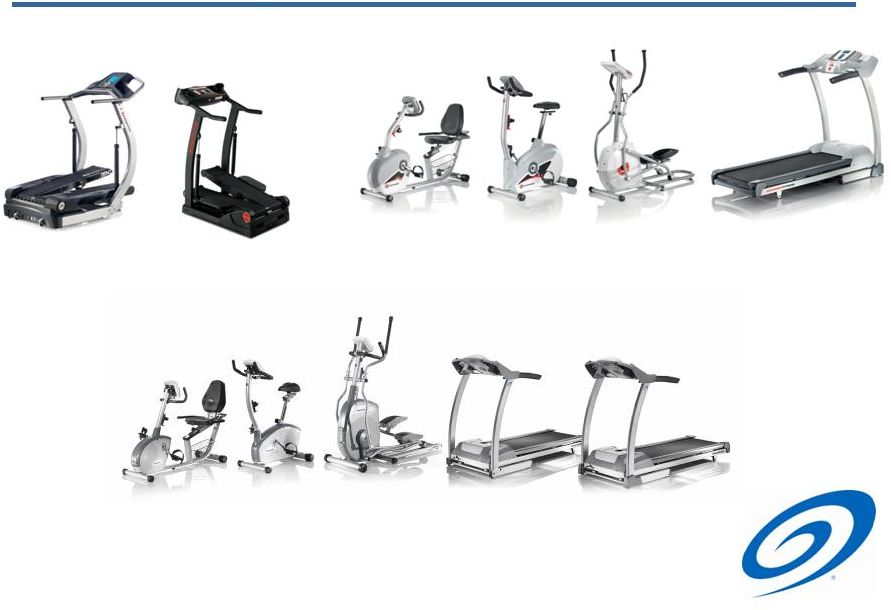

Nautilus Cardio

Product Lines TreadClimber

Schwinn

Fitness

Nautilus

5 |

Nautilus Strength

Product Lines Bowflex

/ Nautilus

SelectTech

Dumbbells

Bowflex

Revolution and Rod Based

Home Gyms

Universal Strength Accessories

6 |

Background to

Restructuring •

2008 recession severely affected all business lines

–

Retail consumer discretionary expenditures deferred

–

Direct consumer credit availability contracted

–

Commoditization of commercial health equipment market accelerated

•

Restructuring Plan

–

Radically reduced fixed operating expenses

–

Exited commercial equipment business

–

Refocused consumer business on the larger cardio equipment market

opportunity

–

Upgraded consumer finance program with a new, more aggressive, provider

7 |

Brand

Strength Nautilus owns four of the premier brands in the fitness industry

8 |

Consumer Reach

- Direct

•

Direct to Consumer

–

Our direct to consumer business utilizes television and online advertising to drive sales via

our websites and within our internal call center

9 |

Consumer Reach

- Retail

•

Retail

–

Distributes products via multiple locations in the US and Canada, as well as through leading

e-commerce sites such as Amazon.com

10 |

Innovation

•

Throughout our restructuring and cost cutting, Nautilus has continued to invest in

research and development

•

Key areas of focus for future products

–

Further

enhancements

to

proprietary

TreadClimber

cardio

machine

–

Low cost / single area targeted strength products featuring videos

–

New resistance mechanisms and consoles in exercise bikes

–

International market ready versions of products to allow for growth outside the

US and Canada

Product Concepts in

Development

11 |

Near Term Cardio

Focus •

The most popular fitness activity in

the U.S. is walking

(110M participants)

*Source: SGMA 2010 -

Tracking the Fitness Movement

Yoga / Pilates

Stretching

26.5 Million

Home Gym

24.8 Million

Cardio:

Elliptical / Treadmill

77.9 Million

Walking for Fitness

110 Million

U.S. Fitness Participation (2010)*

Indoor Bike

34.8 Million

12 |

TreadClimber

•

Allows the user to walk

during use,

resulting in low impact to joints and

knees

•

Machine’s combined motion of walking

with the calorie burn

of running at

6mph*

•

Proprietary product

–

Significant patent protection

13

*Source: Independent research at Adelphi University and University of Wisconsin -

LaCrosse |

TreadClimber

in the Direct Channel

•

Television and Online Media Target High Value Consumers

–

Creative and network placement allow for tailoring the product message to a

specific audience

–

Improved buyer demographics

–

TreadClimber

product line appeals an incremental customer base of the long

standing home gym product line:

•

High Operating Leverage

–

Relatively high gross margins

•

Low Capital Requirements for Growth

–

Negative working capital model

Age Profile

18-24

25-34

35-44

45-54

55+

Rod Based Gym

15%

24%

27%

22%

12%

TreadClimber

4%

14%

26%

35%

18%

14 |

Operating

Statistics •

Selected data from continuing operations

–

Lower fixed operating expenses

–

Retail sales level stabilizing and showing signs of improvement

–

Direct sales benefited from new consumer financing programs implemented in

September 2010

–

Adjusted Operating Loss is a non-GAAP measure. Management believes that

showing operating loss net of restructuring expenses and asset impairment losses

enables more meaningful comparisons of operating results among periods

* Preliminary and unaudited

2009

2010

($ millions)

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4*

Retail

$ 12.5

$ 11.4

$ 15.7

$ 24.0

$ 15.9

$ 11.8

$ 16.1

$ 23.9

% growth

(50.3%)

(39.8%)

(33.8%)

(9.4%)

27.0%

4.1%

2.9%

(0.4%)

Direct

40.7

28.2

25.3

28.9

28.5

18.4

21.5

28.2

% growth

(41.5%)

(31.7%)

(34.5%)

(19.9%)

(30.0%)

(34.6%)

(14.8%)

(2.4%)

Corporate

0.9

0.5

0.4

0.8

1.2

0.4

0.9

1.4

Total Revenue

$ 54.1

$ 40.1

$ 41.4

$ 53.7

$ 45.6

$ 30.6

$ 38.5

$53.5

% growth

(42.9%)

(33.5%)

(33.7%)

(14.1%)

(15.6%)

(23.6%)

(7.2%)

(0.3%)

Gross Profit

$ 30.3

$ 19.8

$ 20.3

$ 26.1

$ 23.0

$ 13.5

$ 16.6

as a % of revenue

56.0%

49.4%

49.0%

48.6%

50.4%

44.1%

43.1%

Operating Expenses

34.0

34.7

23.1

33.9

24.9

20.2

19.8

Operating Loss

(3.7)

(14.9)

(2.8)

(7.7)

(1.9)

(6.8)

(3.2)

Adjustments:

Restructuring Expenses

2.0

11.8

0.2

0.1

-

-

-

Asset Impairment Losses

-

-

2.1

3.8

-

-

-

Adjusted Operating Loss *

$ (1.7)

$ (3.1)

$ (0.5)

$ (3.8)

$ (1.9)

$ (6.8)

$ (3.2)

as a % of revenue

(3.1%)

(7.7%)

(1.2%)

(7.1%)

(4.2%)

(22.2%)

(8.3%)

15 |

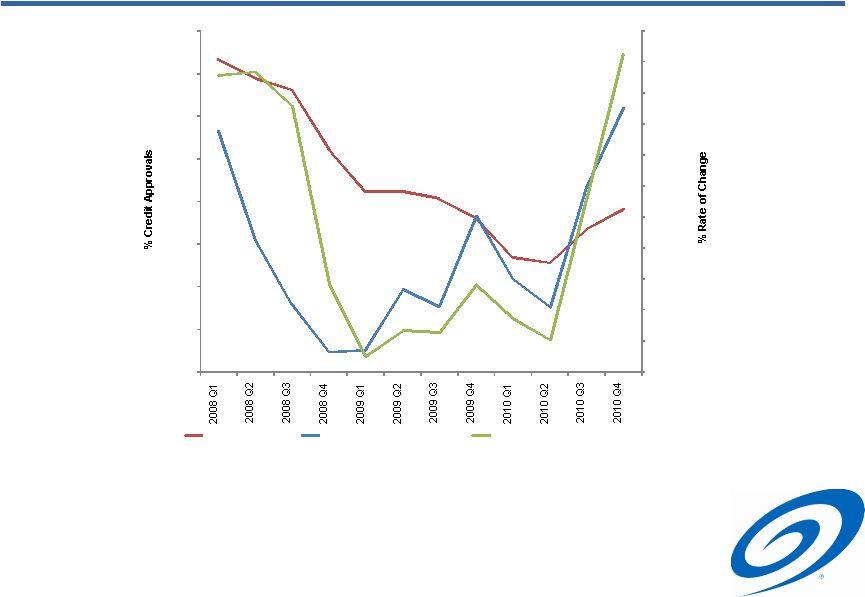

Rate of Change:

Direct Sales versus Credit Approvals •

Strong correlation between financing availability and Direct-to-Consumer sales

16

(45.0%)

(40.0%)

(35.0%)

(30.0%)

(25.0%)

(20.0%)

(15.0%)

(10.0%)

(5.0%)

-

5.0%

10.0%

-

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

40.0%

Credit Approvals

Revenue % Rate of Change

Credit Approvals % Rate of Change |

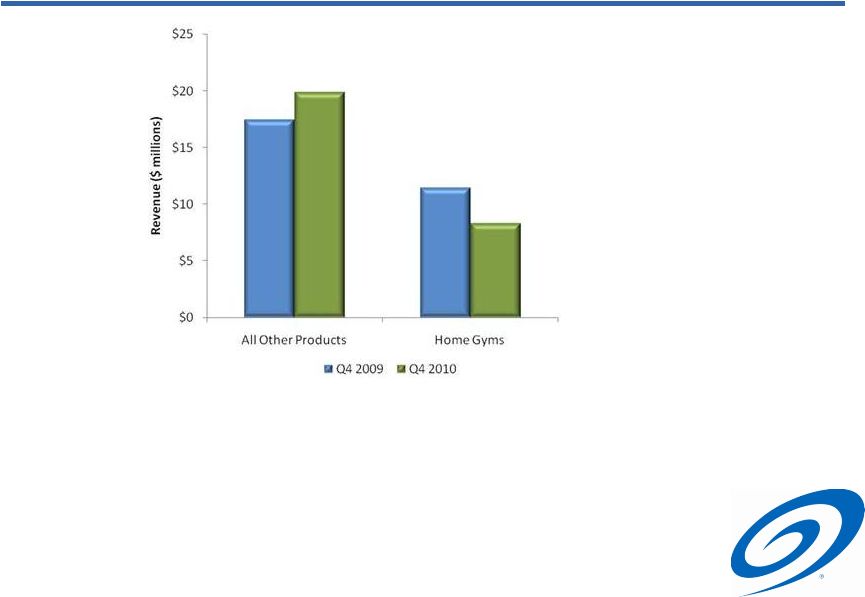

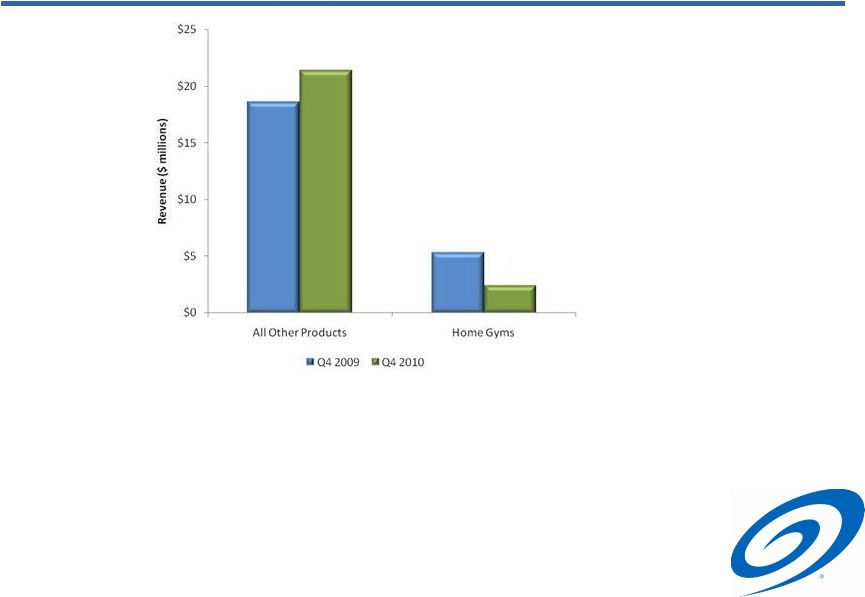

Results of Cardio

Strategy – Direct

•

Q4

2010

Cardio

year-over-year

growth

rate

of

14%

•

Home

Gyms

sales

declined

27%

year-over-year

–

Declining proportion of sales mix

•

Credit approval rate trend is improving for Cardio products

–

Will begin to compare favorably to prior year in 2011

–

Q4 growth achieved with lower than prior year approval rate in cardio

–

Opportunity to increase advertising to increase sales

* Q4 2010 Preliminary and unaudited

17 |

Results of Cardio

Strategy – Retail

•

Q4 2010 Cardio year-over-year growth rate of 15%

–

Excellent performance in stationary bikes

•

Home Gyms sales declined 54% year-over-year

–

Sales level becoming immaterial

* Q4 2010 Preliminary and unaudited

18 |

Balance Sheet

Strength •

Improved balance sheet strength during economic downturn

–

Focus on liquidity results in adequate balance sheet strength

–

Permits self-financing in seasonally high working capital quarter (September)

•

Working capital performance has improved

–

Exit from Commercial business significantly reduced working capital investment

A/R

Inventory

DSO

Turnover

December 2007

54 days

4.9x

December 2008

53 days

3.8x

December 2009

47 days

6.8x

September 2010

29 days

6.5x

19

Net Cash/

Gross

($ millions)

(Debt)

Cash

Actual December 2007

(71)

$

8

$

Less: Acquisition commitment

(69)

-

Pro Forma December 2007

(140)

$

8

$

Actual December 2008

(12)

$

6

$

Actual December 2009

7

$

7

$

Actual September 2010

9

$

14

$ |

Summary

•

Four highly regarded brand names

•

Participation in the larger cardio equipment market improving

•

Capability to reach end consumers with branded products across multiple

distribution channels

•

Restructuring in response to recession has significantly reduced

breakeven level

•

Balance sheet stronger than pre-recession level

–

Cash of $14.5 million with no pending debt maturities

•

Improving market and credit approvals outlook

•

Direct model allows for growth with little to no additional capital required

20 |

|