Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENCORE CAPITAL GROUP INC | d8k.htm |

Celebrating Five Years in India: An Update on Our Strategy

to Drive Growth and Shareholder Value

January 12, 2011

Exhibit 99.1 |

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

2

The statements in this presentation that are not historical facts, including, most

importantly, those statements preceded by, or that include, the words

“may,” “believe,”

“projects,”

“expects,”

“anticipates”

or the negation thereof, or similar

expressions, constitute “forward-looking statements”

within the meaning of the Private

Securities Litigation Reform Act of 1995 (the “Reform Act”).

These statements may

include,

but

are

not

limited

to,

statements

regarding

our

future

operating

results

and

growth.

For all “forward-looking statements,”

the Company claims the protection of

the safe harbor for forward-looking statements contained in the Reform

Act. Such

forward-looking statements involve risks, uncertainties and other factors which

may cause actual results, performance or achievements of the Company

and its

subsidiaries to be materially different from any future results,

performance or

achievements expressed or implied by such forward-looking statements. These

risks, uncertainties and other factors are discussed in the reports filed by

the Company with the Securities and Exchange Commission, including the most

recent reports on Forms 10-K, 10-Q and 8-K, each as it may be

amended from time to time. The

Company disclaims any intent or obligation to update these forward-looking

statements.

FORWARD-LOOKING STATEMENTS |

AGENDA

3

•

Discuss our rationale for choosing India

•

Highlight our business continuity plans and risk mitigation

strategies for our India operations

•

Describe Encore’s success in India and discuss how our Indian

operations can continue to positively contribute to the Company's

future

•

Provide an overview of the Business Process Outsourcing sector

|

4

We believe that we are the only company in our industry with a successful

late stage collection platform in India

India now represents half of our call center collections and we expect this

contribution to continue to increase, both on an absolute and a relative

basis

Beyond collections, our India site now directs several IT and other

administrative functions

The India management team has an average of 12 years of industry

experience and individual team members have worked for U.S.

multinationals including GE Capital, Dell, IBM, and American Express

OUR INDIA OPERATION DRIVES SIGNIFICANT VALUE |

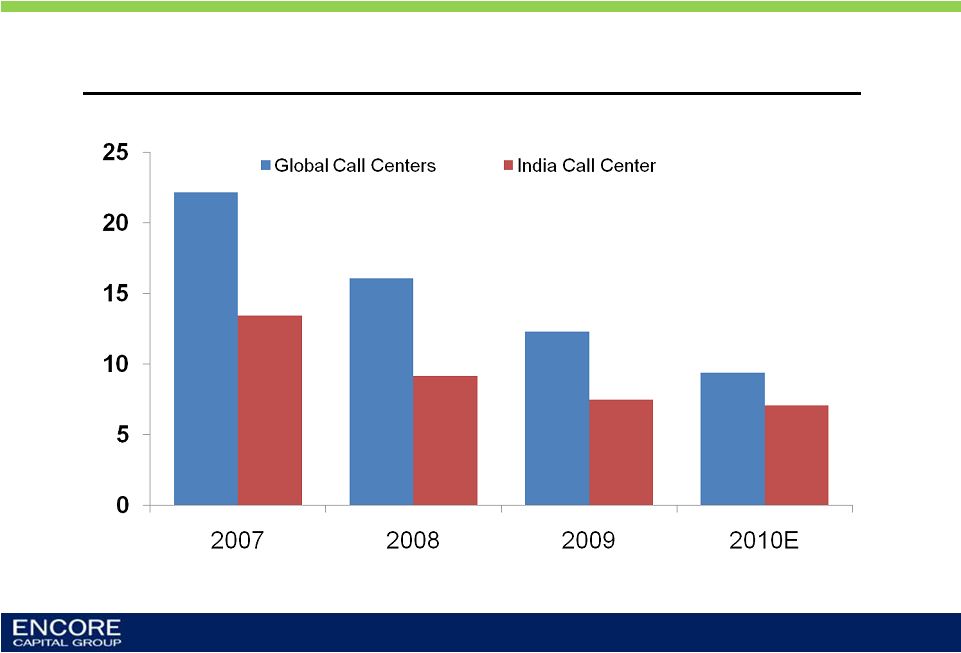

THE

SUCCESS OF OUR INDIA EXPANSION HAS FUNDAMENTALLY CHANGED ENCORE’S COST

STRUCTURE 5

Collection sites’

direct cost per dollar collected

(%) |

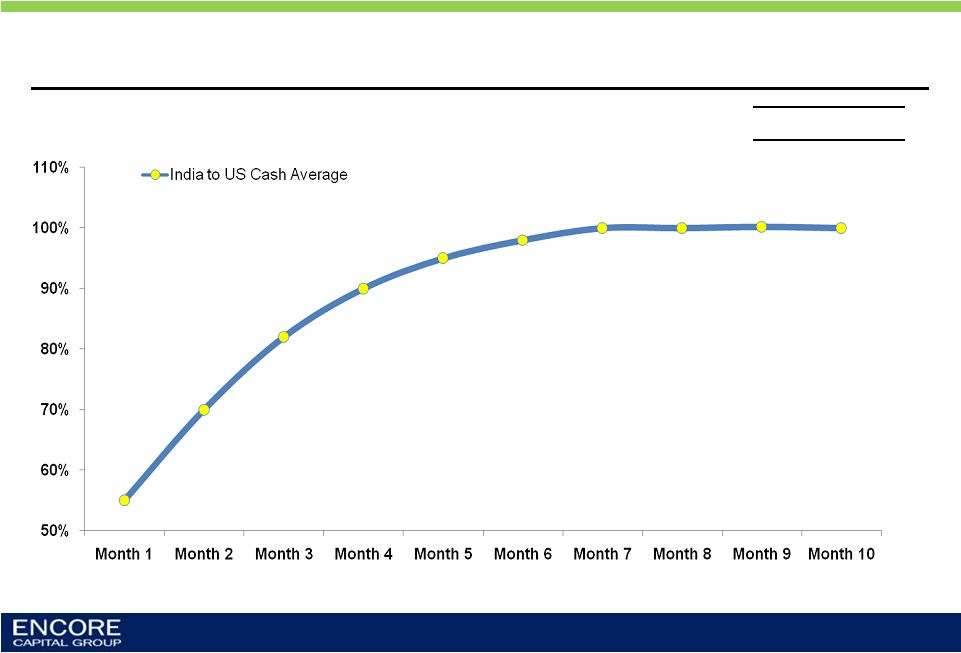

6

Cash

average

comparison

between

India

and

U.S.

collectors,

using

a

specific

collection team for comparison

THIS IS A RESULT OF OUR ABILITY TO CREATE WORK TEAMS IN INDIA THAT

PERFORM AT LEVELS CONSISTENT WITH OUR DOMESTIC SITES

(%)

ILLUSTRATION |

%

on a dollar of face 7

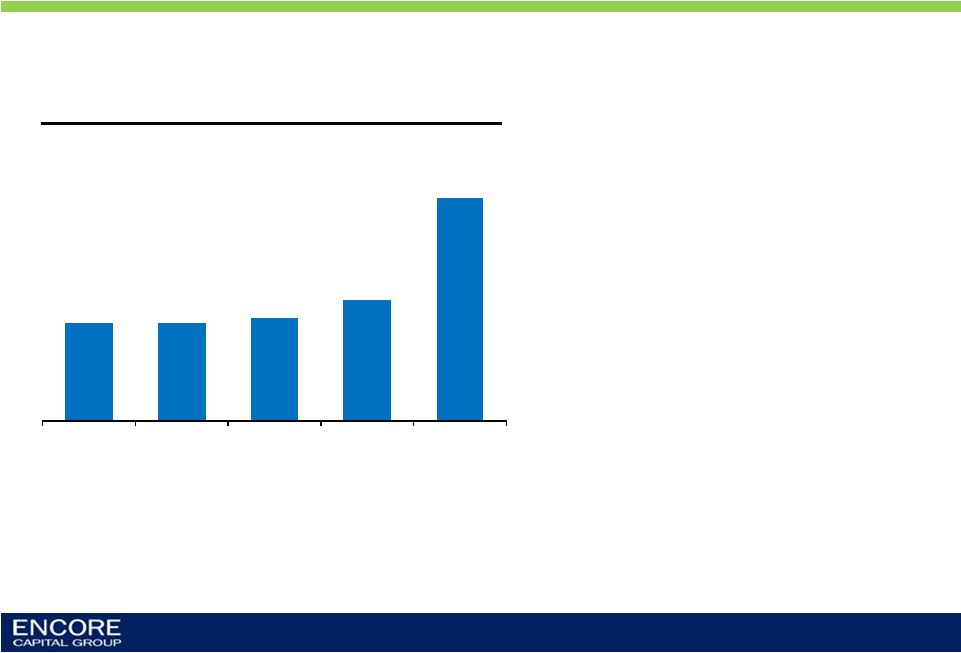

WE MADE THE DECISION TO ESTABLISH OFFSHORE OPERATIONS IN EARLY

2005, AS INDUSTRY PRICING WAS INCREASING

•

We expected the high cost

environment to persist for some time

due to the significant influx of capital

•

We were convinced that a successful

offshore facility would give us the

flexibility to bid higher prices for

portfolios and maintain strong

margins

•

To our knowledge, there were no

other offshore initiatives being

undertaken by our competitors

•

We aggressively pursued this

opportunity, meeting with offshore

experts in early 2005 and opening

our doors in October 2005

Pricing trend from one issuer through time

4.3%

4.3%

4.5%

5.3%

9.8%

2001

2002

2003

2004

2005 |

8

THE DELHI NATIONAL CAPITAL REGION BECAME THE LOCATION OF CHOICE

BECAUSE OF A COMBINATION OF FACTORS

Highly qualified skill pool

(4 million English speaking

residents & 2.2 million new college

graduates across India every year)

50-75% cost

reduction

compared to

U.S.

Entrepreneurial

culture

Significant presence of large

multi-national corporations

Continually improving

infrastructure |

WE HAVE

VALIDATED THIS DECISION SEVERAL TIMES DURING THE LAST 5 YEARS BY EXPLORING

NUMEROUS ALTERNATIVES, NEAR AND FAR 9

Relative Competitiveness Index (not industry or function specific)

100.0

97.8

94.3

92.6

91.4

90.1

89.1

87.9

87.7

86.4

86.2

84.4

81.0

80.0

75.8

74.6

74.1

73.6

73.3

72.8

71.1

71.1

70.6

India

Vietnam

Philippines

China

Russia

Malaysia

Mexico

Hungary

Czech Republic

Brazil

Poland

Distribution of weights: Human Capital-40%; Cost-20%; Environment-20%;

Infrastructure-10%; Risk-10% Source: Encore Capital Group

|

WHILE

INDIA HAS EXCEEDED EXPECTATIONS, SUCCESS DID NOT COME EASILY AND WILL BE

DIFFICULT FOR OTHERS TO REPLICATE College graduates

with strong career

and family aspirations

Establishing brand

identity takes time

Work between

5:00pm and 3:00am

Collecting unpaid

consumer receivables

10

Overcome concerns

about job stability

and career growth

We have not

terminated a single

U.S. position to

move them to India

during our call center

expansion

Work hours, travel time, cultural

differences

The learning curve is

long and demanding

Attracting the right

talent is not easy

The U.S. workforce

needs to support

the enterprise,

without reservation

The logistics are difficult to manage |

AGENDA

11

•

Discuss our rationale for choosing India

•

Highlight our business continuity plans and risk mitigation

strategies for our India operations

•

Provide an overview of the Business Process Outsourcing sector

•

Describe Encore’s success in India and discuss how our Indian

operations can continue to positively contribute to the Company's

future |

Many of those

early ventures

led to negative

stereotyping of

Indian workers’

accents

Special Economic Zones

create incentives to attract

new foreign investors,

followed

by

the

advent

of

3

rd

party BPOs

and significant

off-shoring by large IT

companies like IBM, Dell, HP

The National

Association of

Software and

Services Companies

(NASSCOM) is

founded,

serving

as

the Indian chamber of

commerce for the IT-

BPO industry

12

THE INFORMATION TECHNOLOGY ENABLED SERVICES INDUSTRY (ITES)

BEGAN MORE THAN 30 YEARS AGO

In the early 1980s,

British Airways and

American Express

began using

employees in India

for back-office

operations

The Software

Technology Parks of

India

is

established

to

support growth by

providing access to

physical infrastructure,

increased opportunity for

foreign investment, and

tax incentives

General Electric

explores voice

operations in India

1980

1991

1988

1997

2001 |

Source: NASSCOM

($ Billions, % of GDP)

Indian Information Technology Enabled Services (ITES) industry

growth (2004-2009)

THE INDUSTRY HAS GROWN DRAMATICALLY AND NOW ACCOUNTS FOR

ALMOST SIX PERCENT OF INDIA’S GROSS DOMESTIC PRODUCT

13 |

14

Source: NASSCOM

($ Billions)

Indian BPO sector growth (2004-2009)

WITHIN THE INFORMATION TECHNOLOGY ENABLED SERVICES INDUSTRY, THE

BPO SECTOR’S REVENUE HAS INCREASED 400% TO ALMOST $15 BILLION

|

Source: NASSCOM

THE BPO SECTOR PROVIDES SERVICES TO MANY INDUSTRIES AND

COUNTRIES, WITH MORE THAN 60% BEING PROVIDED TO THE UNITED STATES

Indian BPO sector by industry

(%)

Indian BPO sector by geography

(%)

15 |

AGENDA

16

•

Discuss our rationale for choosing India

•

Highlight our business continuity plans and risk mitigation

strategies for our India operations

•

Provide an overview of the Business Process Outsourcing sector

•

Describe Encore’s success in India and discuss how our Indian

operations can continue to positively contribute to the Company's

future |

17

THE FIRST FEW YEARS WERE MARKED BY CONSTANT TRIAL AND ERROR,

WITH SUCCESS COMING TOWARD THE END OF YEAR TWO

2005

Journey

begins

35 employees

2007

First taste

of success

•

Shifted to higher balance

accounts drives strong

performance

•

Started competing with

U.S. on paper of similar

balance and age

310 employees

Note: Employees refers to the total site staffing number as of last working day of

the year 2006

Year of

growing pains

•

Only working low

balance accounts

•

Limited connection to

the U.S.

•

High attrition and low

performance

187 employees |

18

THAT SUCCESS FUELED A PERIOD OF RAPID EXPANSION OF PEOPLE AND

FUNCTIONS

2008

Accelerating

confidence

and trust

•

Successfully ramped

up hiring without

compromising

performance

•

New work groups

established

•

Meaningfully reduced

attrition

463 employees

2009

Expansion of

influence

and impact

•

Significant involvement

in collection strategy

•

Built analytics, IT and

bankruptcy servicing

teams

•

Invested in world-class

facility

891 employees

Note: Employees refers to the total site staffing number as of last working day of

the year 2010E +

Enabling

future growth

•

India is expected to

account for approximately

50% of all call center

collections in 2011

•

Fundamentally improved

internal cost to collect

•

Enhancing our ability to

purchase portfolios and

win new bankruptcy

servicing contracts

1,213 employees |

19

India collections growth

THE INDIA SITE HAS INCREASED ITS OUTPUT BY 1,000% AND IS NOW EXPECTED TO

CONTRIBUTE 50% OR MORE OF ENCORE’S CALL CENTER COLLECTIONS IN 2011

(% of total AM headcount)

India AM* headcount as percentage of total

234

341

665

909E

Total India AM

headcount:

($ Millions)

* Note: AM stands for account manager, which can be used interchangeably with the

term collector |

20

THIS GROWTH HAS ENABLED US TO REDUCE OUR INTERNAL, DIRECT COST-

TO-COLLECT BY 58% OVER THE LAST 4 YEARS

Variable cost to collect *

(%)

* Represents salaries, variable compensation and employee benefits

|

21

ORIGINAL

SITE

CURRENT

SITE*

Available

capacity

Occupied

capacity

THE SCALE WE HAVE ACHIEVED IN OUR NEW BUILDING IS DRIVING MUCH OF

THE COST SAVINGS, WHILE PROVIDING ROOM FOR EXPANSION

386

1213

367

* Estimate as of last working day of the year |

22

IN THE PROCESS, WE MAINTAINED OUR COST PER COLLECTION EMPLOYEE

DURING A PERIOD OF WAGE EXPANSION IN INDIA

*

Cost

per

FTE

is

a

monthly

figure

which

includes

all

India

site

costs |

23

Delhi National Capital Region Population

21,000,000

Proficient in English

4,000,000

Employable / willing to work in BPOs

600,000

Employed in international BPOs

211,000

India site collector headcount budgeted Dec 2010

900+

Source: NASSCOM

DEMOGRAPHIC AND MACROECONOMIC CONDITIONS WILL EASILY

ACCOMMODATE FUTURE EXPANSION |

24

Pay for Performance

Growth & Development

Employee Engagement

Employee Wellness

•

Variable compensation plans

foster a meritocracy and provide

significant incentives

•

Top performers earn 3 to 4 times

the India BPO sector average

•

Cultural events held frequently

to build camaraderie between

employees

•

Employee surveys done every

other year to gauge morale and

identify areas of improvement

•

Focused training designed to

facilitate the movement of

employees between work groups

•

Partnering with local universities

to provide on-site courses to

further our employees’

education

•

Employee Assistance Program

(EAP) instituted to support

employees’

needs

•

Programs like smoking cessation

and the introduction of an on-site

gym help promote wellness and

well-being in the workplace

WE HAVE CREATED A CORPORATE CULTURE DESIGNED TO ATTRACT AND

RETAIN TOP TALENT

The acronym “EG”

stands for “Encore Giants”

which is a term that refers to our India employees and that recognizes their

contribution to the Company’s success |

25

AND OUR SOCIAL RESPONSIBILITY INITIATIVES HAVE HELPED BUILD BRAND

EQUITY IN THE COMMUNITY

WE INTEGRATE OUR

COMMUNITY OUTREACH

PROGRAM IN ALL OUR

ENGAGEMENT EFFORTS

EDUCATION IS ONE SOCIAL

CAUSE WE SUPPORT AS

AN ORGANIZATION |

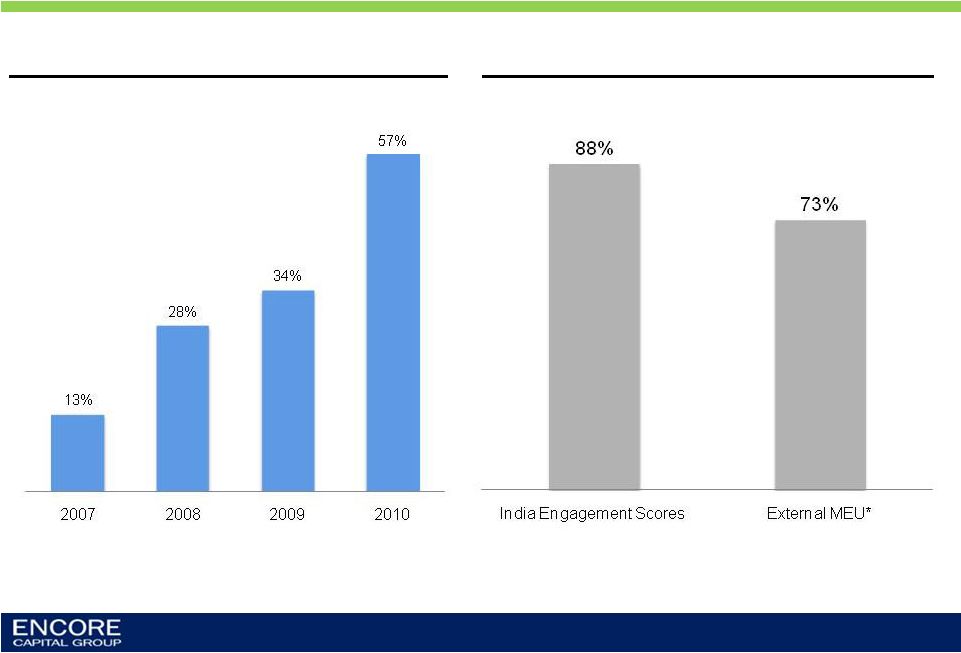

26

Account Manager hiring: Employee referrals

(%)

2009 India Engagement Scores (Internal)

(%)

*

MEU

represents

the

‘Most

Engaged

Units’

for

clients

of

Kenexa,

our

external

provider

of

industry

employee

survey

data

THE SUCCESS OF THESE INVESTMENTS CAN BE SEEN IN OUR EVOLVING

HIRING PRACTICES & THE LEVEL OF ENGAGEMENT OF OUR EMPLOYEES

Source: Encore Capital Group |

27

Honing

Refining

On-the-job training in a

focused learning environment

Ongoing job skill training

•

6 months of concentrated

development

•

Needs based “capsule”

training to enhance

performance though skill

development

•

Integrated approach for

learning reinforcement

with Quality and

Operations teams

ONCE HIRED, SKILLS ARE NURTURED THROUGH STRUCTURED LEARNING AND

DEVELOPMENT

Learning

3 week new hire classroom

training

•

Business understanding

•

Functional & technical

knowledge

•

Compliance training

•

Basic job skill

development |

28

1-

3 Months

4-

6 Months

7 -15 Months

15+ Months

Tenure

ONBOARDING SKILL

DEVELOPING SKILL

LEVERAGING SKILL

LOWER COLLECTABILITY

HIGHER COLLECTABILITY

ILLUSTRATION

MAINTAINING A STABLE WORKFORCE IS IMPORTANT, BECAUSE IT TAKES

ABOUT A YEAR FOR A COLLECTOR TO REACH THEIR FULL POTENTIAL

After

approximately 12

months, cash

average per AM

ramps

significantly

0

0.5

1

1.5

2

2.5

3

3.5

4

4.5 |

OUR

INVESTMENT IN PERSONNEL IN 2010 SHOULD BEGIN PAYING SIGNIFICANT DIVIDENDS IN

2011 29

Encore India Account Manager headcount and indicative cash average

Headcount (number); Cash average (indicative)

Source : Encore Capital Group |

30

WE PLACE A SIGNIFICANT EMPHASIS ON COMPLIANCE |

AGENDA

31

•

Discuss our rationale for choosing India

•

Highlight our business continuity plans and risk mitigation

strategies for our India operations

•

Provide an overview of the Business Process Outsourcing sector

•

Describe Encore’s success in India and discuss how our Indian

operations can continue to positively contribute to the Company's

future |

32

WE HAVE A SYSTEMATIC RISK MANAGEMENT STRATEGY

COMPLIANCE AND

REPORTING

CURRENCY RISK

INDIA SITE

RISK

MANAGEMENT

STRATEGY

DATA

MANAGEMENT

ENVIRONMENTAL

THREATS |

WITH A

SOPHISTICATED FRAMEWORK AROUND EACH AREA OF RISK 33

•

All consumer data resides in U.S.

•

Stringent controls around access to data

•

Zero tolerance policy on violations

Consumer data security

•

Systematic hedging program

Currency fluctuations

•

Segregation of duties / SOX controls

•

Periodic audits by KPMG

•

SAS 70 audits

Compliance & Internal control

Environmental risks

•

Comprehensive Business Continuity Plan

•

Redundant IT infrastructure

•

Strategically located site |

34

We believe that we are the only company in our industry with a successful

late stage collection platform in India

India now represents half of our call center collections and we expect this

contribution to continue to increase, both on an absolute and a relative

basis

Beyond collections, our India site now directs several IT and other

administrative functions

The India management team has an average of 12 years of industry

experience and individual team members have worked for U.S.

multinationals including GE Capital, Dell, IBM, and American Express

SUMMARY |