Attached files

| file | filename |

|---|---|

| EX-23.1 - Desert Hawk Gold Corp. | v207954_ex23-1.htm |

As

Filed with the Securities and Exchange Commission on January 12,

2011

Registration

No. 333-169701

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

PRE-EFFECTIVE

AMENDMENT NO. 3

TO

FORM

S-1/A

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES

ACT OF 1933

DESERT

HAWK GOLD CORP.

(Exact

name of Registrant as Specified in Its Charter)

|

Nevada

|

1040

|

82-0230997

|

||

|

(State or other jurisdiction of

incorporation or

organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification No.)

|

7723

North Morton Street

Spokane,

WA 99208

(509)

434-8161

(Address,

including zip code, and telephone number, including area code,

of

registrant's principal executive offices)

Robert

E. Jorgensen, CEO

8921

N. Indian Trail Road, #288

Spokane,

WA 99208

(509)

434-8161

(Name,

address, including zip code, and telephone number

including

area code, of agent for service)

Copies

to:

Ronald

N. Vance, P.C.

Attorney

at Law

1656

Reunion Avenue

Suite

250

South

Jordan, UT 84095

(801)

446-8802

(801)

446-8803 (fax)

Approximate

date of commencement of proposed sale to the public: From time to

time after this Registration Statement becomes effective.

If any of

the securities being registered on this form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. x

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. ¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. ¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definitions of “large accelerated filer,” “accelerated

filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act. (Check one):

|

Large

accelerated filer

|

¨

|

Accelerated

filer

|

¨

|

|

Non-accelerated

filer

|

¨

|

Smaller

reporting company

|

x

|

|

CALCULATION OF REGISTRATION FEE

|

||||||||||||||||

|

Title of Each Class

of Securities to be

Registered

|

Amount to be

Registered

|

Proposed Maximum

Offering Price Per

Share (1)

|

Proposed Maximum

Aggregate Offering

Price

|

Amount of

Registration Fee

|

||||||||||||

|

Common

Stock, $.001 par value

|

7,369,038 | $ | 0.70 | $ | 5,158,327 | $ | 367.79 | |||||||||

|

Common

Stock, $.001 par value

|

1,437,050 | (2)(3) | $ | 0.70 | $ | 1,005,935 | $ | 71.72 | ||||||||

|

TOTAL

|

8,806,088 | $ | 6,164,262 | $ | 439.51 | |||||||||||

(1)

Estimated pursuant to Rule 457 solely for the purpose of calculating the amount

of the registration fee. The selling stockholders will offer to sell the shares

of common stock covered by this prospectus at $0.70 per share until our shares

of common stock are quoted on the OTC Bulletin Board, or listed for trading or

quoted on any other exchange, and thereafter at prices determined at the time of

sale by the selling stockholders.

(2)

Represents the number of shares of our common stock issuable upon the conversion

of Series A Preferred Stock issued to DMRJ Group I, LLC on July 14, 2010, based

on a conversion price of $0.70 per share.

(3) We

are registering 150% of the number of shares presently issuable upon conversion

of the Series A Preferred Stock issued to DMRJ Group I, LLC on July 14, 2010,

representing our good faith estimate of the number of shares that may become

issuable in the future as a result of conversion price adjustments. The

conversion price of the Series A Preferred Stock is subject to adjustment in the

event of issuance of common stock at an issue price less than the conversion

price at the time of the issuance. If the number of shares issuable upon

conversion of the shares of Series A Preferred Stock exceeds the registered

amount, we will not rely on Rule 416 to cover the additional shares, but will

instead file a new registration statement.

The

registrant hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the registrant shall file a

further amendment which specifically states that this registration statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the registration statement shall become

effective on such date as the Commission, acting pursuant to Section 8(a), may

determine.

The

information in this prospectus is not complete and may be

changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is

effective. This prospectus is not an offer to sell these securities

and it is not soliciting offers to buy these securities in any state where the

offer or sale is not permitted.

Preliminary

Prospectus

Subject

to Completion, dated January 12, 2011

Desert

Hawk Gold Corp.

8,327,071

Shares of Common Stock

This

prospectus relates to the resale by the selling stockholders of up to 7,369,038

shares of our common stock, including 5,997,610 outstanding shares and up to

1,371,428 shares issuable upon conversion of outstanding promissory notes or

payment of penalties on the promissory notes. The shares being

offered also include 958,033 shares reserved for issuance upon conversion of our

Series A Preferred Stock. The selling stockholders, or their pledgees, donees,

transferees or other successors-in-interest, may offer the shares of our common

stock for resale in the over-the-counter market, in isolated transactions, or in

a combination of such methods of sale. The selling shareholders will

set a price of $0.70 per share until our shares are quoted on the OTC Bulletin

Board and thereafter at prevailing market prices or privately negotiated

prices. There will be no underwriter’s discounts or commissions,

except for the charges to a selling stockholder for sales through a

broker-dealer. All net proceeds from a sale will go to the selling

stockholder and not to us. We will pay the expenses of registering

these shares.

There is

currently no public market for our common stock. Our stock is

not quoted on the Pink Sheets or the OTC Bulletin Board and is not listed on any

exchange.

Investing

in our stock involves risks. You should carefully consider the

Risk Factors beginning on page 2 of this

prospectus.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of

these securities or passed upon the adequacy or accuracy of this

prospectus. Any representation to the contrary is a criminal

offense.

The

date of this prospectus is ____________, 2011

TABLE

OF CONTENTS

|

Page

|

||

|

PROSPECTUS

SUMMARY

|

1

|

|

|

RISK

FACTORS

|

2

|

|

|

USE

OF PROCEEDS

|

11

|

|

|

MARKET

FOR OUR COMMON STOCK

|

12

|

|

|

FORWARD-LOOKING

STATEMENTS

|

11

|

|

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

14

|

|

|

BUSINESS

AND PROPERTIES

|

20

|

|

|

LEGAL

PROCEEDINGS

|

36

|

|

|

MANAGEMENT

|

36

|

|

|

EXECUTIVE

COMPENSATION

|

41

|

|

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

45

|

|

|

SELLING

STOCKHOLDERS

|

44

|

|

|

DESCRIPTION

OF COMMON STOCK

|

47

|

|

|

PLAN

OF DISTRIBUTION

|

49

|

|

|

LEGAL

MATTERS

|

51

|

|

|

EXPERTS

|

51

|

|

|

ADDITIONAL

INFORMATION

|

|

52

|

We have

not authorized anyone to provide you with information different from that

contained in this prospectus. The selling stockholders are offering

to sell, and seeking offers to buy, shares of our common stock only in

jurisdictions where offers and sales are permitted.

Unless

otherwise indicated, any reference to Desert Hawk, or as “we”, “us”, or “our”

refers to Desert Hawk Gold Corp. and/or its wholly owned subsidiary, Blue Fin

Capital, Inc.

ii

PROSPECTUS

SUMMARY

The

following summary highlights material information contained in this

prospectus. This summary does not contain all the information you

should consider before investing in the securities. Before making an

investment decision, you should read the entire prospectus carefully, including

the “Risk Factors” section, the financial statements and the notes to the

financial statements.

Desert

Hawk Gold Corp.

Desert

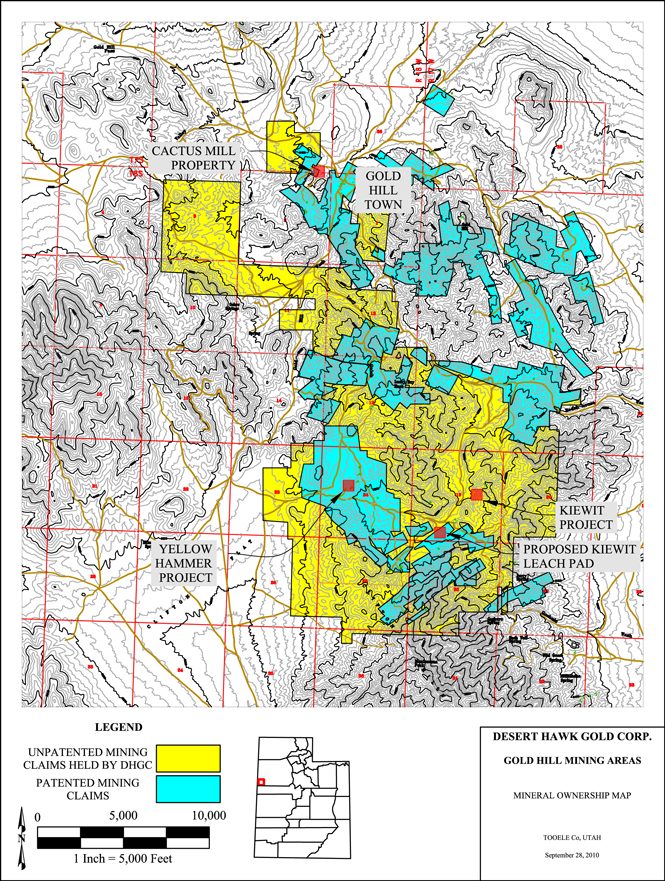

Hawk Gold Corp. is an exploration stage company which holds mining claims in

Utah and Arizona. Through two lease agreements which encompass all of

the Utah claims, we intend to conduct exploration and pilot activities on claims

located in the Gold Hill Mining District in Tooele County,

Utah. Within this mining district we hold leasehold interests in 334

unpatented load and placer mining claims, including an unpatented mill site

claim, 42 patented claims, and five Utah state mineral leases located on state

trust lands, covering approximately 33 square miles. We also hold

eight unpatented lode mining claims in Yavapai County, Arizona, on which we have

no current plans to conduct exploration. Our primary focus will be in

the Gold Hill Mining District and we intend to concentrate our activities on the

Yellow Hammer lode claims, located on four of the patented claims, seven of the

unpatented Kiewit lode claims, and the pilot mill located on the Cactus Mill

unpatented mill site. We intend to maintain our leasehold interest in

the additional mining claims and leases in this district for future exploration,

if warranted, but we have no current plans to conduct exploration on these

additional claims and leases. We have not identified any proven or

probable reserves on any of our mining claims or leases.

We were

originally incorporated in the State of Idaho on November 5, 1957, under the

name of Lucky Joe Mining Company. For several years the company

bought and sold mining leases and claims, but in 1995 we ceased all principal

business operations. In 2001 control of the company was acquired by

Robert E. Jorgensen, John Ryan, and Howard M. Crosby, who purchased a

controlling number of shares and assumed management of the company for the

purpose of reengaging in mining operations. Mr. Jorgensen acquired

principal stock and management control of the company from Messrs Ryan and

Crosby in January 2006. In 2008 we changed the domicile of the

company from the State of Idaho to the State of Nevada by merging the Idaho

corporation into a newly formed Nevada corporation which was incorporated on

July 17, 2008. Following the change of domicile, on April 3, 2009, we

changed the name of the company to Desert Hawk Gold Corp. We have one

subsidiary, Blue Fin Capital, Inc., which is wholly owned by us and which holds

the Arizona mining claims.

In April

2009, we affected a one-for-twelve reverse split of our issued and outstanding

shares of common stock. Unless otherwise indicated, all references herein to

shares outstanding and share issuances have been adjusted to give effect to this

stock split.

On July

14, 2010, we entered into an Investment Agreement, which was amended on November 8,

2010 (which we refer to throughout this document as the Investment

Agreement) with DMRJ Group I, LLC (which we refer to as DMRJ Group). Under

the terms of the Investment Agreement, we may borrow up to $6,500,000 to fund

our mining activities in the Gold Hill Mining District. We also issued

958,033 shares of our Series A Preferred Stock to the DMRJ Group as additional

consideration for entering into the Investment Agreement with us. For

a discussion of the terms of the Investment Agreement, see the section heading

“Business and Properties – DMRJ Group Investment Agreement”

below.

In fall

2009 we completed 116 drill holes on the Yellow Hammer claims ranging in depth

from 16 to 72 feet, totaling approximately 6,000 feet of drilling. In

fall of 2010 we completed the rebuild of the pilot mill on the Cactus Mill

site.

Historically,

we have generated no revenues from operations, have experienced losses since

inception of our current exploration stage on May 1, 2009, and currently rely

upon the funds from DMRJ Group to fund our planned exploration

activities. As of January 3, 2011, our cash position was

approximately $589,918 and we had received loan advances from DMRJ Group of

$2,000,000, plus $313,235 for prepaid interest. Over the next 12

months we have the following principal objectives: to continue

processing activities at our pilot plant on the Cactus Mill site using

mineralized material extracted from the Yellow Hammer claims; to amend our

permitted activities at the Cactus Mill property to include a heap leach

facility to process material from the Yellow Hammer claims; and to continue the

application process for a large mining operations permit for conducting

exploration activities on the Kiewit claims and for constructing and operating a

heap leach facility near the claims. We believe that through the

financing with DMRJ Group we have sufficient funds available to commence the

extraction and processing of mineralized material on the Yellow Hammer project,

complete the amendment process for the Cactus Mill leach pad and complete the

permitting process for the Kiewit project, including construction of a heap

leach facility. However, the repayment of debt and continued operations

beyond this initial stage is dependent upon generating revenue from the

processing of mineralized material from the Yellow Hammer claims at the Cactus

Mill pilot plant.

1

Through

this prospectus, certain selling stockholders are offering up to 8,327,071

shares of our common stock. Approximately 1,440,000 of these shares

were purchased at $0.70 per share in two non-public offerings sold in 2009 and

2010. Another 289,584 of these shares were sold at $0.05 per share in

a non-public offering in 2008. Also, 2,713,636 of these shares were

issued by us in exchange for the outstanding stock of Blue Fin Capital, Inc. in

December 2009. Approximately 1,254,390 of these shares were issued to

the selling stockholders for services preformed for us. Finally,

300,000 of the shares were issued as bonuses to two parties in connection with

loans of $600,000 to us and approximately 1,071,428 shares are issuable upon

conversion of these loans and 300,000 are issuable as penalty shares if we fail

to repay the loan when due. In addition, we are registering for

resale 958,033 shares issuable upon conversion of our outstanding shares of

Series A Preferred Stock.

Our

principal executive offices are located at 7723 North Morton Street, Spokane, WA

99208. We maintain a mailing address for our company at 8921 N.

Indian Trail Road, #288, Spokane, WA 99208. Our

telephone number is (509) 434-8161. We do not maintain a company

website.

The

Offering

|

Common

stock offered by selling stockholders:

|

Up

to 5,997,610 outstanding shares of common stock and up to 1,371,428 shares

issuable upon conversion of or penalty payments under outstanding

promissory notes.

Up

to 958,033 shares of common stock underlying Series A Preferred

Stock

|

|

|

Offering

Price:

|

All

shares offered by means of this prospectus will be sold at $0.70 per share

until the common stock is quoted on the OTC Bulletin Board and thereafter

at prevailing market prices.

|

|

|

Common

stock outstanding:

Before offering

After offering

|

7,586,411

9,915,872

(assuming issuance of 1,371,428 shares upon conversion of our outstanding

promissory notes and payment of penalty shares on the promissory notes and

issuance of 958,033 shares upon conversion of the outstanding shares of

preferred stock)

|

|

|

Use

of proceeds:

|

We

will not receive any proceeds from the sale of the common stock by the

selling stockholders.

|

RISK

FACTORS

Investment

in our common stock has a high degree of risk. Before you invest you

should carefully consider the risks and uncertainties described below and the

other information in this prospectus. If any of the following risks

actually occur, our business, operating results and financial condition could be

harmed and the value of our common stock could go down. This means

you could lose all or a part of your investment.

2

Risks

Related to Our Company and its Business

If

we fail to repay the loan advances from DMRJ Group in a timely manner or

otherwise breach our agreement with this lender, we would likely lose our

interest in our mining leases and other assets.

Our loan

advances from DMRJ Group under the Investment Agreement are secured by all of

our assets, including our mining leases and equipment. Each separate

loan advance to us pursuant to the Investment Agreement provides for a specific

repayment date of principal and, to the extent interest on the loan is not

prepaid at the time of the particular loan advance, we have monthly obligations

to pay interest on the amount borrowed after the first year of the loan

advance. Repayment of loan advances made for our Yellow Hammer claims

commences in March 2011 and advances made for the Kiewit property must be repaid

commencing seven months after the first advance. All outstanding

balances on any other advances are due upon maturity, which is July 13,

2012. The Investment Agreement also contains numerous affirmative and

negative covenants which require us to perform certain obligations or refrain

from certain actions so long as any amounts are owed to DMRJ Group under the

Investment Agreement. If we fail to meet all of our covenants under

the agreement or if we fail to make any required payment of principal or

interest when due, it is likely that DMRJ Group would call the full amount of

the outstanding balances on our loans immediately due. If we are

unable to repay the outstanding balances at this time, we anticipate that DMRJ

Group would foreclose on its security interest and would likely take control of

or liquidate our mining leases and other assets. Because the

Investment Agreement limits our ability to raise outside funds during the

effective period of the Investment Agreement, it is unlikely that we would be

able to obtain alternate financing to satisfy the obligations owed to DMRJ Group

in the event of foreclosure. If we lose our mining leases and other

assets to DMRJ Group in foreclosure, we would not be able to continue our

business operations as currently planned and you would lose your entire

investment in our common stock.

Because

of our historic losses from operations since the inception of our exploration

stage on May 1, 2009, there is substantial doubt about our ability to continue

as a going concern.

Our

auditor’s report on our 2009 consolidated financial statements includes an

additional explanatory paragraph that states that our recurring losses from

operations raise substantial doubt about our ability to continue as a going

concern. These consolidated financial statements for the year ended

December 31, 2009, were prepared on the basis that our company is a going

concern, which contemplates the realization of its assets and the settlement of

its liabilities in the normal course of operations. Our ability to

continue as a going concern is uncertain and dependent upon continuing to obtain

the financing necessary to meet our financial commitments and to complete the

exploration of our mining properties and/or realizing proceeds from the

sale of mineralized material from the properties. Our continuation as

a going concern is primarily dependent upon the continued financing from DMRJ

Group under the Investment Agreement and the attainment of profitable

operations. As at September 30, 2010, we had cash and cash equivalents of

$409,700, negative working capital of ($1,032,364), and accumulated losses of

$2,968,087 since inception of our current exploration stage. These

factors raise substantial doubt regarding our ability to continue as a going

concern. Neither our 2009 audited financial statements nor our

interim unaudited financial statements for the nine months ended September 30,

2010, include any adjustments to the recoverability and classification of

recorded asset amounts and classification of liabilities that might be necessary

should we be unable to continue as a going concern.

If

we fail to meet certain milestones in our funding agreement with DMRJ Group, we

will not have access to the full amount of the funds available under this

arrangement, which could materially hamper our ability to continue our planned

operations.

Management

anticipates that the minimum cash requirements to fund our proposed exploration

program can only be met through our financing arrangement with DMRJ

Group. In order to continue to borrow funds under our Investment

Agreement with DMRJ Group, we are required to meet certain milestones in our

operations. For the final two $500,000 advances related to the Yellow

Hammer project, we must have commenced mining of copper from the property.

For advances on the Kiewit project we must have obtained and be in compliance

with all environmental and mining permits for the project and have paid our

initial Yellow Hammer advance repayment amount for the month of February

2011. This repayment amount is $511,616. If we fail

to meet these milestones, these funds will not be available to us and we have no

other source for funding to continue our planned activities.

3

If

we are unable to generate revenue from the sale of mineralized material from the

Yellow Hammer claims, we will likely not be able to continue our

operations.

We have no history of

producing metals from any of our properties. Our properties are all

exploration stage properties in various stages of exploration and we have no proven or

probable reserves on any of these properties. The first

phase of our business plan is to process mineralized material from the Yellow

Hammer claims at the pilot plant and sell any concentrate produced by us from

the Cactus Mill pilot plant. We have not completed any

feasibility study of the Yellow Hammer claims and there are no known or

established commercially minable deposit for extraction on these claims and no

known mineral deposit which could be economically extracted. We also

have no firm off-take agreements for any concentrate produced by

us. If the mineralized material from the Yellow Hammer claims fails

to produce concentrate that can be sold at a profit for a sufficient period to

repay our outstanding debt to DMRJ Group and others, it is unlikely that we

would be able to continue any operations or explore our other mining properties

and it is probable that our proposed business would fail.

We

have a history of losses and are dependent upon revenue from our planned

operations through our Cactus Mill pilot plant to continue our proposed

operations.

In the

fiscal year ended December 31, 2009, we had net losses of

$518,219. For the nine months ended September 30, 2010, we had

comprehensive losses of $2,482,403. Since the commencement of our

exploration stage on May 1, 2009, we have experienced accumulated losses of

$2,968,087. We have not commenced commercial production on any of our

mineral properties. We have no revenues from operations and anticipate we

will have no operating revenues until we commence mineralized material

processing operations on one or more of our properties. All of our

properties are in the exploration stage, and we have no known mineral reserves

on our properties. Even if we generate

revenue from mineralized material on the Yellow Hammer or other claims, we may

not achieve or sustain profitability in the future. If we do not

begin to generate revenues before our current cash resources expire, we will

either have to suspend or cease operations, in which case you will lose your

investment.

Although

we intend to commence the processing of mineralized material from the Yellow

Hammer claims, we do not have any proven or probable reserves on this

site. As a result we may not be able to locate mineral deposits or

reserves on this site which could be economically and legally extracted or

produced.

Our first

phase of proposed operations includes processing mineralized material from our

Yellow Hammer claims at our pilot plant on our Cactus Hill

property. Nevertheless, we have not identified any proven or probable

reserves on these claims which makes these extraction operations on them very

speculative. If we are not able to quickly locate mineralized

material which can be economically extracted and produced, the funds we spend on

these claims may be lost which could have a material negative impact on our

ability to continue operations.

Changes

in the market prices of copper, gold and other metals, which in the past have

fluctuated widely, will affect the profitability of our proposed operations and

financial condition.

Our

potential profitability and long-term viability depend, in large part, upon the

market price of copper, gold and other metals and minerals which may be

extracted from our mining claims and leases. The market price of copper,

gold and other metals is volatile and is impacted by numerous factors beyond our

control, including:

|

|

·

|

expectations

with respect to the rate of

inflation;

|

|

|

·

|

the

relative strength of the U.S. dollar and certain other

currencies;

|

|

|

·

|

interest

rates;

|

|

|

·

|

global

or regional political or economic

conditions;

|

|

|

·

|

supply

and demand for jewelry and industrial products containing metals;

and

|

|

|

·

|

sales

by central banks and other holders, speculators and producers of gold and

other metals in response to any of the above

factors.

|

4

We

cannot predict the effect of these factors on metal prices. In

particular, gold and copper prices have fluctuated during the last several

years. The price of copper (London Fix) has ranged from

approximately $1.50 to approximately $3.25 per ounce during calendar 2009,

closing at approximately $3.25 on December 30, 2009; from approximately

$2.78 to approximately $4.41 per ounce during 2010 to close

on December 31, 2010, at approximately $4.41 per ounce. The

price of gold (London Fix) has ranged from $810 to $1,212 per ounce during

calendar 2009, closing at $1,087 on December 30, 2009; from $1,052 to $1,426 per

ounce during 2010 to close on December 31, 2010, at $1,410.25 per ounce. A

decrease in the market price of copper, gold and other metals could affect the

commercial viability of our properties and our anticipated exploration of such

properties in the future. Lower copper or gold prices could also adversely

affect our ability to finance exploration of our properties.

In

addition, the makeup of gold investors and users has changed significantly which

has affected the price of gold in particular in recent

years. Historically, the demand for gold was driven by the needs of

jewelers, dentists and electronics manufacturers who used gold in their

businesses. In 1998 investors in gold accounted for only 6.9% of

demand. During 2009 they accounted for 39% and in the second quarter

of 2010, they accounted for 51%. During the first quarter of 2009,

when the stock market was at its lowest, investors accounted for 60% of the

demand for gold. This shift in demand for gold could mean that

positive changes in the macro-economy could lead investors to sell gold in large

quantities, which could result in dramatically decreased demand and lower prices

for gold. These lower prices could have a negative impact on our

proposed business.

We

have significant cash commitments under our lease agreements and if we fail to

meet these obligations, we could lose our right to conduct mining activities on

these claims.

Under

our current lease agreements for our claims in the Gold Hill Mining District, we

are obligated to commence operations of the claims within three years and pay

annual maintenance costs on the claims. The annual claim maintenance

costs, including annual maintenance fees payable to the BLM for the unpatented

claims, the annual state trust lands mineral lease fees, and property tax

payments are substantial. For 2010 and following years we are

responsible for these costs. If we fail to make these maintenance,

tax and other payments, we may lose the right to continue mining activities on

the claims. In addition, pursuant to the terms of our lease

agreements, if we fail to commence commercial scale operations on certain of the

claims prior to July 2012, we will be required to pay $50,000 for an annual

holding fee to retain rights to these claims. We have paid the 2010

maintenance costs in the aggregate amount of $46,760 for the unpatented claims

in the Gold Hill Mining District. We also paid $6,890 for the 2010

mineral lease fees on two of the Utah mineral leases. We also paid

$6,024 for 2010 property taxes on the Utah patented claims. We

anticipate that future annual fees will be comparable, and if we are unable to

pay these fees from DMRJ Group loan advances or revenue generated from our

extraction activities in the future, we would lose our interest in all of our

claims and leases.

We

may not be able to obtain all required permits and licenses to commence

exploration activities on our properties, or the permitting process could be

delayed, which could cause delays in our proposed plan of operations or increase

the cost of those planned operations.

Our

current proposed and future operations, including the initial extraction and

processing of mineralized material from our Yellow Hammer claims, require

permits from governmental authorities and such operations are and will be

governed by laws and regulations governing exploration, taxes, labor standards,

occupational health, waste disposal, toxic substances, land use, environmental

protection, mine safety and other matters. Companies engaged in

exploration of mining properties and related facilities generally experience

increased costs, and delays in these activities and other schedules as a result

of the need to comply with applicable laws, regulations and

permits. Our current Small Mining Operations Permit for the Yellow

Hammer claims is limited to operations in an area within five

acres. Management anticipates that this permit will be sufficient for

planned extraction activities on the Yellow Hammer claims for only one to three

years and would not permit commencement of operations on the Kiewit

claims. We do not have in place the necessary permits to commence

operations on the Kiewit claims. A Large Mining Operations Permit for

the Kiewit claims will require an extensive environmental assessment or

preparation of a Plan of Operation. We have a permit to operate our

proposed pilot plant on the Cactus Mill property, but do not have the required

permits to add a planned heap leach facility near this property or for the

Kiewit claims. We cannot predict if all permits which may be required

for continued exploration activities or construction of facilities will be

obtainable on reasonable terms or within the periods planned by us. Costs

related to applying for and obtaining permits and licenses may be prohibitive

and could delay our planned exploration activities. Failure to comply with

applicable laws, regulations and permitting requirements may result in

enforcement actions, including orders issued by regulatory or judicial

authorities causing operations to cease or be curtailed, and may include

corrective measures requiring capital expenditures, installation of additional

equipment, or remedial actions.

5

Our

activities are subject to environmental laws and regulations that may increase

our costs of doing business and restrict our planned mineral extraction and

processing activities.

All

phases of our planned mineral extraction and processing activities are subject

to environmental regulation in the jurisdictions in which we operate, in

particular Tooele County, Utah. Environmental legislation is evolving in a

manner which will require stricter standards and enforcement, increased fines

and penalties for non-compliance, more stringent environmental assessments of

proposed projects and a heightened degree of responsibility for companies and

their officers, directors and employees. These laws address emissions into

the air, discharges into water, management of waste, management of hazardous

substances, protection of natural resources, antiquities and endangered species

and reclamation of lands disturbed by mining operations. A Large

Mining Operations Permit for our Kiewit claims will also require an extensive

environmental assessment or preparation of a Plan of

Operation. Compliance with environmental laws and regulations and

future changes in these laws and regulations may require significant capital

outlays and may cause material changes or delays in our operations and future

activities. It is possible that future changes in these laws or

regulations could have a significant adverse impact on our properties or some

portion of our business, causing us to re-evaluate those activities at that

time.

Land

reclamation requirements for our properties may be burdensome and expensive.

In

addition to the current reclamation bonds posted by us, we will likely have

additional reclamation requirements associated with our Large Mining Operations

Permit for which we have applied for the Kiewit claims. Reclamation

requirements by governmental authorities are generally imposed on mineral

exploration companies (as well as companies with mining operations) in order to

minimize long-term effects of land disturbance. Reclamation may include

requirements to control dispersion of potentially deleterious effluents

and reasonably re-establish pre-disturbance land forms and

vegetation. In order to carry out reclamation obligations imposed on us in

connection with our potential exploration activities, we must allocate financial

resources that might otherwise be spent on further exploration programs.

If we are required to carry out unanticipated reclamation work, our

financial position could be adversely affected.

We

are dependent upon the services of our President to provide the principal mining

expertise for our proposed exploration activities. The loss of Mr.

Havenstrite could delay our business plan or increase the costs associated with

our plan.

Other

than our President, Rick Havenstrite, our officers and directors have no

professional accreditation or formal training in the business of mineral

exploration. With no direct training or experience these other

members of our management team may not be fully aware of many of the specific

requirements related to working within this industry. Decisions so

made without this knowledge may not take into account standard engineering

management approaches that experienced exploration corporations commonly

make. Consequently, our business, earnings and ultimate financial

success could suffer irreparable harm as a result of management’s lack of

experience in the industry. The loss of our President could adversely

affect our business. We have an employment agreement with Mr.

Havenstrite for an initial period of four years until 2014. However,

we do not maintain key-man insurance on Mr. Havenstrite. We may not

be able to hire and retain personnel in the future, or the cost to retain

replacement personnel may be excessive, in the event Mr. Havenstrite becomes

unavailable for any reason.

Title

to our properties may be subject to other claims, which could affect our

property rights and claims.

There are

risks that title to our properties may be challenged or impugned. Our

principal properties are located in Utah and may be subject to prior unrecorded

transfer agreements and royalty rights and title may be affected by other

undetected defects. There may be valid challenges to the title of our

properties which, if successful, could impair exploration operations on the

claims. This is particularly the case in respect of our properties through

which we hold our interest solely pursuant to leases with the claim holders, as

such interests are substantially based on contract as opposed to a direct

interest in the property.

6

Several

of the mineral rights to our properties consist of unpatented mining claims

created and maintained in accordance with the U.S. General Mining Law.

Unpatented mining claims are unique property interests, and are generally

considered to be subject to greater title risk than other real property

interests because the validity of unpatented mining claims is often uncertain.

This uncertainty arises, in part, out of the complex federal and state

laws and regulations under the U.S. General Mining Law, including the

requirement of a proper physical discovery of valuable minerals within the

boundaries of each claim and proper compliance with physical staking

requirements. Also, unpatented mining claims are always subject to

possible challenges by third parties or validity contests by the federal

government. The validity of an unpatented mining or mill site claim, in

terms of both its location and its maintenance, is dependent on strict

compliance with a complex body of federal and state statutory and decisional

law. In addition, there are few public records that definitively determine

the issues of validity and ownership of unpatented mining claims. Should

the federal government impose a royalty or additional tax burdens on the

properties that lie within public lands, the resulting mining operations could

be seriously impacted, depending upon the type and amount of the

burden.

We

do not maintain insurance with respect to certain high-risk activities, which

exposes us to significant risk of loss.

Mining

operations generally involve a high degree of risk. Hazards such as

unusual or unexpected formations or other conditions are often

encountered. We may become subject to liability for pollution or

hazards against which we cannot insure or against which we cannot maintain

insurance at commercially reasonable premiums. Any significant claim would

have a material adverse effect on our financial position and

prospects. We are not currently covered by any form of

environmental liability insurance, since insurance against such risks, including

liability for pollution, is prohibitively expensive. We may have to

suspend operations or take interim cost compliance measures if we are

unable to fully fund the cost of remedying an environmental problem, if any of

these uninsured events were to occur.

A

shortage of equipment and supplies could adversely affect our ability to operate

our business.

We are

dependent on various supplies and equipment to carry out our exploration

activities. These include crushing services for mineralized material

from our Yellow Hammer claims, road grading services, chemicals and maintenance

equipment for our pilot plant, and parts and supplies for our extraction and

hauling equipment. We have no long-term agreements to provide these

supplies or services. The shortage of such supplies, equipment and

parts could have a material adverse effect on our ability to carry out our

operations and therefore limit or increase the cost of our exploration

activities.

Increased

competition could adversely affect our ability to attract necessary capital

funding or acquire suitable producing properties or prospects for mineral

exploration in the future.

The

mining industry is intensely competitive. Significant competition exists

for the acquisition of properties producing or capable of producing gold or

other metals. We may be at a competitive disadvantage in acquiring

additional mining properties even in the Gold Hill Mining District because we

must compete with other individuals and companies, many of which have greater

financial resources, operational experience and technical capabilities than we

have. We may also encounter increasing competition from other mining

companies in our efforts to hire experienced mining professionals.

Competition for exploration resources at all levels is currently very

intense, particularly affecting the availability of manpower, drill rigs, mining

equipment and production equipment. Increased competition could adversely

affect our ability to attract future capital funding or acquire suitable

producing properties or prospects for mineral exploration in the

future.

We

compete with larger, better capitalized competitors in the mining

industry.

The

mining industry is competitive in all of its phases, including financing,

technical resources, personnel and property acquisition. It requires

significant capital, technical resources, personnel and operational experience

to effectively compete in the mining industry. Because of the high costs

associated with exploration, the expertise required to analyze a project’s

potential and the capital required to explore a mine, larger companies with

significant resources may have a competitive advantage over us. We face

strong competition from other mining companies, in particular Rio Tinto which

operates a large copper mine in the area, some with greater financial resources,

operational experience and technical capabilities than we have. As a

result of this competition, we may be unable to maintain or acquire future

financing, personnel, technical resources or attractive mining properties on

terms we consider acceptable or at all.

7

Increased

commodity and labor costs could affect our financial condition.

We

anticipate that costs at our Gold Hill projects will frequently be subject to

variation from one year to the next due to a number of factors, such as changing

grades of mineralized material, metallurgy and revisions to mine plans, if any,

in response to the physical shape and location of the mineral body. In

addition, costs are affected by the price of commodities such as fuel, chemicals

and electricity as well as labor costs. Such commodities are at times

subject to volatile price movements, including increases that could make

exploration activities at certain operations less profitable. We do not have firm

contracts or commitments for the commodities or all labor in connection with the

exploration or extraction activities on the mining claims. A

material increase in these costs could have a significant effect on our cost of

operations and potential profitability.

Transportation

difficulties and weather interruptions may affect and delay proposed activities

and could impact our proposed business.

Our

mining properties are accessible by road and there are no other means of

transportation available such as rail or navigable water ways. The

climate in the area is hot and dry in the summer but cold and subject to snow in

the winter, which could at times hamper accessibility depending on the winter

season precipitation levels. Significant snowfall could make

accessing our properties difficult or impossible by truck. As a

result, our exploration plans could be delayed for certain periods each year.

These delays could affect our ability to process and transport mineralized

material from the claims to the pilot plant which could have a material impact

on our ability to generate revenue.

Our

directors and officers may have conflicts of interest as a result of their

relationships with other companies.

Certain

of our officers and directors are also directors, officers or shareholders of

other companies that are similarly engaged in the business of acquiring,

exploring and exploiting mining properties. For example, John Ryan, one of

our directors, also serves as a director for Gold Crest Mines, Inc., Trend

Mining Company, Lucky Friday Extension Mining Company, Inc., Mineral Mountain

Mining and Milling Company, Tintic Standard Gold Mines, Inc., Consolidated

Goldfields, Inc., and Silver Verde May Mining Company,

Inc. Consequently, there is a possibility that our directors and/or

officers may be in a position of conflict in the future. In addition,

our President, Rick Havenstrite, dedicates part of his time to operating his

overhead door business in Reno, Nevada, which means that he is not able to

devote all of his business time to our company.

We

do not have water currently available in sufficient quantity to operate our

planned leaching facility near the Kiewit claims, and if we are unable to

produce sufficient water, we may not be able to commence planned activities on

these claims.

The

Kiewit claims are located in an arid high desert climate with no other water

source than may be provided through a well. We have not tested the

area near the claims for the proposed well or any other water source sufficient

to operate the planned Kiewit leaching facility. In addition, if the

water table for the planned well is deeper than we estimate, the cost of

constructing and maintaining the well may increase. If we are unable

to locate a suitable water source by means of the proposed well or otherwise, we

may not be able to proceed with our proposed activities on the Kiewit claims,

which could also affect our ability to secure necessary operating permits for

the leaching facility and future loan advances from DMRJ.

8

Risks

Related to Our Common Stock

There

is currently no public trading market for our common stock which means that you

may be required to hold your shares in our company for an indefinite

period.

Our

common stock is not quoted on either the OTC Bulletin Board or the Pink Sheets

and is not listed on any exchange. Until the common stock is quoted

on an electronic quotation service or listed on an exchange, it is unlikely that

any public market for the common stock will be established. It is

unlikely that our company would qualify for listing on a stock exchange in the

near future, if ever. Application for quotation on an electronic

quotation service requires finding a market maker willing to make the

application. The application process entails review by FINRA, the

self-regulated industry processer of these applications, and may take several

months. The application process cannot commence until the

registration of which this prospectus is a part is declared effective by the

Securities and Exchange Commission. We have not identified any

broker-dealers who may be willing to make application on our

behalf.

Because our shares are designated as

Penny Stock, broker-dealers will be less likely to trade in our stock in the

future due to, among other items, the requirements for broker-dealers to

disclose to investors the risks inherent in penny stocks and to make a

determination that the investment is suitable for the

purchaser.

Our

shares are designated as “penny stock” as defined in Rule 3a51-1 promulgated

under the Exchange Act and thus, if a public market for the stock develops in

the future, may be more illiquid than shares not designated as penny

stock. The SEC has adopted rules which regulate broker-dealer

practices in connection with transactions in “penny stocks.” Penny

stocks are defined generally as non-NASDAQ equity securities with a price of

less than $5.00 per share; that are not traded on a “recognized” national

exchange; or in issuers with net tangible assets less than $2,000,000, if the

issuer has been in continuous operation for at least three years, or

$10,000,000, if in continuous operation for less than three years, or with

average revenues of less than $6,000,000 for the last three

years. The penny stock rules require a broker-dealer to deliver a

standardized risk disclosure document prepared by the SEC, to provide the

customer with current bid and offer quotations for the penny stock, the

compensation of the broker-dealer and its salesperson in the transaction,

monthly account statements showing the market value of each penny stock held in

the customer’s account, to make a special written determination that the penny

stock is a suitable investment for the purchaser and receive the purchaser’s

written agreement to the transaction. These disclosure requirements

may have the effect of reducing the level of trading activity, if any, in the

secondary market for a stock that is subject to the penny stock

rules. Since our securities are subject to the penny stock rules,

investors in the shares may find it more difficult to sell their shares in any

market which may develop in the future. Many brokers have decided not

to trade in penny stocks because of the requirements of the penny stock rules

and, as a result, the number of broker-dealers willing to act as market makers

in such securities is limited. The reduction in the number of

available market makers and other broker-dealers willing to trade in penny

stocks may limit the ability of purchasers in this offering to sell their stock

in any secondary market which could develop in the future. These

penny stock regulations, and the restrictions imposed on the resale of penny

stocks by these regulations, could adversely affect our stock price if a public

trading market for our stock is established in the future.

Our board of directors can, without

stockholder approval, cause preferred stock to be issued on terms that adversely

affect common stockholders.

Under our

articles of incorporation, our board of directors is authorized to issue up to

10,000,000 shares of preferred stock, only 958,033 of which are issued and

outstanding as of the date of this prospectus, and to determine the price,

rights, preferences, privileges and restrictions, including voting rights, of

those shares without any further vote or action by our stockholders, except as

limited by the rights under our Series A Preferred Stock. If the

board causes any additional preferred stock to be issued, the rights of the

holders of our common stock could be adversely affected. The board’s

ability to determine the terms of preferred stock and to cause its issuance,

while providing desirable flexibility in connection with possible acquisitions

and other corporate purposes, could have the effect of making it more difficult

for a third party to acquire a majority of our outstanding voting

stock. Additional preferred shares issued by the board of directors

could include voting rights, or even super voting rights, which could shift the

ability to control the company to the holders of the preferred

stock. These preferred shares could also have conversion rights into

shares of common stock at a discount to the market price of the common stock

which could negatively affect the market for our common stock. In

addition, preferred shares would have preference in the event of liquidation of

the corporation, which means that the holders of preferred shares would be

entitled to receive the net assets of the corporation distributed in liquidation

before the common stock holders receive any distribution of the liquidated

assets.

9

We have not paid, and do not intend

to pay, dividends on our common shares and therefore, unless our common stock

appreciates in value, our investors may not benefit from holding our common

stock.

We have

not paid any cash dividends since inception. We do not anticipate

paying any cash dividends on our common stock in the foreseeable

future. In addition, provisions in our Investment Agreement with DMRJ

Group restrict our ability to declare and pay dividends on common stock as long

as we have outstanding obligations to DMRJ Group. Nevertheless, if

our common stock is not quoted on the OTC Bulletin Board or listed on a senior

exchange on or before July 13, 2011, and during any period we fail to maintain a

quotation or listing for our common stock, the holders of the Series A Preferred

Stock shares are entitled to quarterly dividends equal to 10% of our

consolidated net income for each quarter commencing with the quarter beginning

July 1, 2011. In addition they are entitled to dividends or

distributions made to the holders of our common stock to the same extent as if

such holders of the Series A shares had converted their preferred shares into

common stock. As a result, our common stock investors will not be able to

benefit from owning our common stock unless a market for our common stock

develops in the future and the market price of our common stock becomes greater

than the price paid for the stock by these investors.

Any public trading market for our

common stock which may develop in the future will likely be a volatile one and

will generally result in higher spreads in stock prices.

If a

public trading market for our common stock develops in the future, it would

likely be in the over-the-counter market by means of the OTC Bulletin

Board. The over-the-counter market for securities has historically

experienced extreme price and volume fluctuations during certain

periods. These broad market fluctuations and other factors, such as

our ability to implement our business plan pertaining to the Gold Hill

properties, as well as economic conditions and quarterly variations in our

results of operations, may adversely affect the market price of our common

stock. In addition, the spreads on stock traded through the

over-the-counter market are generally unregulated and higher than on the NASDAQ

or other exchanges, which means that the difference between the price at which

shares could be purchased by investors on the over-the-counter market compared

to the price at which they could be subsequently sold would be greater than on

these exchanges. Significant spreads between the bid and asked prices

of the stock could continue during any period in which a sufficient volume of

trading is unavailable or if the stock is quoted by an insignificant number of

market makers. We cannot insure that our trading volume will be

sufficient to significantly reduce this spread, or that we will have sufficient

market makers to affect this spread. These higher spreads could

adversely affect investors who purchase the shares at the higher price at which

the shares are sold, but subsequently sell the shares at the lower bid prices

quoted by the brokers. Unless the bid price for the stock increases

and exceeds the price paid for the shares by the investor, plus brokerage

commissions or charges, the investor could lose money on the

sale. For higher spreads such as those on over-the-counter stocks,

this is likely a much greater percentage of the price of the stock than for

exchange listed stocks. There is no assurance that at the time the

investor wishes to sell the shares, the bid price will have sufficiently

increased to create a profit on the sale.

There

may be conflicts of interest between our outside legal counsel who assisted us

in preparation of the registration statement of which this prospectus is a part

and our company because of the ownership of shares of our company by

him.

The

attorney who prepared the registration statement of which this prospectus is a

part is also a shareholder which creates the potential for a conflict of

interest in his representation of our company. He owns 15,000 shares

of our common stock which represents less than 1% of the outstanding

shares. Conflicts of interest create the risk that he may have an

incentive to act adversely to the interests of the company, especially where he

would have a pecuniary interest in selling his shares in the

future. Further, our attorney’s pecuniary interest may at some point

compromise his fiduciary duty to our company, in which event he would likely

resign and we would be required to retain new counsel.

10

Rule

144 will not be available for the outstanding shares acquired after 1995 for a

period of at least one year after the original filing date of the registration

statement of which this prospectus is a part, which means that these

shareholders may not be able to sell their shares in the open market during this

period.

Rule 144,

as recently amended, does not permit reliance upon this rule for the resale of

shares sold after the issuer first became a shell company, until the issuer

meets certain requirements, including cessation as a shell company, the filing

of a registration statement, and the filing for a period of one year periodic

reports required under the Exchange Act. We estimate that

approximately 1,416,074 of our outstanding shares, excluding the shares included

for resale in this prospectus, were purchased after the company first became a

shell company in 1995. In addition, we believe all of the issued and

outstanding shares of the selling stockholders in this prospectus were acquired

after 1995, which means that these persons would not be able to sell their

shares during this waiting period except pursuant to this

prospectus. If for any reason we withdraw this registration statement

or fail to file our periodic reports, these persons may not be able to publicly

resell their shares.

FORWARD-LOOKING

STATEMENTS

The

statements contained in this prospectus that are not historical facts,

including, but not limited to, statements found in the section entitled “Risk

Factors,” are forward-looking statements that represent management’s beliefs and

assumptions based on currently available information. Forward-looking

statements include the information concerning our possible or assumed future

results of operations, business strategies, need for financing, competitive

position, potential growth opportunities, potential operating performance

improvements, ability to retain and recruit personnel, the effects of

competition and the effects of future legislation or

regulations. Forward-looking statements include all statements that

are not historical facts and can be identified by the use of forward-looking

terminology such as the words “believes,” “intends,” “may,” “should,”

“anticipates,” “expects,” “could,” “plans,” or comparable terminology or by

discussions of strategy or trends. Although we believe that the

expectations reflected in such forward-looking statements are reasonable, we

cannot give any assurances that these expectations will prove to be

correct. Such statements by their nature involve risks and

uncertainties that could significantly affect expected results, and actual

future results could differ materially from those described in such

forward-looking statements.

Among the

factors that could cause actual future results to differ materially are the

risks and uncertainties discussed in this prospectus. While it is not

possible to identify all factors, we continue to face many risks and

uncertainties including, but not limited to, the following:

|

|

·

|

environmental

hazards;

|

|

|

·

|

metallurgical

and other processing problems;

|

|

|

·

|

unusual

or unexpected geological

formations;

|

|

|

·

|

global

economic and political conditions;

|

|

|

·

|

disruptions

in credit and financial markets;

|

|

|

·

|

global

productive capacity;

|

|

|

·

|

changes

in product costing; and

|

|

|

·

|

competitive

technology positions and operating interruptions (including, but not

limited to, labor disputes, leaks, fires, flooding, landslides, power

outages, explosions, unscheduled downtime, transportation interruptions,

war and terrorist activities).

|

Mining

operations are subject to a variety of existing laws and regulations relating to

exploration, permitting procedures, safety precautions, property reclamation,

employee health and safety, air and water quality standards, pollution and other

environmental protection controls, all of which are subject to change and are

becoming more stringent and costly to comply with. Should one or more

of these risks materialize (or the consequences of such a development worsen),

or should the underlying assumptions prove incorrect, actual results could

differ materially from those expected. We disclaim any intention or

obligation to update publicly or revise such statements whether as a result of

new information, future events or otherwise.

The risk

factors discussed in “Risk Factors” above could cause our results to differ

materially from those expressed in forward-looking statements. There

may also be other risks and uncertainties that we are unable to predict at this

time or that we do not now expect to have a material adverse impact on our

business.

We will

not receive any proceeds from the sale of the common stock by the selling

stockholders.

11

Market

Information

There is

currently no public market for our common stock and it is not currently quoted

or traded on any established public trading market. We intend to make

application for quotation of our common stock on the OTC Bulletin Board promptly

following the effective date of the registration statement of which this

prospectus is a part.

At January

7, 2011, we had no options or warrants outstanding, but we did have outstanding

promissory notes convertible into shares of our common stock. These

three-year notes in the principal aggregated amount of $600,000 were issued on

November 30, 2009, and bear interest at 15% which is payable

monthly. The principal amount of these notes and interest are

convertible into our common shares at any time through November 30, 2012, at the

rate of $0.70 per share. The principal on these notes is convertible

into approximately 857,143 shares as of the maturity date of the

notes. If we fail to repay the loans at maturity, we have agreed to

issue additional shares to the lenders at the rate of one share for each $2.00

owed at maturity and the maturity date will be extended for one

year. We also have outstanding 958,033 shares of Series A Preferred

stock which are convertible into 958,033 shares of common

stock.

We have

granted registration rights only to the selling stockholders

herein. We have not proposed to publicly offer any shares of our

common stock in a primary offering.

Availability

of Rule 144

Rule 144

was adopted by the SEC to provide shareholders a safe harbor which, if followed,

would allow shareholders an opportunity to publicly resell restricted or control

securities without registration. However, Paragraph (i) of Rule 144

states that the provisions of the rule are not available for the resale of

securities initially issued by a shell company, or a company which at the time

of issuance had ever been a shell company, until certain conditions are

met. These conditions include the following: the issuer had ceased to

be a shell company; it is subject to the reporting requirements of the Exchange

Act; it has filed all reports and other materials required during the last 12

months, or for a shorter period it was required to file the reports; it has

filed “Form 10 information;” and one year has elapsed from the date the “Form 10

information” was filed. We ceased principal operations in 1995 and

became a shell company. Although management does not believe we are

currently a shell company, as a former shell company, our shareholders will not

be able to rely on Rule 144 until at least one year from the filing date of the

registration statement of which this prospectus is a part, except for

shareholders owning shares which were issued by us prior to the time we first

became a shell company in 1995. Management estimates that

approximately 1,198,729 shares were issued prior to 1995 and would be eligible

for resale pursuant to Rule 144.

Holders

At January

7, 2011, we had approximately 605 holders of our common stock. The

number of record holders was determined from the records of our transfer agent

and does not include beneficial owners of common stock whose shares are held in

the names of various security brokers, dealers, and registered clearing

agencies. We have appointed Over the Counter Stock Transfer, 231 East

2100 South, Salt Lake City, UT 84115, to act as the transfer agent of our common

stock. We act as our own transfer agent for the Series A Preferred

Stock.

Dividends

We have

never declared or paid any cash dividends on our common stock. We do

not anticipate paying any cash dividends to stockholders of our common stock in

the foreseeable future. In addition, any future determination to pay

cash dividends will be at the discretion of the Board of Directors and will be

dependent upon our financial condition, results of operations, capital

requirements, and such other factors as the Board of Directors deem

relevant.

12

So long

as we have any outstanding obligations to DMRJ Group under the provisions of our

Investment Agreement, we are prohibited from declaring or paying any dividends,

except on our Series A Preferred Stock. In addition, we are

prohibited from declaring a dividend on our common stock if at the time any

dividends on our Series A Preferred Stock are unpaid.

The

holders of the Series A shares are entitled to quarterly dividends equal to 10%

of our consolidated net income for each quarter commencing with the quarter

beginning July 1, 2011. Nevertheless, if our common stock is quoted

on the OTC Bulletin Board or listed on a senior exchange on or before July 13,

2011, and so long as the common stock continues to be so quoted or listed, no

quarterly dividends will be payable or accrue. In addition they are

entitled to dividends or distributions made to the holders of our common stock

to the same extent as if such holders of the Series A shares had converted their

preferred shares into common stock.

Securities

Authorized for Issuance under Equity Compensation Plans

The

following table sets forth as of the most recent fiscal year ended December 31,

2010, certain information with respect to compensation plans (including

individual compensation arrangements) under which our common stock is authorized

for issuance:

|

Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

(a)

|

Weighted-average exercise

price of outstanding

options, warrants and

rights

(b)

|

Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a) and

(b))

(c)

|

||||||||||

|

Equity

compensation plans approved by security holders1

|

-0- | — | 2,413,333 | |||||||||

|

Equity

compensation plans not approved by security holders

|

-0- | -0- | -0- | |||||||||

|

Total

|

-0- | -0- | 2,413,333 | |||||||||

|

1

|

As

originally adopted, our 2008 Stock Option/Stock Issuance Plan authorized

the granting of up to 15,000,000 shares, either as stock options or

restricted stock grants. As a result of a stock split effective

April 30, 2009, the number of shares authorized under the plan was reduced

to 1,250,000,

and on February 28, 2010, the plan was amended to increase the number of

shares authorized under the plan to 3,000,000, of which 586,667 had

been issued as stock grants under the plan prior to December 31, 2010,

leaving 2,413,333 shares available for future issuance under the

plan. No options had been granted under the plan as of December

31, 2010.

|

In July

2008 the Board of Directors adopted the 2008 Stock Option/Stock Issuance Plan,

which was approved by our shareholders in August 2008. The purpose of

the plan is to provide eligible persons an opportunity to acquire a proprietary

interest in our company and as an incentive to remain in our

service.

In

February 2010 we amended the plan to increase the number of shares available

from 1,250,000 to 3,000,000 shares of common stock which are authorized for

nonstatutory and incentive stock options and stock grants under the plan, which

are subject to adjustment in the event of further stock splits, stock dividends,

and other situations. So long

as we have any outstanding obligations to DMRJ Group, we are restricted to

granting options or issuing shares under the plan in excess of 1,100,000 shares,

of which we have issued 586,667 shares as of January 7,

2011.

The plan

is administered by the Board of Directors. The persons eligible to

participate in the plan are as follows: (a) employees of our company and any of

its subsidiaries; (b) non-employee members of the board or non-employee members

of the Board of Directors of any of its subsidiaries; and (c) consultants and

other independent advisors who provide services to us or any of our

subsidiaries. Options may be granted, or shares issued, only to

consultants or advisors who are natural persons and who provide bona fide

services to us or one of our subsidiaries, provided that the services are not in

connection with the offer or sale of securities in a capital-raising

transaction, and do not directly or indirectly promote or maintain a market for

our securities.

13

The plan

will continue in effect until all of the stock available for grant or issuance

has been acquired through exercise of options or grants of shares, or until July

12, 2018, whichever is earlier. The plan may also be terminated in

the event of certain corporate transactions such as a merger or consolidation or

the sale, transfer or other disposition of all or substantially all of our

assets.

Management’s

Discussion and analysis of Financial Condition and Results of Operations

analyzes the major elements of our balance sheets and statements of

income. This section should be read in conjunction with our

Consolidated Financial Statements and accompanying notes and other detailed

information included in this prospectus.

Overview

We are a

mineral exploration company with proposed projects located in the Gold Hill

Mining District in Tooele County, Utah. We are currently focused on

extracting mineralized material from the Yellow Hammer claims for processing at

the Cactus Mill pilot plant, and completing the permitting process for our

Kiewit claims and construction of a heap leach facility near these

claims. We are also in the process of seeking an amendment to our

current mill site permit to allow us to construct and operate a heap leach

facility near the pilot mill. We propose to extract any copper, gold,

and silver from the mineralized material and sell the concentrate in readily

available markets. We also intend to extract tungsten and to

attempt to locate a market to sell any product extracted from the mineralized

material.

We were

originally incorporated in the State of Idaho on November 5,