Attached files

| file | filename |

|---|---|

| 8-K - SUN HEALTHCARE GROUP INC | form8k.htm |

| EX-99.1 - SUN HEALTHCARE GROUP INC | ex99-1.htm |

EXHIBIT 99.2

JPMorgan Healthcare Conference

San Francisco, CA

January 10, 2011

1

Statements made in this Confidential Information Memorandum that are not historical facts are "forward-looking" statements (as

defined in the Private Securities Litigation Reform Act of 1995) that involve risks and uncertainties and are subject to change at any

time. These forward-looking statements may include, but are not limited to, statements containing words such as "anticipate,"

"believe," "plan," "estimate,” "expect,” "hope,” "intend,” "may” and similar expressions. Forward-looking statements in this

Confidential Information Memorandum also include all statements regarding expected financial position, results of operations, cash

flows, liquidity, financing plans, business strategy, growth opportunities, plans and objectives of management for future operations,

the impact of reductions in reimbursements and other changes in government reimbursement programs and the timing and impact of

the proposed restructuring transactions. Factors that could cause actual results to differ are identified in the public filings made by

Sun with the Securities and Exchange Commission and include changes in Medicare and Medicaid reimbursements; the impact that

healthcare reform legislation will have on Sun’s business; Sun’s ability to maintain the occupancy rates and payor mix at Sun’s

healthcare centers; potential liability for losses not covered by, or in excess of, Sun’s insurance; the effects of government

regulations and investigations; the significant amount of Sun’s indebtedness, covenants in Sun’s debt agreements that may restrict

Sun’s activities and Sun’s ability to make acquisitions, incur more indebtedness; the impact of the current economic downturn on

Sun’s business; the ability of Sun to collect its accounts receivable on a timely basis; increasing labor costs and the shortage of

qualified healthcare personnel; and Sun’s ability to receive increases in reimbursement rates from government payors to cover

increased costs. More information on factors that could affect Sun’s business and financial results are included in Sun’s public filings

made with the Securities and Exchange Commission, including Sun’s Annual Report on Form 10-K and Quarterly Reports on Form

10-Q, copies of which are available on Sun’s web site, www.sunh.com. There may be additional risks of which Sun is presently

unaware or that Sun currently deems immaterial.

defined in the Private Securities Litigation Reform Act of 1995) that involve risks and uncertainties and are subject to change at any

time. These forward-looking statements may include, but are not limited to, statements containing words such as "anticipate,"

"believe," "plan," "estimate,” "expect,” "hope,” "intend,” "may” and similar expressions. Forward-looking statements in this

Confidential Information Memorandum also include all statements regarding expected financial position, results of operations, cash

flows, liquidity, financing plans, business strategy, growth opportunities, plans and objectives of management for future operations,

the impact of reductions in reimbursements and other changes in government reimbursement programs and the timing and impact of

the proposed restructuring transactions. Factors that could cause actual results to differ are identified in the public filings made by

Sun with the Securities and Exchange Commission and include changes in Medicare and Medicaid reimbursements; the impact that

healthcare reform legislation will have on Sun’s business; Sun’s ability to maintain the occupancy rates and payor mix at Sun’s

healthcare centers; potential liability for losses not covered by, or in excess of, Sun’s insurance; the effects of government

regulations and investigations; the significant amount of Sun’s indebtedness, covenants in Sun’s debt agreements that may restrict

Sun’s activities and Sun’s ability to make acquisitions, incur more indebtedness; the impact of the current economic downturn on

Sun’s business; the ability of Sun to collect its accounts receivable on a timely basis; increasing labor costs and the shortage of

qualified healthcare personnel; and Sun’s ability to receive increases in reimbursement rates from government payors to cover

increased costs. More information on factors that could affect Sun’s business and financial results are included in Sun’s public filings

made with the Securities and Exchange Commission, including Sun’s Annual Report on Form 10-K and Quarterly Reports on Form

10-Q, copies of which are available on Sun’s web site, www.sunh.com. There may be additional risks of which Sun is presently

unaware or that Sun currently deems immaterial.

The forward-looking statements involve known and unknown risks, uncertainties and other factors that are, in some cases, beyond

Sun’s control. Sun cautions that any forward-looking statements made by Sun are not guarantees of future performance. Sun

disclaims any obligation to update any such factors or to announce publicly the results of any revisions to any of the forward-looking

statements to reflect future events or developments.

Sun’s control. Sun cautions that any forward-looking statements made by Sun are not guarantees of future performance. Sun

disclaims any obligation to update any such factors or to announce publicly the results of any revisions to any of the forward-looking

statements to reflect future events or developments.

References to “Sun” refer to Sun Healthcare Group, Inc. and its subsidiaries

Forward-Looking Statements

2

References are made in this presentation to EBITDA, EBITDA margin, EBITDAR and EBITDAR margin, which are non-GAAP

financial measures. EBITDA is defined as net income before loss (gain) on discontinued operations, interest expense (net of interest

income), income tax expense (benefit) and depreciation and amortization. EBITDA margin is EBITDA as a percentage of revenue.

EBITDAR is EBITDA before rent expense and EBITDAR margin is EBITDAR as a percentage of revenue. Sun believes that

EBITDA, EBITDA margin, EBITDAR and EBITDAR margin provide useful information regarding Sun's operational performance

because these financial measures enhance the overall understanding of the financial performance and prospects for the future of

Sun's core business activities, provide consistency in Sun's financial reporting and provide a basis for the comparison of results of

core business operations between current, past and future periods. These measures are also some of the primary indicators Sun

uses for planning and forecasting in future periods, including trending and analyzing the core operating performance of its business

from period to period without the effect of GAAP expenses, revenues and gains that are unrelated to day-to-day performance.

Non-GAAP Financial Measures

3

Ø Attractive industry fundamentals

§ Healthcare policy favors SNFs - delivers effective clinical outcomes at lower costs

§ Favorable demographics - Increasing senior population

§ Number of SNF beds has steadily declined creating favorable supply / demand dynamics

Ø Nationally diversified portfolio of centers and services

§ Focus on high acuity and clinically complex patients

§ Urban and rural markets

Ø Proven and experienced management team

§ Consistent operating performance

§ No change in operating management

Investment Highlights

4

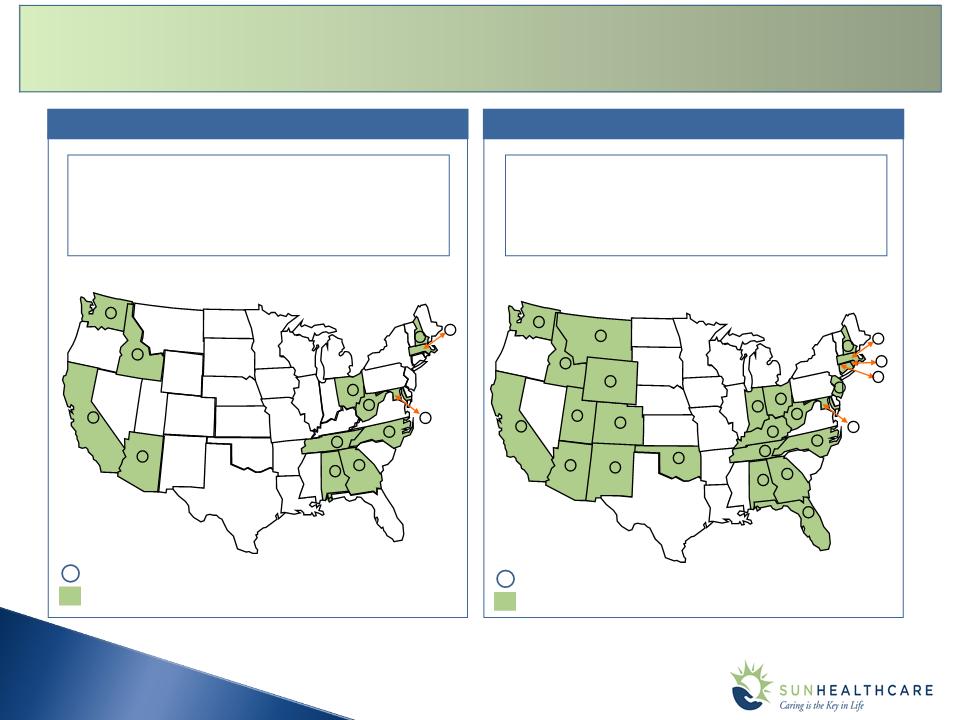

Number of Centers Per State

States with Centers

IN 2005: Sun Operated 104 Inpatient Centers in 13 States

7

7

22

1

1

11

9

5

7

9

8

10

7

A History of Portfolio Expansion & Growth

Number of Centers Per State

States with Centers

TODAY (1): Sun Operates 202 Inpatient Centers in 25 States

5

5

11

15

1

1

9

1

9

9

2

20

3

18

10

1

15

2

17

7

9

8

8

9

7

Revenue ($M’s) $882.1

Normalized EBITDAR ($M’s) 60.6

Margin 6.9%

Skilled Mix 16.1%

Length of Stay 37 Days

Revenue ($M’s) $1,897.3

Normalized EBITDAR ($M’s) 248.5

Margin 13.0%

Skilled Mix 19.2%

Length of Stay 30 Days

(1) LTM September 30, 2010

5

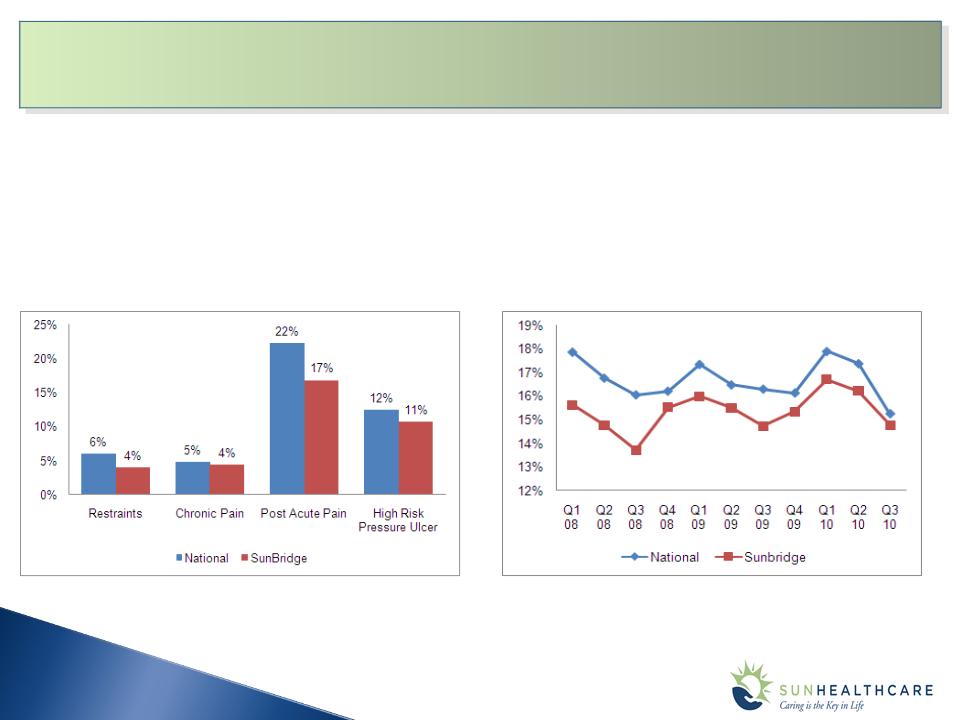

…With Patient Care As Its Top Priority

Ø Based on a recent independent survey, 86% of our current residents/patients would recommend our

center to others; 87% expressed overall satisfaction

center to others; 87% expressed overall satisfaction

Trend in Rehospitalizations

§ By responding to medical condition changes, return-to-

hospital rates are markedly lower than our peers

hospital rates are markedly lower than our peers

Quality Measures

§ Key quality metrics continue to improve and trend

better than national averages

better than national averages

The above graph represents the percent of patients rehospitalized within 20

days of admission to a skilled nursing center. Patients are more prone to

hospital readmissions within 20 days following acute hospitalization.

days of admission to a skilled nursing center. Patients are more prone to

hospital readmissions within 20 days following acute hospitalization.

6

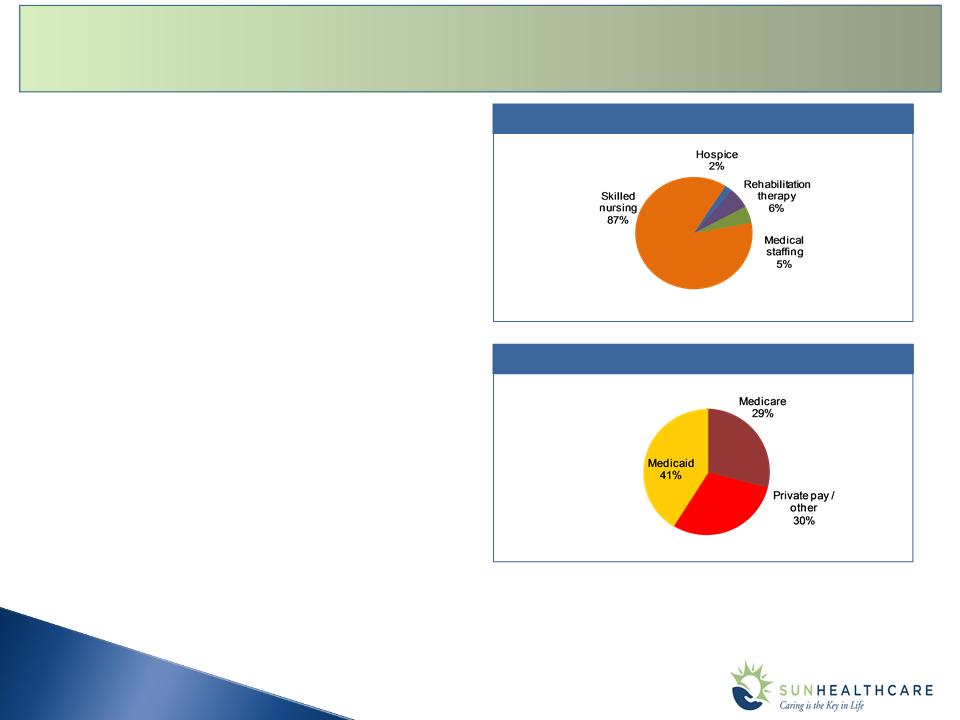

Skilled Nursing Services (SunBridge)

§ 202 skilled nursing centers

§ 19,500 patients/residents

Hospice Services (SolAmor)

§ Growing business operating in 10 states with

20 offices with 4 startups

20 offices with 4 startups

Rehabilitation Therapy Services (SunDance)

§ Contract services, rehab agency,

management services

management services

§ 344 contracts with non-affiliated entities

§ Provides services to substantially all

SunBridge skilled nursing centers

SunBridge skilled nursing centers

Medical Staffing Services (CareerStaff)

§ Primarily hospital setting (also serves SNFs,

schools, prisons)

schools, prisons)

§ 60% + of billings are for therapists (also

provide nursing and pharmacy services)

provide nursing and pharmacy services)

9/30/10 LTM Net Revenue = $1.9 billion

9/30/10 LTM Net Revenue = $1.9 billion

Note: Inpatient segment includes both the SunBridge & SolAmor business lines

Net Revenue by Line of Business

Net Revenue by Source

Sun Healthcare Today

SunBridge Healthcare Corporation

Ø Centers include skilled nursing centers,

assisted living centers and independent living

centers

assisted living centers and independent living

centers

Ø Provides services that:

§ Focus on higher acuity, short-term stay

patients

patients

§ Include specialty services that address local

market needs

market needs

Ø 67 centers have Rehab Recovery Suites

(“RRS”) with 1,647 beds as of September 30,

2010

(“RRS”) with 1,647 beds as of September 30,

2010

§ Specialize in Medicare / managed care

patients

patients

Ø 46 wings dedicated to Alzheimer’s

patients (Solana)

patients (Solana)

SunBridge

|

OPERATING PROFILE

as of September 30, 2010

|

|

|

Centers

States

|

202

25

|

|

Property Type:

Skilled Nursing

SNF/AL/IL

AL

Mental Health

IL

|

166 (82%)

16 (8%)

10 (5%)

8 (4%)

2 (1%)

|

|

Beds:

Licensed

Available

|

23,189

22,407

|

|

YTD 9/30/10 Occupancy %

|

87.1%

|

|

SNF Skilled Mix:(YTD 9/30/10)

% of Patient Days

% of SNF Revenue

|

19.2%

37.9%

|

7

SolAmor Hospice Corporation

ØProvides hospice services in affiliated skilled

nursing centers, non-affiliated skilled nursing

centers and the patient’s home

nursing centers, non-affiliated skilled nursing

centers and the patient’s home

ØOperates in 10 states; 9 of which have

affiliated skilled nursing centers

affiliated skilled nursing centers

§ Synergistic service as 6% - 10% of patients

in SNFs eligible for hospice services

in SNFs eligible for hospice services

ØHistorical growth due to de novo start-ups and

acquisitions

acquisitions

§ Holisticare in 2008

§ Allegiance in 2009

§ Countryside in 2010

ØStrong contributor to earnings

SolAmor

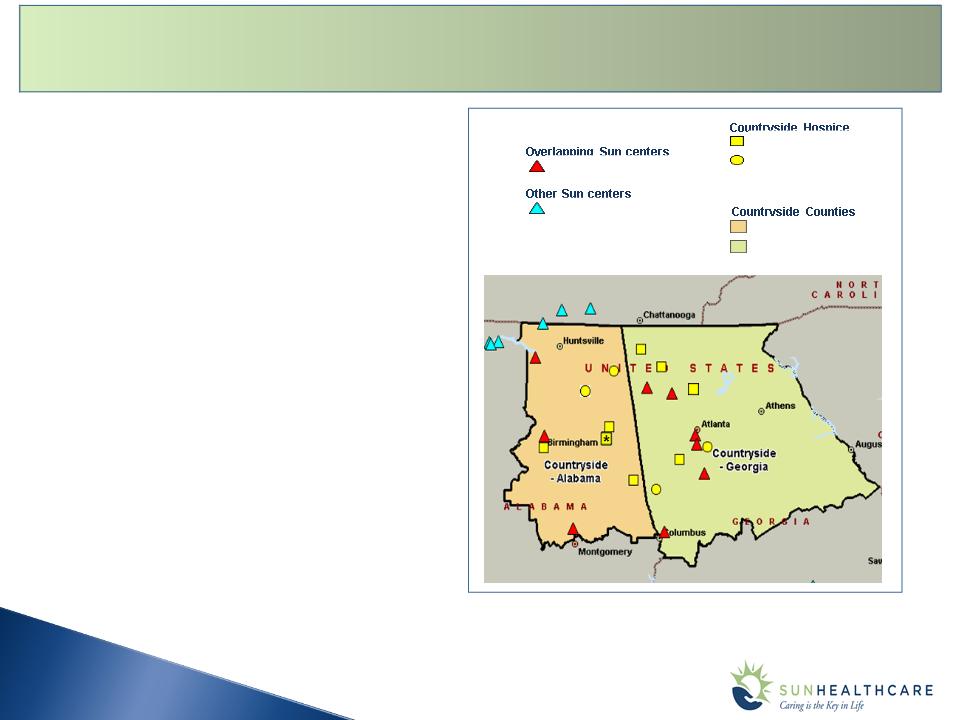

8

Average Daily Census

Acquisition Rationale:

ØGood geographic overlap to our SunBridge

portfolio

portfolio

§ 7 existing offices / 4 startup offices -

growing or opening in 2011

growing or opening in 2011

§ Shares markets with 9 existing

SunBridge centers

SunBridge centers

§ Expands SolAmor platform to ten states

and approximately 1,050 patients daily

and approximately 1,050 patients daily

ØOpportunity to grow in SNF settings (initially a

home-based business)

home-based business)

ØNew presence in 2 markets (AL & GA) with

barriers to entry:

barriers to entry:

§ Alabama is not issuing any new

provider licenses for Hospice unless

you are already a certified provider

provider licenses for Hospice unless

you are already a certified provider

§ Georgia is a lengthy process

Countryside Hospice Care, Inc. Acquisition

9

Sun center

Other Sun centers

Countryside

Countryside - Startup

Countryside - Alabama

Countryside - Georgia

SunDance Rehabilitation Corporation

Ø Broad array of rehabilitation therapy services

for post acute patients provided in skilled

nursing centers and assisted living facilities

for post acute patients provided in skilled

nursing centers and assisted living facilities

Ø Provides rehabilitation therapy services to 476

centers in 37 states

centers in 37 states

§ 344 centers operated by non-affiliated

parties

parties

§ 132 SNF centers operated by SunBridge

§ In most of the remaining 50 affiliated SNF

centers, services provided by staff employed

by center

centers, services provided by staff employed

by center

Ø Approximately 60% of revenue from non-

affiliated sources

affiliated sources

SunDance

10

Revenue

Revenue Per Contract

($ in thousands)

CareerStaff Unlimited, Inc.

Ø Provides temporary medical staffing to

hospitals, skilled nursing facilities, schools and

prisons

hospitals, skilled nursing facilities, schools and

prisons

§ Approximately 60% of billings are for

therapists

therapists

Ø Operates in 36 states

§ National network of 33 branches with 27

offices

offices

Ø Diversified staffing approach:

§ Per diem, travel and permanent placement

§ Places a wide array of healthcare

professionals: therapists, nurses,

pharmacists, and physicians

professionals: therapists, nurses,

pharmacists, and physicians

Ø Full-service human resources manager

CareerStaff

11

Revenue

EBITDA and margin

($ in millions)

12

POSITIONING FOR THE FUTURE

Leveraging Opportunities in the Care Chain

13

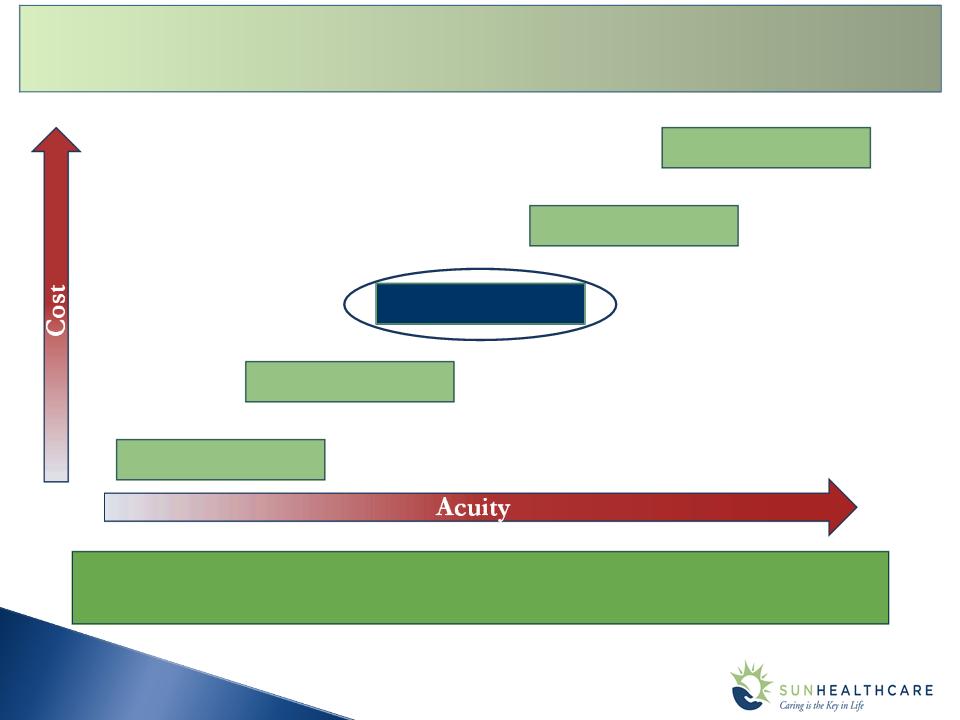

Acute Care

LTAC

SNF

Assisted Living

Home Based Care

Sweet Spot - Lower Cost Provider to Higher Acuity Patients = Higher

Margins and Greater Opportunities

Margins and Greater Opportunities

14

Resource Utilization Group (RUG) payment system

Ø Payments to SNFs vary based on the intensity of clinical services provided to Medicare

patients

patients

Ø Resource Utilization Group IV (RUG IV) system replaced existing RUG III system

effective October 1, 2010

effective October 1, 2010

Ø The new RUG IV system:

§ Updated the RUG III system by changing and refining the 53 categories in RUG III to

create 66 categories that more accurately reflect the cost of services provided

create 66 categories that more accurately reflect the cost of services provided

§ 13 new RUGs categories focused on medical complexity

§ Eliminates the lookback period

§ Changes the reimbursement level for therapy delivered concurrently

RUG IV: What It Means

**Positive Opportunity for Sun**

15

Ø Near Term: RUG IV Medicare System Implementation

§ RUG IV continues to place emphasis on higher acuity patients

§ Requires centers to optimize therapy delivery using a combination of individual, group, concurrent and

nursing rehabilitation to increase efficiency

nursing rehabilitation to increase efficiency

§ New rate structure creates new opportunities for a broader array of clinically complex patients

Ø Longer Term: Continued focus on post-acute care solutions

§ Accountable Care Organizations (ACO) will need to partner with high acuity SNFs to provide faster

discharges and lower levels of readmission

discharges and lower levels of readmission

§ Focus shifts to patient pathway from individual-setting reimbursement

Ø SNFs will play an integral role in multi-provider systems

§ Cost savings are real and proven

§ Clinical capabilities continue to increase and broaden

Reimbursement Evolution Favors SNFs

Further Expansion of Product & Service Offering

16

Ø Expand clinical products/services to improve ability to capture clinically complex patients

§ Upgrade complement of clinicians and their skill sets

§ Focus on clinical competencies

• Tracheotomy care, HIV / Isolation, advanced IV capabilities, etc.

§ Expand packaging and selling of clinical service offerings

Ø Specialty unit development in markets that provide unique opportunities (e.g. ventilator

program)

program)

Ø Rehab Recovery Suites remain a relevant strategy to attract and care for short-term high-

acuity patients

acuity patients

§ Anticipate adding 600 new beds in 2011 or 31% growth in capacity

• 2,580 beds covering nearly 70% of the urban-based centers

17

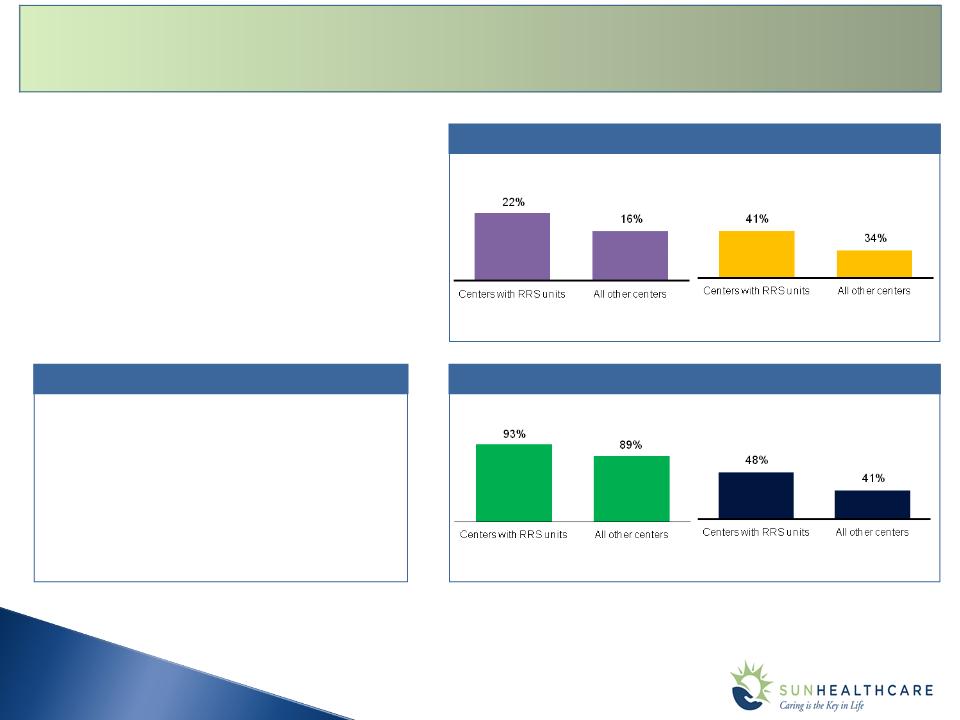

Rehab Recovery Suites - Product Profile

Rehab Recovery Suites (RRS)

ØSeparate and distinct units within a center

ØEnhanced therapy and clinical product

ØHospitality services - dedicated concierge

Skilled Mix (Q3 ’10)

Acuity - Rehab / Rehabilitation Extensive Services (Q3 ’10)

% of Days

% of Revenue

Rehab

REX

n Number of centers: 67

n Number of beds: 1,647

n Average bed size: 25 beds per center

n Cost / bed: $25,000

n Development time: 6 - 9 months

RRS Metrics

Long-Term Asset Modernization Initiative

ØLong term capital investment strategy

designed to upgrade, reconfigure and fully

renovate nursing centers

designed to upgrade, reconfigure and fully

renovate nursing centers

§ Focus on privacy for patients, enhanced

amenities/public spaces, designated units

with specific purpose

amenities/public spaces, designated units

with specific purpose

§ Create improved work environment for

staff and attending physicians to enhance

ability to deliver care

staff and attending physicians to enhance

ability to deliver care

§ Upgrade therapy and external

environment to enhance living experience

and create unique exercise venues

environment to enhance living experience

and create unique exercise venues

ØSelection is dictated by market demographics,

competitive profile and return on investment

competitive profile and return on investment

ØCurrently committed to renovate 17 centers

ØPartnering with landlords (REITs) to fund

many of these projects and paying a cost of

capital add on to rent

many of these projects and paying a cost of

capital add on to rent

18

Focus on skilled nursing

growth

growth

Ø Increase skilled nursing

revenue and contribution by

revenue and contribution by

§ Maintaining high

occupancy rates

occupancy rates

§ Continue focus on high

acuity and Medicare

patients

acuity and Medicare

patients

§ Expand product array for

clinically complex

patients

clinically complex

patients

§ Partnering with local

medical communities

medical communities

Seek growth in ancillary

businesses

businesses

Ø Grow hospice operations and

leverage new acquisition

leverage new acquisition

§ Synergistic to skilled nursing

business

business

Ø Focus on rehabilitation therapy

business by

business by

§ Expanding product offerings

§ Improving labor productivity

and profitability

and profitability

Utilize Sun’s financial

flexibility

flexibility

Ø Targeted acquisitions of

new skilled nursing centers

and ancillary-services

providers

new skilled nursing centers

and ancillary-services

providers

Ø Growth-oriented capital

spending

spending

§ RRS initiatives targeting

higher-acuity patients

higher-acuity patients

§ Modernization initiative

Sun’s Growth Strategy

19

20

2011 OUTLOOK

21

2011 Guidance

22

Portfolio:

Ø No acquisitions or dispositions beyond the recently

announced purchase of Countryside Hospice Care, Inc.

announced purchase of Countryside Hospice Care, Inc.

Ø Excludes results of operations of two nursing centers in

Oklahoma with leases expired at our option on

December 31, 2010 and one nursing center that we

expect to sell in 2011

Oklahoma with leases expired at our option on

December 31, 2010 and one nursing center that we

expect to sell in 2011

Reimbursement:

Ø Medicare rates:

§ Net positive impact to average Medicare rates from

RUG-IV, partially offset by:

RUG-IV, partially offset by:

− Labor and other costs associated with higher-

acuity patients

acuity patients

− Elimination of concurrent therapy

− Impact of Medicare Part B Multiple Procedure

Payment Reduction (MPPR)

Payment Reduction (MPPR)

Ø Medicaid rates, net of provider taxes, are expected to be

flat in 2011

flat in 2011

2011 Guidance Parameters

Post-Restructuring with Sabra:

Ø Sun currently leases 86 formerly owned centers from

Sabra, resulting in an increased rent of $70.4 million

Sabra, resulting in an increased rent of $70.4 million

Ø Operating leases

Ø Traditional triple net leases

Ø Lesser of CPI of 2.5% escalators

Capital:

Ø Capital expenditures in the range of $55 to $60 million

principally to support:

principally to support:

§ Routine maintenance and renovations for nursing

centers and IT systems

centers and IT systems

§ Build-out of more than 600 new beds for our Rehab

Recovery Suites, bringing our total to 2,580 and a

31% increase over 2010

Recovery Suites, bringing our total to 2,580 and a

31% increase over 2010

Ø Interest of approximately $20 million reflecting an average

debt balance of $150 million at a blended interest rate of

9%

debt balance of $150 million at a blended interest rate of

9%

§ $10 million required debt reduction

§ Includes $6.3 million related to Sun’s letter of credit

facility

facility

Ø Effective tax rate of 41% and 2011 cash income taxes paid

between $12 million and $14 million

between $12 million and $14 million

23

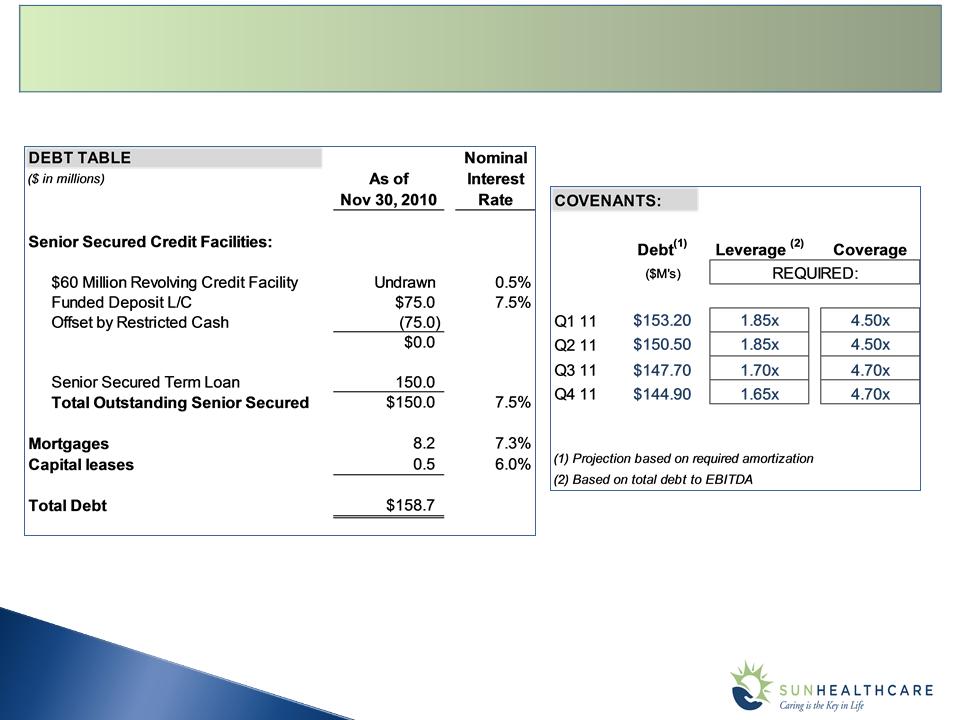

Debt Table & Bank Covenants

FREE CASH FLOW

24

*Based upon 2011 guidance

25