Attached files

| file | filename |

|---|---|

| EX-3.2 - Greatmat Technology Corp | v207558_ex3-2.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K/A

(Amendment

No. 1)

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of

Report (Date of Earliest Event Reported): October 30, 2010

Greatmat

Technology Corporation

(Exact

name of registrant as specified in its charter)

|

Nevada

|

000-53481

|

68-0681042

|

||

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Commission

File Number)

|

|

(IRS

Employer Identification

No.)

|

Room

2102-03, 21/F, Kingsfield Centre

18-20

Shell Street, North Point, Hong Kong

(Address

of principal executive offices)

Telephone

– 852-2891-2111

Aurum

Explorations, Inc.

(Former

Name)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see

General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a -12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d -2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e -4(c))

EXPLANATORY

NOTE

The

purpose of this Amended Current Report on Form 8-K/A is to amend certain Items

as listed below (together, the “Amended Items”) of our Current Report on Form

8-K which was filed with the Securities and Exchange Commission (the “SEC”) on

November 3, 2010 (the “Original 8-K”). These amendments are being

made (i) to address certain comments received from the Staff of the SEC with

respect to the Original 8-K, (ii) to correct certain errors discovered in the

unaudited consolidated financial statements of the Company’s recently acquired

subsidiary Greatmat Holdings Limited and subsidiaries for the six months ended

June 30, 2010 and the related pro forma financial information of the Company as

of and for the six months ended June 30, 2010, as well as the related discussion

in Management’s Discussion and Analysis of Financial Condition and Results of

Operations, and (iii) to file the unaudited consolidated financial statements of

the Company’s recently acquired subsidiary Greatmat Holdings Limited and

subsidiaries for the nine months ended September 30, 2010 and the related pro

forma financial information of the Company as of and for the nine months ended

September 30, 2010, and to add a comparison of the three and nine months ended

September 30, 2010 and 2009 to Management’s Discussion and Analysis of Financial

Condition and Results of Operations, which financial statements and related

information were not available at the time of the filing of the Original

8-K.

The

Amended Items are contained in the following sections: “Special Note Regarding

Forward Looking Statements,” Item 2.01 – Description of Business – Our Corporate

History and Background, —Customers, —Patents, —Trademarks, —Competition,

—Cyclicality, Item 2.01—Management’s Discussion and Analysis of Financial

Condition and Results of Operations—Results of Operations—Comparison of Three

Months Ended September 30, 2010 and 2009 (Unaudited), —Comparison of Nine Months

Ended September 30, 2010 and 2009 (Unaudited), —Comparison of Six Months Ended

June 30, 2010 and 2009 (Unaudited), —Comparison of Three Months Ended June 30,

2010 and 2009 (Unaudited), —Liquidity and Capital Resources, Item 2.01—Directors

and Executive Officers, Promoters and Control Persons—Directors and Executive

Officers, Item 2.01—Market Price and Dividends on our Common Equity and Related

Stockholder Matters, and Item 9.01—Financial Statements and Exhibits—(a)

Financial Statements of Business Acquired, (b) Pro Forma Financial Information,

and (d) Exhibits.

Except as stated herein, this Current

Report on Form 8-K/A does not reflect events occurring after the filing of the

Original 8-K on November 3, 2010 and no attempt has been made is this Current

Report on Form 8-K/A to modify or update other disclosures as presented in the

Original 8-K. Accordingly, this Form 8-K/A should be read in conjunction with

the Original 8-K and our filings with the SEC subsequent to the filing of the

Original 8-K.

In

particular, the body of this Amended Current Report on Form 8-K/A does not

reflect the amendment of the Company’s Articles of Incorporation filed on

December 22, 2010, pursuant to which the name of the Company was changed from

“Aurum Explorations, Inc.” to “Greatmat Technology Corporation,” the number of

authorized shares of common stock of the Company was increased from 50,000,000

to 100,000,000, and the outstanding shares of common stock of the Company were

combined in a 1-for-5 reverse stock split effective December 28,

2010.

1

SPECIAL

NOTE REGARDING FORWARD LOOKING STATEMENTS

This

report contains forward-looking statements. The forward-looking statements are

contained principally in the sections entitled “Description of Business,” “Risk

Factors,” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations.” These statements involve known and unknown risks,

uncertainties and other factors which may cause our actual results, performance

or achievements to be materially different from any future results, performances

or achievements expressed or implied by the forward-looking statements. In some

cases, you can identify forward-looking statements by terms such as

“anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,”

“plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar

expressions intended to identify forward-looking statements.

Forward-looking statements reflect our current views with respect to future

events and are based on assumptions and subject to risks and uncertainties.

Given these uncertainties, you should not place undue reliance on these

forward-looking statements. These forward-looking statements include, among

other things, statements relating to:

|

|

·

|

the impact that a downturn or

negative changes in the market for building materials may have on

sales.

|

|

|

·

|

our ability to obtain additional

capital in future years to fund our planned

expansion.

|

|

|

·

|

economic, political, regulatory,

legal and foreign exchange risks associated with our

operations.

|

|

|

·

|

the loss of key members of our

senior management and our qualified sales

personnel.

|

|

|

·

|

our continued relationship with

our single third-party manufacturer of our

goods.

|

Also,

forward-looking statements represent our estimates and assumptions only as of

the date of this report. You should read this report and the documents that we

reference and filed as exhibits to the report completely and with the

understanding that our actual future results may be materially different from

what we expect. Except as required by law, we assume no obligation to update any

forward-looking statements publicly, or to update the reasons actual results

could differ materially from those anticipated in any forward-looking

statements, even if new information becomes available in the

future.

Use

of Certain Defined Terms

Except

where the context otherwise requires and for the purposes of this report

only:

|

|

·

|

the “Company,” “we,” “us,” and

“our” refer to the combined business of (i) Aurum Explorations, Inc. or

“Aurum,” a Nevada corporation, (ii) Greatmat Holdings Limited, or

“Greatmat Holdings,” a BVI limited company and wholly-owned subsidiary of

Aurum, (iii) Greatmat Technology Limited, or “Greatmat Limited,” a Hong

Kong limited company and wholly-owned subsidiary of Greatmat Holdings,

(iv) Greatmat Technology (HK) Limited, or “Greatmat Hong Kong,” a Hong

Kong limited company and wholly-owned subsidiary of Greatmat Holdings, and

(v) Greatmat Technology (China) Limited, or “Greatmat China,” a BVI

limited company and wholly-owned subsidiary of Greatmat Holdings, as the

case may be;

|

|

|

·

|

“BVI” refers to the British

Virgin Islands;

|

|

|

·

|

“Exchange Act” refers to the

Securities Exchange Act of 1934, as

amended;

|

|

|

·

|

“Hong Kong” refers to the Hong

Kong Special Administrative Region of the People’s Republic of China and

“Hong Kong dollars” and “HK$” refer to the legal currency of Hong

Kong;

|

|

|

·

|

“PRC,” “China,” and “Chinese,”

refer to the People’s Republic of China (excluding Hong Kong and

Taiwan);

|

2

|

|

·

|

“Renminbi” and “RMB” refer to the

legal currency of China;

|

|

|

·

|

“Securities Act” refers to the

Securities Act of 1933, as amended;

and

|

|

|

·

|

“U.S. dollars,” “dollars” and “$”

refer to the legal currency of the United

States.

|

In this

current report we are relying on and we refer to information and statistics

regarding the building materials industry and economy in East Asia and that we

have obtained from various cited government and institute research publications.

Much of this information is publicly available for free and has not been

specifically prepared for us for use or incorporation in this current report on

Form 8-K or otherwise. Although the Company believes such information is

accurate, the Company has not independently verified such

information.

ITEM

1.01

ENTRY

INTO A MATERIAL DEFINITIVE AGREEMENT

On

October 30, 2010, we entered into and closed a share exchange agreement, or the

Share Exchange Agreement, with Greatmat Holdings Limited, a BVI company, or

Greatmat Holdings, Chris Yun Sang SO, the sole shareholder of Greatmat Holdings,

and Yau-sing TANG, our sole director and former sole officer and majority

beneficial shareholder, pursuant to which we acquired 100% of the issued and

outstanding capital stock of Greatmat Holdings in exchange for 36,560,700 shares

of our Common Stock, which constituted 75.0% of our issued and outstanding

capital stock as of and immediately after the consummation of the transactions

contemplated by the Share Exchange Agreement.

The

foregoing description of the terms of the Share Exchange Agreement is qualified

in its entirety by reference to the provisions of the agreement filed as Exhibit

2.1 to this report, which are incorporated by reference herein.

ITEM

2.01

COMPLETION

OF ACQUISITION OR DISPOSITION OF ASSETS

On

October 30, 2010, we completed an acquisition of Greatmat Holdings pursuant to

the Share Exchange Agreement. The acquisition was a reverse acquisition in

accordance with ASC 805-40 “Reverse Acquisitions”. The legal parent is Aurum

Explorations, Inc. which was the accounting acquiree while the Greatmat group of

companies was the accounting acquirer. There was no non-controlling interest

after the acquisition. This transaction was accounted for as a recapitalization

effected by a share exchange, wherein Greatmat Holdings is considered the

acquirer for accounting and financial reporting purposes. The assets and

liabilities of the acquired entity have been brought forward at their book value

and no goodwill has been recognized.

As a

result of the acquisition, our consolidated subsidiaries include Greatmat

Holdings Limited, our wholly-owned subsidiary which is incorporated under the

laws of the BVI, Greatmat Technology Limited, or Greatmat Limited, a

wholly-owned subsidiary of Greatmat Holdings which is incorporated under the

laws of Hong Kong, Greatmat Technology (HK) Limited, or Greatmat Hong Kong, a

wholly-owned subsidiary of Greatmat Holdings which is incorporated under the

laws of Hong Kong, and Greatmat Technology (China) Limited, or Greatmat China, a

wholly-owned subsidiary of Greatmat Holdings which is incorporated under the

laws of the BVI. Greatmat Limited, Greatmat Hong Kong and Greatmat China

are sometimes collectively referred to herein as the “Operating

Subsidiaries.”

3

FORM

10 DISCLOSURE

As

disclosed elsewhere in this report, on October 30, 2010, we acquired Greatmat

Holdings in a reverse acquisition transaction. Item 2.01(f) of Form 8-K

states that if the registrant was a shell company like we were immediately

before the reverse acquisition transaction disclosed under Item 2.01, then the

registrant must disclose the information that would be required if the

registrant were filing a general form for registration of securities on Form 10

upon consummation of the transaction.

Accordingly,

we are providing below the information that would be included in a Form 10 if we

were to file a Form 10. Please note that the information provided below

relates to the combined enterprises after the acquisition of Greatmat Holdings,

except that information relating to periods prior to the date of the reverse

acquisition only relate to Greatmat Holdings and its consolidated subsidiaries

unless otherwise specifically indicated.

DESCRIPTION

OF BUSINESS

Business

Overview

Greatmat

was established in May 2004 and is a leading innovative building material

company that provides customers with customized designs, manufacturing solutions

and technical advice for building projects. In particular, Greatmat is a

supplier of high-quality engineered stone floor and wall surfaces to commercial

construction projects in China, Hong Kong and elsewhere in Asia. Our

principal business consists of the design, research and development and

production of engineered stone for installation in construction projects.

Our company headquarters and main sales office is located in Hong

Kong.

Greatmat

possesses a strong research and development team to help develop new solutions

and innovative designs. We are often sought after by major property

developers who want a unique material appearance for their flooring and exterior

walls, typically in exclusive shopping centers around Asia. The Company

designs, produces, sells and services all of its finished products.

Project after project, the Company keeps coming up with unique finishing

materials for ever-demanding property developers in Asia. After years in

the building material industry, Greatmat has built a reputation in the region

for having one of the highest quality standards in the field.

In 2005,

Greatmat was awarded a grant from the Hong Kong Innovative Technology Fund for

creating a new environmentally-friendly solution which could be applied to the

walls, flooring and exterior of commercial buildings. In 2009, the Company

was also awarded a Hong Kong Award for Environmental Excellence. Greatmat

has successfully completed numerous signature projects in Hong Kong, Japan,

Singapore and China for blue-chip clients such as Swire Properties, Sino Group,

the Hong Kong Jockey Club, Sun Hung Kei Properties, Hang Lung Properties, and

Shui On Properties, just to name a few. We maintain a website at http://www.greatmat.com,

which is not incorporated into this Report.

4

Greatmat

Flooring on Display in Disneyland Hong Kong

Our

Corporate History and Background

Aurum

Explorations, Inc. was originally incorporated under the laws of the State of

Nevada on April 27, 2007. Prior to our reverse acquisition of Greatmat

Holdings, Aurum had originally intended to acquire exploration and development

stage natural resource properties. The Company acquired the mineral rights

to one property which subsequently reverted before the Company began mining

operations. In July 2009, there was a change in control of Aurum.

Thereafter, Aurum became dormant and began actively seeking a business

combination through the acquisition of, or merger with, an operating business.

From July 2009 until the present, Aurum was inactive and was a “shell company”

as defined in Rule 12b-2 under the Exchange Act.

As a

result of our reverse acquisition of Greatmat Holdings, we are no longer a shell

company and active business operations were revived.

Acquisition

of Greatmat Holdings

On

October 30, 2010, we completed a reverse acquisition transaction through a share

exchange with Greatmat Holdings and its sole shareholder, whereby we acquired

100% of the issued and outstanding capital stock of Greatmat Holdings in

exchange for 36,560,700 shares of our Common Stock, which constituted 75.0% of

our issued and outstanding capital stock as of and immediately after the

consummation of the reverse acquisition. As a result of the reverse

acquisition, Greatmat Holdings became our wholly-owned subsidiary and the former

shareholder of Greatmat Holdings became our controlling stockholder. The

share exchange transaction with Greatmat Holdings and its shareholder, or Share

Exchange, was treated as a reverse acquisition, with Greatmat Holdings as the

acquirer and Aurum as the acquired party for accounting purposes. Unless the

context suggests otherwise, when we refer in this report to business and

financial information for periods prior to the consummation of the reverse

acquisition, we are referring to the business and financial information of

Greatmat Holdings and its consolidated subsidiaries.

5

Immediately

prior to the Share Exchange, the common stock of Greatmat Holdings was solely

owned by Chris Yun Sang SO, the founder and chief executive officer of

Greatmat.

Upon the

closing of the reverse acquisition, Yau-sing TANG, Aurum’s sole director and

officer, submitted a resignation letter pursuant to which he resigned from all

offices that he held effective immediately and from his position as our director

that will become effective on the tenth day following the mailing by us of an

information statement, or the Information Statement, to our stockholders that

complies with the requirements of Section 14f-1 of the Exchange Act. In

addition, our board of directors on October 30, 2010 increased the size of our

board of directors to three directors and appointed Chris Yun Sang SO, Carol Lai

Ping HO and Rick Chun Wah TSE to fill the vacancies created by such resignation

and increase in the size of the board, which appointments will become effective

upon the effectiveness of the resignation of Yau-sing TANG on the tenth day

following the mailing by us of the Information Statement to our

stockholders. In addition, our sole executive officer Yau-sing TANG was

replaced upon the closing of the reverse acquisition as indicated in more detail

below.

As a

result of our acquisition of Greatmat Holdings, we now own all of the issued and

outstanding capital stock of Greatmat Holdings, which in turn owns all of the

issued and outstanding capital stock of Greatmat Limited, Greatmat Hong Kong and

Greatmat China, our operating subsidiaries.

Greatmat

Limited was established in Hong Kong in September 2010. Greatmat Hong Kong

was established in Hong Kong in May 2004. Greatmat China was established

in the British Virgin Islands in December 2008. Greatmat Holdings was

established in the British Virgin Islands in July 2010 to serve as an

intermediate holding company. Greatmat Holdings currently owns 100% of

Greatmat Limited, Greatmat Hong Kong and Greatmat China. Chris Yun Sang SO

currently serves as the sole director of each of Greatmat Holdings, Greatmat

Limited and Greatmat Hong Kong, and Greatmat Holdings currently serves as the

sole director of Greatmat China.

Our

Corporate Structure

All of

our business operations are conducted through our Hong Kong and BVI

subsidiaries. The chart below presents our corporate structure. We

conduct business in China through Greatmat China, we conduct business in Hong

Kong through Greatmat Hong Kong, and we conduct business in all other export

markets through Greatmat Limited.

6

Our Industry and Principal

Markets:

The

Chinese economy has grown by leaps and bounds since the PRC government

introduced economic reforms in the late nineteen seventies. From the mid

nineteen nineties onward, China became one of the fastest growing economies in

the world. China’s GDP growth has since been the envy of the world and one

of the main engines driving its growth is in the area of infrastructure,

renovation and real estate development, as these sectors exceeded the growth

rate of the general GDP by a substantial margin. Correspondingly, the

growth in sales of building materials in China also outstripped GDP growth

during the same period.

According

to the Economic Times, China is projected to overtake the U.S. as the world’s

largest construction market by 2018. In the next ten years, China’s

construction market is projected to be worth about $2.4 trillion and represent

19.1% of global construction output. Despite India’s continued

construction boom, China’s construction market is still projected to be three or

four times larger than India’s at the end of the next decade.

At the

current pace of growth, China will have 200 modern cities within the next

decade. Cities, commercial buildings and shopping malls are all competing

against each other largely on the basis of aesthetic appeal. The fact that

many of these newly erected commercial structures are designed by foreign

architects and interior designers has increased the demand for high-quality

innovative materials with unique finishing looks. It is our aim to capture

a larger portion of this high-end segment of the market.

At

present, we are well positioned to capitalize on this growing demand. Over

the past years, the Company has completed numerous high profile projects in Hong

Kong and China. Because our main office is strategically situated in Hong Kong,

the Company is in close contact with its core customers which are mainly the

major Hong Kong and foreign property developers. The Company is also well

situated to do business in other major markets in Asia and the Middle

East.

Greatmat

Flooring Installed in the Hong Kong Coliseum

7

Our

principal end-markets are high-end shopping malls, buildings and other

commercial projects in China, Hong Kong and elsewhere in Asia. In the

future, we hope to expand our markets to North America and worldwide. The

Company believes that there are excellent growth opportunities for our business

within China and the rest of Asia. Despite the economic downturn, it is

also our belief that the USA could provide ample opportunities as well.

The Company also believes there may be significant business opportunities in

other closely related industry segments that it has not yet

explored.

Engineered

or reconstituted stone is just being introduced and accepted in the Chinese

market. Real estate developers are always looking for high-end building

materials which can enhance and distinguish the aesthetic appeal of their

projects. However, budget is always a concern. This is where we can meet

their need as we are able to provide high-end finishing materials at only half

the price of some of our competitors, and with faster turnaround times.

Furthermore, our customers are increasingly environmentally conscious and our

products use recycled materials and can reduce the production of construction

waste.

Traditionally,

property developers would have only a limited number of choices for their wall

or flooring surfaces. If a developer was big enough, perhaps it might be

able to commission a manufacturer to produce something unique for them.

But this was quite rare and very expensive and time consuming. Therefore,

most developers typically choose building materials “off the rack” from a

manufacturer’s showroom. Greatmat offers an innovative solution to its

corporate clients who want that “special” building material for their signature

project, yet at a reasonable cost. We believe that this is a rather

revolutionary way of doing business in the building materials industry.

Instead of bringing samples to show to the client, Greatmat simply asks the

client what they would like to achieve in their flooring or wall design.

Then Greatmat can come up with a solution to fulfill the client’s stated

wish. We believe that this is one of the reasons why we have been so

successful in pitching new projects. In addition, Greatmat keeps raising

the bar for its competitors by setting higher and higher standards (even by U.S.

standards) for the quality and features of its products. Greatmat also

provides a ten year product warranty in writing for all of its products.

We believe our novel approach to providing customized solutions for our clients

is a win-win situation for both parties. And a major advantage of this

model for Greatmat is that Greatmat is not required to hold any inventory of its

products.

8

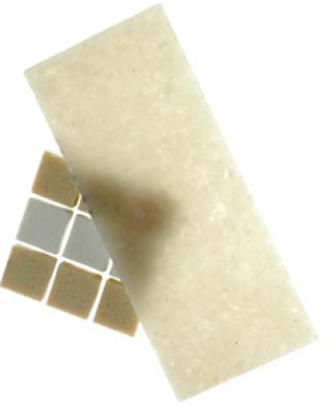

A

Greatmat Surface Making Use of Discarded Tires

Our

Products

Greatmat

has developed a new finishing building material by applying a newly modified

chemical together with recycled materials such as glass, quartz and other

materials. Greatmat has patented and trademarked this new finishing

material as “Sani-Crete” stone.

Sani-Crete

stone can be used for the exterior and interior of a new or renovated building

structure, and can be applied to floors and walls. “Sani-Crete” stone is

much stronger than ordinary finishing building materials and is suitable for

heavy duty/high traffic area building projects, such as shopping malls,

commercial buildings, residential towers and hospitals. Technical test

data have shown that Sani-Crete stone products outperform natural stone for

durability, hardness and waterproofing. Sani-Crete stone has the added

benefit of being “anti-bacterial” and “anti-virus,” making it suitable even for

scientific laboratories and hospitals.

Sani-Crete

stone can be produced in virtually any color, graphic pattern, surface texture,

size and thickness, and can duplicate the appearance of any kind of natural

stone pattern, including stones that are no longer naturally available.

Our products offer value-added attributes such as high wind velocity resistance

and resistance to color fading. Since we can produce and apply all kinds

of patterns such as corporate or brand logos onto patterned stone, we believe

that there is a good opportunity for us to market our products to the high-end

luxury brand market segment.

9

Tactile

Elements for the Benefit of the Visually Impaired

Graphical

Elements Incorporated into a Greatmat Surface

10

With a

minimum thickness of only 5 millimeters, Sani-Crete stone is well-suited for

flooring as well. This thinness provides a large advantage in connection

with renovation work because the Sani-Crete surface will not damage most

substrates, thereby eliminating the need for taking out the original substrate

and creating additional construction waste. Sani-Crete stone can be laid

directly on any kind of material surface, such as the ceramic tile, stone and so

forth, which can prove to be economical, time-saving and efficient for the

renovation process.

Sani-Crete

is a co-epoxy based liquid chemical which can be mixed with other elements such

as glass or quartz, or applied directly as a functional finishing decorative

building material. Sani-Crete stone can be produced in tile form (known as

the Sani-Crete Reconstituted Stone) or in liquid form and applied directly on a

construction site to be a jointless finishing building material (known as the

Sani-Crete H-Series). Sani-Crete stone can also be combined with other

solid elements such as bamboo, gold, etc. to form new patterns.

Examples

of Greatmat Products with Translucent Effect

Currently,

the bulk of our manufactured products belong to the “Quartz” line

collection. The Quartz line of products mixes fine quartz or marble with

various recycled materials to produce sophisticated textures in various

attractive colors. We are currently developing our new “Clone” and “Glow”

lines, which may require substantial investments in the near future. We

have begun to take orders for our Clone and Glow product lines and we expect to

start production in 2011. Our Clone line of products reproduces the

appearance of certain natural stones, but typically with a much lower cost and

better performance than the original natural stone. Our Glow line of

products literally glows by radiating light that they have absorbed and stored,

creating a dramatic aesthetic effect as well as providing safety benefits.

We are not aware of any other companies making products similar to our Clone and

Glow lines in Asia.

11

A

Kitchen Counter Top Made from Sani-Crete

Our

Third-Party Manufacturer

With a

view to enhancing the efficiency of our operations, Greatmat has outsourced, and

currently intends to continue to outsource, the manufacturing process for all of

our products to our third-party manufacturer, Yunfu Changyi Stone Factory, a

company located in the PRC. The third-party manufacturer is exclusively

engaged in the manufacturing of Greatmat products based on specifications and

designs received from Greatmat and does not itself engage in the marketing, sale

and distribution of building material products or the production of building

material products for anyone other than Greatmat. As a result, there is no

competition between Greatmat and its third-party manufacturer with respect to

Greatmat’s end-customers. In the interest of efficiency, the Company

sometimes engages its third-party manufacturer to carry out research and

development activities on its behalf.

The

Company’s relationship with its third-party manufacturer is governed by an

Exclusive Manufacturing Agreement dated June 30, 2004 between Greatmat Hong Kong

and Yunfu, a copy of which is filed as Exhibit 10.1 to this report.

Pursuant to the terms of the Exclusive Manufacturing Agreement, during the term

of the agreement, the Company is required to use Yunfu exclusively to process

its engineered stone, and Yunfu may only provide manufacturing and processing

services for the Company’s products. The original term of the Exclusive

Manufacturing Agreement ended on June 30, 2009, whereupon the agreement was

automatically renewed for an indefinite period. As a result, there is

currently no fixed term for the agreement and either party may terminate the

agreement at any time. See the Risk Factor below “RISKS RELATED TO OUR

BUSINESS—We rely on a

single third-party manufacturer to manufacture our

products.”

Pursuant

to the terms of the Exclusive Manufacturing Agreement, Greatmat provides all of

the machines, equipment and packaging, as well as designs and logos and certain

specialized materials, to be used in production of its products to Yunfu.

Yunfu provides the physical manufacturing facility, utilities and certain basic

materials, as well as all of the labor in producing the engineered stone

products, and is responsible for meeting the specifications for the products set

forth in the work orders, while Greatmat provides management and technical

support and retains the right to inspect the production process. Yunfu is

responsible for meeting PRC legal requirements with respect to the facility and

its workers. The processing fee to be paid by Greatmat to Yunfu is agreed

to by both parties when the order is placed, with 30% of such fee payable upon

placing the order and 70% due when the final products are inspected and

approved. Greatmat is required to order a minimum amount of products from

Yunfu each year or pay a sizable penalty. Greatmat has never failed to

meet its minimum purchase requirements with Yunfu, nor does it expect any

problem in meeting such requirements in the future.

12

Our

Production Process

Recycled

elements, such as quartz, stone or glass are grinded into various sizes of fine

powder. Dirt particles in the powder are then taken away by means of

filtration while metallic material is removed using magnetic force.

Different sizes of the powder are independently mixed to provide different

batches of evenly-sized powdered material. They are then mixed

together. Sani-Crete co-epoxy base liquid chemical is added and mixed with

these powders. The resulting chemical mix will go through a process which

includes high pressure compression, vacuum and machine vibration. The

semi-finished product is taken out to dry for a few hours. The mold is

then taken away and the semi-finished product will be left for 24 hours of

cooling. The semi-finished product is then shaved to the requested

thickness by a heavy-duty machine. Once the desired thickness is reached,

the semi-finished product is polished. “Anti-dirt” coating is applied to

the surface. Another layer of protective cover is then added to the

surface. The product is then cut to the requested size. Once the

final quality control check is done, the finished product is packed and

shipped. Greatmat does not install the finished product in the

construction project, but will provide developers with referrals to contractors

able to install the finished products.

Quality

control is an important part of our production process. Greatmat currently

employs six employees in the quality control division. These employees are

responsible for quality inspections throughout the production processes.

All raw materials, semi-finished products and final products are subject to

sampling and quality inspection in connection with each stage of

processing.

Raw

Materials

The main

raw materials used in our production process are glass, quartz, and a special

mix of adhesives. We purchase most of the raw materials from Chinese

suppliers and the raw materials are generally in abundant supply and available

from numerous sources. Many of our raw materials are recycled from

otherwise unwanted waste materials. The price and availability of raw

materials may vary from year to year due to market conditions and production

capacities. We do not expect a lack of availability or significant price

increases for our raw materials in the foreseeable future. We currently

purchase adhesive material from Cathay Coating, a Taiwanese company, and quartz

from Dak Wai, a Chinese company.

Energy is

also a significant cost in our production. Any increase or material

fluctuation in energy and fuel costs could have a material adverse effect on our

business, financial condition and results of operations.

Customers

We have

about 20 customers and they are all large property developers based in Hong Kong

and China. Most of our customers are well-established and well-known

property developers headquartered in Hong Kong and almost all are publicly

listed companies in Hong Kong. In fact, we currently are doing business

with five of the six largest property developers in Hong Kong. Currently,

our largest customer in terms of sales is Hang Lung Properties, which currently

accounts for about 50% of our 2010 sales. Our next two largest customers

are China Estate Holdings and Sino Group, which each account for about 20% of

our sales.

Currently,

about 65% of our sales are to projects in China, about 30% to Hong Kong, and

about 5% to other parts of Asia. We are currently planning to increase the

percentage of our sales to other parts of Asia in order to reduce our risk

related to geographic concentration.

Contract

Pricing

Our work

is performed under fixed-price contracts. It typically takes us between

one to three months to perform one of our contracts. Under fixed-price

contracts, we receive a fixed price. A disadvantage of fixed-price

contracts is that we realize a profit only if we control our costs and prevent

cost over-runs on the contracts, which can oftentimes be out of our control,

such as cost of materials. An advantage of these contracts is that we can adjust

the material and technology that we use in the project, as long as we satisfy

the requirements of our customer, and there is a potential to benefit from lower

costs of materials.

13

During

2009, we completed about 30 projects, large to small. Our two largest projects

were worth approximately $3,300,000 and $800,000 and they accounted for about

62% and 15% of our sales, respectively, for the year ended December 31,

2009. We currently estimate that our three largest projects in 2010 will

be worth about $6,500,000, $1,200,000 and $650,000 when completed.

Contract

Backlog

As of

October 2010, our total backlog of orders considered to be firm was

approximately $7.5 million. This is comprised of three different projects; one

is a large shopping complex by Hang Lung Properties in China and two are

infrastructure projects by the Hong Kong government in Hong Kong.

We define

backlog as the total anticipated revenue from projects already begun and

upcoming projects for which contracts have been signed or awarded and pending

signing. We view backlog as an important statistic in evaluating the level

of sales activity and short-term sales trends in our business. However, as

backlog is only one indicator, and is not an effective indicator of the ultimate

profitability of our sales, we do not believe that backlog should be used as the

sole indicator of our future earnings. There can be no assurance that the

backlog at any point in time will translate into net revenue in any subsequent

period.

Sales

and Marketing

Sales

We have a

marketing staff of five people, who market primarily to major property

developers in Hong Kong. We also have one

independent sales representative in China. We believe that we will

be better able to satisfy the different needs of our clients by expanding the

scope of our offerings in the future. We also believe that we will be

better able to market our products abroad by establishing offices in other

cities.

Sales

managers lead our sales and marketing efforts through our domestic headquarters

in Hong Kong. Our sales representatives attempt to maintain relationships

with governments, developers, general contractors, architects, engineers, and

other potential sources of business to determine potential new projects under

consideration. Our sales efforts are further supported by our executive officers

and engineering personnel, who have substantial experience in the design,

engineering, fabrication, and installation of engineered stone

surfaces.

We

primarily compete for new project opportunities through our relationships and

interaction with our active and prospective customer base, which we believe

provides us with valuable current market information and sales opportunities. In

addition, we are often contacted by governmental agencies in connection with

public construction projects, and by large private-sector project owners and

general contractors and engineering firms in connection with new building

projects both in China and other countries, often at the recommendation of

architects and engineers we have worked with in the past.

Marketing

Management

believes that we have developed a reputation for innovative technology and

quality in the market for specialty high-end finishing materials. Marketing

efforts are geared towards advancing us as a brand of choice for building the

world’s most modern and challenging projects. To better showcase our products to

potential customers, we plan to exhibit at leading trade shows and exhibitions

and are striving to improve our company website.

Research

and Development

Producers

of construction materials face strong pressure to respond quickly to industry

demands with new designs and product innovations that support rapidly changing

technical demand and regulatory requirements. We devote a substantial amount of

attention to the research and development of advanced engineered stone materials

that meet the demands of project-specific needs while striving to lead the

industry in value, materials and processes. We have sophisticated in-house

R&D and testing facilities, a highly technical onsite team, and access to

highly specialized market research, cooperation with leading research

institutions, experienced management, and close relationships with leading

materials experts. We currently expend about 5% of our sales on research and

development. We bear the cost of our research and development

ourselves.

14

Patents

We rely

on a combination of trade secret and patent laws to protect our proprietary

technology. We have made substantial investments in improving our

manufacturing process which have enabled us to improve the properties of our

products and facilitated our development of new products. The Company has

received a patent from the Hong Kong government relating to the manufacture of a

seamless inlay surface, which patent expires on April 6, 2012. The

Company does not believe that the expiration of this patent will have a material

impact on its business, as the formulas and process for producing its Sani-Crete

stone products are trade secrets not known to the Company’s

competitors.

Trademarks

Our

products are sold under the brands Greatmat and Sani-Crete, which are officially

registered trademarks in Hong Kong. Sani-Crete is also an officially

registered trademark in the PRC. Registration of trademarks is

effective for as long as we continue to use the trademarks and renew the

registrations. The trademark registrations for the marks “Greatmat

Sani-Crete”, “Greatmat” and “Sani-Crete” in Hong Kong and “Sani-Crete” in the

PRC will expire on May 11, 2016, April 2, 2014, December 21, 2013, and May 20,

2020, respectively, if not renewed by the Company prior to these dates, which

the Company currently intends to do. We believe that our

trademarks are of considerable value to us as they allow our customers to

differentiate our products from those of our competitors and allow us to reap

the benefits of our marketing efforts. Although the enforceability of

trademark rights in the PRC and elsewhere in Asia is somewhat more developed

than with respect to patent rights, there is still some risk that we will not be

able to stop infringement of such rights.

Employees

At

October 30, 2010, we maintained nine full-time corporate staff employees

stationed in Hong Kong. There are 120 full-time workers of Chinese

nationality in our third-party manufacturer’s facility dedicated exclusively to

producing our products, although they are technically not Greatmat’s

employees. Our employees are not covered by collective bargaining

agreements. We believe that our relationships with our employees are

good.

Our

Facilities and Property

We do not

own or lease any of our production facilities, which are operated by our

third-party manufacturer. We have leased our executive offices in Hong

Kong under a two-year lease which expires in May 2011. The monthly rental

and management fees due under the lease total about HK$18,607 (US$2,385).

We are currently looking into alternative office leasing arrangements at the end

of our current lease and do not believe that the termination of this lease

should have an adverse effect on our business.

Competition

We

believe that we are well positioned vis-à-vis our competitors based on our

following competitive strengths:

|

|

•

|

Well known reputation in our

market for high quality work

|

|

|

•

|

High efficiency and resulting low

cost

|

|

|

•

|

Ability to expand our customer

base in new markets within a relatively short time frame through

referrals

|

|

|

•

|

Access to a large pool of

engineering talent resulting in technical innovations and strong ability

to market and commercialize our technical

innovations

|

15

|

|

•

|

Continual improvement of our

product development, product quality and customer

service

|

|

|

•

|

Ability to produce higher

value-added products

|

|

|

•

|

Ability to expand our production

capacity in a relatively short time

frame

|

We are

currently aware of about 30 manufacturers of quartz-based engineered stone in

the world. Therefore, supplies are somewhat limited. We estimate

that about 80% of these manufacturers target the low-end price-sensitive segment

of the market and have little research and development capacity. Interest

in this low-end segment of the market has been limited because of the perception

that it is capital intensive and offers little potential for profit. Our

principal competitors in the market for engineered stone products include mostly

imported European manufacturers from Spain and Italy.

We view

most of our competitors in the building materials market in Hong Kong and China

basically to be trading firms which are inflexible in terms of their product

offerings and cost. They obtain their showroom samples from their

manufacturer and cannot modify them because their product is mass

produced. In contrast, we are able to offer our customers customized

solutions based on their specifications and particular needs. The

Company therefore believes that it competes successfully on the basis of

offering a superior value proposition based on its ability to provide customized

high-quality products at reasonable prices, while most of its competitors offer

more limited and commoditized product offerings that typically offer less value

to the customer for the same level of expenditure.

Cyclicality

Our

industry is affected by a variety of factors, including fluctuations in new

shopping mall projects and volatility in the real estate market. We manage

potential risks in the PRC’s volatile market environment by operating in

different business segments and serving different customer bases.

Operating in different business segments allows us to better cope with the

cyclical nature of China’s building material industry. We believe that the

combinations of our different business segments (which produce different

products and serve different customers) will enabled us to reduce the disruptive

effects of such downturns on our sales and operations.

In

addition, we also intend to expand to other Asian and North American markets in

order to reduce our dependency on the China and Hong Kong markets. We

plan to expand to other Asian cities by means of cooperation (perhaps a joint

venture) with a strong local partner in each such additional Asian country,

whereby we will produce specific products (made according to the local tastes

and likings) while our working partner will provide the customer contacts and

services. We are currently holding discussions with potential partners in

several additional Asian markets, although there can be no assurance that any of

such plans or discussions will come to fruition. With respect to North American

markets, our role for the foreseeable future will be limited to producing and

exporting products based upon customer orders. In the past, we have produced

some small quantity shipments for North American customers. Because of the

current poor economic conditions in the building industry in North America, we

are not actively pursuing this market for the time being.

Regulation

Because

our exclusive third-party contract manufacturer is located in the PRC, our

business may be deemed to be to some extent regulated by the national and local

laws of the PRC. We believe that our conduct of our business materially

complies with existing Hong Kong and PRC laws, rules and

regulations.

General

Regulation of Businesses

We

believe that our third-party contract manufacturer is in material compliance

with all applicable labor and safety laws and regulations in the PRC, including

the PRC Labor Contract Law, the PRC Production Safety Law, the PRC Regulation

for Insurance for Labor Injury, the PRC Unemployment Insurance Law, the PRC

Provisional Insurance Measures for Maternity of Employees, PRC Interim

Provisions on Registration of Social Insurance, PRC Interim Regulation on the

Collection and Payment of Social Insurance Premiums and other related

regulations, rules and provisions issued by the relevant governmental

authorities from time to time, for their operations in the PRC.

According

to the PRC Labor Contract Law, employers are required to enter into labor

contracts with their employees. They are required to pay no less than local

minimum wages to their employees. They are also required to provide their

employees with labor safety and sanitation conditions satisfying PRC government

laws and regulations.

16

Environmental

Matters

Our

third-party manufacturer is subject to various pollution control regulations

with respect to noise, water and air pollution and the disposal of waste and

hazardous materials. They are also subject to periodic inspections by

local environmental protection authorities. We are not currently subject

to any pending actions alleging any violations of applicable environmental laws

or regulations, nor have we been punished or reprimanded for violating any such

laws or regulations. We aim to develop our business without compromising

environmental protection.

Insurance

We have

standard insurance coverage as required by Hong Kong law, including property

coverage for our office premises and coverage for our employees in the case of

work-related injury. We do not carry liability or business interruption

coverage. Insurance companies in Hong Kong offer limited business

insurance products. While business interruption insurance is available to a

limited extent in Hong Kong, we have determined that the risks of interruption,

cost of such insurance and the difficulties associated with acquiring such

insurance on commercially reasonable terms make it impractical for us to have

such insurance. As a result, we could face liability from the interruption of

our business as summarized under “Risk Factors – Risks Related to Our Business –

We do not carry business interruption or other insurance, so we have to bear

losses ourselves.”

17

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. You should

carefully consider the risks described below, together with all of the other

information included in this report, before making an investment decision. If

any of the following risks actually occurs, our business, financial condition or

results of operations could suffer. In that case, the trading price of our

common stock could decline, and you may lose all or part of your investment. You

should read the section entitled “Special Notes Regarding Forward-Looking

Statements” above for a discussion of what types of statements are

forward-looking statements, as well as the significance of such statements in

the context of this report.

RISKS

RELATED TO OUR BUSINESS

We

have a short operating history.

We were

founded in 2004. We may not succeed in implementing our business plan

successfully because of competition from domestic and foreign market entrants,

failure of the market to accept our products, or other reasons. Therefore,

you should not place undue reliance on our past performance as they may not be

indicative of our future results.

Our

senior management lacks experience managing a public company and complying with

laws applicable to operating as a U.S. public company.

On

October 30, 2010, Greatmat Holdings completed a transaction with Aurum, the

result of which was for Greatmat Holdings to become wholly-owned subsidiaries of

Aurum, a U.S. public company. At the same time, however, the management of

Aurum resigned from its positions within Aurum, and the management of Greatmat

became the management of our Company. While the previous management of

Aurum had experience in managing a U.S. publicly traded company, the management

of Greatmat did not. Prior to the completion of the Share Exchange,

Greatmat was operated as a private company located in Hong Kong.

As a

result of these transactions, our Company will become subject to laws,

regulations and obligations that did not previously apply to it, and our senior

management currently has limited experience in complying with such laws,

regulations and obligations. For example, we will need to comply with the

Nevada laws applicable to companies that are domiciled in that state. By

contrast, such senior management is currently experienced in operating the

business of Greatmat in compliance with Hong Kong law. Similarly, by virtue of

these transactions we will be required to file quarterly and annual reports and

to comply with U.S. securities and other laws, which may not have applied to our

Company in the past. These obligations can be burdensome and complicated,

and failure to comply with such obligations could have a material adverse effect

on our company. In addition, we expect that the process of learning about such

new obligations as a public company in the United States will require senior

management to devote time and resources to such efforts that might otherwise be

spent on the operation of the business of selling and producing engineered stone

products.

We

face risks related to general domestic and global economic conditions and to the

current credit crisis.

Our

current operating cash flows provide us with stable funding capacity.

However, the current uncertainty arising out of domestic and global economic

conditions, including the recent disruption in credit markets, poses a risk to

the Asian economy, and may impact our ability to manage normal relationships

with our customers, suppliers and creditors. If the current situation

deteriorates significantly, our business could be materially negatively

impacted, as demand for our products may decrease from a slow-down in the

general economy, or supplier or customer disruptions may result from tighter

credit markets.

Our

business is subject to the health of the PRC, Hong Kong and Asian economies and

our growth may be inhibited by the inability of potential customers to fund

purchases of our products.

Our

products are dependent on the strength of the construction industry in China,

Hong Kong and elsewhere in Asia, which could be adversely affected by an

economic downturn.

18

In

order to grow at the pace expected by management, we will require additional

capital to support our long-term growth strategies. If we are unable to obtain

additional capital in future years, we may be unable to proceed with our plans

and we may be forced to curtail our operations.

We will

require additional working capital to support our long-term growth strategies,

which include increasing the number of projects we take on, establishing

additional marketing and research facilities, developing additional product

lines and engaging in increased promotion of our products and brands. Our

working capital requirements and the cash flow provided by future operating

activities, if any, may vary greatly from quarter to quarter, depending on the

volume of business during the period. We may not be able to obtain adequate

levels of additional financing, whether through equity financing, debt financing

or other sources. Additional financings could result in significant

dilution to our earnings per share or the issuance of securities with rights

superior to our currently outstanding securities. In addition, we may grant

registration rights to investors purchasing our equity or debt securities in the

future. If we are unable to raise additional financing, we may be unable to

implement our long-term growth strategies, develop or enhance our products and

related brands, take advantage of future opportunities or respond to competitive

pressures on a timely basis.

We depend on the leadership

and services of Chris Yun Sang SO who is our founder and chief executive

officer, and our business and growth prospects may be severely disrupted if we

lose his services.

Our future success is

dependent upon the continued service of Chris Yun Sang SO, our founder and chief

executive officer. We rely on his industry expertise

and experience in our business operations, and in particular, his business

vision, management skills, and working relationships with our employees and

customers. We do not have an employment agreement with Mr. So and he is

under no obligation to remain

with Greatmat. We do not maintain key-man life insurance for Mr. So.

If he is unable or unwilling to continue in his present position or if he

joins a competitor or forms a competing company, we may not be able to replace

him easily or at all. As a result,

our business and growth prospects may be severely disrupted if we lose his

services.

If

we are unable to attract and retain senior management and qualified technical,

research and sales personnel, our operations, financial condition and prospects

will be materially adversely affected.

Our

future success depends in part on the contributions of our management team and

key technical, research and sales personnel and our ability to attract and

retain qualified new personnel. In particular, our success depends on the

continuing employment of our Chief Executive Officer, Chris Yun Sang SO, our

General Manager, Carol Lai Ping HO, and our Marketing Director, Rick Chun Wah

TSE. We do not have employment agreements with any of our management

personnel or employees. There is significant competition in our industry

for qualified managerial, technical, research and sales personnel and we cannot

assure you that we will be able to retain our key senior managerial, technical,

research and sales personnel or that we will be able to attract, integrate and

retain other such personnel that we may require in the future. If we are

unable to attract and retain key personnel in the future, our business,

operations, financial condition, results of operations and prospects could be

materially adversely affected.

We

rely on a single third-party manufacturer to manufacture our

products.

We depend

on a single contract manufacturer to manufacture the products that we

sell. Any significant problems at our third-party manufacturer’s

production facility could impact our ability to deliver our products. If

this contract manufacturer is unable to maintain adequate manufacturing and

shipping capacity, it may be unable to provide us with timely delivery of

products of acceptable quality. Our inability to meet our customers’ demand

for our products could have a material adverse impact on our business, financial

condition and results of operations. In addition, if the prices charged by

this contractor increase for reasons such as increases in labor costs or

currency fluctuations, our cost of manufacturing would increase, adversely

affecting our results of operations. We also depend on third parties to

transport and deliver our products. Due to the fact that we do not have any

independent transportation or delivery capabilities of our own, if these third

parties are unable to transport or deliver our products for any reason, or if

they increase the price of their services, including as a result of increases in

the cost of fuel, our operations and financial performance may be adversely

affected.

19

We

require our contract manufacturer to meet our standards in terms of product

quality and other matters. Any failure by our contract manufacturer to meet

these standards, to adhere to labor or other laws or to diverge from our

mandated practices, and the potential negative publicity relating to any of

these events, could harm our business and reputation.

Our

agreement with our contract manufacturer is terminable at will by either party.

To the extent we are unable to maintain or secure relationships with quality

manufacturers, our business could be harmed.

The

interests of our third-party manufacturer may diverge from ours, and we may not

have the ability to make it act in a manner consistent with our best

interests.

Our

business relationship with our third-party manufacturer does not allow us to

control its actions in the way that we could if we owned it. Although we are

currently operating under an exclusive manufacturing agreement that prohibits

them from competing with us, this agreement may be terminated at any time by

either party. As a result, we may not be able to prevent our exclusive

manufacturer from engaging in activities or pursuing strategic objectives that

conflict with our interests or strategic objectives. Our ability to influence or

control its business depends on the nature of our contractual relationship. We

are not entitled to participate in the management of our exclusive

manufacturer.

If

we are unable to accurately estimate and control our contract costs and

timelines, then we may incur losses on our contracts, which may result in

decreases in our operating margins and in a significant reduction or elimination

of our profits.

If we do

not control our contract costs, we may be unable to maintain positive operating

margins or experience operating losses. All of our sales are from fixed-price

contracts. Under fixed-price contracts, we receive a fixed price. Consequently,

we realize a profit on fixed-price contracts only if we control our costs and

prevent cost over-runs on the contracts. If we are unable to estimate and

control costs and/or project timelines, we may incur losses on our contracts,

which may result in decreases in our operating margins and in a significant

reduction or elimination of our profits.

We

depend on a small number of customers for the vast majority of our sales. A

reduction in business from any of these customers could cause a significant

decline in our sales and profitability.

The large

majority of our sales are generated from a small number of customers. Currently,

our largest customer in terms of sales is Hang Lung Properties, which currently

accounts for about 50% of our 2010 sales. Our next two largest customers are

China Estate Holdings and Sino Group, which each account for about 20% of our

sales. We expect that we will continue to depend upon a small number of

customers for a significant majority of our sales for the foreseeable future. A

reduction in business from any of these customers could cause a significant

decline in our sales and profitability.

Our

operations rely on a continuous power supply and the ready availability of

utilities and any shortages or interruptions could disrupt our operations and

increase our expenses.

The

manufacture of our products relies on a continuous and uninterrupted supply of

electric power, water and natural gas, as well as waste and emission discharge

facilities. Any shortage, interruption or discharge curtailment would

significantly disrupt our operations and increase our expenses although we have

backup generators or alternate sources of power to support our production in the

event of a blackout. In addition, our insurance coverage does not extend to any

damage resulting from interruption in our power supply. Any interruption in our

ability to continue operations at our facilities could damage our reputation,

harm our ability to retain existing customers or obtain new customers and could

result in severe loss, any of which could have a material adverse effect on our

business, financial condition and/or results of operations.

Increases

in energy and fuel costs would have a material adverse effect on our business,

financial conditions and results of operations.

Energy is

a significant cost in our production. Any increase or material fluctuation in

energy and fuel costs could have a material adverse effect on our business,

financial condition and/or results of operations.

20

We

may not be able to realize our expected production capacity increase to reap the

full economic benefits of our increased sales.

If we

fail to obtain our desired production output levels from our third-party

manufacturer due to insufficient funding, technical difficulties, human or other

resource constraints, or for whatever other reasons, we may not be able to

attain our desired production capacity or obtain the intended economic benefits

of our increased sales, such as economies of scales, in a full or timely manner,

which may adversely affect our business, results of operations and/or financial

conditions.

We

may incur substantial costs as a result of warranty and product liability claims

which could have an adverse effect on our results of operations.

The

development, manufacture, sale and use of our products involve risks of warranty

and product liability claims. We provide a ten-year warranty for all of our

products. Warranty and product liability claims would not be covered by our

insurance. Warranties of such an extended length pose a risk to us of

unanticipated future expenses. In the past, we have corrected any problems with

respect to our products by repairing or replacing the product in issue with

minimal expense. Historically, we have not recorded any warranty expense as we

have incurred minimal expense related to warranty claims. We may be required to

record material expense in the future if actual costs for these warranties are

different from our assumptions.

We do not maintain any

business liability, disruption or litigation insurance coverage for our

operations, and any business liability, disruption or litigation we experience

might result in our incurring substantial costs and the diversion of

resources.

Insurance companies in Hong

Kong offer limited business insurance products and offer business limited

liability insurance. While business disruption insurance is available to a

limited extent in Hong Kong, we have determined that the risks of

disruption, cost of such insurance and the difficulties associated with

acquiring such insurance on commercially reasonable terms make it impractical

for us to have such insurance. As a result, we do not have any business

liability, disruption or litigation

insurance coverage for our operations in Hong Kong SAR, Macau SAR or the PRC.

Any business disruption or litigation may result in our incurring substantial

costs and the diversion of resources.

Our

quarterly operating results are likely to fluctuate, which may affect our stock

price.

Our

quarterly revenues, expenses, operating results and gross profit margins vary

from quarter to quarter. As a result, our operating results may fall below the

expectations of securities analysts and investors in some quarters, which could

result in a decrease in the market price of our common stock. The reasons our

quarterly results may fluctuate include:

|

|

·

|

variations in profit margins

attributable to different production

contracts;

|

|

|

·

|

changes in the general

competitive and economic

conditions;

|

|

|

·

|

delays in, or uneven timing in

the delivery of, customer orders;

and

|

|

|

·

|

the introduction of new products

by us or our

competitors.

|

Period to

period comparisons of our results should not be relied on as indications of

future performance.

21

Our

limited ability to protect our intellectual property, and the possibility that

our technology could inadvertently infringe technology owned by others, may

adversely affect our ability to compete.

We rely

on a combination of patents, trademarks and trade secret laws to protect the

technological know-how and brands that comprise our intellectual property. A

successful challenge to the ownership of our intellectual property could

materially damage our business prospects. Our competitors may assert that our

technologies or products infringe on their patents or proprietary rights. We may

be required to obtain from others licenses that may not be available on

commercially reasonable terms, if at all. Problems with intellectual property

rights could increase the cost of our products or delay or preclude our new

product development and commercialization. If infringement claims against us are

deemed valid, we may not be able to obtain appropriate licenses on acceptable

terms or at all. Litigation could be costly and time-consuming but may be

necessary to protect our technology license positions or to defend against

infringement claims.

Our

business may be subject to seasonal and cyclical fluctuations in

sales.

We may

experience seasonal fluctuations in our revenue. Moreover, our revenues are

usually slightly higher in the third and fourth quarters due to seasonal

purchases.

RISKS

RELATED TO DOING BUSINESS IN CHINA

Changes

in China's political or economic situation could harm us and our operating

results.

All of

our business operations are currently conducted in Hong Kong, under the

jurisdiction of the Hong Kong SAR, Macau SAR and PRC governments. All of our

products are manufactured by our sole manufacturer in the PRC, and we sell the

majority of our products to customers in the PRC. Accordingly, our results of

operations, financial condition and prospects are subject to a significant

degree to economic, political and legal developments in China. However, economic

reforms adopted by the Chinese government have had a positive effect on the

economic development of the country, but the government could change these

economic reforms or any of the legal systems at any time. This could either

benefit or damage our operations and profitability. Some of the things that

could have this effect are:

|

|

·

|

Level of government involvement

in the economy;

|

|

|

·

|

Control of foreign

exchange;

|

|

|

·

|

Methods of allocating

resources;

|

|

|

·

|

Balance of payments

position;

|

|

|

·

|

International trade restrictions;

and

|

|

|

·

|

International

conflict.

|

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in many ways. For example, state-owned enterprises still constitute a large portion of the Chinese economy and weak corporate governance and a lack of flexible currency exchange policy still prevail in China. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy was similar to those of the OECD member countries.

Fluctuation

in the value of RMB and the Hong Kong Dollar relative to other currencies may

have a material adverse effect on our business and/or an investment in our

shares.

Payments

from our customers in China are denominated in Hong Kong Dollars. The value of

RMB and the Hong Kong Dollar against the U.S. dollar and other currencies may

fluctuate and is affected by, among other things, changes in political and

economic conditions. Although the exchange rate between RMB and the U.S. dollar

has been effectively pegged by the People’s Bank of China since 1994, and the

rate between the Hong Kong Dollar has been pegged to the U.S. dollar since 1983,

there can be no assurance that these currencies will remain pegged to the U.S.

dollar, especially in light of the significant international pressure on the

Chinese government to permit the free floatation of the RMB, which would result

in fluctuations in the exchange rate between the RMB and the U.S. dollar. In

addition, a strengthening of the U.S. dollar against the Hong Kong Dollar, if it

occurred, would adversely affect the value of your investment.

22

You

may face difficulties in protecting your interests, and your ability to protect

your rights through the U.S. federal courts may be limited because our

subsidiaries are incorporated in non-U.S. jurisdictions, we conduct

substantially all of our operations in Hong Kong, and all of our officers reside

outside the United States.

Although

we are incorporated in Nevada, we conduct substantially all of our operations

through our wholly owned subsidiaries in Hong Kong. All of our officers reside

outside the United States and some or all of the assets of those persons are

located outside of the United States. As a result, it may be difficult or

impossible for you to bring an action against us or against these individuals in

Hong Kong in the event that you believe that your rights have been violated