Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - AUXILIUM PHARMACEUTICALS INC | dex991.htm |

| 8-K - AUXILIUM PHARMACEUTICALS, INC. -- FORM 8-K - AUXILIUM PHARMACEUTICALS INC | d8k.htm |

1

January 2011

(NASDAQ: AUXL)

Exhibit 99.2 |

2

Safe Harbor Statement

We will make various remarks during this presentation that constitute “forward-looking

statements” for purposes of the safe harbor provisions under The Private Securities

Litigation Reform Act of 1995, including statements regarding: the pricing, time to market, size of market, growth potential and therapeutic

benefits of the Company’s products and product candidates, including those for the treatment of

Peyronie’s disease and Frozen Shoulder syndrome; the size and development of the

Dupuytren’s market in the U.S., the EU and the rest of the world; the potential for XIAFLEX to become the standard of care for

Dupuytren’s contracture; the potential for XIAFLEX to be used in multiple indications; the effect

of the identified leading indicators on the success of the XIAFLEX launch and future net

revenues; the ability to obtain reimbursement in the U.S. for XIAFLEX for the treatment of Dupuytren’s; the timing of new

reimbursement codes for XIAFLEX and the effect of the reimbursement process on the success of the

XIAFLEX launch; physicians and sites that are moving from test drive to increasing usage; the

generation of cash through licensing of XIAFLEX in other territories and for new indications; the timing and

likelihood of approval of the Marketing Authorization Application for XIAFLEX for the treatment of

Dupuytren’s contracture in the European Union, and timing and likelihood of success of

launch, if approved; future Testim market share, prescriptions and sales growth and factors that may drive such growth; size

and growth potential of the testosterone replacement therapy market and the gel segment thereof and

factors that may drive such growth; the likelihood of generic competition in the testosterone

replacement therapy gel market; competitive developments affecting the Company’s products and product

candidates, including generic competition in the testosterone replacement therapy market; the scope,

timing, methodology, endpoints, safety, execution and results of the phase III studies for

XIAFLEX for the treatment of Peyronie’s disease; the size of the Peyronie’s market and any increase in treatment for

Peyronie’s; business development efforts and opportunities to build out the Company’s

pipeline; the Company’s development and operational goals and strategic priorities for

2011, including building out its pipeline in specialty therapeutic areas; the ability to fund future operations; the opportunities and

strategies to build shareholder value; the Company’s expected financial performance during 2011

and financial milestones that it may achieve for 2011, including 2011 XIAFLEX U.S. net revenues

and Pfizer royalty and contract revenues; and the likelihood or timing of the Company becoming profitable. All

remarks other than statements of historical facts made during this presentation, including but not

limited to, statements regarding future expectations, plans and prospects for the Company,

statements regarding forward-looking financial information and other statements containing the words “believe,” “may,”

“could,” “will,” “estimate,” “continue,”

“anticipate,” “intend,” “should,” “plan,” “expect,” and similar expressions, as they relate to the Company, constitute

forward-looking statements. Actual results may differ materially from those reflected in

these forward-looking statements due to various factors, including general financial,

economic, regulatory and political conditions affecting the biotechnology and pharmaceutical industries and those discussed in Auxilium's

Annual Report on Form 10-K for the year ended December 31, 2009 and in Auxilium’s Quarterly

Report on Form 10-Q for the period ended September 30, 2010 under the heading “Risk

Factors,” which are on file with the Securities and Exchange Commission (the “SEC”) and may be accessed electronically by

means of the SEC’s home page on the Internet at http://www.sec.gov or by means of the

Company’s home page on the Internet at http://www.auxilium.com under the heading “For

Investors - SEC Filings.” There may be additional risks that the Company does not presently know or that the Company currently

believes are immaterial which could also cause actual results to differ from those contained in the

forward-looking statements. Given these risks and uncertainties, any or all of these

forward-looking statements may prove to be incorrect. Therefore, you should not rely on any such factors or forward-

looking statements.

In addition, forward-looking statements provide the Company’s expectations, plans or

forecasts of future events and views as of the date of this presentation. The Company

anticipates that subsequent events and developments will cause the Company’s assessments to change. However, while the

Company may elect to update these forward-looking statements at some point in the future, the

Company specifically disclaims any obligation to do so. These forward-looking

statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this

presentation. |

3

Our Strategy Is to Become a Highly Profitable

and Sustainable Biopharmaceutical Company

Maximize Value of

Testim

and XIAFLEX

Deliver on

Current Pipeline

Build Out

Pipeline in

Specialty

Therapeutic

Areas |

XIAFLEX and Testim

Are Global Product

Opportunities

U.S.

Canada

EU

ROW

Open

Open

Territory

XIAFLEX

Testim

4 |

Auxilium

Has a 6 Year Net Revenue CAGR

of 40.2%

4Q10 XIAFLEX Net

Revenues $8.4M

(including $7.3M in U.S.

revenues)

4Q10 Testim

Net

Revenues $53.4M,

13.3% y/y

growth

5 |

6 |

7

•

Excessive collagen in fascia of hand

•

Nodules or pits are an early, active

presentation

•

Rope-like cords develop in the finger

and result in contractures

•

Quality of life and daily activities

affected

•

Surgery has been reserved for

advanced disease due to the nature of

the disease, unpredictable results,

complications, long recovery time and

recurrence/additional surgeries

Dupuytren’s Contracture Is Debilitating for Patients

and Surgery Has Been the Standard of Care

Immediately post-operative

Intra-operative open fasciectomy

Pictures

courtesy

of

Dr.Clayton

Peimer

pre-operative open fasciectomy |

8

We Believe XIAFLEX Is a Paradigm

Changing Treatment

•

Simple, non-invasive injection of XIAFLEX

•

Established mechanism of action and selective for specific types of collagen

•

XIAFLEX’s

post-approval profile is consistent with clinical trial experience

Pre XIAFLEX injection

30 days following XIAFLEX

injection |

9

Strategy for Establishing XIAFLEX as the

Standard of Care

•

Disseminate excellent clinical efficacy and safety data

•

Facilitate peer to peer dialogue

•

Educate patients on a non-invasive option

•

Smooth the reimbursement process

•

Activate a critical mass of experienced prescribers |

10

XIAFLEX Launch Strategy is Tailored to

Customer Needs

•

~ 6,000 target physicians

–

Hand surgeons, plastic surgeons, orthopedic

surgeons, general surgeons, rheumatologists

•

~ 100 field based personnel

–

Sales reps, sales managers, and reimbursement

specialists

•

Medical science liaisons

–

Key opinion leader and regional opinion leader

support |

11

We

Believe

the

U.S.

Dupuytren’s

Opportunity

Is

Significant

70,000 Surgical

2,3,4

Patients Annually

300,000 Diagnosed

Patients Annually

2,3,4

>1 Million Diagnosed

Patients

2,4

1.

Dupuytren’s

Disease

–

Tubiana,

LeClerq,

Hurst,

Badalamente,

Mackin

2.

SDI Claims Data Based Projections

3.

Medicare

Data

Based

Projections

(BESS

database

used,

Medicare

5%

database

also

used

to

validate

numbers)

4.

Auxilium

Research

(Patient

Segmentation,

Forecast

Research,

WK/AMA

Databases)

Sources:

$1 Billion Annual

Market Opportunity

>$3 Billion Market

Opportunity

$350 Million

Market

Opportunity |

12

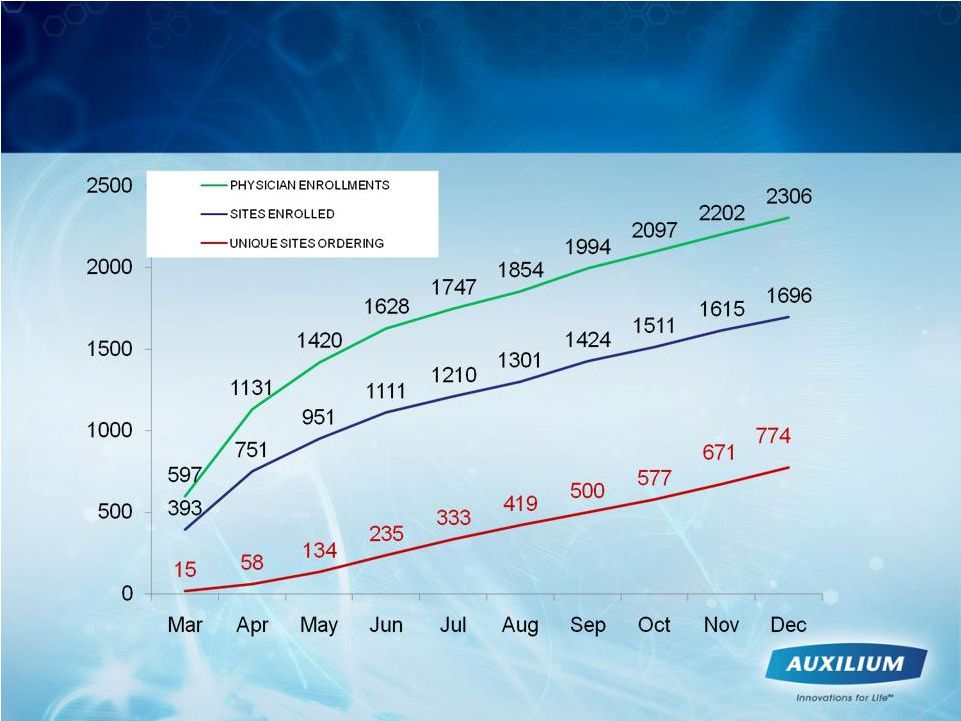

Enrollment and Sites that Have Ordered

XIAFLEX Are Trending Positively |

We

Believe that Quarterly XIAFLEX Unit Sales Growth Increased Steadily in

2010 1Q10

2Q10

3Q10

4Q10

13 |

14

Sites Are Increasing XIAFLEX Usage

Injections per Site |

15

We Expect the Global Dupuytren’s Market to

Develop in 2011 and 2012

U.S.

•

XIAFLEX specific J-code J0775 effective Jan. 1

•

U.S. CPT code guidance expected for Jan. 2012

•

Increasing peer to peer dialogue programs for U.S.

physicians

•

Targeted U.S. patient education campaign planned

ROW

•

Pfizer launches XIAFLEX in EU for Dupuytren’s

following expected Q1 2011 approval |

16

XIAFLEX Revenue Guidance for 2011

U.S. Net Revenues

$50 –

$60 million

Pfizer Royalties &

Contract Revenues

$5 –

$7 million

Total Revenues

$55 –

$67 million |

Testim

®

1% Testosterone Gel

•

Indicated for testosterone replacement therapy in adult

males for hypogonadism

•

Launched in U.S. in 2003 and EU in 2006

•

>7 yrs of use with established safety and efficacy

>

~100M daily doses since launch

>

16 clinical studies involving approx. 1,800 patients

•

Applied once daily at 5-10mg

>

90% stay on starting dose of 5mg (one tube)

>

Simple application process

17 |

18

Hypogonadism

Is an Unmet Need and

Under-penetrated Market

•

39% of U.S. males over 45 yrs are

hypogonadal

>Less than 10% of affected population

receives treatment

•

Increasing physician and patient education

and awareness should result in increased

treatment

1

Mulligan T. et al. Int J. Clin Pract

2006

1 |

19

Gels Continue to Drive Significant Growth in

TRT Marketplace

Source: IMS data

$35

$117

$198

$281

$334

$371

$439

$545

$685

$892

$1,025

$49

$59

$77

$118

$210

$302

$390

$451

$483

$554

$663

$810

$1,041

0

200

400

600

800

1,000

1,200

1,400

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Nov

Gel

Patch

Oral

Injectables

($ in millions)

Gel Segment Growth ($)

Nov 2010 L12M:

29.3%

($ in millions)

Gel Segment Growth ($)

Nov 2010 L12M:

29.3%

($ in millions)

Gel Segment Growth ($)

Nov 2010 L12M:

29.3%

($ in millions)

Gel Segment Growth ($)

Nov 2010 L12M:

29.3%

$1,185 |

20

Testosterone Replacement Therapy Landscape

is Changing

•

New competition in 2011 should help

increase overall market

–

Axiron 2% solution

–

Fortesta 2% gel

–

Androgel 1.6% gel seeking approval

•

Expected further increase in physician and

patient education and awareness |

21

Delivering on Current Pipeline

PRODUCT

LATE RESEARCH

PRE-CLINICAL PHASE I PHASE II PHASE

III MARKET

TESTIM®

GEL

XIAFLEX®

XIAFLEX®

XIAFLEX®

Hypogonadism

Dupuytren’s contracture

Peyronie’s disease

Frozen Shoulder Syndrome |

22

1

Smith BH. Am J Clin

Pathol. 1966;45:670-678.

2

Somers KD, Dawson DM. J Urol. 1997;157:311-315.

•

Scarring phenomenon affecting the

tunica

albuginea

•

Plaques

show

excessive

collagen

deposition

•

Potential Symptoms

>

Pain with erection, penile curvature/

deviation, penile shortening, indentations,

and/or erectile dysfunction

>

May experience difficulty with sexual

intercourse, loss of self-esteem,

and depression

Peyronie’s

disease Is a Devastating Disorder

with No Approved Therapies

1

2 |

23

1

Bella A. Peyronie’s Disease J Sex Med 2007;4:1527–1538

2

Lue TF, et al. Summary of the recommendations on sexual dysfunctions in men. J Sex

Med 2004;1:6–23. 3

Mulhall JP, et al. Subjective and objective analysis of the prevalence of

Peyronie’s disease in a population of men presenting for prostate

cancer screening. J Urol 2004;171:2350–3. 4

Smith BH. Am J Clin Pathol. 1966;45:670-678.

5

Lindsay MB, J Urol.

1991;146:1007-1009.

6

Nyberg L, J Urol.128: 48, 1982

•

Prevalence of Peyronie’s disease is estimated to be approximately

5% in adult men

1,2,3

>

Actual prevalence may be higher, based on autopsies

4

•

Prevalence rate increases with age

>

The average age of disease onset is 53 years

5

•

High association with other diseases such as:

>

Diabetes, erectile dysfunction (ED), Dupuytren’s contracture,

plantar fascial contracture, tympanosclerosis, gout, and Paget’s

disease

6

We believe Peyronie’s Disease Is Under-

diagnosed and Under-treated |

24

Peyronie’s Disease Phase III Development

Program

Study

Type

~ #

Subjects

Sites

XIAFLEX:

Placebo

Duration

AUX-CC-803

Double-blind,

placebo controlled

300

~ 30 US

5 AUS

2:1

52 Wks

AUX-CC-804

Double-blind,

placebo controlled

300

~ 30 US

5 AUS

2:1

52 Wks

AUX-CC-802

Open Label

250

12 US

6 NZ

18 EU

N/A

36 Wks

AUX-CC-805

Pharmacokinetics

16

1 US

N/A

4 Wks

XIAFLEX 0.58 mg

Two injections per treatment cycle

24 to 72 hours between injections

Penile plaque modeling following each cycle

Up to 4 cycles at 6 week intervals

Co-primary endpoints of disease bother and penile curvature

|

25

We Believe Changes to the Phase IIb Trial Design

Should Increase the Chance of Success in Phase III

•

4 cycles of therapy in the phase III trial

•

All patients receive modeling in the phase III trial

•

All patients must have greater than 12 months of

disease since diagnosis to enter the phase III trial

Mean net improvements in phase IIb penile

curvature and bother domain for modeling

arm would have met statistical significance

using phase III co-primary endpoint

requirements |

26

Business Development Efforts Focused on

Building Out Pipeline

•

Leverage current infrastructure of Testim and

XIAFLEX field forces with marketed products

•

Seeking Phase II and later assets in Urology,

Endocrinology, Rheumatology, and Orthopedics

•

Niche products with specialty physician call

points also represent development opportunities |

27

Q4 ’10 Growth

2010

Growth

($ Millions)

vs. 2009

Full Year vs. 2009

Testim

U.S.

$52.1

23.3%

$190.0 25.0% Testim

Ex U.S. & Contract

$1.3 (73.7%)

$3.0

(64.2%)

Testim

Total

$53.4

13.3%

$193.0 20.3% XIAFLEX

U.S. $7.3

-

$14.1

-

XIAFLEX Contract

$1.1

22.1%

$4.3

22.1%

XIAFLEX

Total

$8.4

845.0%

$18.4

416.7%

Total

Revenues

$61.8

28.7%

$211.4

28.9%

2010

Preliminary

Net

Revenue

Cash as of 9/30/2010 = $142.4 million |

28

Strategic Priorities in 2011

•

Maximize XIAFLEX net revenues for Dupuytren’s contracture in

the U.S.

•

Support Pfizer in the launch of Dupuytren’s contracture in the

EU

•

Enroll Peyronie’s disease phase III clinical program

•

Projected double-blind study enrollment to be completed in 1Q11

•

Phase III studies top-line results anticipated in 1H12

•

Advance XIAFLEX new indication(s)

•

Maximize global Testim revenues |

29

Our Strategy Is to Become a Highly Profitable

and Sustainable Biopharmaceutical Company

Maximize Value of

Testim and XIAFLEX

Deliver on

Current Pipeline

Build Out

Pipeline in

Specialty

Therapeutic

Areas |