Attached files

| file | filename |

|---|---|

| EX-32.1 - SOMBRIO CAPITAL 10K, CERTIFICATION 906 - SOMBRIO CAPITAL CORP | sombrioexh32_1.htm |

| EX-31.1 - SOMBRIO CAPITAL 10K, CERTIFICATION 302 - SOMBRIO CAPITAL CORP | sombrioexh31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended October 31, 2010

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to________________

Commission file number 000-52667

SOMBRIO CAPITAL CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

98-0533822

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

311 Tawny Road, Sarnia,

|

|

|

Ontario, Canada

|

N7S 5K1

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code 519-542-1229

Securities registered under Section 12(b) of the Act:

|

None

|

N/A

|

|

Title of each class

|

Name of each exchange on which registered

|

Securities registered under Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of class)

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by checkmark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes o No x

Indicate by checkmark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o (Do not check if a smaller reporting company)

|

Accelerated filer

|

o | |

|

Non-accelerated filer

|

o |

Smaller reporting company

|

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes x No o

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed fiscal quarter: 218,749.80 based on a price of $0.10 per share, being the issue price per share of the last private placement of our company in April, 2007. The aggregate market value as determined by the average of bid and ask closing prices is inapplicable due to the fact that the common shares of our company have not traded to date.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PAST FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes o No o N/A

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 7,187,498 shares of common stock as of January 7, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) any annual report to security holders; (2) any proxy or information statement; and (3) any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). Not Applicable

2

PART I

Forward Looking Statements.

This annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and not in limitation:

|

●

|

the uncertainty that we will not be able to successfully identify and evaluation a suitable business opportunity;

|

|

●

|

risks related to the large number of established and well-financed entities that are actively seeking suitable business opportunities;

|

|

●

|

risks related to the failure to successfully management or achieve growth of a new business opportunity; and

|

|

●

|

other risks and uncertainties related to our business strategy.

|

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to "common stock" refer to the common shares in our capital stock.

As used in this annual report, the terms "we", "us", "our", and "Sombrio" mean Sombrio Capital Corp., unless the context clearly requires otherwise.

ITEM 1. BUSINESS

General

We were incorporated as Sombrio Capital Corp. under the laws of Nevada on March 31, 2006. We are an exploration stage company engaged in the acquisition and exploration of mineral properties. On January 28, 2009, we decided to abandon our Lincoln 1 mineral claim due to our unsuccessful explorations to date and our inability to attract investment capital to proceed with further exploration on the claim.

On April 20, 2010, we entered in a Mineral Lease Agreement whereby we leased from Timberwolf Minerals, LTD a total of five (5) unpatented lode mining claims in the State of Nevada which we refer to as the Enright Hill Prospect. These mineral claims are located in Sections 7 & 8, Township 46 North, Range 5 East, Mt. Diablo Meridian, Elko County, Nevada, USA, owned by Timberwolf Minerals LTD.

3

According to the lease Sombrio has agreed to pay Timberwolf Minerals, LTD minimum royalty payments which shall be paid in advance. Sombrio paid the sum of $5,000 upon execution of this lease, plus State and Bureau of Land Management filing fees for 2010 totaling $756.50 . Sombrio has agreed to pay $7,500 on or before the first anniversary of the lease, $10,000 on or before the second and third anniversary of the lease, $25,000 on or before the fourth anniversary of the lease and each annual payment after that shall be $25,000. Sombrio will pay Timberwolf Minerals, LTD a royalty of 1.5% of the Net Returns from all ores, minerals, concentrates, or other products mined and removed from the property and sold or processed by Sombrio, quarterly. Sombrio has the right to purchase the total 1.5% Net Smelter Return before the seventh (7th) Anniversary for a total cost of $5,000,000. If Sombrio fails to pay the purchase price before the 7th Anniversary, the lease agreement will terminate and the property will be returned to the Lessor. The term of this lease is for twenty (20) years, renewable for an additional twenty (20) years so long as conditions of the lease are met.

Our plan of operations is to conduct mineral exploration activities on the Enright Hill Prospect in order to assess whether these claims possess commercially exploitable mineral deposits. (Commercially exploitable mineral deposits are deposits which are suitably adequate or prepared for productive use of a natural accumulation of minerals or ores). Our exploration program is designed to explore for commercially viable deposits of gold, silver, copper or any other valuable minerals. (Commercially viable deposits are deposits which are suitably adequate or prepared for productive use of an economically workable natural accumulation of minerals or ores). We have not, nor has any predecessor, identified any commercially exploitable reserves of these minerals on our mineral claims. (A reserve is an estimate within specified accuracy limits of the valuable metal or mineral content of known deposits that may be produced under current economic conditions and with present technology). We are an exploration stage company and there is no assurance that a commercially viable mineral deposit exists on our mineral claims.

Upon acquiring a lease on the Enright Hill Prospect, David A. Wolfe, Professional Geologist, prepared a geologic report for us on the mineral exploration potential of the claims. Mr. Wolfe is the President of Timberwolf Minerals LTD, the company from whom we leased the property. Included in this report is a recommended exploration program which consists of mapping, sampling, staking additional claims and drilling.

At this time we are uncertain of the extent of mineral exploration we will conduct before concluding that there are, or are not, commercially viable minerals on our claims. Further phases beyond the current exploration program will be dependent upon numerous factors such as Mr. Wolfe’s recommendations based upon ongoing exploration program results and our available funds.

We have no revenues, have achieved losses since inception, have been issued a going concern opinion by our auditors and rely upon the sale of our securities to fund operations. We will not generate revenues even if our exploration program indicates that a mineral deposit may exist on our mineral claims. Accordingly, we will dependent on future additional financing in order to maintain our operations and continue our exploration activities.

If we are unable to raise additional funds and we do not start generating revenue to a point where we can continue to operate, we may be forced to cease operations and close our business. We are still pursuing our business plan but to date we have not been able to raise additional funds through either debt or equity offerings, and without additional cash we will not be able to pursue our plan of operations and will not be able to begin generating revenue. We believe that we may not be able to raise the necessary funds to continue to pursue our business operations. As a result of the foregoing, we have recently begun to explore our options regarding the development of a new business plan and direction. We are currently engaged in discussions with a company regarding the possibility of a reverse merger involving our company. At this stage, no definitive terms have been agreed to and neither party is currently bound to proceed with the merger.

Competition

We are a junior mineral resource exploration company. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to achieve the financing necessary for us to conduct further exploration of our mineral properties.

4

We will also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to make investments in junior mineral exploration companies. The presence of competing junior mineral exploration companies may impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors.

We will also be competing with other junior and senior mineral companies for available resources, including, but not limited to, professional geologists, camp staff, helicopter or float planes, mineral exploration supplies and drill rigs.

Compliance with Government Regulation

As we undertake exploration of our mineral claims, we will be subject to compliance with government regulation that may increase the anticipated time and cost of our exploration program. There are several governmental regulations that materially restrict mineral exploration. We will be subject to the laws of the State of Nevada as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program. We currently have budgeted $1,000 for regulatory compliance.

Employees

Currently our only employee is our sole director and officer. We do not expect any material changes in the number of employees over the next 12 month period. We anticipate that we will be conducting most of our business through agreements with consultants and third parties. Our sole officer does not have an employment agreement with us.

Subsidiaries

We do not have any subsidiaries.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark.

ITEM 1A. RISK FACTORS

Our Common shares are considered speculative. Prospective investors should consider carefully the risk factors set out below:

RISKS RELATING TO OUR BUSINESS AND FINANCIAL CONDITION

If we do not obtain additional financing, our business plan will fail.

Our current operating funds not sufficient to complete the initial phase of preliminary exploration of our mineral claims and we will need to obtain additional financing in order to complete our business plan. As of October 31, 2010, we had cash on hand of $Nil and working capital of $(37,125). Our business plan calls for significant expenses in connection with the exploration of our mineral claims. The exploration programs on our property as recommended by our consulting geologist is estimated to cost approximately $149,100. We will require additional financing in order to complete phase one through four of the recommended exploration program. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Obtaining additional financing would be subject to a number of factors, including the market price of gold. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

5

Because we lease the Enright Hills Prospect, we face the risk of not being able to meet the requirements of the lease and may be forced to default on the agreement

Under the terms of the lease on the Enright Hills Prospect, Sombrio has agreed to pay minimum annual royalties on or before April of every year. If Sombrio is unable to meet these obligations, we may be forced to default on the agreement and the lease may be terminated by the owner resulting in lose of the property for Sombrio.

Because we have only recently commenced business operations, we face a high risk of business failure and this could result in a total loss of your investment.

We have only begun the initial stages of exploration of our mineral claims, and thus have no way to evaluate the likelihood whether we will be able to operate our business successfully. We were incorporated on March 31, 2006, and to date have been involved primarily in organizational activities, evaluating resource projects and staking mineral claims. We have not earned any revenues and have not achieved profitability as of the date of this prospectus. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates. We have no history upon which to base any assumption as to the likelihood that our business will prove successful, and we can provide no assurance to investors that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will likely fail and you will lose your entire investment in this offering.

Because we do not have any revenues, we expect to incur operating losses for the foreseeable future.

We have never earned revenues and we have never been profitable. Prior to completing exploration on the mineral property, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. If we are unable to generate financing to continue the exploration of our mineral claims, we will fail and you will lose your entire investment in this offering.

We have yet to attain profitable operations and because we will need additional financing to fund our exploration activities, our accountants believe there is substantial doubt about the company’s ability to continue as a going concern.

We have incurred a net loss of $147,898 for the period from March 31, 2006 (inception) to October 31, 2010, and have no revenues to date. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the development of our mineral claim. These factors raise substantial doubt that we will be able to continue as a going concern.

Our financial statements included with this prospectus have been prepared assuming that we will continue as a going concern. Our auditors have made reference to the substantial doubt as to our ability to continue as a going concern in their audit report on our audited financial statements for the period ended October 31, 2010. If we are not able to achieve revenues, then we may not be able to continue as a going concern and our financial condition and business prospects will be adversely affected.

If our costs of exploration are greater than anticipated, then we will not be able to complete the exploration program for our Enright Hills Prospect without additional financing, of which there is no assurance that we would be able to obtain.

We are proceeding with the initial stages of exploration on our Enright Hills Prospect. We are proceeding to carry out an exploration program that has been recommended in a geological report that we obtained on the Enright Hills Prospect. This exploration program outlines a budget for completion of the recommended exploration program. However, there is no assurance that our actual costs will not exceed the budgeted costs. Factors that could cause actual costs to exceed budgeted costs include increased prices due to competition for personnel and supplies during the summer exploration season, unanticipated problems in completing the exploration program and delays experienced in completing the exploration program. Increases in exploration costs could result in us not being able to carry out our exploration program without additional financing. There is no assurance that we would be able to obtain additional financing in this event.

6

Because of the speculative nature of exploration of mining properties, there is substantial risk that no commercially exploitable minerals will be found and our business will fail.

We are in the initial stages of exploration of our mineral claims, and thus have no way to evaluate the likelihood that we will be successful in establishing commercially exploitable reserves of gold or other valuable minerals on our mineral claims. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The search for valuable minerals as a business is extremely risky. We may not find commercially exploitable reserves of gold or silver in our mineral claim. Exploration for minerals is a speculative venture necessarily involving substantial risk. The expenditures to be made by us on our exploration program may not result in the discovery of commercial quantities of ore. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. In the course of carrying out exploration of our Enright Hills Prospect, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. We currently have no such insurance nor do we expect to get such insurance for the foreseeable future. If a hazard were to occur, the costs of rectifying the hazard may exceed our asset value and cause us to liquidate all of our assets, resulting in the loss of your entire investment in this offering.

If we discover commercial reserves of precious metals on our mineral property, we can provide no assurance that we will be able to successfully advance the mineral claims into commercial production.

Our mineral property does not contain any known bodies of ore. If our exploration programs are successful in establishing ore of commercial tonnage and grade, we will require additional funds in order to advance the mineral claims into commercial production. In such an event, we may be unable to obtain any such funds, or to obtain such funds on terms that we consider economically feasible, and you may lose your entire investment in this offering.

Because access to our mineral claims is often restricted by inclement weather, we may be delayed in our exploration and any future mining efforts.

Access to the mineral claims is restricted to the approximate period between Easter and Thanksgiving of each year due to snow and storms in the area. As a result, any attempts to visit, test or explore the property are largely limited to the few months out of the year when weather permits such activities. These limitations can result in significant delays in exploration efforts, as well as in mining and production in the event that commercial amounts of minerals are found. This could cause our business venture to fail and the loss of your entire investment in this offering.

As we undertake exploration of our mineral claims, we will be subject to compliance with government regulation that may increase the anticipated time and cost of our exploration program.

There are several governmental regulations that materially restrict mineral exploration. We will be subject to the laws of the State of Nevada as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program. We currently have budgeted $1,000 for regulatory compliance.

7

If we do not find a joint venture partner for the continued development of our mineral claims, we may not be able to advance the exploration work.

If the initial results of our mineral exploration program are successful, we may try to enter into a joint venture agreement with a partner for the further exploration and possible production of our mineral claims. We would face competition from other junior mineral resource exploration companies if we attempt to enter into a joint venture agreement with a partner. The possible partner could have a limited ability to enter into joint venture agreements with junior exploration programs and will seek the junior exploration companies who have the properties that they deem to be the most attractive in terms of potential return and investment cost. In addition, if we entered into a joint venture agreement, we would likely assign a percentage of our interest in the mineral claims to the joint venture partner. If we are unable to enter into a joint venture agreement with a partner, we may fail and you will lose your entire investment in this offering.

Because our executive officer has limited experience in mineral exploration and does not have formal training specific to the technicalities of mineral exploration, there is a higher risk that our business will fail.

Our executive officer has limited experience in mineral exploration and does not have formal training as a geologist or in the technical aspects of management of a mineral exploration company. As a result of this inexperience, there is a higher risk of our being unable to complete our business plan for the exploration of our mineral claims. With no direct training or experience in these areas, our management may not be fully aware of many of the specific requirements related to working within this industry. Our decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, the lack of training and experience of our management in this industry could result in management making decisions that could result in a reduced likelihood of our being able to locate commercially exploitable reserves on our mineral claims with the result that we would not be able to achieve revenues or raise further financing to continue exploration activities. In addition, we will have to rely on the technical services of others with expertise in geological exploration in order for us to carry our planned exploration program. If we are unable to contract for the services of such individuals, it will make it difficult and maybe impossible to pursue our business plan. There is thus a higher risk that our operations, earnings and ultimate financial success could suffer irreparable harm and our business will likely fail and you will lose your entire investment in this offering.

Because our executive officer has other business interests, he may not be able or willing to devote a sufficient amount of time to our business operation, causing our business to fail.

Our executive officer is spending approximately eight hours per week of his business time on providing management services to us. While our executive officer presently possesses adequate time to attend to our interests, it is possible that the demands on him from his other obligations could increase, with the result that he would no longer be able to devote sufficient time to the management of our business. This could negatively impact our business development.

Because of the fiercely competitive nature of the mining industry, we may be unable to maintain or acquire attractive mining properties on acceptable terms which will materially affect our financial condition.

The mining industry is competitive in all of its phases. We face strong competition from other mining companies in connection with the acquisition of properties producing, or capable of producing, precious and base metals. Many of these companies have greater financial resources, operational experience and technical capabilities. As a result of this competition, we may be unable to maintain or acquire attractive mining properties on terms we consider acceptable or at all. Consequently, our revenues, operations and financial condition could be materially adversely affected.

Because our director is a Canadian resident, difficulty may arise in attempting to effect service or process on him in Canada.

Because our sole director is a Canadian resident, difficulty may arise in attempting to effect service or process on him in Canada or in enforcing a judgment against Sombrio’s assets located outside of the United States.

8

Because our president owns 69.56% of our outstanding common stock, investors may find that corporate decisions influenced by the president are inconsistent with the best interests of other stockholders.

Mr. MacAlpine is our president, chief financial officer and sole director. He owns approximately 69% of the outstanding shares of our common stock. Accordingly, he will have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. While we have no current plans with regard to any merger, consolidation or sale of substantially all of its assets, the interests of Mr. MacAlpine may still differ from the interests of the other stockholders. Mr. MacAlpine owns 5,000,000 common shares for which he paid $0.001.

RISKS RELATING TO OUR COMMON STOCK

We have not paid any dividends and do not foresee paying dividends in the future.

Payment of dividends on our common stock is within the discretion of the board of directors and will depend upon our future earnings, our capital requirements, financial condition and other relevant factors. We have no plan to declare any dividends in the foreseeable future.

Our common stock is illiquid and shareholders may be unable to sell their shares.

There is currently a limited market for our common stock and we can provide no assurance to investors that a market will develop. If a market for our common stock does not develop, our shareholders may not be able to re-sell the shares of our common stock that they have purchased and they may lose all of their investment. Public announcements regarding our company, changes in government regulations, conditions in our market segment or changes in earnings estimates by analysts may cause the price of our common shares to fluctuate substantially. These fluctuations may adversely affect the trading price of our common shares.

Our common stock is subject to the “Penny Stock” rules of the SEC, which will make transactions in our common stock cumbersome and may reduce the value of an investment in our common stock.

The shares of the company constitute a penny stock under the Securities and Exchange Act. The shares will remain classified as a penny stock for the foreseeable future. Our securities are subject to the “penny stock rules” adopted pursuant to Section 15(g) of the Exchange Act. The penny stock rules apply generally to companies whose common stock trades at less than $5.00 per share, subject to certain limited exemptions. Such rules require, among other things, that brokers who trade “penny stock” to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade “penny stock” because of the requirements of the “penny stock rules” and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. In the event that we remain subject to the “penny stock rules” for any significant period, there may develop an adverse impact on the market, if any, for our securities. Because our securities are subject to the “penny stock rules”, investors will find it more difficult to dispose of our securities. Further, it is more difficult: (i) to obtain accurate quotations, (ii) to obtain coverage for significant news events because major wire services, such as the Dow Jones News Service, generally do not publish press releases about such companies, and (iii) to obtain needed capital.

ITEM 2. PROPERTIES.

Executive Offices

Our executive offices are located at 311 Tawny Road, Sarnia, Ontario N7S 5K1, Canada. Mr. Ken MacAlpine, our sole director and officer, currently provides this space to us free of charge. This space may not be available to us free of charge in the future. We do not own any real property.

The Enright Hill Property

The Enright Hill Prospect is comprised of five (5) unpatented lode mining claims located in Sections 7& 8 Township 46 North, Range 55 East, Mt. Diablo Meridian, Elko County, Nevada, USA, owned by Timberwolf Minerals LTD. Details of the unpatented mining claims are as follows:

9

|

Claim Name

|

BLM Serial No.

|

|

|

EH-3

|

998680

|

|

|

EH-4

|

998681

|

|

|

EH-5

|

998682

|

|

|

EH-6

|

998683

|

|

|

EH-12

|

998689

|

Location and Access

The Enright Hill Prospect is located in the Hicks District, approx. 10 miles Northeast of Mountain City, in northern Elko County. The property is approx. 80 miles north of Elko, Centered on Sections 7 & 8, T 46 N, R 55 E, MDPM.

The property lies at elevations of 7,000 to 7,500 ft. The area is inaccessible in winter, from roughly Thanksgiving to Easter, but could be kept open without too much difficulty once production begins.

From St. Hwy NV225 at Wildhorse Reservoir, turn East onto Gold Creek Road, go approx. 8 miles, turn left(North) on well-traveled dirt road approx. 7 miles to T-intersection. Turn right (East) approx. 6 miles, turn left (North) on well-traveled dirt road, past The Mahoganies, 14 miles to turnoff on left 2 miles to property.

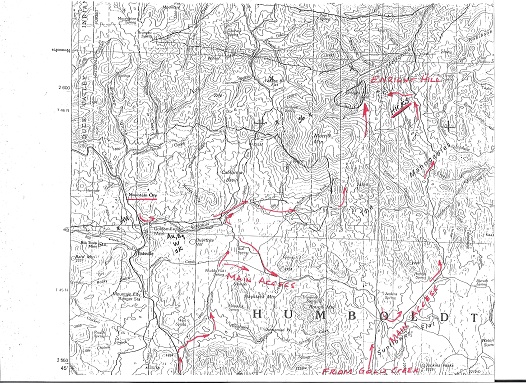

A map showing the location and access to the Enright Hill Prospect is provided below:

10

Local Resources

Water for drilling is available from a spring on the east side of the property. A larger stream is located approx. 5-6 miles south on access road. Production quantities would require water wells on the property. Contacts with basin-fill Tertiary volcanics along the eastern flank of the property typically carry large quantities of water in this type terrain. There are several locations from which to bring in electric within 5-10 miles, which is not an uncommon distance in Nevada. There are several open-pit gold mines in the area just west of Wildhorse Reservoir, now closed and inactive, which obtained local labor. Jerritt Canyon mine, located approx. 10 miles south of Wildhorse Reservoir supplements the local labor force with workers bussed in from Elko. At this time, production at Jerritt is shut down with short periods of activity, and all local labor should be available. All other services are available out of Elko.

Physiography and Climate

The property lies at elevations of 7,000 to 7,500 ft. The area is inaccessible in winter, from roughly Thanksgiving to Easter, but could be kept open without too much difficulty once production began.

Historical Exploration

History

Prospectors found gold on Enright Hill in the 1870's and quickly developed small working at the Bieroth Adit, the Enright Hill Deposit, and the Never Sweat Mine.

The Enright Hill property has been the focus of a number of limited exploration efforts in recent time. In the 1970’s, Cordilleran Exploration drilled 21 holes to depths of 10-160 ft, intersecting 1-3 oz/t Ag mineralization. Presumably the holes were drilled along the altered quartz-sericite-arsenopyrite zone that trends northeast from the Bieroth Adit, where numerous un-reclaimed drill roads and trenches are cut perpendicular to the altered trend.

In 1989, Westfield Minerals announced a small gold resource of approx. 20,000 oz. on Enright Hill. It is not known if this was based solely on prior work, or if Westfield drilled any additional holes on the property. The resource is unconfirmed and should be considered a potential resource only.

In 1996, the Timberwolf Minerals identified the area while consulting for Crown Resources, and recommended the area for acquisition. Crown staked the open ground in the area, but did not contact Banner Development Corporation, who held a block of claims over the central mineralized structure. Crown’s efforts were limited to minimal mapping and geochemical sampling. Crown discontinued its exploration program in 1998, and quit- claimed the property to the author. Efforts to find another interested party at that time of depressed metal prices were unsuccessful, and the area was dropped.

Banner held their claims until approx. 2000, then re-staked a limited line of SW trending claims in 2002-2003, leaving the main mineralized drill target mostly open.

The open area on Enright Hill was re-staked by Timberwolf Minerals in September, 2008.

Present Condition and Current State of Exploration

The Enright Hills Prospect presently does not have any known mineral reserves. The property that is the subject of our mineral claims is undeveloped and does not contain any open-pit or underground mines. There is no plant or equipment located on the property that is the subject of the mineral claim.

Geology of the Enright Hill Prospect

The Enright Hill area lies in a structurally complex area. The property lies along the northeast extension of the Midas Rift, a broad northeast-trending zone of left-lateral strike-slip faulting that extends from California across Nevada and into Wyoming. The Comstock Lode, Florida Canyon, Getchell/Twin Creeks, Midas, Jerritt Canyon, Big Springs, and Doby George deposits all occur along this major structural zone.

11

Geological Report on the Enright Hills Prospect

The geologic report obtained on the Enright Hills Prospect concluded that at Enright Hill, drill targets in the upper plate, in Chainman shales and altered intrusive, as well as the lower plate carbonates, are as yet untested. The overall target area, defined by alteration and anomalous gold-silver values, underlies an area at least 3,000 to 4,000 ft wide and 5,000 ft long, elongate NE-SW.

Our Planned Exploration Program

The geological report of David A. Wolfe recommended the completion a four phase preliminary exploration program which is summarized below. We have determined, based on the recommendation of the initial geological report, to proceed with this exploration program.

|

Phase

|

Description of Phase of Exploration

|

Estimated Cost

|

||||

|

Phase I

|

Detailed mapping and geochemical sampling

|

$ | 5,200.00 | |||

|

Phase II

|

Additional geologic mapping and geochemical sampling based on preliminary sampling

|

10,050.00 | ||||

|

Phase III

|

Drill hole planning, staking and permitting

|

18,850.00 | ||||

|

Phase IV

|

Reverse Circulation drilling of 3 holes to 900 ft each

|

115,000.00 | ||||

|

Total Estimated Cost

|

$ | 149,100.00 | ||||

Phase One of the Exploration Program

The first phase of the exploration program is the detailed mapping and geochemical sampling of the claims and target areas near the top of Enright Hill to better define the gold-silver mineralization, and further enhance the project. This will phase require approximately 6 days on the property and the collection of approximately 25 samples. The company currently does not have sufficient cash reserves to proceed with this phase of its exploration program.

Phase Two of the Exploration Program

We will base Phase Two on the recommendations of a summary report of Phase One carried out by Mr. Wolfe. We expect Phase Two to consist of follow up mapping and geochemical sampling based on any trends identified in Phase One. Phase Two is expected to require approximately 10 days in the field and the collection of approximately 50 samples. The company currently does not have sufficient cash reserves to proceed with this phase of its exploration program.

Phase Three of the Exploration Program

Phase three of the exploration will be based on the summary reports of both Phase One and Two of the exploration program and is expected to consist of drill hole planning, staking and permitting. We expect to stake and permit approximately 20 additional claims. The company currently does not have sufficient cash reserves to proceed with this phase of its exploration program.

Phase Four of the Exploration Program

We will make a determination whether to proceed with the fourth phase of the exploration program upon completion of phase three. In completing this determination, we will make an assessment as to whether the results of the three phases of the work program are sufficiently positive to warrant us proceeding with further additional exploration. The geochemistry of the selected samples collected will have to show trace amounts of mineralization, including gold

12

and copper, to be considered positive. The fourth phase of the exploration program would likely be comprised of a reverse circulation drill program of three holes of approximately 900 feet each and a geological interpretation of the results of the drilling program. The drilling program would require access to the site of the mineral claims with drilling equipment, the issuance of a work permit and the posting of a bond. The estimated cost of completion of this fourth phase of the exploration program is approximately $115,000. This phase is expected to take approximately four to eight weeks to complete. Positive drilling results at this phase could indicate zones of mineralization but will not indicate, in any way, mineral reserves.

We anticipate engaging David Wolfe to conduct each phase of the exploration work on the property, based on his experience with the exploration of the property and his knowledge of the surrounding geology. The company currently does not have sufficient cash reserves to proceed with any phase of its exploration program.

We plan to continue exploration of our mineral claims for so long as the results of the geological exploration that we complete indicate the further exploration of our mineral claims is recommended.

If our exploration activities result in an indication that our mineral claims contain potentially commercial exploitable quantities of gold and/ or silver, then we would attempt to complete feasibility studies on our property to assess whether commercial exploitation of the property would be commercially feasible. There is no assurance that commercial exploitation of our mineral claims would be commercially feasible even if our initial exploration programs show evidence of gold and/ or silver mineralization. Further, additional advanced exploration of our property beyond the third phase of the exploration program which, will include comprehensive drilling of our property, will be required before any feasibility study may be completed.

If we determine not to proceed with further exploration of our mineral claims due to results from geological exploration that indicate that further exploration is not recommended or due to our lack of financing, we will attempt to acquire an interest in a new resource property. Due to our limited finances, there is no assurance that we would be able to acquire an interest in a new property that merits further exploration. If we were to acquire an interest in a new property, then our plan would be to conduct resource exploration of the new property. In any event, we anticipate that our acquisition of a new property and any exploration activities that we would undertake will be subject to our achieving additional financing, of which there is no assurance.

ITEM 3. LEGAL PROCEEDINGS.

We know of no material, active or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

None.

13

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market for Securities

Our common shares are quoted on the Over-The-Counter Bulletin Board under the trading symbol “SBPP.OB”. Our shares have been quoted on the Over-The-Counter Bulletin Board since September 18, 2007. There have been no trades in our shares of common stock since September 18, 2007.

Our transfer agent is Island Stock Transfer, of 100 2nd Avenue, S, Suite 104N, St. Petersburg, FL 33701; telephone number 727.289.0010; facsimile: 727.289.0069.

Holders of our Common Stock

As of January 7, 2011, there were 49 registered stockholders holding 7,112,500 shares of our issued and outstanding common stock.

Dividend Policy

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

|

1.

|

We would not be able to pay our debts as they become due in the usual course of business; or

|

|

|

2.

|

Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution.

|

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Recent Sales of Unregistered Securities

We have not sold any equity securities that were not registered under the Securities Act during the fiscal year ended October 31, 2010.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fiscal year ended October 31, 2010.

Securities Authorized for Issuance Under Equity Compensation Plans

We do not have any equity compensation plans.

14

ITEM 6. SELECTED FINANCIAL DATA.

Not Applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The following discussion should be read in conjunction with our audited financial statements and the related notes that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include those discussed below and elsewhere in this annual report.

Our audited consolidated financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

Plan of Operations

Our plan of operations for the next twelve months is to complete the following objectives:

1. We plan to complete the phase one of our recommended exploration program on our Enright Hill Prospect mineral claims. Phase one will consist of detailed mapping and geochemical sampling of the claims and target areas near the top of Enright Hill to better define the gold-silver mineralization. Phase one is estimated to cost approximately $5,200. We hope to commence this phase of our exploration program in Spring of 2011 and have results in late-spring 2011, depending on the availability of our consulting geologist. We currently do not have sufficient cash reserves to proceed with this phase of the exploration program. Our President Mr. MacAlpine has agreed to lend the company sufficient capital to cover phase one of our exploration program.

2. We plan to complete phase two of our recommended exploration program on our Enright Hill mineral claims. Phase two will consist of further detailed mapping and geochemical sampling of the claims. and is estimated to cost approximately $10,500. We hope to commence this second phase of our exploration program in Summer of 2011, depending on the availability of our consulting geologist. The company currently does not have sufficient cash reserves to proceed with this phase of its exploration program.

3. If warranted by the results of phase three, we intend to proceed with phase three of our recommended exploration program. Phase three is estimated to cost $18,850 and will be comprised of drill hole planning, staking and permitting. The company currently does not have sufficient cash reserves to proceed with this phase of its exploration program.

4. We anticipate spending approximately $2,000 in ongoing general and administrative expenses per quarter for the next twelve months, for a total anticipated expenditure of $6,000 over the next twelve months. The general and administrative expenses for the year will consist primarily of professional fees for the audit and legal work relating to our regulatory filings throughout the year, as well as transfer agent fees, annual lease payments and general office expenses.

As at October 31, 2010, we had cash reserves of $Nil and working capital of $(37,125). Our cash and working capital is not sufficient to enable us to complete any phases of our exploration program. Our President Mr. MacAlpine has agreed to lend the company sufficient capital to cover phase one of our exploration program and our general and administrative expenses for the next twelve months. However, our ability to complete phase two, three and four of the recommended work program will be subject to us obtaining additional financing as these expenditures will exceed our cash reserves.

If we are unable to raise additional funds and we do not start generating revenue to a point where we can continue to operate, we may be forced to cease operations and close our business. We are still pursuing our business plan but to date we have not been able to raise additional funds through either debt or equity offerings, and without additional cash we will not be able to pursue our plan of operations and will not be able to begin generating revenue. We believe that we may not be able to raise the necessary funds to continue to pursue our business operations. As a result of the foregoing, we have recently begun to explore our options regarding the development of a new

15

business plan and direction. We are currently engaged in discussions with a company regarding the possibility of a reverse merger involving our company. At this stage, no definitive terms have been agreed to and neither party is currently bound to proceed with the merger.

Anticipated Cash Requirements

We anticipate that we will incur the following expenses over the next twelve months:

|

1.

|

$6,000 in connection with our administrative expenses;

|

|

2.

|

$15,700 for exploration expenses related to phase one and phase two of our plan of operations.

|

Results of Operations

The following summary of our results of operations should be read in conjunction with our audited financial statements for the year ended October 31, 2010 which are included herein.

Our operating results for the years ended October 31, 2010, 2009, 2008 and 2007 are summarized as follows:

|

Years Ended

|

||||||||||||||||

|

October31,

|

||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

|||||||||||||

|

Revenue

|

$ | - | $ | - | $ | - | $ | - | ||||||||

|

Operating Expenses

|

27,137 | 11,370 | 50,643 | 57,724 | ||||||||||||

|

Net Loss

|

$ | 27,137 | $ | 11,370 | $ | 54,239 | $ | 57,724 | ||||||||

Our operating results for the three months ended October 31, 2010, and 2009 are summarized as follows:

|

|

Three Months Ended

|

|||||||

|

|

October31,

|

|||||||

|

|

2010

|

2009

|

||||||

|

|

|

|||||||

|

Revenue

|

$ | - | $ | - | ||||

|

Operating Expenses

|

1,577 | 2,070 | ||||||

|

Net Loss

|

$ | 1,577 | $ | 2,070 | ||||

Revenues

We have had no operating revenues since our inception on March 31, 2006 through to the period ended October 31, 2007. We anticipate that we will not generate any revenues for so long as we are an exploration stage company.

Expenses

Our expenses for the years ended October 31, 2010, 2009 and 2008 are outlined in the table below:

|

Years Ended

|

||||||||||||

|

October 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

Exploration Expenses

|

$ | 15,757 | $ | - | $ | 3,446 | ||||||

|

Filing Fees

|

4,146 | 6,198 | 2,373 | |||||||||

|

General and Administrative

|

108 | 1,464 | 757 | |||||||||

|

Professional Fees

|

7,126 | 3,708 | 32,574 | |||||||||

|

Transfer Agent Fees

|

- | - | 11,493 | |||||||||

|

Total Expenses

|

$ | 27,137 | $ | 11,370 | $ | 50,643 | ||||||

16

Our expenses for the three months ended October 31, 2010 and 2009 are outlined in the table below:

|

|

Three Months Ended

|

|||||||

|

|

October 31,

|

|||||||

|

|

2010

|

2009

|

||||||

|

|

|

|||||||

|

Exploration Expenses

|

$ | - | $ | - | ||||

|

Filing Fees

|

872 | 429 | ||||||

|

General and Administrative

|

- | 441 | ||||||

|

Professional Fees

|

705 | 1,200 | ||||||

|

Transfer Agent Fees

|

||||||||

|

Total Expenses

|

$ | 1,577 | $ | 2,070 | ||||

Exploration Expenses

The increase in our exploration expenses for the year ended October 31, 2010 compared to October 31, 2009 was primarily due to the fact that we acquired the Enright Hills Property.

Professional Fees

Professional fees include our accounting and auditing expenses incurred in connection with the preparation and audit of our financial statements and professional fees that we pay to our legal counsel. Our accounting and auditing expenses were incurred in connection with the preparation of our audited financial statements and unaudited interim financial statements and our preparation and filing of a post-effective amendment to our registration statement with the SEC. Our legal expenses represent amounts paid to legal counsel in connection with our corporate organization. Legal expenses increased in fiscal 2010 as a result of the preparation and filing of the post effective amendment to our registration statement, and decreased in the last quarter of 2010 as the Company did more of the corporate organization itself.

Liquidity And Capital Resources

Working Capital

|

Percentage

|

||||||||||||

|

As at

|

As at

|

Increase /

|

||||||||||

|

October 31, 2010

|

October 31, 2009

|

(Decrease)

|

||||||||||

|

Current Assets

|

$ | - | $ | 62 | (100 | %) | ||||||

|

Liabilities

|

$ | 37,125 | $ | 10,050 | 369 | % | ||||||

|

Working Capital

|

$ | (37,125 | ) | $ | (9,988 | ) | (371 | %) | ||||

Cash Flows

|

Percentage

|

||||||||||||

|

Year Ended

|

Year Ended

|

Increase /

|

||||||||||

|

October 31, 2010

|

October 31, 2009

|

(Decrease)

|

||||||||||

|

Cash used in Operating Activities

|

$ | (14,047 | ) | $ | (20,047 | ) | (29 | %) | ||||

|

Cash provided by Investing Activities

|

$ | - | $ | - | N/A | |||||||

|

Cash provided by Financing Activities

|

$ | 13,985 | $ | 10,064 | 38 | % | ||||||

|

Foreign Exchange Effect on Cash

|

- | $ | 940 | (100 | %) | |||||||

|

Net Increase (Decrease) in Cash

|

$ | - | $ | (9,403 | ) | (100 | %) | |||||

17

We anticipate that we will incur approximately $6,000 for operating expenses, including professional, legal and accounting expenses associated with our reporting requirements under the Exchange Act during the next twelve months. Accordingly, we will need to obtain additional financing in order to complete our business plan.

Cash Used In Operating Activities

We used cash in operating activities in the amount of ($14,047) during the year ended October 31, 2010 and ($20,407) during the year ended October 31, 2009. Cash used in operating activities was funded by cash from financing activities, and the proceeds of loans.

Cash From Investing Activities

No cash was used or provided in investing activities during the years ended October 31, 2010 and October 31, 2009.

Cash from Financing Activities

We generated $13,985 from financing activities during the year ended October 31, 2010 compared to $10,064 from financing activities during the year ended October 31, 2009.

Going Concern

The financial statements accompanying this report have been prepared on a going concern basis, which implies that our company will continue to realize its assets and discharge its liabilities and commitments in the normal course of business. Our company has not generated revenues since inception and has never paid any dividends and is unlikely to pay dividends or generate earnings in the immediate or foreseeable future. The continuation of our company as a going concern is dependent upon the continued financial support from our shareholders, the ability of our company to obtain necessary equity financing to achieve our operating objectives, and the attainment of profitable operations. As at October 31, 2010, our company has accumulated losses of $162,118 since inception. We do not have sufficient working capital to enable us to carry out our stated plan of operation for the next twelve months. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should our company be unable to continue as a going concern.

Due to the uncertainty of our ability to meet our current operating expenses and the capital expenses noted above in their report on the financial statements for the year ended October 31, 2010, our independent auditors included an explanatory paragraph regarding concerns about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that lead to this disclosure by our independent auditors.

The continuation of our business is dependent upon us raising additional financial support. The issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

Future Financings

We anticipate continuing to rely on equity sales of our common shares in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing stockholders. There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our planned activities. Ken MacAlpine has agreed to provide loans to a minimal amount to carry on our legal, accounting and reporting needs.

18

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Application of Critical Accounting Estimates

The financial statements of our company have been prepared in accordance with generally accepted accounting principles in the United States. Because a precise determination of many assets and liabilities is dependent upon future events, the preparation of financial statements for a period necessarily involves the use of estimates which have been made using careful judgment.

The financial statements have been prepared within the framework of the significant accounting policies summarized below:

Mineral Property and Exploration Costs

We are an exploration stage mining company and have not yet realized any revenue from our operations. We are primarily engaged in the acquisition, exploration and development of mining properties. Exploration costs are expensed as incurred regardless of the stage of development or existence of reserves. Costs of acquisition are capitalized subject to impairment testing, in accordance with Financial Accounting Standards 144 (“FAS 144”), “Accounting for the Impairment or Disposal of Long-Lived Assets”, when facts and circumstances indicate impairment may exist.

We regularly perform evaluations of any investment in mineral properties to assess the recoverability and/or the residual value of our investments in these assets. Also, long-lived assets are reviewed for impairment whenever events or circumstances change which indicate the carrying amount of an asset may not be recoverable.

Management periodically reviews the carrying value of its investments in mineral leases and claims with internal and external mining related professionals. A decision to abandon, reduce or expand a specific project is based upon many factors including general and specific assessments of mineral deposits, anticipated future mineral prices, anticipated future costs of exploring, developing and operating a production mine, the expiration term and ongoing expenses of maintaining mineral properties and the general likelihood that we will continue exploration on such project. We do not set a pre-determined holding period for properties with unproven deposits, however, properties which have not demonstrated suitable metal concentrations at the conclusion of each phase of an exploration program are re-evaluated to determine if future exploration is warranted, whether there has been any impairment in value and that their carrying values are appropriate.

Recent Accounting Pronouncements

In May, 2009, the FASB issued ASC 855, Subsequent Events, which established general standards of accounting and disclosure for events that occur after the balance sheet date, but before financial statements are issued or available to be issued. In accordance with ASC 855, the Company has evaluated subsequent events through the date the financial statements were filed.

In June, 2009, the FASB issued their final SFAS, No. 168, “FASB Accounting Standards Codification ( “ASC”) and the Hierarchy of Generally Accepted Accounting Principles”. This was reflected in the codification as FASB ASC 105, Generally Accepted Accounting Principles. “ASC” is the single source of authoritative US generally accepted accounting principles recognized by the FASB to be applied to nongovernmental entities. It is effective for financial statements issued for interim and annual periods ending after September 15, 2009. It will not have an impact on the Company’s financial position, results of operations or cash flows.

In January 2010, the FASB issued ASU No. 2010-01, amending SFAS No. 168, “The FASB Accounting Standards Codification™ and the Hierarchy of Generally Accepted Accounting Principles.” This Standard codified in ASC 105 is being modified to include the authoritative and non-authoritative levels of GAAP. This amendment is

19

effective for financial statements issued for interim and annual periods ending after September 15, 2009. ASU No. 2010-01 has no effect on the Company’s financial position, statements of operations, or cash flows at this time.

In February 2010, the FASB issued ASU No. 2010-09, “Subsequent Events (ASC Topic 855), Amendments to Certain Recognition and Disclosure Requirements.” This Standard update requires an SEC Filer to (1) evaluate subsequent events through the date that the financial statements are issued or available to be issued, (2) defines “SEC Filer” as an entity that is required to file or furnish its financial statements with either the SEC or, with respect to an entity subject to Section 12(i) of the Securities Exchange Act of 1934, as amended, the appropriate agency under that Section, (3) not be bound to disclosing the date through which subsequent events have been evaluated, (4) note the definition of public entity is no longer defined nor necessary for Topic 855, (5) note the scope of the reissuance disclosure requirements is refined to include revised financial statements only. These Updates are effective for interim or annual periods ending after June 15, 2010. ASU No. 2010-09 has no effect on the Company’s financial position, statements of operations, or cash flows at this time.

20

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

SOMBRIO CAPITAL CORP.

(An Exploration Stage Company)

FINANCIAL STATEMENTS

OCTOBER 31, 2010 and 2009

(Stated in U.S. Dollars)

21

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To: The Board of Directors and Stockholders

Sombrio Capital Corporation

I have audited the accompanying balance sheets of Sombrio Capital Corporation as of October 31, 2010 and 2009 and the related statements of operations, equity and cash flows for the years ended October 31, 2010 and 2009, and for the three month periods ended October 31, 2010 and 2009, and for the period since inception (March 31, 2006) to October 31, 2010. These financial statements are the responsibility of the Company’s management. My responsibility is to express an opinion on these financial statements based on my audit.

I conducted my audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor was I engaged to perform, an audit of its internal control over financial reporting. My audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, I express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that my audit provides a reasonable basis for my opinion.

In my opinion the financial statements referred to above present fairly, in all material respects, the financial position of Sombrio Capital Corporation as of October 31, 2010 and 2009 and the related statements of operations, changes in stockholders’ equity and cash flows for the years ended October 31, 2010 and 2009, and for the three month periods ended October 31, 2010 and 2009, and for the period since inception (March 31, 2006) to October 31, 2010 in conformity with United States generally accepted accounting principles.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. As discussed in Note 1 to the financial statements, the Company has incurred significant losses and has no revenue. This raises substantive doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/ s /

John Kinross-Kennedy

Certified Public Accountant

Irvine, California

December 20, 2010

22

|

SOMBRIO CAPITAL CORPORATION

|

||||||||

|

(An Exploration Stage Company)

|

||||||||

|

BALANCE SHEETS

|

||||||||

|

as at October 31, 2010 and 2009

|

||||||||

|

(Stated in U.S. dollars)

|

||||||||

|

2010

|

2009

|

|||||||

|

ASSETS

|

||||||||

|

Current

|

||||||||

|

Cash

|

$ | - | $ | 62 | ||||

| $ | - | $ | 62 | |||||

|

LIABILITIES

|

||||||||

|

Current

|

||||||||

|

Accounts payable and accrued liablilities

|

$ | 13,090 | $ | - | ||||

|

Non current

|

||||||||

|

Loan Payable

|

24,035 | 10,050 | ||||||

| 37,125 | 10,050 | |||||||

|

STOCKHOLDERS' EQUITY

|

||||||||

|

Capital Stock

|

||||||||

|

Authorized:

|

||||||||

|

100,000,000 common voting stock with a par value of

|

||||||||

|

$0.001 per share

|

||||||||

|

5,000,000 preferred stock with a par value of $0.001

|

||||||||

|

per share

|

||||||||

|

Issued and outstanding:

|

||||||||

|

7,187,498 common shares as at October 31, 2010 and 2009

|

7,188 | 7,188 | ||||||

|

Additional Paid-In Capital

|

116,122 | 116,122 | ||||||

|

Accumulated Other Comprehensive Income

|

1,683 | 1,683 | ||||||

|

Deficit Accumulated During The Exploration Stage

|

(162,118 | ) | (134,981 | ) | ||||

| - | (9,988 | ) | ||||||

| $ | - | $ | 62 | |||||

The accompanying notes are an integral part of these financial statements.

23

|

SOMBRIO CAPITAL CORPORATION

|

||||||||||||||||||||

|

(An Exploration Stage Company)

|

||||||||||||||||||||

|

STATEMENT OF OPERATIONS

|

||||||||||||||||||||

|

(Stated in U.S. Dollars)

|

||||||||||||||||||||

|

Cumulative

|

||||||||||||||||||||

|

Period from

|

||||||||||||||||||||

|

Inception

|

||||||||||||||||||||

|

March 31,

|

||||||||||||||||||||

|

For the three Months Ended

|

For the Year Ended

|

2006 to

|

||||||||||||||||||

|

October 31,

|

October 31,

|

Oct. 31,

|

||||||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

2010

|

||||||||||||||||

|

Revenue

|

$ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

|

Exploration Expenses

|

- | - | 15,757 | 32,809 | ||||||||||||||||

|

Filing Fees

|

872 | 429 | 4,146 | 6198 | 15,935 | |||||||||||||||

|

General and Administrative

|

441 | 108 | 1464 | 8,204 | ||||||||||||||||

|

Professional Fees

|

705 | 1,200 | 7,126 | 3708 | 82,108 | |||||||||||||||

|

Transfer Agent fees

|

- | - | - | 0 | 19,466 | |||||||||||||||

| 1,577 | 2,070 | 11,380 | 11,370 | 142,765 | ||||||||||||||||

| - | ||||||||||||||||||||

|

Operating Loss

|

(1,577 | ) | (2,070 | ) | (27,137 | ) | (11,370 | ) | (158,522 | ) | ||||||||||

|

Write Down of Mineral Property

|

3,596 | |||||||||||||||||||

| - | ||||||||||||||||||||

|

Net Loss For The Period

|

(1,577 | ) | (2,070 | ) | (27,137 | ) | (11,370 | ) | (162,118 | ) | ||||||||||

|

Basic and Diluted Loss Per share

|

$ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||||||

|

Weighted Average Number

|

||||||||||||||||||||

|

Of Common Shares Outstanding

|

7,187,498 | 7,187,498 | 7,187,498 | 7,187,498 | ||||||||||||||||

|

STATEMENT OF COMPREHENSIVE LOSS

|

||||||||||||||||||||

|

Cumulative

|

||||||||||||||||||||

|

from Inception

|

||||||||||||||||||||

|

March 31,

|

||||||||||||||||||||

|

For three Months Ended

|

For the Year Ended

|

2006 to

|

||||||||||||||||||

|

October 31,

|

October 31,

|

Oct. 31,

|

||||||||||||||||||

| 2010 | 2009 | 2010 | 2009 | 2010 | ||||||||||||||||

|

Other Comprehensive Loss

|

||||||||||||||||||||

|

Net loss for the period

|

$ | (1,576 | ) | $ | (1,577 | ) | $ | (27,137 | ) | $ | (27,137 | ) | $ | (162,118 | ) | |||||

|

Foreign currency translation

|

||||||||||||||||||||

|

adjustment

|

940 | 1,683 | ||||||||||||||||||

|

Total Comprehensive Loss

|

$ | (1,576 | ) | $ | (1,577 | ) | $ | (27,137 | ) | $ | (26,197 | ) | $ | (160,435 | ) | |||||

The accompanying notes are an integral part of these financial statements.

24

|

SOMBRIO CAPITAL CORPORATION

|

||||||||||||

|

(An Exploration Stage Company)

|

||||||||||||

|

STATEMENT OF CASH FLOWS

|

||||||||||||

|

(Stated in U.S. Dollars)

|

||||||||||||

|

Cumulative

|

||||||||||||

|

Period

|

||||||||||||

|

from

|

||||||||||||

|

Inception

|

||||||||||||

|

March 31,

|

||||||||||||

|

Year Ended

|

2006 to

|

|||||||||||

|

October 31,

|

Oct. 31,

|

|||||||||||

|

2010

|

2009

|

2010

|

||||||||||

|

Cash flows (Used In) operating activities:

|

||||||||||||

|

Net loss for the period

|

$ | (27,137 | ) | $ | (11,370 | ) | $ | (162,118 | ) | |||

|

Adjustments to reconcile net loss to