Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest event Reported): January 5, 2011, (December 31, 2010)

VELVET ROPE SPECIAL EVENTS, INC.

(Exact name of registrant as specified in its Charter)

|

Delaware

|

333-154422

|

80-0217073

|

|

(State or other jurisdiction

of incorporation or organization)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

68 Harbin Road, Shenyang, Liaoning, People’s Republic of China, 110002

|

|

(Address of Principal Executive Offices)

|

86-24-2250-1035

(Registrant’s telephone number, including area code)

264 S. La Cienega Blvd., Suite 700

Beverly Hills, CA, USA, 90211

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 8-K and other reports filed by us from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, our management as well as estimates and assumptions made by our management. When used in the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to us or our management identify forward looking statements. Such statements reflect the current view of our management with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) as they relate to our industry, our operations and results of operations, and any businesses that we may acquire. Should one or more of the events described in these risk factors materialize, or should our underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although we believe that the expectations reflected in the forward looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the U.S. federal securities laws, we do not intend to update any of the forward-looking statements to conform them to actual results. The following discussion should be read in conjunction with our pro forma financial statements and the related notes that will be filed herein.

In this Form 8-K, references to “we,” “our,” “us,” “our company,” “the Company,” “Velvet Rope,” or the “Registrant” refer to Velvet Rope Special Events, Inc., a Delaware corporation.

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

As more fully described in Item 2.01 below, effective December 31, 2010, we acquired China Currency Development Limited (“China Currency”), a Hong Kong corporation based in the People’s Republic of China (“PRC”) engaged in the sale, installation and service of security and safety systems. The acquisition was carried out in accordance with a Share Exchange Agreement dated December 31, 2010 (the “Exchange Agreement”) among China Currency, Velvet Rope, Maneeja Noory (our controlling shareholder and former officer and director), and ACE Strategy Holidings Limited (“ACE”), a company incorporated in the British Virgin Islands on March 5, 2009, and the sole shareholder of China Currency prior to our acquisition.

China Currency was incorporated in Hong Kong on March 12, 2009 and has two wholly owned subsidiaries, Liaoning Huaxun Security Operation Service Co., Ltd. (“Liaoning”), and Shenyang Huaxun (“Shenyang Security”). Liaoning was incorporated as a “wholly owned foreign enterprise” in the PRC on April 7, 2009. Shenyang Security was incorporated in the PRC on March 23, 2006 and is itself a wholly owned subsidiary of Liaoning. Shenyang Security is the operating entity for the security and safety systems business of China Currency

The close of the Exchange Agreement transaction (the "Closing") took place on December 31, 2010 (the “Closing Date”). On the Closing Date, pursuant to the terms of the Exchange Agreement, we acquired all of the outstanding capital stock and ownership interests of China Currency (the “Interests”) from ACE. In exchange, we issued to the designees of China Currency 1,173,000 shares of our common stock and 68,445 warrants with each warrant to purchase 1 share of our common stock at an exercise price of $5.11 vested immediately and expiring on December 31, 2013. The material terms of the Exchange Agreement are more fully described in Exhibit 2.1 of this report.

As a consequence of China Currency becoming our wholly owned subsidiary, we have adopted the business of China Currency as operated by its wholly owned subsidiary Shenyang Security. Since March 23, 2006, Shenyang Security has engaged in the sale, distribution, installation and maintenance of security and safety systems, as well as the development of software related to the operation of security and safety systems. Shenyang Security’s products include alarm, digital video surveillance, communications, and other systems for home, commercial, institutional, public and private security and safety purposes. Shenyang Security operates primarily in the People’s Republic of China (“PRC” or “China”). Because we have adopted the business of China Currency, all references in this report to “Velvet Rope”, the “Company”,“we”, “us”, “our” and similar terms refer collectively to Velvet Rope,

2

China Currency, Liaoning and Shenyang Security. Additionally, the consolidated financial statements in this report include the accounts of China Currency, Liaoning and Shenyang Security, for which we are the primary beneficiary. All inter-company accounts and transactions have been eliminated in consolidation.

This transaction is discussed more fully in Section 2.01 of this Report.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

ITEM 3.02 UNREGISTERED SALES OF EQUITY SECURITIES

ITEM 4.01 CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT

ITEM 5.01 CHANGES IN CONTROL OF REGISTRANT

ITEM 5.02 DEPARTURE OF DIRECTORS OR PRINCIPAL OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF PRINCIPAL OFFICERS

CLOSING OF EXCHANGE AGREEMENT

As described in Item 1.01 above, on December 31, 2010 we acquired China Currency pursuant to a Share Exchange Agreement among China Currency, Velvet Rope, Maneeja Noory (our former controlling shareholder and former officer and director), and ACE Strategy Holdings Limited (“ACE”), a company incorporated in the British Virgin Islands and the sole shareholder of China Currency prior to our acquisition. China Currency is a Hong Kong based company carrying on business in the security and safety systems industry. The closing of the transaction took place on December 31, 2010 (the “Closing Date”). On the Closing Date, pursuant to the terms of the Exchange Agreement, we acquired all of the outstanding capital stock and ownership interests of China Currency from ACE. In exchange, we cancelled an aggregate of 3,920,000 shares of our common stock held by Maneeja Noory, our former director and officer, and issued to 15 non-US designees of ACE 1,173,000 shares, (approximately 84.20% of our common stock outstanding after the Closing) and 68,445 warrants with each warrant to purchase 1 share of our common stock at an exercise price of $5.11 per share. The warrants vested immediately upon issuance and will expire on December 31, 2013. Both the number and purchase price of the warrants are adjustable for any future dilution or concentration of our common stock resulting from a capital reorganization. The aforementioned shares and warrants were issued in an offshore transactions relying on Regulation S of the Securities Act of 1933.

Pursuant to the Share Exchange Agreement, the Company is also obligated to use its commercially reasonable efforts to effect a 1 for 5.113636 forward share split and a name change to Eastern Security & Protection Services, Inc. within 90 days after the Closing Date.

On the Closing Date, China Currency became our wholly owned subsidiary. The complete terms of the Exchange Agreement are set out in Exhibit 2.1 of this report. As of the Closing Date we had 1,393,000 shares issued and outstanding, and outstanding warrants to purchase 68,445 shares of our common shares exercisable until December 31, 2013 at a price of $5.11 per share. There were no other outstanding convertible securities.

Also, effective as of December 31, 2010, Mr. Edmund Forister, resigned as our sole director and officer. Mr. Forister’s resignation did not result from any disagreement or dispute with the Company. On the same date, our board of directors increased its size from one to four members and appointed Mr. Rui Tan, Ms. Jing Wang, Mr. Chuan Gao, and Mr. Cheng Fang, to fill the ensuing vacancies. The directors’ appointments became effective upon the closing of the reverse acquisition on December 31, 2010. In addition, our board of directors appointed Mr. Rui Tan to serve as our President, Chief Executive Officer, and Chair, Ms. Jing Wang to serve as our Chief Financial Officer, and Mr. Xin Tian to serve as our Chief Operating Officer. The appointments took effect immediately at the closing of the reverse acquisition.

3

CORPORATE HISTORY AND STRUCTURE

Background and Corporate History of Velvet Rope Special Events, Inc.

We were originally organized under the laws of the State of California on August 22, 2005, as Velvet Rope Special Events, Inc. and became a Delaware Corporation on June 17, 2008. From our inception, we were engaged in various business endeavors including full-service corporate and social event planning for organizations and individuals. Recently, our management decided to redirect our business focus towards identifying and pursuing options regarding the acquisition of operating businesses.

On December 31, 2010, we completed a reverse acquisition transaction with China Currency Development Limited, Maneeja Noory (our former controlling shareholder and former officer and director), and ACE Strategy Holdings Limited (“ACE”), pursuant to which we acquired 100% of the issued and outstanding capital stock of China Currency in exchange for 1,173,000 shares of our common stock, par value $0.0001, and 68,445 warrants with each warrant to purchase 1 share of our common stock at an exercise price of $5.11 per share. The warrants vested immediately upon issuance and will expire on December 31, 2013. Both the number and purchase price of the warrants are adjustable for any future dilution or concentration of our common stock resulting from a capital reorganization. The 1,173,000 and 64,445 warrants issued to the designees of ACE constituted 84.94% of our issued and outstanding capital stock on a fully-diluted basis (which assumes the issuance of the common shares underlying the warrants) immediately after completion of the reverse acquisition and after giving effect to the concurrent cancellation of 3,920,000 shares of our common stock by Ms. Noory.

As a consequence of the Exchange Agreement we adopted the business of China Currency and its subsidiaries, Liaoning and Shenyang Security.

Corporate History of China Currency Development Limited and its Subsidiaries

Shenyang Huaxun Jiuding Venture Technology Co., Ltd (“Shenyang Security”) was incorporated on March 23, 2006 under the laws of the People’s Republic of China (“PRC”) with an initial contribution of RMB 3 million (approximately US$ 411,300). Shenyang Security provides designing, installation and testing services of security and safety systems, which integrates development, consulting, distributing, marketing, and maintenance of digital video surveillance and network communication.

Liaoning Huaxun Security Service Operation Co., Ltd (“Liaoning Huaxun”) was incorporated on April 7, 2009 under the laws of the PRC with an initial contribution of RMB 20 million (approximately US$ 2,934,000). Its business scope includes: designing, installation and maintenance services of security and safety systems; designing and installation of telecommunication system; integration of computer system; wholesale of electronic machinery product, computer and accessorial equipment.

China Currency Development Limited (“China Currency”) was incorporated on March 12, 2009 under the laws of Hong Kong as the holding company of Liaoning Huaxun.

On July 13 2009, the 10 individual shareholders of Shenyang Security entered into a transfer agreement with Liaoning Huaxun to transfer its ownership in Shenyang Security to Liaoning Huaxun. The consideration for the acquisition was RMB 3 million ($411,300).

On July 18, 2009, the 8 individual shareholders of Liaoning Huaxun entered into a transfer agreement with China Currency to transfer its ownership in Liaoning Huaxun to China Currency. The consideration for the acquisition was RMB 20 million ($2,934,000). Liaoning Huaxun’s business license has been updated to reflect China Currency as shareholder for Liaoning Huaxun.

4

For accounting purposes, the reverse acquisition transaction with China Currency was treated as a reverse acquisition, with China Currency as the acquirer and Velvet Rope Special Events, Inc. as the acquired party. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of China Currency and its subsidiaries.

The consolidated financial statements include the accounts of the China Currency, Liaoning Huaxun and Shenyang Security, for which the Company is the primary beneficiary. All inter-company accounts and transactions have been eliminated in consolidation.

Reorganization and Revised Structure

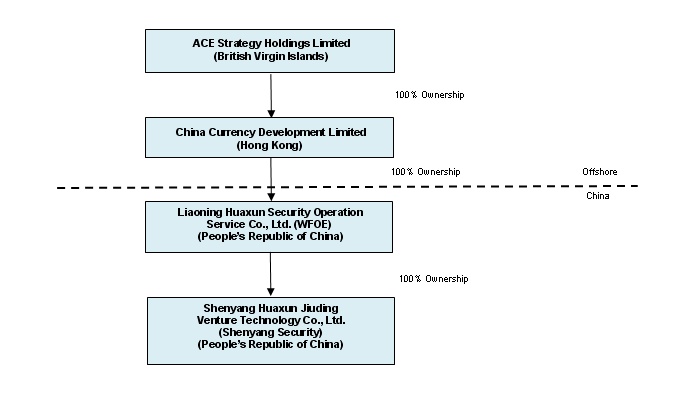

The following diagram sets forth the corporate structure of ACE before the reverse acquisition:

As a result of the consummation of the Exchange Agreement, as of December 31, 2010:

|

●

|

China Currency became our wholly-owned subsidiary;

|

|

●

|

In exchange for all of the outstanding shares in the capital stock of China Currency, the designees of ACE received 1,173,000 newly issued shares of our common stock and 68,445 warrants with each warrant to purchase 1 share of our common stock at an exercise price of $5.11 per share. The warrants vested immediately upon issuance and will expire on December 31, 2013. Both the number and purchase price of the warrants are adjustable for any future dilution or concentration of our common stock resulting from a capital reorganization. .

|

|

●

|

Immediately following the closing of the reverse acquisition, 1,173,000 shares of our common stock and 68,445 warrants issued to the designees of ACE represent approximately 84.94% of our issued and outstanding shares on a fully diluted basis (which assumes the issuance of the shares underlying the 68,445 warrants).

|

5

The organization and ownership structure of the Company subsequent to the consummation of the reverse acquisition as summarized in the paragraphs above is as follows:

This transaction closed on December 31, 2010.

Background of Shenyang Huaxun (Shenyang Security)

Overview of Our Business

Shenyang Security was incorporated in the PRC on March 23, 2006 and is the entity through which our business is operated. We are primarily engaged in the sales, distribution, installation and maintenance of security and safety products and systems, and the development of security and safety system related software. Our customers are presently located almost exclusively in the PRC. and are primarily comprised of: (i) governmental entities, such as customs agencies, courts, public security bureaus, and prisons; (ii) non-profit organizations, including schools, museums, sports arenas, and libraries; and (iii) commercial entities, such as airports, hotels, real estate, banks, mines, railways, supermarkets, and entertainment venues; and, (iv) residential property owners and tenants. Our revenues are not concentrated within any one customer or group of related customers.

A majority of our revenues are derived from the sale and installation of packaged securityand safety solutions, including alarm, and surveillance, and first responder alert systems. We also provide after-sale service and maintenance of such systems. Because the majority of our revenues are derived from installations, they are generally non-recurring. Maintenance services for our packaged solutions are included for the first year following installation. Our customers may separately purchase ongoing maintenance services after the first year. We presently operate almost exclusively in Liaoning province in the Northeastern region of the People’s PRC. Our sales network covers most populated areas of Liaoning, but we rely on the provincial capital city of Shenyang for the majority of our revenues. According to the PRC National Bureau of Statistics, Liaoning province had a total population of approximately 43 million people as of the end of 2008.

Our subsidiary Shenyang Security has an administrative office and distribution center located in the city of Shenyang. Our corporate headquarters and the Company’s operations are located in City of Shenyang, Liaoning Province,

6

China. Substantially all of our employees are located in China. As of December 31, 2010, we had approximately 150 full time employees.

Our operations are fully equipped with warehousing, distribution and information management capabilities. As one of the first authorized security systems companies in Liaoning Province, we currently have two distribution centers in Shenyang. We have sold and serviced surveillance and safety systems to: 1) governmental entities, such as customs agencies, courts, public security bureaus, and prisons; (2) non-profit organizations, including schools, museums, sports arenas, and libraries; and, (3) commercial entities, such as airports, hotels, real estate, banks, mines, railways, supermarkets, and entertainment venues.

We have experienced increased revenues over the past two years. Our revenues increased from $2.73 million in fiscal year 2008 to $6.27 million in fiscal year 2009, representing an increase of approximately 129%. Similarly, our net income increased from $570,312 in fiscal 2008 to $1,783,955 in fiscal 2009, representing an increase of approximately 212%. We strive to provide customer-driven, one-stop services to our clients and actively pursue acquisition prospects and other strategic opportunities to expand our product range and the scope and capacity of our services.

Our Industry

We operate in the security and personal protection industry in the Peoples Republic of China. Because the PRC is home to approximately one-fifth of the world’s population and a rapidly expanding middle class, our management believes that the Chinese market presents significant potential for the safety and protection services industry.

The safety and protection industry in the PRC is highly fragmented. The government of the PRC aims to enhance the competitiveness and effectiveness of security and safety systems companies generally by encouraging the integration of operations and the optimization of resources allocation through corporate restructuring and consolidation at regional levels.

In recent years, major security and safety systems companies in the PRC have started the industry consolidation process via mergers and acquisitions aimed at increasing market share and competitiveness.

Regulations promulgated by governmental agencies in China relating to the surveillance and safety industry often create opportunities for us. Currently, there are a number of current and planned regulations that we believe offer significant growth opportunities. For example, sseveral ordinances have been passed by the Chinese government which require surveillance and safety systems to be installed in: (1) approximately 660 cities throughout China for street surveillance; (2) all entertainment locations starting from March 1, 2006; (3) all Justice Departments and Courts; and (4) all coal mines in China (currently estimated at 24,000) from the beginning of 2008. Although there is no guarantee that we will benefit from these ordinances, we aim to compete for any resulting sales opportunities, whether through participation in contract bidding processes, strategic marketing initiatives, or industry and government relations strategies. To that effect, we maintain a government policy monitoring group within our Company that regularly monitors changes in governmental regulations affecting the surveillance and safety industry in China. If we determine that a new regulation or a change to an existing regulation presents an opportunity for us, we will actively pursue that opportunity. We aim to act promptly in response to policy changes and to turn them into business opportunities with the goal of sustaining the growth we have achieved since the inception of our business.

We are also actively evaluating targets for near-term acquisition and other strategic opportunities to expand our business. Our desired acquisition targets are regional market leaders who operate customer and emergency service call centers, provide digital supervision alarm systems, guard dispatch or patrol vehicle services, and who provide safety and surveillance monitoring and alarm response services generally. We are also seeking acquisition targets that carry on business in areas complementary to our current business, such a fire safety and access control.

7

Our Business

Our business has relationships with over 90 safety and security systems original equipment manufacturers throughout China. Typically, we enter into master agreements with our suppliers at the beginning of each year, which provide the general terms, prices and conditions for transactions in the supplier's products over the year. We then enter into separate purchase agreements each time we actually purchase products from a supplier. When we purchase the products from our suppliers, we take title to the items and book them as inventory. We then sell and install the products to our customers.

We have integrated operations in the sales and service of security and safety systems, our principal business. We conduct our business through Shenyang Security by purchasing from security and safety system suppliers and then selling, installing and servicing the products to our customers. Our security and safety systems business is focused on the market of Liaoning province, which includes major cities such as, Shenyang, Anshan, Benxi, Dalian, and Dandong, which have approximately 42 million people. We operate a large regional security and safety systems network in Liaoning province supported by strategically placed facilities. For the year ended December 31, 2009, revenue generated from our security and safety systems business was $6.27 million.

We sell, install and service over 400 products from approximately 90 suppliers through our distribution network in compliance with PRC regulations. In 2009, revenue derived from the sales, installation and service of third-party products constituted all of our revenue. The terms of our distribution agreements vary between suppliers and vary in terms of payment period, arrangement of delivery, pricing and quality requirements. The general payment terms vary from advance deposit, to cash on delivery, to payment up to 90 days from delivery, and the payment can be settled by means of bank collection, remittance, bills payable, postal check. The delivery is either to our warehouse, railway station, or prescribed destination within Shenyang City. The quality of safety and security systems supplied is in accordance with the prescribed national standard requirement. Our top 5 suppliers in our security and safety systems business accounted for 97% of our purchases in 2009.

Information Regarding our Operating Divisions

In fiscal year 2009, our operations were comprised of two operating divisions:

|

|

●

|

The Suppy and Installation Project Division provides design, sales, installation, of electronics security and safety systems to residential, commercial, industrial and governmental customers;

|

|

|

●

|

The Service Division provides security and safety services and maintenance; and,

|

With these two divisions, we are able to provide one-stop service to our customers, including not only products, but also services, installations, maintenance, software, system upgrading, and other related solutions, which we believe many of our competitors cannot match.

8

Supply and Installation Division

Our Installation Division performs installations of surveillance and safety products and systems for customer projects. It also provides project design, material supply, engineering, and operating maintenance services. Our Installation Segment has provided these services in China for five years and has successfully completed 10 projects in 2009. Our Installation Segment supplied and installed surveillance and safety systems for various projects involving railways, schools, banks, highways, commercial buildings, and public security and government entities, among others.

In 2004, the Chinese government promulgated the “Safe City” (or “Plan 3111”) initiative, which requires about 660 cities throughout China to install and operate street surveillance, and we are a government-recommended Safe City vendor. Our Installation Division is devoted to constructing Safe City projects as well as many other surveillance and safety projects in China. Our one-stop technical support and service system including project design, material supply, engineering and operating maintenance, offers an all-covered solution.

Service Division

Our Service Division provides general services to our clients. Our Service Division offers a full range of surveillance and safety services, including network alarm response services, safety and surveillance products and solutions’ post-sale, maintenance services, software upgrading services, project integration services, security guard services, safety and surveillance consulting services, and safety and surveillance trustee services.

Principal Products

We sell security, surveillance and safety products supplied by third-party electronic companies. Our main products include standalone DVRs, embedded DVRs, mobile DVRs, digital cameras, intelligent control system software platforms, perimeter security alarm systems, monitors, and auxiliary apparatuses.

|

|

●

|

Standalone DVRs

|

The standalone DVR stores digital images captured by security cameras. It also controls the recording functions of the cameras and manages the storage of the data. This product has a pre-installed surveillance software system, which enables it to perform access control and recording functions. This product has the competitive features of small size, low cost and high reliability. The primary markets for this product are small- to medium-size businesses, non-profit organizations and private residences. It is generally used for small-scale surveillance and safety needs.

|

|

●

|

Embedded DVRs

|

Similar to the standalone DVR, the embedded DVR provides recording and compression functions. As compared to the standalone DVR, the embedded DVR has higher capacity to accommodate the recording functions for a greater number of cameras. The primary markets for these products are large projects and community security projects.

9

|

|

●

|

Mobile DVRs

|

Similar to the standalone DVR, the mobile DVR is smaller in size and has a maximum of 4 ports. The mobile DVR can be installed in a vehicle and enables recording of digital video images within the vehicle’s cabin. The primary markets for this product are the transportation industry and governmental agencies.

|

|

●

|

Digital Cameras

|

Digital cameras can be easily installed in most locations on a customer’s site. The range of cameras that we sell includes high-speed dome cameras, which can view 360 degrees, pan, zoom, and tilt, all at high speed, color Charge Coupled Device (CCD) cameras, indoor color CCD dome cameras, color/black and white CCD flying saucer cameras, infrared CCD multi-function cameras, mini-digital signal processing cameras, indoor standalone sphere CCD cameras, and network high-speed sphere CCD cameras.

|

|

●

|

Intelligent High-Speed Dome Cameras

|

The intelligent high-speed dome camera is an integrated camera system using high-speed, spherical, 360-degree movement. The high-speed dome camera is developed with a shield and platform. The shield protects the camera while the platform provides greater control over the camera’s direction and view. The intelligent high-speed dome camera is mostly used in mountainous, wet and unstable conditions.

|

|

●

|

Intelligent Control System Software Platforms

|

The intelligent control system software platforms are used for the management of all integration of security equipment and IP-based network security management software. We will continue to strengthen our software development platform with a more organic combination with hardware and software to achieve greater success when bidding for Safe City projects.

|

|

●

|

Perimeter Security Alarm Systems

|

The perimeter security alarm system is a motion sensor which concentrates on protecting all of the accessible entry points and prevents intrusion at home. The alarm system is highly resistant to interference and influence by environmental effects and the surrounding magnetic field.

|

|

●

|

Monitors

|

The security monitors provide high-definition video, reliability and color reducibility. Monitor products include LCD multiple screen combination panel walls, LCD advertising players, built-in quadruple LCD/CRT monitors, IP monitor, and progressive scanning color digital monitors.

Marketing

Our customers are primarily: (1) governmental entities, such as customs agencies, courts, public security bureaus, and prisons; (2) non-profit organizations, including schools, museums, sports arenas, and libraries; and (3) commercial entities, such as airports, hotels, real estate, banks, mines, railways, supermarkets, and entertainment venues; and (4) multi-unit residential real estate developers. Because a large percentage of our revenues are derived from the installation of surveillance and safety systems which are generally non-recurring, we do not rely exclusively on one single or a small group of customers. We generally do not generate significant revenues from any existing client after the installation project is completed unless that client has additional installation sites for which our services might be required.

10

We have developed a multi-tiered marketing plan, allowing us to effectively market products and services to our clients. We sell most of our products and services through our own distribution network. Our distribution and sales networks cover most of Liaoning’s populated areas, but we rely on the city of Shenyang for the majority of our revenues.

In addition to our own branch offices and employees, we cooperate with independent sales agents and have established close relationships with these sales agents in order to take advantage of their regional resources and provide products and services that are tailored to the needs of our customers in those regions.

Through this distribution and marketing network, we believe we can continue to promote our brand recognition, strengthen the management of our distribution network and improve our sales revenue and market share.

Seasonality

Our operating results and operating cash flows historically have been subject to seasonal variations. Our revenues are usually higher in the second half of the year than in the first half of the year, and the first quarter is usually the slowest quarter because fewer projects are undertaken during and around the Chinese spring festival.

Principal Customers

We have more than 1000 customers. Our customers are primarily: 1) governmental entities, such as customs agencies, courts, public security bureaus, and prisons; (2) non-profit organizations, including schools, museums, sports arenas, and libraries; (3) commercial entities, such as airports, hotels, real estate, banks, mines, railways, supermarkets, and entertainment venues; and (4) multi-unit residential real estate developers. Our five largest customers accounted for approximately 59.55% of our revenues for the year ended December 31, 2009.

|

Customer Type

|

Percentage of Revenue

|

|

Governmental Entities

|

7.91 %

|

|

Non-Profit Organizations

|

6.34 %

|

|

Commercial Entities

|

19.35 %

|

|

Residential

|

63.12 %

|

|

Other

|

3.21%

|

For the year ended December 31, 2009, our five largest customers were:

|

Customer Name

|

Address

|

Percentage of Sales

|

|

Liaoning Dongchuan Real Estate

Development Co., Ltd.

|

No.128, Huanghe North Street,

Huanggu District, Shenyang,

Liaoning

|

28.71

|

|

Shenyang Cheng Jian Tong Xin

Intelligence Engineering Co., Ltd.

|

Floor 7, No.8, Renao Road,

Shenhe District, Shenyang,

Liaoning

|

19.47

|

|

Shenyang Yu Tong Shi Jie Digital

Scientific and Technical Engineering Co., Ltd.

|

No.54, Sanhao Street,

Heping District, Shenyang,

Liaoning

|

6.34

|

|

Shenyang Shenhe District Information Center

|

Shengjing Road, Shenhe District,

Shenyang, Liaoning

|

3.24

|

|

Shenyang Shenhe District Government

|

Shengjing Road, Shenhe District,

Shenyang, Liaoning

|

1.79

|

11

Principal Suppliers

Shenzhen is one of the biggest and most concentrated bases for electronic products in China. As a result, there are numerous suppliers and vendors of safety and security systems products. Because of the high level of competition among the suppliers, the prices of our principal products are relatively stable, and we are able to purchase these products at reasonable prices. We have entered into written contracts with several major suppliers and vendors.

We purchase all of the products we sell and install from PRC based manufacturers. We have approximately 90 suppliers. Our five largest suppliers accounted for approximately 97% of our costs for the year ended December 31, 2009.

For the year ended December 31, 2009, our five largest suppliers were:

|

Supplier Name

|

Address

|

Percentage of

Purchased Products

|

|

Shenyang New Hongyu Scientific and

Technical Co., Ltd.

|

No.2005, Wuchan Building, No.54,

Sanhao Street, Heping District, Shenyang, Liaoning

|

53.28

|

|

Shenyang Jia Jie Wei Ye Electronic

Co., Ltd.

|

No.1-20-3, No.90-1, Sanhao Street,

Heping District, Shenyang, Liaoning

|

37.83

|

|

Shenyang New Development Area Xi Ke

Rui Electronic Co., Ltd.

|

No.90, Sanhao Street,

Heping District, Shenyang, Liaoning

|

3.11

|

|

Shenyang Wantai Security Electronic

Sales Office Co., Ltd.

|

No.64, Sanhao Street, Heping District,

Shenyang, Liaoning

|

1.82

|

|

Shenyang High Technical Development

Area Jiang Yin Shuang Feng Electronic

Scientific and Technical Co., Ltd.

|

No, 118, Sanhao Street, Heping District,

Shenyang, Liaoning

|

1.03

|

Competition

There are many companies in China engaged in the business of surveillance and safety products and designing and installing surveillance and safety systems. The surveillance and safety industry in China is still nascent, and no company has obtained the dominating position. In addition, it is difficult in the surveillance and safety industry for very large companies to reap benefits from their size, because most of surveillance and safety projects require the product to be specially tailored to meet customers’ individual requirements.

In the surveillance and safety industry, competition is based on price, product quality, ability to distribute products, and ability to provide after-sales service.

We believe our major competitors include, but are not limited to, the following: China Network Communication Corporation; China Security & Surveillance Technology, Inc.; China Telecommunications Corporation; Zhejiang Dahua Technology Co., Ltd.; Huawei Technologies Co., Ltd.; Nanwang Information Industry Group Co., Ltd.; and, Harbin Synjones Electronic Co., Ltd.

Some of our competitors are larger than we are and possess greater name recognition, assets, personnel, sales, and financial resources. However, these competitors generally have higher prices for their products, and most of them do not have distribution networks in Liaoning that are as developed as ours.

12

We believe that the range of our product and service offerings, our brand recognition by the market, our capital resources, our relatively low labor costs, and our extensive distribution channels enable us to compete favorably in the market for the surveillance and safety products and services that we offer in China.

Government Regulations

Because most of our operating subsidiaries are located in the PRC, we are regulated by the national and local laws of the PRC.

There is no private ownership of land in China, and all land ownership is held by the government of the PRC, its agencies and collectives. Land use rights for commercial use can be obtained from the government for a period of up to 50 years, and are typically renewable. Land use rights can be transferred upon approval by the land administrative authorities of the PRC (State Land Administration Bureau) upon payment of the required land transfer fee.

In addition, we are also subject to the PRC’s foreign currency regulations. The PRC government has control over RMB reserves through, among other things, direct regulation of the conversion of RMB into other foreign currencies. Although foreign currencies which are required for “current account” transactions can be bought freely at authorized Chinese banks, the proper procedural requirements prescribed by Chinese law must be met. At the same time, Chinese companies are also required to sell their foreign exchange earnings to authorized Chinese banks and the purchase of foreign currencies for capital account transactions still requires prior approval of the Chinese government.

We believe that we are in material compliance with all registrations and requirements for the issuance and maintenance of all licenses required by the governing bodies, and that all license fees and filings are current.

Environmental Regulations

The major environmental regulations applicable to us include the PRC Environmental Protection Law, the PRC Law on the Prevention and Control of Water Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Air Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Solid Waste Pollution, and the PRC Law on the Prevention and Control of Noise Pollution.

We have not been named as a defendant in any legal proceedings alleging violation of environmental laws and have no reasonable basis to believe that there is any threatened claim, action or legal proceedings against us that would have a material adverse effect on our business, financial condition or results of operations due to any non-compliance with environmental laws. To the knowledge of our management, we have been in full compliance with environmental protection regulations during at least the past three years.

Tax

Pursuant to the Provisional Regulation of China on Value Added Tax ("VAT") and their implementing rules, all entities and individuals that are engaged in the sale of goods, the provision of repairs and replacement services and the importation of goods in China are generally required to pay VAT at a rate of 17.0% of the gross sales proceeds received, less any deductible VAT already paid or borne by the taxpayer. Further, when exporting goods, the exporter is entitled to a portion of or all the refund of VAT that it has already paid or borne.

Foreign Currency Exchange

Under the PRC foreign currency exchange regulations applicable to us, the Renminbi is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Conversion of Renminbi for capital account items, such as direct investment, loan, security investment and

repatriation of investment, however, is still subject to the approval of the PRC State Administration of Foreign Exchange, or SAFE. Foreign-invested enterprises may only buy, sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital

13

account item transactions, obtaining approval from the SAFE. Capital investments by foreign-invested enterprises outside of China are also subject to limitations, which include approvals by the Ministry of Commerce, the SAFE and the State Reform and Development Commission.

Dividend Distributions

Under applicable PRC regulations, foreign-invested enterprises in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a foreign-invested enterprise in China are required to set aside at least 10.0% of their after-tax profit based on PRC accounting standards each year to its general reserves until the accumulative amount of such reserves reach 50.0% of its registered capital. These reserves are not distributable as cash dividends.

Intellectual Property

Our business depends, in part, on our ability to conduct our business without infringing on the proprietary rights of others. Similarly, we intend to maintain and protect all future intellectual property rights that may arise from our research and development activities. We rely primarily on employee and third-party confidentiality agreements to safeguard our intellectual property. We intend to register any rights that we may have in the future and that arise under trademark, copyright or patent law, as reasonably required in order to ensure the success of our business. As of December 31, 2010, we had not attempted to register any such rights.

PRC law provides that anyone wishing to exploit the patent of another must conclude a written licensing contract with the patent holder and pay the patent holder a fee. One rather broad exception to this, however, is that, where a party possesses the means to exploit a patent but cannot obtain a license from the patent holder on reasonable terms and in reasonable period of time, the PRC State Intellectual Property Office, or SIPO, is authorized to grant a compulsory license. A compulsory license can also be granted where a national emergency or any extraordinary state of affairs occurs or where the public interest so requires. SIPO, however, has not granted any compulsory license up to now. The patent holder may appeal such decision within three months from receiving notification by filing a suit in a people's court.

Research and Development

Currently, we have approximately 15 employees devoted to our research and development efforts, which are aimed at finding new varieties of products, improving existing products, improving overall product quality, and reducing production costs. We established a research and development center located in Shenyang in 2010.

Employees

We have approximately 148 full-time employees. Approximately 31 of them are administrative and accounting staff, approximately 15 of them are research and development staff and approximately 102 of them are engineers and sales staff.

As required by applicable Chinese law, we have entered into employment contracts with most of our officers, managers and employees. We believe that we maintain a satisfactory working relationship with our employees, and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations. Our employees in China participate in a state pension plan organized by Chinese municipal and provincial governments. We are required to contribute monthly to the plan at the rate of 23% of the average monthly salary. In addition, we are required by Chinese law to cover employees in China with various types of social insurance. We believe that we are in material compliance with the relevant PRC laws.

With the expansion of our business operations and several anticipated acquisitions, we expect that the number of our employees will increase in the next 12 months.

Our management believes that we maintain good relations with our employees.

14

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this offering that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

Our operating history may not serve as an adequate basis to judge our future prospects and results of operations.

Our operating history may not provide a meaningful basis on which to evaluate our business. We cannot assure you that we will maintain our profitability or that we will not incur net losses in the future. We expect that our operating expenses will increase as we expand. Any significant failure to realize anticipated revenue growth could result in significant operating losses.

Due to the nature of our business, we do not have significant amounts of recurring revenues from our existing customers, and we are highly dependent on new business development.

Most of our revenues are derived from the installation of surveillance and safety systems which are generally non-recurring. Our customers are primarily governmental entities, non-profit organizations and commercial entities, such as airports, customs agencies, hotels, real estate developments, banks, mines, railways, supermarkets, and entertainment enterprises. We sell and install security systems for these customers and generate revenues from the sale of these systems to our customers and, to a lesser extent, from maintenance of these systems for our customers. After we have sold and installed a system at any particular customer site, we have generated the majority of revenues from that particular client. We do not expect to generate significant revenues from any existing client in future years unless that client has additional installation sites for which our services might be required. Therefore, in order to maintain a level of revenues each year that is at or in excess of the level of revenues we generated in prior years, we must identify and be retained by new clients. If our business development, marketing and sales techniques do not result in an equal or greater number of projects of at least comparable size and value for us in a given year compared to the prior year, then we may be unable to increase our revenues and earnings or even sustain current levels in the future.

A decrease or delay in state or local mandating and funding of surveillance and safety system installation and operation may cause our revenues and profits to decrease.

We depend substantially on national, state and local government laws mandating and funding surveillance and safety system installation and operation in China. We expect that this dependence will continue for the foreseeable future. If China’s priorities change, whether due to tightening budgets, shifting policy, or otherwise, initiatives such as the Safe City Project may be abandoned or cut back, and our financial condition and results of operations may suffer material adverse effects.

We may be unable to compete successfully against new and existing competitors.

The major market for our products and business operations is the cities, villages and towns of province. We may face increasing competition in the future as we expand our business in Liaoning province and our adjacent provinces. As we expand our operations in the sales and service security and safety systems market, we will encounter competition from other companies existing in our target markets, such as China Network Communication Corporation, China Security & Surveillance Technology, Inc., and China Telecommunications Corporation, and may face future competition from new foreign and domestic competitors entering the security and safety systems market in China. Our current and future competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional and distribution activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. Competition could reduce our market share or force us to lower our prices to unprofitable levels.

15

Our current business operations rely heavily upon Mr. Rui Tan, our Chief Executive Officer and Chair, and adding other key employees essential to growing our business.

We have been heavily dependent upon the expertise and management of Mr. Rui Tan, our Chair and Chief Executive Officer, and his continued services. The loss of Mr. Tan’s services could seriously interrupt our business operations. Although we have entered into an employment contract with Mr. Tan, pursuant to which Mr. Tan agrees to serve as our full time Chief Executive Officer, and Mr. Tan has not indicated any intention of leaving us, the loss of his service for any reason could have a very negative impact on our ability to fulfill our business plan. In addition, we face competition for attracting skilled personnel. If we fail to attract and retain qualified personnel to meet current and future needs, this could slow our ability to grow our business, which could result in a decrease in market share.

The limited public company experience of our management team could adversely impact our ability to comply with the reporting requirements of U.S. Securities Laws.

Our management team has limited public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. Our senior management has never had sole responsibility for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement programs and policies in an effective and timely manner that adequately respond to such increased legal, regulatory compliance and reporting requirements, including the establishing and maintaining internal controls over financial reporting. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting requirements of the Securities Exchange Act of 1934 (the “Exchange Act”), which is necessary to maintain our public company status. If we were to fail to fulfill those obligations, our ability to continue as a U.S. public company would be in jeopardy in which event you could lose your entire investment in our company.

If we need additional capital to fund our growing operations, we may not be able to obtain sufficient capital and may be forced to limit the scope of our operations.

In connection with our growth strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the release of competitive products by our competition; and (iii) the amount of our capital expenditures, including acquisitions. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

If we cannot obtain additional funding, we may be required to: (i) limit our marketing efforts; and (ii) decrease or eliminate capital expenditures. Such reductions could materially adversely affect our business and our ability to compete.

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are acceptable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to our common stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

Our business could be adversely affected by reduced levels of cash, whether from operations or from borrowings.

Historically, our principal sources of funds have been cash flows from operations and borrowings from banks and other institutions. Our operating and financial performance may generate less cash and could result in our failing to comply with our credit agreement covenants. We were in material compliance with these covenants in fiscal year 2009 and expect to be in compliance with these covenants during fiscal year 2010. However, our ability to remain in compliance in the future will depend on our future financial performance and may be affected by events beyond our control. There can be no assurance that we will generate sufficient earnings and cash flow to remain in compliance with the credit agreement, or that we will be able to obtain future amendments to the credit agreement to avoid a default. In the event

16

of a default, there can be no assurance that we could negotiate a new credit agreement or that we could obtain a new credit agreement with satisfactory terms and conditions within a reasonable time period.

We sometimes extend credit to our customers. Failure to collect the trade receivables or untimely collection of them could affect our liquidity.

We extend credit to some of our customers while generally requiring no collateral. Generally, our customers pay in instalments, with a portion of the payment upfront, a portion of the payment upon receipt of our products by our customers and before the installation, and a portion of the payment after the installation of our products and upon satisfaction of our customer. Sometimes, a small portion of the payment will not be paid until after a certain period following the installation. We perform ongoing credit evaluations of our customers’ financial condition and generally have no difficulties in collecting our payments. However, if we encounter future problems collecting amounts due from our clients or if we experience delays in the collection of amounts due from our clients, our liquidity could be negatively affected.

If our subcontractors fail to perform their contractual obligations, our ability to provide services and products to our customers, as well as our ability to obtain future business, may be harmed.

Many of our contracts involve subcontracts with other companies upon which we rely to perform a portion of the services that we must provide to our customers. There is a risk that we may have disputes with our subcontractors, including disputes regarding the quality and timeliness of work performed by those subcontractors. A failure by one or more of our subcontractors to satisfactorily perform the agreed-upon services may materially and adversely impact our ability to perform our obligations to our customers, could expose us to liability and could have a material adverse effect on our ability to compete for future contracts and orders.

We may have difficulty defending our intellectual property rights from infringement resulting in lawsuits requiring us to devote financial and management resources that would have a negative impact on our operating results.

We regard our trademarks and other similar intellectual properties as critical to our success. We rely on trademark and other similar intellectual properties, as well as confidentiality and license agreements with certain of our employees, customers and others to protect our proprietary rights. We have received trademark registration for certain of our products in the PRC. No assurance can be given that our licenses will not be challenged, invalidated, infringed or circumvented, or that our intellectual property rights will provide competitive advantages to us. There can be no assurance that we will be able to obtain a license from a third-party technology that we may need to conduct our business or that such technology can be licensed at a reasonable cost.

Presently, we sell our products mainly in PRC. To date, no trademark or patent filings have been made other than in PRC. To the extent that we market our products in other countries, we may have to take additional action to protect our intellectual property. The measures we take to protect our proprietary rights may be inadequate and we cannot give you any assurance that our competitors will not independently develop products and processes that are substantially equivalent or superior to our own or copy our products.

There is no assurance that we will pay dividends to shareholders in the future.

Our board of directors does not intend to distribute dividends in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

We may incur significant costs to ensure compliance with United States corporate governance and accounting requirements.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more

17

time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Our growth strategy requires us to make acquisitions in the future which could subject us to significant risks, any of which could harm our business.

Our growth strategy includes identifying and acquiring or investing in suitable candidates on acceptable terms. Over time, we may acquire or make investments in other providers of products that complement our business and other companies in the security industry. The successful integration of these companies and any other acquired businesses require us to:

|

|

●

|

integrate and retain key management, sales, research and development, production and other personnel;

|

|

|

●

|

incorporate the acquired products or capabilities into our offerings from an engineering, sales and marketing perspective;

|

|

|

●

|

coordinate research and development efforts;

|

|

|

●

|

integrate and support pre-existing supplier, distribution and customer relationships; and

|

|

|

●

|

consolidate duplicate facilities and functions and combine back office accounting, order processing and support functions.

|

Acquisitions involve a number of risks and present financial, managerial and operational challenges, including:

|

|

●

|

diversion of management’s attention from running our existing business;

|

|

|

●

|

increased expenses, including travel, legal, administrative and compensation expenses resulting from newly hired employees;

|

|

|

●

|

increased costs to integrate personnel, customer base and business practices of the acquired company with our own;

|

|

|

●

|

adverse effects on our reported operating results due to possible write-down of goodwill associated with acquisitions;

|

|

|

●

|

potential disputes with sellers of acquired businesses, technologies, services, products and potential liabilities; and,

|

|

|

●

|

dilution to our earnings per share if we issue common stock in any acquisition.

|

Moreover, performance problems with an acquired business, technology, product or service could also have a material adverse impact on our reputation as a whole. Any acquired business, technology, product or service could significantly underperform relative to our expectations, and we may not achieve the benefits we expect from our acquisitions. Geographic distance between business operations, the compatibility of the technologies and operations being integrated and the disparate corporate cultures being combined also presents significant challenges. Acquired businesses are likely to have different standards, controls, contracts, procedures and policies, making it more

18

difficult to implement and harmonize company-wide financial, accounting, billing, information and other systems. If we cannot overcome these challenges, we may not realize actual benefits from past and future acquisitions, which will impair our overall business results.

Our acquisition strategy also depends on our ability to obtain necessary government approvals, as described under “- Risks Related to Doing Business in China - We may be unable to complete a business combination transaction efficiently or on favorable terms due to complicated merger and acquisition regulations which became effective on September 8, 2006.”

Due to our rapid growth in recent years, our past results may not be indicative of our future performance so evaluating our business and prospects may be difficult.

Our business has grown and evolved rapidly in recent years as demonstrated by our growth in sales revenue from approximately $2,738,111 in 2008 to $6,273,361 in 2009. We may not be able to achieve similar growth in future periods, and our historical operating results may not provide a meaningful basis for evaluating our business, financial performance and prospects. Therefore, you should not rely on our past results or our historical rate of growth as an indication of our future performance. Management's estimates and assumptions affect reported amounts of expenses and changes in those estimates could impact operating results.

Goodwill and other indefinite-lived intangible assets are tested for impairment at least annually, and the results of such testing may adversely affect our financial results. We use a variety of valuation techniques in determining fair value. The impairment review is highly judgmental and involves the use of significant estimates and assumptions. These estimates and assumptions have a significant impact on the amount of any impairment charge recorded, and actual results may differ significantly from the estimates and assumptions used.

We recognize deferred tax assets and liabilities for the expected future tax consequences of events which are included in the financial statements or tax returns. In assessing the realizability of the deferred tax assets, management makes certain assumptions about whether the deferred tax assets will be realized. We expect the deferred tax assets currently recorded to be fully realizable; however, there can be no assurance that an increased valuation allowance would not need to be recorded in the future.

Our facilities, or facilities of our customers or suppliers, could be susceptible to natural disasters.

All of our facilities and many of the facilities of our customers and suppliers are located in China. Natural disasters, such as floods and earthquakes, occur frequently in China, and they pose substantial threats to businesses with operations there. As a developing country, China’s emergency-response ability is limited, and its ability to provide emergency reconstruction and other aid to businesses affected by natural disasters is limited. Should a natural disaster severely damage one of our facilities, or damage a major facility of one or more of our significant customers or suppliers, our business could be materially disrupted.

Our insurance coverage may be inadequate to protect us against losses.

Like many other Chinese companies, we do not carry property insurance coverage for our facilities and inventories and do not have any business liability, loss of data or business interruption insurance coverage for our operations in China. If any claims for injury are brought against us, or if we experience any business disruption, litigation or natural disaster, we might incur substantial costs and diversion of resources.

19

Our quarterly operating results are likely to fluctuate, which may affect our stock price.

Our quarterly revenues, expenses, operating results and gross profit margins vary from quarter to quarter. As a result, our operating results may fall below the expectations of securities analysts and investors in some quarters, which could result in a decrease in the market price of our common stock. The reasons our quarterly results may fluctuate include:

|

|

●

|

seasonality inherent in the surveillance and safety industry;

|

|

|

●

|

variations in profit margins attributable to product mix;

|

|

|

●

|

changes in the general competitive and economic conditions;

|

|

|

●

|

delays in, or uneven timing in the delivery of, customer orders;

|

|

|

●

|

the introduction of new products by us or our competitors; and

|

|

|

●

|

delays in surveillance and safety funding and budgetary restraints on national and local government spending.

|

Period to period comparisons of our results should not be relied on as indications of future performance.

Future government regulations or other standards could have an adverse effect on our operations.

Our operations are subject to a variety of laws, regulations and licensing requirements of national and local authorities in the PRC. In certain jurisdictions, we are required to obtain licenses or permits and to meet certain standards in the conduct of our business. The loss of such licenses, or the imposition of conditions to the granting or retention of such licenses, could have an adverse effect on us. In the event that these laws, regulations and/or licensing requirements change, we may be required to modify our operations or to utilize resources to maintain compliance with such rules and regulations. In addition, new regulations may be enacted that could have an adverse effect on us.

Our limited ability to protect our intellectual property, and the possibility that our technology could inadvertently infringe technology owned by others, may adversely affect our ability to compete.

We rely on a combination of trademarks, copyrights, trade secret laws, confidentiality procedures and licensing arrangements to protect our intellectual property rights. A successful challenge to the ownership of our technology could materially damage our business prospects. Our competitors may assert that our technologies or products infringe on their patents or proprietary rights. We may be required to obtain from others licenses that may not be available on commercially reasonable terms, if at all. Problems with intellectual property rights could increase the cost of our products or delay or preclude our new product development and commercialization. If infringement claims against us are deemed valid, we may not be able to obtain appropriate licenses on acceptable terms or at all. Litigation could be costly and time-consuming but may be necessary to protect our technology license positions or to defend against infringement claims.

We may be exposed to liabilities under the Foreign Corrupt Practices Act and Chinese anti-corruption laws, and any determination that we violated any of these laws could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. We are similarly subject to Chinese anti-corruption laws. We have operations, agreements with third parties and make sales in China, which may experience corruption. Our activities in China create the risk of unauthorized payments or offers of payments by one of the employees, consultants, sales agents or distributors of our Company, even though these parties are not always subject to our control. It is our policy to implement safeguards to discourage these practices by our employees. However, our existing safeguards and any future improvements may prove to be less than effective, and the employees,

20

consultants, sales agents or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA or Chinese anti-corruption laws may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the U.S. government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

China Currency is a Hong Kong company, while our operating subsidiaries are PRC companies, and most of our officers and directors reside outside the United States. Therefore, certain judgments obtained against our Company by our shareholders may not be enforceable in Hong Kong or China.

China Currency is a Hong Kong company and our operating subsidiaries are PRC companies. Most of our officers and directors reside outside of the United States. All or substantially all of our assets and the assets of these persons are located outside of the United States.

As a result, it may not be possible for investors to effect service of process within the United States upon our Company or such persons or to enforce against it or these persons the United States federal securities laws, or to enforce judgments obtained in United States courts predicated upon the civil liability provisions of the federal securities laws of the United States, including the Securities Act and the Exchange Act.

Risks Related To Our Industry

Seasonality affects our operating results.

Our sales are affected by seasonality. Our revenues are usually higher in the second half of the year than in the first half of the year because fewer projects are undertaken during and around the Chinese spring festival.

Our success relies on our management’s ability to understand the highly evolving surveillance and safety industry.

The Chinese surveillance and safety industry is nascent and rapidly evolving. Therefore, it is critical that our management is able to understand industry trends and make good strategic business decisions. If our management is unable to identify industry trends and act in response to such trends in a way that is beneficial to us, our business will suffer.

If we are unable to respond to the rapid changes in our industry and changes in our customer’s requirements and preferences, our business, financial condition and results of operations could be adversely affected.

If we are unable, for technological, legal, financial or other reasons, to adapt in a timely manner to changing market conditions or customer requirements, we could lose customers and market share. The surveillance and safety industry is characterized by rapid technological change. Sudden changes in customer requirements and preferences, the frequent introduction of new products and services embodying new technologies and the emergence of new industry standards and practices could render our existing products, services and systems obsolete. The emerging nature of products and services in the surveillance and safety industry and their rapid evolution will require that we continually improve the performance, features and reliability of our products and services. Our success will depend, in part, on our ability to:

|

|

●

|

enhance our existing products and services;

|

|

|

●

|

anticipate changing customer requirements by designing, developing, and launching new products and services that address the increasingly sophisticated and varied needs of our current and prospective customers; and

|

|

|

●

|

respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis.

|

21

The development of additional products and services involves significant technological and business risks and requires substantial expenditures and lead time. If we fail to introduce products with new technologies in a timely manner, or adapt our products to these new technologies, our business, financial condition and results of operations could be adversely affected. We cannot assure you that even if we are able to introduce new products or adapt our products to new technologies that our products will gain acceptance among our customers. In addition, from time to time, we or our competitors may announce new products, product enhancements or technological innovations that have the potential to replace or shorten the life cycles of our existing products, and that may cause customers to refrain from purchasing our existing products, resulting in inventory obsolescence.

We may not be able to maintain or improve our competitive position among strong competition in the surveillance and safety industry, and we expect this competition to continue to intensify.

The Chinese surveillance and safety industry is highly competitive. In addition, since China joined the World Trade Organization, we also face competition from international competitors. Some of our international competitors are larger than us and possess greater name recognition, assets, personnel, sales and financial resources. These entities may be able to respond more quickly to changing market conditions by developing new products and services that meet customer requirements or are otherwise superior to our products and services and may be able to more effectively market their products than we can because they have significantly greater financial, technical and marketing resources than we do. They may also be able to devote greater resources than we can to the development, promotion and sale of their products. Increased competition could require us to reduce our prices, result in our receiving fewer customer orders, and result in a loss of our market share. We cannot assure you that we will be able to distinguish ourselves in a competitive market. To the extent that we are unable to successfully compete against existing and future competitors, our business, operating results and financial condition could be materially adversely affected.

Our product offerings involve a lengthy sales cycle and we may not anticipate sales levels appropriately, which could impair our profitability.