Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MOSAIC CO | d8k.htm |

Phosphate

and

Potash

Market

Volatility

Déjà

Vu All Over Again?

Ohio AgriBusiness

Association and OSU Extension

2011 Crop Production Conference

Columbus, OH

January 6, 2011

Dr. Michael R. Rahm

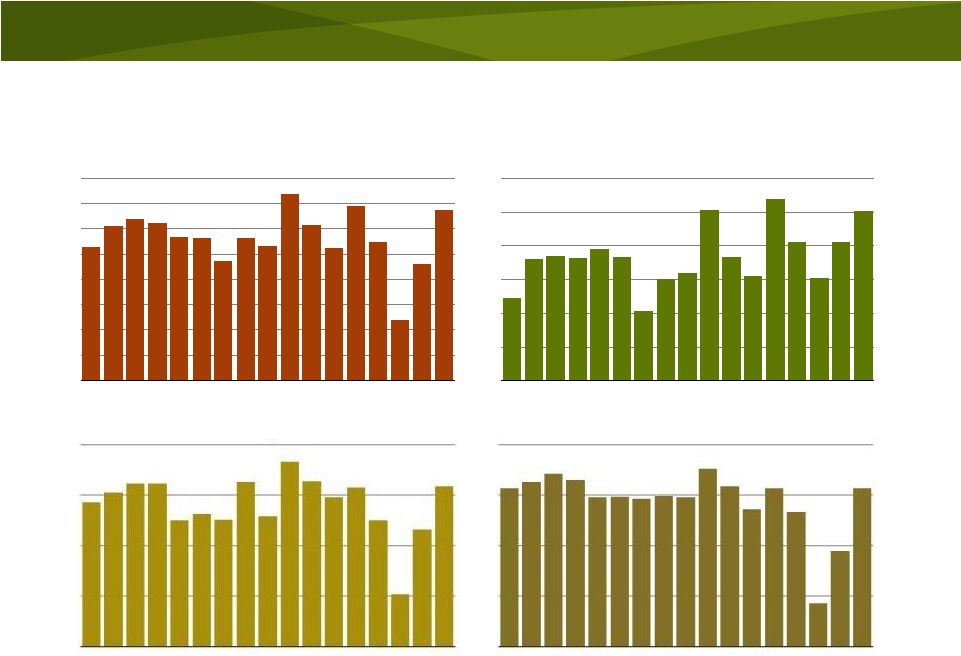

Vice President, Market and Strategic Analysis

The Mosaic Company

Exhibit 99.1 |

2

Safe Harbor Statement

This presentation contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. Such statements

include, but are not limited to, statements about future financial and operating results. Such statements are

based upon the current beliefs and expectations of The Mosaic Company’s

management and are subject to significant risks and uncertainties.

These

risks

and

uncertainties

include

but

are

not

limited

to

the

predictability

and

volatility

of,

and

customer

expectations

about,

agriculture,

fertilizer,

raw

material,

energy

and

transportation

markets

that

are

subject

to

competitive

and

other

pressures

and

economic and credit market conditions; the build-up of inventories in the

distribution channels for crop nutrients; changes in foreign currency and

exchange rates; international trade risks; changes in government policy; changes in environmental and other

governmental regulation, including greenhouse gas regulation, and implementation

of the U.S. Environmental Protection Agency’s numeric water quality

standards for the discharge of nutrients into Florida lakes and streams; further developments in the lawsuit

involving the federal wetlands permit for the extension of the Company’s

South Fort Meade, Florida, mine into Hardee County, including orders,

rulings, injunctions or other actions by the court or actions by the plaintiffs, the Army Corps of Engineers or others

in relation to the lawsuit, or any actions the Company may identify and implement

in an effort to mitigate the effects of the lawsuit; other difficulties or

delays in receiving, or increased costs, or revocation, of, necessary governmental permits or approvals; the

effectiveness of our processes for managing our strategic priorities; adverse

weather conditions affecting operations in Central Florida or the Gulf Coast

of the United States, including potential hurricanes or excess rainfall; actual costs of various items

differing from management’s current estimates, including among others asset

retirement, environmental remediation, reclamation or other environmental

regulation, or Canadian resource taxes and royalties; accidents and other disruptions involving Mosaic’s

operations, including brine inflows at its Esterhazy, Saskatchewan potash mine and

other potential mine fires, floods, explosions, seismic events or releases

of hazardous or volatile chemicals, as well as other risks and uncertainties reported from time to time in

The Mosaic Company’s reports filed with the Securities and Exchange

Commission. Actual results may differ from those set forth in the

forward-looking statements. |

Topics

January 2011 vs. January 2008

Powerful Demand Drivers –

Upbeat Forecasts

Phosphate Outlook:

Surging Demand –

Uncertain Supply

Potash Outlook:

Increasingly Tight Fundamentals

Factors to Watch (and Handicap)

3 |

January 2011 vs. January 2008 |

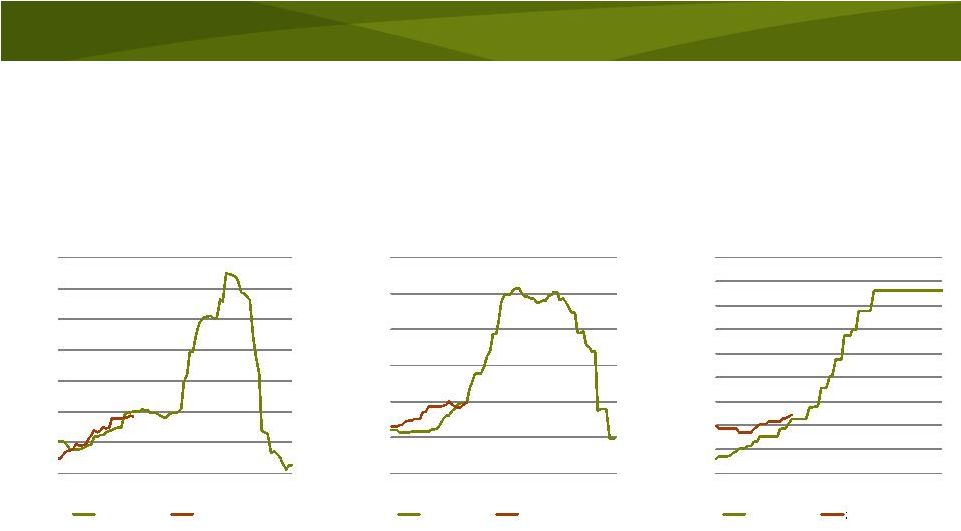

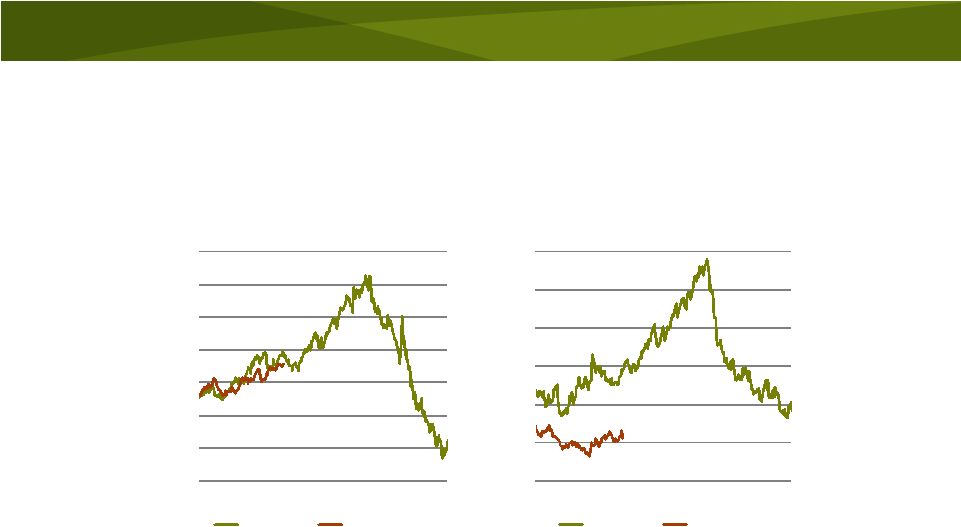

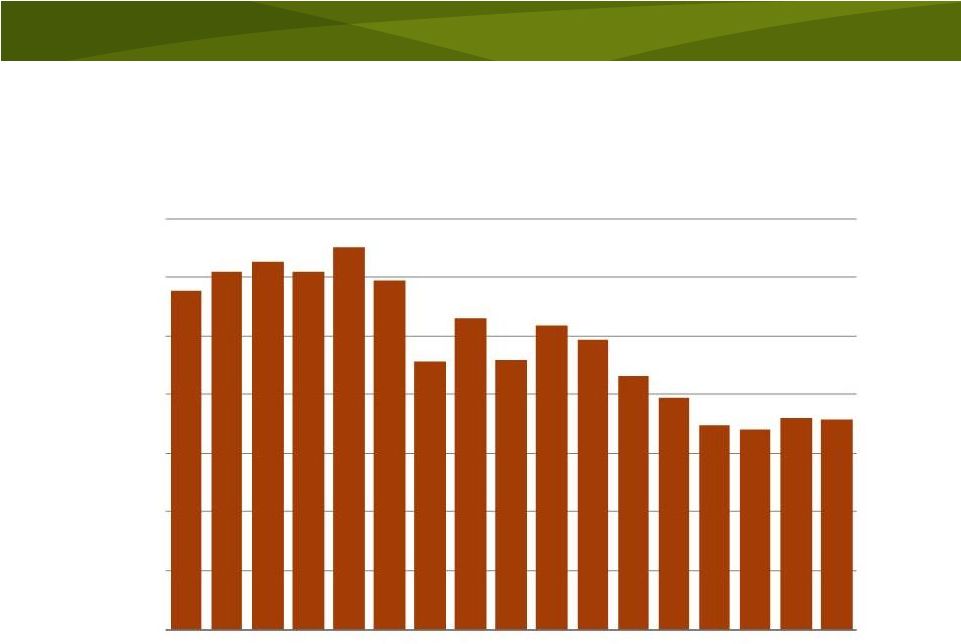

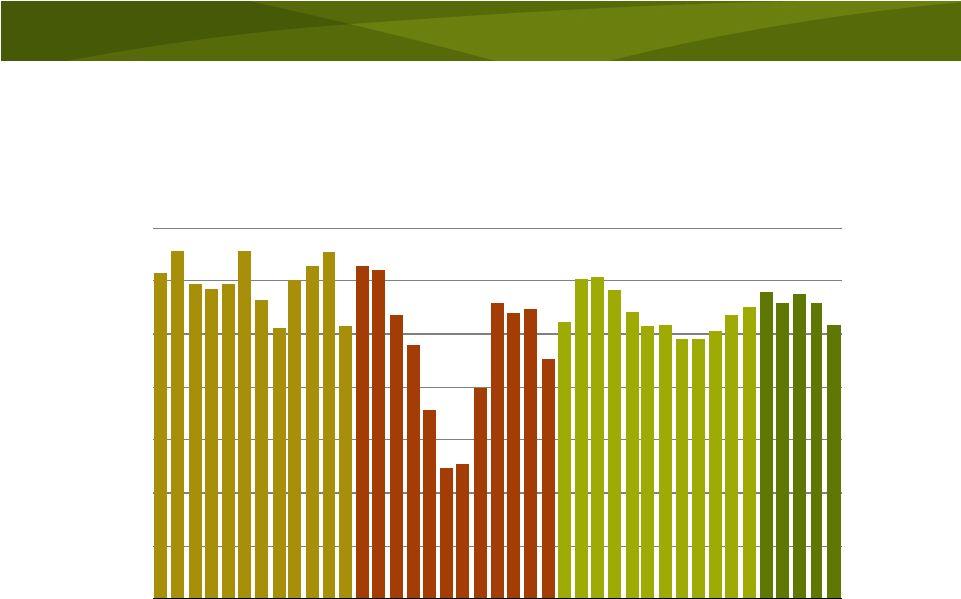

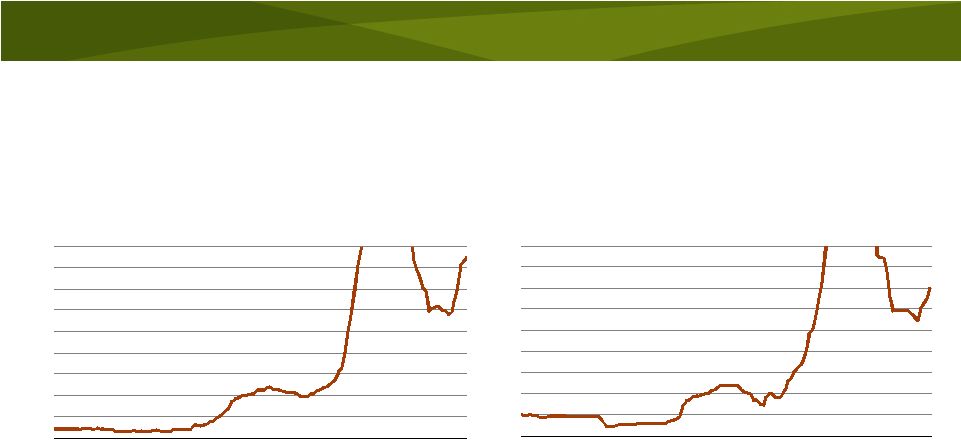

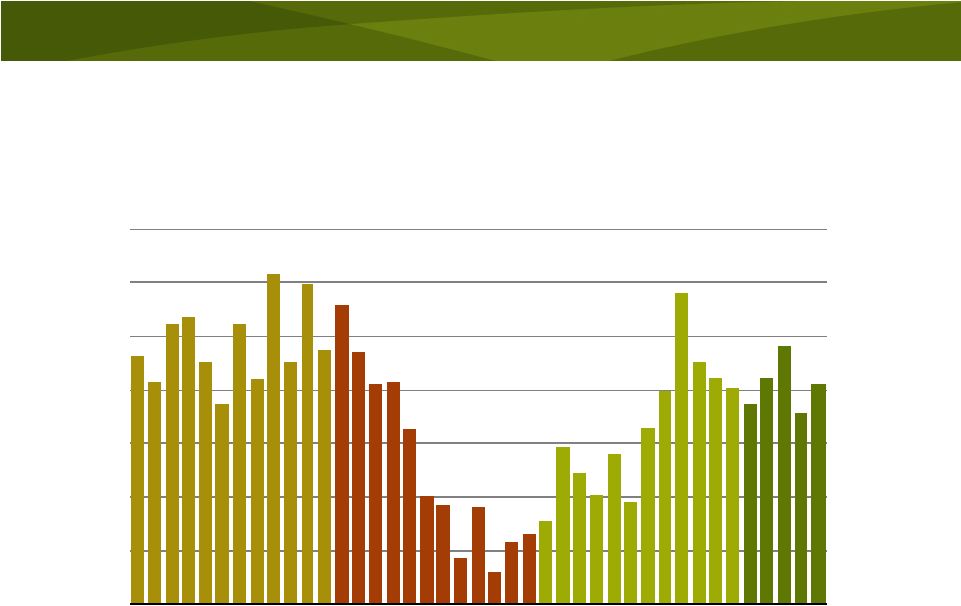

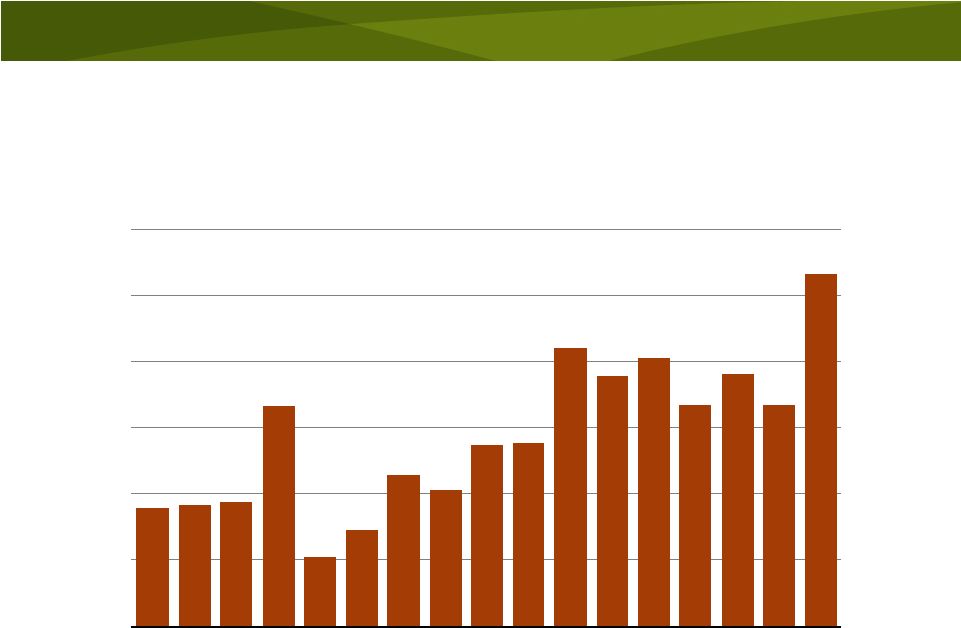

5

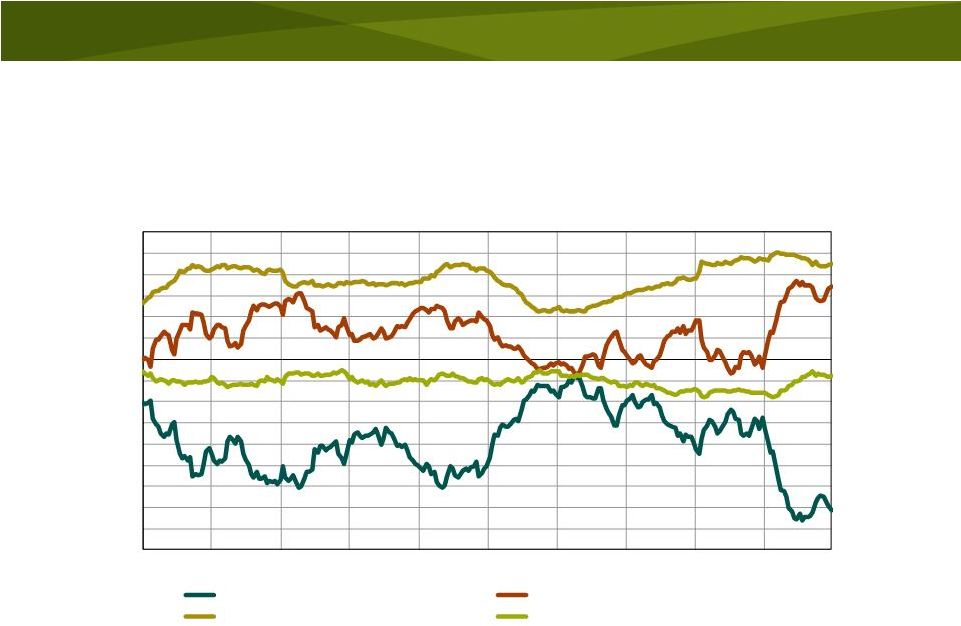

Current prices for crop nutrient products are at

roughly the same levels as 2008

Weekly published prices

2007/2008 -

Jul 1 2007 to Dec 31 2008

2010/2011 -

Jul 1 2010 to Dec 31 2010

200

300

400

500

600

700

800

900

Jul

Oct

Jan

Apr

Jul

Oct

$ Tonne

Mideast Granular Urea Prices

2007/2008

2010/2011

Source: Fertilizer Week America

200

400

600

800

1000

1200

1400

Jul

Oct

Jan

Apr

Jul

Oct

$ Tonne

Tampa fob DAP Prices

2007/2008

2010/2011

Source: Fertecon

200

300

400

500

600

700

800

900

1000

1100

Jul

Oct

Jan

Apr

Jul

Oct

$ Tonne

Brazil cnf

MOP Prices

2007/2008

2010/2011

Source: ICIS |

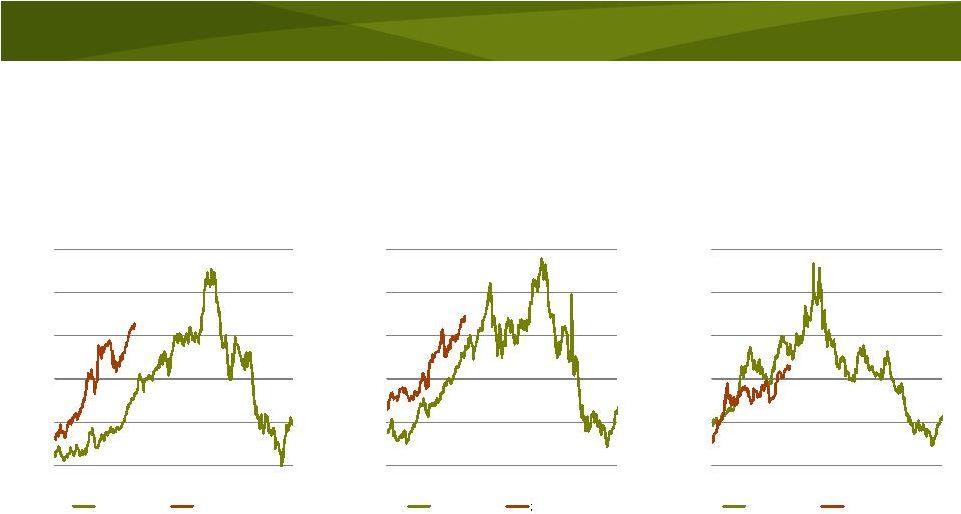

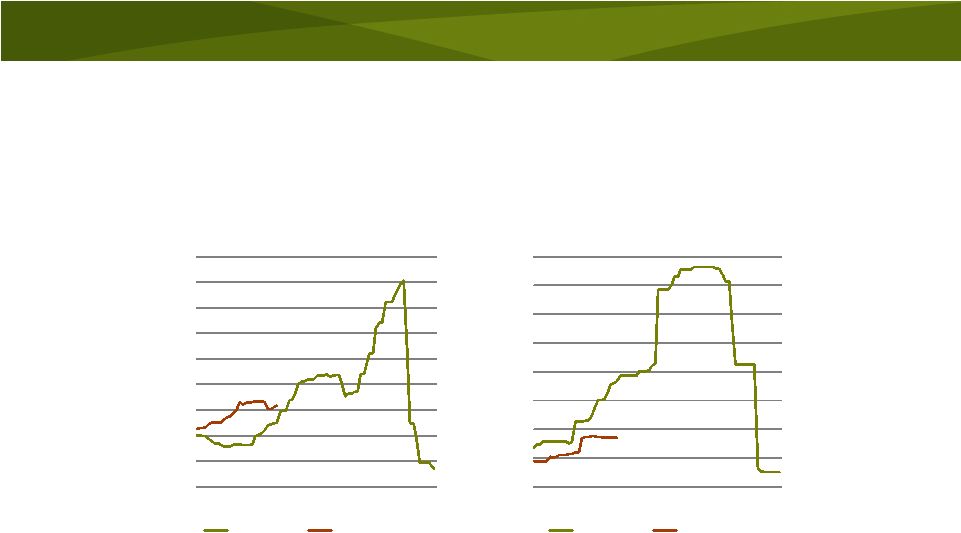

6

Nearby corn and soybean prices are higher,

but wheat prices are less than in 2008

Daily Close of Nearby Futures Contract

2007/2008 -

Jul 1 2007 to Dec 31 2008

2010/2011 -

Jul 1 2010 to Jan 3 2011

3.0

4.0

5.0

6.0

7.0

8.0

Jul

Oct

Jan

Apr

Jul

Oct

$ BU

Corn Prices

2007/2008

2010/2011

Source: CBOT

7.0

9.0

11.0

13.0

15.0

17.0

Jul

Oct

Jan

Apr

Jul

Oct

$ BU

Soybean Prices

2007/2008

2010/2011

Source: CBOT

4.0

6.0

8.0

10.0

12.0

14.0

Jul

Oct

Jan

Apr

Jul

Oct

$ BU

HRW Wheat Prices

2007/2008

2010/2011

Source: KCBOT |

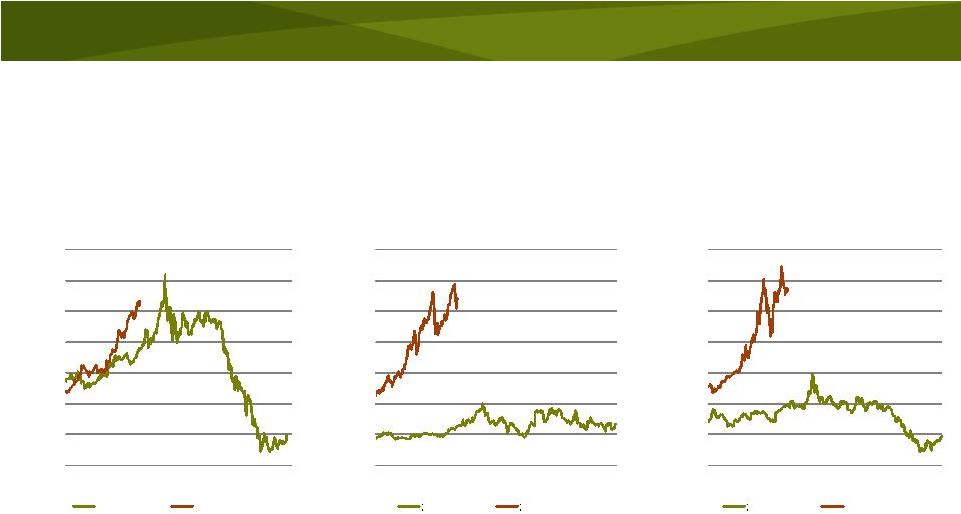

7

But much higher prices for other commodities -

implying greater competition for acres in 2011

Daily Close of Nearby Futures Contract

2007/2008 -

Jul 1 2007 to Dec 31 2008

2010/2011 -

Jul 1 2010 to Jan 3 2011

1200

1700

2200

2700

3200

3700

4200

4700

Jul

Oct

Jan

Apr

Jul

Oct

RM

Tonne

Palm Oil Prices

2007/2008

2010/2011

Source: Kuala Lumpur Exchange

5

10

15

20

25

30

35

40

Jul

Oct

Jan

Apr

Jul

Oct

CTS LB

Sugar (#11) Prices

2007/2008

2010/2011

Source: ICE

30

50

70

90

110

130

150

170

Jul

Oct

Jan

Apr

Jul

Oct

CTS LB

Cotton Prices

2007/2008

2010/2011

Source: ICE |

8

Oil prices are about the same but natural gas

prices are significantly less than in 2008

Daily Close of Nearby Futures Contract

2007/2008 -

Jul 1 2007 to Dec 31 2008

2010/2011 -

Jul 1 2010 to Jan 3 2011

20

40

60

80

100

120

140

160

Jul

Oct

Jan

Apr

Jul

Oct

$ BBL

WTI Crude Oil Prices

2007/2008

2010/2011

Source: NYMEX

2

4

6

8

10

12

14

Jul

Oct

Jan

Apr

Jul

Oct

$ MMBtu

HH Natural Gas Prices

2007/2008

2010/2011

Source: NYMEX |

9

100

200

300

400

500

600

700

800

900

1000

Jul

Oct

Jan

Apr

Jul

Oct

$ Tonne

India cnf Ammonia Prices

2007/2008

2010/2011

Source: Fertecon

0

100

200

300

400

500

600

700

800

Jul

Oct

Jan

Apr

Jul

Oct

$ Tonne

China cnf Sulphur Prices

2007/2008

2010/2011

Source: Fertecon

Weekly published prices

2007/2008 -

Jul 1 2007 to Dec 31 2008

2010/2011 -

Jul 1 2010 to Dec 31 2010

Ammonia

prices

are

higher,

but

sulphur

prices

are

lower

than

in

2008

–

less

cost

pressure |

10

The ratio of the crop nutrient price index to

the crop price index has declined in 2010

0.50

0.75

1.00

1.25

1.50

1.75

2.00

2.25

2.50

00

02

04

06

08

10

Crop Nutrient Price Index/Crop Price Index Ratio

Ratio

Average |

Powerful Demand Drivers -

Upbeat

Demand Forecasts |

12

Strong

price

signals

–

an

acreage

donnybrook

Daily Close of New Crop Options January 1 2010 to January 3 2011

3.75

4.00

4.25

4.50

4.75

5.00

5.25

5.50

5.75

Jan

Apr

Jul

Oct

Jan

$ BU

New Crop Corn Prices

Dec 2011

Dec 2012

Source: CBOT

9.00

9.50

10.00

10.50

11.00

11.50

12.00

12.50

13.00

13.50

Jan

Apr

Jul

Oct

Jan

$ BU

New Crop Soybean Prices

Nov 2011

Source: CBOT

5.20

5.60

6.00

6.40

6.80

7.20

7.60

8.00

8.40

8.80

9.20

Jan

Apr

Jul

Oct

Jan

$ BU

New Crop HRW Wheat Prices

July 2011

July 2012

Source: KCBOT

Nov 2012 |

13

Daily Close of Nearby Futures Contract January 1 2010 to January 3 2011

And not just corn

12

16

20

24

28

32

36

Jan

Apr

Jul

Oct

Jan

CTS/LB

Sugar (#11) Price

Daily Close of Nearby Futures Contract

Source: ICE

60

80

100

120

140

160

180

Jan

Apr

Jul

Oct

Jan

CTS/LB

Cotton Price

Daily Close of Nearby Futures Contract

Source: ICE

9

10

11

12

13

14

15

Jan

Apr

Jul

Oct

Jan

CTS/LB

Rice (#2) Price

Daily Close of Nearby Futures Contract

Source: CBOT |

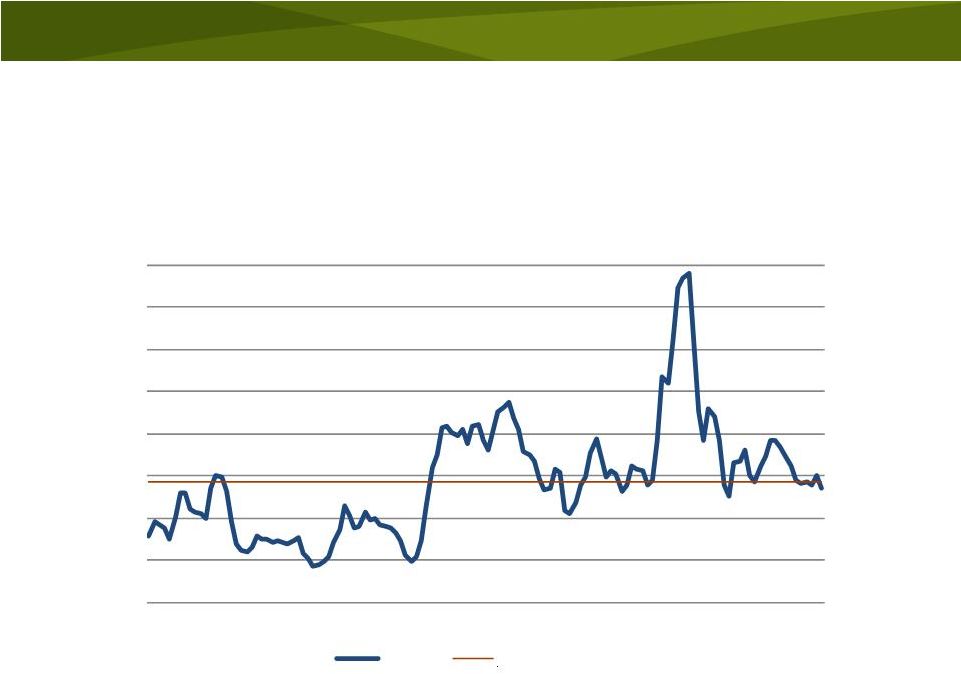

Is

it speculative exuberance? 14

-900,000

-800,000

-700,000

-600,000

-500,000

-400,000

-300,000

-200,000

-100,000

0

100,000

200,000

300,000

400,000

500,000

600,000

1/3/2006

7/3/2006

1/3/2007

7/3/2007

1/3/2008

7/3/2008

1/3/2009

7/3/2009

1/3/2010

7/3/2010

Contracts

Source: CFTC Commitments of Traders Weekly Report

Corn

Net Position by Futures Market Participants

Data thru December 28, 2010

Large Commercial Hedgers

Large Speculative Traders

Commodity Index Traders

Small Non-Reportable Positions |

Or

is it fundamental strength? 15

0

25

50

75

100

125

150

175

200

225

70

72

74

76

78

80

82

84

86

88

90

92

94

96

98

00

02

04

06

08

10

Mil Tonnes

World Corn Stocks

China

Rest of World

Source: USDA |

Or

is it fundamental strength? 16

0

7

14

21

28

35

42

49

56

63

70

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

70

72

74

76

78

80

82

84

86

88

90

92

94

96

98

00

02

04

06

08

10

Pct of Use

Bil Bu

U.S. Corn Stocks

Stocks

Pct of Use

Source: USDA and Mosaic

Key

Assumptions

for

2011/12

Planted acreage: 92.5 million

Trend Yield: 163.2 bu

acre

Total use: 13.55 bil

bu |

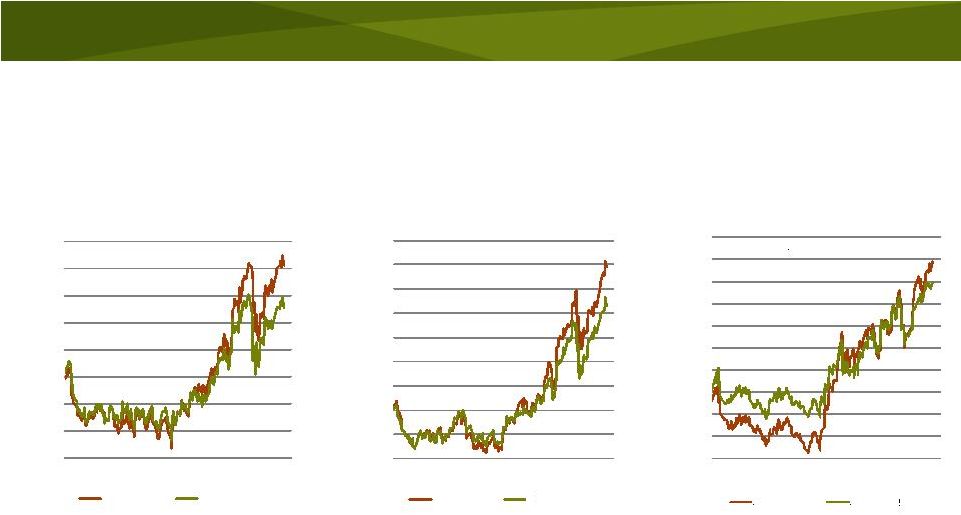

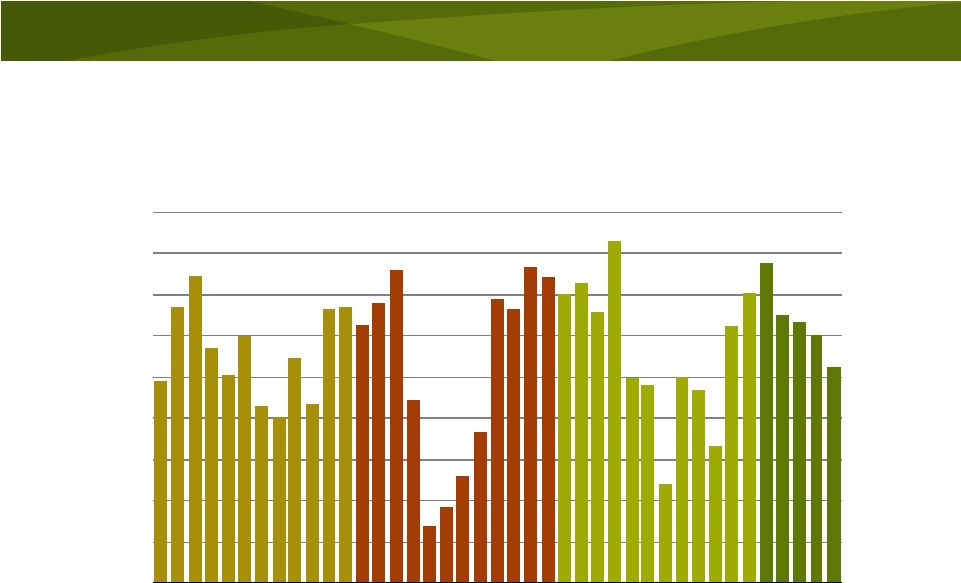

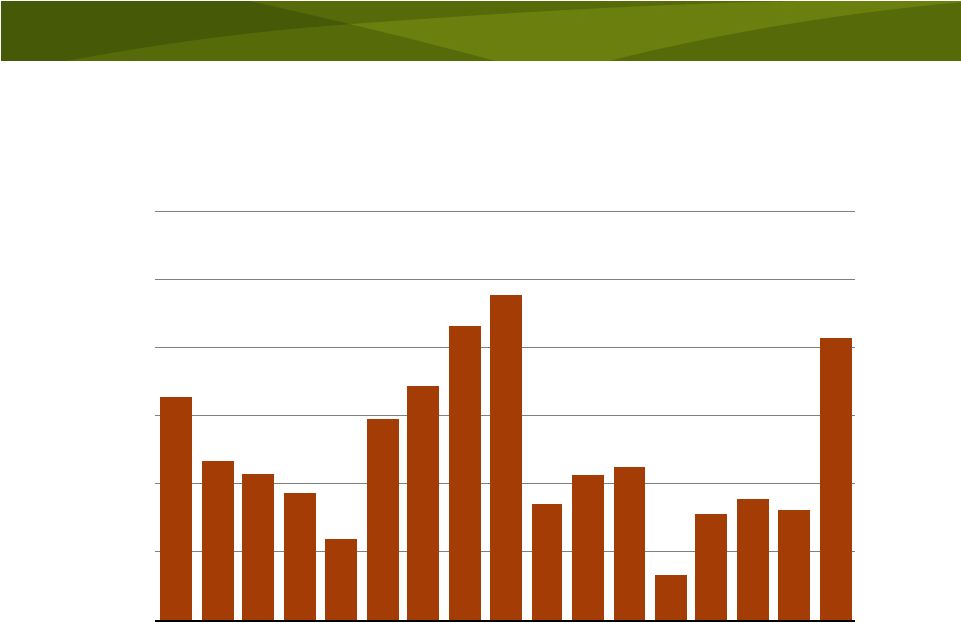

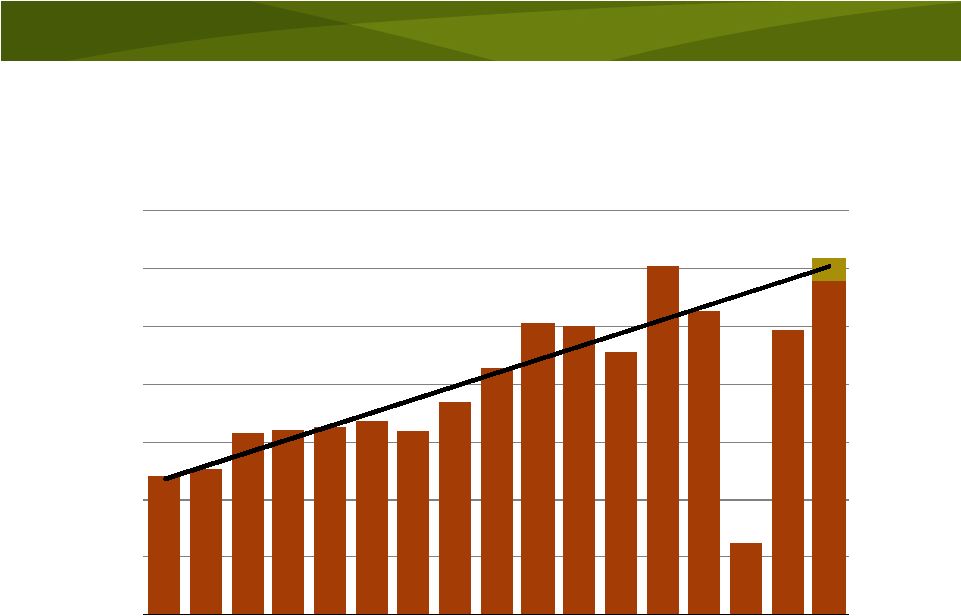

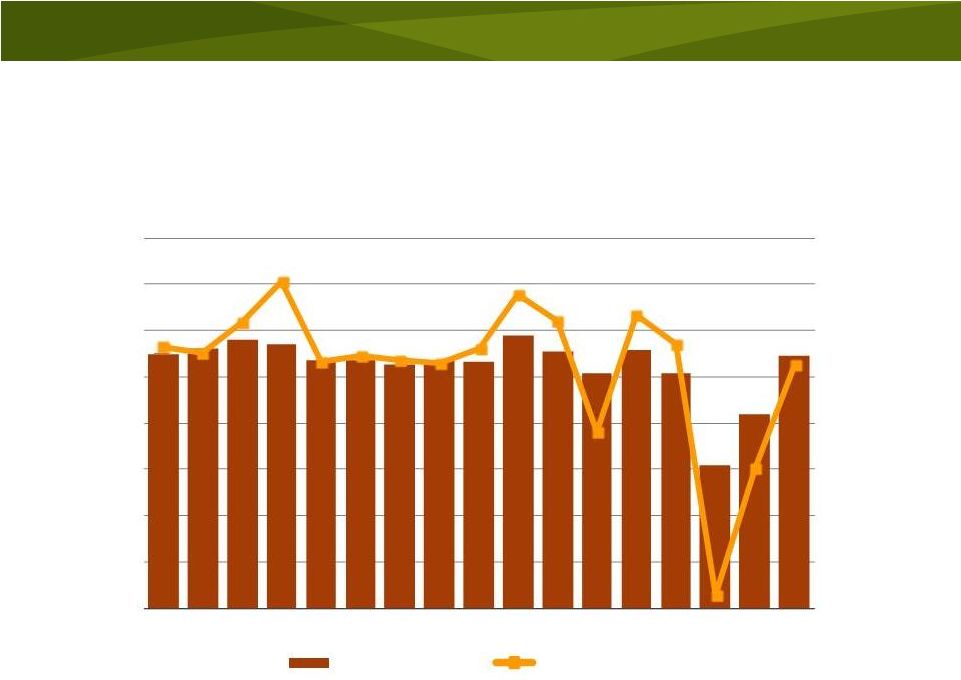

17

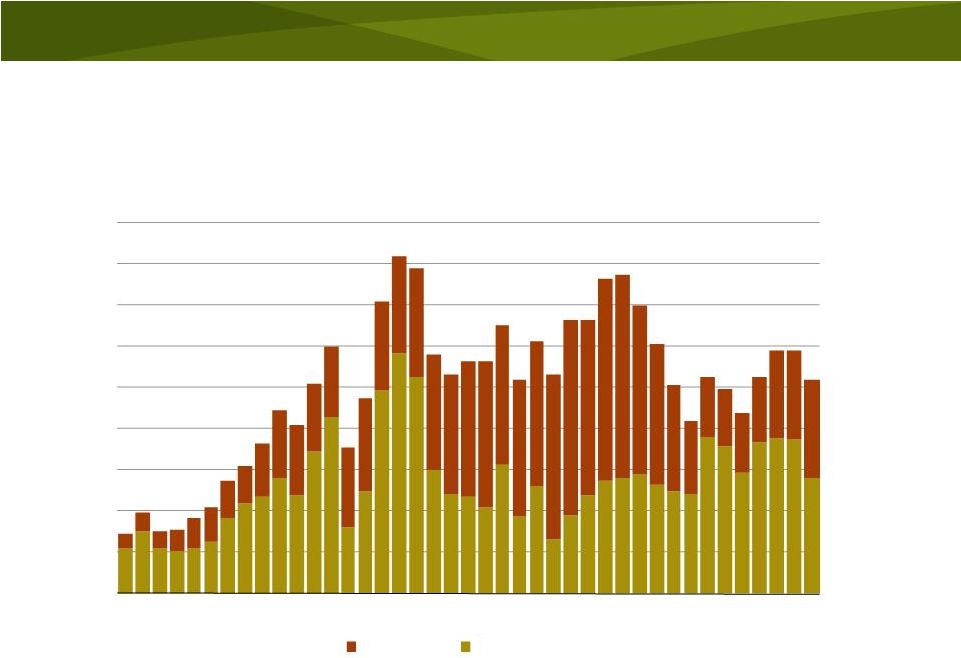

Strong global growth expected in 2011/12

100.0

110.0

120.0

130.0

140.0

150.0

160.0

170.0

180.0

95/96

97/98

99/00

01/02

03/04

05/06

07/08

09/10E

11/12F

Mil Tonnes

Source: IFA December 2010

World Nutrient Use

75.0

80.0

85.0

90.0

95.0

100.0

105.0

110.0

95/96

97/98

99/00

01/02

03/04

05/06

07/08

09/10E

11/12F

Mil Tonnes N

Source: IFA December 2010

World Nitrogen Use

25.0

27.5

30.0

32.5

35.0

37.5

40.0

42.5

95/96

97/98

99/00

01/02

03/04

05/06

07/08

09/10E

11/12F

Mil

Tonnes

P

O

Source: IFA December 2010

World Phosphate Use

15.0

17.5

20.0

22.5

25.0

27.5

30.0

95/96

97/98

99/00

01/02

03/04

05/06

07/08

09/10E

11/12F

Mil

Tonnes

K

O

Source: IFA December 2010

World Potash Use

2

2

5 |

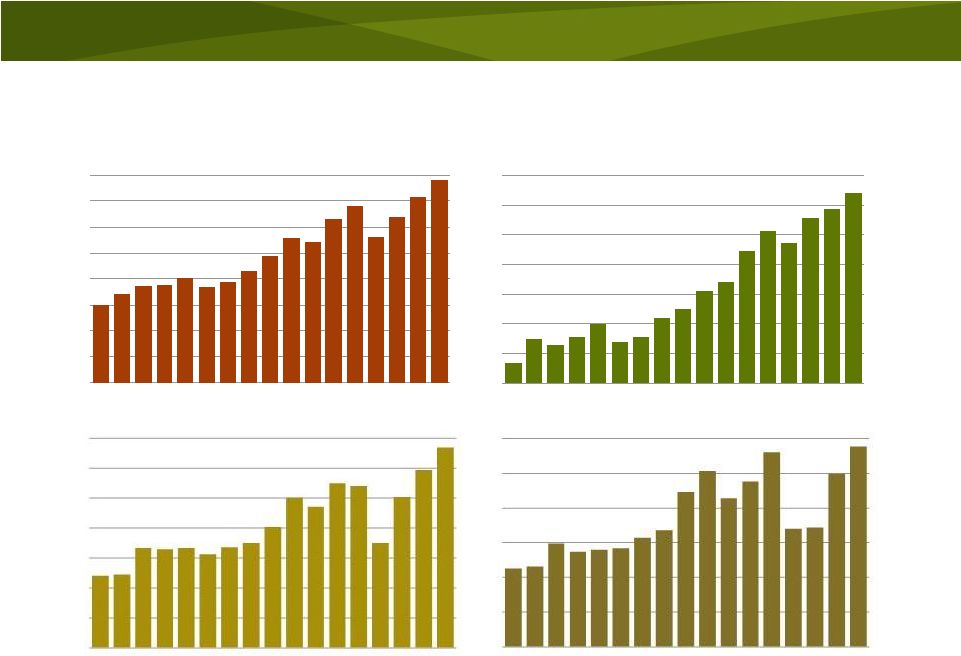

18

U.S. demand projected to grow 10%

16

17

18

19

20

21

22

23

24

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09E

10E

11F

Mil Tons

Fertilizer Year Ending June 30

U.S. Nutrient Use

Source: AAPFCO and Mosaic

10.5

11.0

11.5

12.0

12.5

13.0

13.5

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09E

10E

11F

Mil Tons N

Fertilizer Year Ending June 30

U.S. Nitrogen Use

Source: AAPFCO and Mosaic

3.0

3.5

4.0

4.5

5.0

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09E

10E

11F

Fertilizer Year Ending June 30

U.S. Phosphate Use

Source: AAPFCO and Mosaic

2.0

3.0

4.0

5.0

6.0

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09E

10E

11F

Fertilizer Year Ending June 30

U.S. Potash Use

Source: AAPFCO and Mosaic

Mil

Tonnes

P

O

2

5

Mil

Tonnes

K

O

2 |

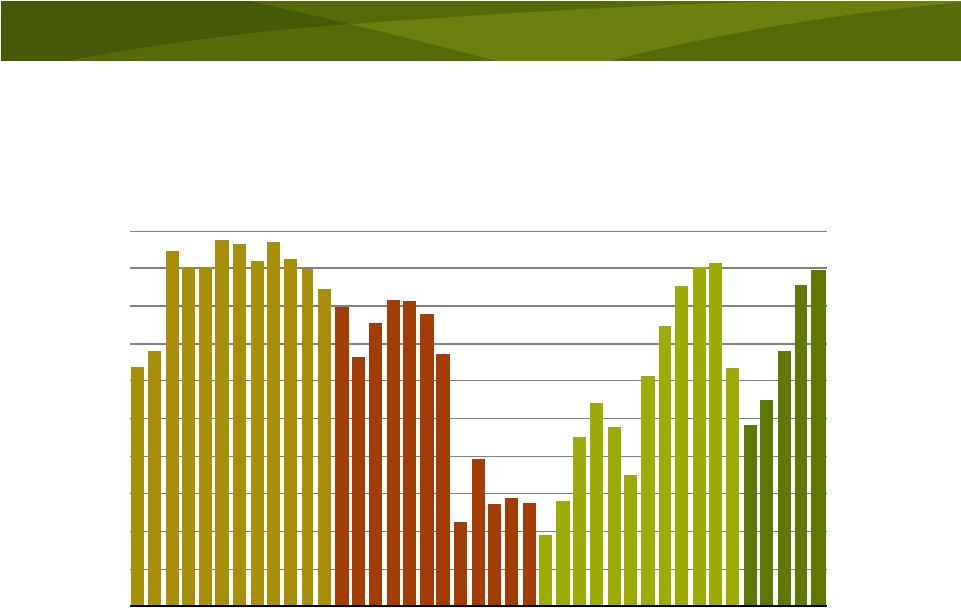

19

60

65

70

75

80

85

90

95

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11F

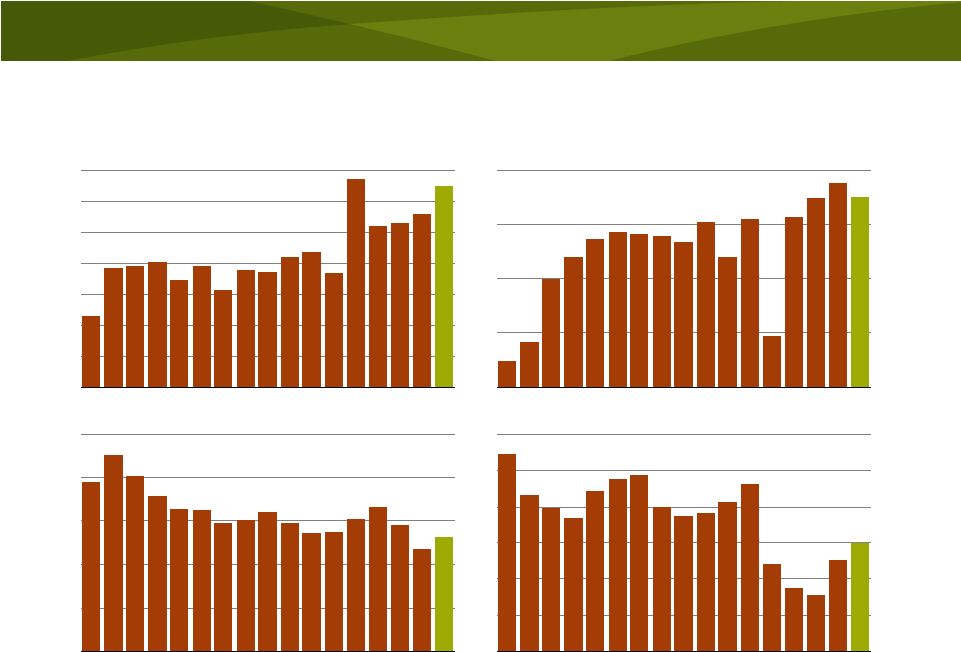

Mil Acres

U.S. Corn Planted Acres

Source: USDA and Mosaic

60

65

70

75

80

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11F

Mil Acres

U.S. Soybean Planted Acres

Source: USDA and Mosaic

Positive U.S. demand drivers

30

40

50

60

70

80

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11F

Mil Acres

U.S. Wheat Planted Acres

Source: USDA and Mosaic

6

8

10

12

14

16

18

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11F

Mil Acres

U.S. Cotton Planted Acres

Source: USDA and Mosaic |

Phosphate Outlook:

Surging Demand –

Uncertain Supply |

Market stable to slightly softer during this

seasonally slow period

21

100

150

200

250

300

350

400

450

500

550

600

650

00

01

02

03

04

05

06

07

08

09

10

11

$ MT

DAP Prices

fob Tampa Vessel

Source: Fertecon

100

150

200

250

300

350

400

450

500

550

600

00

01

02

03

04

05

06

07

08

09

10

11

$ ST

DAP Prices

NOLA Barge

Source: Green Markets |

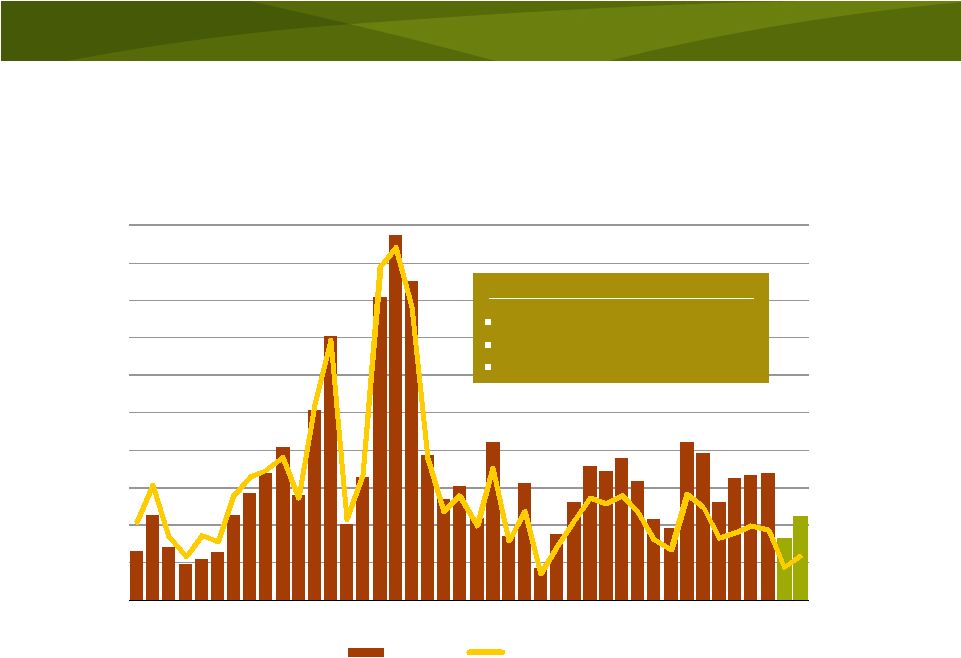

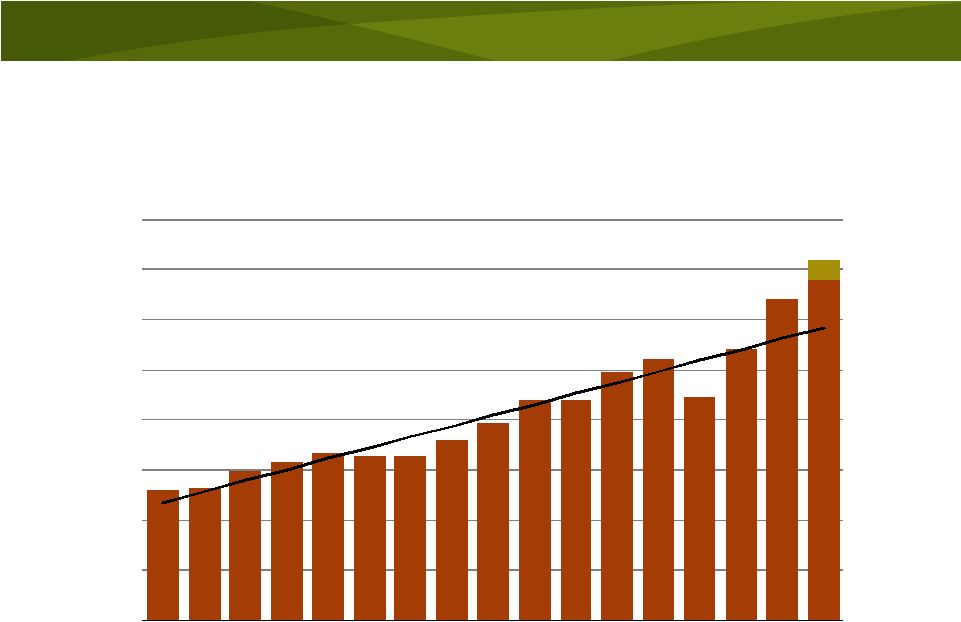

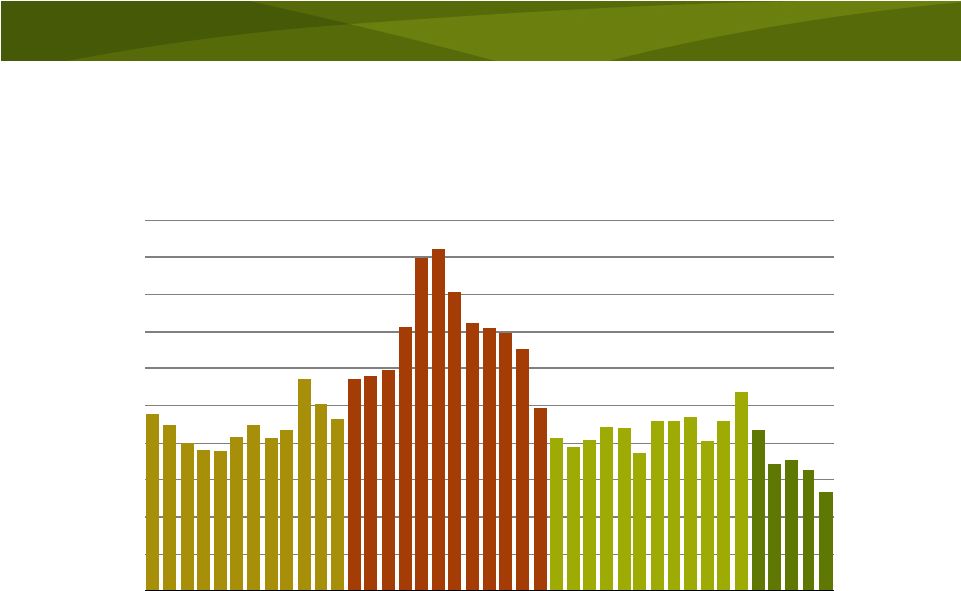

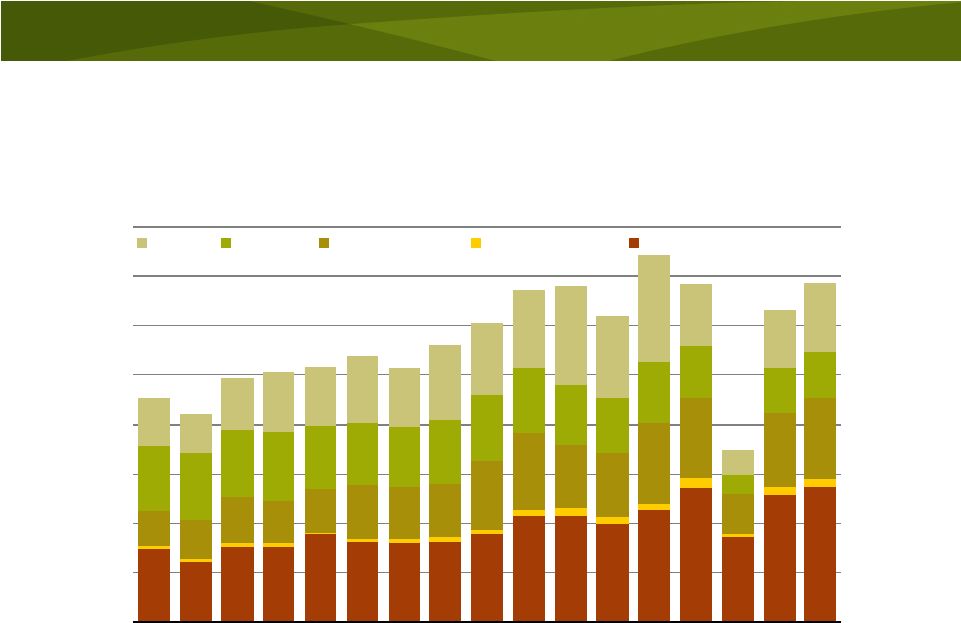

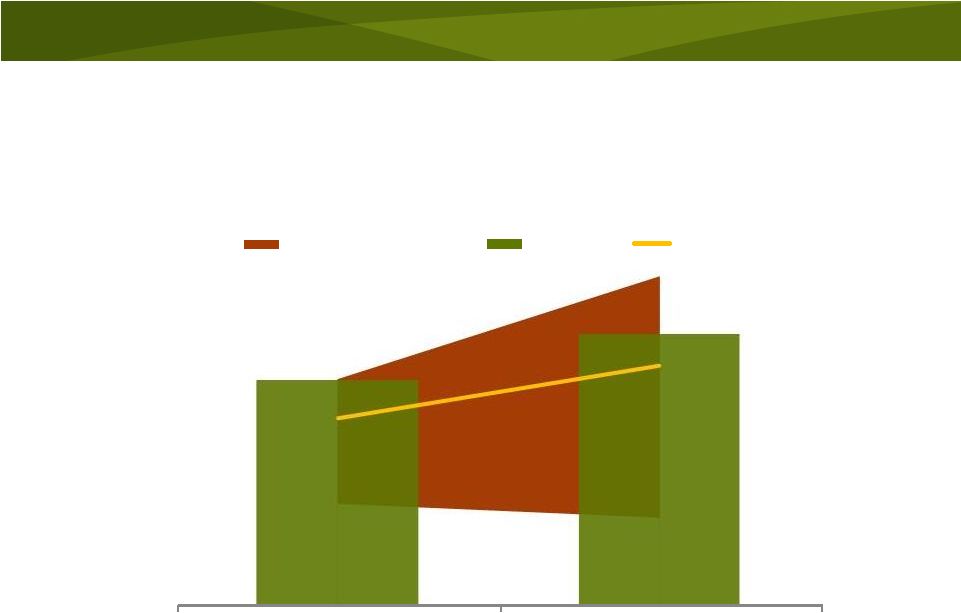

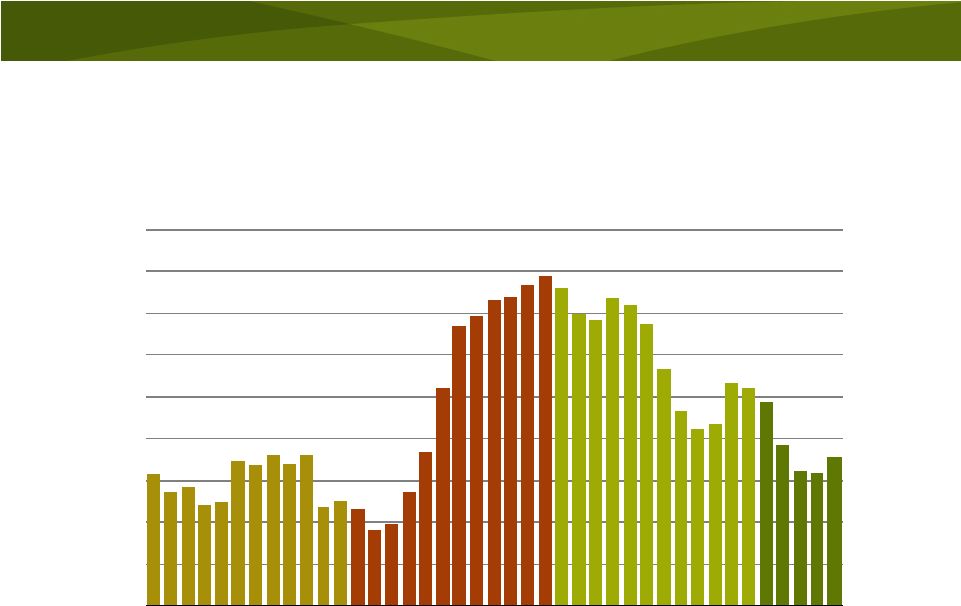

25

30

35

40

45

50

55

60

65

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10F

11F

Mil Tonnes

DAP/MAP/TSP

World Processed Phosphate Shipments

Surging global phosphate shipments

22

Source: Fertecon and Mosaic (Forecast Range for 2011, Trend 1995-2010)

|

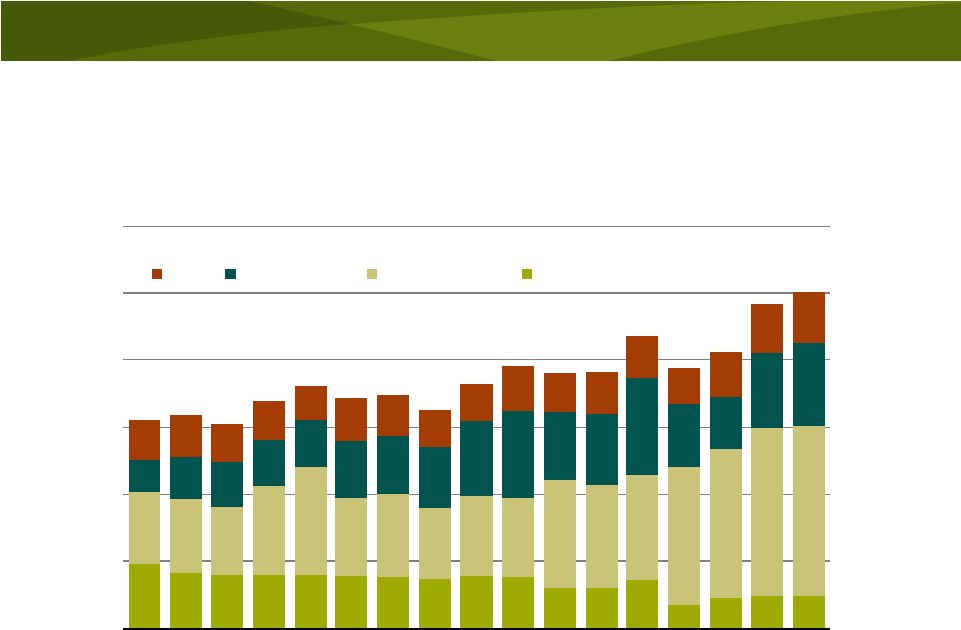

Record phosphate trade

23

0

5

10

15

20

25

30

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10F

11F

Mil Tonnes

DAP/MAP/TSP

World Processed Phosphate Import Demand

(Excludes China)

Other

Latin America

Asia less China

Europe

Source: Fertecon, IFA and Mosaic |

24

U.S. DAP/MAP exports stable in 2010/11

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11F

Mil Tons

U.S. DAP and MAP Exports

Source: TFI and Mosaic

Fertilizer Year Ending June 30 |

25

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

Jul

07/08

Oct

Jan

Apr

Jul

08/09

Oct

Jan

Apr

Jul

09/10

Oct

Jan

Apr

Jul

10/11

Oct

Mil Tons

U.S. DAP and MAP Exports

Source: TFI

U.S. exports off 7% FY 2010/11 YTD |

26

4.5

5.0

5.5

6.0

6.5

7.0

7.5

8.0

8.5

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

5.5

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09E

10F

11F

Mil Tons

DAP/MAP

Mil Tons

P

2

O

5

U.S. Phosphate Use and DAP/MAP Shipments

Phosphate Use

DAP/MAP Shipments

Source: AAPFCO, TFI and Mosaic

Fertilizer Year Ending June 30

U.S. shipments forecast to climb another 13% |

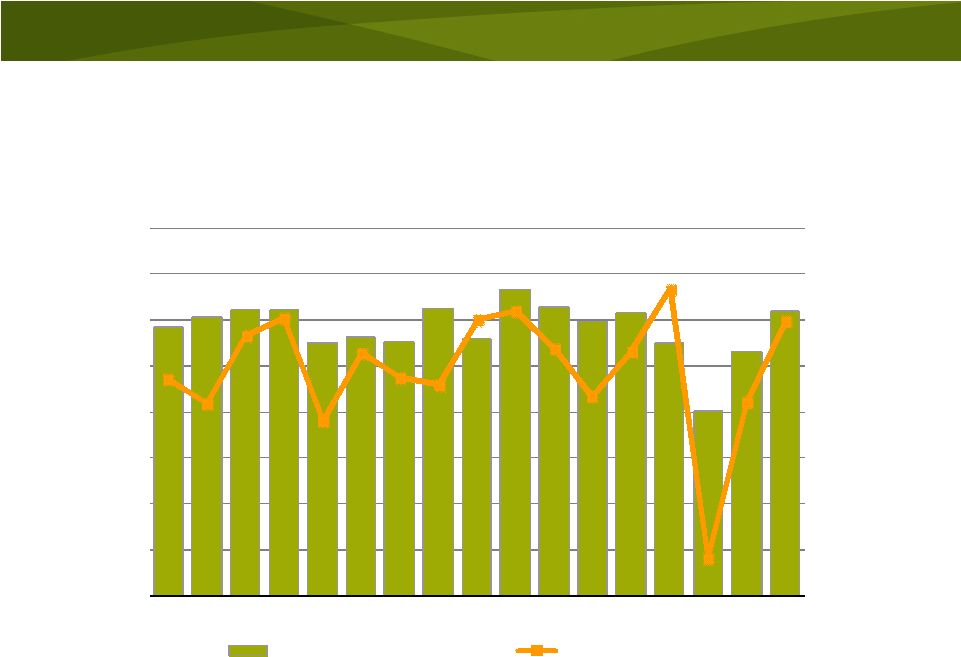

Strong Spring shipments are expected

following an outstanding fall season

27

Source: TFI, US Department of Commerce and Mosaic

0.0

1.0

2.0

3.0

4.0

5.0

6.0

Jun

-Nov

Dec-May

Mil Tons

Implied North American Phosphate Shipments

5-Yr Min-Max Range

2010/11

5-Yr Average |

28

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

Jul

07/08

Oct

Jan

Apr

Jul

08/09

Oct

Jan

Apr

Jul

09/10

Oct

Jan

Apr

Jul

10/11

Oct

Mil Tons

U.S. DAP and MAP Production

Source: TFI

Production down 2% FY 2010/11 YTD |

29

0.0

0.1

0.2

0.3

0.4

0.5

0.6

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11F

Mil Tons

U.S. DAP and MAP Imports

Source: TFI, USDOC, and Mosaic

Fertilizer Year Ending June 30

Surge of phosphate imports |

30

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

Jul

07/08

Oct

Jan

Apr

Jul

08/09

Oct

Jan

Apr

Jul

09/10

Oct

Jan

Apr

Jul

10/11

Oct

Mil Tons

U.S. DAP and MAP Producer Stocks

Source: TFI

Record-low inventory level at producer sites |

31

Bottom Line

Global shipments on a new growth trajectory

–

Global phosphate shipments likely increased to 57.0 MMT in

2010 and are forecast to increase to 59-61 MMT in 2011

–

Strong growth in Latin America and Asia

–

U.S. shipments projected to climb to 7.5 MST in 2010/11

based on higher acreage and application rates

–

“Perfect

Storm”

fall

season

in

NA

but

more

than

half

of

projected demand still ahead this spring

Supply uncertainties still overhang the market

–

Availability and cost of raw materials

–

Chinese export availability

–

Startup of new capacity in Saudi Arabia

–

Mosaic’s South Fort Meade mining permit

Market is expected to remain tight until new

capacity comes online |

Potash Outlook:

Increasingly Tight Fundamentals |

100

150

200

250

300

350

400

450

500

550

00

01

02

03

04

05

06

07

08

09

10

11

$ ST

MOP Prices

Blend Grade fob U.S. Midwest Warehouse

Source: Green Markets

Prices firm based on tighter fundamentals

33

100

150

200

250

300

350

400

450

500

550

00

01

02

03

04

05

06

07

08

09

10

11

$ MT

MOP Prices

Blend Grade c&f Brazil

Source: ICIS |

25

30

35

40

45

50

55

60

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10F

11F

Mil Tonnes

KCL

World MOP Shipments

34

Global shipments back on track

Source: Fertecon and Mosaic (Forecast Range for 2011, Trend 1995-2006)

|

35

0

5

10

15

20

25

30

35

40

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10F

11F

Mil Tonnes

KCL

World MOP Import Demand

(excluding Canda > U.S. shipments)

Other

Europe

Latin America

North America

Asia

Source: Fertecon and Mosaic

Second highest world import demand |

NA

exports projected to increase 36% 36

0

2

4

6

8

10

12

14

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11F

Mil Tons

KCL

North American MOP Exports

U.S.

Canada

Source: IPNI and Mosaic

Fertilizer Year Ending June 30 |

NA

exports up 74% FY 2010/11 YTD 37

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

Jul

07/08

Oct

Jan

Apr

Jul

08/09

Oct

Jan

Apr

Jul

09/10

Oct

Jan

Apr

Jul

10/11

Oct

Mil Tons

KCL

North American MOP Exports

Source: IPNI |

38

NA shipments forecast to climb another 28%

5

6

7

8

9

10

11

12

13

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11F

Mil Tons

KCL

Mil Tons

K O

North

American

Potash

Use

and

MOP

Shipments

Ag Use

Total Shipments

Source: IPNI and Mosaic

Fertilizer Year Ending June 30

2 |

“Perfect storm”

fall application season in NA

39

Source: IPNI, US Department of Commerce and Mosaic

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

Jun

-Nov

Dec-May

Mil Tons

KCl

Implied North American MOP Shipments

5-Yr Min-Max Range

2010/11

5-Yr Average

|

NA

production up 79% FY 2010/11 YTD 40

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

Jul

07/08

Oct

Jan

Apr

Jul

08/09

Oct

Jan

Apr

Jul

09/10

Oct

Jan

Apr

Jul

10/11

Oct

Mil Tons

KCL

North American MOP Production

Source: IPNI |

Record NA imports expected in 2010/11

41

0.0

0.2

0.4

0.6

0.8

1.0

1.2

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11F

Mil Tons

KCL

North American MOP Imports

Source: IPNI, USDOC, and Mosaic

Fertilizer Year Ending June 30 |

Demand pulls down NA producer inventories

42

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

Jul

07/08

Oct

Jan

Apr

Jul

08/09

Oct

Jan

Apr

Jul

09/10

Oct

Jan

Apr

Jul

10/11

Oct

Mil Tons

KCL

North American MOP Producer Stocks

Source: IPNI |

Bottom Line

Potash shipments are back on track

–

Global shipments forecast to increase to 49.7 MMT in

2010 and to 53-56 MMT in 2011

–

Broad-based demand recovery

–

NA shipments forecast to climb to more than 10.3 MST in

2010/11 based on higher acreage and application rates

–

“Perfect

Storm”

fall

season

in

NA

but

more

than

half

of

projected demand still ahead this spring

Producers struggled to keep up with peak

shipments this fall

Market is expected to remain tight until new

capacity comes online

43 |

Factors to Watch

Agricultural commodity prices

–

Macroeconomic developments and value of the dollar

–

Weather developments during the next 60 to 120 days

•

Southern Hemisphere: La Nina effect (hot and dry Dec-Feb in

southern Brazil and northern Argentina)

•

Northern Hemisphere: 2011 spring planting conditions

–

A Chinese surprise (i.e. significant corn imports)

–

Grain and oilseed demand destruction

–

Speculative positions (and what might spook the herd)

Phosphate market uncertainties

–

Raw materials costs and availability

–

Indian DAP subsidy for fiscal 2011/12

–

Chinese export supplies

–

Start-up of the Ma’aden facility

–

Resolution of the South Fort Meade mine permit issue

Intangibles

–

Buyer sentiment and price expectations

–

Changes in distribution pipeline inventories

–

P&K demand destruction

44 |

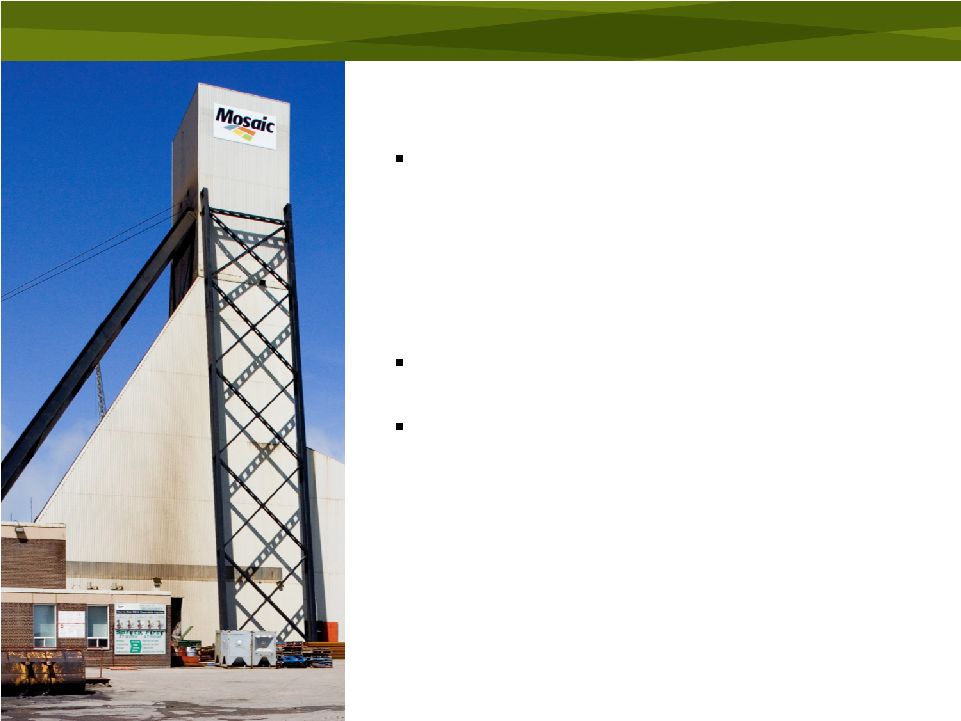

Phosphate

and

Potash

Market

Volatility

Déjà

Vu All Over Again?

Ohio AgriBusiness

Association and OSU Extension

2011 Crop Production Conference

Columbus, OH

January 6, 2011

Dr. Michael R. Rahm

Vice President, Market and Strategic Analysis

The Mosaic Company

Thank You! |